| SHOEI Co., Ltd. (7839) |

|

||||||||||||||

Company |

SHOEI Co., Ltd. |

||

Code No. |

7839 |

||

Exchange |

First Section, TSE |

||

Chairman |

Masaru Yamada |

||

President |

Hironori Yasukochi |

||

Headquarters |

Ueno 5-8-5, Taito-ku, Tokyo |

||

Year End |

September |

||

Website |

|||

*Share price as of close on December 4, 2015. Number of shares outstanding at end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. From the current fiscal year, the definition for net income has been changed to net income attributable to parent company shareholders (Abbreviated as Parent Company Net Income)

This Bridge Report discusses the fiscal year September 2015 earnings results for SHOEI Co., Ltd.

|

|

| Key Points |

|

| Company Overview |

|

Management Policy: Achieve World's Top Levels in Three Realms

<Business Description>

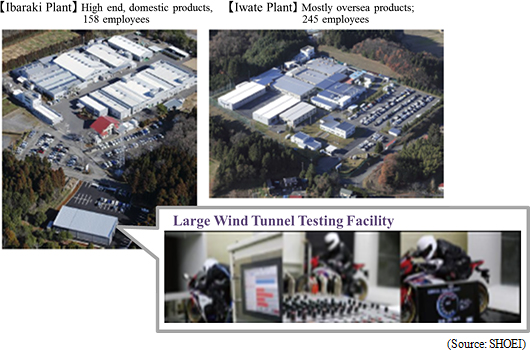

Motorcycle use helmets account for about 90% of total sales. SHOEI focuses upon high value-added "premium helmets" that are manufactured at its two plants in Ibaraki (Inashiki City) and Iwate (Ichinoseki City) Prefectures in Japan. The Company is able to maintain high quality levels and prevent the leakage of its technology by maintaining manufacturing facilities within Japan.

<Overseas Sales Account for 75% of Total>

<Focus Upon Craftsmanship to Maintain Top Market Share - Two Domestic Plants in Ibaraki and Iwate Manufacture 100% of Products>

SHOEI produces premium brand helmets that are recognized as the highest quality products by motorcycle riders around the world. Their helmets boast of extremely intricate designs that provide not only superb functionality with superior wind resistance characteristics, but also very fashionable looks. With their helmets, safety comes with comfortability. SHOEI's persistence in its pursuit of helmet designs that are comfortable to their users is the driving force behind its top market share.

<Corporate History>

SHOEI was established as polyester processing manufacturer in 1954. In March 1959, SHOEI Kako Co., Ltd. was turned into a corporation and it used its polyester processing technologies to enter the helmet market. In January 1960, production of helmets for motorcycle riders was started, and in July 1968 a subsidiary was established in the United States, entering an overseas market. In July 1987, entry to the French market was launched along with the establishment of a local subsidiary. However, the bursting of the bubble economy within Japan forced SHOEI to file for corporate reorganization in May 1992. In September 1992, the current Chairman Masaru Yamada, who was working at Mitsubishi Corporation, took on the administrator task of the corporate reorganization. During the reorganization process, SHOEI also entered the German market with the establishment of a German subsidiary in March 1994 made possible by the smooth reorganization efforts. The reorganization was successfully completed in a relatively short period of time of four years and three months in March 1998 and along with the completion of the reorganization, the Company name was changed to SHOEI Co., Ltd. in December 1998. In July 2004, SHOEI listed its shares on the JASDAQ Market. Then SHOEI moved its listing to the Second Section of the Tokyo Stock Exchange in September 2007 (JASDAQ listing was eliminated at the same time), and moved to the First Section of the Tokyo Stock Exchange in October 2015. Currently, SHOEI's name is recognized globally as the top manufacturer of premium helmets.

<Basic Strategy to Achieve Stable Medium- to Long-Term Growth, Stable Profitability>

(1) Defend our own Company

(2) Maintain manufacturing functions in Japan and high levels of employment (Carrying on the tradition of craftsmanship)

(3) Maintain healthy financial conditions

(4) Ongoing investments (New product development, cost reductions, product quality improvements, higher levels of safety)

(5) Become the world's number one manufacturer of premium helmets

(6) Develop new markets, strengthen positioning in existing markets

(7) Impartial and fair distribution of profits (50% dividend payout ratio, distribution to employees and company as retained earnings)

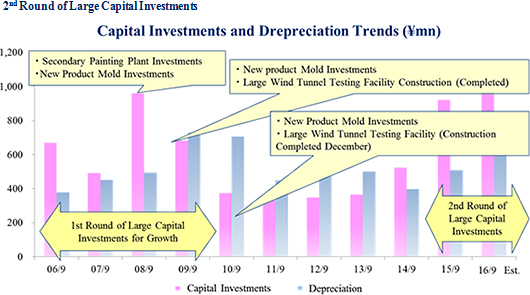

With the manufacture of all its products at two domestic plants in Ibaraki and Iwate, SHOEI strives to achieve the number one position in the global premium helmet market by (2) maintaining manufacturing functions and high levels of employment in Japan (Carrying on the craftsmanship tradition), (4) conducting ongoing investments (New product development, cost reductions, product quality improvements, higher levels of safety), and (6) developing new markets and strengthening its positioning in existing markets through the coordinated effort with its overseas subsidiaries. With regards to (4) ongoing investments (New product development, cost reductions, product quality improvements, higher levels of safety), the second round of large capital investments was started in fiscal year September 2015 for the purpose of achieving stable operations over the long term. Following the first round of large capital investments for growth between fiscal years September 2006 to 2009, which centered on the large wind tunnel testing facility, the total investment is expected to be ¥4 billion over 5 years. Capital investments in fiscal year September 2016 are expected to amount to ¥1.113 billion, and the estimate of ¥2.456 billion in operating cash flow is expected to absorb this large investment and enable SHOEI to secure free cash flow of ¥1.306 billion.  According to a large United States information services company, the average ROE for Tokyo Stock Exchange First Section listed companies stood at 8.15% at the end of fiscal year March 2015, compared with 8.56% at end of fiscal year March 2014. While SHOEI has a fiscal year that lags the companies listed in this survey by six months, it has been able to achieve much higher ROE than the average for the First Section companies in fiscal year September 2015. SHOEI's levels of leverage are low due to its strong financial foundations, and profitability has a room for rapid improvement when higher sales is achieved based upon the high margin of profitability of its high value-added premium helmets. Total asset turnover ratio may decline over the near term due to the start of "the second round of large investments to achieve stable management over the long term" during fiscal year September 2015. |

| Fiscal Year September 2016 Earnings Results |

Sales, Ordinary Income Rise by 6.2% and 16.9% Year-On-Year

Sales rose by 6.2% year-on-year to ¥14.244 billion. A 27.3% year-on-year rise in sales to North America due to aggressive purchases by local sales agents and a 5.9% year-on-year increase in sales within Japan due to inbound demand and despite the abating of the special demand created by the rush to beat the consumption tax hike were recorded. At the same time, favorable sales of the German, French and Italian subsidiaries contributed to a 1.6% increase in sales in Europe despite the strengthening of the yen relative to the euro. Sales to other geographic regions fell by 15.9% year-on-year due to inventory adjustments in Australia.With regards to profits, increases in pay, bonuses, depreciation, marketing expenses in Canada, and racer sponsor contracts fees boosted operating expenses by a large margin. However, the higher sales and weaker yen against US dollar allowed gross income to rise by 11.7% year-on-year, and operating income to rise by 16.1% year-on-year to ¥3.210 billion. Litigation settlement with an Italian sales agent (¥49 million) and fixed asset disposal loss (¥21 million) contributed to the booking of an extraordinary loss, but lower corporate and strategic reductions in tax rates allowed parent company net income to rise by 19.6% year-on-year to ¥1.996 billion. During the term, the average foreign exchange rates were ¥120.04 to the US dollar (¥102.96 in the previous term) and ¥137.48 to the euro (¥139.34 in the previous term). Also, the non-operating loss arising from foreign exchange translation loss amounted to ¥117 million. Dividend is expected to be raised by ¥12 from the previous term-end to ¥72 per share. SHOEI maintains a consolidated dividend payout ratio target of 50%.  New Products Introduced in 2015 HORNET ADV (Europe, Japan) / HORNET X2 (North America), J-FORCE IV

The new products introduced in 2015 included the sports utility helmets "HORNET ADV" and "HORNET X2" introduced to three geographic regions (Europe, North America, and Japan) and the premium open-faced "J-FORCE IV" as a new product focusing on Japanese market in the "J-FORCE" series in Japan."HORNET ADV/HORNET X2" belongs to a new category of helmets. It provides both strength and performance for cross-country riding while at the same time offering the beauty and comfort of on-road helmets. SHOEI defines helmets in this category as sport utility helmets (SUH), which pursue sporty riding for all kind of situations.

Capital investments in fiscal year September 2015, as is already explained, was ¥923 million. The installation of additional air handling unit (AHU) and air cooling chiller (Equipment to maintain air at a determined temperature) were mainly conducted along with investments for crisis management (Improvements in productivity from large improvements in the operating environment during the summer and increased stability of chemical product quality levels anticipated). Capital investments and depreciation are expected to amount to ¥1.113 and ¥0.630 billion (¥0.509 billion in FY9/15) in fiscal year September 2016, respectively. Free cash flow is expected to reach ¥1.306 billion.  |

||||||||||||||||||||||

| Fiscal Year September 2016 Earnings Estimates |

Sales Expected to Rise by 1.2 %, Ordinary Income to Decline by 17.5%

SHOEI's earnings estimates call for sales to rise by 1.2% year-on-year to ¥14.420 billion during fiscal year September 2016. The contribution from increased marketing facilities in China under the enhanced sales activities are expected to boost sales of other regions higher, along with a slight increase in sales of Europe (Sales volumes in Europe expected to trend sideways). Sales in North America are expected to trend weakly due to inventory adjustments resulting from the aftermath of the strong shipments recorded in the term just ended, and sales within Japan are expected to decline slightly.Operating income is expected to fall by 22.1% year-on-year to ¥2.5 billion. Increases in labor expenses resulting from hikes in wages (A 4% year-on-year increase in wages, same as the previous year, of ¥57 million anticipated), advertising in the North American market (¥179 million), rising cost at the European subsidiaries arising from the weaker euro relative to the yen (¥100 million arising from inventory evaluation loss), and increasing depreciation (¥120 million) are anticipated, along with a decline in unrealized profits (¥70 million). Non-operating income is expected to improve due to the lack of any anticipated foreign exchange translation losses. At the same time, the reduction in tax rate and assumption of strategic tax reductions are expected to contribute to a 13.9% year-on-year decline in parent company net income to ¥1.720 billion. Average foreign exchange rate assumptions during the coming term are ¥120.00 per US dollar (¥120.04 in FY9/15) and ¥132.00 per euro (¥137.48 in FY9/15). However, SHOEI has reserved half of its needs for euros of 7.00 million at ¥138.25 per euro (No currency reservations have been made for US dollar). Capital investment and depreciation are expected to amount to ¥1.113 and ¥0.630 billion, respectively. With regards to cash flow, reductions in inventories, accounts receivable and tax expenses are expected to allow the net inflow of operating cash flow to rise above the previous year's level to ¥2.456 billion despite anticipation of a decline in pretax income. Investing cash flow is expected to see a net outflow of ¥1.150 billion due to an increase in capital investments. Consequently, a net inflow of free cash flow of ¥1.306 billion is expected to be recorded. A dividend of ¥62 per share is anticipated.  (2) Business Environment and SHOEI's Positioning

The correlation between sales trends of new motorcycles and SHOEI products during 2015 was high, and the decline in motorcycle sales resulting from the rush to purchase ahead of the hike in the consumption tax contributed to a decline in product sales within Japan. At the same time, sales in overseas markets continued to rise. Specifically, domestic sales fell by 6.5% year-on-year from January to July, while sales in Spain, United Kingdom, Italy and Germany rose by 19%, 18%, 14% and 5.6% year-on-year, respectively during the period from January to October. At the same time, contrary to the expectation, sales in France declined by 3%. Also, sales in the United States and Canada rose by 6% (January to September) and just under 3% (January to July), respectively.A comparison of overseas trends relative to SHOEI's main Japanese rival (Ministry of Finance Trade Data, October 2014 to September 2015) shows that SHOEI maintained a high share of 74.2% of exports, excluding the Asia region. And while this reflects a slight decline from the 76.3% share of exports recorded during the period from October 2013 to September 2014 caused by the strong sales of GT-Air and NXR hit products, it compares favorably with the 70.8% and 74.8% share of exports during the October 2011 to September 2012 and October 2012 to September 2013 periods, respectively. By geographic region, the share of exports to Europe was 73.3% (77.2% in October 2013 to September 2014), 76.4% of exports to North America (74.9% during the same period), and 70.6% of exports to other regions (73.6% during the same period). However, exports to Asia, of which statistics have been available since last year, remained at a low 33.6% share, compared with 38.0% in the previous term. This low share of exports is attributed to a lack of marketing to consumers in the local markets. Therefore, SHOEI has signed contracts with a local sales agent headquartered in Amoy, China that has eight facilities throughout China to cultivate local demand (Collaboration was conducted with only one agent in Beijing until now).  (3) Winning Models for the 2016 Season

The game winning "X-14 (North America and Japan) / X-Spirit III (Europe)" under the Company's flagship racing model will be introduced for the 2016 motorcycle riding season in Japan, North America and Europe as well as the "J・O" model in Japan and Europe to help create a new product category for SHOEI.

X-14 (North America, Japan) / X-Spirit III (Europe)

"X-14 (North America and Japan) / X-Spirit III (Europe)" model is a product which eliminates all compromises to become the most optimized product for racing applications. It is a full-face on-road type helmet and positioned to become the flagship model for SHOEI. MOTO GP motorcycle racing champion Marc Marquez and nearly all other motorcycle racers sponsored by SHOEI participated in the development of this new helmet and had nothing but praise to say about it. In particular, Marc Marquez had high words of praise about its aerodynamic performance, along with comments from other racers praising the ventilation, fit, noise resistance and wide field of vision. Participants at the American International Motorcycle Expo (AIM Ezpo) held in Florida, United States in October also expressed their strong support for the product."X-Spirit III" will go on sale from March 2016 (Shipments started in January 2016) in Europe at a suggested retail price of between 699.00 and 869.00 euros (Germany and France, including tax). "X-14" will go on sale from February 2016 (Shipments started in January 2016) in North America at a suggested retail price of between 681.99 and 839.99 US dollars (Excluding tax). "X-14" will go on sale in Japan from spring 2016, but the suggested retail price has yet to be determined.  J・O

"J・O" is an open-face type helmet with an inner compartment shield that targets riders of custom and classic motorcycles. It has been developed in response to the trend for motorcycle manufacturers to release new models that are reminiscent of old styled motorcycle models made in the past. This model introduces a new category of products for SHOEI, advancing such characteristics as "lightweight, compact and fashionable." Concepts so unconventional to SHOEI the product was received with surprise and favorable impression at"EICMA" held in Milano, Italy in November.Sales in Europe are expected to begin from March 2016 (Shipments started in January 2016) at a suggested retail price of between 329.00 and 379.00 euros (Germany and France, including tax). Sales in Japan are expected to begin from spring 2016 (Suggested retail price has yet to be determined).  |

| Conclusions |

|

At the same time, full-capacity production conditions are anticipated to continue until May or June 2016 and this near-term strength in production has not been factored into earnings estimates. Furthermore, the yen continues to strengthen relative to the euro (Assumption of ¥132.00 per euro), but half of its needs of 7.00 million euros have been reserved at ¥138.25 per euro, a rate which is more favorable than the previous-term's rate of ¥137.48 per euro. While the product may not contribute significantly to earnings in fiscal year September 2016, the game winning helmet "X-14 (North America, Japan) and X-Spirit III (Europe)" is expected to become the status quo for the premium motorcycle helmet and will strengthen SHOEI's presence in the three markets of Japan, North America and Europe in 2016. "X-14 / X-Spirit III" is a top class premium helmet that lies outside of the high volume sales product category, but is designed to become the highest rated products at the top class of helmets. Therefore, the yen based pricing of about ¥90,000 and ¥80,000 expected in Europe (including tax) and North America (excluding tax), respectively suggest that sales volumes are not likely to be that large. Moreover, SHOEI has recognized its limitations of relying upon only one sales agent in Beijing, China to cover the entire country as a reason for its weak positioning relative to rival manufacturers in the China market. Despite the fact that the motorcycle market is focused upon electric motorcycles and maintains restrictions upon large gasoline engine motorcycles, sales of Japanese large gasoline engine motorcycles have trended favorably in China. Therefore, the premium helmet market is also expected to expand. To rectify this weakness in China, SHOEI will form marketing contracts with a new sales agent to provide strengthened sales coverage on a nationwide basis in China. Consequently, SHOEI can be expected to see its share rise in coming years in China. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016 Investment |