| enish, inc. (3667) |

|

||||||||

Company |

enish, inc. |

||

Code No. |

3667 |

||

Exchange |

1st Section of Tokyo Stock Exchange |

||

Industry |

Information, Communications |

||

President |

Kouhei Antoku |

||

HQ Address |

Roppongi Hills Mori Tower 39F 6-10-1, Roppongi Minato-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

* Stock price as of close on February 25, 2015

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. 20 for 1 and 2 for 1 stock splits were performed in September 2012 and October 2013 respectively.

* EPS has been adjusted retroactively to reflect these stock splits. |

|

| Key Points |

|

| Company Overview |

|

Native applications are those that can be enjoyed by users by downloading them to their smartphones. Browser applications, on the other hand, are not downloaded but can be accessed and enjoyed over various platforms like GREE, mixi, and Mobage. Both forms of applications are provided free of charge, but various items including tools (In the case of "Bokuno Restaurant II," recipes and items to decorate the interior of restaurants can be purchased to make the games more fun to use and more attractive to virtual customers within the game) used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and a portion of the fees received is paid by enish to the platform providers as usage fees, etc. <Business Description>

enish maintains only a single business segment entitled the social applications business (Games are considered as one type of application category). Based upon the Company's earnings foundation built up in the browser application business, enish is also fortifying its efforts in the newer native applications business. While games are provided free of charge, various items including tools used in the games to make them more enjoyable are offered for purchase. Responsibility for collection of the fees charged to users for items purchased over browser applications is seconded to the social network services (SNS) platform providers, and a fee is paid by enish to the platform providers as usage fees, etc. In addition, enish is cultivating the "Online to Offline (O2O) business where advertisements are posted within the games (Providing companies which seek to use games as opportunities to promote sales).

<Company History>

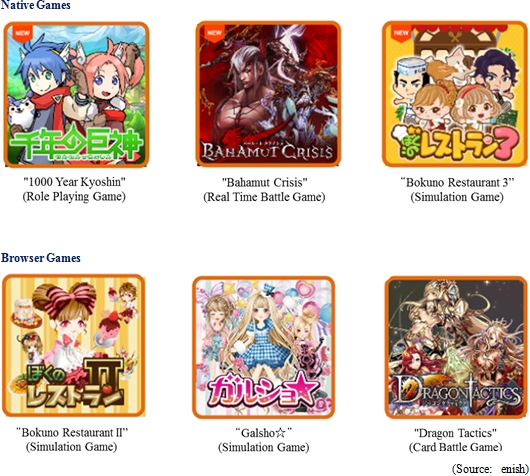

<Main Titles>

"Bokuno Restaurant II", "Galsho☆" and other management simulation games are long selling games that are popular with female users. In particular, sales of "Galsho☆"continue to grow despite the passage of four years since its release. The ratio of male to female users of browser-based games is 39.1% to 60.9% respectively.enish is promoting a shift from browser games to native games and it released three native games of "1000 Year Kyoshin", "Bahamut Crisis", and "Bokuno Restaurant 3" during fiscal year December 2014.   <Growth Strategy>

Based upon the stable earnings derived from the long-selling browser based games, enish seeks to promote "native applications", a "global business deployment strategy (in Asia and English speaking countries)" and the O2O business as part of its strategy of expanding its overall business. During fiscal year December 2014, three native game titles were released along with the implementation of measures to strengthen hiring and training of human resources for the development structure of native games. During fiscal year December 2015, enish will implement efforts to strengthen and fortify its overseas development structure in Asia and English speaking countries. Furthermore, the Company will implement measures to create an organization of native game users within and outside of Japan and to invigorate this organization as part of the deployment of a full scale O2O business.   Moreover, return on equity can be expected to recover to between 5% and 6% should enish achieve its earnings estimates for fiscal year December 2015.  |

| Fiscal Year December 2014 Earnings Results |

Sales, Current Profit Decline 2.6%, 86.0% Year-On-Year

enish announced a revision to its earnings on February 4 (Calling for sales of ¥6.452 billion and operating and net profits of ¥140 and ¥20 million respectively), and actual results were in line with these revisions. enish experienced a decline in sales of 2.6% year-on-year to ¥6.452 billion due to the lull in demand caused by the shift from browser games to native games during fiscal year December 2014. Development for five native game titles has been completed, of which three titles have been already released. At the same time, sales of the simulation games "Bokuno Restaurant II" and"Galsho☆" continue to trend strongly, while sales of "Dragon Tactics" (Card battle game) declined by a large margin and sales of "Sakigake! Otokojuku" languished. Near term, sales of "Dragon Tactics" and "Sakigake! Otokojuku" appear to have bottomed.Operating profit declined by 86.6% year-on-year to ¥149 million. Developmental costs for titles to be released in fiscal year December 2015 caused cost of sales margin to rise by 12.3% points year-on-year to 78.9%, and contributed to a 15.5% year-on-year rise in cost of sales to ¥5.092 billion. Higher labor expenses arising from increases in personnel and advertising for native games to be released during the term caused sales, general and administrative expenses to rise by 9.7% year-on-year to ¥1.211 billion.  Higher Development, Advertising Expenses Contribute to a Current Loss of ¥138 Million in the Fourth Quarter

In the realm of native games, "Bokuno Restaurant 3" and "Bahamut Crisis" were released in the second quarter, and "1000 Year Kyoshin" in the third quarter. All of these games have achieved sales as expected. At the same time, a decline in main browser games during the second quarter was offset with restructuring of the operational structure thereafter and sales growth turned positive for "Bokuno Restaurant II" and "Galsho☆", and sales of "Dragon Tactics" and "Sakigake! Otokojuku" appear to have bottomed.While quarterly sales declined during the second quarter, they began to grow from the third quarter on a quarter-on-quarter basis and fourth quarter sales rose by 3.7% compared with the third quarter. However, labor and outsourcing fees associated with development work for titles released in 2015 increased, and commission payments rose due to a recovery in browser games causing cost of sales to rise by 8.9%. Increases in advertising expenses for native games including "1000 Year Kyoshin" and commission payments for overseas business deployment caused sales, general and administrative expenses to rise by 66.1% year-on-year. The number of employees stood at 195 (Including 17 consigned staff) at the end of the term. By function, 26% of these employees are engineers, 35% designers, 25% directors, and 17% administrative staff. Optimization of the allocation of staff has been nearly completed along with the shift from browser to native games. enish will continue to conduct hiring on a highly selective basis.     |

| Fiscal Year December 2015 Earnings Estimates |

Sales, Current Profit Expected to Rise 31.7%, 98.3% Year-On-Year

Six new titles are expected to be released during the latter half of the second quarter to the first half of the third quarter (June, July, and August). In addition to the contribution from new titles, fine-tuning of the three native game titles released during the term just ended has been completed and is expected to contribute to a 31.7% year-on-year increase in sales to ¥8.5 billion. With regards to profits, an increase in anticipatory investment including developmental expenses for new titles is expected to be successfully absorbed and allow operating income to rise by 101.1% year-on-year to ¥0.3 billion. In overseas markets, the anticipated release of six titles including "1000 Year Kyoshin" during the coming term has not been completely factored into enish's sales and profit estimates.While an operating loss is anticipated during the first half due to anticipatory investments for new titles, the contribution from these new titles is expected to contribute to a turn to profits during the second half. The ratio of browser games to native games during the first and second halves is expected to be 90% to 10% and 40% to 60% respectively. Furthermore, the projected advertising expense per title is expected to be several tens of millions of yen, but the actual spending will be conducted flexibly with a view to the cost per acquisition (CPA) of users.  (2) Basic Strategy in FY12/15

Based upon the earnings foundations established by existing titles, new native game introductions are expected to contribute to higher sales and profits. At the same time, "1000 Year Kyoshin" is expected to be released in Korea, and facilitation of offices in preparation for the publications business is expected to be conducted in China, Hong Kong, Taiwan, Thailand, etc.

Existing Titles: Maintain Earnings Foundation

Browser Game

While a progressive decline in sales is unavoidable due to the shift to native games, the stable operational structure helped to limit the decline to a minimum level (The decline in sales of the four main titles in the fourth quarter over the third quarter was limited to 2%). enish will consign operations of browser games to collaborative partners to reduce costs while maintaining stable operations (the transfer of operations has been nearly completed by the end of the term just ended). Moreover, enish will continue to maintain control over important functions and conduct quality checks on a monthly basis with its collaborative partners.

Native Games

In order to leverage the experiences gained in the term just ended, enish will continue to conduct fine-tuning. In addition to the traditional battles waged with computers in the game "1000 Year Kyoshin", more functionality that allows for more diversified events and for users to control consumption including "player versus player" (PvP) and "monster skill slot system" functions will be added. Significant renewals including improvements in the action speed and the volume of "Bokuno Restaurant 3" will be performed during the coming term. An Android version of "Bahamut Crisis", which was originally released as an i-OS version during fiscal year December 2014, was launched in January 2015 and PvP and GvG functions have also been added.

Overseas Deployment of "1000 Year Kyoshin"

In addition to the Japan release during the term just ended, "1000 Year Kyoshin" will also be deployed in overseas markets as well. In order to make this game into a long selling game within Japan, 1) main story and contents additions on an ongoing basis will be conducted, 2) overall improvements in the cultivation system including skill cultivation function will be added, and 3) improvements including new roles for cultivated characters to play a part through PvP and RAID (Function that allows other users to form teams to do battle in the game) will also be performed. At the same time, a release in Korea is expected during this spring.

New Native Titles

Development of six titles is currently being conducted for release during fiscal year December 2015. Four of these titles target male users (Mid-core users), and two target female users (Light users). The titles targeting male users are real time tactical battle role playing games (RPG) that boast of unique characters, and includes "Valiant Soul", which is designed to target the major genre of the global market that depicts a fantasy world where battles using swords and magic are carried out and allows for real time battles with a high amount of freedom in customization of characters. Another game in this category is "Project 3" (Provisional name) which is similar to "Valiant Soul" and is designed with various features to make it a long selling hit game. A fashion game that allows for users to manipulate avatars to change clothes, and an agricultural cultivation simulation game are being developed to target female users.

Efforts to Implement the Pipeline

enish is implementing efforts to "facilitate its in-house native game development structure" and "optimize its development process." With regards to the "facilitation of its in-house native game development structure," the transfer of its browser application operations to external partners allowed it to shift its personnel to native game and raise the ratio of native game employees to 80% of the total. With regards to the "optimization of the development process," development teams with specialized knowledge of project management for developmental tasks have been established to collateralize quality while avoiding delays in releases. Development has been conducted in line with various milestones and monitoring of progress.

|

| Interview Notes |

|

<Development of 3 Native Games and Valuable Experiences Gained from Operations>

To laymen, the difference between browser and native games is merely the ability to play games using a browser (Server) or to play games downloaded to terminals; in either case, games provide the same ability to be played on handset terminals. However, native games require "specialized know-how and technology for both development and operations, which are completely different from browser games."Specifically, "development for browser games can be done primarily on the server side, whereas native games require development on both the server side and the terminal (Client) side, and therefore requires consideration of manipulation speed (Loading time) and client side resources (CPU loads and memory consumption)". Therefore, the development of details of the games can be performed but users could become dissatisfied should the delicate balance between manipulation speed and client resource consumption deteriorate. In addition, "users of native games are much more sensitive to the consumption speed of games than is commonly thought". Therefore, "the key point for native games is to how much detail can be built into the game by the time of its release, unlike browser games, where key performance indicator analysis can be performed for additional events and stages to be added later." For example, browser game development expenses range roughly from ¥30 to ¥50 million, while native game development expenses cost about five times as much or about ¥200 million (although enish has no problems with funding for these expenses). <Survivors Will Continue to Enjoy Profits for the Time Being, but in the Longer Run, There is a Need to Establish an Earnings Foundation Based Upon Native Games>

"Currently there are few new title introductions into the browser game market, with the profits being divided by the survivors in the market. The avatar function of browser games (Not available in native games) is highly regarded by female users, and avatars are part of the reason for the strong popularity of browser games including simulation games and avatar type games amongst female users." But "because of the arduous process of registering with provider platforms before using browser games, new users of online games increasingly choose native games, making the outlook for browser games in the long term highly uncertain. Therefore, there is a need to shift our focus from browser games to native games."Fortunately, "liquidity in the market for engineers and technicians is growing and hiring of technicians with superior skills is now much easier than it was at the time of the start of our native game business." Essentially, technicians maintain a strong desire to create things freely, and various game companies have facilitated native game development environments that appeal to these technicians. Interview Conclusion, Investment Bridge's Opinion

Despite the difficulties encountered during fiscal year December 2014, enish was able to gain valuable experiences in the development of three native game titles and in their operations. Moreover, facilitation of the internal structure for development and operations of browser games, including the new operational structure, and improved technician hiring conditions were achieved, contributing to facilitation and fortification of the development structure for native games (A six line development structure has been established).The maintenance of long selling browser games that cannot be copied by competitors and the IPO conducted at the start of the shift in the market from browser games to native games acted as a distraction that contributed to a delay in development of adequate responses to native games. However, the IPO gave enish access to capital necessary for growth, and enabled it to fund the facilitation of its development and operating structures. Amidst these conditions, there appears to be no other companies currently operating in the native game market with the strengths of enish in simulation games and avatar type games. Consequently enish can leverage these strengths to go on the offensive. While enish will leverage its experiences in simulation games and avatar type games to establish a foothold and secure earnings in the native game market, it will also seek to establish a business model that includes RPG and battle games. Through this strategy, enish should be able to realize latent growth in the market and attract attention of users. Another attractive point of the Company is its global business deployment and its O2O business. |

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015 Investment Bridge Co., Ltd. All Rights Reserved. |