Bridge Report:(1716)DAI-ICHI CUTTER KOGYO the first half of the fiscal year June 2020

President Masamitsu Takahashi | DAI-ICHI CUTTER KOGYO K.K. (1716) |

|

Company Information

Market | TSE 1st |

Industry | Construction |

President | Masamitsu Takahashi |

HQ address | 833 Hagisono, Chigasaki-shi, Kanagawa |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury shares) | Total market cap | ROE (Act.) | Trading Unit | |

1,688 yen | 5,691,631 shares | ¥9,607 million | 12.5% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥22.00 | 1.3% | ¥189.75 | 8.9 x | ¥1,981.09 | 0.9 x |

* The share price is the closing price as of February 28, 2020. The number of shares outstanding is calculated based on those at the end of the latest quarter excluding the number of treasury stock. ROE and BPS are the last quarter’s results.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Income Attributable to Owners of Parent | EPS | DPS |

June 2016 Act. | 12,857 | 1,733 | 1,780 | 1,115 | 196.01 | 12.00 |

June 2017 Act. | 12,840 | 1,412 | 1,473 | 990 | 174.01 | 15.00 |

June 2018 Act. | 16,283 | 2,187 | 2,263 | 1,487 | 261.37 | 25.00 |

June 2019 Act. | 14,871 | 1,760 | 1,843 | 1,251 | 219.80 | 20.00 |

June 2020 Est. | 15,700 | 1,730 | 1,856 | 1,080 | 189.75 | 22.00 |

* The estimated values are based on the forecasts made by the Company.

* Unit: million yen, yen

We will report on the financial results of DAI-ICHI CUTTER KOGYO for the first half of the fiscal year ending June 2020 and the outlook for the fiscal year ending June 2020.

Table of Contents

Key Points

1. Corporate Overview

2. First Half of the Fiscal Year ending June 2020 Earnings Results

3. Fiscal Year ending June 2020 Earnings Forecasts

4. Future Plans - Medium-Term Business Plan (from FY2019 to FY 2021)-

5. Conclusions

<Reference: Corporate Governance>

Key Points

- In the first half of the FY ending June 2020, sales and operating income increased 19.6% and 32.1% respectively year on year. Sawing and drilling works, the Company’s core business, rose 24.1% year on year as mainly transportation infrastructure performed well and also ASIRE, a company that has strength in water jet for architecture, was made into a subsidiary. Projects with high profitability, such as operations related to water supply and airport, and curtailment of variable costs and selling, general and administrative expenses caused operating income margin to improve 1.3 points to 14.2%.

- The earnings forecast for the full fiscal year remains unchanged, and the Company expects to see a 5.6% increase in sales and a 1.7% decrease in operating income. The forecasts for the second half are conservative as demand for operation in the Tokyo metropolitan area is expected to drop during and around the Olympics. The Company plans to strengthen efforts to win highway renewal work orders for the next term. It will also continue to focus on recruiting and training. For the next FY ending June 2021, the Company expects to see a 10.8% increase in sales and a 10.4% increase in operating income from its forecast in FY ending June 2020, as there will be no more temporary factors affecting the results.

- The progress rates toward the forecast for the full year are 56.7% for sales (50.0% in the previous term on a full-term results basis) and 73.2% for operating income (54.4% in the previous term on a full-term results basis). While they are progressing at a faster pace than expected, the forecast for the full fiscal year was kept unchanged considering the uncertainty regarding the impact of the Olympics. However, the medium-term outlook is favorable. Infrastructure developed during the period of high economic growth is now in a phase to be renewed or repaired, which means that business opportunities are expanding for the Company, being the largest in the industry for sawing and drilling works, which are compatible with renewal and repair works. The Company will expand its operations while improving productivity and the working environment.

1.Corporate Overview

DAI-ICHI CUTTER KOGYO is providing maintenance and repair services for social infrastructure based on its expertise in diamond and water jet method, as well as services of building maintenance and reuse and recycling of IT equipment. The diamond method uses industrial diamonds to saw and drill roads and structures. In the conventional concrete crushing method, it was always necessary to be conscious of nuisances such as noise, vibration, dust, but in the diamond method, the operation can be executed safely, speedily, accurately and without having an adverse effect on the environment. On the other hand, the water jet method destroys concrete bonds by jetting water under extremely high pressure. With this method, a concrete structure can be repaired with pinpoint accuracy without damaging reinforcing steels.

The Group includes 5 consolidated subsidiaries, WALLCUTTING Co., Ltd which engages in wire saw and core boring works; KOUMEI Corporation which is strong in offshore engineering (underwater sawing and drilling works); Shin Shin Corporation which is based in Okinawa Prefecture; ASIRE Corporation which is strong in architecture-related water jet method; Movable Trade Networks Corporation which engages in reuse and recycling business; and equity method affiliates Diamond Kiko Corporation.

[Management Philosophy: Aiming to be the best group by contributing to the society with the specialized technologies and high-quality services]

With "aiming to be the best group by contributing to the society with specialized technologies and high-quality services" as its management philosophy, the Group provides specialized technologies at various construction sites with the keywords of "Sawing" "Chipping" "Cleaning" "Stripping" and "Grinding".

Business Policy: We intend to pursue aggressive sales strategies by utilizing our organizational capacity and business development capability.

Construction Policy: We improve our quality construction power.

Safety Policy: We promote the health and safety of our employees.

1-1 Business Overview

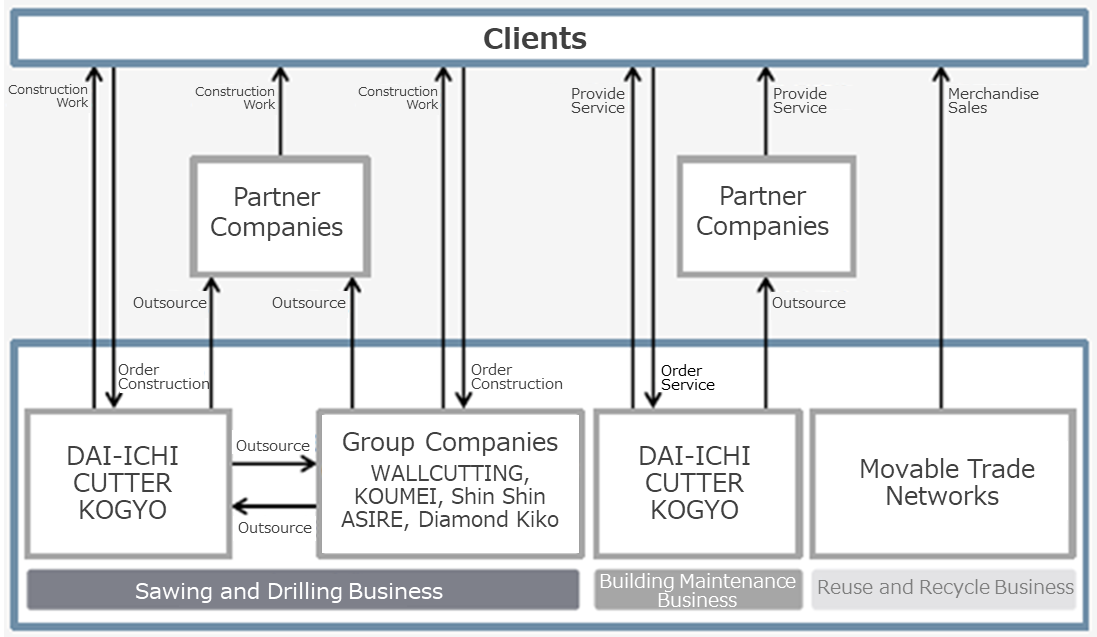

The business is divided into several categories, Sawing and Drilling Business, Building Maintenance Business, and Reuse and Recycling Business. The Sawing and Drilling Business is handled by DAI-ICHI CUTTER KOGYO, WALLCUTTING, KOUMEI Corporation, Shin Shin Corporation, ASIRE Corporation and Diamond Kiko. The Building Maintenance Business is handled by DAI-ICHI CUTTER KOGYO and the Reuse and Recycling Business is handled by Movable Trade Networks respectively.

Sales Distribution Ratio in FY ended June 2019 was 85.1%, 2.3%, and 12.6%.

(Source: the reference material of the Company)

Sawing and Drilling Business

“Sawing and drilling” refers to the sawing and drilling work necessary for various types of road pavement and the demolition and removal of concrete structures. The Company’s Sawing and Drilling Business mainly focuses on the diamond method using industrial diamond (Diamond Method is a registered trademark of DAI-ICHI CUTTER KOGYO) and the water jet method using water pressure. Wastewater generated from sawing and drilling work is collected and neutralized at a large intermediate treatment facility to be reused as cutting water. Waste generated from sawing concrete is dehydrated and recycled into raw materials for concrete.

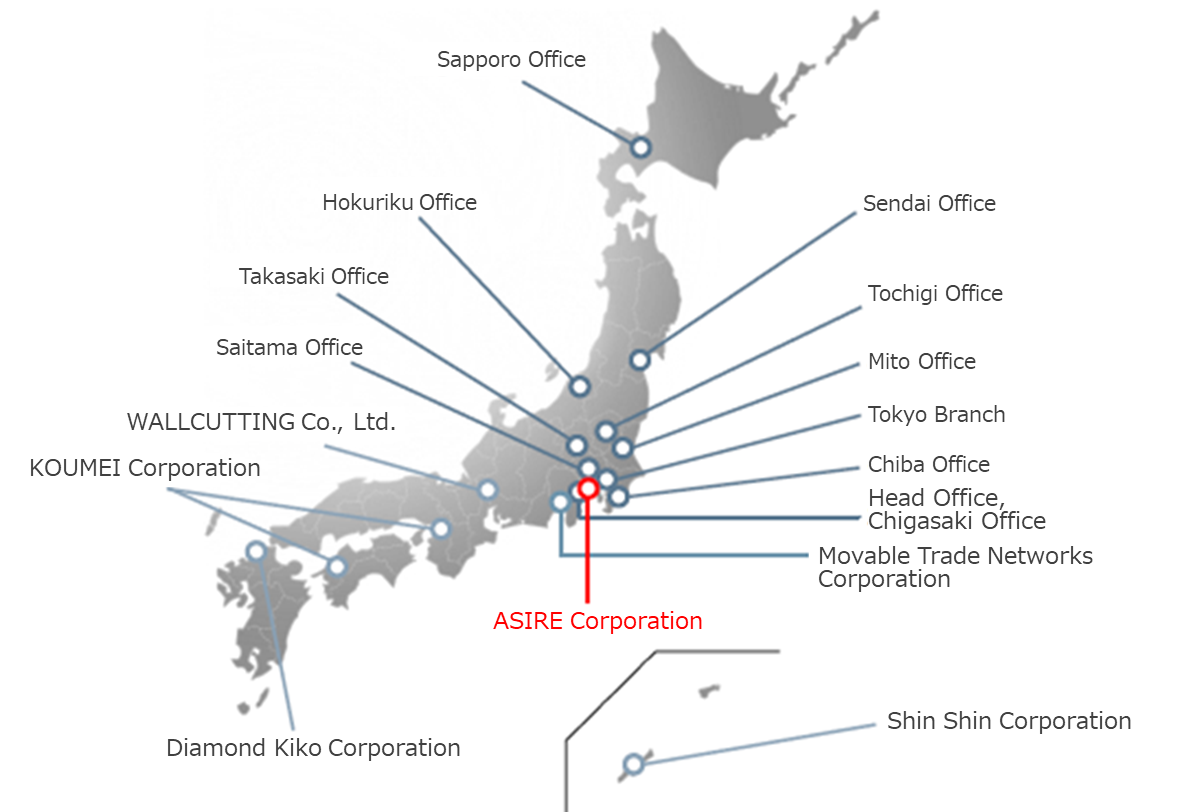

The Group operates nationwide. DAI-ICHI CUTTER KOGYO’s sales operation covers all eastern Japan. ASIRE has sales based in Kanagawa and Osaka. WALLCUTTING has sales based mainly in the Tokai region. KOUMEI has sales based in Osaka and the Chugoku and Shikoku regions. Shin Shin has sales based in Okinawa prefecture. Diamond Kiko has sales based in the Kyushu region.

As a contractor, the Group plays a major role in the work and maintenance of infrastructure, and its main clients are general contractors, road contractors, and facility providers. When they receive an order, they order sawing and drilling work of concrete to the Group. Since its clients mainly engage in public works, most of the works carried out by the Group are public works (except ASIRE whose clients are from the private sector). On the other hand, works other than public ones include maintenance of chemical plants, oil refineries, electric power plants as well as cleaning by water jet method. Works are classified into civil engineering works, architecture-related works, urban civil engineering works, road and airport works, and plant maintenance.

Main Clients

TAISEI CORPORATION, OBAYASHI CORPORATION, KAJIMA CORPORATION, SHO-BOND CORPORATION, TEKKEN CORPORATION, TOTETSU KOGYO CO., LTD., JFE Engineering Corporation, IHI Infrastructure Systems Co., Ltd., Nomura Real Estate Partners Co., Ltd., Taisei Rotec Corporation, KAJIMA ROAD CO., LTD., Sankyu Inc., Mitsubishi Jisho Community Co., Ltd., Mitsui Fudosan Residential Service Co., Ltd., NIPPO CORPORATION, THE NIPPON ROAD Co., Ltd., SHIMIZU CORPORATION, Sumitomo Mitsui Construction Co., Ltd. (in random order).

Civil Engineering Work DAI-ICHI CUTTER KOGYO undertakes repair and removal services for large structures, such as bridge, port and dam, as well as sawing and drilling services under special environments such as underwater operation. In those specific cases, services are carried out by the Company’s exclusive engineers.

|

Architecture-Related Work Various kinds of services for demolition and renewal works are carried out, such as demolition work of a building, base isolation work, seismic retrofit, repair work, and new construction. In addition, the Company can carry out service which is difficult by conventional methods, using alternative methods suitable for reducing the environmental load on the surrounding facilities.

|

Urban Civil Engineering Work The Company constructs civil engineering related works in urban infrastructure, such as railway operation, waste treatment facility, and waterworks facility, and is also involved in environment-related works that can be handled in total from planning to operation.

|

Road and Airport Construction The Company carries out various types of sawing and surface treatments for road repair, removal of deteriorated concrete, core drilling for installing lights, runway grooving at airports and others. Its strength is its ability to be able to do the operation even under specific conditions thanks to unique equipment such as grooving machines and custom-made vehicles for core drilling.

|

Maintenance of Production Facilities In the maintenance of production facilities, the Company carries out cleaning for plant maintenance, fireless sawing for remodeling work, repainting of floors, and substrate treatment. The Company ensures the quality and safety of the work by stationing certified workers for industrial cleaning.

|

Building Maintenance Business

DAI-ICHI CUTTER KOGYO is the only one in the group which handles with this business. In complex housing and office buildings, the Company carries out drain pipe cleaning, water tank cleaning, water supply facility inspection, floor cleaning, fiberscope survey, mechanical pit cleaning and so on services.

Reuse and Recycling Business

Reuse and Recycling Business is undertaken by Movable Trade Networks, a non-consolidated subsidiary, not subject to the equity method, and two non-equity method affiliates. In the Reuse Business, used IT-related equipment and office automation equipment, such as tablets, PCs, server, and liquid crystal displays (LCD displays), are purchased mainly from companies, and this equipment are sold mainly to corporate clients after data erasing and repairing. The Company also provides data erasing services of IT-related equipment and office installation services of office automation equipment mainly for corporate clients. Used products that are difficult to reuse are dismantled and then sold to material manufacturers. Afterwards, material dealers carry out intermediate processing and recycling. The items that the Company sells to recyclers range from general materials to “rare metals” such as gold, silver, cobalt and others.

1-2 Technology (The Company’s original method) - Diamond Method and Water Jet Method -

Diamond Method

The method is to saw and drill roads or structures by using an industrial diamond. Based on the five basic methods of flat sawing, core drilling, wall sawing, wire sawing, and grooving, the Company has developed a wide variety of diamond methods with its unique ideas.

The tools used in the diamond method are “Diamond Blade”, “Diamond Bit”, and “Diamond Wire”, each of which uses diamond segments. “Diamond Blade” is a blade whose edge is attached with segments made by hardening diamond powder with metal bond. The object is cut by rotating “Diamond Blade” at high speed (using different sizes depending on the type of material and the depth of sawing). “Diamond Bit” is a cylindrical tool with a cutting edges of diamond tips. It is rotated at a high speed to bore an object (using different bits depending on the size of a hole and the depth of the hole). “Diamond Wire” is made by attaching beads made by sintering diamond segments with metal bond to a wire at fixed intervals. “Diamond Wire” can cut any object even in a complicated shape.

Water Jet Method

In this method, high-speed water, pressurized and compressed by a high-pressure water generator and jetted from a nozzle, is used for chipping and washing. This method is attracting attention from the industry as an excellent method with consideration for the environment, because it has features such as generating less distortion, few microcracks, and less vibration.

The Company uses the system in a wide range of fields, including civil engineering, architecture, plant maintenance and the environment. In civil engineering and architecture, it is used in concrete removal, molding (opening through concrete walls, selective demolition of concrete structure), surface treatment, coating removal, cleaning, and others. In plant maintenance, it is used in cleaning work (including scale removal, and others.) of plant equipment such as tank reactors, and others. In addition, this method can be used for sawing metal (abrasive sawing), so it can be deployed in places where fire is strictly prohibited.

Less Vibration | Unlike the impact crushing by breakers, rock drills, and others, it is characterized by the mechanism to crush cement mortar bond of concrete by the energy of ultra-high-pressure water jetted from the nozzle. |

Minimal Impact on the Structure | Since deformation, strain and residual stress given to the object are small and microcracks are hardly generated, it is possible to work with the minimized impact on the structure. |

Pinpointed Removal | By setting the appropriate pressure and flow rate, only the deteriorated part of the concrete can be removed with pinpoint accuracy without damaging the reinforcing steels. |

Removing only Coating and Stains | By adjusting the pressure, only the coating or stains of the object can be removed. |

Remote Operation | Remote operation of the machine is easy because the nozzle does not contact with the object. This allows operation in curves and on curved surfaces with uniform quality. |

1-3 Core Competence

DAI-ICHI CUTTER KOGYO’s core competence is “human capital,” such as engineers, sales organization, and a network with partner companies. It is a source of high technology and strong sales and operation ability.

Group of Engineers (human capital) | A pioneer in the diamond industry with advanced technology and an overwhelming scale |

Sales Organization (human capital) | An organized sales structure which is rare in the industry |

Network of partner companies (human capital) | A high-quality network with partner companies, as well as branches and offices nationwide. |

Nationwide Business Development | A sales activity regardless of region because of its nationwide branches and offices. |

Nationwide Business Development

(Source: the reference material of the Company)

2. First Half of the Fiscal Year ending June 2020 Earnings Results

2-1 Consolidated Earnings

| 1H FY 2019 | Ratio to Sales | 1H FY 2020 | Ratio to Sales | Y-on-Y | Initial Forecast | Compared to Forecast |

Net Sales | 7,437 | 100.0% | 8,895 | 100.0% | +19.6% | 8,157 | +9.1% |

Gross Profit | 2,432 | 32.7% | 2,979 | 33.5% | +22.5% | - | - |

SG&A | 1,474 | 19.8% | 1,713 | 19.3% | +16.2% | - | - |

Operating Income | 958 | 12.9% | 1,266 | 14.2% | +32.1% | 1,024 | +23.7% |

Ordinary Income | 1,009 | 13.6% | 1,358 | 15.3% | +34.5% | 1,097 | +23.8% |

Profit attributable to owners of parent | 668 | 9.0% | 841 | 9.5% | +26.0% | 704 | +19.6% |

* Unit: million yen

* Ratio to Sales and Y-on-Y are calculated with numbers in units of a thousand yen, which is given on the financial results and securities reports.

19.6% increase in sales and 32.1% increase in operating income year on year

Net Sales were 8,895 million yen, up 19.6% year-on-year. Sawing and drilling works, the Company’s core business, rose 24.1% year on year as mainly transportation infrastructure performed well and also ASIRE, a company that has strength in water jet for architecture, was made into a subsidiary. The sales of the Building Maintenance Business also rose 5.4% year on year with an increase in the number of new contracts for high-rise condos, etc. mainly in the Tokyo metropolitan area, but the sales of the Reuse and Recycling Business declined 7.1% year on year due to the poor stocking of notebook computers.

Operating income was 1,266 million yen, up 32.1% year on year. Projects with high profitability, such as operations related to water supply and airport, and curtailment of variable costs caused gross profit margin to improve 0.8 points to 33.5%. Although selling, general and administrative expenses augmented 16.2% year on year with an increase in personnel in view of the future market expansion, selling, general and administrative ratio dropped 0.5 points to 19.3%.

2-2 Segment Earnings Trends

| 1H FY 2019 | Ratio to Sales/ Profit Ratio | 1H FY 2020 | Ratio to Sales/ Profit Ratio | Y-on-Y |

Sawing and Drilling Work | 6,296 | 84.6% | 7,813 | 87.8% | +24.1% |

Building Maintenance | 170 | 2.3% | 179 | 2.0% | +5.3% |

Reuse and Recycling | 971 | 13.1% | 902 | 10.1% | -7.1% |

Consolidated sales | 7,437 | 100.0% | 8,895 | 100.0% | +19.6% |

Sawing and Drilling Work | 1,249 | 19.8% | 1,516 | 19.4% | +21.4% |

Building Maintenance | 16 | 9.6% | 17 | 9.8% | +6.3% |

Reuse and Recycling | -11 | - | 67 | 7.4% | - |

Adjustments | -295 | - | -334 | - | - |

Consolidated operating income | 958 | 12.9% | 1,266 | 14.2% | +32.1% |

* Unit: million yen

* Ratio to Sales and Y-on-Y are calculated with numbers in units of a thousand yen, which is given on the financial results and securities reports.

Sawing and Drilling Business

The sales of completed works were 7,813 million yen (up 24.1% year on year), while income was 1,516 million yen (up 21.4% year on year). While the sales of transportation infrastructure such as expressways and railways increased around 45% year on year mainly in the Tokyo metropolitan area, the sales of service infrastructure works of ASIRE and water supply augmented about 16% year on year, and the sales of industrial infrastructure works including electricity-related work also rose around 30% year on year.

Building Maintenance Business

The sales of completed works were 179 million yen (up 5.3% year on year), while income was 17 million yen (up 6.3% year on year). The Company accepted the most profitable orders under the system placing importance on profitability, and carrying out operations on weekdays led many works to be handled by partner companies. As a result, sales augmented with an improvement in profitability.

Reuse and Recycling Business

Sales of goods were 902 million yen (down 7.1% year on year), while income was 67 million yen (loss of 11 million yen in the same period of the previous term). Sales declined due to the poor stocking of notebook computers, but profitability improved as the Company made profitable small transactions (the number of projects increased), and integrated operation bases by opening a large-scale operation yard (in Ebina, Kanagawa Prefecture).

Ratio to Sales

| Service Infrastructure | Transportation Infrastructure | Industry Infrastructure | Building Maintenance | Reuse and Recycling |

1H FY 6/19 | 53.3% | 21.3% | 10.0% | 2.3% | 13.1% |

1H FY 6/20 | 51.1% | 26.0% | 10.8% | 2.0% | 10.1% |

2-3 Financial Condition and Cash Flows (CF)

Financial condition

| June 2019 | December 2019 |

| June 2019 | December 2019 |

Cash | 5,698 | 5,338 | Payables | 718 | 875 |

Receivables | 2,480 | 3,338 | Taxes Payable | 240 | 526 |

Inventories | 574 | 503 | Retirement Provisions & Liabilities | 520 | 564 |

Current Assets | 8,913 | 9,289 | Interest-Bearing Liabilities | 1 | 53 |

Tangible Assets | 3,326 | 4,036 | Lease Obligations | 26 | 80 |

Intangible Assets | 104 | 500 | Liabilities | 2,348 | 3,185 |

Investment & Others | 960 | 1,103 | Net Assets | 10,956 | 11,742 |

Noncurrent Assets | 4,391 | 5,639 | Total Liabilities and Net Assets | 13,304 | 14,928 |

* Unit: million yen

Total assets at the end of the second quarter went up 1,623 million yen from the end of the previous term to 14,928 million yen as the Company expanded its operation and made ASIRE into a subsidiary. The Company is operating essentially without borrowing and has a high current ratio of 385.0% (493.3% at the end of the previous term). It also has a strong financial stability with fixed ratio at 207.5% (226.2% at the end of the previous term) and capital-to-asset ratio at 75.5% (79.3% at the end of the previous term).

Cash Flows (CF)

| 1H FY 2019 | 1H FY 2020 | Y-on-Y | |

Operating Cash Flow (A) | 588 | 852 | +263 | +44.8% |

Investing Cash Flow (B) | -410 | -1,145 | -735 | - |

Free Cash Flows (A + B) | 178 | -293 | -471 | - |

Financing Cash Flow | -158 | -152 | +5 | - |

Term End Cash and Equivalents | 5,316 | 5,253 | -63 | -1.2% |

* Unit: million yen

An operating CF of 852 million yen was secured with a pre-tax profit of 1,371 million yen (1,020 million yen in the previous term), a depreciation of 226 million yen (187 million yen in the previous term), and tax expenses of -209 million yen (-493 million yen in the previous term). Investing CF includes the acquisition of tangible fixed assets, expenses incurred for M&A of ASIRE, etc., and financing CF consists of mainly payment of dividends.

3. Fiscal Year ending June 2020 Earnings Forecasts

3-1 Consolidated Earnings

| FY 2019 Act. | Ratio to Sales | FY 2020 Est. | Ratio to Sales | Y-on-Y |

Net sales | 14,871 | 100.0% | 15,700 | 100.0% | + 5.6% |

Operating Income | 1,760 | 11.8% | 1,730 | 11.0% | -1.7% |

Ordinary Income | 1,843 | 12.4% | 1,856 | 11.8% | + 0.7% |

Profit Attributable to Owners of Parent | 1,251 | 8.4% | 1,080 | 6.9% | -13.7% |

*Unit: million yen

The forecast for the full fiscal year remains unchanged. Sales are projected to grow 5.6% year on year while operating income is expected to decline 1.7% year on year.

Although the results of the first half exceeded the forecast made at the beginning of the term, the forecast for the second half was conservative as demand for sawing and drilling works in the Tokyo metropolitan area is anticipated to decline during and around the Olympics.

In the Sawing and Drilling Business, the Company will enhance sales of the expressways for which East Nippon, Central Nippon, West Nippon Expressway Companies (NEXCO) are working on renewal projects, bridge repair works, electricity-related works, etc. In the Building Maintenance Business, it will continue to strengthen its business placing importance on profitability and focusing on high-rise apartment buildings. In the Reuse and Recycling Business, it will focus on acquiring new large clients.

The Company plans to pay an annual dividend of 22 yen per share, which is an increase of 2 yen (projected dividend payout ratio of 11.6%). For the time being, it plans to actively invest in "Human Capital" "Productivity" "Research and Development" and "Expanding the Scope of Business", trying to raise the level of the dividend payout ratio over the medium term.

4. Future Plans - Medium-Term Business Plan (from FY2019 to FY 2021)-

The strengths of DAI-ICHI CUTTER KOGYO, the industry leader, are the number and quality of “human capital.” As the maintenance and repair market is expected to grow with deterioration of infrastructure, the Company is implementing the following four basic strategies mainly related to “human capital.”

Basic Strategy. 1 Strengthening and expanding human resource recruitment and development | ・Carrying out various activities for the recruitment and discovery of human resources. ・Enhancement of training systems and provision of support for acquisition of official qualifications to retain human resources ・Improvement in work-life balance ・Employment of foreign workers |

Basic Strategy. 2 Strengthening business development | ・Further cultivation of existing customers ・Acquire potential customers ・Carrying out activities in pursuit of profits ・Overseas business expansion ・Expansion of business fields |

Basic Strategy. 3 Strengthening the network of partner companies | ・Maintenance and improvement of the quality of service by providing technical guidance to partner companies, etc. ・Active utilization of partner companies for efficient business operation ・Expansion of business fields including capital alliance and M&A |

Basic Strategy. 4 Research and development | ・Establishment of methods by carrying out numerous experimental operations and demonstration tests ・Investment in new technology (including business and capital alliance) |

Growth investment

The Company will “construct a strong human resource base” as it will serve as the key element for continuous growth of existing businesses, mainly Sawing and Drilling Business, overseas business expansion in the future, and business expansion in new business fields. The Company will invest 2.52 billion yen over 3 years in human capital development, productivity improvement, expansion of business fields, and research and development.

The Company invested 720 million yen in human capital (workers), as they are its core competence, in FY 2019, the first year of the Medium-term Business Plan. Due to the acquisition of ASIRE which will be consolidated from FY ending June 2020, the cumulative investment forecast for 3 years has been increased to 2.52 billion yen from the original 2 billion yen.

Growth Investment Plan

| Detail | FY 2019 Act. | FY 2020 Target | FY 2021 Target | Total |

Human Resources Development | Recruitment and training | 170 million yen | 100 million yen | 100 million yen | 370 million yen |

Productivity Improvement | Improving the workplace environment and promoting work style reforms | 400 million yen | 300 million yen | 300 million yen | 1 billion yen |

Expansion of Business Fields | Establish new sales offices, M&A | 120 million yen | 700 million yen | 200 million yen | 1.02 billion yen |

Research and Development | Investment in R&D and new technologies | 30 million yen | 50 million yen | 50 million yen | 130 million yen |

Total | 720 million yen | 1.15 billion yen | 650 million yen | 2.52 billion yen | |

4-1 Human Capital Development

DAI-ICHI CUTTER KOGYO will continue to implement measures to strengthen recruitment and retain human resources. The Company plans to actively hire both new graduates and mid-career workers, and it will strengthen cooperation with each university through direct engagement with university club activities for the former. As for mid-career workers, the Company will transform the system of recruitment from the one that meets the demand of each region to year-round recruitment conducted by the head office in which workplace is not restricted. In addition, the Company started distributing “interactive videos” in which the story develops as the viewers choose answers, in order to make its existence, which has been hidden, visible.

As a measure to enhance the retention rate, the Company will develop its branding strategy by promoting its work style reforms.

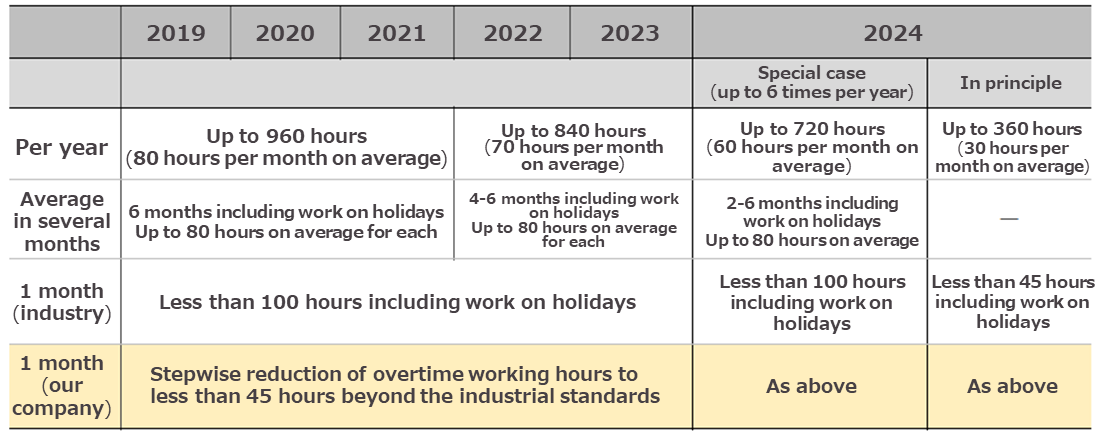

As part of the branding strategy, the Company will work on visualizing the future and deliver the attraction of working at the Companies sites by utilizing Instagram and Facebook. Furthermore, it will promote work style reforms ahead of regulations of the industry considering the “need to make the workplace attractive in comparison to other industries to secure human resources.”

Upper limit of overtime hours and the Company’s initiative

(Source: the reference material of the Company)

4-2 Business development

The Company aims to acquire large-scale projects planned for transportation and industrial infrastructure and floor slab renewal projects planned for bridges in the highway renewal project. Also, the Company will strengthen SFA (Sales Force Automation) and work on visualization of customer and project management through IT investment and strengthen the coordination among the Group companies and departments within the Company in order to enhance response capabilities to customers and projects across business areas.

Large-scale projects include transportation infrastructure works, such as floor slab replacement of Yodogawaoohashi of National Route 2 (Osaka), aseismic reinforcing work of the bridge of the Tohoku Expressway in Tochigi Prefecture, improvement work of Tozai Line (Tokyo), which has one of the worst crowds among other railways, to reduce congestion and prevent delays, and expansion of Haneda Airport (Tokyo), and industrial infrastructure works, such as repair work of the hydroelectric power station of Sagurigawa Dam (Niigata) and demolition work of the chimney of Naie Thermal Power Station (Hokkaido). As for floor slab renewal work, the Company expects to receive orders for 8 properties which includes the total of 25 bridges along with the orders already received in the FY ending June 2020, and 10 properties which includes the total of 26 bridges in the FY ending June 2021.

Regarding utilization of SFA, the Company will digitalize management of actions, customers, and projects, and reports. In order to enhance response capabilities to customers and projects across business areas, the Company established a floor slab replacement project team across the offices, branch offices, operations departments, and even Group companies, while keeping the highway renewal projects which are under progress all over Japan in mind.

4-3 Strengthening of the network of partner companies

The Company plans to strengthen the network by supporting partner companies by improving the productivity through enhancement of training and vehicle allocating functions.

Training systems

The Industrial Safety and Health Act, which established standards regarding safety and health of workers, was revised as part of development of related laws to promote work style reforms, and enforced in April 2019. From the perspective of preventing occupational accidents, construction companies are also required to take appropriate measures in support of the revised Health Act, but many of them, mainly small-to-medium-scale companies, lack understanding and satisfactory trainings systems. As part of strengthening of the network of partner companies, the Company will provide different types of training related to the revised Health Act to each partner company. In addition, a regular training will also be carried out every month.

The official operation of “Construction Career Up System (CCUS)” led by the Ministry of Land, Infrastructure, Transport and Tourism started in April 2019. The CCUS makes the qualifications, experiences, hands-on experience of workers and site foremen working at worksites into database and allows management of work history on IC cards, and it was established to improve problems related to wages and career advancement with the aim of making the industry attractive. The Company plans to familiarize the partner companies with the system through enlightenment activities.

Vehicle allocating functions

In the Group, around 1,000 workers operate at about 300 sites every day. The Company will promote the establishment of an allocation system by optimizing regions, work types and skill levels in order to respond to work style reforms and shortage of labor, reduce working hours, and improve productivity. It will also make efforts to establish a system to realize paperless operations.

4-4 Research and development - Hydro-JetRD method, Ecoa Core Drill, visualization-

The “Hydro-JetRD method” (developed jointly with TOBISHIMA CORPORATION and Hanshin Expressway Company Limited in June 2019), a new method for shortening the operation period for bridge floor slab replacement won “Technology Award” of Kansai Branch of the Japan Society of Civil Engineers, “Infrastructure Technology Development Award” of Japan Institute of Country-ology and Engineering, and “President’s Award” of Hanshin Expressway Company Limited. It uses separation technology of steel beams and RC floor slabs resulting from the improvement and combination of the Company’s technologies “XY chipping device” and “WJ drilling device,” and is currently under preparation to be used for the traffic lanes.

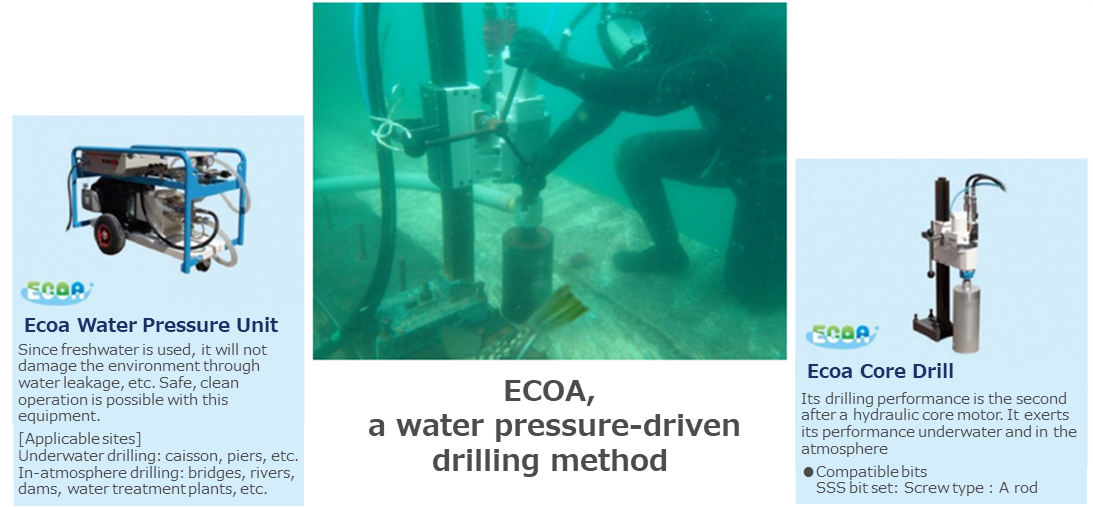

The Company developed “Ecoa Core Drill” jointly with SHIBUYA Co., Ltd. (Hatsukaichi, Hiroshima Prefecture; President Norikazu Shibuya). “Ecoa Core Drill” is a drilling machine equipped with a water pressure-driven drilling motor which avoids the risk of oil leakage during waterside or submerged works (water pressure-driven drilling method). In waterside or submerged work in which electric tools cannot be used, operations are generally carried out using hydraulic oil equipment and air tools, and is therefore necessary to take measures to prevent oil leakage from the hydraulic oil equipment. As “Ecoa Core Drill” is equipped with a water pressure-driven drilling motor (which does not use hydraulic oil), it does not require measures to prevent oil leakage or the disposal of waste oil, which leads to an improvement in work efficiency and a reduction of workload. It can provide added value for water-involving works at rivers, ports, etc.

As for “visualization,” the Company started working on visualizing the levels of finished works of the surface treatment method. The purpose is to quantify the levels of finished works which relied on the intuition of workers so far, and the Company aims to put it into use within 2020.

(Source: the reference material of the Company)

5.Conclusions

The progress rates toward the forecast for the full year are 56.7% for sales (50.0% in the previous term on a full-term results basis) , 73.2% for operating income (54.4% in the previous term on a full-term results basis), 73.2% for ordinary income (54.8% in the previous term on a full-term results basis), and 77.9% for net income (53.4% in the previous term on a full-year results basis). While they are progressing at a faster pace than expected, the forecast for the full fiscal year was kept unchanged considering the uncertainty regarding the impact of the Olympics.

Although the landing point of the current term is hard to foresee due to the Olympics, the medium-term outlook is favorable. Infrastructure developed during the period of high economic growth must be renewed or repaired now as their durability and strengths are declining. The generation of “constructing” is shifting to the generation of “renovation and renewal,” as suggested by the scale of the renewal and repair market, which will be up to around 5.1 trillion yen in 2023 according to the Ministry of Land, Infrastructure, Transport and Tourism. The maintenance and renewal expenditures are expected to reach nine trillion yen in 2038, exceeding the total investment (maintenance cost + renewal cost + disaster-relief expenses + cost of new establishment) in 2010. This is anticipated to bring great benefits to the Company, being the largest in the industry for sawing and drilling works, which are compatible with renewal and repair works. The Company will expand its operations while improving productivity and the working environment. We look forward to the future progress.

<Reference: Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an Audit & Supervisory Board |

Directors | 5 directors, including 2 outside directors |

Auditors | 3 auditors, including 2 outside auditors |

◎Corporate Governance Report (last updated on October 7, 2019)

Basic Concept

The Company recognizes that building a corporate governance system that enables coexistence and co-prosperity with stakeholders, such as clients, shareholders, local communities, and employees, and improving corporate value over the medium to long term is an important management issue. In addition, in order to ensure the transparency and soundness of management, they appointed outside auditors and outside directors to strengthen management monitoring functions.

<the Principles of the Corporate Governance Code which the Company doesn’t Carry out and the Reasons >

[Principle 1 -4. Strategically held shares]

As a general rule, they do not strategically hold shares. However, if it is determined that maintaining and strengthening stable business relationships in total consideration of the nature and scale of transactions will contribute to the improvement of the Company’s corporate value, the Company may strategically hold shares of its clients. The Board of Directors examines each year whether the shares held by the Company contribute to the improvement of corporate value. If it is judged that the holding of the shares is no longer meaningful, as a result of the examination, the Company will proceed with selling the shares as deemed appropriate. Regarding the exercise of voting rights in shares held by the Company, the Company will exercise the voting rights after examining whether there is any possibility of damaging the Company's corporate value.

[Principle 5 -1. Policy on constructive dialogue with shareholders]

The Company’s Corporate Planning Department is in charge of investor relations. For shareholders and investors, it holds semiannual financial results briefings and hold individual meetings. In addition, the Company recognizes that in order to promote constructive dialogue with shareholders and investors, building and maintaining trusting relationships with them is important, and that for this purpose, it is essential to appropriately disclose information. In order to put this awareness into practice, in addition to disclosure based on laws and regulations, the Company actively discloses information deemed important to shareholders and other stakeholders (including non-financial information) as well as actively discloses management strategies and the state of management on its website.

The design and disclosure of policies concerning the development of organizational structure and its initiatives to promote constructive dialogue with shareholders will be subject to future consideration.

<The Principles of the Corporate Governance Code which the Company Disclosed>

Principle 3 -1. Enhancement of Information Disclosure

(i)The Company’s corporate philosophy and other information are disclosed on the Company website and in the financial results explanatory materials.

(ii)Basic policies on corporate governance are disclosed on the Company website and in the report on corporate governance.

(iii)The compensation for directors and corporate auditors is determined by resolution of the board of directors within the limit defined at the shareholders meeting, with due consideration of contribution of each director and their business performances in view of future management strategies.

The above information is disclosed in the Securities Report.

(iv)The Company does not stipulate the policies and procedures for nominating candidates for directors and corporate auditors in its internal rules, but the board of directors selects candidates who are capable of fulfilling the duties and responsibilities of directors and corporate auditors who have abundant experience and high insight with excellent character.

(v)Reasons for selecting candidates for directors and corporate auditors are disclosed in the notice of convocation of the general meeting of shareholders.

The purpose of this report is to provide information only and not for soliciting or promoting you to make investments. The information and opinions contained in this report are provided by our company based on data which are publicly available. The information in this report is based on the sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. We do not guarantee the accuracy, completeness or validity of the information and opinions, nor do we bear any responsibility for the same. All rights relating to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions shall be made by the responsibility of individuals with thorough consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (DAI-ICHI CUTTER KOGYO: 1716) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.