Bridge Report:(2462)LIKE fiscal year ended May 2022

Yasuhiko Okamoto, Chairman andPresident | LIKE, Inc. (2462) |

|

Company Overview

Market | TSE Prime Market |

Industry | Service |

Chairman and President | Yasuhiko Okamoto |

HQ Address | Shibuya Mark City West 17F, 1-12-1 Dogenzaka, Shibuya-ku, Tokyo |

Year-end | The end of May |

Homepage |

Stock Information

Share Price | Shares Outstanding (Excluding treasury shares) | Market Cap | ROE (Act.) | Trading Unit | |

2,303 yen | 19,190,103 shares | 44,195 million | 25.2% | 100 shares | |

Dividend Yield (Est.) | Dividend Yield (Est.) | EPS(Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

53.00円 | 2.3% | 174.57 yen | 13.2x | 730.69円 | 3.2x |

* The share price is the closing price on August 2. The number of shares issued at the end of the latest quarter excludes its treasury shares.

* ROE and BPS are results for FY 5/22, EPS and DPS are forecasts for FY 5/23, and figures rounded.

Earnings Trends

Year | Sales | Operating Profit | Current Profit | Net Profit | EPS | DPS |

May 2018 | 45,663 | 1,915 | 3,889 | 1,532 | 81.49 | 29.00 |

May 2019 | 47,797 | 1,746 | 3,753 | 1,595 | 84.58 | 26.00 |

May 2020 | 51,072 | 2,000 | 4,067 | 1,793 | 94.41 | 28.00 |

May 2021 | 54,274 | 3,610 | 5,341 | 3,262 | 171.10 | 50.00 |

May 2022 | 57,642 | 4,238 | 5,234 | 3,268 | 170.87 | 52.00 |

May 2023 Est. | 61,600 | 4,350 | 5,300 | 3,350 | 174.57 | 53.00 |

* Estimates are those of the company. Unit is million yen, EPS and DPS are yen. Net profit is profit attributable to owners of the parent. Hereinafter the same shall apply.

* EPS reflects the change made after a 2 for 1 stock split was conducted in September 2017.

This Bridge Report presents details of the fiscal year ended May 2022 earnings results and fiscal year ending May 2023 earnings forecast for LIKE, Inc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended May 2022 Earnings Results

3. Fiscal Year ending May 2023 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended May 2022, sales increased 6.2%, and ordinary income decreased 2.0% from the previous term. The sales of childcare support services, comprehensive human resources services, and nursing care-related services increased. Sales exceeded the forecast in the comprehensive human resources services thanks to the good performance in the mobile and logistics/manufacturing sectors. Gross profit margin declined due to an increase in various costs such as school lunches and utilities. Still, operating income increased 17.4% due to a decrease in SG&A expenses resulting from the improved efficiency in headquarters operations. Ordinary income decreased due to the decline in equipment subsidy income in the section of non-operating income. A term-end dividend of 26.00 yen/share was paid, and the annual dividend was 52.00 yen/share.

- For the term ending May 2023, sales are expected to increase 6.9% year on year, and ordinary income is projected to rise 1.3%. In childcare support services, the company plans to open around 10 licensed nursery schools and expects a 4.4% increase in sales. In the comprehensive human resources services, the company will intensify its investment in growing markets, including logistics/manufacturing, nursing care, construction, and foreign human resources, which will result in a 12.0% increase in sales. Regarding nursing care-related services, the company plans to continue opening new facilities centering on paid nursing homes with healthcare services for the elderly and will promote collaboration with the comprehensive human resource services business, and it is projected that sales will increase 1.2%. The company will also seek opportunities for M&A in all businesses. The company will pay an interim dividend of 26.00 yen/share and a term-end dividend of 27.00 yen/share for an annual dividend of 53.00 yen/share.

- In the term ended May 2022, sales and operating income reached record highs, demonstrating steady growth. Regarding the forecast for the term ending May 2023, Chairman and President Okamoto commented, "If possible, we would like to exceed the company's forecast greatly." Thus, we expect a double-digit increase in operating income. In the childcare support service business, it is likely that there will be a significant rise in the number of commissioned operations of public nursery schools in the future. In the comprehensive human resources services, we can expect further expansion in the logistics and manufacturing sector, which grew significantly in the term ended May 2022. Chairman and President Okamoto stated that the company wants to significantly exceed the targets of the medium-term plan, that is 100 billion yen in sales and 8 billion yen in operating income, while achieving sales expansion through M&A, and demonstrated confidence that the company will achieve that. In addition, the company will fully use its know-how that has been nurtured since its founding in "recruiting unqualified and inexperienced human resources early and in large numbers and turn them into capable staff" for the effective utilization of foreigners in the future, especially to solve the severe labor shortage in the nursing care industry. Assuming the achievement of the medium-term plan, EPS is expected to be around 250 yen without considering the subsidy income to be recorded as non-operating income. Regarding the stock price, considering the ambitious comment that the company wants to greatly exceed the earnings forecast for the term ending May 2023 and the profit level in the medium-term plan, we think it is undervalued.

1. Company Overview

Based upon its corporate management philosophy of “Planning the Future – Leveraging Human Resources to Create the Future,” LIKE endeavors to create an “indispensable corporate group structure” that is capable of providing vital services at every stage of life (from the cradle to the happy twilight years) in the operating realms of child and nursing care, human resources and other services.

(Source: the company)

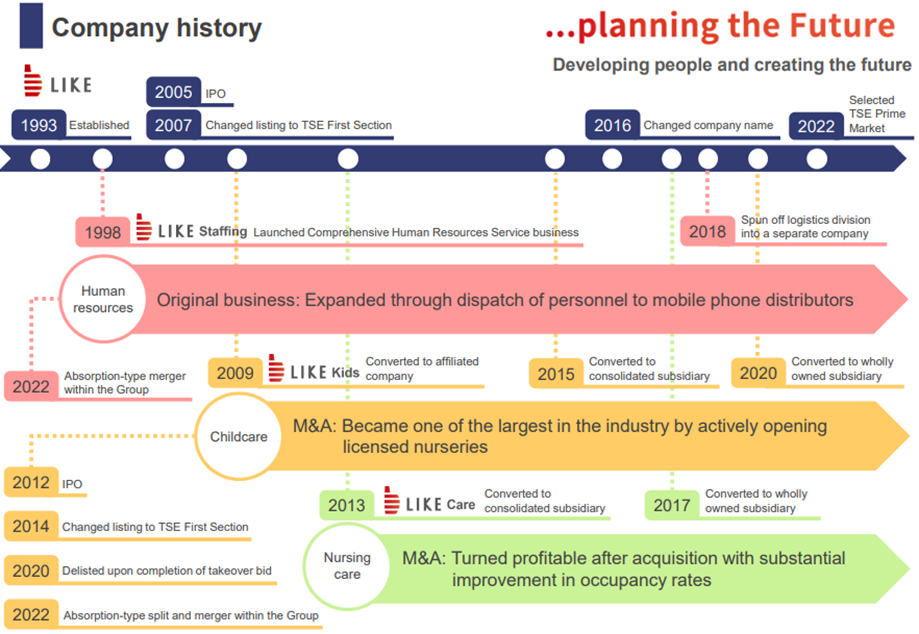

【1-1 Corporate history】

LIKE was established in 1993 for the purpose of operating the travel package planning business. The foothold for the current main business is the comprehensive human resources service business, which was launched in 1998. The company was listed on Mothers in 2005 and moved to the first section of the Tokyo Stock Exchange in 2007. Selected the Prime Market of TSE in April 2022. In 2009, the company shifted to a holding company structure and expanded its business domain to include childcare services and nursing care-related services through acquisitions.

(Source: the company)

【1-2 Business Segments and LIKE Group Companies】

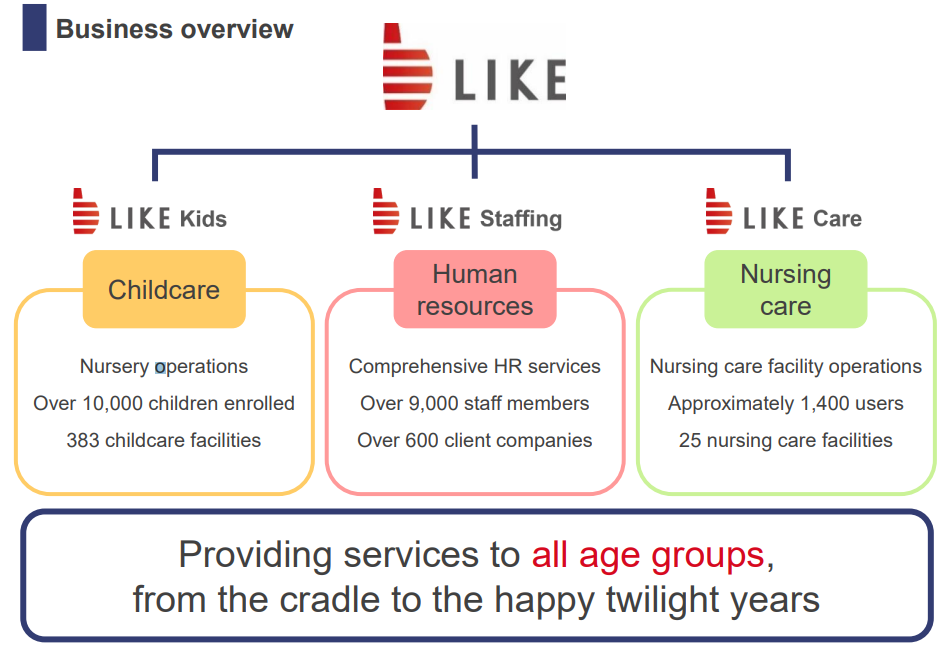

LIKE’s business segments are divided into operation of public childcare facilities and child-rearing support services on consignment, the comprehensive human resources services business, which includes human resources dispatch, business process consignment, dispatched worker for employment and job placement, hiring and training support services, the childcare support services business, which includes consigned operation of public and private childcare facilities, the nursing care services business, which includes nursing facility operations.

(Source: the company)

The LIKE Group comprises the holding company LIKE, Inc., four consolidated subsidiaries and one non-equity accounting method affiliate. The consolidated subsidiaries include LIKE Kids, Inc., which is engaged in contracted childcare and public childcare services (operation of authorized nursery schools, etc.), LIKE Staffing, Inc., which provides worker dispatch and business process consignment services to cellular telephone shops within its comprehensive human resources services business, and LIKE Care, Inc, which operates nursing-care facilities. In addition, LIKE Products , Inc. was newly established to promote sales of goods and services by leveraging its know-how for facility operation. In addition to these, a joint venture company called Career Design Academy, Inc., has been created to provide corporate training services with LIKE Staffing, Inc., and T-Gaia Corporation (Tokyo Stock Exchange, Prime Market, Stock code:3738) providing 20% and 80% of the capital, respectively.

Establishment of LIKE Products

Promoted sales of goods and services utilizing the know-how for facility operation

①Procurement of goods within the Group | ➢ To first integrate intra-group purchasing processes ➢ Cost reduction by taking advantage of economies of scale |

②Streamlining of business operations | ➢ Integration of purchasing procedures to improve operational efficiency ➢ Promotion of digitalization through the installation of systems |

③External sales of goods and services | ➢ Sales of goods and services for childcare and nursing care households ➢ External sales of operation package services for business operators |

【1-3 The Like Group's Strengths】

Human resources management skills cultivated in the human resources business, which is the founder's business (Turning unqualified and inexperienced human resources into the workforce quickly and in large numbers) | × | Flexible positioning in growing labor-intensive markets |

Business synergies based on strengths

Synergies among businesses through employees based on human resources management skills

(Source: the company)

Characteristics of Business Development Based on Strengths

Capabilities held by the Group correspond to success factors in labor-intensive growth markets | & | Appropriate resources allocation and positioning through agile management decisions |

⬇

Targeting not only the three existing businesses but also the entire labor-intensive growing market |

【1-4 Mid-term Management Plan】

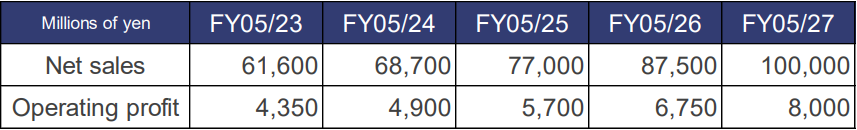

A new medium-term management plan was formulated.

■Purpose of the New Mid-term Management Plan

The spread of infectious diseases generated an opportunity for the Company to reaffirm how much society needs the services of each of the businesses operated by the Corporate Group. The changes in the business environment caused by the spread of infectious diseases and the normalization of the business environment due to the subsiding of infectious diseases foreshadow a new competitive environment, and the Company sees these changes as an opportunity for business growth. The company has formulated a new medium-term plan to seize these opportunities to achieve overwhelming business growth and become a truly "indispensable company" to the world.

■Performance Targets in the Medium-Term Management Plan

The company plans to achieve sales of 100 billion yen and an operating income of 8 billion yen in FY 5/27. Based on the premise of organic growth, the company aims to further expand its business performance through M&A.

(Source: the company)

The company will strive to complete the plan in order to contribute to the realization of a sustainable society by providing its services widely to the world and helping solve various social issues.

■Previous Achievements with Mid-term Management Plans

Steady expansion of business performance by strategically building a portfolio of businesses through M&A while expanding into growth segments in existing businesses.

FY 5/15-FY 5/17 | ➢ Substantial achievement of the plan due to the inclusion of childcare business in the scope of consolidation ➢ Establishment of a business structure composed of childcare, human resources, and nursing care businesses | Net sales: 18 billion yen → 40 billion yen |

FY 5/17-FY 5/19 | ➢ Business expansion through aggressive opening of childcare facilities ➢ Rapid growth in human resources business in the logistics field | Net sales: 40 billion yen → 47.7 billion yen |

FY 5/21-FY 5/25 | ➢ Disclosure of results with ranges of financial figures due to the impact of COVID-19 ➢ Achieved the plan for FY 5/21-FY 5/22 | Net sales: 54.2 billion yen →70-83 billion yen (plan) |

■Strategies to achieve the mid-term management plan

①Childcare Support Services

Sales forecast for FY 5/27: 36.3 billion yen

Market Trends | ➢ The number of people needing childcare is expected to increase from 2.73 million to 3.34 million between 2020 and 2040. ➢ The number of people needing childcare as of 2021 was 2.74 million, almost in line with the forecast. ➢ The number of children on waiting lists for daycare centers: 5,634, the number of potential children on waiting lists: 63,581, and the number of children on waiting lists for school-age children: 13,416, indicating that there is still a need to secure childcare facilities. | |

|

|

|

Strategy |

To establish facilities | ➢ Focus on opening various types of facilities, such as licensed preschools, outsourced facilities, and after-school childcare centers ➢ Increase of cases in which the operation of public preschools is outsourced ➢ Considering opening new facilities in new areas such as the Kansai region |

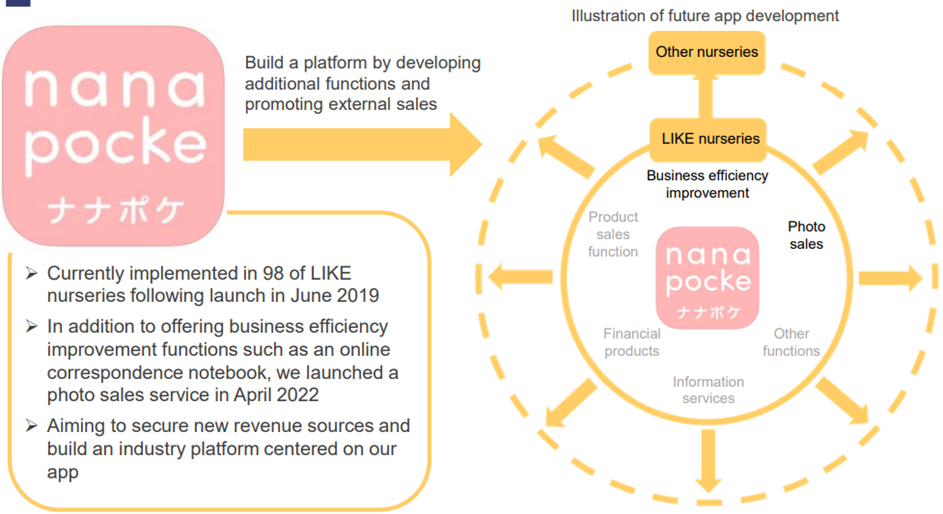

New Businesses | ➢ To promote the platform business centered on the company's "Nana Pocke" app ➢ Photo sales service "Nana Pocke Photo" will be rolled out to all preschools in July. ➢ To develop BPO services such as billing services for local governments | |

M&A | ➢ Actively considering M&A as an effective strategy due to the large number of companies in the industry ➢ Going forward, competition will become fiercer due to the declining birthrate. ➢ Industry reorganization including listed companies is expected to become more active. | |

②Comprehensive human resources services

Sales forecast for FY 5/27: 45 billion yen

Market Trends & Strategy | Mobile | ➢ Aiming to increase the market share as the number of carrier shops declines and agencies consolidate/withdraw, in parallel with the shift from the needs for full-time employees to the needs for temporary staffing ➢ Aiming for large orders for outsourcing to consumer electronics mass retailers |

Call center | ➢ Focus on sales activities targeted at major vendors to increase the market share ➢ To respond to growth in the BPO field due to personnel shortages and workstyle reforms ➢ To actively participate in bidding for public projects | |

Logistics and manufacturing | ➢ To improve profit margin by switching from temporary staffing to undertaking tasks ➢ To dispatch staff such as drivers and fork operators with great pay ➢ To dispatch staff for processes from manufacturing to sales | |

Childcare and nursing care | ➢ For the childcare industry, they will concentrate on sales activities in the Tokyo metropolitan area to increase synergy with the Company's childcare division and increase the number of staff in operation. ➢ For the nursing care industry, they will strengthen support for both Japanese and foreign personnel | |

Construction | ➢ To expand sales bases from Tokyo and Osaka to meet the local staffing needs of major clients, aiming to expand business performance. ➢ To increase the number of professional personnel through BIM training for inexperienced staff |

③Nursing care-related services

Sales forecast for FY 5/27: 9.3 billion yen

Market Trends | ➢ Japan's aging population is expected to increase further, and this trend is expected to intensify in metropolitan areas, especially in Tokyo metropolitan area. ➢ In addition, Japan is expected to face a shortage of up to 690,000 caregivers by 2040, and the needs for nursing care and nursing care personnel are certain to increase. | |

|

|

|

Strategy | To establish facilities | ➢ To open 1 to 3 nursing-care facilities per year, mainly in the Tokyo metropolitan area ➢ Actively developing projects not only from major housebuilders, but also from local design companies and various other channels |

Foreign human resources | ➢ 7,000 people have been accepted for the specified skilled nursing care field, while the quota is 60,000 people. ➢ Currently, approximately 40 foreign workers are employed at the Company's nursing care facilities. ➢ In the future, the Company will continue to actively promote acceptance in cooperation with the human resources department. | |

M&A | ➢ Considering mergers and acquisitions mainly with nursing home operators ➢ Currently, the company's facilities are located in the Tokyo metropolitan area, mainly in Kanagawa Prefecture, but the company is also considering expansion into other areas through M&A. | |

④New Initiatives

Sales forecast for FY 5/27: 9.4 billion yen

Market Trends & Strategy | Foreign human resources | ➢ Introducing foreign human resources with visa status "Specified Technical Skills" ➢ Also considering introductions for the building cleaning, lodging, food service, and food and beverage manufacturing industries ➢ Activate partnerships with local institutions and schools in Southeast Asian countries that send out foreign students. ➢ To establish classes exclusive to Like for foreign students through tie-ups with Japanese language schools in Japan. ➢ To simultaneously consider improving profitability through M&A of local subsidiaries, etc. |

Like Products | ➢ To initially promote efficiency by integrating purchasing processes within the group, but gradually begin external sales ➢ Aiming to expand business for both consumers and businesses by utilizing know-how gained from more than 10,000 children and more than 400 facilities operated by the company. ➢ For consumers, they aim to create a platform by expanding the services provided, including not only hardware but also software. ➢ For businesses, they provide facility management package services to meet growing outsourcing needs. |

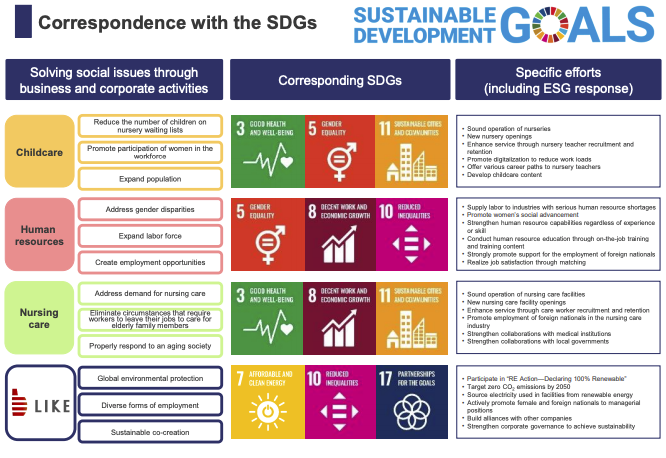

【1-5 Efforts toward SDGs】

■Relationship between the Group's Businesses and Sustainability

Each business is directly related to social issues, and the company's business expansion itself will lead to the realization of a sustainable society.

(Source: the company)

■Linkage with SDGs

(Source: the company)

■Environmental Preservation Initiatives

February 2022: Certified as an "Eco-First Company" by the Ministry of the Environment

(From the company's data) | A system under which the Minister of the Environment certifies companies that are "advanced, unique, and industry-leading in their business activities" in the environmental field (environmentally advanced companies in the industry). |

Like Group "Eco-First Commitment" (summary)

1.The company will promote environmental education through its business activities and contribute to the development of human resources who will support a sustainable society.

2.The company will focus on reducing the burden on the environment through business activities and act proactively to realize a circular economy.

3. The company will reduce CO₂ emissions and actively work to build a decarbonized society.

4.The company will engage in environmentally friendly management and contribute to environmental preservation in a broad range of areas.

5.The company will not only contribute to solving own social issues, but also support companies that are working to solve ESG-related issues.

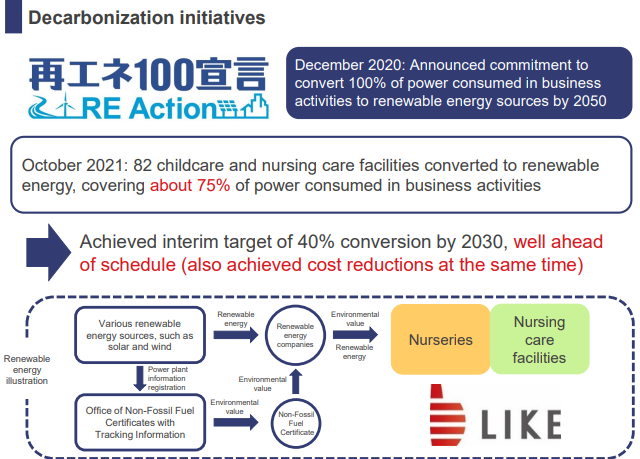

■Decarbonization initiatives

(Source: the company)

【1-6 Shareholder Benefit Program】

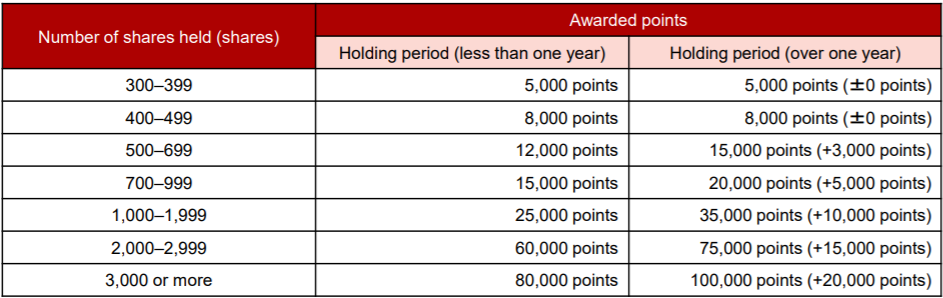

provides the “LIKE Premium Benefit Club.”

Targets: Shareholders who are listed on the shareholder list as of the end of May every year and possess 300(3 lots) or more shares of LIKE.

Contents: Points are given to shareholders every July, based on the table below. In the special website (https://like.premium-yutaiclub.jp), shareholders can exchange their shareholder’s benefit points for some of over 5,000 kinds of complimentary items, including food products, home appliances, gifts, and miscellaneous goods.

(Source: the company)

The “LIKE Premium Benefit Club” has been changed (announced on January 12, 2021).

The number of points awarded has significantly increased. For example, if you hold 500 shares for less than one year, you will receive 12,000 points instead of 7,000 points, and if you hold 500 shares for one year or longer, you will receive 15,000 points instead of 7,700 points.

2. Fiscal Year ended May 2022 Earnings Results

(1) Consolidated Earnings

| FY 5/21 | Ratio to Sales | FY 5/22 | Ratio to Sales | YoY | Est. | Rate of change |

Sales | 54,274 | 100.0% | 57,642 | 100.0% | +6.2% | 57,500 | +0.2% |

Gross Profit | 9,778 | 18.0% | 10,145 | 17.6% | +3.8% | - | - |

SG&A | 6,167 | 11.4% | 5,906 | 10.2% | -4.2% | - | - |

Operating Profit | 3,610 | 6.7% | 4,238 | 7.4% | +17.4% | 3,800 | +11.5% |

Current Profit | 5,341 | 9.8% | 5,234 | 9.1% | -2.0% | 5,500 | -4.8% |

Net Profit | 3,262 | 6.0% | 3,268 | 5.7% | +0.2% | 3,300 | -0.9% |

*Units: million yen

*Figures include reference figures calculated by Investment Bridge Co.; Ltd. Actual results may differ (Abbreviated hereafter).

Sales were up 6.2% year on year, and ordinary income was down 2.0% year on year.

Sales increased 6.2% year on year to 57,642 million yen. The sales of childcare support services, comprehensive human resources services, and nursing care-related services rose. Sales exceeded the forecast, thanks to the good performance of the mobile, logistics, and manufacturing divisions in the comprehensive human resource services. Operating income increased 17.4% year on year to 4,238 million yen. In terms of profits, gross profit margin fell from 18.0% in the previous fiscal year to 17.6%, mainly due to the disappearance of a high-margin benefit project recorded in the human resources business in the same period of the previous fiscal year and an increase in various costs such as school lunch costs and utility costs due to the resumption of normal operation of nursery schools. On the other hand, SG&A personnel expenses decreased as personnel costs declined due to progress in the efficiency of headquarters operations through inter-group cooperation and the disappearance of temporary TOB expenses that were incurred in the previous fiscal year. Thus, SG&A ratio fell 1.2 points from 11.4% in the previous term to 10.2%. As a result, operating income margin improved from 6.7% in the previous term to 7.4%. In childcare support services and nursing care-related services, existing nursery schools and nursing care facilities were operating smoothly, which led to sales exceeding the budget. Non-operating income decreased 2.0% year on year to 5,234 million yen mainly because equipment subsidy income dropped from 1,783 million yen in the previous fiscal year to 1,025 million yen due to differences in areas where licensed nursery schools were opened and differences in the borne maintenance costs (whether only the interior furnishing cost was borne or the costs of the building itself were borne). Profit attributable to owners of the parent increased 0.2% year on year to 3,268 million yen. A term-end dividend of 26.00 yen/share was implemented, and the annual dividend was 52.00 yen/share.

(2) Segment Earnings Trends

| FY 5/21 | Ratio to Sales | FY 5/22 | Ratio to Sales | YoY |

Childcare Support | 26,396 | 48.6% | 27,790 | 48.2% | +5.3% |

Comprehensive Human Resources | 20,301 | 37.4% | 22,087 | 38.3% | +8.8% |

Nursing Care | 7,252 | 13.4% | 7,506 | 13.0% | +3.5% |

Others | 323 | 0.6% | 258 | 0.4% | -20.1% |

Sales, Total | 54,274 | 100.0% | 57,642 | 100.0% | +6.2% |

Childcare Support | 2,118 | 47.8% | 2,579 | 52.7% | +21.8% |

Comprehensive Human Resources | 1,922 | 43.4% | 1,870 | 38.2% | -2.7% |

Nursing Care | 347 | 7.9% | 426 | 8.7% | +22.6% |

Others | 40 | 0.9% | 15 | 0.3% | -61.3% |

Adjustments | -818 | - | -653 | - | - |

Operating Profits, Total | 3,610 | 100.0% | 4,238 | 100.0% | +17.4% |

*Units: million yen

*“Others” indicates businesses which are not included in the report segment. Operating profit ratio refers to pre-adjusted consolidated operating income as 100%.

Childcare Support Service Business

Sales were 27,790 million yen (up 5.3% year on year), and operating income was 2,579 million yen (up 21.8% year on year).

The company made every effort to improve childcare from all aspects, including not only the opening of new private licensed nurseries but also undertaking the operation of nursery schools established by local governments, establishing new nursery schools in large-scale development projects by real estate developers, operating in-house company-led nursery schools established by hospitals, companies, universities, and managing public after-school clubs for schoolchildren and nursery centers. In addition, by working closely with Like Staffing Inc., the company focused on hiring excellent nursery teachers to ensure the quality of childcare. The company has established 11 new licensed nursery schools (11 in April 2022), 6 commissioned childcare facilities (2 in September 2021, 3 in October, and 1 in December), 6 after-school childcare centers and nursery centers (2 in January 2022, and 4 in April).

Comprehensive Human Resources Service business

Sales were 22,087 million yen (up 8.8% year on year), and operating income was 1,870 million yen (down 2.7% year on year).

In the mobile industry, the fourth carrier, which entered the market in April 2020, has moved into a phase of strengthening its sales structure, further intensifying competition among carriers to acquire customers. Orders to the company are also increasing. In the logistics industry, large-scale logistics facilities started operating one after another in response to the expansion of the EC market, and sales increased in response to the strong demand for human resources. For the childcare and nursing care industry, where the shortage of human resources is becoming more serious, the company has reviewed its in-house sales system, promoted optimal recruitment media measures, and linked its know-how in operating facilities at Like Kids and Like Care to its recruiting capabilities to strengthen the dispatch and introduction of human resources. The company also focused more on expanding services and employment support services for foreign workers in the construction industry, which the company is promoting as the next growth pillar. Regarding employment support services for foreign workers, the needs for human resources in all industries, which had temporarily slowed down due to the spread of the novel coronavirus, are steadily recovering as the economy picks up.

The breakdown of sales by industry is shown in the table.

Sales Breakdown by Industry of Comprehensive Human Resources Service Business

Sales by Industry (Units: million yen) | FY 5/21 | FY 5/22 | YoY | |||

Sales | Ratio to sales | Sales | Ratio to sales | Increase/decrease | Rate of change | |

Mobile phone | 11,481 | 56.6% | 11,694 | 52.9% | +212 | +1.9% |

Manufacturing and logistics | 4,716 | 23.2% | 6,490 | 29.4% | +1,773 | +37.6% |

Call center | 2,037 | 10.0% | 2,338 | 10.6% | +301 | +14.8% |

Childcare | 330 | 1.6% | 371 | 1.7% | +40 | +12.4% |

Nursing care | 217 | 1.1% | 133 | 0.6% | -83 | -38.6% |

Construction | 198 | 1.0% | 228 | 1.0% | +30 | +15.3% |

Others | 1,319 | 6.5% | 829 | 3.8% | -490 | -37.1% |

Total | 20,301 | 100.0% | 22,087 | 100.0% | +1,785 | +8.8% |

Due to reclassification, part of Mobile phone is changed to Call center (Fiscal year 5/21: 658 million)

(Made by Investment Bridge referring to company website)

➢ Mobile: Sales increased due to the growth of demand for personnel as a result of the aggressive sales of the fourth carrier

➢ Logistics & Manufacturing: Continued business expansion with the start of operations of large-scale logistics facilities

➢ Childcare/nursing care:

・LIKE Kids: 264 million yen (up 4 million yen year on year)

・LIKE Care: 241 million yen (up 23 million yen year on year)

➢ Othe Dropped due to the end of benefit projects (591 million yen in the previous fiscal year)

Nursing Care Service Business

Sales were 7,506 million yen (up 3.5% year on year), and operating income was 426 million yen (up 22.6% year on year).

On July 1, 2022, Sunrise Villa Itabashi Mukaihara (64 rooms) was newly opened, increasing the number of facilities the company operates to 26. In addition, residents have been steadily moving into Sunrise Villa Yokohama Higashi-Terao, which opened on March 1, 2021, due to its favorable location and flexible acceptance system that matches each individual with the level of nursing care they need. It has been fully occupied during the fiscal year ended May 2022. Facility operations remain steady, which led to an increase in sales and profit.

(3) Financial Conditions and Cash Flow

◎Financial Condition

| May 2021 | May 2022 |

| May 2021 | May 2022 |

Cash | 9,536 | 10,623 | Accounts payable | 3,161 | 3,684 |

Receivables | 4,879 | 5,425 | Taxes Payable | 1,614 | 1,268 |

Current Assets | 16,126 | 17,748 | Security Deposits | 861 | 825 |

Tangible Assets | 15,068 | 15,683 | Interest Bearing Liabilities (Inc. Leases) | 16,736(2,197) | 16,315(2,439) |

Intangible Assets | 1,084 | 681 | Liabilities | 25,770 | 25,358 |

Investments, Others | 5,431 | 5,267 | Net Assets | 11,940 | 14,022 |

Noncurrent Assets | 21,584 | 21,632 | Total Liabilities, Net Assets | 37,711 | 39,380 |

*Units: million yen

Total assets at the end of the fiscal year ended May 2022 stood at 39,380 million yen, up 1,669 million yen from the end of the previous term.

Current assets rose 1,621 million yen from the end of the previous term to 17,748 million yen. This was due to an increase of 1,087 million yen in cash and deposits and an increase of 545 million yen in notes, accounts receivable, and contract assets (trade receivables).

Noncurrent assets increased 47 million yen from the end of the previous term to 21,632 million yen. This was attributable to an increase of 614 million yen in tangible assets due to opening new facilities in the childcare support service business, a decrease of 444 million yen due to amortization of goodwill, and a decrease of 134 million yen in investment securities.

Current liabilities decreased 425 million yen from the end of the previous term to 11,640 million yen. This was due to an increase of 523 million yen in accounts payable, a decrease of 454 million yen in income taxes payable, and an increase of 425 million yen in current portion of long-term debt.

Noncurrent liabilities decreased 836 million yen from the end of the previous term to 13,718 million yen. This was due to factors such as 1,088 million yen decrease in long-term loans and 242 million yen increase in lease obligations.

Net assets increased 2,081 million yen from the end of the previous term to 14,022 million yen. This was due to the posting of 3,268 million yen in profit attributable to owners of the parent and 1,166 million yen in dividend payments.

Equity ratio rose 3.9 points from the end of the previous term to 35.6%.

◎Cash Flows (CF)

| FY 5/21 | FY 5/22 | Increase/Decrease | |

Operating CF (A) | 5,695 | 4,710 | -985 | -17.3% |

Investing CF (B) | -1,806 | -1,666 | +140 | - |

Free CF (A+B) | 3,888 | 3,043 | -844 | -21.7% |

Financing CF | -7,444 | -1,956 | +5,487 | - |

Balance of cash and cash equivalents at end of period | 9,516 | 10,603 | +1,087 | +11.4% |

*Unit: million yen.

Cash and cash equivalents at the end of the fiscal year ended May 2022 stood at 10,603 million yen, up 1,087 million yen from the end of the previous term. Although there were negative factors such as purchase of property, plant and equipment and expenses for repayment of long-term loans, there were positive factors such as posting income before income taxes and other adjustments and an increase in borrowings.

There was a cash inflow of 4,710 million yen from operating activities. This included recording income before income taxes and other adjustments of 5,219 million yen, recording depreciation of 1,322 million yen, recording amortization of goodwill of 444 million yen, and paying 2,499 million yen in income taxes.

There was a cash outflow of 1,666 million yen from investing activities. This included proceeds from the sale and redemption of marketable and investment securities of 59 million yen and purchases of property, plant and equipment of 1,573 million yen associated with opening new facilities in the childcare support service business.

There was a cash outflow of 1,956 million yen from financing activities. This included an income from long-term loans of 2,300 million yen, repayments of long-term loans of 2,963 million yen, and cash dividends paid of 1,165 million yen.

3. Fiscal Year ending May 2023 Earnings Forecast

(1) Consolidated Earnings

| FY5/22 Act. | Ratio to sales | FY5/23 Est. | Ratio to sales | YoY |

Net Sales | 57,642 | 100.0% | 61,600 | 100.0% | +6.9% |

Child-Rearing Support Service | 27,790 | 48.2% | 29,000 | 47.1% | +4.4% |

Comprehensive human resources service | 22,087 | 38.3% | 24,740 | 40.2% | +12.0% |

Nursing Care-Related Service | 7,506 | 13.0% | 7,600 | 12.3% | +1.2% |

Multimedia services, other | 258 | 0.4% | 260 | 0.4% | +0.6% |

Operating Profit | 4,238 | 7.4% | 4,350 | 7.1% | +2.6% |

Ordinary Profit | 5,234 | 9.1% | 5,300 | 8.6% | +1.3% |

Profit attributable to owners of parent | 3,268 | 5.7% | 3,350 | 5.4% | +2.5% |

*Units: million yen

Sales expected grow 6.9% and ordinary income projected to rise 1.3% in the fiscal year ending May 2023

In the fiscal year ending May 2023, sales are expected to increase 6.9% year on year to 61.6 billion yen, and ordinary income is projected to rise 1.3% year on year to 5.3 billion yen.

Regarding sales in each segment, the sales of childcare support services are projected to rise 4.4% year on year to 29 billion yen, the sales of comprehensive human resources services are forecast to increase 12.0% to 24,740 million yen, and the sales of nursing care-related services are expected to rise 1.2% to 7.6 billion yen.

In the childcare support service business, the company plans to open around 10 licensed nursery schools. In addition to licensed nursery schools, the company will strongly promote the development of facilities from all aspects, including undertaking the operation of nursery schools established by local governments, opening new nursery schools in large-scale development projects by real estate developers, operating in-house childcare facilities such as company-led childcare facilities established by hospitals, companies, and universities, and operating local governments' after-school childcare centers and nursery centers. In terms of securing nursery teachers, the company will strive to acquire excellent human resources and improve the quality of childcare by demonstrating synergies with the comprehensive human resources service business. In the future, due to the declining number of births, competition will intensify, determining the winners and losers among childcare providers, and there are many enterprises in the industry and the share of major providers is low. In this situation, the company aims not only for self-sustaining growth utilizing internal resources, but also for nonconsecutive earnings expansion by flexibly implementing M&A.

In the comprehensive human resources service business, while focusing on the mobile industry, the company's original business, the company will intensify its intensive investment in growing markets to dramatically expand its business by investing management resources in the fields of logistics/manufacturing, nursing care, construction, and foreign human resources, which are expected to have strong demand for human resources and high growth potential.

In the nursing care-related service business, to meet the growing demand for nursing care in the Tokyo metropolitan area, the company will continue to open new facilities, mainly paid nursing homes for the elderly with healthcare services. By collaborating with the comprehensive human resources service business, the company will also further accelerate the acceptance of foreigners with specific skills in facilities and improve the quality of facility services by securing nursing care human resources. Furthermore, the company will continue to maximize group synergies to contribute to resolving the shortage of nursing care personnel, which is a social issue, and improving the quality of services in the nursing care industry as a whole by introducing highly educated and excellent foreign personnel to other nursing care providers.

Based on its policy of targeting a consolidated dividend payout ratio of 30%, the company plans to pay an interim dividend of 26.00 yen/share and a term-end dividend of 27.00 yen/share for an annual dividend of 53.00 yen/share.

(2) Business Overview, Strengths/Characteristics, Market Trends, and Growth Strategies

- Childcare Support Service -

Overview

➢ The company is aware of the issue of the high rate of turnover of female workers because of childcare in the Comprehensive Human Resources Service with which it started off.

➢ Sales have grown about 15 times for the past 15 years compared to the years before the company acquired capital.

➢ Operating profit/loss also increased significantly to 2,579 million yen in FY 5/22 from a deficit of 40 million yen in FY 5/16 when the company began to prepare consolidated financial statements.

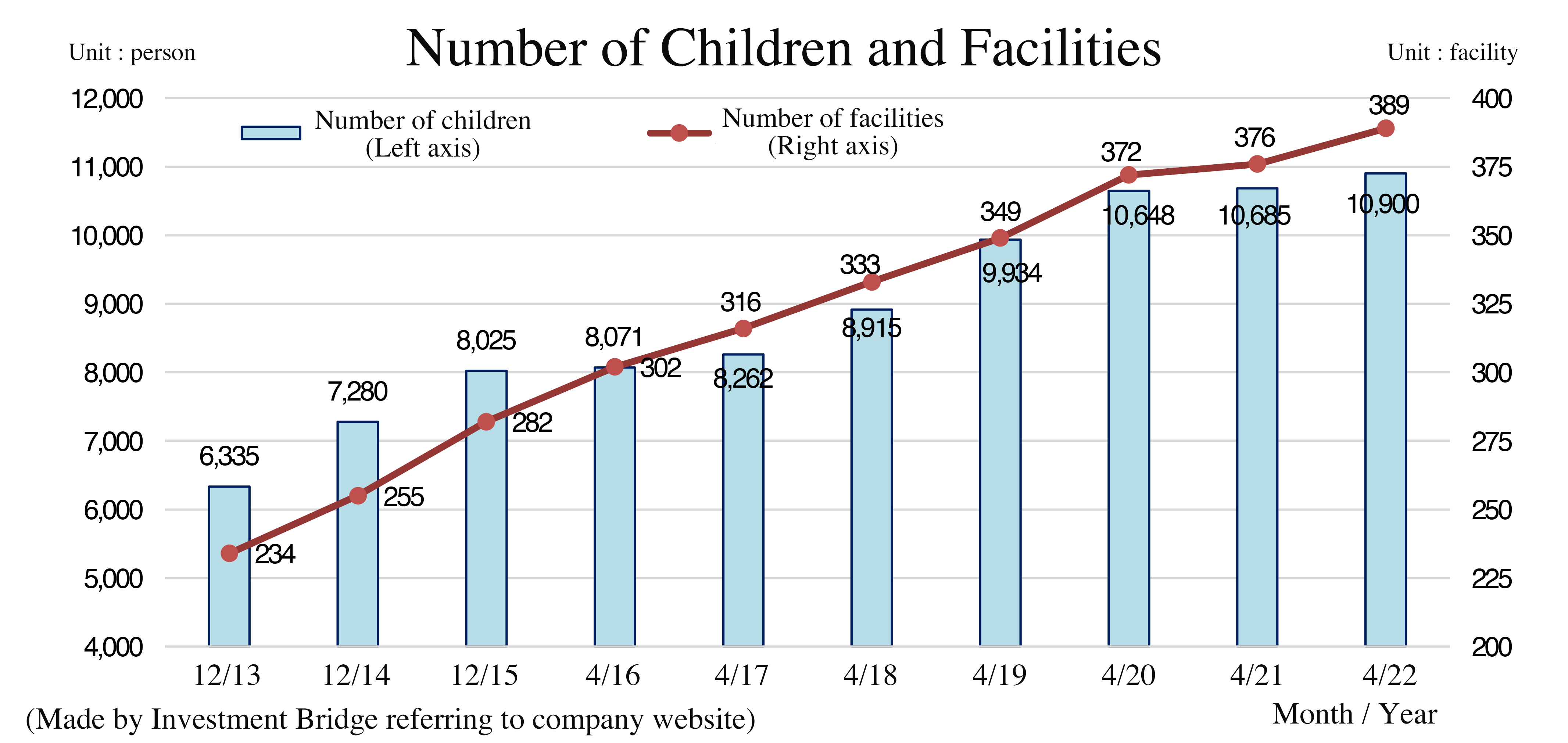

➢ The company operates 389 nursery schools mainly in the Tokyo metropolitan area that take care of over 10,000 children, generating the second largest sales in the industry.

Strengths/characteristics

➢ Recruitment capacity: The company develops human resources through synergy with the human resources department and cross-sectional adoption of training contents.

➢ Dominance: The company operates nursery schools primarily in the Tokyo metropolitan area and establishes a comfortable working environment by offering its workers a flexible choice of places of work.

➢ Economies of scale: The company reduces cost and provides diverse career paths through operation of a number of nursery schools.

➢ Facility location: The company has advanced development capabilities thanks to close relationship with real estate developers.

Market size and trend

➢ The market size: 2.9 trillion yen

➢ The number of births in 2021 was about 810,000, the lowest since the start of statistical recording, and there are concerns about a decrease of marriages due to the spread of the novel coronavirus.

➢ The national population as of 2020 was less than that in 2015, while the population has increased in the Tokyo metropolitan area and some other areas.

➢ As of April 2021, there were 5,634 children on waiting lists for daycare facilities, which is on the decline, but the problem is still severe in the Tokyo metropolitan area.

➢ As of May 2021, there were 13,416 children on waiting lists for after-school childcare centers. This presents an issue as well as the need to eliminate the difficulties for parents to balance work and childcare, which increase when their children enter elementary school. Although the trend is declining, these problems are severe in the Tokyo metropolitan area.

➢ Under the new worry-free childcare plan, childcare facilities for approximately 140,000 children will be newly established by the end of the fiscal year 2024 to quickly eliminate waiting lists for children and improve female employment rate.

➢ Although the active job openings-to-applicants ratio for childcare workers is on a downward trend, it remains nearly double that of all occupations. Thus, the shortage of childcare workers continues.

➢ As of 2017, the ratio of for-profit corporations among childcare facilities was 6.2%. Entry into the stock market is progressing, but many are still operating as non-profit corporations.

➢ Due to the shift from kindergartens, the needs for childcare facilities are projected to increase 1.4 times from 2015 (2.33 million children) to 2040 (3.34 million children).

【Growth strategies】

➢ Realizing self-sustaining growth in all aspects, including not only the opening of new private licensed nurseries but also undertaking the operation of public childcare facilities, and managing large-scale development projects, after-school childcare centers, nursery centers, hospitals, and companies.

➢ Aiming to increase its market share further through a roll-up M&A strategy since there are many competitors in the industry as the company is one of the largest in the industry and has a market share of only around 1%.

- Comprehensive Human Resources Service -

Overview

➢ The company expands the scale of this business, with which the corporate group started off, through staffing service targeting mobile phone distributors.

➢ The company has 13 business bases throughout Japan.

➢ The number of staff members in operation is over 8,000 and the number of client companies is over 600.

➢ The company has the third largest share in the human resources industry (sales and marketing support human resources business section).

【Strengths/Characteristics】

➢ Training know-ho Unique know-how in turning unqualified and inexperienced job seekers into capable staff

➢ Industry specialization: Specializing in growing markets and essential industries

➢ Number of business partners: Stability by having many business partners despite being industry-specific

➢ Group synergy: Acquisition of expertise through collaboration with childcare and nursing care businesses

【Market trends】

➢ The market size is 2.7 trillion yen

➢ The EC market is expanding year by year. In recent years, its infrastructure has already been developed, and regarding the logistics and manufacturing, the development of logistics facilities that support EC is progressing rapidly.

➢ In construction, the shortage of human resources is expected to be about 470,000 to 930,000 people in the fiscal year 2025, and the aging of human resources is also a critical issue. Therefore, early rejuvenation is urgently needed.

➢ Approximately 2.43 million long-term care workers will be needed in the fiscal year 2025, and it is essential to accept foreign workers to secure human resources.

【Growth strategies】

➢ Among the existing business areas, the company will enhance sales in the human resources business for construction and nursing care as both industries are expected to face a shortage of up to 1.25 million people by 2025.

➢ In addition to accepting foreign human resources, the company will strengthen the dispatch and personnel introduction business by focusing more on human resource education and training the company's full-time employees to acquire the needed skill sets.

- Nursing Care Related Service -

Overview

➢ The company operates 26 facilities mainly in Kanagawa and Tokyo with about 1,400 users.

➢ The major form of facility that the company operates is fee-based nursing care centers for assisted living (17 of the total of 26 facilities).

➢After acquisition of this business, the company improved the occupation rate from the 60%-level to over 90% through synergy with the human resources department.

➢ Operating profit grew to 426 million yen in FY 5/22 from a deficit of 217 million yen in FY 5/14 when the company began to prepare consolidated financial statements.

【Strengths/Characteristics】

➢ End-of-life nursing care: One of the company’s strengths lies in its medical collaborations and the availability of end-of-life nursing care at almost all facilities.

➢ 24-hour nursing care: Depending on the facility, nurses provide support 24 hours a day, 365 days a year.

➢ Recruiting ability: The company recruits staff through synergies with the human resources division and offers full support.

➢ Facility location: The facility development capability has been horizontally expanded in the childcare business, and facilities have been established mainly in the Tokyo metropolitan area.

【Market trends】

➢ The market size is 1 trillion yen.

➢ The aging rate, which is the percentage of the population aged 65 and over, is expected to rise year by year, especially the number of those aged 75 and over is projected to grow.

➢ Assuming an increase in the population index of people aged 65 and over, particularly in metropolitan areas, the demand for nursing care will continue to grow in large cities and mainly in the Tokyo metropolitan area.

【Growth strategies】

➢ The company aspires to open 1 to 3 new facilities annually, mainly paid nursing homes for the elderly with healthcare services (specified facilities).

➢ The company will maximize synergies with the Group’s human resources business by enabling human resource development superior to other companies through utilizing facilities operated by the company for on-the-job training for foreign human resources.

-Foreign talents-

➢ It is an area to be commercialized in the future with a market scale of 1 trillion yen.

➢ The company will promote employment support for foreigners with specified skills, focusing on human resource services for nursing care as well as building cleaning, lodging, restaurants, and food and beverage manufacturing industries among the 14 specified skills industries.

➢ The company is accumulating the know-how for full-scale acceptance of foreign workers after the novel coronavirus subsides, aiming for a recruitment business with a scale of several thousand people per year.

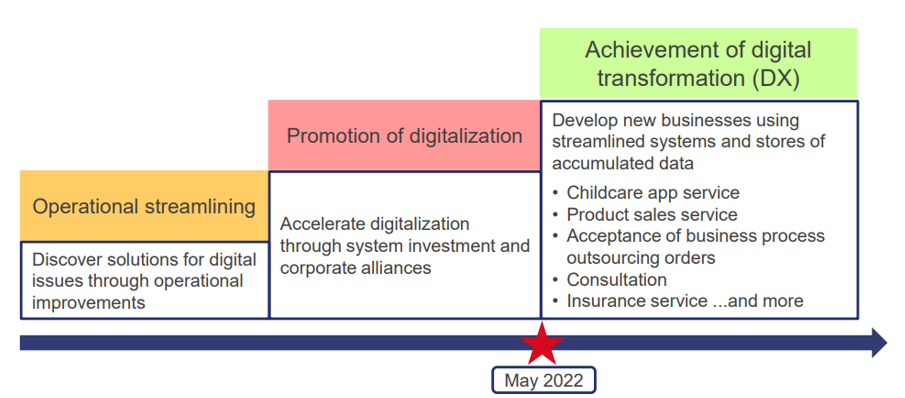

DX Strategies

April 2021: Certified as a DX Certified Business Operator established by the Ministry of Economy, Trade, and Industry

During the fiscal year ended May 2022, the company strongly promoted digitization, including the complete renewal of the core systems.

After the fiscal year ending May 2023, the company will realize DX, creating new businesses using data acquired.

(Source: the company)

The company’s Nana Pocke

The company aims to promote DX in the industry and acquire revenue sources that do not rely on subsidies by creating its original platform, the Nana Pocke application.

(Source: the company)

4. Conclusions

In the fiscal year ended May 2022, sales and operating income reached record highs, and although ordinary income decreased due to a decline in equipment subsidy income, it showed steady growth. Regarding the forecast for the fiscal year ending May 2023, the company expects only a slight increase in sales and profit, but Chairman and President Okamoto commented, "If possible, we would like to exceed that greatly," and we expect continuous double-digit growth in operating income. In the childcare support service business, the company seems to have received many inquiries and consultations from local governments regarding managing public childcare facilities. In the future, there is a possibility that the number of commissions to manage public childcare facilities will increase significantly. In the comprehensive human resources services, further expansion in the logistics and manufacturing sector, which grew significantly in the term ended May 2022, can be expected. Nursing-related services seem to be facing difficulties due to the rapid increase in the number of newly infected people with the novel coronavirus. However, from a long-term perspective, the effective use of foreign human resources can resolve the labor shortage that has been a struggle in the industry, and significant growth can be expected.

The company also announced a new medium-term plan. Chairman and President Okamoto stated that the company wants to significantly exceed the target of 100 billion yen in sales and 8 billion yen in operating income, including sales expansion through M&A, in the fiscal year ending May 2027 and was confident that the company will achieve that. In addition, the company will fully use its know-how that has been nurtured since its founding in "the recruitment of unqualified and inexperienced human resources early and in large numbers and turning them into capable staff" to effectively utilize foreigners in the future. It is expected that there will be a severe labor shortage in the future in Japan, and this will lead to the solution to this major social problem. Moreover, assuming the achievement of the medium-term plan, EPS is expected to be around 250 yen without considering the subsidy income to be recorded in the section of non-operating income.

Regarding its share price, although PER is at the same level as the Tokyo Stock Exchange's Prime Market average, considering the company's ambitious comment that it wants to greatly exceed the forecast for the fiscal year ending May 2023 and the profit level in the medium-term plan, we think it is undervalued.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory committee |

Directors | 7 directors, including 3 outside ones |

◎ Corporate Governance Report:Updated on December 27, 2021

Basic Policy

Our company aims to be a corporate group that is indispensable to society at any stage of life with a group mission of “planning the future – Developing people and creating the future –” and recognizes the initiatives for corporate governance as an essential management task. For its realization, we make use of our holding company structure and consolidate the compliance system in the holding company so that executives, employees and service users of our group can take fair and efficient actions at all times, and attempt to strengthen corporate governance of the whole group by centralizing the functions of the holding company by the management of the entire group.

1. Ensuring the rights and equality of shareholders

We take appropriate measures so that the rights of shareholders, including the voting rights at the general shareholders meeting, are substantially ensured.

2. Appropriate cooperation with stakeholders excluding shareholders

On the basis of our group mission, we will continue to enhance our corporate value by acting in good faith with all stakeholders including service users, clients, shareholders and employees, keeping in mind the Code of Conduct and principles of action.

3. Appropriate disclosure of information and ensuring transparency

We will make appropriate disclosure of information based on laws and ordinances and actively provide non-financial information and information other than the information disclosed based on laws and ordinances.

4. Responsibilities of the Board of Directors and others

The board of directors formulates the basic policy and strategies for the management of the group and manages and supervises the business firm. It operates as a body that supervises the management decision-making in the entire group and the business execution by the board of directors. In addition, the independent outside director works to strengthen the management discipline and increase the transparency further.

5. Dialogue with shareholders

Our company puts importance on dialogue with shareholders for maximizing our corporate group’s value, and we deal with requests from shareholders for dialogue at any time.

Dialogues with shareholders are held by the IR department, IR officers, and management executives as necessary.

Implementation Status of Principles of Corporate Governance Code

<The number of principles of Corporate Governance Code the Company does not comply with: 3, including the following>

【Supplementary principle 1-2-4】

We are not currently using the electronic voting platform, but we plan to use it from the Ordinary General Meeting of Shareholders scheduled to be held in August 2022.

【Supplementary principle 4-10-1】

The composition of our directors is four internal directors and three independent outside directors, which does not reach the majority, and we have not established a voluntary independent advisory committee. Regarding the appointment of director candidates and director remuneration, prior to the resolution of the Board of Directors, explanations are given to independent outside directors, and appropriate advice is obtained. Since we obtain appropriate involvement and advice of independent outside directors regarding nomination of candidates for directors and directors’ remuneration as mentioned above, we consider that the independence, objectivity, and accountability of the functions of our board of directors pertaining to the aforementioned matters have been sufficiently secured.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

We will consider strategically holding shares of any listed company only when synergy of corporate value improvement has been recognized. Our company has confirmed the significance of the strategically held shares that we are currently possessing. Furthermore, with regard to the exercise of our voting rights as to those strategically held shares, we will declare our intention to approve or disapprove a case by taking into account whether the relevant company’s corporate value is improved and whether the exercise impacts our company.

【Principle 2-6】

We are not asset owners since we have not introduced a fund-type and contract-type defined neither benefit pension nor a welfare pension fund assumed in the Corporate Governance Code.

【Principle 5-1】

-Our company promotes constructive dialogue with shareholders by designating a department and an officer in charge of investor relations so that they carry out our group’s overall investor relations activities.

-Regarding information disclosure, the company has established a "Disclosure Policy" that summarizes its basic approach, and in accordance with this, the company is working on fair, timely, and appropriate disclosure.

Our company strives to disclose information in a fair, timely, and proper manner pursuant to the Disclosure Policy that we have formulated for organizing our basic ideas.

-The Disclosure Policy is disclosed on our website (https://www.like-gr.co.jp/ir/policy.html).

-Details of our investor relations activities are as mentioned in Section 2 “Implementation Status of Policies Regarding Shareholders and Other Stakeholders” of this report.

Tokyo Stock Exchange Corporate Governance Information Service:

https://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Report on LIKE, Inc. (2462) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url:www.bridge-salon.jp/