| Kyoritsu Maintenance Co., Ltd. (9616) |

|

||||||||||||||

Company |

Kyoritsu Maintenance Co., Ltd. |

||

Code No. |

9616 |

||

Exchange |

TSE 1st Section |

||

Chairman |

Haruhisa Ishizuka |

||

President |

Mitsutaka Sato |

||

HQ Address |

2-18-8 Soto Kanda, Chiyoda-ku, Tokyo |

||

Year-end |

March |

||

URL |

|||

*Share price as of closing on June 5, 2015. Number of shares outstanding as of most recent quarter end excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

This Bridge Report provides information about Kyoritsu Maintenance Co., Ltd. including a review of its fiscal year March 2015 earnings.

|

|

| Key Points |

|

| Company Overview |

<Corporate History>

Kyoritsu Maintenance was established in September 1979. The founder, Haruhisa Ishizuka, has long been associated with the food services industry and started the Company by taking on the operations of corporate cafeteria facilities on a consigned basis. In the following year of 1980 in Sakura City, Chiba Prefecture, the Company established a two story wooden structure with 28 small four Japanese straw mat rooms as its first dormitory facility. Based on the principle of providing "food" that "fosters the health and well being of students to put their parents' minds at ease," Kyoritsu was able to steadily expand its student dormitory business through partnerships with various schools. The Company steadily expanded its operating territory to cover the Tokyo, Kanagawa, Nagoya and Osaka regions. In April 1985, Kyoritsu began offering corporate dormitories to employees that offered highly unique features of "individual rooms with commissary functions providing breakfast and dinner," and "large bathing facilities" as comforting amenities for residents. In June 1993, the Company moved its headquarters to its current location and in July of the same year it entered the resort hotel business with the opening of a facility in Nagano Prefecture, followed by their entry to the business hotel realm in August with the opening of a facility in Saitama Prefecture. In September 1994, Kyoritsu listed its shares on the JASDAQ Market (At the time called the OTC Market), in March 1999 it moved its listing to the Second Section of the Tokyo Stock Exchange, and then to the First Section in September 2001.

|

| Fiscal Year March 2015 Earnings Results |

Sales, Ordinary Income Rise 4.7%, 12.7% YY

Sales rose by 4.7% year-on-year to ¥110.212 billion, due in part to the strong occupancy rates seen at the start of the term in the dormitory business of 97.2%, up 0.2% points from the previous term start. In the hotel business, which is growing strongly, both Dormy Inn and resort hotels recorded increases in occupancy rates from the previous term on the back of higher usage by inbound travelers from overseas and subsequent strong room pricing trends. The 0.7% point increase in gross income margin helped to offset a 0.4% point rise in sales, general and administrative expense margin from the previous term and allowed operating income to rise by 9.7% year-on-year to ¥8.217 billion. Declines in interest payments and an increase in foreign exchange gains allowed ordinary and net incomes to rise by 12.7% and 14.6% year-on-year to ¥7.663 and ¥4.387 billion respectively. Ordinary income rose for the fifth consecutive term to the third consecutive term of record high profits.

Dormitory Business

Sales and operating income rose by 2.9% and 4.1% year-on-year to ¥42.665 and ¥6.371 billion respectively. Occupancy rates at the start of the term rose by 0.2% year-on-year to 97.2%, and the number of contracted rooms rose by 858 to 33,480 at the term start. New collaboration for student dormitories were formed with Atomi University , Tohoku Institute of Technology, Kobe Women's University and other educational institutions. Furthermore, the number of foreign student residents rose to account for 10.0% of all student residents. The total number of contracts for student dormitory rooms rose by 1.1% year-on-year to 19,741 and their sales rose by 0.9% year-on-year to ¥24.966 billion. With regards to dormitories, increases in hiring by financial institutions and the introduction of dormitories by new companies led to increases in the number of contracts. The number of employee dormitory resident contacts rose by 4.9% year-on-year to 9,113 and sales rose by 8.2% year-on-year to ¥10.464 billion.Introduction of residents to Domeal rooms from collaborating schools and companies, and residents switching from dormitories with cafeteria services contributed to a 6.2% year-on-year increase in residents to 4,635 and a 4.6% year-on-year rise in sales to ¥3.890 billion. Kyoritsu Maintenance's efforts to differentiate its services by promoting its status as "Japan's top dormitory operator" allowed sales to rise by 0.9% year-on-year to ¥3.344 billion.  Hotel Business

Sales rose by 7.9% year-on-year to ¥46.929 billion and operating income grew by 23.6% year-on-year to ¥4.736 billion. Both the Dormy Inn and resort hotel facilities recorded strong occupancy rates and pricing trends. The number of rooms at the 72 hotel facilities rose by 212 year-on-year to 10,824.

Dormy Inn (Business Hotel) Business

Favorable trends at "Natural Hot Spring Satsuki no Yu Dormy Inn EXPRESS Kakegawa" and "Natural Hot Spring Yugiri no Yu Dormy Inn PREMIUM Namba" facilities newly opened during the previous term and strong trends at existing facilities contributed to high occupancy rates. Occupancy rates at existing facilities rose by 1.0% point year-on-year to 88.1%, and the ADR rose by ¥400 year-on-year to ¥8,700. "Dormy Inn PREMIUM Shibuya Jingumae," "Dormy Inn Tokyo Hatchobori," and "Dormy Inn PREMIUM Kyoto Ekimae" also enjoyed extremely high occupancy rates.The recent weaker yen and strengthened marketing in Korea and other Asian countries to cultivate inbound hotel users contributed to steady growth in foreign hotel guests. The number of inbound foreign hotel users rose by 5.8% points year-on-year to 10.6% during fiscal year March 2015, with their share rising each year and to 13.2% in the fourth quarter. Furthermore, the ratio of inbound foreign users exceeded 50% at the "Dormy Inn PREMIUM Namba," "Dormy Inn Shinsaibashi," and "Dormy Inn Akihabara." The ADR of inbound foreign users of ¥10,300 was significantly higher than the ¥8,600 for Japanese users, and inbound foreign usage has contributed to increases in both pricing and occupancy rates. Despite the burden of expenses for preparation of overseas business deployment, favorable occupancy rates and higher pricing enabled profits to grow.   Resort Hotel Business

The opening of "Inishie no Yado Ikyu" timed to match the grand relocation ceremony of the Ise Jingu Shrine in the previous term and an increase in domestic travelers and repeat users of existing facilities contributed to a 3.3% point year-on-year increase in occupancy rates to 83.6%. "La Vista Hakodate Bay" and the hotel in Kyoto trended strongly and helped to offset the negative impact of strong typhoons and heavy rains that occurred during the term under review. Consequently, ADR rose by ¥400 year-on-year to ¥38,400.

Other Businesses

Sales rose by 0.8% year-on-year to ¥36.286 billion, while operating loss expanded to ¥95 million from ¥34 million during the previous term. Comprehensive building management services sales declined by 3.1% year-on-year to ¥12.626 billion but operating income rose by 114.0% year-on-year to ¥376 million. While the sales of facilities owned by Kyoritsu during the previous term caused sales to decline, profits actually increased on the back of optimization of construction division work.The food services business recorded a 2.9% year-on-year increase in sales to ¥5.330 billion and operating loss declined to ¥1 million from ¥43 million in the previous term. Efforts to strictly control costs were successful in limiting the loss despite difficult operating conditions arising from delays in the recovery in consumption in the wake of the consumption tax hike and increases in materials costs. The construction business recorded a 24.8% year-on-year rise in sales to ¥9.456 billion but operating income declined 9.2% year-on-year to ¥277 million. The negative impact of continued high development costs were offset by higher orders for hotel construction work. The other segment recorded growth in sales of 27.6% year-on-year to ¥8.871 billion, but operating loss increased to ¥748 from ¥472 million in the previous term. Wellness life business recorded expansion of losses due to expenses for launching business.   |

| New Midterm Business Plan "Kyoritsu Full Accelerator Plan" Created |

|

Business Environment

"Japan Revitalization Strategy" 2014 Revised

Future Events

Basic Policies

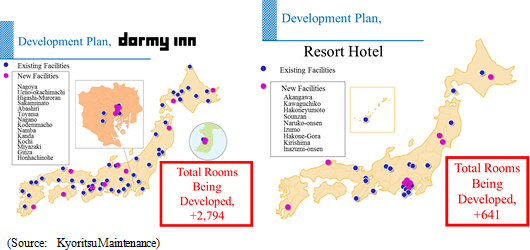

1. Focused and aggressive development investment will be accelerated to meet customer needs2. Strengthen profitability by optimizing the balance between value and price The number of rooms under development are 4,930 dormitory and Domeal rooms, 2,794 Dormy Inn rooms, and 641 resort hotel rooms. Dormitory Business Development Plan

|

| Fiscal Year March 2016 Earnings Estimates |

Sales, Ordinary Income Expected to Rise by 10.4%, 2.4% YY Respectively

Kyoritsu Maintenance's fiscal year March 2016 earnings estimates call for sales and ordinary income growth of 10.4% an 2.4% year-on-year to ¥121.7 and ¥7.850 billion respectively. The dormitory business is expected to record increases in sales and operating income of 4.1% and 3.4% year-on-year to ¥44.420 and ¥6.590 billion respectively. Occupancy rates at the start of the term rose by 0.1% year-on-year to 97.3%, and large consignment projects were booked. The increase in sales is expected to absorb increases in rent and lease fees and depreciation expenses, and to allow profits to grow. The hotel business is expected to see 11.2% and 3.8% year-on-year growth in sales and operating income to ¥52.185 and ¥4.914 billion, due to the ability to absorb the initial year losses of ¥827 million arising from openings of new facilities including four Dormy Inns and three resort hotel facilities. Occupancy rates at business and resort hotels are expected to trend in line with the term just ended at 88.2% and 83.3% respectively. Hotel room prices are expected to rise by ¥400 to ¥9,100 in business hotels and ¥1,800 to ¥40,900 in resort hotels. Other business is expected to see a 25.9% year-on-year increase in sales and record operating income of ¥495 million, which compares with the loss of ¥95 million in the previous term. The construction business is expected to see higher sales on the back of the rush to develop hotels, and comprehensive building management services and PKP businesses are expected to contribute to profits. A full year dividend of ¥50 per share (¥25 paid at the end of the first half) is anticipated. Moreover, this represents a real ¥10 increase in dividends (a real 20% increase) after the 1.2 for 1 stock split conducted on March 31, 2015 is taken into consideration.

|

| Conclusions |

|

<Disclaimer>

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015 All Rights Reserved by Investment Bridge Co., Ltd. |