Bridge Report:(2317)Systena Second quarter of fiscal year ending March 2022

Yoshichika Hemmi, Chairman |

Kenji Miura, President | Systena Corporation (2317) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Information and communications |

Representative Director | Yoshichika Hemmi, Kenji Miura |

Address | 14F Shiodome Building 1-2-20 Kaigan, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥2,016 | 96,847,828 shares | ¥195,245 million | 20.6% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

- | -% | ¥55.46 | 36.3x | ¥280.64 | 7.2x |

*The share price is the closing price on November 26. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter.

*ROE is the value as of the end of FY 3/21. EPS is taken from the estimates of FY 3/22, and BPS is from the financial results of the second quarter of FY 3/22.

*With December 1, 2021 being the effective date, the company resolved to carry out a 4-for-1 stock split. The term-end dividend per share for FY 3/22 (forecast) is undisclosed because it cannot be simply summed up when the stock split is taken into consideration (if the stock split is not taken into consideration, the annual dividend would be 20 yen/share, unchanged from the previous term).

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit Attributable to Owners of Parent | EPS | DPS |

March 2018 (Actual) | 54,320 | 5,170 | 5,147 | 3,542 | 36.32 | 46.00 |

March 2019 (Actual) | 59,742 | 6,902 | 6,706 | 4,584 | 47.00 | 16.00 |

March 2020 (Actual) | 64,552 | 8,163 | 7,871 | 5,471 | 56.22 | 20.00 |

March 2021 (Actual) | 60,871 | 8,006 | 7,507 | 4,974 | 51.36 | 20.00 |

March 2022 (Estimate) | 66,100 | 8,300 | 8,004 | 5,371 | 55.46 | - |

*The estimated values were provided by the company. Unit: Million yen

*In June 2018, a 4-for-1 stock split was conducted. (EPS is revised retroactively.) DPS for FY 3/18 is the number before stock split.

*With December 1, 2021 being the effective date, the company resolved to carry out a 4-for-1 stock split. The term-end dividend per share for FY 3/22 (forecast) is undisclosed because it cannot be simply summed up when the stock split is taken into consideration (if the stock split is not taken into consideration, the annual dividend would be 20 yen/share, unchanged from the previous term).

This Bridge Report reviews financial results of the second quarter of fiscal year ending March 2022 and full-year earnings forecasts of Systena Corporation.

Table of Contents

Key Points

1. Company Overview

2. Medium-Term Management Plan (FY 3/19-FY 3/25)

3. Second quarter of Fiscal Year ending March 2022 Earnings Results

4. Fiscal Year ending March 2022 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of FY 3/22, sales increased 5.4% year on year, and operating income grew 4.8% year on year. Sales grew 5.4% year on year to 30,876 million yen. The Cloud business continued to grow at a high rate. In addition, both the Solution Design Business and the Framework Design business performed well, contributing to the overall business earnings. Inquiries related to digital transformation (DX) continued to be favorable company-wide. The Solution Design business, where high-profit projects are on the rise, supported the company's profits. In addition, although the financial sector is still in the recovery phase, the Framework Design business, which has advanced the acquisition of new projects in the public sector and the distribution and service sector, also saw a double-digit increase in profits.

- There is no change in the earnings forecast. For FY 3/22, the company estimates that sales and operating income will rise 8.6% and 3.7%, respectively, year on year. As the IT investment by clients, which has been restricted due to the spread of COVID-19, is expected to recover and the activities for promoting DX and popularizing telework are estimated to be intensified, sales and profit are projected to grow in all of the core businesses: the Solution Design, Framework Design, IT Service, and Business Solution (previous name: Solution Sales) businesses. If the stock split is not taken into consideration, the annual dividend would be 20 yen/share, unchanged from the previous term (10 yen at the end of the first half and 10 yen at the end of the fiscal year).

- The novel coronavirus continued to spread during the first quarter, but the pandemic has finally begun to subside. In the Framework Design business, new developments will gradually start in the financial sector, where recovery is lagging. In addition, the increase of projects in the "DX" area is proceeding more smoothly than expected. Thus, it is highly anticipated that the company will grow further toward the post-pandemic era. As the business operation of Canbus. will begin in the U.S., we would like to keep an eye on its progress.

1. Company Overview

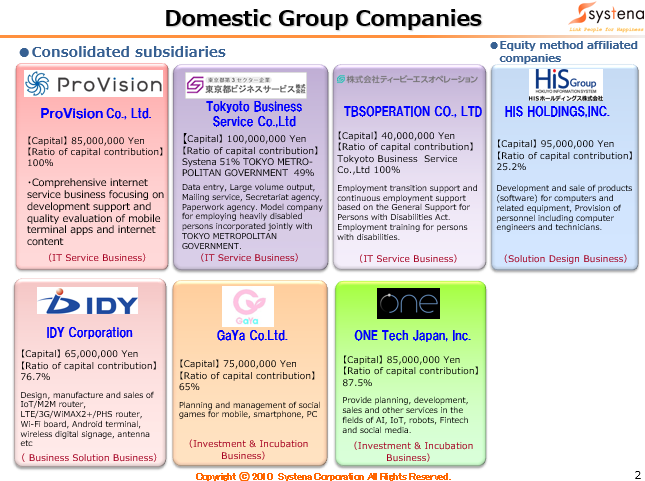

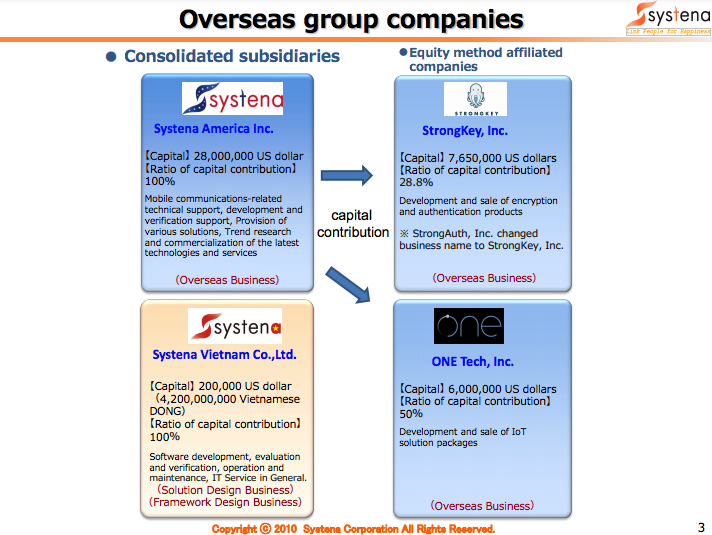

Systena Corporation was founded, when System Pro Corp. absorbed Katena Corp., which was an equity-method affiliate, on April 1, 2010. It is cultivating new domains by operating the business that fuses the former System Pro’s technologies, know-how, and open technologies for designing, developing, and testing mobile terminals and the financial knowledge and infrastructure technologies of the former Katena Corp. It forms a corporate group with 8 consolidated subsidiaries and 3 equity-method affiliates.

【Management goal - To become one of Japan's leading IT companies and support the Japanese economy from the ground up!】

In order to attain this objective, the company pursues good balances between conflicting items, such as “destruction and creation”, “stability and growth,” and “maintenance and innovation” as its basic policy.

【Target management indicators】

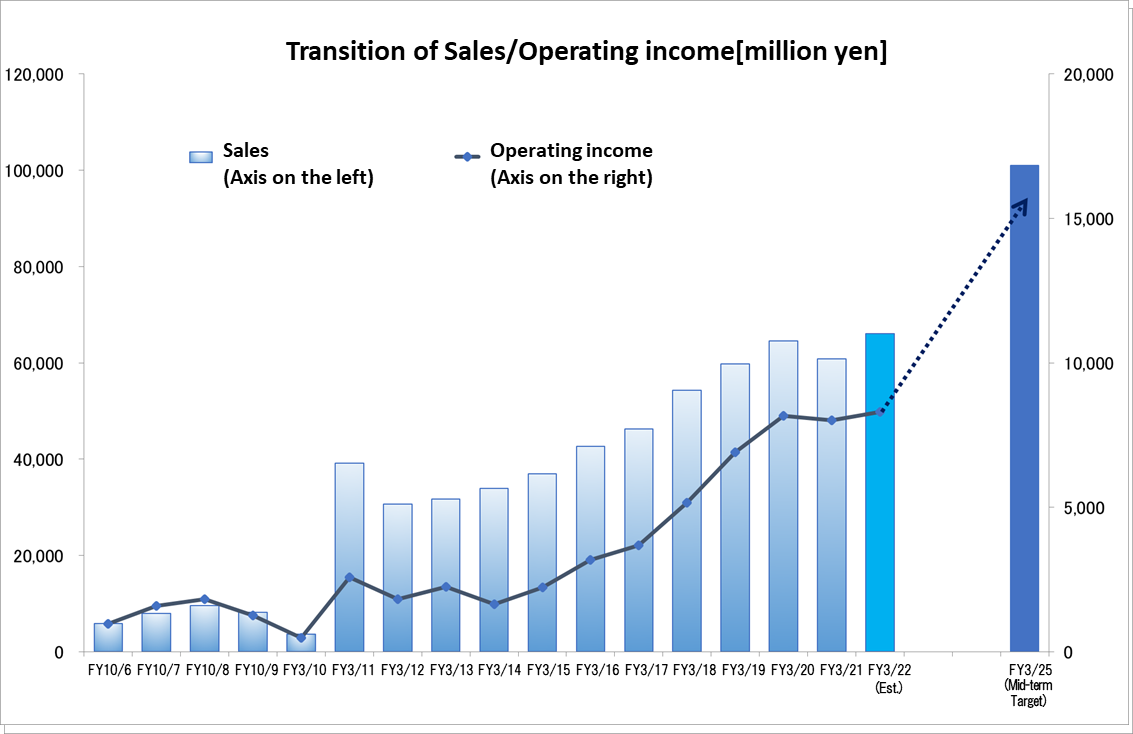

The company sets stably high dividends, high return on equity and high operating income rate as target managerial indicators. To achieve these goals, the company aims to develop a highly profitable structure under its basic policy for business administration. As for its near-term goals (mid-term management goals), the company declares to generate consolidated sales of 101 billion-yen, operating income of 15.2 billion yen (an operating income rate of 15%), per-capita operating income of 2.6 million yen, and 25% ROE in the term ending March 2025.

1-1 Business description

The business of Systena Corporation is classified into the Solution Design Business, the Framework Design Business the IT Service Business, the Solution Sales, the Cloud Business, the Overseas Business, and the Investment & Incubation Business.

Involving all group companies, they offer comprehensive solution services for planning, designing, developing, installing, and maintaining systems and giving user support, including the development and quality check of software for automatic driving and in-vehicle systems, social infrastructure systems, online business systems, IoT-related systems, robots, AI, and mobile devices, the development of systems for financial institutions, system operation, help desk management, the sale of IT products, system integration, the provision of cloud services, and the development of game content.

◎Solution Design Business (accounting for 39.1% in FY 3/21)

The company concentrates its managerial resources on five business categories; “in-vehicle” items such as automatic driving technology and telematics where its know-how nurtured through the development of mobile terminals can be utilized, “social infrastructure” in the fields of electric power, transportation, aviation, space, defense, etc., “Internet business” for communications carriers, e-commerce, education, e-books, etc., “smart devices/robots/AI,” including smartphones, home appliances, and robots, and “business operation systems,” including workflow and order receipt/placement systems. In every category, the company is swamped with inquiries about the development, testing of IoT-related systems and services. In addition, Systena Vietnam Co., Ltd., which is an overseas affiliate, functions as an offshore foothold for developing, testing, evaluating, maintaining, and operating software, handling all kinds of IT services, and so on. Clients include telecommunications carriers, telecom equipment manufacturers, automobile manufacturers, Internet business enterprises, etc.

◎Framework Design Business (accounting for 8.4% in FY 3/21)

Systena Corporation develops financial systems and foundational systems for not only life and non-life insurance companies, but also banks inside and outside Japan. As for life and non-life insurance tasks, the company has developed solutions for dealing with a broad range of tasks, including information management, contract management, insurance premium calculation, agency business, and sales management. As for banking tasks, the company has developed a variety of systems for sales branches and external channels in the field of open systems, while handling main frames. In the past, development and operation of financial systems accounts for most parts of the work, but nowadays, new businesses such as robotic process automation (RPA), cloud services, data analysis, voice recognition, and image recognition have grown to make up 40% of total sales. The company is further cultivating the financial market and expanding its business horizontally to other business fields, through cross-selling to customers of the IT Service Business and the Solution Sales or the cooperation with the Solution Design Business in solutions, such as smartphone apps and online apps. Like the Solution Design Business section, Systena Vietnam Co., Ltd. is functioning as an offshore foothold.

◎IT Service Business (accounting for 15.4% in FY 3/21)

Systena Corporation operates and maintains systems and networks, and offers IT outsourcing services including help desk operation, user support, data inputting, and large-volume output. Clients are mainly electric-appliance manufacturers, financial institutions, foreign-affiliated enterprises, and public offices.

◎Solution Sales Business-Renamed the Business Solution business in FY 3/22 (accounting for 35.2% in FY 3/21)

The company sells IT products including servers, PCs, peripheral devices, and software, to enterprises and integrates systems. The company is shifting business model from selling hardware to offering services. The company aims to expand its business and improve its added value by meeting the changing demands from ownership to usage (cloud, etc.) in cooperation with the IT Service Business section, etc. Clients are mainly electric-appliance manufacturers and foreign-affiliated enterprises.

◎Cloud Business (accounting for 2.4% in FY 3/21)

The company offers services ranging from the support for installation of cloud services to the provision of apps. For example, it offers cloud services of the Systena version of groupware combined with “Cloudstep,” which was developed jointly by the company and “Google Workspace”, “Canbus.,” a cloud database service, which was launched in May 2017, and “Web Shelter,” an anti-phishing solution for smartphones. It currently specializes in the public cloud, but it is also preparing for offering the private cloud service. “Cloudstep” is a collective term including business applications for improving the usability of cloud services, such as “Google Workspace”, and management tools for administrators. Clients include medium to large-sized companies that conduct general business, etc.

◎Overseas Business (accounting for 0.3% in FY 3/21)

The U.S. subsidiary operates two core businesses; one is the support for development and testing mobile and communications-related products, and the other is the researching on trends of the latest technologies and services and incubation in the U.S. The Vietnamese subsidiary is recognized as an offshore foothold that develops, tests, evaluates, maintains, and operates software, and handles all kinds of IT services. Clients include Japanese enterprises, American enterprises, telecommunications carriers, telecom equipment manufacturers, etc.

◎Investment & Incubation Business (accounting for 0.3% in FY 3/21)

The strategic subsidiary “ONE Tech Japan, Inc.” conducts the planning, development, sale, and service provision in the fields of IoT, robots, FinTech, and social media. GaYa Co., Ltd. develops game content for smartphones, offers the contents to leading SNS websites and undertakes the operation of video games developed and released by other companies.

*Adjustment ▲1.1%

1-2 Group Companies

(Taken from the reference material of the company)

(Taken from the reference material of the company)

2. Medium-Term Management Plan (FY 3/19-FY 3/25)

The company has been promoting its 5-year medium-term plan, which was formulated in 2019 and will end in FY 3/24. However, in FY 3/21, the company was faced with a decline in sales due to stagnation of the economic activity caused by COVID-19. In light of these circumstances, the company has decided to postpone the achievement year of the mid-term plan for one year and set FY 3/25 as the final year of the new plan, aiming for the previous plan targets of 101 billion yen in sales and 15.2 billion yen in operating income.

FY 3/22 and FY 3/23 will be a period of upfront investment, whereas full-scale business expansion is expected in FY 3/24 and FY 3/25.

[Major Management Policies - Improving Productivity through Data Management - ]

・To conduct cost control precisely and grasp real profits and losses early by utilizing the IT management system established with the Canbus. Platform, which was developed in house

・The company aims to maximize profits by thoroughly improving productivity based on management information quantified by visualization of management data and AI-based prediction.

[Strategy, Key Management Indicators, and Targets for FY 3/25]

The company will concentrate its management resources on automotive, cashless/payment, robotics/IoT/RPA/cloud, and its own products and services, which it positions as the areas that will grow the most in the next 10 years.

Key Management Indicators, and Targets for FY 3/25

The company's key management indicators are consolidated net sales, operating income, operating margin, operating income per capita, and ROE. For FY 3/25, the company has set the following targets: consolidated net sales of 101 billion yen, operating income of 15.2 billion yen, operating margin of 15%, operating income per capita of 2.6 million yen, and ROE of 25%.

[Targets and Initiatives by Segment]

◎Solution Design Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Estimates | FY 3/25 Targets |

Sales | 212 | 229 | 238 | 208 | 395 |

Operating income | 37 | 40 | 41 | 39 | 71 |

*Unit: Hundred Million yen

*From FY3/22, the segment of subsidiary ProVision, which had been included in the Solution Design business, was changed to the IT Services business, and the segment of subsidiary IDY was changed to the Business Solution business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company is aiming for sales of 39.5 billion yen in FY 3/25 (21.2 billion yen in FY 3/19) and an operating income of 7.1 billion yen (3.7 billion yen in FY 3/19). They aim to expand the industry by concentrating on the Internet business, which is experiencing an increase in social demand due to the impact of COVID-19. The in-vehicle business, which is undergoing a period of transformation in the industry, will be selected and concentrated on with a long-term perspective. The company also aims to stimulate demand for digital transformation by transforming customers' business models and processes and to expand its business by providing not only system integration but also its own services.

The plan for FY 3/25 by field is as follows: sales of 6.5 billion yen in automotive (2.7 billion yen in FY 3/19), sales of 8.0 billion yen in social infrastructure/products (0.8 billion yen in FY 3/19), sales of 20.0 billion yen in the Internet business (10.2 billion yen in FY 3/19), and sales of 5.0 billion yen in DX services (2.3 billion yen in FY 3/19).

In addition to infotainment and sharing, which are the current mainstays of the automotive industry, there are many business opportunities in MaaS, connected cars, automated driving, and safety measures. In the area of social infrastructure/products, demand is expected to grow for the development of communication robots as well as lifestyle robots such as nursing care, industrial robots, and robots and systems for medical use. In the Internet business, the focus will be on education-related and 5G-related services, as well as AI and IoT. In business systems, in addition to work style reforms and open source applications, which are currently in high demand, development demand can be expected for AI, business automation, DX, and countermeasures for human resource shortages.

◎Framework Design Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Estimates | FY 3/25 Targets |

Sales | 53 | 58 | 51 | 51 | 75 |

Operating income | 8.4 | 10.6 | 8.6 | 8.7 | 12.5 |

*Unit: Hundred Million yen

*From FY3/22, the new service field segment included in the Framework Design business was changed to the Business Solution business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company is aiming for sales of 7.5 billion yen in FY 3/25 (5.3 billion yen in FY 3/19) and an operating income of 1.25 billion yen (840 million yen in FY 3/19). While developing know-how in financial system development, the company will make changes to become DX-compatible and actively expand its business to new and existing customers. In addition, the company will strengthen its contract development system, achieve comprehensive support for development, infrastructure, and maintenance, create a new growth engine for the DX era, and expand into SaaS utilization development. In the insurance, banking, and social infrastructure sectors, the company will work to expand the domain of existing customers, renew core systems in response to digitalization, and acquire support for integration. In public and distribution services, the company aims to expand into new areas by deploying its know-how in the financial sector and to maximize the value of DX-related development.

The plan for FY 3/25 by business field is as follows: 3.0 billion yen in sales from existing financial businesses (2.5 billion yen in FY 3/19), 2.0 billion yen in sales from new businesses in the public and other sectors (0.5 billion yen in FY 3/19), and 1.5 billion yen in sales from DX-related businesses (no track record).

◎IT Service Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Estimates | FY 3/25 Targets |

Sales | 78 | 87 | 94 | 154 | 180 |

Operating income | 11 | 13 | 14 | 20 | 35.5 |

*Unit: Hundred Million yen

*From FY3/22, the segment of the subsidiary ProVision, which was included in the Solution Design Business, was changed to the IT Services Business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company aims to achieve sales of 18 billion yen in FY 3/25 (7.8 billion yen in FY 3/19) and an operating income of 3.55 billion yen (1.1 billion yen in FY 3/19). Based on know-how cultivated through projects, the company will focus on high value-added outsourced contracting services of IT support, IT infrastructure, and PMO, as well as assessment and consulting services. In addition to the expansion of "Software Quality Assurance Services" BtoBtoC "Social Games," "Internet Business" and other entertainment domains, the company aims to expand the BtoB enterprise domain. In these areas, the company will work to expand its business field by strengthening alliances and new services and expanding its bases.

The company's plan by field for FY 3/25 is as follows: sales of "IT support," "IT infrastructure," "PMO," and outsourced contracting services will be 8 billion yen (4.5 billion yen in FY 3/19), and sales of quality verification services will be 6 billion yen (3.3 billion yen in FY 3/19).

◎Solution Sales Business-Renamed the Business Solution business in FY 3/22

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Estimates | FY 3/25 Targets |

Sales | 240 | 259 | 214 | 238 | 353.9 |

Operating income | 12 | 16 | 14 | 16 | 24.5 |

*Unit: Hundred Million yen

*From FY3/22, the new service field included in the Framework Design business and the segment of subsidiary IDY included in the Solution Design business were changed to the Business Solution business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company is aiming to achieve sales of 35.39 billion yen in FY 3/25 (24 billion yen in FY 3/19) and an operating income of 2.45 billion yen (1.2 billion yen in FY 3/19). The company will create and expand value-added businesses by providing solution services to solve customers' management issues such as productivity improvement, cost reduction, and security enhancement as a comprehensive sales force, and transform itself into an ICT partner that supports customers' businesses, leading to continuous sales and profit growth. The numerical targets for FY 3/25 are a 40% increase compared to FY3/19 in the existing business, a 180% increase in the service business, and a 350% increase in the DX business.

◎Cloud Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Estimates | FY 3/25 Targets |

Sales | 11 | 14 | 15 | 15 | 19.7 |

Operating income | 2 | 2 | 3 | 1 | 5 |

*Unit: Hundred Million yen

The company is aiming for sales of 1.97 billion yen in FY 3/25 (1.1 billion yen in FY 3/19) and an operating income of 500 million yen (200 million yen in FY 3/19). The company will accelerate the subscription model through its DX platform "Canbus." which promotes DX. In addition, they aim to grow their high value-added business with "Cloudstep" and "Canbus." to support process innovation through remote work and other work style reforms.

◎Overseas Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Estimates | FY 3/25 Targets |

Sales | 1 | 1 | 1.9 | 2.3 | 6.4 |

Operating income | -0.3 | -0.2 | 0.07 | 0.08 | 2.5 |

*Unit: Hundred Million yen

The company aims to achieve sales of 640 million yen in FY 3/25 (100 million yen in FY 3/19) and an operating income of 250 million yen (30 million yen loss in FY 3/19). In the U.S., the company will promote joint sales with One Tech in the field of edge AI building on its technical support for Japanese companies. The company will also provide technical support to Japanese companies in the U.S., PoC in the U.S., and incubation support services to solidify its sales and profit base.

*The fiscal year ended March 2010 was an irregular five-month period due to changing the accounting period.

3. Second quarter of Fiscal Year ending March 2022 Earnings Results

3-1 Consolidated Business Result of the first half of fiscal year March 2022

| 1H of FY 3/21 | Ratio to net sales | 1H of FY 3/22 | Ratio to net sales | YOY |

Net sales | 29,304 | 100.0% | 30,876 | 100.0% | +5.4% |

Gross profit | 6,928 | 23.6% | 7,417 | 24.0% | +7.1% |

SG&A expenses | 3,245 | 11.1% | 3,558 | 11.5% | +9.6% |

Operating income | 3,683 | 12.6% | 3,858 | 12.5% | +4.8% |

Ordinary income | 3,723 | 12.7% | 3,738 | 12.1% | +0.4% |

Profit Attributable to Owners of Parent | 2,511 | 8.6% | 2,518 | 8.2% | +0.3% |

*Unit: Million yen

Sales and operating income increased by 5.4% and 4.8%, respectively, year on year.

While economic activities were restrained due to measures to prevent the spread of the novel coronavirus, the company continued to promote business activities through remote sales and, IT support and software development support through telework. The company also promoted sales with an emphasis on retaining existing customers.

Sales increased 5.4% year on year to 30,876 million yen. The Business Solution business struggled due to the difficulty in procuring IT equipment due to the weakening of demand for telework and the shortage of semiconductors. The Cloud business continued to grow at a high rate. In addition, both the Solution Design business and the Framework Design business performed well, contributing to the overall business earnings. Inquiries related to digital transformation (DX) continued to be favorable company-wide.

The Solution Design business, where high-profit projects are on the rise, supported the company's profits. In addition, although the financial sector is still in the recovery phase, the Framework Design business, which has advanced the acquisition of new projects in the public sector and the distribution and service sector, also saw a double-digit increase in profits. Regarding the Cloud business, it accumulated profit centered on Canbus., the company's original service, contributing to the rise in profits. On the other hand, although the deficit narrowed, the Overseas business was a burden to the profit growth. The Business Solution business, which was affected by the global shortage of semiconductors, recorded a 16% year-on-year decrease in operating income. Gross profit margin improved 0.4 points year on year to 24.0%. The ratio of SG&A expenses to sales rose 0.4 points to 11.5%.

*In the first quarter of this year, the company reconsidered its business management categories. ProVision Inc., which had been classified as part of the Solution Design business, was changed to be part of the IT Service business, and IDY Corporation was changed to be part of the Business Solution business. In addition, new service fields such as RPA, which had been classified as part of the Framework Design business, were reclassified as the Business Solution business.

*For the year-on-year comparison, the figures for the same quarter of the previous year are reclassified into the new reporting segments (the same shall apply hereinafter).

3-2 Trends by segment

| 1H of FY 3/21 | Composition ratio/Income margin | 1H of FY 3/22 | Composition ratio/ Income margin | YOY |

Solution Design | 9,422 | 32.2% | 9,718 | 31.5% | +3.1% |

Framework Design | 2,219 | 7.6% | 2,370 | 7.7% | +6.8% |

IT Service | 6,553 | 22.4% | 7,443 | 24.1% | +13.6% |

Solution Sales | 10,578 | 36.1% | 10,472 | 33.9% | -1.0% |

Cloud | 655 | 2.2% | 1,003 | 3.3% | +53.2% |

Overseas Business | 91 | 0.3% | 88 | 0.3% | -4.1% |

Investment & Incubation Business | 86 | 0.3% | 87 | 0.3% | +0.5% |

Adjustment | -304 | -1.1% | -306 | -1.1% | - |

Consolidated Sales | 29,304 | 100.0% | 30,876 | 100.0% | +5.4% |

Solution Design | 1,523 | 16.2% | 1,606 | 16.5% | +5.5% |

Framework Design | 357 | 16.1% | 421 | 17.8% | +17.9% |

IT Service | 913 | 13.9% | 952 | 12.8% | +4.3% |

Solution Sales | 812 | 7.7% | 682 | 6.5% | -16.0% |

Cloud | 104 | 16.0% | 212 | 21.1% | +103.0% |

Overseas Business | 7 | 7.6% | -1 | -1.4% | - |

Investment & Incubation Business | -35 | -41.1% | -15 | -18.3% | - |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 3,683 | 12.6% | 3,858 | 12.5% | +4.8% |

*Unit: Million yen

Solution Design Business - Sales: 9,718 million yen (+3.1% YoY), Operating income: 1,606 million yen (+5.5% YoY)

Mainly in the fields of “mobility” and “5G,” the in-vehicle business and the social infrastructure business performed well. Inquiries related to DX are on the rise as customers are mindful of the post-pandemic era. The company is also actively developing new growth domains, and this has led to an increase in sales.

Framework Design Business - Sales: 2,370 million yen (+6.8% YoY), Operating income: 421 million yen (+17.9% YoY)

In the financial field, although the decreasing trend of large-scale projects due to the uncertainty during the novel coronavirus crisis has subsided, the operation of new development projects has been delayed, and this domain is still in the process of recovery. However, at its financial results briefing, the company indicated that the business sales bottomed out in the first half of the year. Also, inquiries about DX-related projects are steadily increasing, and the company continues developing them actively.

In the public field, projects related to the Social Security and Tax Number System and infrastructure construction are expanding, which led to an increase of orders. As with finance, the company is actively developing this domain to acquire DX-related projects.

In the distribution and service field, the company strengthened the commissioned development business targeting private mid-sized companies and acquired new projects through maintenance and development services that utilize development laboratories.

IT Services Business - Net sales: 7,443 million yen (+13.6% YoY), Operating income: 952 million yen (+4.3% YoY)

Amid the novel coronavirus crisis, the number of companies working on DX promotion and further work style reform is increasing regardless of industries, and a trend of rebuilding and optimizing the conventional IT environment has begun. Under these circumstances, there was an increase in the number of high-value-added projects that create workstyles for customers, such as the construction of mobile environments, as IT support services that aid the promotion of customers' businesses and the introduction of cloud solutions are accelerating. This led to an increase in sales and profits. In addition, the company improved alliances with manufacturers by using IT training and security services that promote remote working as sales hooks, which led to the development of new customers.

Solution Sales Business: Sales: 10,472 million yen (down 1.0% YoY), Operating Income: 682 million yen (down 16.0% YoY)

In addition to the weakening of demand for remote work, the difficulty in procuring IT equipment continued due to the global shortage of semiconductors. Thus, sales decreased slightly. However, in the system integration business, the company received orders for projects regarding the construction of security and hybrid environments, the transition to cloud environments for digitalization by the DX promotion departments, which were integrated at the beginning of the term, and system development. Furthermore, high value-added comprehensive service projects requiring identifying the roadmap, installing IT equipment, infrastructure construction, system development, and maintenance and operations are expanding.

Cloud Business - Sales: 1,003 million yen (+53.2% YoY), Operating income: 212 million yen (+103.0% YoY)

Inquiries about Canbus. increased from companies promoting workstyle reforms through remote working and companies shifting to data-driven operations considering the post-pandemic era. The company itself has adopted Canbus. company-wide to promote data management. Inquiries are also increasing from companies considering rebuilding groupware suitable for remote work. Cloudstep is also performing steadily.

Overseas business – Sales: 88 million yen (down 4.1% YoY), Operating loss: 1 million yen (down 8 million yen YoY)

The Japanese market continues to witness some severe circumstances as the POC project, which the company was preparing, was stopped due to the impact of the novel coronavirus crisis. However, there were increases of inquiries and additional orders for unique operational efficiency services and smart factory projects using AI and IoT (LoRa) from companies in the U.S. and Japan. In addition, the company's engineers have been praised for the high quality of their output, and ordered works are currently being shifted from competitors to the company. The business is progressing steadily, as the original service Canbus., which has accumulated a track record in Japan, was released in the U.S.

3-3 Financial Conditions and CF

Financial Conditions

| March 2021 | September 2021 |

| March 2021 | September 2021 |

Cash and deposits | 19,037 | 19,513 | Trade payables | 5,257 | 4,098 |

Trade receivables | 12,826 | 11,750 | Accounts payable and accrued expenses | 1,872 | 2,210 |

Inventories | 831 | 655 | Income taxes payable | 1,681 | 1,352 |

Current assets | 33,420 | 32,885 | Provision for bonuses | 1,227 | 1,202 |

Tangible Assets | 917 | 973 | Interest-Bearing Liabilities | 1,550 | 1,550 |

Intangible Assets | 307 | 305 | Liabilities | 12,889 | 11,271 |

Investments and Others | 4,240 | 4,652 | Net assets | 25,996 | 27,545 |

Noncurrent assets | 5,465 | 5,931 | Total Liabilities and Net Assets | 38,886 | 38,817 |

*Unit: Million yen

Total assets at the end of September 2021 were 38,817 million yen, down 69 million yen from the end of the previous fiscal year. On the asset side, notes receivable, accounts receivable, and contract assets declined, but cash & deposits increased and investments and other assets notably increased due to an increase in security deposits and leasehold. Regarding liabilities, accounts payable and income taxes payable decreased. Capital-to-asset ratio was 70.0%, up 4.1 points from the end of the previous fiscal year.

3-4 Recent Topics

Application for selection of the new market category

The Tokyo Stock Exchange is establishing three new market categories: Prime Market, Standard Market, and Growth Market, in line with the market reorganization scheduled in April 2022. The company announced on September 16, 2021 that the board of directors resolved to select and apply for the Prime Market, which is positioned as the highest in the new market categories (*It was confirmed that the company meets the listing maintenance standards of the market on July 9, 2021).

Exhibiting at the WinActor Lounge 2021

WinActor Lounge is an event held by NTT DATA to overcome the business environment that is facing a major turning point. It provides the management theory that considers the future of companies, precedent cases of leading Japanese companies, and information on cutting-edge collaborative solutions that realize these. In this event, all this information can be collected in one place. It was held online in 2021 following the previous event, which was held in 2020.

Under the theme of "Let's adopt AI and RPA!", the company introduced its collaboration with WinActor, which has the largest share in Japan and is used by more than 6,500 companies in a wide range of fields, and AI/AI-OCR products as RPA tools that match the business of Japanese companies. Many visitors of the virtual exhibition booth sought proposals that could only be made by Systena, which handles a large number of RPA tools in addition to WinActor.

4. Fiscal Year ending March 2022 Earnings Estimates

4-1 Consolidated Earnings Estimates

| FY 3/21 Results | Ratio to net sales | FY 3/22 Estimates | Ratio to net sales | YOY |

Net sales | 60,871 | 100.0% | 66,100 | 100.0% | +8.6% |

Operating income | 8,006 | 13.2% | 8,300 | 12.6% | +3.7% |

Ordinary income | 7,507 | 12.3% | 8,004 | 12.1% | +6.6% |

Profit Attributable to Owners of Parent | 4,974 | 8.2% | 5,371 | 8.1% | +8.0% |

*Unit: Million yen

There is no change in earnings forecasts. Sales and operating income are estimated to rise 8.6% and 3.7%, respectively, year on year.

For FY 3/22, the company estimates that sales will rise 8.6% year on year to 66.1 billion yen and operating income will rise 3.7% year on year to 8.3 billion yen. As the IT investment by clients, which has been restricted due to the spread of COVID-19, is expected to recover and the activities for promoting DX and popularizing telework are estimated to be intensified, sales and profit are projected to grow in all of the core businesses: the Solution Design, the Framework Design, the IT Service, and the Business Solution (previous name: Solution Sales) businesses. On the other hand, the Cloud business is estimated to see an increase in sales and a decrease in profit, due to the application of the new accounting standards and the setting of new prices. As the Framework Design business saw a significant decline in performance in the previous term due to the decrease of business inquiries about new transactions, the postponement and suspension of transactions amid the COVID-19 pandemic in the existing financial domain, the sales and operating income of this business are expected to grow at the highest rates. In addition, operating margin is projected to drop 0.6 points from the previous term to 12.6%, due to the rise in upfront investment, including the increase of employees, the expansion of business footholds, and the augmentation of promotional costs.

Regarding dividends, the company will pay an interim dividend of 10 yen/share as planned. The company resolved to carry out a 4-for-1 stock split with December 1, 2021 being the effective date. Therefore, the term-end dividend will be 2.50 yen/share if the stock split is considered (if the stock split is not considered, it will be 10 yen/share. Thus, there is virtually no change from the initial plan).

4-2 Outlook and efforts for each segment

| FY 3/21 | Composition ratio/ Income margin | FY 3/22 Estimates | Composition ratio/ Income margin | YOY |

Solution Design | 19,163 | 31.5% | 20,750 | 31.4% | +8.3% |

Framework Design | 4,498 | 7.4% | 5,121 | 7.7% | +13.8% |

IT Service | 13,662 | 22.4% | 15,383 | 23.3% | +12.6% |

Business Solution | 22,343 | 36.7% | 23,835 | 36.1% | +6.7% |

Cloud | 1,484 | 2.4% | 1,500 | 2.3% | +1.1% |

Overseas Business | 188 | 0.3% | 230 | 0.3% | +22.2% |

Investment & Incubation | 178 | 0.3% | 211 | 0.3% | +18.4% |

Adjustment | -647 | -1.0% | -930 | -1.4% | - |

Consolidated Sales | 60,871 | 100.0% | 66,100 | 100.0% | +8.6% |

Solution Design | 3,624 | 18.9% | 3,870 | 18.7% | +6.8% |

Framework Design | 772 | 17.2% | 867 | 16.9% | +12.2% |

IT Service | 1,873 | 13.7% | 1,950 | 12.7% | +4.1% |

Business Solution | 1,499 | 6.7% | 1,634 | 6.9% | +9.0% |

Cloud | 300 | 20.2% | 100 | 6.7% | -66.7% |

Overseas Business | 7 | 4.0% | 8 | 3.5% | +6.1% |

Investment & Incubation | -71 | -39.9% | -142 | -67.3% | - |

Adjustment | - | - | 13 | - | - |

Consolidated Operating Income | 8,006 | 13.2% | 8,300 | 12.6% | +3.7% |

*Unit: Million yen

The segment of the subsidiary ProVision (earnings forecast for this term: sales of 5 billion yen and an operating income of 500 million yen) has been transferred from the Solution Design business to the IT Service business. The segment of the subsidiary IDY (earnings forecast for this term: sales of 342 million yen and an operating income of 16 million yen) has been transferred from the Solution Design business to the Business Solution business. The segment of new services (earnings forecast for this term: sales of 1 billion yen and an operating income of 110 million yen) has been transferred from the Framework Design business to the Business Solution business. The results for FY 3/21 are those after the above transfer, and year-on-year changes are based on the figures after the above transfer.

◎Solution Design business - Sales: 20,750 million yen(+ 8.3%YoY), Operating Income: 3,870 million yen (+6.8%YoY)

Through selection and concentration, the company will concentrate on promising domains and aim to create business domains with high added value.

◆Aggressive expansion into growing areas

Work on new development in growing areas such as Mobility, 5G, AI, IoT, and DX.

◆Shift to comprehensive solutions

The company will support the customers' services in all processes, ranging from IT consulting to operation. The company aims to provide added value to customers and build a highly profitable structure by expanding its range of services from conventional design, development, and evaluation to planning, operation, IT consulting, and service operations,

◆Development of new business and new fields by strengthening services

The company will strengthen its DX-related services and create new businesses. The company aims to expand its original products and services that are developed to reflect the needs of its customers, such as the cloud attendance management service “TimeTapps” that targets hospitals and medical professionals, the groupware that supports data management “Palette,” the unattended hospitality reception system “WelTouch,” the in-house currency system “TenaPoint.,” and “TENA TECH.,” where technical know-how can be shared internally. Furthermore, as in the case of Osaka and Ehime prefectures, the company will develop original products and services that solve the problems of local governments, introduce them to other local governments, and connect them to SI.

◎Framework Design Business - Sales: 5,121 million yen (+13.8% YoY), Operating Income: 867 million yen (+12.2% YoY)

The company aims to maximize orders by focusing on growing areas, both in existing businesses centered on the financial sector and in new business areas.

From FY 3/22, the new service field included in this business will be changed to the Business Solution business. By specializing more in contract development and SI, the company aims to attract new customers in the newly launched fields of public services, transportation, infrastructure, services, logistics, etc.

◆Maximize existing businesses and expand into growing areas

The company will continue projects centered on insurance and financial systems and building of infrastructure. The company will also actively continue to expand business in the public sector and the distribution and service sector.

◆Actively seek orders for DX projects

The company will strengthen both its sales and technical systems in order to win orders for core system renewal and infrastructure construction (cloud computing) projects associated with DX.

◆Expansion of service-oriented business

They will expand their services in the areas of "contract development," "business support," and "cloud deployment." In addition, they will increase orders by strengthening cooperation between headquarters and service vendors.

◎IT Service Business - Sales: 15,383 million yen (+12.6% YoY), Operating Income: 1,950 million yen (+4.1% YoY)

In an environment where more and more customers are promoting DX and accelerating work style reforms, the company will restructure and optimize the existing IT environment and expand IT support services for companies creating new business models.

In FY 3/21, the company gained 72 new client companies and will work to increase transactions with these clients. In addition, 15 new services are planned for this fiscal year.

◆Further focus on high added value cases

Based on the know-how accumulated through the provision of staff-assigned services such as "helpdesk" and "system operator" services, the company will focus on providing services that are more directly linked to the growth and speed up of customers' businesses thereof, such as value-added commissioned services including "IT support," "IT infrastructure," and "PMO," as well as "assessment" and "consulting" services that take advantage of the company's experience in responding to customer requests in response to changes in the business environment.

◆Expansion of software quality assurance services (QA services)

The company will focus on expanding existing domains and developing new business in the enterprise domain by leveraging the quality assurance services which has been developed in the entertainment domain, where orders for social games online business, etc. are growing.

◆Attracting new customers and creating business models

The company will expand the scope of new services and support through investment in human resource development and alliances with group companies and partner companies. They will also strengthen their services and sales by strengthening remote marketing and opening regional offices.

In addition, ProVision, which changed its segment from Solution Design to IT Services from this fiscal year, aims to expand in the entertainment domain, such as social games and online business (BtoBtoC), as well as to expand in the enterprise domain by utilizing the company's business knowledge. In addition, for Tokyo Metropolitan Business Service, in order to establish a system of 200 people with disabilities, the company aims to expand its business and supportive consulting services for people with disabilities to both the company’s and ProVision's customers (support centers, consulting services).

◎Business Solution Business - Sales: 23,835 million yen (+6.7% YoY), Operating Income: 1,634 million yen (+9.0% YoY)

The name of the business segment was changed from Solution Sales to Business Solution Business in FY 3/22. Despite investment restraint due to the impact of the novel coronavirus, efforts to normalize DX and telework are expanding. In this environment, the company will work to expand existing businesses and shift its focus to growing areas. From FY 3/22, IDY, a subsidiary with strengths in new service fields primarily in RPA, which was included in the Framework Design business, and in 5G edge gateways, which was included in the Solution Design business, was reclassified to the Business Solution business segment. The company will link its expanded service menu in the RPA and 5G fields to the enhancement of its sales capabilities.

◆Investment to expand the solution domain

To expand its service lineup and conduct marketing targeting profit divisions.

◆Strengthening initiatives to the hybrid environment

To adapt to the hybrid environments and strengthen alliances with cloud partners

◆Expansion of DX-related services

The company will expand its service menu including RPA and data collaboration tools.

◆Improving profitability by expanding sales of services

To provide one-stop services for all services of All Systena.

◎Cloud Business -Sales: 1,500 million yen (+1.1% YoY), Operating Income: 100 million yen (-66.7% YoY)

Inquiries for business improvements and in-house infrastructure development considering the post-pandemic era are on the rise. The company aims to expand into the DX field through aggressive upfront investment in its own services, centered on “Canbus.” By the way, the adoption of the new accounting standards which requires accounting for profits according to the percentage-of completion method is expected to result in a decrease of approximately 100 million yen of operating income. In addition, the price revisions for Google products purchased by the company are expected to result in another decrease of approximately 100 million yen of operating income.

◆Upfront investment to increase awareness of "Canbus." and promote it

To actively enhance the alliances and start offering Canbus. on an OEM basis.

◆Upfront investment accompanying service enhancements

In order to make a variety of operations feasible as a DX platform, the company will enhance its product capabilities and strengthen its human resources to improve support capabilities and increase customer satisfaction.

◎Overseas Business -Sales: 230 million yen (+22.2% YoY), Operating Income: 8 million yen (+6.1% YoY)

As measures, the company is expanding sales of AI and IoT services, technical support for PoC development between Japanese companies in Silicon Valley and startup companies, and the scope of orders received in existing transactions. Furthermore, the company will start the operation of Canbus.

◆Expanding Sales of AI and IoT Services

In addition to horizontal expansion to industries that have already introduced the service, the company will aggressively market its unique cold chain and smart factory services powered by AI and IoT (LoRa).

◆Expansion of technical support for PoC development between Japanese companies in Silicon Valley and start-ups

They aim to acquire continuing orders of PoC development projects with Japanese companies in Silicon Valley and startup companies and to reduce costs by utilizing offshore Vietnam.

◆Expanding the scope of orders in existing business

Due to the high quality of the company's engineers' output and their ability to respond flexibly and make proposals from the customer's point of view, there has been an accelerating trend of transferring the work of competitors to the company.

◆Start of marketing of Canbus.

To support the DX of local companies' operations, the company will promote Canbus., which has steadily gained a track record in Japan.

5. Conclusions

The novel coronavirus continued to spread during the first quarter, but the virus has finally begun to subside. In the Framework Design business, new developments will gradually start in the financial sector, where recovery is lagging. In addition, the increase of projects in the "DX" area is proceeding more smoothly than expected. Thus, it is highly anticipated that the company will grow further toward the post-pandemic era. As pointed out in the previous report, "there is room for further acceleration in the Cloud business sales by improving services and product capabilities and raising awareness (strengthening sales promotion)," the business continued to record high growth in the second quarter. Canbus, which is classified as an overseas business, will be released in the U.S. We would like to keep an eye on its progress (because it is anticipated that inquiries in Japan will accelerate again, if it performs favorably in the United States).

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with corporate auditors |

Directors | 11 directors, including 3 outside ones |

Auditors | 4 auditors, including 4 outside ones. |

◎Corporate Governance Report (Updated on November 18, 2021)

Basic policy

Our company will promote speedy business administration based on swift decision making to keep up with the rapid changes in the business environment and enhance the efficiency of business administration, and achieve sustainable business development, the increase in shareholder value, and the continuous return of profit to shareholders. In addition, our company will tighten our corporate governance in order to harmonize the interests of stakeholders, including shareholders, customers, business partners, employees, and local communities, maximize overall profit, secure the soundness of business administration, and comply with laws and regulations thoroughly. To do so, we will sincerely accept instructions and suggestions from external experts (audit corporations, lead-managing securities firms, lawyers, labor and social security attorneys, judicial scriveners, and others) and stakeholders, and strive to improve the fairness and transparency of our business administration. Then, we will develop a structure suited for our corporate scale by utilizing our inherent flexibility and make efforts to brush up ourselves as a listed company that always cares for stakeholders, including shareholders, strengthen corporate governance, and disclose appropriate information in a timely manner.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 3-1-3 Approaches to Sustainability】

Please refer to the following website for our sustainability initiatives. In addition, we would like to explain our response to the disclosure requirements under the TCFD or equivalent guidelines that are imposed only on companies listed on the prime market.

As our company is engaged in the provision of IT services and not in the manufacture of goods or other businesses that have a heavy burden on the environment, we do not anticipate that climate change issues will have a significant impact on our business at this time. However, based on the recognition that the global environment is the common property of all mankind and an important deposit from the future, we have been certified for ISO 140001 since 2004, and are making efforts to reduce the use of resources and the emission of waste. In addition, the IT-related part of each company's response to climate change is entirely in our business domain, and the expansion of our revenue will contribute to our customers' business efficiency, which will lead to the reduction of resource use and waste emissions, thus contributing to the preservation of the global environment. Therefore, we believe that the growth of our company will lead to the mitigation of climate change. Based on the above approach, we are not currently working on disclosure based on TCFD or an equivalent guideline. We will consider this in the future, as needed. For more information on our environmental initiatives, please refer to the following website.

Our approaches to Sustainability https://www.systena.co.jp/sustainability/

Our approaches to environmenthttps://www.systena.co.jp/sustainability/esg_environment.html

【Supplementary Principle 4-3-3 Establishment of objective, timely, transparent procedures for dismissing the CEO】

In our company, the representative director and chairperson, who is the founder and owner of our company, leads our business administration as CEO, and the representative director and president marshals employees based on appropriate evaluation of their performance, etc. as chief operating officer (COO). In addition, each representative director is monitored by 7 outside executives (3 outside directors and 4 outside auditors) who satisfied the requirements for becoming independent executives. If an event which would lead to the dismissal of a representative director occurs, the board of directors will have discussions and make decisions based on suggestions from independent executives, to cope with said event. Therefore, the board of directors has not yet established objective, timely, transparent procedures for dismissing the CEO. We will discuss this matter, when necessary.

【Supplementary Principle 4-10-1 Establishment of independent advisory committees, such as arbitrary nominating committees and compensation committees】

All 7 executives, including 3 outside directors and 4 outside auditors, satisfy the requirements for independent executives specified by Tokyo Stock Exchange. Each independent executive actively expresses their opinions and gives timely, appropriate advice during deliberations about important matters at meetings of the board of directors, by utilizing their expertise and plenty of experience. Accordingly, we have not yet established an independent advisory committee. We will discuss this matter, when necessary.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 4-11-3: Analysis and Evaluation of the Effectiveness of the Entire Board of Directors, and Summary of Results】

The Company's attending members of Board of Directors consists of 15 members, seven of whom are outside directors or auditors and are independent officers as defined by the Tokyo Stock Exchange. To analyze and evaluate the effectiveness of the Board of Directors, all directors and corporate auditors conducted a self-evaluation of the composition and operation of the Board of Directors using the "Questionnaire for the Evaluation of the Board of Directors," and two outside directors, excluding one newly appointed outside director and four outside corporate auditors discussed the results of the questionnaire in an outside directors' meeting. As a result of the analysis of the self-evaluation in the questionnaire and the discussions at the outside directors' meeting, we have confirmed that the Board of Directors of the Company is engaged in discussions that contribute to sustainable growth and the enhancement of shareholder value from a medium- to long-term perspective by utilizing the knowledge and experience of each of the directors and officers, and that sufficient discussions are taking place for the supervision of management, which we believe ensures the effectiveness of the Board of Directors. In principle, we will analyze and evaluate the effectiveness of the Board of Directors as a whole every year with reference to the self-evaluation of directors and auditors, and make further improvements to ensure that the Board remains effective and that there is effective discussion.

【Principle 5-1 Policy on Constructive Dialogue with Shareholders】

We have established and disclosed a disclosure policy to promote constructive dialogue with our shareholders. For more information, please refer to the details posted on our website. https://www.systena.co.jp/ir/management/disclosure.html

For more information on the systems and measures to be taken, please refer to "2. IR Activities" in "III. Status of Implementation of Measures Related to Shareholders and Other Stakeholders" in this report.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (Systena Corporation: 2317) and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/