| KYB Corporation (7242) |

|

||||||||

Company |

KYB Corporation |

||

Code No. |

7242 |

||

Exchange |

TSE 1st Section |

||

Industry |

Equipment for transportation |

||

Representative Director, Chairman and President Executive Officer |

Yasusuke Nakajima |

||

Address |

World Trade Center Bldg., 4-1, Hamamatsu-cho 2-chome, Minato-ku, Tokyo |

||

Year-end |

End of March |

||

URL |

|||

*The share price is the closing price on November 28. The number of shares issued and BPS were the values for the first half of this term.

*ROE is from the previous term. |

||||||||||||||||||||||||

|

|

*The forecast is from the company. From the term ended Mar. 2016, the IFRS has been used. The amounts in the term ended Mar. 2015 are those after the IFRS adjustment. From the term ended Mar. 2016, net income is profit attributable to owners of the parent.

*The company conducted 1-for-10 reverse share split on Oct. 1, 2017. DPS for the term ending Mar. 2018 represent the amounts taking the 1-for-10 reverse split into account. EPS and DPS are not adjusted. *For the term ending Mar. 2019, the company decided not to pay the interim dividend, and the term-end dividend is still to be determined. This report outlines the financial results of KYB for the first half of the term ending Mar. 2019, etc. |

| Key Points |

|

| About nonconforming acts in the inspection process for seismic isolation/mitigation oil dampers for buildings (Overview) |

|

In October 2018, it was revealed that the performance inspection records for seismic isolation/mitigation oil dampers products, which are manufactured and sold by KYB and its subsidiary named Kayaba System Machinery Co., Ltd., were falsified and then the products that do not comply with the criteria approved by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) or clients' specs were attached to buildings.

KYB will continue investigation under the basic policy of replacing nonconforming products and products for which it is unknown whether falsification was made. While giving top priority to relieving owners, occupants, and others of worries and concerns, the company will report its concrete measures, etc. to construction companies and design firms, examine safety, and give detailed explanations to related people, including owners, under the supervision of the Ministry of Land, Infrastructure, Transport and Tourism and relevant administrative organizations.

(Details of the falsification)

In general, if it turns out through performance inspection that any value of a product does not satisfy specs, the product will be disassembled and adjusted until it satisfies the specs. In this case, the nonconforming value was falsified, and reported as an inspection record.

(Background revealing the Incident, countermeasures, etc.)

On September 8, 2018, At Kayaba System Machinery Co., Ltd. an investigation was commenced due to a report of the suspicion of falsification of performance inspection record data from employees, which resulted in an order prohibiting falsification being issued. On September 12, an internal task force was established inside KYB and investigation was started. As a result, it was concluded that the performance inspection data had been falsified, and the company reported the fact to the Ministry of Land, Infrastructure, Transport and Tourism on September 19. Since then, the company has been identifying problematic products and buildings, and conducting structural calculation for examining the safety of buildings that do not satisfy criteria significantly. On September 26, the company established an external examination committee, and commenced more meticulous investigation.

In October, it was unveiled that pistons and packings made from materials that do not satisfy the specs approved by the Minister had been used, and the company reported it to the Ministry of Land, Infrastructure, Transport and Tourism.

(Period in which the falsification was committed, the number of buildings equipped with nonconforming items, and the number of nonconforming products)

The period in which the falsification was probably conducted is over 15 years from January 2003 to September 2018.

According to the news release on November 9, nonconforming or unknown seismic isolation oil dampers were used in 894 buildings and the number of such products was 7,537, while nonconforming or unknown seismic mitigation oil dampers were used in 80 buildings and the number of such products was 3,331. The products for which it is still unclear whether performance inspection data have been falsified are under investigation.

According to the news release on November 15, however, they are suspected of committing nonconforming acts other than coefficient correction in the oil damper inspection process. Accordingly, there is a possibility that the judgments about nonconforming items, unknown items, and conforming items, the number of problematic buildings, and the number of problematic products will be changed.

(Verification of safety)

Following the instruction from the Ministry of Land, Infrastructure, Transport and Tourism, the company chose 7 buildings equipped with nonconforming oil dampers that significantly deviate from criteria, and performed safety verification by a third party through structural calculation. The results indicate that the buildings can withstand serious earthquakes with a seismic intensity of 6 upper to around 7.

Also for other problematic buildings, the company has started the safety examination with structural calculation in cooperation with construction companies and design firms.

(Activities from now on)

The company has established an internal task force, which is led by the president Nakajima, and an external examination committee, and proceeds with the investigation into facts and the analysis of causes.

After the safety examination, the company will exchange opinions with related people, including owners, occupants, construction companies, and design firms, conduct coordination and implement countermeasures, under the basic policy of replacing non-conforming products and all suspected products.

While giving explanations and apologies to related people and establishing, fortifying, and diffusing compliance systems, the company will work on the development of a system for producing more oil dampers (from 100 dampers per month to 500 dampers per month) for replacement in November. Production and replacement will start in December, but the production of products for replacement is estimated to be continued until September 2020, assuming the currently grasped number of problematic buildings.

(Effects on business performance)

As a provision for product warranties regarding this issue, 14,425 million yen was posted in the 2nd quarter of the fiscal year 2018.

This amount was obtained based on the number of the above mentioned nonconforming and suspected dampers: 10,928 ( seismic isolation: 7,550, mitigation: 3,378, as of Nov. 2). The company thinks that when it becomes possible to estimate the cost for replacing products and compensating for the replacement, etc. in a reliable manner, it may produce significant effects on the financial results of KYB.

|

| Company Overview |

|

The largest manufacturer of independent hydraulic equipment in Japan. Based on hydraulic technology, the company offers products and technologies in a wide range of fields such as "automobiles", "motorcycles", "construction machinery", "industrial vehicles", "aircraft", "railroads" and "special purpose vehicles".

KYB has a high market share with many products. For instance, shock absorbers for automobiles account for 46% of the domestic market and 14% of the global market.

【2-1 Corporate history】

The roots come from "Kayaba Research Center", which was established by Shiro Kayaba, who is an inventor and a founder, in November 1919.

In January 1927, a self-employed enterprise, Kayaba Seisakusho, was established for manufacturing hydraulic dampers, catapults, etc. for aircraft.

In March 1935, Kayaba Manufacturing Co., Ltd. was established.

After the end of World War II, in June 1956, Kayaba Auto Service Co., Ltd. was established for offering products and services.

In October 1959, company's stocks were listed on the Tokyo Stock Exchange.

In July 1974, KYB Corporation of America was established in the United States in order to enter the North American commercial market. Then, the company actively entered foreign markets such as Asia and Europe.

In October 1985, the company name "Kayaba" was changed from kanji (Chinese characters) to katakana (Japanese Characters).

In October 2015, the trade name was changed from Kayaba Manufacturing Co., Ltd. to KYB Corporation in order to further strengthen the brand image.

【2-2 Corporate Philosophy / Management Philosophy】

◎KYB Corporate Symbol

As they changed the corporate name from "Kayaba Manufacturing Co., Ltd." to "KYB Corporation" in 2015, they aim to popularize the KYB brand on a global basis.

Therefore, as shown below, the logo "KYB" has the meaning and spirit.

(Logo Meaning)

Slanted slits in each letter represent comfortable sunlight cast through the trees and sunbeams illuminating the road ahead. The logo represents an image of unconstrained growth and flexible response to the trends of the era. The right side of the letter "B" represents liquid pressure indicating the origin of KYB. Using italic letters expresses a sense of speedy movement, progressiveness, growth potential, innovativeness.

(What the corporate color means)

Red represents enthusiasm to create a society where industrial crafting brings happiness to everyone and to provide the technologies that bring a warm and comfortable life. KYB names this red "KYB Red" as the corporate color.

(Taken from KYB's website)

◎Corporate Statements

(Logo Meaning)

Slanted slits in each letter represent comfortable sunlight cast through the trees and sunbeams illuminating the road ahead. The logo represents an image of unconstrained growth and flexible response to the trends of the era. The right side of the letter "B" represents liquid pressure indicating the origin of KYB. Using italic letters expresses a sense of speedy movement, progressiveness, growth potential, innovativeness.

(What the corporate color means)

Red represents enthusiasm to create a society where industrial crafting brings happiness to everyone and to provide the technologies that bring a warm and comfortable life. KYB names this red "KYB Red" as the corporate color.

(Taken from KYB's website)

◎Corporate Statements

The characteristics of products such as precise quality and reliable technology are expressed with the statement.

It means that not only providing reliable quality to general consumers and business partners leads to stakeholders' "advantage (superiority)", but also the joy of manufacturing, which enables each employee to realize that they can change the world with sure quality, becomes "advantage (merit)".

◎Corporate Spirit

As a KYB group that contributes to society by providing technologies and products that make people's lives safe and comfortable, they have the following management philosophy and management vision.

The characteristics of products such as precise quality and reliable technology are expressed with the statement.

It means that not only providing reliable quality to general consumers and business partners leads to stakeholders' "advantage (superiority)", but also the joy of manufacturing, which enables each employee to realize that they can change the world with sure quality, becomes "advantage (merit)".

◎Corporate Spirit

As a KYB group that contributes to society by providing technologies and products that make people's lives safe and comfortable, they have the following management philosophy and management vision.

【2-3 Environment Surrounding the Company】

(1) Market Environment

The automobile market and the construction machinery market have a great effect on KYB's performance.

KYB recognizes the current and future situations of the two markets as follows.

① Automobile Market 【2-3 Environment Surrounding the Company】

(1) Market Environment

The automobile market and the construction machinery market have a great effect on KYB's performance.

KYB recognizes the current and future situations of the two markets as follows.

① Automobile Market

The global demand for automobiles is expected to increase slightly, driven by emerging countries such as Southeast Asia. The global demand for automobiles is expected to increase slightly, driven by emerging countries such as Southeast Asia.

Domestic car sales are expected to see a certain amount of demand, but the impact of negotiations for eliminating trade deficit with the United States is unpredictable. Domestic car sales are expected to see a certain amount of demand, but the impact of negotiations for eliminating trade deficit with the United States is unpredictable.

The commercial market is expected to expand mainly in emerging countries.

KYB supplies shock absorbers (SA) for new vehicles directly to automobile manufacturers as Tier 1, and also supplies them to auto parts stores, repair shops, etc. through agencies for aftermarket as well.

The company calls the former "OEM" and the latter "marketed".

Japanese cars are popular in Asia, the Middle East and others, and the commercial market is important for KYB. The commercial market is expected to expand mainly in emerging countries.

KYB supplies shock absorbers (SA) for new vehicles directly to automobile manufacturers as Tier 1, and also supplies them to auto parts stores, repair shops, etc. through agencies for aftermarket as well.

The company calls the former "OEM" and the latter "marketed".

Japanese cars are popular in Asia, the Middle East and others, and the commercial market is important for KYB.

② Construction Machinery Market ② Construction Machinery Market

The Chinese market is booming, as the demand for infrastructure and its renewal is growing nationwide. The Chinese market is booming, as the demand for infrastructure and its renewal is growing nationwide.

In the European and U.S. markets, the demand for small-sized excavators as urban construction machinery is strong. In the European and U.S. markets, the demand for small-sized excavators as urban construction machinery is strong.

The Indian market is growing, thanks to the active investment in infrastructure.

The company expects that the demand for excavators weighing 6 tons or more will remain strong and the market of excavators weighing less than 6 tons will keep growing healthily. The Indian market is growing, thanks to the active investment in infrastructure.

The company expects that the demand for excavators weighing 6 tons or more will remain strong and the market of excavators weighing less than 6 tons will keep growing healthily.

(2) Competitors

① AC Business

KYB's domestic competitors include Showa Corporation (7274, TSE 1st section), 33.4% of whose shares are held by Honda, and Hitachi Automotive Systems, Ltd. (unlisted), a group company of Hitachi.

Its global competitors consist of ZF in Germany, Tenneco in the U.S., and so on. ZF has a long history and intimate relationships with European automobile manufacturers.

The company's share in the commercial product market is slightly less than 20%. Tokico (which was acquired through M&A by Hitachi and is unlisted; today it is one of the brands of Hitachi Automotive Systems) and Monroe (a commercial brand of Tenneco) have earned a large market share in Japan and globally, respectively.

KYB competes with Showa, which is closely related to Honda, in the market of shock absorbers for motorcycles, and with JTEKT Corporation (6473, TSE 1st section) and NSK Ltd. (6471, TSE 1st section) in the steering market.

② HC Business

In the market of cylinders, which are the parts with the highest sales ratio in KYB, Chinese manufacturers and the like are extending their influences.

KYB's competitors include Nabtesco (6268, TSE 1st section) in the market of control valves for which KYB has the advanced technology, and Nabtesco and Nachi-Fujikoshi (6474, TSE 1st section) in the market of travel motors.

In addition, the largest construction machinery manufacturer in Japan manufactures a number of parts internally. (2) Competitors

① AC Business

KYB's domestic competitors include Showa Corporation (7274, TSE 1st section), 33.4% of whose shares are held by Honda, and Hitachi Automotive Systems, Ltd. (unlisted), a group company of Hitachi.

Its global competitors consist of ZF in Germany, Tenneco in the U.S., and so on. ZF has a long history and intimate relationships with European automobile manufacturers.

The company's share in the commercial product market is slightly less than 20%. Tokico (which was acquired through M&A by Hitachi and is unlisted; today it is one of the brands of Hitachi Automotive Systems) and Monroe (a commercial brand of Tenneco) have earned a large market share in Japan and globally, respectively.

KYB competes with Showa, which is closely related to Honda, in the market of shock absorbers for motorcycles, and with JTEKT Corporation (6473, TSE 1st section) and NSK Ltd. (6471, TSE 1st section) in the steering market.

② HC Business

In the market of cylinders, which are the parts with the highest sales ratio in KYB, Chinese manufacturers and the like are extending their influences.

KYB's competitors include Nabtesco (6268, TSE 1st section) in the market of control valves for which KYB has the advanced technology, and Nabtesco and Nachi-Fujikoshi (6474, TSE 1st section) in the market of travel motors.

In addition, the largest construction machinery manufacturer in Japan manufactures a number of parts internally.

【2-4 Business contents】

(1) Segments

KYB's business segments are composed of the following three segments: the "AC Business" consisting of hydraulic shock absorbers for automobiles and motorcycles, power steering, etc., the "HC Business" including hydraulic equipment for industrial use mainly for construction machinery, and the "Others" segment which handles special purpose vehicles such as concrete mixer trucks, aircraft components, seismic isolation/mitigation oil dampers for buildings, electronics, and the like. 【2-4 Business contents】

(1) Segments

KYB's business segments are composed of the following three segments: the "AC Business" consisting of hydraulic shock absorbers for automobiles and motorcycles, power steering, etc., the "HC Business" including hydraulic equipment for industrial use mainly for construction machinery, and the "Others" segment which handles special purpose vehicles such as concrete mixer trucks, aircraft components, seismic isolation/mitigation oil dampers for buildings, electronics, and the like.

① AC (Automotive Components) Business

This segment consists of shock absorbers for automobiles and motorcycles, hydraulic equipment for automobiles, and other products. ① AC (Automotive Components) Business

This segment consists of shock absorbers for automobiles and motorcycles, hydraulic equipment for automobiles, and other products.

<Major Products>

◎ Automobiles

(Shock absorbers)

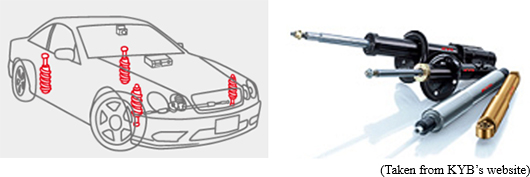

A shock absorber is a device that absorbs vibration of the car body, being mounted between the body and the tires together with a spring. <Major Products>

◎ Automobiles

(Shock absorbers)

A shock absorber is a device that absorbs vibration of the car body, being mounted between the body and the tires together with a spring.

Each automobile is equipped with a "suspension" which is the system that improves riding comfort and operational stability.

Suspensions have two main functions; one is, as buffers, to prevent transmission of rough road profiles to the car body and another is to set the position of the wheels and axles and press the wheels down on the roads.

Basically, a suspension is composed of a suspension arm which fixes the wheel position, a spring which supports the car weight and absorbs vibration, and a shock absorber (damper) which dampens vibration of the spring.

Automobiles absorb shock caused by uneven road profiles by contracting the springs, but due to their characteristics, the springs rebound to get back to their original position after the contraction.

The top of a spring is connected to the car body and the bottom is coupled with a suspension that includes the heavy tires and brake, which results in, due to inertia, repetition of expansion and contraction of a spring in a range wider than one necessary for returning to its original position.

The role of shock absorbers is to reduce the above-mentioned excess vibration as soon as possible in order to stabilize the car body.

Each automobile is equipped with a "suspension" which is the system that improves riding comfort and operational stability.

Suspensions have two main functions; one is, as buffers, to prevent transmission of rough road profiles to the car body and another is to set the position of the wheels and axles and press the wheels down on the roads.

Basically, a suspension is composed of a suspension arm which fixes the wheel position, a spring which supports the car weight and absorbs vibration, and a shock absorber (damper) which dampens vibration of the spring.

Automobiles absorb shock caused by uneven road profiles by contracting the springs, but due to their characteristics, the springs rebound to get back to their original position after the contraction.

The top of a spring is connected to the car body and the bottom is coupled with a suspension that includes the heavy tires and brake, which results in, due to inertia, repetition of expansion and contraction of a spring in a range wider than one necessary for returning to its original position.

The role of shock absorbers is to reduce the above-mentioned excess vibration as soon as possible in order to stabilize the car body.

The vehicle in which the shock absorber is functioning properly achieves the following:

The vehicle in which the shock absorber is functioning properly achieves the following:

Reduction in unnecessary movement of springs to secure riding comfort Reduction in unnecessary movement of springs to secure riding comfort

Improvement of the brake performance Improvement of the brake performance

Smoothness in taking corners

The force that controls expansion and contraction of springs and reduce vibration is called "damping force." The "hydraulic technology," which KYB has cultivated and improved since its inauguration, plays a significant role in generating "damping force."

The tube of a shock absorber contains oil with a piston moving in it.

A piston has holes through which oil passes when the piston moves following vibration, and the resistance of the oil generates "damping force." In addition, the moving speed of pistons varies with the degree and velocity of vibration from the car body, and the faster a piston moves, the larger "damping force" becomes. This is called "damping force characteristics." Smoothness in taking corners

The force that controls expansion and contraction of springs and reduce vibration is called "damping force." The "hydraulic technology," which KYB has cultivated and improved since its inauguration, plays a significant role in generating "damping force."

The tube of a shock absorber contains oil with a piston moving in it.

A piston has holes through which oil passes when the piston moves following vibration, and the resistance of the oil generates "damping force." In addition, the moving speed of pistons varies with the degree and velocity of vibration from the car body, and the faster a piston moves, the larger "damping force" becomes. This is called "damping force characteristics."

KYB's shock absorbers developed based on its sophisticated technology has earned reputation from a number of automobile manufacturers worldwide, leading to the large market share as mentioned below.

Furthermore, it is said that shock absorbers usually need to be replaced after 5 years from the date of first registration or when the travel distance reached 100,000 km as they deteriorate due to various factors including travel distance and lapse of time and the function decreases.

This replacement demand, which in other words is the commercial product market, is one of the greatest business opportunities for the company.

(Steering)

It is the steering system that provides "the function of taking curves," one of the three basic functions of automobiles including "driving," "taking curves," and "stopping."

KYB's shock absorbers developed based on its sophisticated technology has earned reputation from a number of automobile manufacturers worldwide, leading to the large market share as mentioned below.

Furthermore, it is said that shock absorbers usually need to be replaced after 5 years from the date of first registration or when the travel distance reached 100,000 km as they deteriorate due to various factors including travel distance and lapse of time and the function decreases.

This replacement demand, which in other words is the commercial product market, is one of the greatest business opportunities for the company.

(Steering)

It is the steering system that provides "the function of taking curves," one of the three basic functions of automobiles including "driving," "taking curves," and "stopping."

KYB's steering components include the "hydraulic power steering (PS)" that uses the hydraulic power assist unit to support turning of the steering wheel done by drivers and steer the tires, and the "electric power steering (EPS)" that uses the electric power assist unit composed of a motor, a controller, a torque sensor, etc. to support turning of the steering wheel and steer the tires.

The "PS" enables steering operation by a mere movement thanks to hydraulic force and is an indispensable component for safe driving because of its ability to expeditiously avert risks, whereas the "EPS" whose power source is a battery improves fuel efficiency compared to the "PS" whose power source is the engine of a car.

KYB's steering components include the "hydraulic power steering (PS)" that uses the hydraulic power assist unit to support turning of the steering wheel done by drivers and steer the tires, and the "electric power steering (EPS)" that uses the electric power assist unit composed of a motor, a controller, a torque sensor, etc. to support turning of the steering wheel and steer the tires.

The "PS" enables steering operation by a mere movement thanks to hydraulic force and is an indispensable component for safe driving because of its ability to expeditiously avert risks, whereas the "EPS" whose power source is a battery improves fuel efficiency compared to the "PS" whose power source is the engine of a car.

◎ Motorcycles

(Suspensions)

Suspensions minimize shock to the car body regardless of road surface conditions, pursuing comfort. ◎ Motorcycles

(Suspensions)

Suspensions minimize shock to the car body regardless of road surface conditions, pursuing comfort.

*Rear cushion unit (RCU)

The company's RCUs boost riding comfort by maintaining the posture of vehicles and absorbing vibration and shock from the road surfaces.

*Rear cushion unit (RCU)

The company's RCUs boost riding comfort by maintaining the posture of vehicles and absorbing vibration and shock from the road surfaces.

② HC (Hydraulic Components) Business

The HC Business consists of hydraulic equipment for industrial use and other products. ② HC (Hydraulic Components) Business

The HC Business consists of hydraulic equipment for industrial use and other products.

<Major Products>

The mechanism of the drive system of construction machinery such as shovels consists of various parts as shown below, including control valves, piston pumps, travel motors, swing motors, and cylinders; it is the control valve, which is the "brain" of construction machinery, that controls a variety of actuators (a drive unit which converts energy to translational or rotary motion through hydraulic pressure and electric motors) to enable smooth movement of driving, turning, and bending and stretching of the arms.

KYB's control valves have realized more advanced control by combining electric control with its special hydraulic technology.

In addition, KYB is one of the few manufacturers that manufacture all of the above-mentioned parts.

KYB's competitive edge is that it can make suggestion to construction machinery manufacturers because it manufacturers all kinds of parts as just mentioned. <Major Products>

The mechanism of the drive system of construction machinery such as shovels consists of various parts as shown below, including control valves, piston pumps, travel motors, swing motors, and cylinders; it is the control valve, which is the "brain" of construction machinery, that controls a variety of actuators (a drive unit which converts energy to translational or rotary motion through hydraulic pressure and electric motors) to enable smooth movement of driving, turning, and bending and stretching of the arms.

KYB's control valves have realized more advanced control by combining electric control with its special hydraulic technology.

In addition, KYB is one of the few manufacturers that manufacture all of the above-mentioned parts.

KYB's competitive edge is that it can make suggestion to construction machinery manufacturers because it manufacturers all kinds of parts as just mentioned.

③ Special purpose system, etc. (System products and others)

This is composed of special purpose vehicles, hydraulic equipment for aircraft, system products, electronics, and such. ③ Special purpose system, etc. (System products and others)

This is composed of special purpose vehicles, hydraulic equipment for aircraft, system products, electronics, and such.

KYB's concrete mixer trucks have high mixing and emission performance, accounting for about 85% of the domestic market share.

It offers highly-reliable products for aircraft, including various actuators, weight-saving accumulators, and wheel brakes.

KYB's concrete mixer trucks have high mixing and emission performance, accounting for about 85% of the domestic market share.

It offers highly-reliable products for aircraft, including various actuators, weight-saving accumulators, and wheel brakes.

(2) Clients and sales channels

◎ Clients

The following is a list of KYB's major clients.

Its shock absorbers are mounted on about 60% of automobiles manufactured by Toyota globally. They are also adopted to about 30% and about 10% of automobiles manufactured by Nissan and Honda, respectively, contributing to KYB's large market share. (2) Clients and sales channels

◎ Clients

The following is a list of KYB's major clients.

Its shock absorbers are mounted on about 60% of automobiles manufactured by Toyota globally. They are also adopted to about 30% and about 10% of automobiles manufactured by Nissan and Honda, respectively, contributing to KYB's large market share.

◎ Sales channels

As previously mentioned, KYB supplies its shock absorbers through 2 sales channels including the OEM production system for new vehicles and sale on the market for used vehicles.

Although sales of OEM products are higher, its commercially-available products sold as its private brand show great profitability and thus the company will expand the business to the global markets.

KYB's commercially-available shock absorbers can be mounted on about 90% of Japanese, American, and European automobiles used worldwide today. What is behind such a high coverage rate is the strong relationships KYB has with major automobile manufacturers including Toyota.

(3) Global network

In 24 countries worldwide including Japan, KYB has 48 group companies, establishing strong global networks. ◎ Sales channels

As previously mentioned, KYB supplies its shock absorbers through 2 sales channels including the OEM production system for new vehicles and sale on the market for used vehicles.

Although sales of OEM products are higher, its commercially-available products sold as its private brand show great profitability and thus the company will expand the business to the global markets.

KYB's commercially-available shock absorbers can be mounted on about 90% of Japanese, American, and European automobiles used worldwide today. What is behind such a high coverage rate is the strong relationships KYB has with major automobile manufacturers including Toyota.

(3) Global network

In 24 countries worldwide including Japan, KYB has 48 group companies, establishing strong global networks.

(4) Research and Development

(Structure)

KYB has established a global and optimum research and development (R&D) structure by setting R&D bases in 5 regions including Japan, North America, Europe, China, and Thailand.

While the R&D bases in regions other than Japan basically engage in development of model products and development for enhancing product appeal such as performance improvement and cost reduction, R&D from the long-term perspectives are carried out mainly in Basic Technology R&D Center (Sagamihara-shi, Kanagawa) and Production Technology R&D Center (Kani-shi, Gifu) in Japan and R&D of highly unique prior art, etc are performed.

In addition, the know-how about production equipment designing which has been cultivated in Production Technology R&D Center and each plant is gathered in Machine Tools Center (Kani-shi, Gifu) in order to strengthen and propel internal manufacturing of equipment, jigs, and tools for which KYB has strived to boost innovative spirit and reliability.

In Electronics Technology Center (Sagamihara-shi, Kanagawa), a system that collects technologies for designing and evaluating electronics, increases development capabilities, and conducts a series of processes ranging from product development to prototype evaluation and mass production in a smooth and prompt manner has been established.

Regarding high-functionality and systematization of its products, KYB, in addition to independent development, propels joint research and development with its clients or related equipment manufacturers. The company is also endeavoring proactively to developing advanced technology through industry-academia collaboration.

(Variation in R&D expenses)

Since the term ended Mar. 2013, the company has raised its awareness about the ratio of R&D expenses to sales, maintaining the ratio at about 2%. (4) Research and Development

(Structure)

KYB has established a global and optimum research and development (R&D) structure by setting R&D bases in 5 regions including Japan, North America, Europe, China, and Thailand.

While the R&D bases in regions other than Japan basically engage in development of model products and development for enhancing product appeal such as performance improvement and cost reduction, R&D from the long-term perspectives are carried out mainly in Basic Technology R&D Center (Sagamihara-shi, Kanagawa) and Production Technology R&D Center (Kani-shi, Gifu) in Japan and R&D of highly unique prior art, etc are performed.

In addition, the know-how about production equipment designing which has been cultivated in Production Technology R&D Center and each plant is gathered in Machine Tools Center (Kani-shi, Gifu) in order to strengthen and propel internal manufacturing of equipment, jigs, and tools for which KYB has strived to boost innovative spirit and reliability.

In Electronics Technology Center (Sagamihara-shi, Kanagawa), a system that collects technologies for designing and evaluating electronics, increases development capabilities, and conducts a series of processes ranging from product development to prototype evaluation and mass production in a smooth and prompt manner has been established.

Regarding high-functionality and systematization of its products, KYB, in addition to independent development, propels joint research and development with its clients or related equipment manufacturers. The company is also endeavoring proactively to developing advanced technology through industry-academia collaboration.

(Variation in R&D expenses)

Since the term ended Mar. 2013, the company has raised its awareness about the ratio of R&D expenses to sales, maintaining the ratio at about 2%.

(Area of focus)

KYB is propelling the development of products by dealing with performance improvement, high functionality, and systematization and considering eco-friendliness with respect to energy and environmental issues through weight saving, energy saving, reduction in environmentally hazardous substances. At the same time, it is striving to strengthen its production technology capabilities.

In addition, following the accelerated globalization, it aims to set up a strategic and global production, sales, and technological structure, including development of human resources with global outlooks and establishment of a standardized management system.

Lately, the company has focused on product development related to autonomous driving systems.

One example is the technology that integrates EPS (electronic steering) and shock absorbers.

KYB considers that the technology, which enables more comfortable and smoother driving in any road surface conditions independently of the drivers' skills and judgment, is definitely indispensable for automobiles with the autonomous driving system.

Furthermore, KYB deems the "steering by wire" system is another technology whose importance will grow in the future.

In the conventional steering operation, movement is transmitted to the steering gear box and tires through the steering shaft, whereas the "steering by wire" system conveys steering movement via electronic signals.

Some of the system's advantages include the capability of relieving drivers' fatigue due to less vibration from the tires, and the capability of automatically adjusting sideslips of the car body due to strong winds which conventionally needed to be adjusted through an intentional steering operation by drivers. In addition, thanks to the "steering by wire" system, the steering wheel may not necessarily be mounted on the right front of a car, and therefore, the system's potential for considerably changing the way automobiles are, including the design and functions, has attracted much attention.

Although several issues still exist, KYB is further brushing up the system as its unique EPS technology.

【2-5 Characteristics and strengths】

◎ Large shares in various product markets

KYB has earned a large market share of multifarious products, with the domestic share of OEM shock absorbers for automobiles being 46% and its global share being 14%, the global share of hydraulic cylinders for construction machinery being 30%, the domestic share of concrete mixer trucks being 85%, and the domestic share of oil dampers for seismic isolation and vibration suppression being 45%.

◎ Superior core technology

Such large market shares are attributed to the great trust in its products from clients as indicated by the fact that KYB has about 60% share on a global basis in Toyota Motor which vies with Volkswagen and GM for the position of the world's largest automobile manufacturer. The basis of the clients' trust is nothing else but the superior "hydraulic" technology that KYB has cultivated and enhanced for the past 100 years since its foundation.

KYB's two core technologies, the "vibration control technology" represented by its shock absorbers and oil dampers for seismic isolation and vibration suppression and the "power control technology" typified by its control valves for shovels and electric power steering, have gained high reputation from clients and thus are used in diverse circumstances.

【2-6 Shareholder return】

Aiming for a consolidated payout ratio of 30% or higher, it decided that dividends shall be distributed basically at the annual DOE of 2% or higher. This means that dividends will be paid stably at DOE of 2% when the business performance is sluggish, whereas shareholder return will be made depending on profit when the business performance is healthy.

【2-7 ROE analysis】

(Area of focus)

KYB is propelling the development of products by dealing with performance improvement, high functionality, and systematization and considering eco-friendliness with respect to energy and environmental issues through weight saving, energy saving, reduction in environmentally hazardous substances. At the same time, it is striving to strengthen its production technology capabilities.

In addition, following the accelerated globalization, it aims to set up a strategic and global production, sales, and technological structure, including development of human resources with global outlooks and establishment of a standardized management system.

Lately, the company has focused on product development related to autonomous driving systems.

One example is the technology that integrates EPS (electronic steering) and shock absorbers.

KYB considers that the technology, which enables more comfortable and smoother driving in any road surface conditions independently of the drivers' skills and judgment, is definitely indispensable for automobiles with the autonomous driving system.

Furthermore, KYB deems the "steering by wire" system is another technology whose importance will grow in the future.

In the conventional steering operation, movement is transmitted to the steering gear box and tires through the steering shaft, whereas the "steering by wire" system conveys steering movement via electronic signals.

Some of the system's advantages include the capability of relieving drivers' fatigue due to less vibration from the tires, and the capability of automatically adjusting sideslips of the car body due to strong winds which conventionally needed to be adjusted through an intentional steering operation by drivers. In addition, thanks to the "steering by wire" system, the steering wheel may not necessarily be mounted on the right front of a car, and therefore, the system's potential for considerably changing the way automobiles are, including the design and functions, has attracted much attention.

Although several issues still exist, KYB is further brushing up the system as its unique EPS technology.

【2-5 Characteristics and strengths】

◎ Large shares in various product markets

KYB has earned a large market share of multifarious products, with the domestic share of OEM shock absorbers for automobiles being 46% and its global share being 14%, the global share of hydraulic cylinders for construction machinery being 30%, the domestic share of concrete mixer trucks being 85%, and the domestic share of oil dampers for seismic isolation and vibration suppression being 45%.

◎ Superior core technology

Such large market shares are attributed to the great trust in its products from clients as indicated by the fact that KYB has about 60% share on a global basis in Toyota Motor which vies with Volkswagen and GM for the position of the world's largest automobile manufacturer. The basis of the clients' trust is nothing else but the superior "hydraulic" technology that KYB has cultivated and enhanced for the past 100 years since its foundation.

KYB's two core technologies, the "vibration control technology" represented by its shock absorbers and oil dampers for seismic isolation and vibration suppression and the "power control technology" typified by its control valves for shovels and electric power steering, have gained high reputation from clients and thus are used in diverse circumstances.

【2-6 Shareholder return】

Aiming for a consolidated payout ratio of 30% or higher, it decided that dividends shall be distributed basically at the annual DOE of 2% or higher. This means that dividends will be paid stably at DOE of 2% when the business performance is sluggish, whereas shareholder return will be made depending on profit when the business performance is healthy.

【2-7 ROE analysis】

|

| First Half of the Fiscal Year March 2019 Earnings Results |

Sales grew thanks to the healthy performance of construction machinery, but a loss was posted due to a provision for product warranties related to nonconforming acts for seismic isolation/mitigation oil dampers.

Sales were 202.8 billion yen, up 7.0% year on year. Both the AC and HC businesses saw sales growth. Especially, the sales quantity of the HC business increased as the construction machinery market was thriving.

The segment profit dropped 11.5% year on year to 9.5 billion yen. Although the two segments witnessed sales growth, the profit of the AC business declined due to the stagnation in the North American market, etc. and the profit growth of the HC business was slight due to the cost augmentation caused by the increase in production output.

There was an operating loss of 11.3 billion yen. The company posted a loss related to the U.S. antitrust law amounting to 4.4 billion yen and an impairment loss of 2 billion yen as well as a provision for product warranties related to nonconforming acts for seismic isolation/mitigation oil dampers amounting to 14.4 billion yen.

The results significantly fell below the initial estimate, and it is difficult to estimate the effects of factors that could worsen the company's business performance, such as the costs involved in replacing products and compensation necessitated due to the replacement work. Accordingly, the company decided not to pay the interim dividend. The term-end dividend is still to be determined. Sales grew thanks to the healthy performance of construction machinery, but a loss was posted due to a provision for product warranties related to nonconforming acts for seismic isolation/mitigation oil dampers.

Sales were 202.8 billion yen, up 7.0% year on year. Both the AC and HC businesses saw sales growth. Especially, the sales quantity of the HC business increased as the construction machinery market was thriving.

The segment profit dropped 11.5% year on year to 9.5 billion yen. Although the two segments witnessed sales growth, the profit of the AC business declined due to the stagnation in the North American market, etc. and the profit growth of the HC business was slight due to the cost augmentation caused by the increase in production output.

There was an operating loss of 11.3 billion yen. The company posted a loss related to the U.S. antitrust law amounting to 4.4 billion yen and an impairment loss of 2 billion yen as well as a provision for product warranties related to nonconforming acts for seismic isolation/mitigation oil dampers amounting to 14.4 billion yen.

The results significantly fell below the initial estimate, and it is difficult to estimate the effects of factors that could worsen the company's business performance, such as the costs involved in replacing products and compensation necessitated due to the replacement work. Accordingly, the company decided not to pay the interim dividend. The term-end dividend is still to be determined.

Sales quantity increased in Europe, China, etc., but the company saw a decline in profit as well as sales growth, due to the stagnation in the North American market and the deficit in a Brazilian company, which became a consolidated subsidiary of KYB.

Sales quantity increased in Europe, China, etc., but the company saw a decline in profit as well as sales growth, due to the stagnation in the North American market and the deficit in a Brazilian company, which became a consolidated subsidiary of KYB.

As the construction machinery market was thriving, sales grew from the previous term, but the segment profit increase was slight, due to the cost augmentation caused by the increase in production output, etc.

As the construction machinery market was thriving, sales grew from the previous term, but the segment profit increase was slight, due to the cost augmentation caused by the increase in production output, etc.

While sales increased in China, where the construction machinery market is healthy, and Europe, where the performance of products for automobile is favorable, sales were sluggish in the U.S. Overseas sales ratio rose from 55.1% to 56.1%.

While sales increased in China, where the construction machinery market is healthy, and Europe, where the performance of products for automobile is favorable, sales were sluggish in the U.S. Overseas sales ratio rose from 55.1% to 56.1%.

Current assets declined 5 billion yen from the end of the previous term, as inventory assets rose, but cash, etc. decreased. Noncurrent assets rose 4 billion yen from the end of the previous term due to the growth of property, plant, and equipment, etc. Consequently, total assets dropped 900 million yen to 411.5 billion yen.

