Bridge Report:(2157)Koshidaka HOLDINGS the first half of Fiscal Year August 2019

Hiroshi Koshidaka President | Koshidaka HOLDINGS Co., Ltd(2157) |

|

Company Information

Market | TSE 1st Section |

Industry | Service |

President | Hiroshi Koshidaka |

HQ Address | World Trade Center Building 23rd Floor, 2-4-1 Hamamatsucho, Minato-ku, Tokyo |

Year-end | August |

Homepage |

Stock Information

Share Price | Share Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,670 | 81,318,284 shares | ¥135,802 million | 18.7% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥12.00 | 0.7% | ¥64.01 | 26.1 x | ¥315.51 | 5.29 x |

*The share price is the closing price on April 18. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. ROE and BPS are the values at the end of the pervious term.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Aug. 2015Act. | 44,257 | 4,394 | 4,492 | 2,098 | 28.20 | 30.00 |

Aug. 2016Act. | 51,170 | 4,810 | 4,699 | 1,900 | 26.18 | 32.00 |

Aug. 2017Act. | 55,283 | 6,146 | 6,354 | 3,255 | 43.63 | 36.00 |

Aug. 2018Act. | 61,771 | 7,858 | 8,207 | 4,426 | 54.44 | 25.00 |

Aug. 2019Est. | 66,044 | 9,345 | 9,307 | 5,205 | 64.01 | 12.00 |

* Unit: million yen

*The forecasted values were provided by the company.

*From fiscal year August 2016, the definition of net profit has been changed to net profit attributable to parent company shareholders. (The same shall apply hereinafter.)

*A 4-for-1 stock split was conducted in June 2018.(EPS and DPS have been revised retroactively)

This Bridge Report presents an overview of Koshidaka HOLDINGS’s earnings results for the first half of fiscal year ended August 2019 and earnings estimates for full fiscal year August 2019.

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year ended August 2019 Earnings Results

3. Fiscal Year August 2019 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of the term ending Aug. 2019, sales and operating profit grew 7.2% and 35.2%, respectively, year on year. The sales of both the karaoke and Curves Fitness Club businesses marked a record high for the first half. The profitability of the karaoke business improved due to the favorable performance of existing stores and the decline in goodwill amortization, and the profitability of the Curves Fitness Club business improved, due to the reduction of royalties after the acquisition of the global headquarters of Curves despite the burden of amortization of trademark rights, etc.

- There is no revision to the full-year earnings forecast. Sales and operating profit are estimated to increase 6.9% and 18.9%, respectively, year on year. The progress rates of sales and operating profit toward the full-year estimates are 49.3% and 53.3%, respectively. The progress rate of profit is high, but the company plans to open 21 karaoke stores in the second half, while it opened 14 stores in the first half, augmenting upfront cost. Therefore, the forecast is conservative. For the full year, the three businesses are projected to see sales growth, while profitability will increase in the karaoke and Curves Fitness Club businesses. On the other hand, there is a possibility that the profit from the hot spring business will decline due to the augmentation of energy cost. The company plans to pay a term-end dividend of 6 yen/share, that is, 12 yen/share per year (virtually up 2 yen/share, considering the stock split in Jun. 2018).

- The year 2019 will see “the Golden Week composed of 10 consecutive holidays” and “the consumption tax hike,” which are positive and negative factors, respectively, for consumer spending. When there are many holidays, karaoke clubs attract customers. The company plans to meet the demand in the 10 consecutive holidays and strengthen its competitiveness by securing “personnel,” training them to make them helpful in actual business as soon as possible, and energizing all stores. On the other hand, the consumption tax rate is scheduled to be raised this fall, and there is concern over its impact on consumer spending. However, they said that the previous consumption tax hikes did not affect the Curves Fitness Club business and the other businesses significantly. The leisure activities provided by the karaoke and Curves Fitness Club businesses can be enjoyed at low prices, at a nearby place, in a short period of time, and business operation is reasonable; accordingly, it seems that the tax hike does not affect the business so much.

1. Company Overview

Koshidaka HOLDINGS Co., Ltd. is a “comprehensive entertainment and leisure services provider” and it promotes a strategy of “creating new businesses in existing industries” in the four realms of “amusement,” “sports and fitness,” “tourism and travel,” and “hobbies and cultural activities.” Based upon its two main cornerstones of the karaoke club business and Curves Fitness Club business, Koshidaka has been able to continue to grow both sales and profits since its listing and is cultivating new businesses such as its hot spring facilities, which is becoming a steadfast contributor to earnings.

1-1 Corporate Philosophy

Koshidaka maintains a corporate philosophy of “contributing to the creation of a peaceful world by providing bountiful hope and lifestyles rich with entertainment, while continuing to provide evolutionary and significant services and products to people worldwide.” Based upon this corporate philosophy, Koshidaka has also established five visions: 1) cultivating new businesses in existing industries to provide easily accessible entertainment that only requires a short amount of time, and is close and reasonable, 2) developing optimized businesses and structures based upon conditions in each country, area, and industry, 3) continuing to offer surprising and highly satisfying services and products with customers’ needs in mind, 4) fostering inspired and entrepreneurial human resources, and 5) seeking to cultivate and maximize synergies between the various businesses of the group.

1-2 Koshidaka Group

Koshidaka HOLDINGS Co., | |

Koshidaka Co., Ltd. | Karaoke Business (including the “Karaoke Honpo Manekineko,” “One Kara,” Individual Use Karaoke Club) |

Hot spring business (“Maneki No Yu,” “Lamp No Yu”) | |

Koshidaka Korea Co., Ltd. | Karaoke club operations in Korea |

KOSHIDAKA INTERNATIONAL PTE.LTD. KOSHIDAKA SINGAPORE PTE.LTD. KOSHIDAKA MALAYSIA SDN. BHD. KOSHIDAKA THAILAND CO.,LTD. | Intermediary holding company that oversees karaoke business operations in Southeast Asia Company that operates karaoke business in Singapore with 10 directly operated clubs in Singapore It directly runs 2 karaoke store in Malaysia. A local corporation was established in Thailand in Feb. 2018 and operates one store.. |

Curves Holdings Co., Ltd. Curves Japan Co., Ltd. High Standard Co., Ltd Curves International, Inc. | Intermediary holding company for three Curves Fitness Club business related companies Curves franchise business headquarter and directly operated store operations Operation of 62 Curve Fitness Clubs in Hokkaido, Saitama, Tokyo and Chiba Global franchiser of the Curves business |

Koshidaka Products Co., Ltd. | Management of group intellectual properties and real estate |

Koshidaka Business Support Co., Ltd. | Intermediate group management |

1-3 Business Segments

Karaoke Club Business

(Source: the company)

The company has the second largest number of karaoke stores in this industry, succeeding in differentiating them with its high-quality services and low prices. It established a business base by operating regional and suburban stores, and started concentrating on the opening of stores in the Tokyo Metropolitan Area and downtown areas in the term ended Aug. 2015. This has helped expand the karaoke business in recent years. The company is also expanding overseas business, and owns stores in South Korea, Singapore, Malaysia, and Thailand.

Curves Fitness Club Business

The company offers “Curves,” a 30-min fitness exercise lesson exclusively for women, via directly managed and franchised gyms. As of the end of the first half of the term ending Aug. 2019, the company has 1,946 gyms in Japan and 819,000 members. The company boasts the largest sales, the largest number of gyms, and the largest number of members in this industry. It had been an area franchiser (a local headquarters managing the business in Japan) under the control of the global headquarters of Curves, but the company acquired the global headquarters of Curves in Mar. 2018.

Hot Spring Business

Under the brand names “Maneki-no-yu” and “Lamp-no-yu,” five facilities are operated in Japan. The company succeeded in moving into the black by taking measures for reeling in various customers, adopting a variety of contents, and promoting the energy saving for equipment.

2. First Half of Fiscal Year ended August 2019 Earnings Results

2-1 Consolidated Earnings

| First Half of FY Aug. 18 | Ratio to sales | First Half of FY Aug. 19 | Ratio to sales | YoY | Forecast | Difference from the forecast |

Sales | 30,394 | 100.0% | 32,582 | 100.0% | +7.2% | 31,961 | +1.9% |

Gross profit | 7,973 | 26.2% | 10,003 | 30.7% | +25.5% | - | - |

SG&A | 4,286 | 14.1% | 5,018 | 15.4% | +17.1% | - | - |

Operating Income | 3,687 | 12.1% | 4,984 | 15.3% | +35.2% | 4,123 | +20.9% |

Ordinary Income | 3,860 | 12.7% | 4,992 | 15.3% | +29.3% | 4,109 | +21.5% |

Net profit attributable to parent | 2,320 | 7.6% | 2,931 | 9.0% | +26.3% | 2,258 | +29.8% |

*Unit: million yen

Sales and operating profit grew 7.2% and 35.2%, respectively, year on year.

Both the karaoke and Curves Fitness Club businesses hit a record high for the first half, and consolidated sales were 32,582 million yen, up 7.2% year on year. As for profits, the profitability of the karaoke business improved due to the favorable performance of the existing stores and the curtailment of opening of new stores, and the profitability of the Curves Fitness Club business, too, increased due to the decrease of royalties, etc. after the acquisition of the global headquarters of Curves; accordingly, gross profit rate rose. As the rise in gross profit offset the augmentation of SG&A due to the amortization of trademark rights, etc., operating profit increased 35.2% year on year to 4,984 million yen.

2-2 Sales and Profit by Business Segment

| First Half of FY Aug. 18 | Ratio to sales・Profit margin | First Half of FY Aug. 19 | Ratio to sales・Profit margin | YoY | Forecast | Difference from the forecast | ||||||

Karaoke Club | 15,706 | 51.7% | 17,740 | 54.4% | +12.9% | 17,131 | +3.6% | ||||||

Curves Fitness Club | 13,711 | 45.1% | 13,863 | 42.5% | +1.1% | 13,818 | +0.3% | ||||||

Hot Spring | 819 | 2.7% | 822 | 2.5% | +0.4% | 855 | -3.9% | ||||||

Real Estate Management | 157 | 0.5% | 156 | 0.5% | -0.6% | 155 | +0.6% | ||||||

Consolidated Sales | 30,394 | 100.0% | 32,582 | 100.0% | +7.2% | 31,961 | +1.9% | ||||||

Karaoke Club | 1,571 | 10.0% | 2,389 | 13.5% | +52.0% | 1,578 | +51.4% | ||||||

Curves Fitness Club | 2,431 | 17.7% | 2,985 | 21.5% | +22.8% | 2,769 | +7.8% | ||||||

Hot Spring | 45 | 5.5% | 31 | 3.8% | -31.5% | 90 | -65.1% | ||||||

Real Estate Management | 63 | 40.3% | 28 | 18.3% | -54.8% | 78 | -64.1% | ||||||

Adjustments | -425 | - | -449 | - | - | -393 | - | ||||||

Consolidated Operating Income | 3,687 | 12.1% | 4,984 | 15.3% | +35.2% | 4,123 | +20.9% | ||||||

*Unit: million yen

Karaoke Club Business

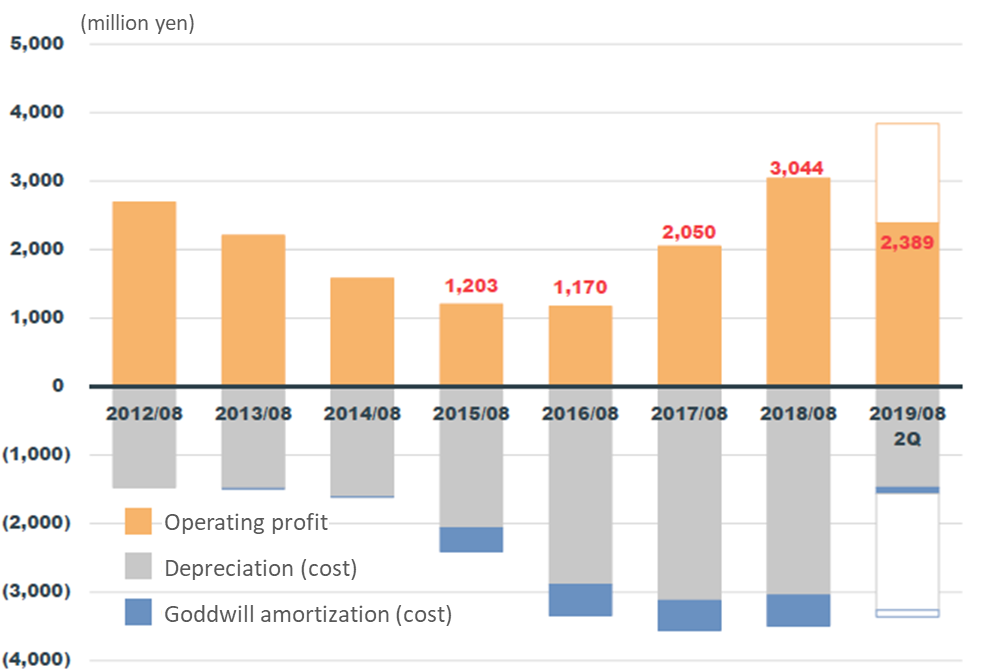

Sales were 17,740 million yen, up 12.9% year on year, while operating profit was 2,389 million yen, up 52.0% year on year. In value terms, sales grew 2,033 million yen. In detail, the new stores in Japan increased sales by 1,509 million yen, and the existing stores rose sales by 793 million yen, which offset the decline in overseas sales (down 84 million yen) and the effect of closure of stores (down 184 million yen). Operating profit rose 817 million yen. While gross profit grew 856 million yen (increasing gross profit rate from 20.4% to 22.9%), the decline in goodwill amortization (down 134 million yen) due to the posting of impairment loss in the previous term and R&D cost (down 36 million yen) caused SG&A to decrease 36 million yen (while advertisement cost augmented 56 million yen and IT-related cost grew 18 million yen).

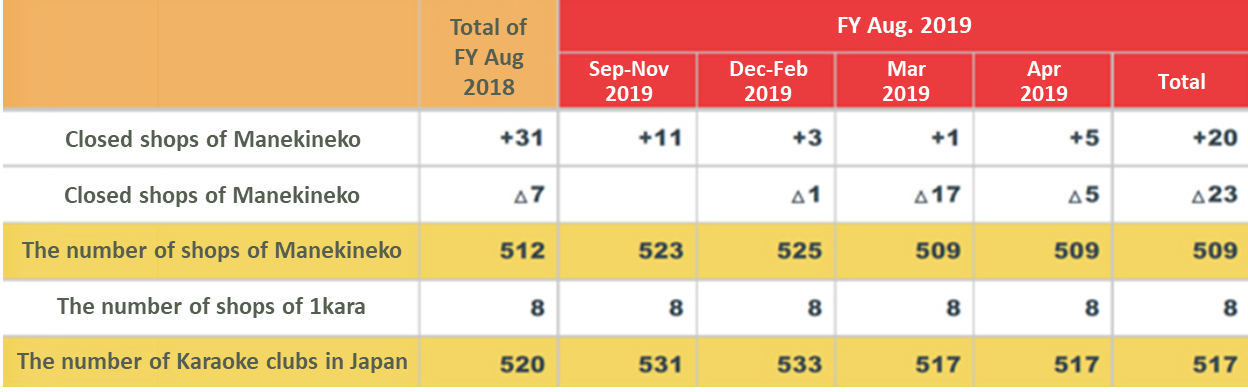

The company opened 14 stores (15 stores in the previous year), and the number of stores in Japan as of the end of the first half is 533 (506 as of the end of the same period of the previous year). Among the 14 stores, 8 stores were opened in the vicinity of a station or a downtown area (18 out of 31 stores were opened in such areas in the previous term ended Aug. 2018, and 32 out of 44 stores were opened in such areas in the term ended Aug. 2017). Since the stores in the vicinity of stations or downtown areas performed well thanks to the effects of the measures for reeling in customers, the sales of the existing stores grew 5.5% year on year (as the number of customers rose 7% and average spending per customer dropped 1.4%).

The number of stores outside Japan is 23. In detail, the company operates 10 stores in Singapore, 10 stores in South Korea, 2 stores in Malaysia, and 1 store in Thailand. Sales and profit declined in both Singapore and South Korea. The sales from the stores in Singapore increased in the previous term after the remodeling of the stores, and declined in the current term (as the effect of the remodeling subsided in about half a year), and expensive rents, etc. in Singapore compared with other Southeast Asian countries became burdens. In South Korea, the company started business with stores exclusively for karaoke without serving food or drink, but shifted to stores where eating and drinking are allowed, as a trial-and-error adjustment. In the second half, it plans to close down one store. In Malaysia, the company opened the first store in Jul. 2018, and the second store “Manekineko 1” in November. The business in Malaysia made a good start. Since the rents in Malaysia are low, it is expected that the business there will move into the black soon. Furthermore, the company opened the first store of Manekineko in Thailand in Feb. 2019.

| Sales | Operating Income | Club Number at Term End | |||

First Half of FY Aug. 18 | First Half of FY Aug. 19 | First Half of FY Aug. 18 | First Half of FY Aug. 19 | First Half of FY Aug. 18 | First Half of FY Aug. 19 | |

Singapore | 836 | 799 | 76 | -7 | 10 | 10 |

South Korea | 216 | 169 | -30 | -28 | 14 | 10 |

Total | 1,052 | 968 | 46 | -36 | 24 | 20 |

*Unit: million yen, store

Significant increase in Cash Flow(CF) is also a feature of Karaoke Club Business in the first half of this FY.

(Source: the company)

Curves Fitness Club Business

Sales were 13,863 million yen, up 1.1% year on year, and operating profit was 2,985 million yen, up 22.8% year on year. In value terms, sales grew 151 million yen. In detail, the sales from the opening of stores decreased 106 million yen, but the sales from the running of stores increased 134 million yen, and the sales from shopping rose 19 million yen steadily (while the sales at stores rose 38 million yen and other sales increased 65 million yen). Operating profit grew 553 million yen. Gross profit rate improved from 33.7% to 42.1%, due to the reduction in cost of sales for shopping (down 469 million yen) and paid royalties, etc. (down 416 million yen), offsetting the augmentation of SG&A due to the increase in amortization of trademark rights, etc. (540 million yen) and depreciation (up 153 million yen) (while commissions decreased 260 million yen).

As of the end of the first half, the number of stores is 1,946 (1,860 as of the end of the same period of the previous year), and the number of members is 819,000 (806,000 as of the end of the same period of the previous year). The sales of proteins were 7.2 billion yen (7.1 billion yen in the same period of the previous year).

Hot Spring Business

Sales increased year on year from 819 million yen to 822 million yen, but energy costs augmented, decreasing gross profit rate from 9.0% to 8.1%. SG&A declined 6 million yen, but operating profit decreased year on year from 45 million yen to 31 million yen.

Real Estate Management

Sales were 156 million yen, down 0.6% year on year, while operating profit was 28 million yen, down 54.8% year on year. Operating profit declined, because 39 million yen was posted as a cost for acquiring real estate for lease.

2-3 Financial Position and Cash Flow

Balance Sheet Summary

| 8/18 | 2/19 |

| 8/18 | 2/19 |

Cash | 11,926 | 11,630 | Payables | 2,430 | 2,243 |

Receivables | 3,824 | 3,730 | Expenses Payable | 2,433 | 2,083 |

Inventories | 1,123 | 1,238 | Taxes Payable | 1,873 | 1,824 |

Current Assets | 19,963 | 18,973 | Deposits received | 1,806 | 1,772 |

Tangible Assets | 17,552 | 21,137 | Interest-bearing liabilities(Lease obligations) | 24,348(27) | 24,552(15) |

Intangible Assets | 24,627 | 23,924 | Liabilities | 41,660 | 40,974 |

Investments and Others | 6,214 | 6,220 | Net Assets | 26,697 | 29,281 |

Noncurrent Assets | 48,394 | 51,282 | Total Liabilities and Net Assets | 68,357 | 70,256 |

*Unit: million yen

The total assets as of the end of the first half were 70,256 million yen, up 1,898 million yen from the end of the previous term. On the debit side, tangible assets grew due to the acquisition of real estate for lease, and intangible assets decreased (as goodwill and trademark rights dropped 629 million yen). On the credit side, net assets, mainly retained earnings, increased. For acquiring real estate for lease, the company borrowed 2.5 billion yen as short-term debts, but changed them into long-term debts in March. Capital adequacy ratio is 41.7% (37.5% at the end of the previous term).

Cash Flow(CF)

| First Half of FY Aug. 18 | First Half of FY Aug. 19 | YoY | |

Operating cash flow(A) | 2,184 | 5,721 | +3,536 | +161.9% |

Investing cash flow (B) | -2,973 | -5,621 | -2,648 | - |

Free・Cash Flow(A+B) | -788 | 99 | +888 | -112.7% |

Financing cash flow | -2,384 | -403 | +1,980 | - |

Cash and Equivalents at the end of term | 10,594 | 11,588 | +993 | +9.4% |

Unit: million yen

Due to the improvement in CF of the karaoke business, operating CF grew 2.6 times year on year from 2,184 million yen to 5,721 million yen, compensating for the investments for opening karaoke stores, acquiring real estate for lease, and so on.

3. Fiscal Year August 2019 Earnings Estimates

3-1 Consolidated Earnings

| FY Aug. 18 Act. | Ratio to sales | FY Aug. 19 Est. | Ratio to sales | YoY |

Sales | 61,771 | 100.0% | 66,044 | 100.0% | +6.9% |

Operating Income | 7,858 | 12.7% | 9,345 | 14.1% | +18.9% |

Ordinary Income | 8,207 | 13.3% | 9,307 | 14.1% | +13.4% |

Net profit attributable to parent | 4,426 | 7.2% | 5,205 | 7.9% | +17.6% |

*Unit: million yen

There is no revision to the full-year earnings forecast, and it is estimated that sales and operating profit will rise 6.9% and 18.9%, respectively, year on year.

The progress rates toward the full-year estimates are 49.3% for sales, 53.3% for operating profit, 53.6% for ordinary profit, and 56.3% for net profit. The progress rates of profits are high, but the estimates are conservative, because upfront costs will augment as the company plans to open 21 karaoke stores in the second half while it opened 14 stores in the first half.

For the full year, the three businesses are projected to see sales growth, while profitability will increase in the karaoke and Curves Fitness Club businesses. On the other hand, there is a possibility that the profit from the hot spring business will decline due to the augmentation of energy cost.

3-2 Segments Earning Trends

| FY Aug. 18 Act. | Ratio to sales | FY Aug. 19 Est. | Ratio to sales | YoY |

Karaoke Club | 31,936 | 51.7% | 35,234 | 53.3% | +10.3% |

Curves Fitness Club | 27,933 | 45.2% | 28,793 | 43.6% | +3.1% |

Hot Spring | 1,587 | 2.6% | 1,707 | 2.6% | +7.5% |

Real Estate Management | 313 | 0.5% | 311 | 0.5% | -0.8% |

Consolidated Sales | 61,771 | 100.0% | 66,044 | 100.0% | +6.9% |

Karaoke Club | 3,153 | 36.2% | 3,839 | 37.9% | +21.8% |

Curves Fitness Club | 5,345 | 61.4% | 5,930 | 58.5% | +10.9% |

Hot Spring | 71 | 0.8% | 205 | 2.0% | +188.5% |

Real Estate Management | 133 | 1.5% | 157 | 1.5% | +18.3% |

Adjustments | -846 | - | -787 | - | - |

Consolidated Operating Income | 7,858 | - | 9,345 | - | +18.9% |

*Unit: million yen

Karaoke Club Business

Scrap & Build

(Source: the company)

The company plans to open profitable large-scale stores in the vicinity of stations and downtown areas in the Tokyo Metropolitan Area and close down small-sized shops in regional and suburban areas. As part of this plan, the company opened 6 stores in two months: March and April, and strategically closed down 22 shops in regional and roadside areas. The 20 stores opened during a period from the beginning of the term to April have 33.3 karaoke rooms on average (25.5 rooms in the previous term). Meanwhile, the closed stores had 15.2 rooms on average.

Continuation of the marketing strategy

The company will continue its marketing strategy, which supports the unrivaled capability of reeling in customers. It started “Mafu (no time restriction)” in the Kanto region in January 2019, and made it available nationwide in February 2019. At first, it was a limited-time campaign, but the company decided to continue it in March. In April, the company launched “Maneki de Kazokuwari (discounts for families)” nationwide. “Mafu” is a service exclusively for the students of universities, junior colleges, and vocational schools, in which they can sing and drink beverages as they want with no time restriction by paying 300 yen per person during a period from 18:00 from Sunday to Thursday. Customers can enjoy karaoke all night without worrying about the time. On the other hand, “Maneki de Kazokuwari” is a service of not charging each elementary/middle school student who comes with his/her father, mother, grandfather, or grandmother. This is based on the idea of attracting more customers while allowing the slight decrease in average spending per customer.

Differentiation by serving food and drink, and continuation of new services, etc. that need development

The company will differentiate its services by serving food and drink. As the second collaboration after the successful one with “Tsukiji-Gindako,” the company has launched the collaborative campaign with “Gogocurry” nationwide. At Karaoke Manekineko, customers can savor the curries of Gogocurry, which triggered the Kanazawa curry boom. The company plans to keep collaborating with popular restaurant brands, etc. In addition, the number of subscribers to “Manekineko App,” a membership service app, which was released in October, exceeded 800,000, and is still growing. It seems that its point system, upgrading system, etc. are highly evaluated. In addition to these campaigns, the company will continue automation and streamlining activities.

All stores and rooms will become no-smoking on Sep. 1, 2019.

From the viewpoint of CSR, the company joined the project for preventing passive smoking before the Tokyo Olympics in 2020. In detail, it plans to prohibit smoking in all stores and rooms from Sep. 1, 2019. Since this policy was announced on Jan. 15, 2019, the company has been making all rooms no-smoking one after another, and as of Apr. 18, 80.3% of stores prohibit smoking in all rooms (In the Tokyo Metropolitan Area, all stores are already no-smoking). They said that no-smoking stores are highly evaluated by families and women, and reel in young customers, too.

Foray into the blue-ocean market

Outside Japan, the company plans to open stores in Malaysia, where two stores were opened and made a good start, Thailand, where the first store was opened, and also Indonesia, where rents are low like in Malaysia and the company is preparing for opening stores.

Curves Fitness Club Business

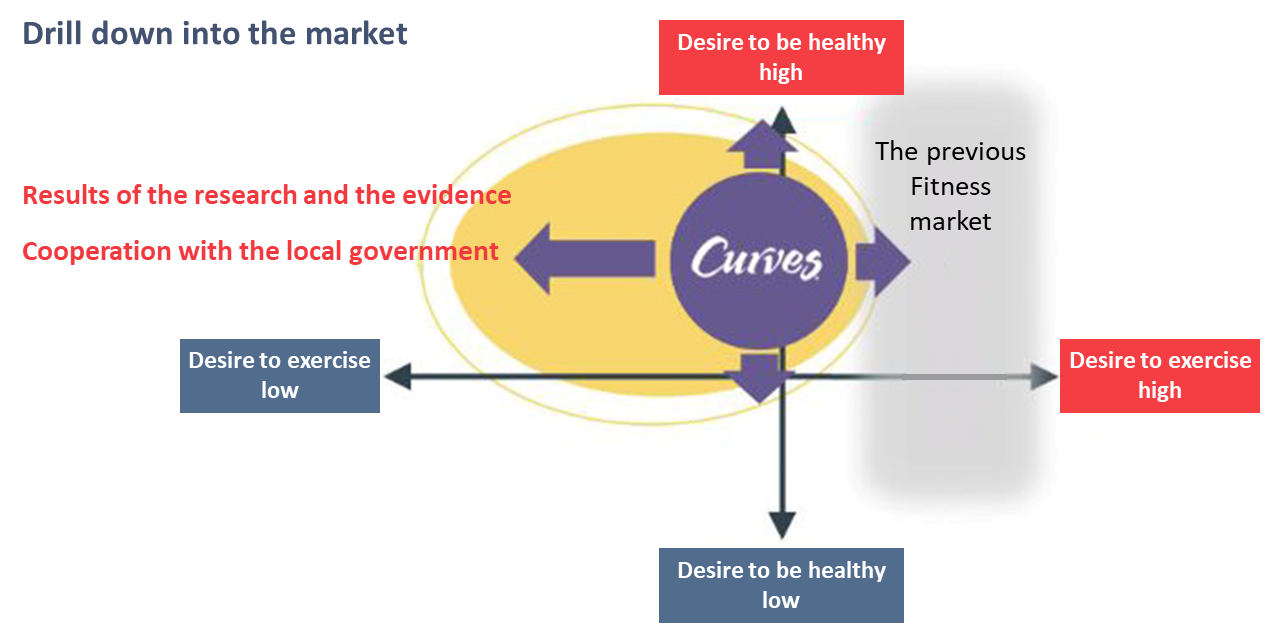

The company will further cultivate the market, improve its services, and continue the feasibility study for “Men’s Curves.” In addition, it will implement global strategies based on the global headquarters of Curves.

Further cultivation of the market, and improvement of services

The company will strive to attract customers who are health-conscious, but do not have a willingness to exercise in cooperation with municipalities, etc., and improve its services, to increase the retention rate of members and reduce the rate of cancellation. The average rate of cancellation from January to March was 2.69%, down 0.17 points year on year. This rate is sufficiently low for fitness gyms, but the company aims to decrease it to less than 2%, by having customers realize the outcomes of their efforts.

Men’s Curves

The first gym of “Men’s Curves” performs healthily (with the average number of members being 340), and its sales have already exceeded the break-even point, and the company plans to open the second gym this year. The company thinks of operating multiple gyms, but it is necessary to reduce the rate of withdrawal from membership, which is slightly higher than the assumed rate.

Global strategies

The company has grasped the current situation, and is designing concrete strategies. The number of affiliated gyms of Curves is 4,000 worldwide. Out of them, about 2,000 gyms are in Japan. The potential is great outside Japan, but seniors in developing and semi-developed countries have a low level of awareness for fitness. Therefore, the company plans to expand this business first in Europe and North America.

(Source: the company)

3-3 Shareholder Return

The term-end dividend is to be 6 yen/share. Combined with the interim dividend, the annual dividend amount is 12 yen/share, showing a dividend increase for 11 consecutive terms since it was listed. As benefits for shareholders, the company presents coupons and tickets for choosing gifts from a catalogue to shareholders as described below (giving more benefits to long-term shareholders).

| Continuous holding of shares for less than 3 years | Continuous holding of shares for 3 years or longer |

100 shares - 399 shares | Shareholder’s complimentary ticket worth 2,000 yen* | Shareholder’s complimentary ticket worth 4,000 yen* |

400 shares - 3,999 shares | Shareholder’s complimentary ticket worth 5,000 yen* Catalog gift worth 3,000 yen | Shareholder’s complimentary ticket worth 10,000 yen* Catalog gift worth 3,000 yen |

4,000 shares and more | Shareholder’s complimentary ticket worth 5,000 yen* Catalog gift worth 5,000 yen | Shareholder’s complimentary ticket worth 10,000 yen* Catalog gift worth 5,000 yen |

4. Conclusions

The performance of the karaoke market seems on a plateau, but the karaoke business of the company saw good results of all measures for attracting customers, including the continuation of “Mafu” targeted at the students of universities, junior colleges, and vocational schools, which was started in January, and each measure successfully reeled in customers. This outcome is reflected in the favorable performance of the existing stores, mainly the stores in vicinity of stations and downtown areas in the Tokyo Metropolitan Area.

The year 2019 will see “the Golden Week composed of 10 consecutive holidays” and “the consumption tax hike,” which are positive and negative factors, respectively, for consumer spending. When there are many holidays, karaoke clubs attract customers. The company plans to meet the demand in the 10 consecutive holidays and strengthen its competitiveness by securing “personnel,” training them to make them helpful in actual business as soon as possible, and energizing all stores. On the other hand, the consumption tax rate is scheduled to be raised this fall, and there is concern over its impact on consumer spending. However, they said that the previous consumption tax hikes did not affect the Curves Fitness Club business and the other businesses significantly. The leisure activities provided by the karaoke and Curves Fitness Club businesses can be enjoyed at low prices, at a nearby place, in a short period of time, and business operation is reasonable; accordingly, it seems that the tax hike does not affect the business so much.

Reference: Regarding Corporate Governance

◎ Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 3 outside ones |

◎ Corporate Governance Report

Updated on December 4, 2018

Basic Policy

The basic policy for corporate governance of our corporate group is to achieve swift decision making and flexible organizational operation for strengthening our corporate competitiveness amid the rapidly changing business environment, while keeping the transparency and soundness of business administration for maximizing the corporate value with respect to shareholders, and we have developed systems and implemented some measures for it. The important mission in our business administration is to achieve sustainable growth and improve our medium and long-term corporate value. In order to fulfill this mission, our corporate group has fostered good relationships with all stakeholders, including shareholders and customers, while respecting their respective standpoints, and set our group’s “management philosophy” and “behavioral standards” for following the philosophy.

Corporate Mission

Our mission is to contribute to the realization of lifestyles full of leisure and to the establishment of a peaceful world filled with hope by continuing to create, offer and provide the world with new and meaningful products and services.

“Code of Conduct”

1. Entrepreneurship | 6. Fairness and selflessness |

2. Customers First | 7. Compliance |

3. Creation of new services | 8. Firm mindset of conserving the earth environment |

4. Polishing of hospitality | 9. Personnel who can brush up themselves |

5. Spirit of prioritizing morals over profits | 10.Rich opportunities |

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 4-1-2 Roles and duties of the board of directors (1) Mid-term management plan

As for the mid-term management plan, the board of directors checks and shares the grounds for producing the plan, its details and progress, but its details have not been announced, because the business environment changes considerably and we need to modify the plan flexibly.

Considering the changes in the business environment, etc., we will discuss the disclosure of the mid-term management plan.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 5-1 Policy for developing systems and activities for promoting constructive dialogue with shareholders

(Basic policy)

Through constructive dialogue with shareholders, our company will deepen their understanding of our company, so that it will contribute to our sustainable growth and the improvement in mid/long-term corporate value.

(Section in charge)

When a shareholder applies for (face-to-face) dialogue, our IR division will deal with the application. After checking the purpose, etc. of the (face-to-face) dialogue, our CEO or executive in charge will dialogue with the shareholder if necessary.

(Dialogue methods other than personal interviews)

Our company holds results briefing sessions, etc., at which our CEO and other directors disclose information on a regular basis.

(Prevention of leak of insider information)

For the management of insider information, our company makes efforts to manage information rigorously and prevent the leak of insider information, in accordance with our in-house rule titled “Regulations for internal information control and prevention of insider trading.”

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved.

|

To view back numbers of Bridge Reports on Koshidaka HOLDINGS Co., Ltd. (2157) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/