Bridge Report:(6044)SANKI SERVICE Fiscal Year May 2019

Yoshikane Nakashima, President | SANKI SERVICE CORPORATION (6044) |

|

Company Information

Market | TSE 1st Section |

Industry | Service industry |

President | Yoshikane Nakashima |

HQ Address | 576-1 Abo Kou, Himeji-shi, Hyogo Prefecture |

Year-end | End of May |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

873 | 5,834,285 shares | 5,093 million | 16.6% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR(x) |

30.00 | 3.4% | 67.22 | 13.0 x | 470.38 | 1.9 x |

* The share price is the closing price as of August 30, 2019. Shares Outstanding, ROE, DPS, EPS and BPS are cited from its “Financial Results of Fiscal Year ended May 2019.”

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May 2016 Act. | 6,617 | 394 | 357 | 251 | 45.85 | 15.00 |

May 2017 Act. | 8,777 | 538 | 533 | 360 | 64.53 | 20.00 |

May 2018 Act. | 11,148 | 777 | 776 | 527 | 93.76 | 28.00 |

May 2019 Act. | 11,050 | 652 | 659 | 431 | 74.25 | 30.00 |

May 2020 Est. | 12,100 | 600 | 597 | 392 | 67.22 | 30.00 |

*Unit: million yen, yen. The estimated values are based on the forecasts made by the Company. Net income is profit attributable to owners of the parent. The same applies hereinafter.

We will report on the financial results of SANKI SERVICE CORPORATION for the fiscal year ended May 2019 and its new Medium-term Business Plan.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended May 2019 Earnings Results

3. Fiscal Year ending May 2020 Earnings Forecasts

4. New Medium-Term Business Plan (from FY 2020 to FY 2022)

5. Conclusions

<Reference: “Corporate Governance”>

Key Points

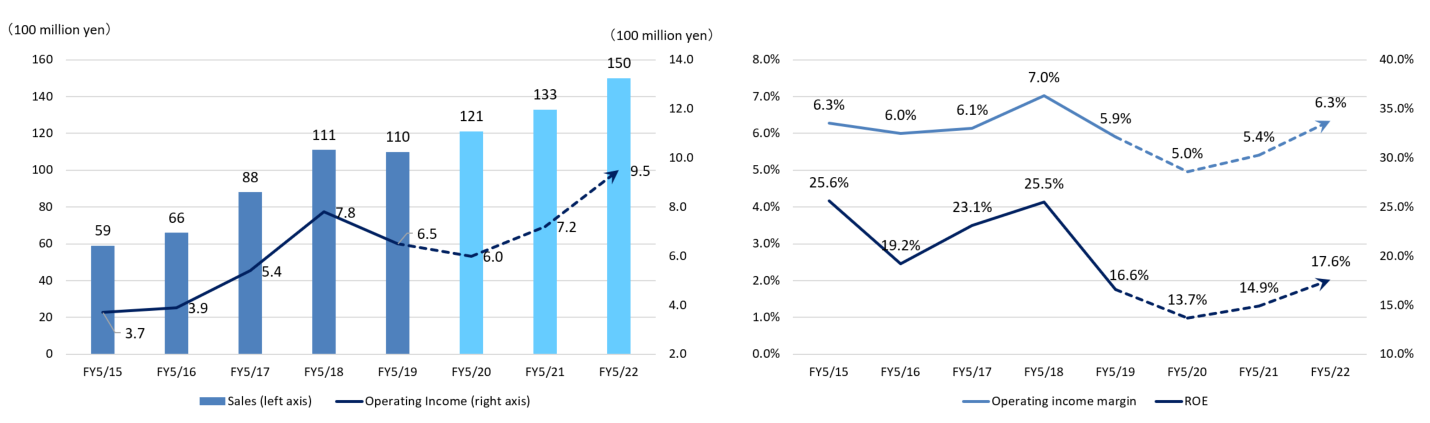

- The Sales in FY ended May 2019 (FY2019) were 11,050 million yen, down 0.9% year-on-year. Since many of its highly profitable energy-saving work projects were delayed over fiscal years and its system of accepting orders for the existing large-scale projects were enforced, SANKI SERVICE had to spend more time for negotiations over new contracts for comprehensive maintenance services than scheduled. Its operating Income also dropped 16.0% year-on-year to 652 million yen. Since there were fewer highly profitable energy-saving work, its gross margin declined 0.2% year-on-year. Its expenses also increased due to the initial costs for a joint company in Vietnam where the Company has newly expanded its business and other costs such as those for enhancing its corporate structure (including to increase employees) in order to improve its capacity to deal with major client companies. As a result, neither sales nor profit reached the initial forecasts.

- For FY ending May 2020 (FY2020) SANKI SERVICE forecasts that Sales will grow 9.5% year-on-year to 12.1 billion yen while Operating Income will shrink by 8.1% year-on-year to 600 million yen. The Company will invest in strengthening its business infrastructure for further growth in FY 2020, which falls on the first year of its new Medium-term Business Plan. The Company is expected to recover its financial achievements in the second half of the term. The dividend is to be 30.00 yen/share, which remains the same as the previous term. The estimated payout ratio is 44.6%. While the Company is aiming at a payout ratio of around 30%, it also considers a stable dividend policy.

- SANKI SERVICE has formulated “Medium-term Business Plan: Innovation and Sustainable Growth SANKI 2022” for the coming three years starting in FY2020. Under this business plan, the Company will propel forward “enhancement of the business infrastructure for further growth” in FY2020, which is the phase 1, and pursue “innovation and sustainable growth” in FY2021 and FY2022 as the phase 2, and then aims to achieve “Sales of 15 billion yen, Operating Income of 950 million yen, Operating Income Margin of 6.3%, and ROE of 17.6%” in FY2022.

- The unexpected results from the delay of the energy-saving work projects was not recovered in the second half of FY2019, forcing the Company to finish the term with slightly declined sales and profits despite its initial forecast of their increase. As for FY2020, it is forecasted that sales and profits will decrease in the first half, but sales will increase throughout the year although profits will decrease. This is because SANKI SERVICE will make proactive investments in “improving staff engineers to increase the services provided by them,” “strengthening the business infrastructure,” and “boosting the IT base” in the first year of its new Medium-term Business Plan. Amid the growing shortage of manpower, it shall be watched how the Company will carry out the basic strategies of its Medium-term Business Plan, including “the increase of the services provided by their staff engineers” and “strengthening of the business infrastructure,” and how quickly the Company can promote its monetization strategy for the overseas business in which it has entered the market in Vietnam, in addition to China.

1. Company Overview

SANKI SERVICE CORPORATION engages in the “Comprehensive Maintenance Business” that provides stores and other various facilities with maintenance services in a bundled manner for such equipment as air conditioning equipment, kitchen equipment, and freezers and refrigerators entrusted by clients, the “Specific Manufacturer’s Product Maintenance Business” in which the Company, as a manufacturer’s designated service provider, works for the maintenance, replacement, and repair of large-sized air conditioning equipment manufactured mainly by the Panasonic Group, and the “Energy Saving Business,” which is related to services of enhancing energy efficiency, such as work to increase energy efficiency of professional-use large-sized air conditioning equipment and work of installing light-emitting diode (LED) lights. The Company’s strengths are its advanced technologies and stable stock business. Based on the stably growing Specific Manufacturer’s Product Maintenance segment, the Company aims to expand the Comprehensive Maintenance Business segment and overseas businesses and improve their profitability.

1-1 Corporate History

SANYO Air Conditioning System Services Co., Ltd. (currently known as Panasonic Commercial Equipment Systems Co., Ltd.), which strived to expand the business of selling large air conditioning equipment across Japan, looked for a store designated service provider who could be entrusted to take care of maintenance services including installation, assembly, trial operation, maintenance, and management of equipment in each area, and in October 1976, Hyogo Kiko Co., Ltd. undertook the business as part of the operations of its Machinery Department.

In July 1977, SANKI SERVICE CORPORATION was founded, and the “Maintenance Business” was fully launched.

The relationship between SANYO Air Conditioning System Services (SANYO) and the Company was strong from the beginning as proved by the fact that the Osaka Center of SANKI SERVICE was set up within the Osaka Center Office of SANYO. Furthermore, the Company precisely met the needs of SANYO which desired to develop its business swiftly and it appreciated the Company’s efforts to develop its organizational structure through proactive recruitment activities and rich educational programs, including technical training, and so the Company was entrusted with their businesses in other areas than Osaka and set up the Tokyo Center in October 1977 followed by opening of the Nagoya Center in April 1978, which accelerated its business expansion to the Tokyo, Nagoya and Osaka regions.

Then, the Company set up offices in Kobe and Sapporo, propelling nationwide business expansion. In September 1998, it founded Shanghai Sanki Building Facility Service Co., Ltd. designed for maintenance services of air conditioning equipment in Shanghai, China.

Meanwhile, in September 2000, the Company established a call center that operates 24 hours a day, 365 days a year and started expanding the “Comprehensive Maintenance Business,” which is currently one of its three core businesses, throughout Japan. In an effort to accelerate the Comprehensive Maintenance Business in China, it opened a call center available all year round in Shanghai in February 2012.

The Company got listed on the Japanese Association of Securities Dealers Automated Quotations (JASDAQ) of the Tokyo Stock Exchange (TSE) in April 2015. It was transferred to the Second Section of TSE in April 2016, and then to the First Section of TSE in April 2017, just 2 years after the first listing.

1-2 Corporate Philosophy

SANKI SERVICE CORPORATION has set its new corporate philosophy consisting of the following four elements: “Philosophy,” “Mission,” “Vision,” and “Action Guidelines.”

The Company believes that it will be able to prove its business value permanently not only in Japan, but also globally by encouraging all of its employees to share and practice the mission for the society, the vision for the future, and the action guidelines for the achievement of its goals according to the invariable philosophy that is the starting point of SANKI SERVICE.

(Philosophy)

We contribute to the society through improvement and creation of our technology and services. |

We prove our commitment to taking on every challenge through our Customer First principle. |

We grow through work and build a mentally fulfilled life. |

(Mission)

“More Comfort and Everlasting Safety”

This shows our commitment to make our clients’ environment more comfortable and to provide them with constant safety.

(Vision)

As a leading company in the age of eco-consciousness, we promote our values to the world while aiming to improve our client satisfaction further and to enrich the life of each of our staff members.

(Action Guidelines – Trust –)

“Promise” - Keeping a promise brings us fortune. |

“Greeting” - Pleasant greetings foster harmonious relationships. |

“Conversation” – Conversation gives a hint to understand needs and feelings of the speakers. |

“Youth” – Keeping young and taking on a challenge generates quantum growth. |

“Skills” – Skills and abilities prove our professionalism. |

1-3 Market Environment

Under the deflationary environment where large improvement of sales cannot be expected it is vital for restaurants and retail stores using various kinds of equipment, such as air conditioners, heating and cooling instruments, and kitchen equipment to conduct severe cost management in order to win the competition against competitors.

Especially restaurants and retail stores that are propelling opening of chain stores nationwide have strong needs for total cost reduction by managing each piece of equipment in accordance with a single national standard. The Company estimates the scale of the market for Comprehensive Maintenance segment is about 3 trillion yen (*) and will develop the broad market proactively.

*With regard to the Company’s clients in major 3 business categories (food service, distribution, and entertainment), it is assumed that maintenance cost makes up 3% of the sales of their chain stores nationwide.

The Company’s major competitors include some listed companies, such as Nippon Air Conditioning Services Co., Ltd. (4658; TSE 1st section) and Shin Maint Holdings Co., Ltd. (6086; TSE Mothers), and several unlisted companies. In the Comprehensive Maintenance segment, the Company competes with service departments of equipment manufacturers.

In order to compete with these companies, SANKI SERVICE has performed self-analysis, concluding that its strengths are “enriched call center services available all year round,” “capabilities to deal with emergencies nationwide,” “advanced systematization, including online systems,” and “abilities to handle equipment of every and all manufacturers.”

Code | Company name | Net Sales | Sales Growth | Operating Income | Profit Growth | Operating Margin | Market Capitalization | PER | PBR | ROE |

4658 | Nippon Air Conditioning Services | 48,000 | +3.5% | 2,650 | +1.9% | 5.5% | 25,728 | 14.4 | 1.5 | 10.8 |

6044 | SANKI SERVICE | 12,100 | +9.5% | 600 | -8.1% | 5.0% | 6,213 | 15.8 | 2.3 | 16.6 |

6086 | Shin Maint Holdings | 15,000 | +6.0% | 738 | +16.4% | 4.9% | 11,005 | 20.1 | 5.0 | 24.9 |

*Unit: million yen、 x、%。

* Net Ssales and Operating Income are estimates for the current term provided by each of the companies. The ROE is the actual results of the previous term. The Market Capitalization, PER, and PBR are based on the closing price on July 16, 2019.

1-4 Business Description

1. Business Field

The Company engages in 3 businesses, including the “Comprehensive Maintenance Business,” “Specific Manufacturer’s Product Maintenance Business” and “Energy Saving Business.”

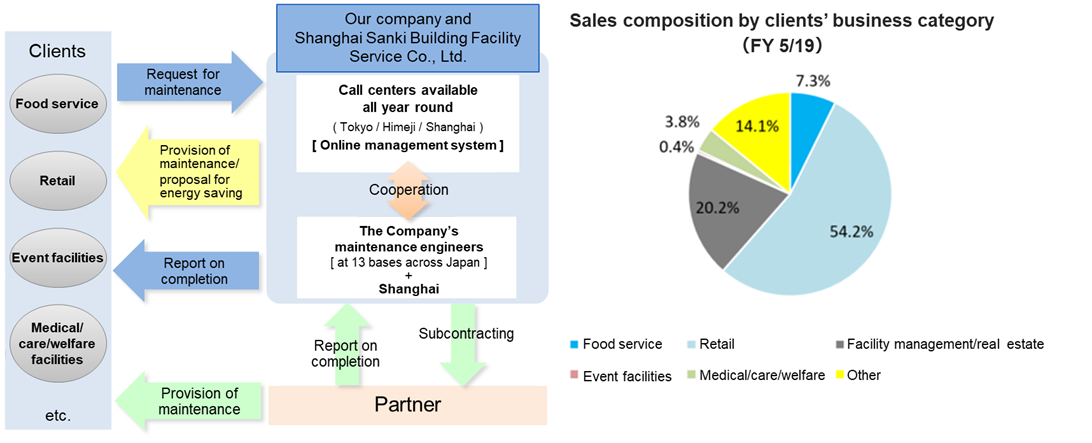

(1) Comprehensive Maintenance Business

Targeting major clients, including restaurants and retail chain stores, the “Comprehensive Maintenance Business” offers comprehensive maintenance and management services for such equipment as air conditioners, kitchen instruments, freezers and refrigerators, electrical facilities, water supply, drainage, and sanitary facilities, and firefighting equipment, regardless kinds of the manufacturers or models of the equipment, by accepting outsourcing from clients.

SANKI SERVICE will endeavor to expand the business to larger markets by taking the advantage of the skills that it has cultivated in the Specific Manufacturer’s Product Maintenance Business.

|

(Source: the reference material of the Company)

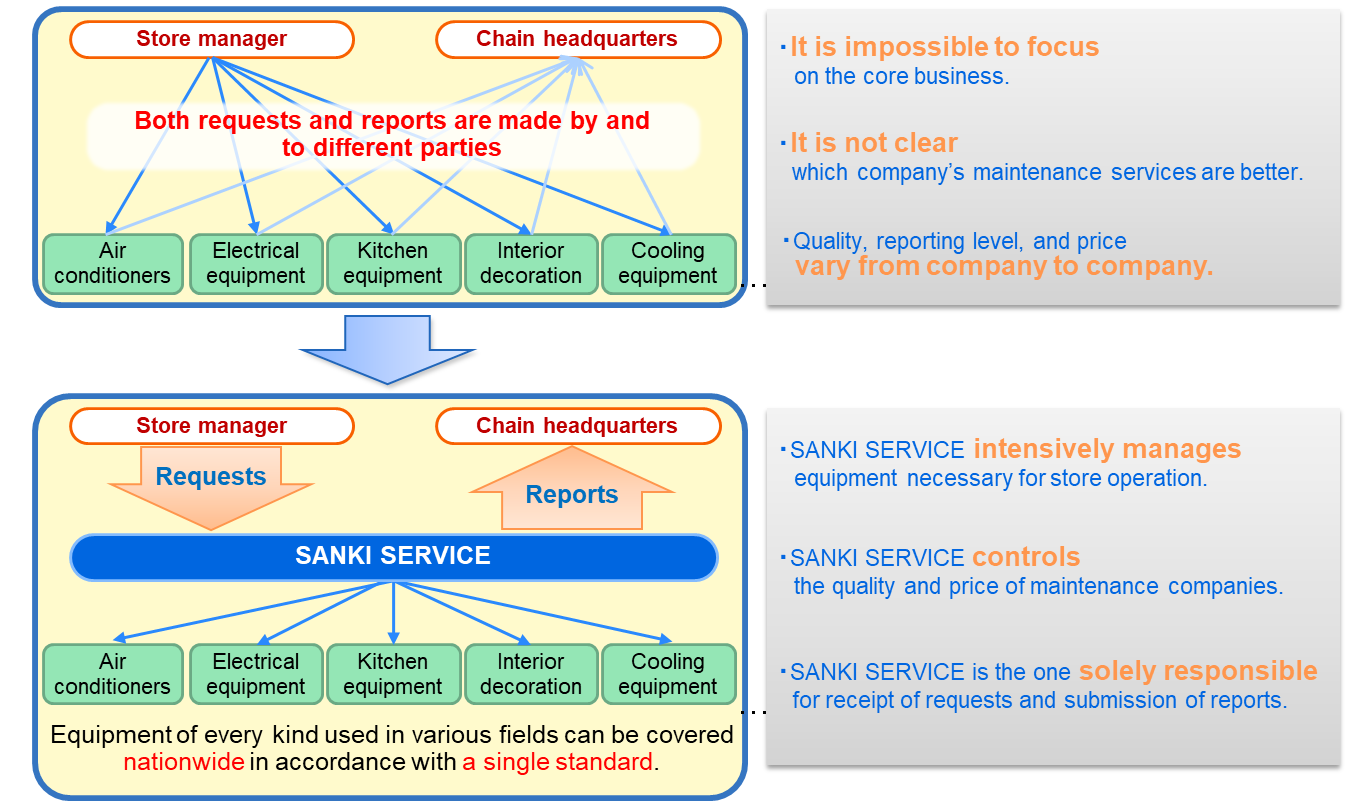

In the food service and retail industries, chain stores that have a competitive edge in terms of financial power and economies of scale are increasing market share under the prolonged deflationary environment; however, it is difficult even for the chain stores to rapidly boost sales, and cost management is the high-profile issue for winning the fierce competition.

Even under such circumstances, in many of the chain stores, the chain headquarters themselves or each of the chain stores have to request their own business operators specializing in each piece of equipment for maintenance, inspection, and troubleshooting. This has made it not only difficult for the chain stores to focus on their regular businesses but also caused them a burden to perform proper cost management in terms of time and money because the service quality, post-maintenance reports, and prices vary depending to the business operators.

In contrast, the Company enters into a bundled contract with the headquarters of each chain store and offers intensive management of each piece of equipment in accordance with a single nationwide standard. Therefore, SANKI SERVICE can control the service quality and price by serving as the one that is solely responsible for receipt of requests and submission of reports, which allows client companies to concentrate on their core businesses and manage costs properly.

(Source: the reference material of the Company)

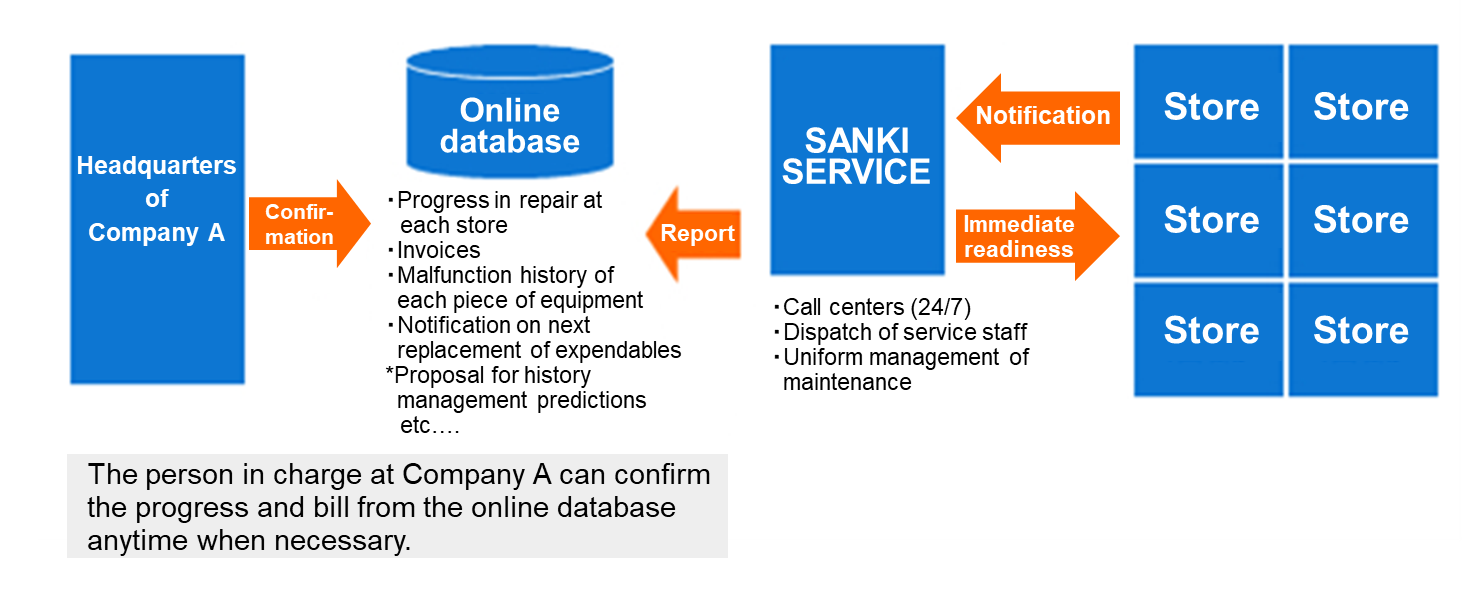

In addition, the Company can respond swiftly through its call centers available 24 hours a day, 365 days a year, report on repair using its website, and provide with real-time risk forecasts based on a variety of data, such as the usage status and aging of equipment, accurately fulfilling the needs of the food service and retail industries that cannot suspend their business even when trouble occurs.

Furthermore, the Company provides agent businesses such as estimate of fiscal budgets and attending at blackout recovery work, services related to compliance issues such as handling of legal amendments, submitting required documents to administrative agencies, and to management such as making of a security plan, cleaning and prevention of insects and rats, and tenant replacement for new store openings and renovation of existing stores.

As mentioned above, the Company’s strengths are not only capabilities to deal with simple repairs and malfunctions but also the ability to provide “optimum management of total costs,” which is aimed not just at cost reduction through outsourcing but including indirect costs, for which the Company has gained excellent reputation from client companies that hope to concentrate their business resources to their respective priority fields.

Both about 200 maintenance engineers of the Company, who work for the 13 bases across Japan, and partner companies to which the Company has entrusted maintenance works (about 2,000 companies in Japan) visit clients’ stores and provide maintenance services.

<Example proposals in Comprehensive Maintenance Business>

[Case 1. Proposal made to a major convenience store chain for uniform management of maintenance of air conditioning equipment]

Number of target stores: About 21,000 stores

Target are Throughout Japan

Operating hours: 24 hours a day, 365 days a year

(Client’s situation and problems revealed through the interview)

* The client has conventionally entrusted maintenance to a business operator that is not a specialist. Air conditioning troubles were not solved; on the contrary, the number of troubles kept going up.

* The data accumulated were not used properly for improvement.

The Company made the following proposal in response to such circumstances:

* Repair work for accidental problems can be reduced by regularly cleaning and inspecting air conditioning equipment.

* As the Company specializes in air conditioning systems, it can present the client a proposal for improvement taking a full advantage of the accumulated data.

[Case 2. Proposal made to the leading ready-made meal chains for acceptance of repair requests through call centers]

Number of target stores: About 3,000 stores

Target are Throughout Japan

Operating hours: 24 hours a day, 365 days a year

(Client’s situation and problems revealed through the interview)

* The head office bore enormous administrative burdens, and indirect costs (personnel expenses) were increasing.

* The client used multiple maintenance providers and thus could not manage maintenance in a unified manner, resulting in a huge total cost for repair (They didn’t take their advantage of scale efficiently).

* An increase or decrease in the number of stores made it difficult for them to control personnel expenses.

* The client was worried about losing business opportunity because they had no sufficient system for arranging maintenance established and they couldn’t deal with troubles of the equipment during holidays and at night.

* Information was not put together or utilized appropriately because the client used different maintenance providers for each store or each piece of equipment.

The Company made the following proposal in response to such circumstances:

* The Company can provide the client with a maintenance plan for the timing of replacement of expendables and repair work of the common equipment among the chain stores as it can collect information and data of repairs of the equipment through its total maintenance service.

* There will be no need for the client to change the number of administrative personnel due to an increase or decrease in the number of stores by outsourcing all of the maintenance work to the Company.

* Reports and invoices can be handled easily by using the online system of SANKI SERVICE.

* As the call centers are available all year round, even urgent troubles can be dealt with quickly, preventing losses of business opportunities.

(Source: the website of the Company)

(Situation after resolution of the problems)

* The recording function of repairs and maintenance history on the online system has enabled the client to make plans to replace expendables and their budgets.

* The status of progress with maintenance at each store of the client has been made available all the time on their exclusive web page via the online system, enabling their staff members to share the information on the status of each store effectively within their departments.

* As the efficiency of its maintenance management has been improved, the client can concentrate their human resources to their core business sectors, including development.

* Problems due to aging expendables can be obviated, reducing urgent troubles.

[Case 3. Proposal made to a leading food supermarket for facility management (FM)]

Number of target stores: About 60 stores

Target are Kansai region

Operating hours: 24 hours a day, 365 days a year

(Client’s situation and problems revealed through the interview)

* The head office bore enormous administrative burdens, and indirect costs (personnel expenses) were increasing.

* The client used multiple maintenance providers and thus could not manage maintenance in a unified manner, resulting in a huge total cost for repair (They didn’t take their advantage of scale efficiently).

* The client was worried about losing business opportunity because they had no sufficient system for arranging maintenance established and they couldn’t deal with troubles of the equipment during holidays and at night.

* Information was not put together or utilized appropriately because the client used different maintenance providers for each store or each piece of equipment.

* Their staff members in charge of equipment management are aging, casting a shadow on the future organization of equipment management department.

The Company brought forward the following proposal in response to such circumstances:

* The repairing history of each piece of equipment can be collected with the Company centrally serving as an agent for maintenance work, which makes it possible to predict the tendency of expendables, and malfunctions of equipment of the same model used at different stores.

* The burdens on the head office can be lightened by outsourcing all the store management operations, including security and maintenance, to the Company.

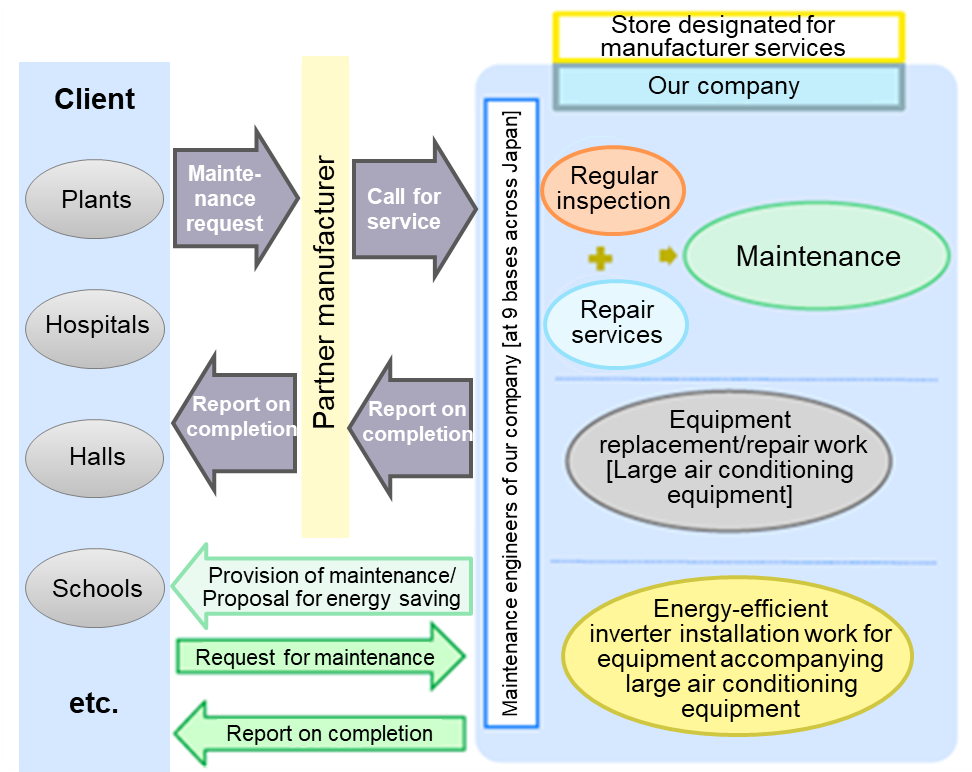

(2) Specific Manufacturer’s Product Maintenance Business

As a designated service provider for manufacturer services of Panasonic Commercial Equipment Systems Co., Ltd., which has engaged in sales, installation, and services regarding professional-use equipment and systems in the Panasonic Group, the Company offers regular inspection and repairing services for various equipment of business use, including large-sized air conditioning equipment at the stores, offices and facilities of their clients who have bought their products.

In recent years, the Company has been expanding its business domain through various approaches, such as energy-saving inverter installation work(*) accompanying large-sized air conditioning equipment, maintenance services for electrical equipment other than large air conditioners, kitchen equipment for business use and plumbing and sanitary facilities, as well as upgrading or replacement of large-scale equipment.

As almost all of the staff members who provide maintenance services are its employees, SANKI SERVICE can improve their techniques further through its comprehensive trainings and accumulate the know-hows in the company and will increase and enrich the services provided by its staff engineers.

(Source: the reference material of the Company)

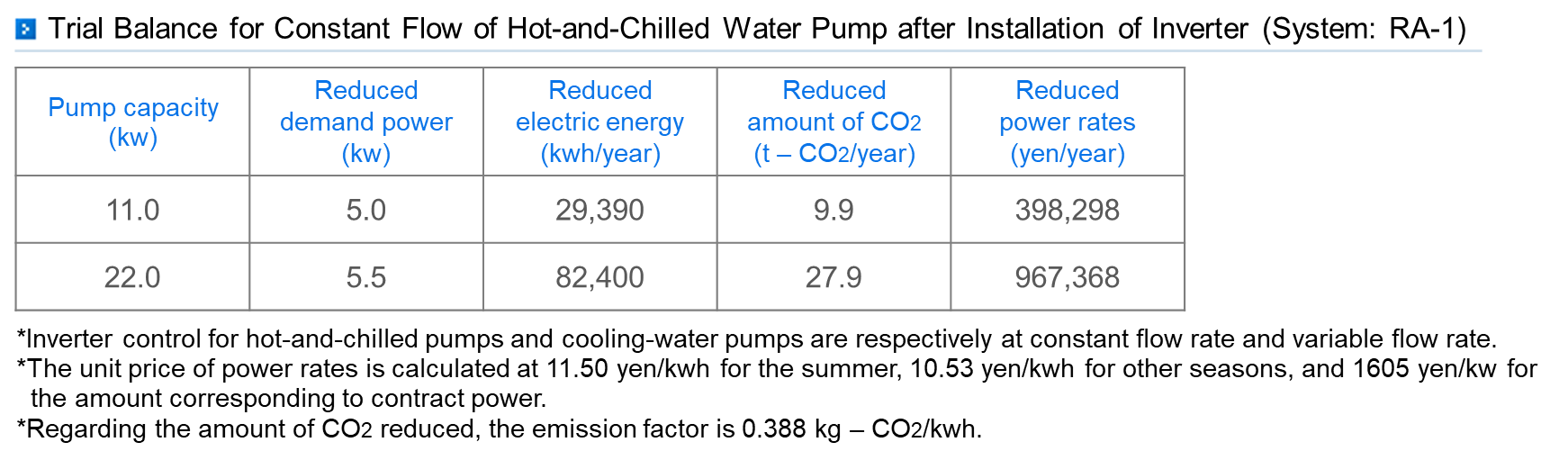

*Inverter installation work

The pumps used in air conditioning equipment circulate water by the rotating motion of motors. As a motor fully rotates all the time as far as electric current is flowing, the amount of circulating water becomes sometimes excessive. Decreasing the rotation speed of a motor by an “inverter” which controls the rotation speed and adjusting the amount of water reduces the electricity consumed by the motor and results in power saving. The work to install an inverter to an air conditioner is called an inverter installation work.

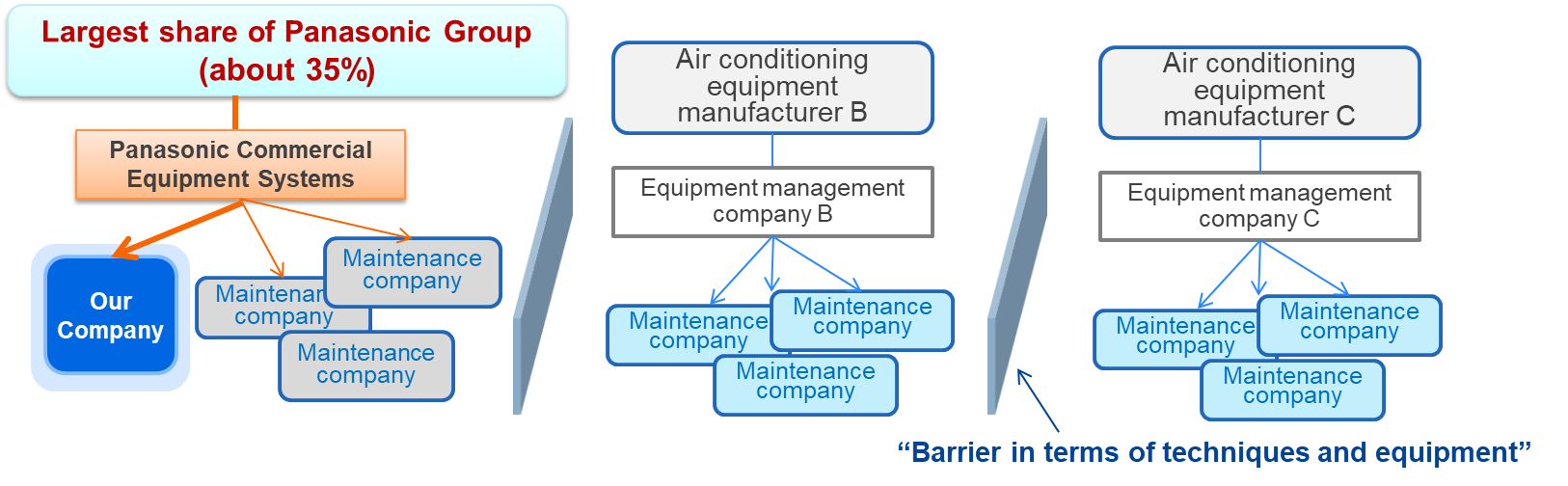

In the Specific Manufacturer’s Product Maintenance Business, due to these business characteristics, the Company’s client should be limited to a company, that is, Panasonic Commercial Equipment Systems.

Maintenance business of air conditioning equipment is a niche industry in which new companies rarely break ground because most of manufactures have an equipment management company within their group and it has multiple maintenance providers entrusted with maintenance work of their own products of air conditioning equipment which require different techniques and components depending on the products.

(Source: the reference material of the Company)

As a maintenance service provider for Panasonic Commercial Equipment Systems the Company has secured the largest market share of about 20% all across Japan, which becomes approximately 40% when limited to Tokyo, Nagoya, and Osaka areas. As mentioned in Corporate History, the Company has successfully cemented a relationship with the Panasonic Group by engaging in maintenance of air conditioning equipment manufactured by the Group in an earlier stage. Besides, among the maintenance service providers for the air conditioning equipment of the Panasonic Group only the Company has more than 300 staff engineers, which makes it the top share company that can provide the service nationwide.

As manufacturers tend to entrust management services of their products in a lump to large-sized companies which have abundant experiences in terms of technological quality and efficiency, the Company aims to secure by far its largest share through further enhancement of its maintenance techniques.

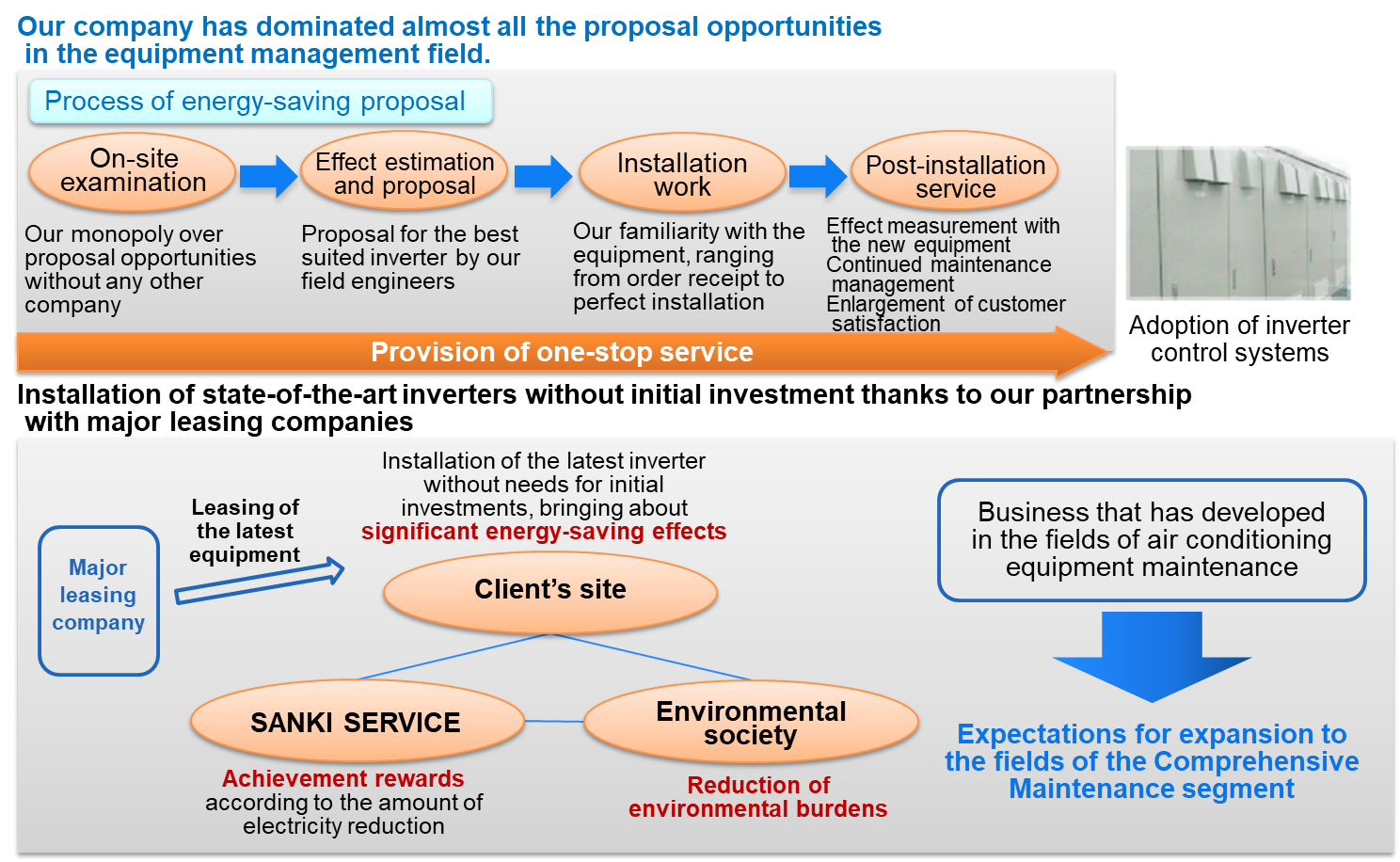

Its top market share has brought the Company not only the business stability but also opportunities of new business expansion.

Based on its experiences in the field of air conditioning equipment maintenance, only the Company can take advantage of it to make a proposal of new services. For instance, in the aforementioned energy-saving inverter installation work, the Company can offer its clients a one-stop service, including on-site examination, effect estimation, proposal for installation, installation work, and post-installation services. In partnership with major leasing companies the Company can offer its clients a service which enables the clients to have inverters of the latest model installed in their facilities without any initial investment cost, allowing end users to obtain a pronounced effect of energy saving. The Company also will be able to earn new revenue, which is a compensation for the result of saving energy. Furthermore, the Company plans to promote this energy saving proposal for the “Comprehensive Maintenance Business” to develop further business opportunities.

(3) Energy Saving Business

The Company makes proposals of energy-saving work, equipment installation and its related construction services to the clients both of the Comprehensive Maintenance and Specific Manufacturer’s Product Maintenance Businesses.

(Source: the reference material of the Company)

The Company’s proposals include introduction of inverter control systems, installation of inverters in the pumps of air conditioning equipment, renewal of air conditioning and heat source equipment, installation of LED lighting, and limiting on maximum power consumption. It plans to continue enriching the lineup of energy-saving services.

Since the Company has accumulated data on the situations of the clients of the Comprehensive Maintenance and Specific Manufacturer’s Product Maintenance Businesses through its on-site work to make its proposals, it has almost all the proposal opportunities, facing nearly no competitor.

Also, its partnership with major leasing companies the Company can offer its clients a chance to have state-of-the-art inverters installed in their facilities without a huge initial investment cost.

Starting with maintenance services for air conditioning equipment, the Company has developed its business and plans to expand it further in the field of Comprehensive Maintenance service.

[Case 4. Proposal of energy saving made to a confectionary manufacturer with over 20 stores]

(Client’s situations and problems revealed through the interview)

* The client is very cost-conscious and has examined every chance of cost-cutting.

* Their cooling equipment operates 24 hours a day throughout a year, which has room to have cost cut.

Thus, the Company made the following proposal: “ By installing an inverter control system to the air conditioning equipment (an absorption hot and chilled water generator) which runs 24 hours a day it will be possible to adjust consumed power efficiently, and its costs will be reduced significantly, and so the client can recoup the initial cost in 3 years.”

(Source: the website of the Company)

(Result)

As the result shows that the target values have been realized as estimated in the first year of the installation, and it has become realistic for the client to recoup the initial investment cost in three years, they have decided to have the second inverter controlling system installed.

* The period required for the recoup in the case of 24 hours a day running.

1-5 Characteristics and strengths

◎Stable Stock Business

In the Specific Manufacturer’s Product Maintenance Business, as the Company has only one client, Panasonic Commercial Equipment Systems, a rapid growth cannot be expected, but stable sales growth can be expected through regular inspection, repair, and other services. In addition, there is very little possibility of price competition due to new market entry. As a result, the Company is able to maintain a stable profit margin.

◎High technology

As mentioned above, in the Specific Manufacturer’s Product Maintenance Business, almost 100% of the maintenance engineers are its employees and so the Company can give them comprehensive hands-on training and on-the-job training to further improve their abilities.

As a result, their technical abilities are constantly improved and their know-how is accumulated efficiently, which enables them to have the upper hand on their competitors not only in the Specific Manufacturer’s Product Maintenance Business but also in the Comprehensive Maintenance Business in which the Company is aiming for further expansion of the business.

1-6 ROE Analysis and Shareholder return

| FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

ROE (%) | 25.6 | 19.2 | 23.1 | 25.5 | 16.6 |

Net Income margin (%) | 3.63 | 3.81 | 4.11 | 4.73 | 3.90 |

Total asset turnover (times) | 2.41 | 2.27 | 2.67 | 2.72 | 2.39 |

Leverage [times]( x) | 2.93 | 2.22 | 2.11 | 1.98 | 1.78 |

The sales and profits decreased in FY 2019, making all of Net Income margin, Total asset turnover and Leverage, decline, and ROE dropped as well.

As described below, SANKI SERVICE aims to improve ROE to 17.6% in FY 2022, the final year of its new Medium-term Business Plan.

Attentions shall be paid to how much the Company can recoup the investment they will make in this fiscal year and how much these ratios will be improved.

As its dividend distribution policy, the Company plans to return its profits, targeting a payout ratio of 30%. As for its internal reserve, it will utilize it as financial resources to strengthen the corporate structure and develop its future business expansion. SANKI SERVICE plans to flexibly acquire treasury shares, considering the current level of its share price and the financial conditions.

As an incentive to be a long-term shareholder, the Company presents a prepaid gift card which is equivalent to 1,000 yen to the shareholders who possess one unit of its shares (100 shares) to increase their number.

2. Earnings Results of Fiscal Year ended May 2019

(1) Consolidated Business Results

| FY 2018 | Ratio to sales | FY 2019 | Ratio to sales | Y-on-Y | Compared with the initial forecasts |

Sales | 11,148 | 100.0% | 11,050 | 100.0% | -0.9% | -11.6% |

Gross profit | 2,453 | 22.0% | 2,411 | 21.8% | -1.7% | - |

SG&A | 1,676 | 15.0% | 1,758 | 15.9% | +4.9% | - |

Operating Income | 777 | 7.0% | 652 | 5.9% | -16.0% | -25.4% |

Ordinary Profit | 776 | 7.0% | 659 | 6.0% | -15.1% | -24.2% |

Net profit | 527 | 4.7% | 431 | 3.9% | -18.2% | -25.6% |

*Unit: million yen

*Net profit is profit attributable to owners of the parent company.

Both sales and profits decreased, falling short of the initial estimates.

Sales were 11,050 million yen, down 0.9% year-on-year. Since many of its highly profitable energy-saving work projects were delayed over fiscal years and its system of accepting orders for the existing large-scale projects were enforced, SANKI SERVICE had to spend more time for negotiations over new contracts for Comprehensive Maintenance Services than scheduled.

Its operating Income also dropped 16.0% year-on-year to 652 million yen. Since there were fewer highly profitable energy-saving work, its gross margin declined 0.2% year-on-year. Its expenses also increased due to the initial costs for a joint company in Vietnam where the Company has newly expanded its business and other costs such as those for enhancing its corporate structure (including to increase employees) in order to improve its capacity to deal with major client companies. As a result, neither sales nor profit reached the initial forecasts.

◎Quarterly Earnings

| 1Q of FY 2017 | 2Q | 3Q | 4Q | 1Q of FY 2018 | 2Q | 3Q | 4Q | 1Q of FY 2019 | 2Q | 3Q | 4Q |

Sales | 1,868 | 2,381 | 2,136 | 2,392 | 2,125 | 3,154 | 2,587 | 3,282 | 2,662 | 3,269 | 2,352 | 2,766 |

Sales Growth Rate | +28.2% | +39.8% | +59.1% | +13.2% | +13.7% | +32.5% | +21.1% | +37.2% | +25.3% | +3.7% | -9.1% | -15.7% |

Operating Income | 25 | 246 | 74 | 193 | 28 | 353 | 142 | 254 | 72 | 321 | 24 | 235 |

Profit Growth Rate | +54.7% | +50.7% | - | -8.4% | +11.8% | +43.8% | +90.3% | 31.5% | +150.8% | -9.1% | -83.0% | -7.3% |

Profit Margin | 1.4% | 10.3% | 3.5% | 8.1% | 1.4% | 11.2% | 5.5% | 7.7% | 2.7% | 9.8% | 1.0% | 8.5% |

*Unit: million yen

Sales and profits decreased in both the third and fourth quarters of FY 2019.

(2) Analysis of sales trends

◎ Trends by customers’ industry (non-consolidated basis)

| FY 2017 | Ratio to sales | FY 2018 | Ratio to sales | FY 2019 | Ratio to sales | Y-on-Y |

Restaurants | 1,663 | 19.4% | 1,575 | 14.5% | 779 | 7.3% | -50.5% |

Retailers | 3,189 | 37.3% | 4,959 | 45.6% | 5,778 | 54.2% | +16.5% |

Facility management & Real estate | 1,938 | 22.6% | 1,876 | 17.3% | 2,157 | 20.2% | +15.0% |

Event facilities | 48 | 0.6% | 44 | 0.4% | 44 | 0.4% | 0.0% |

Medical, Legal, Welfare | 330 | 3.9% | 365 | 3.4% | 406 | 3.8% | +11.2% |

Other | 1,389 | 16.2% | 2,049 | 18.9% | 1,504 | 14.1% | -26.6% |

Total | 8,558 | 100.0% | 10,868 | 100.0% | 10,668 | 100.0% | -1.8% |

*Unit: million yen

Sales from retailers continued to grow, accounting for over 50% of the total sales. Sales from restaurants declined because some of the clients stopped outsourcing.

◎ Trends by service type (non-consolidated basis)

| FY 2017 | Ratio to sales | FY 2018 | Ratio to sales | FY 2019 | Ratio to sales | Y-on-Y |

Servicing/Repair | 4,448 | 52.0% | 5,355 | 49.3% | 5,427 | 50.9% | +1.3% |

Regular work | 1,998 | 23.3% | 2,756 | 25.3% | 2,691 | 25.2% | -2.4% |

Construction | 2,112 | 24.7% | 2,757 | 25.4% | 2,548 | 23.9% | -7.6% |

Total | 8,558 | 100.0% | 10,868 | 100.0% | 10,668 | 100.0% | -1.8% |

*Unit: million yen

The delay of some construction work over the fiscal years caused the decrease of its number. Sales from the other two services were almost the same level as the previous term.

(3) Financial position and cash flows

◎ Main BS

| End of May 2018 | End of May 2019 |

| End of May 2018 | End of May 2019 |

Current Assets | 3,950 | 3,377 | Current Liabilities | 1,867 | 1,393 |

Cash and Deposits | 1,560 | 1,288 | Accounts Payable for construction contracts | 1,154 | 827 |

Accounts Receivable | 2,215 | 1,870 | Short-term Borrowings | 59 | 59 |

Noncurrent Assets | 784 | 1,144 | Noncurrent Liabilities | 422 | 383 |

Tangible Assets | 377 | 375 | Long-term Borrowings | 100 | 40 |

Intangible Assets | 51 | 320 | Total Liabilities | 2,289 | 1,777 |

Investment, Others | 356 | 448 | Net Assets | 2,445 | 2,744 |

Total Assets | 4,735 | 4,522 | Retained Earnings | 1,453 | 1,722 |

|

|

| Total Liabilities and Net Assets | 4,735 | 4,522 |

|

|

| Outstanding contract balance of Long-term Borrowings | 160 | 100 |

|

|

| Capital Adequacy Ratio | 51.6% | 60.7% |

*Unit: million yen

Current Assets decreased 573 million yen from the end of the previous term due to the drops in Cash and Deposits, and Accounts Receivable. Noncurrent Assets increased by 360 million yen from the end of the previous term due to increasing intangible fixed assets (lease assets) and others, resulting in total assets of 4,522 million yen decreased 213 million yen from the end of the previous term.

Total Liabilities decreased 512 million yen from the end of the previous term to 1,777 million yen due to the decreased Accounts Payable for construction contracts.

Net Assets went up 299 million yen from the end of the previous term to 2,744 million yen, due to the growth of Retained Earnings. Equity Ratio was 60.7%, up 9.1% from the end of the previous term.

◎ Cash Flows

| FY 2018 | FY 2019 | Increase/Decrease |

Operating Cash Flow | 464 | 314 | -149 |

Investing Cash Flow | -72 | -404 | -331 |

Free Cash Flow | 391 | -90 | -481 |

Financing Cash Flow | 154 | -193 | -348 |

Term End Cash and Equivalents | 1,361 | 1,077 | -284 |

*Unit: million yen

The increase of Intangible Assets due to the introduction of a new IT system and an acquisition of investment securities among others decreased Investing CF further, resulting in Free CF in the red.

Financing CF fell into negative territory due to the lack of the proceeds from issuance of common shares recorded in the previous term. The cash position declined.

(4) Topics

(1) Establishment of a joint company in Vietnam

In May 2019, SANKI SERVICE set up SANKI-SONADEZI JOINT STOCK COMPANY jointly with the SONADEZI Group, a Vietnamese public company in order to expand their business in the ASEAN region following China, and started its operation in Vietnam in July.

The capital contribution ratio of SANKI SERVICE, SONADEZI GIANG DIEN SHAREHOLDING COMPANY, and President Nakashima of SANKI SERVICE are 49%, 49% and 2% respectively.

With its real Gross Domestic Product (GDP) growth rate of 7.1% in 2018, Vietnam is expected to continue developing at a rate of 6% level in the medium and long-term. The country is moving up in the rankings of “the Ease of Doing Business” index presented by the World Bank annually.

The SONADEZI Group developed an industrial complex where about 500 companies are located, and SONADEZI GIANG DIEN SHAREHOLDING COMPANY, the partner company of the joint venture project, will take on a strategical task of tenant brokerage and management for the industrial complex. With its extensive technical capabilities and know-how cultivated in Japan, SANKI SERVICE will take advantage of the customer base of SONADEZI effectively to expand its business there.

SANKI SERVICE aims to reach its target sales of 1 billion yen in the Maintenance Service Business in five years from now.

(2) Enhancement of the Corporate Governance Structure

SANKI SERVICE plans to appoint Ms. Yoshiko Sasao (born on April 2, 1960) as a new outside director upon approval of the annual general meeting of shareholders scheduled on August 28, 2019.

Working for Recruit Co., Ltd. and managing several companies afterwards, Ms. Sasao currently occupies the position of the head of the Work Style Reform Promotion Office as an executive officer at JDC Corporation.

As she will be its first female outside director, the Company expects her to propel its management strategies forward and realize the corporate visions by utilizing her abundant business experience and expertise and give it valuable advices on work style reforms and women’s promotions and others.

3. Earnings Forecasts of Fiscal Year ending May 2020

(1) Full-year earnings forecasts

| FY 2019 | Ratio to sales | FY 2020 Est. | Ratio to sales | Y-on-Y |

Sales | 11,050 | 100.0% | 12,100 | 100.0% | +9.5% |

Operating Income | 652 | 5.9% | 600 | 5.0% | -8.1% |

Ordinary Profit | 659 | 6.0% | 597 | 4.9% | -9.3% |

Net Profit | 431 | 3.9% | 392 | 3.2% | -9.1% |

*Unit: million yen. The estimated values are those announced by the Company.

(Trends in First Half and Second Half of FY 2020)

| 1H of FY 2020 Est. | Y-on-Y | 2H of FY 2020 Est. | Y-on-Y |

Sales | 4,840 | -18.4% | 7,260 | +41.8% |

Operating Income | 240 | -39.0% | 360 | +39.0% |

*Unit: million yen. The estimates for the first half of the term are as those announced by the Company. The estimates for the second half are calculated by subtracting the estimated values for the first half from the forecasts for the full year.

Sales will increase while Profits will decrease. The Company will strengthen its business infrastructure through the investment in the first fiscal year according to its Medium-term Business Plan.

SANKI SERVICE forecasts that Sales will grow 9.5% year-on-year to 12.1 billion yen while Operating Income will decrease by 8.1% year-on-year to 600 million yen.

The Company will invest in strengthening its business infrastructure for further growth in FY 2020, which is the first year of its new Medium-term Business Plan. Its financial performances are expected to recover in the second half of the term.

The dividend is to remain as 30.00 yen/share, the same of the previous term. The estimated payout ratio is 44.6%.

While the Company is aiming at a payout ratio of around 30%, it also considers a stable dividend policy.

4. New Medium-term Business Plan (from FY 2020 to FY 2022)

SANKI SERVICE has made its new “Medium-term Business Plan: Innovation and Sustainable Growth SANKI 2022” for the coming three years beginning from FY2020 based on above mentioned its new corporate philosophy.

(1) Recognition of the business environment and the direction of its business strategies

SANKI SERVICE recognizes the following “opportunities for business growth” and “business risks” in its future business fields:

(Opportunities for Business Growth)

■ Growing needs for energy-efficient equipment and increasing public awareness of energy-saving

■ Expanding demand for installing air conditioning equipment at elementary and junior high schools in the wake of global warming,

■ Advance in demand for measures to deal with natural disaster, such as typhoons and earthquakes, and

■ Expanding markets of hospitals and nursing care facilities for the elderly amid the aging society, etc.

(Business Risks)

■ New entries of major companies and companies in different fields into the market,

■ Changes in the maintenance technology due to the cutting-edge technology, such as artificial intelligence (AI) and Internet of Things (IoT),

■ A growing number of facilities and equipment of maintenance free (to decrease demand for repair services), and

■ Difficulty in recruiting employees due to the competitive labor market.

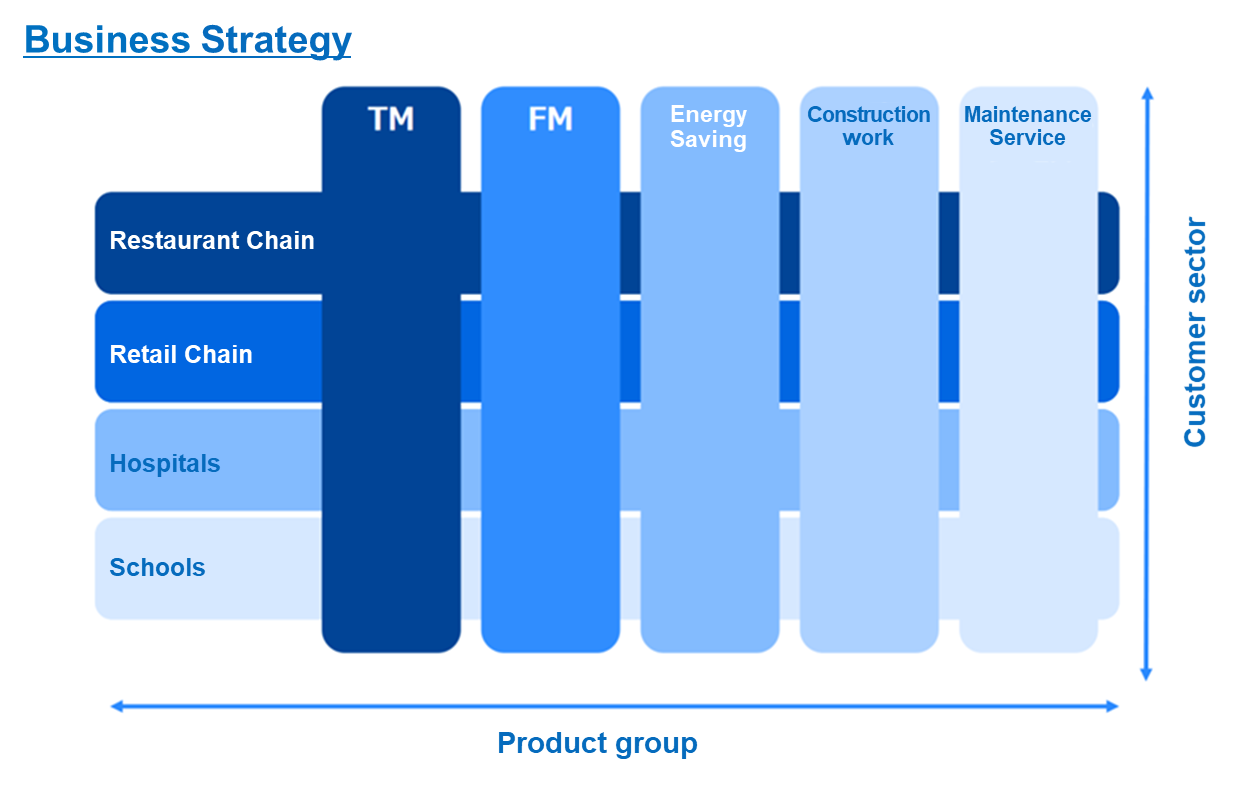

Considering these situations, SANKI SERVICE has developed its business strategy for each of the service as follows:

Maintenance Service | To increase services provided by its staff engineers for maintenance of air-conditioning equipment and to train them to be multiskilled engineers. |

Comprehensive Maintenance Service | To improve the service quality and to make competitive proposals of value-added services |

Energy-saving Service | To create new business opportunities through corporate alliances |

(2) Basic strategy

SANKI SERVICE has drawn up the following eight basic strategies with the aim of strengthening the management foundation and business growth:

<Key Strategies for Medium-term Business Plan 2022>

Management foundation | 1 | Promotion of the new corporate philosophy | ・To enforce its new corporate philosophy thoroughly in the Company using a variety of tools, and promote it outside efficiently as well, and ・To recruit and train employees according to the new corporate philosophy and increase the employees who can practice the philosophy. |

2 | Personnel-system reform | ・To change its personnel-system from the one based on “quantitative” judgement according to individual personality, career, working times to “qualitative” assessment which evaluates its staff members by their motivations, efforts and achievements, and ・To establish the system in the company as a structure to develop the employees who are proactive and capable to practice the corporate philosophy. | |

Business growth | 3 | Enrichment of the lineups of the services provided by its staff engineers | ・To improve the profitability by providing more services provided by its staff engineers, utilizing its accumulated techniques and maintenance know-hows, and ・To train them at the training center in the headquarters to make them the multiskilled efficiently and quickly. |

4 | Improvement of the quality of Comprehensive Maintenance Services | ・To train operators at the call centers to make them enough knowledgeable and hospitable to take care any orders and requests by the clients, ・To set standards on its maintenance work and provide various services to the clients, ・To exploit new and prospective partner companies, and ・To enhance the quality management. | |

5 | Creation of new eco-businesses | ・To create new eco-business, focusing environment and energy-saving through alliances with other firms, and develop them as new driving force for SANKI SERVICE | |

6 | Strengthening of the business operation | ・To set up a corporate sales department to efficiently analyze and understand the industrial structure and problems of client companies and are identify clear targets, and ・To understand clients’ needs and their problems accurately to propose best solutions for them and improve their satisfaction. | |

7 | Building and strengthening of the profitable structure of the overseas business (China and Vietnam) | ・To set up an overseas business department to manage corporate resources of its subsidiaries and the joint company and allocate the resources to each of the business segments in the best and most appropriate way, and ・To support the business of the subsidiaries and the joint company by developing their customer bases and new service products through the alliances. | |

8 | Enhancing of its competitiveness by the IT system | ・To continue investing in its core business system and improve the business efficiency of Comprehensive Maintenance Services and the ability to make business proposals further in order to keep expanding the business and differentiate SANKI SERVICE from its competitors |

(3) Business in Japan

(1) Mission

SANKI SERVICE has mapped out the following five business strategies:

Thorough expansion of the lineups of services for air-conditioning equipment provided by its staff engineers |

Strengthening of its capability to deal with facility upgrade and installation projects |

Establishment of its all-around business operation |

Expansion of each of its business |

Enhancement of its hospitable system for major clients |

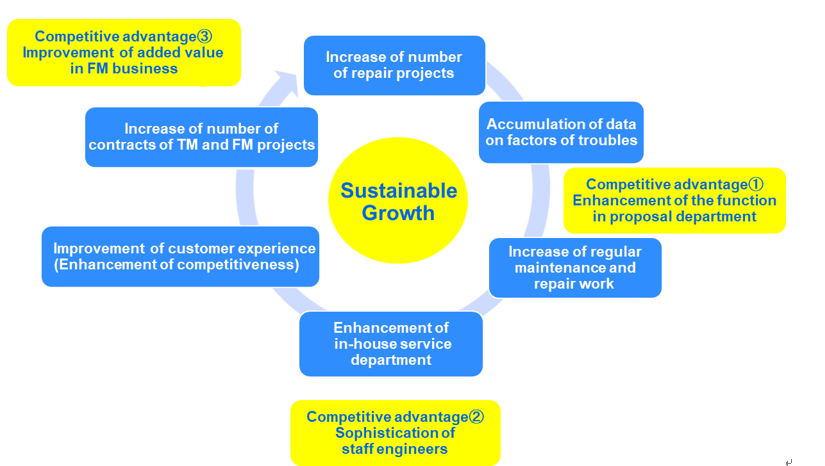

(2) Growth cycle

SANKI SERVICE follows the sustainable growth cycle by utilizing its three advantages through the intimate collaboration among its departments.

(Source: the reference material of the Company)

(3) Growth strategy

◎ Staff assignment

SANKI SERVICE promotes more effective sales activities by getting the right people in the right seats considering each of their expertise, know-hows and specialty.

(Source: the reference material of the Company)

◎ Strategy by business segment

The major strategies and target growth rate for each business segment are as follows:

Business Segment | Major Strategies | Target growth rate (3-year CAGR) |

Comprehensive Maintenance Business | *To improve the service quality of the Company by having its employees fully understand and recognize that they are professional engineers of a comprehensive maintenance service company, *To make and enhance value-added proposals to its clients, and *To acquire new clients and regain old clients from its competitors.

SANKI SERVICE has set up a new department which specializes in exploring new and good business partners in order to improve its services further. It will improve its staff members’ ability to make various proposals to their clients from the viewpoint of managers. | Sales: +11.5% Gross Profit: +12.2% |

Air Conditioning Equipment Maintenance Business | *To build the stable transaction relationship with SEVEN-ELEVEN JAPAN CO., LTD., *To improve the ability to analyze data obtained from a large number of client stores and to make proposal using the analysis, and *To expand the transactions of air-conditioning equipment maintenance services effectively by applying the same business scheme horizontally.

As for the SEVEN-ELEVEN JAPAN CO., LTD. project, SANKI SERVICE will thoroughly manage the progress of the project to boost customer satisfaction. | Sales: +11.4% Gross Profit: +13.2% |

Facility and Environmental Solution Business | *To improve the ability to make proposals of facility update to both its existing and new clients in much swifter manners, *To grade up the quality and control system of construction work, and *To create new opportunities for eco-business.

SANKI SERVICE will take full advantage of its high-skilled engineers who give it the upper hand over competitors. The Company will consider future opportunities to have an alliance with other companies to create new eco-business. | Sales: +16.3% Gross Profit: +16.0% |

Maintenance Service Business | *To thoroughly improve the lineups of the services provided by its staff engineers, *To increase multiskilled engineers, and *To streamline the operation of the service staff.

In addition to expand the service areas by strengthening recruitment of service staff, SANKI SERVICE aims to increase multiskilled engineers who can handle at least 2 different models of air-conditioning equipment and to improve the monthly sales per service staff | Sales: +12.7% Gross Profit: +16.7% |

*Sales from internal transaction are included in the CAGR of each business segment.

(4) Numerical Target

| FY 2019 Act. | FY 2020 | FY 2021 | FY 2022 |

Sales | 110 | 121 | 133 | 150 |

Operating Income | 6.5 | 6 | 7.2 | 9.5 |

Profit Margin | 5.9% | 5.0% | 5.4% | 6.3% |

ROE | 16.6% | 13.7% | 14.9% | 17.6% |

*Unit: 100 million yen

Identifying the theme for Phase 1 in FY 2020 as “to strengthen the business infrastructure for further growth,” SANKI SERVICE will take such approaches as “to promote the new corporate philosophy,” “to grow leaders of next-generations,” “to increase multiskilled staff engineers,” “to enhance recruitment of engineers according to the enrichment of the lineups of the services provided by its staff engineers,” “to improve its sales structure,” “to enhance the IT foundation,” and “to reform the personnel-system.”

Profit Margin is expected to decrease from the previous term because Phase 1 is the stage of making active investments.

The theme of FY2021 and FY2022, which are Phase 2, is “innovation and sustainable growth.”

The Company will undertake the tasks “to improve the lineups of the services for air-conditioning equipment provided by its staff engineers,” “to strengthen the capability to deal with facility and installation projects,” “to further improve the quality of Comprehensive Maintenance Services (including the quality control of call centers and partners)” and “to horizontally develop large-scale projects for Comprehensive Maintenance Services.”

It is expected that, in FY2022, the final fiscal year of the Medium-term Business Plan, both Operating Income Margin and ROE will exceed those achieved in FY2019.

5. Conclusions

The unexpected results from the delay of the energy-saving work projects was not recovered in the second half of FY2019, forcing the Company to finish the term with slightly declined sales and profits despite its initial forecast of their increase.

As for FY2020, it is forecasted that sales and profits will decrease in the first half, but sales will increase throughout the year although profits will decrease. This is because SANKI SERVICE will make proactive investments in “improving staff engineers to enhance their services,” “strengthening the business infrastructure,” and “boosting the IT base” in the first year of its new Medium-term Business Plan.

Amid the growing shortage of manpower, it shall be watched how the Company will carry out the basic strategies of its Medium-term Business Plan, including “the enhancement of services provided by its staff engineers” and “strengthening of the business infrastructure,” and how quickly the Company can promote its monetization strategy for the overseas business in which it has entered the market in Vietnam, in addition to China.

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with corporate auditors |

Directors | 6 directors, including 2 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

◎ Corporate Governance Report (Last updated on April 11, 2019)

<Basic Concept>

Our company’s basic policy on corporate governance is to become a company that earns trust of society by establishing “swifter decision-making for its management” through a corporate structure which can handle changes of management environments swiftly, and by carrying out “transparent and effective corporate management” to provide our shareholders and the society with accurate information in a timely manner.

Recognizing that enhancement of our corporate governance is one of the most important corporate management challenges, our company has invigorated the Board of Directors, strengthened our information control system, and promoted the thorough legal compliance in the company.

<the Principles of the Corporate Governance Code which our company doesn’t carry out and the reasons>

Principles | Reasons for not implementing the principles |

【Supplementary Principle 1-2-4】 | As for the electronic reports and English translation of meeting announcements and other information, our company has not carried out them so far, considering their cost performance based on the ratio of institutional and overseas investors. But, we will carry them out when the ratio increases enough to do it. |

【Supplementary Principle 4-10-1】 | Our company has not set up a non-mandatory advisory committee to discuss important matters related to nomination and compensation of directors. However, our Board of Directors consists of a total of 9 members including 2 outside directors and 3 outside auditors who are highly independent, allowing us to receive proper advices from them about such important matters as nomination and compensation of the directors. |

<Disclosure by Our Company According to the Principles of the Corporate Governance Code >

Principles | Disclosed contents |

【Principle 1-4 Strategically held shares】 | 1) Policy on strategically held shares of listed companies Our company strategically holds shares of our clients and partner companies when it makes our business relationships stronger and expands transaction opportunities and thus our company’s corporate value shall increase and bring profits to our shareholders.

Also, our company confirms the validity of strategically holding such shares through the Board of Directors that timely checks the status of the shares and examines its economic rationality in a medium- and long-term and purposes of holding the shares. We will take some corrective actions, such as to reduce the number of strategically held shares when holding the shares is considered inappropriate.

2) Policy on exercise of voting rights on strategically held shares Our company exercises the voting rights on strategically held shares case by case, by considering each of the bills, whether it will increase the medium- and long-term corporate values of the companies or not, and it will contribute to improve the shareholder value of our company or not.

3) Policy on how to deal with wills of the strategic holders of our company’s shares to sell the shares (Note 1) Our company shall not prevent strategic holders of our company’s shares from selling them when they express their intention to do so.

4) Policy on transactions with the strategic holders of our company’s shares Our company does not conduct any transactions, which could threaten the interest of our company or the common interest of shareholders, with strategic holders of our company’s shares. Note 1: “Strategic holders of our company’s shares” are the shareholders who possess our company’s shares as strategically held shares. |

【Principle 5-1. Policy on constructive dialogue with shareholders】 | Our company has set up a department responsible for constructive dialogue with shareholders and disclosure of information and designated a director in charge. We usually respond to the shareholders who request talks (interviews) with us positively and the person in charge of the talks (interviews) shall meet the shareholders as they wish. |

The purpose of this report is to provide information only and not for soliciting or promoting you to make investments. The information and opinions contained in this report are provided by our company based on data which are publicly available. The information in this report is based on the sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. We do not guarantee the accuracy, completeness or validity of the information and opinions, nor do we bear any responsibility for the same. All rights relating to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions shall be made by the responsibility of individuals with thorough consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |