Bridge Report:(1716)DAI-ICHI CUTTER KOGYO second quarter of FY ending June 2022

President Masamitsu Takahashi | DAI-ICHI CUTTER KOGYO K.K. (1716) |

|

Company Information

Market | TSE 1st |

Industry | Construction |

President | Masamitsu Takahashi |

HQ address | 833 Hagisono, Chigasaki-shi, Kanagawa |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (End of term) | Total market cap | ROE (Act.) | Trading Unit | |

1,310 yen | 12,000,000 shares | ¥15,720 million | 13.6% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥27.00 | 2.1% | ¥137.46 | 9.5x | ¥1,365.03 | 1.0x |

* The share price is the closing price as of March 11, 2022. Number of shares issued, DPS, EPS and BPS are taken from the brief report on earnings results for the second quarter of FY ending June 2022. ROE is from the previous results.

Earnings Trends

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Profit Attributable to Owners of Parent | EPS | DPS |

June 2018 Act. | 16,283 | 2,187 | 2,263 | 1,487 | 130.68 | 12.50 |

June 2019 Act. | 14,871 | 1,760 | 1,843 | 1,251 | 109.90 | 10.00 |

June 2020 Act. | 17,440 | 2,296 | 2,482 | 1,523 | 133.86 | 12.50 |

June 2021 Act. | 19,337 | 2,760 | 2,936 | 1,743 | 153.16 | 18.00 |

June 2022 Est. | 19,998 | 2,746 | 2,922 | 1,564 | 137.46 | 27.00 |

* The estimated values are based on the forecasts made by the Company. Unit: million-yen, yen

*A 2-for-1 stock split was conducted on January 1, 2021. EPS and DPS were adjusted retroactively.

We will report on the financial results of DAI-ICHI CUTTER KOGYO K.K. for the second quarter of FY ending June 2022, the outlook for the fiscal year ending June 2022 and so on.

Table of Contents

Key Points

1. Corporate Overview

2. The Second Quarter of Fiscal Year ending June 2022 Earnings Results

3. Fiscal Year ending June 2022 Earnings Forecasts

4. Progress of Medium-term Business Plan Strategy FY6/22-FY6/24

5. Conclusions

<Reference1: Medium-term Business Plan Strategy FY6/22-FY6/24>

<Reference2: Corporate Governance>

Key Points

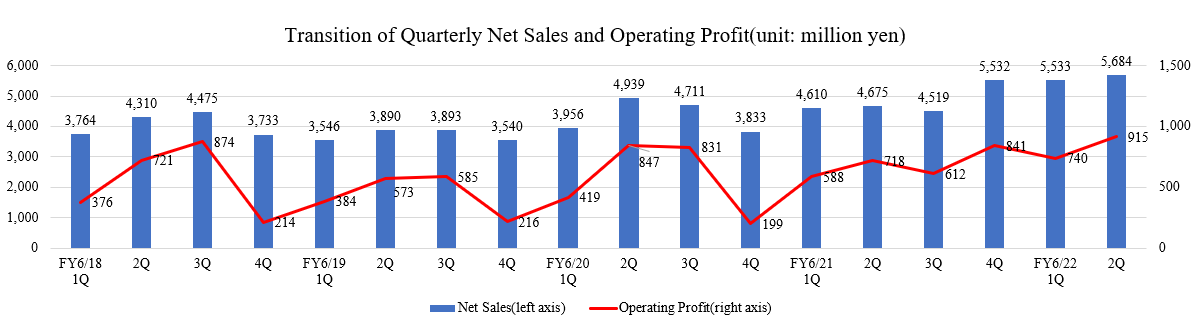

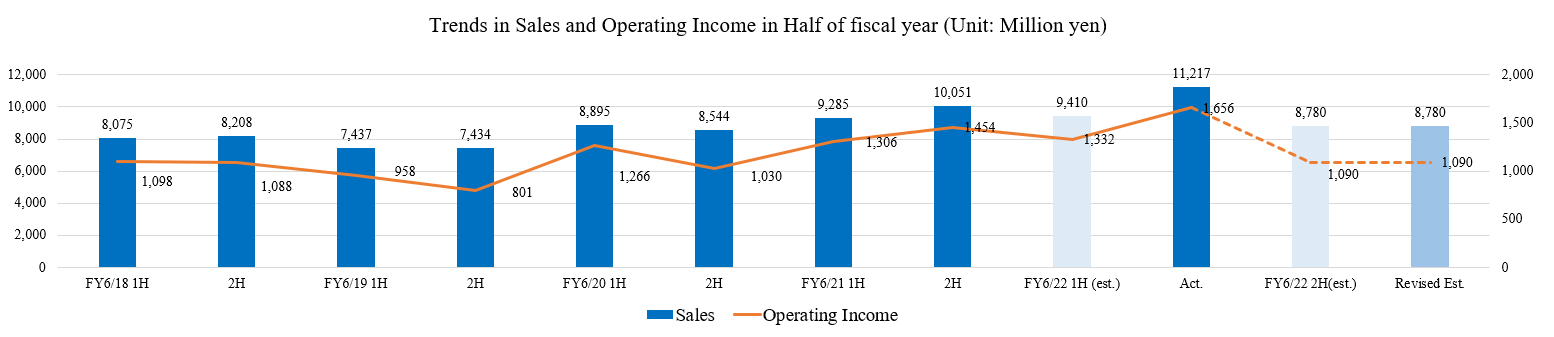

- The sales in the FY ended June 2021 were 11,217 million yen, up 20.8% year on year. Sales grew in all the business segments. Operating income rose 26.8% year on year to 1,656 million yen. The sales growth increased outsourcing ratio, and gross profit margin declined 2.1 points; however, gross profit rose 13.5% year on year. Selling, general and administrative (SG&A) expenses went up, but were offset by the sales increase, and operating income margin improved 0.7 points owing to a double-digit rise in profit. Both sales and profit exceeded their initial forecasts. On a quarterly basis, growth in private projects in the second quarter (October to December) increased net sales of completed projects. Both sales and operating income marked quarterly record highs.

- The company has upwardly revised its full-year earnings forecast for the FY ending June 2022 because the number of orders received for private projects in the first half of the term significantly exceeded its initial forecast. The revision, however, is for an excess in the business results in the first half, and the forecast for the second half remains unchanged. It is expected that sales will grow 3.4% year on year to 19,998 million yen and operating income will drop 0.5% year on year to 2,746 million yen. As the company’s business is often related to public work projects, sales in the fourth quarter (April to June) tend to be on a decline. The company has forecasted that sales in the fourth quarter (April to June) this fiscal year will be on a par with an average year, and it expects that annual profit will shrink slightly year on year. No change has been made in the estimated dividend amount. The company plans to pay a dividend of 27 yen per share, up 9 yen per share year on year. The dividend payout ratio will be 19.6%.

- Regarding the performance in each business segment, in the Sawing and Drilling Business, the company is expected to enjoy year-on-year growth in both sales and profit thanks to strong performance with highway and bridge repair projects throughout the second half of the term. In the Building Maintenance Business, sales will be on an upward trend owing mainly to projects entrusted by major developers as in the first half. In the Reuse and Recycling Business, profit margin will improve in the second half.

- In the previous fiscal year, the company achieved all the numerical targets of its mid-term management plan, and this fiscal year, it made a good start with double-digit increases in sales and profit regardless of the impact of the novel coronavirus infection. The progress rate has reached 56.1% and 60.3% in sales and operating income, respectively, this fiscal year, exceeding its average rates. Although the company has made no change in the forecast for the second half of the term, it has delivered solid business performance in such projects as highway and bridge repair, which is its forte, and is seemingly making steady progress with business enhancement in the Tokyo metropolitan area and the Kansai and Kyushu areas as aimed in “expansion in existing markets” in the mid-term management plan. While it is expected that sales will grow slightly and profit will shrink slightly this fiscal year, we would like to keep an eye on how much revenue the company will be able to generate in the second half of the term.

1.Corporate Overview

DAI-ICHI CUTTER KOGYO is providing maintenance and repair services for social infrastructure based on its expertise in diamond and water jet method, as well as services of building maintenance and reuse and recycling of IT equipment. The diamond method uses industrial diamonds to saw and drill roads and structures. In the conventional concrete crushing method, it was always necessary to be conscious of nuisances such as noise, vibration, dust, but in the diamond method, the operation can be executed safely, speedily, accurately and without having an adverse effect on the environment. On the other hand, the water jet method destroys concrete bonds by jetting water under extremely high pressure. With this method, a concrete structure can be repaired with pinpoint accuracy without damaging reinforcing steels.

The Group includes 5 consolidated subsidiaries, WALLCUTTING Co., Ltd which engages in wire saw and core boring works; KOUMEI Corporation which is strong in offshore engineering (underwater sawing and drilling works); Shin Shin Corporation which is based in Okinawa Prefecture; ASIRE Corporation which is strong in architecture-related water jet method; Movable Trade Networks Corporation which engages in reuse and recycling business; and Diamond Kiko Corporation, which is an equity method affiliate.

The company operates 23 business establishments, including newly established ones and subsidiaries acquired through M&A, around Japan.

1-1 Corporate History

The founder of the Company, who worked at the operation company that introduced flat saws for roads for the first time in Japan, foresaw the expansion in demand for that in the future. He then founded the Company in Chigasaki in Kanagawa Prefecture in August 1967. He did this to engage in the sawing and drilling work of asphalt and concrete structures with the diamond method.

The Company had few projects at first. However, the Ministry of operation (no Ministry of Land, Infrastructure, Transport and Tourism) issued a directive making it mandatory to use flat saws from a safety perspective when performing road cutting work. This triggered an increase in the amount of this work.

While other companies in the same industry were doing business locally, the Company expanded to Chiba, Tochigi, Mito and Takasaki upon opening its Sapporo Office in June 1969. At the same time, it also expanded the scope of its operations to include the drilling and cutting work of concrete structures in addition to road cutting. The mobility to respond quickly to customer needs, the level of operation quality, and the wealth of knowledge and expertise on materials and machines used in operations have been highly appreciated by the Company’s customers. Therefore, its business operations steadily expanded and it registered its stock over the counter with the Japan Security Dealers Association in 2004.

In the 2000s, the Company further accelerated its diversification of methods and expansion of offices across Japan through M&As. It then listed on the First Section of the Tokyo Stock Exchange in December 2017. It is working to solve the social issues faced by Japan (e.g., aging infrastructure).

【1-2. Corporate Philosophy】

The company updated its corporate brand when formulating is new mid-term management plan (FY ending June 2022 to FY ending June 2024). At the same time, it also established the following tagline*, purpose, statement and mission.

|

|

TAGLINE | RESET AND GO |

PURPOSE | To protect the safety of social infrastructure in both ordinary times and emergencies to support a stable society |

STATEMENT | Much of the social infrastructure built during the post-war period of rapid economic grow is approaching the time when it needs to be renovated. In addition to roads and water services across Japan, if the buildings, power plants, dams, railroads and other infrastructure used on a daily basis come to a stop, it will have a massive impact on daily lives and the economy. Before that happens, we at Daiichi Cutter will work on removing and restarting old structures prior to building new ones as the first step in social infrastructure renovation work. We will aim to create an environment in which diverse people can work even if the number of young workers decreases by improving work efficiency, developing personnel training systems and innovating technology in addition to ensuring safety and security in our daily operations. We will aim for an environment in which anyone can work by collaborating with people who speak different languages around the world. It may also eventually become possible to perform work with robots without sending people to dangerous sites. Natural disasters occur frequently in Japan. Disaster response has become commonplace. We will train on a daily basis to display our real abilities even in work in an emergency and to work safely even in dangerous places. We are not just craftsmen. We bring innovation to our daily work. This leads to us supporting society. We will aim to be a company called the number one in the world and in the universe. |

MISSION | To contribute to the development of industry by creating a safe and pleasant working environment for craftsmen regardless of gender or nationality.

To respond to the challenges of society and customers by refining highly efficient and low-environmental burden construction technologies.

To be a company that society and families can take pride in by aiming to be stylish people without becoming selfish. |

※TAGLINE

These are words that express a company’s concept and philosophy or simply state what value that company, its products and its services provide.

【1-3. Business Overview】

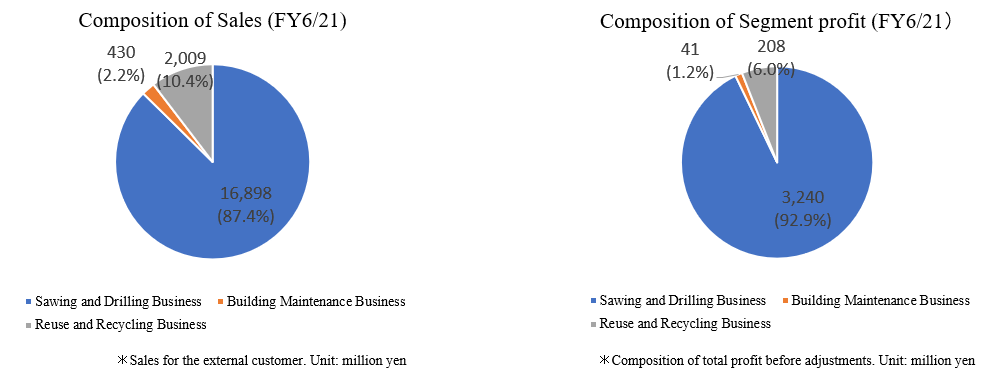

The business is divided into several categories, Sawing and Drilling Business, Building Maintenance Business, and Reuse and Recycling Business. The Sawing and Drilling Business is handled by DAI-ICHI CUTTER KOGYO, WALLCUTTING, KOUMEI Corporation, Shin Shin Corporation, ASIRE Corporation and Diamond Kiko. The Building Maintenance Business is handled by DAI-ICHI CUTTER KOGYO and the Reuse and Recycling Business is handled by Movable Trade Networks respectively.

<Sawing and Drilling Business>

“Sawing and drilling” refers to the sawing and drilling work necessary for various types of road pavement and the demolition and removal of concrete structures. The Company’s Sawing and Drilling Business mainly focuses on the diamond method using industrial diamond (Diamond Method is a registered trademark of DAI-ICHI CUTTER KOGYO) and the water jet method using water pressure. Wastewater generated from sawing and drilling work is collected and neutralized at a large intermediate treatment facility to be reused as cutting water. Waste generated from sawing concrete is dehydrated and recycled into raw materials for concrete.

(Source: The Company’s website)

The Group operates nationwide. DAI-ICHI CUTTER KOGYO’s sales operation covers all eastern Japan. ASIRE has sales based in Kanagawa and Osaka. WALLCUTTING has sales based mainly in the Tokai region. KOUMEI has sales based in Osaka and the Chugoku and Shikoku regions. Shin Shin has sales based in Okinawa prefecture. Diamond Kiko has sales based in the Kyushu region.

As a constructor, the Group plays a major role in the work and maintenance of infrastructure, and its main clients are general contractors, road contractors, and facility providers. When they receive an order, they order sawing and drilling work of concrete to the Group. Since its clients mainly engage in public works, most of the works carried out by the Group are public works (except ASIRE whose clients are from the private sector). On the other hand, works other than public ones include maintenance of chemical plants, oil refineries, electric power plants as well as cleaning by water jet method. Works are classified into civil engineering works, architecture-related works, urban civil engineering works, road and airport works, and plant maintenance.

◎Main Clients

TAISEI CORPORATION, OBAYASHI CORPORATION, KAJIMA CORPORATION, SHO-BOND CORPORATION, TEKKEN CORPORATION, TOTETSU KOGYO CO., LTD., JFE Engineering Corporation, IHI Infrastructure Systems Co., Ltd., Nomura Real Estate Partners Co., Ltd., Taisei Rotec Corporation, KAJIMA ROAD CO., LTD., Sankyu Inc., Mitsubishi Jisho Community Co., Ltd., Mitsui Fudosan Residential Service Co., Ltd., NIPPO CORPORATION, THE NIPPON ROAD Co., Ltd., SHIMIZU CORPORATION, Sumitomo Mitsui Construction Co., Ltd. (in random order).

◎Main operating work contents

Civil Engineering Work DAI-ICHI CUTTER KOGYO undertakes repair and removal services for large structures, such as bridge, port and dam, as well as sawing and drilling services under special environments such as underwater operation. In those specific cases, services are carried out by the Company’s exclusive engineers. |

Architecture-Related Work Various kinds of services for demolition and renewal works are carried out, such as demolition work of a building, base isolation work, seismic retrofit, repair work, and new construction. In addition, the Company can carry out service which is difficult by conventional methods, using alternative methods suitable for reducing the environmental load on the surrounding facilities. |

Urban Civil Engineering Work The Company operates civil engineering related works in urban infrastructure, such as railway operation, waste treatment facility, and waterworks facility, and is also involved in environment-related works that can be handled in total from planning to operation. |

Road and Airport Operation The Company carries out various types of sawing and surface treatments for road repair, removal of deteriorated concrete, core drilling for installing lights, runway grooving at airports and others. Its strength is its ability to do the operation even under specific conditions thanks to unique equipment such as grooving machines and custom-made vehicles for core drilling. |

Maintenance of Production Facilities In the maintenance of production facilities, the Company carries out cleaning for plant maintenance, fireless sawing for remodeling work, repainting of floors, and surface treatment. The Company ensures the quality and safety of the work by stationing certified workers for industrial cleaning. |

◎Main technology : The Company’s original method

*Diamond Method

The method is to saw and drill roads or structures by using an industrial diamond. Based on the five basic methods of flat sawing, core drilling, wall sawing, wire sawing, and grooving, the Company has developed a wide variety of diamond methods with its unique ideas.

The "Diamond Method" is a registered trademark of the company, and it has the No. 1 track record in the industry.

The tools used in the diamond method are “Diamond Blade”, “Diamond Bit”, and “Diamond Wire”, each of which uses diamond segments.

“Diamond Blade” is a blade whose edge is attached with segments made by hardening diamond powder with metal bond.

The object is cut by rotating “Diamond Blade” at high speed (using different sizes depending on the type of material and the depth of sawing).

“Diamond Bit” is a cylindrical tool with a cutting edges of diamond tips. It is rotated at a high speed to bore an object (using different bits depending on the size of a hole and the depth of the hole).

“Diamond Wire” is made by attaching beads made by sintering diamond segments with metal bond to a wire at fixed intervals. “Diamond Wire” can cut any object even in a complicated shape.

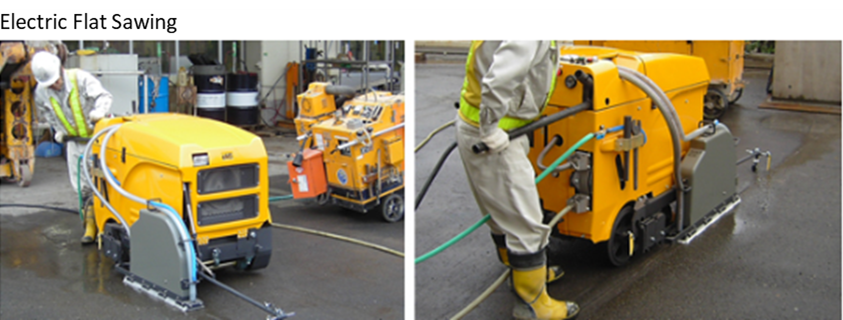

Flat Sawing

Generally, flat sawing is the most suitable solution to sawing horizontal surfaces such as floors, floor slabs and pavement. The machine is mounted with a diamond blade. An operator walks from behind and operates the machine by only himself as the machine progresses. It is used for joint sawing, sawing concrete parts for replacement and removal of damaged pavement, and sawing pavement parts when laying pipes under the pavement such as electricity, telephone, gas, water, and sewer pipes. The power source of the machine is gasoline, diesel, electricity and oil pressure. Water is set to come up to the sawing edge during the sawing process in order to cool the cutting edge heated by sawing (dry flat sawing uses compressed air for cooling).

(Source: The Company’s website)

Core Drilling

In this method, holes are made on objects that are drilled by a diamond bit. Core drilling is used in the field where accurate circular sawing is required. Any diameter of hole can be easily perforated, for water supply and drainage pipes, electric wiring, ducts for air-conditioning system, seismic reinforcement, and others. Core drilling can be very useful when the accuracy of the finish is especially required, such as when collecting samples for strength inspection, drilling holes for anchor bolts, and stitch drilling when removing a part of a thick wall.

(Source: The Company’s website)

Wall Sawing

In this method, a traveling guide rail is fixed to a wall, a slope, a floor or the like with anchor bolts, and an object is cut by high-speed rotation of a diamond blade and movement of a machine on the track. Wall sawing is often used to install door openings, vents, and windows, and can be cut at both right and oblique angles. As it saws along the rail, it can accurately secure an opening. It can also be operated remotely, making it safe to work in any situation. The compact and lightweight machine makes it easy to carry and provides excellent mobility even in places with limited work space such as buildings, expressways and subways.

(Source: The Company’s website)

Wire Sawing

In this method, an object is cut by rotating the wire saw at a high speed by a hydraulic or engine type machine while maintaining a constant tension in the wire saw. The method can easily saw a thick and complicated structure regardless of the shape of the object. It can also be operated remotely or automatically, so it can be used safely and freely in all environments, including underwater, high places, and undergrounds.

(Source: The Company’s website)

Grooving

In this method, multiple shallow grooves (safety groove) are carved on a road surface in a direction parallel or perpendicular to the traveling direction of vehicles. Diamond blades are attached to a cylindrical device called a drum at a predetermined pitch, which is rotated to cut a road surface (to improve quality of the road surface by improving slip resistance and drainage). And a drum is attached with a grooving machine. There are both dry method and wet method, and by carving grooves on runways, paved roads and steep slopes, slippage can be prevented. This method was first used at an airport in England in 1956, and has spread throughout the world.

(Source: The Company’s website)

*Water Jet Method

In this method, high-speed water, pressurized and compressed by a high-pressure water generator and jetted from a nozzle, is used for chipping and washing. This method is attracting attention from the industry as an excellent method with consideration for the environment, because it has features such as generating less distortion, few microcracks, and less vibration.

The Company uses the water jet method in a wide range of fields, including civil engineering, architecture, plant maintenance and the environment. In civil engineering and architecture, it is used in concrete removal, molding (opening through concrete walls, selective demolition of concrete structure), surface treatment, coating removal, cleaning, and others. In plant maintenance, it is used in cleaning work (including scale removal, and others.) of plant equipment such as tank reactors, and others. In addition, this method can be used for sawing metal (abrasive sawing), so it can be deployed in places where fire is strictly prohibited.

(The strong point of Water Jet Method)

Less Vibration | Unlike the impact crushing by breakers, rock drills, and others, it is characterized by the mechanism to destroy cement mortar bond of concrete by the energy of ultra-high-pressure water jetted from the nozzle. |

Minimal Impact on the Structure | Since deformation, strain and residual stress given to the object are small and microcracks are hardly generated, it is possible to work with the minimized impact on the structure. |

Pinpointed Removal | By setting the appropriate pressure and flow rate, only the deteriorated part of the concrete can be removed with pinpoint accuracy without damaging the reinforcing steels. |

Removing only Coating and Stains | By adjusting the pressure, only the coating or stains of the object can be removed. |

Remote Operation | Remote operation of the machine is easy because the nozzle does not contact with the object. This allows operation in curves and on curved surfaces with uniform quality. |

<Building Maintenance Business>

DAI-ICHI CUTTER KOGYO is the only one in the group which handles this business. In complex housing and office buildings, the Company carries out drain pipe cleaning, water tank cleaning, water supply facility inspection, floor cleaning, fiberscope survey, mechanical pit cleaning and so on.

<Reuse and Recycling Business>

Reuse and Recycling Business is undertaken by Movable Trade Networks Co., Ltd., a non-consolidated subsidiary subject to the equity method, and two non-equity method affiliates. In the Reuse Business, used IT-related equipment and office automation equipment, such as tablets, PCs, server, and liquid crystal displays (LCD displays), are purchased mainly from companies, and this equipment are sold mainly to corporate clients after data erasing and repairing. The Company also provides data erasing services of IT-related equipment and office installation services of office automation equipment mainly for corporate clients. Used products that are difficult to reuse are dismantled and intermediate processed, then sold to material manufacturers which carries out recycling. The items that the Company sells to recyclers range from general materials to “rare metals” such as gold, silver, cobalt and others.

2. The Second Quarter of Fiscal Year ending June 2022 Earnings Results

2-1 Consolidated Earnings for the first half

| 2Q of FY 6/21 | Ratio to Sales | 2Q of FY 6/22 | Ratio to Sales | Year on Year | Compared to Forecast |

Net Sales | 9,285 | 100.0% | 11,217 | 100.0% | +20.8% | +19.2% |

Gross Profit | 3,162 | 34.1% | 3,589 | 32.0% | +13.5% | - |

SG&A | 1,856 | 20.0% | 1,933 | 17.2% | +4.2% | - |

Operating Profit | 1,306 | 14.1% | 1,656 | 14.8% | +26.8% | +24.4% |

Ordinary Profit | 1,415 | 15.2% | 1,760 | 15.7% | +24.4% | +25.1% |

Quarterly Net Profit | 825 | 8.9% | 901 | 8.0% | +9.3% | +20.7% |

* Unit: million yen. Compared to the revised forecast is to the earnings forecast announced in May 2021.

Sales and profits increased, and forecasts were also exceeded.

Sales were 11,217 million yen, up 20.8% year on year. Sales grew in all the business segments. Operating income rose 26.8% year on year to 1,656 million yen. The sales growth increased outsourcing ratio, and gross profit margin declined 2.1 points; however, gross profit rose 13.5% year on year. Selling, general and administrative (SG&A) expenses went up, but were offset by the sales increase, and operating income margin improved 0.7 points owing to a double-digit rise in profit. Both sales and profit exceeded their initial forecasts. On a quarterly basis, growth in private projects in the second quarter (October to December) increased net sales of completed projects. Both sales and operating income marked quarterly record highs.

(Note) As the business of the company is mostly related to public works, Net Sales tend to be concentrated in the second quarter (October to December) and the third quarter (January to March), while the Net Sales in the first quarter (July to September) and the fourth quarter (April to June) tend to be smaller. The company plans to level off the deviations in business performance, but it is estimated that Net Sales will continue to be concentrated in the second and third quarters for some time.

2-2 Segment Earnings Trends

| 2Q of FY 6/21 | Ratio to Sales/ Profit Ratio | 2Q of FY 6/22 | Ratio to Sales/ Profit Ratio | Year on Year |

Sawing and Drilling Business | 8,158 | 87.9% | 9,766 | 87.1% | +19.7% |

Building Maintenance Business | 217 | 2.3% | 230 | 2.1% | +6.0% |

Reuse and Recycling Business | 909 | 9.8% | 1,220 | 10.9% | +34.1% |

Consolidated sales | 9,285 | 100.0% | 11,217 | 100.0% | +20.8% |

Sawing and Drilling Business | 1,535 | 18.8% | 1,943 | 19.9% | +26.6% |

Building Maintenance Business | 20 | 9.4% | 22 | 9.7% | +10.1% |

Reuse and Recycling Business | 102 | 11.2% | 92 | 7.6% | -9.5% |

Adjustments | -350 | - | -402 | - | - |

Consolidated operating profit | 1,306 | 14.1% | 1,656 | 14.8% | +26.8% |

* Unit: million yen. Operating income composition is the ratio of operating income to net sales.

Sawing and Drilling Business

Net sales of completed projects grew 19.7% year on year to 9,766 million yen because the number of orders received, and projects carried out mainly for private works showed extremely robust increases. Profit rose following the increase in net sales of completed projects.

Building Maintenance Business

Net sales of completed projects stood at 230 million yen, up 6.0% year on year, because of the company’s efforts to win orders for new projects from major developers primarily in the Tokyo metropolitan area. In addition, profit grew following the increase in net sales of completed projects. The efforts to improve the network with partner companies bore fruit.

Reuse and Recycling Business

The company strived to find new customers for sale of such items as used smartphones; however, profit shrank while sales increased, because unprofitable products accounted for many of the sales.

2-3 Financial Condition and Cash Flows (CF)

Financial condition

| June 2020 | December 2021 | Increase/Decrease |

| June 2020 | December 2021 | Increase/Decrease |

Current Assets | 10,915 | 11,544 | +628 | Current Liabilities | 2,756 | 2,754 | -1 |

Cash | 6,640 | 6,250 | -389 | Purchased Liabilities | 1,076 | 864 | -211 |

Receivables | 3,645 | 4,757 | +1,111 | Short-term Loans Payable | 34 | 29 | -4 |

Fixed Assets | 7,076 | 7,321 | +245 | Fixed Liabilities | 914 | 937 | +23 |

Tangible Assets | 5,225 | 5,522 | +297 | Long-term Loans Payable | 212 | 235 | +22 |

Intangible Assets | 388 | 354 | -33 | Liabilities Total | 3,670 | 3,691 | +21 |

Investment & Others | 1,461 | 1,443 | -17 | Net Assets | 14,321 | 15,173 | +852 |

Total Assets | 17,991 | 18,865 | +873 | Retained Earnings | 12,811 | 13,602 | +791 |

|

|

|

| Total Liabilities and Net Assets | 17,991 | 18,865 | +873 |

*Unit: Million-yen. Borrowings include lease obligations.

Total assets increased 873 million yen from the end of the previous term to 18,865 million yen, due to the augmentation of receivables, tangible assets, etc.

Liabilities remained almost the same and rose only 21 million yen from the end of the previous term to 3,691 million yen.

Net assets grew 852 million yen from the end of the previous term to 151,73 million yen, due to the increases in retained earnings and valuation difference on available-for-sale securities, etc.

Capital-to-asset ratio increased 0.5 points from the end of the previous term to 76.3%.

Cash Flows (CF)

| 2Q of FY 6/21 | 2Q of FY 6/22 | Year on Year |

Operating Cash Flow | 856 | 375 | -481 |

Investing Cash Flow | -981 | -527 | +453 |

Free Cash Flow | -124 | -152 | -28 |

Financing Cash Flow | -50 | -236 | -186 |

Term End Cash and Equivalents | 6,141 | 6,220 | +79 |

* Unit: million yen

The positive range of operating cash flow and free cash flow narrowed due to an increase in trade receivables.

The cash position is the same level at the end of the same period of the previous year..

3. Fiscal Year ending June 2022 Earnings Forecasts

3-1 Consolidated Earnings

| FY 6/21 Act. | Ratio to Sales | FY 6/22 Est. | Ratio to Sales | Year on Year | Revised Rate | Progress Rate |

Net sales | 19,337 | 100.0% | 19,998 | 100.0% | +3.4% | +9.9% | 56.1% |

Operating Profit | 2,760 | 14.3% | 2,746 | 13.7% | -0.5% | +13.4% | 60.3% |

Ordinary Profit | 2,936 | 15.2% | 2,922 | 14.6% | -0.5% | +13.7% | 60.3% |

Net Profit | 1,743 | 9.0% | 1,564 | 7.8% | -10.3% | +11.0% | 57.7% |

*Unit: million yen

Earnings forecasts were revised upwardly

The company has upwardly revised its full-year earnings forecast for the FY ending June 2022 because the amount of orders received for private projects in the first half of the term significantly exceeded its initial forecast. The revision, however, is for an excess in the business results in the first half, and the forecast for the second half remains unchanged. It is expected that sales will grow 3.4% year on year to 19,998 million yen and operating income will drop 0.5% year on year to 2,746 million yen. As the company’s business is often related to public work projects, sales in the fourth quarter (April to June) tend to be on a decline. The company has forecasted that sales in the fourth quarter (April to June) this fiscal year will be on a par with an average year, and it expects that annual profit will shrink slightly year on year. No change has been made in the estimated dividend amount. The company plans to pay a dividend of 27 yen per share, up 9 yen per share year on year. The dividend payout ratio will be 19.6%.

3-2 Segment trend

| FY 6/21 | Ratio to Sales/ Profit Ratio | FY 6/22 Est. | Ratio to Sales/ Profit Ratio | Year on Year | Progress Rate |

Sawing and Drilling Business | 16,898 | 87.4% | 17,267 | 86.4% | +2.2% | 56.6% |

Building Maintenance Business | 430 | 2.2% | 438 | 2.2% | +1.9% | 52.6% |

Reuse and Recycling Business | 2,009 | 10.4% | 2,293 | 11.5% | +14.2% | 53.2% |

Consolidated sales | 19,337 | 100.0% | 19,998 | 100.0% | +3.4% | 56.1% |

Sawing and Drilling Business | 3,240 | 19.2% | 3,273 | 19.0% | +1.1% | 59.4% |

Building Maintenance Business | 41 | 9.6% | 38 | 8.7% | -8.6% | 58.9% |

Reuse and Recycling Business | 208 | 10.4% | 202 | 8.8% | -2.8% | 45.8% |

Adjustments | -729 | - | -767 | - | - | - |

Consolidated operating profit | 2,760 | 14.3% | 2,746 | 13.7% | -0.5% | 60.3% |

* Unit: million yen. Operating income composition is the ratio of operating income to net sales.

*Sawing and Drilling Business

Both sales and profit will increase year on year owing to brisk performance with highway and bridge repair projects throughout the second half of the term.

*Building Maintenance Business

Sales mainly from projects for major developers are expected to increase as in the first half of the term.

*Reuse and Recycling Business

Profit margin will improve in the second half of the term.

4. Progress with the Mid-term Management Plan (FY June 2022 – FY June 2024)

In the first half of FY June 2022, the company has made progress as follows with the four priority strategies of its mid-term management plan (FY June 2022 – FY June 2024):

① Personnel strategy

* Strategies and measures

・Realization of a concept of brand development × employee experience (EX) × safety and security = sustainability.

・Enhancement of the personnel in managerial positions, an increase in the number of staff, and ensuring diversity.

* Progress and achievements

The company strives to instill its corporate brand in-house by forming a project team specializing in brand development.

② Advantage enhancement strategy

* Strategies and measures

・Acceleration of investment in automation and visualization of the existing technologies as a leading company in the industry.

・Up-front investment in technology-related development in the field of infrastructure maintenance.

* Progress and achievements

The company’s working group for research and development has expanded investment in technological visualization.

③ Governance strategy

* Strategies and measures

・Establishment of a governance framework that meets the criteria for the Prime Market, and enhancement of disclosure related to sustainability.

・Deeper communication with shareholders (proactive disclosure of non-financial information, diversified indexes, and shareholder return policies).

* Progress and achievements

Outside directors make up most of the board of directors in the company.

④ Growth strategy

* Strategies and measures

・Expansion of the areas that the company has covered in the existing markets, and preparation for launching new businesses

・Enrichment and expansion of the network through organic mergers and acquisitions, capital tie-ups, and alliances

* Progress and achievements

The company is seeking powerful business partners with the aim of strengthening its competitiveness in the existing markets.

5. Conclusions

In the previous fiscal year, the company achieved all of the numerical targets of its mid-term management plan, and this fiscal year, it made a good start with double-digit increases in sales and profit regardless of the impact of the novel coronavirus infection. The progress rate has reached 56.1% and 60.3% in sales and operating income, respectively, this fiscal year, exceeding its average rates. Although the company has made no change in the forecast for the second half of the term, it has delivered solid business performance in such projects as highway and bridge repair, which is its forte, and is seemingly making steady progress with business enhancement in the Tokyo metropolitan area and the Kansai and Kyushu areas as aimed in “expansion in existing markets” in the mid-term management plan. While it is expected that sales will grow slightly and profit will shrink slightly this fiscal year, we would like to keep an eye on how much revenue the company will be able to generate in the second half of the term.

<Reference1: Medium-term Business Plan Strategy FY6/22-FY6/24>

The company announced its mid-term management plan (FY ending June 2022 to FY ending June 2024) in November 2021.

4-1 Look back of the previous Medium-term Business Plan Strategy

The company announced its mid-term management plan (FY ending June 2022 to FY ending June 2024) in November 2021. The new mid-term management plan expresses how it can provide value to social issues as a company involved in the maintenance and repair of social capital stock. Moreover, it expresses the framework for how it will provide value to social issues such as creating an attractive workplace and passing on technologies in response to the accelerating decline in the birthrate and the aging of the population. It has also updated its corporate branding. To that end, the company placed a focus on people in its previous mid-term management plan and worked on the following four basic strategies: “basic strategy 1: enhance and expand personnel recruitment and training,” “basic strategy 2: enhance sales deployment,” “basic strategy 3: enhance partner company network,” and “basic strategy 4: conduct R&D.”

The status of achievement of each item established as numerical targets is as below.

◎Quantitative Targets of recent three years

| FY 6/19 Plan | FY 6/19 Act. | FY 6/20 Plan | FY 6/20 Act. | FY 6/21 Plan | FY 6/21 Act. |

Net Sales | 14,318 | 14,871 | 15,700 | 17,440 | 17,400 | 19,337 |

Operating Profit | 1,624 | 1,760 | 1,730 | 2,296 | 1,910 | 2,760 |

Operating Profit Margin | 11.3% | 11.8% | 11.0% | 13.2% | 11.0% | 14.2% |

Profit Attributable to Owners of Parent | 1,014 | 1,251 | 1,080 | 1,523 | 1,190 | 1,743 |

EPS | 89.12 | 109.90 | 94.88 | 133.86 | 104.54 | 153.16 |

|

|

|

|

|

|

|

Number of Employees (Consolidated) | 500 | 501 | 525 | 568 | 550 | 608 |

*Unit: Million-yen, yen, person. EPS is shown for the previous fiscal year according to the current number of shares outstanding, since a 1:2 stock split was implemented on January 1, 2021.

The company exceeded its planned values for all items.

◎Sales Composition Ratio by Infrastructure

| FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 | FY 6/20 | FY 6/21 Act. |

Living Infrastructure | 62.0% | 59.1% | 56.9% | 58.9% | 54.8% | 56.4% |

Transportation Infrastructure | 23.5% | 26.6% | 27.0% | 29.0% | 32.2% | 33.9% |

Industrial Infrastructure | 14.6% | 14.3% | 16.1% | 12.1% | 12.9% | 9.7% |

The bullish market conditions have served as a tailwind for transportation infrastructure. Although this ratio increased, there was a slump in industrial infrastructure due to the impact of COVID-19. The ratio of transportation and industrial infrastructure has increased over the past three years for the overall ratio.

◎Growth Investment

| Content | FY 6/19 Act. | FY 6/20 Act | FY 6/21 Plan | FY 6/21 Act. | 3 years accumulative |

Human Resource Development | Recruitment and Training | 170 | 200 | 100 | 160 | 530 |

Productivity Improvement | Improvement of workplace environment and promotion of work style reforms | 400 | 410 | 300 | 1,160 | 1,970 |

Expansion of Business Fields | Establishment of new offices, M&A | 120 | 870 | 200 | 10 | 1,000 |

Research and Development | Investment in R&D and new technologies | 30 | 80 | 50 | 130 | 240 |

Total | 720 | 1,560 | 650 | 1,460 | 3,740 | |

*Unit: million yen

The company has proactively invested in personnel education, R&D, base function enhancement and M&As. Its investment record exceeded its target investment level (2,000 million yen). This led to the source of growth.

4-2 New Mid-term Management Plan

The new mid-term management plan expresses how it can provide value to social issues as a company involved in the maintenance and repair of social capital stock. Moreover, it expresses the framework for how it will provide value to social issues such as creating an attractive workplace and passing on technologies in response to the accelerating decline in the birthrate and the aging of the population.

The company’s business is deeply related to social issues. This means it strongly feels the need to clarify its reason for existence, to increase communication to business partners, shareholders and communities in addition to company employees, and to make preparations in ordinary times to continue to have an existence of being the first to rush to disasters that have been more frequent and severe in recent years. It decided to update its corporate branding in line with its mid-term management plan.

(1) Brand Update

President Takahashi and interested employees worked together to update the corporate branding in the branding project. At the same time, it established the following tagline*, purpose, statement and mission.

|

|

TAGLINE | RESET AND GO |

PURPOSE | To protect the safety of social infrastructure in both ordinary times and emergencies to support a stable society |

STATEMENT | Much of the social infrastructure built during the post-war period of rapid economic grow is approaching the time when it needs to be renovated. In addition to roads and water services across Japan, if the buildings, power plants, dams, railroads and other infrastructure used on a daily basis come to a stop, it will have a massive impact on daily lives and the economy. Before that happens, we at Daiichi Cutter will work on removing and restarting old structures prior to building new ones as the first step in social infrastructure renovation work. We will aim to create an environment in which diverse people can work even if the number of young workers decreases by improving work efficiency, developing personnel training systems and innovating technology in addition to ensuring safety and security in our daily operations. We will aim for an environment in which anyone can work by collaborating with people who speak different languages around the world. It may also eventually become possible to perform work with robots without sending people to dangerous sites. Natural disasters occur frequently in Japan. Disaster response has become commonplace. We will train on a daily basis to display our real abilities even in work in an emergency and to work safely even in dangerous places. We are not just craftsmen. We bring innovation to our daily work. This leads to us supporting society. We will aim to be a company called the number one in the world and in the universe. |

MISSION | To contribute to the development of industry by creating a safe and pleasant working environment for craftsmen regardless of gender or nationality.

To respond to the challenges of society and customers by refining highly efficient and low-environmental burden construction technologies.

To be a company that society and families can take pride in by aiming to be stylish people without becoming selfish. |

※TAGLINE

These are words that express a company’s concept and philosophy or simply state what value that company, its products and its services provide.

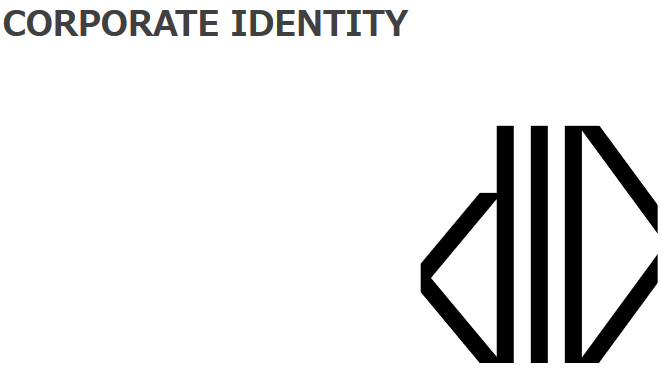

(2) Position of the Mid-term Management Plan 2024

The mid-term management plan is a guidepost and a commitment to achieving the company’s purpose to protect the safety of social infrastructure in both ordinary times and emergencies to support a stable society.

The company will provide value through infrastructure cleansing (cutting and drilling / building maintenance), reuse and recycling, and services for small and mid-sized construction companies by utilizing its personnel, expertise, network and finance capital to solve social issues such as safety and security, sustainable growth, and a recycling-orientated society.

(Source: The Company’s website)

(3) Overview of the Mid-term Management Plan 2024

The company is committed to environment (E), society (S) and governance (G) targets and numerical targets (financial and non-financial) while aiming to become the world’s number one engineer group and to achieve a market capitalization of 100,000 million yen for its long-term outlook.

It has established a personnel strategy, advantage enhancement strategy, governance strategy and growth strategy to realize that.

Reason Why Daiichi Cutter Kogyo Is Particular about Engineers (Craftsmen and Skilled Workers)

It is said that one-third of the approximately 3.4 million workers currently engaged in construction will leave their jobs due to aging while the birthrate declines and the population ages in the labor-intensive construction industry. To deal with this decrease in craftsmen, construction is being outsourced at construction sites and the conversion to fabless is proceeding by assembly products manufactured in factories on-site. To that end, craftsmen are positioned as subcontractors rather than demonstrating their skills. Their treatment has also declined. There is a negative spiral in that this environment makes becoming a craftsman even less popular.

On the other hand, social infrastructure in Japan is aging. The situation is such that 63% of the approximately 726,000 overpasses and 52% of the approximately 44,000 port facilities that exist in Japan will be more than 50 years old in 15 years. Moreover, looking at long-term trends in the Japanese construction market, the total amount of net social capital stock has seen less of an increase since 2000. It has changed from being flat to slightly declining in recent year. This indicates that construction investment is shifting from new establishment and new construction to maintenance and repair. Accordingly, while it has been almost 50 years since most infrastructure structures were newly established as mentioned above, the necessity of demolishing and rebuilding and rehabilitating for long-term use is rapidly increasing together with the aging of social infrastructure.

In the midst of this gap developing, the company believes there is no doubt that the value in having people will rise incomparably higher than it is now. It also thinks that the competitive advantage of companies with people will improve dramatically. Accordingly, it recognizes that providing excellent engineers (craftsmen and skilled workers) is its social responsibility.

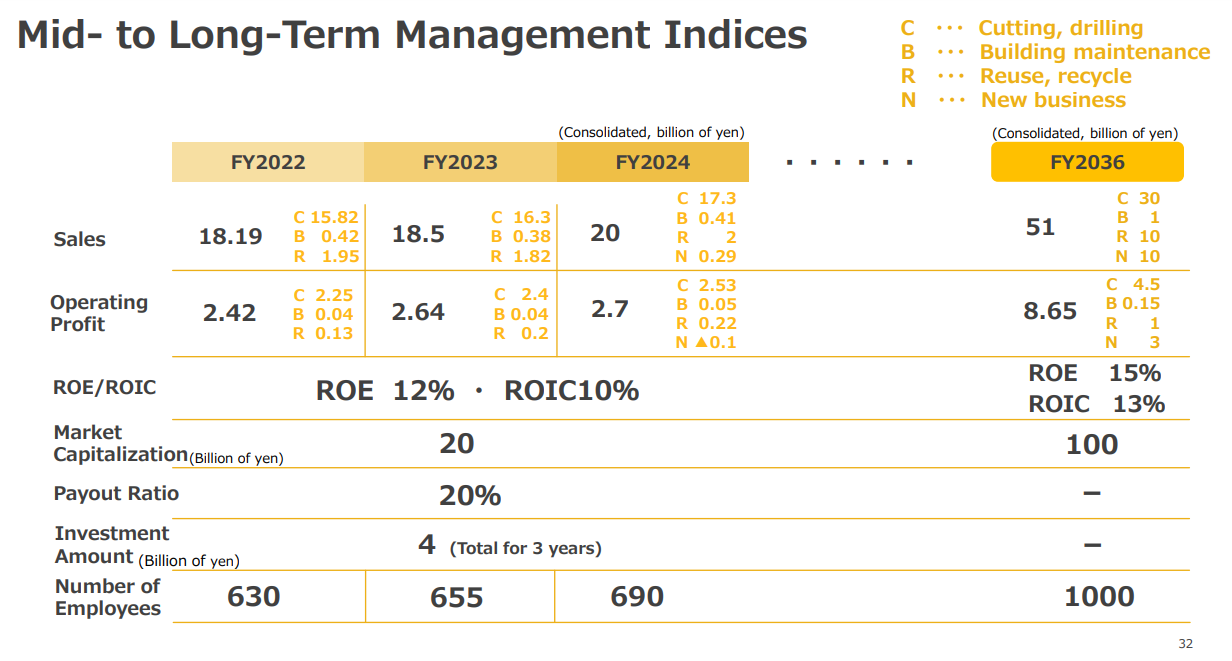

(3) Mid-term Management Targets

The numerical targets of the company for its new mid-term management plan and for the FY ending June 2036 are as follows.

(Source: The Company’s website)

(4) Overview of Each Strategy

The overview of the four strategies – personnel strategy, advantage enhancement strategy, governance strategy and growth strategy – to achieve its commitments is as follows.

①Personnel Strategy

The company has set targets in the three themes that form the basis of sustainable growth.

Theme | Target |

Diversification and improvement in the quality of the employee experience (EX)

| Engineer career diversification Educational opportunities according to life stage Advancement of women in the workplace |

Branding | Visualization of social value Showcasing of stylishness Expansion of partners (stakeholders) |

Pursuit of safety and security | Visualization of safety Securing of work life Safe environment |

◎Diversification and Improvement in the Quality of the Employee Experience

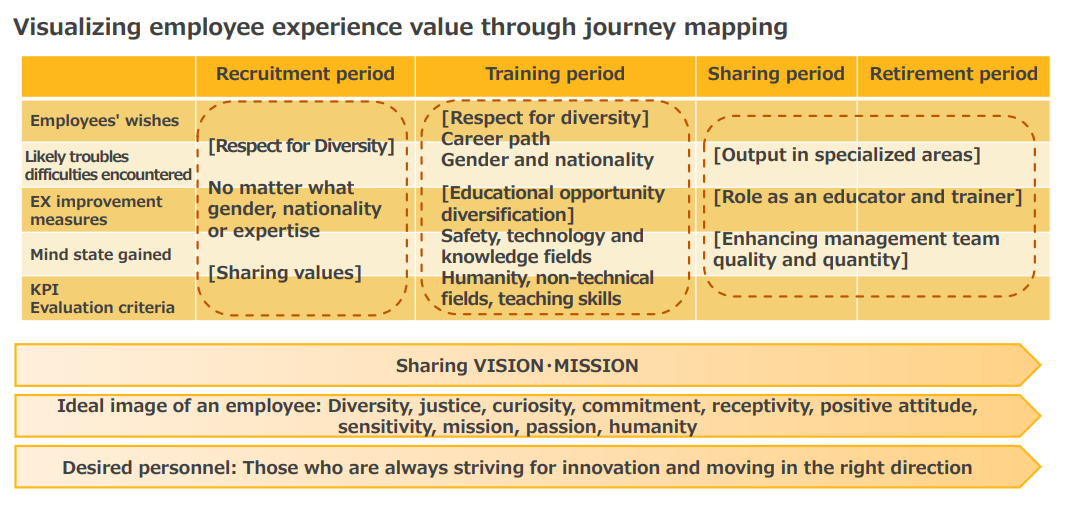

The company will create a journey map from when an employee joins the company until when he/she leaves to visualize the employee experience value.

It is very important to always share the vision and mission.

(Source: The Company’s website)

◎Branding

The company will expand stakeholder trust through brand renewal and action.

Stakeholders include people and organizations that the company may build a relationship within the future (e.g., potential shareholders, potential business partners, potential employees and potential stakeholders) in addition to current shareholders, customers, suppliers, partner companies and employees.

Daiichi Cutter Kogyo will increase the number of employees who take pride in their work at the company, candidates for recruitment who want to work at the company, stakeholders who want to help the company somehow, customers who want to work together with the company and shareholders who want to support the company with a corporate culture that places compliance at its core.

◎Safety and Security

The company achieved its targets for 2023 in relation to an initiative it has been concentrating on to curtail overtime hours to within 840 hours a month (70 hours a month on average) and to within 80 hours on average for four six months including holiday work ahead of schedule.

It will aim to achieve its target of less than 45 hours including holiday work in principle by 2024.

The company is also striving for the following: “time: complete five-workday week system and an increase in the number of annual holidays, “remuneration: increase in base salary and expansion of retirement system using shares” and “lifestyle: expansion of insurance, promotion of health and diversification of working styles.”

Moreover, in addition to diversifying the training system by year, rank and purpose, the company is also focusing on safety and technology training (e.g., safety patrols, safety and technology visualization, and compliance).

②Advantage Enhancement Strategy

The company has set the following three themes and targets.

Theme | Target |

R&D

| R&D Subcommittee New Co-Dimensional Innovation Lab. (CDI-Lab.) development organization Skills × tech |

Group deployment | Maximization of the benefits of group companies Personnel exchange Sharing of education |

Partner company network enhancement | Opening of maintenance areas Safety education Support for hiring inexperience people |

◎R&D

The R&D Subcommittee comprised of the Construction Division and Sales Division under the direct control of the President is working on areas from the improvement of existing technology to automation and visualization.

The company is promoting development projects regardless of their size under the keywords of "troubles,” “inconvenience” and “eco” with a development organization for both self-recommendations and recommendations by others.

It has output 172 items over the past eight years. This has produced construction methods and technologies unique to the company.

The company has established a new Co-Dimensional Innovation Lab. (CDI-Lab) development organization.

This is an independent organization in the company. It operates separately from the aforementioned R&D Subcommittee. The company is also considering acquiring external experts for it.

Therefore, it is compartmentalized from the R&D Subcommittee’s improvement of existing technologies. It mainly develops advanced IoT-compatible machines from basic research, research assist technologies and develops new construction methods in the mid- to long-term (e.g., digital transformation-compatible machine development, assist technologies and new construction methods).

It provides productivity improvement and burden reduction widely to the entire industry with development of advanced technologies and construction methods. In this way, it is transforming the professional construction industry that is indispensable for Japan into a sustainable and attractive workplace. Moreover, the company see it as its mission to contribute to the deep tech* economy.

*Deep Tech

This is an initiative to solve problems that have a massive impact on the world based on scientific discoveries and innovative technologies

◎Group Deployment

The company is involved in the specialized construction business in a niche industry. Therefore, it needs to secure a certain number of construction projects and customers to pursue scale of sales and profits. Consequently, it has worked on deploying across Japan using M&As at an early stage.

It provides multifaceted benefits including training, recruitment, personnel exchanges and sales for the companies in its group. This has led to sales and profits increasing significantly for each company after consolidation.

◎Partner Company Network Enhancement

The network with partner companies is a very important element in the competitive advantage of the company. Its network with partner companies enabled the company’s aforementioned advancement across Japan. Accordingly, it recognizes its partner companies as important partners. It forbids its partner companies to be called “subcontractors” internally.

It believes it has an obligation to provide safe and secure foundations to partner companies for the company’s sustainable growth and social contribution.

Many of its partner companies are small operators. Therefore, it works on preparations with the opening of maintenance areas, the provision of various safety education programs and the provision of recruitment support based on the current situation in which it is difficult to develop infrastructure alone.

③Governance Strategy

The company has set the following three themes and targets. It is aiming for a level of conformity with the Prime Market to which it has applied for selection.

Theme | Target |

Governance enhancement | Enhancement of the supervisory functions of the board of directors Enhancement of management and internal audit departments Basic philosophy and action guidelines formulation and education enhancement |

Enhancement of sustainability-related disclosures | Clarification of the sustainability policy TCFD support Diversification of non-financial information disclosures |

Deepening of dialogue with shareholders | Shareholders return policy Specification of capital costs Enhancement of information dissemination |

◎Governance Enhancement

The company is looking to enhance its supervisory functions by raising its external ratio of Directors to more than half of them, of Corporate Auditors to all of them and of members of top decision-making bodies to more than half of them.

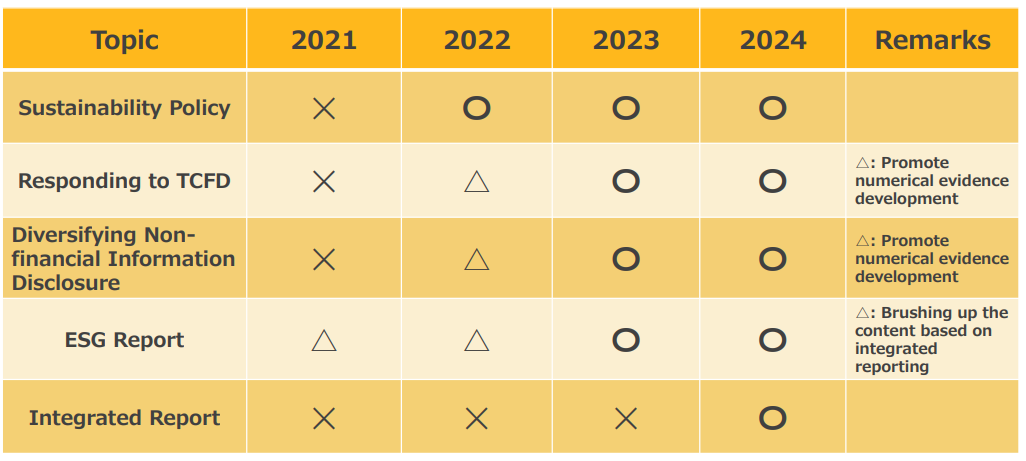

◎Enhancement of Sustainability-related Disclosures

It is working on its response to each challenge according to the following schedule, contributing to society, and presenting and widely raising the recognition of a sustainable business model.

(Source: The Company’s website)

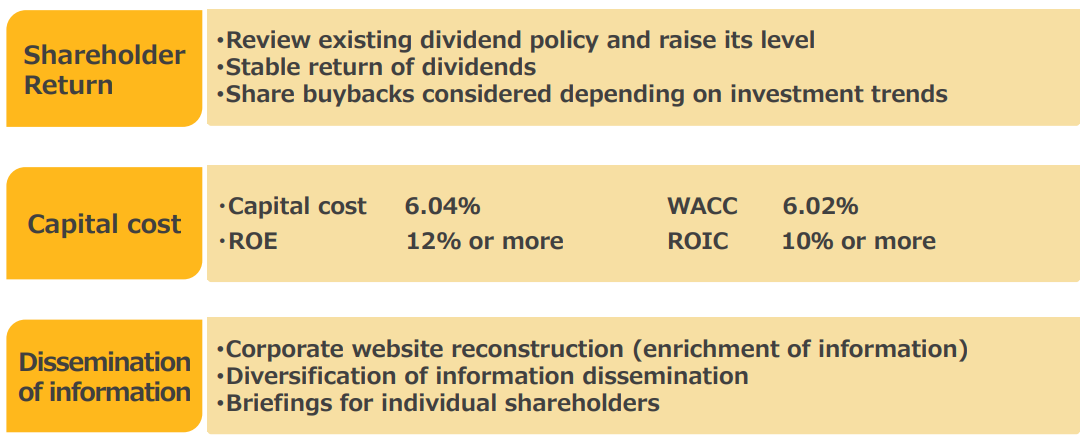

◎Deepening of Dialogue with Shareholders

The company is aiming to achieve the following targets.

(Source: The Company’s website)

④Growth Strategy

The company has set the following three themes and targets.

Theme | Target |

Expansion in existing markets | Strengthening in the central Tokyo metropolitan area Strengthening in the Kyushu area Carbon neutral Space-related business |

M&As | Existing business (business succession, growth companies and niche specialized companies) Search for peripheral businesses |

New businesses | Trial and error toward the fourth segment Preparations for the commercialization of the unique strengths of internal personnel capital |

◎Expansion in Existing Markets

The company estimates that the size of the market in the central Tokyo metropolitan area is 3,000 million yen per year, 8,000 million yen per year in Kyushu and 50,000 million yen per year in Kansai.

The company is looking to capture the green growth strategy market by being carbon neutral.

The Electric Power Department currently has the highest CO2 emission ratio by department. However, it is expected that the ratio derived from electric power will further increase in the future due to the electrification of industries and transportation that now use fossil fuels. It will explore the electric power industry.

The estimated market size is 17,000 million yen.

The company expects to acquire spaceport development and maintenance-related business and to be active in outer space in the space-related market.

In the case of the former, development of a spaceport (departure and landing site) is expected to proceed in the future based on the Basic Space Plan determined by the Cabinet in June 2020. Therefore, it is working to acquire airport development-related technologies that are the specialty of the company.

In the case of the former, it will seek out businesses that allow it to utilize its expertise in outer space as the world’s number one engineer group.

It is currently participating as the only full member specialist construction company in Space Port Japan*.

*Space Port Japan

This is an organization aiming to widely promote the Japanese space-related industry by opening a spaceport in Japan. Under this aim, it is creating business opportunities, exchanging information and cooperating with related companies and organizations in Japan and overseas, disseminating information, and holding seminars and events.

◎M&As

The company is aiming to become a receptacle for engineers and technologies with high-added value that will be in short supply in the future. Under this aim, it is promoting an M&A strategy.

It has three M&A policies.

*Clarification of Business Areas

Specialized construction companies involved with the five keywords that are the specialty of the company: cutting, chipping, cleaning, stripping and grinding

*Before and After the Supply Chain

Companies involved in surveys, design and maintenance before and after the construction work in the company’s business

*Related Businesses with Specialized Technologies

Companies with specialized technologies, mechanisms and customer bases that cannot be found elsewhere

◎New Businesses

The company has the expertise needed by companies that find it difficult to comply with regulatory frameworks (e.g., the subcontracting format and SMEs). Accordingly, it believes this expertise has a high level of synergy with an improvement in productivity of SMEs. Consequently, it is exploring service businesses for SMEs using that expertise.

It will target SMEs. SMEs account for 99.7% of Japanese companies. There are approximately 470,000 companies in the construction industry alone. It will contribute to lowering the turnover rate by providing education in addition to contributing to an improvement in administrative productivity in SMEs through the development and provision of services for SMEs.

<Reference2: Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with a board of company auditors |

Directors | 5 directors, including 3 outside directors |

Auditors | 3 auditors, including 3 outside auditors |

◎Corporate Governance Report (last updated on December 21, 2021)

Basic Concept

The Company recognizes that building a corporate governance system that enables coexistence and co-prosperity with stakeholders, such as clients, shareholders, local communities, and employees, and improving corporate value over the medium to long term is an important management issue. In addition, in order to ensure the transparency and soundness of management, they appointed outside auditors and outside directors to strengthen management monitoring functions.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

*The following information is based on the Corporate Governance Code revised in June 2021:

<the Principles of the Corporate Governance Code which the Company doesn’t Carry out and the Reasons >

[Principle 1 -4. Strategically held shares]

As a general rule, they do not strategically hold shares. However, if it is determined that maintaining and strengthening stable business relationships in total consideration of the nature and scale of transactions will contribute to the improvement of the Company’s corporate value, the Company may strategically hold shares of its clients. The Board of Directors examines each year whether the shares held by the Company contribute to the improvement of corporate value. If it is judged that the holding of the shares is no longer meaningful, as a result of the examination, the Company will proceed with selling the shares as deemed appropriate. Regarding the exercise of voting rights in shares held by the Company, the Company will exercise the voting rights after examining whether there is any possibility of damaging the Company's corporate value.

【Supplementary Principle 2-4-1】

Putting importance on the development of an environment that allows each of our employees to show their diverse values and abilities to the fullest, our company promotes human resources regardless of gender or how they were recruited through comprehensive judgment of their respective abilities and aptitude. Now our company has not set any measurable numerical goals regarding diversity in our human resources, but we will discuss such goals as well as continue pursuing our policies toward ensuring diversity.

Or company has recognized initiatives on sustainability as an important business issue from the perspective of medium- and long-term improvement in corporate value. Currently, our company is holding discussions about policies and approaches in regard to sustainability, and we intend to disclose our policies and approaches as soon as we have given shape to them.

【Supplementary Principle 4-11-1】

Our company’s view on the balance between knowledge, experience, and skills of the board of directors as a whole, an attitude to such matters as diversity, and policies and procedures for appointment of directors is on a par with the one regarding nomination of candidates for directors, and the details are as stated in Principle 3-1 (iv).

We have disclosed information associated with the aforementioned in a report concerning corporate governance.

Furthermore, given an appropriate size of the board for operating a highly efficient business system, our company has appointed two inside directors, three outside directors (who are three independents outside directors), and three outside auditors at the moment. The three outside directors are an expert on labor issues, a person who is well versed in corporate management and serves as a representative director at another company, and a person with extensive experience with management at listed companies. In addition, our board of company auditors consists of a CSR consultant, a person with extensive experience with internal audits, a certified accountant who has profound knowledge of corporate accounting, and a lawyer acquainted with corporate legal affairs, indicating that our company considers the balance of our board of directors as a whole for a healthy and sustainable business growth.

[Principle 5 -1. Policy on constructive dialogue with shareholders]

The Company’s Finance and Accounting Department oversees investor relations. For shareholders and investors, it holds semiannual financial results briefings and hold individual meetings. In addition, the Company recognizes that in order to promote constructive dialogue with shareholders and investors, building and maintaining trusting relationships with them is important, and that for this purpose, it is essential to appropriately disclose information. In order to put this awareness into practice, in addition to disclosure based on laws and regulations, the Company actively discloses information deemed important to shareholders and other stakeholders (including non-financial information) as well as actively discloses management strategies and the state of management on its website.

The design and disclosure of policies concerning the development of organizational structure and its initiatives to promote constructive dialogue with shareholders will be subject to future consideration.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 3 -1. Enhancement of Information Disclosure

(i)The Company’s corporate philosophy and other information are disclosed on the Company website and in the financial results explanatory materials.

(ii)Basic policies on corporate governance are disclosed on the Company website and in the report on corporate governance.

(iii)The compensation for directors and corporate auditors is determined by resolution of the board of directors within the limit defined at the shareholders meeting, with due consideration of contribution of each director and their business performances in view of future management strategies.

The above information is disclosed in the Securities Report.

(iv)The Company does not stipulate the policies and procedures for nominating candidates for directors and corporate auditors in its internal rules, but the board of directors selects candidates who are capable of fulfilling the duties and responsibilities of directors and corporate auditors who have abundant experience and high insight with excellent character.

(v)Reasons for selecting candidates for directors and corporate auditors are disclosed in the notice of convocation of the general meeting of shareholders

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |