| Nihon Enterprise Co., Ltd. (4829) |

|

||||||||

Company |

Nihon Enterprise Co., Ltd. |

||

Code No. |

4829 |

||

Exchange |

Tokyo Stock Exchange, First Section |

||

Industry |

Information, Communications |

||

President |

Katsunori Ueda |

||

HQ Address |

Shibuya 1-17-8, Shibuya-ku, Tokyo, Japan |

||

Year-end |

May |

||

Home Page |

|||

* Share price as of close on April 4, 2016.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. Effective from fiscal year May 2016, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated hereafter as parent net income).

* A 100 for 1 stock split was conducted on December 1, 2013. This Bridge Report provides details of Nihon Enterprise Co., Ltd. and information pertaining to earnings results for the third quarter of fiscal year May 2016. |

| Key Points |

|

| Company Overview |

|

Nihon Enterprise listed its shares on the NASDAQ Japan Market (Currently called the JASDAQ Market) of the Osaka Securities Exchange on February 16, 2001. On July 10, 2007, it moved its listing to the Second Section Market of the Tokyo Stock Exchange, and then to the First Section Market on February 28, 2014. <Corporate Philosophy>

Nihon Enterprise's employees are committed to maintaining the basic corporate philosophy by repeatedly learning from the philosophy reflected in its "Mission Statement, Doctrine, and Five Spirits" and "Nihon Enterprise Management Principles." President Katsunori Ueda believes that it is Nihon Enterprise's obligation to maximize "shareholder value" and "make effective use of capital by not wasting a single yen".President Katsunori Ueda founded Nihon Enterprise with the strong motivation of "contributing to society through its businesses" and the Company pursues the achievement of this goal. Consequently, the Company seeks to contribute to society by increasing the satisfaction of its users through the provision of convenient information technology equipment and interesting and diverse contents and services. Based upon the management philosophy of President Katsunori Ueda, the bulk of the ordinary income earned in the founding year of the Company was donated to the Japan Red Cross Society, the Japan National Council of Social Welfare and various children's institutions. Also, donations were made to the Japan Red Cross Society at the time of the Great East Japan Earthquake to support the victims and the reconstruction efforts in North Eastern Japan. Mission Statement

Nihon Enterprise seeks to contribute to society and to promote culture through its activities conducted as a commercial entity.

Philosophy

Nihon Enterprise vows to achieve the five commitments listed below in its pursuit of improving employment conditions.

<Corporate Group: 9 Consolidated Subsidiaries, 5 Non-Consolidated Subsidiaries>

The Nihon Enterprise Group is comprised of a total of nine consolidated subsidiaries with seven within Japan including the company Dive Co., Ltd., which provides advertising services, At The LOUNGE Co., Ltd. which provides music related services, Advanced Traffic Information Services, Corporation (ATIS Corp.), which provides traffic and other information services, 4QUALIA Co., Ltd., which provides web and mobile site development and maintenance services and contents development, HigLab Co., Ltd., which conducts native application development as part of the mobile contents business, and One Inc., which provides voice communications related solutions, and Aizu Laboratory, Inc., which conducts smartphone application planning and development. The two overseas subsidiaries include Enterprise (Beijing) Information Technology Co., Ltd., , which oversees the operations in China and operates cellular telephone retail shops, and Rice CZ ( Beijing) New media technology Co., Ltd., which provides IT related educational services in China. The Group also maintains five non-consolidated subsidiaries of which three operate in Japan including Yamaguchi Regenerative Energy Factory Co., Ltd., which was established in June 2015 to conduct smart community business, Promote, Inc., which conducted a third party placement funding in July 2015 and provides development of applications for smartphones and automated kitting tools, and NE Yinrun Co., Ltd., which was established in October 2015 to provide wholesale services in China. In addition, two non-consolidated subsidiaries are operated in overseas markets including Rise MC (Beijing) Digital Information Technology Co., Ltd., which provides mobile contents distribution and character licensing services in China, and NE Mobile Services (India) Private Limited, which is a company operating in India. <Characteristics, Strengths>

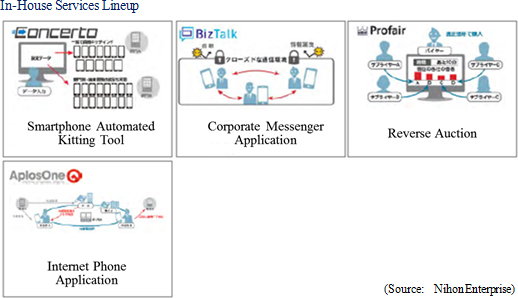

A characteristic and strength of Nihon Enterprise is its "devotion to in-house development". The Company maintains a unique strategy focused upon the development and ownership of its own contents created in house (Intellectual properties) as part of its unique business model. This strategy has also enabled the Company to expand sales of its performance based compensation (Success fees) contents through cooperation with cellular telephone sales companies to conduct affiliate program contents sales (Real affiliates developed independently). In addition, these experiences are leveraged in its mobile communications solutions for corporations.

|

| Various Business Strategy Achievements in Fiscal Year May 2016 |

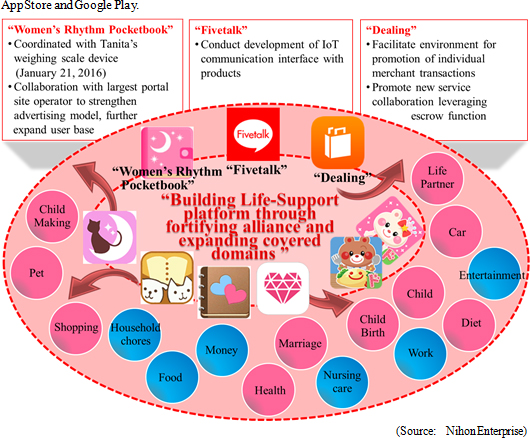

Within the entertainment category, Nihon Enterprise maintains a total of over 30 contents in popular genre are distributed across various carrier platforms, and is implementing efforts to distribute new contents through various alliances. "Kokoro to Shintai Music" music service, which had been distributed across au Smart Pass and App Pass platforms, also began being distributed across NTT Docomo's d Menu platform from February 15, 2016. In the lifestyle category, efforts will be made to establish the life support platform by strengthening of alliances and expanding coverage area. During the aggregated first three quarters, strengthening of "Women Rhythm Pocketbook", "Fivetalk", "Dealing" and other existing contents was conducted along with efforts to expand the coverage area, including the successful launch of "Everyday Dog and Cat Diary" distributed across carrier platforms (October 2 to December 17, 2015), and "Lets Make Kids' Lunch" and "Welcome to Prince's Room" distributed across App Store and Google Play.    In the solutions business, efforts were implemented to strengthen in-house services and consigned development, and cultivate businesses that can contribute to rejuvenation of regional economies. The operating environment for consigned development was favorable on the back of an expansion in information system investments by corporations and intensified shortages of information technology engineers. During the aggregated first through third quarters, website creation for major esthetic beauty salons and major publishing companies, distributed computing system creation for game companies, and debugging services grew. With regards to new projects, validation services for carriers, hospital reservation system development project and consigned development and operations of interactive voice response (IVR) and web services were acquired. Progress was also made in cultivating new customers and demand at the end of the fiscal year in March. With regards to in-house services responding to the introduction of smartphones and tablets by corporations, the subsidiary Promote, Inc. saw favorable sales of kitting tools.    Marriage, pregnancy, child birth, child rearing support application "Chiba My Style Diary" (Chiba Prefecture) Smart Agriculture (Aizu Wakamatsu City, Fukushima Prefecture) Energy Conservation Visualization (Fukushima Prefecture) Tourism Business (Inbound) Factory Visit Application (Saitama Prefecture) Tourism Business Navigation Application "Fingertip Navigation", From Fukushima to Japan Nationwide Tourism Business History Search AR Navigation "Shiroishsi Shiro Shiro Navigation" (Shiroishi City, Miyagi Prefecture) Falling Birthrate Countermeasure, Child Rearing Support Application "Shimoda Child Diary" (Shimoda City, Shizuoka Prefecture) Solar Power Generation Based Regional ICT Service (Ube City, Yamaguchi Prefecture) Administrative - Resident Information Sharing Application (Yokoshibako Town, Chiba Prefecture) |

| Third Quarter of Fiscal Year May 2016 Earnings Results |

Monthly Fixed Rate Fee Membership Numbers Rising, Solutions (Consigned Development), Advertising Sales Growth Contributes to Large Improvement in Operating Profitability

Sales of ¥1.474 billion were recorded during the third quarter of fiscal year May 2016 on the back of a large year-on-year increase in sales of the solutions business resulting from strong demand for solutions and advertising related work. At the same time, the contents services business saw a year-on-year decline in its sales, despite the ability to secure similar level of sales as the previous year in lifestyle contents and an increase in sales of traffic information due to a rise in the number of members. Furthermore, entertainment sales have begun to recover after declining for the past two consecutive quarters.With regards to profits, cost of sales margin rose on the back of an increase in the sales composition of the solutions business, but a decline in sales, general and administrative expenses due in part to lower advertising expenses and the rise in sales allowed operating income to improve from a ¥13 million loss in the previous third quarter to a profit of ¥108 million in the current third quarter. Advertising expenses had risen during the previous first half due to aggressive advertising for games, and during the current first half for traffic information and prefatory sales of collaborating cellular telephone sales companies (Tie-up advertising promotion). These efforts have contributed to an increase in sales of traffic information and contributions from the newly acquired monthly fixed rate subscribing members during the third quarter. At the same time, the spending upon advertising is expected to subside from here forward.    Sales, Ordinary Income Rise 7.5%, 33.1% Year-On-Year

Sales rose by 7.5% year-on-year to ¥4.022 billion. While sales of the contents services business declined by 11.4% year-on-year to ¥1.693 billion due to weak contents sales over carrier platforms, sales of the solutions business rose by 27.3% year-on-year to ¥2.328 billion. At the same time, operating income rose by 32.8% year-on-year to ¥152 million. The increase in the solutions business composition of sales from 48.9% to 57.9% contributed to an increase in the cost of sales margin and a decline in gross income by 1.3% year-on-year to ¥1.771 billion. However, sales, general and administrative expenses declined by 3.7% year-on-year to ¥1.618 billion on the back of reductions in advertising spending from ¥582 million in the previous term to ¥471 million in the current term. The decline in net income is attributed to the decline in extraordinary income from sale of investment securities from ¥331 million in the previous term to ¥17 million in the current term.

At the same time, the solutions business benefitted from large growth in sales of consigned development and other solutions services. Also, a strong tripling of handset terminals sales to corporations in China allowed the overseas category to see a strong rise in sales. The influence of the disappearance of extraordinary demand seen in the previous term has been mostly offset and sales of the advertising category (Advertising agency services) remained basically in line with the previous year.  |

| Fiscal Year May 2016 Earnings Estimates |

Full Year Earnings Estimates Remain Unchanged, Sales, Ordinary Income Expected to Rise 2.4%, 12.4% Year-On-Year

Sales, operating income, and ordinary income achieved during the first three quarters of the current fiscal year represent 76.8%, 72.6% and 72.9% respectively of full year estimates for the current term (Similar achievement figures in the previous term were 73.1%, 60.5% and 61.6% respectively). Efforts to develop new contents, improve user engagement, and fortify alliances will be conducted to improve sales of the contents business. At the same time, efforts will be made in the solutions business to capture fiscal year end demand in March. Nihon Enterprise is expected to pay a yearend dividend of ¥3 per share.

|

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016, All Rights Reserved by Investment Bridge Co., Ltd. |