Bridge Report: (3633) GMO Pepabo

President Kentaro Sato | GMO Pepabo, Inc. (3633) |

|

Company Information

Market | JASDAQ |

Industry | Information and communications |

President | Kentaro Sato |

HQ Address | Cerulean Tower, 26-1 Sakuragaoka-cho, Shibuya-ku, Tokyo |

Year-end | December |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥ 6,450 | 2,637,927 Shares | 17,014 million | 33.3% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥ 65.00 | 2.0% | ¥ 259.41 | 24.9 x | ¥ 624.89 | 10.3 x |

*The share price is the closing price on February 20, 2019. The number of shares issued was taken from the brief financial report on the latest term.

*ROE and BPS are actual results at the end of the previous term. The company will implement 1:2 stock split on April 1, 2019.

*For DPS and dividend yield, the stock split was taken into consideration.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Dec. 2014 | 4,533 | 724 | 742 | 410 | 151.73 | 67.50 |

Dec. 2015 | 5,697 | -621 | -597 | -797 | -299.93 | 0.00 |

Dec. 2016 | 6,890 | 108 | 135 | 153 | 58.24 | 15.00 |

Dec. 2017 | 7,365 | 143 | 172 | 119 | 45.49 | 12.50 |

Dec. 2018 | 8,200 | 467 | 524 | 467 | 177.30 | 52.50 |

Dec. 2019 Est. | 9,200 | 950 | 962 | 684 | 259.41 | 65.00 |

*The forecasted values are from the Company. Consolidated values have been used from the term ended December 2012. Non-consolidated values have been used from the term ended December 2017. Consolidated values have been used from the term ended December 2019.

The company will implement 1:2 stock split on April 1, 2019. DPS is adjusted retrospectively. DPS for the term ended December. 2018 includes the commemorative dividend of 5.00 yen. (Unit: Million yen or yen)

*Unit: million yen

We introduce GMO Pepabo's FY December 2018 earnings results etc.

Table of contents

Key Points

1. Company Overview

2. FY December 2018 Earnings Results

3. FY December 2019 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for the term ended December 2018 were 8,200 million yen, up 11.3% year on year. The core business was healthy as a whole. Operating income was 467 million yen, up 225.6% year on year. Sales grew, and the increase rate of SG&A expenses was as low as 3.4% due to decreased promotion costs of the Handmade business. Sales and net income marked record highs. Sales, operating income and ordinary income also exceeded the second revised forecasts. The company set the year-end dividend at 105.00 yen per share in line with the basic policy targeting a payout ratio of 50%. The dividend increased from 50.00 yen per share at the beginning of the year to 55.00 yen per share through three revisions.

- Sales forecast for the term ending December 2019 is 9,200 million yen, up 12.2% year on year, and operating income is expected to be 950 million yen, up 103.1% year on year. Sales are expected to grow for all segments. The Handmade business, for which promotion costs will decline, will turn profitable on a full year basis, resulting in a large increase in operating income. Sales and profit are expected to mark record highs again for the term ending December 2019. As of April 1, 2019, 1:2 stock split will be implemented. The dividend forecast is 65.00 yen per share, and the expected payout ratio is 50.1%.

- In the Handmade business aimed at gaining profits this fiscal year, the company will establish new monetization points such as sales from fees associated with the distribution amount and sales from the offline measures with prioritized policy, “multi-tier profits”, utilizing the service infrastructure that was established in the past. The increase in revenue for the current fiscal year is 225 million yen. Composition of the sales from fees associated with the distribution amount and sales from the offline measures is unknown, but it seems that sales from fees associated with the distribution amount will be the priority for the moment. In that sense, it will be a point of focus whether the distribution amount, which is estimated to be 1.3 billion yen, up 7.6% year on year, will grow as expected, while the company conducts efficient promotion management. Also, we will pay close attention to the trend of the e-commerce (EC) support business, where both sales and profit are expected to achieve double-digit growth.

1. Company Overview

GMO Pepabo provides individual users who want to express themselves through the Internet with several services, including rental servers, domain acquisition agency, online shop development ASP. Its characteristics and strengths include the diversity of services based on internal production and unique corporate culture.

In addition to the stable revenue from the existing stock-type business (business with moderate yet stable income), the company aims to grow further based on Handmade crafts market service “minne”, an online C-to-C service of handmade market launched in 2012 for handmade products.

1-1 Corporate History & Profile of the President

In January 2003, the founder Kazuma Ieiri established the limited company “paperboy & co.” for the purpose of operating personal hosting business.

Around that time, the Internet environment had already advanced from the early period to the spread period, but it was still necessary to install your own server in order to distribute information through your website. Most services were targeted at corporations, and too expensive for individuals to use.

In that circumstance, the company launched a hosting service while setting a monthly charge at several hundred yen, with the aim of offering Internet infrastructure for “individuals who want to express themselves” at affordable prices. One year later, it started the service of obtaining a domain on behalf of each customer. The company grew its business steadily, by grasping the multifaceted needs of individual users who want to distribute information and express themselves through the Internet.

The company's far-sightedness both in recognizing the commercial potential of blogs, which had already been showing a sign of spread in the U.S., and in developing the environment for using blogs in Japanese, was a significant growth driver.

In March 2004, the company conducted the allocation of new shares to a third party, which was GMO Internet, Inc. (named Global Media Online Co., Ltd. at that time), and became a member of the GMO Internet group.

Around that time, several leading Internet firms had strong interests in paperboy & co., and requested capital participation. Among these firms, the GMO Internet group, which operated services with a main focus on corporations, was judged as the most appropriate collaborator for exerting synergetic effects, creating new services, etc.

After that, the company launched a succession of new services, including online shop development and creation service and rental servers for creators, achieving steady business expansion. In December 2008, it was listed on the JASDAQ market. In April 2014, the company was renamed as GMO Pepabo, Inc.

President Kentaro Sato was born in January 1981. He created websites, etc. on his own, and was invited by Mr. Ieiri to offer help to the predecessor of the company while he was still a student. In January 2003, he participated in the establishment of the company. After serving as Executive Secretary, and Representative Director, Vice President, and Head of the Management Planning Section, he was appointed as Representative Director and President in March 2009. He also serves as Director of GMO Internet.

1-2 Management Philosophy, etc.

Under the following corporate ethos and missions, GMO Pepabo aims to offer an Internet environment that is attractive and easy to use for individual users.

Corporate ethos | We can make it more fun. |

In 2008 we set this phrase as our corporate ethos. As users’ activities for expressing themselves were undergoing diversification and our company was gradually growing, we upheld this ethos, while believing in our potential of “challenging ourselves to make things more enjoyable.” There are countless things that can be made more enjoyable regardless of one’s occupation and age, such as the creation of enjoyable services, the design of plans that would be considered as fun, and enjoying your work more. The company Pepabo is composed of staff members who are glad to hear “I like it!” and delighted to hear “It is fun!” (Taken from the website of GMO Pepabo) | |

Mission | To connect and expand possibilities through the Internet |

As we have been assisting individuals in expressing themselves with Internet services, we set the above mission in 2013, that is, the 11thyear after the establishment of Pepabo, with the hope of “pursuing the potential of the Internet and expression and then providing everyone with a chance to flourish”. When the possibilities of those who want to initiate something by utilizing the Internet encounter the services provided by Pepabo, we hope that new potentials such as−“An online shop I opened in the form of a hobby became my business,” and “Uploading my music to my website led to my debut from a label” will emerge. We operate our services while pursuing the potential of the Internet and expression, create something new for expanding the talents and possibilities of individuals, and develop an environment in which the Internet would bring out the capabilities of a broad range of people and allow them to flourish. (Taken from the website of GMO Pepabo) | |

1-3 Business Description

Under the above corporate ethos and mission, the company provides individual users who want to “initiate something through the Internet” with a wide array of Internet services at affordable prices, and supports individual expression activities with the Internet.

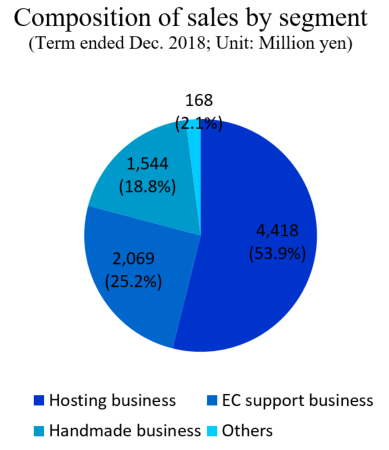

Reported segments are “Hosting business”, “EC support business”, and “Handmade business”. The company also has “Other business” segment, including the rental blog service “JUGEM”

1-3-1 Hosting business

GMO Pepabo offers servers, functions, domains, etc. for establishing websites. Sales is derived mainly from the usage fee of such services.

(Major services)

Service name | Content | Brief description |

Lolipop! | Rental server service | Rental servers targeting a wide range of people ranging from Internet beginners to corporations. The company launched a hosting service at prices that can be paid with “pocket money” so that anyone can use this service at ease. With this, it enabled individuals to use rental servers. The company offers multiple plans to meet various needs of customers from individuals to corporations. It offers plentiful manuals for producing and operating a website easily, responsive customer services, and software for designing a website. The number of contracts is about 400,000. |

Muu Muu Domain | Domain acquisition agency service | Low-cost domain acquisition agency service. The company introduced a system for acquiring a domain easily online at the start of this service, dispelling the conventional recognition that “registering a domain is complicated, because it requires a lot of paperwork” and making obtaining a domain easier. The number of contracts is about 1,240,000. |

heteml | Rental servers for creators | Rental servers for creators. The company offers an environment for enabling advanced website operation with “original SSL,” which makes it possible to develop a safe website, the multi-domain function to operate more than one website, and a backup option for storing data in a server regularly. The company uses SSD for storage and customers can upload images and videos smoothly due to its large capacity. |

Petit Homepage Service | Design-oriented website production service | A website production service with the concept of “paper websites,” which is favored by mainly photo enthusiasts and housewives. This service emphasizes design, and enables you to produce a website as if it was a diary or sketchbook. |

30days Album | Online photo album service | Service for sharing, storing, and disclosing photo and video data online. In addition to the basic functions of an online album for sharing photos safely and photo storage with unlimited capacity, the company offers apps that are compatible with various devices, including smartphones and tablets. With this service, you can enjoy photos in your house, office, and any other places. |

1-3-2 EC support business

GMO Pepabo offers the services for developing online shops, operating online shopping malls, and establishing the websites of stores for supporting e-commerce (EC) at low rates. The sales of this business are mainly from charges for use and commissions.

(Major services)

Service name | Content | Brief description |

Color Me Shop | online shop development and creation service | The company offers a system for enabling even inexperienced owners to open online shops easily at low cost. Over 350 functions and rich design templates are offered regardless of scale of their shops, so that all the owners can feel satisfied. Also, the company holds seminars for shop owners at real places and offers assistance actively for them. The number of contracts is about 43,000. |

Goope | ASP service creating websites | Website creation service for shops and companies. From the individual to the official site of the shop and company, this service prepares the design and contents which can create various websites in advance and can create homepages with high designability even for novice users who do not have web designing experience. |

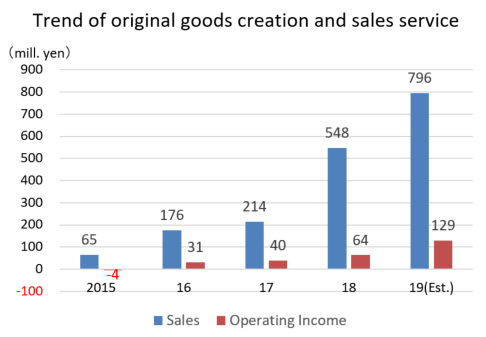

SUZURI | Service for producing and selling original goods | This service enables you to produce and sell T-shirts, mugs, etc. with your original illustrations or photos easily. There are no risks of initial investment cost, inventory management, etc. and “SUZURI” supports the entire processes from production to delivery. Accordingly, even beginners can use this service with peace of mind. The annual distribution amount is 260 million yen. The number of users as of the end of December 2018 is about 230,000. |

Canvath | On-demand original goods development service | Service that enables you to produce your original goods, such as T-shirts, accessories, and mugs, just by uploading an illustration you have drawn or a photo you have taken with your smartphone. |

1-3-3 Handmade business

At present, the company is committing most of its efforts towards developing the customer to customer handmade crafts market “minne”.

(Taken from the website of minne)

Overview

Launched in 2012, “minne” is a C-to-C online market for connecting artists, who want to exhibit and sell their handmade products, and consumers, who want to purchase one-of-a-kind items or characteristic works.

As of the end of December 2018, the number of registered artists is 490,000 and the number of products on display is 9.13 million. These numbers indicate that “minne” is the largest C-to-C handmade product market in Japan. Pepabo aims to further accelerate its growth and make it overwhelming No.1.

The development of this service was started because it turned out to be consistent with the corporate policy of “supporting those who want to express themselves” when the company discussed various plans for increasing its growth rate further.

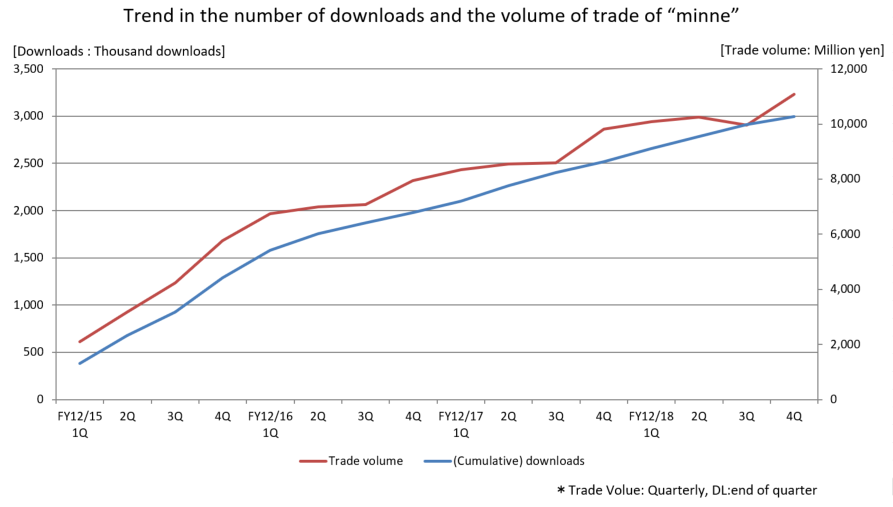

This service is provided through the website and app, and most of users use the app. As of the end of December 2018, the number of app downloads is 10,270,000.

Market scale and background of growth

The “C-to-C” business, which means the trade of products and services among customers through the Internet, is growing rapidly.

Products and services offered on the Internet are diverse, which include auctions, flea markets, ticket sale, and accommodation in private houses, but the company estimates that distribution amounts of the C-to-C market and handmade product websites in the domestic hobby market are approximately 100 billion yen and 20 billion yen, respectively, and both are experiencing double-digit growth continuously.

The distribution amount of “minne” for the year 2018 was 12.07 billion yen, up 17.3% year on year.

*Background of the growth of the C-to-C market

It is suggested that the following three factors exist behind the growth of the C-to-C market:

1) Spread of smartphones

When an artist puts his/her artwork on display by using a PC, he/she needs to take pictures, import images into a PC, input and upload the description of his/her work. At present, however, anyone can put his/her products on display just by taking pictures of the products with a smartphone and inputting necessary text in a form. Namely, the hurdle for presenting artworks to the market has been significantly lowered.

2) Change in awareness from ownership to sharing

As the age of mass production and consumption ended and the way of thinking for valuing materials, including the environment and sustainability, has spread, “sharing economy”, in which items you own but do not use are shared with others, is growing. Auctions, flea markets, etc. are typical of this trend.

3) Place where individuals can exert their abilities

Many cases substantiate the fact that since the Internet can connect you with people around the world, you can flourish by yourself as long as you are competent, like celebrities, leading companies, etc., even if you are not famous. Stimulated by this trend, an increasing number of individuals aim to express themselves and flourish in the C-to-C market. The artists who exhibit their artworks in “minne” are the very examples of such individuals.

System of minne

*Merits for artists and purchasers

Artists | Just by registering product information and images, artists can have their own gallery pages. A user’s page, which can manage the sale and order receipt for products, is simple and highly operable. Therefore, it can be easily used by even beginners who don’t know how to create or operate a website. Registration is free of charge. |

Purchasers | “minne” displays many unique items, including one-of-a-kind accessories, bags, and characteristic sundries. In addition, visitors can check the products picked up by minne staff, and the items bookmarked by other users, to enjoy shopping. |

*minne’s business model and payment settlement method

When a product is sold, the company pays the amount calculated by subtracting 10% from the selling price to the seller (artist).

As for the transfer of proceeds from sale, the company adopted the escrow service for satisfying the needs of both buyers: “I want to pay the price after receiving the product” and sellers: “I want to ship the product after receiving the price”.

Progress of minne

The trends of the distribution amount and the number of app downloads, which are the key performance indicators of “minne,” are as follows.

To further grow and expand as the largest handmade craft market in the Japan, the company believes that it is important to improve services by conducting diversified businesses including the distribution amount to be acquired online, hosting various offline events and strengthening efforts with companies that will support artists’ activities. Therefore, in January 2019, the company decided to end the monthly disclosure of “minne” distribution amount.

1-4 Characteristics and strengths

Based on the strength of being able to acquire stable revenue from the existing recurring-revenue businesses including the “Lolipop!” of the Hosting business and “Color Me Shop” of the EC Support business, the company will work on new services such as “SUZURI” and “minne” and will pursue the expansion of the company scale by making promotional investments.

Since the beginning of aggressive investment centered on “minne” in the term ended December 2015, sales have grown rapidly, and the estimated operating income in 2019 exceeds that in the same period of the previous year when aggressive investments were made (the term ended December 2014). As such, the business strategy of the company is steadily bearing a fruit.

The company will also utilize the service infrastructure that it has cultivated since its founding to create synergies through cooperation with other companies’ services such as “Canvath”, which the company acquired in April 2018, and GMO Creators Network, which became a subsidiary in February 2019. It aims to raise the growth angle.

1-5 Characteristics and strengths

1-5-1 Provision of a variety of services based on internal production

As mentioned in the section “Business contents,” the company offers a wide array of services, differentiating it considerably from competitors.

According to President Sato, such diversity of services can be achieved only because the company possesses a system capable of not only development, but also the ability to design and market services by itself. This leads to excellent speed and quality, and is essential for making the Internet business successful.

1-5-2 Unique corporate culture

The mission of the company is to root for “individuals who want to express themselves”. To do so, the company itself needs to express itself, and the active outputting through the Internet is now its established homegrown corporate culture.

1-6 ROE analysis

| Dec. 2012 | Dec. 2013 | Dec. 2014 | Dec. 2015 | Dec. 2016 | Dec. 2017 | Dec. 2018 |

ROE (%) | 26.4 | 23.3 | 20.5 | -51.6 | 14.6 | 10.5 | 33.3 |

Net income ratio to sales [%] | 10.40 | 9.80 | 9.04 | -13.99 | 2.22 | 1.63 | 5.70 |

Total asset turnover | 2.26 | 1.16 | 1.10 | 1.34 | 1.56 | 1.46 | 1.43 |

Leverage [times] | 2.09 | 2.04 | 2.05 | 2.74 | 4.20 | 4.45 | 4.08 |

In the term ended December 2018, ROE also increased due to a significant improvement in margin.

The estimated net income margin for the term ended December 2018 is 7.4%. Its basic ROE is estimated to be at a high level.

1-7 Shareholder return

The target payout ratio is 50% or more. The company has a basic policy to stably and appropriately return profits to shareholders while improving profitability and strengthening financial structure.

2. Fiscal Year December 2018 Earnings Results

2-1 Overview of Earnings Results

| FY 12/17 | Composition Ratio | FY 12/18 | Composition Ratio | YOY | Compared with the initial forecast | Revised forecast comparison |

Sales | 7,365 | 100.0% | 8,200 | 100.0% | +11.3% | +5.1% | +0.6% |

Gross margin | 4,436 | 60.2% | 4,908 | 59.8% | +10.6% | - | - |

SG&A expenses | 4,292 | 58.3% | 4,440 | 54.1% | +3.4% | - | - |

Operating income | 143 | 2.0% | 467 | 5.7% | +225.6% | +41.7% | +3.9% |

Ordinary income | 172 | 2.3% | 524 | 6.4% | +203.2% | +58.8% | +4.8% |

Net income | 119 | 1.6% | 467 | 5.7% | +289.8% | +80.3% | -6.6% |

*Revised forecast was announced in December 2018.

*Unit: million yen

Sales grew and profit increased significantly. Sales and net income marked record highs and exceeded the forecast.

Sales increased 11.3% year on year to 8,200 million yen. The core business was healthy as a whole.

Operating income rose 225.6% to 467 million yen. Sales grew, and the increase rate of SG&A expenses was as low as 3.4%, due to decreased promotion costs of the Handmade business.

Sales and net income marked record highs. Sales, operating income and ordinary income also exceeded the second revised forecasts.

On December 17, 2018, the company set the year-end dividend to 105.00 yen per share in line with the basic policy targeting a payout ratio of 50%. The dividend increased from 50.00 yen per share at the beginning of the year to 55.00 yen per share through three revisions.

Quarterly Trends Unit: million yen

| FY 12/16 | FY 12/17 | FY 12/18 | |||||||||

1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | |

Sales | 1,651 | 1,773 | 1,716 | 1,749 | 1,805 | 1,863 | 1,816 | 1,880 | 1,897 | 2,117 | 2,073 | 2,111 |

Operating | -174 | 55 | 124 | 103 | 117 | -26 | 131 | -79 | 151 | 136 | 109 | 69 |

2-2 Trend of each segment

| FY 12/17 | Composition Ratio | FY 12/18 | Composition Ratio | YOY | Compared with the initial forecast |

Sales |

|

|

|

|

|

|

Hosting | 4,122 | 56.0% | 4,418 | 53.9% | +7.2% | +1.8% |

EC support | 1,624 | 22.1% | 2,069 | 25.2% | +27.4% | +26.5% |

Handmade | 1,392 | 18.9% | 1,544 | 18.8% | +10.9% | -4.2% |

Others | 226 | 3.0% | 168 | 2.1% | -25.5% | - |

Total | 7,365 | 100.0% | 8,200 | 100.0% | +11.3% | +5.1% |

Operating income |

|

|

|

|

|

|

Hosting | 1,312 | 31.8% | 1,415 | 32.0% | +7.8% | +3.4% |

EC support | 775 | 47.8% | 831 | 40.2% | +7.2% | +13.0% |

Handmade | -1,037 | - | -682 | - | - | - |

Others | 99 | 44.0% | 31 | 18.6% | -68.5% | - |

Adjustment | -1,007 | - | -1,128 | - | - | - |

Total | 143 | 2.0% | 467 | 5.7% | +225.6% | +41.7% |

*The composition ratio of operating income means profit rate on sales. Unit: million yen

2-2-1 Hosting

Sales increased and profit grew.

The number of subscriptions to the rental server service decreased 1,895 from the end of the previous term to 436,276. With the "Lolipop!", the company began offering the official version of the new plan "Managed Cloud" in April 2018, aiming to expand the target group and strengthened the promotion of the superior plans and option functions. As a result, the customer unit price rose 6.0% from the same period last year to 358 yen.

As for "Muu Muu Domain," in August 2018, the company renewed the design of the website and also improved the domain search function. As a result, the number of registered domains increased 11,351 to 1,241,668. As a result of raising prices for partial services with a high cost rate, the customer unit price also rose.

Both sales and profit exceeded the initial forecast.

2-2-2 EC support

Sales increased and profit grew.

As for “Color Me Shop,” because of an incident of information leakage occurred in January 2018, the company refrained from implementing promotional measures. As a result, the number of contracts decreased 2,006 from the same period last year to 43,238. However, due to the continued upselling strategy, the customer unit price rose 8.6% from the same period last year to 2,608 yen.

As for the original goods production and sale service “SUZURI”, the company worked on the expansion of items and user functions including adding new items such as interior items and Autumn and Winter fashion items and offering services of duplex printing. As a result, the cumulative number of members reached 230,000.

Since the launch of “SUZURI” in 2014, the distribution amount and the number of users has been increasing steadily, and the company officially opened a platform for supporting creators as a new service. As the company took over “Canvath”, an on-demand original goods production service in April 2018, the company established “SUZURI Business Division” with the aim of expanding its service and market by strengthening its management and systems.

Both sales and profit exceeded the initial forecast.

2-2-3 Handmade

Sales grew, and loss shrank.

As for “minne”, the company improved convenience by carrying out continuous improvement of functions and addition of functions. It also implemented offline measures and collaborative activities with various companies. Since the promotion activities took place mostly on-line, the cost of advertisement decreased 200 million yen.

In October 2018, the cumulative number of smartphone app downloads exceeded 10 million. Distribution amount also exceeded 12 billion yen per year.

The unit price for orders has continued to rise to 3,112 yen.

Sales did not reach the initial forecast. The amount of loss was almost as planned.

2-3 Financial Situation and Cash Flow

Main BS

| End of Dec. 2017 | End of Dec. 2018 |

| End of Dec. 2017 | End of Dec. 2018 |

Current assets | 4,358 | 4,853 | Current liabilities | 4,099 | 4,294 |

Cash and deposits | 1,591 | 1,802 | Trade payables | 121 | 147 |

Trade receivables | 800 | 900 | Other accounts payables | 1,627 | 1,568 |

Securities | 1,745 | 1,886 | Advances received | 1,678 | 1,729 |

Noncurrent assets | 1,018 | 1,224 | Total liabilities | 4,153 | 4,370 |

Property, plant and equipment | 297 | 266 | Net assets | 1,223 | 1,706 |

Intangible assets | 245 | 335 | Legal retained earnings | 1,056 | 1,457 |

Investments, others | 475 | 622 | Total liabilities, net assets | 5,376 | 6,077 |

Total assets | 5,376 | 6,077 | Equity ratio | 21.6% | 27.1% |

*Unit: million yen

Total assets increased 7 million yen from the end of the previous term to 6,077 million yen, due to an increase in cash and deposits and the growth of investments, others.

Total liabilities augmented 216 million yen from the end of the previous term to 4,370 million yen.

Net assets rose 483 million yen to 1,706 million yen, due to an increase in legal retained earnings. As a result, equity ratio grew 5.5% from the end of the previous term to 27.1%.

Cash flow

| FY12/17 | FY12/18 | YoY |

Operating CF | 639 | 674 | +34 |

Investing CF | -294 | -311 | -17 |

Free CF | 345 | 363 | +17 |

Financing CF | -79 | -51 | +27 |

Cash & Equivalents | 2,391 | 2,702 | +311 |

*Unit: million yen

There is no major change in the level of each CF. The free CF maintained surplus.

The cash position improved.

2-4 Topics

◎ GMO Creators Network, which manages a factoring service for freelancers, became a subsidiary of the company.

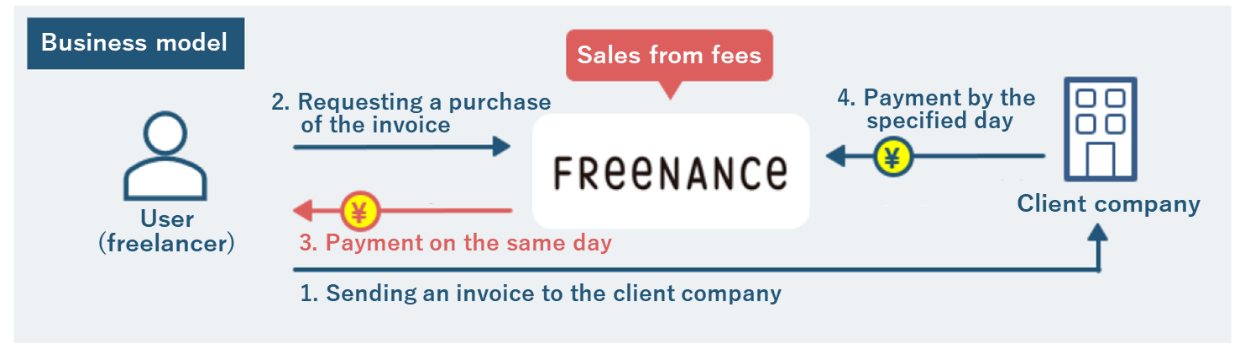

In February 2019, the company underwrote a third-party allotment of new shares to be executed by GMO Creators Network, Inc., which operates “FREENANCE,” a factoring service for freelancers, and set it as a consolidated subsidiary (ownership ratio of voting rights: 51.0%). The acquisition price was 93 million yen.

(Overview of GMO Creators Network, Inc.)

GMO Creators Network was established in April 2002. The company provides a variety of services to support the activities of individual creators such as the writer registration website “woofoo.net” (*). In October 2018, in order to establish an environment where freelancers can work with peace of mind, it began offering a freelance factoring service “FREENANCE” * for the first time in Japan.

In the term ended Dec. 2018, sales were 302 million yen (up 30.7% year on year), and operating income was 4 million yen (up 300.0% year on year).

Writer registration website “woofoo.net”

It is an editorial production website with approximately 20,000 registered writers. It covers a wide range of areas including entertainment, finance, investment, real estate, law, and medicine, and clients can request creation of contents such as highly specialized columns.

A factoring service, “FREENANCE” for freelancers

This is a financial support service for freelancers to extend funds to them by buying invoices from them.

A freelancer who is a user of the service sends an invoice to the client company and requests “FREENANCE” to purchase the invoice. The freelancer then receives the amount subtracting the fee from “FREENANCE” on the same day. “FREENANCE” receives payment from the client company on the due date specified in the invoice

Invoice purchase limit is from 10,000 yen to 3 million yen, and the fee that “FREENANCE” receives is 3 to 10% of invoice value.

(Taken from the company’s material)

(Background and reasons for making consolidated subsidiaries)

According to the company data, the number of freelancers in Japan is 11.19 million in 2018, and the economic scale (annual compensation amount) is about 20 trillion yen.

Freelancers account for 17% of the working population, as the work spreads via the Internet.

Meanwhile, establishment of appropriate laws such as application of workers; accident insurance and fair contract rules with client companies is under consideration.

Freelancers establish a contract with a client every time when there is a work. Therefore, the timing of remuneration transfer varies. Even the monthly income goes up and down and the cash flow is unstable even for the freelancers with relatively large volume of work. In addition, they are also faced with issues; for example, they cannot focus on their main business because they have various tasks such as payment management, even though they become independent to have a free working style.

About 5.3 million people, which is about 90% of the users of GMO Pepabo, excluding end users such as buyers in the Handmade business, are individuals and individual business owners including freelancers. These users are a great wealth for the company.

Also, the largest handmade market service in Japan “minne” and original goods creation and sales service “SUZURI” support new ways of working such as side jobs and freelance works, and they are becoming more important day by day as a place where creators are active.

Under these circumstances, GMO Pepabo and GMO Creators Network thought that it would be possible to provide high value-added services, leveraging the service infrastructure and strengths of each, such as the method of operation and know-how of marketing, through strong tie-ups between the two companies as they work on supporting creator activities in different fields.

In particular, they thought creating and maximizing business synergies through collaboration between the service platform centering on individuals and individual business owners registered at GMO Pepabo and “FREENANCE” will lead to continuous growth of both companies. This is why GMO Pepabo acquired the shares of GMO Creators Network.

(Future development)

The global factoring market is huge as the trading volume exceeded 160 trillion yen in 2016. The factoring services for individuals, “FUNDBOX” (USA), which was established in 2012, raised about 19.8 billion yen, and the sales in 2017 were about 6 billion yen.

The size of the factoring market in Japan in 2016 is 5 trillion yen, which is still small compared with the global market, but the company sees that individual factoring needs will continue to grow, especially among freelancers.

Based on the achievement that the number of applications for “FREENANCE” increased greatly due to appeal to the “Lolipop!” users, the company is planning to create a tie-up between “minne” and “SUZURI” where there are many freelance users (total number of artistsand creators is about 600,000 in 2018).

◎ Implementation of stock split and substantial expansion of the shareholder benefit plan

Stock split

In order to improve the liquidity and further expand the investor base by lowering the amount per unit of investment and creating a more accessible environment for investment, the company will implement 1:2 stock split as of April 1, 2019.

Substantial expansion of the shareholder benefit plan

Currently, as a shareholder special benefit system, the company offers two types of shareholder benefits for shareholders who own 1 (100 shares) or more units: points/coupon gift corresponding to the number of shares held and GMO click securities fee cash back. For this current stock split, because the criteria for “the number of shares held” will not change, the stock split will be a substantial system expansion.

3. Fiscal Year December 2019 Earnings Estimates

3-1 Full-year earnings forecast

| FY12/18 | Composition ratio | FY12/19 (Est.) | Composition ratio | YoY |

Sales | 8,200 | 100.0% | 9,200 | 100.0% | +12.2% |

Operating income | 467 | 5.7% | 950 | 10.3% | +103.1% |

Ordinary income | 524 | 6.4% | 962 | 10.5% | +83.6% |

Net income | 467 | 5.7% | 684 | 7.4% | +46.5% |

*The estimated values were announced by the company.

*Unit: million yen

Sales and profit grow. They will mark the record highs during this fiscal year, too.

Sales are estimated to be 9,200 million yen, up 12.2% year on year. Operating income is estimated to be 950 million yen, up 103.1% year on year.

Sales are estimated to grow for all segments. The Handmade business, for which promotion costs will decline, will turn profitable on a full year basis, resulting in a large increase in operating income.

Sales and profit will mark the record highs again for the current fiscal year.

As of April 1, 2019, 1:2 stock split will be implemented. The dividend forecast is 65.00 yen per share, and the expected dividend payout ratio is 50.1%.

3-2 Trend of each segment

| FY12/18 | FY12/19 (Est.) | YoY |

Sales |

|

|

|

Hosting | 4,418 | 4,596 | +4.0% |

EC support | 2,069 | 2,426 | +17.3% |

Handmade | 1,544 | 1,770 | +14.6% |

Operating Income |

|

|

|

Hosting | 1,415 | 1,300 | -8.1% |

EC support | 831 | 948 | +14.1% |

Handmade | -682 | 77 | - |

*Unit: million yen

3-2-1 Hosting

Sales are estimated to grow while profit declines.

The number of rental server contracts in 2018 was 436,000, which was a net decrease due to a reduction in the number of inflows to “Lollipop!” However, the website renewal in January 2017 prevented further reduction in the number of inflows. In the future, the company will enhance specifications and strengthen promotion activities by, for example, increasing advertising expenses by 80 million yen to 260 million yen, in order to increase the number of contracts.

3-2-2 EC support

Sales and profit are estimated to grow.

The total distribution amount of shops that use “Color Me Shop,” a service to open and develop online stores, is 130 billion yen and is steadily increasing. Along with the diversification of handling commodities, the company is considering building a platform to meet various needs.

The company will create an environment to provide systems and functions developed not only by the company but also by third parties, like App Store and Google Play, to shop owners. It will be able to release them in the first half of the current fiscal year.

Through the partner apps, various functions such as product recommendation enhancement, customer service on the EC website, streamlining of product delivery, and real store collaboration will be available to shop owners.

Sales are generated from the application fees from shop owners.

The performance of the original goods creation and sales service is growing rapidly due to expansion of “SUZURI” and “Canvath”, that was acquired in 2018. Sales in 2019 is estimated to increase 45% year on year to 790 million yen and operating income is estimated to grow 101% to 120 million yen.

3-2-3 Handmade

Sales will increase, and profit will turn to black.

Since its establishment, “minne” has been building a service infrastructure as the top handmade product market in Japan, in terms of the number of artists, the number of works, and the number of app downloads. So far, it has been focusing on “expansion of awareness” as a priority policy, and its income has been mostly from the fees from new users whom the company acquired by devoting resources on advertising expenses such as television commercials.

From 2019, the next priority policy will be to “create multilayered profit” utilizing the service infrastructure constructed in the past.

As specific measures, the company will acquire sales generated from fees by efficient promotion operation with the aim of improving the purchase rate and repeat rate, instead of mass advertisement. It will also develop offline measures such as holding workshops and create new monetization points.

As a result, the company estimates that the promotional cost will decrease about 700 million yen, but the distribution amount will increase 7.6% from the previous term to 13,000 million yen.

In addition, the company anticipates that sales composition by offline measures such as events for handmade products and workshops will be 10% in 2019, but it is planning to expand it to 50% in the future.

In addition to the handmade craft market, the medium- to long-term vision for “minne” is to develop relevant services centered on handmade products, to enter the overseas market, and aim at becoming the leader for the CtoC handmade integrated platform in the world.

(Taken from the company’s material)

4.Conclusions

In the Handmade business aimed at gaining profits this fiscal year, the company will establish new monetization points such as sales from fees associated with the distribution amount and sales from the offline measures with prioritized policy, “multi-tier profits”, utilizing the service infrastructure that was established in the past.

The increase in revenue for the current fiscal year is 225 million yen. Composition of the sales from fees associated with the distribution amount and sales from the offline measures is unknown, but it seems that sales from fees associated with the distribution amount will be the priority for the moment. In that sense, it will be a point of focus whether the distribution amount, which is estimated to be 1.3 billion yen, up 7.6% year on year, will grow as expected, while the company conducts efficient promotion management. Also, we will pay close attention to the trend of the e-commerce (EC) support business, where both sales and profit are expected to achieve double-digit growth.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory committee |

Directors | 12 directors, including 2 outside ones |

◎ Corporate Governance Report

Last update date: March 18, 2018

"We are implementing all the basic principles of corporate governance code," says the company.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |