| A&T Corporation (6722) |

|

||||||||

Company |

A&T Corporation |

||

Code No. |

6722 |

||

Exchange |

JASDAQ |

||

Industry |

Electrical equipment (manufacturing industry) |

||

President |

Shigetaka Misaka |

||

Address |

Yokohama Plaza Bldg. 2-6 Kinko-cho, Kanagawa-ku, Yokohama-shi |

||

Year-end |

End of December |

||

URL |

|||

* The share price is the closing price on September 1, 2016. The number of shares issued was taken from the brief financial report for the latest period.ROE and BPS are those for the previous term.

|

||||||||||||||||||||||||

|

|

* The forecasted values were provided by the company.

This report outlines A&T Corporation, briefly reports the results for the 2nd quarter of the term ending Dec. 2016, mentions the interview with the president Misaka, and so on. |

| Key Points |

|

| Company Overview |

|

The company excels at proposing an optimal one-stop solution for preparing necessary products in a laboratory, installing and operating equipment while proposing a layout, and possesses advanced technologies that are highly evaluated by leading overseas OEM clients. In the development process, Tokuyama Corporation formed a business tie-up with Analytical Instruments Inc., which develops, manufactures, and sells clinical test equipment and had been leading the industry by releasing such products as fully automatic blood sugar analyzer in 1978, and in Apr. 1988, they founded a joint venture for distributing their products, A&T Corporation. ("A" of Analytical Instruments and "T" of Tokuyama were combined.) In November 1990, the company established Esashi Factory, which is now the primary production site, in Iwate Prefecture. In 1994, A&T Corporation underwent absorption-type merger, integrating the diagnosis system division of Tokuyama Corporation. The period from the 1980s to the 1990s was the growth period of the clinical testing industry, in which many core technologies were developed, and the company expanded its business steadily while taking advantage of that trend. In Jul. 2003, the company issued over-the-counter shares. It is now listed in the JASDAQ market of Tokyo Stock Exchange.  ◎ Market scale

According to the Fuji Research Institute Corporation, the scale of the Japanese clinical testing market was 463.9 billion yen in 2015, accounting for 6.0% of the scale of the global market, but the market growth is slight, because the growth of immunoserological tests became sluggish. The market scale is estimated to be 489 billion yen in 2020, with average annual growth rate being only 1.1%. (Domestic and global markets) Based on the information in the website of the Japan Association of Clinical Reagents Industries, A&T Corporation estimated that the scale of the Japanese market of related devices and reagents is about 530 billion yen. The market scales of clinical chemistry and hematology tests are 175.9 billion yen and 27.5 billion yen, respectively. On the other hand, also according to the Fuji Research Institute, the global market scale reached about 62.3 billion US dollars (6.23 trillion yen under the assumption that 1 dollar is equivalent to 100 yen) in 2015, and is projected to keep growing at an annual rate of 2.4%, and reach about 70.4 billion US dollars (7.04 trillion yen under the assumption that 1 dollar is equivalent to 100 yen). It is expected that Eastern Europe, Russia, Asia, South America, and Africa, where the testing environment is still to be developed, will lead the growth. It was mentioned that as the Japanese market was already saturated, Japanese manufacturers would try to operate their business in the global market by utilizing their advanced technology and quality based on their stable business bases in Japan.  (Trend in each testing field)

Immunoserological testing formed the largest market (37.1%; about 23.1 billion US dollars; about 2.31 trillion yen), and the market of tests mainly for infectious diseases is growing. The blood testing market, in which A&T Corporation operates business, accounts for 7.5% and has a scale of about 4.7 billion US dollars (about 470 billion yen). In North America, Europe (especially western Europe), and Japan, blood testing has been already diffused, and the market growth is stagnant or slightly increasing. In Asia and other regions, the market is growing, and expected to keep growing steadily, according to the survey. (Trend of IVD devices)

According to "Statistical Survey on Trends in Pharmaceutical Production" by the Ministry of Health, Labour and Welfare, the scale of the Japanese medical products market (domestic production amount + import amount - export amount) in 2014 was about 2.7 trillion yen. Products for medical treatment is dominant, and medical laboratory testing equipment, which is handled by A&T Corporation, has a market scale of 57.3 billion yen (production: 169.4 billion yen, import: 20.3 billion yen, export: 132.3 billion yen). While there is a significant excess of imports of medical product, there is an excess of exports of IVD devices. This indicates how competitive Japanese companies are. Like Hitachi and Toshiba supply testing equipment to Roche in Switzerland and Abbott in the U.S., respectively, as OEMs, A&T Corporation supplies OEM products to Siemens. Namely, testing equipment made in Japan is now indispensable in the global clinical testing field.     (What is clinical testing?)

Clinical tests can be classified into "clinical imaging test" for directly examining the body with medical equipment, such as X-ray equipment, CT, MRI, electrocardiographic and ultrasonic equipment, and "laboratory tests" for examining biological samples (specimens), such as blood, urine, stool, and cells, collected from patients. A&T Corporation handles products used for laboratory testing, especially blood tests. There are a variety of blood tests conducted at hospitals and in comprehensive medical checkups, including the tests of the hepatic system, the renal system, uric acid, the lipid system, glucose metabolism, blood cells, and infectious diseases. A&T Corporation mainly conducts business related to "electrolyte tests" and "glucose tests." "Electrolyte tests"

The water content constitutes about 60% of the human body, as body fluids, including intracellular fluid and blood plasma. Body fluids are classified into electrolytes, which are mineral ions that dissolve in water and conduct electricity (such as sodium, potassium, calcium, and chlorine), and non-electrolytes, which dissolve in water, but do not conduct electricity (such as glucose and urea). Each electrolyte takes important roles for keeping human beings alive while maintaining a healthy balance -"sodium" adjusts the water content of the body, "potassium" controls muscles and nerves, "calcium" forms bones and teeth, conveys nervous stimuli, and coagulates blood, and "chlorine" supplies oxygen to the inside of the body. If the concentration of electrolytes in blood is abnormal, there is a possibility that the kidneys or hormones are malfunctioning. The purpose of electrolyte tests is to measure the concentration of each electrolyte ion in body fluid, detect the disruption of a balance, and then diagnose a disorder in the body. Sampled blood and urine are examined with testing device.  "Glucose tests"

The sugar in blood plasma (blood sugar) is composed mostly of glucose, which is the only energy source for the central nervous system, including the cerebrum. When the stomach is empty (over 5 hours after eating), the liver emits about 8 grams of glucose per hour, and the brain consumes about half of them, and muscles and red blood cells consume one fourth of them, respectively. Blood sugar level in its normal condition is strictly controlled while keeping a balance between the increase through the absorption from the intestine and the generation in the liver and the decrease through the consumption in the muscles. If this control does not work properly, hyperglycemia or hypoglycemia will occur. A glucose test is conducted for measuring the concentration of glucose in blood or urine.  1. Business Field

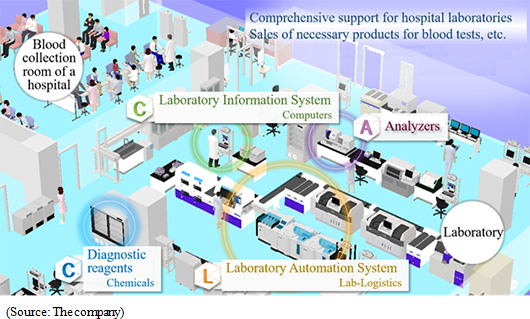

The business of A&T Corporation is composed of the "blood testing business," in which the company develops, manufactures, and sells clinical testing devices, reagents, supplies, etc. for blood tests, and the "IT and automation support business," which facilitates the streamlining of manual work in hospital laboratories with IT and automated systems. The company comprehensively supports hospital laboratories.

(Since this company conducts this business only, neither its brief financial reports nor securities reports contain segment information. It should be noted that the company discloses the sales of each product series in reference materials for briefing results, etc., but not the sales of each type of business.)

(1) Blood testing business

(Outline)

The company works on developing, manufacturing, and selling laboratory testing devices for "electrolyte tests" and "glucose tests," reagents for clinical tests (for measuring the concentrations of electrolytes, blood sugar, etc.), and supplies (such as sensors installed in analyzer), and offers customer support.

(Commercial distribution)

*Inside JapanThe company directly sells analyzers, reagents, and supplies to small and medium-sized hospitals via 8 branches nationwide. As of now, about 4,000 units of equipment are in operation. *Outside Japan The company sells analyzers as an OEM. It supplies electrolyte units, which are the specialty products of the company, to other Japanese manufacturers, including JEOL (6951, 1st section of TSE). The OEM clients combine the unit with large-size clinical chemistry analyzers and sell them. As an OEM, JEOL supplies products to Siemens, which is one of global enterprises handling large-size clinical chemistry analyzers. (Business model)

Once laboratory testing equipment is newly installed, clinical reagents and supplies will continuously delivered, and the maintenance service for the equipment will be offered. Once adopted, it is rare for client hospitals to change manufacturers considering the continuity of test data and usability, and so it is difficult for new manufacturers to enter the market. 7 to 10 years later, upgraded models will replace them. This characterizes this business field. (Major enterprises in this field)

Sysmex (6869, 1st section of TSE), Hitachi High-Technologies (8036, 1st section of TSE), JEOL (6951, 1st section of TSE), Wako Pure Chemical Industries (unlisted), ARKRAY (unlisted)

(2) IT and automation support business

(Outline)

In the case of blood tests, it is necessary to convey patient's blood (specimen) sampled in a blood collection room to a clinical laboratory and manually set the specimen at testing equipment. As several kinds of tests need to be conducted for many specimens at the same time, this work is extremely labor-intensive and inefficient, and the human error of taking a wrong specimen is difficult to avoid. In these circumstances, A&T Corporation supports the streamlining of the testing process with the following 2 systems.   Through the introduction of LIS, it became possible to put together the data of test results, which had been printed out for each test item, and give feedback to medical doctors swiftly and accurately. In addition, the data mining function is helpful for reducing the number of times of abnormal value retesting and the duration of testing. (Commercial distribution)

*Inside JapanTargeting the laboratories of medium and large-sized hospitals, the sales division of A&T Corporation sells LIS in cooperation with hospital information system manufacturers, including Hitachi, IBM, and Fujitsu, and LAS in cooperation with large-size clinical chemistry and immunoassay analyzer manufacturers, including Hitachi, Toshiba, and JEOL, as comprehensive proposals*. *For the details of comprehensive proposals, see the section "1-5 Characteristics and Strengths." *Outside Japan The company sells LAS directly to Asia, including South Korea and China. In the U.S., the company sells blood aliquotting instruments to business partners as an OEM. (Business model)

In addition to the maintenance service of LIS and LAS after their installation, the company can connect additional systems, customize the system, and so on for LIS, and can offer maintenance services, sell supplies, and so on for LAS. For both of the systems, stable sales can be expected. Like laboratory testing equipment, clients are rarely motivated to shift to other manufacturer's equipment, considering usability, data continuity, etc. The price range per transaction is 10 to 50 million yen for LIS, and 10 to 100 million yen for LAS. (Major enterprises in this field)

LIS: Sysmex CNA (subsidiary of Sysmex), local vendors, etc.LAS: IDS (unlisted), Hitachi-Aloka (unlisted), Siemens, etc. 2. Development systems

A&T Corporation adopted matrix management combining a wide array of products and element technologies for electrical, mechanical, chemical, and information systems that have been nurtured for many years. The company is developing products for offering comprehensive solutions related to C.A.C.L. beyond product categories. About 80 staff members are employed at the headquarters and Shonan Office. The ratio of R&D cost to sales is 9.1%, for the term ended Dec. 2015. The company will continue active R&D with the ratio of R&D cost being around 10%. 3. Production systems

There are two production sites: Shonan Factory, in Kanagawa Prefecture, for manufacturing clinical reagents and supplies and Esashi Factory, in Iwate Prefecture, for producing equipment and Laboratory Automation System (LAS). The company manufactures high-quality, safe products with advanced equipment under rigorous management. In cooperation with the development section, the company is striving to improve quality and streamline operation. In order to develop the foundation for expanding sales further, the company will construct a new building with a total floor area of 7,300 m2 at Esashi Factory by investing 1.7 billion yen, and strengthen capabilities considerably. 4. Sales routes and methods

As mentioned above, A&T Corporation sells its products to client hospitals via 8 branches in Japan, by utilizing its capability of proposing comprehensive solutions. Outside Japan, the company supplies products to overseas clients and dealers including Siemens through domestic OEM partners such as JEOL. To expand its business scale by supplying products as an OEM like this is the basic strategy, and the company concentrates on the diversification of OEM clients. The direct overseas sales to overseas clients and dealers and its ratio for the term ended Dec. 2015 were about 600 million yen and 5.9%, respectively, but the ratio of virtual overseas sales, including the (estimated) overseas sales via domestic OEM clients, for the term ended Dec. 2015 was 23.4%. The cumulative value for the second quarter of the term ending Dec. 2016 is 25.9%, which indicates upward momentum. ◎ Capability of proposing comprehensive solutions

A&T Corporation handles products mainly for electrolyte and glucose tests, and does not handle products for other tests. However, client hospitals need to install a variety of testing instruments in their clinical laboratories. To meet their needs, the Laboratory Automation System (LAS) has an automatic conveyor line that is compatible with not only its own products, but also other manufacturers' instruments. There are few manufacturers that possess technologies for producing systems for connecting their own products and other manufacturers' products freely and conveying them. Accordingly, the company occupies about 30% of the Japanese market. The sales staff of the company not only delivers equipment, but also proposes a layout for the most efficient testing with 3D CAD or the like, while considering the area and shape of a laboratory. All above, the company can offer optimal one-stop solutions for preparing necessary products in a laboratory, installing and operating equipment while proposing a layout. This is highly evaluated by client hospitals. ◎ Advanced technologies in specific fields

A&T Corporation handles products mainly for "electrolyte tests" and "glucose tests." Especially, its advanced technology for electrolyte analyzers can be verified by the fact that its products are supplied to JEOL, which is a leading manufacturer of measurement devices, including medical instruments, and Siemens, which is a large global company. As mentioned in the section of the market environment, Japanese medical laboratory testing equipment is highly competent in the world, and A&T Corporation contributes to the competitiveness of Japanese products.  The estimated ratio of net income to sales for this term is 5.3%, lower than that for the previous term, but under the assumption that total asset turnover ratio and leverage will be nearly constant, ROE is forecasted to remain 2-digit. |

| 2Q of Fiscal Year December 2016 Earnings Results |

Decreases in sales and profit

Sales were 4.7 billion yen, down 6.5% year on year. The number of large-scale transactions for a laboratory information system (LIS) decreased. The sales volume of diagnostic reagents declined, too. However, the sales were the second highest sales for the 2nd quarter in the history of the company. As the sales of competitors' products grew and gross profit rate dropped through the modification to the combination of products, gross margin decreased. SG&A expenses rose 0.1%. The augmentation of R&D staff was curtailed through staffing, the selection and concentration of investments, but due to the decline in sales, operating income dropped 27.3% year on year to 584 million yen. As loss on relocation amounting to 114 million yen was posted through the restructuring of its Chinese joint venture, net income decreased 35.0% year on year to 335 million yen. Sales did not reach the estimate, but profit exceeded the forecasted value.  ◎ Clinical testing equipment and systems

The OEM sales of laboratory testing equipment were sluggish. Sales dropped 15.5% year on year. As for laboratory information system, the number of large-scale transactions in Japan declined, as the company concentrated on the follow-up services after the launch of the new product CLINILAN GL-3 and the results for the same period in the previous year were favorable. The performance of laboratory automation system did not change from the previous year. ◎ Diagnostic reagents for clinical tests

Mainly, direct sales were sluggish.

Sales decreased 5.0% year on year. ◎ Supplies

Since the number of units of laboratory testing equipment in operation the company sold as an OEM increased, the results of supplies were healthy.

Sales rose 1.3% year on year. ◎ Others

The sales of other manufacturers' products accompanying the large-scale domestic transactions for laboratory information and automation systems grew.

Sales increased 37.2% year on year.  Due to the decrease in trade payables and short-term interest-bearing debts, current liabilities shrank 991 million yen. Because of the decline in long-term interest-bearing debts, noncurrent liabilities decreased 130 million yen from the end of the previous term, and total liabilities dropped 1,121 million yen to 2,991 million yen. Due to the augmentation of retained earnings, net assets grew 189 million yen to 5.9 billion yen. Consequently, equity ratio increased by 8.3 points from 58.1% at the end of the previous term to 66.4%.  Due to the decrease in short-term debts, etc., financing CF dropped further. The cash position improved. |

| Fiscal Year December 2016 Earnings Estimates |

Sales grew, but operating income dropped, because gross margin declined due to the modification to the combination of products.

Taking into the account the results for the 2nd quarter, the full-year estimates of cost of sales, gross margin, and SG&A expenses have been revised. Sales did not change, but cost of sales augmented. The company plans to offset it by controlling SG&A expenses through optimal staffing, selection and concentration of investments. Estimated operating, ordinary, and net incomes have not been revised. The sales of a laboratory automation system (LAS) and supplies grew from the previous term, but gross margin dropped due to the modification to the combination of products. The drop in gross margin cannot be offset by SG&A control, and profits were high in the previous term. Accordingly, all profit items from operating income onwards are estimated to decrease.        |

| Interview with President Misaka |

|

Q: "What do you think of the company's strengths and key characteristics?"

A: "Our strengths are comprehensive solutions and high technology. We will keep taking on challenges and pursuing high growth."

Q: "As a president, how do you consider your own mission?"

A: "My goal is to grow the top line. In order to accomplish that, I will focus on improving our productive capacities and development capabilities."

Q: "Please tell us about your strategy from the short, medium and long term viewpoints."

A: "In the short and medium terms, we aim to expand LIS, LAS and OEM supply, and in the long term, we want to expand our activities beyond the laboratories."

*POCT (Point Of Care Testing: immediate testing at the clinic)

Real-time testing carried out at the site of medical care, using miniature analyzers and rapid diagnostic kits. Includes all the clinical tests that are not carried out in hospital labs or outsourced centers. For this reason, wide-ranging and diverse cases can be assumed with regard to the locations where these tests are conducted or the methods used. As the healthcare professional conducts the tests beside the patient, the examination time is shortened and the patient feels closer to the test. These benefits are said to contribute to faster and better medical care and nursing, the prevention of disease and the promotion of health, thereby aiding in the improvement of the QOL (Quality of Life) of the patients. Q: "Please give us your thoughts on corporate governance."

A: "I aim to build a firm relationships with all stakeholders, starting with shareholders."

Q: "Finally, please give us a message for your investors."

A: "We will polish various technologies and press ahead with commercializing them. I hope investors will focus on that potential and support us."

|

| Conclusions |

|

In the case of A&T Corporation, OEM products for JEOL are supplied to Siemens, and we would like to see how speedily OEM clients will be diversified and increased, as the company emphasizes this. In addition, LIS and LAS are considered to be in high demand not only in Japan but also in overseas market, and so we can expect the cultivation of overseas market. On the other hand, the evaluation in the stock market is extremely low, with PER at a one-digit level and PBR less than 1, partially because profit dropped this term. It is hoped that A&T Corporation will increase its popularity and manifest mid-term growth strategies. |

| <Reference: Regarding corporate governance> |

◎ Corporate Governance Report

The company submitted a latest corporate governance report on Mar. 31, 2016.As a JASDAQ listed company, the company fully follows the 5 items of basic principles of the corporate governance code. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2016 Investment Bridge Co., Ltd. All Rights Reserved. |