Bridge Report:(2593)ITO EN the fiscal year April 2020

ITO EN, LTD. (Common stock: 2593, Preferred stock: 25935) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

President | Daisuke Honjo |

Address | 47-10, Honmachi 3-chome, Shibuya-ku, Tokyo |

Year-end | April |

URL |

Stock Information

<Common Stock>

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥6,140 | 88,188,913 shares | ¥541,479 million | 5.2% | 100 shares | |

DPS (Forecast) | Dividend yield (Actual) | EPS (Actual) | PER (Actual) | BPS (Actual) | PBR (Actual) |

¥40.00 | 0.7% | ¥104.46 | 58.8 times | ¥1,221.92 | 5.0 times |

* The share price is the closing price on June 17.

<Preferred Stock>

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥2,120 | 33,054,872 shares | ¥70,076 million | 5.2% | 100 shares | |

DPS (Forecast) | Dividend yield (Actual) | EPS (Actual) | PER (Actual) | BPS (Actual) | PBR (Actual) |

¥50.00 | 2.4% | ¥114.46 | 18.5 times | ¥1,226.92 | 1.7 times |

* The share price is the closing price on June 17.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

April 2017 (Actual) | 475,866 | 21,774 | 21,524 | 13,693 | 108.77 | 40.00 |

April 2018 (Actual) | 494,793 | 22,043 | 21,441 | 12,553 | 99.79 | 40.00 |

April 2019 (Actual) | 504,153 | 22,819 | 23,211 | 14,462 | 116.02 | 40.00 |

April 2020 (Actual) | 483,360 | 19,940 | 19,432 | 7,793 | 61.53 | 40.00 |

April 2021 (Forecast) | 481,000 | 20,000 | 19,800 | 13,000 | 104.46 | 40.00 |

* The forecasted values were provided by the company.

* Unit: Million yen, yen

This Bridge Report outlines the results of ITO EN for the fiscal year ended April 2020 and the outlook for the term ending April 2021.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended April 2020 Earnings Results

3. Fiscal Year Ending April 2021 Financial Estimates

4. Marketing Strategies

5. Conclusions

<Reference: Regarding Corporate Governance>

Key points

- For the term ended April 2020, sales and operating income dropped 4.1% and 12.6%, respectively, year on year. Despite the shrinkage of the beverage market due to unfavorable weather, the company’s focus on profitable sales proved successful, with an increase in operating income by 8.6% despite the decrease in sales by 2.5% year on year till the third quarter, but it could not offset the decline in the fourth quarter (9.5% drop in sales and 67.3% drop in operating income), which was significantly affected by the COVID-19 crisis. For ITO EN (non-consolidated), however, operating income rose 4.9% year on year thanks to the improved profitability and profit increased for the full year, despite a 4.2% decline in sales. The dividends are expected to be 40 yen/share for common shares and 50 yen/share for preferred shares.

- While many companies have their earnings forecasts still to be determined, the forecast for the term ending April 2021 disclosed by the company expects sales to drop 0.5% year on year and operating income to rise 0.3% year on year. Although the beverage market in 2020 is anticipated to fall 6.3% from the previous year, the company will improve the safe and secure “Oi Ocha” brand to capture the attention of genuineness-oriented and health-conscious consumers by launching products utilizing the health value of tea and strengthening the use of social networking sites and e-commerce. In addition, there is still room for improvement in the product lineup, and the company will promote different sales strategies for each product, such as reinforcing and curbing sales in view of profitability.

- As a result of the above initiatives, the sales of Japanese tea/healthy tea and vegetable juice are projected to grow steadily, while the sales of coffee, carbonated drinks, etc., are estimated to fall, along with black tea, which saw a significant growth in the previous term. As for profit, despite the expected increase in sales commissions and advertisement costs, changes in the product lineup are anticipated to improve the profitability and efficiency of the handing and distribution of ingredients, materials, and products.

1. Company Overview

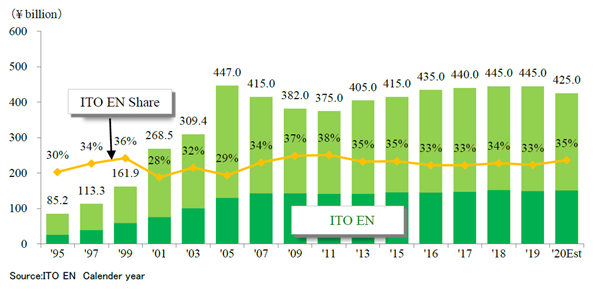

ITO EN mainly manufactures and sells beverages (including tea beverages such as green tea, coffee, and vegetable beverage ), and tea leaves, and also operates restaurants and conducts franchise (FC) business of Tully’s Coffee, etc., manufactures and sells supplements via its subsidiaries. In Japan, the company has the largest share of 33% (as of 2019) in the market of green tea beverages, including “Oi Ocha.” In addition, it owns a variety of popular product brands, such as “Kenko Mineral Mugicha” (barley tea) which is the bestselling caffeine-free tea beverage, “Ichinichibun no Yasai” (Vegetable Beverage ), the most selling 100% vegetable beverage, and “TULLY’S COFFEE” which is the top-selling bottle-shaped canned black coffee product developed in cooperation with Tully’s Coffee Japan Co., Ltd.. Each of them has achieved an annual sales quantity of over 10 million cases (“Oi Ocha” has sold about 90 million cases).

The ITO EN Group is composed of 31 consolidated subsidiaries, including Tully’s Coffee Japan Co., Ltd. and Chichiyasu Company, and 3 companies accounted for using the equity method. With the aim of becoming a “Global Tea Company,” it is developing the ITO EN brand and cultivating new green tea markets in the U.S. (mainly New York), China, Australia and Southeast Asia.

Management Principle “Always Putting the Customer First”

1-1.Five Concepts for Product Development since the Establishment of the Company

(Source: The company)

1-2.Outline of the business

The business of ITO EN is classified into the Beverages Business and Tea Leaves, which manufactures and sells tea leaves and beverages, the Restaurant Business, in which Tully’s Coffee Japan Co., Ltd. operates specialty coffee shops and FC business, and The Others, in which Mason Distributors, Inc. (Florida, the U.S.) manufactures and sells supplements.

For the term ended April 2020, the sales of ITO EN (non-consolidated) accounted for 85.0% of the Tea Leaves and Beverages Business (78.2% of consolidated sales). As for the composition of the sales(non-consolidated), tea leaves make up 9.3%, beverages 89.9%, and others 0.8%.

| Sales | Composition ratio | YoY | Operating income | Composition ratio | YoY |

Tea Leaves and Beverages Business (A) | 444,411 | 91.3% | -4.1% | 18,783 | 4.2% | -5.2% |

Restaurant Business | 32,811 | 6.7% | -5.1% | 1,725 | 5.3% | -50.8% |

Others | 9,424 | 1.9% | -1.3% | 656 | 7.0% | -14.9% |

Adjustment | -3,287 | - | - | -1,224 | - | - |

Total (Consolidated sales/operating income) | 483,360 | 100.0% | -4.1% | 19,940 | 4.1% | -12.6% |

ITO EN (non-consolidated):B (composition rati B/A) | 377,787 | 78.2% | -4.2% | 16,626 | 4.4% | +4.9% |

* Unit: Million yen

Product brands representative of ITO EN, LTD. that have sold over 10 million cases annually

(Source: The company)

1-3 Management strategy: Corporate sustainability and a global tea company

The company will conduct corporate sustainability-oriented activities for long-term business administration while considering the influence on the environment, economies, and society, and aim to become a global tea company.

