| Will Group (6089) |

|

||||||||

Company |

Will Group, Inc. |

||

Code No. |

6089 |

||

Exchange |

First Section of Tokyo Stock Exchange |

||

Industry |

Services |

||

President and CEO |

Ryosuke Ikeda |

||

Address |

1-32-2 Honcho, Nakano-ku, Tokyo, Japan |

||

Year-end |

End of March |

||

URL |

|||

* Share price as of closing on the end of December 17, 2014. The number of outstanding shares was obtained by subtracting the number of treasury shares from the number of outstanding shares at the end of the term written in the summary of the financial results for the latest term. ROE is the value for the previous term. BPS is the value for the previous term. (the share split (1 : 2) dated September 1, 2002 considered)

|

||||||||||||||||||||||||

|

|

* The estimated values are by the Company. Consolidated since the term ended March 2012. Shares were split with a ratio of 1 : 200 on October 10, 2013, and with a ratio of 1 : 2 on September 1, 2014. EPS and DPS were calculated retroactively.

|

| Key Points |

|

| Company Overview |

He faced a lot of difficulties, but he learned from his experience that by brushing up your value, developing confidence, improving yourself and going forward positively, you will be able to make surrounding people forward-thinking and positive. As he became certain that the social mission of President Ikeda and the Company is to positively influence their surrounding people and organizations, he decided to define their "Mission, Vision and Value" with his own words. ◎ Market Trend  On the other hand, the "2018 problem" in the personnel dispatch field has been pointed out from the mid-term viewpoint. In April 2018, it will have been 5 years since the enforcement of the "Amended Labor Contract Act (for fixed-term employment contracts)" in April 2013. In accordance with the "5-year rule" of fixed-term employment contracts, workers who have worked under a fixed-term contract for 5 years can switch to indefinite-term employment (indefinite-term employment contract) by applying for it. The "bill for amending the Worker Dispatch Law" was not approved at the Diet session last autumn due to the general election after the dismissal of the House of Representatives, but its important new provision is that "the same worker can work at the same workplace as a dispatched worker for up to 3 years, and if the period of working as a dispatched worker exceeds 3 years, the worker dispatching firm shall employ said worker as a full-time employee or promote the firm hiring said worker to employ said worker directly," after the enforcement in April 2015. This amendment would also abolish the indefinite-term dispatch, which has been permitted only in "26 specialized businesses" (for other businesses, the employment period as a dispatched worker has been up to 3 years), and, in every business, enable the firms hiring dispatched workers to keep hiring dispatched workers by replacing them every 3 years under the condition that they listen to the opinions of labor unions. Because of these factors, it is extremely unclear how many workers will demand the shift to indefinite-term employment and how dispatched workers will change their awareness, but worker dispatching firms will need to strengthen the businesses of undertaking tasks, introducing personnel, etc. In addition, it is difficult from the financial aspect for small and medium-sized staffing firms to shift to indefinite-term employment or employ dispatched workers as full-time employees, and so it is anticipated that the industry will become oligopolistic through M&A, etc. of leading companies, mainly listed firms. ◎ Competitors

The competitors in the sales outsourcing business, whose sales account for 40% of total sales, are mostly the following three companies: Backs Group Inc. (unlisted), HITO-Communications (3654, the first section of the Tokyo Stock Exchange) and J-Com Holdings Co. Ltd. (2462, the first section of the Tokyo Stock Exchange). The business contents and share evaluation, etc. of Will Group were compared with those of these competitors and P&P Holdings (6068, JASDAQ), which supports sales activities.

① Sales outsourcing business

Net sales: 11,172 million yen, operating income: 497 million yen (results for the term ended March 2014)  ② Call center outsourcing business

Net sales: 6,975 million yen, operating income: 295 million yen (results for the term ended March 2014)  ③ Factory outsourcing business

Net sales: 6,287 million yen, operating income: 148 million yen (results for the term ended March 2014)    |

| Characteristics and Strengths |

|

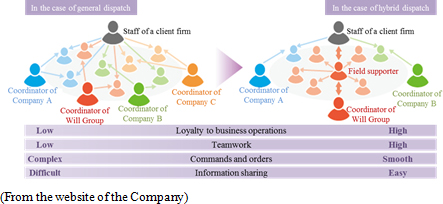

(1) "Hybrid dispatch" with field supporters

The system called "hybrid dispatch" characterizes the Company in the personnel dispatch field and drives the growth of the Company.<Outline of hybrid dispatch> Personnel dispatch means the dispatch of workers who have concluded an employment contract with a staffing firm to client firms that have signed a labor dispatch contract with the staffing firm. It is characterized by the division between the employment and chain-of-command relations. Staffing firms receive the fees for personnel dispatch from client firms in accordance with worker dispatch contracts, and pay salaries to dispatched workers in accordance with employment contracts. At each workplace, dispatched workers follow the instructions and orders from the staff of client firms. In many cases of general dispatch, workers dispatched from several different staffing firms work together at the same place, and so it becomes difficult for the staff of the client firm to share information and give appropriate instructions and orders. In many cases, full-time employees called coordinators of a staffing firm assist dispatched workers, but the coordinators do not always stay at workplaces, and so they cannot respond swiftly to various daily troubles at consumer electronics mass retailers, the phone booths of call centers, etc. In addition, dispatched workers in case of general dispatch tend to have weak loyalty and a low spirit of teamwork, and so they tend to quit soon or cause troubles frequently, although these depend on the working environments, type of job, each worker's individual attributes, etc. Accordingly, problems often arise both for client and staffing firms. In the case of Will Group's "hybrid dispatch," full-time employees called field supporters (FS) show up at the workplace, and work together with the dispatched workers, while managing, instructing and educating them on the spot on a daily basis. In short, this is a system where a team led by a field supporter engages in operations.  Meanwhile for the Company, when full-time employees stay at workplaces, the morale of dispatched workers is enhanced, bettering teamwork and strengthening the sense of responsibility of dispatched workers. In addition, the presence of the full-time employees enables to immediately meet the client firms' needs and to flexibly respond to an ad hoc plan of increasing manpower. As this system is highly evaluated by client firms, they often place more orders for worker dispatch, and even sign outsourcing contracts. In some cases, client firms want to directly employ excellent dispatched workers, and Will Group introduces the personnel. Hybrid dispatch thus often increases business opportunities. On average, one FS supervises about 50 dispatched workers, but for promising clients, with the expectations of future business expansion, a more compact team is first dispatched, so that they may understand the advantage of "hybrid dispatch" and place more orders. The number of field supporters as of the end of September 2014 is 198, up 17 from the same period of the previous year. The Company plans to further increase the number. <What enables hybrid dispatch>

Investors may naturally wonder if "hybrid dispatch," Will Group's signature method, can be imitated by competitors.To this question, President Ikeda replied as follows: (2) Business operation specializing in various categories

The 3 major businesses of Will Group earn over 90% of total sales. Each business specializes in a category.

By utilizing the expertise in the categories in which these businesses specialize, the Company conducts unique measures for contributing to the business expansion of client firms. |

| Summary of 1H of FY March 2015 Earnings Results |

Performance is favorable in all segments, with considerably increased sales and profits

Sales were 15.1 billion yen, up 22.2% from the same period of the previous year. All of the 3 major segments saw a double-digit sales growth rate. SG & A increased 23.2% from the same period of the previous year, but were offset by the increase in sales. Consequently, operating income, etc. showed double-digit growth. In the sales outsourcing business, client firms wanted to directly employ dispatched workers, and so the Company introduced the personnel. Accordingly, the sales from personnel dispatch were smaller than the estimate, while the sales from personnel introduction exceeded the estimate. This did not affect sales significantly, but the sales from personnel introduction, whose profit margin is high, increased, and so gross profit was higher than the estimate. SG & A were smaller than the estimate, because costs of system repair, etc. were carried over to the third quarter. As a result, profits were much higher than the revised estimates.  ① Sales outsourcing business

Mainly the business of undertaking tasks was healthy. As the business of undertaking tasks, whose profit margin is high, grew, profit margin increased, absorbing the augmentation in personnel expenses, and then profits rose significantly. More recruitment activities that do not use external media, such as word-of-mouth and repeat recruitment, are conducted, streamlining recruitment. ② Call center outsourcing business

The Company concentrated on the cultivation of new clients, and dispatched more workers, achieving a double-digit sales growth rate. However, the number of short-term contracts assuming the long-term contracts with promising clients of telemarketing agencies increased, augmenting the cost of recruitment and decreasing profits. ③ Factory outsourcing business

It was healthy, as mainly the business of personnel dispatch grew. There is stable demand from food manufacturers. Profits increased almost two-fold. ④ Others

The sales from the dispatch of workers to offices, etc. increased from 613 million yen in the same period of the previous year to 882 million yen. In addition, the promising businesses, including the dispatch of care workers, the introduction of IT personnel and overseas businesses, grew considerably. The sales of a Singaporean subsidiary acquired in August contributed to the performance of the Company. The Company continues upfront investment for growth.   Net assets grew 217 million yen, due to the increase in retained earnings, etc. As a result, capital-to-asset ratio decreased to 40.8%, down 0.3% from the end of the previous term.  Cash position improved. (4) Topics

Will Group focuses on the expansion of overseas businesses as one of the pillars for the next growth, and established WILL GROUP Asia Pacific Pte. Ltd. in February 2014, with the purposes of expanding businesses and streamlining the process of finding business opportunities in ASEAN. ◎ Acquisition of a personnel service firm in Singapore In August 2014, the consolidated subsidiary WILL GROUP Asia Pacific Pte. Ltd. acquired 60% of the shares of "Scientec Consulting Pte. Ltd.," a Singaporean personnel service company, turning it into a subsidiary. Since its inception in October 2001, Scientec Consulting Pte. Ltd. has been conducting executive search, personnel introduction, etc. for leading multinational firms that have regional headquarters in Singapore, and has the advantage in supplying personnel in the healthcare and life science industries. WILL GROUP Asia Pacific Pte. Ltd. decided to acquire the shares of Scientec Consulting Pte. Ltd. for obtaining the know-how of not only the personnel services in the healthcare and life science industries, but also systematized training programs and executive search.  |

| FY March 2015 Earnings Estimates |

There are no revisions to the earnings forecast. Double-digit increases in sales and profits.

There are no revisions to the full-year earnings estimates. The new subsidiary Scientec Consulting Pte. Ltd. is expected to contribute to sales and gross profit, but in the sales outsourcing business, the sales from personnel dispatch that had been estimated to be posted from the third quarter were shifted to the sales from personnel introduction in the second quarter, and so results are estimated to be as forecasted. As for profits, the accrued expenses in the second quarter are to be paid in the second half. Sales were 32.9 billion yen, up 22.8% from the previous term. Sales growth rate is estimated to remain over 20% following the previous term. A double-digit increase in sales is expected in each segment. Profit margin will slightly decline, but a double-digit profit growth rate is expected. The Company aims to achieve the stability of personnel dispatch and the profitability of the businesses of introducing personnel and undertaking tasks in a good balance. Dividend is estimated to be 9.25 yen/share, equal to the dividend for the previous term. (In the previous term, the Company paid a common dividend of 18.50 yen/share and a commemorative dividend of 7.50 yen/share, and split shares with a ratio of 1 : 2 on September 1, 2014.) The forecasted payout ratio is 8.4%.  |

| Growth Strategies |

③ Creation of new markets

Although this will depend on the future legislation, the irregular and regular employment markets are now divided, and it is difficult for irregular workers who wish to work as full-time employees to pursue their careers as they want.(1) Irregular to regular-creation of a career path market According to the "online questionnaire survey targeted at dispatched workers (released on January 15, 2014)" conducted by the Japan Staffing Services Association, about 70% of respondents hope to "work as dispatched workers at the current client firms for the foreseeable future," but about 50% wish to "work as full-time employees" several years later.  In this situation, Will Group will reinforce the personnel introduction business, in which the Company educates dispatched workers, makes them accumulate practical experience and introduces them to client firms as full-time employees, regardless of the date of the termination of the dispatch period. Client firms have the advantage of being able to decide whether or not to recruit workers after seeing them working at actual workplaces and, therefore, of lower likelihood of mismatch. There is another advantage, that is, Will Group can operate more profitable businesses, and the reputation as a staffing company that has paved the career path to full-time employment helps secure workers and increases retention rate. Depending on the ability of workers, the Company introduces them to more promising workplaces and firms, rather than their current workplaces. By "creating an unprecedented career path market," the Company aims to develop win-win relations among dispatched workers, client firms and Will Group. (2) Expansion of new business fields

Will Group considers that personnel services can be classified into the "stock type (personnel dispatch, task undertaking, etc.)," which can earn stable profits with continued contracts although profitability is not high, and the "flow type (personnel introduction, executive search, etc.)," which is highly profitable although contracts are one-time. The Company is offering personnel services in the following fields, with the aim of establishing the next core business early, in addition to the current 3 core businesses.

|

| Interview with President Ryosuke Ikeda |

|

<Regarding growth strategies>

<Strengths of Our Company>

<For diffusing management philosophy>

<Message to Investors>

|

| Conclusions |

As Will Group was listed in the first section of the Tokyo Stock Exchange and entered the same stage as the two competitors HITO-Communications and J-COM Holdings, we would like to see how the Company will compete with them by utilizing the strength of hybrid dispatch, as well as the progress of the development of new businesses.  Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015 Investment Bridge Co., Ltd. All Rights Reserved. |