| HOUSE DO Co, Ltd. (3457) |

|

||||||||

Company |

HOUSE DO Co, Ltd. |

||

Code No. |

3457 |

||

Exchange |

1st section of TSE |

||

Industry |

Real estate business |

||

President and CEO |

Masahiro Ando |

||

Address |

Headquarters: 17F, Marunouchi Trust Tower North, 1-8-1 Marunouchi, Chiyoda-ku, Tokyo Head Office: 670 Tearaimizu-cho, Nakagyo-ku, Kyoto-shi, Kyoto |

||

Year-end |

End of June |

||

URL |

|||

* Share price is the closing price on March 1, 2018. The number of shares issued and BPS was taken from the summary of business results for the first quarter of FY6/18. ROE is the value from the previous term.

|

||||||||||||||||||||||||

|

|

* The forecasted values were provided by the company. Net income is profit attributable to shareholders of the parent company. Hereinafter the same shall apply.

This report provides the outlines of HOUSE DO Co., Ltd., the first half of fiscal year June 2018 earnings results, full fiscal year June 2018 earnings forecasts, and the description of its mid-term management plan and growth strategy. |

| Key Points |

|

| Company Overview |

|

Strongly doubting the situation in which services are company-oriented while they should be customer-oriented, such as the lack of transparency, he responded to the needs of customers appropriately, and offered a lot of information on property speedily, winning the trust of customers and then improving business results. When he visited the U.S. to see the real estate industry there, he was deeply impressed by a franchisee real estate broker conducting community-based business competing with large companies while caring about customers. He felt that doing this business in Japan is meaningful and valuable, because it would lead to the reform of the Japanese real estate industry, and started developing a franchise chain for real estate brokerage in Japan. In February 2006, he launched Franchisee Business. When he approached real estate brokers, they were reluctant at first, but he gave careful instructions to personnel in other fields including architecture and renovation, who have keen interests in real estate. His business was highly evaluated, partially because there were no companies that teach real estate practice, and the franchise chain grew healthily. In January 2009, he established HOUSE DO Co., Ltd.. As its business expanded, its brand power was strengthened steadily, and HOUSEDO was listed on Mothers of Tokyo Stock Exchange in March 2015. Moreover, the company moved its market from Mothers to the 1st section of TSE in December 2016. All of them are based on President and CEO Ando's awareness and thoughts about the current Japanese real estate industry.  The company focuses on the increase of franchised stores for contributing to the proactive disclosure of real estate information to the consumers and the promotion of the House-Leaseback Business, the Real Estate Finance Business, and the Reverse Mortgage Guarantee Business in cooperation with financial institutions to offer real estate solutions in the aging society. The company operates unique businesses compared with other real estate-related firms as a "real estate service provider" or "specialty store retailer of private label apparel (SPA) in the real estate sector" that can grasp the needs and wants of the customers and offer a variety of reliable and convenient services.   (1) Franchisee Business

(Outline)

HOUSEDO provides small and medium-sized real estate firms that require a brand or network and companies that plan to launch real estate distribution business with the know-how of real estate brokerage and trading (attracting customers, IT strategies, education and training and motivating employees etc.). For the purpose of popularizing its brand throughout the market, the company has implemented brand strategies while featuring Mr. Atsuya Furuta, who is a former professional baseball player and coach and currently a baseball commentator, since Jul. 2013. HOUSEDO has been advertised actively via TV and radio commercials, signboards, flyers, the mass media, websites, etc., announcing consistent brand strategies. By superimposing Mr. Furuta's personality, working attitude, and sincerity onto the image of HOUSEDO, the company won the trust of clients, making them feel reliable. By developing a nationwide chain, HOUSEDO aims to make real estate information open and create reliable, convenient contact points with customers under the corporate ethos. Since its franchise system provides franchisees with a variety of methods for reeling in customers for increasing sales based on the experiences of its headquarters and directly managed stores and the practical know-how to educate personnel, even companies that have no experience of real estate brokerage can start the business, and so it is highly evaluated. Many companies from different industries became franchisees, accounting for 70%.  The royalties the company receives from franchisees are monthly fixed, without fluctuations. Through these efforts, it has established a close network among the head office, directly managed stores, and franchised stores. In December 2017, it established a new real estate rental business brand called "RENT Do!." Currently in Japan, vacant rooms and houses including rental properties are increasing due to the imbalance between population decrease and excessive housing supply. This is a major issue in leasing management. The company sees that there is a big business opportunity in the real estate rental business, which is initiated in the "RENT Do!" brand, together with a synergistic effect with the buying and selling business that the company has been undertaking.  Although it is currently in the stage of pilot operation using properties owned by the company, it is addressing various pay-by-the-hour rental needs, and usage is steadily going. By combining with the development of "RENT Do!," in collaboration with franchised stores and real estate rental operators nationwide, the company plans to work on this "Time Room Cloud" as a measure to deal with vacant spaces. The number of franchised stores approximately doubled in the past 5 years. The company first aims to increase the number of the stores to "700 by 2020 and 1,000 by 2025 in Japan" and the after "50,000 in Asia."  (Main services)

Provision of website systems

HOUSEDO offers practically useful systems that have been nurtured in business scenes since its inception, including the systems information provision, including online search, support for sales and business operation, and matching. "DO NETWORK!," which is aimed at increasing and retaining customers efficiently and streamlining business operation to the maximum degree, is equipped with various functions for producing original flyers, managing property, customers, in order to reduce the burden of routine work for sales staff. In addition, the company started offering "10-second-Do! - Real Estate Assessment in 10 Seconds," the automatic assessment of real estate utilizing artificial intelligence (AI), and this is causing response from customers . Training for franchisee stores

As for education, HOUSEDO carries out sales training, through which even inexperienced real-estate agents can learn the fundamentals and become competent sales person. These are IT-based sales activities, financial planning, and property assessment, to support franchised stores in improving their business capabilities. In the training, the company utilizes "DO CHANNEL!," which has website-based learning functions/e-learning systems, as well as group learning. This system has over 1,000 contents, and trainees can attend necessary courses online anytime. After franchised stores are opened, supervisors give appropriate instructions and regional study sessions are held regularly. Supervisors give strategic guidance for marketing, attracting customers, managing sales activity records/ sales, and reviewing store management, etc. At "HOUSEDO FC Awards," which is attended by the staff of all franchised stores, they share the corporate targets and goals of the next fiscal year and the latest information on real estate, and excellent stores are commended, for motivating employers and employees. At the other session, HOUSEDO successful sharing session, they share the successful cases of nationwide franchised stores each other, and brush up themselves through friendly competition. (2) House-Leaseback Business

(Outline)

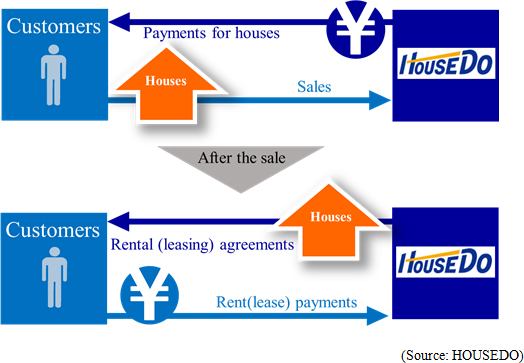

HOUSEDO concentrates on House-Leaseback Business as one of the future core businesses.President and CEO Ando came up with the concept that "you can keep living in your house even after selling it" and aired it by radio, causing greater repercussions than expected. Therefore, he started commercialization, and completed it in a few months. (What is House-Leaseback?)

"House-Leaseback" means a sales and leaseback system with which real estate owners can keep living in their houses in accordance with a lease contract with HOUSEDO after selling the houses to the company.Going beyond the conventional purchase system, which only provided an option to "sell real estate," the company offers services under the concept of "utilizing real estate."  (Background of the growth of House-Leaseback Business, and the market environment)

House-Leaseback Business is in demand for the following reasons:

This system offers a significant advantage -they can continue their business using business assets while paying lease fees in accordance with lease contracts. This business category was named "Asset-Leaseback," and it was launched in August 2015. According to "Statistical Survey on Housing and Land 2013" (the Ministry of Internal Affairs and Communications), the total number of households and the ratio of owner-occupied households in Japan are as tabulated below.  As birthrate is declining and nuclear families are increasing, the necessity to own houses decreased if there are no heirs or the number of family members is small. Accordingly, it is expected that more seniors will have cash for leading more affluent lives, and then the ways of living of elderly people will change considerably. The trend of such changes can be verified by the fact that 3 megabanks have recently started "reverse mortgage," which means that customers borrow money from financial institutions by pledging their houses and when they die, the financial institutions foreclose and sell the houses through auction to recoup the money. It is expected to grow considerably like House-Leaseback Business. (House-Leaseback Business of HOUSEDO)

HOUSEDO, which launched House-Leaseback Business in 2013, excels at evaluating markets based on its assessment skills, which have nurtured for many years, sales skills, and a nationwide network of stores.This business is attractive to HOUSEDO in the following aspects: (3) Real Estate Finance Business

(Outline)

HOUSEDO offers real estate secured loans to individuals and corporations so that they can procure funds by utilizing their real estate. Some customers who inquired about House-Leaseback service can pledge their real estate, and some other customers do not need to dispose of their real estate for procuring necessary funds. In addition, the company meets various needs for the funds for the trading such as between relatives or parents and children whose trading price tends to become opaque making it difficult to receive loans from banks, the funds for purchasing a second house or real estate for investment, the funds for business operation, equipment investment of enterprises and real estate secured loans for customer with foreign nationality. HOUSEDO can offer real estate secured loans based on the appropriate, speedy evaluation with reference to the information on real estate around Japan, using HOUSEDO Chain. It is expected to grow as the supplementary business for House-Leaseback Business. Also, in October 2017, the company launched the Reverse Mortgage Guarantee Business through collaboration with Osaka Shinkin Bank. Its 100% subsidiary, FINANCIAL DO, performs collateral evaluation and guarantee business for reverse mortgage products provided by the bank. In the future, it will also promote partnerships with other financial institutions to expand service areas and businesses. (4) Real Estate Buying and Selling Business

(Outline)

HOUSEDO acquires real estate, adds value, and sells them to general customers and investors - the company buys, renovates, and sells used houses, builds and sells new housing, develops residential land, renovates and sells buildings for investment. For procuring real estate, the company gathers information from its directly managed stores, franchised stores , and "Project Partner System," which is a collaborative business with real estate agents. Since HOUSEDO operates both the Real Estate Brokerage and Sales Businesses in an integrated manner, it has a good grasp of the needs from sellers and buyers, and owns contact points throughout Japan. Accordingly, it can procure and sell real estate while considering regional characteristics and demand. (Main services)

Services for corporations

Under the policy of "taking full advantage of good real estate information," HOUSEDO operates collaborative systems and business models with franchised stores and real estate agents around Japan."JV Partner System" (joint purchase of real estate) is a new business model for purchasing and selling real estate by combining the information gleaned from directly-managed and franchised stores and realty firms nationwide and HOUSEDO's financial power and sales capabilities. Services for individuals and corporations

HOUSEDO directly buys real estate by utilizing nationwide networks with its directly managed and franchised stores.When requested by a customer, staff can visit the customer on that day, and suggest a price on the spot. This is one of the reasons why HOUSEDO is highly evaluated. Assessed prices are suggested in three stages: "price for selling in about 3 months," "price for selling in about 1 month," and "price for immediate purchase" in brokerage. Under the brand philosophy of making real estate information open , the company discloses the nearby cases by using "DO TOUCH! MAP," which is a system for disclosing information of real estate transactions, so that general customers can trust the company and have transactions without anxiety. Operation of stores

HOUSEDO operates stores as "Store for buying houses and other real estate."Its stores are operated dual to Satellite Stores for Real Estate Brokerage Business, and suggest purchase prices, while selling real estate as brokers. (5) Real Estate Brokerage Business

(Outline)

In Real Estate Brokerage Business, HOUSEDO introduces not only "ready-built houses," "used houses," and "land," but also proposes the combinations of "land and new house construction," "used houses and renovation," "selling plans and relocation," etc. while accurately grasping the needs of customers. Also, the company gives proposals to customers from the early stage, and comprehensively supports customers for financial plans and insurance in buying their houses without worry. HOUSEDO aims to reform the Japanese realty industry drastically, and develop a new distribution system for housing, so that customers can move into their ideal houses according to their life stages. It hopes to transfer the initiative from the realty industry to customers who live in houses. Accordingly, the company aims to establish a highly transparent, flexible distribution system for trading real estate without anxiety after understanding property, by disclosing information on real estate and delivering information within 24 hours after receiving an inquiry. In detail, the company swiftly provides customers with the latest information on real estate with various methods, including the online media such as the Internet and websites, newspaper inserts, housing magazines, and the posting system for distributing flyers to each household around each store. (Main services)

Website for retrieving real estate

The company operates "HouseDo.com," which enables customers to search for the real estate managed by franchised stores and directly managed stores throughout Japan, and "Do-Search!," a realty search engine exclusively for each store."HouseDo.com" is a portal site operated by the FC headquarters of HOUSEDO, which features recommendable houses in each area, around each railroad line, or in the vicinity of each station and finds desirable real estate based on the date of stores nationwide. It is aimed at introducing a wide array of houses to customers around Japan. "Do-Search!" enables customers to search for real estate managed by each store, and respective stores take the initiative in operating it. It is aimed at offering information to local customers swiftly based on community-based sales activities combining flyers, ads directly put into mailboxes, etc. Operation of stores

HOUSEDO brokers real estate deals via "Housing information mall," a roadside large-scale store, and "Satellite Store," a directly managed store specializing in sales and brokerage. The company not only introduces real estate, but also proposes renovation, financial plans, and insurance at the early stage, to offer one-stop services at the "Housing information mall".

(6) Renovation Business

(Outline)

In the 21st century, the company set up the concept of "recology," which is coined by fusing "recycle" and "ecology," and aims to renovate housing for the coming 100 years. The company has a service menu for a broad range of customers and prices, including the repair for restoring used houses to their original states, the large-scale remodeling or renovation for adding new value, such as functions and design, after-sale maintenance, and minor remodeling for dealing with troubles. As standard services, the company inspects houses and checks earthquake resistance, and has an enriched guarantee system (issuing a warranty for every construction work, offering a warranty for up to 10 years, taking out a liability insurance contract for up to 300 million yen, guaranteeing the operation of housing equipment for up to 10 years, and so on). These services allow customers to feel secure. (Outline of services)

Operation of websites

In addition to the portal site for all kinds of renovation services, the company operates a website for the remodeling of plumbing products, roofs, and outer walls.

Operation of stores

HOUSEDO offers this service at Kyoto-Chuo Showroom, Kyoto-Kita Showroom, Ageo-Okegawa Showroom and Housing information mall, which is directly managed by the company.

(1) Ability to supervise franchisee stores

What matters most to franchised stores is "how to reel in many customers?" in Franchisee Business. President and CEO Ando insists that the ability to supervise the stores for attracting customers is the most significant strength of HOUSEDO.The improvement of the ability to reel in customers means the practice of the corporate ethos since HOUSEDO's inauguration: "Customers' needs can be satisfied by providing them with a lot of information swiftly." The provision of know-how via the online system "DO NETWORK!" and franchisee training is highly evaluated by franchised stores, Therefor, these are considerable facilitates that makes the franchise chain the growth. (2) Capabilities of local markets-based assessment skills and sales skills, and nationwide coverage

With the goal of achieving "1,000 stores by 2025 in Japan," the company is developing and expanding its franchise chain network. The remarkable strengths of HOUSEDO are the capabilities of local markets-based assessment skills and sale skills utilizing this network. This is competitive advantage, which the company can exert these capabilities throughout Japan based on its competent network.  In addition to the Franchisee Business, highly profitable the Steady-income businesses, including the House-Leaseback and Real Estate Finance Businesses, are forecasted to grow, keeping ROE high. |

| First Half of the Fiscal Year June 2018 Earnings Results |

Increased both in sales and profit. They marked record highs for the first half.

Sales were 9,532 million yen, up 11.1% year on year. The Franchisee Business, which is the core business of HOUSEDO, was healthy. Considering the special factor of the previous term, sales increased in all segments. Gross margin grew 20.5% year on year to 3,915 million yen. Gross margin also increased 3.2 points to 41.1%, due to growth of the Steady-income businesses.Operating income increased by 38.7% year on year to 888 million yen, as SG&A increase mostly from the personnel and advertisement costs was absorbed by the effect of increased sales. Both sales and profit exceeded the initial forecast.  ① Franchisee Business

Sale and profit increased.As for the Franchisee Business, which is the core business of the Steady-income businesses, the number of new franchisee contracts has steadily increased to 63 and the total number of franchised stores is now 501. It was because of the company promoted real estate firms in urban areas to become a franchisee, advertised its services through TV and radio commercials, etc., improved its reliability and corporate brand value as a listed company on the first section of Tokyo Stock Exchange. Moreover, there are needs for the establishment of dual stores that are both satellite stores and stores specializing in buying houses and other real estate. The number of newly opened stores is 65 and the total number of opened stores is 415 due to the effects of the establishment of a system in which supervisors support franchised stores and the enrichment of service contents. The company launched a new brand "RENT Do!" and entered the real estate rental business. (The business began in February 2018.) ② House-Leaseback Business

Sale and profit decreased.Inquiries and transactions increased due to the improvement in the popularity of services through advertisements using TV and radio commercials, etc. and the increase in reliability as a listed company on the first section of Tokyo Stock Exchange. Though the sale and profit this year showed decreases due to an extraordinary sale of a building worth 307 million yen for investment and a high-priced property worth 177 million yen in the previous term. Without the special factor, sale and profit grew 31.3% and 51.0%, respectively. The number of contracts increased by 1 to 151 compared to that of the previous term. The number of properties owned increased by 2 to 142, while the ones sold increased by 7 to 24, producing the sale of 566 million yen. The total number of properties owned is 626, and the total amount of properties owned (sum of acquisition prices, undepreciated) is 9,110 million yen. The company started operation in Fukuoka prefecture in addition to three major metropolitan areas. ③ Real Estate Finance Business

Sale and profit grew considerably.The company cultivated sales channels by flexibly responding to various needs for funds from clients, by offering real estate secured loans utilizing the capability of assessing real estate, which is a strength of the HOUSEDO group. Operating this business for supplementary the House-Leaseback Business, the company produced synergetic effects, concentrated on the cooperation with franchised stores, and actively collaborated with financial institutions. In October 2017, the company launched the Reverse Mortgage Guarantee Business to meet the needs of the declining birthrate and aging society. The total number of real estate secured loans and reverse mortgage guarantees increased by 41 to 88, and the real estate secured loans outstanding increased by 2,240 million yen to 3,258 million yen. ④ Real Estate Buying and Selling Business

Sale and profit increased.The company rigorously selected real estate for investment and high-priced property mainly in urban areas while considering risks. While mortgage rates remain extremely low, which led to the client needs for low-cost but high-quality used real estate, the company changed from the prudent attitude at the beginning of the term to a usual one from the second half and increased the number of real estate transactions by implementing following measures; it focused on strict compliance with the policy for procuring real estate only that can meet the needs of clients, and active procurement in the area of directly managed stores. Inventories are 5.6 billion yen, nearly the same as they were at the end of the previous term. The company will maintain them at around 5 billion yen, paying more attention to their turnover rate than the balance. ⑤ Real Estate Brokerage Business

Sale and profit grew.The number of brokerage transactions was 1,546, up 139 year on year. New stores were opened in Okinawa and Aichi Prefectures. Actual demand remained favorable, partially because mortgage rates remained extremely low. The company strived to lead customers to directly managed stores through community-based posting strategies in addition to the ad strategies using websites and the media, such as newspapers, TV and radio commercials. ⑥ Renovation Business

Sales and profit decreased.In the Renovation Business, the company aims to increase the orders for renovation while selling used housing based on the cooperation with the Real Estate Buying and Selling Business and Real Estate Brokerage Business. Moreover, the company holds renovation events in collaboration with housing equipment manufactures actively to attract customers. Although sales decreased from the previous year due to sales of 200 million yen by new construction contracts in the same period of the previous year, actual revenue grew and orders received are showing steady growth.  The equity ratio rose 13.2% to 26.9% from 13.7% at the end of the previous fiscal year.  The investing CF remained the same level, and the deficits of free CF shrank. Although there was income from issuance of shares, the surplus of financial CF shrank due to a decrease in revenue from long-term loans and an increase in expenditure to pay back the loans. The cash position improved. (4) Topics

In December 2017, the company started recruiting "Europe/US Style Real Estate Agents Program" for the registration-style agent system that is different from the conventional form of employment and adopted the mainstream business model in the Western real estate transactions. ◎Launch of the "Europe/US Style Real Estate Agents Program" for real estate sales (What is the Europe/US Style Real Estate Agent Program?) A real estate sales professional will conclude an outsourcing contract with the company as an agent. This will enable the agent to conduct real estate transactions as a sole proprietor while freely utilizing the company's diverse management assets. It is a mechanism that is commonly adopted in real estate transactions in the United States, where real estate businesses are more advanced. An agent in the United States belongs to a real estate company that is qualified to perform real estate brokerage businesses. The agent does not have an employment agreement but carries out real estate sales based on a service agreement with a real estate company to which the agent belongs as an independent sole proprietor. The seller and buyer use different agents, and the agents generally proceed with transactions appropriately and efficiently as representatives of their customers and obtain reward fees upon establishment of the transaction. Aiming to provide high quality services to its customers, the company has been providing the agent program as a pilot project since 2014, and it decided to start offering the full-fledged service. The registered agents of Europe/US Style Real Estate Agent Program can use superior management tools such as the company's "branding power," "reeling customer," "creditworthiness," "customer and property IT management system," and "network of over 500 nationwide stores" without initial costs, while devoting themselves to real estate sales and brokerage works as sole proprietors. After registration, the agents will be paid an incentive of 48% to 90% of the operating income when they manage to establish a sales contract. In addition to being able to freely decide working hours, etc., they can also have secondary jobs. This means they can choose a work-life balance tailored to individual needs. Because labor force population is decreasing due to declining birthrate and aging society, it is predicted that it will become more difficult to secure talented personnel. Under this circumstance, it is a great advantage for the company to be able to secure industry-ready and excellent professionals of the real estate business. It is aiming for 100 registered agents during this term, by initially conducting recruitment in the metropolitan area. |

| Fiscal Year June 2018 Earnings Forecasts |

Sales and profit are forecasted to rise, due to the growth of the Steady-income businesses.

There is no change in the forecast of full year. Sales are forecasted to be 17,146 million yen, up 1.8% year on year. The Franchisee Business, which is the core business of HOUSEDO, is expected to keep growing. The sales of the House-Leaseback Business are forecasted to decrease due to special factors in the previous term, but the sales of other segments are projected to rise. Operating income is forecasted to be 1,603 million yen, up 28.4% year on year. Profit is forecasted to grow by double digits, despite the investment in personnel resources, advertisement, etc. for expanding its business, thanks to the prosperity of the Steady-income businesses with a high profit rate. The company expects the further expansion of the Steady-income businesses towards the second half of the year. The dividend amount is to be 27.00 yen/share, up 7 yen/share year on year. The forecasted payout ratio is more than 25.0%.  ① Franchisee Business

Sale and profit are forecasted to grow. The company will keep striving to increase the numbers of franchised stores. With the synergy between the Real Estate Brokerage and Real Estate Buying and Selling Businesses, the company will dual stores of a "satellite shop" and a "store specializing in buying houses and other real estate." It is forecasted that the number of franchise contracts will be 573, up 105 year on year, and the number of newly opened stores is 457, up 79 year on year. ② House-Leaseback Business

Sale is forecasted to decrease, while profit is forecasted to rise slightly. Since the company sold 5 pieces of high-priced real estate and earned sales of 833 million yen and a profit of 132 million yen in the previous term, it is forecasted that sales will decrease and profit will be unchanged, but if this is not taken into account, sales are projected to grow 40.1% year on year. Excluding the revenue from apartment buildings, the operating income of this business (unconsolidated) is projected to rise 47.9% year on year. As needs are strong, the company will strengthen personnel and advertisement to accelerate its growth. It is forecasted that the average number of contracts will be 36.3, up 11 year on year, and the number of properties purchased will be 436, up 51.4% year on year. It is forecasted that the total number of properties owned is 863, up 68.2% year on year, and the total amount of properties owned (sum of acquisition prices, undepreciated) is 11,907 million yen, up 65.7% year on year. ③ Real Estate Finance Business, etc.

Sale and profit are projected to increase significantly. Based on the cooperation with the House-Leaseback Business, the amount of real estate secured loans will increase. It is forecasted that the total number of loans executed with reverse mortgage guarantees will be doubled to 207 cases, and the loan outstanding is expected to be 5.4 billion yen, up 2.5 billion yen year on year. ④ Real Estate Buying and Selling Business

Sale and profit are forecasted to grow.Since actual demand is expected to remain favorable, the company will procure real estate actively in the target areas of directly managed stores. While emphasizing turnover rate, the company plans to keep inventories at the level of 5 billion yen. The number of transactions is expected to be 305. ⑤ Real Estate Brokerage Business

Sale is forecasted to increase, but profit decrease.Thanks to the improvement of popularity due to the increase of FC stores, the number of brokerage transactions is expected to keep growing steadily. The number of transactions is forecasted to grow 5.4% year on year to 2,881. The company will keep transferring personnel to the Steady-income businesses, while pursuing synergetic effects with related businesses of purchase, renovation, fire insurance, mortgages, etc. ⑥ Renovation Business

Sale is forecasted to increase, but profit decrease.The number of renovation contracts and the number of deliveries are planned to be 2,180, up 2.3% year on year, and 2,283, up 10.0% year on year, respectively.  |

| Mid-Term Management Plan and Growth Strategy |

|

(1) Mid-term management plan

In Aug. 2016, the company announced a 3-year mid-term management plan, which began in the term ended June 2017, and it is ongoing.

◎ Growth strategies

The company will make efforts to shift from "labor-intensive businesses" including the Real Estate Brokerage, Real Estate Buying and Selling, and Renovation Businesses to "Steady-income businesses" including the Franchisee, House-Leaseback, and Real Estate Finance Businesses.For this purpose, the company proactively invested in advertisement and human resource in the fiscal year ended Jun. 2017. The Franchisee Business and the House-Leaseback Business accounted for 100 million yen each, totaling 200 million yen.  (2) For further growth

Aiming to achieve further growth, the company has started "RENT Do!" and "Time Room Cloud" by taking Japanese social issues such as increasing vacant houses and rooms and aging society as a new business opportunity. Because the company are striving to reform the real estate industry with the vision that "we aim to provide HOUSEDO contact locations that are more convenient and reliable to people in all areas of Japan" with the thoughts and awareness of the issues about the current real estate industry in Japan. Furthermore, it launched "Reverse Mortgage Guarantee" in addition to "House Leaseback" and "Real Estate Secured Loans" to focus on development of "Real Estate + Finance" business through which the company supplies funds by using assets to meet the funding demand of the elderly people who own real estate properties. Moreover, the company believes that establishing and disseminating the "HOUSEDO! Bank Vision" that carries out appraisal using artificial intelligence and provides real estate secured loans by FinTech is also an important driving force for the growth.  |

| Conclusions |

|

|

| <Reference: Regarding corporate governance> |

◎ Corporate Governance Report

The company submitted the latest corporate governance report on September 27, 2017.

|

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |