Bridge Report:(3822)Minori Solutions Fiscal Year March 2019

President Yuji Morishita | Minori Solutions Co., Ltd. (3822) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Information and communications |

President | Yuji Morishita |

HQ Address | Shinjuku NS Building, 2-4-1, Nishi-Shinjuku, Shinjuku-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥1,760 | 8,609,160 shares | ¥15,152 million | 15.9% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥45.00 | 2.6% | ¥148.10 | 11.9x | ¥922.12 | 1.9x |

*The share price is the closing price on June 18.

*The number of issued shares is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter. ROE, BPS are actual results at the end of the previous term.

Non-Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 (Actual) | 14,768 | 1,057 | 1,078 | 702 | 79.93 | 29.00 |

March 2017 (Actual) | 15,541 | 1,338 | 1,356 | 963 | 109.67 | 33.00 |

March 2018 (Actual) | 16,428 | 1,515 | 1,526 | 1,044 | 118.81 | 36.00 |

March 2019 (Actual) | 16,957 | 1,711 | 1,728 | 1,218 | 139.51 | 42.00 |

March 2020 (Est.) | 17,800 | 1,830 | 1,840 | 1,275 | 148.10 | 45.00 |

(Unit: Million yen or yen)

*The forecast is from the company.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended March 2019 Earnings Results

3.Fiscal Year ending March 2020 Earnings Forecasts

4.Conclusions

Reference: Regarding corporate governance

Key Points

- In the term ended March 2019, sales and operating income rose by 3.2% and 13.0% year on year, respectively. The number of development projects increased in the fields of manufacturing, public services and energy, and distribution and services. Operating income margin improved 0.9 points to 10.1%, as a result of enhancing project management and shifting to highly profitable projects. The year-end dividend is 24 yen per share, an increase of 4 yen per share. Together with the dividend at the end of the first half, the annual dividend is 42 yen per share (payout rati 30.1%), which is an increase of 6 yen per share.

- Sales and operating income for the term ending March 2020 are predicted to go up by 5.0% and 6.9%, respectively, from the previous term. In the fields of financing, public services and energy, communications, and distribution and services, orders and sales will increase, and the field of transportation such as system operation will also improve. In terms of profit, gross profit margin is expected to continue improving along with the increase in projects with all-in contracts and strengthening project management in the software development sector. The term-end dividends are to be 22 yen per share in the first half and 23 yen per share in the second half, totaling an annual dividend of 45 yen per share (payout rati 30.4%), which is an increase of 3 yen per share.

- In the medium/long term, the company is aiming for providing “high value-added services.” The point of focus in the future is whether it can foster “high value-added” new businesses while improving the performance of existing businesses. Low-competitive, high-value-added CAE solutions and cloud solutions that can be introduced in a short period of time with low initial costs will play a role in the “high value-added services,” and it was confirmed that they were doing well in the term ended March 2019. The dedicated R&D team’s efforts are also part of the “high value-added services,” and we would like to pay attention to them as well as the progress of the afore-mentioned solutions.

1. Company Overview

Minori Solutions business is supported by two pillars: development of software and operation/management of systems. It sells hardware, RPA services, etc. for developing software, including IT consultation and product services. JSC Co., Ltd., which specialized in the development and operation of resident systems mainly for financial institutions, such as banks and credit-card companies, and E-Wave Co., Ltd. fully undertook the development of systems in a broad range of fields, including manufacturing, transportation, and distribution, merged into Minori Solutions Co., Ltd. in April 2010 for a new beginning. The “Minori” in the corporate name represents an ear of grains, means “bearing fruit,” and was infused with the hope that all employees will join hands to improve its corporate value further and produce good results as the “Minori” for clients, stakeholders, and employees, under the new organization after the merger.

1-1. Corporate ethos and rules of conduct

Corporate ethos

Through the use of our information technology, we will contribute to the creation of an affluent and fruitful society by growing, taking on challenges and always having high ambitions.

Rules of conduct

1. Ensure trust: We will observe relevant laws and regulations, ensure fair transactions, protect the confidentiality of information on clients, follow the basic rules for the proper management of personal information, etc., and execute fair corporate activities.

2. Coexist with clients: We will make continuous efforts to maintain and improve reliable relationships with clients, and aim to create the prosperity of clients and the growth of our company.

3. Continuation of self-reform: We will always be ambitious, and try to reform ourselves by taking on challenges to grow.

1-2. Business contents

The business of Minori Solutions is classified into the following three segments: software development business, system operation/management business, and system-related device sale business. Software development business includes the developing and updating of systems and software as well as IT consultancy. The system operation/management business consists of operation, maintenance, and management of developed systems, and help desk work. The system-related device sale business handles the sale of devices related to system development. The ratios of their sales are 76.3, 21.9%, and 1.8%, respectively (FY 3/19).

The software development business is divided into two types: one is the business of undertaking the development of an entire system and the other is the business of partially developing systems while staying in client companies (dispatching about 100 workers for some clients). For banks, workers are stationed there for ensuring security, and for other businesses, system development is fully entrusted in most cases. The business of stationing workers in client companies, which is recognized by the company as recurring revenue-type business, (although the performance of short-term projects fluctuates), is stable. In this business, the company receives fees for each month and each worker like worker dispatch business. On the other hand, the business of fully undertaking system development is highly profitable, but the number of orders fluctuates, causing development risk.

In the system operation and management business, Minori Solutions operates and manages systems (by stationing workers at clients’ data centers to operate and manage the systems of end users, stationing workers at the facilities of end users to operate and manage them, and conducting operation and management via networks), operates call centers (help desks), and more.

As for the business of selling system devices, the number of cases in which devices are delivered through development is decreasing, and enterprises are adopting cloud computing, which leads to decline in sales. However, the contribution of sale of devices has been insignificant from the beginning, so its effect on profit is minor.

Sales for each business field of end users

As for the sales for each field of end users, finance, in which resident services are dominant, accounts for 32.5%, and manufacturing with transactions with wide categories of companies makes up 22.0% and distribution/service and others accounts for 11.7%. The sales in other fields, including information, transportation, communications, public services/energy fields, account for 7 to 10%, respectively. Although finance has a high ratio, the business fields of end users excluding it are equally diverse. End users are excellent enterprises and with their performance, they are expected to maintain a certain level of investment, despite some fluctuation. Their business fields are also diverse. Therefore, the amounts of orders and sales are stable.

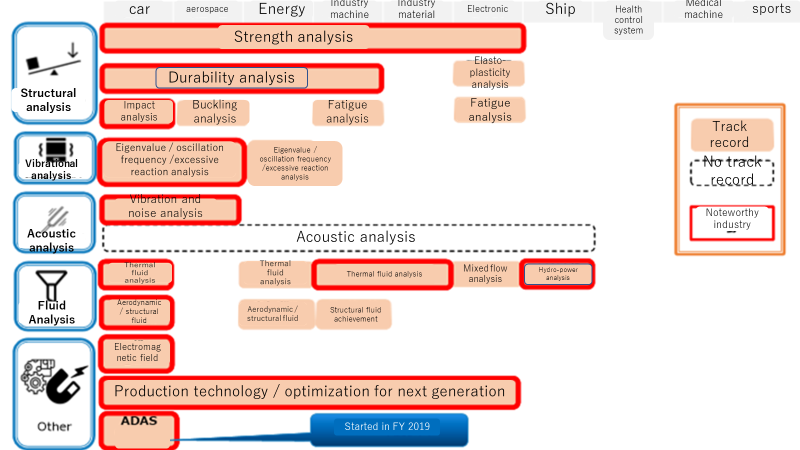

The sales of manufacturing include the sales of computer aided engineering (CAE) solutions, which are unique among system integrators (SI). In the case of new car development, for example, a CAE solution is to render a new car (not only its appearance, but also its internal structure) with a 3D system on PC based on the data of the new car under development (including design and materials), and conduct all kinds of simulation necessary for development, including strength, endurance, vibration, collision, and hydrodynamic and aerodynamic tests. The simulation data are analyzed to determine if the new car fulfills the design requirements, and the analysis results are summarized in reports including countermeasures, as needed, and the reports are submitted to automobile manufacturers. By utilizing these reports, the automobile manufacturers can reduce the number of prototype cars and demonstration tests, resulting in shortened development period and lower development costs. The main clients are domestic automobile manufacturers. In the domestic market, most products are produced in-house, and so competitors are few. Users are increasing in the fields of aircrafts, power generation equipment, artificial satellites, smartphones, etc.

Sales for each business field of end users for the term ended March 2019

| Sales | Composition ratio |

| Sales | Composition ratio |

Finance | 5,514 | 32.5% | Public services/energy | 1,425 | 8.4% |

Manufacturing | 3,726 | 22.0% | Communications | 1,196 | 7.1% |

Information | 1,643 | 9.7% | Distribution, services, etc. | 1,987 | 11.7% |

Transportation | 1,465 | 8.6% | Total | 16,957 | 100.0% |

(unit: million yen)

1-3. Strengths and characteristics - stable revenue base, excellent financial standing, and achievements of unique CAE solutions -

End users are distributed in a good balance among the fields of manufacturing, information, distribution, services, transportation, public services, energy, communications, and especially finance, and Minori Solutions offers comprehensive services, including development, operation, and management, in most cases. Accordingly, its revenue base is stable. All of the end users are leading or top-class companies in each field, and most of them have been using the service of Minori Solutions for many years.

Therefore, its financial standing is so excellent that equity ratio is 68.3% (results for the term ended March 2019 and same below), current ratio is 344.6%, and rate of return on invested capital is 15.0%.

In addition, the company possesses unique characteristics, including the experience of CAE solutions for structural and hydrodynamic analyses, and the business footholds in Sendai, Matsumoto, Nagoya, and Fukuoka, as well as the headquarters in Tokyo and Osaka Branch earning profits while contributing to local economies.

2. Fiscal Year ended March 2019 Earnings Results

2-1. Non-Consolidated business results

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YOY | Initial Forecast | Ratio to forecast |

Sales | 16,428 | 100.0% | 16,957 | 100.0% | +3.2% | 16,800 | +0.9% |

Gross margin | 2,696 | 16.4% | 2,894 | 17.1% | +7.4% | 2,756 | +5.0% |

SG&A expenses | 1,181 | 7.2% | 1,182 | 7.0% | +0.1% | 1,211 | -2.3% |

Operating income | 1,515 | 9.2% | 1,711 | 10.1% | +13.0% | 1,545 | +10.8% |

Ordinary income | 1,526 | 9.3% | 1,728 | 10.2% | +13.2% | 1,555 | +11.2% |

Net income | 1,044 | 6.4% | 1,218 | 7.2% | +16.7% | 1,050 | +16.0% |

*Unit: million yen

Operating income rose 0.9 points to 10.1%.

Sales increased by 3.2% year on year to 16,957 million yen. Sales of mainstay software development increased 3.4% year on year due to an increase in number of development projects in the fields of manufacturing, public services and energy, and distribution and services, while sales of system operation management also grew by 5.1% year on year mainly in the fields of information and manufacturing. On the other hand, sale of system-related devices declined by 20.7% as a result of that the large-scale hardware targeting financial institutions was sold last year.

Operating income increased by 13.0% year on year to 1,711 million yen. Gross profit margin improved 0.7 points to 17.1 % due to the enhancement of project management in software development, shifting to highly profitable projects in system operation management, and healthy sales associated with licenses of “SAP® Business ByDesign®” and RPA “MinoRobo®” under sales of system-related devices. Selling, general and administrative (SG&A) expenses decreased 2.3% year on year due to the expense reduction mainly on personnel through work-style reform and so on, although RPA promotional expenses, etc. increased. The increase in net income was caused by the decline in the tax burden rate (31.6% to 30.3%).

The dividend is 24 yen per share for the second half, which is an increase of 4 yen per share, and the year-end dividend is 42 yen per share (payout rati 30.1%), an increase of 6 yen per share per year, including 18 yen per share at the end of the first half. The company’s policy is to provide stable and sustainable dividends and secure a payout ratio of 30% or more.

Sales and profit in each segment

| FY 3/18 | Composition ratio | FY 3/19 | Composition ratio | YOY |

Software development | 12,516 | 76.2% | 12,944 | 76.3% | +3.4% |

System operation/management | 3,533 | 21.5% | 3,712 | 21.9% | +5.1% |

Sale of system-related devices | 378 | 2.3% | 300 | 1.8% | -20.7% |

Sales | 16,428 | 100.0% | 16,957 | 100.0% | +3.2% |

Software development | 1,838 | 14.7% | 2,042 | 15.8% | +11.1% |

System operation/management | 385 | 10.9% | 412 | 11.1% | +7.0% |

Sale of system-related devices | 19 | 5.1% | 19 | 6.6% | +1.5% |

Adjustment | -728 | - | -763 | - | - |

Operating income | 1,515 | 9.2% | 1,711 | 10.1% | +13.0% |

(unit: million yen)

Breakdown of SG&A expenses

| FY 3/18 | Composition ratio | FY 3/19 | Composition ratio | YOY |

Personnel Expense | 794 | 67.2% | 769 | 65.1% | -3.0% |

Travel Expense | 19 | 1.6% | 14 | 1.2% | -27.9% |

Depreciation expense | 15 | 1.3% | 6 | 0.6% | -56.5% |

Handling charge | 55 | 4.7% | 61 | 5.2% | +11.3% |

Land rent | 17 | 1.5% | 17 | 1.5% | -2.1% |

Others | 278 | 23.6% | 313 | 26.5% | +12.3% |

Total expense on SG&A | 1,181 | 100.0% | 1,182 | 100.0% | +0.1% |

(unit: million yen)

2-2. Sales in each business field of end users

| FY 3/18 | Composition ratio | FY 3/19 | Composition ratio | YOY |

Finance | 5,803 | 35.3% | 5,514 | 32.5% | -5.0% |

Manufacturing | 3,185 | 19.4% | 3,726 | 22.0% | +17.0% |

Information | 1,528 | 9.3% | 1,643 | 9.7% | +7.5% |

Transportation | 1,397 | 8.5% | 1,465 | 8.6% | +4.9% |

Public services/energy | 1,239 | 10.0% | 1,425 | 8.4% | +15.0% |

Communications | 1,642 | 7.5% | 1,196 | 7.1% | -27.2% |

Distribution/Services and Others | 1,632 | 9.9% | 1,987 | 11.7% | +21.8% |

Total | 16,426 | 100.0% | 16,957 | 100.0% | +3.2% |

(unit: million yen)

Sales in the field of finance decreased by 5.0% year on year to 5,514 million yen as conventional projects were completed in the previous term, despite an increase in sales related to RegTech projects. RegTech is a coined term from two words, “Regulation” and “Technology,” and is a technology that enables users to cut down on costs of dealing with financial regulations. More stringent financial controls have been imposed since the global financial crisis in 2008, boosting the costs required for financial institutions to conform to the regulations. Therefore, Minori Solutions is striving to establish a system that will allow financial institutions to effectively satisfy the regulations by using a multitude of technologies such as artificial intelligence, big data analysis, and blockchain.

In the manufacturing sector, sales increased by 17.0% year on year to 3,726 million yen as a result of an expansion of the CAE (numerical analysis) business and an increase in number of development projects due to the progression of customers (end users) development in the Kansai region. Furthermore, in the information sector, sales in the various service support business increased by 7.5% year on year to 1,643 million yen, and sales in the transportation sector increased by 4.9% year on year to 1,465 million yen due to investments in updating core systems of major customers. In the public services and energy sector, sales increased by 15.0% year on year to 1,425 million yen along with an increase of sales targeting power companies on the projects of separating the power generation section from the power distribution section. On the other hand, sales in the communication sector decreased by 27.2% year on year to 1,196 million yen as large-scale projects were completed in the previous term.

In the distribution and services sector, sales increased by 21.8% year on year to 1,987 million yen with the help of development projects related to “SAP® Business ByDesign®.” “SAP® Business ByDesign®” is a SaaS cloud service that is designed for medium- and small-sized companies and provided on the HANA cloud platform of SAP SE (in Germany). As a business partner of SAP Japan that is the Japanese subsidiary of SAP SE, Minori Solutions deals with requests and questions regarding installation of the cloud service, which SAP Japan receives from customers, and provides services of installation consulting and system construction for cloud applications. The company plans to take in new demand for systems, with the installation of “SAP® Business ByDesign®” as a stepping-stone. It records the sales related to installation consulting and system construction under software development, and the sales associated with licenses under sale of system-related devices.

2-3.Financial Conditions and Cash Flow (CF)

Financial Conditions

| 3/18 | 3/19 |

| 3/18 | 3/19 |

Cash, Equivalents | 6,674 | 7,330 | Payables | 1,239 | 1,258 |

Receivables | 2,826 | 2,746 | Account payable and accrued expenses | 377 | 392 |

Inventories | 74 | 89 | Accrued tax payable and consumption tax etc. | 472 | 468 |

Current Assets | 9,688 | 10,259 | Asset Retirement Obligation and reserve for retirement benefits for officers | 613 | 683 |

Tangible Fixed Assets | 117 | 143 | Interest Bearing Liabilities | 400 | 400 |

Intangible Fixed Assets | 30 | 33 | Liabilities | 3,569 | 3,676 |

Investments, Others | 1,107 | 1,179 | Net Assets | 7,374 | 7,938 |

Fixed Assets | 1,255 | 1,356 | Total Liabilities, Net Assets | 10,944 | 11,615 |

(unit: million yen)

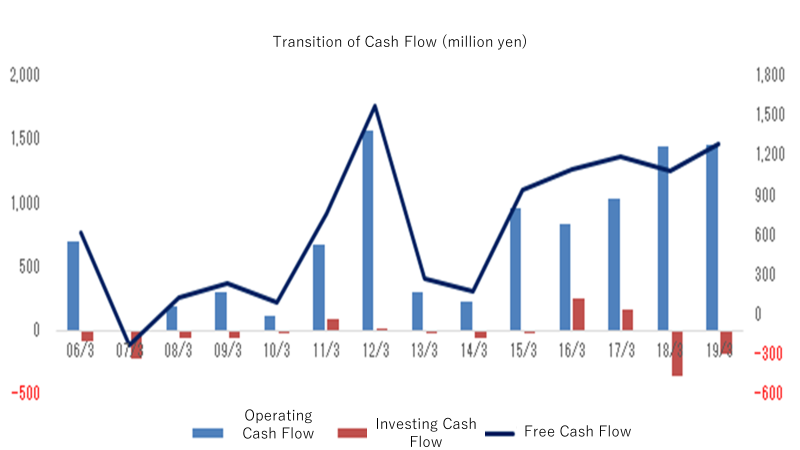

Total assets as of the end of the term stood at 11,615 million yen, up 671 million yen from the end of the previous term. The main increase items are cash and deposits and net assets. Since the term ended Mar. 2016, there has been more than 1 billion yen in free CF, and reflecting this, the company’s financial position is rich in cash. Liquidity is also high because management resources are concentrated in the main businesses. Capital-to-asset ratio was 68.3% (67.4% at the end of the previous term).

The company’s features and strengths are the industry-leading operating income margin of over 10% and the financial position with excellent liquidity and stability as well as the customer base and technological capabilities.

Cash flow statement

| FY 3/18 | FY 3/19 | YoY | |

Operating Cash Flow | 1,436 | 1,460 | +23 | +1.6% |

Investing Cash Flow | -353 | -179 | +173 | - |

Free Cash Flow | 1,083 | 1,280 | +197 | +18.2% |

Financing Cash Flow | -407 | -624 | -217 | - |

Cash, Equivalents at the end of term | 6,594 | 7,250 | +655 | +9.9% |

(unit: million yen)

Reference: Trends of ROE

| FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 |

ROE | 13.56% | 12.46% | 15.49% | 14.98% | 15.91% |

Net income rate | 4.97% | 4.76% | 6.20% | 6.36% | 7.19% |

Total asset turnover | 1.78 | 1.77 | 1.76 | 1.62 | 1.50 |

Leverage | 1.53x | 1.48x | 1.42x | 1.45x | 1.47x |

* ROE = Net Income rate × Total Asset Net over × Leverage

*The total assets and equity capital used for the calculation are the average value of the balances.

3.Fiscal Year March 2020 Earnings Estimates

3-1.Non-Consolidated earnings forecast

| FY 3/19 | Ratio to sales | FY 3/20 Forecast | Ratio to sales | YOY |

Sales | 16,957 | 100.0% | 17,800 | 100.0% | +5.0% |

Gross margin | 2,894 | 17.1% | 3,056 | 17.2% | +5.6% |

SG&A expenses | 1,182 | 7.0% | 1,226 | 6.9% | +3.7% |

Operating income | 1,711 | 10.1% | 1,830 | 10.3% | +6.9% |

Ordinary income | 1,728 | 10.2% | 1,840 | 10.3% | +6.5% |

Net income | 1,218 | 7.2% | 1,275 | 7.2% | +4.6% |

(unit: million yen)

Sales and operating income are estimated to grow 5.0% and 6.9% year on year, respectively.

It is forecasted that sales will grow by 5.0% year on year to 17,800 million yen. Orders and sales are expected to increase in the sectors including finance, public services and energy, communications, and distribution and services, which have strong sales products, while the transportation sector is also expected to grow steadily for providing system operation, etc. Although trade friction may affect production, CAE is expected to increase with new businesses in new fields.

Operating income is also estimated to grow by 6.9% year on year to 1,830 million yen. It is expected that the gross profit margin will continue improving as a result of an increase in the number of development projects with all-in contracts in the software development sector, enhancement of project management, and an increase of sales of internally-developed application “MinoRobo®” and cloud service licenses in the system-related device sale sector. Although SG&A expenses are expected to increase mainly in personnel expenses and sales promotion expenses etc., the SG&A expenses ratio is predicted to improve by suppressing the growth of other expenses.

The amount of dividend for the end of the first half is to be 22 yen per share and 23 yen in the second half, totaling 45 yen per share (the payout ratio estimated to be 30.4%), an annual increase of 3 yen per share.

3-2.Forecasts by business fields of end users

The finance sector is expected to expand to the life insurance and non-life insurance industries, while RegTech-related development will continue. Although there is an uncertainty in the manufacturing sector such as the effects of trade friction, CAE solution services will increase with the expansion of service targets (new fields such as ADAS). In the transportation sector, a steady growth is expected with the system operation related to the core operations of the user companies.

The public services and energy sector will expand by responding to various demands from electric power companies. Based on the revision of the Electricity Business Act of June 2015, separation of electrical power generation from power distribution and transmission will take place in April 2020. As a result, electric power companies are developing systems that support the separation since they will be unable to concurrently work in the power generation and transmission businesses. The company is the Group that has business transactions with Tohoku Electric Power, Kansai Electric Power, and Kyushu Electric Power, and it is working to strengthen order response capabilities and win orders by utilizing resources across the Group consisted of the regional power supply organizations that are specialized in electricity.

In addition, the communication sector is expected to expand development for major carriers, and the distribution and services sector is expected to increase sales related to “SAP® Business ByDesign®.”

3-3.Engagement in each segment

Software development

The company will strive to improve profitability by strengthening the ability to receive orders and expanding projects with all-in contracts. In order to strengthen the ability to receive orders, for services related to SI, it will increase utilization of financial experts through institutionalization and expand the RegTech field in the finance sector, and in the public services and energy sector, it will use resources and win orders from the cross-sectional regional organization specialized in power. Furthermore, it will strive to expand cloud solutions and one-stop services in the distribution and services sector. In addition, while expanding the CAE services in the Kansai region, it will work on developing new fields such as ADAS.

Meanwhile, in order to improve profitability through expansion of the projects with all-in contracts, the company will increase orders for all-in contract projects and enhance project management.

“Advanced Driver-Assistance Systems (ADAS)” is a generic term for driving support functions and systems such as Adaptive Cruise Control (ACC), Forward Collision Warning (FCW) and Advanced Emergency Braking System (AEBS). It is a function/system for a vehicle itself to grasp surrounding information as well as to detect and avoid the possibility of an accident in advance. For ADAS, devices and software such as sensors and ECUs are required to develop.

Operation and management of system

The company will develop solutions for business efficiency by using RPA and proposing business operation support using AI, etc. to improve the profit margin. In addition, as for the SI services, it will attempt to capture the operation needs as the number of direct transactions with end users are increasing.

Sales of system devices

The company will develop systems in response to customers’ request and sell a variety of devices that accompany infrastructure base construction. It will also work on increasing the sales of its own RPA product, “MinoRobo®” and sales of cloud service licensing.

4. Priority Policies in Mid-Term Management Plan and Progress

【Basic Strategies and Priority Policies】

Topics |

| Basic strategies | Priority measures |

Study on high value-added/next generation business ↓ Efforts of a dedicated R&D team and new development of CAE |

| High value-added business administration | ・Creation of a high value-added business using a variety of new technologies, such as “cloud,” “IoT,” “big data analysis,” “AI,” and “FinTech” ・Expansion of transactions with end users in both the existing businesses and new businesses ・Development of new businesses through promotion of internal intrapreneurship |

| Improvement of the Minori brand | ・Enhancement of technological abilities, quality, organizational capabilities, and thorough risk management to realize “Minori, stepping together with clients” ・Promotion of businesses in highly public fields and those that would contribute to local community, as Minori as a member of the society ・Propelling commercialization of Minori Solutions’ original services, tools, and packages (e.g. “MinoRobo®,” power solutions, etc.) | |

Development of cloud services ↓ Expansion of projects that utilize “SAP® Business ByDesign®” |

| ||

| Attractive company with a comfortable working environment (healthy management, and work-style reform) | ・Healthy management ・Diversity management ・Company where employees can thrive through diverse work styles | |

Starting of the sales of own products ↓ Starting of sales of a RPA application “MinoRobo®” through distributers |

| ||

| Simple & speedy (management with swift decision-making) | ・Swift (speedy) decision-making ・Self-reliant behavior of each employee ・Simple relationship between employees and the management | |

Creation of a comfortable working environment ↓ Received 3.5 stars from the Nihon Keizai Shimbun “Smart Work Management” survey.

|

|

In the term ended March 2019, the company saw sales increases in the CAE solutions, the business fields it has been working on as part of its effort toward high value-added business administration. Its dedicated R&D team, which was newly formed with the aim of researching high value-added and next-generation businesses, also started bearing fruit. Furthermore, development projects to utilize “SAP® Business ByDesign®,” which is deployed as a cloud service, also expanded steadily. As for the RPA product named “MinoRobo®,” one of the attempts to improve the Minori brand, the company released a new version with boosted online performance and usability in August, and its sale through distributors began in the second half. In addition, the efforts to create a comfortable work environment were valued, and the company earned higher points at the Nihon Keizai Shimbun “Smart Work Management” survey.

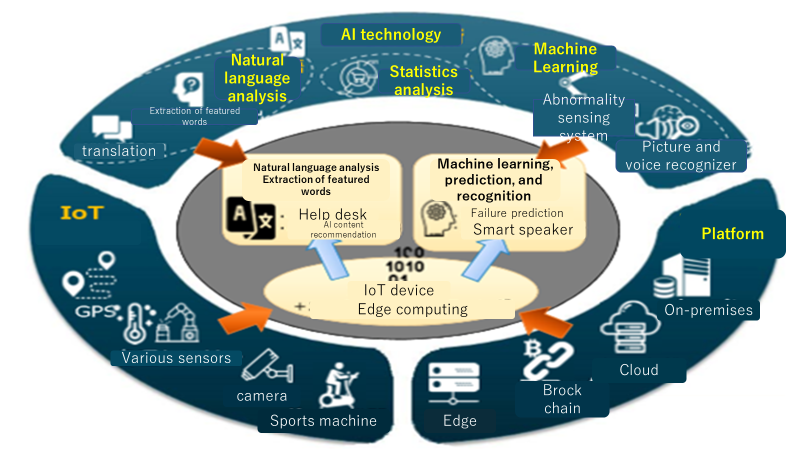

Efforts of the dedicated R&D team

The dedicated R&D team is putting forth efforts in pursuit of the themes: “a voice interface utilizing smart device,” “content matching through the extraction of characteristic words and the machine learning,” and “high-speed image recognition technology using edge computing.” Based on the results of these efforts, it will contribute to local communities through social business (related to disaster management information), offer solutions for business streamlining, and support innovation of customers.

(Resource taken from the company)

In the term ended March 2019, the company completed a prototype of the “smart speaker system for disaster management” that can convey information on disaster management by voice, using an AI-based speaker, as part of the contributions to local communities in the social business (related to disaster management information). Demonstration experiments on the usefulness of the system began as a means of transmitting disaster prevention information in collaboration with local authorities, etc. In cooperation with “L-Alert®,” the system of sharing disaster management information the Ministry of Internal Affairs and Communications is attempting to popularize, the “smart speaker system for disaster management” delivers disaster management information, such as evacuation advisory sent by local authorities, etc. via Internet communication lines to the AI-based speaker and relays the information vocally.

In addition, regarding the solution for business streamlining, the company developed a learning model specialized in the images used in customer services. It will improve work efficiency by replacing human with AI (image recognition) at work.

Novel development of the CAE solution

With regards to CAE solutions, the company will continue strengthening the solutions in the field of conventional structural analysis, vibration analysis, acoustic analysis, and fluid analysis, and it will also develop solutions in the production technology systems, electromagnetic field analysis, mechanism analysis, 1D (MBD), and next-generation optimization in collaboration with CAE software vendors. Furthermore, it will enter the ADAS field this term. The business of CAE solutions has been continuously expanding as a result of efforts to expand in new fields and develop new customer industries. The sales in the term ended March 2017 were a little over 700 million yen, but they were expanded to 900 million yen in the term ended March 2019. It is aiming for 1,000 million yen in the term ending March 2020.

(Resource taken from the company)

Development of RPA “MinoRobo®”

The selling points of the company’s RPA product, “MinoRobo®,” a solution with a concept of “RPA” for daily use, are that it is equipped with a user-friendly UI and enables even laypeople to easily generate scenarios. “MinoRobo®” can automatically process a great deal of routine work in a short period of time (eliminating multifarious time-consuming manual tasks and realizing significant improvement in business efficiency) by setting the computer operation by a person in charge as a “scenario.” As the scenario can be produced without special knowledge of programming, persons in charge of operation can easily configure scenarios according to their respective operations. In addition, “MinoRobo®” is certified as one of the tools subjected to the “subsidy program for IT introduction” by the Ministry of Economy, Trade and Industry, and users will receive a subsidy of up to 1.5 million yen for its installation.

In the term ended March 2019, the company provided case studies at the seminar titled “Work-style reform promotion through introduction of RPA” held by the Japan Information Technology Services Industry Association (JISA) (on September 19, 2018). In addition, it exhibited at the “RPA/Business AI Conference 2018 Fall” hosted by Nikkei Business Publications, Inc. (on September 26) and made a keynote speech. Furthermore, the company started sales of the product through distributors in the second half and participated in an exhibition, “RPA DIGITAL WORLD 2018 Digital Robot CAMP in Odaiba” on November 22.

4. Conclusions

With the emergence of new technologies and changes in the human resource environment, business transformation using digital technologies is an important management issue regardless of the type of business. In addition, “2025 Digital Cliff,” announced by the Ministry of Economy, Trade and Industry in its report titled “DX Report: Overcoming of ‘2025 Digital Cliff’ Involving IT Systems and Full-fledged Development of Efforts for DX” is claimed as an issue as well. Thus, the prospect of the information service industry is bright. The company also possesses strong products for each customer industry, such as FinTech / RegTech in the finance sector, CAE in the manufacturing sector, and separation of power generation and distribution in the power sector.

Nonetheless, the company aims to “provide high value-added services” in the medium- and long-term in order to foster “high value-added” new businesses while improving the performance of existing businesses. Low-competitive, high-value-added CAE solutions and cloud solutions that can be introduced in a short period of time with low initial costs will play a role in the “high value-added services,” and it was confirmed that they were doing well in the term ended March 2019. The dedicated R&D team’s efforts are also part of the “high value-added services,” and we would like to pay attention to them as well as the progress of the afore-mentioned solutions.

<Reference: Regarding corporate governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit supervisory committee |

Directors | 11 directors, including 3 external ones |

◎ Corporate Governance Report (Updated on July 4, 2019)

Basic Policy

The company considers that the basic policy for corporate governance is to secure the transparency, swiftness, and fairness of business administration and execution, clarify responsibilities, enlarge business scale, and comply with laws and regulations thoroughly, in order to improve and maximize its corporate value.

<Major principles that have not been followed, and reasons>

Minori Solutions develops a medium-term business plan, sets targets for sales, operating income and operating income margin, and formulates specific measures to achieve them. The medium-term business plan is disclosed on the company’s website. It is also reviewed as appropriate when there are significant changes in the business results and future social and economic conditions etc., and the contents of the amendment are disclosed when there are changes that should be disclosed. In the future, it will consider the ways to review the business portfolio and explain the approach to allocate management resources such as capital investment, research and development expenses, human resources investment, etc. along with the concept of capital cost.

<Major principles that have been followed>

【Principle 1-4 Cross-shareholdings】

<Policy concerning cross-shareholdings>

Minori Solutions will hold the shares of other companies as cross-shareholdings only if it is deemed necessary after comprehensive examination of medium- to long-term economic rationality and future prospects for the purpose of smooth business management, and maintenance and strengthening of business relationships. As for the holding status of major cross-shareholdings, the Corporate Planning Department confirms the basic policy described above every year for each stock and verifies medium- to long-term economic rationality, taking into account the capital cost of the company. In this way, the significance of cross-shareholdings is confirmed, and in principle, it sells the shares for which the Board of Directors determines to have no significance.

<Contents of verification concerning cross-shareholdings>

The shares held are reviewed as appropriate at the Board of Directors based on economic rationality and changes in the business environment, etc.

<Standard for the exercise of voting rights for cross-shareholdings>

The company exercises voting rights for cross-shareholdings appropriately, after carefully reviewing the contents of the proposal, conducting dialogue with companies as necessary, and determining whether or not it will contribute to the improvement of the shareholder value of the company.

【Supplementary principle 4-11-3 Analysis and evaluation of the effectiveness of the entire Board of Directors】

The management status of the Board of Directors is as follows.

Based on the above, Minori Solutions will explore measures to enhance the effectiveness of the Board of Directors and improve the quality of discussions at the Board of Directors.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of bridge Reports on Minori Solutions Co, Ltd. (3822) and Bridge Salon (IR seminar), please go to our website at the following URL. https://www.bridge-salon.jp/