Bridge Report:(2317)Systena the 1st quarter of Fiscal Year March 2020

Yoshichika Hemmi, Chairman |

Kenji Miura, President | Systena Corporation (2317) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Information and communications |

Representative Director | Yoshichika Hemmi, Kenji Miura |

Address | 14F Shiodome Building 1-2-20 Kaigan, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,787 | 97,541,789 shares | ¥174,307 million | 24.6% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥20.00 | 1.1% | ¥52.70 | 33.9 times | ¥208.11 | 8.6 times |

*The share price is the closing price on July 26. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. ROE and BPS are the values as of the end of the previous term.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit Attributable to Owners of Parent | EPS | DPS |

March 2016 (Actual) | 42,695 | 3,172 | 3,208 | 2,249 | 22.65 | 32.00 |

March 2017 (Actual) | 46,255 | 3,693 | 3,407 | 2,197 | 22.42 | 36.00 |

March 2018 (Actual) | 54,320 | 5,170 | 5,147 | 3,542 | 36.32 | 46.00 |

March 2019 (Actual) | 59,742 | 6,902 | 6,706 | 4,584 | 47.00 | 16.00 |

March 2020 (Estimate) | 63,147 | 7,865 | 7,622 | 5,140 | 52.70 | 20.00 |

* The estimated values were provided by the company. Unit: Million yen

* In June 2018, a 4-for-1 stock split was conducted. (EPS revised retroactively.)

This Bridge Report overviews the financial results of Systena Corporation for the 1st quarter of the term ending March 2020 and includes the full-year outlook.

Table of Contents

Key Points

1. Company Overview

2. 1Q of Fiscal Year March 2020 Earnings Results

3. Fiscal Year March 2020 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

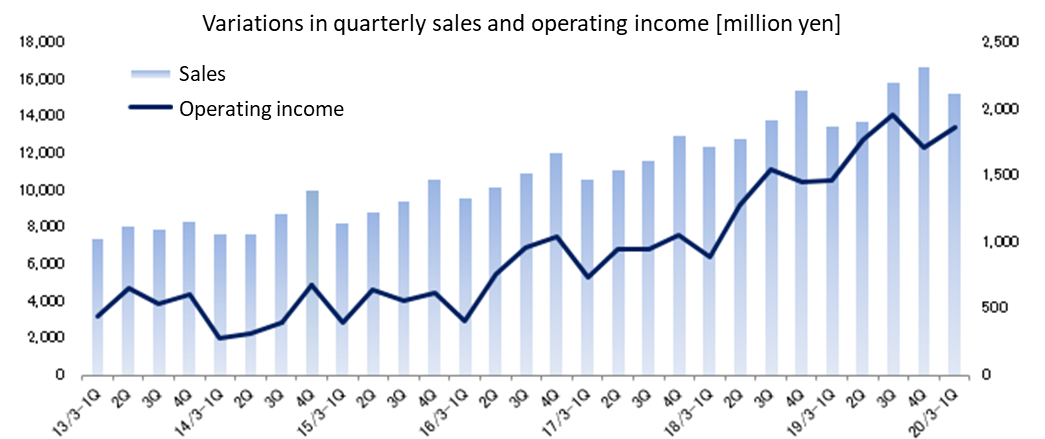

- For 1Q of FY 3/20 (April to June), sales and operating income grew 13.1% and 27.0%, respectively, year on year. The sales of the Solution Design Business, which is conducted mainly in the fields of in-vehicle systems and Internet business, increased 14.0% year on year; the sales of the Framework Design Business, which saw growth in the existing financial field and the field of new services, such as automation solutions for business operation, rose 7.8% year on year; the sales of the IT Service Business, which is shifting to contracting business with high added value, grew 11.3% year on year; the sales of the Solution Sales, which made deals for updating the software installed in Windows 7 and server solutions, increased 14.0% year on year. In this way, the sales of its core businesses grew in parallel with the improvement in profitability.

- There is no revision to the full-year forecast, and it is estimated that sales and operating income will rise 5.7% and 14.0%, respectively, year on year (the estimates for the first half not disclosed). The sales of the Solution Design Business are estimated to increase 10.5% year on year due to the increase of in-vehicle systems, etc.; the sales of the Framework Design Business are projected to grow 9.0% year on year; moreover, the sales of the IT Service Business are forecasted to rise 11.0% year on year. In this way, the sales and profit of the core businesses are expected to grow. The sales of the Solution Sales are estimated to decline slightly due to the decrease in product sales, but profit is projected to rise, thanks to the improvement in operating income rate through services with high added value. As for dividends, the company plans to pay an interim dividend of 10 yen/share and a term-end dividend of 10 yen/share, for a total of 20 yen/share, up 4 yen/share (payout ratio estimated to be 38%).

- The progress rate toward the full-year forecast is 24.1% for sales (the progress rate toward the annual sales in the same period of the previous yea 22.6%), and 23.7% for operating income (the progress rate toward the annual operating income in the same period of the previous yea 21.3%). The progress rates in this term are healthy and higher than those in the previous term. In June, the company participated in “MONET Consortium,” which was established by MONET Technologies, Inc., which was jointly founded by Softbank Corporation, Toyota Motor Corporation, etc. By utilizing the technologies, it has nurtured, Systena Corporation will promote next-generation mobility services and help solve social issues. We would like to expect their advance.

1. Company Overview

Systena Corporation was founded, when System Pro Corp. absorbed Katena Corp., which was an equity-method affiliate, on April 1, 2010. It is cultivating new domains by operating the business that fuses the former System Pro’s technologies, know-how, and open technologies for designing, developing, and testing mobile terminals and the financial knowledge and infrastructure technologies of the former Kanena Corp. It forms a corporate group with 9 consolidated subsidiaries and 3 equity-method affiliates.

【1-1 Basic policy for company management - business administration that puts importance on the balance between stability and growth】

The management objective of the Systena Group is “To become one of Japan's leading IT companies and support the Japanese economy from the ground up.” In order to attain this objective, the company pursues good balances between conflicting items, such as “destruction and creation, “stability and growth,” and “maintenance and innovation” as its basic policy.

【1-2 Target managerial indicators】

The company sets stably high dividends, a high return on equity, and a high operating income rate as target managerial indicators. To achieve them, it aims to develop a highly profitable structure under its basic policy for business administration. In its near-term goals (mid-term management goals), it declares consolidated sales of 101 billion yen, an operating income of 15.2 billion yen (an operating income rate of 15%), a per-capita operating income of 2.6 million yen, and an ROE of 25% in the term ending March 2024.

【1-3 Business description and the Systena Group】

The business of Systena Corporation is classified into the Solution Design Business (accounting for 36.7% of total sales in the 1st quarter of FY 3/20), the Framework Design Business (accounting for 8.9%), the IT Service Business (13.3%), the Solution Sales (39.1%), the Cloud Business (1.9%), the Overseas Business (0.1%), and the Investment & Incubation Business (0.4%) (adjustment amount: -0.4%).

In FY 3/20, business segments were changed, eliminating the Consumer Service Business and dividing it into the Solution Design Business and the Investment & Incubation Business.

◎Solution Design Business: Systena Corporation, ProVision Co., Ltd., IDY Corporation, HIS HOLDINGS, INC., Systena Vietnam Co., Ltd.

The company concentrates its managerial resources on automatic driving, where its know-how nurtured through the development of mobile terminals can be utilized, “in-vehicle” items, such as telematics, “social infrastructure” in the fields of electric power, transportation, aviation, space, defense, etc., “Internet business” for communications carriers, e-commerce, education, e-books, etc., “smart devices/robots/AI,” including smartphones, home appliances, and robots, and “business operation systems,” including workflow and order receipt/placement systems. In every category, the company is swamped with inquiries about the development and testing of IoT-related systems and services. In addition, Systena Vietnam Co., Ltd., which is an overseas affiliate, functions as an offshore foothold for developing, testing, evaluating, maintaining, and operating software, handling all kinds of IT services, and so on.

◎Framework Design Business: Systena Corporation, ProVision Co., Ltd., Systena Vietnam Co., Ltd.

Systena Corporation develops financial systems and foundational systems for life and non-life insurance companies and banks inside and outside Japan. As for life and non-life insurance tasks, the company has developed solutions for dealing with a broad range of tasks, including information management, contract management, insurance premium calculation, agency business, and sales management. As for banking tasks, the company has developed a variety of systems for sales branches and external channels in the field of open systems, while handling main frames. At present, its main tasks are the development and operation of financial systems; however, through cross-selling by the cooperation with the IT Service Business section and the Solution Sales section and offering solutions using smartphone apps, online apps, etc. by the cooperation with the Solution Design Business section, it is promoting sales further in the financial field and expanding business in other fields. Like the Solution Design Business section, Systena Vietnam Co., Ltd. is functioning as an offshore foothold.

◎IT Service Business: Systena Corporation, Tokyoto Business Service Co., Ltd.

Systena Corporation operates and maintains systems and networks, and offers IT outsourcing services, including help desk operation, user support, data inputting, and large-volume output. Clients include electric-appliance manufacturers, financial institutions, foreign-affiliated enterprises, and public offices.

◎Solution Sales Business: Systena Corporation

The company sells IT products, including servers, PCs, peripheral devices, and software, to enterprises and integrates systems. It is shifting from the business of selling hardware to the business of offering services. It aims to expand its business and improve its added value by meeting the needs that are changing from ownership to use (cloud, etc.) in cooperation with the IT Service Business section, etc. Clients include electric-appliance manufacturers and foreign-affiliated enterprises.

◎Cloud Business: Systena Corporation

The company offers services ranging from the support for installation of cloud services to the provision of apps. For example, it offers cloud services of the Systena version of groupware combined with “Cloudstep,” which was developed jointly by the company and G Suite, “Canbus.,” a cloud database service, which was launched in May last year, and “Web Shelter,” an anti-phishing solution for smartphones. It currently specializes in the public cloud, but it is also preparing for the private cloud. “Cloudstep” is a collective term including business applications for improving the usability of cloud services, such as “G Suite,” and management tools for administrators.

◎Overseas Business Systena America Inc., Systena Vietnam Co., Ltd.

The U.S. subsidiary operates two core businesses; one is the support for development and testing mobile and communications-related products, and the other is the research on trends of the latest technologies and services and incubation in the U.S. The Vietnamese subsidiary is recognized as an offshore foothold that develops, tests, evaluates, maintains, and operates software, and handles all kinds of IT services.

◎Investment & Incubation Business: Internet of Things, Inc., GaYa Co., Ltd.

The strategic subsidiary “Internet of Things, Inc.” conducts the planning, development, sale, and service provision in the fields of IoT, robots, FinTech, and social media. GaYa Co., Ltd. develops game content for smartphones, offers them to leading SNS sites, and undertakes the operation of video games developed and released by other companies.

Systena group

Consolidated subsidiary | Capital contribution ratio | Business description |

ProVision Co., Ltd. | 100% | Support for development of software for mobile terminals, evaluation of quality of the software and apps, operation and maintenance of systems |

Tokyoto Business Service Co., Ltd. | 51% | Date inputting, large volume output, etc. (a model enterprise employing severely disabled people, which was jointly established with the Tokyo Metropolitan Government) |

IDY Corporation | 76.7% | Sale of communications devices and software, and development for wireless communications

|

GaYa Co., Ltd. | 65% | Planning, development, and provision of social games for smartphones, entrusted development, support for development, etc. |

Internet of Things, Inc. | 100% | Provision of services, including the planning, development, and sale in the fields of IoT, robots, FinTech, and social media |

Systena America Inc. | 100% | A subsidiary in the U.S. Support for development and testing and provision of solutions for mobile and communications-related items. Survey on trends of the latest technologies and services, and commercialization. |

Systena Vietnam Co., Ltd. | 100% | A subsidiary in Vietnam. Development, testing, evaluation, operation, and maintenance of software. All kinds of IT services. |

Equity-method affiliate | Capital contribution ratio | Business description |

HIS HOLDINGS, INC. | 25.36% | Establishment of systems, development and sale of packaged software (near-shore development based in Hokkaido) |

StrongKey, Inc. | 28.84% | Development and sale of encoding and authentication products *The corporate name changed from StrongAuth, Inc. |

ONE Tech, Inc. | 50% | A joint venture with Plasma, Inc., which possesses one of the largest PFs in the U.S. Development and sale of IoT solution packages. |

*In addition to the above, the company has a consolidated subsidiary: TBS Operation Co., Ltd., which is a subsidiary of Tokyoto Business Service Co., Ltd. The company invests in the equity-method affiliates: StrongKey, Inc. and ONE Tech, Inc. via Systena America Inc.

【1-4 New mid-term management plan (FY 3/20 to FY 3/24)】

The 5-year mid-term plan aimed at consolidated sales of 101 billion yen and an operating income of 15.2 billion yen in FY 3/24 is ongoing. The company plans to increase operating income rate to 15% and ROE to 25% by boosting profitability by 20%. In order to achieve these goals, the company will enhance marketing, enrich its products and services, invest in mainly promising fields, abolish and rebuild some existing businesses under the management policy of “improving production based on data-based management,” and actively operate overseas business, including the IoT business and encryption security business, which are Investment & Incubation Business in the U.S.

The company plans to concentrate its managerial resources on the fields of automotive items, cashless settlement, robots, IoT, RPA, and cloud services, which are expected to grow the most in the coming decade, and also on the domains of its products and services.

| FY 3/19 Results | Composition ratio/ Income margin | FY 3/20 Estimates | Composition ratio/ Income margin | FY 3/24 Plan | Composition ratio/ Income margin |

Solution Design | 21,214 | 35.5% | 23,450 | 37.1% | 40,950 | 40.6% |

Framework Design | 5,294 | 8.9% | 5,770 | 9.1% | 9,400 | 9.3% |

IT Service | 7,827 | 13.1% | 8,692 | 13.8% | 11,060 | 11.0% |

Solution Sales | 24,032 | 40.2% | 24,000 | 38.0% | 36,580 | 36.2% |

Cloud | 1,129 | 1.9% | 1,230 | 2.0% | 1,970 | 1.9% |

Overseas Business | 120 | 0.2% | 150 | 0.2% | 640 | 0.6% |

Investment & Incubation Business | 397 | 0.7% | 305 | 0.5% | 400 | 0.4% |

Adjustment | -272 | -0.5% | -450 | -0.7% | - | - |

Consolidated Sales | 59,742 | 100.0% | 63,147 | 100.0% | 101,000 | 100.0% |

Solution Design | 3,666 | 17.3% | 4,408 | 18.8% | 8,100 | 19.8% |

Framework Design | 841 | 15.9% | 968 | 16.8% | 1,600 | 17.0% |

IT Service | 1,067 | 13.6% | 1,220 | 14.0% | 2,350 | 21.2% |

Solution Sales | 1,155 | 4.8% | 1,242 | 5.2% | 2,300 | 6.3% |

Cloud | 197 | 17.5% | 64 | 5.2% | 500 | 25.4% |

Overseas Business | -31 | - | -15 | - | 250 | 39.1% |

Investment & Incubation Business | 5 | 1.3% | -22 | - | 100 | 25.0% |

Consolidated Operating Income | 6,902 | 11.6% | 7,865 | 12.5% | 15,200 | 15.0% |

*Unit: Million yen

2. 1Q of Fiscal Year March 2020 Earnings Results

(1) Consolidated Business Results for the 1st quarter

| FY 3/19 1Q (April to June) | Ratio to net sales | FY 3/20 1Q (April to June) | Ratio to net sales | YOY |

Net sales | 13,476 | 100.0% | 15,246 | 100.0% | +13.1% |

Gross profit | 2,953 | 21.9% | 3,399 | 22.3% | +15.1% |

SG&A expenses | 1,485 | 11.0% | 1,535 | 10.1% | +3.4% |

Operating income | 1,468 | 10.9% | 1,864 | 12.2% | +27.0% |

Ordinary income | 1,419 | 10.5% | 1,817 | 11.9% | +28.0% |

Profit Attributable to Owners of Parent | 943 | 7.0% | 1,230 | 8.1% | +30.5% |

*Unit: Million yen

Sales and operating income grew 13.1% and 27.0%, respectively, year on year.

Sales were 15,246 million yen, up 13.1% year on year. The sales of the Solution Design Business, which is conducted in the fields of mainly intelligent transportation systems (ITS), mobility services, and 5G communications, increased 14.0% year on year; the sales of the Framework Design Business, which saw growth in the existing financial field and the field of new services, such as automation solutions for business operation, rose 7.8% year on year; the sales of the IT Service Business, which is shifting to contracting business with high added value, grew 11.3% year on year, and the sales of the Solution Sales, which met the demand for updating Windows 7-installed machines and received many orders for server solutions, increased 14.0% year on year. In this way, the sales of its core businesses grew.

Operating income was 1,864 million yen, up 27.0% year on year. The profit of the Cloud Business declined due to the increase of personnel, etc. and the Overseas Business incurred an operating loss due to upfront investment, but the profit rate of the Solution Design Business increased 2.7 points to 17.3%. Like this, the profitability of its core businesses improved.

(2) Trends in each segment

◎ Solution Design Business

Sales were 5,601 million yen, up 14.0% year on year, and operating income was 970 million yen, up 35.7% year on year. In the field of in-vehicle devices, the company developed apps for intelligent transportation systems (ITS) and received more orders, increasing sales, in the field of mobility services, by focusing on its communication technologies that the company is proud of. In the field of social infrastructure, sales grew mainly in the profitable fields, including the infrastructure development for 5G communications, smart parking lots utilizing IoT devices, and smart gas. In addition, the company saw sales growth in the Internet business field, through the development of EC sites regarding the online shopping market, the development for cashless settlement, the modification, development, and evaluation of services for 5G, etc. and also the rise in sales of business operation systems by offering solutions, including the actualization of DX with swift low-cost services utilizing open source software (OSS). (DX stands for digital transformation, which means the change in strategies, products, workflow, etc. by utilizing the latest digital technologies.)

In the fields of smart devices, robots, and AI, which are related to development of smartphones, home appliances, robots, etc., the company withdrew from the development of smartphones, which are decreasing, but specialized in quality inspection and is shifting to the development of “robots and information appliances,” “artificial intelligence (AI),” and “IoT-related devices.”

◎Framework Design Business

Sales were 1,349 million yen, up 7.8% year on year, and operating income was 230 million yen, up 28.0% year on year. This business is classified into the financial one targeted at mainly existing clients and the new service one that mainly offers solutions for automating business operation. The company met the needs from clients in both fields, increasing orders from them.

In the first quarter, the sales in both the existing financial domain and the new service domain increased. In the existing financial domain, the development of a large-scale insurance system, which has been continued since the previous term, and the development of new operation systems for finance and insurance contributed to sales growth. In the new service domain, the sales from licenses for business operation automation solutions, on which the company concentrates, grew, thanks to the collaboration with product vendors, sales promotion by exhibitions, seminars, campaigns, and the support for development, etc. increased, too.

◎IT Service Business

Sales were 2,024 million yen, up 11.3% year on year, and operating income was 252 million yen, up 14.0% year on year. The company is shifting from the conventional service of dispatching “help desk staff,” “system operators,” and others by utilizing its capacity of hiring workers to the business of undertaking “IT support” and “IT infrastructure development,” and increased “PMO” transactions with high added value, in which the company assists mainly the profit divisions of client companies in utilizing IT strategically. (PMO stands for project management office, which means the tasks of controlling, managing, and supporting projects). Furthermore, the company increased new clients for “AI chatbots,” “IT training,” and “e-learning” for reforming ways of working, “the support for installation of security systems, training and education for security” as risk management for information security, “the shift to Windows 10” expecting the discontinuation of support for Windows 7, “the adoption of smart devices,” etc., and increased personnel required for expanding its business through the diversification of recruitment methods.

◎Solution Sales

Sales were 5,959 million yen, up 14.0% year on year, and operating income was 409 million yen, up 26.6% year on year. Under the slogans “the improvement of productivity by utilizing IT” and “the reform of ways of working,” the company offers solutions for mobile items, security, cloud services, etc., and the enhance the cooperation between sections inside the company.

In the first quarter, the company focused on the proposals for mobile PCs and cloud solutions and the development of a hybrid environment based on cloud computing and on-premises servers. As a result, it met the demand for updating Windows 7-installed machines and offered many server solutions, such as lump-sum transactions for systems, including development. Then, sales grew in parallel with the significant improvement in profitability.

◎Cloud Business

Sales were 282 million yen, up 24.3% year on year, and operating income was 18 million yen, down 51.6% year on year. The enhancement of the functions of “Cloudstep,” groupware linked to “G Suite” and “Microsoft Office 365,” met the needs from existing customers, leading to up-selling. In addition, the company succeeded in receiving an order for a large-scale project, which requires system integration, in which the company excels, and this boosted sales.

In addition, the company received more inquiries about “Canbus.,” which is a business app platform for actualizing DX (certified as a target of “IT subsidiaries” by the Ministry of Economy, Trade and Industry in June) from mainly start-up firms and large companies promoting DX, including the reform of ways of working.

As for profit, the company bore the cost for upfront investment, including the enhancement of functions of “Cloudstep” and the increase and training of personnel for improving support services. It was projected from the beginning that the profit of this business would decline due to upfront investment, and operating income for the term ending March 2020 is estimated to drop 67.6% year on year.

◎Overseas Business

Sales were 22 million yen, up 10.4% year on year, and operating loss was 18 million yen (16 million yen in the same period of the previous year). The company was not able to recoup upfront investments, including the cost for development of “an IoT platform” and “encryption and next-generation security solutions,” but received continuous orders from existing clients (leading manufacturers) and additional development orders from new Japanese clients in the East Coast since the end of the previous term, increasing sales of the U.S. subsidiary. In addition, the Vietnamese subsidiary grew offshore development.

ONE Tech, Inc., which is a joint venture between the U.S. subsidiary and Plasma, Inc., is developing the AI unit of the “IoT platform” of Plasma, Inc., as the platform was adopted for large-scale agricultural IoT in Australia. Recently, the company has received an increasing number of inquiries about IoT projects from Japanese-affiliated enterprises in the U.S.

As CCPA (described below) will be enforced in January 2020, the company receives an increasing number of inquiries about “Tellaro,” a security solution for encryption and next-generation authentification of StrongKey, Inc., which has globally offered services to central banks, leading financial institutions, military organizations, etc. around the world. For full-scale sale in Japan from the second half of this term, the company developed the Japanese version and additional Japanese specs, drafted manuals, conducted marketing activities, designed sales strategies, and posted ads in magazines. The company plans to accelerate the collaborative business not only inside Japan, but also in other Asian countries and the U.S.

CCPA stands for the California Consumer Privacy Act, which is the law of the state of California for entitling consumers to control the handling of their personal information. This act applies to not only the enterprises in California, but also enterprises that have earned a certain amount of sales ($25 million) and obtained personal information (including business cards and email addresses) of the citizens of the state of California.

◎Investment & Incubation Business

Internet of Things, Inc. is developing a data utilization app (a smartphone app of Canbus.) for actualizing IT-based business administration with IoT for clients of Canbus., an IoT sensor for incorporating in-company data into Canbus., and the OBD II (an interface for self-diagnosis) module for incorporating vehicle information.

GaYa Co., Ltd., which develops and manages video game content for smartphones, offers SNS games developed in-house to leading SNS sites, and operates video games developed and released by other companies. In order to receive orders for design and development of systems for content other than video games from this term, the company is cementing cooperation with overseas enterprises. In this first quarter, while some entrusted operation and development of video games ended, the company held new events for existing game titles and energize them.

| FY 3/19 1Q (April to June) | Composition ratio/ Income margin | FY 3/20 1Q (April to June) | Composition ratio/ Income margin | YOY |

Solution Design | 4,913 | 36.5% | 5,601 | 36.7% | +14.0% |

Framework Design | 1,251 | 9.3% | 1,349 | 8.9% | +7.8% |

IT Service | 1,818 | 13.5% | 2,024 | 13.3% | +11.3% |

Solution Sales | 5,225 | 38.8% | 5,959 | 39.1% | +14.0% |

Cloud | 227 | 1.7% | 282 | 1.9% | +24.3% |

Overseas Business | 20 | 0.1% | 22 | 0.1% | +10.4% |

Investment & Incubation Business | 111 | 0.8% | 63 | 0.4% | -43.2% |

Adjustment | -91 | -0.7% | -56 | -0.4% | - |

Consolidated Sales | 13,476 | 100.0% | 15,246 | 100.0% | +13.1% |

Solution Design | 715 | 14.6% | 970 | 17.3% | +35.7% |

Framework Design | 179 | 14.4% | 230 | 17.1% | +28.0% |

IT Service | 221 | 12.2% | 252 | 12.5% | +14.0% |

Solution Sales | 323 | 6.2% | 409 | 6.9% | +26.6% |

Cloud | 37 | 16.7% | 18 | 6.5% | -51.6% |

Overseas Business | -16 | - | -18 | - | - |

Investment & Incubation Business | 5 | 5.3% | 1 | 2.1% | -77.1% |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 1,468 | 10.9% | 1,864 | 12.2% | +27.0% |

*Unit: Million yen

* The business of GaYa Co., Ltd., which had been categorized into Consumer Service Business until FY 3/19, and other businesses are included in Investment & Incubation Business and Solution Design Business from FY 3/20.

(3) Financial Conditions

| March 2019 | June 2019 |

| March 2019 | June 2019 |

Cash and deposits | 14,376 | 13,302 | Trade payables | 6,056 | 4,776 |

Trade receivables | 13,486 | 11,984 | Income taxes payable | 1,853 | 295 |

Current assets | 29,166 | 26,737 | Provision for bonuses | 1,494 | 541 |

Noncurrent assets | 4,738 | 4,279 | Liabilities | 13,312 | 10,195 |

Total assets | 33,904 | 31,017 | Net assets | 20,592 | 20,822 |

*Unit: Million yen

The total assets as of the end of the first quarter stood at 31,017 million yen, down 2,887 million yen from the end of the previous term. Due to seasonal factors, cash and deposits, income taxes payable, and provision for bonuses decreased. Capital-to-asset ratio was 66.2% (59.9% as of the end of the previous term).

Through the third-party allocation of shares in parallel with the adoption of the stock-based compensation system for directors and executive officers, the company will retire 410,400 treasury shares on August 13 (disposal price: 1,803 yen/share).

3. Fiscal Year March 2020 Earnings Estimates

(1) Full-year Consolidated Earnings Estimates

| FY 3/19 Results | Ratio to net sales | FY 3/20 Estimates | Ratio to net sales | YOY |

Net sales | 59,742 | 100.0% | 63,147 | 100.0% | +5.7% |

Operating income | 6,902 | 11.6% | 7,865 | 12.5% | +14.0% |

Ordinary income | 6,706 | 11.2% | 7,622 | 12.1% | +13.7% |

Profit Attributable to Owners of Parent | 4,584 | 7.7% | 5,140 | 8.1% | +12.1% |

*Unit: Million yen

It is estimated that sales and operating income will grow 5.7% and 14.0%, respectively, year on year.

The sales of the core businesses are expected to grow and profitability is estimated to improve, as the company will offer more services in the existing businesses and conduct new businesses.

As for the performance of each business, it is projected that the sales of the Solution Design Business will grow 10.5% year on year, due to the increase of “Internet services,” about which the company has received many inquiries, and “in-vehicle systems,” “robots,” and “AI,” on which the company will focus. The sales of the Framework Design Business will increase 9.0% year on year, thanks to promising and profitable projects for “insurance systems,” “settlement,” and “infrastructure development.” The sales of the IT Service Business will rise 11.0% year on year, as the company will shift to the contracting business with high added value for “IT support,” “IT infrastructure,” “PMO,” and “LABO,” which can be differentiated with the company’s know-how nurtured through projects and English services. In every business, profitability is expected to improve.

On the other hand, the sales of the Solution Sales are estimated to decline slightly from the previous term due to the drop in product sales, but operating income rate is expected to rise through services with high added value.

It is also forecasted that the sales of the Cloud Business will rise 8.9% year on year, as there will be demand related to the reform of ways of working and the sales of the Overseas Business will increase 24.8% year on year, as the security products of StrongKey will be sold on a full-scale basis as regulations will be tightened, such as GDPR. The profit of the Cloud Business is projected to decline 67.6%, although sales will grow from the previous term, because the company will bear the cost for upfront investment for expanding the sales of its own services, including Canbus.

As for dividends, the company plans to pay an interim dividend of 10 yen/share and a term-end dividend of 10 yen/share, for a total of 20 yen/share, up 4 yen/share (payout ratio estimated to be 38%).

(2) Outlook for each segment

| FY 3/19 Results | Composition ratio/ Income margin | FY 3/20 Estimates | Composition ratio/ Income margin | YOY |

Solution Design | 21,214 | 35.5% | 23,450 | 37.1% | +10.5% |

Framework Design | 5,294 | 8.9% | 5,770 | 9.1% | +9.0% |

IT Service | 7,827 | 13.1% | 8,692 | 13.8% | +11.0% |

Solution Sales | 24,032 | 40.2% | 24,000 | 38.0% | -0.1% |

Cloud | 1,129 | 1.9% | 1,230 | 2.0% | +8.9% |

Overseas Business | 120 | 0.2% | 150 | 0.2% | +24.8% |

Investment & Incubation | 397 | 0.7% | 305 | 0.5% | -23.3% |

Adjustment | -272 | -0.5% | -450 | -0.7% | - |

Consolidated Sales | 59,742 | 100.0% | 63,147 | 100.0% | +5.7% |

Solution Design | 3,666 | 17.3% | 4,408 | 18.8% | +20.2% |

Framework Design | 841 | 15.9% | 968 | 16.8% | +15.1% |

IT Service | 1,067 | 13.6% | 1,220 | 14.0% | +14.2% |

Solution Sales | 1,155 | 4.8% | 1,242 | 5.2% | +7.5% |

Cloud | 197 | 17.5% | 64 | 5.2% | -67.6% |

Overseas Business | -31 | - | -15 | -10.0% | - |

Investment & Incubation | 5 | 1.3% | -22 | -7.2% | -520.4% |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 6,902 | 11.6% | 7,865 | 12.5% | +13.9% |

*Unit: Million yen

* From FY 3/20, Consumer Service Business will be included in Investment & Incubation.

4. Conclusions

The progress rate toward the full-year forecast is 24.1% for sales (the progress rate toward the annual sales in the same period of the previous yea 22.6%), 23.7% for operating income (21.3%), 23.8% for ordinary income (21.2%), and 23.9% for net income (20.6%). The progress rates in this term are healthy and higher than those in the previous term.

In June, the company participated in “MONET Consortium,” which was established by MONET Technologies, Inc., which was jointly founded by Softbank Corporation, Toyota Motor Corporation, etc. MONET Consortium is an industrial association operated by MONET Technologies, Inc., and develops and popularizes an open platform for MaaS in Japan, settle social issues regarding transportation, and create new value. The Systena Group has engaged in R&D for distributing MaaS by using “WebMotive,” a platform for vehicle information management software developed by Systena and an IoT module for vehicles developed by Internet of Things, Inc. of the Systena Group. By combining it with Systena’s technology for incorporation into communications devices, such as smartphones, know-how for developing and financial and business operation systems, and the technology nurtured through the development of websites, cloud systems, etc., the company plans to promote next-generation mobility services and solve social issues regarding transportation. We would like to expect their advance.

Reference: Regarding Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9 directors, including 2 outside ones |

Auditors | 4 auditors, including 4 outside ones. |

◎ Corporate Governance Report (Updated on June 25, 2019)

Basic policy

Our company will promote speedy business administration based on swift decision making to keep up with the rapid changes in the business environment and enhance the efficiency of business administration, and achieve sustainable business development, the increase in shareholder value, and the continuous return of profit to shareholders. In addition, our company will tighten our corporate governance in order to harmonize the interests of stakeholders, including shareholders, customers, business partners, employees, and local communities, maximize overall profit, secure the soundness of business administration, and comply with laws and regulations thoroughly. To do so, we will sincerely accept instructions and suggestions from external experts (audit corporations, lead-managing securities firms, lawyers, labor and social security attorneys, judicial scriveners, and others) and stakeholders, and strive to improve the fairness and transparency of our business administration. Then, we will develop a structure suited for our corporate scale by utilizing our inherent flexibility and make efforts to brush up ourselves as a listed company that always cares for stakeholders, including shareholders, strengthen corporate governance, and disclose appropriate information in a timely manner.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 4-1-3 Plan for finding successors to CEO and others】

Our company has two representative directors, namely, the representative director and chairperson, who is the founder, and a representative director and president in his early 50s. Our company is still an owner-led enterprise in which the representative director and chairperson, who founded our company, conducts business administration as chief executive officer under the managerial policy of selection and concentration. The plan for finding successors will depend on the future business environment and managerial policies, so we think that to leave it to the discretion of the chairperson is the best way for the growth of our company. Accordingly, the board of directors is not involved in the formulation or operation of concrete plans for finding successors, as of now. From now on, we will discuss this matter if necessary.

【Supplementary Principle 4-3-3 Establishment of objective, timely, transparent procedures for dismissing the CEO】

In our company, the representative director and chairperson, who is the founder and owner of our company, leads our business administration as CEO, and the representative director and president marshals employees based on appropriate evaluation of their performance, etc. as chief operating officer (COO). In addition, each representative director is monitored by 6 outside executives (2 outside directors and 4 outside auditors) who satisfied the requirements for becoming independent executives. If an event which would lead to the dismissal of a representative director occurs, the board of directors will have discussions and make decisions based on suggestions from independent executives, to cope with said event. Therefore, the board of directors has not yet established objective, timely, transparent procedures for dismissing the CEO. We will discuss this matter, when necessary.

【Supplementary Principle 4-10-1 Establishment of independent advisory committees, such as arbitrary nominating committees and compensation committees】

Two out of nine directors of our company are independent outside ones, who do not form a majority of the board of directors, but 6 outside executives, including them and 4 outside auditors, satisfy the requirements for independent executives specified by Tokyo Stock Exchange. Each independent executive actively expresses their opinions and gives timely, appropriate advice during deliberations about important matters at meetings of the board of directors, by utilizing their expertise and plenty of experience. Accordingly, we have not yet established an independent advisory committee. We will discuss this matter, when necessary.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

Our policy is not to strategically hold shares of listed companies, and there are no shares we hold strategically.

【Principle 1-7 Transactions among related parties】

In our company, conflict-of-interest and competing transactions shall be discussed and reported at a meeting of the board of directors. The board of directors approves each of such transactions in advance and reports on results.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (Systena Corporation: 2317) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/