| Takemoto Yohki Co., Ltd. (4248) |

|

||||||||||

Company |

Takemoto Yohki Co., Ltd. |

||

Code No. |

4248 |

||

Exchange |

Second Section, TSE |

||

Industry |

Chemical (Manufacturing) |

||

President |

Emiko Takemoto |

||

HQ |

2-21-5 Matsugaya, Taito-ku, Tokyo |

||

Year-end |

End December |

||

URL |

|||

* Stock price as of closing on April 10, 2015. Number of shares at the end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. A 10 for 1 stock split was performed on September 12, 2014 and EPS and dividends have been retroactively adjusted to reflect this split.

We present this Bridge Report reviewing the company overview, the first half of the fiscal year December 2015 business performance and future growth strategy for Takemoto Yohki Co., Ltd.

|

| Key Points |

|

| Company Overview |

|

<Corporate History>

Shigeru Takemoto (Grandfather of the current President Emiko Takemoto) started his business under the name of Takemoto Shoten in 1950, amidst the shortages of goods in the post World War II era, for the recycling of glass products. In 1953, Mr. Takemoto converted his business into a limited company and renamed it Takemoto Yohki Co., Ltd. and began manufacturing glass containers. In 1963, Takemoto started dealing in its signature brand "Standard Bottles."A regional sales office was opened in Osaka in 1980. Masahide Takemoto (Currently advisor to the Company and the father of Emiko Takemoto) took the helm of the Company and explored new markets in the Kansai region, where its main sales had been limited to "custom made" products, with bottle dealers and accessory dealers being separated. In its efforts, the Company leveraged both the "Standard Bottles" and "one stop product provision." The wide range of products allowed the Company to capture demand from customers and expand its sales channels. After the expansion into the Osaka region, a groundbreaking feat back then, the Company further expanded into Fukuoka, Sapporo, and Nagoya regions, and succeeded in building its nationwide sales and service coverage network.

<Market Environment>

As demonstrated in the graph shown below, the market value of the shipments of packaging containers has trended sideways in recent years, and the outlook for declines in the Japanese population is expected to limit any increases in demand within Japan in the future.

Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production." Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production." Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions." Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions." Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured both on time and in the required volumes. Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured both on time and in the required volumes. <Business Description>

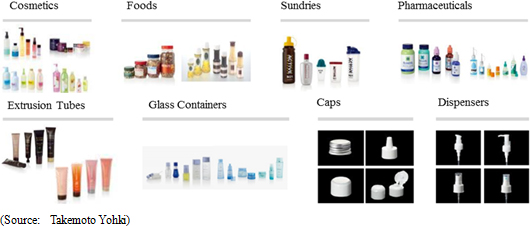

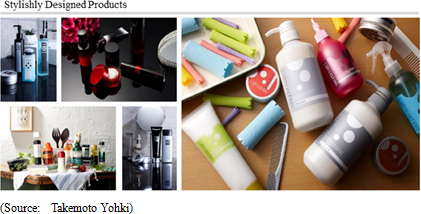

Takemoto Yohki Co., Ltd. manufactures and sells containers and accessories such as caps and dispensers, for use by customers in the cosmetics and beauty, general and health foods, sundries, and chemical and pharmaceuticals industries. The Company does not manufacture mere containers to hold substances; it primarily creates high value-added products while paying close attention to design, function, barriers, safety and environmental issues.

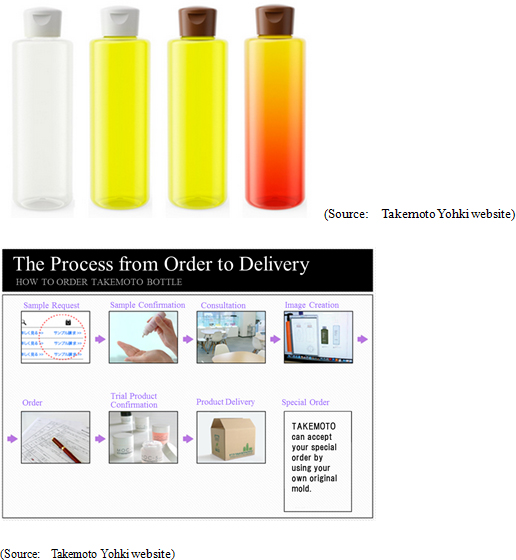

Business Model Business ModelIn contrast to the above, Takemoto Yohki creates molds in-house on behalf of the customer. Having allowed the customer to choose molds of its preference from a wide range of products, Takemoto manufactures and delivers the products. Therefore, the delivery time and development costs of packaging containers are reduced and customers can purchase only the required amount of containers as needed at the time. In this manner, Takemoto Yohki is able to plan and create its own brand of containers, which it calls "Standard Bottles," through this strategy of creating and owning the molds in-house. Takemoto owned 2,777 molds as of the end of June 2015 and boasts of the industry's largest collection of molds. At the same time, Takemoto can offer customized products that match customers' needs by using different caps and other accessory parts, and by changing the color and printing used on the Standard Bottle products. Furthermore, the Company boasts of inventories of 1,213 types of products, helping it to realize short delivery times of a wide variety of products in small lots.  Standard Bottle sales comprise approximately 70% of total sales. In addition, the Company deals in products made from molds manufactured by customers and, as part of its trading firm function, purchases products made by other companies.   <Characteristics and Strengths>

Takemoto Yohki boasts of an extremely wide range of clients with some 4,603 customers within and outside Japan. The stable cash flow derived from this strong customer base enables Takemoto to make sustained investments in product molds. Furthermore, the Company's high quality proposal-based marketing capability contributes to high levels of customer satisfaction and repeat business.

① Broad Customer Base ② Bountiful Stock of Molds

As explained earlier, the bountiful stock of 2,777 product molds allows Takemoto Yohki to respond flexibly to customers' needs. In addition, the Company is fortifying its product lineup and promoting development of high-value- added container products with design and functionality taken into consideration. At the same time, efforts are being made to reduce investment burden and risks by standardizing, communizing, and miniaturization.

③ Flexible Product Supply Structure

Takemoto has built a structure that can supply a wide range of products in small volumes and in short delivery times through its manufacturing network of 7 plants within Japan and 2 in overseas markets. Moreover, new manufacturing technologies are being introduced aggressively with product cost, strength and quality in mind, and in order to respond to customers' needs for customized products.

④ "High Levels of Development and Proposal-Based Marketing"

The high levels of development and proposal-based marketing capabilities are the source of the sustained increase in corporate value and contribute to the establishment of a wide customer base. About forty planning, development and technology staff endeavor to realize various ideas for products, taking material, shape, functionality, and safety into consideration. About 1,000 types of Standard Bottle brand products are on display at the Kappabashi Showroom and reflect the high levels of development and proposal-based marketing capabilities of the Company.

|

| First Half of Fiscal Year December 2015 Earnings |

Operating profit of ¥634 million was recorded during the first half, on the back of successful resin raw materials cost reduction efforts effective in Japan from February onwards. Furthermore, improvements in manufacturing efficiency in China also allowed profit margins to rise. By customer industry categories, sales of cosmetics and beauty related products accounted for just under 60% of total sales, and by product categories, sales of in-house "Standard Bottles" products accounted for about 70%. Both of these figures remained relatively unchanged. Sales of both in-house Standard Bottles and custom bottles made from customers' own molds are expected to grow.   Current liabilities declined by ¥46 million despite an increase in accounts payables. Noncurrent liabilities also declined by ¥85 million due in part to a decline in long term loans, and total liabilities fell by ¥131 million to ¥4.898 billion. Net assets rose by ¥385 million to ¥5.463 billion on the back of an increase in retained earnings. Consequently equity ratio rose by 2.5% points to 52.7%.  Acquisition of tangible noncurrent assets contributed to a net outflow of investing cash flow of ¥955 million. Repayment of long term loans caused a net outflow of financing cash flow. As a result of these developments, cash and equivalents declined by ¥528 million from the end of the previous fiscal year to ¥1.257 billion. (4) Topics

Takemoto Packaging maintained 2,777 molds created in-house as of the end of June 2015.① Metal Molds Development Conditions Some of the metal mold manufacturing processes which had been conducted by the Chinese subsidiary were taken back in-house, and metal mold design standardization and development structure expansion and fortification efforts are being implemented to enable Takemoto Yohki to create 500 molds (Total number for both Standard Bottles and custom bottles) by 2017. At the same time, measures to improve quality, shorten delivery times, and reduce costs will be conducted. The Takemoto Yohki Group expects to manufacture 230 molds during the current term.  ② Operations Start at New Plant

In order to secure space accompanying the expanded production of the J-Tom Facility, the operation specializing in extrusion tubes, hitherto made at its plant in Toyama City, Toyama Prefecture, was relocated to a new plant that was constructed in Tateyama-machi, Nakaniikawa-gun, Toyama Prefecture. The new plant began full operation in May 2015. Treatment care products and ultraviolet light protective cream use packaging are manufactured at this new plant.Aside from these products, a plant currently being constructed (the fifth phase construction) at the facilities in Yuki City, Ibaraki Prefecture is expected to be completed during fiscal year December 2015 for printing and secondary formation processes. ③ Development Examples

A 2cc pump dispenser package, which is highly rare for Japan, has been developed. This dispenser is waterproof and is suitable for a wide range of product applications in the toiletries and cosmetics realms. Development for these dispensers will continue to be promoted in the future. This packaging has been developed especially for fundamental cosmetics. In addition to preventing oxidation and being able to handle high viscosity products thereby reducing the residual waste product left over in the packaging, this product also boasts of improved protective quality of contents and the ability to reduce costs through repeat usage. This packaging has been developed for hair dyeing applications. This packaging allows for the contents to be applied directly to the area to be dyed because of its functional cap. |

| Fiscal Year December 2015 Earnings Outlook |

Takemoto Yohki Maintains Its Existing Earnings Estimates, Expects Continued Growth in Sales, Profits

Takemoto Yohki maintains its existing earnings estimates, which call for sales to rise by 4.9% year-on-year to ¥11.605 billion. This sales growth is attributed to the new molds manufactured in Japan and China during 2014.Operating profit is expected to rise by 18.5% year-on-year to ¥1.040 billion. The higher sales are expected to absorb increases in raw materials and labor costs from both Japan and overseas markets arising from expanded production and to allow profits to grow. Control of sales, general and administrative expenses are expected to allow operating profit margin to rise by 1.1% to 9.0%. An interim period end dividend payment of ¥12.00 per share is expected to be paid, combined with an anticipated yearend dividend payment of ¥12.00 for a full year dividend payment of ¥24.00. Consequently, dividend payout ratio is expected to be 20.3%, or just slightly above the Company's target of 20%.  |

| Midterm Business Plan Achievements |

|

Takemoto Yohki maintains the theme of "aggressively taking on new challenges as a development and proposal type bottle packaging manufacturer that is the most sought after company in the world by customers." The numerical targets of this midterm business plan are as follows:  (1) Main Points

<Sales>

Sales are expected to continue to grow on the back of aggressive investments in new metal molds in both Japan and China.Furthermore, Takemoto Yohki has already started cultivating new markets as part of its long-term business growth strategy with facilities opened in Europe and India, in addition to those already operating in the United States, and Thailand. <Operating Profit>

Capital investments to fortify and expand the manufacturing structure, reduce delivery times and improve quality are being implemented to expand sales. At the same time, anticipatory investments to cultivate human resources are also being made with the goal of maintaining operating profit margin of 9%.

<Metal Mold Investments>

In addition to aggressive investments in metal molds for product development in Japan and China, metal mold investments are being made for the United States, Thailand and other markets as well. The number of metal molds developed in-house in Japan and China will be raised from 203 in fiscal year December 2014 to 500 in the future. Orders for standardized, communized and miniaturized metal molds for custom bottles will be expanded. The share of Standard Bottles sales is expected to decline from the current ratio of 72% in the previous term to 62% in fiscal year December 2017.

<Numerical Targets>

While the long term target for return on equity (ROE) is 15%, a lower target of 12.5% has been established as part of the current midterm business plan due to the priority placed upon anticipatory investments.

(3) Overseas Business Deployment Achievements

<China>Despite slowing growth rates in the economy, the Chinese market remains to be a huge market. In addition to differentiating itself from competitors by developing high value added products and fortifying metal mold creation capabilities, Takemoto Yohki is considering strengthening its overall manufacturing capacity. <India> While the timing of the establishment of a subsidiary in India has been revised, Takemoto Yohki will continue conducting market research on the needs of customers and the market with a view to opening a facility there. <Europe> A subsidiary was established on September 16, 2015 in the Netherlands for the purpose of conducting studies of the market and potential sales opportunities locally. <Southeast Asia> Takemoto Yohki is considering upgrading the office in Thailand to become a local corporation. <United States> Consideration of a local business partner is currently being conducted. |

| An Interview with President Emiko Takemoto |

|

<China Market>

While there are many concerns arising from the rapid slowing in the economy and the large decline in share prices in China, there has been no significant change in the order trends for products noted by Takemoto Yohki.However, we still need to be careful and respond carefully to how we extend credit. <Near-Term Business Conditions, Midterm Business Plan>

As I mentioned at the start of the term that we would shift into a higher gear with regards to our business from the current term, our actual business has exceeded both our plans for the first half and the results of the previous year.In particular, our ability to exceed the previous year's levels when there was a rush to purchase ahead of the hike in the consumption tax is attributed to ad hoc demand for containers for aroma and fragrance related product applications and is a reflection of underlying strong demand for our products. And while we are on target to achieve the goals determined within our midterm business plan, we need to accelerate the speed of development for Standard Bottles a step further. We will also implement measures to achieve development of 500 molds by 2017 and will further fortify our human resources and our overall development structure. <Regarding Custom Bottle Innovation>

Takemoto Yohki has determined to adopt the name "Custom Bottle Innovation" in April for a project designed to double the number of client proposals and to strengthen our proposal marketing capability.But because most of our proposal-based sales and marketing have been for Standard Bottles, our managing directors who understand the meaning, concept and actual work flow for "Custom Bottle Innovation" have been responsible for conducting sales and marketing activities. In the future, we will educate all of our sales staff by sharing information to enable them to conduct sales and marketing for custom bottles. Because many of our clients think of Takemoto Yohki as only manufacturing Standard Bottle branded containers and packaging, our marketing and sales efforts for our custom bottles has been well received by customers. Therefore, these efforts have enabled us to strengthen our relationships with clients by providing them with potential solutions to match their needs and to expand our share. <Need for Ongoing Strengthening of Our Development Capabilities>

One of our largest strengths is our development capability. Our development staff with bountiful experience have taken the lead in our development function until now, and we will train new staff how to leverage the knowhow and experiences accumulated within Takemoto Yohki, and how to establish close relationships with customers based upon their knowledge of customers' needs and overseas market conditions. In addition to innovation in our development processes, we will endeavor to provide high value added services acting as consultants and advisors in our marketing efforts through collaboration with universities to introduce new plastic processing technologies into our design and manufacturing processes. In addition to cultivating designers that can conduct a wide range of design functions, we will also cultivate the diverse talent of our sales staff to provide a wide range of marketing functions. <Efforts to Deal with Environmental Issues>

As a company that deals in plastic products that use petrochemicals, Takemoto Yohki takes proactive steps to help preserve the environment.Based upon the theme of developing containers and packaging that are environmentally friendly, we pursue a strategy that entails four main goals of 1) manufacture of containers and bottles that use "recycled PET" reclaimed from used bottles, 2) manufacture of products that use environmentally friendly materials such as "biomass plastics" that do not use petroleum materials, 3) manufacture of reusable containers and packaging that can be used repeatedly or can contribute to volume reduction, and 4) developing products which reduce the carbon footprint. In particular, "biomass plastic" products are particularly advantageous in that they can reduce the use of petroleum materials by over 40%. Pricing is determined comprehensively by customers in the process of selecting a product and cannot be determined solely by Takemoto Yohki, but we will promote proposal-based marketing activities designed to gain further acceptance of our products by clients. |

| Conclusion |

|

As in the previous Bridge Report, a comparison is provided below between the earnings results and share price index of Takemoto Yohki and those of the peer group companies, which have been selected on the basis of keywords such as plastic, packaging and manufacturer. Relative to the peer group, the high return on equity of Takemoto Yohki has contributed to a relatively high price-to-book ratio.   <Disclaimer>

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015, Investment Bridge Co., Ltd. All Rights Reserved. |