| enish, inc. (3667) |

|

||||||||

Company |

enish, inc. |

||

Code No. |

3667 |

||

Exchange |

Mothers Market of the TSE |

||

Industry |

Information, Communications |

||

President |

Masanori Sugiyama |

||

HQ Address |

1-13-1 Hiroo 1-13-1, Shibuya-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

* Stock price as of close on August 9, 2013. ROE and BPS based on actual results at end of previous term.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. A 20 for 1 stock split was performed in September 2012. Fiscal Year December 2010 was an irregular 11 month accounting period.

|

|

| Key Points |

|

| Company Overview |

|

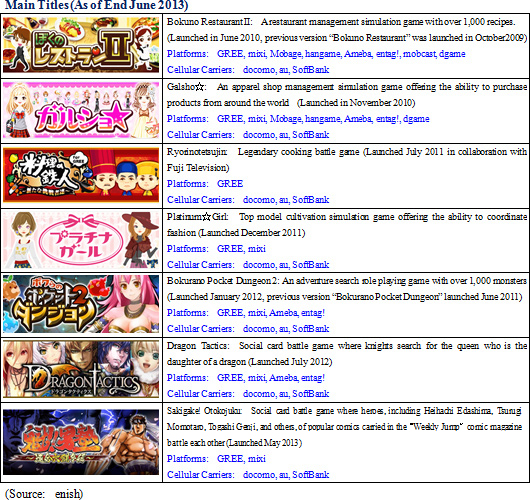

<Business Description>

enish maintains only a single business segment entitled social applications business. In this business, games developed in-house are provided via "GREE," "Mobage," "mixi," "hangame," "Ameba," "entag!," and other SNS and social game platforms to be played by feature phone and smartphone users. Games are provided free of charge, but various items including tools used in the games to make them more enjoyable are offered for purchase over phones (For example, "Bokuno Restaurant II" sells recipes and decorations designed to make restaurants in the game more popular). The collection of fees from users is outsourced to the SNS platform operators, and they keep a portion of the fees as system usage commissions.70% to 80% of "Bokuno Restaurant II" and 90% of "Galsho☆"users are called "F1 Layer" users and represent a group of Japanese in their 20s to 30s, who are primarily women with high purchasing power. Therefore, enish is in the process of creating battle games to expand the number of male users. For the first half of the fiscal year December 2013, "Bokuno Restaurant II," "Galsho☆," "Dragon Tactics," "Pocket Dungeon 2," "Sakigake! Otokojuku" and others accounted for 34%, 22%, 27%, 9%, 2% and 6% of non-consolidated sales respectively.  <Strengths>

The social games business employs a model where games are provided to users free of charge with earnings being derived from the sale of tools used in these games. Therefore, the key to making successful games is to increase their quality levels so that they captivate users and "make them want to purchase tools to enjoy the games even more." Furthermore, making improvements in the game system to match the changing tastes of users after the release of games is also important in ensuring their continued popularity and profitability.enish leverages its data mining capability to analyze user information to derive game utilization rates, continuation rates, fee charge rates, and other data needed to optimize their games on an ongoing basis. While these optimization efforts are not unique to only enish, the fact that they have numerous long selling games that continue to contribute to earnings over the long term in a market where many games are only distributed for several weeks is a reflection of the accuracy of enish's data analysis, and the success of its various measures. Furthermore, new title planning and development activities are based on these successes as part of a strategy to launch new titles on a sustained basis. Another of enish's strengths is its effort to facilitate a framework that enables the quick provision of games over a wide range of multiple platforms. Consequently, the Company is able to choose the most appropriate platform after considering the users and characteristics of each platform to best match the characteristics of its games. Furthermore enish is able to quickly plan and develop applications in short periods of time and produce flexible responses that match the speed of growth in the social games market (Framework refers to the software that functions as a foundation when application software are first developed.).  |

| First Half of Fiscal Year December 2013 Earning Result |

Contribution from "Dragon Tactics" Compliments Stronger Than Expected Demand for Existing Titles

Sales rose by 81.6% year-over-year to ¥3.146 billion during the current first half due largely to contributions from "Dragon Tactics" launched in July 2012, and stronger than expected demand for existing titles including "Bokuno Restaurant II" and "Galsho☆," which were made possible by an expansion in the platforms to which contents were provided. Because "Sakigake! Otokojuku," the only new title released during the first half, was launched in late May 2013, its contribution to first half earnings was limited (Accounting for only 2% of first half sales).With regards to profits, anticipatory investments from new title development and advertising fees caused cost of sales and sales, general and administrative (SG&A) expenses to rise. However, strict controls of these and other costs and higher sales allowed both cost of sales and SG&A to fall relative to sales. Moreover, enish adopts a policy of writing off the development fees as costs in the term they occur and does not book them in their balance sheet (Some of these fees can be considered anticipatory expenses). Furthermore, enish revised its first half earnings estimates upwards on June 17 and called for sales and operating, current and net profits of ¥3,100, ¥615, ¥615, and ¥365 million respectively.  Sales, Current Profit Rose by 73.9%, 152.0% YY

While the upwardly revised earnings for the first half of the current term announced on June 17 took the strong second quarter performance into consideration, the actual results exceeded the second quarter estimates for sales and operating profit of ¥1,500 and ¥206 million.

In addition, efforts to expand the number of platforms to which contents are provided allowed the share of sales over mixi and mobage to rise from 13% and 9% to 21% and 12% respectively. At the same time, sales via GREE rose but its share of total sales fell from 71% to 53% and the number of platforms to which contents were provided rose to eight as of the second quarter end. Also, the expansion in the smartphone market allowed sales to smartphones to rise from 23% in the previous first half to 46% in the current first half.  Sales, general and administrative expenses rose by 14.8% year-over-year to ¥229 million. The implementation of effective strategies for advertising and human resources allowed the ratios of advertising and labor expenses to sales to decline. The effective human resources strategy is attributed to increases in efficiency of hiring due to the increased brand awareness of enish made possible by the listing of its shares. Furthermore, the effective hiring is expected to allow enish to fortify its development structure ahead of schedule during the second half and with a view to longer term growth of the company from the next term forward. Consequently, the Company expects to raise the number of its employees from its initial plans of 157 to 165 (Number of employees at the end of the first half totaled 144, including 28 dispatched workers) at the end of the current term end.   |

| Fiscal Year December 2013 Earnings Estimates |

|

(1) Endeavors During the Second Half

In addition to increasing the number of new titles expected to be launched from three to four (One browser application title, and three native application titles), hiring of human resources with a focus upon developmental staff will also be promoted ahead of plans (The target number of total employees expected to on payroll by the end of the term has been raised from 157 to 165) during the second half. Due to a lack of space given the anticipated increases in the number of employees, enish expects to move its headquarters. Moving expenses and other costs associated with the move have already been factored into earnings estimates for the second half, and the actual move is expected to take place at the end of the current fiscal year or in the first half of the next fiscal year.In addition, enish will continue to pursue its multiple platform strategy as a means of leveraging its existing titles to reduce development costs and create new revenue opportunities by providing them to new platforms. In overseas markets, enish expects to launch its first title in Korea during the fourth quarter (October to December), and advertising and operational costs associated with this launch have already been factored into second half earnings (No sales from this launch have been included in the second half estimates). enish expects to leverage its bountiful experiences and superior contents in overseas markets with high volume and high growth potential. With regards to the "Online to Offline" (O2O) business, which is part of the Company's strategy of diversifying into peripheral businesses to the game business, enish expects to promote a location game through collaboration with COLOPL, Inc. (Formed on July 18). As a new endeavor, a provision of an "intellectual applications" will be started during the fourth quarter.   Full Year Estimates Remain Unchanged, Sales, Operating Profit Expected to Rise by 51.2%, 23.1% YY

Sales and operating profit recorded during the first half have attained 47% and 88% of enish's full year estimates. In particular, the much better than anticipated performance of profits during the first half and the fact that full year profit estimates remain unchanged were the reasons for the high attainment rate. However, developmental and advertising costs are expected to be raised above initial estimates because of enish's decision to increase the number of new title releases from three to four during the second half. Furthermore, if profits appear to exceed full year estimates, the Company is expected to implement aggressive investments ahead of plans for expansion of its businesses in the coming terms. And while the timing of the anticipated move has not been determined yet, various costs expected to arise from the move of enish's headquarters have also been included in the second half estimates.While dividend estimate has not been officially announced yet, enish is expected to increase its dividend by ¥6 to ¥34 per share should it be able to achieve its net profit estimate. The company maintains a dividend payout ratio target of 20%. |

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2013 Investment Bridge Co., Ltd. All Rights Reserved. |