Bridge Report:(2196)ESCRIT the Fiscal Year March 2020

President Morihiro Shibutani | ESCRIT INC. (2196) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Service business |

Representative Director and COO | Morihiro Shibutani |

Address | Kowa Nishi-shimbashi B Bldg., 2-14-1 Nishi-shimbashi, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share price | Shares Outstanding | Total Market Cap | ROE (Actual) | Trading Unit | |

¥402 | 11,986,500 shares | ¥4,818 million | 6.2% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

Undecided | - | Undecided | - | ¥638.52 | 0.6 times |

*Share price is as of closing on June 19. The numbers were taken from the brief financial report for the term ended March 2020. The forecast for this term is still to be determined, due to the spread of COVID-19.

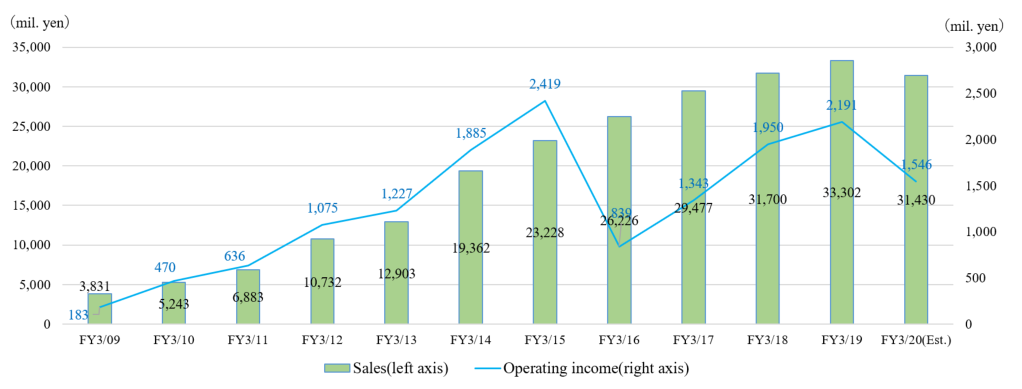

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2017 (Actual) | 29,477 | 1,343 | 1,224 | 713 | 59.89 | 12.00 |

March 2018 (Actual) | 31,700 | 1,950 | 1,830 | 665 | 55.72 | 12.00 |

March 2019 (Actual) | 33,302 | 2,191 | 2,123 | 1,078 | 90.01 | 12.00 |

March 2020 (Actual) | 31,430 | 1,546 | 1,499 | 455 | 38.79 | 16.00 |

March 2021 (Estimate) | - | - | - | - | - | - |

*Unit: Million yen. The forecast for this term is still to be determined, due to the spread of COVID-19. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines ESCRIT INC. and includes financial results of the term ended March 2020 and more.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2020 Earnings Results

3. Fiscal Year ending March 2021 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for the fiscal year ended March 2020 were 31,430 million yen, down 5.6% year on year. As for the general bridal services, sales declined despite the full-year operation of the new bridal stores opened in the previous term, due to the impact of the change in wedding dates caused by Typhoon Hagibis in October 2019 and the postponement of a large number of weddings and receptions to the following year or later, due to the spread of COVID-19 around the end of the term. As for the construction and real estate business, sales dropped due to sales of large-scale real estate in the previous term. SG&A expenses were at the same level as the previous term, but operating income decreased 29.4% year on year to 1,546 million yen as sales declined. Net income declined 57.7% year on year as an impairment loss of 750 million yen related to some facilities among the owned fixed assets was recorded as an extraordinary loss. The company will pay a dividend of 16 yen/share as initially planned.

- Although the company is estimated to post a loss for the fiscal year ending March 2021 due to the spread of COVID-19, it has not yet determined the earnings and dividend estimates since it is difficult to reasonably calculate them. The company will make an announcement as soon as it becomes possible to calculate the earnings forecast.

- The company planned to exceed the operating income of the fiscal year ended March 2015 and mark a record high in the fiscal year ended March 2020, but unfortunately sales and profit dropped due to the impact of COVID-19. Since forecasts for the fiscal year ending March 2021 have not been determined, investors have no choice but to wait for the quarterly disclosure, but if possible, we would like to see qualitative information such as operating conditions.

- While the business environment has become tough for companies providing wedding-related services, we would like to see whether the company can use this situation as an opportunity to increase its market share as a “wedding company pursuing entertainment” based on its unique business strategy that emphasizes software, which is its competitive advantage.

1. Company Overview

ESCRIT is a company that provides various types of wedding services nationwide, such as wedding halls and guesthouses. The company has venues inside train station buildings and near train stations, which is one of its distinctive features. The company’s main strength lies in its unique business strategy that emphasizes software and its sales and profits growth that exceed those of other companies in the same industry. The company also focuses on attracting clients through collaborative projects with anime and game characters. ESCRIT will keep strengthening the business foundation and pursue further growth under the leadership of President Shibutani.

【1-1 Corporate History】

Mr. Hiroshi Iwamoto (Representative Chairman and Chief Executive Officer of ESCRIT INC.), who played a key role in launching the bridal magazine “Zexy” at Recruit Co., Ltd. (now Recruit Holdings Co., Ltd.), had seen the bridal industry on a daily basis and figured out a differentiation factor that would set his business apart from other companies and achieve great growth. That is why, in June 2003, he decided to start up his own bridal business and founded this company. The differentiation factor was “focusing on intangibles, not tangibles.” In other words, it was building a high-profit business model through having the strength of human resources as the company’s core value and allowing its diverse personnel to exhibit their abilities and expertise to the maximum.

At the time, the main trend was guest house weddings with luxurious facilities as its selling point. However, the company believed that convenience is more important to the guest, so they set up chapels and banquet halls in buildings near train stations. Even though the company did not have dazzling guest house weddings, they decided they could fully satisfy their clients using their intangible assets and without depending on tangible ones.

Their differentiation strategy was a great success. ESCRIT INC. was recognized as “the model for station building weddings” and started to expand its business rapidly. As other companies started to enter the market, the company found it necessary to raise capital to accelerate launching new venues in convenient locations mainly around the Tokyo metropolitan region. Therefore, in March 2010, ESCRIT listed its stocks in Mothers of Tokyo Stock Exchange and in November 2012, they changed to the first section of Tokyo Stock Exchange.

However, due to the rapid expansion in venues and M&A (the number of venues increased by 13 in one year), the company faced a shortage in personnel and a weakening in the sales force in the existing venues, etc. This led to the company issuing profit warnings in February 2016 for the first time since being listed (sales decreased by 12% and operating income decreased by 66%). Furthermore, the executives who should have focused their efforts on the restoration of the company resigned, taking with them their subordinates, which caused a grave turmoil within the company.

At this moment of crisis, which was the first since the company’s establishment, the one who took charge and worked on restoring the company was Representative Director and Chief Operating Officer, Morihiro Shibutani. Under the strong leadership of Mr. Shibutani, the restoration has been progressing steadily.

【1-2 Company Philosophy and Vision】

The company name “ESCRIT” comes from the pronunciation of the initials of “STAFF CREATE.”

“Times change, but “the strength of human resources” does not. Trustworthy staff and a trustworthy team exceed the clients’ expectations.”

“We aspire to become a company where its core value lies in the strength of its human resources, and its diverse personnel can exhibit their abilities and expertise to the maximum and benefit from one another. Our highly qualified staff provides high-quality services that guarantee client satisfaction. We are building a business where we reach success depending on “the strength of human resources,” and our talents play the leading role.”

(Cited from ESCRIT’s Website)

This philosophy is the reason behind the company focusing on creating an environment where the most important management resources, human resources, can be active and succeed at the utmost extent without depending on tangible assets.

【1-3 Market Environment】

(1) Market Environment Overview

According to a survey by a private research company, the market scale of wedding receptions, ceremonies and parties in Japan (including the ceremonies that were arranged in Japan and performed overseas) is declining at an annual rate of less than 1%.

The main two factors for this are as follows:

① The decreasing number of marriages due to the population decline

While the children of baby boomers, a generation that was a relatively large population, are reaching their mid-forties, the population of the generation that is within the average age for the first marriage, the generation that was born between the late 1980s and 1990s and now between 29 and early thirties, will continue to decline.

② The trend of curbing expenditures for wedding-related goods and services

In parallel with the spread of various values, there is a trend of curbing expenditures on wedding-related goods and services and of prioritizing the improvement of the everyday life instead, such as “no reception marriages” where the couple does not hold a wedding reception or has a small party inviting only their parents and close friends. Furthermore, in addition to the state of oversupply of wedding facilities that we are already in, the opening of new facilities has a constant appeal. Hence, time and labor cost to acquire visitors and orders are expected to continue increasing, which will result in the increase in the bridal businesses facing management troubles.

Nevertheless, even though it is highly unlikely for the market scale to stop shrinking, it remains to be around 1.4 trillion yen. Using its unique strategy, ESCRIT steadily squeezes out the demand in the market and it has the potential to achieve further growth.

◎ Competitors in the Bridal Industry

Code | Company Name | Sales | Sales Growth Rate | Operating Income | Operating Income Growth Rate | Operating Income Margin | Total Market Cap | PER | PBR | ROE |

2196 | ESCRIT INC. | - | - | - | - | - | 4,818 | - | 0.6 | 6.2 |

2198 | IKK Inc. | - | - | - | - | - | 17,434 | - | 1.3 | 11.0 |

2418 | TSUKADA GLOBAL HOLDINGS Inc. | - | - | - | - | - | 16,254 | - | 0.4 | 7.0 |

2424 | Brass Corporation | - | - | - | - | - | 2,877 | - | 0.9 | 10.6 |

4331 | TAKE AND GIVE. NEEDS Co., Ltd. | - | - | - | - | - | 8,997 | - | 0.4 | 4.3 |

4696 | WATABE WEDDING CORPORATION | - | - | - | - | - | 3,587 | - | 0.3 | 6.5 |

*Units: Million yen and times. Total market cap and PBR are based on the closing value on June 19, 2020. ROE is from the results of the previous term. Throughout all the companies, the forecast for this term is still to be determined, due to the spread of COVID-19.

【1-4 Business Description】

(1) Segment

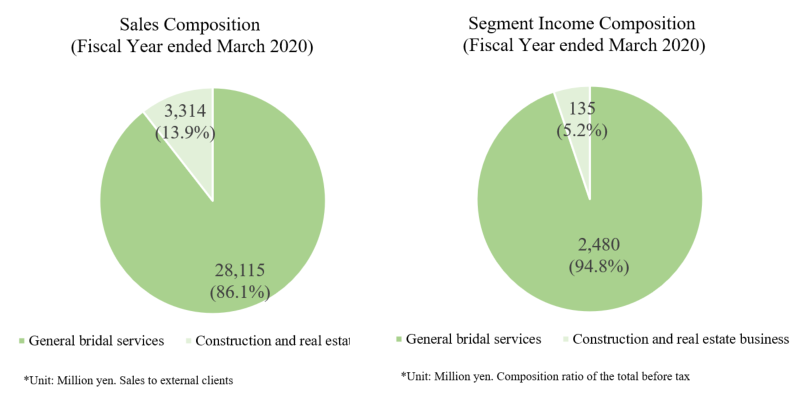

The company consists of two segments: the general bridal services segment and the construction and real estate business segment.

① General Bridal Services

In addition to directly managing 34 halls nationwide, ESCRIT provides bridal services such as planning and managing ceremonies and wedding receptions through cooperating with other facilities. They provide accommodation services through collaborating with hotels, restaurant services through collaborating with restaurants, and banquet services including planning and managing all sorts of parties.

In the directly managed wedding facilities, as “a city wedding coordinator that does not stick to the facilities’ styles,” the company manages diverse styles of ceremonies and wedding reception facilities to satisfy the needs of its various clients.

ESCRIT pays great attention to offering a sense of “privacy” to the facilities and “originality” to the wedding production for the bride, groom, and guests. The company provides clients with “custom made wedding services” to match their tastes in clothes, flowers, guest gifts, food, drinks and wedding production at the solemnizations and wedding receptions, offering them a comprehensive production of their event.

The company promotes in-house production rather than outsourcing to other companies, especially when it comes to clothes, flowers and wedding production. The company employees themselves consult with the clients, accommodating their wishes to every little detail, aiming to further improve client satisfaction.

Furthermore, the company assigns an exclusive chapel or lobby space for each banquet hall in the multiple banquet halls (wedding reception halls) facilities managed by the company to provide a sense of “privacy” to the wedding production.

In the bridal industry, there are many mansion style guest house facilities that are used to give a sense of “privacy” and “originality” to the wedding production. However, with ESCRIT, people can have similar production in addition to having it in a venue with a perfect style that suits its location.

Also, the company undertakes the comprehensive management of bridal services for hotels and restaurants.

(From the company website)

② Construction and Real Estate Business

The group company, Shibutani & Co., conducts different businesses such as contracted work on internal and external construction mainly for restaurants and retail shops, design supervision, construction of independent houses and condominiums, container business, and consulting services.

【1-5 Characteristics and Strengths】

(1) Unique Strategy Focusing on Intangibles

ESCRIT believes that tangible assets have its booms and trends which would definitely change. Thus, it saw the “limitations of tangible assets when it comes to having a competitive advantage in increasing the client base,” as a hindrance to the longtime growth of the company, which led them to focus on the power of intangible assets instead.

With the “high operational skills” of its outstanding staff as its foundation, the company is expanding its “wedding party hall management business.”

Another huge characteristic of ESCRIT, which sets it apart from other companies, is developing the operational know-how of the business such as achieving company differentiation through building alliances with various companies. This leads to increasing the client base, even when having different tangible assets, and achieving a high level of customer satisfaction even without conducting any excessive investments.

The keys behind that are the three business strategies: “personnel strategy,” “venue strategy” and “one-stop service strategy.”

Using these three strategies, the company aims to drastically differentiate itself within the industry and achieve a stable business model that would not be affected by the new standards in the bridal business or the changes in the tangible assets and style.

➀ Personnel Strategy

ESCRIT believes in the importance of staff feeling satisfied in their jobs and their continuing on evolving and developing their abilities to the utmost degree as part of the organization. The company is also working on developing individuals’ capabilities and building an organization with a culture of openness and freedom.

The company builds a working environment where personnel are able to continue working. Moreover, as a company that promotes women’s participation in the workplace, ESCRIT is implementing various policies such as support for the work styles associated with different life stages, enhancing welfare and support for career development.

These efforts lead to the company’s biggest competitive advantage; fostering the power of its intangible assets.

➁ Venue Strategy

The currently mainstream guest house weddings’ share is considered to be only around 20% in the bridal market, which is estimated to be worth around 1.4 trillion yen.

Through experience and evidence so far, the company, which believes that “tangible assets have limitations when it comes to having a competitive advantage in increasing the client base,” is pursuing the possibility of profit in all the domains and not focusing on the narrow market of a specific wedding style.

Therefore, ESCRIT is developing its business of various style facilities such as hotels, restaurants, guest houses and wedding halls, centering its business on meeting the needs of the changing market.

At the same time, the company is focusing on increasing the client base not only by launching new venues but also by improving the existing ones. This would lead to achieving stable and steady growth which in return leads to fulfilling the expectations of the stakeholders.

③ One-Stop Service Strategy

In the bridal business, things such as the dress, makeup, and flowers are generally outsourced to an external contractor, which causes the huge problem of not being able to fulfill the clients’ requests fully.

That is why, as it was mentioned previously, the company promotes in-house production of clothes, flowers, and wedding production. By enhancing this one-stop service system, the company can achieve further improvement in client satisfaction.

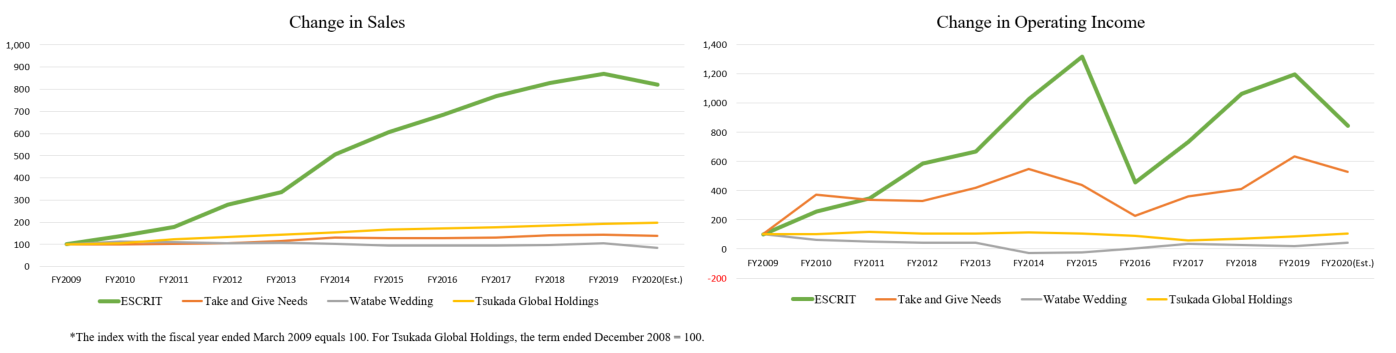

(2) Growth of Sales and Profit that Exceeds Those of Competitors

The graph below represents a comparison of the variations in sales and operating income among the three companies with the bigger scale of sales than ESCRIT (Tsukada Global Holdings, Take and Give Needs and Watabe Wedding) according to the table “Competitors in the Bridal Industry” in page 4. If we look at the growth of ESCRIT’s sales and profit, we will find that it is better than the rest of the companies.

The foundation of this growth is the “power of intangible assets,” the philosophy of the company since its founding and what President Shibutani has been strongly promoting.

【1-6 ROE Analysis】

| FY3/13 | FY3/14 | FY3/15 | FY3/16 | FY3/17 | FY3/18 | FY3/19 | FY3/20 |

ROE (%) | 32.3 | 34.4 | 32.6 | 6.9 | 12.7 | 10.7 | 15.6 | 6.2 |

Net profit to sales ratio (%) | 5.72 | 5.69 | 6.20 | 1.37 | 2.42 | 2.10 | 3.24 | 1.45 |

Total asset turnover ratio | 1.53 | 1.57 | 1.33 | 1.18 | 1.15 | 1.18 | 1.28 | 1.30 |

Leverage | 3.69 | 3.86 | 3.95 | 4.27 | 4.55 | 4.32 | 3.79 | 3.27 |

【1-7 Initiatives in ESG】

As it is shown in the origin of the company’s name, the strength of its human resources is the core value of ESCRIT. Therefore, the company actively promotes various policies especially related to the “Social” in ESG that aims to build a comfortable working environment.

(1) Promotion of health-oriented management

The following is “ESCRIT’s Declaration of Health-oriented Management.”

In ESCRIT, we believe that it is most important for each and every one of our employees to be healthy mentally and physically and work energetically to be able to deliver our clients’ happiest moments.

With the idea that “the foundation of the company’s activities is ensuring the safety and health care for the employees and the creation of a comfortable working environment,” from now on, we declare that we will actively exert more efforts toward improving the work environment so that both ESCRIT employees and the company could work in good health for a long time.

Representative Director Morihiro Shibutani |

① Main Measures

In order to provide “health care” for the entire company, ESCRIT is working on health management (analysis of the results of the periodic medical examinations and achieving a good work-life balance), disease prevention (prevention of infectious diseases and lifestyle diseases and control of women’s diseases), management of mental health and promotion of continuous movement.

② Evaluation

*Certified as “Excellent Corporation in Health-oriented Management 2020”

In March 2020, ESCRIT was certified as “Excellent Corporation in Health-oriented Management 2020 (large corporation category)” by the Ministry of Economy, Trade and Industry and Nippon Kenko Kaigi as its efforts in promoting health-oriented management were highly evaluated.

“Excellent Corporation in Health-oriented Management Certificate” commends corporations, such as large corporations and small and medium-sized enterprises, that are conducting excellent health-oriented management based on their efforts to address local health issues and the health improvement initiatives promoted by Nippon Kenko Kaigi.

*Certified as “Tokyo Sports Promotion Company” and “Sports Yell Company”

ESCRIT was certified as “Tokyo Sports Promotion Company” and “Sports Yell Company”.

“Tokyo Sports Promotion Company Certificate” is a certificate awarded to companies that encourage employees’ sports activities and provide support to athletes, groups, and tournaments and so on within the sports segment.

To encourage employees’ sports activities, ESCRIT holds several types of sports events, hosting “Kizuna” Ekiden relay race, creating club activities, as well as having policies such as recruiting top athletes to coach the employees’ clubs.

Also, ESCRIT actively works on supporting athletes (employing Honami Suzuki, Japan’s representative in women’s fencing epee individual) and contributing to the sports culture (such as the execution of a partnership with the table tennis professional league “T.T Saitama”). These efforts led to receiving the “Tokyo Sports Promotion Company Certificate.”

“Sports Yell Company” system is a system that aims to encourage “people in the generation in the prime of their lives” who lack exercise to practice sports and work on creating a social movement for sports. Japan Sports Agency certifies companies that actively work on implementing sports activities to improve their employees’ health. Through this “Sports Yell Company” certificate, Japan Sports Agency aims to help improve the social evaluation of companies that are working on strategic measures to manage their employees’ health.

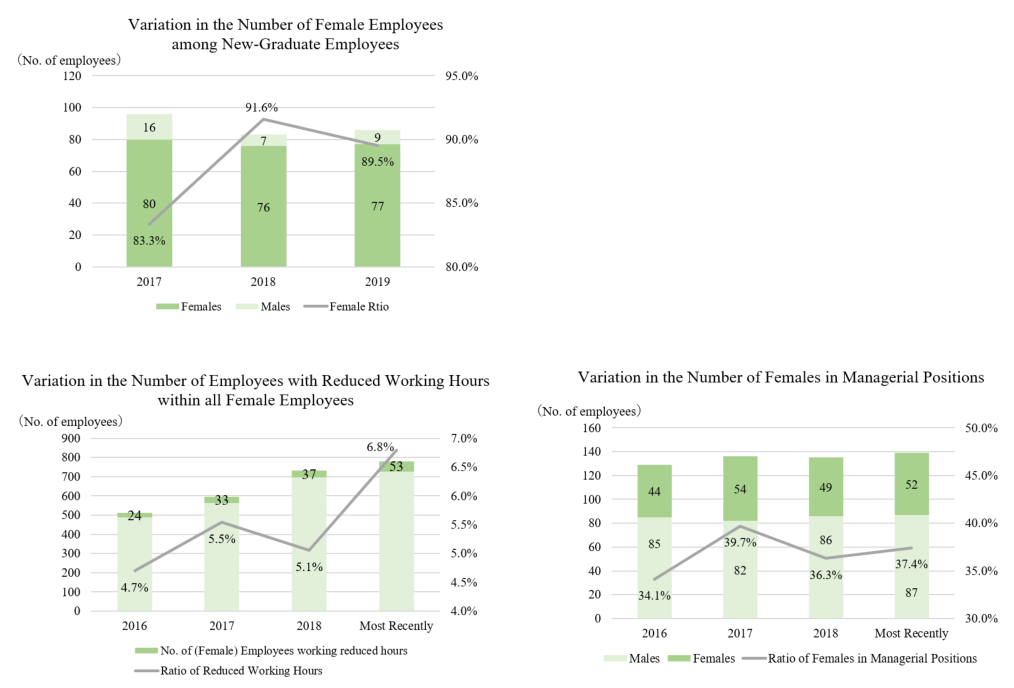

(2) The Various Policies to Promote Women’s Participation and Achievements

① Main Measures

ESCRIT has many occupations where women flourish, such as wedding planners, bridal stylists and floral designers, and female employees account for 70% of the total number of employees at the end of March 2019.

Since ESCRIT aspires to become a company where all its employees are evaluated fairly based on their capabilities and regardless of their gender and what life stage they are in, promotion of women’s participation in the workplace was one of the policies of the company’s mid-term management plan.

Based on this policy, the company implemented the following “measures to promote women’s participation.”

Measures | Outline |

Providing a stress-free environment that facilitates access to health care for women during pregnancy

| *Implementing a “Start of the Pregnancy Consultations” Pregnant employees can talk with their bosses and the human resources officers about any concerns on physical health or work tasks to reassure them that they can go through their pregnancy with ease.

*Providing time for hospital visits Providing time for hospital visits to have medical examinations during working hours in order to ensure access to health care. (Men accompanying pregnant women to hospital visits are also provided with time to do so) |

Promotion of extending the maternal leave and providing men with paternity leave | *Extending the pre-childbirth maternal leave period Extending the period from the six weeks stipulated in the law to eight weeks.

*Encouraging male employees to take a paternity leave Recommending that fathers take a maximum of eight days of paternity leave in the period of two months from the day their children are born. (it can also be used to attend the birth) |

Implementing consultations before employees’ return to work and supporting their smooth return to the workplace | *Implementation of “Comeback Consultations” Employees coming back to work can talk with their bosses and the human resources officer about any requests such as working hours, in order to be able to have a concrete idea about the working style after returning to work. |

Support for the balance of childrearing and work after returning to the workplace | *Support of gradual entry at daycare Employees are exempted from going to work during the phase of their child’s gradual entry to daycare.

*Reduced working hours, extending the leave for caring for a sick child and overtime restrictions Extending the childrearing-friendly reduced working hours until the child enters elementary school. Extending the overtime restrictions until the child enters elementary school. Extending the period an employee can take a leave for caring for a sick child until the child graduates’ junior high school. |

Additionally, because ESCRIT aims to provide a comfortable working environment not only for women but also for all its employees, it also focuses its efforts on “measures to optimize working hours,” “establishing of a counseling service section for women,” “training for employees in managerial positions,” “training for all employees” and “career advancement training for women.”

➁ Achievements

As a result of these measures, women’s participation increased in a noticeable pattern as shown in the graph below. Also, employee satisfaction is steadily increasing with employees giving testimonies such as “I am enjoying motherhood and work thanks to the implemented support system. In the future, I want to be a role model for working women.” (Cited from the company’s website)

The goal was to increase the number of employees with reduced working hours to 50. However, since this goal was achieved by the end of March 2019, the company is working on setting another goal.

ESCRIT aims to increase the ratio of females in managerial positions to 50% by the fiscal year 2022.

➂ Evaluation

*Receiving the “Eruboshi” (L Star) Certificate from the Minister of Health, Labor, and Welfare

In July 2018, ESCRIT received the “Eruboshi (L Star)” certificate from the Minister of Health, Labor and Welfare for its excellent efforts in promoting women’s participation in the workplace to become the first company in the bridal industry to obtain this certificate based on the Act on Promotion of Women's Participation and Advancement in the Workplace.

“Eruboshi (L Star)” certificate is a system where the Minister of Health, Labor, and Welfare certifies excellent companies with conditions that promote women’s participation in the workplace according to the Act on Promotion of Women's Participation and Advancement in the Workplace. There are five assessment criteria for the “Eruboshi” (L Star) which are: “recruitment,” “continued employment,” “working styles, including working hours,” “ratio of managerial positions” and “various career courses.”

The “Eruboshi” certificate is hard to obtain. So far, around 20,000 companies applied for it, but only around 600 companies received it. ESCRIT’s measures that were mentioned above were acknowledged to exceed the standards, which is why the company received the certificate.

*Certified as “Semi-Nadeshiko”

In March 2020, ESCRIT was selected as one of the listed enterprises that are outstanding in terms of encouraging women’s success in the workplace by the Ministry of Economy, Trade and Industry and the Tokyo Stock Exchange and received the “Semi-Nadeshiko Brands” certification.

The Nadeshiko Brand is an initiative aiming to introduce certain TSE-listed enterprises that are outstanding in terms of encouraging women’s success in the workplace as attractive stocks to investors who place emphasis on improving corporate value in the mid-and long-term, thereby further growing investments in such outstanding enterprises and accelerating efforts by each enterprise to encourage women’s success in the workplace. Since 2012, the Ministry of Economy, Trade and Industry and the Tokyo Stock Exchange have been selecting the enterprises jointly.

ESCRIT was selected as a “Semi-Nadeshiko Brands,” which is equivalent to the Nadeshiko Brand (runner-up as enterprises), for its measures to promote women’s participation (mainly by incorporating them into management strategies, establishing an environment and rules, and raising awareness among managers) were highly evaluated.

(3) Converting all contract employees to permanent employees

After considering the long-term career development for the employees, in August 2018, ESCRIT decided to convert all its contract employees to permanent employees.

The company had several professions such as wedding planners, bridal stylists and floral designers where the majority of its employees were contract employees. However, the company abolished the contract employment system, converting it to a new relocation-less permanent employment system (geographically confined permanent employee).

Now, contract employees are playing an important role within the companies. In ESCRIT, employees can comfortably work on their long-term career development in light of the changes in the employment circumstances and women’s participation conditions.

2. Fiscal Year ended March 2020 Earnings Results

(1) Overview of consolidated financial results

| FY3/19 | Ratio to sales | FY3/20 | Ratio to sales | YOY | Compared to the original forecast |

Sales | 33,302 | 100.0% | 31,430 | 100.0% | -5.6% | -8.6% |

Gross profit | 18,695 | 56.1% | 17,944 | 57.1% | -4.0% | -8.1% |

SG&A expenses | 16,504 | 49.6% | 16,397 | 52.2% | -0.6% | -3.7% |

Operating income | 2,191 | 6.6% | 1,546 | 4.9% | -29.4% | -38.2% |

Ordinary income | 2,123 | 6.4% | 1,499 | 4.8% | -29.4% | -37.5% |

Net income | 1,078 | 3.2% | 455 | 1.5% | -57.7% | -68.6% |

*Unit: Million yen

Due to the spread of COVID-19, sales and profit decreased.

The sales for the fiscal year ended March 2020 were 31,430 million yen, down 5.6% year on year. As for the general bridal services, sales declined despite the full-year operation of the new bridal stores opened in the previous term, due to the impact of the change in wedding dates caused by Typhoon Hagibis in October 2019 and the postponement of a large number of weddings and receptions to the following year or later, due to the spread of COVID-19 around the end of the term. As for the construction and real estate business, sales dropped due to sales of large-scale real estate in the previous term. SG&A expenses were at the same level as the previous term, but operating income decreased 29.4% year on year to 1,546 million yen as sales declined. Net income declined 57.7% year on year as an impairment loss of 750 million yen related to some facilities among the owned fixed assets was recorded as an extraordinary loss. The company will pay a dividend of 16 yen/share as initially planned.

(2) Results of each segment

| FY3/19 | Ratio to sales | FY3/20 | Ratio to sales | YOY | Compared to the original forecast |

Sales |

|

|

|

|

|

|

General bridal services | 28,671 | 86.1% | 28,115 | 89.5% | -1.9% | -7.5% |

Construction and real estate business | 4,631 | 13.9% | 3,314 | 10.5% | -28.4% | -17.2% |

Total | 33,302 | 100.0% | 31,430 | 100.0% | -5.6% | -8.6% |

Segment income |

|

|

|

|

|

|

General bridal services | 3,016 | 10.5% | 2,480 | 8.8% | -17.8% | -31.7% |

Construction and real estate business | 282 | 6.1% | 135 | 4.1% | -52.1% | +50.0% |

Adjusted amount | -1,107 | - | -1,069 | - | - | - |

Total | 2,191 | 6.6% | 1,546 | 4.9% | -29.4% | -38.2% |

*Unit: Million yen. The composition ratio means operating income margin.

(General bridal services)

Sales and profit decreased.

Despite the full-year operation of two facilities opened in the previous term, Typhoon Hagibis caused changes in wedding dates, and over 400 of the approximately 1,000 weddings and receptions scheduled for late February to March have been postponed to the following year or later due to the spread of COVID-19.

◎ Order receipt situation

The backlog of orders for the Core Bridal Service at the end of March increased due to the postponement of weddings to be carried out from late February to March to the next term or later. The backlog of orders as of the end of April increased 0.7% for the Core Bridal Service and decreased 4.7% for the New Bridal Service year on year due to the reduced number of orders and increased cancellations resulting from suspension of business operations.

*Core Bridal Service

| FY3/19 | FY3/20 | YOY |

Number of weddings carried out | 5,304 | 5,266 | -0.7% |

Number of orders received | 6,989 | 6,839 | -2.1% |

The backlog of orders | 4,064 | 4,395 | +8.1% |

Average price per couple | 3,779 | 3,729 | -1.7% |

*Unit: Thousand yen.

*New Bridal Service

| FY3/19 | FY3/20 | YOY |

Number of weddings carried out | 3,259 | 3,224 | -1.1% |

Number of orders received | 3,790 | 3,718 | -1.9% |

The backlog of orders | 1,673 | 1,762 | +5.3% |

*Core Bridal Service: targets wedding ceremonies and receptions with 30 or more attendees in directly managed facilities.

*New Bridal Service: includes figures of subsidiaries, entrusted operations, weddings with a small number of guests, Toku-Navi (figures for the alliance venue), and resort weddings.

The numbers of customers traveling from abroad were removed from the above figures to avoid duplication.

(Construction and real estate business)

Sales and profit decreased.

In the same period of the previous year, renovated large-scale real estate was sold, which resulted in a decrease in sales of this term.

(3) Financial conditions and cash flow

◎ Main balance sheet

| End of Mar.2019 | End of Mar.2020 |

| End of Mar.2019 | End of Mar.2020 |

Current assets | 7,661 | 6,499 | Current liabilities | 8,852 | 8,464 |

Cash and deposits | 4,814 | 4,130 | Notes and accounts payable | 1,464 | 1,072 |

Notes and accounts receivable | 298 | 263 | Short-term loans payable | 2,520 | 2,174 |

Real estate for sale | 810 | 816 | Non-current liabilities | 8,945 | 7,284 |

Non-current assets | 17,452 | 16,729 | Long term interest-bearing liabilities | 5,720 | 4,111 |

Property, plant and equipment | 12,182 | 11,118 | Total liabilities | 17,798 | 15,749 |

Investments and other assets | 5,182 | 5,564 | Net assets | 7,316 | 7,478 |

Total assets | 25,114 | 23,228 | Retained earnings | 6,208 | 6,499 |

|

|

| Total liabilities and net assets | 25,114 | 23,228 |

|

|

| Capital-to-asset ratio | 29.1% | 33.7% |

*Unit: Million yen.

Due to the decrease in cash and deposits and also in property, plant and equipment (buildings and structure) caused by the posting of impairment losses, total assets were 23.2 billion yen, down 1.8 billion from the end of the previous term.

Total liabilities were 15.7 billion yen, down 2 billion yen from the end of the previous term due to the decrease in debts, corporate bonds, etc.

Net assets increased 100 million yen from the end of the previous term to 7.4 billion yen.

Capital-to-asset ratio increased 3.1% from the end of the previous term to 32.2%.

In view of the impact of the spread of COVID-19, the company borrowed a total of 2.8 billion yen from eight partner financial institutions at the end of April 2020 in order to increase the stability of the company’s operations by keeping a substantial amount of cash reserves.

The borrowing period is 1-10 years and the interest rate is the basic rate + spread.

◎Cash flows

| FY3/19 | FY3/20 | Change |

Operating CF | 3,164 | 2,918 | -246 |

Investing CF | -831 | -1,203 | -372 |

Free CF | 2,333 | 1,714 | -618 |

Financing CF | -2,341 | -2,347 | -6 |

Balance of cash and cash equivalents | 4,568 | 3,934 | -634 |

*Unit: Million yen

The surplus of operating CF and free CF shrank due to the decrease in net income before taxes and other adjustments.

The cash position declined.

(4) Topics

1 Established the Nomination and Remuneration Committee

In May 2020, the company established the “Nomination and Remuneration Committee,” which is a voluntary advisory committee of the Board of Directors, in order to ensure the fairness, transparency and objectivity of procedures related to the nomination and remuneration of directors and enhance the corporate governance system.

The committee will deliberate on and report to the Board of Directors on “matters related to the election and dismissal of directors (matters to be resolved at general meetings of shareholders),” “matters related to the selection and dismissal of representative directors,” “matters related to the remuneration of directors,” and “other important management matters deemed necessary by the Board of Directors.”

The Nomination and Remuneration Committee members shall consist of three or more directors appointed by a resolution of the Board of Directors, the majority of whom shall be independent outside directors.

2 Opened “Ravimana Kobe”

In March 2020, the company opened “Ravimana Kobe” in Chuo Ward, Kobe, Hyogo.

Located on the west coast of Kobe Airport Island, this facility is easily accessible and has two independent chapels and nine party halls on the vast grounds, which makes it suitable for both resort weddings and natural weddings surrounded by greenery.

3 Active renovation

In the fiscal year ended March 2020, the company renovated 16 facilities. It strives to attract a larger number of customers and improve customer satisfaction further, by responding to diversifying customer needs and adding value to existing facilities.

4 Joined Keidanren

In December 2019, the company officially joined the Japan Federation of Economic Organizations (Keidanren).

The company will actively participate in Keidanren’s activities to realize “Society 5.0 for SDGs” set by the country and cooperate with other member enterprises, while continuing to create an environment in which female employees can play an active role and respond to diversifying wedding-related needs to revitalize the bridal market.

3. Fiscal Year ending March 2021 Earnings Estimates

◎ Forecast of financial results and Dividend

Although the company is estimated to post a loss for the fiscal year ending March 2021 due to the spread of COVID-19, it has not yet determined the earnings and dividend estimates since it is difficult to reasonably calculate them. The company will make an announcement as soon as it becomes possible to calculate the earnings forecast.

4. Conclusions

The company planned to exceed the operating income of the fiscal year ended March 2015 and mark a record high in the fiscal year ended March 2020, but unfortunately sales and profit dropped due to the impact of COVID-19. Since forecasts for the fiscal year ending March 2021 have not been determined, investors have no choice but to wait for the quarterly disclosure, but if possible, we would like to see qualitative information such as operating conditions.

While the business environment has become tough for companies providing wedding-related services, we would like to see whether the company can use this situation as an opportunity to increase its market share as a “wedding company pursuing entertainment” based on its unique business strategy that emphasizes software, which is its competitive advantage.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors

Organization type | Company with an audit and supervisory board |

Directors | 4 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones. |

◎Corporate Governance Report

The latest update: June 20, 2019

<Basic Policy>

We think that gaining the trust of all stakeholders, namely customers, shareholders, clients, employees, and society will lead to the sustainable improvement of the corporate value. To achieve that, ensuring the management effectiveness and transparency and constructing a sound organization structure are indispensable, and we believe that the initiatives for corporate governance are extremely important. Therefore, we created the “Business Code of Conduct” and we are working on its dissemination among all the employees so that they can share our company’s values and ethics.

Furthermore, in order to ensure the management effectiveness, we reevaluate the organizational structure as needed simultaneously with the business expansion achieved thanks to corporate growth, and work on establishing effective management and accountability structures for each organizational department.

Besides, in order to ensure the transparency of management, we enhance the internal control functions so that the Audit and Supervisory Board will ensure the compliance with the Board of Directors' administration, laws, regulations, the Articles of Incorporation, and internal regulations. Moreover, we are taking measures to be able to disclose information in a swift and appropriate manner.

We also aim to enhance corporate governance by conducting sincere corporate activities that achieve synergy between corporate profit and corporate social responsibility while aiming to improve the corporate value and realizing the management that takes in the interests of all stakeholders including shareholders.

< Reasons for Non-compliance with the Principles of the Corporate Governance Code >

Principles | Reasons for not implementing the principles |

【Supplementary Principle 4-1-2 Mid-term management plan】 | We have only disclosed the policy of the mid-term management plan, and didn’t disclose the numerical targets. However, for single years, we disclose the forecasted results at the beginning of the relative year, and in case there is a deviation between the forecast and the actual result we analyze the determining factors and reflect it in the plan of the next term onwards. |

【Supplementary Principle 4-10-1 The appropriate involvement and advice of independent outside directors in considerations related to important matters such as the selection and remuneration of directors】 | Regarding the selection of directors and management-level officials, they are selected after deliberation in the Board of Directors meetings that independent outside directors attend. As for the remuneration, the assigned Representative Director determines the remuneration within the limits set in the shareholders general meeting and based on the internal regulations related to remuneration. We currently don’t involve or consult independent outside directors, but we will take measures in the future to establish a system that can ensure better transparency. |

< Disclosure Based on the Principles of the Corporate Governance Code>

Principles | Disclosure contents |

【Principle 1-4 So-called strategically held shares】 | Our company’s standards pertaining to strategically held shares are as below. (1) In principle, we do not strategically hold shares for the purpose of strategic holding. (2) In case there is a proposal for strategic holding that contributes to the sustainable growth of the company, the decision of strategic holding is judged through voting in the Board of Directors meeting after discussing its risks, returns, etc. and clarifying the purpose of holding. |

【Principle 5-1 Policy for promoting constructive dialogue with shareholders】

| The policies below are published on the website as the “basic policies for IR activities.”

Constantly providing information related to our company in a fair and timely manner is the basic policy for IR activities. Through these activities, we aim to have communication with the shareholders and investors for sound corporate management and to maximize the shareholders' value. As for the dialogue with the shareholders, the director who oversees the Administrative Division also serves as IR director and actively handles queries, etc. including individual meetings.

Moreover, in order to deliver information about our company to many people, we hold briefing sessions aimed at analysts. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |