Bridge Report:(1716)DAI-ICHI CUTTER KOGYO Second quarter of the FY ending June 2021

President Masamitsu Takahashi | DAI-ICHI CUTTER KOGYO K.K. (1716) |

|

Company Information

Market | TSE 1st |

Industry | Construction |

President | Masamitsu Takahashi |

HQ address | 833 Hagisono, Chigasaki-shi, Kanagawa |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (End of term) | Total market cap | ROE (Act.) | Trading Unit | |

1,336 yen | 12,000,000 shares | ¥16,032 million | 13.5% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥14.00 | 1.0% | ¥101.99 | 13.1x | ¥1,116.73 | 1.2x |

* The share price is the closing price as of March 4, 2021. The number of outstanding shares, DPS, EPS, and BPS were taken from the brief report on earnings results for the second quarter of the FY ending June 2021. ROE is the result in the previous term.

Earnings Trends

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Profit Attributable to Owners of Parent | EPS | DPS |

June 2017 Act. | 12,840 | 1,412 | 1,473 | 990 | 87.00 | 7.50 |

June 2018 Act. | 16,283 | 2,187 | 2,263 | 1,487 | 130.68 | 12.50 |

June 2019 Act. | 14,871 | 1,760 | 1,843 | 1,251 | 109.90 | 10.00 |

June 2020 Act. | 17,440 | 2,296 | 2,482 | 1,523 | 133.86 | 12.50 |

June 2021 Est. | 16,860 | 1,888 | 1,983 | 1,160 | 101.99 | 14.00 |

* The estimated values are based on the forecasts made by the Company.

* Unit: million-yen, yen

*A 2-for-1 stock split was conducted on January 1, 2021. EPS and DPS were adjusted retroactively.

We will report on the financial results of DAI-ICHI CUTTER KOGYO K.K. for the second quarter of the FY ending June 2021, the outlook for the fiscal year ending June 2021 and so on.

Table of Contents

Key Points

1. Corporate Overview

2. The second quarter of the Fiscal Year ending June 2021 Earnings Results

3. Fiscal Year ending June 2021 Earnings Forecasts

4. Future Plan -Medium-term Business Plan-

5. Conclusions

<Reference: Corporate Governance>

Key Points

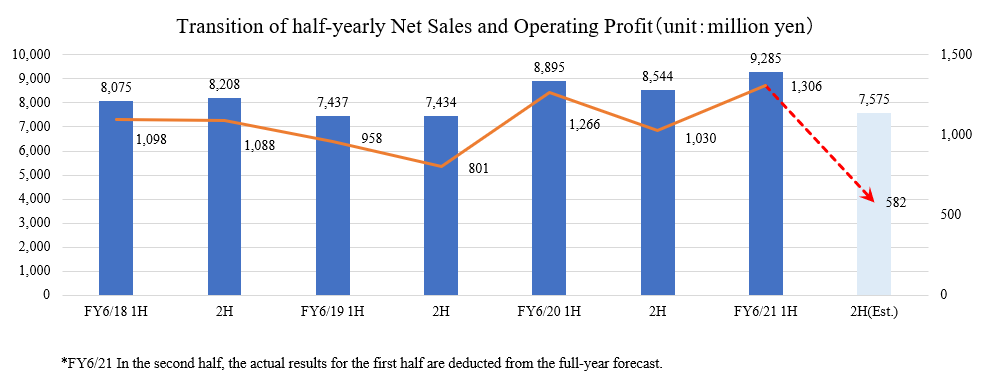

- The Net Sales for the second quarter of the FY ending June 2021 were 9,285 million yen, up 4.4% year on year. The sales of the Sawing and Drilling Business, which is their mainstay, increased 4.4%, mainly due to the repair works of expressways and bridges. The sales of the Building Maintenance Business rose 21.3% year on year, despite the effects of the COVID-19 pandemic. The sales of the Reuse and Recycling Business, too, grew 0.8% year on year. Operating Profit rose 3.2% year on year to 1,306 million yen. Gross profit margin increased 0.6 points, thanks to the improvement in operation rate of sawing and drilling works and the adjustment of less profitable projects in the Reuse and Recycling Business. It offset the augmentation of SG&A, including the costs for investing in R&D for enhancing technological capabilities and the costs for recruitment, training, etc. of personnel. Net Profit declined 2.0% year on year to 825 million yen, due to the increase in income taxes. Net Sales and Operating Profit both hit record highs, exceeding the estimates, but the company considers that declining domains are becoming apparent in the COVID-19 crisis.

- In the first half, Net Sales and Profit increased, exceeding the initial estimates, but the full-year earnings forecasts for the FY ending June 2021 were left unchanged, because some domains are declining amid the COVID-19 crisis. Net Sales are estimated to decrease 3.3% year on year to 16.86 billion yen. The company is expected to receive orders for anti-deterioration works, which are not urgent, in a relatively stable manner, but due to the drop in revenues amid the COVID-19 pandemic, the domains related to investment of private sectors are projected to decline, and in the field of public investment, the allocation of budgets to construction investment is forecasted to decrease, due to the allocation of budgets to the projects for coping with the COVID-19 will be made from the next fiscal year. Operating Profit is estimated to drop 17.8% year on year to 1.88 billion yen. As the profits of general contractors are projected to decrease, the company assumes that it will become difficult to receive orders through competitive bidding due to the pressure to cut prices. The company aims to maintain profitability by focusing on new operation methods and advantageous fields, and plans to continue active investment in R&D for enhancing its technological capabilities and in recruitment, training, etc. of personnel while studying the investment field and its details. The term-end dividend is to be 14 yen/share, up 1.5 yen/share, and the estimated payout ratio is 13.7%.

- In the first half of the FY ending June 2021, Net Sales and Profit grew, but Quarterly Net Sales and Profit in the period from October to December dropped. It seems that the number of orders for works related to airports, which are the forte of the company, was sluggish in the COVID-19 crisis. In the second half, whether the Tokyo Olympic and the Paralympic Games will be held or not will affect the business performance of the company in various ways. If they are held, the use of heavy-duty trucks will be restricted and the operation of Metropolitan Expressway will be delayed. If they are not held, the operation will progress, but private capital investment is estimated to decline. Amid the COVID-19 crisis, the business environment will remain uncertain, but from a short-term standpoint, we would like to wait for the earnings results for the third quarter (January to March).

- From a mid-term viewpoint, we are interested in what kind of roadmap will be shown in the next mid-term plan, as all the values planned in the current mid-term plan have been achieved one year earlier than expected. Among the efforts for strengthening human capital, which is the core competence of the company, reform of workstyles is a challenge for the company, while being the most important key to the sustainable improvement of their corporate value.

1.Corporate Overview

DAI-ICHI CUTTER KOGYO is providing maintenance and repair services for social infrastructure based on its expertise in diamond and water jet method, as well as services of building maintenance and reuse and recycling of IT equipment. The diamond method uses industrial diamonds to saw and drill roads and structures. In the conventional concrete crushing method, it was always necessary to be conscious of nuisances such as noise, vibration, dust, but in the diamond method, the operation can be executed safely, speedily, accurately and without having an adverse effect on the environment. On the other hand, the water jet method destroys concrete bonds by jetting water under extremely high pressure. With this method, a concrete structure can be repaired with pinpoint accuracy without damaging reinforcing steels.

The Group includes 5 consolidated subsidiaries, WALLCUTTING Co., Ltd which engages in wire saw and core boring works; KOUMEI Corporation which is strong in offshore engineering (underwater sawing and drilling works); Shin Shin Corporation which is based in Okinawa Prefecture; ASIRE Corporation which is strong in architecture-related water jet method; Movable Trade Networks Corporation which engages in reuse and recycling business; and Diamond Kiko Corporation, which is an equity method affiliate.

The company operates 23 business establishments, including newly established ones and subsidiaries acquired through M&A, around Japan.

1-1 Corporate History

The founder of the Company, who worked at the operation company that introduced flat saws for roads for the first time in Japan, foresaw the expansion in demand for that in the future. He then founded the Company in Chigasaki in Kanagawa Prefecture in August 1967. He did this to engage in the sawing and drilling work of asphalt and concrete structures with the diamond method.

The Company had few projects at first. However, the Ministry of operation (no Ministry of Land, Infrastructure, Transport and Tourism) issued a directive making it mandatory to use flat saws from a safety perspective when performing road cutting work. This triggered an increase in the amount of this work.

While other companies in the same industry were doing business locally, the Company expanded to Chiba, Tochigi, Mito and Takasaki upon opening its Sapporo Office in June 1969. At the same time, it also expanded the scope of its operations to include the drilling and cutting work of concrete structures in addition to road cutting. The mobility to respond quickly to customer needs, the level of operation quality, and the wealth of knowledge and expertise on materials and machines used in operations have been highly appreciated by the Company’s customers. Therefore, its business operations steadily expanded and it registered its stock over the counter with the Japan Security Dealers Association in 2004.

In the 2000s, the Company further accelerated its diversification of methods and expansion of offices across Japan through M&As. It then listed on the First Section of the Tokyo Stock Exchange in December 2017. It is working to solve the social issues faced by Japan (e.g., aging infrastructure).

【1-2. Corporate Philosophy】

The company's management philosophy is “aiming to be the best group by contributing to the society with specialized technologies and high-quality services".

The Company provides specialized technologies at various job sites with the keywords of "Sawing" "Chipping" "Cleaning" "Stripping" and "Grinding". The Company develops its respective businesses for the entire world and aims to become the best company.

Marketing Policy | To conduct active proposal-based marketing by utilizing organizational power and information |

Operation Work Policy | To enhance operation work capabilities, which represent the quality of the company |

Safety Policy | To protect the safety and health of workers |

【1-3. Business Overview】

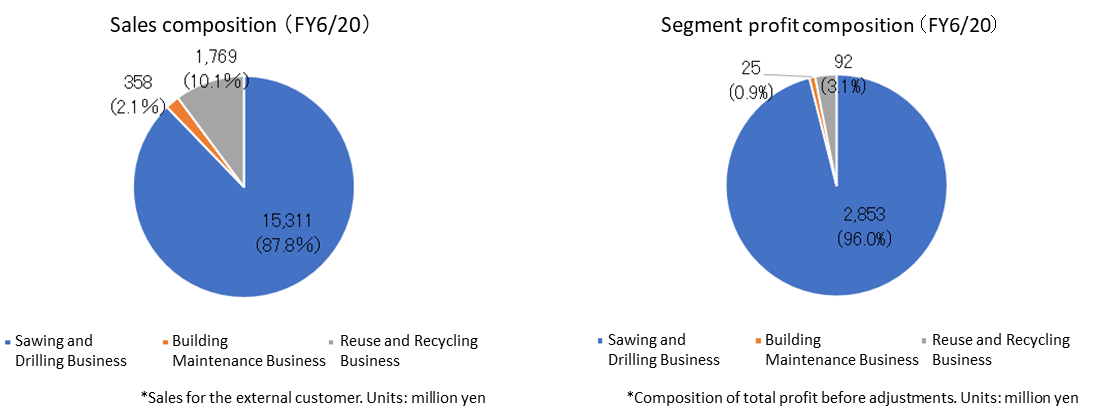

The business is divided into several categories, Sawing and Drilling Business, Building Maintenance Business, and Reuse and Recycling Business. The Sawing and Drilling Business is handled by DAI-ICHI CUTTER KOGYO, WALLCUTTING, KOUMEI Corporation, Shin Shin Corporation, ASIRE Corporation and Diamond Kiko. The Building Maintenance Business is handled by DAI-ICHI CUTTER KOGYO and the Reuse and Recycling Business is handled by Movable Trade Networks respectively.

<Sawing and Drilling Business>

“Sawing and drilling” refers to the sawing and drilling work necessary for various types of road pavement and the demolition and removal of concrete structures. The Company’s Sawing and Drilling Business mainly focuses on the diamond method using industrial diamond (Diamond Method is a registered trademark of DAI-ICHI CUTTER KOGYO) and the water jet method using water pressure. Wastewater generated from sawing and drilling work is collected and neutralized at a large intermediate treatment facility to be reused as cutting water. Waste generated from sawing concrete is dehydrated and recycled into raw materials for concrete.

(Source: The Company’s website)

The Group operates nationwide. DAI-ICHI CUTTER KOGYO’s sales operation covers all eastern Japan. ASIRE has sales based in Kanagawa and Osaka. WALLCUTTING has sales based mainly in the Tokai region. KOUMEI has sales based in Osaka and the Chugoku and Shikoku regions. Shin Shin has sales based in Okinawa prefecture. Diamond Kiko has sales based in the Kyushu region.

As a constructor, the Group plays a major role in the work and maintenance of infrastructure, and its main clients are general contractors, road contractors, and facility providers. When they receive an order, they order sawing and drilling work of concrete to the Group. Since its clients mainly engage in public works, most of the works carried out by the Group are public works (except ASIRE whose clients are from the private sector). On the other hand, works other than public ones include maintenance of chemical plants, oil refineries, electric power plants as well as cleaning by water jet method. Works are classified into civil engineering works, architecture-related works, urban civil engineering works, road and airport works, and plant maintenance.

◎Main Clients

TAISEI CORPORATION, OBAYASHI CORPORATION, KAJIMA CORPORATION, SHO-BOND CORPORATION, TEKKEN CORPORATION, TOTETSU KOGYO CO., LTD., JFE Engineering Corporation, IHI Infrastructure Systems Co., Ltd., Nomura Real Estate Partners Co., Ltd., Taisei Rotec Corporation, KAJIMA ROAD CO., LTD., Sankyu Inc., Mitsubishi Jisho Community Co., Ltd., Mitsui Fudosan Residential Service Co., Ltd., NIPPO CORPORATION, THE NIPPON ROAD Co., Ltd., SHIMIZU CORPORATION, Sumitomo Mitsui Construction Co., Ltd. (in random order).

◎Main operating work contents

Civil Engineering Work DAI-ICHI CUTTER KOGYO undertakes repair and removal services for large structures, such as bridge, port and dam, as well as sawing and drilling services under special environments such as underwater operation. In those specific cases, services are carried out by the Company’s exclusive engineers. |

Architecture-Related Work Various kinds of services for demolition and renewal works are carried out, such as demolition work of a building, base isolation work, seismic retrofit, repair work, and new construction. In addition, the Company can carry out service which is difficult by conventional methods, using alternative methods suitable for reducing the environmental load on the surrounding facilities. |

Urban Civil Engineering Work The Company operates civil engineering related works in urban infrastructure, such as railway operation, waste treatment facility, and waterworks facility, and is also involved in environment-related works that can be handled in total from planning to operation. |

Road and Airport Operation The Company carries out various types of sawing and surface treatments for road repair, removal of deteriorated concrete, core drilling for installing lights, runway grooving at airports and others. Its strength is its ability to do the operation even under specific conditions thanks to unique equipment such as grooving machines and custom-made vehicles for core drilling. |

Maintenance of Production Facilities In the maintenance of production facilities, the Company carries out cleaning for plant maintenance, fireless sawing for remodeling work, repainting of floors, and surface treatment. The Company ensures the quality and safety of the work by stationing certified workers for industrial cleaning. |

◎Main technology : The Company’s original method

*Diamond Method

The method is to saw and drill roads or structures by using an industrial diamond. Based on the five basic methods of flat sawing, core drilling, wall sawing, wire sawing, and grooving, the Company has developed a wide variety of diamond methods with its unique ideas.

The "Diamond Method" is a registered trademark of the company, and it has the No. 1 track record in the industry.

The tools used in the diamond method are “Diamond Blade”, “Diamond Bit”, and “Diamond Wire”, each of which uses diamond segments.

“Diamond Blade” is a blade whose edge is attached with segments made by hardening diamond powder with metal bond.

The object is cut by rotating “Diamond Blade” at high speed (using different sizes depending on the type of material and the depth of sawing).

“Diamond Bit” is a cylindrical tool with a cutting edges of diamond tips. It is rotated at a high speed to bore an object (using different bits depending on the size of a hole and the depth of the hole).

“Diamond Wire” is made by attaching beads made by sintering diamond segments with metal bond to a wire at fixed intervals. “Diamond Wire” can cut any object even in a complicated shape.

Flat Sawing

Generally, flat sawing is the most suitable solution to sawing horizontal surfaces such as floors, floor slabs and pavement. The machine is mounted with a diamond blade. An operator walks from behind and operates the machine by only himself as the machine progresses. It is used for joint sawing, sawing concrete parts for replacement and removal of damaged pavement, and sawing pavement parts when laying pipes under the pavement such as electricity, telephone, gas, water, and sewer pipes. The power source of the machine is gasoline, diesel, electricity and oil pressure. Water is set to come up to the sawing edge during the sawing process in order to cool the cutting edge heated by sawing (dry flat sawing uses compressed air for cooling).

(Source: The Company’s website)

Core Drilling

In this method, holes are made on objects that are drilled by a diamond bit. Core drilling is used in the field where accurate circular sawing is required. Any diameter of hole can be easily perforated, for water supply and drainage pipes, electric wiring, ducts for air-conditioning system, seismic reinforcement, and others. Core drilling can be very useful when the accuracy of the finish is especially required, such as when collecting samples for strength inspection, drilling holes for anchor bolts, and stitch drilling when removing a part of a thick wall.

(Source: The Company’s website)

Wall Sawing

In this method, a traveling guide rail is fixed to a wall, a slope, a floor or the like with anchor bolts, and an object is cut by high-speed rotation of a diamond blade and movement of a machine on the track. Wall sawing is often used to install door openings, vents, and windows, and can be cut at both right and oblique angles. As it saws along the rail, it can accurately secure an opening. It can also be operated remotely, making it safe to work in any situation. The compact and lightweight machine makes it easy to carry and provides excellent mobility even in places with limited work space such as buildings, expressways and subways.

(Source: The Company’s website)

Wire Sawing

In this method, an object is cut by rotating the wire saw at a high speed by a hydraulic or engine type machine while maintaining a constant tension in the wire saw. The method can easily saw a thick and complicated structure regardless of the shape of the object. It can also be operated remotely or automatically, so it can be used safely and freely in all environments, including underwater, high places, and undergrounds.

(Source: The Company’s website)

Grooving

In this method, multiple shallow grooves (safety groove) are carved on a road surface in a direction parallel or perpendicular to the traveling direction of vehicles. Diamond blades are attached to a cylindrical device called a drum at a predetermined pitch, which is rotated to cut a road surface (to improve quality of the road surface by improving slip resistance and drainage). And a drum is attached with a grooving machine. There are both dry method and wet method, and by carving grooves on runways, paved roads and steep slopes, slippage can be prevented. This method was first used at an airport in England in 1956, and has spread throughout the world.

(Source: The Company’s website)

*Water Jet Method

In this method, high-speed water, pressurized and compressed by a high-pressure water generator and jetted from a nozzle, is used for chipping and washing. This method is attracting attention from the industry as an excellent method with consideration for the environment, because it has features such as generating less distortion, few microcracks, and less vibration.

The Company uses the water jet method in a wide range of fields, including civil engineering, architecture, plant maintenance and the environment. In civil engineering and architecture, it is used in concrete removal, molding (opening through concrete walls, selective demolition of concrete structure), surface treatment, coating removal, cleaning, and others. In plant maintenance, it is used in cleaning work (including scale removal, and others.) of plant equipment such as tank reactors, and others. In addition, this method can be used for sawing metal (abrasive sawing), so it can be deployed in places where fire is strictly prohibited.

(The strong point of Water Jet Method)

Less Vibration | Unlike the impact crushing by breakers, rock drills, and others, it is characterized by the mechanism to destroy cement mortar bond of concrete by the energy of ultra-high-pressure water jetted from the nozzle. |

Minimal Impact on the Structure | Since deformation, strain and residual stress given to the object are small and microcracks are hardly generated, it is possible to work with the minimized impact on the structure. |

Pinpointed Removal | By setting the appropriate pressure and flow rate, only the deteriorated part of the concrete can be removed with pinpoint accuracy without damaging the reinforcing steels. |

Removing only Coating and Stains | By adjusting the pressure, only the coating or stains of the object can be removed. |

Remote Operation | Remote operation of the machine is easy because the nozzle does not contact with the object. This allows operation in curves and on curved surfaces with uniform quality. |

<Building Maintenance Business>

DAI-ICHI CUTTER KOGYO is the only one in the group which handles this business. In complex housing and office buildings, the Company carries out drain pipe cleaning, water tank cleaning, water supply facility inspection, floor cleaning, fiberscope survey, mechanical pit cleaning and so on.

<Reuse and Recycling Business>

Reuse and Recycling Business is undertaken by Movable Trade Networks Co., Ltd., a non-consolidated subsidiary subject to the equity method, and two non-equity method affiliates. In the Reuse Business, used IT-related equipment and office automation equipment, such as tablets, PCs, server, and liquid crystal displays (LCD displays), are purchased mainly from companies, and this equipment are sold mainly to corporate clients after data erasing and repairing. The Company also provides data erasing services of IT-related equipment and office installation services of office automation equipment mainly for corporate clients. Used products that are difficult to reuse are dismantled and intermediately processed, then sold to material manufacturers which carry out the recycling. The items that the Company sells to recyclers range from general materials to “rare metals” such as gold, silver, cobalt and others.

2. The second quarter of the Fiscal Year ending June 2021Earnings Results

2-1 Consolidated Earnings for the first half

| FY 6/20 2Q | Ratio to Sales | FY 6/21 2Q | Ratio to Sales | Y-on-Y | Compared to Forecast |

Net Sales | 8,895 | 100.0% | 9,285 | 100.0% | +4.4% | +5.5% |

Gross Profit | 2,979 | 33.5% | 3,162 | 34.1% | +6.1% | - |

SG&A | 1,713 | 19.3% | 1,856 | 20.0% | +8.3% | - |

Operating Profit | 1,266 | 14.2% | 1,306 | 14.1% | +3.2% | +19.6% |

Ordinary Profit | 1,358 | 15.3% | 1,415 | 15.2% | +4.2% | +17.2% |

Quarterly Net Profit | 841 | 9.5% | 825 | 8.9% | -2.0% | +2.7% |

EBITDA | 1,493 | 16.8% | 1,576 | 17.0% | +5.6% | - |

* Unit: million yen

4.4% increase in Sales and 3.2% increase in Operating Profit year-on-year. Net Sales and Operating Profit both hit record highs, exceeding the estimates.

The Net Sales for the second quarter of the FY ending June 2021 were 9,285 million yen, up 4.4% year on year. The sales of the Sawing and Drilling Business, which is their mainstay, increased 4.4%, mainly due to the repair works of expressways and bridges. The sales of the Building Maintenance Business rose 21.3% year on year, despite the effects of the COVID-19 pandemic. The sales of the Reuse and Recycling Business, too, grew 0.8% year on year.

Operating Profit rose 3.2% year on year to 1,306 million yen. Gross profit margin increased 0.6 points, thanks to the improvement in operation rate of sawing and drilling works and the adjustment of less profitable projects in the Reuse and Recycling Business. It offset the augmentation of SG&A, including the costs for investing in R&D for enhancing technological capabilities and the costs for recruitment, training, etc. of personnel. Net Profit declined 2.0% year on year to 825 million yen, due to the increase in income taxes.

Net Sales and Operating Profit both hit record highs, exceeding the estimates, but the company considers that declining domains are becoming apparent in the COVID-19 crisis.

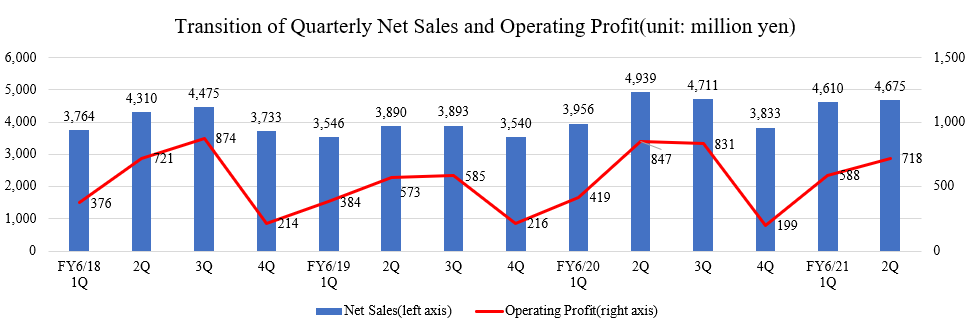

Quarterly Net Sales and Profit decreased from the second quarter of the previous term before the onset of the pandemic.

(Note) As the business of the company is mostly related to public works, Net Sales tend to be concentrated in the second quarter (October to December) and the third quarter (January to March), while the Net Sales in the first quarter (July to September) and the fourth quarter (April to June) tend to be smaller. The company plans to level off the deviations in business performance, but it is estimated that Net Sales will continue to be concentrated in the second and third quarters for some time.

2-2 Segment Earnings Trends

| FY 6/20 2Q | Ratio to Sales/ Profit Ratio | FY 6/21 2Q | Ratio to Sales/ Profit Ratio | Y-on-Y |

Sawing and Drilling Business | 7,813 | 87.8% | 8,158 | 87.9% | +4.4% |

Building Maintenance Business | 179 | 2.0% | 217 | 2.3% | +21.3% |

Reuse and Recycling Business | 902 | 10.1% | 909 | 9.8% | +0.8% |

Consolidated sales | 8,895 | 100.0% | 9,285 | 100.0% | +4.4% |

Sawing and Drilling Business | 1,516 | 19.4% | 1,535 | 18.8% | +1.2% |

Building Maintenance Business | 17 | 9.8% | 20 | 9.4% | +16.5% |

Reuse and Recycling Business | 67 | 7.4% | 102 | 11.2% | +52.3% |

Adjustments | -334 | - | -350 | - | - |

Consolidated operating profit | 1,266 | 14.2% | 1,306 | 14.1% | +3.2% |

* Unit: million yen

Net Sales and Profit grew in all business segments.

Sawing and Drilling Business

Net Sales were 8.15 billion yen, up 4.4% year on year, and profit was 1.53 billion yen, up 1.2% year on year.

The number of orders for mainly repair works of expressways and bridges increased. Meanwhile, the orders related to living infrastructure and industrial infrastructure declined. Asire Corporation, which became a consolidated subsidiary in the previous term, contributed to Net Sales and Profit.

Building Maintenance Business

Net Sales were 210 million yen, up 21.3% year on year, and profit was 20 million yen, up 16.5% year on year.

The company approached leading developers for making new deals mainly in the Tokyo Metropolitan Area. The company mainly conducted the works that had been put off due to COVID-19 in the fourth quarter of the previous term.

Operation rate rose. The enhancement of the network of affiliated companies was successful.

Reuse and Recycling Business

Net Sales were 900 million yen, up 0.8% year on year, and profit was 100 million yen (67 million yen in the previous term).

The company concentrated on increasing customers related to the sales of used smartphones, etc., and succeeded to gain major customers with high profit margin. As the company also curtailed SG&A, profit margin rose 3.8 points.

2-3 Financial Condition and Cash Flows (CF)

Financial condition

| June 2020 | Dec 2020 |

| June 2020 | Dec 2020 |

Cash | 6,348 | 6,171 | Payables | 637 | 697 |

Receivables | 2,640 | 2,959 | Taxes Payable | 502 | 524 |

Inventories | 468 | 523 | Retirement Provisions & Liabilities | 577 | 601 |

Current Assets | 9,630 | 9,774 | Interest-Bearing Liabilities | 101 | 246 |

Tangible Assets | 4,063 | 4,964 | Lease Obligations | 64 | 61 |

Intangible Assets | 466 | 427 | Liabilities | 2,985 | 3,251 |

Investment & Others | 1,373 | 1,407 | Net Assets | 2,548 | 13,322 |

Noncurrent Assets | 5,903 | 6,799 | Total Liabilities and Net Assets | 15,533 | 16,573 |

*Unit: Million-yen

Total assets increased 1,040 million yen from the end of the previous term to 16,573 million yen, due to the augmentation of receivables, tangible assets, etc.

Liabilities rose 266 million yen from the end of the previous term to 3,251 million yen, due to the increase in long-term debts, etc.

Net assets grew 773 million yen from the end of the previous term to 13,322 million yen, due to the increases in retained earnings and valuation difference on available-for-sale securities, etc.

Capital-to-asset ratio declined 0.4 points from the end of the previous term to 76.7%.

Cash Flows (CF)

| FY 6/20 2Q | FY 6/21 2Q | Y-on-Y |

Operating Cash Flow | 852 | 856 | +4 |

Investing Cash Flow | -1,145 | -981 | +164 |

Free Cash Flow | -293 | -124 | +168 |

Financing Cash Flow | -152 | -50 | +102 |

Term End Cash and Equivalents | 5,253 | 6,141 | +887 |

* Unit: million yen

Operating CF was almost unchanged from the previous term. The deficits of investing CF and free CF shrank, as there was no longer expenditure for acquiring the shares of a subsidiary that changed the scope of consolidation, which was posted in the previous term.

The cash position improved.

3. Fiscal Year ending June 2021 Earnings Forecasts

3-1 Consolidated Earnings

| FY 6/20 Act. | Ratio to Sales | FY 6/21 Est. | Ratio to Sales | Y-on-Y |

Net sales | 17,440 | 100.0% | 16,860 | 100.0% | -3.3% |

Operating Profit | 2,296 | 13.2% | 1,888 | 11.2% | -17.8% |

Ordinary Profit | 2,482 | 14.2% | 1,983 | 11.8% | -20.1% |

Net Profit | 1,523 | 8.7% | 1,130 | 6.7% | -23.8% |

*Unit: million yen

No change in earnings forecasts. Net Sales are expected to decrease 3.3% year-on-year, Operating Profit is expected to decrease 17.8%

In the first half, Net Sales and Profit grew, exceeding the initial estimates, but the full-year earnings forecasts were left unchanged, because some domains became sluggish in the COVID-19 crisis. Net Sales are estimated to decrease 3.3% year on year to 16.86 billion yen. The company is expected to receive orders for anti-deterioration works, which are not urgent, in a relatively stable manner, but due to the drop in revenues amid the COVID-19 pandemic, the domains related to investment of private sectors are projected to decline, and in the field of public investment, the allocation of budgets to operation investment is forecasted to decrease, due to the allocation of budgets to the projects for coping with the COVID-19 will be made from the next fiscal year.

Operating Profit is estimated to drop 17.8% year on year to 1.88 billion yen. As the profits of general contractors are projected to decrease, the company assumes that it will become difficult to receive orders through competitive bidding due to the pressure to cut prices. The company aims to maintain profitability by focusing on new operation methods and advantageous fields, and plans to continue active investment in R&D for enhancing its technological capabilities and in recruitment, training, etc. of personnel while studying the investment field and its details.

The term-end dividend is to be 14 yen/share, up 1.5 yen/share, and the estimated payout ratio is 13.7%.

4.Future Plan -Medium-term Business Plan-

Outline of Medium-term Business Plan

DAI-ICHI CUTTER KOGYO is part subcontractors who dispatch engineers directly. However, it has established a unique position specializing in sawing and drilling work as a "specialized contractor," and the formation of a group of engineers with high technical capabilities essential for sawing and drilling work is the key to growth. For this reason, the Company’s Medium-term Business Plan is pursuing four basic strategies with a focus on human capital.

The quantitative targets for Sales, Profits, number of employees and others were achieved a year ahead of schedule in FY ended June 2020, but DAI-ICHI CUTTER KOGYO will continue to further strengthen its activities in the transportation infrastructure and industrial infrastructure sectors in the Sawing and Drilling Business (increasing the Sales Composition Ratio).

The investment for growth (improving personnel and productivity, expanding the business domain, and conducting R&D) will be continued. The company plans to fulfill its responsibilities for CSR and SDGs through the post-disaster restoration volunteer system and the agreement for support at the time of disaster with public institutions.

As for transportation and industrial infrastructure, the company hopes to raise the ratio of sales from them to total sales of 50% by the FY ending June 2024, five years from now.

(The ratio between the sales of living infrastructure and the sales of transportation and industrial infrastructure in the FY ended June 2018 was 56.9: 43.1)

4-1 Quantitative Targets

| FY 6/19 Plan | FY 6/19 Act. | FY 6/20 Plan | FY 6/20 Act. | FY6/21 Plan | FY 6/21 2Q |

Net Sales | 14,318 | 14,871 | 15,700 | 17,440 | 17,400 | 9,285 |

Operating Profit | 1,624 | 1,760 | 1,730 | 2,296 | 1,910 | 1,306 |

Operating Profit Margin | 11.3% | 11.8% | 11.0% | 13.2% | 11.0% | 14.1% |

Profit Attributable to Owners of Parent | 1,014 | 1,251 | 1,080 | 1,523 | 1,190 | 825 |

EPS | 89.12 | 109.90 | 94.88 | 133.86 | 104.54 | 72.49 |

|

|

|

|

|

|

|

Number of Employees (Consolidated) | 500 | 501 | 525 | 568 | 550 | 578 |

*Unit: Million-yen, yen, person. EPS is shown for the previous fiscal year according to the current number of shares outstanding, since a 1:2 stock split was implemented on January 1, 2021.

The quantitative targets for all items were achieved a year ahead of schedule in FY ended June 2020, the second year of the Medium-term Business Plan. As of the end of the first half of this term, financial figures are healthy.

4-2 Sales Composition Ratio by Infrastructure

| FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 | FY 6/20 | FY 6/21 2Q |

Living Infrastructure | 62.0% | 59.1% | 56.9% | 58.9% | 54.8% | 51.4% |

Transportation Infrastructure | 23.5% | 26.6% | 27.0% | 29.0% | 32.2% | 38.1% |

Industrial Infrastructure | 14.6% | 14.3% | 16.1% | 12.1% | 12.9% | 10.5% |

The sales related to railroads and airports were affected strongly by the COVID-19 crisis, but the sales from anti-deterioration works of expressways (renewal of slabs and aseismic reinforcement) were healthy. As a result, the ratio of sales related to transportation infrastructure increased.

4-3 Growth Investment

| Content | FY 6/19 Act. | FY 6/20 Act | FY 6/21 Plan | FY 6/21 2Q | 3 years accumulative |

Human Resource Development | Recruitment and Training | 170 | 200 | 100 | 130 | 470 |

Productivity Improvement | Improvement of workplace environment and promotion of work style reforms | 400 | 410 | 300 | 510 | 1,110 |

Expansion of Business Fields | Establishment of new offices, M&A | 120 | 870 | 200 | 10 | 1,190 |

Research and Development | Investment in R&D and new technologies | 30 | 80 | 50 | 10 | 160 |

Total | 720 | 1,560 | 650 | 660 | 2,930 | |

*Unit : million yen

As a result of the acquisition of two companies in FY ended June 2020, the cumulative investment forecast for 3 years increased to 2.93 billion yen (when the Medium-term Business Plan was formulated, it was planned to be 2 billion yen in 3 years).

4-4 SDGs Activities

DAI-ICHI CUTTER KOGYO aims to contribute to the achievement of SDGs based on the idea that “as a player who supports social infrastructure, contributions to stakeholders including local communities are the repayment of favors and are indispensable for continuing its business in the future.”

In detail, the company was selected as a partner for the naming right contract, which was attempted by Chigasaki City for the first time, in January 2021. The central park, which is a place for citizens’ relaxation, was named Daiichi Cutter Kiiro Park in April 2021.

It has been 54 years since the company built its headquarters in Chigasaki City, and many employees are citizens of Chigasaki. The company has grown, with the support from this region. Hoping to contribute to the local economy and enhance employees’ awareness of social contribution through this naming right, the company applied for the partner’s position and was selected. (Activities related to SDGs 11 and 15 among 17 SDGs)

On February 1, 2021, the company launched IBUKI, a service supporting the employment of disabled people at indoor farms. The company’s employees with disabilities engage in the cultivation of herbs and the processing of herbs for drinks, such as herbal tea, at the booth of the company in IBUKI EBINA FARM 3. (Activities related to SDGs 8 and 10 among 17 SDGs)

In addition, the company donated yellow safety hats for first-year elementary school pupils to Chigasaki City. Chigasaki City used to distribute yellow hats to elementary schools free of charge, but due to financial difficulties, the city planned to shift to a system in which safety hats are purchased by respective households in fiscal 2021. Receiving this information, the company decided to purchase 2,140 hats for first-year pupils and school cloth badges to be attached to them, and will donate them via the city. (Activities related to SDGs 4 and 11 among 17 SDGs)

4-5 Future plan

The future plans for investment in human resources, marketing, and R&D, which are their basic strategies, are as follows.

(1) Investment in human resources

The formation of a group of excellent craftsmen is a key to their sustainable growth.

① Recruitment

In order to recruit personnel continuously and surely, the company is diversifying recruitment methods.

The company will cement the cooperation with individual universities and diversify routes for recruiting new graduates, including offer types and introduction types.

As for the employment of mid-career workers, the company used to recruit them in each region according to demand, but will shift to a system of recruiting them throughout the year in all regions, because it is producing good results.

② Brand development

The company will focus on the brand development of craftsmen, who take significant roles for maintaining and repairing the deteriorated infrastructure in Japan.

In the first half of this term, the company produced and released a video for introducing its vision, etc.

https://www.youtube.com/watch?v=JywTRAXxLYs

The company aims to enhance its corporate value by designing a mid-term brand development strategy and linking it with the next mid-term management plan.

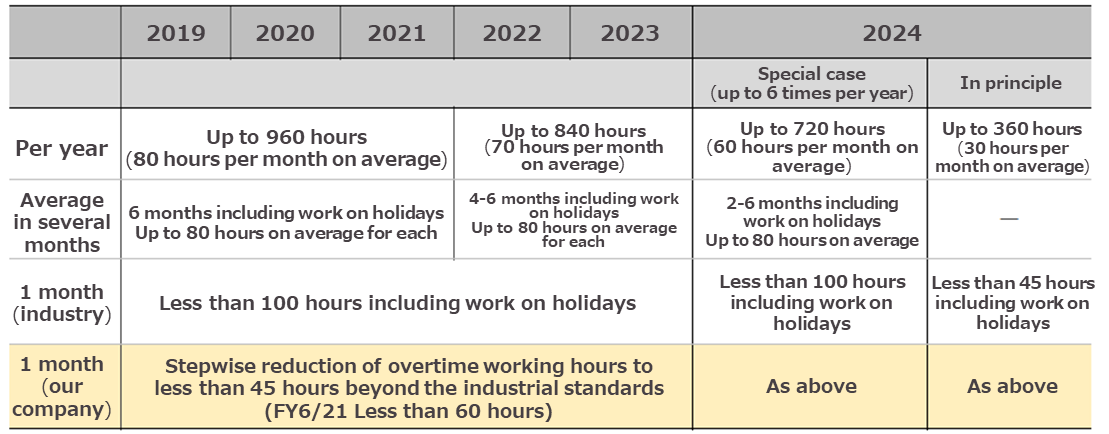

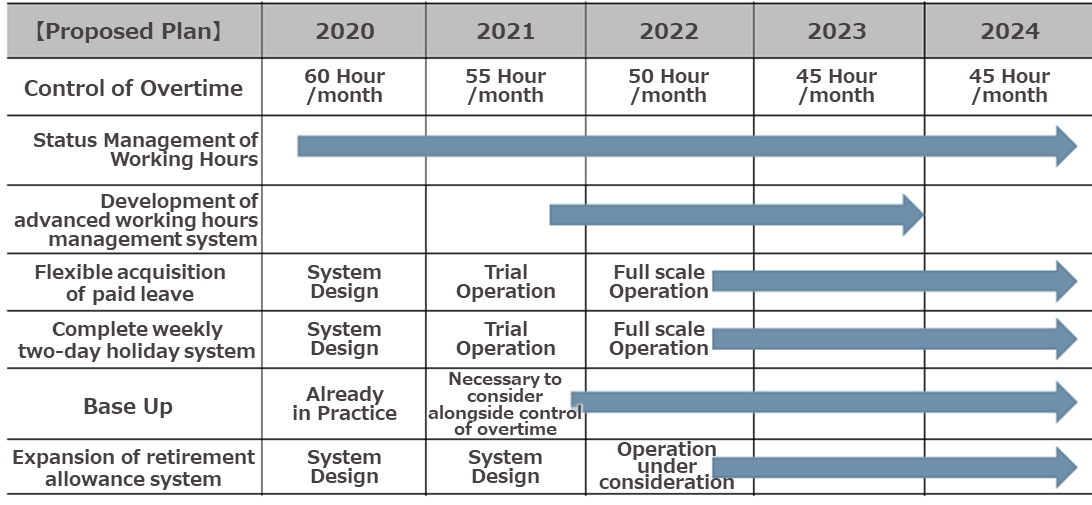

③ Work Style Reforms

DAI-ICHI CUTTER KOGYO will promote work style reforms and a work-life balance project in line with the industry standards. In work style reforms, the Company will promote a work style reform that precedes the following industry regulations from the viewpoint that it is necessary to have an attractive workplace compared to other industries in order to secure human resources.

(Source: the reference material of the Company)

Furthermore, in the work-life balance project, the Company aims not only to comply with overtime regulations but also to pursue a more attractive working style compared to other industries. In the next term, the company plans to start a system in which employees can take paid holidays flexibly on a full-scale basis.

(Source: the reference material of the Company)

(2) Marketing

① Large-scale projects

The company received orders for aseismic reinforcement of water supply facilities in Chiba and repairment of pump stations in Tokyo in the field of living infrastructure, embankment improvement in Kanagawa and expressway improvement in Tokyo in the field of transportation infrastructure, and repairment of a blast furnace in Hokkaido and installation of an offshore wind power plant in Akita in the field of industrial infrastructure.

The company will accumulate the experience of installing offshore wind power plants, with an eye on the carbon neutral in 2050.

② Renewal of slabs

As the number of orders and business inquiries exceeds supply capacity, the company aims to maximize efficiency by developing a group-wide system for receiving orders and conducting works.

To do so, the company formed a project team for replacing slabs composed of members from the operation, design, and marketing sections.

Seasonal factors (spring and autumn) are strong for this work, so the company will pay attention to the balance with other works.

③ Information control

The company is developing SFA (sales force automation), and plans to start operating it in the next term.

More advanced and labor-saving information sharing will be realized, and productivity will be improved through remote processing and shortened operation hours.

(3) R&D

① Follow-up pulley

The company developed a follow-up pulley unit, which improves productivity by saving labor and workforce in setups.

Drawing their inspiration from the braking mechanism in another field, they embodied their idea. The fact that it was developed in house based on the knowledge of employees without involving any manufacturers is meaningful, from the viewpoints of growth and accumulation of technological development capabilities.

② Technologies under development

The company started applying the visualization of skills of expert engineers, which is for increasing the speed of acquiring skills, to a broad range of fields.

In addition, the company is developing dry operation methods, semi-automation of works, cutting depth management methods, etc.

③ Developed technologies

The Hydro-Jet RD method, which enables rapid repair of slabs, was used in the first half.

Based on this experience, the company will apply this method to expressways around Japan.

Ecoa Core Drill, a hydraulic boring method, is being tentatively adopted in works related to rivers, dams, and ports.

As it has been registered in NETIS, New Technology Information System of the Ministry of Land, Infrastructure, Transport and Tourism, the number of business inquiries is expected to increase.

The company is developing more related technologies.

5.Conclusions

In the first half of the FY ending June 2021, Net Sales and Profit grew, but Quarterly Net Sales and Profit in the period from October to December dropped. It seems that the number of orders for works related to airports, which are the forte of the company, was sluggish in the COVID-19 crisis.

In the second half, whether the Tokyo Olympic and the Paralympic Games will be held or not will affect the business performance of the company in various ways. If they are held, the use of heavy-duty trucks will be restricted and the operation of Metropolitan Expressway will be delayed. If they are not held, the operation will progress, but private capital investment is estimated to decline. Amid the COVID-19 crisis, the business environment will remain uncertain, but from a short-term standpoint, we would like to wait for the earnings results for the third quarter (January to March).

From a mid-term viewpoint, we are interested in what kind of roadmap will be shown in the next mid-term plan, as all the values planned in the current mid-term plan have been achieved one year earlier than expected. Among the efforts for strengthening human capital, which is the core competence of the company, reform of workstyles is a challenge for the company, while being the most important key to the sustainable improvement of their corporate value.

<Reference: Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with a board of company auditors |

Directors | 5 directors, including 2 outside directors |

Auditors | 3 auditors, including 2 outside auditors |

◎Corporate Governance Report (last updated on October 2, 2020)

Basic Concept

The Company recognizes that building a corporate governance system that enables coexistence and co-prosperity with stakeholders, such as clients, shareholders, local communities, and employees, and improving corporate value over the medium to long term is an important management issue. In addition, in order to ensure the transparency and soundness of management, they appointed outside auditors and outside directors to strengthen management monitoring functions.

<the Principles of the Corporate Governance Code which the Company doesn’t Carry out and the Reasons >

[Principle 1 -4. Strategically held shares]

As a general rule, they do not strategically hold shares. However, if it is determined that maintaining and strengthening stable business relationships in total consideration of the nature and scale of transactions will contribute to the improvement of the Company’s corporate value, the Company may strategically hold shares of its clients. The Board of Directors examines each year whether the shares held by the Company contribute to the improvement of corporate value. If it is judged that the holding of the shares is no longer meaningful, as a result of the examination, the Company will proceed with selling the shares as deemed appropriate. Regarding the exercise of voting rights in shares held by the Company, the Company will exercise the voting rights after examining whether there is any possibility of damaging the Company's corporate value.

[Principle 5 -1. Policy on constructive dialogue with shareholders]

The Company’s Corporate Planning Department is in charge of investor relations. For shareholders and investors, it holds semiannual financial results briefings and hold individual meetings. In addition, the Company recognizes that in order to promote constructive dialogue with shareholders and investors, building and maintaining trusting relationships with them is important, and that for this purpose, it is essential to appropriately disclose information. In order to put this awareness into practice, in addition to disclosure based on laws and regulations, the Company actively discloses information deemed important to shareholders and other stakeholders (including non-financial information) as well as actively discloses management strategies and the state of management on its website.

The design and disclosure of policies concerning the development of organizational structure and its initiatives to promote constructive dialogue with shareholders will be subject to future consideration.

<The Principles of the Corporate Governance Code which the Company Disclosed>

Principle 3 -1. Enhancement of Information Disclosure

(i)The Company’s corporate philosophy and other information are disclosed on the Company website and in the financial results explanatory materials.

(ii)Basic policies on corporate governance are disclosed on the Company website and in the report on corporate governance.

(iii)The compensation for directors and corporate auditors is determined by resolution of the board of directors within the limit defined at the shareholders meeting, with due consideration of contribution of each director and their business performances in view of future management strategies.

The above information is disclosed in the Securities Report.

(iv)The Company does not stipulate the policies and procedures for nominating candidates for directors and corporate auditors in its internal rules, but the board of directors selects candidates who are capable of fulfilling the duties and responsibilities of directors and corporate auditors who have abundant experience and high insight with excellent character.

(v)Reasons for selecting candidates for directors and corporate auditors are disclosed in the notice of convocation of the general meeting of shareholders

The purpose of this report is to provide information only and not for soliciting or promoting you to make investments. The information and opinions contained in this report are provided by our company based on data which are publicly available. The information in this report is based on the sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. We do not guarantee the accuracy, completeness or validity of the information and opinions, nor do we bear any responsibility for the same. All rights relating to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions shall be made by the responsibility of individuals with thorough consideration. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |