Bridge Report:(2196)ESCRIT Fiscal Year March 2019

President Morihiro Shibutani | ESCRIT INC. (2196) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Service business |

Representative Director and COO | Morihiro Shibutani |

Address | Kowa Nishi-shimbashi B Bldg., 2-14-1 Nishi-shimbashi, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share price | Shares Outstanding | Total Market Cap | ROE (Actual) | Trading Unit | |

¥754 | 11,982,000 shares | ¥9,034 million | 15.6% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥16.00 | 2.1% | ¥122.05 | 6.2 times | ¥615.53 | 1.2 times |

*Share price is as of closing on June 28. The number of shares outstanding, ROE, DPS, EPS and BPS were taken from the brief financial report for the term ended March 2019.

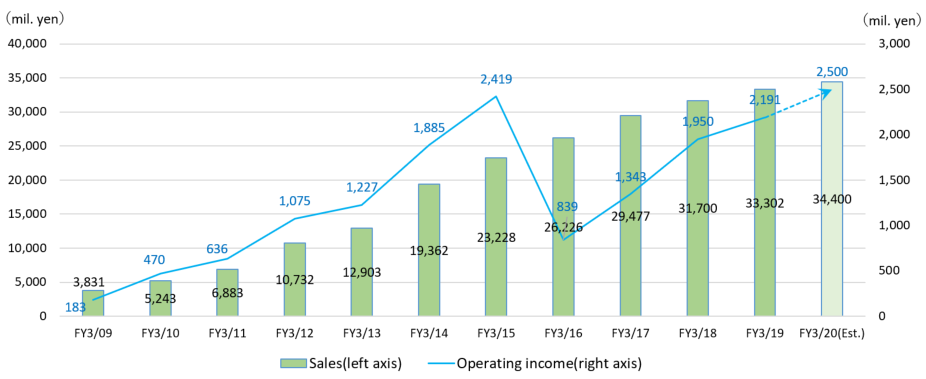

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 (Actual) | 26,226 | 839 | 787 | 359 | 30.39 | 12.00 |

March 2017 (Actual) | 29,477 | 1,343 | 1,224 | 713 | 59.89 | 12.00 |

March 2018 (Actual) | 31,700 | 1,950 | 1,830 | 665 | 55.72 | 12.00 |

March 2019 (Actual) | 33,302 | 2,191 | 2,123 | 1,078 | 90.01 | 12.00 |

March 2020 (Estimate) | 34,400 | 2,500 | 2,400 | 1,450 | 122.05 | 16.00 |

*Unit: Million yen. The estimated values were provided by the company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines ESCRIT INC. and includes financial results and an interview with Mr. Shibutani, the company president.

Table of Contents

Key Points

1. Company Overview

2. Financial Results

3. Initiatives of the Mid-term Management Policy

4. Interview with the President Shibutani

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- ESCRIT is a company that provides various types of wedding services nationwide, such as wedding halls and guesthouses. It has its own business strategy that focuses on intangible assets such as human resources and the outstanding growth of its sales and profit superior to other companies in the industry, which is one of its major strengths and features. Under the leadership of President Shibutani, the company will strengthen its operation base and pursue further growth.

- The company proactively promotes various initiatives in order to build a comfortable working environment as it perceives the human resources as a core value. In particular, it promotes health-oriented management and women’s activities for its ESG social factors. Furthermore, the company’s initiatives for female success promotion have been highly praised.

- It is estimated that sales for the fiscal year ending March 2020 will grow 3.3% year on year to 34.4 billion yen and operating income will rise 14.1% year on year to 2.5 billion yen. Gross profit margin and operating income margin will both increase by 0.7%. The company expects that profits will hit a record high in the current year, which is the last year of the mid-term management plan. Dividends are estimated at 16.00 yen per share, up 4 yen per share from the previous term, with 2 yen /share for the interim dividend, and 2 yen /share for the term-end dividend. The payout ratio is estimated at 13.1%.

- We asked President Shibutani about his ideal state of ESCRIT INC., the initiatives to improve competitiveness, and his message to shareholders and investors. Toward shareholders and investors, he mentioned, “We have a big chance lying before us. However, please understand that we are cautiously proceeding with opening new stores in order not to cause any trouble for our investors and shareholders. We hope to have all your support for the mid to long term, as we will pursue entertainment as a new business model while continuing to tackle new challenges to set new standards in the wedding market.”

- In the interview with President Shibutani, which lasted for about an hour, what impressed us most is the balance of his comments: “The bridal industry is not shrinking – using essential business-centered thinking, we should recognize that the decrease of vendors outweighs the decrease of weddings, and if we don't call this a chance then what is,” and “We do not think that haphazardly opening new branches constitutes growth. In order to avoid causing trouble for our investors, we would like you to kindly understand that we are being cautious about opening new branches.”

- We wonder if the major factor for achieving a rapid recovery from the disastrous situation in 2016 is the balanced perspective and the firm stance of the company through which it managed to see opportunities by doubting the 2 prevailing views: “the bridal industry = shrink” and “growth strategy = stores expansion strategy,” and pursue steady growth. This term concluded the 3-year mid-term management policy, and we are closely monitoring what strategies the company will follow in its next mid-term management plan with which it aspires to be a wedding company that pursues entertainment.

1. Company Overview

ESCRIT is a company that provides various types of wedding services nationwide, such as wedding halls and guesthouses. The company has venues inside train station buildings and near train stations, which is one of its distinctive features. The company’s main strength lies in its unique business strategy focusing on its intangible assets such as human resources and its sales and profits growth that exceed those of other companies in the same industry. The company also focuses on attracting clients through collaborative projects with anime and game characters. ESCRIT will keep strengthening the business foundation and pursue further growth under the leadership of President Shibutani.

【1-1 Corporate History】

Mr. Hiroshi Iwamoto (Representative Chairman and Chief Executive Officer of ESCRIT INC.), who played a key role in launching the bridal magazine “Zexy” at Recruit Co., Ltd. (now Recruit Holdings Co., Ltd.), had seen the bridal industry on a daily basis and figured out a differentiation factor that would set his business apart from other companies and achieve great growth. That is why, in June 2003, he decided to start up his own bridal business and founded this company. The differentiation factor was “focusing on intangibles, not tangibles.” In other words, it was building a high-profit business model through having the strength of human resources as the company’s core value and allowing its diverse personnel to exhibit their abilities and expertise to the maximum.

At the time, the main trend was guest house weddings with luxurious facilities as its selling point. However, the company believed that convenience is more important to the guest, so they set up chapels and banquet halls in buildings near train stations. Even though the company did not have dazzling guest house weddings, they decided they could fully satisfy their clients using their intangible assets and without depending on tangible ones.

Their differentiation strategy was a great success. ESCRIT INC. was recognized as “the model for station building weddings” and started to expand its business rapidly. As other companies started to enter the market, the company found it necessary to raise capital to accelerate launching new venues in convenient locations mainly around the Tokyo metropolitan region. Therefore, in March 2010, ESCRIT listed its stocks in Mothers of Tokyo Stock Exchange and in November 2012, they changed to the first section of Tokyo Stock Exchange.

However, due to the rapid expansion in venues and M&A (the number of venues increased by 13 in one year), the company faced a shortage in personnel and a weakening in the sales force in the existing venues, etc. This led to the company issuing profit warnings in February 2016 for the first time since being listed (sales decreased by 12% and operating income decreased by 66%). Furthermore, the executives who should have focused their efforts on the restoration of the company resigned, taking with them their subordinates, which caused a grave turmoil within the company.

At this moment of crisis, which was the first since the company’s establishment, the one who took charge and worked on restoring the company was Representative Director and Chief Operating Officer, Morihiro Shibutani. Under the strong leadership of Mr. Shibutani, the restoration has been progressing steadily and it is expected that the highest operating income that was recorded in the fiscal year ended March 2015 will be renewed in the fiscal year ending March 2020 for the first time in five fiscal years.

【1-2 Company Philosophy and Vision】

The company name “ESCRIT” comes from the pronunciation of the initials of “STAFF CREATE.”

“Times change, but “the strength of human resources” does not. Trustworthy staff and a trustworthy team exceed the clients’ expectations.”

“We aspire to become a company where its core value lies in the strength of its human resources, and its diverse personnel can exhibit their abilities and expertise to the maximum and benefit from one another. Our highly qualified staff provides high-quality services that guarantee client satisfaction. We are building a business where we reach success depending on “the strength of human resources,” and our talents play the leading role.”

(Cited from ESCRIT’s Website)

This philosophy is the reason behind the company focusing on creating an environment where the most important management resources, human resources, can be active and succeed at the utmost extent without depending on tangible assets.

【1-3 Market Environment】

(1) Market Environment Overview

According to a survey by a private research company, the market scale of solemnizations, wedding receptions and wedding parties in Japan (including the solemnizations that were arranged in Japan and performed overseas) is declining at an annual rate of less than 1%.

The main two factors for this are as follows:

①The decreasing number of marriages due to the population decline

While the children of baby boomers, a generation that was a relatively large population, are reaching their mid-forties, the population of the generation that is within the average age for the first marriage, the generation that was born between the late 1980s and 1990s and now between 29 and early thirties, will continue to decline.

②The trend of curbing expenditures for wedding-related goods and services

In parallel with the spread of various values, there is a trend of curbing expenditures on wedding-related goods and services and of prioritizing the improvement of the everyday life instead, such as “no reception marriages” where the couple does not hold a wedding reception or has a small party inviting only their parents and close friends.

Furthermore, in addition to the state of oversupply of wedding facilities that we are already in, the opening of new facilities has a constant appeal. Hence, time and labor cost to acquire visitors and orders are expected to continue increasing, which will result in the increase in the bridal businesses facing management troubles.

Nevertheless, even though it is highly unlikely for the market scale to stop shrinking, it remains to be around 1.4 trillion yen. Using its unique strategy, ESCRIT steadily squeezes out the demand in the market and it has the potential to achieve further growth.

◎ Competitors in the Bridal Industry

Code | Company Name | Sales | Sales Growth Rate | Operating Income | Operating Income Growth Rate | Operating Income Margin | Total Market Cap | PER | PBR | ROE |

2196 | ESCRIT INC. | 34,400 | +3.3 | 2,500 | +14.1 | 7.3% | 9,070 | 6.2 | 1.2 | 15.6 |

2198 | IKK Inc. | 20,010 | 0.0 | 1,910 | -7.6 | 9.5% | 21,179 | 16.8 | 1.8 | 12.2 |

2418 | TSUKADA GLOBAL HOLDINGS Inc. | 63,000 | +4.7 | 5,500 | +4.8 | 8.7% | 29,376 | 9.2 | 0.8 | 7.0 |

2424 | Brass Corporation | 10,010 | +3.1 | 600 | -13.1 | 6.0% | 3,825 | 10.4 | 1.1 | 7.0 |

4331 | TAKE AND GIVE. NEEDS Co., Ltd. | 67,500 | +0.9 | 4,000 | -6.6 | 5.9% | 13,947 | 8.1 | 0.6 | 10.4 |

4696 | WATABE WEDDING CORPORATION | 51,000 | +5.2 | 800 | +38.5 | 1.6% | 5,886 | 14.7 | 0.6 | 2.1 |

*Units: Million yen and times. The figures are the company’s forecast for this fiscal year. Total market cap, PER and PBR are based on the closing value on June 25, 2019. ROE is from the results of the previous term.

While ESCRIT has the highest ROE among all the wedding companies, it also has the lowest PER. Thus, there is a need to boost company awareness and promote further understanding of the company’s growth strategy.

【1-4 Business Description】

(1) Segment

The company consists of two segments: the general bridal services segment and the construction and real estate business segment.

① General Bridal Services

In addition to directly managing 32 halls nationwide, ESCRIT provides bridal services such as planning and managing solemnizations and wedding receptions through cooperating with other facilities. They provide accommodation services through collaborating with hotels, restaurant services through collaborating with restaurants, and banquet services including planning and managing all sorts of parties.

In the directly managed wedding facilities, as “a city wedding coordinator that does not stick to the facilities’ styles,” the company manages diverse styles of solemnization and wedding reception facilities to satisfy the needs of its various clients.

ESCRIT pays great attention to offering a sense of “privacy” to the facilities and “originality” to the wedding production for the bride, groom, and guests. The company provides clients with “custom made wedding services” to match their tastes in clothes, flowers, guest gifts, food, drinks and wedding production at the solemnizations and wedding receptions, offering them a comprehensive production of their event.

The company promotes in-house production rather than outsourcing to other companies, especially when it comes to clothes, flowers and wedding production. The company employees themselves consult with the clients, accommodating their wishes to every little detail, aiming to further improve client satisfaction.

Furthermore, the company assigns an exclusive chapel and lobby space for each banquet hall in the multiple banquet halls (wedding reception halls) facilities managed by the company to provide a sense of “privacy” to the wedding production.

In the bridal industry, there are many mansion style guest house facilities that are used to give a sense of “privacy” and “originality” to the wedding production. However, with ESCRIT, people can have similar production in addition to having it in a venue with a perfect style that suits its location.

Also, the company undertakes the comprehensive management of bridal services for hotels and restaurants.

(From the company website)

②Construction and Real Estate Business

The group company, Shibutani & Co., conducts different businesses such as contracted work on internal and external construction mainly for restaurants and retail shops, design supervision, construction of independent houses and condominiums, container business, and consulting services.

【1-5 Characteristics and Strengths】

(1) Unique Strategy Focusing on Intangibles

ESCRIT believes that tangible assets have its booms and trends which would definitely change. Thus, it saw the “limitations of tangible assets when it comes to having a competitive advantage in increasing the client base,” as a hindrance to the longtime growth of the company, which led them to focus on the power of intangible assets instead.

With the “high operational skills” of its outstanding staff as its foundation, the company is expanding its “wedding party hall management business.”

Another huge characteristic of ESCRIT, which sets it apart from other companies, is developing the operational know-how of the business such as achieving company differentiation through building alliances with various companies. This leads to increasing the client base, even when having different tangible assets, and achieving a high level of customer satisfaction even without conducting any excessive investments.

The keys behind that are the three business strategies: “personnel strategy,” “venue strategy” and “one-stop service strategy.”

Using these three strategies, the company aims to drastically differentiate itself within the industry and achieve a stable business model that would not be affected by the new standards in the bridal business or the changes in the tangible assets and style.

①Personnel Strategy

ESCRIT believes in the importance of staff feeling satisfied in their jobs and their continuing on evolving and developing their abilities to the utmost degree as part of the organization. The company is also working on developing individuals’ capabilities and building an organization with a culture of openness and freedom.

The company builds a working environment where personnel are able to continue working. Moreover, as a company that promotes women’s participation in the workplace, ESCRIT is implementing various policies such as support for the work styles associated with different life stages, enhancing welfare and support for career development.

These efforts lead to the company’s biggest competitive advantage; fostering the power of its intangible assets.

②Venue Strategy

The currently mainstream guest house weddings’ share is considered to be only around 20% in the bridal market, which is estimated to be worth around 1.4 trillion yen.

Through experience and evidence so far, the company, which believes that “tangible assets have limitations when it comes to having a competitive advantage in increasing the client base,” is pursuing the possibility of profit in all the domains and not focusing on the narrow market of a specific wedding style.

Therefore, ESCRIT is developing its business of various style facilities such as hotels, restaurants, guest houses and wedding halls, centering its business on meeting the needs of the changing market.

At the same time, the company is focusing on increasing the client base not only by launching new venues but also by improving the existing ones. This would lead to achieving stable and steady growth which in return leads to fulfilling the expectations of the stakeholders.

③One-Stop Service Strategy

In the bridal business, things such as the dress, makeup, and flowers are generally outsourced to an external contractor, which causes the huge problem of not being able to fulfill the clients’ requests fully.

That is why, as it was mentioned previously, the company promotes in-house production of clothes, flowers, and wedding production. By enhancing this one-stop service system, the company can achieve further improvement in client satisfaction.

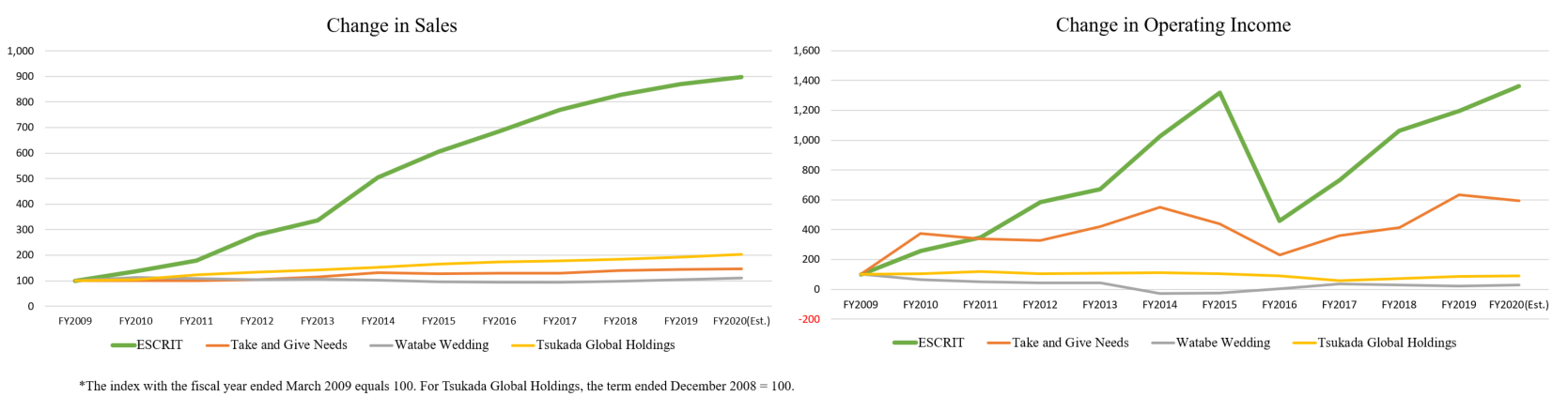

(2) Growth of Sales and Profit that Exceeds Those of Competitors

The graph below represents a comparison of the variations in sales and operating income among the three companies with the bigger scale of sales than ESCRIT (Tsukada Global Holdings, Take and Give Needs and Watabe Wedding) according to the table “Competitors in the Bridal Industry” in page 4. If we look at the growth of ESCRIT’s sales and profit, we will find that it is better than the rest of the companies.

While, as for operating income, Tsukada Global Holdings and Watabe Wedding’s profits peaked in 2010-2011, the operating income of ESCRIT is expected to hit a record high this fiscal year, capturing a lot of attention for being able to continue expanding its sales and profit even in such a harsh business environment.

The foundation of this growth is the “power of intangible assets,” the philosophy of the company since its founding and what President Shibutani has been strongly promoting.

【1-6 ROE Analysis】

| FY3/13 | FY3/14 | FY3/15 | FY3/16 | FY3/17 | FY3/18 | FY3/19 |

ROE (%) | 32.3 | 34.4 | 32.6 | 6.9 | 12.7 | 10.7 | 15.6 |

Net profit to sales ratio (%) | 5.72 | 5.69 | 6.20 | 1.37 | 2.42 | 2.10 | 3.24 |

Total asset turnover ratio | 1.53 | 1.57 | 1.33 | 1.18 | 1.15 | 1.18 | 1.28 |

Leverage | 3.69 | 3.86 | 3.95 | 4.27 | 4.55 | 4.32 | 3.79 |

Even though ROE is still lower than the last peak in the fiscal year ended March 2014, it bottomed out in the fiscal year ended March 2016 and now it is far higher than the 8% that is generally expected to Japanese companies.

This fiscal year’s net profit to sales ratio is estimated to be 4.2% and the company is expected to achieve a high ROE.

【1-7 Initiatives in ESG】

As it is shown in the origin of the company’s name, the strength of its human resources is the core value of ESCRIT. Therefore, the company actively promotes various policies especially related to the “Social” in ESG that aims to build a comfortable working environment.

(1) Promotion of health-oriented management

The following is “ESCRIT’s Declaration of Health-oriented Management.”

In ESCRIT, we believe that it is most important for each and every one of our employees to be healthy mentally and physically and work energetically to be able to deliver our clients’ happiest moments.

With the idea that “the foundation of the company’s activities is ensuring the safety and health care for the employees and the creation of a comfortable working environment,” from now on, we declare that we will actively exert more efforts toward improving the work environment so that both ESCRIT employees and the company could work in good health for a long time.

Representative Director Morihiro Shibutani |

①Main Measures

In order to provide “health care” for the entire company, ESCRIT is working on health management (analysis of the results of the periodic medical examinations and achieving a good work-life balance), disease prevention (prevention of infectious diseases and lifestyle diseases and control of women’s diseases), management of mental health and promotion of continuous movement.

②Evaluation: Certified as “Tokyo Sports Promotion Company” and “Sports Yell Company”

ESCRIT was certified as “Tokyo Sports Promotion Company” and “Sports Yell Company” as an appreciation for its efforts.

“Tokyo Sports Promotion Company Certificate” is a certificate awarded to companies that encourage employees’ sports activities and provide support to athletes, groups, and tournaments and so on within the sports segment.

To encourage employees’ sports activities, ESCRIT holds several types of sports events, hosting “Kizuna” Ekiden relay race, creating club activities, as well as having policies such as recruiting top athletes to coach the employees’ clubs.

Also, ESCRIT actively works on supporting athletes (employing Honami Suzuki, Japan’s representative in women’s fencing epee individual) and contributing to the sports culture (such as the execution of a partnership with the table tennis professional league “T.T Saitama”). These efforts led to receiving the “Tokyo Sports Promotion Company Certificate.”

“Sports Yell Company” system is a system that aims to encourage “people in the generation in the prime of their lives” who lack exercise to practice sports and work on creating a social movement for sports. Japan Sports Agency certifies companies that actively work on implementing sports activities to improve their employees’ health. Through this “Sports Yell Company” certificate, Japan Sports Agency aims to help improve the social evaluation of companies that are working on strategic measures to manage their employees’ health.

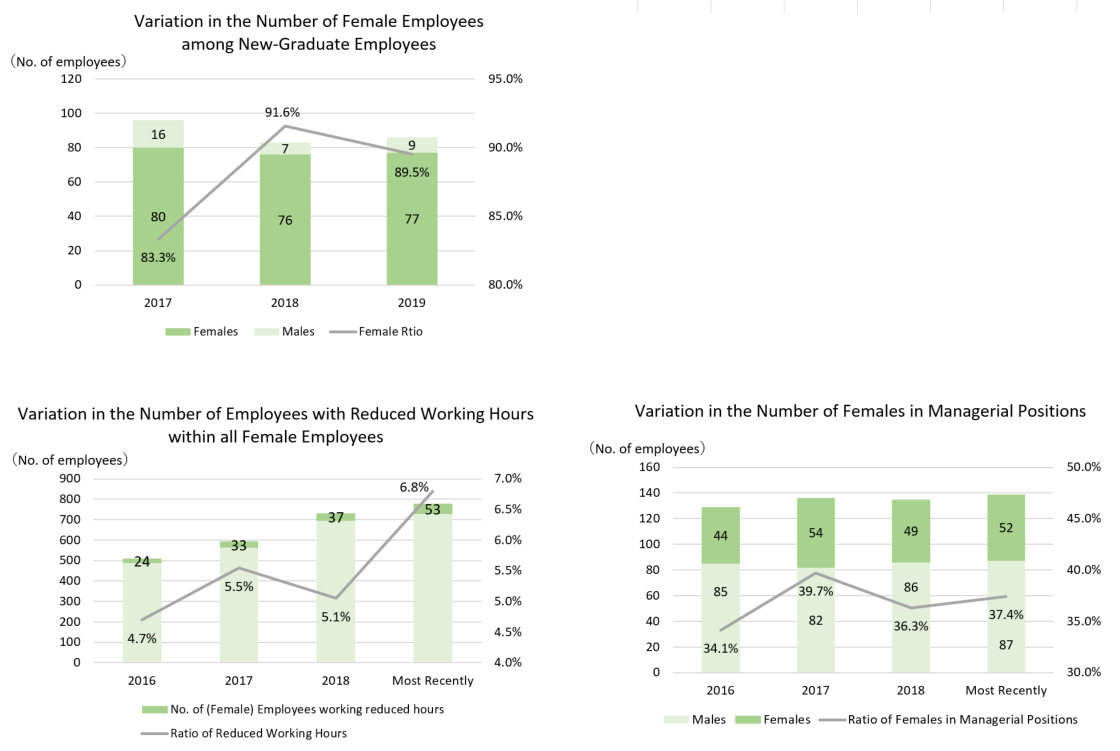

(2) The Various Policies to Promote Women’s Participation and Achievements

① Main Measures

ESCRIT has many occupations where women flourish, such as wedding planners, bridal stylists and floral designers, and female employees account for 70% of the total number of employees at the end of March 2019.

Since ESCRIT aspires to become a company where all its employees are evaluated fairly based on their capabilities and regardless of their gender and what life stage they are in, promotion of women’s participation in the workplace was one of the policies of the company’s mid-term management plan.

Based on this policy, the company implemented the following “measures to promote women’s participation.”

Measures | Outline |

Providing a stress-free environment that facilitates access to health care for women during pregnancy | *Implementing a “Start of the Pregnancy Consultations” Pregnant employees can talk with their bosses and the human resources officers about any concerns on physical health or work tasks to reassure them that they can go through their pregnancy with ease.

*Providing time for hospital visits Providing time for hospital visits to have medical examinations during working hours in order to ensure access to health care. (Men accompanying pregnant women to hospital visits are also provided with time to do so) |

Promotion of extending the maternal leave and providing men with paternity leave | *Extending the pre-childbirth maternal leave period Extending the period from the six weeks stipulated in the law to eight weeks.

*Encouraging male employees to take a paternity leave Recommending that fathers take a maximum of eight days of paternity leave in the period of two months from the day their children are born. (it can also be used to attend the birth) |

Implementing consultations before employees’ return to work and supporting their smooth return to the workplace | *Implementation of “Comeback Consultations” Employees coming back to work can talk with their bosses and the human resources officer about any requests such as working hours, in order to be able to have a concrete idea about the working style after returning to work. |

Support for the balance of childrearing and work after returning to the workplace | *Support of gradual entry at daycare Employees are exempted from going to work during the phase of their child’s gradual entry to daycare.

*Reduced working hours, extending the leave for caring for a sick child and overtime restrictions Extending the childrearing-friendly reduced working hours until the child enters elementary school. Extending the overtime restrictions until the child enters elementary school. Extending the period an employee can take a leave for caring for a sick child until the child graduates’ junior high school. |

Additionally, because ESCRIT aims to provide a comfortable working environment not only for women but also for all its employees, it also focuses its efforts on “measures to optimize working hours,” “establishing of a counseling service section for women,” “training for employees in managerial positions,” “training for all employees” and “career advancement training for women.”

② Achievements

As a result of these measures, women’s participation increased in a noticeable pattern as shown in the graph below. Also, employee satisfaction is steadily increasing with employees giving testimonies such as “I am enjoying motherhood and work thanks to the implemented support system. In the future, I want to be a role model for working women.” (Cited from the company’s website)

The goal was to increase the number of employees with reduced working hours to 50. However, since this goal was achieved by the end of March 2019, the company is working on setting another goal.

ESCRIT aims to increase the ratio of females in managerial positions to 50% by the fiscal year 2022.

③ Evaluation: Receiving the “Eruboshi” (L Star) Certificate from the Minister of Health, Labor, and Welfare

In July 2018, ESCRIT received the “Eruboshi (L Star)” certificate from the Minister of Health, Labor and Welfare for its excellent efforts in promoting women’s participation in the workplace to become the first company in the bridal industry to obtain this certificate based on the Act on Promotion of Women's Participation and Advancement in the Workplace.

“Eruboshi (L Star)” certificate is a system where the Minister of Health, Labor, and Welfare certifies excellent companies with conditions that promote women’s participation in the workplace according to the Act on Promotion of Women's Participation and Advancement in the Workplace. There are five assessment criteria for the “Eruboshi” (L Star) which are: “recruitment,” “continued employment,” “working styles, including working hours,” “ratio of managerial positions” and “various career courses.”

The “Eruboshi” certificate is hard to obtain. So far, around 20,000 companies applied for it, but only around 600 companies received it. ESCRIT’s measures that were mentioned above were acknowledged to exceed the standards, which is why the company received the certificate.

(3) Converting all contract employees to permanent employees

After considering the long-term career development for the employees, in August 2018, ESCRIT decided to convert all its contract employees to permanent employees.

The company had several professions such as wedding planners, bridal stylists and floral designers where the majority of its employees were contract employees. However, the company abolished the contract employment system, converting it to a new relocation-less permanent employment system (geographically confined permanent employee).

Now, contract employees are playing an important role within the companies. In ESCRIT, employees can comfortably work on their long-term career development in light of the changes in the employment circumstances and women’s participation conditions.

2. Financial Results

(1) Fiscal Year March 2019 Earnings Results

① Overview of financial results

| FY3/18 | Ratio to sales | FY3/19 | Ratio to sales | YOY | Initial estimate comparison |

Sales | 31,700 | 100.0% | 33,302 | 100.0% | +5.1% | +0.0% |

Gross profit | 17,799 | 56.1% | 18,695 | 56.1% | +5.0% | -0.4% |

SG&A expenses | 15,849 | 50.0% | 16,504 | 49.6% | +4.1% | -0.7% |

Operating income | 1,950 | 6.2% | 2,191 | 6.6% | +12.4% | +1.9% |

Ordinary income | 1,830 | 5.8% | 2,123 | 6.4% | +16.0% | +3.6% |

Net income | 665 | 2.1% | 1,078 | 3.2% | +61.9% | +2.7% |

*Unit: Million yen

Sales and profit increased, and the performance was as estimated.

Sales were 33.3 billion yen, up 5.1% year on year. Sales increased for both businesses, to which launching new stores for the general bridal services contributed.

Operating income was 2.1 billion yen, up 12.4% year on year, and despite the increase in costs for opening new stores and expanding in Taiwan, the company achieved cost control by cutting costs and achieved double-digit increase in profit for 3 consecutive terms.

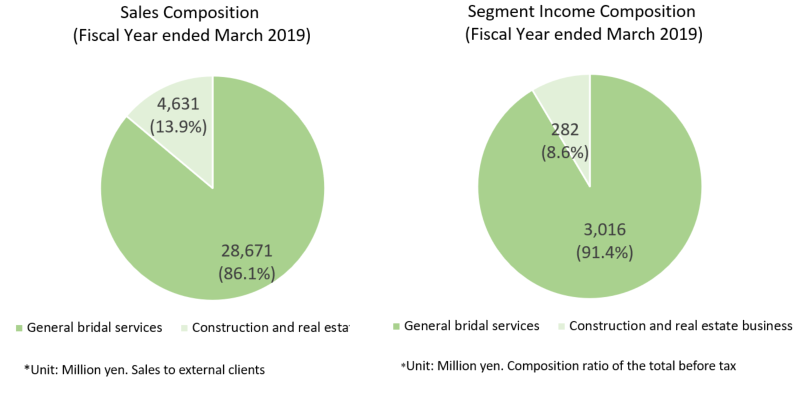

② Results of each segment

| FY3/18 | Composition ratio | FY3/19 | Composition ratio | YOY |

Sales |

|

|

|

|

|

General bridal services | 27,289 | 86.1% | 28,671 | 86.1% | +5.1% |

Construction and real estate business | 4,410 | 13.9% | 4,631 | 13.9% | +5.0% |

Total | 31,700 | 100.0% | 33,302 | 100.0% | +5.1% |

Segment income |

|

|

|

|

|

General bridal services | 3,125 | 11.5% | 3,016 | 10.5% | -3.5% |

Construction and real estate business | 229 | 3.8% | 282 | 4.9% | +23.1% |

Adjusted amount | -1,404 | - | -1,107 | - | - |

Total | 1,950 | 6.2% | 2,191 | 6.6% | +12.4% |

*Unit: Million yen. The composition ratio means operating income margin.

(General bridal services)

Sales increased, but profit decreased.

Thanks to the full-year operation of new stores in Saitama New Urban Center opened in the previous term, and starting operation of the new store in Hiroshima opened in April and the new store in Shibuya opened in September, sales increased. However, profit was less than that in the previous year due to the costs for opening new stores in Shibuya, Hiroshima, and Taiwan.

The capital investment amount reached 1,054 million yen for establishing 2 new sales offices and renovating 8 current offices, etc.

◎ Order receipt situation

The number of orders for both the Core Bridal Service and New Bridal Service was healthy and the backlog of orders expanded by double digits.

*Core Bridal Service

| FY3/18 | FY3/19 | YOY |

Number of weddings carried out | 5,166 | 5,304 | +2.7% |

Number of orders received | 6,566 | 6,989 | +6.4% |

The backlog of orders | 3,600 | 4,064 | +12.9% |

Average price per couple | 3,763 | 3,779 | +0.4% |

*Unit: thousand yen.

*New Bridal Service

| FY3/18 | FY3/19 | YOY |

Number of weddings carried out | 2,836 | 3,259 | +14.9% |

Number of orders received | 3,286 | 3,790 | +15.3% |

Number of orders backlog | 1,448 | 1,673 | +15.5% |

*Core Bridal Service: targets wedding ceremonies and receptions with 30 or more attendees in directly managed facilities.

*New Bridal Service: includes figures of subsidiaries, entrusted operations, weddings with a small number of guests, Toku-Navi (figures for the alliance venue), and resort weddings.

The numbers of customers traveling from abroad were removed from the above figures to avoid duplication.

(Construction and real estate business)

Sales and profit increased

Construction works were finished as planned, and renovated real estate was sold.

③ Financial conditions and cash flow

◎ Main balance sheet

| End of FY3/18 | End of FY3/19 |

| End of FY3/18 | End of FY3/19 |

Current assets | 8,747 | 7,661 | Current liabilities | 10,422 | 8,852 |

Cash and deposits | 4,804 | 4,814 | Notes and accounts payable | 1,543 | 1,464 |

Notes and accounts receivable | 540 | 298 | Short-term loans payable | 3,106 | 2,520 |

Real estate for sale | 1,315 | 810 | Non-current liabilities | 10,192 | 8,945 |

Non-current assets | 18,346 | 17,452 | Long term interest-bearing liabilities | 7,159 | 5,720 |

Property, plant and equipment | 13,162 | 12,182 | Total liabilities | 20,615 | 17,798 |

Investments and other assets | 5,031 | 5,182 | Net assets | 6,479 | 7,316 |

Total assets | 27,094 | 25,114 | Retained earnings | 5,304 | 6,208 |

*Unit: Million yen |

|

| Total liabilities and net assets | 27,094 | 25,114 |

|

|

| Capital-to-asset ratio | 23.9% | 29.1% |

Total assets were 25.1 billion yen, down 1.9billion yen year on year due to the decrease in real estate for sale, and property, plant and equipment (buildings and structures), etc.

Total liabilities were 17.7 billion yen, down 2.8billion yen year on year due to the decrease in debts, corporate bonds, etc.

Net assets increased 800 million yen year on year to 7.3 billion yen as retained earnings increased 900 million yen year on year.

Capital-to-asset ratio increased 5.2% from the end of the previous term to 29.1%.

◎ Cash flows

| FY3/18 | FY3/19 | Change |

Operating CF | 1,826 | 3,164 | +1,338 |

Investing CF | -2,098 | -831 | +1,267 |

Free CF | -272 | 2,333 | +2,605 |

Financing CF | -855 | -2,341 | -1,485 |

Balance of cash and cash equivalents | 4,568 | 4,568 | +0 |

*Unit: Million yen

The surplus of operating CF expanded due to the increase of profit before income taxes, etc.

The deficit of investing CF shrank, which made free CF positive.

The deficit of financing CF expanded due to the repayment of debts and corporate bonds.

The cash position remained unchanged.

④ Main initiatives for the fiscal year ended March 2019

◎ Opening new stores

Type | Name and location | Operation starting time |

Wedding facility | LAGUNAVEIL HIROSHIMA: Hiroshima city, Hiroshima Prefecture | April 2018 |

Wedding facility | LAGUNAVEIL ATELIER: Shibuya-ku, Tokyo | September 2018 |

Dress store | PRIMACARA Omotesando store: Minato-ku, Tokyo | July 2018 |

The dress store opened as a flagship store to represent the brand image in order to boost the brand power of the original wedding dress brand “PRIMACARA,” and generate and acquire new demand for marriage ceremony needs starting with dresses.

It has all the necessary facilities to bring out the charm of the dresses such as a good location at a 2 minutes’ walk from Omotesando station and a spacious main display with a ceiling height of 6 m.

◎ Overseas business

In March 2018, the Taiwan subsidiary launched a directly managed salon.

The company aims to increase customers by taking advantage of the increase in foreign demand for weddings.

The company aims to generate new demand for weddings of foreigners by offering proposals from a touristic perspective thanks to the easily accessible domestic location, which is one of the company’s strengths, not to mention the high popularity of resort weddings.

◎ Renovation

The company renovated 8 operation facilities (3 in Tokyo, 1 in Osaka, 1 in Fukui, 1 in Toyama, and 2 in Tochigi).

The company’s art director Ms. Chie Morimoto was involved in the concept design of some of the renovated venues, and the company offers various options to satisfy the various needs of customers such as customers who like nature-inspired venues, customers who prefer photogenic venues, etc., while the company enhanced added-value of existing facilities to strengthen the capability to attract customers and improve satisfaction of customers.

◎ Alliance with ANA and JAL

Following the alliance with All Nippon Airways Co., Ltd., in December 2016, the company formed another alliance with Japan Airlines Co., Ltd. (JAL, First Section of Tokyo Stock Exchange, 9201) in September 2018, and started offering services to let the customers accumulate miles according to their total expenses for wedding ceremonies. The company will work towards acquiring new customers and the vitalization of the market by responding to the diverse needs and motives for wedding ceremonies.

◎ A joint project with Samantha Thavasa

The company collaborated with Samantha Thavasa Japan Limited (Mothers of Tokyo Stock Exchange, 7829) and launched a new wedding plan called “Samantha Wedding” in February 2019.

The wedding plan features extensive Samantha Thavasa world elements, from the venue decorations and gadgets to original wedding cakes, surprise content, etc.

◎ Initiatives for new collaborations

Following the initiatives for Disney, Sanrio, and Monster Hunter, the company started an initiative with the world-famous, “Pokémon.”

It launched the “Pokémon bridal fair (free consultation wedding ceremonies)” as a new wedding plan, and started receiving reservations in February 2019.

In order to activate the bridal industry where weddings without a ceremony increase and the couples who have a wedding ceremony decrease, the company utilized its strengths to the fullest including the in-house production of dresses, flowers, and other services, and has paired up with numerous companies to provide unrivaled contents, such as holding various bridal fairs.

As for the “Pokémon” initiative, the bride and groom and their guests can enjoy this wedding plan where the company offers marriage registration and an original paper bag as perquisite for participating in the bridal fair. Additionally, this bridal fair offers the bride and groom a "Pikachu welcome card" as a congratulatory present for making their vows, and arranges for a greeting by Pikachu on the wedding day. The venue is also decorated with Pikachu, so that brides, grooms, and guests can enjoy them.

(2) Fiscal Year March 2020 Earnings Estimates

① Forecast of financial results

| FY3/19 | Ratio to sales | FY3/20 (Estimate) | Ratio to sales | YOY |

Sales | 33,302 | 100.0% | 34,400 | 100.0% | +3.3% |

Gross profit | 18,695 | 56.1% | 19,529 | 56.8% | +4.5% |

SG&A expenses | 16,504 | 49.6% | 17,029 | 49.5% | +3.2% |

Operating Income | 2,191 | 6.6% | 2,500 | 7.3% | +14.1% |

Ordinary income | 2,123 | 6.4% | 2,400 | 7.0% | +13.0% |

Net income | 1,078 | 3.2% | 1,450 | 4.2% | +34.5% |

*Unit: Million yen. The forecasts are released by the company.

Sales and profit will increase, and profit ratio will also increase. Profit will hit a record high.

It is estimated that sales will grow 3.3% year on year to 34.4 billion yen and operating income will rise 14.1% year on year to 2.5 billion yen. Gross profit margin and operating income margin will both increase by 0.7%. Profit is expected to hit a record high in the current year, which is the last year of the mid-term management plan.

Dividends are estimated at 16.00 yen per share, up 4 yen per share from the previous term, with 2 yen /share for the interim dividend, and 2 yen /share for the term-end dividend. The payout ratio is estimated at 13.1%.

② Results for each segment

| FY3/19 | Composition ratio | FY3/20 (Estimate) | Composition ratio | YOY |

Sales |

|

|

|

|

|

General bridal services | 28,671 | 86.1% | 30,398 | 88.4% | +6.0% |

Construction and real estate business | 4,631 | 13.9% | 4,002 | 11.6% | -13.6% |

Total | 33,302 | 100.0% | 34,400 | 100.0% | +3.3% |

Segment income |

|

|

|

|

|

General bridal services | 3,016 | 10.5% | 3,633 | 12.0% | +20.4% |

Construction and real estate business | 282 | 4.9% | 90 | 2.2% | -68.1% |

Adjusted amount | -1,107 | - | -1,223 | - | - |

Total | 2,191 | 6.6% | 2,500 | 7.3% | +14.1% |

*Unit: Million yen. The composition ratio of operating income is operating income margin.

(General bridal services)

Sales and profit are projected to increase.

The stores opened in the previous term in Hiroshima and Shibuya will operate full-year.

The orders and unit prices are estimated to be at the same level as those in the previous term.

The costs include the prior expenses of 120 million yen due to the overseas business expansion (resort wedding and foreigners wedding).

(Construction and real estate business)

Sales and profit are estimated to decrease.

Considering the market environment including the order receipt situation, the steep rise in materials costs, the labor shortage, etc., profit is expected to decrease.

As for the real estate renovation, the owned properties are not included in the plan.

3. Initiatives of the Mid-term Management Policy

The company is proceeding with 6 measures based on the mid-term management policy that starts in the term ended March 2018 and finishes in the term ending March 2020.

The company self-evaluates the progress at the end of the previous term as below.

The mid-term management policy | Improve the profitability of current businesses and generate new profitability base. -Ensure making profit growth each term- |

(All measures and self-evaluation)

Measure | Progress | Evaluation |

Opening new stores | *New stores in Hiroshima started operation in April 2018, and Shibuya in September. *Performance was solid including stores opened in the previous term in Saitama. | 〇 |

Reinforcing existing stores | *Carried out the most major renovation ever for 8 facilities. While the effect varied, the order receipt situation was improved. *Continue to make efforts to build a system for maintaining a high unit price and human resources development. | △ |

Fostering new businesses | *Aiming to meet the needs for foreigner weddings, the company established and launched a local corporation in Taiwan. *Orders on resort weddings in Okinawa, Hawaii, etc. have increased. | - |

Improving cost | *After the facilities renovation, integrate offices of different tenants in extra spaces and reduce rents and such. *Various costs improvements including utility expenses, consumables, and linen. | ◎ |

Advertising strategies | *Utilizing popular characters for product development, etc. and strengthening alliances with other corporations. *This term, the company started a joint project with Samantha Thavasa Japan Limited, a collaboration with Pokémon, etc. | 〇 |

A ladies-first strategy | *Promoting various measures to improve diverse work environments so that women can achieve more success. *the company’s delicate support to women’s childcare leaves and returning to work was praised and it obtained the “Eruboshi” certification from the Minister of Health, Labor and Welfare. | ◎ |

As for reinforcing existing stores, from the renovation perspective, the company managed to make adequate investments. However, since more time is required to produce results in addition to the semi-permanent nature of human resources development, the evaluation was “△.” The company will continue to make efforts to devise a system for maintaining a high unit price.

Regarding the cost improvements, the company has made consideration of every aspect and has yielded results.

As for the advertising strategies, the company will put various ideas into practice and aim to produce an unmatchable added value that is unique to the company.

As mentioned above regarding the ladies-first strategy, it received praise from inside and outside the company.

4. Interview with President Shibutani

We asked President Shibutani about his ideal state of ESCRIT INC., the initiatives to improve competitiveness, and his message to shareholders and investors.

Q: “You were appointed as president in April 2016. Two months earlier, your company, which had been repeating upward revisions every term, unavoidably needed to make a downward revision for the first time. There was considerable confusion within the company at that time. As president, how did you approach the situation?”

A: “We had fallen to the nadir. Enlisting cooperation from all the remaining employees, we were able to make an upward revision a year later. Our approach at the time was to “re-do everything.” In particular, we focused our efforts on a thorough retraining of the managerial class by adopting a competition principle. Everything has finally started to work well, but it has by no means reached my desired level. We will continue our training without pause.”

Initially, my relationship with the chairman Mr. Iwamoto was only business-related (author’s note: Mr. Shibutani is the fourth-generation owner-president of an excellent construction company in Nara Prefecture, Shibutani & Co., which has been in business for over a century. Shibutani and Co. worked with ESCRIT on interior finishing), but after finding a good mutual understanding, I was strongly encouraged to join ESCRIT and help in its growth. In the spirit of brotherhood, I joined the company in 2013.

Seeing the downward revision in February 2016, all employees needed to join hands to confront the crisis, but one member of the management ranks resigned, taking some employee. What followed was that while I was not an expert in the wedding business, I was the one selected out of many candidates to lead the rebuilding. Since I entered this company in a somewhat fateful way, I was determined to keep my resolve and overcome the problem.

We had fallen all the way to the bottom. Enlisting cooperation from all the remaining employees, we were able to make an upward revision a year later. Our approach at the time was to “re-do everything.”

Although weddings were not my primary line of business, I have confidence in my perspectives and actions as a business owner. I felt that our business was riddled with various gaps and holes.

Back then, in addition to the purchase of food, drinks, and dresses, I was involved in marketing and the training of managers.

In particular, as part of the training for the managerial class at the top of each of our venues, we adopted a thorough meritocratic system. Until then, it was nearly impossible to be demoted once you became a manager in our company, but in reality, there were some managers who could not handle leadership roles. With such people in managerial roles, we could not guarantee the happiness of shareholders and other employees, and therefore decided on a thorough re-training.

In addition, we strengthened the deputy managerial system, and fostered capable deputy managers so that business would continue healthily even if managers were demoted. With these competitive measures in place, managers improved their performance to ensure that they would not be demoted.

I think the most significant aspect of our reform was that the competitive principle created improvements even in areas which I could not see with my own eyes.

After that, we diffused the competitive principle, and focused our efforts on ensuring that the organization would function well as a whole, arranging the company into an East Japan and West Japan branch office system, with a section chief who would supervise managers, a branch manager who would supervise section chiefs, and a general manager who would supervise branch managers.

It has been nearly five years, and compared with how it was before I worked on the reform, there has been a lot of progress and we have done well to make it this far – everything has finally started to work well, but my honest impression is that we have not yet reached my desired level.

Thus, we will continue our training without pause.

Q: “Your company’s biggest strength and competitive advantage appear to be the power of your people, and your intangible assets, but in order to stay competitive, it appears necessary to continue to improve these aspects. What are you working on in that regard as president?”

A: “Of course, we are working on creating a comfortable working environment, but the main point would be education and training. I myself have been holding study and training sessions where I take on the role as a lecturer. Through our monthly teleconferences and ordinary meetings at our 33 venues throughout the country, we are continuing to teach the foundational values of our business. I believe that my great mission is to unify the will and intentions of all our employees.”

Of course, we are working on creating a comfortable working environment, but the main point would be education and training.

The company’s initiatives are to continuously do things like keeping track of new trends, developing new products and holding presentations with our customers in our training system.

I myself have been holding study and training sessions where I take on the role as a lecturer. One initiative of ours is to further improve the level of employees worth training; another is to train senior executives who will lead the company in the future.

From a business standpoint, I think that selling fish, selling cars, selling homes, and selling weddings can be all seen as the same. Therefore, I will thoroughly continue to teach the foundational marketing wisdom of how to direct customers’ attention our way

It is essential that my message is delivered to all employees, so in addition to giving lectures to thousands of employees at our monthly nationwide teleconference, I travel to one of our 33 venues and hold a lunch meeting at that venue. I do this twice per month, visiting all of our venues one by one. The reason I started doing this is because a rural employee wrote on social media, “The president, who I’d only seen in teleconferences, came to see us.”

I’m not a celebrity, so I thought it couldn’t be good that an employee would call me “someone I’d only seen on TV.”

I wake up at five in the morning, take the plane or the train to the venue, and return to Tokyo the same day after finishing the lunch meeting.

To be honest, I would like to stay for a night, and relax while enjoying the regional specialties of each place, but I don’t do that.

After all, whether a startup like ours can succeed depends on the initiative taken by its leadership.

Unlike some major companies, we don’t expect that our sales will increase even if we don’t do anything, so our leadership really needs to take initiative.

My personal schedule is not private, so my actions are monitored by my employees.

I often tell my employees, “You say that you’re so busy, but why don’t you take a look at my schedule. I bet your schedule has got to be easier than mine.”

I work so hard that I can confidently assert that.

I believe that my great mission is to unify the will and intentions of all our employees by taking measures such as these.

Q: “Next, I would like to ask about business operation. How do you, as president, see the current state of the bridal industry as well as the future business environment of the industry? Under such situation, what is the state of the company ESCRIT aims to achieve?”

A: “It is often said that the wedding industry is shrinking, but it’s not as if the number of weddings will increase given the declining population and the decrease in spending, so this is a completely natural trend. Recognizing that the sharp decrease of vendors outweighs the gradual decrease of weddings is the essence of business-centered thinking – thus, one can say that this is a big chance. Grasping this opportunity, we plan to open up the market with a competitive advantage that other companies cannot imitate.”

Currently, with couples who do not wish to hold a wedding ceremony or couples who wish to hold their wedding ceremonies overseas, the needs of consumers have been greatly diversified, while at the same time, the number of marriages has also decreased, leading many to comment that the industry itself is shrinking. I think that simply saying that the industry is shrinking does not grasp the essence of the problem.

The population is decreasing, as is the number of couples getting married. Personal income isn’t increasing either.

Given these circumstances, it’s not as if the number of weddings will increase – thus, rather than a case of shrinking numbers, this is a completely natural trend.

If we think of the current situation as a natural trend, our approach to the situation can also be changed. If we say that numbers are shrinking, this can create a bad impression and create a negative mood, but I don’t think that way at all, and rather think that there are chances for business within this natural trend.

Even now, there is still a large market worth 1.4 trillion yen, while on the other hand, the number of our competitors who are leaving this business is increasing at an accelerating rate.

As the proprietor of Shibutani & Co., a company which has been in business for over a century, I recognize that this situation should be seen positively as an important opportunity.

That is to say, rather than seeing the situation as one of shrinking numbers, we should recognize that the decrease in the number of vendors outweighs the gradual decrease in the number of weddings – this is the essence of business-centered thinking.

In addition to our Taiwan subsidiary having opened a directly managed salon in the previous fiscal year, we opened our first chapel in Hawaii. It’s important that we try to attract foreigners coming to Japan to have ceremonies and Japanese customers wishing to have ceremonies overseas. However, I think we need to have careful judgement when doing business which takes place outside Japan.

In any case, grasping the opportunity presented by the fact that the decrease of vendors outweighs the decrease of weddings, we plan to open up the market with a competitive advantage other companies cannot imitate.

Q: “What else would you like to tell us?”

A: “To differentiate ourselves from other companies, we will emphasize “entertainment value.” We would like to pursue brand development so that ESCRIT will flash into customers’ mind when they think of an entertaining wedding.

With the continuing diversification of needs and the high demand for affordable services, to differentiate ourselves from other companies, we will emphasize “entertainment value.”

The first thing we worked on was a partnership with Disney. At our own venues, it’s possible to hold wedding receptions that use Disney princesses as motifs. In addition, we have collaborated with Sanrio, Pokémon, and Monster Hunter, and have worked to establish a project together with the women’s brand Samantha Thavasa.

(Taken from the reference material of the company)

While our competitors are struggling to attract customers, our company has attracted customers who were interested in our unique initiatives, in addition to attracting customers through regular media such as Zexy. Furthermore, in contrast to our customers who were attracted to us through media such as Zexy, customers who were attracted through our unique initiatives were largely those who originally had many worries about wedding planning, largely centering around the time and money needed. These customers then attended our events and saw how wonderful a wedding can be – many thought “I can be like a Disney princess too!” or “even Pikachu and Hello Kitty will come!” and in the end decided to have a wedding ceremony. Ultimately, we are also stirring up demand.

In the future, we would like to strongly set forth such entertainment value, by developing and establishing our brand so that ESCRIT will flash into customers’ mind when they think of an entertaining wedding, which takes inspiration from the slogan we had at the time of our founding: ESCRIT will flash into customers’ mind when they think of a wedding inside a building.

Q: “Next, please give us a brief review of your mid-term management policy. You showed that fostering new businesses was set at “-”. Could you explain what this means?”

A: “Regarding overseas business, we do not take risks blindly, and we will monitor the situation over the current term. We plan to determine our next move after we monitor the situation.”

As I mentioned earlier, our subsidiary in Taiwan opened a directly managed salon in the previous fiscal year, and we opened the first chapel in Hawaii. It’s important that we try to reel in foreigners coming to Japan to have ceremonies and Japanese customers wishing to have ceremonies overseas. However, during this term, we will monitor the situation. We will have to decide our next step after keeping our eye on the situation. We cannot keep our old approach of simply deciding where to go next right off the bat. Instead, we will have to check up on the status of our marina chapel and judge whether our strategies towards overseas business are working well – if we judge that they are, we will start to work from there.

Some investors ask, “What will you do next?” but we believe that it is our job to ensure a solid return from the important funds of our investors, so we cannot move blindly. This is what I mean when I say that we will have to keep our eye on the situation this term. In this sense, we are operating under the condition of “-.”

Q: “Next, please comment on your measures of improving cost and a ladies-first strategy, both of which are set at ◎.”

A: “We have done a lot of work on cost reduction. Furthermore, we think that it is possible to make an environment in which women can work sufficiently, can work while having fun, and can work for a long time.”

Regarding cost reductions, we had only rapidly opened new branches, and had not always made the most of negotiations utilizing the advantage of scale for cost. Over the past two years, we looked over these on a case-by-case basis, renegotiated, and made cuts.

With regard to the ladies-first strategy, seventy percent of our employees are women, so considering the prospect of health, marriage, and childbirth for our female employees, we are employing this measure because we believe that our fortunes depend on how great achievements women accomplish at our company.

In the previous fiscal year, we obtained the Eruboshi Certification from the Minister of Health, Labor and Welfare.

Even in an environment in which employees have to work on weekends, we think that it is possible to make an environment in which women can work sufficiently, can work while having fun, and can work for a long time.

Q: “As president, what do you think your current challenges are?”

A: “Our employees are young. We are frequently sending the message that we need to grow from a startup into a mature company. In addition to growing ESCRIT into a strong entertainment-oriented wedding company under my tenure, I believe that my mission is to train up employees who are suitable for entering the management team.”

There are many different challenges, but a primary one is that our employees are very young. We are frequently sending the message that we need to grow from a startup into a mature company. Having youthful energy is important, but it is also important to have self-discipline. However, since we are a company which is being supported by so many young people, I believe we need to develop them into mature employees as soon as we can.

In order to do so, we need to create a system with which even young employees will be able to run the company, so in addition to growing ESCRIT into a strong company under my tenure, I believe that my mission is to develop employees who are suitable for entering the management team.

Q: “Thank you. Lastly, please tell us your message to shareholders and investors.”

A: “There is plenty of opportunity opening up in front of us. However, as a growth strategy, we do not think that haphazardly opening new branches constitutes growth. In order to avoid causing trouble for our investors, we would like you to kindly understand that we are being cautious about opening new branches. Looking forwards, we will pursue “entertainment value” as a new business model, and will continue to be at the forefront of the wedding industry in terms of pursuing new ideas, so we wish for your support from a mid-to-long term perspective.”

As I mentioned earlier, the wedding industry is not shrinking – using essential business-centered thinking, we should recognize that the decrease of vendors outweighs the gradual decrease of weddings, and therefore, we should recognize that there is plenty of opportunity opening up in front of us.

Putting to use the fact that our stocks are listed and taking into account the resulting confidence and creditworthiness, our vision has been firmly identified.

However, as a growth strategy, we do not think that haphazardly opening new branches constitutes growth. As long as investors are spending their hard-earned money on us, it is necessary to be very careful when opening new branches in the current age, as there is a high likelihood that that expansion could become a burden and lead to losses. There is nothing worse than this for our investors, so although some investors might find the situation somewhat unsatisfactory, we would like you to kindly understand that we are being more cautious than some investors when it comes to opening new branches.

On the other hand, it has been 16 years since our company’s establishment, so we are also investing in the renovation of our older venues.

By renovating our older venues and hosting renovation fairs, we can expect a considerable increase in customer attraction.

That is to say, I wish for your understanding that investing in renovations is also a splendid way to expand our business.

Looking forward, we will pursue “entertainment value” as a new business model, and at risk of sounding extreme, I want to pursue wedding parties which can make you feel the same way you feel when going to a magic show or attending a concert.

I want guests to think, “if ESCRIT is holding the reception, then I want to go.” We want to be chosen not just by appealing to the bride and groom with pricing and upgrades, but by providing a place of ceremony which will make guests happy, and in turn make the bride and groom happy as well. In this way, we will continue to be at the forefront of the wedding industry in terms of pursuing new ideas, so we would appreciate your support from a mid-to-long term perspective.

5. Conclusions

In the interview with President Shibutani, which lasted for about an hour, what impressed us most is the balance of his comments: “The bridal industry is not shrinking – using essential business-centered thinking, we should recognize that the decrease of vendors outweighs the gradual decrease of weddings, and if we don't call this a chance then what is,” and “We do not think that haphazardly opening new branches constitutes growth. In order to avoid causing trouble for our investors, we would like you to kindly understand that we are being cautious about opening new branches.”

We wonder if the major factor for achieving a rapid recovery from the disastrous situation in 2016 is the balanced perspective and the firm stance of the company through which it managed to see opportunities by doubting the 2 prevailing views: “bridal industry = shrink” and “growth strategy = stores expansion strategy” and pursue steady growth.

This term concluded the 3-year mid-term management policy, and we are closely monitoring what strategies the company will follow in its next mid-term management plan with which it aspires to be a wedding company that pursues entertainment.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors

Organization type | Company with an audit and supervisory board |

Directors | 4 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones. |

◎Corporate Governance Report

The latest update: June 20, 2019

<Basic Policy>

We think that gaining the trust of all stakeholders, namely customers, shareholders, clients, employees, and society will lead to the sustainable improvement of the corporate value. To achieve that, ensuring the management effectiveness and transparency and constructing a sound organization structure are indispensable, and we believe that the initiatives for corporate governance are extremely important. Therefore, we created the “Business Code of Conduct” and we are working on its dissemination among all the employees so that they can share our company’s values and ethics.

Furthermore, in order to ensure the management effectiveness, we reevaluate the organizational structure as needed simultaneously with the business expansion achieved thanks to corporate growth, and work on establishing effective management and accountability structures for each organizational department.

Besides, in order to ensure the transparency of management, we enhance the internal control functions so that the Audit and Supervisory Board will ensure the compliance with the Board of Directors' administration, laws, regulations, the Articles of Incorporation, and internal regulations. Moreover, we are taking measures to be able to disclose information in a swift and appropriate manner.

We also aim to enhance corporate governance by conducting sincere corporate activities that achieve synergy between corporate profit and corporate social responsibility while aiming to improve the corporate value and realizing the management that takes in the interests of all stakeholders including shareholders.

< Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

Principles | Reasons for not implementing the principles |

【Supplementary Principle 4-1-2 Mid-term management plan】 | We have only disclosed the policy of the mid-term management plan, and didn’t disclose the numerical targets. However, for single years, we disclose the forecasted results at the beginning of the relative year, and in case there is a deviation between the forecast and the actual result we analyze the determining factors and reflect it in the plan of the next term onwards. |

【Supplementary Principle 4-10-1 The appropriate involvement and advice of independent outside directors in considerations related to important matters such as the selection and remuneration of directors】 | Regarding the selection of directors and management-level officials, they are selected after deliberation in the Board of Directors meetings that independent outside directors attend. As for the remuneration, the assigned Representative Director determines the remuneration within the limits set in the shareholders general meeting and based on the internal regulations related to remuneration. We currently don’t involve or consult independent outside directors, but we will take measures in the future to establish a system that can ensure better transparency. |

< Disclosure Based on the Principles of the Corporate Governance Code (Excerpts) >

Principles | Disclosure contents |

【Principle 1-4 So-called strategically held shares】 | Our company’s standards pertaining to strategically held shares are as below. (1) In principle, we do not strategically hold shares for the purpose of strategic holding. (2) In case there is a proposal for strategic holding that contributes to the sustainable growth of the company, the decision of strategic holding is judged through voting in the Board of Directors meeting after discussing its risks, returns, etc. and clarifying the purpose of holding. |

【Principle 5-1 Policy for promoting constructive dialogue with shareholders】

| The policies below are published on the website as the “basic policies for IR activities.”

Constantly providing information related to our company in a fair and timely manner is the basic policy for IR activities. Through these activities, we aim to have communication with the shareholders and investors for sound corporate management and to maximize the shareholders' value. As for the dialogue with the shareholders, the director who oversees the Administrative Division also serves as IR director and actively handles queries, etc. including individual meetings. Moreover, in order to deliver information about our company to many people, we hold briefing sessions aimed at analysts. https://www.ESCRIT.jp/ir/disclo/ |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |