| Takemoto Yohki Co., Ltd. (4248) |

|

||||||||||

Company |

Takemoto Yohki Co., Ltd. |

||

Stock Code |

4248 |

||

Exchange |

Second Section, TSE |

||

Industry |

Chemical (Manufacturing) |

||

President |

Emiko Takemoto |

||

HQ Address |

2-21-5 Matsugaya, Taito-ku, Tokyo |

||

Year-end |

End December |

||

URL |

|||

* Stock price as of closing on March 17, 2016. Number of shares at the end of the most recent quarter excluding treasury shares.

ROE and BPS are from the end of the recent fiscal year. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. A 10 for 1 stock split was performed on September 12, 2014 and EPS and dividends have been retroactively adjusted to reflect this split.

We present this Bridge Report reviewing the company overview, the first half of the fiscal year December 2015 business performance and future growth strategy for Takemoto Yohki Co., Ltd.

|

| Key Points |

|

| Company Overview |

|

<Corporate History>

Shigeru Takemoto (Grandfather of the current President Emiko Takemoto) started his business under the name of Takemoto Shoten in 1950, amidst the shortages of goods in the post World War II era, for the recycling of glass products. In 1953, Mr. Takemoto converted his business into a limited company and renamed it Takemoto Yohki Co., Ltd. and began manufacturing glass containers. In 1963, Takemoto started dealing in its signature brand "Standard Bottles."A regional sales office was opened in Osaka in 1980. Masahide Takemoto (Currently advisor to the Company and the father of Emiko Takemoto) took the helm of the Company and explored new markets in the Kansai region, where its main sales had been limited to "custom made" products, with bottle dealers and accessory dealers being separated. In its efforts, the Company leveraged both the "Standard Bottles" and "one stop product provision." The wide range of products allowed the Company to capture demand from customers and expand its sales channels. After the expansion into the Osaka region, a groundbreaking feat back then, the Company further expanded into Fukuoka, Sapporo, and Nagoya regions, and succeeded in building its nationwide sales and service coverage network.

<Market Environment>

As demonstrated in the graph shown below, the market value of the shipments of packaging containers has trended sideways in recent years, and the outlook for declines in the Japanese population is expected to limit any increases in demand within Japan in the future.

Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production." Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production." Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions." Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions." Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured both on time and in the required volumes. Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured both on time and in the required volumes. <Business Description>

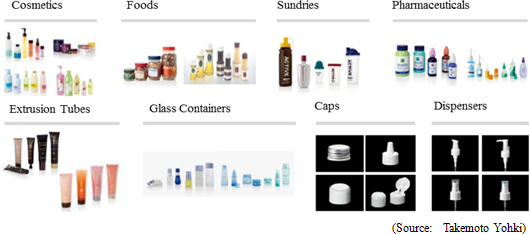

Takemoto Yohki Co., Ltd. manufactures and sells containers and accessories such as caps and dispensers, for use by customers in the cosmetics and beauty, general and health foods, sundries, and chemical and pharmaceuticals industries. The Company does not manufacture mere containers to hold substances; it primarily creates high value-added products while paying close attention to design, function, barriers, safety and environmental issues.

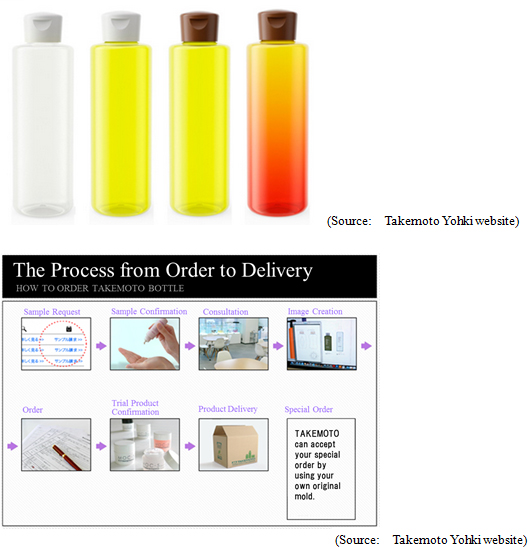

Business Model Business ModelIn contrast to the above, Takemoto Yohki creates molds in-house on behalf of the customer. Having allowed the customer to choose molds of its preference from a wide range of products, Takemoto manufactures and delivers the products. Therefore, the delivery time and development costs of packaging containers are reduced and customers can purchase only the required amount of containers as needed at the time. In this manner, Takemoto Yohki is able to plan and create its own brand of containers, which it calls "Standard Bottles," through this strategy of creating and owning the molds in-house. Takemoto owned 2,843 molds as of the end of December 2015 and boasts of the industry's largest collection of molds. At the same time, Takemoto can offer customized products that match customers' needs by using different caps and other accessory parts, and by changing the color and printing used on the Standard Bottle products. Furthermore, the Company boasts of inventories of 1,213 types of products, helping it to realize short delivery times of a wide variety of products in small lots.  Standard Bottle sales comprise approximately 70% of total sales. In addition, the Company deals in products made from molds manufactured by customers and, as part of its trading firm function, purchases products made by other companies.   ROE is considered by the Company to be an "important management benchmark" and it will endeavor to achieve a stable level of 15% or above over the medium term. <Characteristics and Strengths>

Takemoto Yohki boasts of an extremely wide range of clients with some 4,648 customers within and outside Japan. The stable cash flow derived from this strong customer base enables Takemoto to make sustained investments in product molds. Furthermore, the Company's high quality proposal-based marketing capability contributes to high levels of customer satisfaction and repeat business.

① Broad Customer Base ② Bountiful Stock of Molds

As explained earlier, the bountiful stock of 2,843 product molds allows Takemoto Yohki to respond flexibly to customers' needs. In addition, the Company is fortifying its product lineup and promoting development of high-value- added container products with design and functionality taken into consideration. At the same time, efforts are being made to reduce investment burden and risks by standardizing, communizing, and miniaturization.

③ Flexible Product Supply Structure

Takemoto has built a structure that can supply a wide range of products in small volumes and in short delivery times through its manufacturing network of 7 plants within Japan and 2 in overseas markets. Moreover, new manufacturing technologies are being introduced aggressively with product cost, strength and quality in mind, and in order to respond to customers' needs for customized products.

④ "High Levels of Development and Proposal-Based Marketing"

The high levels of development and proposal-based marketing capabilities are the source of the sustained increase in corporate value and contribute to the establishment of a wide customer base. About forty planning, development and technology staff endeavor to realize various ideas for products, taking material, shape, functionality, and safety into consideration. About 1,000 types of Standard Bottle brand products are on display at the Kappabashi Showroom and reflect the high levels of development and proposal-based marketing capabilities of the Company.

|

| Fiscal Year December 2015 Earning Overview |

Sales, Profits Grow by Double Digits on Strong Demand for Standard Bottles and Improvement in Capacity Utilization Rates, Beat Estimates

Sales rose by 10.5% year-on-year to ¥12.221 billion.Demand for Standard Bottle brand products within Japan remained strong and newly acquired projects also rose. Demand from cosmetics related applications within Japan was strong due to increased inbound demand. At the same time, aggressive development and proposal-based marketing allowed both Standard Bottle and custom bottle product development to trend favorably. In addition, an expansion in extruded tube production due to the start of operations of the new plant in May 2015 also contributed to the higher sales and profits. In China, development and proposal-based marketing allowed sales of both Standard Bottle and custom bottle products to grow. In addition, strengthened marketing led to an increase in new project acquisitions. The weakening of the yen relative to the Chinese yuan contributed to a ¥319 million increase in foreign exchange translation gains. Operating profits rose by 42.5% year-on-year to ¥1.250 billion. Within Japan, a change in depreciation and amortization accounting practice from declining balance method to straight line method and declines in plastic raw materials pricing also contributed to the higher profits. And in China, favorable foreign exchange rates, in addition to improvement in capacity utilization rates and declines in raw materials prices, contributed to a ¥36 million increase in foreign exchange translation gains. Increases in orders for new projects and repeat business, and the foreign exchange translation gains of the China subsidiary due to weak yen contributed to the upward revision to earnings in November 2015. In addition, Takemoto Yohki raised its dividend payment forecast from ¥12 to ¥16 per share, to yield a full year dividend payment of ¥28 when combined with the interim dividend of ¥12, and for a dividend payout ratio of 19.2%.   Along with an increase in payables, current liabilities rose by ¥132 million. Noncurrent liabilities rose on the back of a ¥219 million increase in long term loans, and total liabilities rose by ¥351 million from the end of the previous term to ¥5.381 billion at the end of the current term. Net assets rose ¥498 million to ¥5.575 billion on the back of an increase in retained earnings. Consequently, capital adequacy ratio rose by 0.7% points to 50.9%.  An increase in acquisition of tangible assets and other factors contributed to an expansion in the net cash outflow of investing activities, and caused free cash flow to turn from a net inflow in the previous term to a net outflow in the current term. The disappearance of income derived from the issuance of shares in the previous term caused a net outflow to be seen in financing cash flow. Cash position declined by ¥417 million from the previous term to ¥1.369 billion during the current term. (4) Topics

Some of the metal mold manufacturing processes which had been conducted by the Chinese subsidiary were taken back in-house, and metal mold design standardization and development structure expansion and fortification efforts are being implemented as part of Takemoto Yohki's medium term target of doubling its metal mold development capacity of 2015 by 2018.◎ Metal Molds Development Conditions Takemoto Yohki was able to manufacture 244 metal molds, exceeding the 230 metal molds (in a total of Standard Bottle and custom bottle products) that the Company had planned to produce in fiscal year December 2015.  |

| Fiscal Year December 2016 Earnings Estimates |

Consecutive Terms of Sales Growth, but Anticipatory Investments Lead to Profit Decline

Takemoto Yohki's earnings estimates call for a 4.6% year-on-year increase in sales to ¥12.788 billion due to the outlook for a continued expansion in demand for Standard Bottle brand products. Aggressive development and proposal-based marketing will be conducted to expand sales of custom made bottles as well. At the same time, an increase in raw materials pricing, in part, is expected to contribute to a decline in gross profit margin.Operating profit is expected to decline by 3.9% year-on-year to ¥1.202 billion due to increases in depreciation arising from anticipatory investments to expand manufacturing capacity. Interim and yearend dividends of ¥14.00 per share each are expected to be paid, for a full year dividend of ¥28.00 per share and a projected dividend payout ratio of 20.4%, which is in line with the Company's dividend payout ratio target of 20%.  However, the influence of the currency translation of the Chinese Yuan Renminbi (RMB) relative to the Japanese Yen (JPY) is large because of the Chinese subsidiary. And despite the small scale of the United States subsidiary, the influence of the US Dollar (USD) is also large because of the sourcing of raw materials |

| Medium Term Business Plan Achievements |

|

| An Interview with President Emiko Takemoto |

|

<Expansion of Custom Bottle Innovation>

In addition to the continued expansion in demand for Standard Bottle brand products, awareness is also steadily on the rise among our employees about custom bottle innovation.If Standard Bottle products are "set meals," then custom bottles are what could be called "creative cuisine." And while staff from not only marketing and development, but also technology, manufacturing, and patent related divisions need to participate in projects for Standard Bottle brand products, weekly performance of the "plan, do, check, act" (PDCA) cycle is conducted to help successfully resolve various issues of clients. This track record has enabled Takemoto Yohki to meet the requirements of its clients and expand its business. The rich customer base and metal mold inventories, and the ability to supply products that respond to clients' needs have been critical factors in making the Standard Bottle business successful. Consequently, Takemoto Yohki is equipped with one of the world's largest inventories of molds as well as a business structure capable of acquiring clients from all over the world. In addition, the ability to increase the capacity utilization of metal molds will lead to a reduction in costs and internalization will also lead to further reductions in costs that will help to raise the Company's competitive strength. Therefore, Takemoto Yohki should be able to leverage its assets of development and technological expertise cultivated in the Standard Bottle business to expand the custom bottle innovation business. <With Regards to the Chinese Market>

The slowing in growth of the Chinese economy is actually larger than anticipated.Takemoto Yohki has expanded the range of its clients beyond the cosmetics industry to include those in the food and pharmaceutical industries. At the same time, the high quality of its client base has prevented the Company from being affected by uncollectible accounts and other unfavorable trends. But because uncertainties surrounding the Chinese economy are expected to continue, Takemoto Yohki is strengthening its credit management function a step further by acquiring various detailed financial data on clients. Also, the outstanding earnings estimates have been based on conservative assumptions for the conditions within China. <Future Metal Mold Development>

Takemoto Yohki maintains targets of expanding molds by over double their current level to 420 in 2017, and 540 in 2018.The development processes are mainly conducted in China. And in addition to capital investments for plants, investments in staff hiring and training to improve efficiency of the manufacturing process and raise retention rates are also necessary. Moreover, efforts are being conducted at both the China subsidiary and the parent Takemoto Yohki to further improve the management capabilities to ensure smooth operations of the entire Takemoto Yohki Group. Meanwhile on the Japanese side, recruiting good designers is important, because the Japanese operations play the design function. Also critical in Japan is hiring patent experts, due to anticipated need for globally conducting patent surveys. Furthermore, there is a need to cultivate staff with a wide range of skills within the marketing and design functions, in addition to the actual process of conducting product design. |

| Conclusion |

|

And while profits are forecast to decline due to anticipatory investments in the coming term, the potential for positive surprises exists if Takemoto Yohki can achieve higher sales by expanding top-line growth. <Disclaimer>

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016, Investment Bridge Co., Ltd. All Rights Reserved. |