| KYB Corporation (7242) |

|

||||||||

Company |

KYB Corporation |

||

Code No. |

7242 |

||

Exchange |

TSE 1st Section |

||

Industry |

Equipment for transportation |

||

President |

Yasusuke Nakajima |

||

Address |

World Trade Center Bldg., 4-1, Hamamatsu-cho 2-chome, Minato-ku, Tokyo |

||

Year-end |

End of March |

||

URL |

|||

*The share price is the closing price on June 27. The number of shares issued, ROE and BPS were the values for the previous term.

*The company conducted 1-for-10 reverse share split on Oct. 1, 2017. DPS and EPS represent the amounts before taking into account the 1-for-10 reverse split. |

||||||||||||||||||||||||

|

|

*The forecast is from the company. From the term ended Mar. 2016, the IFRS has been used. The amounts in the term ended Mar. 2015 are those after the IFRS adjustment. From the term ended Mar. 2016, net income is profit attributable to owners of the parent.

*The company conducted 1-for-10 reverse share split on Oct. 1, 2017. DPS and EPS for the term ending Mar. 2018 represent the amounts before taking into account the 1-for-10 reverse split. This report outlines the financial results of KYB for the term ended Mar. 2017 and its mid-term management plan, and includes the interview with Mr. Nakajima, Representative Director, President, and Executive Officer. |

| Key Points |

|

| Company Overview |

|

KYB has a high market share with many products. For instance, shock absorbers for four-wheeled vehicles account for 43% of the domestic market and 15% of the global market. In January 1927, a self-employed enterprise, Kayaba Seisakusho, was established for manufacturing hydraulic dampers, catapults, etc. for aircraft. In March 1935, Kayaba Manufacturing Co., Ltd. was established. After the end of World War II, in June 1956, Kayaba Auto Service Co., Ltd. was established for offering products and services. In October 1959, company's stocks were listed on the Tokyo Stock Exchange. In July 1974, KYB Corporation of America was established in the United States in order to enter the North American commercial market. Then, the company actively entered foreign markets such as Asia and Europe. In October 1985, the company name "Kayaba" was changed from kanji (Chinese characters) to katakana (Japanese Characters). In October 2015, the trade name was changed from Kayaba Manufacturing Co., Ltd. to KYB Corporation in order to further strengthen the brand image. As they changed the corporate name from "Kayaba Manufacturing Co., Ltd." to "KYB Corporation" in 2015, they aim to popularize the KYB brand on a global basis. Therefore, as shown below, the logo "KYB" has the meaning and spirit.  Slanted slits in each letter represent comfortable sunlight cast through the trees and sunbeams illuminating the road ahead. The logo represents an image of unconstrained growth and flexible response to the trends of the era. The right side of the letter "B" represents liquid pressure indicating the origin of KYB. Using italic letters expresses a sense of speedy movement, progressiveness, growth potential, innovativeness. (What the corporate color means) Red represents enthusiasm to create a society where industrial crafting brings happiness to everyone and to provide the technologies that bring a warm and comfortable life. KYB names this red "KYB Red" as the corporate color. ◎Corporate Statements

It means that not only providing reliable quality to general consumers and business partners leads to stakeholders' "advantage (superiority)", but also the joy of manufacturing, which enables each employee to realize that they can change the world with sure quality, becomes "advantage (merit)". ◎Corporate Spirit

As a KYB group that contributes to society by providing technologies and products that make people's lives safe and comfortable, they have the following management philosophy and management vision.

(1) Market Environment

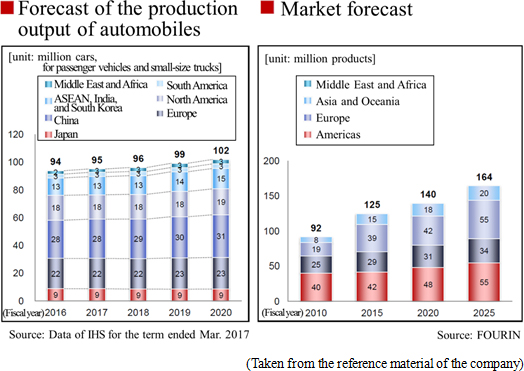

The automobile market and the construction machinery market have a great effect on KYB's performance. KYB recognizes the current and future situations of the two markets as follows. ①Automobile Market

The company calls the former "OEM" and the latter "marketed". Japanese cars are popular in Asia, the Middle East and others, and the commercial market is important for KYB.  ②Construction Machinery Market

(2) Competitors

KYB's domestic competitors include Showa Corporation (7274, TSE 1st section), 33.4% of whose shares are held by Honda, and Hitachi Automotive Systems, Ltd. (unlisted), a group company of Hitachi.① AC Business Its global competitors consist of Sachs in Germany, Tenneco in the U.S., and so on. Sachs has a long history and intimate relationships with European automobile manufacturers. The company's share in the commercial product market is slightly less than 20%. Tokico (which was acquired through M&A by Hitachi and is unlisted; today it is one of the brands of Hitachi Automotive Systems) and Monroe (a commercial brand of Tenneco) have earned a large market share in Japan and globally, respectively. KYB competes with Showa, which is closely related to Honda, in the market of shock absorbers for motorcycles, and with JTEKT Corporation (6473, TSE 1st section) and NSK Ltd. (6471, TSE 1st section) in the steering market. ② HC Business

In the market of cylinders, which are the parts with the highest sales ratio in KYB, Chinese manufacturers and the like are extending their influences. KYB's competitors include Nabtesco (6268, TSE 1st section) in the market of control valves for which KYB has the advanced technology, and Nabtesco and Nachi-Fujikoshi (6474, TSE 1st section) in the market of travel motors. In addition, the largest construction machinery manufacturer in Japan manufactures a number of parts internally.  (1) Segments

KYB's business segments are composed of the following three segments: the "AC Business" consisting of hydraulic shock absorbers for automobiles and motorcycles, power steering, etc., the "HC Business" including hydraulic equipment for industrial use mainly for construction machinery, and the "Others" segment which handles special purpose vehicles such as concrete mixer trucks, aircraft components, system products, electronics, and the like.

① AC (Automotive Components) Business

This segment consists of hydraulic shock absorbers for automobiles and motorcycles, hydraulic equipment for automobiles, and other products.

<Major Products>

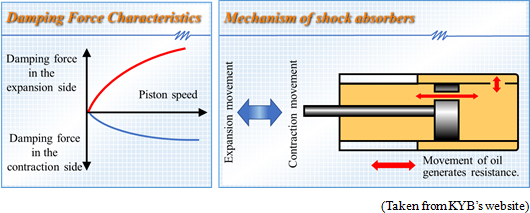

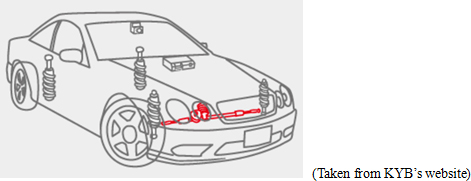

A shock absorber is a device that absorbs vibration of the car body, being mounted between the body and the tires together with a spring.

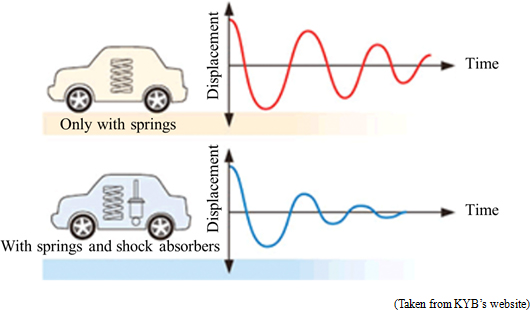

◎ Automobiles (Shock absorbers)  Suspensions have two main functions; one is, as buffers, to prevent transmission of rough road profiles to the car body and another is to set the position of the wheels and axles and press the wheels down on the roads. Basically, a suspension is composed of a suspension arm which fixes the wheel position, a spring which supports the car weight and absorbs vibration, and a shock absorber (damper) which dampens vibration of the spring. Automobiles absorb shock caused by uneven road profiles by contracting the springs, but due to their characteristics, the springs rebound to get back to their original position after the contraction. The top of a spring is connected to the car body and the bottom is coupled with a suspension that includes the heavy tires and brake, which results in, due to inertia, repetition of expansion and contraction of a spring in a range wider than one necessary for returning to its original position. The role of shock absorbers is to reduce the above-mentioned excess vibration as soon as possible in order to stabilize the car body  The tube of a shock absorber contains oil with a piston moving in it. A piston has holes through which oil passes when the piston moves following vibration, and the resistance of the oil generates "damping force." In addition, the moving speed of pistons varies with the degree and velocity of vibration from the car body, and the faster a piston moves, the larger "damping force" becomes. This is called "damping force characteristics."  Furthermore, it is said that shock absorbers usually need to be replaced after 5 years from the date of first registration or when the travel distance reached 100,000 km as they deteriorate due to various factors including travel distance and lapse of time and the function decreases. This replacement demand, which in other words is the commercial product market, is one of the greatest business opportunities for the company. (Steering)

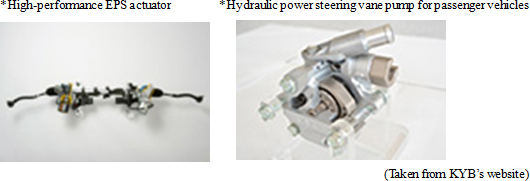

It is the steering system that provides "the function of taking curves," one of the three basic functions of automobiles including "driving," "taking curves," and "stopping."

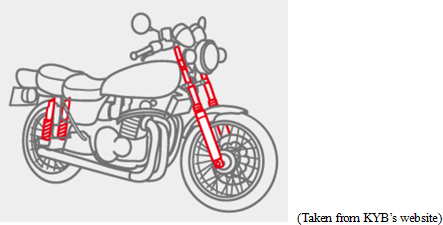

The "PS" enables steering operation by a mere movement thanks to hydraulic force and is an indispensable component for safe driving because of its ability to expeditiously avert risks, whereas the "EPS" whose power source is a battery improves fuel efficiency compared to the "PS" whose power source is the engine of a car.  ◎ Motorcycles

Suspensions minimize shock to the car body regardless of road surface conditions, pursuing comfort.

(Suspensions)  The company's RCUs boost riding comfort by maintaining the posture of vehicles and absorbing vibration and shock from the road surfaces.  ② HC (Hydraulic Components) Business

The HC Business consists of hydraulic equipment for industrial use and other products.

<Major Products>

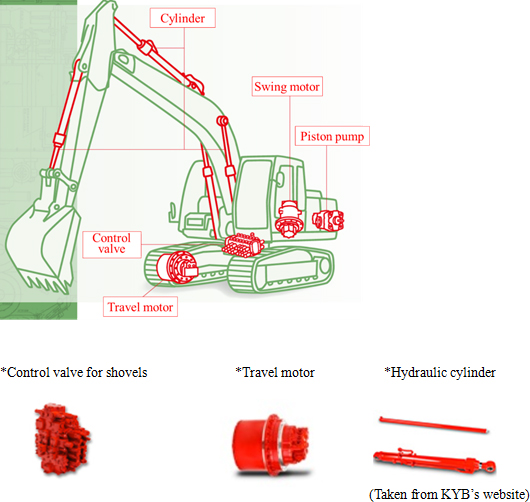

The mechanism of the drive system of construction machinery such as shovels consists of various parts as shown below, including control valves, piston pumps, travel motors, swing motors, and cylinders; it is the control valve, which is the "brain" of construction machinery, that controls a variety of actuators (a drive unit which converts energy to translational or rotary motion through hydraulic pressure and electric motors) to enable smooth movement of driving, turning, and bending and stretching of the arms.KYB's control valves have realized more advanced control by combining electric control with its special hydraulic technology. In addition, KYB is one of the few manufacturers that manufacture all of the above-mentioned parts. KYB's competitive edge is that it can make suggestion to construction machinery manufacturers because it manufacturers all kinds of parts as just mentioned.  ③ Other

The other businesses are composed of special purpose vehicles, hydraulic equipment for aircraft, system products, electronics, and such.

It offers highly-reliable products for aircraft, including various actuators, weight-saving accumulators, and wheel brakes. In addition, KYB has the largest market share in the Japanese market of seismic isolation systems and earthquake dampers to which its unique hydraulic technology has been applied.  (2) Clients and sales channels

◎ ClientsThe following is a list of KYB's major clients. Its shock absorbers are mounted on about 60% of automobiles manufactured by Toyota globally. They are also adopted to about 30% and about 10% of automobiles manufactured by Nissan and Honda, respectively, contributing to KYB's large market share.  ◎ Sales channels

As previously mentioned, KYB supplies its shock absorbers through 2 sales channels including the OEM production system for new vehicles and sale on the market for used vehicles. Although sales of OEM products are higher, its commercially-available products sold as its private brand show great profitability and thus the company will expand the business to the global markets. KYB's commercially-available shock absorbers can be mounted on about 90% of Japanese, American, and European automobiles used worldwide today. What is behind such a high coverage rate is the strong relationships KYB has with major automobile manufacturers including Toyota. (3) Global network

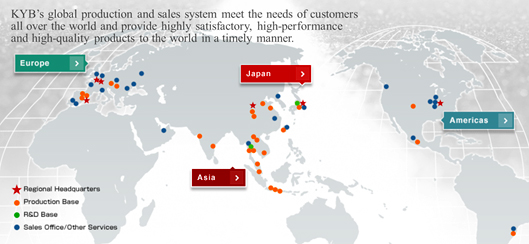

In 23 countries worldwide including Japan, KYB has a total of 64 bases, including 49 group companies, regional headquarters (6), production bases (37), and sales office/other service (21), establishing strong global networks.

(4) Research and Development

(Structure)KYB has established a global and optimum research and development (R&D) structure by setting R&D bases in 5 regions including Japan, North America, Europe, China, and Thailand. While the R&D bases in regions other than Japan basically engage in development of model products and development for enhancing product appeal such as performance improvement and cost reduction, R&D from the long-term perspectives are carried out mainly in Basic Technology R&D Center (Sagamihara-shi, Kanagawa) and Production Technology R&D Center (Kani-shi, Gifu) in Japan and R&D of highly unique prior art, etc are performed. In addition, the know-how about production equipment designing which has been cultivated in Production Technology R&D Center and each plant is gathered in Machine Tools Center (Kani-shi, Gifu) in order to strengthen and propel internal manufacturing of equipment, jigs, and tools for which KYB has strived to boost innovative spirit and reliability. In Electronics Technology Center (Sagamihara-shi, Kanagawa), a system that collects technologies for designing and evaluating electronics, increases development capabilities, and conducts a series of processes ranging from product development to prototype evaluation and mass production in a smooth and prompt manner has been established. Regarding high-functionality and systematization of its products, KYB, in addition to independent development, propels joint research and development with its clients or related equipment manufacturers. The company is also endeavoring proactively to developing advanced technology through industry-academia collaboration. (Variation in R&D expenses) Since the term ended Mar. 2013, the company has raised its awareness about the ratio of R&D expenses to sales, maintaining the ratio at about 2%.  KYB is propelling the development of products by dealing with performance improvement, high functionality, and systematization and considering eco-friendliness with respect to energy and environmental issues through weight saving, energy saving, reduction in environmentally hazardous substances. At the same time, it is striving to strengthen its production technology capabilities. In addition, following the accelerated globalization, it aims to set up a strategic and global production, sales, and technological structure, including development of human resources with global outlooks and establishment of a standardized management system. Lately, the company has focused on product development related to automatic driving systems. One example is the technology that integrates EPS (electronic steering) and shock absorbers. KYB considers that the technology, which enables more comfortable and smoother driving in any road surface conditions independently of the drivers' skills and judgment, is definitely indispensable for automobiles with the automatic driving system. Furthermore, it deems the "steering by wire" system is another technology whose importance will grow in the future. In the conventional steering operation, movement is transmitted to the steering gear box and tires through the steering shaft, whereas the "steering by wire" system conveys steering movement via electronic signals. Some of the system's advantages include the capability of relieving drivers' fatigue due to less vibration from the tires, and the capability of automatically adjusting sideslips of the car body due to strong winds which conventionally needed to be adjusted through an intentional steering operation by drivers. In addition, thanks to the "steering by wire" system, the steering wheel may not necessarily be mounted on the right front of a car, and therefore, the system's potential for considerably changing the way automobiles are, including the design and functions, has attracted much attention. Although several issues still exist, KYB is further brushing up the system as its unique EPS technology. ◎ Large shares in various product markets

KYB has earned a large market share of multifarious products, with the domestic share of OEM shock absorbers for automobiles being 43% and its global share being 15%, the global share of hydraulic cylinders for construction machinery being 27%, the domestic share of concrete mixer trucks being 83%, and the domestic share of earthquake dampers and the seismic isolation system being 38%.◎ Superior core technology Such large market shares are attributed to the great trust in its products from clients as indicated by the fact that KYB has about 60% share on a global basis in Toyota Motor which vies with Volkswagen and GM for the position of the world's largest automobile manufacturer. The basis of the clients' trust is nothing else but the superior "hydraulic" technology that KYB has cultivated and enhanced for the past 100 years since its foundation. KYB's two core technologies, the "vibration control technology" represented by its shock absorbers and hydraulic earthquake dampers and the "power control technology" typified by its control valves for shovels and electric power steering, have gained high reputation from clients and thus are used in diverse circumstances. Before the review, it set the annual DOE (Dividend on Equity ratio) at 2% or higher on a consolidation basis; however, while aiming for a consolidated payout ratio of 30% or higher, it decided that dividends shall be distributed basically at the conventional annual DOE of 2% or higher from the interim dividend allocation in this term. This means that dividends will be paid stably at DOE of 2% when the business performance is sluggish, whereas shareholder return will be made depending on profit when the business performance is healthy.  Given that, for the term ending Mar. 2018, the total asset turnover and leverage are unchanged and the forecasted net income margin is 2.61%, ROE for this term will be 5.9%, which means there is still ample room for improvement. We should keep an eye on KYB's efforts at increasing profitability, such as profit improvement at overseas bases and acceleration of innovative manufacturing. |

| Fiscal Year March 2017 Earnings Results |

Sales were on a plateau, and profit grew thanks to cost reduction.

Sales were 355.3 billion yen, nearly unchanged from the previous term. The sales of the AC business dropped due to the yen appreciation, etc., while the sales of the HC business for construction machinery grew thanks to the recovery of the Chinese market. The ratio of overseas sales declined 1.4% year on year to 53.5%. Through the reform of its business structure, especially the cost reduction in the entire corporate group, cost rate and SG&A ratio improved 0.1% and 0.2%, respectively, segment income rose 5.9% year on year to 18.6 billion yen, and operating income increased 344.8% year on year to 19.2 billion yen. Net income became positive. Both sales and profit exceeded their respective initial estimates and revised estimates, but below the goals of the mid-term management plan.   Sales dropped due to the impact of the strong yen regardless of the overall healthy market conditions in and outside Japan. 2) Hydraulic shock absorbers for motorcycles Sales rose thanks to the growing number of shock absorbers sold in China, Vietnam, and India. 3) Hydraulic equipment for automobiles While the number of hydraulic pumps sold declined, sales exceeded those of the previous term because the respective number of electric power steering and CVT (Continuously Variable Transmission) vane pumps sold was healthy. 4) Others Sales of other products, including ones for ATV (All Terrain Vehicles), dropped.  Demand increased in Japan in response to the exhaust gas regulations, and overseas sales showed a double-digit increase thanks to the recovery in the Chinese market. 2) Others Sales decreased.    Current liabilities augmented 4.8 billion yen due to the increase in trade payables, etc. Noncurrent liabilities increased 1 billion yen, due to the augmentation of debts, etc. Total liabilities were 211.5 billion yen, up 5.9 billion yen from the end of the previous term. Total assets grew 16.3 billion yen due to the increase in retained earnings. Consequently, the ratio of the equity that belongs to the owners of the parent company increased 1.8 points from 41.3% at the end of the previous term to 43.1%.  (5) Topics

At the 95th shareholders' meeting held in June 2017, KYB introduced a system called "Smart Summons" that enables access to documents related to shareholders' meetings via smartphones, tablets, and computers with the aim of increasing convenience of shareholders.◎ Introduction of a "Smart Summons" system that allows access to documents related to shareholders' meetings via smartphones, tablets, and computers As the "Smart Summons" functions in collaboration with the website for online execution of voting rights, voting rights can be executed on the Internet through electronic devices such as smartphones. In addition, contents of Smart Summons are accessible freely by not only shareholders but also other people. Taking into consideration the "Corporate Governance Codes" published by Tokyo Stock Exchange, KYB propels various efforts such as information disclosure that can be easily understood by shareholders in a proper manner and environmental arrangement that enables shareholders to smoothly execute their voting rights, and continues endeavoring to enrich dialogue with shareholders. |

| Fiscal Year March 2018 Earnings Estimates |

Sales and profit are estimated to decline.

Sales are estimated to be 355 billion yen, nearly unchanged from the previous term. The assumed exchange rates for this fiscal year are 1 US dollar = 100 yen and 1 euro = 110 yen, while the actual rates in the previous year were 1 US dollar = 108.38 yen and 1 euro = 118.79 yen. Although sales in the HC business increased, the impact of foreign exchange in the AC business remains high. Operating income is projected to be 15.6 billion yen, down 18.9% year on year. The profit of the HC business is estimated to decline due to the combination of product lines. On Oct. 1, 2017, the company plans to conduct a 1-for-10 reverse share split. As for dividends, the company plans to pay an interim dividend of 6 yen/share and a term-end dividend of 65 yen/share (taking into account the reverse split). When the reverse split is not taken into account, the annual dividend will be 12.5 yen/share, up 0.5 yen/share year on year. Payment ratio is estimated to be 34.3%.  Both sales and profit are forecasted to decrease due to a declining sales caused by the impact of the strong yen and a deteriorated profitability resulted from the rising price of steel material. *HC Business It is anticipated that the Chinese market continues its recovery and the domestic market condition is favorable mainly in the first half; however, it is projected that sales will rise but profit will drop because of an expected deterioration of profitability attributed to changes in product compositions, the increasing price of steel material, and such. (3) Capital investment plan

KYB plans to continue to make investment, aiming for innovative manufacturing and establishment of an optimum production system.

|

| 2017 Mid-term Management Plan |

|

(1) Numerical goals

Under the slogan of "A GLOBAL KYB - CHALLENGE & INNOVATION -," KYB is striving to "complete drastic structural reform" in FY2017 and will make efforts to realize "sustainable growth," "stabilization of the earning base," and "solving managerial issues" in FY2018 and 2019 with the aim of "achieving sales of 398 billion yen in fiscal 2019." The company will aim to achieve sales of 500 billion yen in the group companies as a whole and earn the rating "A" as soon as possible after fiscal 2020.

(3) Topics

KYB established the motorsports department on April 1, 2017 with the aim not only of making a presence of the KYB brand stronger through motorsports but also of expanding technical capacities and developing human resources in the extreme world of motorsports.◎ Establishment of the motorsports department In the LMP class, which is the top category of the world endurance championships for automobiles, KYB's EPS was mounted on 26 vehicles out of the 31 participating vehicles in the previous term. The company, this term, aims to supply its EPS to all of the participating vehicles and provide technical support. At the same time, it will strive to realize the first installation of its shock absorbers in the class. Meanwhile, KYB supplied its suspensions to the Moto2 class in the previous term. The company will continuously accumulate results in this term and the subsequent terms in order to provide its suspensions to vehicles participating in the MotoGP class, which is the premier motorsports championship, in fiscal 2019. |

| Interview with President Nakajima |

|

Q: "In your opinion as president, what are KYB's strengths?"

A: "The knowledge and know-how that we have cultivated while developing innovative monozukuri (manufacturing), and our high level of technological capabilities as a corporate group."

In order to refine this strength, the recruitment and training of skilled personnel are crucial. Although we have a long history, the number of engineering students who are familiar with our company is still low, unfortunately. We need to take initiatives to make our company known to students, for example, by improving the KYB brand. In terms of developing employees' skills, various training and education systems are important, but I believe that the enhancement of "site-oriented awareness" is the most important. In sales, when there's some kind of trouble at a production site and it causes inconvenience to customers, they should go to the site themselves and see what happened with their own eyes, and then prepare a report for customers instead of just receiving a report from the factory. By doing so, we will further gain the customer's trust. The "site" exists not only in sales and production but in all workplaces and occupations, and by having "site-oriented" awareness, I'd like all employees to gain the ability to truly determine the nature of things, not just superficially. Also, by sending employees abroad from a young age to have them absorb various cultures and ways of thinking and gain a broad range of skills as businessmen, we would be able to achieve personnel development for brushing up our strengths further. Q: "Could you please review the previous medium-term management plan?"

A: "In the AC (Automotive Components) business, there were some problems remaining in the management of overseas factories. In the HC (Hydraulic Components) business, although the objective was unattained due to deteriorating demand, the implementation of a structural reform increased profitability."

From now on, in order to reduce the impact of exchange rates as much as possible, we want to raise the profitability of each of our bases and prepare an "Earn More" system while further advancing efforts such as local production and consumption. Regarding the HC business, based on the demand for construction machinery in 2010, we invested carefully so as not to inconvenience customers, but due to the stall of the Chinese market thereafter, the demand sharply declined and the gap between estimates and results became exceedingly large. However, due to the effect of structural reforms implemented in fiscal 2015 and the bottoming-out of demand for construction machinery in China, we were able to greatly restore profitability in the final year, fiscal 2016. Currently, we are proceeding with restructuring, aiming for a profit-earning structure that can generate profits no matter how much the amount of work is reduced. Q: "What point are you particularly focused on in the new mid-term plan?"

A: "Strengthening the product capabilities of shock absorbers for original equipment manufacturers (OEM), which is a core business. The development and introduction of innovation lines are crucial."

Our test course reproduces the road surface conditions of Europe, North America, Japan, and Asia respectively, according to each environment. There, we use various types of vehicles to make comparisons, and adjust the product development system to meet customers' needs. Further improving the "high performance, high quality" brand image is extremely important because it also leads to the expansion of highly profitable commercial business. It is also necessary to develop and introduce innovative production lines to increase competitiveness. In the current shock absorber production line, there are still many areas that depend on manual labor, such as inspection. We realize that the development and installation of automated lines and other innovative production lines are an urgent matter in order to cope with the increasing manpower shortage and improve the management in overseas factories. At the moment I really feel like we aren't profiting as much as we could be. We invested quite a lot of money during the previous mid-term plan period, but there are still many locations where improvements could be made in terms of profitability. We must reorganize and improve our manufacturing approach to achieve the basic profit-earning structure "6:3:1 structure" (variable cost: 6, fixed cost: 3, profit: 1). I want to recognize the issues and gaps at each base, promptly crush them one by one, and build a system generating profits that match the investments as quickly as possible. Q: "Finally, could you kindly give a message to shareholders and investors?"

A: "We're aiming to be the top brand in the world, so I would ask you to keep an eye on our company, and support us from a medium to long-term perspective."

We're aiming to be the top brand in the world, so I would ask you to keep an eye on our company in the future, and support us from a medium to long-term perspective. |

| Conclusions |

|

Profit grew considerably in the previous term, but sales and profit are estimated to decline this term. Sales and profit have been on a plateau for several years, probably because the profit expansion trend is unclear. In order to make the share price get out of this stagnation and get on an upward trend, it is indispensable to complete the 2017 mid-term management plan without fail. The key is the recovery speed of the HC business with the base of the stable profit from the AC business. The markets of railroads and others are promising, but considering the time span of the fiscal year 2019, we should pay attention to the trend of construction machinery, which is dominant. We would like to pay attention to how the company will cope with the uncertainty in dependence on the huge Chinese market and boost profit. |

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

Last update date: Jun. 28, 2016

|

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |