Bridge Report:(2462)LIKE the first half of fiscal year ending May 2021

Yasuhiko Okamoto, President | LIKE , Inc. (2462) |

|

Company Overview

Exchange | Tokyo Stock Exchange, First Section |

Industry | Service |

President | Yasuhiko Okamoto |

HQ Address | Shibuya Mark City West 17F, 1-12-1 Dogenzaka, Shibuya-ku, Tokyo |

Year-end | The end of May |

HP |

Stock Information

Share Price | Shares Outstanding (excluding treasury shares) | Market Cap | ROE (Act.) | Trading Unit | |

¥2,002 | 19,073,584 shares | ¥38,185 million | 18.9% | 100shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥30.00 | 1.5% | ¥99.86 | 20.0x | ¥529.94 | 3.8x |

* The share price is the closing price on February 5. The number of shares issued at the end of the latest quarter excludes its treasury shares.

* ROE and BPS are results for FY 5/20, EPS and DPS are forecasts for FY 5/21, and figures rounded.

Earnings Trends

Year | Sales | Operating Profit | Current Profit | Net Profit | EPS | DPS |

May 2016 | 31,844 | 953 | 1,426 | 1,795 | 97.67 | 40.00 |

May 2017 | 40,051 | 1,524 | 2,493 | 810 | 43.27 | 36.00 |

May 2018 | 45,663 | 1,915 | 3,889 | 1,532 | 81.49 | 29.00 |

May 2019 | 47,797 | 1,746 | 3,753 | 1,595 | 84.58 | 26.00 |

May 2020 | 51,072 | 2,000 | 4,067 | 1,793 | 94.41 | 28.00 |

May 2021 Est. | 54,000 | 2,150 | 4,100 | 1,900 | 99.86 | 30.00 |

* Estimates are those of the Company. Unit is million yen, EPS and DPS are yen.

* From FY5/16, the definition for net profit has been changed to net profit attributable to parent company stockholders (Hereinafter the same applies).

* EPS reflects the change made after a 2 for 1 stock split was conducted in September 2017.

This Bridge Report presents details of the first half of fiscal year ending May 2021 earnings results and fiscal year ending May 2021 earnings estimates for LIKE , Inc.

Table of Content

Key Points

1. Company Overview

2.First half of Fiscal Year ending May 2021 Earnings Results

3. Fiscal Year ending May 2021 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of the term ending May 2021, sales grew 5.7% year on year, and ordinary profit increased 85.8% year on year. Sales increased for the child-rearing support services and nursing care-related services. In the comprehensive human resources services, sales decreased only slightly, as the company shifted its business domain to focus on what is essential to society amid the coronavirus disaster, and thanks to the growth in services for the manufacturing and logistics, call centers, and construction industries. In terms of profit, gross profit margin increased year on year from 15.3% to 16.4%, and the SG&A-to-sales ratio improved from 12.0% to 11.8%. The child-rearing support services, comprehensive human resources service, and nursing care-related services all posted double-digit profit growth, achieving substantial profit growth following the first quarter.

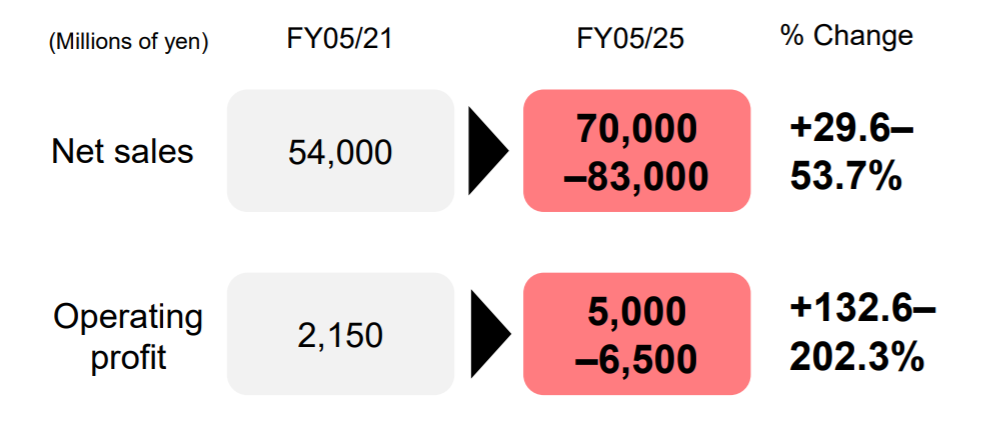

- The full-year forecast remains unchanged, with sales expected to increase 5.7% and ordinary profit estimated to grow 0.8%. There is no revision to the dividend forecast, either, which is expected to be 30.0 yen/share, up 2.0 yen/share year on year. A new medium-term business plan has been formulated. The company aims to achieve sales of 70-83 billion yen and an operating profit of 5-6.5 billion yen. It also considers ESG initiatives, formulation of DX strategies, and M&A and business alliances as important initiatives.

- In the middle of the coronavirus crisis, sales were strong in the first half following the first quarter. The company’s strategy of focusing on “must haves” continues to be successful. We consider that the focus this time is on the medium-term business plan. The medium-term business plan is a range plan, and EPS is expected to be in the range of 200-250 yen. The company plans to aggressively pursue M&A and business alliances, making this medium-term business plan with a variety of possibilities. The child-rearing support services and nursing care-related services are projected to see stable growth. The focus will be on the expansion of the comprehensive human resources service. The reason why the medium-term business plan is a range plan is because there is a possibility of changes in the expansion of these services. However, the company is making steady progress in this area, as sales to the construction industry, which it launched as a new business, have increased significantly. We also have high expectations for its DX initiatives. We believe that the share price is sufficiently low considering the profit level in the medium-term business plan. ESG investment has been in the spotlight recently, and there is a great deal of room for review of the share price in light of this, as well as the enhanced shareholder benefits.

1. Company Overview

Based upon its corporate management philosophy of “Planning the Future – Leveraging Human Resources to Create the Future,” LIKE endeavors to create a comprehensive life support corporate group structure that is capable of providing vital services at all stages of life (from the cradle to the happy twilight years) in the operating realms of child and nursing care, human resources and other services.

(Source: the company)

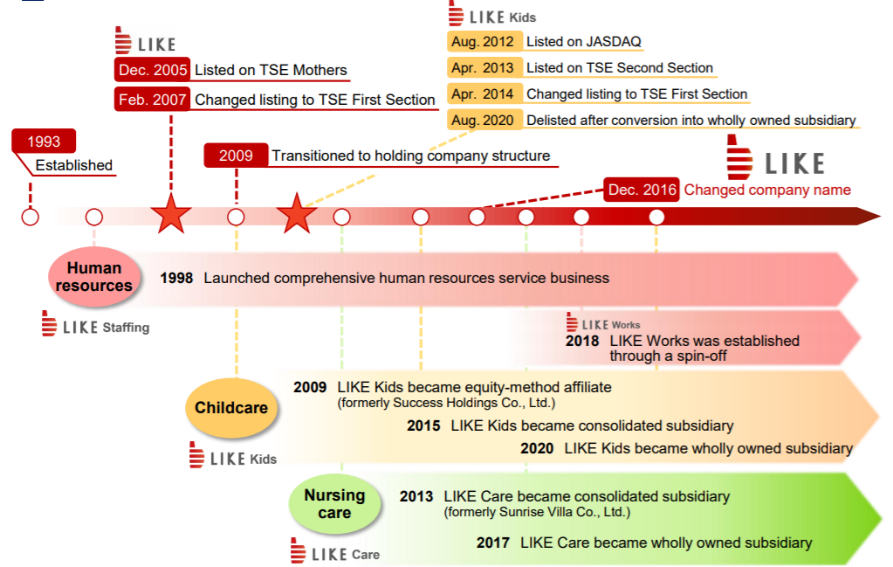

【1-1 Corporate history】

LIKE was established in 1993 for the purpose of operating the travel package planning business. The foothold for the current main business is the comprehensive human resources service business, which was launched in 1998. The company was listed on Mothers in 2005 and moved to the first section of the Tokyo Stock Exchange in 2007. In 2009, the company shifted to a holding company structure and expanded its business domain to include childcare services and nursing care-related services through acquisitions.

(Source: the company)

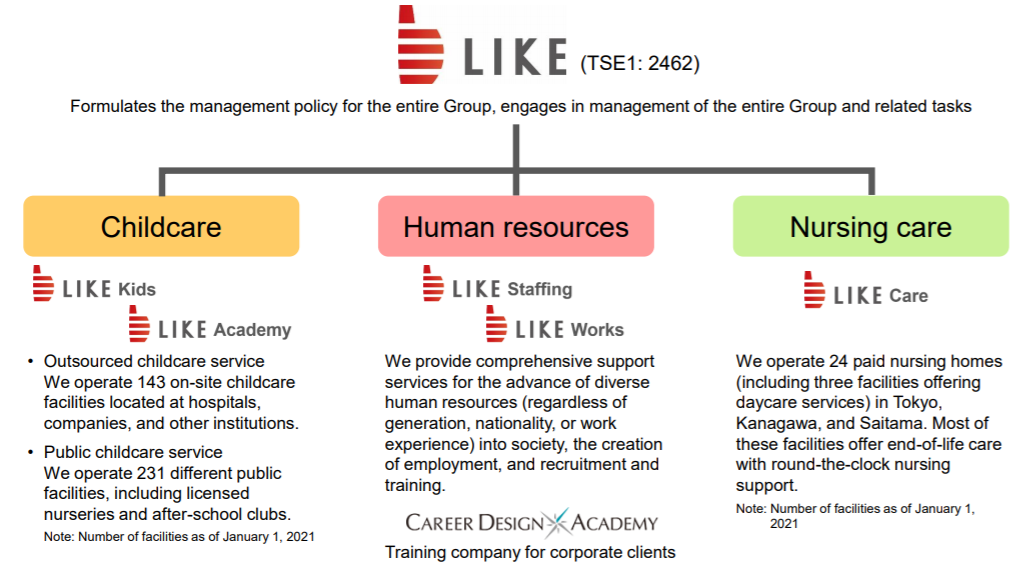

【1-2 Business Segments and LIKE Group Companies】

LIKE’s business segments are divided into operation of public childcare facilities and child-rearing support services on consignment, the comprehensive human resources services business, which includes human resources dispatch, business process consignment, dispatched worker for employment and job placement, hiring and training support services, the childcare support services business, which includes consigned operation of public and private childcare facilities, the nursing care services business, which includes nursing facility operations.

(Source: the company)

The LIKE Group is comprised of the holding company LIKE, Inc., five consolidated subsidiaries and one non-equity accounting method affiliate. The consolidated subsidiaries include LIKE Kids, Inc. and its subsidiary, LIKE Academy, Inc., which is engaged in contracted childcare and public childcare services (operation of authorized nursery schools, etc.), LIKE Staffing, Inc., which provides worker dispatch and business process consignment services to cellular telephone shops within its comprehensive human resources services business, LIKE Works, Inc. providing comprehensive human resources services to the logistics and manufacturing industries and LIKE Care, Inc, which operates nursing-care facilities. In addition to these, a joint venture company called Career Design Academy, Inc., has been created to provide corporate training services with LIKE Staffing, Inc. and T-Gaia Corporation (Tokyo Stock Exchange, First Section, Stock code:3738) providing 20% and 80% of the capital, respectively. Among these subsidiaries, the policy to convert LIKE Kids, Inc. (6065) into a wholly-owned subsidiary through a takeover bid. From LIKE , Inc.’s point of view, in order for LIKE Kids, Inc. to overcome managerial problems, such as fundraising to solve the waiting-list children problem and survive the fierce competition in the childcare industry, there is a need to increase the usage of LIKE , Inc.’s management resources and display greater synergy.

【1-3 Medium Term Business Plan】

The company formulated a new medium-term business plan. In light of the impact of the novel coronavirus, the company has disclosed a range of plans for the term ending May 2025, which is the final year of the medium-term business plan.

(Source: the company)

Background to the Formulation of the Medium-Term Management Plan

Solving social issues through business centered on childcare, human resources, and nursing care

Eliminate the waiting list for children | Promote women’s participation | Increase the labor population | Eliminate the need to leave one’s job for nursing care

| Respond to demand for nursing care

| ・・・ |

As the world is undergoing drastic changes due to the spread of the novel coronavirus, all businesses are once again recognized as infrastructure for daily life and new demands are being created, in addition to continuing and expanding existing services that are needed.

In order to create a sustainable future through our business, we have established a policy for the period up to the term ending May 2025, and are striving to achieve the plan. |

Key initiatives to achieve the Medium-Term Business Plan

ESG Initiatives |

In order for the Group to continue to solve social issues through its business, it must create a sustainable future.

The Group will strengthen its efforts in the areas of “Environment,” “Social,” and “Governance.”

Environment

➢ Joined “RE Action—Declaring 100% Renewable.”

➢ Set goal to derive 100% of power needs for business activities from renewable energy sources by 2050 (40% by 2030).

➢ Raise environmental awareness through business activities, and contribute to the development of human resources that support a sustainable society

➢ Focus on reducing environmental load through business activities, and aim to create a circular economy.

➢ Reduce CO2 emissions, and contribute to the creation of a carbon-free society.

➢ Pursue environmentally friendly management, and make broad contributions to preserve the environment.

➢ Support companies that endeavor to resolve ESG-related issues.

Social

➢ Our Group’s businesses aim to resolve social issues.

Governance

➢ Outside directors make up 50% of our Board of Directors.

➢ Women make up 33.3% of our Board of Directors.

➢ To ensure our Group’s officers, employees, and service users can always perform their functions in a fair manner, we have taken advantage of our holding company structure to consolidate compliance systems in the holding company. By having the holding company concentrate on group-wide management, we aim to strengthen corporate governance across the Group.

Formulation of DX strategies |

It is indispensable to promote digital transformation (DX) and create new services and businesses in order to continue to stably provide services that are needed and to meet newly created demands.

☆Updating existing services

Shift from real to digital × Maximization of customer satisfaction

The company will realize updates with the digital technology to increase corporate value.

☆Utilizing the impact on the industry to promote digitalization

Top-class business scale in the industry in all businesses of childcare, human resources, and nursing care

The company will accelerate digitalization of the entire industry by becoming a model case for improving operational efficiency using the digital technology.

☆Creation of new value through the use of data

Data obtained by providing services to parents/children, job seekers/staff, residents/families, etc.

The company will create new services and businesses that are essential to society.

☆Creation of new value derived from the digital technology

Services that could not be provided due to limitations such as distance and time

The company will realize services and businesses that are essential to society using the digital technology.

M&A and business alliances |

After building a core business in the human resources services, the company has expanded its business to include childcare and nursing care through M&A and business alliances, and has expanded its domain in the human resources as well. For this reason, it is actively promoting M&A and business alliances.

The company is building a group structure with the expectation that sales will exceed 100 billion yen by the term ending May 2025 due to an increase in the number of projects related to its main domain, including childcare and nursing care-related services, which are facing challenges in securing human resources, succession issues, and management systems.

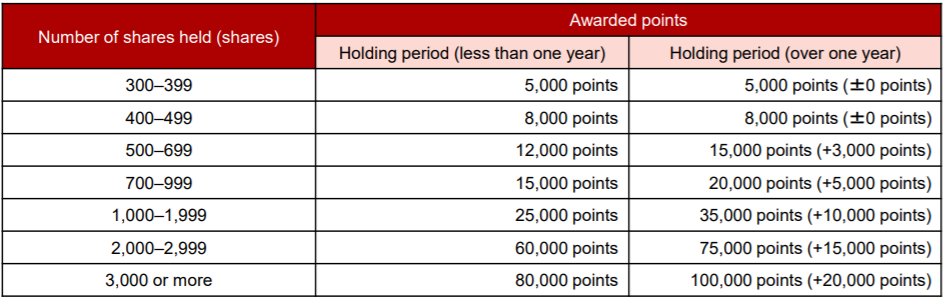

【1-4 Shareholder Benefit Program】

Provides the “LIKE Premium Benefit Club.”

Targets: Shareholders who are listed on the shareholder list as of the end of May every year and possess 300(3 lots) or more shares of LIKE.

Contents: Points are given to shareholders every July, based on the table below. In the special website (https://like.premium-yutaiclub.jp), shareholders can exchange their shareholder’s benefit points for some of over 2,000 kinds of complimentary items, including food products, home appliances, gifts, and miscellaneous goods.

The “LIKE Premium Benefit Club” has been changed (announced on January 12, 2021).

The number of points awarded has significantly increased. For example, if you hold 500 shares for less than one year, you will receive 12,000 points instead of 7,000 points, and if you hold 500 shares for one year or longer, you will receive 15,000 points instead of 7,700 points.

2. First half of Fiscal Year ending May 2021 Earnings Results

(1) Consolidated Earnings

| First half of FY 5/20 | Ratio to sales | First half of FY 5/21 | Ratio to sales | Y on Y |

Sales | 24,723 | 100.0% | 26,132 | 100.0% | +5.7% |

Gross Profit | 3,773 | 15.3% | 4,277 | 16.4% | +13.3% |

SG&A | 2,957 | 12.0% | 3,093 | 11.8% | +4.6% |

Operating Profit | 816 | 3.3% | 1,183 | 4.5% | +45.0% |

Current Profit | 924 | 3.7% | 1,718 | 6.6% | +85.8% |

Net Profit | 480 | 1.9% | 835 | 3.2% | +74.0% |

(Units:¥mn)

* Figures include reference figures calculated by Investment Bridge Co.; Ltd. Actual results may differ (Abbreviated hereafter).

Sales increased 5.7% year on year, and ordinary profit rose 85.8% year on year.

Sales increased 5.7% year on year to 26,132 million yen. Recognizing that the business domains of the company are essential to people’s lifestyles, not only in the childcare and nursing care industries through the management of in-company childcare centers, authorized nursery schools, after-school clubs for schoolchildren, etc. built by hospitals, enterprises, etc. and nursing care centers which ensure the health and safety of the elderly, but also through customer support and the sale of devices in the telecommunication industry, which supports the network infrastructure that make work-from-home and e-commerce possible, the manufacturing and distribution industry which supports the smooth distribution of daily necessities, as well as the construction industry, which is responsible for the construction and preservation of various facilities necessary for daily life, the focus was on the maintenance of an easy-to-work environment and job creation in order to increase the workforce.

Due to the spread of the novel coronavirus, sales in the fashion industry (apparel and cosmetics) and foreign-related manufacturing declined and a planned sales promotion event was cancelled in the comprehensive human resources service. However, the impact of the spread of the novel coronavirus on the company’s performance as a whole was minimal, as the company was able to change its focused industry during the previous fourth quarter, as it has been conducting its business by focusing on what is essential to society.

As for profit, gross profit margin rose from 15.3% to 16.4%. The cost of sales ratio improved by 1.3 points in the child-rearing support services, 1.0 points in the comprehensive human resources service, and 0.9 points in the nursing care-related services, as a result of the company’s awareness of appropriate profits to ensure the continuation of its business, since all businesses are essential to society. SG&A-to-sales ratio improved from 12.0% to 11.8%. Despite the increase in taxes and public charges due to a rise in the number of authorized nursery schools in operation and an increase in land rent due to office relocations, the company continued to make progress in improving the efficiency of headquarters operations and hiring through inter-group collaboration in the first quarter (June to August). As a result, operating profit margin increased from 3.3% to 4.5%, and operating profit grew 45.0% year on year to 1,183 million yen. Double-digit profit growth was achieved in each business, exceeding the budget. Ordinary profit rose 85.8% year on year to 1,718 million yen due to an increase in non-operating profit from equipment subsidies, and profit attributable to owners of parent increased 74.0% year on year to 835 million yen.

(2) Segment Earnings Trends

| First half of FY 5/20 | Ratio to sales | First half of FY 5/21 | Ratio to sales | YoY |

Childcare Support | 10,812 | 43.7% | 12,156 | 46.5% | +12.4% |

Comprehensive Human Resources | 10,324 | 41.8% | 10,203 | 39.0% | -1.2% |

Nursing Care | 3,422 | 13.8% | 3,624 | 13.9% | +5.9% |

Others | 164 | 0.7% | 147 | 0.6% | -10.4% |

Sales, Total | 24,723 | 100.0% | 26,132 | 100.0% | +5.7% |

Childcare Support | 259 | 21.8% | 428 | 26.8% | +64.9% |

Comprehensive Human Resources | 794 | 66.7% | 997 | 62.3% | +25.5% |

Nursing Care | 123 | 10.4% | 160 | 10.0% | +29.7% |

Others | 14 | 1.2% | 14 | 0.9% | +1.1% |

Adjustments | -375 | - | -416 | - | - |

Operating Profits, Total | 816 | - | 1,183 | - | +45.0% |

(Units: ¥mn)

* “Others” indicates businesses which are not included in the report segment.

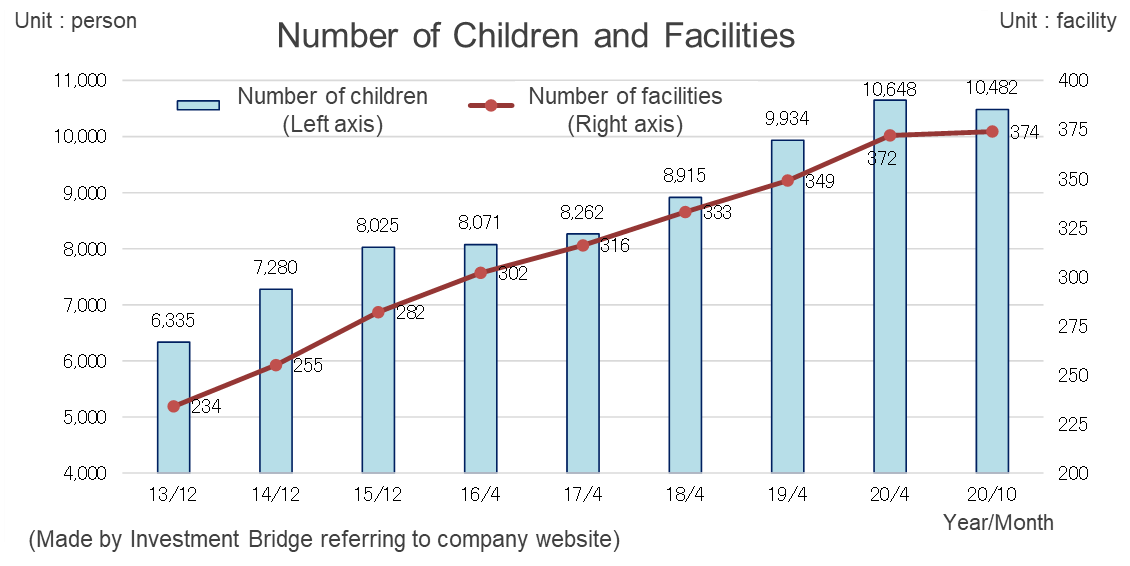

Childcare Support Business

Sales were 12,156 million yen, up 12.4% year on year, and operating profit was 428 million, up 64.9% year on year.

In addition to taking care of the children of medical personnel and people who play a role in protecting the infrastructure of daily life in the coronavirus crisis, childcare facilities are playing an increasingly important role in society as a safety net to prevent parents from isolation as they have fewer opportunities to discuss their concerns due to the new lifestyle.

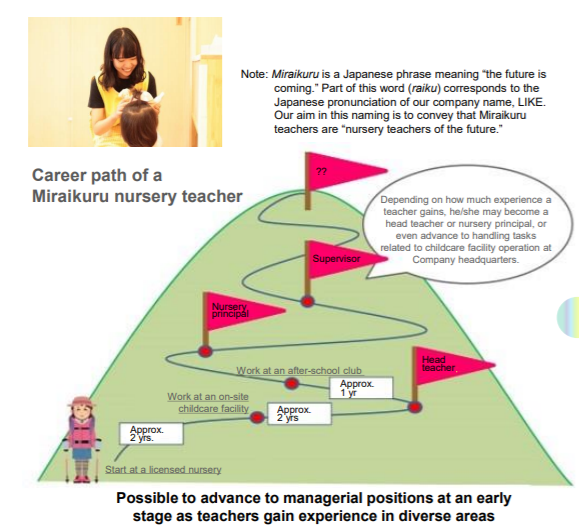

In response to the government’s “New Childcare Security Plan,” which sets a goal of securing childcare services for approx. 140,000 children over the four-year period from FY2021 to FY2024, LIKE Kids and LIKE Academy continued to focus on opening new facilities with convenient locations and equipment, and proposing in-company childcare services to businesses that are struggling to secure personnel. Also, the company made efforts to provide high-quality child-rearing support services, which continue to be chosen by parents and children even in new lifestyles, by utilizing digital technology in the operation of authorized nursery schools and after-school clubs for schoolchildren, as well as in the contracted operation of in-company childcare services such as company-led childcare ones set up by hospitals, enterprises, etc. In response to the worsening shortage childcare workers, the company strengthened its recruiting function through coordination with LIKE Staffing, Inc. to improve the retention rate by creating an easy-to-work environment for nursery teachers, resulting in the smooth acquisition of personnel.

As a result of strengthening the management system so that children can be left in the company’s care with peace of mind to meet the high level of demand for childcare even during the coronavirus crisis and making steady progress in the operation of new nursery schools, sales increased by more than 10% year on year following the first quarter. Operating profit also grew significantly as the company focused on receiving orders and operations at a reasonable profit.

The need for childcare remains at a high level even during the coronavirus crisis. The company strengthened its management system to provide stable services despite the unstable situation, and have already opened five new authorized nursery schools this term (one of which was converted from a ward-run to a private facility). As of the end of November 2020, the number of children in the company’s care exceeded 10,500.

As a result of a tender offer for consolidated subsidiary LIKE Kids, the company acquired all of its shares on August 28, 2020, making it a wholly owned subsidiary, but this will not have an impact on consolidated results until the second quarter.

Comprehensive Human Resources Service Business

Sales were 10,203 million yen, down 1.2% year on year, and operating profit was 997 million yen, up 25.5% year on year.

Recognizing once again that the mobile, manufacturing and logistics, call center, childcare and nursing care, and construction industries, which are the business domains of LIKE Staffing and LIKE Works, support the infrastructure for daily life amidst the spread of the novel coronavirus, there remains a strong demand for human resources known as essential workers. For this reason, they strived to expand its business by focusing on increasing the working population.

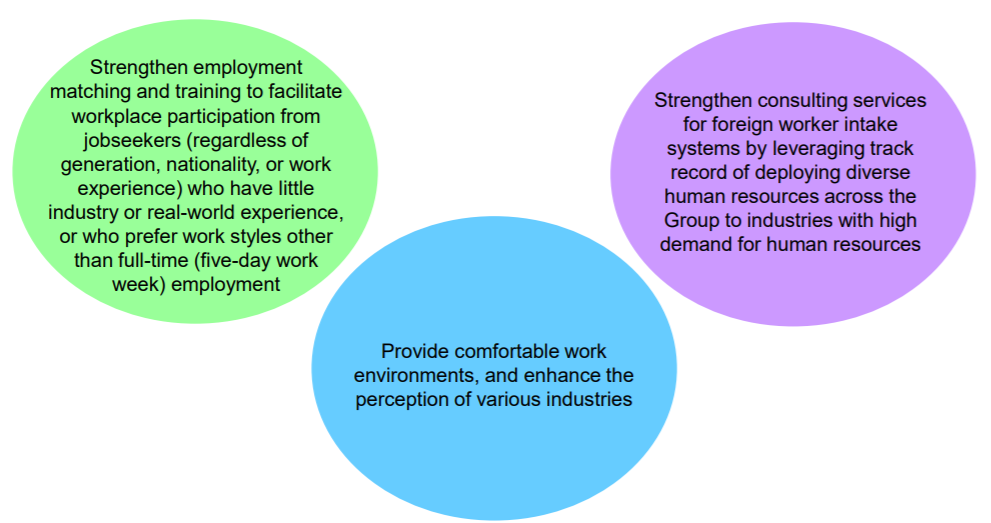

On the other hand, as some enterprises have been forced to reduce their workforce due to changes in the business environment, the companies proposed a variety of working styles for client companies and strengthening their matchmaking, employment follow-up, and training systems in order to support employment for job-seekers who have little work or life experience, or who want to work less than the full-time five days a week by utilizing the knowledge and know-how that they have accumulated in these industries, in order to strengthen job creation in parallel.

In addition, the company continues to focus on the expansion of services for the construction industry and foreign personnel employment support services, which it has been strengthening since the previous term, as new businesses that would become the next growth drivers.

As for services for the construction industry, the number of employees working as construction managers, site supervisors (assistants), site clerks, and BIM/CAD operators exceeded 100 in the first quarter, and the number is increasing further.

Mainly, the Group’s new graduates are working in “expert positions,” where they find out what job they really want to take and how they want to grow by working for the Group and move up in their career. This is a good match for the construction industry, where there is a growing demand for motivated young people who can learn to work as members of society, communicate well, and have no prior work experience in the industry.

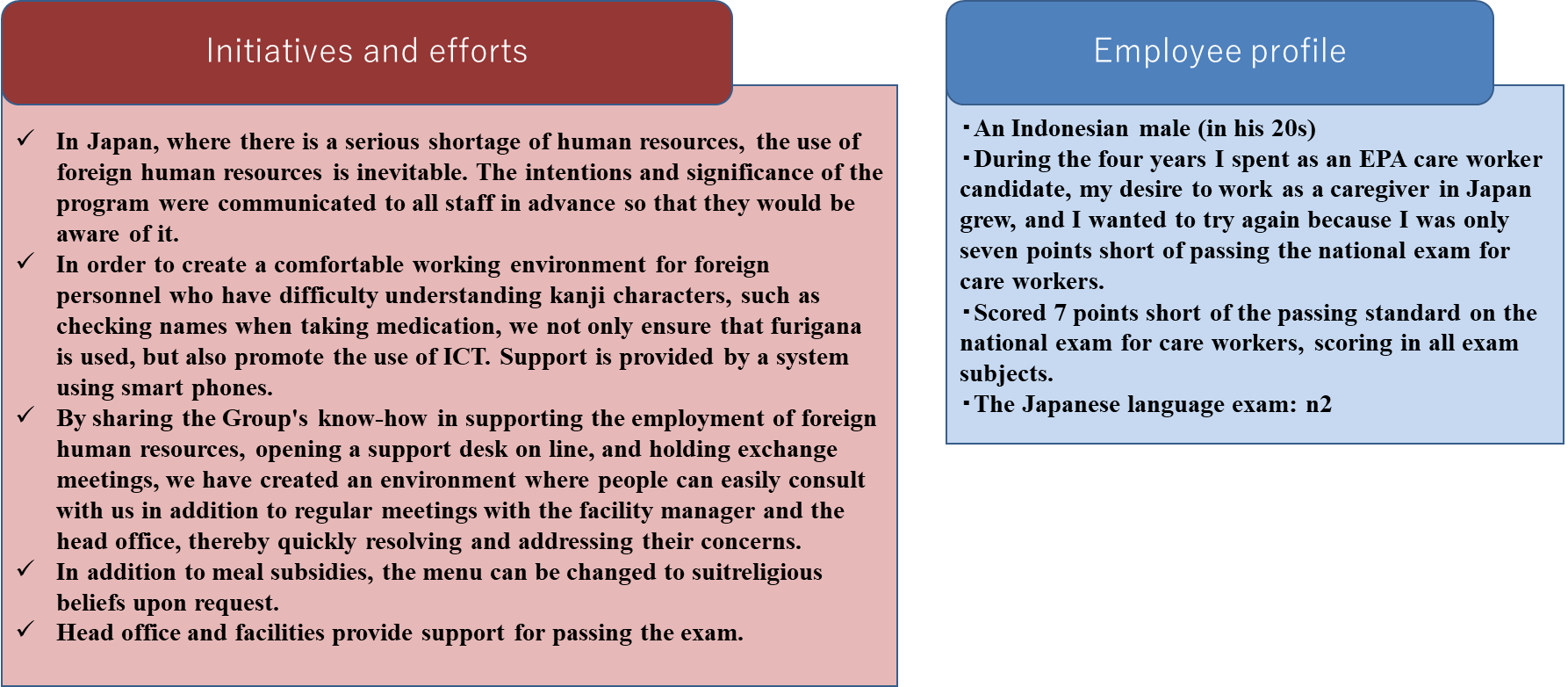

Although the spread of the novel coronavirus has impacted the foreign personnel employment support services, there are more than 130 foreign employees from 26 countries in the Group. In addition, it has been more than a year since the Group has been working with workers with the new resident visa status “Specific skills,” which was enforced in April 2019. Furthermore, 10 people are currently working for the company as they successfully entered the country from overseas. Utilizing its know-how as a leading company in the industry, the company is promoting employment support in the nursing care and construction industries, where demand for human resources is tight, mainly for job seekers who have studies or worked in Japan before, so that more companies can accept them smoothly when immigration is normalized.

Despite the drop in sales in the fashion industry (apparel and cosmetics) and foreign-related manufacturing as well as the cancellation of a planned sales promotion event because of the effects of the spread of the novel coronavirus, the company conducted its business by focusing on what is essential to society.

Sales Breakdown by Industry of Comprehensive Human Resources Service Business

Sales by Industry (Units: ¥mn) | First half of FY 5/20 | First half of FY 5/21 | Y on Y | |||

Sales | Ratio to sales | Sales | Ratio to sales | Increase/decrease | Rate of change | |

Mobile phone | 6,611 | 64.0% | 6,001 | 58.8% | -610 | -9.2% |

Manufacturing and logistics | 1,747 | 16.9% | 2,229 | 21.8% | +482 | 27.6% |

Call center | 635 | 6.2% | 712 | 7.0% | +77 | +12.2% |

Childcare | 192 | 1.9% | 169 | 1.7% | -22 | -11.9% |

Nursing care | 129 | 1.3% | 120 | 1.2% | -8 | -6.8% |

Construction | 44 | 0.4% | 90 | 0.9% | +45 | +101.7% |

Others | 963 | 9.3% | 878 | 8.6% | -84 | -8.7% |

Total | 10,324 | 100.0% | 10,203 | 100.0% | -120 | -1.2% |

*Due to reclassification, part of Call center is changed to Mobile phone (First half 163 million), apparel is included in Others.

(Made by Investment Bridge referring to company website)

Due to the spread of the novel coronavirus, sales promotion activities in stores such as apparel sales and mobile phone campaigns have changed. Continuing from the first quarter, the company focused on industries that support and are essential to the infrastructure of daily life, such as logistics and call centers that support e-commerce sales, construction, childcare, and nursing care, in line with the environment.

Sales declined only slightly as a result of making up for the decrease in sales of apparel (down 586 million yen year on year) and mobile campaigns, which are the mainstay of store sales, through the increased performance in the industries, such as logistics, call centers and construction, which support the infrastructure of daily life.

The company ensured the stable supply of human resources, which is essential for the stable and high-quality operation of the Group’s childcare and nursing care facilities.

・LIFE Kids: 137 million yen (up 7 million yen year on year)

・LIKE Care: 105 million yen (down 2 million yen year on year)

Nursing Care Services Business

Sales were 3,624 million yen, up 5.9% year on year, and operating profit was 160 million yen, up 29.7% year on year.

In addition to ensuring that customers were able to move in with peace of mind even during the coronavirus crisis, the company worked hard to provide high-quality services that continue to be chosen by users and their families by utilizing the digital technology, even in the face of restrictions imposed as a measure against the high risk of infection by the novel coronavirus. Due to the nature of the facility, which has strong ties with medical institutions and provides end-of-life care, there are a certain number of residents who move out due to death, but the occupancy rate is stable at a high level.

Others (Multimedia Service Business)

Sales were 147 million yen, down 10.4% year on year, and operating profit was 13 million yen, up 1.2% year on year.

In the multimedia services business, the company operate one mobile phone shop as a showroom of services for the mobile communications industry, which is the target of the comprehensive human resources service business.

(3) Financial Conditions

◎Financial Condition

| May 2020 | November. 2020 |

| May 2020 | November. 2020 |

Cash | 13,092 | 9,138 | Accounts payable | 3,263 | 3,245 |

Receivables | 4,258 | 3,933 | Taxes Payable | 1,431 | 925 |

Current Assets | 19,617 | 14,506 | Security Deposits | 976 | 908 |

Tangible Assets | 13,346 | 14,052 | Interest Bearing Liabilities (Inc. Leases) | 17,372(1,289) | 1,6937 (1,875) |

Intangible Assets | 1,554 | 1,319 | Liabilities | 25,670 | 25,417 |

Investments, Others | 5,305 | 5,348 | Net Assets | 14,154 | 9,809 |

Noncurrent Assets | 20,207 | 20,720 | Total Liabilities, Net Assets | 39,825 | 35,226 |

(Units: ¥mn)

The total assets at the end of the first half of the term were 35,226 million yen, down 4,598 million yen from the end of the previous term.

Current assets were 14,506 million yen, down 5,111 million yen from the end of the previous term. This is mainly because cash and deposits decreased 3,953 million yen with the repayment of short-term debts, current portion of long-term debts, and long-term debts, and notes and accounts receivables (sales credits) dropped 324 million yen.

Noncurrent assets were 20,720 million yen, up 513 million yen from the end of the previous term. This is mainly because of 705 million increase in tangible assets accompanying the establishment of new nursery schools in the child-rearing support services and a decrease of 222 million yen accompanying the amortization of goodwill.

Current liabilities were 15,684 million yen, down 743 million from the end of the previous term. This is mainly because of a 589 million yen drop in short-term debts, and a 3 million decline in income taxes payable.

Noncurrent liabilities were 9,732 million yen, up 490 million yen from the end of the previous term. This is mainly because lease obligations rose 585 million yen.

Net assets decreased 4,345 million from the end of the previous term to 9,809 million yen. This is mainly because the profit attributable to owners of parent in the fourth quarter was 835 million yen, the dividend amount paid was 266 million yen, noncontrolling interests dropped 4,071 million yen due to the acquisition of all shares of the consolidated subsidiary LIKE Kids on August 28, 2020, and capital surplus declined 957 million yen due to changes in the parent company’s equity in transactions with noncontrolling shareholders.

Capital-to-equity ratio improved 2.5 points from the end of the previous term to 27.8%.

3. Fiscal Year ending May 2021 Earnings Forecast

(1) Consolidated Earnings

| FY5/20 Actual | Ratio to sales | FY5/21 Est. | Ratio to sales | YoY |

Sales | 51,072 | 100.0% | 54,000 | 100.0% | +5.7% |

Child-Rearing Support Services | 22,966 | 45.0% | 26,123 | 48.4% | +13.7% |

Comprehensive Human Resources | 20,814 | 40.7% | 20,507 | 38.0% | -1.5% |

Nursing Care-Related Services | 6,984 | 13.7% | 7,100 | 13.1% | +1.7% |

Multimedia, others | 307 | 0.6% | 270 | 0.5% | -12.1% |

Operating Profit | 2,000 | 3.9% | 2,150 | 4.0% | +7.5% |

Current Profit | 4,067 | 8.0% | 4,100 | 7.6% | +0.8% |

Net Profit | 1,793 | 3.5% | 1,900 | 3.5% | +6.0% |

(Units: ¥mn)

Sales expected to increase 5.7% and ordinary profit estimated to grow 0.8% in FY 5/21.

The full-year forecast remains unchanged, with sales expected to increase 5.7% and ordinary profit estimated to grow 0.8%.

The company conducted a takeover bid for acquiring LIKE Kids, Inc. (6065) as a wholly-owned subsidiary, so at this time of publication of financial results (July 13, 2020), the earnings forecast was still to be determined, but it was determined as a wholly-owned subsidiary and disclosed on July 22, 2020.

There is no revision to the dividend forecast, either, which is expected to be 30.0 yen/share, up 2.0 yen/share year on year.

(2) Strategy in Each Segment

◎ Child-Rearing Support Services Business

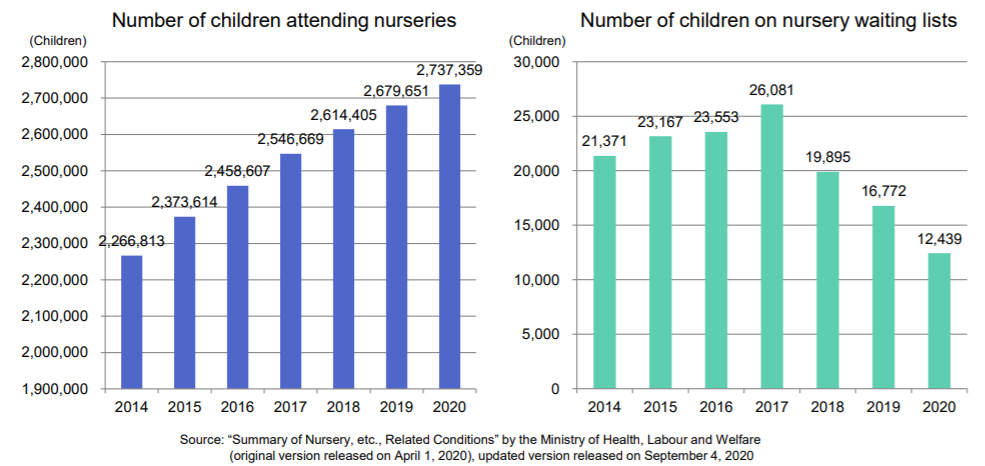

Business environment of child-rearing support services

While the number of children enrolled in nursery schools is growing and the number of children being put on the waiting list for nursery schools is dropping for three years in a row, the Cabinet Office projects that Japan’s capacity will not be sufficient, and 141,000 children will not be able to receive childcare services in fiscal year 2024. The Ministry of Health, Labour and Welfare has drawn up “Shin Kosodate Anshin Plan,” a new child-rearing program aimed at ensuring childcare facilities and services for approximately 140,000 children for the four years from fiscal year 2021 to the end of fiscal year 2024.

(Source: the company)

There are 12,439 children on the waiting list for nursery schools. The number remains high mainly in urban areas.

The number of children on waiting lists in the Tokyo metropolitan area and the Kansai region

Tokyo metropolitan area 4,755 ・Tokyo 2,343 ・Saitama Pref. 1,083 ・Chiba Pref. 833 ・Kanagawa Pref. 496 | Kansai region 2,620 ・Osaka Pref. 348 ・Hyogo Pref. 1,528 ・Shiga Pref. 495 ・Nara Pref. 201 ・Kyoto Pref. 48 |

Business policy on child-rearing support services

To become a business that is essential to children and their guardians

(Source: the company)

Step up openings of new facilities with favorable conditions (location, facilities, etc.), and strengthen proposals for on-site childcare facilities

(Source: the company)

The strong relationships with developers, which LIKE, Inc. has forged in the course of newly opening about 20 licensed nursery schools each year, enable the company to secure property located in highly convenient areas. The company is also capable of creating interior designs by swiftly reflecting social needs.

LIKE, Inc. fosters a comfortable workplace environment by proposing in-company nursery schools to operators that struggle to secure manpower, particularly medical workers and those who protect infrastructure for daily life.

Provision of high value-added services that meet the needs of children and their guardians

○Currently developing an app to maintain close communication with guardians and respond to their needs.

Envisioned features

Sales of photos, sales of nursery necessities that are difficult to carry around or find places of sale, reliable sale and purchase of used items with limited number of users, online classes such as for English language

○ Offer new child-rearing support services that satisfy the needs of children and their guardians in the new normal in the wake of the novel coronavirus crisis

YouTube “Hoiku no Hikidashi” (Ideas for childcare activities)

https://www.youtube.com/channel/UCbQak-4Wmmm9j7D-F9OxMoA/featured

○ Offer clinical psychologists’ online support to parents and guardians who have limited opportunities to seek advice in the new normal amid the novel coronavirus crisis

“Rinsho Shinrishi Yorisoi Madoguchi” (Consultation desk by clinical psychologists)

https://www.like-kn.co.jp/academy/yorisoi-madoguchi.html

Establishment of new childcare facilities, and recruitment and development of human resources who support high value-added childcare services

| Recruit childcare workers, who rarely change their jobs, as generalists and develop management staff who will take central roles in business administration; create a new pay system and training programs and help childcare workers carve out careers Improve the recruitment capability and retention rate using the expertise of LIKE Staffing, Inc. in recruitment and support after employment Expand the capability for matching job seekers to job opportunities by sharing know-how through proactive group-wide personnel exchange Focus on generating human resources through group-wide sharing of education and training contents

|

(Source: the company)

◎ Comprehensive Human Resources Services Business

Business environment of comprehensive human resources services

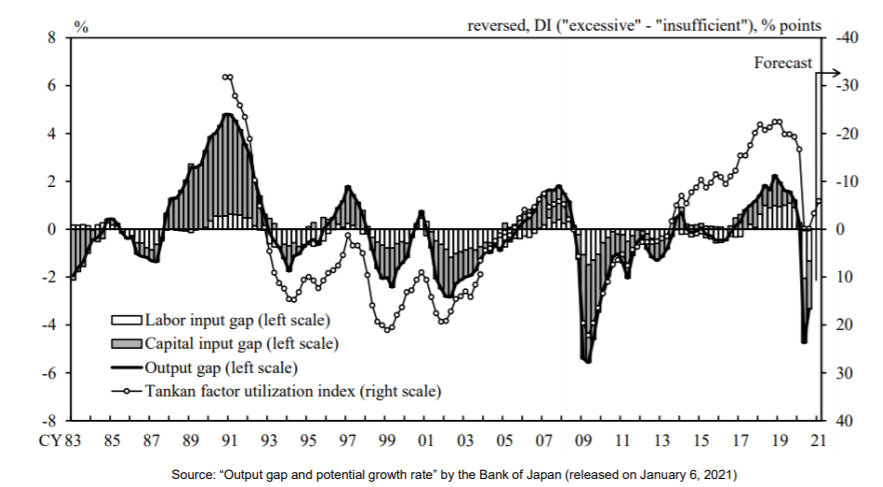

In the period from July to September 2020, the “labor input gap,” which reflects such matters as working hours and the employment rate, remained low at -1.33%, and momentum for restrictions on economic activities is building up nationwide, through which securing employment has emerged as a social issue.

(Source: the company)

While Japan’s overall jobs-to-applicants ratio was low at 1.06 as of November 2020, leading to uncertainties over the future, demand for human resources is rising in industries and occupational categories that support infrastructure for everyday life. In particular, the nursing care industry whose jobs-to-applicants ratio continues to be high at about 4 and the construction industry only 10% of whose workers are 29 years old or younger, will face a desperate labor shortage in the future.

Mobile industry | Demand increases for mobile device sales and customer support personnel to bolster network infrastructure essential for teleworking and e-commerce. |

Call centers | |

Childcare industry | There was pressing demand for personnel even before the pandemic. Demand has further increased as these industries are deemed essential in supporting people working in the lifestyle infrastructure-related industries. Demand cannot be met with the Japanese workforce only. |

Nursing industry | |

Logistics and manufacturing | Demand expands for people who take on light work at warehouses and factories, and for drivers as e-commerce has become the mainstay. |

Construction | Demand grows for personnel who engage in construction, maintenance, and repairs of facilities that are essential to the lives of people. |

Business policy on comprehensive human resources services

To create employment by helping workers with diverse backgrounds seize job opportunities and solve manpower shortages afflicting industries essential for daily life

(Source: the company)

【Progress with new businesses】

Services targeted at the construction industry

| A manpower shortage is a thorny issue for all types of jobs, including construction managers, site supervisors (assistant supervisors), on-site clerical staff, and BIM/CAD operators.

As only 10% of workers in the industry are 29 years old or younger, the industry is struggling to recruit and develop new graduates, and improve retention rate. (Made by Investment Bridge referring to company website) | |||||

|

|

|

|

| ||

➢ This business helps many people serve substantial roles in the construction industry, including people seeking expert positions, which is a career path taken by those who hope to determine which kind of job they want and how they want to grow while working, people who work in different industries but hope to move up the career ladder in the industry, and workers from overseas countries. The number of workers was over 100 as of July 2020, and sales showed growth.

➢ The company fully launched a career transition support business targeting the construction industry and began offering education and training with the aim of developing engineers at “LIKE Challenge Support Omori Eki-mae,” an office for supporting workers in career transition, in October 2020. People attending the training program there are expected to begin to work at the client companies of LIKE, Inc. after mastering how to use specialized software through six-month BIM training.

Employment support services for foreign workers

| August 2019: LIKE Staffing, Inc. was registered by the Commissioner of the Immigration Services Agency of Japan in the registry of “Registered Support Institutions” that provides people with support in their professional, daily, and social lives so that they can stably and smoothly engage in jobs under the Specified Skilled Worker (i)” status. (Registration No.: 19‐001950) September 2019: LIKE Care Inc., which operates 24 nursing centers in the Tokyo metropolitan area, received the certificate of “Specified Skilled Worker (i)” in the nursing sector.

| |

October 2019: Workers certified for the “Specified Skilled Worker (i)” status began their jobs at LIKE Care Inc. March 2020: From among the international students who passed the tests given in Japan, those who were certified for the “Specified Skilled Worker (i)” status began their jobs at LIKE Care Inc. August to November 2020: LIKE Care Inc. received the certificate of “Specified Skilled Worker (i)” newly for eight workers for nursing services.

December 2020: A total of 10 people (five of which are from overseas countries) work at LIKE Care Inc. under the “Specified Skilled Worker (i)” status. |

| |

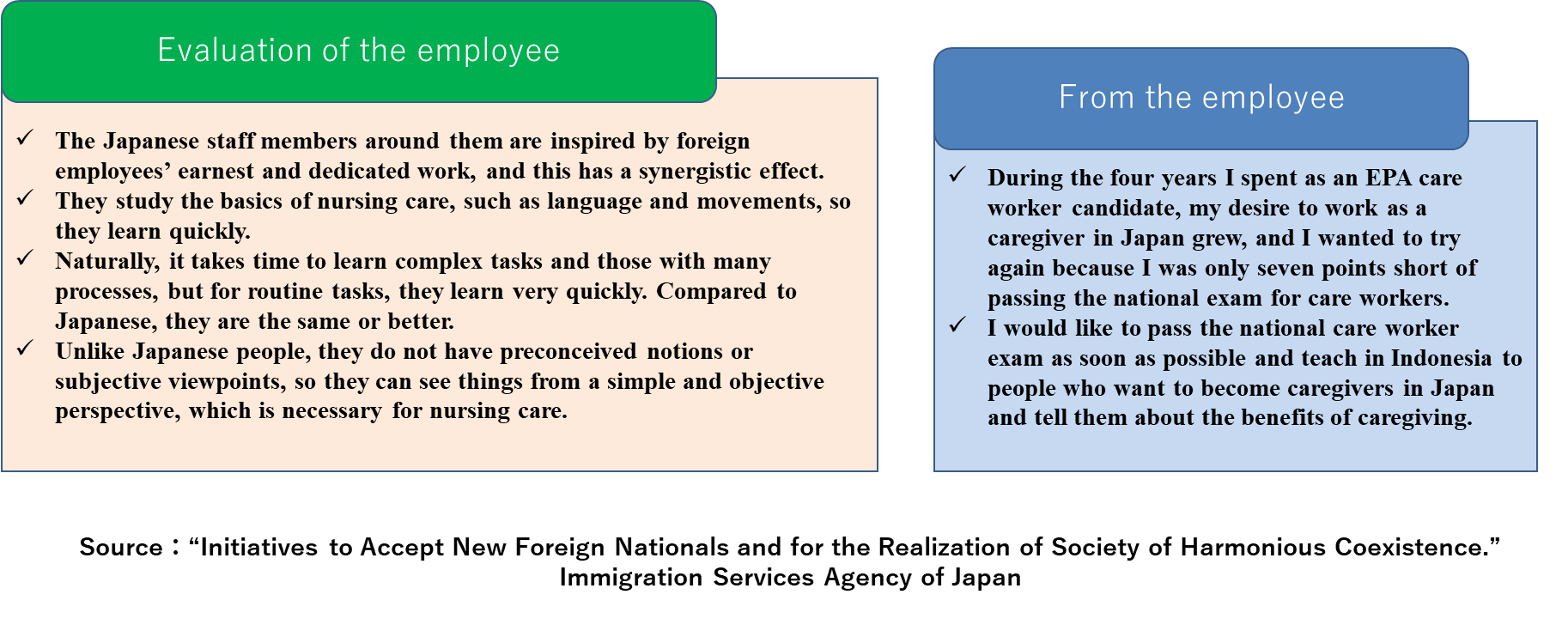

The LIKE Group has more than 130 employees with foreign nationality from over 26 nations and they have been working under the “Specified Skilled Worker” status for over a year; therefore, the corporate group will propel forward employment support services for such industries as nursing care and construction by taking advantage of its know-how as a leading company of the industry.

✓ LIKE, Inc. encourages employment of workers from overseas countries by offering the whole industry its recruitment and development know-how, which is demonstrated by its multifarious achievements, such as the fact that 100% of about 30 foreign care providers, who work at nursing care facilities, passed the care worker induction course.

✓ LIKE, Inc. helps obtain visas by providing education and training programs to workers with working experience in industries in which job opportunities are lost and salaries are cut due to the novel coronavirus crisis and international students who are struggling to find jobs in industries where they hoped to work.

✓ LIKE, Inc. encourages employment of foreign workers living in Japan so that as many companies as possible will be able to employ workers from overseas nations smoothly when the travel ban is lifted.

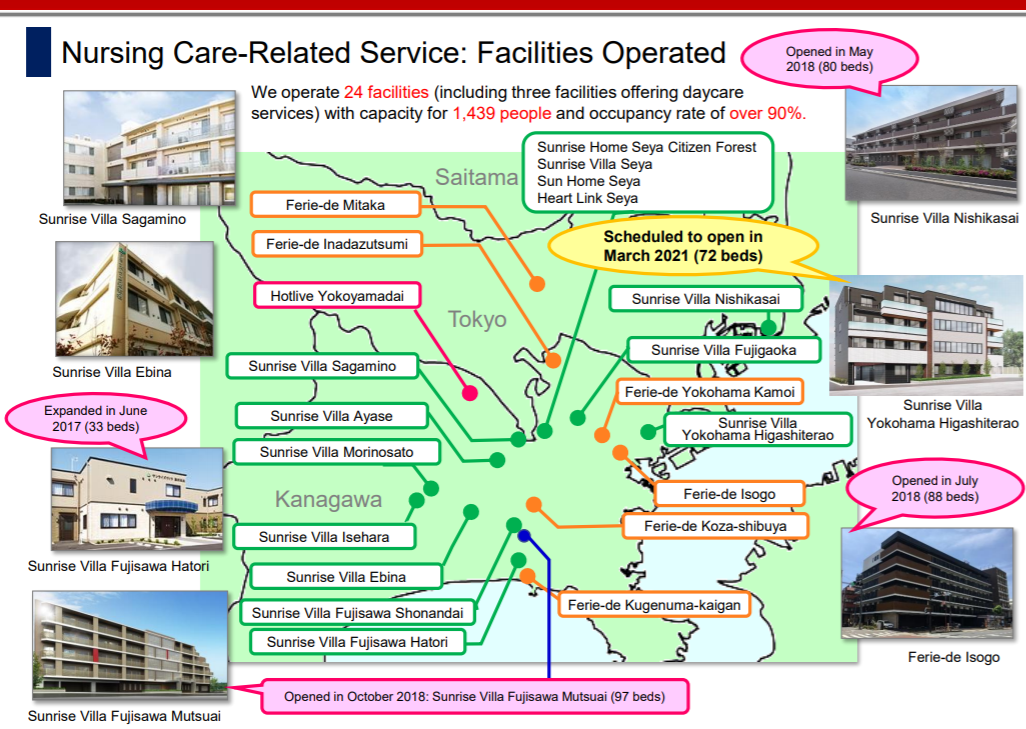

◎ Nursing Care-Related Services Business

Business environment of nursing care-related services

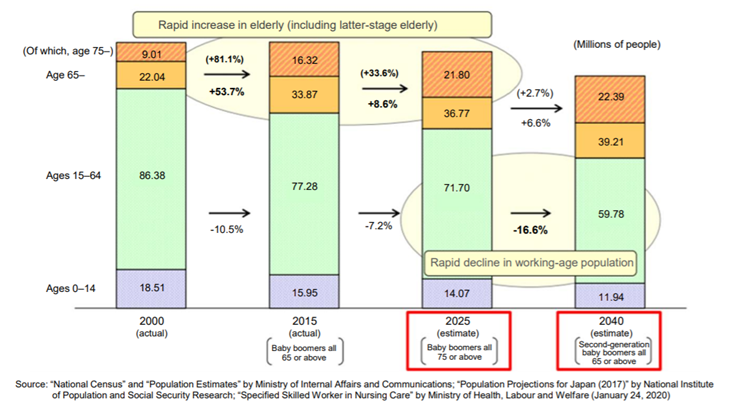

The number of the late elderly is surging, and all people of the baby boomer generation will be 75 years old or older in 2025 and all children of the baby boomer generation will be 65 years old or older in 2040.

(Source: the company)

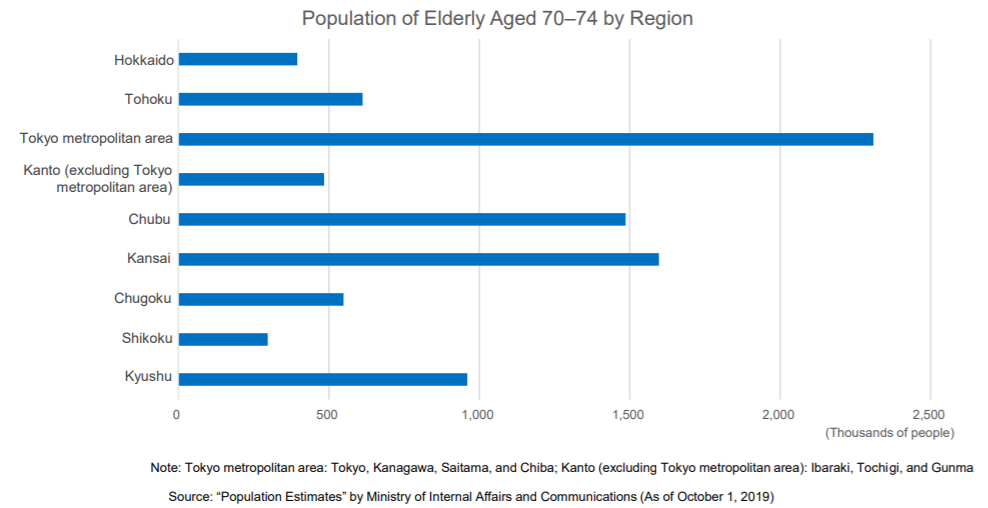

There are 2,310,000 people of the baby boomer generation (those aged 70-74), and they live mainly in the Tokyo metropolitan area.

Demand for nursing care will get stronger in the Tokyo metropolitan area where the corporate group runs the business of nursing care-related services.

(Source: the company)

Business policy on nursing care-related services

To become a business that is essential to users of the services and their families mainly in the Tokyo metropolitan area where demand for nursing care is rising

Enrich services, such as platforms that prevent those who take care of their family members at home from feeling isolated and roles in instilling the concept of diversity into the nursing care industry |

(Source: the company)

(Source: the company)

4. Conclusions

In the middle of the coronavirus crisis, sales were strong in the first half following the first quarter. The company’s strategy to focus on “must haves” continues to be successful. We consider that the focus this time is on the medium-term business plan. In the previous medium-term business plan, which ended in the term ended May 2019, sales fell short of the target, but ordinary profit exceeded it. The new medium-term business plan is a range plan, and EPS is expected to be around 200-250 yen. The company plans to aggressively engage in M&A and business alliances, and is eyeing sales of 100 billion yen. This medium-term business plan can be said to have a variety of possibilities. The child-rearing support services and nursing care-related services are expected to see stable growth, with contributions from new openings and considering the room for market expansion. The focus will be on the expansion of the comprehensive human resources service. The reason why the medium-term business plan is in a range is because there is a possibility of changes in the expansion of these services due to the spread of the novel coronavirus. However, the company is making steady progress in this area, as sales to the construction industry, which it launched as a new business, have increased significantly. We also have high expectations for its DX initiatives. We believe that the share price is sufficiently low considering the profit level in the medium-term business plan. ESG investment has been in the spotlight recently, and there is a great deal of room for review of the share price in light of this, as well as the enhanced shareholder benefits.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory committee |

Directors | 6 directors, including 3 outside ones |

◎ Corporate Governance Report:Updated on August 28, 2020

Basic Policy

Our company aims to be a corporate group that is indispensable to society at any stage of life with a group mission of “planning the future – Developing people and creating the future –” and recognizes the initiatives for corporate governance as an essential management task. For its realization, we make use of our holding company structure and consolidate the compliance system in the holding company so that executives, employees and service users of our group can take fair and efficient actions at all times, and attempt to strengthen corporate governance of the whole group by centralizing the functions of the holding company by the management of the entire group.

1. Ensuring the rights and equality of shareholders

We take appropriate measures so that the rights of shareholders, including the voting rights at the general shareholders meeting, are substantially ensured.

2. Appropriate cooperation with stakeholders excluding shareholders

On the basis of our group mission, we will continue to enhance our corporate value by acting in good faith with all stakeholders including service users, clients, shareholders and employees, keeping in mind the Code of Conduct and principles of action.

3. Appropriate disclosure of information and ensuring transparency

We will make appropriate disclosure of information based on laws and ordinances and actively provide non-financial information and information other than the information disclosed based on laws and ordinances.

4. Responsibilities of the Board of Directors and others

The board of directors formulates the basic policy and strategies for the management of the group and manages and supervises the business firm. It operates as a body that supervises the management decision-making in the entire group and the business execution by the board of directors. In addition, the independent outside director works to strengthen the management discipline and increase the transparency further.

5. Dialogue with shareholders

We put importance on dialogue with shareholders to maximize the corporate value of the group, and respond to requests for dialogue from shareholders at any time. The dialogue with shareholders is carried out by the contact person in charge of IR, executives in charge of IR and the management executives as necessary.

Implementation Status of Principles of Corporate Governance Code

<The number of principles of Corporate Governance Code the Company does not comply with: 3, including the following>

【Supplementary principle 1-2-4】

Our company currently does not have any infrastructure that allows the exercise of electronic voting; however, we will consider using electronic voting by taking into account the proportion of institutional and overseas investors to the total number of shareholders.

【Supplementary principle 4-10-1】

Although we have not set up any independent advisory committee, our company explains nomination of candidates for directors and remuneration of directors to independent outside directors and obtain appropriate advice from them prior to a resolution by the board of directors. Since we obtain appropriate involvement and advice of independent outside directors regarding nomination of candidates for directors and directors’ remuneration as mentioned above, we consider that the independence, objectivity, and accountability of the functions of our board of directors pertaining to the aforementioned matters have been sufficiently secured.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

We will consider strategically holding shares of any listed company only when synergy of corporate value improvement has been recognized. Our company has confirmed the significance of the strategically held shares that we are currently possessing. Furthermore, with regard to the exercise of our voting rights as to those strategically held shares, we will declare our intention to approve or disapprove a case by taking into account whether the relevant company’s corporate value is improved and whether the exercise impacts our company.

【Principle 2-6】

Our company has not adopted a corporate pension plan.

【Principle 5-1】

・Our company has designated a director and contact person , both of which are in charge of overall IR activities for our corporate group, in order to encourage constructive dialogue with shareholders.

・Our company exerts ourselves to disclose information in a fair, timely, and proper manner in accordance with “Disclosure Policy” that we have set forth to organize our basic ideas.

・Our company discloses Disclosure Policy on our website ( https://www.like-gr.co.jp/ir/policy.html ).

・The details of our IR activities are as described in the second section of “Implementation Status of Policies regarding Shareholders and Other Stakeholders” in this report.

Tokyo Stock Exchange Corporate Governance Information Service:

https://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2021 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Report on LIKE, Inc. (2462) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url:www.bridge-salon.jp/