Bridge Report:(2462)LIKE the first half of fiscal year May 2020

Yasuhiko Okamoto, President | LIKE , Inc. (2462) |

|

Company Overview

Exchange | Tokyo Stock Exchange, First Section |

Industry | Service |

President | Yasuhiko Okamoto |

HQ Address | Umeda Hankyu Building Office Tower 19F, Kakudamachi 8-1, Kita-ku, Osaka-shi |

Year-end | The end of May |

HP |

Stock Information

Share Price | Shares Outstanding (excluding treasury shares) | Market Cap | ROE (Act.) | Trading Unit | |

¥1,618 | 19,025,784 shares | ¥30,784 million | 19.1% | 100 shares | |

Dividend Yield (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥28.00 | 1.7% | ¥92.45 | 17.5x | ¥468.57 | 3.5x |

* The share price is the closing price on January 31. The number of shares issued at the end of the latest quarter excludes its treasury shares.

* ROE and BPS are results for FY 5/19, EPS and DPS are forecasts for FY 5/20, and figures rounded.

Earnings Trends

Year | Sales | Operating Profit | Current Profit | Net Profit | EPS | DPS |

May 2016 | 31,844 | 953 | 1,426 | 1,795 | 97.67 | 40.00 |

May 2017 | 40,051 | 1,524 | 2,493 | 810 | 43.27 | 36.00 |

May 2018 | 45,663 | 1,915 | 3,889 | 1,532 | 81.49 | 29.00 |

May 2019 | 47,797 | 1,746 | 3,753 | 1,595 | 84.58 | 26.00 |

May 2020 Est. | 53,500 | 2,200 | 4,000 | 1,750 | 92.45 | 28.00 |

* Estimates are those of the Company. Unit is million yen, EPS and DPS are yen.

* From FY5/16, the definition for net profit has been changed to net profit attributable to parent company stockholders (Hereinafter the same applies).

* EPS reflects the change made after a 2 for 1 stock split was conducted in September 2017.

This Bridge Report presents details of the first half of fiscal year ending May 2020 earnings results and fiscal year ending May 2020 earnings estimates for LIKE , Inc.

Table of Content

Key Points

1. Company Overview

2.The First Half of Fiscal Year ending May 2020 Earnings Results

3. Fiscal Year ending May 2020 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of the term ending May 2020, sales grew 5.4% year on year, while ordinary income declined 25.3% year on year. The sales of comprehensive human resources services dropped, but the sales of childcare support and nursing care services increased by double digits, as new facilities were opened smoothly and the number of users increased. As for profit, gross profit rate decreased, as the additional amount of subsidies for operation of authorized nursery schools in the childcare support services decreased, the subsidies for rents, etc. will be deposited into the company’s account in 3Q or later, and personnel expenses augmented after the increase of human resources for opening new facilities. When compared with the initial earnings forecast, the results are in line with budgets as a whole.

- There is no revision to the full-year earnings forecast. For the term ending May 2020, it is estimated that sales and ordinary income will grow 11.9% and 6.6%, respectively, year on year. In the mobile device field, they pointed out the possibility that sales will fall below the estimate slightly. Meanwhile, the profits from the childcare support and nursing care services seem to exceed the estimates significantly. Strategies will be implemented for each business. The dividend is to be 28 yen/share, including an interim dividend of 14 yen/share and a term-end dividend of 14 yen/share.

- The ordinary income for the first half was down 25.3% year on year, and its progress rate toward the full-year estimate is only 23.1%, but since the timing of receipt of subsidies for the childcare support service business is taken into account in their budget, its progress exceeds the estimates. The results of the nursing care services business, too, exceed the estimates. Accordingly, it can be said that the results are in line with their budget. The scope of business of the company will expand, due to the reform of ways of working, the serious shortage of manpower, the problem of children being put on waiting lists for nursery schools, etc. In these circumstances, the company has secured human resources while utilizing synergetic effects. Despite the latest results, their business is progressing steadily from the short, medium, and long-term viewpoints, so their outlook is bright.

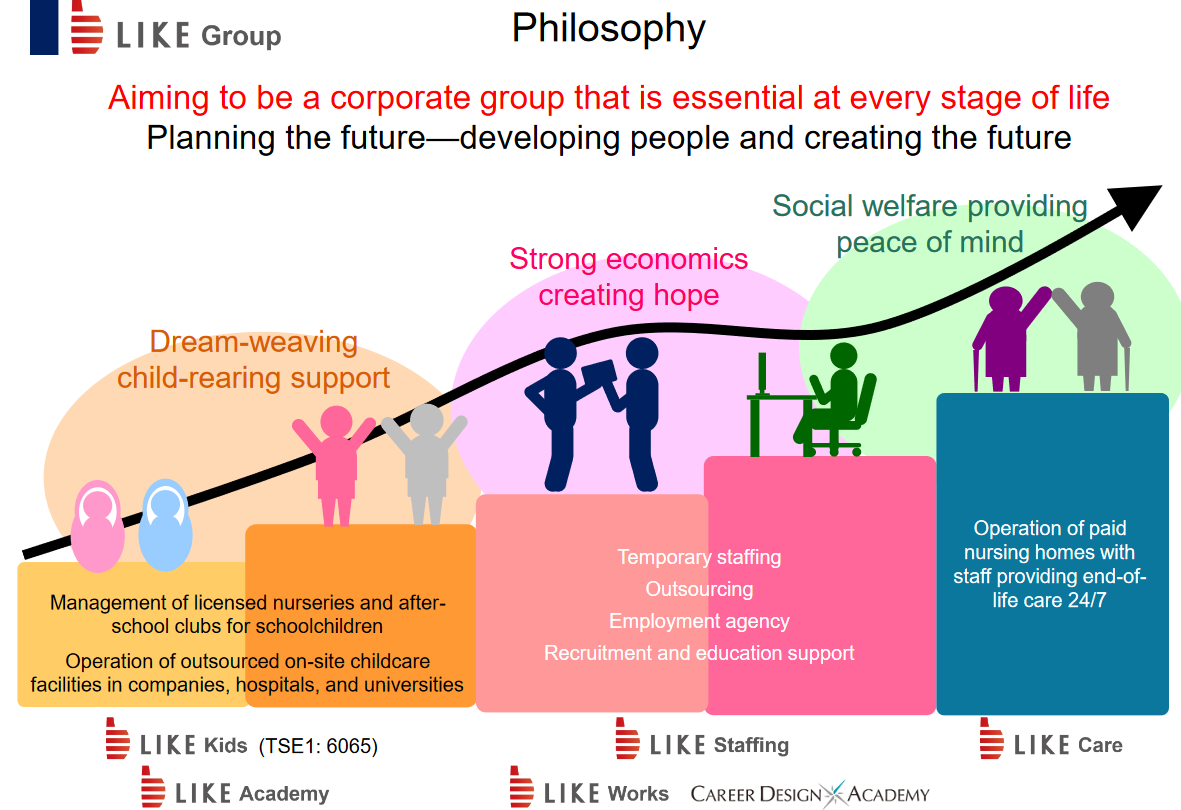

1. Company Overview

Based upon its corporate management philosophy of “Planning the Future – Leveraging Human Resources to Create the Future,” LIKE endeavors to create a corporate group structure that is capable of providing vital services at all stages of life in the operating realms of child and nursing care, human resources and other services.

(Source: the company)

【1-1 Business Segments and LIKE Group Companies】

LIKE’s business segments are divided into the comprehensive human resources services business, which includes human resources dispatch, business process consignment, dispatched worker for employment and job placement, hiring and training support services, the childcare support services business, which includes consigned operation of public and private childcare facilities, the nursing care services business, which includes nursing facility operations.

The LIKE Group is comprised of the holding company LIKE , Inc., five consolidated subsidiaries and one non-equity accounting method affiliate. The consolidated subsidiaries include LIKE Staffing, which provides worker dispatch and business process consignment services to cellular telephone shops within its comprehensive human resources services business, LIKE Works , Inc. providing comprehensive human resources services to the logistics and manufacturing industries, LIKE Kids, Inc. (LIKE Kidsnext Co., Ltd. was renamed on Oct. 1, 2019) and its subsidiary LIKE Academy which provides consigned childcare and public childcare operations (i.e. licensed nurseries etc.), and LIKE Care, Inc. (LIKE Care Next Co., Ltd. was renamed on Oct. 1, 2019), which operates nursing-care facilities. In addition to these, a joint venture company called Career Design Academy Co., Ltd., has been created to provide corporate training services with LIKE Staffing ,Inc. and T-Gaia Corporation (Tokyo Stock Exchange, First Section, Stock code:3738) providing 20% and 80% of the capital, respectively.

【1-2 Medium Term Business Plan】

| FY5/17 | FY5/18 | FY5/19 | |||

Estimates | Results | Estimates | Results | Estimates | Results | |

Sales | 38,300 | 40,051 | 46,400 | 45,663 | 51,000 | 47,797 |

Current Profits | 2,200 | 2,493 | 2,800 | 3,889 | 3,500 | 3,753 |

(Units: ¥mn)

In the fiscal year May 2019, the final year of the three-year medium-term business plan, sales fell short of estimates, but ordinary income was higher than expected. The company plans to disclose the mid-term management plan for the period from the term ending May 2020, as soon as business performance becomes predictable, as there are many uncertainties over the staffing services for the mobile device, construction industries and foreign personnel employment support services in the comprehensive human resources service business, and the effects of decrease of children being put on waiting lists on the demand for new facilities in the childcare support service business, etc. and the progress of enforcement of legal systems.

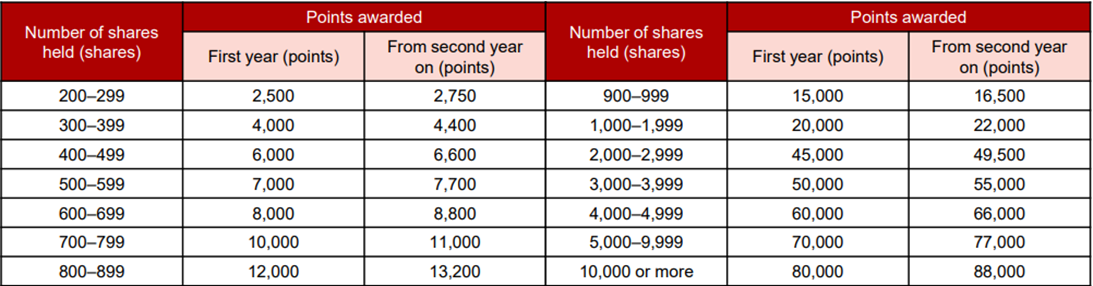

【1-3 Shareholder Benefit Program】

Established the “LIKE Premium Benefit Club.”

Targets: Shareholders who are listed on the shareholder list as of the end of May every year and possess 200(2 lots) or more shares of LIKE.

Contents: Points are given to shareholders every July, based on the table below. In the special website (https://like.premium-yutaiclub.jp), shareholders can exchange their shareholder’s benefit points for some of over 1,000 kinds of complimentary items, including food products, home appliances, gifts, travels, and miscellaneous goods.

(Source: the company)

2. The First Half of Fiscal Year ending May 2020 Earnings Results

(1) Consolidated Earnings

| 1H of FY 5/19 | Ratio to sales | 1H of FY 5/20 | Ratio to sales | Y on Y |

Sales | 23,450 | 100.0% | 24,723 | 100.0% | +5.4% |

Gross Profit | 3,894 | 16.6% | 3,773 | 15.3% | -3.1% |

SG&A | 2,808 | 12.0% | 2,957 | 12.0% | +5.3% |

Operating Profit | 1,086 | 4.6% | 816 | 3.3% | -24.8% |

Current Profit | 1,238 | 5.3% | 924 | 3.7% | -25.3% |

Net Profit | 466 | 2.0% | 480 | 1.9% | +3.0% |

(Units:¥mn)

* Figures include reference figures calculated by Investment Bridge Co.; Ltd. Actual results may differ (Abbreviated hereafter).

Sales grew 5.4% year on year, but ordinary income dropped 25.3% year on year.

Sales were 24,723 million yen, up 5.4% year on year. The sales of comprehensive human resources services dropped, but the sales of childcare support and nursing care services increased by double digits, as new facilities were opened smoothly and the number of users increased.

As for profit, gross profit rate decreased year on year from 16.6% to 15.3%, as the additional amount of subsidies for operation of authorized nursery schools in the childcare support services decreased 90 million yen, the subsidies for rents, etc. will be deposited into the company’s account in 3Q or later, and personnel expenses augmented after increase of human resources for opening new facilities. SG&A rate was unchanged, as the company is streamlining the headquarters’ operation, including recruitment, and reducing costs based on the cooperation among group companies, although taxes and public charges augmented due to the increase of authorized nursery schools the company runs.

As for the comparison with the full-year earnings forecast, the sales of the childcare support and nursing care services both increased by double digits, as new authorized nursery schools were opened and occupants of nursing care facilities opened in the previous term increased smoothly. The performance of the comprehensive human resources services is reportedly in line with the plan because it is estimated that sales are larger in the second half. It is originally estimated that sales will be largest in 4Q (March to May). The progress rate to the full-year estimate is 46.2%, which seems to be low, but they commented that it was in line with their budget as a whole. As for profit, the company took into account the 90-million-yen drop in the additional amount of subsidies for operation of authorized nursery schools in the childcare support service, which became a factor in decreasing profit, the timing of receipt of subsidies for rents, and the augmentation of personnel expenses due to opening the largest number of new authorized nursery schools in the history of the company in April 2020. According to the company, the results in the first half were better than the estimates.

(2) Segment Earnings Trends

| 1H of FY 5/19 | Ratio to sales | 1H of FY 5/20 | Ratio to sales | YoY |

Comprehensive Human Resources | 10,471 | 44.7% | 10,324 | 41.8% | -1.4% |

Childcare Support | 9,820 | 41.9% | 10,812 | 43.7% | +10.1% |

Nursing Care | 2,972 | 12.7% | 3,422 | 13.8% | +15.1% |

Multimedia Service and Others | 185 | 0.7% | 164 | 0.7% | -11.1% |

Sales, Total | 23,450 | 100.0% | 24,723 | 100.0% | +5.4% |

Comprehensive Human Resources | 811 | 57.1% | 794 | 66.7% | -2.1% |

Childcare Support | 627 | 44.1% | 259 | 21.8% | -58.6% |

Nursing Care | -32 | - | 123 | 10.4% | - |

Multimedia Service and Others | 14 | 1.0% | 14 | 1.2% | -5.3% |

Adjustments | -335 | - | -375 | - | - |

Operating Profits, Total | 1,086 | - | 816 |

| -24.8% |

(Units: ¥mn)

Comprehensive Human Resources Services Business

Sales were 10,324 million yen, down 1.4% year on year, and operating income was 794 million yen, down 2.1% year on year.

Amid serious manpower shortages in all industries, businesses, and jobs, the subsidiary LIKE Staffing,Inc. endeavored to expand business with a focus on the service industry, such as mobile communications and apparel industries that are suffering from a lack of sales staff; the call center industries where online shopping, which is surging in popularity, is driving ever-increasing demand; and the childcare and nursing care industries, in which a shortage of childcare providers and certified care workers is becoming a social issue. LIKE Works ,Inc. also worked to expand business, particularly in the manufacturing and logistics industries, where demand is tight due to changes in sales channels. Utilizing the knowledge and know-how that they have accumulated in these industries, they continuously focused on increasing the working population by proposing a variety of working styles for client companies and strengthening their matching, employment follow-up, and training systems in order to support employment for job-seekers who have little work or life experience, or who want to work less than the full-time five days a week.

In addition, the company is cultivating new businesses that would become the next growth drivers, is expanding services for the construction industry, which were launched in December 2018, and concentrates on the stable operation of LIKE Challenge Support, an employment support office for job seekers with disabilities, which was started in April 2019.

Furthermore, as the amended Immigration Control Act was enforced in April 2019 and “Specific skills” were set forth as the new resident visa status, LIKE Staffing has been registered by the Commissioner of Immigration Services Agency as “a registered support institution,” which supports the employment of foreign personnel, as the corporate group employs over 120 foreign full-time employees. In December 2019, the “international business division” was established in LIKE , Inc., and the “personnel introduction business division” was established in LIKE Staffing. In order to help foreign personnel work mainly in the fields of nursing care, accommodation, restaurants, construction, and manufacturing, the company enhanced the recruitment of foreign human resources inside and outside Japan and the introduction of personnel to client enterprises, developed a comfortable working environment in which daily life support is offered, and obtained the resident visa status of the Specified Skilled Worker (i) and realized employment in the nursing care field in cooperation with LIKE Care, Inc. Since the company conducted upfront investment for new businesses, sales and profit declined, but within the estimated range, and the amount of decline shrank.

As for the performance of each type of contract, demand grew for all businesses and jobs due to a growing shortage of human resources. Thanks to the Company’s plan, which is designed to enable workers to flourish even without specific work experience or skills, sales from temporary staffing service contracts (which account for 72.5% of this segment’s sales) went up by 2.5% year on year. Meanwhile, despite strong external demand, sales from outsourcing service contracts (which account for 26.9% of this segment’s sales) fell 10.7% due to selection and concentration with a focus on customers who can build a good long-term relationship together with the Company and its staff. Sales from employment agency contracts (which account for 0.6% of this segment’s sales) increased by 2.4%, indicating almost unchanged because there were a greater number of job seekers who chose to work as temporary workers.

By industry, external demand in its mainstay, the mobile communications industry (which accounts for 62.5% of sales in this segment), was strong, but sales fell 13.4% due to selection and concentration with a focus on customers who can build a good long-term relationship together with the Company and its staff. In childcare and nursing care industries, sales from LIKE Kids increased 6 million yen year on year to 129 million yen, and sales from LIKE Care 4 million yen year on year to 107 million yen. In the call centers and logistics industries, demand has been tightening due to changes in sales channels (such as the Internet), and sales have increased significantly.

Sales by industry

| 1H of FY 5/19 | 1Hof FY 5/20 | YoY | |||

| Sales | Composition ratio | Sales | Composition ratio | Increase/ Decrease | Rate of change |

Mobile industry | 7,447 | 71.1% | 6,448 | 62.5% | -998 | -13.4% |

Apparel industry | 797 | 7.6% | 641 | 6.2% | -156 | -19.6% |

Childcare industry | 206 | 2.0% | 192 | 1.9% | -13 | -6.6% |

Nursing industry | 84 | 0.8% | 129 | 1.3% | +45 | +53.4% |

Call centers | 664 | 6.3% | 798 | 7.7% | +134 | +20.2% |

Logistics and Manufacturing | 1,028 | 9.8% | 1,747 | 16.9% | +718 | +69.9% |

Other | 243 | 2.4% | 366 | 3.5% | +123 | +50.6% |

Total | 10,471 | 100.0% | 10,324 | 100.0% | -147 | -1.4% |

(Units: ¥mn)

The following chart shows quarterly sales and the number of staff at work at the end of the term.

(Unit: Person) | End of May 2012 | End of May 2013 | End of May 2014 | End of May 2015 | End of May 2016 | End of May 2017 | End of May 2018 | End of May 2019 | End of November 2019 |

Active Staff Members | 5,291 | 3,955 | 4,097 | 4,647 | 4,911 | 5,946 | 6,175 | 6,148 | 7,613 |

(Unit: ¥mn) | FY5/18-2Q | 3Q | 4Q | FY5/19-1Q | 21Q | 3Q | 4Q | FY5/20-1Q | 2Q |

Quarterly Sales | 5,371 | 5,427 | 5,645 | 5,312 | 5,159 | 5,069 | 5,140 | 5,063 | 5,260 |

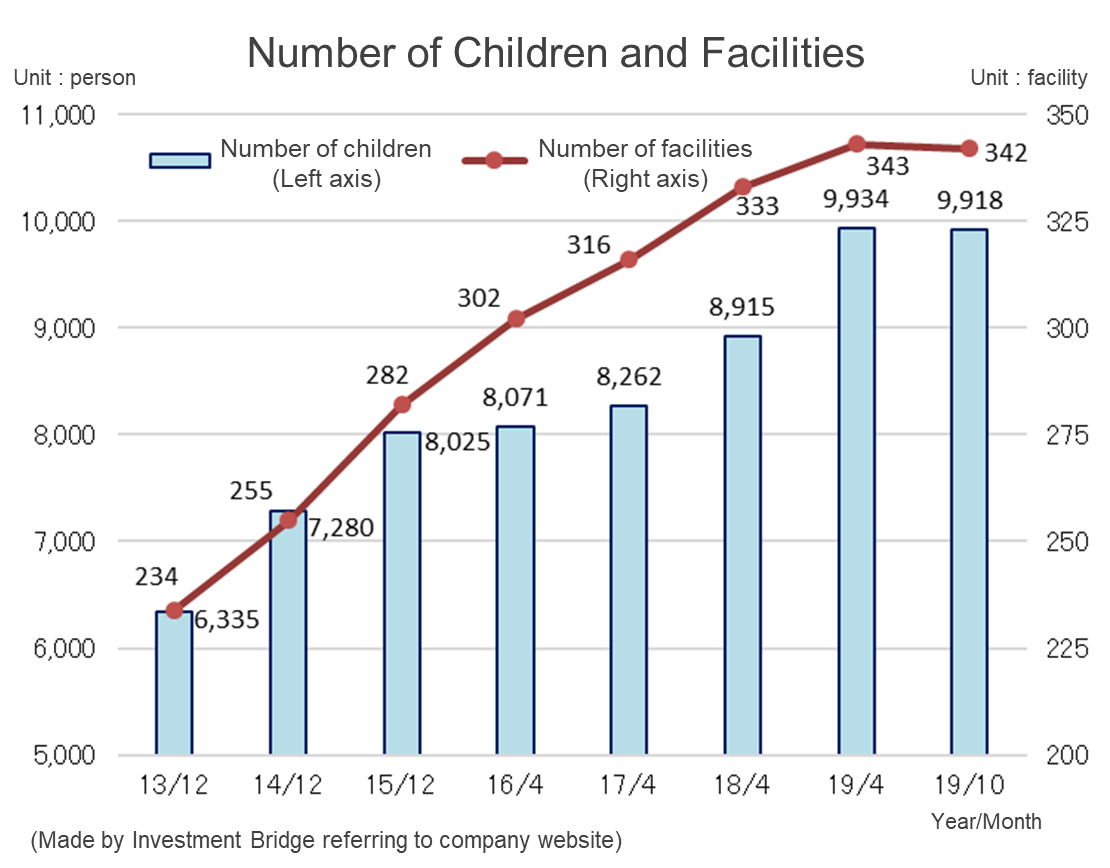

Childcare Support Services Business

Sales were 10,812 million yen, up 10.1% year on year, and operating income was 259 million yen, down 58.6% year on year.

In this industry, the increasing number of children being put on waiting lists and a shortage of childcare workers have been serious issue. there are increasingly more children being put on waiting lists and a shortage of childcare workers. There are various measures being promoted to handle this situation, such as making early education and childcare free. Even under these circumstances, company subsidiaries LIKE Kids and LIKE Academy continued to operate licensed nurseries and school clubs, as well as on-site childcare services (such as childcare put in place by companies, hospitals, and universities). The Company also focused on providing high-quality childcare, which continues to be chosen by customers. They opened new facilities with convenient locations and equipment, and proposed on-site childcare to businesses that were struggling to secure human resources.

As the operation of newly established nursery schools was healthy, sales grew by double digits.

Profit declined mainly because the additional amount of subsidies for operation, which was included in sales of authorized nursery schools, decreased about 90 million yen year on year, the subsidies for rents for authorized nursery schools established in April 2019 are to be provided in 3Q or later, and personnel expenses augmented as the company smoothly secured human resources for opening the largest number of new authorized nursery schools in the history of LIKE Academy in April 2020, but the company already took them into account in their plan. The performance of the childcare support service business as a whole is reportedly better than the estimate.

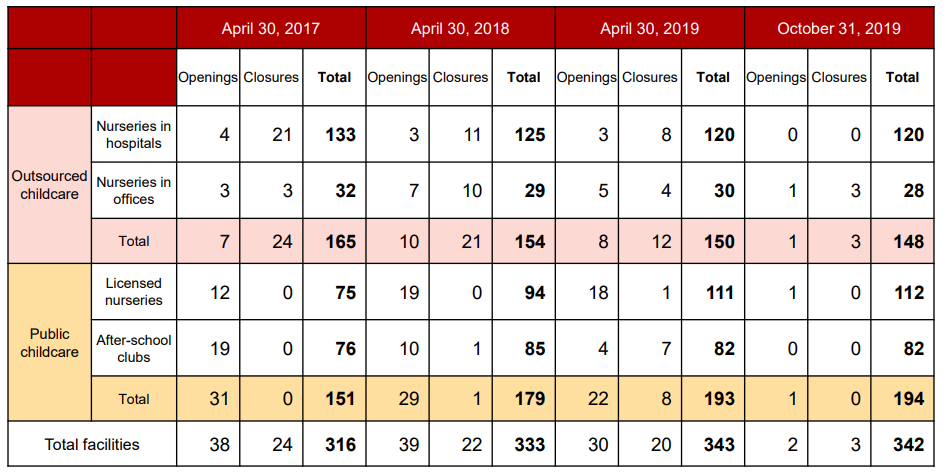

In the first half of the term ending April 2020, the company opened 1 in-office nursery facility and 1 authorized nursery school. As it closed 3 consigned nursery facilities, the number of facilities as of the end of October was 342, down 1 from the end of the previous term. The number of pupils as of the end of October 2019 was 9,918, slightly down from the end of April 2019, but it seemed to exceed 10,000 by the end of December.

Facility Number Trends (with the breakdown)

| Facilities in Hospital | Facilities in Companies etc. | Consigned Facility Total | Certified Facilities | School Clubs | Publicity Operated Facilities Total | Total Facilities |

End of 4/17 | 133 | 32 | 165 | 75 | 76 | 151 | 316 |

End of 4/18 | 125 | 29 | 154 | 94 | 85 | 179 | 333 |

End of 4/19 | 120 | 30 | 150 | 111 | 82 | 193 | 343 |

End of 10/19 | 120 | 28 | 148 | 112 | 82 | 194 | 342 |

Nursing Care Services Business

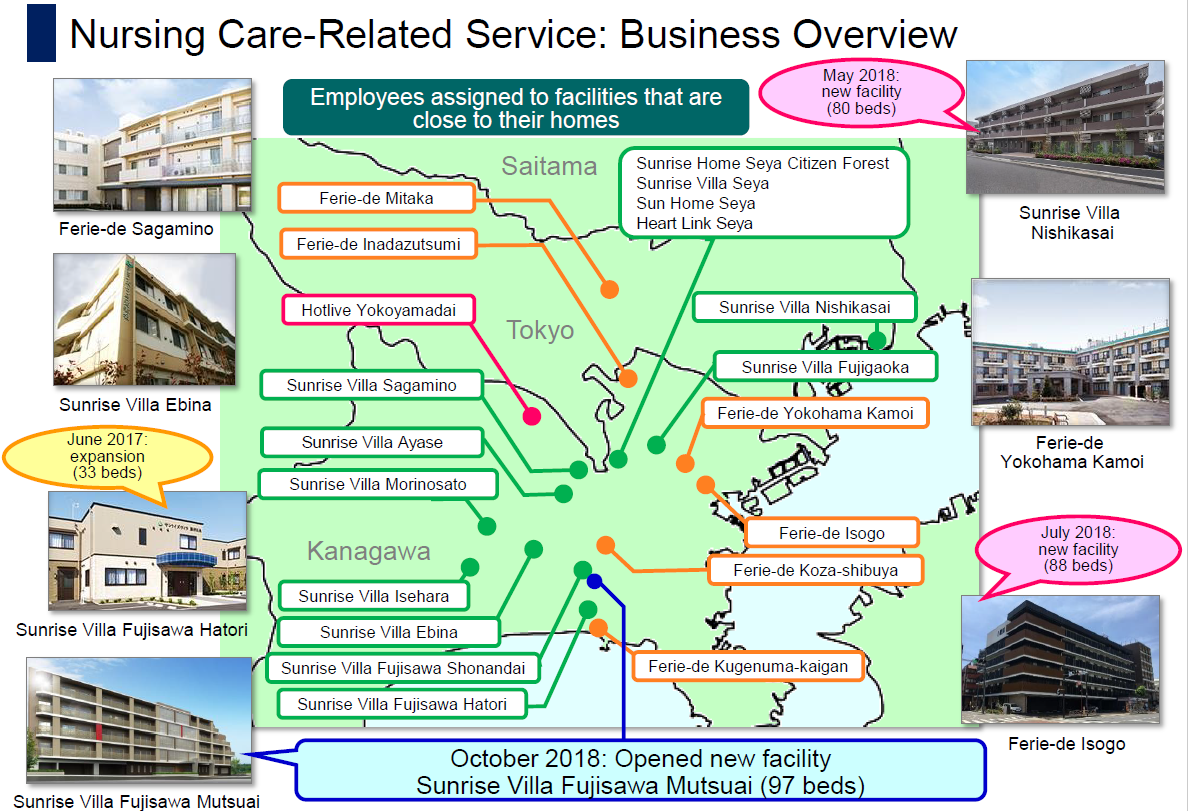

Sales were 3,422 million yen, up 15.1% year on year, and operating income was 123 million yen (a loss of 32 million yen in the same period of the previous year). The subsidiary LIKE Care will continue to operate paid end-of-life nursing homes with round-the-clock care in the Tokyo metropolitan area, including Kanagawa, Tokyo, and Saitama prefectures. They have focused on providing high-quality services that continue to be chosen by customers and their families. The occupancy rate has also been steadily increasing at Sunrise Villa Nishikasai (which opened in May 2018), Ferie-de Isogo (newly opened in July), and Sunrise Villa Fujisawa-Mutsuai (which opened in October). Sunrise Villa Nishikasai is fully occupied and Ferie-de Isogo is about to be fully occupied. The operating income in the first half is reportedly much higher than the estimate.

Other

In the multimedia service business, the Company operates a mobile phone shop as a showroom of services targeted at the mobile communications industry, which is the mainstay for the comprehensive human resources service business

(3) Financial Conditions

◎Financial Condition

| May 2019 | November 2019 |

| May 2019 | November 2019 |

Cash | 7,628 | 7,519 | Accounts payable | 2,967 | 2,978 |

Receivables | 3,795 | 3,712 | Taxes Payable | 1,051 | 911 |

Current Assets | 13,088 | 12,247 | Security Deposits | 896 | 912 |

Tangible Assets | 10,098 | 10,011 | Interest Bearing Liabilities (Inc. Leases) | 10,551(659) | 9,505(640) |

Intangible Assets | 1,979 | 1,759 | Liabilities | 18,268 | 16,786 |

Investments, Others | 5,141 | 5,177 | Net Assets | 12,040 | 12,409 |

Noncurrent Assets | 17,219 | 16,948 | Total Liabilities, Net Assets | 30,308 | 29,195 |

(Units: ¥mn)

The total assets as of the end of the first half of the term ending May 2020 were 29,195 million yen, down 1,112 million yen from the end of the previous term.

Current assets were 12,247 million yen, down 841 million yen from the end of the previous term. This is mainly because cash and deposits decreased 109 million yen due to the repayment of short-term and long-term debts, etc. and notes and accounts receivable decreased 83 million yen.

Noncurrent Assets decreased 271 million yen from the end of the previous term to 16,948 million yen, mainly because amortization of goodwill decreased noncurrent assets by 227 million yen.

Current liabilities dropped 808 million yen from the end of the previous term to 9,566 million yen, mainly because short-term debts decreased 300 million yen and income taxes payable declined 162 million yen.

Noncurrent liabilities decreased 672 million yen from the end of the previous term to 7,220 million yen, mainly because long-term debts dropped 680 million yen.

The balance of net assets increased 368 million yen from the end of the previous term to 12,409 million yen, mainly because the profit attributable to owners of parent was 480 million yen, the dividend amount paid was 264 million yen, and the equity of non-controlling shareholders increased 143 million yen.

Equity ratio rose 1.9 points from the end of the previous term to 31.2%.

3. Fiscal Year ending May 2020 Earnings Forecast

(1) Consolidated Earnings

| FY5/19 Actual | Ratio to sales | FY5/20 Est. | Ratio to sales | YoY |

Sales | 47,797 | 100.0% | 53,500 | 100.0% | +11.9% |

Operating Profit | 1,746 | 3.7% | 2,200 | 4.1% | +26.0% |

Current Profit | 3,753 | 7.9% | 4,000 | 7.5% | +6.6% |

Net Profit | 1,595 | 3.3% | 1,750 | 3.3% | +9.7% |

(Units: ¥mn)

Sales expected to increase 11.9%, and ordinary income forecast to rise 6.6% year on year

There is no revision to the full-year forecast. In the fiscal year May 2020, sales are expected to increase 11.9% year on year to 53.5 billion yen, and ordinary income is expected to rise 6.6% to 4 billion yen year on year.

Sales forecasts by segment are as follows.

Segment Sales

| FY5/19 Actual | Ratio to sales | FY5/20 Est. | Ratio to sales | YoY |

Comprehensive Human Resources | 20,681 | 43.3% | 23,650 | 44.2% | +14.4% |

Childcare Support | 20,534 | 43.0% | 22,800 | 42.6% | +11.0% |

Nursing Care | 6,175 | 12.9% | 6,670 | 12.5% | +8.0% |

Multimedia Service and Others | 407 | 0.8% | 380 | 0.7% | -6.7% |

Sales, Total | 47,797 | 100.0% | 53,500 | 100.0% | +11.9% |

(Units: ¥mn)

There is no revision to the forecast for each segment, but the sales of comprehensive human resources services are declining although the company wants to curb the decline in sales in the mobile device field, where the company is proceeding with selection and concentration of customers. Accordingly, they pointed out the possibility that sales will fall below the estimate slightly. Meanwhile, the performance especially profits of childcare support and nursing care services seem to be much higher than the estimates of the company.

The annual dividend is to be 28 yen/share (including an interim dividend of 14 yen/share; with a payout ratio of 30.3%).

(2) Medium-Term Business Plan for the Period from FY May 2020

In the final year of the Medium-Term Business Plan (FY May 2017 to FY May 2019), which was announced on July 13, 2016, sales fell short of estimates, but ordinary income was much higher than expected.

The company began to develop new businesses that would be the next driving force for growth in FY May 2019.

➢ December 2018: It began to offer human resources services for the construction industry.

➢ April 2019: It began to offer work support services for people with disabilities. They established “Like Challenge Support,” an office to support employment of people with disabilities, in Shinagawa, Tokyo.

➢ It began to make preparations for offering foreign personnel employment support services mainly in the fields of comprehensive human resources services including nursing, lodging, restaurant, construction, and manufacturing, etc. as the Revised Immigration Control Act was enforced in April 2019, and new "Specific skills” were set forth as the new resident visa status.

However, due to many uncertain factors, the next Medium-Term Business Plan for the period from FY May 2020 will be announced only after the company can see daylight.

【Uncertain factors】

➢ Comprehensive human resources services

・Impact of the beginning of services by the 4th operator in the mobile phone industry

・Timing of the establishment of procedures for Specific skills for employment support for foreigners.

➢ Childcare support service

・Impact of solving the issues of children on the wait list for nursery schools on the demand for establishing new authorized nursery schools

➢ Nursing care service

・Permission and approval for new establishment and securing of candidate properties

(3) Strategy by Business Segments

◎Comprehensive Human Resources Services Business

Overview of the Comprehensive Human Resources Services Business

Human resources dispatch service

Dispatch human resources to works related to sales for the service fields such as mobile phone and apparel industries, childcare and nursing care industries, and other industries including call centers, logistics, manufacturing, and construction.

Outsourcing service

Entrusted operation of sales stores, sales promotion campaigns, call centers, distribution centers, etc.

Recruitment service

Fee-based recruitment and contract-to-hire recruitment in the childcare/nursing care industry, construction industry, etc.

Employment/education support service

Recruitment of new graduates. Support for interviews, job offers, and hiring as career advancement follow-ups.

Offer skills and manner training and training for corporate customers.

Market Conditions of Main Services Provided

Mobile Communications | Diversification of products and services lead to critical shortage of sales staff |

Apparel | Decline in workers seeking employment in apparel industry and low retention rates |

Childcare | Intensified problem of children not being able to attend nursery and preschools due to lack of staff, pay and work conditions need to be improved |

Nursing Care | Shortage of 680,000 nursing care providers anticipated by 2035, inability expected to fill this gap by Japanese workers only |

Call Center | Increase in staffing needs for customer call centers due to growth in electronic commerce and Internet sales |

Logistics and Manufacturing | Shortage of workers and drivers in the warehouses and factories dew to the changes in the sales channels such as the Internet |

Construction (☆NEW!) | There are overwhelming personnel shortages in all occupations, including construction managers, worksite supervisors, CAD operators, and salespersons. |

Expansion of the working population using its Corporate Group’s unique know-how of developing job seekers into full-fledged workers regardless of their initial work experience and skills.

Matching

● The work conditions and environments desired by job seekers have been diversifying, such as short working hours and part-time jobs for 3 days a week.

⇒Focus on meeting the needs by presenting a variety of proposals to clients.

● Through meticulous interviews with each job seeker, the company introduces him or her jobs that are well suited to them and meet their desires.

Training

● A well-experienced person in charge of the session not only provides classroom lectures, but also works together with job seekers to turn inexperienced workers into fully contributing ones. It also follows up job seekers from an on-site perspective after they have started working to maintain a high job retention rate.

● As for bringing in foreign human resources, the company can change them into skilled workforce by utilizing skill checks, training, and consulting during the hiring process.

Expansion of Services Provided to Logistics, Manufacturing Industries

☆The services provided to the logistics and manufacturing industries were spun off from LIKE Staffing ,Inc. in June 2018 to become an independent company called LIKE Works ,Inc. with a goal of expanding these services.

➢ This new company provides a wide range of services matching customers’ needs, including human resources dispatching services to the logistics and manufacturing industries in response to the rapid rise in demand for parcel picking and packaging applications.。

➢ It also provides business process consignment for call center services that the Company has cultivated through business of warehouse operation entrusted for many years by major companies operating electronic-commerce websites.

➢ Furthermore, the Company will strive not only to provide staff but also to arrange a worker-friendly environment by setting up childcare facilities through cooperation with LIKE Kids , Inc.

☆ To establish a system to respond to various employment-related needs of logistics operators carefully in collaboration with real estate developers.

Prologis, Inc., a leading global company that owns, manages and develops logistics facilities, established an office that offers recruitment support for companies that have offices in “Prologis Park Chiba 1,” which is a multi-tenant logistics facility in Inage, Chiba City, Chiba Prefecture. Together with “Prologis Park Chiba 2,” which is scheduled to be completed in November 2020, they will become the logistics hub with a total floor area of approximately 210,000 m2.

(Source: the company)

Expansion of service targeting the construction industry

In the construction industry, shortage of human resources is a serious issue in all types of works such as construction managers, site supervisors, CAD operators, and sales personnel, and the number of companies struggling to hire new graduates is also rapidly increasing.

Under this circumstance, the company established the Technology Division in LIKE Staffing ,Inc . in December 2018 and launched human resources services for the construction industry.

➢ The new division employed experts who sought the job while considering what kind of jobs they really want to do and how they would want to grow as a professional at the same time (There are 701 registered workers as of the end of May 2019) and added the construction industry as an option for their career.

The company will support those who wish to enter the construction industry by training them and so on.

Employment support services for people with disabilities

In April 2019, based on the concept “Find excitement in your work style,” the company began offering employment support services for people with disabilities who want to work. By utilizing the strengths of the Group, the company assists job seekers in selecting a job from a wide range of occupations and industries, and help them find a work environment and lifestyle that suits them.

Employment support office

Like Challenge Support Omori Station Square

Location | 2nd floor of Park Win Bldg., 6-17-16 Minami-oi, Shinagawa-ku, Tokyo 140-0013 |

Access | 1 min. on foot from “Kitaguchi (North Exit)” of JR Ōmori Station |

Telephone No. | 03-6404-9440 |

Foreign personnel employment support services

The company promotes employment of foreign human resources, by utilizing its know-how of supporting social advancement regardless of generation, nationality, or career.

The company already has over 120 foreign employees from approximately 17 countries throughout Japan and operates nursing care facilities as the Group. By utilizing know-how in support, development and industry, the company formed an elite team that would lead the way in preparing to hire foreign human resources in FY 2019, mainly in the fields of comprehensive human resources services including nursing, lodging, restaurants, construction, and manufacturing. In April 2019, foreign employees from Vietnam, Myanmar, Indonesia, Nepal, the Philippines, Korea, etc. began working at nursing care facilities. Currently, about 25 foreign employees are actively working.

August 2019: LIKE Staffing ,Inc. was included in the List of Registered Support Organization as the “Registered Support Organization” that supports professional, daily, and social lives of “Specified Skilled Worker (i)” so that they can perform their activities stably and smoothly, upon approval by the Commissioner of Immigration Services Agency (Registration numbe 19-001950).

September 2019: LIKE Care, Inc., which operates 24 nursing care facilities in the Tokyo Metropolitan area, received the certificate to support “Specified Skilled Worker (i)” in the nursing care field.

October 2019: “Specified Skilled Worker (i)” began working at LIKE Care.

December 2019: The Global Business Division was established at LIKE, Inc. The Division is intending to strength the recruitment and training of foreign people who wish to work in Japan, both in Japan and overseas. They also offer employment support services, including visa application and living support, that are offered by LIKE Staffing , Inc. as a Registered Support Organization.

+

Personnel Introduction Business Division was newly established at LIKE Staffing , Inc. It strengthens proposals to client companies to increase the number of job seekers who can work regardless of generation, nationality or work history.

◎Childcare Support Services Business

Outline of Childcare support business

Outsourced Childcare Business

LIKE operates 148 childcare facilities within companies, hospitals, and universities nationwide on a consignment basis

(Source: the company)

Public Childcare Business

The Company also operates 194 publicly owned childcare facilities, such as licensed nursery schools, after-school clubs for schoolchildren, and children’s centers, in the public childcare business.

(Source: the company)

In the first half of the term ending April 2020, the company opened two facilities (1 consigned nursery facility and 1 public nursery facility) and closed 3 facilities (3 consigned nursery facilities).

Variation in the number of facilities in the nursery and childcare support service businesses

The number of facilities is expected to keep increasing.

*The closing of authorized nursery schools, etc. at the end of the term ended April 2019 means that unprofitable authorized nurseries were relocated and became new authorized nursery schools.

(Taken from the reference material of the company)

☆Authorized nursery schools to be opened in April 2020

【Tokyo】 15 facilities

Itabashi-ku: Nijiiro Nursery School Komone

Inagi-shi: Nijiiro Nursery School Yanokuchi

Kōtō-ku: Nijiiro Nursery School Kameido, Nijiiro Nursery School Kitasuna, Nijiiro Nursery School Higashisuna

Shinjuku-ku: Nijiiro Nursery School Nishi-waseda

Sumida-ku: Nijiiro Nursery School Kikukawa

Setagaya-ku: Nijiiro Nursery School Kyuden-nishi

Nakano-ku: Nijiiro Nursery School Kamitakada, Nijiiro Nursery School Nakanoeki-minamiguchi

Nerima-ku: Nijiiro Nursery School Shakujii-machi, Nijiiro Nursery School Sekimachi-kita, Nijiiro Nursery School Hikawadai-daini

Minato-ku: Nijiiro Nursery School Kaigan 3-chome

Kita-ku: Nijiiro Nursery School Shimo

【Kanagawa Prefectures】 5 facilities

Kawasaki-shi: Nijiiro Nursery School Shinmaruko

Sagamihara-shi: Nijiiro Nursery School Kobuchi

Yokohama-shi: Nijiiro Nursery School Tenno-cho, Nijiiro Nursery School Nakayama, Nijiiro Nursery School Hiyoshi

【Aichi Prefecture】 1 facility

Nagoya-shi: Nijiiro Nursery School Umegaoka

*The above names are all provisional.

Aiming to provide high-quality childcare service and be the best childcare business company with both sales and profits growing

An increase in the number of facilities

➢ The Outsourced Childcare Business

Taking advantage of its Group’s long list of client companies, LIKE will put forth efforts to increase the number of facilities that it operates on a consignment basis at reasonable profits for the company-led childcare business program.

➢ The Public Childcare Business

The Company will seek to raise the number of facilities with favorable hardware conditions, which will continue to be chosen by users even after the problem of children who cannot gain entrance to publicly operated nursery schools or preschools has been resolved.

➢ Furthermore, it will endeavor to enrich the contents of its childcare services

Securing Childcare Providers

➢ LIKE will endeavor to boost its hiring capabilities and improve the job retention rate by utilizing the know-how regarding hiring and post-hiring follow-up training of childcare providers that LIKE Staffing has accumulated.

➢ And It will share know-how and strengthen the matching power through proactive interactions between workers within the Corporate Group.

➢ In addition, the Company will strive for creating human resources by sharing training contents within the Group.

Facilitation of a pleasant working environment for childcare providers

LIKE has joined the non-profit organization “Iku-Boss Kigyo Domei” (Literally “Childcare Conscious Boss Corporate Alliance”) in February 2016 as part of its efforts to facilitate an environment that makes working easier for parents and childcare providers. “Iku-Boss” is a concept that calls for companies to create a work environment with a favorable work-life balance, allowing for support of both career and private lifestyles while at the same time allowing workers to realize results in the workplace and enjoying their private life (Non-profit Organization Fathering Japan). Accelerating the effort to establish an “attractive workplace that kindles workers’ willingness to continue working,” LIKE will aim to contribute to improvement and development of childcare services and preschool education throughout Japan.

Adoption of “Miraikuru Nursery Teachers,” childcare providers pursuing a managerial career path

Career development of such workers will be backed up with higher salaries and more in-depth training than general childcare providers. Childcare providers are usually employed as general or part-time workers, and establishment of a unique managerial title is a rare case in the industry

➢ To employ nursery staff, who rarely change their jobs, as general staff and develop management staff who will take central roles in business administration

➢ To establish new pay and training systems, to support career development

Becoming a foundation company in the childcare industry

LIKE aims to be the best childcare provider in Japan. They provide high-quality childcare services and continue to grow in both sales and profits. The website “Hoiku no Hikidashi” (https://www.hoikunohikidashi.jp/), which was designed for only members to view it, is now opened to the public. On this website, they provide information on childcare such as discussions about children and explanations of the childcare support system, as well as information about how children actually play and learn at nursery schools as well as interviews with childcare workers and school instructors, supervised by active childcare workers and university professors, and supported by nursery teachers, students, and parents.

As the number of pupils enrolled in nursery schools is about to reach 10,000 (exceeding 10,000 in December), the company plans to develop apps for establishing a comfortable working environment for nursery staff and meeting needs by closely communicating with guardians, by utilizing the accumulated know-how.

【Functions to be installed】

・Streamlining of nursery staff’s tasks, including communication notebooks

・Sale of photos

・Sale of nursery staff’s must-have items, etc. that are difficult to take home or purchase

・Trade of reliable reuse goods limiting traders

・Correspondence education of English, etc.

Nursing Care Services Business (Operating 24 Facilities with 1,439 Rooms including 3 Day Care Facilities as of end of October 2019)

Outline of Nursing Care Services

Paid-for nursing care facilities including end-of-life care nursing facilities are operated in the Tokyo, Kanagawa, and Saitama regions.

Characteristics and strengths of this business include facilities staffed with helpers and nursing care staff 24 hours a day, 365 days a year, an established track record of high-quality nursing care service provision, daily provision of high-quality food services, and Carefully selected daily meals as energy sources.

(Taken from the company)

Pursuit of high-quality nursing care service

-Making it its subsidiary completely in April 2017 and maximizing its group value -

Differentiation of the service

➢Support services for the independence will be expanded in addition to the end-of-life nursing care provided jointly with medical institutions where nurses will be present round the clock. By providing high-quality nursing care services that are clearly differentiated from other companies, LIKE’s nursing care facilities will continue to be chosen by customers.

Securing nursing care workforce

➢The Company will foster nursing care personnel in tandem with LIKE Staffing, which turns inexperienced staff into skilled workers, and increase the industry’s working population by improving the retention rate.

➢ Since the “Basic Policy on Economic and Fiscal Management and Reform” and “Revised Immigration Control Act” were confirmed by the Cabinet in 2018, the Company intends to prepare for foreign human resources by focusing on expanding the contents of training and employing an elite team to create a system for hiring foreign workers.

Top 150 nursing homes selected by professionals “in which they want to have their parents reside”

According to the Jan. 20 issue of Shūkan Post released on Jan. 5, 2017, six facilities of the company were ranked, including Ferie-de Yokohama-Kamoi ranked first and Sunrise Villa Fujisawa Shounandai ranked fourth.

In cooperation with LIKE Staffing, which exchanges personnel and recruits’ workers on behalf of clients, nursery staff were filled in 2015. The company was able to concentrate on the improvement in quality of services, so occupancy rate increased from 68.0% in Oct. 2013 to over 90% in Sep. 2015 and has been hovering at over 90% since then, and annual profit became positive.

4. Conclusions

The ordinary income for the first half was down 25.3% year on year, and its progress rate toward the full-year estimate is only 23.1%, but since the timing of receipt of subsidies for the childcare support services business is taken into account in their budget, its progress exceeds the estimates. The results of the nursing care services business, too, exceed the estimates. Accordingly, it can be said that the results are in line with their budget. The services for the logistics and manufacturing fields grew considerably, enhancing their presence. Furthermore, foreign personnel employment support services are expected to grow, and its system is about to be completed. As for the comprehensive human resources service business, the company cultivates new businesses in rapid succession, and it is expected to bear fruit. Considering the fact that ordinary income exceeded the estimate in the previous mid-term plan considerably, it is highly likely that profit will also exceed the estimate in the current plan.

The scope of business of the company will expand, due to the reform of ways of working, the serious shortage of manpower, the problem of children being put on waiting lists for nursery schools, etc. In this situation, by utilizing in-company synergy, the company secured human resources for opening 21 authorized nursery schools in April in the childcare support field, which is suffering from the shortage of manpower. Despite the latest results, their business is progressing steadily from the short, medium, and long-term viewpoints.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory committee |

Directors | 7 directors, including 3 outside ones |

◎ Corporate Governance Report:Updated on August 26, 2019

Basic Policy

Our company aims to be a corporate group that is indispensable to society at any stage of life with a group mission of “planning the future – Developing people and creating the future –” and recognizes the initiatives for corporate governance as an essential management task. For its realization, we make use of our holding company structure and consolidate the compliance system in the holding company so that executives, employees and service users of our group can take fair and efficient actions at all times, and attempt to strengthen corporate governance of the whole group by centralizing the functions of the holding company by the management of the entire group.

1. Ensuring the rights and equality of shareholders

We take appropriate measures so that the rights of shareholders, including the voting rights at the general shareholders meeting, are substantially ensured.

2. Appropriate cooperation with stakeholders excluding shareholders

On the basis of our group mission, we will continue to enhance our corporate value by acting in good faith with all stakeholders including service users, clients, shareholders and employees, keeping in mind the Code of Conduct and principles of action.

3. Appropriate disclosure of information and ensuring transparency

We will make appropriate disclosure of information based on laws and ordinances and actively provide non-financial information and information other than the information disclosed based on laws and ordinances.

4. Responsibilities of the Board of Directors and others

The board of directors formulates the basic policy and strategies for the management of the group and manages and supervises the business firm. It operates as a body that supervises the management decision-making in the entire group and the business execution by the board of directors. In addition, the independent outside director works to strengthen the management discipline and increase the transparency further.

5. Dialogue with shareholders

We put importance on dialogue with shareholders to maximize the corporate value of the group, and respond to requests for dialogue from shareholders at any time. The dialogue with shareholders is carried out by the department in charge of IR, executives in charge of IR and the management executives as necessary.

Implementation Status of Principles of Corporate Governance Code

<The number of principles of Corporate Governance Code the Company does not comply with: 3, including the following>

【Supplementary principle 1-2-4】

Our company currently does not have any infrastructure that allows the exercise of electronic voting; however, we will consider using electronic voting by taking into account the proportion of institutional and overseas investors to the total number of shareholders.

【Supplementary principle 4-10-1】

Although we have not set up any independent advisory committee, our company explains nomination of candidates for directors and remuneration of directors to independent outside directors and obtain appropriate advice from them prior to a resolution by the board of directors. Since we obtain appropriate involvement and advice of independent outside directors regarding nomination of candidates for directors and directors’ remuneration as mentioned above, we consider that the independence, objectivity, and accountability of the functions of our board of directors pertaining to the aforementioned matters have been sufficiently secured.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

We will consider strategically holding shares of any listed company only when synergy of corporate value improvement has been recognized. Our company has confirmed the significance of the strategically held shares that we are currently possessing. Furthermore, with regard to the exercise of our voting rights as to those strategically held shares, we will declare our intention to approve or disapprove a case by taking into account whether the relevant company’s corporate value is improved and whether the exercise impacts our company.

【Principle 2-6】

Our company has not adopted a corporate pension plan.

【Principle 5-1】

・Our company has designated a director and established a department, both of which are in charge of overall IR activities for our corporate group, in order to encourage constructive dialogue with shareholders.

・Our company exerts ourselves to disclose information in a fair, timely, and proper manner in accordance with “Disclosure Policy” that we have set forth to organize our basic ideas.

・Our company discloses Disclosure Policy on our website ( https://www.like-gr.co.jp/ir/policy.html ).

・The details of our IR activities are as described in the second section of “Implementation Status of Policies regarding Shareholders and Other Stakeholders” in this report.

Tokyo Stock Exchange Corporate Governance Information Service:http://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Report on LIKE , Inc. (2462) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url:www.bridge-salon.jp/