Current liabilities augmented 2.3 billion yen from the end of the previous term, due to the increase in trade payables. Noncurrent liabilities grew 10 billion yen from the end of the previous term due to the increase in provisions, and total liabilities increased 12.3 billion yen to 238.2 billion yen.

Total capital declined 13.3 billion yen to 173.4 billion yen, due to the drop in retained earnings, etc.

As a result, the ratio of equity attributable to owners of parent decreased 3.1 points from 43.7% to 40.6%.

Current assets declined 5 billion yen from the end of the previous term, as inventory assets rose, but cash, etc. decreased. Noncurrent assets rose 4 billion yen from the end of the previous term due to the growth of property, plant, and equipment, etc. Consequently, total assets dropped 900 million yen to 411.5 billion yen.

Current liabilities augmented 2.3 billion yen from the end of the previous term, due to the increase in trade payables. Noncurrent liabilities grew 10 billion yen from the end of the previous term due to the increase in provisions, and total liabilities increased 12.3 billion yen to 238.2 billion yen.

Total capital declined 13.3 billion yen to 173.4 billion yen, due to the drop in retained earnings, etc.

As a result, the ratio of equity attributable to owners of parent decreased 3.1 points from 43.7% to 40.6%.

The surplus of operating CF shrank due to the posting of pretax quarterly loss, etc. The deficit of investing CF expanded due to the augmentation of purchase of property, plant and equipment, and free CF became negative. Financing CF was nearly unchanged. The cash position worsened.

The surplus of operating CF shrank due to the posting of pretax quarterly loss, etc. The deficit of investing CF expanded due to the augmentation of purchase of property, plant and equipment, and free CF became negative. Financing CF was nearly unchanged. The cash position worsened.

|

| Fiscal Year March 2019 Earnings Estimates |

The estimated profit was revised downwardly, and sales growth and profit decline are forecasted.

The company revised downwardly the estimated profit, because of nonconforming acts in the inspection process for seismic isolation/mitigation oil dampers for buildings.

Sales are estimated to rise 5.7% year on year to 416 billion yen. The HC business is expected to see a double-digit sales growth. The AC business, too, is forecasted to see a sales growth.

The segment profit is projected to decrease 7.2% year on year to 21.3 billion yen. Both the AC and HC businesses are estimated to see sales growth and a decline in profit.

Operating profit is forecasted to drop 96.6% year on year to 700 million yen. The company plans to post 14.4 billion yen as the provision for product warranties related to nonconforming acts for seismic isolation/mitigation oil dampers, 4.4 billion yen as a loss related to the U.S. antitrust law, 2 billion yen as impairment loss, and 3.5 billion yen as a cost for structural reform for hydraulic devices for automobiles.

The assumed exchange rates for this fiscal year are 1 US dollar = 107.63 yen and 1 euro = 128.92 yen, while those for the previous fiscal year were 1 US dollar = 110.85 yen and 1 euro = 129.70 yen. The assumed exchange rates for the second half are 1 US dollar = 105 yen and 1 euro = 128 yen.

As mentioned above, the term-end dividend is still to be determined. The estimated profit was revised downwardly, and sales growth and profit decline are forecasted.

The company revised downwardly the estimated profit, because of nonconforming acts in the inspection process for seismic isolation/mitigation oil dampers for buildings.

Sales are estimated to rise 5.7% year on year to 416 billion yen. The HC business is expected to see a double-digit sales growth. The AC business, too, is forecasted to see a sales growth.

The segment profit is projected to decrease 7.2% year on year to 21.3 billion yen. Both the AC and HC businesses are estimated to see sales growth and a decline in profit.

Operating profit is forecasted to drop 96.6% year on year to 700 million yen. The company plans to post 14.4 billion yen as the provision for product warranties related to nonconforming acts for seismic isolation/mitigation oil dampers, 4.4 billion yen as a loss related to the U.S. antitrust law, 2 billion yen as impairment loss, and 3.5 billion yen as a cost for structural reform for hydraulic devices for automobiles.

The assumed exchange rates for this fiscal year are 1 US dollar = 107.63 yen and 1 euro = 128.92 yen, while those for the previous fiscal year were 1 US dollar = 110.85 yen and 1 euro = 129.70 yen. The assumed exchange rates for the second half are 1 US dollar = 105 yen and 1 euro = 128 yen.

As mentioned above, the term-end dividend is still to be determined.

As for the AC business, it is forecasted that sales will grow slightly, but profit will decline due to the stagnation in the U.S. market and the augmentation of costs for a foothold in Brazil, like in the first half.

As for the HC business, it is projected that sales will increase due to the favorable demand for construction machinery, but profit will drop due to the augmentation of fixed costs through the increase of personnel expenses and production output.

As for the AC business, it is forecasted that sales will grow slightly, but profit will decline due to the stagnation in the U.S. market and the augmentation of costs for a foothold in Brazil, like in the first half.

As for the HC business, it is projected that sales will increase due to the favorable demand for construction machinery, but profit will drop due to the augmentation of fixed costs through the increase of personnel expenses and production output.

|

| Mid-term activities in each business |

|

Due to the problem of nonconforming acts in the inspection process for seismic isolation/mitigation oil dampers for buildings, the company incurs a loss this term, and there remain some uncertainties for expenses for replacement and compensation. In this situation, the company plans to proceed with the structural reform of the AC and HC businesses, which are mainstay, more actively and swiftly. The activities for the two businesses are as follows.

(1) AC business

The company engages in the following activities, under the mid-term policy of "getting on a growth track by integrating and dismantling business footholds according to the change of regions where clients demand products, developing products with high added value, and promoting their sales."

* Completion of drastic structural reform

The primary objective is to reform the structure of the EPS business. In order to enter the growing Chinese market, the company will strive to achieve synergy with Hubei Henglong in China, with which the company formed an alliance, as soon as possible.

It will develop an optimal manufacturing system for each region while enhancing cost competitiveness, concentrate the two-wheel business in Vietnam and India at a more rapid pace, and promote sales to other companies.

* Stabilization of the revenue base

The company is making efforts to enhance productivity by unifying the global specifications of shock absorbers for mass retailers and achieving innovative manufacturing.

In order to increase productivity through innovative manufacturing, it is indispensable to develop a production system without relying on manpower, as personnel expenses are augmenting in emerging countries. Therefore, the company aims to fully automate the manufacturing process by 2026 by building production lines while utilizing IoT and AI and pursuing higher quality.

* Sustainable growth

Based on Europe Technical Center (Munich, Germany), whose operation began in April 2018, the company will make efforts to receive more orders from German Premium 3.

In addition, the company will develop and promote products with high added value for future businesses.

(2) HC business

Under the mid-term policy of "securing stable sales and profit that are not affected by market fluctuations," the company will enhance sales promotion in growing markets into which the company has not yet made inroads based on shovels.

* Completion of drastic structural reform

As for the transfer of the manufacturing lines for control valves for medium and large-sized equipment, the new lines for assembly and coating were completed in May 2018, and the new line for processing is being constructed. The transfer is scheduled to be finished in October 2019 as initially planned.

As for the concentration of motor products in Sagami Factory, the layout for restructuring in China Factory, etc. was determined, and the company started them. The concentration and restructuring are scheduled to be finished in September 2020.

* Stabilization of the revenue base

In order to develop production and delivery systems to meet strong demand, the company engages in the upgrade of equipment for processing parts, the enlargement of assembly lines, the securing of capabilities of existing clients, support for them, the increase of suppliers, etc.

* Sustainable growth

While promoting the sales of hydraulic devices for loaders, the company received orders for control valves for compact track loaders, for which the company had not promoted sales enough.

|

| Conclusions |

|

Seismic isolation/mitigation oil dampers for buildings account for less than 1% of total sales, but they dragged down the company's performance.

According to the progress of investigation, costs may augment due to replacing products and compensation necessitated due to the replacement work, etc. and investors have no choice but to wait and see how things will go.

However, it seems that the structural reform for the AC and HC businesses has been progressing steadily.

We would like to see what kinds of measures KYB will implement for further growing its core business while regaining the trust of all stakeholders and how it will produce achievements at a rapid pace.

|

| <Reference 1: 2017 Midterm Management Plan> |

|

KYB has formulated a 3-year mid-term management plan with the year 2017 (the term ending Mar. 2018) being the first fiscal year and the year 2019 (the term ending Mar. 2020) being the final fiscal year and the plan is ongoing.

(1) Numerical goals

Under the slogan of "A GLOBAL KYB - CHALLENGE & INNOVATION -," KYB is striving to "complete drastic structural reform" in FY2017 and will make efforts to realize "sustainable growth," "stabilization of the earning base," and "solving managerial issues" in FY2018 and 2019. The company will aim to achieve sales of 500 billion yen in the group companies as a whole and earn the rating "A" as soon as possible after fiscal 2020.

KYB aims to increase the number of shock absorbers sold to 88 million (OEM products and commercially-available products account for 68% and 32%, respectively) for fiscal 2020 from 72 million (OEM products and commercially-available products account for 70% and 30%, respectively) in the previous term.

KYB aims to increase the number of shock absorbers sold to 88 million (OEM products and commercially-available products account for 68% and 32%, respectively) for fiscal 2020 from 72 million (OEM products and commercially-available products account for 70% and 30%, respectively) in the previous term.

|

| <Reference 2: Regarding Corporate Governance> |

◎ Corporate Governance Report

Last update date: Jul. 9, 2018

<Basic approach>

In order to respond to the expectations of the stakeholders through realization of sustainable growth and corporate value improvement as well as fulfill the corporate social responsibility of contributing to society, it is our basic approach to pursue the development of a rapid and efficient management structure centered on the Board of Directors and establishment of fair and transparent management supervision functions and work on strengthening and enhancing corporate governance based on the following management philosophy and basic policies.

(Management philosophy)

"KYB group contributes to the society, by serving technologies and products that make people's life safe and comfortable."

1. We shall build a corporate culture that holds high goals and full of vitality.

2. We shall maintain kindness and sincerity, cherish nature and care for the environment.

3. We shall constantly pursue creativity and contribute to the prosperity of customers, shareholders, business partners and society.

(Basic policies)

1. We shall respect the rights of shareholders and ensure their equality.

2. We shall take the benefits of stakeholders including our shareholders into consideration and endeavor to appropriately collaborate with those stakeholders.

3. We shall disclose not only the information in compliance with the relevant laws and regulations, but also actively provide the important and/or useful information to the stakeholders for their well-informed decision making.

4. The Board of Directors shall be aware of its fiduciary responsibility and accountability to the shareholders and shall appropriately fulfill its roles and responsibilities in order to promote sustainable and stable corporate growth and increase corporate value, profitability and capital efficiency.

5. We shall engage in constructive dialogue with the shareholders and make efforts to obtain their support regarding the company's business policies and also reflect their opinions in the improvement of management.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

All principles are written based on the corporate governance code before the revision in June 2018. The update based on the corporate governance code revised in June 2018 is to be conducted by December 2018. ◎ Corporate Governance Report

Last update date: Jul. 9, 2018

<Basic approach>

In order to respond to the expectations of the stakeholders through realization of sustainable growth and corporate value improvement as well as fulfill the corporate social responsibility of contributing to society, it is our basic approach to pursue the development of a rapid and efficient management structure centered on the Board of Directors and establishment of fair and transparent management supervision functions and work on strengthening and enhancing corporate governance based on the following management philosophy and basic policies.

(Management philosophy)

"KYB group contributes to the society, by serving technologies and products that make people's life safe and comfortable."

1. We shall build a corporate culture that holds high goals and full of vitality.

2. We shall maintain kindness and sincerity, cherish nature and care for the environment.

3. We shall constantly pursue creativity and contribute to the prosperity of customers, shareholders, business partners and society.

(Basic policies)

1. We shall respect the rights of shareholders and ensure their equality.

2. We shall take the benefits of stakeholders including our shareholders into consideration and endeavor to appropriately collaborate with those stakeholders.

3. We shall disclose not only the information in compliance with the relevant laws and regulations, but also actively provide the important and/or useful information to the stakeholders for their well-informed decision making.

4. The Board of Directors shall be aware of its fiduciary responsibility and accountability to the shareholders and shall appropriately fulfill its roles and responsibilities in order to promote sustainable and stable corporate growth and increase corporate value, profitability and capital efficiency.

5. We shall engage in constructive dialogue with the shareholders and make efforts to obtain their support regarding the company's business policies and also reflect their opinions in the improvement of management.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

All principles are written based on the corporate governance code before the revision in June 2018. The update based on the corporate governance code revised in June 2018 is to be conducted by December 2018.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

|

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2018, All Rights Reserved by Investment Bridge Co., Ltd. |