Bridge Report:(2317)Systena the financial results of the ended March 2023

Yoshichika Hemmi, Chairman |

Kenji Miura, President | Systena Corporation (2317) |

|

Corporate Information

Exchange | TSE Prime |

Industry | Information and communications |

Representative Director | Yoshichika Hemmi, Kenji Miura |

Address | 14F・16FShiodome Building 1-2-20 Kaigan, Minato-ku, Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥312 | 387,440,812 shares | ¥120,881 million | 22.9% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥10.0 | 3.2% | ¥18.67 | 16.7 x | ¥88.19 | 3.5 x |

*The share price is the closing price on May 19. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. *ROE is the value as of the end of FY 3/23. EPS is taken from the estimates of FY 3/24. BPS is the value as of the FY 3/23.

*With December 1, 2021, being the effective date, a 4-for-1 stock split was conducted.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit Attributable to Owners of Parent | EPS | DPS |

March 2020 (Actual) | 64,552 | 8,163 | 7,871 | 5,471 | 56.22 | 20.00 |

March 2021 (Actual) | 60,871 | 8,006 | 7,507 | 4,974 | 51.36 | 20.00 |

March 2022 (Actual) | 65,272 | 9,106 | 8,578 | 5,992 | 15.47 | - |

March 2023 (Actual) | 74,526 | 9,844 | 9,955 | 7,317 | 18.89 | 8.00 |

March 2024 (Estimate) | 80,386 | 10,610 | 10,644 | 7,233 | 18.67 | 10.00 |

*The estimated values were provided by the company. Unit: Million yen

*EPS in the term ended March 2022 takes the stock split in question into account. EPS for FY2022 takes this stock split into account. Both EPS and DPS were not retroactively adjusted for the stock split. DPS in the term ended March 2022 was 10.00 yen for the interim period and 3.50 yen for the end of the term, but the simple total amounts are not shown due to the implementation of the stock split in question.

This Bridge Report reviews the summary of the financial results of the ended March 2023 and forecasts for the fiscal year ending March 2024 of Systena Corporation.

Table of Contents

Key Points

1. Company Overview

2. Medium-Term Management Plan (FY 3/19-FY 3/25)

3. Fiscal Year ended March 2023 Earnings Results

4. Fiscal Year Ending March 2024 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In FY 3/23, sales rose 14.2% year on year to 74,526 million yen, and operating income increased 8.1% year on year to 9,844 million yen. The Overseas Business struggled, but the Business Solutions Business, which is the mainstay, showed a 18.9% increase year on year, and other segments were healthy in terms of sales. The growth of sales and profit offset the augmentation of personnel expenses for recruiting many new graduates and SGA, including the rents of offices the company increased. Gross profit margin was 24.7%, unchanged from the previous term, and the ratio of SGA to sales rose 0.7 points from the previous term to 11.5%.

- For FY 3/24, the company forecasts that sales will increase 7.9% year on year to 80,386 million yen and operating income will rise 7.8% year on year to 10,610 million yen. Sales and profit are expected to grow in all segments, except the investment field. In particular, the Framework Design Business and the Cloud Business are projected to see a double-digit growth in sales and profit. In the Solution Design Business, which is the mainstay, they will recruit personnel actively to complement mid-career human resources, and concentrate on the improvement of treatment, etc. Accordingly, the profit in this segment is forecast to be flat as a whole. The company plans to pay an interim dividend of 5 yen/share and a term-end dividend of 5 yen/share for 10 yen/share a year, up 2 yen/share from the previous term.

- For the Framework Design Business, President Miura explained that “low-code development has started contributing to the highly profitable structure considerably” and “we are increasing loyal clients.” They plan to further strengthen their DX laboratory. This segment is expected to significantly contribute to overall performance in terms of profit. On the other hand, the company mentioned at a briefing session that the marketing for the Cloud Business needs to be enhanced from now on, but the momentum is weakening, so we would like to pay attention to the contribution of Mingal Co., Ltd., which has been newly established.

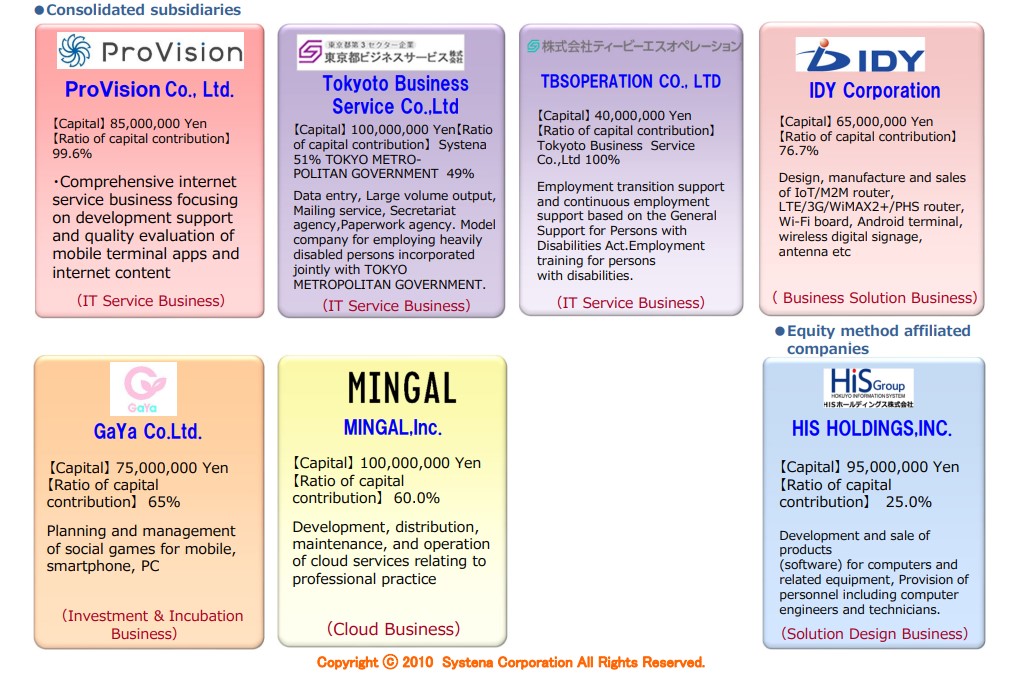

1. Company Overview

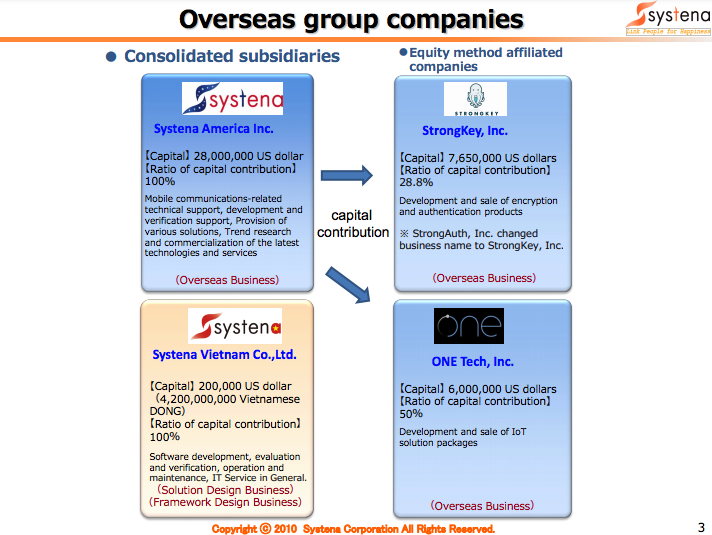

Systena Corporation was founded, when System Pro Corp. absorbed Katena Corp., which was an equity-method affiliate, on April 1, 2010. It is cultivating new domains by operating the business that fuses the former System Pro’s technologies, know-how, and open technologies for designing, developing, and testing mobile terminals and the financial knowledge and infrastructure technologies of the former Katena Corp. It forms a corporate group with 7 consolidated subsidiaries and 3 equity-method affiliates.

【Management goal - To become one of Japan's leading IT companies and support the Japanese economy from the ground up!】

In order to attain this objective, the company pursues good balances between conflicting items, such as “destruction and creation”, “stability and growth,” and “maintenance and innovation” as its basic policy.

【Target management indicators】

The company sets stably high dividends, high return on equity and high operating income rate as target managerial indicators. To achieve these goals, the company aims to develop a highly profitable structure under its basic policy for business administration. As for its near-term goals (mid-term management goals), the company declares to generate consolidated sales of 101 billion-yen, operating income of 15.2 billion yen (an operating income rate of 15%), per-capita operating income of 2.6 million yen, and 25% ROE in the term ending March 2025.

1-1 Business description

The business of Systena Corporation is classified into the Solution Design Business, the Framework Design Business the IT Service Business, the Solution Sales, the Cloud Business, the Overseas Business, and the Investment & Incubation Business.

Involving all group companies, they offer comprehensive solution services for planning, designing, developing, installing, and maintaining systems and giving user support, including the development and quality check of software for automatic driving and in-vehicle systems, social infrastructure systems, online business systems, IoT-related systems, robots, AI, and mobile devices, the development of systems for financial institutions, system operation, help desk management, the sale of IT products, system integration, the provision of cloud services, and the development of game content.

◎Solution Design Business (accounting for 30.0% in FY 3/23)

The company concentrates its managerial resources on five business categories; “in-vehicle” items such as automatic driving technology and telematics where its know-how nurtured through the development of mobile terminals can be utilized, “social infrastructure” in the fields of electric power, transportation, aviation, space, defense, etc., “Internet business” for communications carriers, e-commerce, education, e-books, etc., “smart devices/robots/AI,” including smartphones, home appliances, and robots, and “business operation systems,” including workflow and order receipt/placement systems. In every category, the company is swamped with inquiries about the development, testing of IoT-related systems and services. In addition, Systena Vietnam Co., Ltd., which is an overseas affiliate, functions as an offshore foothold for developing, testing, evaluating, maintaining, and operating software, handling all kinds of IT services, and so on. Clients include telecommunications carriers, telecom equipment manufacturers, automobile manufacturers, Internet business enterprises, etc.

◎Framework Design Business (accounting for 8.2% in FY 3/23)

Systena Corporation develops financial systems and foundational systems for not only life and non-life insurance companies, but also banks inside and outside Japan. As for life and non-life insurance tasks, the company has developed solutions for dealing with a broad range of tasks, including information management, contract management, insurance premium calculation, agency business, and sales management. Previously, their tasks were mostly the development and operation of financial systems, but the projects for developing and operating public and corporate systems are increasing. They are promoting cross-selling to clients of two businesses through the linkage with the IT service business and solution marketing, and pursuing financial systems and applying them to other fields through the linkage with the Solution Design Business for solutions for smartphone apps, web apps, etc. Like the Solution Design Business section, Systena Vietnam Co., Ltd. Is functioning as an offshore foothold.

◎IT Service Business (accounting for 23.8% in FY 3/23)

Systena Corporation operates and maintains systems and networks, and offers IT outsourcing services including help desk operation, user support, data inputting, and large-volume output. Clients are mainly electric-appliance manufacturers, financial institutions, foreign-affiliated enterprises, and public offices.

◎Solution Sales Business(accounting for 35.6% in FY 3/23, The former Solution Sales Business)

The company sells IT products including servers, PCs, peripheral devices, and software, to enterprises and integrates systems. The company is shifting business model from selling hardware to offering services. The company aims to expand its business and improve its added value by meeting the changing demands from ownership to usage (cloud, etc.) in cooperation with the IT Service Business section, etc. Clients are mainly electric-appliance manufacturers and foreign-affiliated enterprises.

◎Cloud Business (accounting for 2.7% in FY 3/23)

The company offers services ranging from the support for installation of cloud services to the provision of apps. For example, it offers cloud services of the Systena version of groupware combined with “Cloudstep,” which was developed jointly by the company and “Google Workspace”, “Canbus.,” a cloud database service, which was launched in May 2017, and “Web Shelter,” an anti-phishing solution for smartphones. It currently specializes in the public cloud, but it is also preparing for offering the private cloud service. “Cloudstep” is a collective term including business applications for improving the usability of cloud services, such as “Google Workspace”, and management tools for administrators. Clients include medium to large-sized companies that conduct general business, etc.

◎Overseas Business (accounting for 0.2% in FY 3/23)

The U.S. subsidiary operates two core businesses; one is the support for development and testing mobile and communications-related products, and the other is the researching on trends of the latest technologies and services and incubation in the U.S. The Vietnamese subsidiary is recognized as an offshore foothold that develops, tests, evaluates, maintains, and operates software, and handles all kinds of IT services. Clients include Japanese enterprises, American enterprises, telecommunications carriers, telecom equipment manufacturers, etc.

◎Investment & Incubation Business (accounting for 0.4% in FY 3/23)

GaYa Co., Ltd. develops game content for smartphones, offers the contents to leading SNS websites and undertakes the operation of video games developed and released by other companies.

*Adjustment ▲0.9%

1-2 Group Companies

(Taken from the reference material of the company)

(Taken from the reference material of the company)

2. Medium-Term Management Plan (FY 3/19-FY 3/25)

The company has been promoting its 5-year medium-term plan, which was formulated in 2019 and will end in FY 3/24. However, in FY 3/21, the company was faced with a decline in sales due to stagnation of the economic activity caused by COVID-19. In light of these circumstances, the company has decided to postpone the achievement year of the mid-term plan for one year and set FY 3/25 as the final year of the new plan, aiming for the previous plan targets of 101 billion yen in sales and 15.2 billion yen in operating income.

FY 3/22 and FY 3/23 will be a period of upfront investment, whereas full-scale business expansion is expected in FY 3/24 and FY 3/25.

[Major Management Policies - Improving Productivity through Data Management - ]

・To conduct cost control precisely and grasp real profits and losses early by utilizing the IT management system established with the Canbus. Platform, which was developed in house.

・The company aims to maximize profits by thoroughly improving productivity based on management information quantified by visualization of management data and AI-based prediction.

[Strategy, Key Management Indicators, and Targets for FY 3/25]

The company will concentrate its management resources on automotive, cashless/payment, robotics/IoT/RPA/cloud, and its own products and services, which it positions as the areas that will grow the most in the next 10 years.

Key Management Indicators, and Targets for FY 3/25

The company's key management indicators are consolidated net sales, operating income, operating margin, operating income per capita, and ROE. For FY 3/25, the company has set the following targets: consolidated net sales of 101 billion yen, operating income of 15.2 billion yen, operating margin of 15%, operating income per capita of 2.6 million yen, and ROE of 25%.

[Targets and Initiatives by Segment]

◎Solution Design Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Results | FY 3/23 Results | FY 3/24 Estimates | FY 3/25 Targets |

Sales | 212 | 229 | 238 | 206 | 223 | 245 | 395 |

Operating income | 37 | 40 | 41 | 41 | 39 | 40 | 71 |

*Unit: Hundred Million yen

*From FY3/22, the segment of subsidiary ProVision, which had been included in the Solution Design business, was changed to the IT Services business, and the segment of subsidiary IDY was changed to the Business Solution business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company is aiming for sales of 39.5 billion yen in FY 3/25 (21.2 billion yen in FY 3/19) and an operating income of 7.1 billion yen (3.7 billion yen in FY 3/19). They aim to expand the industry by concentrating on the Internet business, which is experiencing an increase in social demand due to the impact of COVID-19. The in-vehicle business, which is undergoing a period of transformation in the industry, will be selected and concentrated on with a long-term perspective. The company also aims to stimulate demand for digital transformation by transforming customers' business models and processes and to expand its business by providing not only system integration but also its own services.

The plan for FY 3/25 by field is as follows: sales of 6.5 billion yen in automotive (2.7 billion yen in FY 3/19), sales of 8.0 billion yen in social infrastructure/products (0.8 billion yen in FY 3/19), sales of 20.0 billion yen in the Internet business (10.2 billion yen in FY 3/19), and sales of 5.0 billion yen in DX services (2.3 billion yen in FY 3/19).

In addition to infotainment and sharing, which are the current mainstays of the automotive industry, there are many business opportunities in MaaS, connected cars, automated driving, and safety measures. In the area of social infrastructure/products, demand is expected to grow for the development of communication robots as well as lifestyle robots such as nursing care, industrial robots, and robots and systems for medical use. In the Internet business, the focus will be on education-related and 5G-related services, as well as AI and IoT. In business systems, in addition to work style reforms and open-source applications, which are currently in high demand, development demand can be expected for AI, business automation, DX, and countermeasures for human resource shortages.

◎Framework Design Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Results | FY 3/23 Results | FY 3/24 Estimates | FY 3/25 Targets |

Sales | 53 | 58 | 51 | 51 | 60 | 69 | 75 |

Operating income | 8 | 10 | 8 | 10 | 12 | 14 | 12.5 |

*Unit: Hundred Million yen

*From FY3/22, the new service field segment included in the Framework Design business was changed to the Business Solution business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company is aiming for sales of 7.5 billion yen in FY 3/25 (5.3 billion yen in FY 3/19) and an operating income of 1.25 billion yen (840 million yen in FY 3/19). While developing know-how in financial system development, the company will make changes to become DX-compatible and actively expand its business to new and existing customers. In addition, the company will strengthen its contract development system, achieve comprehensive support for development, infrastructure, and maintenance, create a new growth engine for the DX era, and expand into SaaS utilization development. In the insurance, banking, and social infrastructure sectors, the company will work to expand the domain of existing customers, renew core systems in response to digitalization, and acquire support for integration. In public and distribution services, the company aims to expand into new areas by deploying its know-how in the financial sector and to maximize the value of DX-related development.

The plan for FY 3/25 by business field is as follows: 3.0 billion yen in sales from existing financial businesses (2.5 billion yen in FY 3/19), 2.0 billion yen in sales from new businesses in the public and other sectors (0.5 billion yen in FY 3/19), and 1.5 billion yen in sales from DX-related businesses (no track record).

◎IT Service Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Results | FY 3/23 Results | FY 3/24 Estimates | FY 3/25 Targets |

Sales | 78 | 87 | 94 | 156 | 177 | 194 | 180 |

Operating income | 11 | 13 | 14 | 21 | 25 | 28 | 35.5 |

*Unit: Hundred Million yen

*From FY3/22, the segment of the subsidiary ProVision, which was included in the Solution Design Business, was changed to the IT Services Business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company aims to achieve sales of 18 billion yen in FY 3/25 (7.8 billion yen in FY 3/19) and an operating income of 3.55 billion yen (1.1 billion yen in FY 3/19). Based on know-how cultivated through projects, the company will focus on high value-added outsourced contracting services of IT support, IT infrastructure, and PMO, as well as assessment and consulting services. In addition to the expansion of "Software Quality Assurance Services" BtoBtoC "Social Games," "Internet Business" and other entertainment domains, the company aims to expand the BtoB enterprise domain. In these areas, the company will work to expand its business field by strengthening alliances and new services and expanding its bases.

The company's plan by field for FY 3/25 is as follows: sales of "IT support," "IT infrastructure," "PMO," and outsourced contracting services will be 8 billion yen (4.5 billion yen in FY 3/19), and sales of quality verification services will be 6 billion yen (3.3 billion yen in FY 3/19).

◎Business Solution business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Results | FY 3/23 Results | FY 3/24 Estimates | FY 3/25 Targets |

Sales | 240 | 259 | 214 | 222 | 265 | 276 | 353.9 |

Operating income | 12 | 16 | 14 | 14 | 17 | 18 | 24.5 |

*Unit: Hundred Million yen

*From FY3/22, the new service field included in the Framework Design business and the segment of subsidiary IDY included in the Solution Design business were changed to the Business Solution business. Figures for FY 3/22 and beyond have been adjusted to reflect the change.

The company is aiming for sales of 1.97 billion yen in FY 3/25 (1.1 billion yen in FY 3/19) and an operating income of 500 million yen (200 million yen in FY 3/19). The company will accelerate the subscription model through its DX platform "Canbus." which promotes DX. In addition, they aim to grow their high value-added business with "Cloudstep" and "Canbus." to support process innovation through remote work and other work style reforms.

◎Cloud Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Results | FY 3/23 Results | FY 3/24 Estimates | FY 3/25 Targets |

Sales | 11 | 14 | 15 | 18 | 20 | 22 | 19.7 |

Operating income | 2 | 2 | 3 | 4 | 3 | 4 | 5 |

*Unit: Hundred Million yen

The company is aiming for sales of 1.97 billion yen in FY 3/25 (1.1 billion yen in FY 3/19) and an operating income of 500 million yen (200 million yen in FY 3/19). The company will accelerate the subscription model through its DX platform "Canbus." which promotes DX. In addition, they aim to grow their high value-added business with "Cloudstep" and "Canbus." to support process innovation through remote work and other work style reforms.

◎Overseas Business

| FY 3/19 Results | FY 3/20 Results | FY 3/21 Results | FY 3/22 Results | FY 3/23 Results | FY 3/24 Estimates | FY 3/25 Targets |

Sales | 1.2 | 1.4 | 1.8 | 1.7 | 1.3 | 1.7 | 6.4 |

Operating income | -0.31 | -0.16 | 0.07 | -0.09 | -0.29 | 0.01 | 2.5 |

*Unit: Hundred Million yen

The company aims to achieve sales of 640 million yen in FY 3/25 (100 million yen in FY 3/19) and an operating income of 250 million yen (30 million yen loss in FY 3/19). In the U.S., the company will promote joint sales with One Tech in the field of edge AI building on its technical support for Japanese companies. The company will also provide technical support to Japanese companies in the U.S., PoC in the U.S., and incubation support services to solidify its sales and profit base.

3.Ended March 2023 Earnings Results

3-1 Result of the fiscal year ended March 2023

| FY 3/22 | Ratio to net sales | FY 3/23 | Ratio to net sales | YOY |

Net sales | 65,272 | 100.0% | 74,526 | 100.0% | 14.2% |

Gross profit | 16,127 | 24.7% | 18,393 | 24.7% | 14.1% |

SG&A expenses | 7,020 | 10.8% | 8,549 | 11.5% | 21.8% |

Operating income | 9,106 | 14.0% | 9,844 | 13.2% | 8.1% |

Ordinary income | 8,578 | 13.1% | 9,955 | 13.4% | 16.1% |

Profit Attributable to Owners of Parent | 5,992 | 9.2% | 7,317 | 9.8% | 22.1% |

*Unit: Million yen

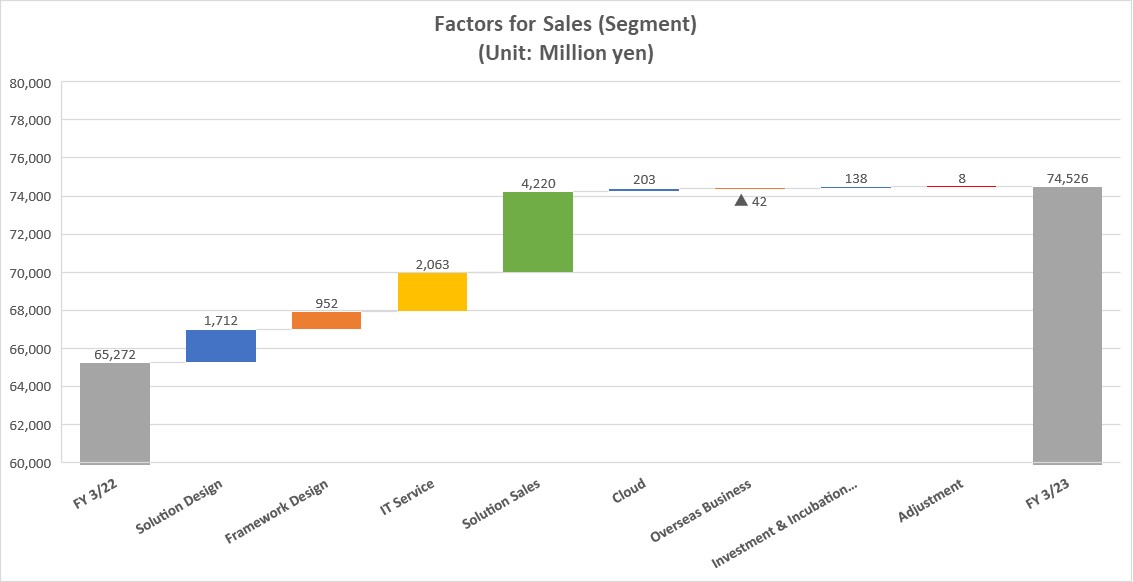

Sales grew 14.2% year on year, and operating income grew 8.1% year on year.

While the impact of COVID-19 subsided and economic and social activities were being normalized, the company further accelerated the abolishment and creation of businesses, and swiftly allocated managerial resources to markets where they could survive by utilizing their strengths in growing fields. In addition, they not only brushed up their marketing capability, but also actively promoted the alliances with partners that possess marketing skills, to enhance the sale of their products and services. Furthermore, they conducted investment for expanding business scale, by continuing the active recruitment of new graduates and the increase of office floor areas.

Sales increased 14.2% year on year to 74,526 million yen. The Overseas Business struggled, although its impact on overall performance was small. The sales of other segments were healthy, as the sales of the Business Solutions Business, which is the mainstay, increased 18.9% year on year.

Regarding profit, the profit of the Solution Design Business declined, but the profit of the Framework Design Business increased 26.1% year on year and the IT Services Business also increased 14.7% year on year, indicating healthy performance. The profit of the Business Solutions Business increased 22.5% year on year, as the company made up for the delay in the first quarter in the second and following quarters. The growth of sales and profit offset the augmentation of personnel expenses for recruiting many new graduates and SGA, including the rents of offices the company increased. Gross profit margin was 24.7%, unchanged from the previous term, and the ratio of SGA to sales rose 0.7 points from the previous term to 11.5%.

3-2 Trends by segment

| FY 3/22 | Composition ratio/Income margin | FY 3/23 | Composition ratio/ Income margin | YOY |

Solution Design | 20,663 | 31.6% | 22,375 | 30.0% | 8.3% |

Framework Design | 5,143 | 7.9% | 6,095 | 8.2% | 18.5% |

IT Service | 15,690 | 24.0% | 17,753 | 23.8% | 13.1% |

Solution Sales | 22,290 | 34.1% | 26,510 | 35.6% | 18.9% |

Cloud | 1,804 | 2.8% | 2,007 | 2.7% | 11.2% |

Overseas Business | 176 | 0.3% | 134 | 0.2% | -23.8% |

Investment & Incubation Business | 171 | 0.3% | 309 | 0.4% | 80.2% |

Adjustment | -668 | -1.0% | -660 | -0.9% | - |

Consolidated Sales | 65,272 | 100.0% | 74,526 | 100.0% | 14.2% |

Solution Design | 4,132 | 20.0% | 3,926 | 17.5% | -5.0% |

Framework Design | 1,014 | 19.7% | 1,279 | 21.0% | 26.1% |

IT Service | 2,197 | 14.0% | 2,521 | 14.2% | 14.7% |

Solution Sales | 1,436 | 6.4% | 1,760 | 6.6% | 22.5% |

Cloud | 406 | 22.5% | 386 | 19.3% | -4.9% |

Overseas Business | -9 | -5.3% | -29 | -21.8% | - |

Investment & Incubation Business | -72 | -42.4% | 0 | -0.2% | - |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 9,106 | 14.0% | 9,844 | 13.2% | 8.1% |

*Unit: Million yen

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

Solution Design Business - Sales: 22,375million yen (+8.3% YoY), Operating Income: 3,926million yen (-5.0% YoY)

The company succeeded in getting orders for large projects in the in-vehicle system business, especially concerning “mobility.” Orders for PMO and IT services increased in the Internet business. As the number of inquiries is healthy, the company intends to keep focusing on these fields. Moreover, inquiries for PMO and IT consulting from enterprises adopting DX services grew. In addition, although staff increased due to recruiting a significant number of new graduates, the company did not launch enough profitable projects as more mid-career engineers retired. In the fourth quarter, the company quickly took countermeasures, such as spurring recruitment by raising wages, concentrating on highly profitable projects and revising the evaluation process in recruitment, but they did not completely cover the deficit.

Framework Design Business - Sales: 6,095 million yen (+18.5% YoY), Operating Income: 1,279 million yen (+26.1% YoY)

In the financial field, inquiries increased especially for DX-related projects, leading to growth in sales. Furthermore, the company proceeded with the development of new domains such as host migration and adoption of cloud services. In the public field, they are actively working on projects for central government ministries and agencies (expansion of both applications and infrastructure). In the corporate field, they have been reinforcing low-code development and succeeded in acquiring new business opportunities through a comprehensive maintenance and development service utilizing DX Laboratory. Consequently, the composition ratio of financial projects, which used to be extremely high in the segment, significantly dropped.

IT Services Business - Sales: 17,753 million yen (+13.1% YoY), Operating Income: 2,521 million yen (+14.7% YoY)

There have been negative developments such as the end of projects for the support and construction of a remote environment and the end of projects for data management and protection, which are the company’s forte and continued to perform favorably during the coronavirus crisis. On the other hand, they reconstructed the three businesses of “IT services,” “PMO” and “IT infrastructure services” and expanded sales and profit by focusing on the development of the IT business service providing DX support for clients and the PMO service, which offers project management support for the adoption of various tools and smart devices. Moreover, they succeeded in acquiring new core clients by reinforcing the utilization of inbound sales of solutions such as “IT training” and “security services.”

The Business Solution – Sales: 26,510 million yen (+18.9% YoY), Operating Income: 1,760million yen (+22.5% YoY)

Although future prospects concerning rising prices of materials, inflation, etc. remain unclear, the company reinforced their marketing activities for coexisting with the coronavirus after the alleviation of restrictions on free movement. In the system integration business, they received orders for the construction of a hybrid environment, migration to a cloud environment as a step toward digitalization, system development and maintenance service projects. Apart from that, there was an increase of one-stop service projects with high value added which encompass the understanding of the roadmap, adoption of IT devices, infrastructure construction, cloud utilization, system development, maintenance and operation. Furthermore, they focused on training a technical team for cloud lift projects using Oracle and Oracle Cloud Infrastructure (OCI), aiming for the creation of a business model independent of physical objects.

The Cloud Business - Sales: 2,007 million yen (+11.2% YoY), Operating Income: 386million yen (-4.9% YoY)

The need to replace systems for business operation has grown due to the recent promotion of DX, leading to an increase of inquiries concerning “Canbus.,” which allows low-code development. Furthermore, there were more inquiries regarding PMO and integration for the reform of business operations from clients who are using “Canbus.” in order to promote DX. Moreover, the company has further expanded “Canbus.” in new fields owing to alliance reinforcement.

Overseas Business: Sales: 134 million yen (-23.8% YoY), Operating Loss: 29 million yen (19 million yen loss increase)

Although the overall tech industry in the U.S. is sluggish, the company continuously received orders for system development and inspection services from Japanese-affiliated enterprises. Furthermore, besides providing system development and inspection services to new enterprises through introduction from long-time existing clients, they also managed to receive repeated orders for PoC development and inspection services for the examination of start-up technologies by Japanese-affiliated enterprises. Moreover, besides the increase of inquiries concerning “Canbus.” from U.S. enterprises, a group company StrongKey became the industry pioneer in making the company’s secure network transmission (PKI) compatible with the smart home integrated standard (Matter), leading to a rapid growth of inquiries.

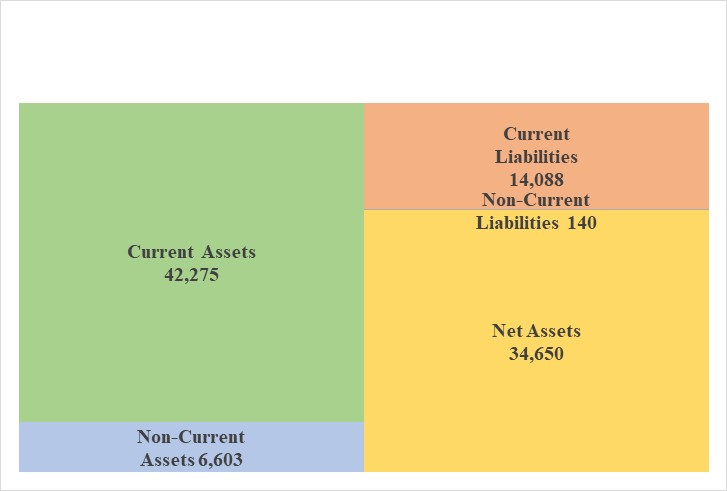

3-3 Financial Conditions

Financial Conditions and CF

| March 2022 | March 2023 |

| March 2022 | March 2023 |

Cash and deposits | 21,657 | 25,033 | Trade payables | 5,696 | 6,096 |

Trade receivables | 14,322 | 14,998 | Accounts payable and accrued expenses | 2,076 | 2,459 |

Inventories | 1,151 | 1,501 | Income taxes payable | 1,525 | 1,524 |

Current assets | 38,002 | 42,275 | Provision for bonuses | 1,348 | 1,460 |

Tangible Assets | 1,058 | 1,622 | Interest-Bearing Liabilities | 1,550 | 1,550 |

Intangible Assets | 278 | 317 | Liabilities | 13,303 | 14,228 |

Investments and Others | 4,138 | 4,663 | Net assets | 30,173 | 34,650 |

Noncurrent assets | 5,475 | 6,603 | Total Liabilities and Net Assets | 43,477 | 48,879 |

*Unit: Million yen. Trade receivables are the sum of notes, accounts receivable and contract assets.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

Total assets at the end of March 2023 were 48,879 million yen, up 5,401 million yen from the end of the previous period. On the asset side, cash and deposits and merchandise increased in current assets. Liabilities increased 925 million yen to 14,228 million yen. Liabilities increased by 925 million yen YoY to 14,228 million yen, mainly due to an increase in accounts payable and accrued expenses. Net assets increased 4.476 million yen YoY to 34.650 million yen. Equity ratio was 69.9%, up 1.4 points from the end of the previous period.

◎Cash Flow

| FY3/22 | FY3/23 | YtoY | |

Operating Cash Flow(A) | 5,544 | 7,648 | 2,104 | 38.0% |

Investing Cash Flow(B) | -559 | -2,016 | -1,457 | - |

Free Cash Flow(A+B) | 4,985 | 5,632 | 647 | 13.0% |

Financing Cash Flow | -1,905 | -2,854 | -949 | 49.8% |

Cash and Equivalents at Term End | 21,964 | 24,792 | 2,828 | 12.9% |

*Unit: Million yen.

In terms of cash flows, the cash flow from operating activities increased year on year, due to the rises in net income before taxes and other adjustments, other accounts payable, and accrued expenses. The cash outflow from investing activities augmented significantly, but the increase in operating cash flow was significant, so free cash flow grew. The cash outflow from financing activities, too, augmented, but this is attributable to the payment of dividends. As a result, the term-end balance of cash and cash equivalents rose 12.9% from the previous term.

3-4 Latest topics

Certified as a “Sports Yell Company 2023”

The company announced on February 17th, 2023, that it had been certified as a “Sports Yell Company 2023” by the Japan Sports Agency.

The Japan Sports Agency certifies companies that actively promote sports activities to improve the health of their employees as “Sports Yell Companies.” Under such circumstances, the company actively engages in organizing various events, supporting company sports club activities, distributing information on exercise and physical training, etc. so that both bodies and minds of their staff brim with vigor and energy while they work, and was certified as a “Sports Yell Company” for the third consecutive year.

Certified as a “Health & Productivity Management Outstanding Organization 2023: Large Enterprise (White 500)”

The company announced on March 8th, 2023 that it had been certified as a “Health & Productivity Management Outstanding Organization 2023 in the Large Enterprise category (White 500),” recognized by the Nippon Kenko Kaigi under the auspices of the Ministry of Economy, Trade and Industry, for the third consecutive year.

The Certified Health & Productivity Management Outstanding Organizations Recognition Program honors corporations such as large enterprises and small and medium-sized enterprises that engage in especially outstanding health and productivity management based on Nippon Kenko Kaigi’s initiatives to advance health, and 2,676 corporations were certified in the large corporation category this time (high-ranking corporations receive the “White 500” title). The company has upheld the “Systena Health Declaration” since 2017, elevating health awareness among staff, measuring health levels at the company and continuously promoting the cultivation of a workplace environment which allows for working healthy and reassured.

Systena America Inc. engages in a demonstration experiment program with Panasonic Automotive Systems at their Silicon Valley base in the U.S.

The U.S. subsidiary Systena America Inc., fully financed by the company (headquarters: Silicon Valley, California, U.S., President & CEO: Mitsuaki Tanaka), announced on March 20th, 2023 that it had been engaging in a demonstration experiment program concerning technologies which could lead to the creation of a next-generation in-vehicle electronics business in collaboration with the Silicon Valley base (hereinafter referred to as “PASSV”) of the Infotainment Systems Department of Panasonic Automotive Systems (headquarters: Yokohama City, Kanagawa Prefecture, President and Representative Directo Masashi Nagayasu).

Systena America Inc. will go on to support the creation and evaluation of Proof of Concept (hereinafter referred to as “PoC”) to inspect the effectiveness of the cutting-edge technologies owned by start-up companies at the PAS-SV base. Meanwhile, they are engaging in research of new technologies for the creation of new functions and new services for next-generation in-vehicle infotainment devices, and proposals and co-creation regarding Car OEM at the PAS-SV base.

Adding Systena America Inc.’s know-how concerning mobility software development and evaluation inspection to this initiative allows for efficient PoC creation and verification.

4. Fiscal Year Ending March 2024 Earnings Estimates

4-1 Consolidated Earnings Estimates

| FY 3/23 Results | Ratio to net sales | FY 3/24 Estimates | Ratio to net sales | YOY |

Net sales | 74,526 | 100.0% | 80,386 | 100.0% | +7.9% |

Operating income | 9,844 | 13.2% | 10,610 | 13.2% | +7.8% |

Ordinary income | 9,955 | 13.4% | 10,644 | 13.4% | +6.9% |

Profit Attributable to Owners of Parent | 7,317 | 9.8% | 7,233 | 9.8% | -1.1% |

*Unit: Million yen

Sales and operating income are expected to grow 7.9% and 7.8%, respectively, year on year.

For FY 3/24, the company forecasts that sales will increase 7.9% year on year to 80,386 million yen and operating income will rise 7.8% year on year to 10,610 million yen. Sales and profit are expected to grow in all segments, except the investment field. In particular, the Framework Design Business and the Cloud Business are projected to see a double-digit growth in sales and profit. In the Solution Design Business, which is the mainstay, they will recruit personnel actively to complement mid-career human resources, and concentrate on the improvement of treatment, etc. Accordingly, the profit in this segment is forecast to be flat as a whole. For the Overseas Business, they aim to move into the black. Operating income margin is expected to be 13.2%, almost unchanged from the previous term.

The company plans to pay an interim dividend of 5 yen/share and a term-end dividend of 5 yen/share for 10 yen/share a year, up 2 yen/share from the previous term.

4-2 Outlook and efforts for each segment

| FY 3/23 | Composition ratio/ Income margin | FY 3/24 Estimates | Composition ratio/ Income margin | YOY |

Solution Design | 22,375 | 30.0% | 24,500 | 30.5% | 9.5% |

Framework Design | 6,095 | 8.2% | 6,900 | 8.6% | 13.2% |

IT Service | 17,753 | 23.8% | 19,413 | 24.2% | 9.3% |

Business Solution | 26,510 | 35.6% | 27,630 | 34.3% | 4.2% |

Cloud | 2,007 | 2.7% | 2,250 | 2.8% | 12.1% |

Overseas Business | 134 | 0.2% | 178 | 0.2% | 32.7% |

Investment & Incubation | 309 | 0.4% | 175 | 0.2% | -43.5% |

Adjustment | -660 | -0.9% | -660 | -0.8% | - |

Consolidated Sales | 74,526 | 100.0% | 80,386 | 100.0% | 7.9% |

Solution Design | 3,926 | 17.5% | 4,020 | 16.4% | 2.4% |

Framework Design | 1279 | 21.0% | 1,450 | 21.0% | 13.3% |

IT Service | 2,521 | 14.2% | 2,800 | 14.3% | 11.1% |

Business Solution | 1,760 | 6.6% | 1,874 | 6.8% | 6.4% |

Cloud | 386 | 19.3% | 439 | 19.5% | 13.6% |

Overseas Business | -29 | -21.8% | 1 | 0.6% | - |

Investment & Incubation | 0 | -0.2% | 26 | 14.9% | - |

Adjustment | - | - | - | - | - |

Consolidated Operating Income | 9,844 | 13.2% | 10,610 | 13.2% | 7.8% |

*Unit: Million yen

◎Solution Design business - Sales: 24,500 million yen(+9.5%YoY), Operating Income: 4,020 million yen (+2.4%YoY)

Through selection and concentration, the company will aim to create business domains with high added value.

◆Aggressive expansion into growing areas

The company will aggressively cultivate high-potential areas such as mobility, 5G, AI, IoT, cashless payment, and digital transformation (DX).

◆Shift to comprehensive solutions

The company supports all processes of the customers' services, from IT consulting to operations. In addition to design, development, and evaluation, the company aims to provide added value to customers and build a highly profitable structure by expanding its range of services to include planning, operations, IT consulting, and service operations.

◆Active recruitment of human resources and reinforcement of the education system

They will carry out active recruitment of human resources and promote collaboration with partners with a view to long term growth. They aim to provide high added value to customers by strengthening the education system. In addition, the company will continue to focus on consolidating large projects, improving the treatment of human resources, and other aspects.

◎Framework Design Business - Sales: 6,900 million yen (+13.2% YoY), Operating Income: 1,450million yen (+13.3% YoY)

The company will continue to aggressively expand into growing areas in the financial, public, and corporate sectors, respectively. They aim to maximize orders by leveraging development know-how and cutting-edge technologies.

◆Maximize existing businesses and expand into growing areas

The company will continue projects centered on insurance/financial system development and infrastructure construction and proceed to actively expand into the public and corporate sectors to build a strong revenue base.

◆Actively seek orders for DX projects

The company will strengthen both sales and technical capabilities to receive orders for DX projects, such as core system reform (migration) and the use of cloud services.

◆Further Expansion of high-value-added business

The company will strengthen DX Lab and expand services for "low-code development" and "DX solutions." The company aims to further improve profitability by strengthening competitiveness through the improvement of added value.

◎IT Service Business - Sales: 19,413 million yen (+9.3% YoY), Operating Income: 2,800 million yen (+11.1% YoY)

In response to demand for DX, the company aims to further expand its business field by broadening its scope in terms of services, markets, and customers.

◆Expansion of project management support business to support customers' DX

The company operates PMO services for operational business improvement and cloud solution adoption for customers considering cost optimization.

◆Expansion of software testing services (QA operations)

Utilizing the knowledge of agile testing services in web/app/SNS games, the company is actively expanding into the business system QA field.

◆Acquisition of new clients to support continuous growth

In addition to traditional outbound sales, the company will increase the number of customers and sales by strengthening the use of inbound sales, using useful information such as service introduction websites and webinars as sales hooks.

◎Business Solution Business: Sales of 27,630 million yen (up 4.2% year on year) and an operating income of 1,874 million yen (up 6.4% year on year)

Shift of focus from the goods business to the services business.

◆Investment to expand the solution domain

To expand its service lineup and conduct marketing targeting profit divisions.

◆Strengthening initiatives to the hybrid environment

Strengthening its measures for hybrid environments and alliances with cloud partners.

◆Expansion of DX-related services

In addition to system development, the company will strengthen the business of restructuring applications in a multi-cloud environment.

◆Improving profitability by expanding sales of services

To provide one-stop services for all services of All Systena.

◎Cloud Business -Sales: 2,250 million yen (+12.1% YoY), Operating Income: 439million yen (+13.6% YoY)

The company aims to expand into the DX field through aggressive upfront investment in its own services, centered on “Canbus.”

◆Upfront investment to increase awareness of "Canbus." and promote it

Aggressively strengthen alliances of "Canbus." to increase recognition and promote new business development.

◆Upfront investment for overseas business expansion

The company aims to cultivate new overseas markets in collaboration with Systena America Inc.

◆Upfront investment accompanying service enhancements

In order to make a variety of operations feasible as a DX platform, the company will enhance its product capabilities and strengthen its human resources to improve support capabilities and conduct an increase in customer satisfaction.

◎Overseas Business -Sales: 178 million yen (+32.7% YoY), Operating Income: 1 million yen (-Loss of 29 million yen in the previous fiscal year)

◆Expansion and cross-sectoral expansion of system development and verification services for Japanese manufacturing companies

The company intends to boost customer satisfaction with the system development and verification services it is currently providing, expand these services in a cross-sectoral manner.

◆Expansion of technical support for PoC development between Japanese companies and start-up companies

Increase orders for PoC development projects between Japanese companies in Silicon Valley and startup companies and respond to them by utilizing offshore Japan and Vietnam with development quality ensured.

◆Expansion of sales of the DX service, Canbus.

Aggressively propose "Canbus." to overseas companies outside Japan to support DX services such as workflow and paperless operations to increase orders.

◆Expanding sales of the BPO service, Remo-oTe

Against the backdrop of skyrocketing U.S. labor costs, the company will increase orders for Remo-oTe, a ticketed BPO service that can be used remotely and on an hourly basis.

◆Collaboration with group companies

The company will further strengthen its sales collaboration with StrongKey, Inc. and ONE Tech, Inc. to expand sales to companies around the world, including the services of both companies.

5. Conclusions

For the Framework Design Business, President Miura explained that “low-code development has started contributing to the highly profitable structure considerably” and “we are increasing loyal clients.” They plan to further strengthen their DX laboratory. This segment is expected to significantly contribute to overall performance in terms of profit. On the other hand, the company mentioned at a briefing session that the marketing for the Cloud Business needs to be enhanced from now on, but the momentum is weakening, so we would like to pay attention to the contribution of Mingal Co., Ltd., which has been newly established.

The only concern is about personnel. The impact of the increase of retirement of mid-career engineers was larger than expected. The company implemented some measures, including the rise in wages, and plans to continue such measures, but all companies in this field are competing for engineers, so the company needs to keep the guard up.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with corporate auditors |

Directors | 9 directors, including 3 outside ones |

Auditors | 4 auditors, including 4 outside ones. |

◎Corporate Governance Report (Updated on June 23, 2022)

Basic policy

Our company will promote speedy business administration based on swift decision making to keep up with the rapid changes in the business environment and enhance the efficiency of business administration, and achieve sustainable business development, the increase in shareholder value, and the continuous return of profit to shareholders. In addition, our company will tighten our corporate governance in order to harmonize the interests of stakeholders, including shareholders, customers, business partners, employees, and local communities, maximize overall profit, secure the soundness of business administration, and comply with laws and regulations thoroughly. To do so, we will sincerely accept instructions and suggestions from external experts (audit corporations, lead-managing securities firms, lawyers, labor and social security attorneys, judicial scriveners, and others) and stakeholders, and strive to improve the fairness and transparency of our business administration. Then, we will develop a structure suited for our corporate scale by utilizing our inherent flexibility and make efforts to brush up ourselves as a listed company that always cares for stakeholders, including shareholders, strengthen corporate governance, and disclose appropriate information in a timely manner.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 3-1-3 Approaches to Sustainability】

Please refer to the following website for our sustainability initiatives. In addition, we would like to explain our response to the disclosure requirements under the TCFD or equivalent guidelines that are imposed only on companies listed on the prime market.

As our company is engaged in the provision of IT services and not in the manufacture of goods or other businesses that have a heavy burden on the environment, we do not anticipate that climate change issues will have a significant impact on our business at this time. However, based on the recognition that the global environment is the common property of all mankind and an important deposit from the future, we have been certified for ISO 140001 since 2004, and are making efforts to reduce the use of resources and the emission of waste. In addition, the IT-related part of each company's response to climate change is entirely in our business domain, and the expansion of our revenue will contribute to our customers' business efficiency, which will lead to the reduction of resource use and waste emissions, thus contributing to the preservation of the global environment. Therefore, we believe that the growth of our company will lead to the mitigation of climate change. Based on the above approach, we are not currently working on disclosure based on TCFD or an equivalent guideline. We will consider this in the future, as needed. For more information on our environmental initiatives, please refer to the following website.

Our approaches to Sustainability https://www.systena.co.jp/sustainability/

Our approaches to environment https://www.systena.co.jp/sustainability/esg_environment.html

【Supplementary Principle 4-3-3 Establishment of objective, timely, transparent procedures for dismissing the CEO】

In our company, the representative director and chairperson, who is the founder and owner of our company, leads our business administration as CEO, and the representative director and president marshals employees based on appropriate evaluation of their performance, etc. as chief operating officer (COO). In addition, each representative director is monitored by 7 outside executives (3 outside directors and 4 outside auditors) who satisfied the requirements for becoming independent executives. If an event which would lead to the dismissal of a representative director occurs, the board of directors will have discussions and make decisions based on suggestions from independent executives, to cope with said event. Therefore, the board of directors has not yet established objective, timely, transparent procedures for dismissing the CEO. We will discuss this matter, when necessary.

【Supplementary Principle 4-10-1 Establishment of independent advisory committees, such as arbitrary nominating committees and compensation committees】

All 7 executives, including 3 outside directors and 4 outside auditors, satisfy the requirements for independent executives specified by Tokyo Stock Exchange. Each independent executive actively expresses their opinions and gives timely, appropriate advice during deliberations about important matters at meetings of the board of directors, by utilizing their expertise and plenty of experience. Accordingly, we have not yet established an independent advisory committee. We will discuss this matter, when necessary.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 4-11-3: Analysis and Evaluation of the Effectiveness of the Entire Board of Directors, and Summary of Results】

The Company's attending members of Board of Directors consists of 13 members, seven of whom are outside directors or auditors and are independent officers as defined by the Tokyo Stock Exchange. To analyze and evaluate the effectiveness of the Board of Directors, all directors and corporate auditors conducted a self-evaluation of the composition and operation of the Board of Directors using the "Questionnaire for the Evaluation of the Board of Directors," and three outside directors and four outside corporate auditors discussed the results of the questionnaire in an outside directors' meeting. As a result of the analysis of the self-evaluation in the questionnaire and the discussions at the outside directors' meeting, we have confirmed that the Board of Directors of the Company is engaged in discussions that contribute to sustainable growth and the enhancement of shareholder value from a medium- to long-term perspective by utilizing the knowledge and experience of each of the directors and officers, and that sufficient discussions are taking place for the supervision of management, which we believe ensures the effectiveness of the Board of Directors. In principle, we will analyze and evaluate the effectiveness of the Board of Directors as a whole every year with reference to the self-evaluation of directors and auditors, and make further improvements to ensure that the Board remains effective and that there is effective discussion.

【Principle 5-1 Policy on Constructive Dialogue with Shareholders】

We have established and disclosed a disclosure policy to promote constructive dialogue with our shareholders. For more information, please refer to the details posted on our website. https://www.systena.co.jp/ir/management/disclosure.html

For more information on the systems and measures to be taken, please refer to "2. IR Activities" in "III. Status of Implementation of Measures Related to Shareholders and Other Stakeholders" in this report.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |