| J-COM Holdings Co., Ltd. (2462) |

|

||||||||

Company |

J-COM Holdings Co., Ltd. |

||

Code No. |

2462 |

||

Exchange |

Tokyo Stock Exchange, First Section |

||

Industry |

Service |

||

President |

Yasuhiko Okamoto |

||

HQ Address |

Umeda Hankyu Building Office Tower 19F, Kakutacho 8-1, Kita-ku, Osaka-shi |

||

Year-end |

May |

||

URL |

|||

* Stock price as of the close on January 21, 2016. Number of shares at the end of the most recent term excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. From the current fiscal year, the definition for net profit has been changed to net profit attributable to parent company shareholders (Abbreviated as parent net profit).

This Bridge Report presents details of the first half of fiscal year May 2016 earnings results for J-COM Holdings Co., Ltd. |

| Key Points |

|

| Company Overview |

|

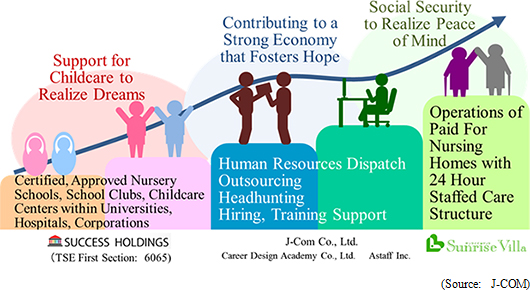

<J-COM Group and Its Business Segment: Providing Solutions to Corporate Clients in the Realm of Human Resources>

J-COM's business segments can be divided between the comprehensive human resources services business, which includes human resources dispatch, business process consignment, dispatched worker for employment and job placement, the nursing care business, which includes nursing facility operations, the multimedia services business, which includes cellular telephone carrier shop operations (Success Holdings Co., Ltd. which conducts the childcare services business was converted to a consolidated subsidiary), and the child care services business as a new segment from fiscal year May 2016, in which operations of public child care facilities and consigned operations of child care related facilities The child care operations company Success Holdings Co., Ltd. was consolidated as of July 2015). The comprehensive human resources services, child care services, nursing care services, multimedia services and other businesses accounted, respectively, for 56.6%, 22.3%, 18.3%, 2.7% and 0.1% of sales during the first half of fiscal year May 2016. The comprehensive human resources services business can be divided by various contract categories including dispatched worker contracts, business process consignment contracts (Processes outsourced to J-COM), and dispatched workers for employment placement and job placement contracts, with each of these sub-segments accounting for 66.2%, 32.3% and 1.5% of segment sales, respectively. At the same time, the cellular telephone, apparel and childcare industries accounted for 77.1%, 9.0% and 1.3% of segment sales respectively. The J-COM Group is comprised of the holding company J-COM Holdings, six consolidated subsidiaries and two non-equity-method affiliates. The consolidated subsidiaries include J-COM Co., Ltd., which provides worker dispatch and business process consignment services to the mobile phone carrier shops within its comprehensive human resources services business, Astaff Inc., which provides worker dispatch of administrative staff and headhunting services and business school operations, Sunrise Villa Co., Ltd., which provides nursing care facility operation services, ACA Healthcare Restructuring Number 1 Investment Partnership L.L.C., which conducts investments in nursing care related businesses, and Success Holdings Co., Ltd. and its subsidiary Success Academy Co., Ltd., which is a certified operator of nursery schools and both of which were consolidated in July 2015.  |

| First Half of Fiscal Year May 2016 Earnings Results |

Sales, Current Profits Rise 54.8%, 157.1%

Sales rose by 54.7% year-on-year to ¥13.330 billion during the first half. In addition to the conversion of Success Holdings Co., Ltd from an equity-method affiliate to a consolidated subsidiary from July 2015, the comprehensive human resources services business saw a 26.2% year-on-year increase in sales on the back of consigned sales of mobile and fiber optic communications packaged services. And while the inclusion of Success Holdings as a consolidated subsidiary has been factored into the upward revision issued during the first quarter, actual earnings still exceeded this upward revision.Despite the influence of the conversion of Success Holdings, which has high cost of sales margins, to become a consolidated subsidiary, the increase in sales of the comprehensive human resources services business and better than expected occupancy rates of Sunrise Villa Co., Ltd. contributed to an improvement in the cost of sales margins of the nursing care services business from 94.6% to 91.2%, and allowed overall consolidated cost of sales to fall by 0.8% points to 83.1%. The ability of J-COM Co., Ltd., which conducts the comprehensive human resources services business, to absorb higher sales, general and administrative expenses arising from an increase in the number of staff in the previous term and from the inclusion of Success Holdings as a consolidated subsidiary allowed operating profits to rise by 157.5% year-on-year to ¥571 million. Net profit rose by 6.8 fold year-on-year to ¥1.496 billion due to the booking of extraordinary income. While an extraordinary loss arising from the director retirement benefit of ¥209 million was booked, an extraordinary profit of ¥1.230 billion arising from marginal profits on gradual acquisition of shares of Success Holdings in the process of its consolidation was also booked.        |

| Medium Term Business Plan (FY5/15 to FY5/17) Achievements |

J-COM Holdings is endeavoring to establish a structure to increase corporate value of the Group and achieve the sales and profit estimates outlined in the Medium Term Business Plan. Furthermore, efforts to share knowledge and know-how and maximize the speed of the decision making process within the Group will be made. As part of these endeavors, President Yasuhiko Okamoto of J-COM Holdings Co., Ltd. has also taken on directorships at the Group's subsidiaries, and an active exchange of human resources for the purpose of sharing knowledge and know-how levels within the Group are being implemented. J-COM endeavors to raise service quality, increase customer and job seeking worker satisfaction, and maximize the number of workers by strengthening the flow of training and work within the comprehensive human resources services business. At the same time, efforts are being implemented to become "the child care service provider of choice" by resolving the shortage of child care providers through collaboration within the Group, provision of 24 hour care and English education. In the nursing care services business, the Group also seeks to become "the nursing care provider of choice" through its efforts to resolve the shortage of care providers through collaboration within the Group, and the provision of 24 hour end of life nursing care.  <Endeavors to Achieve Goals of the Medium Term Business Plan>

As has been explained earlier, Yasuhiko Okamoto, President of J-COM Holdings Co., Ltd., also holds positions as representative directors of all of the Group companies, and the entire Group is making various efforts to increase the human resources exchange and to share knowledge and know-how within the Group. The results of these efforts are already visible. For example, finding qualified and experienced people who can work five days a week full time is difficult, but the Group managed to broaden the scope of hiring (to maximize the number of people employed) by establishing the Group's own training programs and providing proactive support.

(1) Collaboration within the Group  (2) Comprehensive Human Resources Services Business

J-COM seeks to provide solutions to the issues of "securing of human resources" confronting various industries, including the mobile, apparel, child care, nursing care, logistics and call center industries. Furthermore, support through training to allow workers to gain experience and improve their career path is also being provided. At the same time, synergies between Astaff Inc., which conducts considerable amounts of consigned work for the Government, and Career Design Academy Co., Ltd., which provides services to corporations, will be pursued. Furthermore, the Revised Worker Dispatch Law implemented in September 2015 will act as a tailwind for J-COM's businesses.

Training

The non-consolidated subsidiary Career Design Academy Co., Ltd. was established in April 2015 through capital participation by both J-COM and the major cellular telephone sales company T-Gaia Corp. (3738 TSE First Section) for the provision of training to corporate clients. Career Design Academy was capitalized at ¥80.00 million with T-Gaia and J-COM contributing 80% and 20% of this capital respectively. This joint venture company will leverage the strengths of both companies to cultivate human resources who can function as superior sales representatives, and provide customers with various educational solutions, on the job training programs, internal education, training consulting, and development and provision of training materials with a goal of increasing retention rates and boosting careers of workers. Furthermore, inquiries are on the rise from those global companies that aim to expand their sales in Japan through direct sales.

Influence of the Revised Dispatched Worker Act

The Revised Dispatched Worker Act came into force on September 30, 2015. The most important changes are: 1) integration of the dispatched worker business approval system, 2) review of the maximum period that workers can be dispatched and 3) implementation of employment security measures. J-COM views all of these revisions as positive factors for its business.

① Integration of Dispatched Worker Business Approval System

The distinction between the general worker dispatch business (Approval system) and the specified worker dispatch business (Notification system) will be eliminated with all categories of the dispatched worker business being subject to an approval system. Along with this change, companies involved with the dispatched worker business will be required to possess size and quality above a certain level, that is, to maintain net assets and cash of over ¥20.00 and ¥15.00 million respectively, and to offer career support programs to dispatched workers. Therefore, publicly traded companies will have an advantage because of their generally superior financial conditions. Moreover, J-COM has yet another advantage of its already established programs and systems to support career development of workers, including its on-the-job training and educational programs offered to students and part time workers lacking work experience and its ability, so that dispatched workers will have opportunities to climb the corporate ladder based on the years of employment, and ultimately become full time workers in the industry of their choice.

② Review of Maximum Time Period of Dispatched Workers

In addition to the elimination of unlimited period of time for dispatched workers in 26 specific job applications, a revision has been made to transfer the time period from job applications to persons. This shift from job application to person will extend dispatched workers' maximum period of employment at companies to three years. This change will allow dispatched worker companies to stably provide human resources and allow dispatched workers to develop their careers.

③ Employment Security Measures

Various measures have been implemented to strengthen the employment security including opportunities for direct employment at the work places, provision of new dispatched work places, and unlimited employment time periods at the dispatched worker company. The shift from a limited to an unlimited time period of employment will increase the burden upon dispatched worker companies.

(3) Child Care Service Business

J-COM seeks to become Japan's strongest child care services provider by providing high quality child care services while ever increasing both sales and profits. Success Holdings Co., Ltd., a listed company at Tokyo Stock Exchange First Section, was converted to a consolidated subsidiary through a tender offer in July 2015. Success Holdings has two pillars of business: One is consigned child care service business that includes consigned operation of 175 child care facilities such as university hospitals at Tokyo University, Osaka University, etc., and child care facilities in companies and schools; The other is public child care business that includes operation of 106 facilities including licensed and approved nursery centers, small child care facilities, school clubs, and children's houses. Near term trends in new child care facility openings, child care applicants, and child care provider acquisition are exceeding expectations. However, efforts to achieve gains in operating efficiency and streamline the headquarter function, and collaboration with J-COM to secure child care providers will be implemented as part of the strategy of strengthening the earnings generating structure. In addition, fortified efforts to raise the number of facilities that have been outsourced to J-COM to receive high quality child care at appropriate pricing will be implemented along with the conversion of Success Holdings to become a consolidated subsidiary. At the same time, J-COM management will focus upon developing child care facilities with advantageous conditions to remain a highly attractive publicly recognized owned child care facilities operator, and strengthening its follow-up services to raise the overall service quality of facilities run in collaboration with local public entities. (4) Nursing Care Services Business

Efforts to strengthen the earnings generating capability of Sunrise Villa Co., Ltd., which became a consolidated subsidiary in October 2013, are steadily being promoted. Currently, this business is expected to turn profitable during fiscal year October 2016 on the back of far greater than expected improvements in occupancy rates derived from efforts to improve service quality through collaboration with J-COM. Sunrise Villa currently operates 1,123 rooms at 21 facilities (Including 2 day care service facilities).

Medium Term Issue of Securing Human Resources

According to Ministry of Health, Labour and Welfare data, there is expected to be a shortfall of 377,000 care providers at the peak of the aging population problem in 2025. The J-COM Group will leverage its unique know-how and experience in turning human resources with no experience in the care provision business into productive resources. As part of this strategy, the Company will provide support to workers from overseas and Japanese seeking to acquire certification in the form of education and training, thereby turning inexperienced human resources into productive resources.With regards to the utilization of foreign workers, J-COM will promote efforts to facilitate an employment support structure that will enable it to secure human resources from overseas. At the same time, reviews of the Technical Intern Training Program (Nursing care training has been added, and the maximum period has been extended to five years) is expected to act as a tailwind. In addition, training courses for novices in nursing care will be established to enable "workers to acquire certification while working on-the-job" within the certification acquisition support and training programs. These courses will allow J-COM to cultivate nursing care human resources by providing support necessary to resolve the shortages of experience and skills. |

| Fiscal Year May 2016 Earnings Estimates |

Full Year Earnings Revised Upwards on Back of 1st Half Earnings, Now Call for Sales, Current Profit to Rise 74.3%, 214.3%

J-COM's full year earnings estimates call for sales to rise by 74.3% year-on-year to ¥31.5 billion. This large rise in sales is based upon the outlook for a strong ¥10.0 billion increase in sales of the child care services business, a 26.0% year-on-year increase to ¥15.8 billion in sales of the comprehensive human resources business due to strong demand for consigned sales of packaged services during the second half, and a 10.1% year-on-year increase in sales to ¥5.0 billion of the nursing care services business.With regards to profits, profitability of the comprehensive human resources services business is expected to improve on the back of highly profitable consignment projects, and the nursing care services business is anticipated to turn to profits. Furthermore, the addition of profits from the child care services business is expected to boost operating profit by 2.4 fold year-on-year to ¥1.135 billion. Large growth in non-operating income due to the booking of subsidies for facilities in the child care services business, and the booking of an extraordinary profit arising from the conversion of Success Holdings into a consolidated subsidiary are expected to allow net profit to rise by just under six times year-on-year to ¥1.980 billion.  (2) Shareholder Returns

10th Consecutive Year of Higher Dividends, Raised to ¥40

J-COM expects to pay a yearend dividend of ¥25 per share, which represents a ¥10 increase from the initial projection of ¥15 (The actual dividend in the second half of the previous term was ¥15). ¥5 of this ¥10 increase is made in response to the strong first half earnings, and the remaining ¥5 will be paid to commemorate the Company's 10th year anniversary of its listing on December 8, 2005. Combined with the first half dividend, the full year dividend will be ¥40 per share (A ¥10 increase from the previous term). Moreover, dividends are paid twice a year at the ends of both the first half and full year as part of J-COM's consolidated dividend payout ratio target of over 35%.

Shareholder Benefit Plan Introduced

A shareholder benefit plan will be implemented for shareholders of 100 shares (Minimum trading unit) effective as of the shareholder's registry date of end May 2016. J-COM will give shareholders with more than 100 and less than 500 shares a Quo Card prepaid card worth ¥1,000, and to shareholders with more than 500 shares a card worth ¥2,000.

|

| Conclusions |

|

To break this vicious cycle, President Yasuhiko Okamoto of Success Holdings, which became a consolidated subsidiary in summer 2015, promoted efforts to improve the employment terms of child care providers. Two wage hikes subsequently implemented were favorably received by child care providers and its results are already evident, in the form of reduction in the number of care providers quitting during the peak season leading up to March. At the same time, improvements in the quality of service care arising from the improved working conditions have also contributed to a strengthening of the brand. As a certain amount of success of the improvements in working conditions of child care providers has been confirmed, J-COM can now begin focusing on increasing the pricing for consigned projects as a means of improving profitability. As part of this strategy, structural reforms including the separation of facility operations and marketing functions will be implemented (in the form of the Operation Department and the Marketing Department), and the know-how and experience of J-COM in pricing negotiations will be leveraged in negotiations with customers outsourcing work to J-COM. Since many of the care providers prefer to work at locations close enough from their homes to walk or ride bicycles to, J-COM is aggressively referring business to other companies in areas that are difficult to secure care providers. Consequently, sales to the child care industry within the comprehensive human resources business is expanding. Meanwhile, Sunrise Villa has been forced to close a portion of some of its facilities because of a shortage of nursing care providers (Closure of a portion of existing facilities, top floors for example, in line with the number of available nursing care providers). And while recovery of investments has been difficult until now, the inclusion of Sunrise Villa into the J-COM Holdings Group and the subsequent improvement in the ability to secure nursing care providers has led to a reopening of some portions of the nursing care facilities that had been closed. Because of the uncertainties in the ability to secure profits from the increasing number of nursing care facilities introduced to Sunrise Villa as takeover candidates, it will continue to focus upon fortifying the existing facility network over the near future (A highly cautious strategy of opening 1 to 2 new facilities per year is expected to be adopted.). Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016 Investment Bridge Co., Ltd. All Rights Reserved. |