| KITZ (6498) |

|

||||||||

Company |

KITZ CORPORATION |

||

Code No. |

6498 |

||

Exchange |

TSE 1st Section |

||

Industry |

Machinery (Manufacturing) |

||

President |

Yasuyuki Hotta |

||

HQ Address |

1-10-1 Nakase, Mihama-ku, Chiba, 261-8577, Japan |

||

Year-end |

March |

||

URL |

|||

* Stock price as of closing on 5/28. Trading unit has been changed to 100 shares as of 2010/7/1.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company issued on May 14, 2010.

Mail: kitz@cyber-ir.co.jp |

| Key Points |

|

| Company Overview |

|

(Corporate History)

KITZ was originally established in January 1951 under the name of Kitazawa Seisakusho Co., Ltd. to manufacture and sell various valves and other devices. In April 1951 the Nagasaka Plant in Yamanashi Prefecture was completed where the manufacture of bronze valves was started. In March 1959 a subsidiary called Toyo Kinzoku Co., Ltd. was established for the manufacture of brass bars as raw materials for its valves. In September 1962 the Company name was changed to Kitazawa Valve Co., Ltd. and in October of the same year the Company became the first in Japan to use a brass hot forged press machine in its manufacturing process and began sale and manufacture of brass forged valves. Thereafter, the Company expanded its product line-up to include stainless steel materials and the manufacture of stainless steel valves began at its Nagasaka Plant from November 1970. Since the Company’s founding, it has been able to grow by adhering to its mottos of “always providing better products, at cheaper prices, and with quicker delivery times” that make up the foundation of its business. In April 1977 Kitazawa Valve was listed on the Second Section of the Tokyo Stock Exchange, and in September 1984 the Company moved to the First Section. In October 1992 the official English name of KITZ Corporation was adopted in reflection of the Company’s growing global presence. In August 1995 the Company entered the fresh water supply market through its acquisition of Shimizu Alloy Manufacturing Co., Ltd. and subsequent conversion to become a subsidiary. KITZ also entered the field of semiconductor manufacturing through its introduction of industrial use filters in March 1996. From 2001 onwards, KITZ started a strategy of “selection and concentration” within its business realms and also promoted cash flow management as a key management issue. In November 2001 KITZ acquired the semiconductor manufacturing equipment business of the former Benkan Group. In March 2004 KITZ acquired the valve business of Toyo Valve Co., Ltd. and combined it with its bar product business to be spun off and established as a separate company named KITZ Metal Works Co., Ltd. From 2005 to 2006 KITZ acquired the copper bar manufacturing business of Kyoto Brass Co., Ltd. as well as the assets of Kichou Shindosho Co., Ltd. as part of its strategy of fortifying its bar manufacturing business. In May 2007 KITZ established a valve manufacturing company in Lianyungang China called KITZ Corporation of Lianyungang Through this process KITZ has grown to become one of the world’s leading valve manufacturers with 31 consolidated subsidiaries around the world. The “KITZ brand” has also become widely recognized around the world as a manufacturer of high quality valves and other products. (Overview of KITZ’s Business Segments)

KITZ’s business is divided into the Valves Manufacturing, Brass Bar Manufacturing and Services and Other Businesses segments. During fiscal year March 2010 each of these divisions accounted for 73.1%, 16.8% and 10.1% respectively.

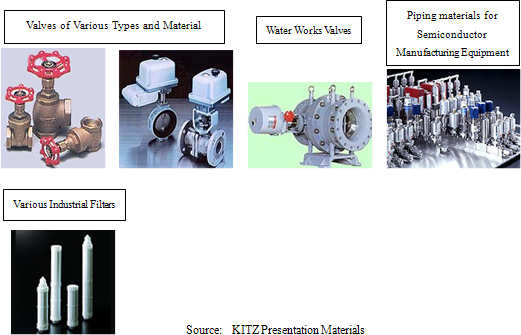

Valve Manufacturing Business

KITZ Group’s core business is the manufacture and sale of valves, connectors and other fluid control devices that play an important role in fresh and sewage water distribution, water heating, gas supply, and air conditioning applications, as well as in various applications within the petroleum, chemical, paper and pulp, semiconductor and other industries.

Brass Bar Manufacturing Business

In the brass bars business KITZ combines copper with zinc to create brass, tin and phosphorous to create phosphor bronze, and nickel and zinc to create nickel silver, which are then used in the dissolving, rolling, pulling, forging, heating, forming processes to create sheets, strips, pipes, bars, wires and other forms. The KITZ Group’s brass bar business uses the raw material of brass to manufacture and sell brass bars. These brass bars are used not only as materials for valves, but also in the manufacture of various water faucets, gas equipment, electrical appliances and other products.

Services and Other Businesses

KITZ operates sports and fitness clubs, hotels and restaurants, and sells glass art work in its services and other businesses division.

|

| Fiscal Year March 2010 Earnings Results |

Declines in Sales, Profits, But Above Estimates

Sales fell by 24.0% year-over-year to ¥96.592 billion during fiscal year March 2010. This decline is attributed to weak demand for valves both within Japan and in overseas markets, and large declines in sales of brass bars. However KITZ’s efforts to reduce both costs of goods sold and fixed costs, and the consolidation of production facilities contributed to an improvement in profitability and operating income fell by a smaller margin of only 3.0% year-over-year. While a foreign currency translation loss of ¥112 million was incurred, improvements in financial income allowed non-operating income to trend sideways. At the same time impairment losses of ¥1.174 billion were incurred on valve manufacturing, fitness clubs, and its Suwa Glass No Mori facilities. Consequently an extraordinary loss of ¥1.762 billion was recorded and net income fell by 9.3% year-over-year. Also overseas sales as a percentage of total sales fell by 0.4% points to 20.9% during the term under review.

Valve Manufacturing Business

While sales bottomed during the first quarter of the fiscal year under review, the pace of the subsequent recovery was very slow and a decline in full year sales could not be averted. And while operating income fell by 14.8% year-over-year, successful efforts to reduce cost of goods sold and other fixed costs allowed the Company to revise its operating income forecasts up four times during the term and in the end its actual operating income results exceeded its outstanding estimates. KITZ attributes the improvement in profitability to lower raw materials prices, efforts to reduce and eliminate various costs including outsourced work, bonuses, and commissions. At the same time the Company explains that reduced order volumes and pricing strategy were two factors that negatively impacted its earnings. Also in December 2009 KITZ acquired the German valve maker Perrin GmbH. In the future, KITZ will leverage Perrin’s strengths to expand sales of products to the petroleum refining and petrochemical manufacturing industries in Europe.

Brass Bar Manufacturing Business

In addition to weak overall demand (brass bar market contracted by 12% year-over-year) for brass and other bars, weakness in the copper markets contributed to declines in product prices. However KITZ was able to offset some of these weak external factors by consolidating its production facilities and through the realization of valuation gains on raw materials, and this division turned to profits during the current term.

Services and Other Businesses

Some of the positive factors affecting this segment include the reductions in highway tolls that contributed to stronger demand for KITZ’s hotel facilities, and the opening of new sports clubs. Despite an increase operating costs from the newly opened facilities, an increase in revenues allowed KITZ to realize a 14.4% year-over-year increase in operating income within this segment.

(3) Financial Conditions and Cash Flow

The increase in intangible fixed assets is attributed to the acquisition of Perrin GmbH, declines in working capital accompanying the weaker sales, and reductions in interest bearing liabilities contributed, which led to a ¥3.567 billion decline in total assets to ¥97.533 billion at the end of the term under review. With regards to cash flow, the acquisition of Perrin led to an increase in the net outflow in investing cash flow, while the decline in working capital led to an increase in the net inflow to operating cash flow. Consequently free cash flow rose to ¥8.759 billion during the current term from ¥7.155 billion in the previous term.

(4) Topics

① Acquisition of Perrin GmbH

KITZ seeks to fortify its product lineup through this acquisition by leveraging Perrin’s technology and know-how in metal seat processing. In the future, KITZ will also utilize Perrin’s sales network along with the networks of its subsidiaries in both Spain and the United Kingdom to fortify and expand its sales in the European market.

② Merger of KITZ Metal Works and Kyoto Brass

In order to create a manufacturing structure that can respond flexibly to changes in demand and raise productivity, KITZ has decided to consolidate the two companies’ manufacturing facilities into a single plant. Thanks to this effort, the brass bar segment saw a large improvement in profitability and recorded a profit during fiscal year March 2010.

|

| Fiscal Year March 2011 Earnings Estimates |

Sales Expected to Grow by 8.7% YoY, Ordinary Income to Trend Sideways

During the coming fiscal year March 2011 KITZ estimates its sales to grow by 8.7% year-over-year to ¥105 billion on the outlook for a recovery in demand and improvements in the market conditions for valves, stronger sales of the brass bars segment, and continued brisk sales in the services and other businesses segment. With regards to profits, KITZ projects a deterioration in gross profit margins and a 1.1% year-over-year decline in operating income due to higher raw materials prices and labor costs arising from improvements in market conditions, marketing costs associated with the valve business, and the disappearance of valuation gains on raw materials in the brass bar business. KITZ also bases its earnings estimates on an exchange rate of ¥90 and ¥130 to the U.S. Dollar and Euro respectively, and electrolytic copper prices of ¥650,000 per ton. A dividend of ¥7 per share is expected to be paid to shareholders.

Valve Manufacturing Business

During the coming fiscal year KITZ anticipates valve sales to rise by 6.9% year-over-year due primarily to strong demand from overseas markets. At the same time demand within the semiconductor related markets in Japan is recovering along with a recovery in demand from the building facility market. However demand from the petroleum refining and petrochemical industries are expected to stagnate, and the Company expects demand from other large projects to decline, contributing to only marginal sales growth in this segment. Demand from the Middle East, Asia and other overseas markets are expected to trend strongly. Furthermore the acquisition of Perrin is expected to boost sales in Europe. With regards to profits, KITZ anticipates the positive factors of increased order volumes and effective measures to reduce costs of goods sold to be offset by increases in raw materials and labor costs, and higher IT related investments and consideration of market price policy to lead to lower growth in operating income of 2.0% year-over-year.

Brass Bar Manufacturing Business

KITZ projects sales to rise by 20.2% year-over-year on the back of increased demand for brass bars and a recovery in overall market conditions. However the disappearance of valuation gains recorded during the term under review is expected to lead to a 32.8% year-over-year decline in operating income.

Services and Other Businesses

The positive impact from the reduced highway tolls is expected to diminish during the coming fiscal year and sales of KITZ’s hotels are expected to decline. At the same time KITZ anticipates a slight decline in sales of glass art work. However new fitness club facilities opened in fiscal year March 2010 are expected to offset these negative factors and allow this division’s sales to rise during fiscal year March 2011. The contribution of the fitness clubs is also expected to raise operating income by 16.6% year-over-year.

|

| “KITZ Global Vision 2020” Long-Term Management Plan, and the Medium-Term Management Plan |

① Overseas Markets

KITZ has a strategy of focusing upon three Regional Headquarters (Asia Pacific, America, and Europe), and two hub markets (China and India) in the creation of its management strategy. At the same time KITZ will fortify its sales, marketing, technology, development and production functions. Furthermore the Company has identified water, air conditioning (HVAC = heating, ventilating, air conditioning), petroleum refining, petrochemical, and chemical industries as highly important markets to cultivate.

② Targeting EPC (Engineering, Procurement, and Construction ) Market

KITZ is targeting clients (EPC) in Japan, Korea, Europe and North America as part of its strategy of raising its share of the downstream petroleum refining, petrochemical and gas markets. For this reason, KITZ has endeavored to create a unified structure that includes the orders, shipment and maintenance processes, introduced a product manager system, and trained highly skilled system engineers.

③ Domestic Market

KITZ is targeting clients in the petroleum refining, petrochemical, machinery, gas, electric power, water processing and environment related industries. And for each of these industries KITZ has developed special manufacturing technologies and special marketing forces as part of a highly efficient and effective sales structure. Furthermore the Company is fortifying its ability to respond to applications in the field of instrumentation (Shift from on-off valves to control valves).

④ Participation in New Growth Markets while Seeking Out M&A Opportunities

KITZ endeavors to fortify its capabilities in such high growth countries such as China and India, and in high growth fields including gas, electric power, energy, water distribution and environment related applications. Furthermore KITZ endeavors to fortify its product line-up and its capabilities in the areas of technology, development, sales, and production, and to gain access to market segments where the company has no or low market share through strategic M&A.

⑤ Product, New Business Development

KITZ is devoting efforts to developing new products and businesses in line with the growing concerns to conserve the environment by “thinking outside of the box” and by expanding its focus beyond the product area of valves.

⑥ Infrastructure Creation

KITZ is creating various infrastructures including human resources structure, information systems, and accounting systems to further raise its presence as a global company.

(2) Long Term Management Plan: “KITZ Global Vision 2020”

KITZ has established an overseas sales ratio target of 50%, and sales and operating income targets of ¥250 billion and ¥20 billion respectively for fiscal year March 2021. In addition, the Company is endeavoring to reduce interest bearing liabilities (From ¥27.5 billion in fiscal year March 2010 to ¥24 billion) and raise its net asset ratio to 70% from 54.3% in fiscal year March 2010. At the same time KITZ expects to raise its return on equity ratio from 6% in fiscal year March 2010 to 7%.

① Concept

KITZ maintains a goal of “evolving to become a truly global company” and raising its competitive standing and societal contribution worldwide by maximizing corporate value.

Concept and Basic Policy by Business Segment

Valve Manufacturing Business

“Global and Domestic:” KITZ strives to become the top player in each market and region it has targeted. As a basic policy, KITZ seeks to expand its market share by introducing products that are created using global standards and have high levels of value addition, and KITZ has targeted three regional headquarters and two hub markets, optimizing sales strategies.

Brass Bar Manufacturing Business

KITZ seeks to raise the value addition of its products by maximizing operating efficiencies and using new materials, as well as to expand this business on a global basis. As a basic policy, KITZ will expand its share of overseas markets by creating a global production structure and reduce costs by raising operational efficiency and holding down raw materials prices. It will also develop new materials and businesses as well.

Services and Other Businesses

KITZ will always maintain the perspective of its customers in mind in the provision of its highly detailed services. As a basic policy, KITZ seeks to achieve the following three points: 1) Management will respond with appropriate solutions to the growing demands for services to maintain health and to care for the elderly. 2) The Company endeavors to provide convenient facilities and services. 3) KITZ will respond with solutions on a global basis. KITZ will also fortify its management platform by pursuing the following strategies. “Realizing a truly global structure by hiring appropriate human resources and providing high levels of training to them,” “facilitate the company’s infrastructure to bolster management on a global basis,” “promoting environmental management throughout the Group to help protect the environment,” and “actively pursuing CSR.” |

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2010, All Rights Reserved by Investment Bridge Co., Ltd. |