| LIKE Co., Ltd. (2462) |

|

||||||||

Company |

LIKE Co., Ltd. |

||

Code No. |

2462 |

||

Exchange |

Tokyo Stock Exchange, First Section |

||

Industry |

Service |

||

President |

Yasuhiko Okamoto |

||

HQ Address |

Umeda Hankyu Building Office Tower 19F, Kakudamachi 8-1, Kita-ku, Osaka-shi |

||

Year-end |

May |

||

Home Page |

|||

* Stock price as of the close on August 3, 2018. Number of shares at the end of the most recent term excluding treasury shares.

* BPS is the actual value from the previous term. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. From FY5/16, the definition for net profit has been changed to net profit attributable to parent company stockholders (Abbreviated as parent net profit).

* FY5/18 EPS reflects the change made after a 2 for 1 stock split was conducted in September 2017. This Bridge Report presents details of the fiscal year May 2018 earnings results and full fiscal year May 2019 earnings estimates for LIKE Co., Ltd. |

|

| Key Points |

|

| Company Overview |

|

<Business Segments and LIKE Group Companies>

LIKE's business segments are divided into the comprehensive human resources services business, which includes human resources dispatch, business process consignment, dispatched worker for employment and job placement, hiring and training support services, the childcare support services business, which includes consigned operation of public and private childcare facilities, the nursing care services business, which includes nursing facility operations, and the multimedia services business, which includes cellular telephone carrier shop operations.

<Shareholder Benefit Program>

LIKE offers a shareholder benefit program including issuance of QUO Card prepaid cards in value of ¥1,000 to holders of between 100 and 500 shares and ¥2,000 to holders of between 500 and 2,000 shares as of the term end in May. Also, discounts on admission to nursing care facilities operated by Sunrise Villa amounting to ¥300,000 (valid for one room per ticket, until the end of August 2020) will be given to holders of over 100 shares.

|

| Fiscal Year May 2018 Earnings Results |

Sales, Current Profit Rise 14.0%, 56.0% Year-On-Year

Sales rose by 14.0% year-on-year to ¥45.663 billion on the back of a 12.5% year-on-year rise in sales of the comprehensive human resources services business driven by strong demand from mobile communications, logistics and call center applications, and a 20.7% year-on-year growth in sales of the childcare support services business derived from contract reviews for and increases in the number of consigned childcare facilities. An expansion in floor space of some facilities allowed sales of the nursing care services business to rise by 4.3% year-on-year.

Comprehensive Human Resources Services Business

Sales and operating profit of the comprehensive human resources services business rose by 12.5% and 2.2% year-on-year to ¥21.786 and ¥2.170 billion respectively. Successful efforts to fortify the job matching and work process training structure for workers seeking to take on jobs in new work realms contributed to the higher sales of this segment. However, a shortage of operational capacity in some consigned projects caused earnings to fall shy of initial estimates at the start of the term and caused profit margin to decline.

Childcare Support Services Business

Sales rose by 20.7% year-on-year to ¥17.776 billion and operating profit recovered from a ¥76 million loss in the previous term to a ¥387 million profit in the current term. In addition to an increase in number of employed childcare providers and childcare provider retention rates made possible through collaboration with LIKE Staffing Co., Ltd. and improvements in care provider employment conditions, an additional ¥200 million in operational subsidies from Government certified childcare facilities during the first quarter and reviews of consigned childcare facilities (Despite a decline in facilities resulting from the cancelation of contracts with those facilities with which contract negotiations were unsuccessful) allowed for profitability to improve.

Nursing Care Services Business

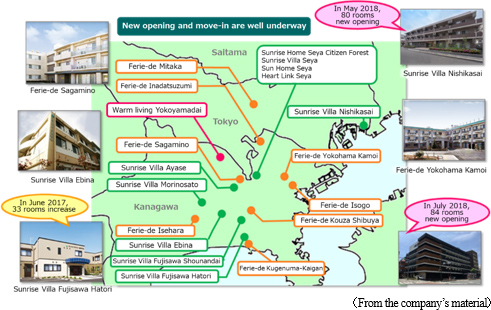

Sales rose by 4.3% year-on-year to ¥5.525 billion, while operating profit fell by 40.8% year-on-year to ¥90 million. Improvement in service quality was realized by relieving the shortage of nursing care providers made possible by outsourcing of the hiring tasks to LIKE Staffing. However, expenses arising from the opening of new facilities in May and July 2018, and the expansion of floor space of the Sunrise Villa Fujisawa Haneshima facility in June 2017 caused profits to decline.

|

| Fiscal Year May 2019 Earnings Estimates |

Estimates Call for Sales to Rise 11.7%, Current Profit to Fall 10.0% Year-On-Year

Sales of the all three main business segments are expected to rise. However, sales growth of the comprehensive human resources services business is expected to remain subdued due to restraint in order taking activities caused by prioritization of improvements in operational strengths. At the same time, the LIKE Group will see limited growth in operating profit as it opens new childcare and nursing care facilities, and makes anticipatory investments in new staff hiring and training to become the leaders of the Group in order to achieve the dramatic growth called for by the new medium term business plan to begin from fiscal year May 2020.

(2) Strategy by Business Segments

Comprehensive Human Resources Services Business

The securing of human resources is an important management issue for companies in all industries. LIKE has highly flexible solutions responding to the needs of job seeking workers including the ability to propose job matching services which cover a wide range of diversified clients and provide flexible working conditions including three day work weeks and shorter working hours. At the same time, the Company endeavors to increase the working population by leveraging the unique knowhow of its Group to turn inexperienced workers into fully contributing workers, raising the job retention rates by close follow up after employment, and by providing classroom and on the job training led by experienced staff. Also, skill evaluation and training will be applied to workers from overseas, whose numbers are expected to grow in the future, in order to quickly turn them into productive resources.

Various Efforts

Amidst the demographic trends of the ninth consecutive year of declines in the Japanese population, and the fall in the share of the Japanese population between the ages of 15 to 64 to below 60% (As of January 1, 2018 Population Survey), there is a need to promote diversification of work styles where jobs applicants of various backgrounds regardless of education, work experience, life experience, job format, working hours, nationality and other factors can be hired for various jobs. Furthermore, there is an absolute need for operations that allow for companies to provide detailed human resources services that match the needs of both the job applicants and hiring companies.LIKE has reduced its growth rates for sales in fiscal year May 2019 from initial plans as it prioritizes increases in profitability through improvements in its operational capability with a view to the dramatic growth called for in the new medium term business plan starting in fiscal year May 2020. Strengthening Services Provided to Logistics, Manufacturing Industries

The services provided to the logistics and manufacturing industries were spun off from LIKE Staffing Co., Ltd. in June 2018 to become an independent company called LIKE Works Co., Ltd. with a goal of expanding these services. This new company provides a wide range of services matching customers' needs, including human resources dispatching services to the logistics and manufacturing industries in response to the rapid rise in demand for parcel picking and packaging applications, and provides business process consignment for call center and storefront sales applications leveraging its experiences with major electronic commerce operating companies. In addition, LIKE will collaborate with LIKE Kids Next Co., Ltd. for the provision of staff to childcare facilities.

Childcare Support Services Business

LIKE operates 154 childcare facilities within companies, hospitals and universities and 179 certified nursery schools, school clubs, and children's museums throughout Japan. 39 new facilities were opened during fiscal year April 2018 (Fiscal year for subsidiaries end in April), including 19 certified nursery schools, 10 school clubs, 10 consigned childcare facilities (Because of the elevation of a specified facility to become a publicly operated childcare facility, the total number of actual publicly operated childcare facilities newly opened is 20, bringing the total to 40).

Increase in Childcare Facilities

With regards to the consigned operation of childcare facilities, the LIKE Group will review various projects from its long list of customers and select the most promising projects with the strongest potential to yield high levels of profitability. At the same time, LIKE seeks to create new childcare facilities that will continue to be chosen by parents even after the problem of children who cannot gain entrance to publicly operated nursery school or preschools is resolved. In addition, efforts will be conducted to fortify childcare service contents. LIKE maintains a target of operating 20 new certified nursery school facilities (four were newly opened during the first half) within fiscal year May 2018.

Securing Childcare Providers

Knowhow regarding hiring and post hiring training of childcare providers accumulated by LIKE Staffing will be leveraged to strengthen the hiring capability and retention rates of childcare providers. Specifically, knowhow will be shared through personnel exchange, matching will be strengthened, and training contents will be shared within the Group.

Nursing Care Services Business (Operating 23 Facilities with 1,320 Rooms including 3 Day Care Facilities)

Paid-for nursing care facilities including end-of-life care nursing facilities are operated in the Tokyo, Kanagawa, and Saitama regions. Strengths of this business include facilities staffed with helpers and nursing care staff 24 hours a day, 365 days a year, an established track record of high quality nursing care service provision, and daily provision of high quality food services.

|

| Conclusions |

|

|

| <Reference: Regarding Corporate Governance> |

◎Corporate Governance Report Updated on August 27, 2018

Basic Policy

Our company aims to be a corporate group that is indispensable to society at any stage of life with a group mission of "…planning the future - Developing people and creating the future -" and recognizes the initiatives for corporate governance as an essential management task. For its realization, we make use of our holding company structure and consolidate the compliance system in the holding company so that executives, employees and service users of our group can take fair and efficient actions at all times, and attempt to strengthen corporate governance of the whole group by centralizing the functions of the holding company by the management of the entire group.

We take appropriate measures so that the rights of shareholders, including the voting rights at the general shareholders meeting, are substantially ensured. 2. Appropriate cooperation with stakeholders excluding shareholders On the basis of our group mission, we will continue to enhance our corporate value by acting in good faith with all stakeholders including service users, clients, shareholders and employees, keeping in mind the Code of Conduct and principles of action. 3. Appropriate disclosure of information and ensuring transparency We will make appropriate disclosure of information based on laws and ordinances and actively provide non-financial information and information other than the information disclosed based on laws and ordinances. 4. Responsibilities of the Board of Directors and others The board of directors formulates the basic policy and strategies for the management of the group and manages and supervises the business firm. It operates as a body that supervises the management decision-making in the entire group and the business execution by the board of directors. In addition, the independent outside director works to strengthen the management discipline and increase the transparency further. 5. Dialogue with shareholders We put importance on dialogue with shareholders to maximize the corporate value of the group, and respond to requests for dialogue from shareholders at any time. The dialogue with shareholders is carried out by the department in charge of IR, executives in charge of IR and the management executives as necessary. <Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 5-1】Tokyo Stock Exchange Corporate Governance Information Service:http://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |