Bridge Report:(3989)SHARING TECHNOLOGY the second quarter of Fiscal Year September 2019

SHARING TECHNOLOGY. INC (3989) |

|

Company Information

Exchange | TSE Mothers |

Industry | Information and communications |

Representative Director & Co-CEO | Masayoshi Shino and Nobuhiro Moriyoshi |

Address | JP Tower Nagoya 19F, 1-1-1, Meieki, Nakamura-ku, Nagoya |

Year-end | End of September |

HP |

Stock Information

Share price | Number of shares issued | Total market cap | ROE (Actual) | Trading Unit | |

¥765 | 18,406,500 shares | ¥14,080 million | 34.1% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥0.00 | - | ¥53.56 | 14.3 times | ¥110.48 | 7.0 times |

The share price is the closing price on July 9.

The number of shares issued and EPS are taken from the brief report on financial results for the Second Quarter of the fiscal year ended September 2019.

ROE and BPS are taken from the brief report on financial results for the fiscal year ended September 2018.

Earnings Trends

Fiscal Year | Sales Revenue | Operating income | Ordinary Income | Net Income | EPS | DPS(Est.) |

September 2016 (Actual) | 1,141 | 57 | 55 | 21 | 1.42 | 0.00 |

September 2017 (Actual) | 1,754 | 400 | 389 | 268 | 16.93 | 0.00 |

September 2018 (Actual) | 4,727 | 553 | 539 | 695 | 38.74 | 0.00 |

September 2019 (Est.) | 8,800 | 1,700 | 1,620 | 973 | 53.56 | 0.00 |

*Units: Million yen

*The estimates are from the Company. The values until the term ended September 2017 are non-consolidated. The values from the term ended September 2018 are consolidated ones based on the IFRS. Ordinary Income does not include tax. Net Income refers to Profit Attributable to Owners of Parent. 3-for-1 share split was conducted on August 6, 2018. EPS has been adjusted retroactively.

This report introduces the company overview, earnings trends, etc. of SHARINGTECHNOLOGY. INC.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year ending September 2019 Earnings Results

3. Fiscal Year September 2019 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The cumulative sales revenue in the first and second quarters of the term ending Sep. 2019 was 3,557 million yen, up 215.7% year on year. Sales in both businesses increased substantially. The company incurred an operating loss of 457 million yen. In order to increase sales revenue, the company strategically invested in advertising and actively made a prior investment in writing contents. As a result, SG&A expenses increased significantly, rising 157.7% year on year.

- There is no change in the full-year forecast. Sales revenue is estimated to be 8.8 billion yen, up 86.1% year on year, and sales revenue in Sharing Technology’s mainstay WEB Business will grow roughly twofold, exceeding total company’s sales revenue growth rate. Operating income is forecast to increase 218.7% to 1.7 billion yen. The company is expecting a significant increase in sales and profits again this term.

- With regard to the full-year forecast, the cumulative progress rate is low as of Q2, but the company expects earnings to increase in the second half due to the contribution of seasonal sales in the main genre, the start of full-scale monetization of investments in writing contents, and increased average spending per inquiry due mainly to “Mover.” For “Mover” in particular, as predicted, the average spending per inquiry is 1.4 times higher than it was before, thanks to the improved contract rate. We would like to pay attention to how much sales revenue and profits will improve in Q3 and Q4, and whether they will coincide with the company’s estimates.

1. Company Overview

Under the corporate philosophy, “Contributing to a safe society by creating a new mechanism.” “We will provide peace of mind for users with ‘household problems’ at the earliest possible moment. Also, we hope that the existence of our service will improve the sense of ease of users with respect to future household problems. We have always improved and will always improve our service in response to the needs of society.”, the Company offers services that match users who are facing “troubles in daily life” with service providers specializing in services related closely to everyday life, by operating “Seikatsu110,” a home service platform, and “Vertical Media site (*)”.

It has realized speedy and high-accuracy business matchmaking services, which no other company can offer, and is striving for further growth by releasing “Mover,” a home service infrastructure with improved functions.

*What is a Vertical Media site?

A Vertical Media site is a website that contains various pieces of information on a specific subject. It is designed in a manner to allow each user who is interested in the subject to efficiently find the information that he or she seeks, bringing advantages not only to users, but also to the operating company of the website because the Company can easily distribute contents that fulfill user needs and the Vertical Media site can be used as an advertising medium that readily appeals to target users.

【1-1 Corporate History】

With the aim of spurring innovations to the society, Rits Co., Ltd., the predecessor of SHARING TECHNOLOGY. INC, was founded in November 2006.

In May 2009, the Company launched the “Net 110 (emergency) business” in which it served as an agency for Internet network service providers.

Learning that people have difficulty in efficiently finding service providers that offer solutions to daily troubles, lock smiths, leaking roofs, water related improvement, termite extermination, renovation, and repair, the company recognized a possibility of creating a new market through effective online business matchmaking services that introduce general consumers to business operators (home service providers), and he then conducted a market survey. What he found out is that, in such service categories, local handyman service providers and other similar operators offered just simple websites.

Therefore, he set up a “Vertical Media site” relating to the daily home service fields and started this business that matches general consumers suffering from unexpected troubles with daily home service providers in April 2012, taking advantage of the know-how that the Company had cultivated.

The Company then began providing a comprehensive portal site, “Seikatsu 110 (Life Emergency Call),” in June 2015.

With a focus on the concept of “sharing economy” which is to efficiently utilize idle assets of daily home service providers, the Company thrived rapidly by realizing the business with its technology and taking in both demand and supply, and got listed on Tokyo Stock Exchange’s Mothers (market of the high-growth and emerging stocks) in August 2017.

The company switched to a new management structure in February 2019, setting its mission as “Contributing to a safe society by creating a new mechanism.”

【1-2 Corporate Philosophy】

As stated above, the company’s corporate philosophy and mission are to “contribute to a safe society by creating a new mechanism.”

The Company, which has provided daily home service matching services that introduce users seeking services to service providers, has established an automatic “matchmaking technology system” that digitizes various information, such as detailed user needs, the characteristics and potential of service providers, and results of matches between users and providers, automatically analyzes the data, and incorporates the analyzed data into the services with increased matchmaking accuracy.

As a leading company in the home services market, SHARINGTECHNOLOGY seeks to maximize corporate value by accurately grasping the needs of society, strengthening existing businesses and conducting active investment. They aim to provide peace of mind for users with ‘household problems’ at the earliest possible moment, and hope that their services will contribute to creating a society where people can live knowing things will turn out fine even if household problems arise.

【1-3 Market Environment】

Throughout Japan, people are confronted with an array of troubles that happen unexpectedly in everyday life(lock smiths, leaking roofs, water related improvement, external/internal improvement, window glass replacement, and pet funerals) and troubles that occur in a specific season of the year(Pest control and extermination, mowing and pruning, typhoon-related repairs and cleanup)meaning that high demand is expected continuously every year, and it is the market in which the company is able to earn stable revenue regardless of various adverse factors, including changes in the outside environment.

Furthermore, the Company predicts that needs from older people who are unable to deal with troubles by themselves will grow more and more in the wake of the decreasing birthrate and aging population. Its services satisfy such demand and have enormous social significance.

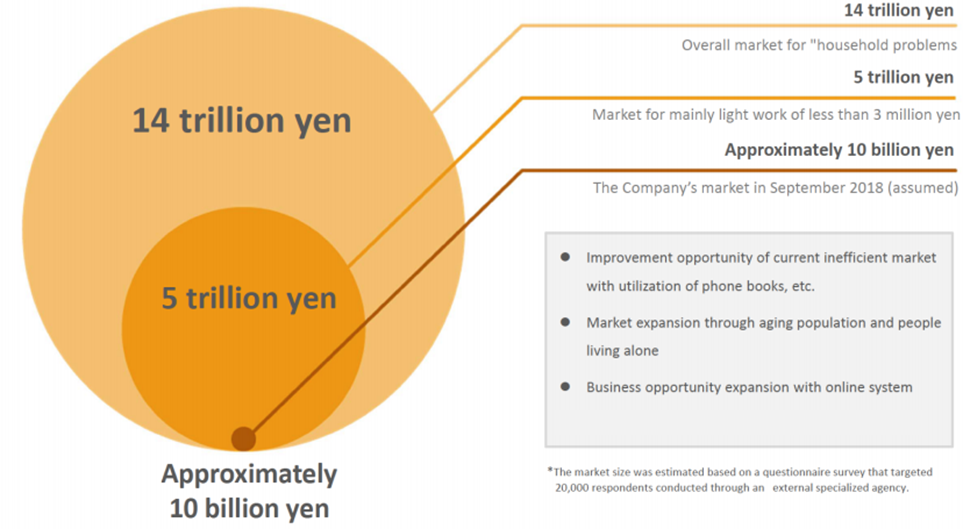

An outside survey company has estimated that, in the market of “troubles in daily life” consisting of projects worth 3 million yen or less, the market scale of the Company’s mainstay service categories (especially light labor) is about 5 trillion yen.

The Company’s current gross merchandise sales stand at about 10 billion yen, which means that its market share is not significant enough considering the above-mentioned market scale, and the Company believes that it can continue to thrive at a high rate.

At the moment, there is no competitor that has built up as large a member-store network as the Company; however, in preparation for future risks, such as the increasing number of firms that will newly enter the field, and intensifying competition with existing competitors, the Company is continuously focusing on cementing relationships with service providers.

(Taken from the reference material of the Company)

【1-4 Business Contents】

The reporting segments are composed of the “WEB business” and the “Investment business.”

(1) WEB business

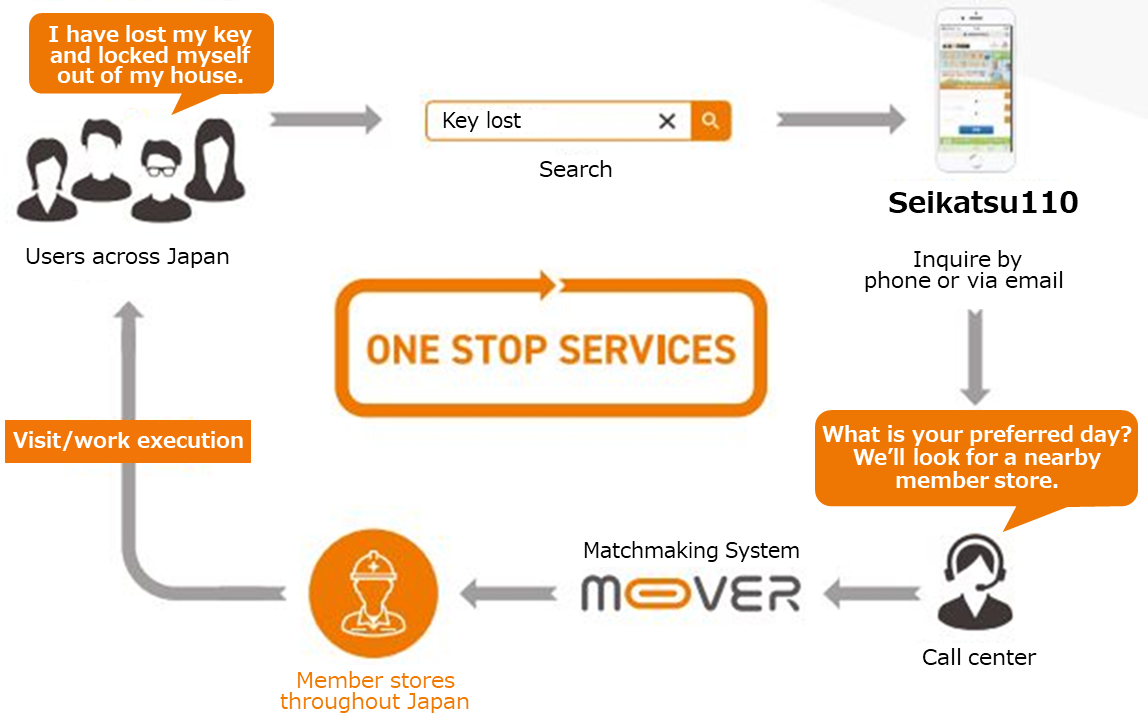

In the “WEB business,” its mainstay, the Company provides business matchmaking services that introduce users facing “troubles in daily life” to service providers specializing in services related closely to everyday life through a comprehensive portal site, “Seikatsu110,” and “Vertical Media site”.

① WEB marketing service

The Company performs matchmaking for a wide range of daily home service fields.

◎ Outline of the daily home service fields

(Taken from the reference material of the Company)

In the “Seikatsu110” service, the Company has offered multifarious contents, including information on service providers, for more than 140 different areas, which makes it possible to swiftly match a user with a proper service provider in response to users’ inquiries.

In addition, the Company regularly delivers contents useful in everyday life to help users enrich their lives.

(Taken from the reference material of the Company)

As of the end of March 2019, the Company operated about 200 Vertical Media sites for assisting users in dealing with troubles in daily life, lock smiths, leaking roofs, termite damage, bee damage, water related improvement, and mowing, covering approximately 140 daily home service categories.

◎ Flowchart of service provision

(Taken from the reference material of the Company)

<About “Mover,” daily home service infrastructure>

“Mover” is a daily home service infrastructure released by the Company, which has realized a swift and highly accurate matchmaking services that cannot be imitated by any other companies, with the aim of further boosting convenience of both users and service providers, and the Company’s own growth.

(Overview)

With each worker at service providers carrying a smartphone on which “Mover” has been installed, a daily home service infrastructure “Mover” is a system that makes it possible to look for the nearest member store all across Japan in real time and send workers to users swiftly by utilizing “GPS information” and the “real-time schedule function.”

Establishing a daily home service infrastructure for providing services at an overwhelmingly fast speed throughout Japan by making the most of “Mover,” SHARING TECHNOLOGY is transforming from a “company operating websites for dealing with troubles in daily life” to a “company that establishes daily home service infrastructure for addressing life-related troubles.”

(Challenges)

The previous system has several problems, such as the following, which have led to some negative consequences, including failures to receive orders and reduced work efficiency at service providers.

・There is lead time from the acceptance of a user’s order to matchmaking.

・Sometimes unable to meet the user's desired visit date and time.

・Workers at service providers have to travel a long distance.

(Characteristics)

In contrast, “Mover” has resolved these problems with additional two functions, which are “GPS information” and the “real-time schedule function.” It is a system that brings significant advantages to both users and service providers, as it provides users with services in the swiftest and fastest manner, and realizes service providers’ sales expansion through improved business efficiency.

*Real-time schedule management function

As the location information and the real-time schedule of each worker at service providers are available in the system, it is possible to propose the date and time for a worker’s visit upon receipt of an inquiry from a user. In fact, when tested by the company, the results were a shorter lead time and a contract rate that was about 1.4 times higher when compared to regular customer service.

*GPS function

As the current location of each worker at service providers has been made available with this function throughout Japan, a user will be introduced to the nearest worker and receive a service in the shortest period of time. This is considered to be one of the factors that lead to an increase in the close rate.

In addition, users wish to receive some of the services offered by the Company at a lower price, such as light bulb replacement and furniture assembly, and taking transportation costs into account, it is not realistic to proactively place advertisements for many of such services; however, if workers’ transportation costs can be reduced with “Mover,” such services will be provided at a price that meets user needs.

(Possibility of a rapid profit increase created by Mover)

A “further increase in the close rate = increase in substantial sales revenue per project” through the use of “Mover” will very likely result in rapid expansion of the Company’s profit.

If the current average close rate after matchmaking was 38.2% and the sales target was 4 billion yen, and the close rate had grown by 15% to about 44% (38.2% × 1.15) thanks to “Mover,” sales would be about 4.6 billion yen (4.0 billion yen × 1.15); however, as costs are fixed, the difference of 600 million yen would be the Company’s profit.

It is possible to increase profit more drastically than ever before by investing the profit earned using “Mover” in online advertising. The Company has established a system for doing so, which we can deem as one of its huge competitive advantages.

◎ Business model

As mentioned above, the Company’s sales consist mainly of remuneration (margin) paid by service providers.

The Company receives remuneration from service providers primarily on a “pay-per-performance” basis in which a member store incurs the obligation of payment right after it completes service provision to a user. Furthermore, a margin is paid to the Company also on a “pay-per-introduction” basis in which the Company receives remuneration from a member store when it introduces a user to the store.

With the intervention of the Company, service providers are able not only to increase the numbers of customers and orders received, but also to earn sales during pockets of time, which makes it possible for them to utilize excess business resources in a more effective fashion. The total number of service providers is over 3,400 as of the end of March 2019.

(2) Investment Business

With a certain degree of investment efficiency taken into consideration in order to accelerate the growth speed of the WEB business, the Company directly holds the shares of its subsidiaries and offers them management consulting.

*Engagement in M&A

Implementing strategy A, B and C, the company has been actively engaging in M&A in order to enhance its corporate value, however the company decided to conduct only M&A which expects significant synergistic effect from now on.

| Overview of strategies | Acquired companies and website |

Strategy A | 30% of return on investment is expected for its web marketing know-how in a short run | The liaison company for franchise ArchiCloud APEXY Co., Ltd. iPhone ambulance Hikkoshi Cheki |

Strategy B | The company aims to enhance its corporate value by boosting its growth with active investment | Re-Abroad Inc.. Discover Co., Ltd., |

Strategy C | The company aims to have stable and continuous business which obtains abundant net assets in contrast with acquisition price. | DENSHI PRINT KOGYO Co., Ltd. Meishi Consultant Co. Ltd. Shiotani Glass Co., Ltd., |

【1-5 Characteristics and Strength】

We can cite the following points as the Company’s powerful competitiveness, and the factors and backgrounds behind its considerable growth potential:

(1) Establishment of a nationwide member-store network based on a pay-per-performance business model

Many small and medium-sized companies, and small business owners still rely on the customer attraction methods using paper and other traditional media that do not always create reliable customer attraction effects. Therefore, the cost for reeling in customers is not necessarily linked to sales.

The pay-per-performance business model does not require payment of initial registration fees or annual contract fees, and makes it possible to effectively receive orders and increase sales while cutting down on the cost of attracting customers. Thus, it is of great appeal to small and medium-sized companies, and small business owners. The Company has successfully captured service providers that possess extensive experience in work execution and are capable of flexibly coping with user needs, and is increasing the member store retention rate, establishing one of the largest member-store networks in Japan.

(2) Business structure that boosts revenue in proportion to data cultivation

A variety of information, such as the trend of user needs in each region, and project-related information including the characteristics and strengths of services of each member store, are being cultivated in the system on a continuous basis through repetitive provision of matchmaking services.

With each worker at service providers carrying a smartphone on which “Mover” has been installed, the new system that builds up a daily home service infrastructure, “Mover,” is a system that allows service providers to send a worker to the user who has placed an order swiftly through an improved matchmaking efficiency, as it has been made possible to look for the nearest member store all across Japan in real time by utilizing GPS information.

Aiming to reduce users’ lead time to “0 minute,” “Mover,” which may be referred to as a “daily home service version of Uber” in a sense, enables the Company to increase revenue by making matches more swiftly and enhancing the close rate.

SHARING TECHNOLOGY is transforming from a “company operating websites for dealing with troubles in daily life” to a “company that establishes daily home service infrastructure for addressing troubles in daily life.”

In addition, the Company analyzes the Cost per Action (CPA) efficiency for all of its Vertical Media sites every day, which allows it to learn about the status of profit and loss by service category in a timely manner. When profit exceeds CPA, the Company proactively capitalizes on advertising costs in order to expand the number of orders received. Furthermore, the system automatically displays an order receipt talk manual for the inquiry telephone number assigned to each Vertical Media site; thus, even when a new service category is added, matchmaking services can be provided swiftly with homogenized operational quality (systematization of highly accurate contract conclusion operations).

*CPA (Cost per Action)

Cost per Action (CPA) is also referred to as cost per conversion, which indicates “the amount of money invested for achieving a conversion.” CPA = advertising cost / No. of conversions

2. Second Quarter of the Fiscal Year ending September 2019 Earnings Results

(1)Overview of consolidated performance (YTD)

| FY 9/18 2Q | Ratio to sales revenue | FY 9/19 2Q | Ratio to sales revenue | YOY |

Sales revenue | 1,126 | 100.0% | 3,557 | 100.0% | +215.7% |

Gross profit | 1,108 | 98.4% | 2,183 | 61.4% | +97.0% |

SG&A expenses | 1,079 | 95.8% | 2,782 | 78.2% | +157.7% |

Operating income | 29 | 1.7% | -457 | - | - |

Pre-tax profit | 22 | 2.0% | -482 | - | - |

Net income | 5 | 0.5% | -374 | - | - |

(Units: Million yen) IFRS。

Sales significantly increased but incurred an operating loss

Sales revenue rose 215.7% year on year to 3,557 million yen. Sales in both businesses increased substantially.

The company incurred an operating loss of 457 million yen. In order to increase sales revenue, the company strategically invested in advertising and actively made a prior investment in writing contents. As a result, SG&A expenses increased significantly, rising 157.7% year on year.

(2) Trends by segment (YTD)

| FY 9/18 2Q | Ratio to sales revenue | FY 9/19 2Q | Ratio to sales revenue | YOY |

Sales revenue |

|

|

|

|

|

Web Business | 1,119 | 99.4% | 2,085 | 58.6% | +86.2% |

Investment Business | 6 | 0.6% | 1,472 | 41.4% | - |

Total | 1,126 | 100.0% | 3,557 | 100.0% | +215.7% |

Revenue by segment |

|

|

|

|

|

Web Business | 414 | 37.0% | -223 | - | - |

Investment Business | -31 | - | 118 | 8.1% | - |

Adjustment | -353 | - | -353 | - | - |

Total | 29 | 2.6% | -457 | - | - |

*Unit: million yen

*Sales revenue refers to sales profits from external customers

*Composition ration of operating income is the same as operating profit margin.

(WEB business)

Sales increased, but a loss was recorded due to upfront investment.

Sales revenue from the “Household problems” business increased steadily, rising 48% year on year.

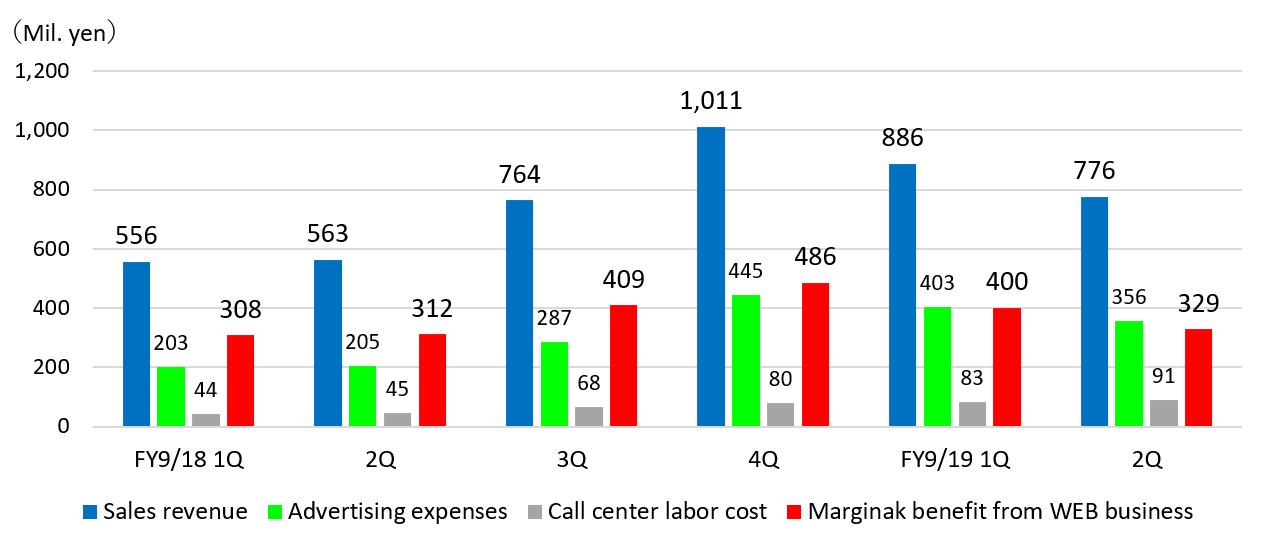

In “Household problems,” “Marginal business income” is the company’s main KPI. “Marginal business income” is the sales revenue from the WEB business minus advertising expenses and call center staffing costs, which are incurred directly on making sales.

(Investment business)

Due to efforts to improve operations at subsidiaries and strengthen management systems, the investment business earned a profit.

3. Fiscal Year September 2019 Earnings Estimates

(1) Overview of the consolidated earnings forecast

| FY 9/18 | Ratio to sales revenue | FY 9/19(Est.) | Ratio to sales revenue | YOY | Progress Rate |

Sales revenue | 4,727 | 100.0% | 8,800 | 100.0% | +86.1% | 40.4% |

Operating income | 553 | 11.7% | 1,700 | 19.3% | +218.7% | - |

Pre-tax profit | 539 | 11.4% | 1,620 | 18.4% | +210.6% | - |

Net income | 695 | 14.7% | 973 | 11.1% | +39.5% | - |

*Units: Million yen

There is no change in the business forecast.

Sales and profit are projected to keep growing considerably.

Sales revenue are estimated to be 8.8 billion yen, up 86.1% year on year. The Company aims to increase the sales revenue from the WEB business, which is its mainstay, roughly twofold, exceeding total Company’s sales revenue growth rate.

Operating income is forecasted to be 1.7 billion yen, up 218.7% year on year.

(2) Activities and policies in this term

Although the progress rate is low, earnings and profit are expected to improve from Q3 (April-June) due to the following three.

① Seasonal sales in main genres

Demand in some of the main genres of “Household problems” (pest control and extermination, mowing and pruning, typhoon-related repairs and cleanup) is seasonal, and rises as temperature gets higher. As such, the company expects sales to increase in the second half of this term as in past years.

② Full-scale monetization began for investments in writing contents

The company's recoupment ratio for investments in writing contents (incoming sales from relevant articles / article production cost) is on track to exceed 100% (recoup all investment costs) in 10-12 months.

Six months have passed since the content articles (produced by writers whom the company has been investing in since last October) were published, and it is expected that they will fully contribute to earnings from now on.

Also, in addition to the main inflow of listings, SHARINGTECHNOLOGY will work to further attract customers by strengthening organic inflows. Organic inflows are expected to be the more profitable of the two, because there are no directly charged advertising expenses (PPC advertisements).

③ “Mover” contributes to the rise in average spending per inquiry

The company pre-launched “Mover” in specific genres. As a result of successfully conducting matching using GPS, the contract rate has been improved in about half of the projects in that genre, and the average spending per inquiry has steadily grown to more than 1.4 times of what it was before the new system was launched.

The company plans to apply this concept to other major genres in the future.

SHARINGTECHNOLOGY has positioned the current term as a period for active upfront investment in the “Household problems” business (including trial measures).

In addition to growth made through listing operations, the company aims to obtain organic inflows by utilizing branding, increasing inflows coming from business alliances, and enhance their ability to attract customers through retention.

They will also implement measures to improve the average spending per inquiry by promoting the widespread use of “Mover.”

4. Conclusion

With regard to the full-year forecast, the cumulative progress rate is low as of Q2, but the company expects earnings to increase in the second half due to the contribution of seasonal sales in the main genre, the start of full-scale monetization of investments in content, and increased average spending per inquiry due mainly to “Mover.” For “Mover” in particular, as predicted, the average spending per inquiry is 1.4 times higher than it was before thanks to the improved contract rate. We would like to pay attention to how much sales and profits will improve in Q3 and Q4, and whether they will coincide with the company’s estimates.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 3 outside ones |

Auditors | 3 auditors, including 3 outside ones |

(data on July 1, 2019)

<Corporate governance report>

Last modified: December 25, 2018.

<Basic Policy>

Our company recognizes that it is indispensable to establish corporate governance in order to expand revenue, improve corporate value, and maximize returns to shareholders as a going concern.

In detail, we think that it is important for our representative director and other directors in charge of business administration to discipline themselves, make appropriate business decisions based on their duties, improve the efficiency and swiftness of business administration, pursue profit through our businesses, secure the soundness of corporate finance, increase its credibility, disclose information timely and properly to secure the transparency and objectivity of business activities, and develop an effective internal control system and it is essential for auditors to maintain their independence and exert their auditing abilities to a sufficient degree.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

It is stated that “our company observe all of the basic principles of the Corporate Governance Code.”

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |