Bridge Report: (2428) WELLNET

Kazuhiro Miyazawa | WELLNET CORPORATION (2428) |

|

Company Information

Exchange | TSE 1st |

Industry | Service |

President | Kazuhiro Miyazawa |

HQ Address | 1-1-7 Uchisaiwaicho, Chiyoda-ku, Tokyo |

Year-end | June |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE Act. | Trading Unit | |

¥1,092 | 18,756,980 shares | ¥20,482 million | 6.0% | 100 shares | |

DPS Est. | Dividend Yield (Est.) | EPS Est. | PER Est. | BPS Act. | DPS Est. |

¥50.00 | 4.6% | - | - | ¥383.33 | 2.8 x |

* Stock price as of the close on February 21, 2019. Number of shares outstanding at the end of the most recent quarter excludes treasury shares.

ROE and BPS are from the previous fiscal year.

The earnings forecast for the fiscal year June 2019 is unpublished as of now as there are many uncertain factors.

Non-Consolidated Earnings Trend

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

June 2014 | 7,600 | 1,473 | 1,488 | 913 | 46.26 | 23.50 |

June 2015 | 8,888 | 1,637 | 1,520 | 938 | 48.37 | 25.00 |

June 2016 | 10,529 | 2,054 | 2,007 | 1,350 | 71.91 | 40.00 |

June 2017 | 10,260 | 1,099 | 1,239 | 869 | 46.36 | 50.00 |

June 2018 | 9,783 | 677 | 708 | 495 | 26.31 | 50.00 |

June 2019 Est. | - | - | - | - | - | 50.00 |

*units: million yen and yen. The estimates were from the company.

”*A 2 for 1 stock split was implemented on July 1。

*The earnings forecast for the fiscal year June 2019 is still to be announced due to a lot of uncertainties.

We present this Bridge Report on WELLNET CORPORATION reviewing its earnings results of the fiscal year June 2019.

Table of Contents

1. Company Overview

2. First Half of Fiscal Year June 2019 Earnings Results and Fiscal Year June 2019 Earnings Estimates

3. Conclusions

4. Reference 1: Outline of the new 5-year mid-term managerial plan>

5. Reference 2: Regarding corporate governance>

Key Points

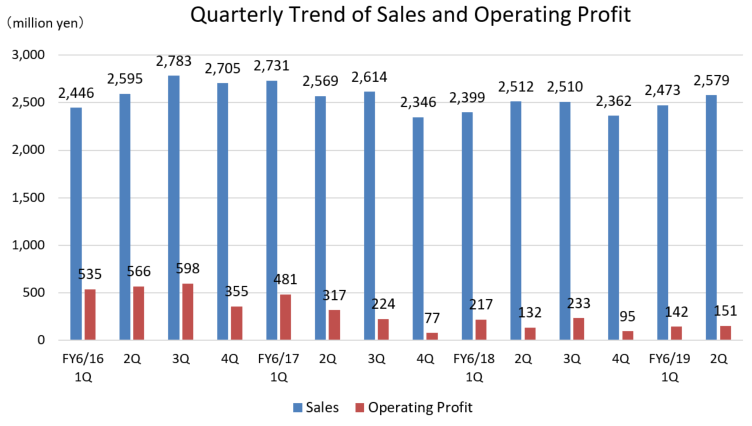

- The sales for the first half of the fiscal year June 2019 were 5,052 million yen, up 2.9% year on year. The market of non-face-to-face payment settlement is expanding, and the decline in sales due to the integration of convenience store chains is ending. In addition, the effects of the revision to conditions for transactions with large clients and the decrease of OEM have subsided as a whole. Excluding these factors, the sales to other enterprises steadily increased about 5% year on year, showing sales growth for 3 consecutive quarters, although the growth rate is not so high on a quarterly basis. Operating profit declined 16.0% year on year to 293 million yen. While gross profit decreased due to the revision to prices for leading enterprises, etc., the company continued active investments, including the increase of personnel, the addition of new app functions, and promotion targeted at consumers.

- While the company has added new functions for “Bus Mori!” and “Shiharai-Hisho,” continued development for automatic operation, and carried out active promotion for increasing popularity and app downloads, there are many uncertainties that would affect business performance. Accordingly, the initial estimates for the fiscal year June 2019 have not been announced. They will be announced, when it becomes possible to forecast business performance rationally. The dividend is to be 50 yen/share, unchanged from the previous term.

- The variations in quarterly sales and operating profit indicate that sales have grown for 3 consecutive terms although the growth rate is low, and operating profit rose 14.4% in the second quarter (October to December). As the market of non-face-to-face payment settlement is growing, the effects of the revision to prices for large clients and the decrease of OEM are subsiding, we would like to pay attention to whether especially sales can keep growing from the third quarter. As an increasing number of clients adopt Shiharai-Hisho and Bus Mori! it is noteworthy when they will start contributing to revenue.

1. Company Overview

WELLNET provides electronic payment settlement system for sales business operators selling various products and services.

With the key concepts of “real time” and “one stop,” WELLNET offers a “convenient direct sales platform” to provide (1) its customers (i.e. the purchaser of service and goods) with the convenience of purchasing whatever they want at any time and from any place, and (2) its sales business operators (i.e. WELLNET's direct customers) with the capability of “maximizing sales opportunities” in selling products and services over the Internet.

The multiple payment service, which is WELLNET’s core business, has been implemented by a wide range of clientele including major Japanese airlines and express bus companies, in addition to major mail-order businesses. Ever since its inception, WELLNET has endeavored to maintain the spirit of taking on new challenges which is engrained in its corporate DNA.

1-1 Corporate History

WELLNET CORPORATION got its start as a subsidiary of a gas and fuel merchant called Ichitaka Takahashi Co., Ltd. in Hokkaido for the purpose of developing new businesses.

At the time of its inception, utility bill payment services at convenience stores had already begun. However, the Company began preparations for the expansion of payment settlement services to include mail order catalog sales.

WELLNET developed an integrated seamless “convenience store consigned bill payment settlement service” that included the functions of printing and mailing of invoices, and bill payment information processing which could be used 24 hours a day, 365 days a year. This system quickly spread amongst product and service merchants because it was distributed free of charge and enabled them to dispense with making large outlays to develop their own payment settlement systems.

Furthermore, WELLNET developed a system that allows customers to avoid having to print out paper copies of invoices and allows for customers to make real time connections for electronic invoices and payments, which is the system currently used widely. The system’s ability to eliminate development costs and to allow customers make electronic payment settlement connections with convenience stores and other payment outlets without the need to sign agreements has contributed to its strong reception and numerous implementations by airlines and bus companies, in addition to boosting WELLNET’s earnings. In 2004, the Company listed its shares on the JASDAQ market.

Thereafter, WELLNET has expanded the provision of its “multiple payment service” to include large companies such as amazon, Yahoo! Shopping, Yahoo! Auction, low cost carrier (LCC) airlines, West Japan Railway Company and JR Kyushu Railway Company. In addition, the Company has also focused its attention upon developing solutions leveraging the know-how of electronic ticket service market including the cellphone ticketing service, which has many good track records.

It was listed in the first section of Tokyo Stock Exchange in December 2014.

The company concentrates on earning profits from “Bus Mori!” which is an innovative solution of using IT for bus operation that can significantly enhance the convenience for both bus operators and users, and “Shiharai-Hisho,” a server-based electronic money service.

1-2 Market Conditions

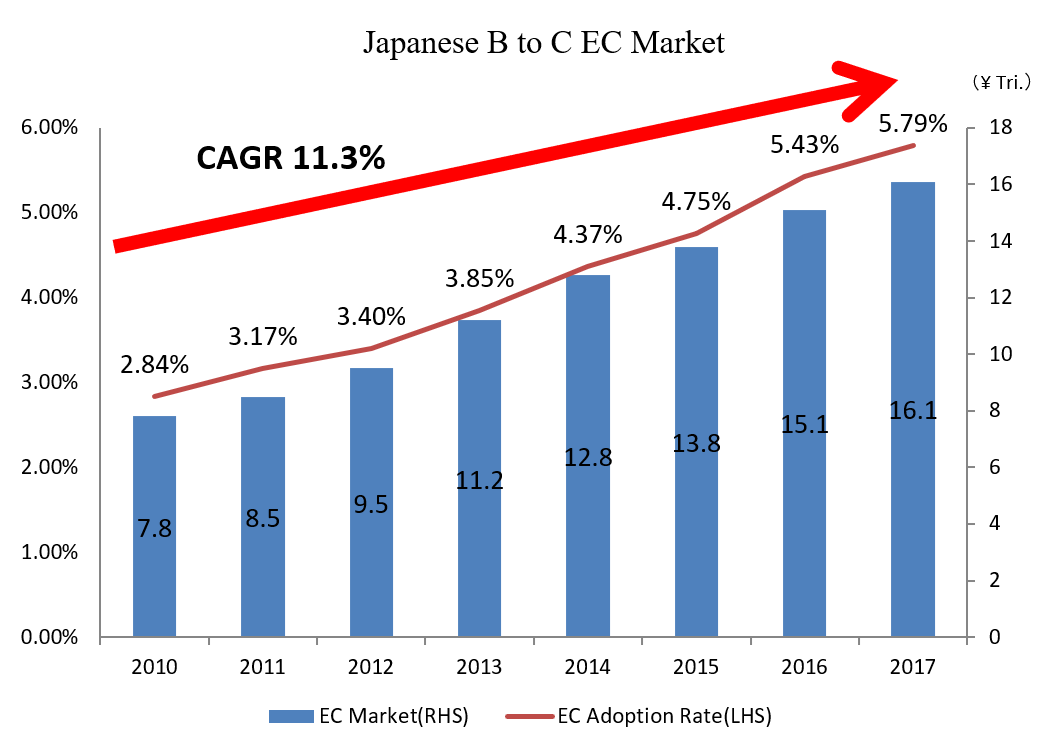

According to the Ministry of Economy, Trade and Industry’s report entitled FY 2017 Research on Infrastructure Development in Japan’s Information-based Economy Society (E-Commerce Market Survey) issued on April 25, 2018, the Japanese electronic commerce market (B to C) for consumers rose by 9.1% year-over-year to ¥16.1 trillion in 2017. Compound average growth rate (CAGR) from 2010 to 2017 is 11.3%.

(Source: The chart made by Investment Bridge based on the data above from the Ministry of Economy, Trade and Industry)

The rate of EC adoption (share of e-commerce transactions amongst all the transactions) is still only 5.79% for the sale of goods, but it is growing steadily.

<B to C EC Market Scale by Industry (2017)>

Industry | EC MARKET (¥100mn) | YY Change (%) | EC ADOPTION RATE (%) | |

Sale of goods | Clothing/Accessories | 16,454 | +7.6% | 11.54% |

“Home appliances | 15,332 | +7.4% | 30.18% | |

Food/ Beverages/ Alcohol | 15,579 | +7.4% | 2.41% | |

Services | Travel services | 33,742 | +11.0% | - |

Financial services | 6,073 | -0.7% | - | |

Ticketing | 4,595 | +2.9% | - | |

Digital | Online games | 14,072 | +7.5% | - |

E-publishing (digital books/magazines) | 2,587 | +20.1% | - | |

Paid video streaming | 573 | +8.3% | - | |

(Source: The chart made by Investment Bridge based on the data above from the Ministry of Economy, Trade and Industry)

1-3 Business Description

With the key concepts of “real time” and “one stop,” WELLNET offers a “convenient direct sales platform” to provide (1) its customers (i.e. the purchaser of service and goods) with the convenience of purchasing whatever they want at any time and from any place, and (2) its sales business operators (i.e. WELLNET's direct customers) with the their capability of “maximizing sales opportunities” in selling products and services over the Internet.

The business segment to be reported is only “payment settlement and authentication business.” The following section will introduce the primary services of WELLNET.

1-4 Settlement service

1-4-1 Multi-payment service

It becomes possible to electronically charge and settle payment on a real-time basis without using any written bills, just by creating a connection with WELLNET.

Business operators do not need to develop systems for connecting to various payment receiving institutions, such as convenience stores, banks, post offices, and credit card companies, or sign individual contracts.

<Advantages and Characteristics>

・ Business operators only have to offer data to WELLNET, after settlement transactions of purchasers and users. WELLNET explains payment methods to purchasers and users.

・ Since it is possible to electronically charge and obtain receipt information on a real-time basis without using any written bills, business operators can use the system instantly.

・ Even if purchase contents (amounts) are changed, the payment of the changed amount can be settled.

・ WELLNET provides modules for receiving information free of charge, and so system connection is easy.

・ WELLNET develops and operates cutting-edge settlement systems, and so business operators do not need to develop systems.

・ The service was launched in July 2000, and has been adopted by all of Japanese airlines, major express buses, major mail-order companies, etc.

・ The operation center offers payment settlement services 24 hours a day, every day, with the 24-hour manned monitoring system.

・ For paperless settlement, WELLNET has developed the largest infrastructure network in Japan.

1-4-2 Paper-less settlement service

It is possible to issue a written bill and charge and settle payment electronically on a real-time basis with a single service.

(Features)

・ Enterprises only have to upload the data of the bills to be sent to their customers to the management window in the WELLNET format. WELLNET sends the bills on behalf of enterprises by mail.

・ The bills include the guide for a website for applying for electronic settlement, and customers easily complete the procedures in the website provided by WELLNET with a PC or a smartphone.

・ Then, it becomes unnecessary to send bills to customers who have applied for paperless settlement.

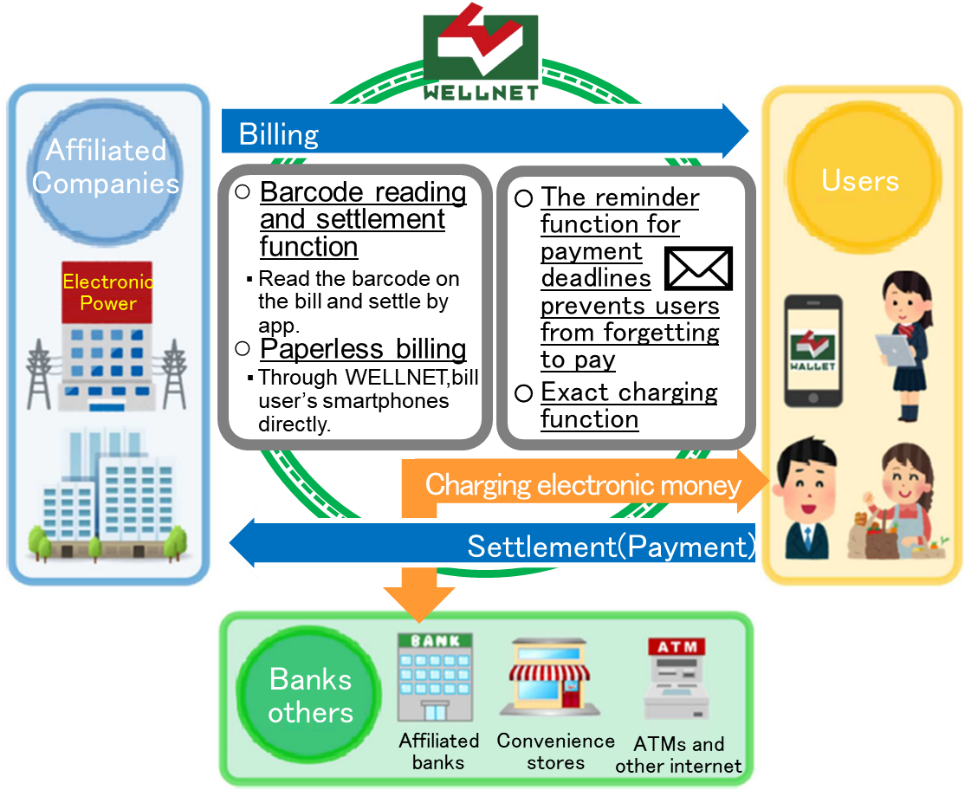

1-4-3 Shiharai-Hisho

A sever-based type electronic money service. By utilizing the smartphone app “Shiharai-Hisho,” it is possible to complete payment anywhere without going to a convenience store or an ATM of banks.

(Source: WELLNET)

(Features)

・ It is possible to pay a bill immediately just by reading the barcode on the bill sent to the customer with a camera.

・ This provides customers who do not have a credit card with an instant payment method.

・ It is also possible to pay instantly from an account of an affiliated bank.

・ It is easy to keep track of the amount of money deposited, as the prepaid electronic money system has been adopted.

・ When the payment of monthly public charges, etc. is registered, the app will notify customers of the deadline for payment, and so this is expected to prevent customers from forgetting to pay a bill.

Major clients that have adopted this service | Kansai Electric Power, Kyushu Electric Power, Tohoku Electric Power, Shikoku Electric Power, Hokkaido Electric Power, Hokuriku Electric Power, JR Bus Group, Ibaraki Kotsu, ALPICO Kotsu, Meitetsu Bus, Mie Kotsu, Kaetsunou Bus, Kawagoe Motor, Kyushu Sanko Bus, Eniwa City in Hokkaido, Hokkaido Chuo Bus, Hokuto Kotsu, Chigin Network Service, AirAsia Japan, Peach Aviation, Kintetsu Department Store, Brandear Auction, Sony Music Artists, Shimamura Music, Qoo10, etc. |

Affiliated banks | Sumitomo Mitsui Banking, Daisan Bank, Mie Bank, Japan Post Bank, Chiba Kogyo Bank, Taiko Bank, Hokkaido Bank, Ehime Bank, Akita Bank, Awa Bank, Kagawa Bank, Bank of Kochi, Shikoku Bank, Tokushima Bank, Hyakujushi Bank, Daishi Bank, Sendai Bank, Chikuho Bank, Tottori Bank, Fukui Bank, Toyama Bank, North Pacific Bank, etc. |

1-5 Cash transfer service

1-5-1 Cash transfer service to the bank account-

This service allows merchants to use the Internet to efficiently make payments to customers for reasons such as refunds for cancellations. WELLNET operates a dedicated website that allows consumers to use an ID received from the merchant and to input their own bank account information for merchants to make payments to.

From the end of October 2018, 24-hour processing for cash transfers is being conducted.

<Advantages and Characteristics>

・ The ability of consumers to input their own bank account information and automatic processing of this information allows merchants to reduce their work load by eliminating the need to input account information.

・ Increases customer satisfaction by allowing merchants to make payment of refunds within the same day.

・ Eliminates the need for merchants to develop their own refund systems.

・ Eliminates the need to retain bank account information of customers and reduces the risk of leakage of personal information.

1-5-2 Cash receipt (Transfer) service at Convenience Stores

As with the Cash transfer service to the bank account, this service concerns refunds when consumers cancel an order from a merchant. Unlike the Cash transfer service to the bank account, this service requires no bank account.

The consumer inputs a cash pickup number and ID (provided by the merchant) into a Lawson convenience store “Loppi” multimedia terminal, which issues a cash exchange ticket, and this cash exchange ticket can be exchanged for cash at the register.

From May 2018, the company partnered with “Seven Payment Service,” making it possible to receive cash at Seven Eleven convenience stores. This significantly increased the number of locations where cash could be received.

<Advantages and Characteristics>

・ Merchants do not need to collect the consumer's account information beforehand.

・ Compared to postal transfers, there are lower costs and cash can be received quickly.

・ Smooth refunds with no risk of errors in handling bank account information.

1-6 Billing (Payment/Invoices at Convenience Stores) Services

1-6-1 Convenience store bill payment service

WELLNET’s bar code payment invoice issuance system and accounts receivable recovery via convenience store consigned bill payment service. Payment information is transmitted on the next business day after the payment is made (For payment at post offices, two business days), and automatically makes ledger notes of the payment.

Currently, bills for mail order sales, etc. can be paid in arrears using this system.

<Advantages and Characteristics>

・ Payments can be made 24 hours a day, 365 days a year at nationwide convenience stores (Available at approximately 58,000 stores with 10 different convenience store chains, as of February 2019), relieving bill paying customers from the need to rush to post offices and banks during normal business hours.

・ Merchants can begin operating the payment systems within short time after application.

・ Merchants can print out their own bill payment receipts, and avoid leakage of customer information because the payment information is based on numeric bar code information only.

1-6-2 Consigned Invoice Issuance Service

WELLNET provides total comprehensive bill payment issuance and payment settlement support services including consigned bar code invoice payment printing and mailing functions, payment confirmation, and payment ledger note.

In particular, its bill payment services are used commonly for payment of services that do not entail shipment of goods (gas bills, various membership fees).

WELLNET also provides a service that reduces postage expenses by allowing business operators to go paperless. By using this service, businesses can promote electronic bills simply by having the bills issued through WELLNET, and enjoy the benefit of reduced postage expenses. In addition, through this service, WELLNET receives billing information from enterprises, so that consumers do not need to read the barcode for billing information, and this promotes the distribution of Shiharai-Hisho among consumers.

1-7 Bus IT solution “Bus Mori!”

In Mar. 2001, WELLNET launched the service of enabling customers to buy a booked ticket for an inter-city express bus anytime 24 hours a day at a convenience store, for the first time in Japan. Since then, the company has concluded a contract with over 100 bus agencies, and issued bus tickets for several hundred routes. In the field of electronic tickets, the company has achieved some results and accumulated know-how to issue and authenticate electronic air tickets for cell phones and then tickets at Sapporo Dome, etc.

The culmination of the know-how is “Bus IT Project Bus Mori!”.

This is an innovative service that can considerably improve the convenience for both bus agencies and users. Users can reserve and purchase bus tickets safely and securely from their smartphone, anytime and anywhere. Bus agencies also become more efficient by using electronic tickets. As a result, sales opportunities can be maximized.

The “Bus Mori!” series has been expanded. It includes “Bus Mori!” a consumer smartphone application, and “Bus Mori! MONTA,” a service for bus agencies that use tablet terminals that allows them to manage express bus reservations in real time.

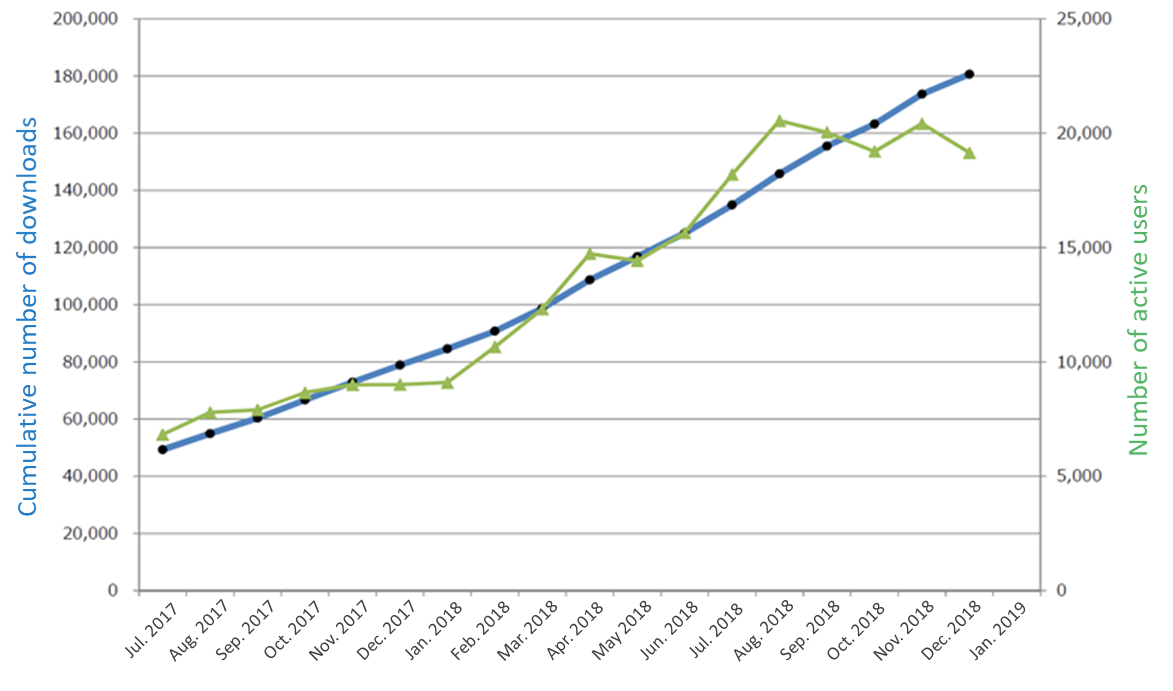

As of March 2019, the number of downloads of “Bus Mori!” was about 220,000, the number of active users who use the app at least once per month was about 30,000, and the number of routes where smartphone tickets can be used was over 250.

The company released the new function “Smartphone Commuter Pass” and started to provide “Electronic Ticket Collection,” “Electronic Coupons,” and “Free Pass” to promote the “Bus IT Project.” which enable both bus companies and users to take big advantage.

1-8 “Bus Mori!” Japan’s first smartphone app for searching for and booking an express bus seat, buying its ticket, and getting on the bus, which increases the convenience of inter-city express buses

As for express bus tickets, it was common to book and buy tickets via the website of each bus agency or by telephone, but this service enabled customers to book and purchase an express bus ticket (while choosing a seat for some routes), change plans, and receive a refund, with simple operation.

In addition to tickets issued at convenience stores, electronic tickets which are displayed on the screen of smartphones are now available, resulting in significant improvement of user-friendliness because users can buy tickets anywhere and anytime 24 hours a day with their smartphones at hand.

Users can receive the latest news about express buses and push notifications when a deadline for payment draws near, while bus agencies can send directions to reach a bus stop.

As for the methods for authenticating electronic tickets, in addition to “Bus Mori! MONTA” which is an in-vehicle tablet terminal that has been already released, the company added the function to authenticate tickets with “electronic punching” to “Bus Mori!” for bus agencies with no “authentication terminal”. This is covering almost all the bus routes and therefore the number of routes where “electronic tickets” are acceptable is increasing.

Outline of the functions of “Bus Mori!”

A smartphone suffices for completing all procedures | |

With a smartphone only, customers can easily purchase any of tickets for inter-city express buses and airport shuttle buses for over 100 companies handled by WELLNET. | |

When a frequently used ticket is registered in “Instant Purchase,” it becomes possible to buy the ticket with one click. | |

For a ticket bought under the “Instant Purchase” mode, it is possible to change it to the ticket for the next bus with one click. (The use for an airport or the like is assumed.) | |

It is also possible to buy a ticket from the list of previously purchased tickets | |

A smartphone suffices for completing the procedures for cancellation. | |

Several languages are available, including Japanese, English and Chinese (simplified). | |

1-9 “Bus Mori! MONTA,” a service of the real-time management of data on express bus reservations for bus agencies

“Bus Mori! MONTA,” which can manage inventory on a real-time basis based on mobile data communications, is characterized by the following functions. It would reduce the burdens on crews and maximize selling opportunities.

・ Electronic seat chart: User can check the reservations and vacant seats of buses currently in operation.

・ Ticket sale: If a user who has not yet paid the fare gets on a bus, the fare for the user can be displayed.

・ Ticket confirmation and authentication: User can authenticate the tickets of users, handle them online, and update reservation information.

From October 2, 2017 to March 31, 2019, the company broadcasted the FM program “Bus-Tabist (Travel by Bus)” for the purpose of promoting Bus Mori! via 38 JFN stations with Tokyo FM being the key station. This program introduced short stories set in routes that have adopted Bus Mori! and reached 1.7 million listeners.

1-10 SUPER SUB” Service

An online ticket solution that provides one-stop, comprehensive services ranging from ticket issuance, payment, and authentication functions.

This system eliminates the need for merchants to develop individual systems that connect to servers, allowing for easy use by not only merchants but also individuals holding events.

This system was launched in June 2012 aiming at increasing the number of customers, in addition to the existing large clients such as airlines and bus companies, based on its efficient and low-cost strategy.

<Advantages and Characteristics>

・ Event organizers can create web pages for their events as to their ticket reservation, application and sales, simply by entering basic information relating to the events such as ticket pricing, location, date of the event, etc. into the registration page (Currently only available to PCs).

・ Simply linking the above web pages to the organizer’s event page will enable the launch of ticket sales.

・ Customers seeking to participate in an event can purchase tickets via PCs, smartphones, and cellular telephones.

・ Both e-tickets and paper tickets printed at convenience stores can be used. The tickets use QR codes and special applications will be used for authentication of these codes for entry to events. The system allows for smooth operations at events through accurate authentication. It is also possible to use just paper tickets, in which case the authentication application is unnecessary.

・ Similar to multiple payment services, this service provides a multitude of various payment settlement methods.

・ The system can be launched within three weeks from application for ticket through installment of the system to the sales of tickets.

・ There are no initial costs or basic monthly fees. In exchange, a commission of 5% of ticket sales is collected to help keep operational costs extremely low.

・ Not only for permanent facilities, this system is suitable for limited time events, concerts, lectures, seminars, regional events, parties, reunions and other events that range from 10 to 5,000 attendants.

1-11 ROE Analysis

| FY6/14 | FY6/15 | FY6/16 | FY6/17 | FY6/18 |

ROE (%) | 11.3 | 11.5 | 16.3 | 10.2 | 6.0 |

Net Profit Ratio Margin | 12.01 | 10.55 | 12.83 | 8.48 | 5.06 |

Total Asset Turnover | 0.36 | 0.43 | 0.52 | 0.47 | 0.50 |

Leverage | 2.58 | 2.50 | 2.44 | 2.54 | 2.38 |

The ROE of WELLNET in the previous term was under 8%, which is the general target for Japanese companies.

This was due to stagnation in sales caused by a decrease in convenience store related sales (PIN/POSA) for existing business, reductions in OEMs, price strategies in regard to major business operators, and a drop in net profit margin due to investment in the company’s growth. However, this is expected to subside soon.

We would like to pay attention to when profitability will recover and allow ROE to rise once more.

1-12 Characteristics and Strengths

1-12-1 Strong Track Record of Implementations, Strong Customer Base

WELLNET’s multiple payment service has developed a highly favorable reputation for its ability to eliminate development expenses at the time of their implementation and the need to form contracts with each payment institution. WELLNET’s service has been introduced to the leading companies in each industry as described below.

One of WELLNET’s largest assets is the highly favorable reputation received from airlines and bus companies for their system’s real time capabilities.

It is this strong customer base that lies at the core of its highly favorable reputation, which is considered to be an important “invisible asset.”

Airlines | All Nippon Airways, Japan Air Lines, Air Do, Star Flyer, Solaseed Air, Oriental Air Bridge, Jetstar, Peach Aviation, Korean Air, Air Asia X, Air China, others |

Buses | Over 500 Japanese bus lines from over 100 bus-operating companies including: Kousoku Bus Net (JR Bus Kanto, Nishi Nihon, Tokai, Chugoku, Shikoku, Kyushu, etc.), Highwaybus.com (Keio Electric Railways, Nagoya Railroad, Tokyu, etc.), @Bus-de (Nishi-Nippon Railroad [Kyushu 14-company confederation including Nishi-Nippon Railroad]), Keihin Kyuko Bus, Airport Limousine (Airport Transport Service), Net-de-bus (Ryobi Bus), Hassha All Right Net (Hankyu Bus, Nankai Bus, Kintetsu Bus, Shinki Bus, Meitetsu Bus, Seibu Bus, Kokusai Kogyo, Alpico Kotsu, Fuji Kyuko, Konan Bus, Odakyu Hakone Highway Bus, Shimotsui Dentetsu Bus, Ichihata Bus, Shikoku Kosoku Bus, Iyo Railway Bus, Kyushu Sanko Bus, etc.), others |

Ferry | Tokai Kisen, Shin Nihonkai Ferry, KYUSYU SHOSEN, Ferry Sunflower, etc. |

Mail Order, Others | Amazon, Yahoo! Shopping, Yahoo! Auction, Qoo 10, Google, Estore, STORES.jp, Takken Family, R-bies, Aflac, AIU, Mitsui Direct, R-bies INC., Dinos, Sofmap, Jalpak, ANA Sales, MOL Ferry, Sony Music Artists, Hankyu Department Store, Tokyu Department Store, Kintetsu Department Store, Saikaya, Kansai Electric Power, Chugoku Electric Power, Chubu Electric Power, Kyushu Electric Power, Hokkaido Electric Power, Hokuriku Electric Power, KDDI, Toyo Keiki (e-gas tickets), University entrance examination fees, University admission fees and tuition, entrance examination fees for various universities, Sundai, Disco Corporation, Shizuoka Cultural Foundation, Hanshin Koshien Stadium, Tokyo Metropolitan Symphony Orchestra, Recruit, The New Japan Philharmonic, NHK Symphony Orchestra, Hanshin Koshien Stadium, Dialog in the Dark Japan, Recruit, Trust Bank others |

Internet DE Transfer | All Nippon Airways, Peach Aviation, So-net, Sagawa Express, Sumitomo Mitsui Card, YJFX! Japan Securities Finance, JFX, Hirose Trader, Brother Industries, Future, Recruit, Benesse Corporation, GREE, Vanilla Air, Askul, others |

1-12-2 Corporate DNA: Always Taking on New Challenges

E-Billing Service, Billing Service, various money transfer services, cellular telephone ticket service and other services and systems developed by WELLNET, in almost all the cases, represent the first applications of their kind to be commercialized within Japan.

Furthermore, the above implementation examples of systems are validation of their superiority. As WELLNET is not an affiliate or subsidiary of a large company, it started out without large amounts of business resources, including money, people and assets.

Despite this fact, the spirit of “always taking on new challenges” engrained in the corporate DNA of WELLNET allowed it to become the “de facto standard setter” in electronic bill payments.

President Miyazawa believes that the meaning and appeal of business are “to continue to believe in your own ability, to envision and take on the risk of developing mechanisms that would be convenient to have, and to provide them in tangible, readily available forms.”

Moreover, in our interview, Mr. Miyazawa also said that “the reason for our Company to exist is to come up with systems that only we can create.”

Since WELLNET is a small company with about 120 employees, keeping up the spirit of taking on new challenges engrained in its corporate DNA and the ideal represented in its corporate principle of “WELLNET Arete” seems to be vital to the company’s existence.

2. First Half of Fiscal Year June 2019 Earnings Results and Fiscal Year June 2019 EarningsEstimates

2-1 Earning overview (Non-Consolidated)

| 1H FY Jun. 18 | Share | 1H FY Jun. 19 | Share | YoY |

Sales | 4,911 | 100.0% | 5,052 | 100.0% | +2.9% |

Gross Profit | 1,068 | 21.8% | 844 | 16.7% | -21.0% |

SG&A | 719 | 14.7% | 551 | 10.9% | -23.4% |

Operating Profit | 349 | 7.1% | 293 | 5.8% | -16.0% |

Ordinary Profit | 366 | 7.5% | 306 | 6.1% | -16.4% |

Net Profit | 240 | 4.9% | 211 | 4.2% | -12.4% |

*Unit: million yen.

Sales grew, but profit dropped.

Sales were 5,052 million yen, up 2.9% year on year. The market of non-face-to-face payment settlement is expanding, and the decline in sales due to the integration of convenience store chains is ending. In addition, the effects of the revision to conditions for transactions with large clients and the decrease of OEM have subsided as a whole. The sales to enterprises other than such large clients steadily increased about 5% year on year.

Operating profit declined 16.0% year on year to 293 million yen. While gross profit decreased due to the revision to prices for leading enterprises, etc., the company continued active investments, including the increase of personnel, the addition of new app functions, and promotion targeted at consumers.

2-2 Financial Condition and Cash Flow

2-2-1 Summarized Balance Sheet

| Jun. 18 | Dec. 18 |

| Jun. 18 | Dec. 18 |

Current Assets | 14,471 | 20,726 | Current Liabilities | 8,725 | 15,649 |

Cash and Deposits | 10,564 | 17,149 | Trade Accounts Payable | 585 | 577 |

Trade Accounts Receivable | 575 | 677 | Settlement Deposits | 6,959 | 13,830 |

Securities | 1,999 | 999 | Fixed Liabilities | 178 | 189 |

Fixed Assets | 2,339 | 2,398 | Long-term Accounts Payable | 119 | 119 |

Tangible Assets | 528 | 480 | Net Assets | 7,907 | 7,286 |

Intangible Fixed Assets | 1,105 | 1,205 | Retained Earnings | 4,690 | 3,854 |

Investments | 705 | 712 | Treasury Stock | -1,054 | -841 |

Total Assets | 16,811 | 23,125 | Liabilities and Net Assets | 16,811 | 23,125 |

*Unit: million yen. Trade accounts receivable is the total of accounts receivable and operating earnings receivable.。 Trade accounts payable is the total of book debt and operating expenses payable.。

Current assets increased 6.2 billion yen from the end of the previous term due to a rising in cash and deposits. Cash and deposits include the settlement deposits in the collection agency business (to be remitted to enterprises in the following month) posted in current liabilities, which amounts to 13.8 billion yen. Total assets increased by 6.3 billion yen from the end of the previous term to 23.1 billion yen.

As for liabilities, current liabilities increased by 6.9 billion yen from the end of the previous term due to an increase of settlement deposits and other factors. Total liabilities stood at 15.8 billion yen, up 6.9 billion yen from the end of the previous term.

The decrease in retained earnings reduced net assets by 600 million yen from the end of the previous term to 7.2 billion yen.

Consequently, capital-to-asset ratio decreased by15.4% to 31.1% from 46.5% at the end of the previous term.

(It is 77.4%, if the settlement deposits are excluded from assets and liabilities.)

2-2-2 Cash Flow

| FY6/18 | FY6/19 | Changes |

Operating Cash Flow | -3,142 | 6,708 | +9,851 |

Investing Cash Flow | -189 | 224 | +413 |

Free Cash Flow | -3,331 | 6,932 | +10,264 |

Financing Cash Flow | -939 | -847 | +92 |

Cash Equivalents | 11,077 | 16,069 | +4,992 |

*Unit: million yen

2-2-3 Regarding the outlook for business performance in the fiscal year June 2019

As of the date of the announcement of financial results for the fiscal year June 2018 (Aug. 7, 2018), the earnings forecast for the fiscal year June 2019 has not been announced at the beginning of the fiscal year, because there are many uncertainties that could affect business performance. Their uncertainties come from that the company is continually developing additional functions and working on the automated operation of “Bus Mori!” and “Shiharai-Hisho,” and they are actively promoting awareness and downloads of the apps. The forecast will be announced when it becomes reasonably possible to estimate figures. The dividend amount is to be 50 yen per share, unchanged from the previous term.

2-2-4 Topics

1) Progress of the Shiharai-Hisho service

* Business operators and financial institutions using the service

6 electric power companies adopt the Shiharai-Hisho service and more companies plan to adopt it this term.

Enterprises other than electric power companies increasingly install Shirai-Hisho, as the first enterprise was JR Kyushu Bus. Through the linkage with Bus Mori! it is possible to use Shiharai-Hisho in a total of 75 routes of Meitetsu Bus, JR Bus Group, etc. In the aviation industry, too, the company plans to offer the service to multiple airlines.

In the banking industry, the company has made it connected with 21 banks, and is expected to increase affiliated banks. For enhancing security, the company installed the biometric identification function and the function to monitor settlement data on a real-time basis. Through this, the cooperation is expected to be accelerated.

2) Progress of the bus IT project

* Functions and current status

The smart ticket (released in August 2016) has been adopted by 36 bus agencies, encompassing 250 routes.

Six companies adopted the smartphone commuter pass released in March 2017, and 11 companies adopted the online student discount released in December 2017.Smartphone Bus Ticket (released in March 2018) have been adopted by 4 companies.

In addition to user functions such as “Free Pass” (released in July 2018) and “Electronic Ticket Collection” (released in January 2018), four bus companies have also adopted “Bus Mori! MONTA” (released in 2016), which is used to manage conductor tasks.

Especially, Smartphone Commuter Pass and Smartphone Bus Ticket are performing well, and becoming must-have in some regions.

* Bus Mori!” Application

The number of downloads of the application “Bus Mori!” have reached 150,000, and active users (those who used the app at least once a month) exceeded 20,000 people. The app is also available in English, Chinese, and Korean (as of the end of September 2018) to be used by tourists.

The added functions include the automatic processing of cancellation when busses are out of service, the assisting function that reminds users of the time of departure and the deadline for payment, and the direct withdrawal from a bank account, which is linked to the Shiharai-Hisho app. The company started researching the function for bus sales management.

In addition, the company started cooperation with “Alipay,” a mobile payment settlement service that is provided by Alibaba in China and is used by over 500 million active users. Then, Alipay users became able to book an expressway bus via the Alipay app.

Furthermore, the linkage with Shiharai-Hisho, a server-type smartphone payment app provided by the company, became full-scale, and 13 companies adopted it. The company plans to enhance the cooperation further.

* Public Relations

A radio program, “Bus-Tabist,” begins to be aired from October 2017 to March 2019, aiming to spur demand for busses, improve the public impression as to busses, and promote the “Bus Mori!” service. The program was broadcasted on 38 radio stations of the Japan FM Network, including TOKYO FM.

3) Corporate Governance System

The company is focusing more on strengthening its governance system than it has in the past, and they have changed to a streamlined and effective management system by dividing business administration and execution. In order to ensure the transparency and objectivity of management, the majority of directors are outside directors.

The company also strengthened their quality control team and internal auditing system to further eliminate mistakes and defects.

3. Conclusions

The variations in quarterly sales and operating profit indicate that sales have grown for 3 consecutive terms although the growth rate is low, and operating profit rose 14.4% in the second quarter (October to December). As the market of non-face-to-face payment settlement is growing, the effects of the revision to prices for large clients and the decrease of OEM are subsiding, we would like to pay attention to whether especially sales can keep growing from the third quarter. As an increasing number of clients adopt Shiharai-Hisho and Bus Mori! it is noteworthy when they will start contributing to revenue.

4.Reference 1: Outline of the new 5-year mid-term managerial plan

(Outline)

WELLNET has made non-face-to-face settlements and related services the domain of the business, and with the know-how and outcomes accumulated in that domain, the company has expanded the business results. The non-face-to-face settlement market is expecting some level of growth, and so the company aims to continue developing and maintaining the current business scheme.

During the new 5-year mid-term managerial plan, the business environment surrounding WELLNET is expected to have massive changes, with the rapid development of FinTech and its implementation in addition to the beginning of the use and application of IoT. WELLNET has made active investments for turning this change into a new business opportunity, and aims to achieve an ordinary profit of ¥5 billion in the term ending Jun. 2021, which is the last fiscal year of the mid-term plan.

5.Reference 2: Regarding corporate governance

5-1 Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 5 directors, including 3 external one |

5-2 Corporate Governance Report

Last update date: September 28, 2018

<Disclosure Based on the Principles of the Corporate Governance Code>

In “Corporate Governance” of the corporate profile in the website of WELLNET, “the policy for the corporate governance code” is disclosed.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Disclosure contents |

【Principle 1-4 So-called strategically held shares】 | The Company considers business strategies and relations with business partners comprehensively. Depending on the number of shares held, the Board of Directors or the Representative Director will determine if there is a valid purpose for strategically held shares, judge whether the benefits and risks associated with holding shares are reasonable for the capital cost, and consider other potential uses for funds, before carrying out such share holdings. In addition, there are no formalized criteria for the exercise of voting rights pertaining to such shares. After considering whether the proposals conform to its own holding policy, whether they contribute to the sound management of the issuing company, and whether corporate value can be improved, the Company examines each proposal and decides whether it is approved or rejected. |

【Principle 4-8 Utilize independent external directors.】 | The Board of Directors is composed of 5 directors, including 3 outside directors (members of the committee for audit, etc.). As the members of the committee for audit, etc. have voting rights at a meeting of the Board of Directors, they can effectively supervise directors and operating officers from an independent objective viewpoint. Accordingly, the Company can conduct fair, transparent business administration. The 3 outside directors (members of the committee for audit, etc.) have been registered as independent outside directors. |

【Principle 5-1 Policy for constructive dialogue with shareholders】

| The Company accepts shareholders’ request for dialogue proactively. For shareholders and investors, the Company holds a session for briefing financial results every six months, and a small meeting when necessary. The Company appoints the director and administrative manager as a director in charge of IR, so that he/she controls the sections related to IR activities, such as the administrative section, and facilitates the daily cooperation between the sections. The director in charge of IR accepts IR-related questions from investors by telephone and at small meetings, etc. and holds a semiannual session for briefing financial results to analysts and institutional investors. At that session, the president or the director in charge of IR gives explanations.

At the dialogue with investors, the Company discusses items regarding the sustainable growth of the Company and the medium/long-term improvement in corporate value at a briefing session or a small meeting, and pays attention to the management of insider information. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019, All Rights Reserved by Investment Bridge Co., Ltd. |