Corporate sustainability

The company always has in mind the issue “what still dissatisfies customers” under the motto “STILL NOW,” which is the central concept for “the customer-first policy.” Under this concept, the company conducts business processes, including planning, development, procurement, production, distribution, marketing, and sales while linking them with CSR activities and CSV (creating shared value) measures aimed at offering social and economic value in primary businesses.

In planning and development, the company plans to adopt 100% recyclable plastic bottles for all “Oi Ocha” products by 2030 to cope with the plastic trash problem, and release environmentally friendly tea bags (single-chamber tea bag with depth) for the first time in Japan. The company will keep developing products by recycling used tea leaves (the company has already developed “GREEN TEA PILLOW-S,” a pillow developed utilizing the deodorizing and antibacterial effects of green tea, in cooperation with France Bed).

|

|

(Source: The company)

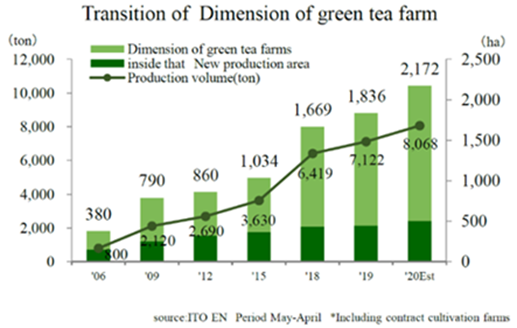

In procurement, the company implements “a project for developing tea plantations,” in which the company signs contracts with farmers for growing teas and develops tea plantations (new plantation project), for the purpose of procuring high-quality tea leaves stably. This activity leads to the actualization of a sustainable agriculture model contributing to the stable business operation of enterprises, procurement of ingredients, regional vitalization, etc. Especially, the “new plantation project,” which brings high value to the society and enterprises through regional vitalization, sustainable agricultural management, etc., was started in Miyazaki Prefecture in 2001, and is to be spread to Shizuoka Prefecture in 2020. In the “project for developing tea plantations,” which provides a sustainable agricultural model, the company is expected to achieve the mid/long-term goal: “a plantation area of 2,000 ha” by the end of April 2021. In addition, the “project for developing tea plantations” is aimed at producing about 35% of the total amount of crude tea used by the company and obtaining 100% GAP certification. GAP certification is given to farms that pursues food safety and environmental conservation. In addition to the global standard “Global GAP,” there are “JGAP,” “ASIAGAP,” etc. offered by Japan GAP Foundation. All farms operated in this project aim to obtain either of these certifications.

|

|

(Source: The company)

In production and distribution, the company adopted the fabless model to entrust external beverage factories that produce high-quality products and reduce the consumption amounts of water and energy. The company outsources production to about 50 beverage factories around Japan, and adopted a system of production and distribution dividing the national land into 5 blocks. In addition, the company adopted environmentally friendly containers based on an original aseptic filling NS system which does not use disinfectants for bottles.

In marketing and sales, the company set the slogan “to invigorate Japan, by increasing the consumption of domestic products,” and sells products that convey the value of domestic agricultural products in cooperation with National Federation of Agricultural Cooperative Associations, which connects producers and consumers. In addition, the company operates hygiene-oriented vending machines as an effort to solve social issues by utilizing the mobility of route sales (affixing antibacterial tea-leaf stickers to vending machines).

|

|

(Source: The company)

Global tea company

As a global tea company, the company aims to become the corporate group “Itoen” that contributes to the “health” of customers around the world and supports the affluent life of each person. To attain this aim, the company will conduct activities as a health creation enterprise which supports corporate sustainability and an affluent life.

In detail, the company is developing sugar-free beverages for the global market, as part of efforts as a health creation enterprise which supports an affluent life. The share of sugar-free beverages in the domestic beverage market increased from 8% to 49% in the 30 years of the Heisei period, and they account for 74% of the company’s products (the company boasts the largest share in the domestic sugar-free beverage market). The activities as a health creation enterprise are carried out for not only consumers, but also employees. Therefore, the company is highly evaluated from the aspect of health-oriented management, in which the health management of employees is considered as strategic managerial investment rather than costs, so the company was certified as one of “excellent corporations that conduct health-oriented management 2020” in a system of the Ministry of Economy, Trade and Industry for commending such corporations.

As for corporate sustainability, as described above, the company will not only tighten corporate governance, but also enhance CSR and ESG activities, including the development of “tea” agriculture. In addition, the company aims to popularize the value of “tea” and establish a high value-added model.

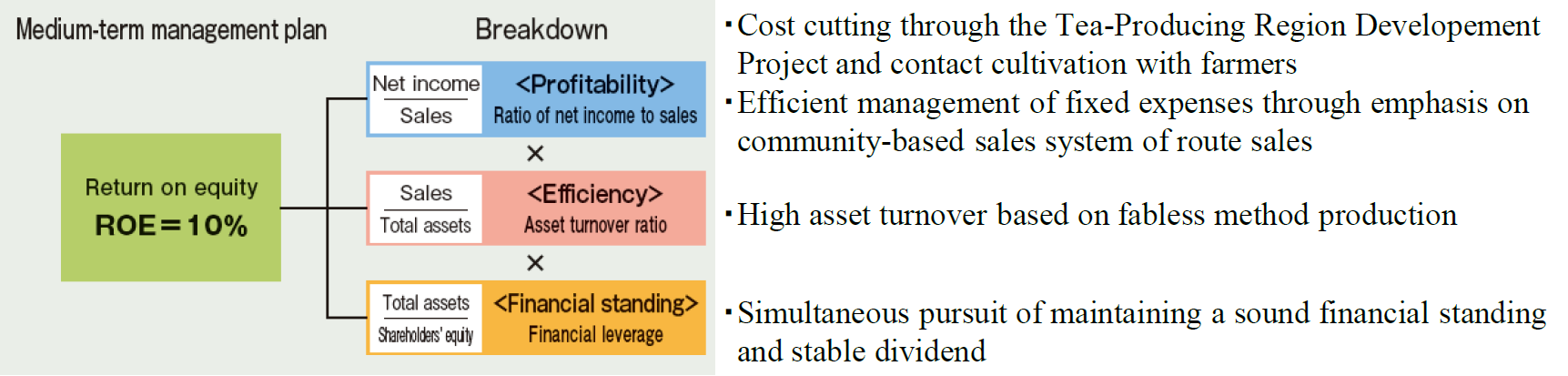

In addition to the above mentioned, the company will improve profitability, capital efficiency, and EPS, pursue stable return to shareholders, and fortify ROE management.

(Source: The company)

2. Fiscal Year Ended April 2020 Earnings Results

2-1. Trend of the beverage market

Year-on-year change rate of sales

| Beverage market (Jan. to Dec.) | ITO EN Beverages Business (May to Apr.) | ITO EN Sales composition ratio |

Tea beverages | +2.3% | -1.4% | 64.3% |

Coffee | -1.9% | -12.5% | 10.8% |

Carbonated beverages | -0.9% | -6.2% | 3.3% |

Mineral water | -1.7% | -14.9% | 2.8% |

Vegetable beverages | -7.2% | -3.5% | 13.0% |

Others | -3.5% | -9.7% | 5.9% |

*Tea beverages: Japanese tea, healthy tea, Chinese tea, black tea. Created based on the company’s materials.

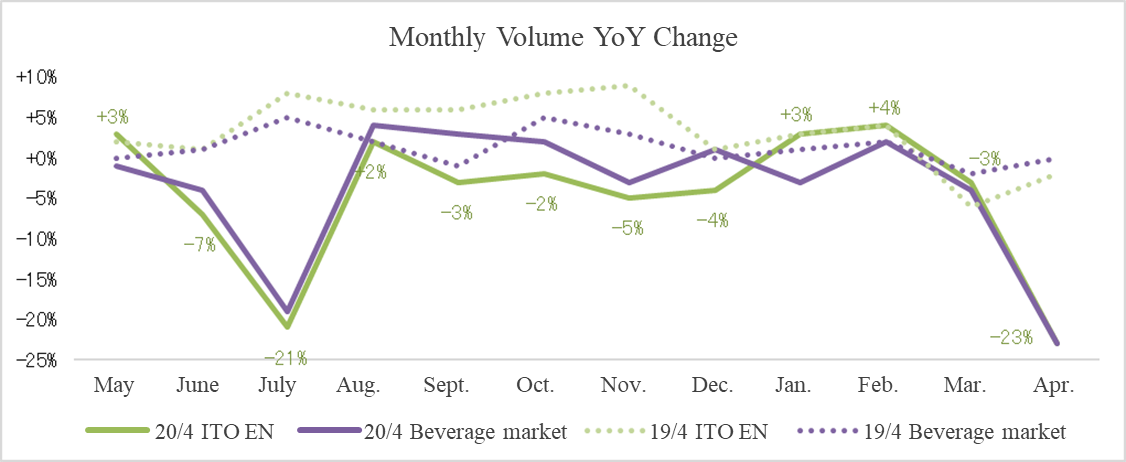

According to the company’s data, in 2019, the scale of the domestic beverage market fell 1.2% year on year to 3.759 trillion yen, due to sluggish demand caused by long rain and low temperatures in July and natural disaster such as typhoons in October, despite a series of price increases for large plastic bottle products since April. However, even under such circumstances, the sales of tea beverages rose 2.3% year on year to 966.5 billion yen and the sales of green tea beverages remained at the same level as the previous year at 445 billion yen.

On the other hand, the sales of the company’s beverage business were 339.3 billion yen, down 4.1% year on year. In June, the company raised prices of products in large plastic bottles one by one and engaged in sales while focusing on profitability by controlling bargain sales of all products. As for respective products, sales of Japanese tea and healthy tea decreased 2.8% year on year due to the declined sales volume, but overall sales of tea beverages dropped only 1.4% as the sales of Chinese tea and black tea increased. In addition, the sales of coffee drinks, for which the company shifted from plastic bottles to bottled cans, declined 12.5% year on year and the sales of mineral water, whose sales were strategically curtailed, also fell 14.9% year on year.

(Source: The company)

According to monthly sales data (non-consolidated and confirmed), in the term ended April 2020, sales decreased 5.3% year on year on a volume basis. Although the sales volume in August increased from the previous year due to the recovery from decreased sales volume caused by the turmoil in logistics last year, the sales volume dropped from June to the end of the year due to the above-mentioned weather factors and sales strategies. In January and February, “Oi Ocha Strong Green Tea,” which was renewed as a food with functional labeling, “Kenko Mineral Mugicha,” which is becoming a popular year-round product, and the new products such as “Relax Jasmine Tea” and “Oi Ocha Iritate Genmaicha” contributed to the increase in sales, exceeding the results of the same month last year. In March and April, the figure was lower than that of the same month last year due to the spread of COVID-19 and the declaration of a state of emergency.

As for respective products, the sales of Japanese tea and healthy tea declined 3.6% year on year as the sales of large plastic bottle products were sluggish due to unfavorable weather in July. The sales of vegetable/fruit drinks, coffee, etc. in plastic bottles dropped significantly, however, the sales of mainstay products in personal size (525/600 ml) such as “Oi Ocha Green Tea” were healthy, and the sales of black tea beverages also grew thanks to the market expansion and the launch of new products.

2-2.Consolidated earnings

| FY 4/19 | Ratio to sales | FY 4/20 | Ratio to sales | YOY | Estimate made in the 2Q | Difference from the estimate |

Sales | 504,153 | 100.0% | 483,360 | 100.0% | -4.1% | 498,000 | -2.9% |

Gross Profit | 240,375 | 47.7% | 232,755 | 48.2% | -3.2% | 241,000 | -3.4% |

SG&A expenses | 217,555 | 43.2% | 212,814 | 44.0% | -2.2% | 218,000 | -2.4% |

Operating Income | 22,819 | 4.5% | 19,940 | 4.1% | -12.6% | 23,000 | -13.3% |

Ordinary Income | 23,211 | 4.6% | 19,432 | 4.0% | -16.3% | 22,800 | -14.8% |

Profit attributable to owners of parent | 14,462 | 2.9% | 7,793 | 1.6% | -46.1% | 14,200 | -45.1% |

*unit: million yen

Sales and operating income declined 4.1% and 12.6%, respectively, year on year. Despite the 4.2% decrease in sales, operating income of ITO EN (non-consolidated) increased 4.9% year on year due to improved profitability.

Sales dropped 2.5% year on year (to 379.2 billion yen) till the third quarter as the company engaged in sales while focusing on profitability, but operating income grew steadily by 8.6% year on year (to 17.8 billion yen). However, in the fourth quarter (Feb. to Apr.), the spread of COVID-19 caused both sales and operating income to fall by 9.5% (to 115.0 billion yen) and 67.3% (to 2 billion yen), respectively, year on year.

For the full year, gross profit rate improved due to changes in the product lineup as a result of putting importance on profitability and lower costs of ingredients and materials, and SG&A expenses decreased 2.2% year on year, mainly for sales commissions, advertisement cost, and transportation costs. However, it was not enough to absorb the decline in sales, so operating income dropped 12.6% year on year. Since an exchange loss of 600 million yen was posted (an exchange loss of slightly under 300 million yen was posted in the previous term), ordinary income fell 16.3% year on year. Net income was 7.7 billion yen, down 46.1% year on year, as the company posted an extraordinary loss of 5 billion yen due to an impairment loss on the entire unamortized balance of goodwill (4.9 billion yen) associated with Distant Lands Trading Company Inc. (Delaware, U.S.A.), which produces and sells coffee beans.

Major Components of SG&A

| 4/19 | Ratio to sales | 4/20 | Ratio to sales | YOY | Estimate made in the 2Q | Difference from the estimate |

Selling commission | 84,760 | 16.8% | 80,537 | 16.7% | -5.0% | 83,774 | -3.9% |

Advertising cost | 11,544 | 2.3% | 11,206 | 2.3% | -2.9% | 12,001 | -6.6% |

Freight cost | 15,210 | 3.0% | 14,651 | 3.0% | -3.7% | 15,274 | -4.1% |

Depreciation and amortization | 11,296 | 2.2% | 10,957 | 2.3% | -3.0% | 11,029 | -0.7% |

Others | 94,745 | 18.8% | 95,463 | 19.7% | +0.8% | 95,922 | -0.5% |

Total | 217,555 | 43.2% | 212,814 | 44.0% | -2.2% | 218,000 | -2.4% |

*unit: million yen

Sales in each company

| 4/19 | Ratio to sales | 4/20 | Ratio to sales | YOY | Estimate made in the 2Q | Difference from the estimate | |

ITO EN (Non-consolidated) | 394,495 | 73.0% | 377,787 | 73.1% | -4.2% | 389,600 | -3.0% | |

Tully`s Coffee Japan Co., Ltd. | 34,568 | 6.4% | 32,811 | 6.3% | -5.1% | 36,300 | -9.6% | |

Chichiyasu Company | 14,409 | 2.7% | 14,251 | 2.8% | -1.1% | 14,216 | +0.2% | |

Other Domestic Subsidiaries | 58,789 | 10.9% | 55,824 | 10.8% | -5.0% | 57,007 | -2.1% | |

US Business (unit: thousand dollars) | 32,385 | 6.0% | 30,971 | 6.0% | -4.4% | 30,997 | -0.1% | |

Other Overseas Subsidiaries | 5,783 | 1.1% | 5,311 | 1.0% | -8.2% | 5,560 | -4.5% | |

Elimination of Internal Transactions | -36,276 | - | -33,595 | - | - | -35,680 | - | |

Consolidated Sales | 504,153 | - | 483,360 | - | -4.1% | 498,000 | -2.9% | |

ITO EN (Non-consolidated) | 15,851 | 4.0% | 16,626 | 4.4% | +4.9% | 17,000 | -2.2% | |

Tully`s Coffee Japan Co., Ltd. | 3,504 | 10.1% | 1,725 | 5.3% | -50.8% | 3,520 | -51.0% | |

Chichiyasu Company | 269 | 1.9% | 410 | 2.9% | +52.4% | 410 | +0.0% | |

Other Domestic Subsidiaries | 2,029 | 3.5% | 1,062 | 1.9% | -47.7% | 1,386 | -23.4% | |

US Business (unit: thousand dollars) | 1,658 | 5.1% | 654 | 2.1% | -60.6% | 1,169 | -44.1% | |

Other Overseas Subsidiaries | 1,080 | 18.7% | 963 | 18.1% | -10.8% | 1,063 | -9.4% | |

Elimination of Internal Transactions | -1,572 | - | -1,500 | - | - | -1,548 | - | |

Consolidated Operating Income (Profit Ratio) | 22,819 | 4.5% | 19,940 | 4.1% | -12.6% | 23,000 | -13.3% | |

*unit: million yen

2-2. Quarterly Performance

| 4/19-1Q | 2Q | 3Q | 4Q | 4/20-1Q | 2Q | 3Q | 4Q | YOY |

Sales | 139,568 | 135,900 | 113,631 | 115,054 | 130,367 | 135,104 | 113,743 | 104,146 | -9.5% |

Gross profit | 64,963 | 64,548 | 53,638 | 57,226 | 62,553 | 64,370 | 55,471 | 50,361 | -12.0% |

SG&A expenses | 58,895 | 57,404 | 50,413 | 50,843 | 56,346 | 56,469 | 51,727 | 48,272 | -5.1% |

Operating income | 6,068 | 7,144 | 3,225 | 6,382 | 6,207 | 7,900 | 3,745 | 2,088 | -67.3% |

Ordinary income | 6,381 | 7,438 | 2,765 | 6,627 | 5,882 | 7,990 | 3,818 | 1,742 | -73.7% |

*unit: million yen

In the fourth quarter (Feb. to Apr.), sales decreased 9.5% year on year and operating income fell 67.3% year on year.

The sales of ITO EN (non-consolidated) declined 8.5% year on year. As for respective channels, sales dropped 1% for supermarket/mass retailers, 9% for convenience stores (CVS), and 19% for vending machines. For supermarkets/mass retailers, purchase opportunities remained stable as demand for stockpiles increased in February and March. On the other hand, the decline in CVS sales reflects fewer opportunities to visit stores, mainly in urban areas, while the decreased sales from vending machines were due to fewer opportunities to purchase from indoor vending machines at offices and other locations, in addition to transportation and tourist facilities. Furthermore, changes in product mix resulted in fewer opportunities to purchase, leading to an 8% year on year decline in the sales of tea beverages, however, the sales of vegetable beverages improved 3% year on year due to increased public health awareness, such as to enhance immunity against COVID-19. Also, the demand for large plastic bottle products grew with an increasing number of people working from home and temporary closure of schools.

Sales Year on Year Comparison

| February | March | April | 4Q | |

ITO EN (Non-consolidated) | +5% | -4% | -22% | -8.5% | |

Type of Business | Supermarket/Mass retailers | +11% | +5% | -13% | -1% |

Convenience Stores CVS | +5% | -8% | -23% | -9% | |

Vending Machines | -7% | -15% | -36% | -19% | |

Type of Product | Tea Beverages | +13% | -2% | -27% | -8% |

Vegetable Beverages | +7% | +2% | +1% | +3% | |

As for group companies, the sales of Tully’s Coffee Japan decreased 34% year on year. The stores in areas where a state of emergency had been declared were closed or had shortened business hours in order to ensure the safety of shoppers and fellow employees (as of the end of April, 97% of stores were closed or had shortened business hours). The business in North America (ITO EN (North America) INC.) experienced temporary demand for online sales (mail-order sales), however, sales dropped 9% year on year due to a decline in the frequency of consumer purchase due to the restrictions on going-out. The sales of the business in China (as the fiscal year for this business ended March 2020, the target period is from January to March 2020) fell 19% year on year. However, the company was able to resume operations, though with restrictions, from mid-Feb onwards, and sales bottomed out in January and recovered in February and March. No impact is observed for the ingredients of the Chinese tea.

Sales Year on Year Comparison

| February | March | April | 4Q | |

Tully’s Coffee Japan | Sales | +3% | -25% | -75% | -34% |

Ratio of stores that were closed or had shortened business hours (As of the end of the month) | 4% | 25% | 97% | - | |

The business in North America(ITO EN (North America) INC.) | Sales | -22% | +10% | -16% | -9% |

| January | February | March | 4Q | |

The business in China | Sales | -26% | -24% | -10% | -19% |

Current initiatives and basic policy for the future

The company continues to operate its business as usual, striving to provide a stable supply of essential beverages while prioritizing the health, safety, and security of its customers (consumers, shareholders, buyers, suppliers, financial institutions, and local communities) and employees. It also provides tea products (beverages and tea leaves) and coffee kettles (free of charge) to medical professionals (as of June 17). The company has been able to ensure sufficient liquidity in its cash reserves and plans to maintain the existing dividend (40 yen/common share and 50 yen/preferred share) based on the idea of stable distribution of profits to shareholders.

2-3.Financial Status and Cash Flows (CF)

Main balance sheet

| End of Apr. 2019 | End of Apr. 2020 |

| End of Apr. 2019 | End of Apr. 2020 |

Cash and deposits | 63,738 | 64,813 | Trade payables | 30,181 | 26,447 |

Trade receivables | 56,581 | 49,168 | Accrued expenses | 24,839 | 23,631 |

Inventories | 43,588 | 45,723 | Interest-bearing debts | 56,542 | 55,742 |

Total current assets | 177,449 | 173,966 | Lease obligations | 12,501 | 9,935 |

Property, plant and equipment | 84,186 | 82,986 | Net defined benefit liability | 10,313 | 10,612 |

Intangible fixed assets | 18,956 | 11,570 | Total liabilities | 153,058 | 140,956 |

Investments and other assets | 23,389 | 22,128 | Total net assets | 150,923 | 149,695 |

Total fixed assets | 126,532 | 116,685 | Total liabilities and net assets | 303,981 | 290,651 |

*unit: million yen

Total assets at the end of the term were 290.6 billion yen, down 13.3 billion yen from the end of the previous term. On the debit side, cash and deposits grew from the end of the previous term, while trade receivables declined due to smaller sales in the fourth quarter and intangible assets dropped because of impairment losses on lease assets and goodwill. On the credit side, net assets decreased, reflecting trade payables, interest-bearing debts, lease obligations, and financial results. Capital-to-asset ratio was 51.0% (49.2% as of the end of the previous term).

Cash Flows (CF)

| FY 4/19 | FY 4/20 | YoY | |

Operating CF (A) | 26,128 | 24,719 | -1,409 | -5.4% |

Investing CF (B) | -10,635 | -9,217 | +1,418 | - |

Free CF (A+B) | 15,493 | 15,502 | +9 | +0.1% |

Financing CF | -15,005 | -12,905 | +2,100 | - |

Balance of cash and cash equivalents at end of period | 61,950 | 63,710 | +1,760 | +2.8% |

*unit: million yen

The company secured operating CF of 24.7 billion yen, including a pretax profit of 14.3 billion yen (22.4 billion yen in the previous term), a depreciation of 13.1 billion yen (13.4 billion yen in the previous term), impairment losses of 5.2 billion yen (400 million yen in the previous term), and a payment amount of corporate tax, etc. of 8.0 billion yen (7.1 billion yen in the previous term). Negative investing CF was due to the purchase of property, plant and equipment and intangible fixed assets, while negative financing CF was due to the acquisition of treasury shares, the repayment of long-term debts and financial lease obligations, and the payment of dividends.

Transition of ROE

| FY 4/16 | FY 4/17 | FY 4/18 | FY 4/19 | FY 4/20 |

ROE | 6.81% | 10.46% | 9.03% | 9.90% | 5.23% |

Net income | 1.85% | 2.88% | 2.54% | 2.87% | 1.61% |

Total assets turnover | 1.62 times | 1.61 times | 1.64 times | 1.67 times | 1.63 times |

Leverage | 2.27 times | 2.25 times | 2.17 times | 2.07 times | 2.00 times |

*ROE = Net income × Total assets turnover × leverage.

3. Fiscal Year Ending April 2021 Financial Estimates

3-1. Consolidated Earnings

| FY 4/20 Results | Ratio to sales | FY 4/21 Forecast | Ratio to sales | YOY |

Sales | 483,360 | 100.0% | 481,000 | 100.0% | -0.5% |

Gross profit | 232,755 | 48.2% | 233,300 | 48.5% | +0.2% |

SG&A expenses | 212,814 | 44.0% | 213,300 | 44.3% | +0.2% |

Operating income | 19,940 | 4.1% | 20,000 | 4.2% | +0.3% |

Ordinary income | 19,432 | 4.0% | 19,800 | 4.1% | +1.9% |

Net income | 7,793 | 1.6% | 13,000 | 2.7% | +66.8% |

*unit: million yen

It is estimated that sales will drop 0.5% while operating income will rise 0.3% from the previous term.

Although the earnings estimate takes into account the impact of COVID-19, especially for the first quarter, the sales of tea and vegetable beverages are expected to be steady, considering the growing public health awareness and the company also anticipates improvement in profitability through changes in product mix, etc. However, given the uncertainty of when the novel coronavirus will be contained, the company will make an announcement as soon as it becomes necessary to revise the forecast.

Major Components of SG&A

| FY 4/20 Results | Ratio to sales | FY 4/21 Forecast | Ratio to sales | YOY |

Selling commission | 80,537 | 16.7% | 80,764 | 16.8% | +0.3% |

Advertising cost | 11,206 | 2.3% | 11,359 | 2.4% | +1.4% |

Freight cost | 14,651 | 3.0% | 14,592 | 3.0% | -0.4% |

Depreciation and amortization | 10,957 | 2.3% | 10,402 | 2.2% | -5.1% |

Others | 95,463 | 19.7% | 96,183 | 20.0% | +0.8% |

Total | 212,814 | 44.0% | 213,300 | 44.3% | +0.2% |

*unit: million yen

Performance in each company

| FY 4/20 Results | Ratio to sales | FY 4/21 Forecast | Ratio to sales | YOY |

ITO EN (Non-consolidated) | 377,787 | 73.1% | 376,200 | 73.0% | -0.4% |

Tully`s Coffee Japan Co., Ltd. | 32,811 | 6.3% | 33,700 | 6.5% | +2.7% |

Chichiyasu Company | 14,251 | 2.8% | 13,548 | 2.6% | -4.9% |

Other Domestic Subsidiaries | 55,824 | 10.8% | 55,087 | 10.7% | -1.3% |

US Business (unit: thousand dollars) | 30,971 | 6.0% | 31,621 | 6.1% | +2.1% |

Other Overseas Subsidiaries | 5,311 | 1.0% | 5,163 | 1.0% | -2.8% |

Elimination of Internal Transactions | -33,595 | - | -34,319 | - | - |

Consolidated Sales | 483,360 | - | 481,000 | - | -0.5% |

ITO EN (Non-consolidated) | 16,626 | 4.4% | 16,700 | 4.4% | +0.4% |

Tully`s Coffee Japan Co., Ltd. | 1,725 | 5.3% | 1,750 | 5.2% | +1.4% |

Chichiyasu Company | 410 | 2.9% | 411 | 3.0% | +0.2% |

Other Domestic Subsidiaries | 1,062 | 1.9% | 956 | 1.7% | -10.0% |

US Business (unit: thousand dollars) | 654 | 2.1% | 1,075 | 3.4% | +64.4% |

Other Overseas Subsidiaries | 963 | 18.1% | 1,018 | 19.7% | +5.7% |

Elimination of Internal Transactions | -1,500 | - | -1,910 | - | - |

Consolidated Operating Income (Profit Ratio) | 19,940 | 4.1% | 20,000 | 4.2% | +0.3% |

average to the US dollar in the term | ¥108.39 |

| ¥108.00 |

|

|

*unit: million yen

4. Marketing strategies

ITO EN (non-consolidated)

| FY 4/20 | Ratio to sales | YOY | FY 4/20 | Ratio to sales | YOY |

Tea leaves | 35,269 | 9.3% | -4.6% | 35,621 | 9.5% | +1.0% |

Beverages | 339,395 | 89.9% | -4.1% | 337,653 | 89.7% | -0.5% |

Others | 3,122 | 0.8% | -13.4% | 2,925 | 0.8% | -6.3% |

Sales | 377,787 | 100.0% | -4.2% | 376,200 | 100.0% | -0.4% |

Japanese Tea/Healthy Tea | 193,246 | 51.2% | -2.8% | 194,645 | 51.6% | +0.7% |

Chinese Tea | 17,219 | 4.6% | +2.6% | 17,234 | 4.6% | +0.1% |

Vegetable | 43,960 | 11.6% | -3.5% | 44,022 | 11.7% | +0.1% |

Fruit | 8,855 | 2.3% | -15.3% | 7,927 | 2.1% | -10.5% |

Coffee | 36,538 | 9.7% | -12.5% | 36,399 | 9.7% | -0.4% |

Black tea | 7,677 | 2.0% | +34.1% | 7,070 | 1.9% | -7.9% |

Functional | 7,763 | 2.1% | -1.3% | 7,239 | 1.9% | -6.7% |

Mineral water | 9,396 | 2.5% | -14.9% | 8,979 | 2.4% | -4.4% |

Carbonated | 11,175 | 3.0% | -6.2% | 10,586 | 2.8% | -5.3% |

Others | 3,562 | 0.9% | -11.9% | 3,552 | 1.0% | -0.3% |

Total sales of beverages | 339,395 | 89.9% | -4.1% | 337,653 | 89.7% | -0.5% |

*unit: million yen

4-1. Oi Ocha

In 2020, the scale of the green tea beverage market is estimated to be 425 billion yen, down 4.5% year on year. However, the company plans to increase its share by 2 points to 35% by promoting “tea” that boasts high health benefits for the new daily life after the pandemic of COVID-19 subsides. The overall sales volume of “Oi Ocha” in the previous year was about 87 million cases, however, the company aspires for 100 million cases and aim to achieve more than 90 million cases as soon as possible.

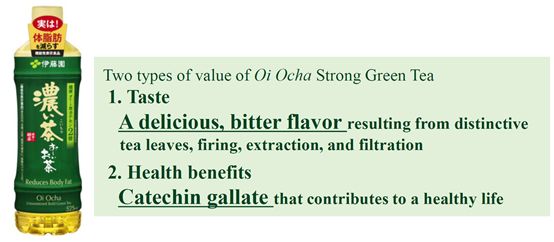

Nowadays, health awareness is dramatically changing with the “to control your own health” being a keyword including “countermeasures for body fat” and “countermeasures for blood cholesterol.” Under these circumstances, “catechins” are gathering attention among the tea beverages, particularly, gallate-type tea catechins. The company will support each individual’s new daily life by promoting and proposing the health benefits of the catechins-rich “Ocha,” through which it will capture demand. On a side note, among all the 8 types of tea catechins, “gallate-type tea catechins” are catechins with gallate in its structural formula and include the 4 catechins: EGCg, ECg, GCg, and Cg, which produce the bitter taste. The company's central research laboratory confirmed that the continuous intake of gallate-type tea catechins is effective in “reducing body fat” and “reducing cholesterol levels in females.” In May 2007, the company announced the results in the 61st meeting of the Japan Society of Nutrition and Food Science at Kyoto International Conference Center.

Trend of the green tea beverages market and ITO EN’s catechin-rich product lineup

|

|

(Source: the company)

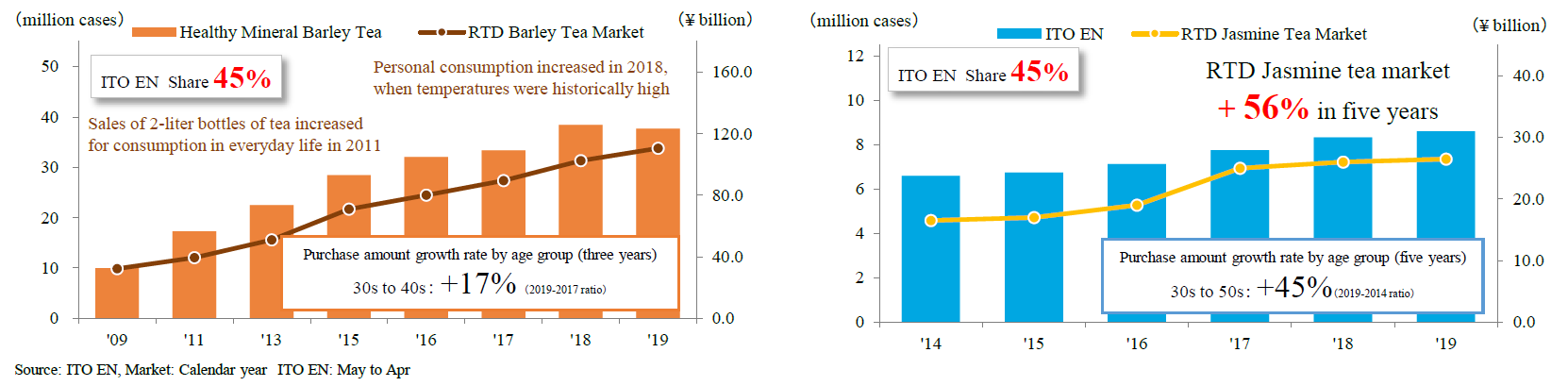

“Oi Ocha Unsweetened Bold Green Tea” with the delicious bitter taste and the new product, “Oi Ocha Decaffeinated Green Tea”

“Oi Ocha Unsweetened Bold Green Tea” is the No.1 green tea beverage containing gallate-type tea catechins among foods with function claim (beverage). A lot of thought was put into the selection of tea leaves, roasting, extraction, and filtration and it is characterized by its bitter taste. Along with the renewal in the last summer, considering it as a beverage displaying functionality in retrospect, the drinkers’ base has expanded regardless of age and gender (normally, it was mainly middle-aged to old males). Sales in the second half increased by 60% year on year and the total number of bottles sold (launched in 2004) exceeded 5 billion (in units of 525-ml bottles).

On the other hand, the caffeine-free green tea beverage, “Oi Ocha Decaffeinated Green Tea” is a new product released on June 29, 2020. It keeps the same taste and aroma of “Oi Ocha,” but takes the caffeine out. According to Fuji Keizai’s “Future outlook on the wellness food products market 2019,” the caffeine-free food products market has increased by 27% in the past 5 years thanks to the contribution of unsweetened tea beverages. By introducing the first caffeine-free green tea beverage, the company will provide a solution for people who want to drink green tea in their relaxing time but avoid caffeine.

|

|

(Source: the company)

4-2. Tea leaves

As at-home consumption increased due to the COVID-19 pandemic, the total sales in the green tea leaves market, which includes tea bags and instant-type convenient products, has grown 6.4% year on year during the period from February to April, however, the sales of the company, whose sales of convenient products are strong, has grown 9.7% exceeding the market growth. The ratio of products simplified for convenience in the green tea leaves market has increased; according to the company’s data, it increased from 25% in 2009 to 43% in 2019. This trend is ongoing. From February to April, the tea bag market grew 13.4% year on year and the company’s sales increased 16.0% year on year. (share: 42%).

On April 6, the company launched the “Oi Ocha Instant Bold Green Tea with Matcha,” which is the food with functional claims and helps to reduce body fat. This product offers consumers a broad variety of ways to enjoy the “Oi Ocha Unsweetened Bold Green Tea” in their own cups or bottles.

(Source: the company)

4-3. Barley and Jasmine Tea

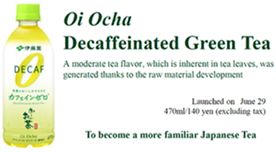

“Kenko Mineral Mugicha” (barley tea) is a caffeine-free drink that can replenish the body with minerals. It is not only consumed during summer, but all year round as it is gaining more recognition. The company plans to promote it as a sports drink and aims to sell 40 million cases in a year as soon as possible (37.7 million cases in FY 4/2020). On the other hand, for the Jasmine tea beverages represented by “Relax Jasmine Tea,” the company did not conduct special advertising activities. However, as the customer base, which was composed of mainly females, has been expanding the previous term’s sales came close to 9 million cases. Currently, there is no competition with national brands, thus the company will concentrate on making advertising activities and aim for a sales scale of 10 million cases as soon as possible. The company is increasing drinking opportunities as it sells diluting can products along with plastic bottles, and it is working towards spreading the habit of drinking Jasmine tea.

Trend of the barley and Jasmine tea beverages market.

(Source: the company)

4-4. Black Tea and Vegetable Beverages

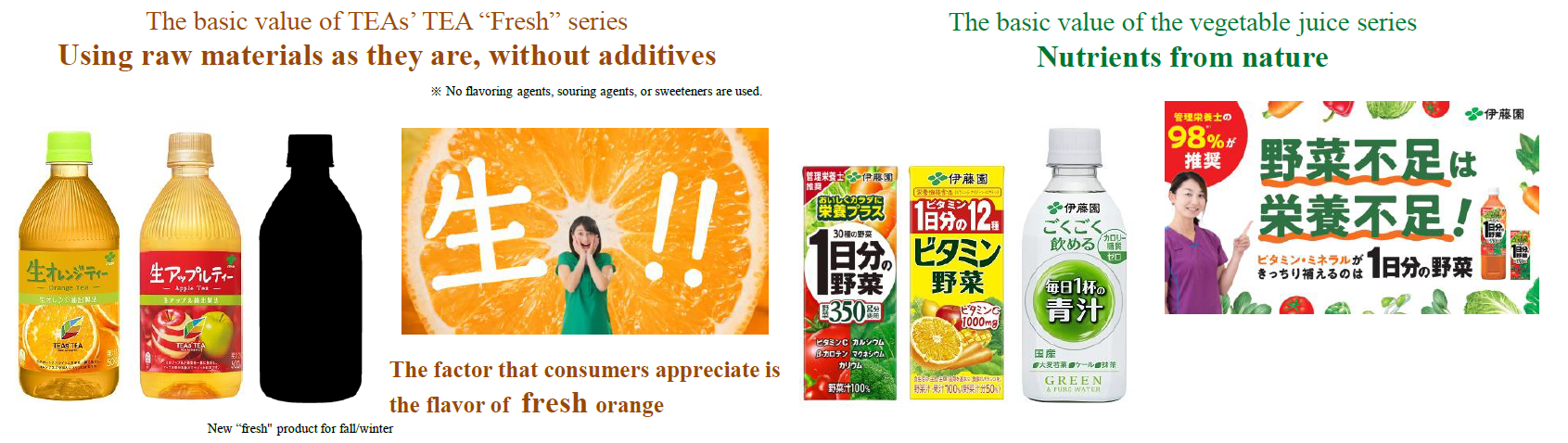

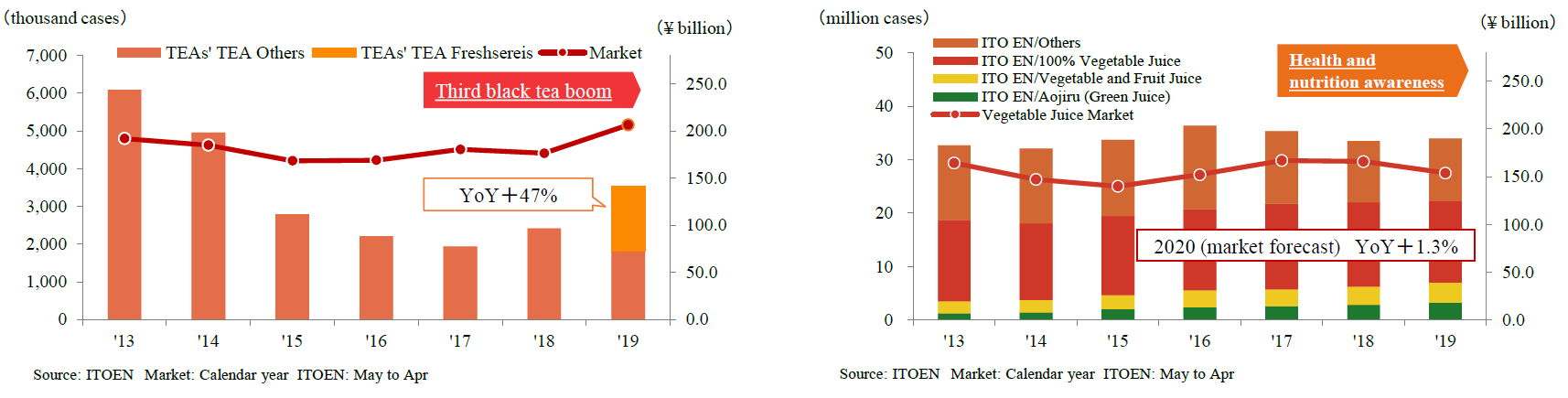

As for the black tea market, the third black tea boom is approaching as each major company is releasing new plastic bottle products, etc. The company’s sales increased 47% year on year thanks to releasing TEAs' TEA AUTHENTIC series, which is based on the concept of not being too sweet with a comforting aroma (only raw ingredients with no additives). Further, the company is increasing brand awareness of the TEAs' TEA AUTHENTIC series as a sweetened tea beverage brand that represents Ito En. On the other hand, regarding vegetable beverages, thanks to the promotion based on “nutrition” and thanks to the increase in brand awareness as a tasty and nutritious vegetable beverage, sales of “Vitamin vegetables” increased 8.9% year on year, “one cup a day Aojiru” by 15.5% (“one day’s worth of vegetables” decreased 3.5% year on year). For the 4th quarter (February-April), the total sales of the three products increased 5.5% year on year.

Sales trend of TEAs’ TEA series and vegetable beverages series

(Source: the company)

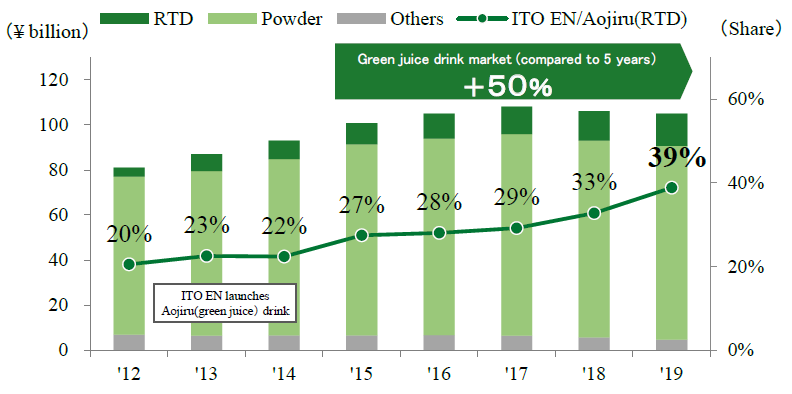

4-5. Vegetable Beverages (Aojiru)

The Aojiru market expands through powder Aojiru and mail orders; currently, it is at a scale of 10 billion yen, however, the powder Aojiru market has matured, thus it is slightly stagnant. In these circumstances, the growing market is the Aojiru beverages market. The company is concentrating its efforts on over-the-counter sales of Aojiru beverages and it is increasing its share in the Aojiru market. Interestingly, referring to the company’s data, the ratio of ready-to-consume beverages is only 9.8% (2019). Along with the convenience of buying from stores, it can be said that over-the-counter sales of Aojiru beverages have significant room for growth. In fact, the company sales expanded 3.5 times in 2 years.

The company uses Barley grass as an ingredient for making Aojiru and thanks to contract farming its procurement is stable (the Aojiru ingredient, “Barley grass” is cultivated during tea down season, thus it is also contributing to making agriculture more efficient.)

Sales trend of the Aojiru beverages series

|

|

(Source: the company)

4-6. Tully’s Coffee

The net increase in the number of stores of the subsidiary, Tully's Coffee Japan Co., Ltd., in FY 4/2020 was only 12. However, in FY 4/2021, it is planning to reach a net increase of 30 (number of stores at the end of the term is 777), including stores opening on the second floor of Keisei line Nippori Station (Arakawa-ku, Tokyo) in May and Ariake Garden (Koto-ku, Tokyo) in June. Through not only stores expansion, but also the launch of the Nata de coco series, the company aims to attract more female customers and strengthen their solution for providing “Cafe at home” through Tully’s custom-made coffee (a proposal of a way to enjoy a fine selection of coffee at home). As for the Nata de coco series, the company launched “red berries Nata de coco” in April, “Mango Tango Nata de coco” and “shiikuwasha Nata de coco” in May. Regarding the “cafe at home” solution, the company launched “Elephant Ruby Laos” in June. Furthermore, it is considering releasing easy-to-use products so that “cafe at home” beginners can enjoy it. Moreover, as a human resources policy, the company adopted the chief barista system in order to train chief baristas, who conduct the coffee awareness program inside and outside the company.

On the other hand, Ito En’s Tully's coffee brand, which represents the shop’s quality, is concentrating on the bottle can black coffee, which boasts the No.1 share and the No.1 repeat customer ratio, and working to differentiate it from other companies’ coffee beverages. In addition, as a consideration to the environment, the company plans to release “TULLY'S COFFEE ESPRESSO with MILK” in July, which will be packaged in paper packs.

Transition of Sales and Number of Stores

(Source: the company)

4-7 Overseas strategies

In FY 4/2020, the global sales of “Oi Ocha” (based on unit quantity) offset the effects of COVID-19 and increased by 4% year on year, mainly in the U.S and China (the cumulative total up to the 3rd quarter was up 12% year on year). The sales in the North American area increased 15% year on year thanks to the expansion of mail order sales (27% year-on-year increase in the previous year). In the future, the company will work on organizing the products’ structure and focus on U.S.-based supermarkets, which are a natural department. Even in China where government control is strict due to COVID-19, sales increased 2% year on year (10% year-on-year increase in the previous term). The company plans for a lateral expansion and will accelerate cultivating the market. Moreover, as an initiative to enable local production for local consumption overseas, it commenced production of teabag products made in Australia and started sales in May 2020.

|

|

(Source: the company)

5. Conclusions

While many companies have their earnings forecasts still to be determined, the company disclosed its earnings estimate. The scale of the beverage market is expected to decrease 6.3% year on year in 2020, but the company will improve its safe and secure “Oi Ocha” brand to attract health-conscious and genuineness-oriented customers by promoting the functionality of “gallate-type tea catechins,” launching new products with zero caffeine, and strengthening marketing policies through the use of social networking sites and e-commerce. Also, the company expects to achieve sales and profits on a par with the previous year’s level by continuing to enhance its profitability through distinctive sales strategy for each product, etc. In fact, sales appear to be slowly recovering with the lifting of the state of emergency. We will be paying attention to the post-pandemic development as well as the company’s unique CSR activities and initiatives to create comprehensive value through its shared-value creation (CSV) program, which aims to simultaneously provide social and economic value within its core business.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 12 directors, including 3 outside ones |

Auditors | 4 auditors, including 3 outside ones |

◎Corporate Governance Report:Updated December 2, 2019

Basic Policy

“Always Putting the Customer First” is the ITO EN Group’s management philosophy. In the ITO EN Group’s Basic Policies, the basis of our business administration to take corporate social responsibility in cooperation with interested parties such as the government, local communities, consumers, shareholders, clients, suppliers, and financial institutions, in order to achieve sustainable growth and development as well as increasing our corporate value. This management philosophy is the fundamental policy behind our group’s corporate ethics and the unchanging truth that supports our corporate governance. Based on this philosophy, all the executives and employees of our group will actively pursue an operation that works towards a sustainable society while responding to the trust of all the interested parties. To realize an appropriate form of corporate governance, our company, which has a board of auditors, carries out audits in which the auditors inquire the business conditions, the decision-making processes, etc. of the representative directors, the directors in charge or the employees of our group companies. The auditors attend every meeting of the board of directors in order to give their objective and impartial opinions on the audit situations concerning the company in general or individual issues, and audit the business execution by the directors in accordance with the audit policies set out by the board of auditors.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

【Supplementary Principle 4-11 (1) Policies for the balance, diversity, and scale of the Board of Directors】

The number of members of the Board of Directors of our company is up to the limit specified by our articles of incorporation. As for its composition, the Board of Directors is basically composed of the necessary and appropriate number of members for making effective decisions and securing substantial discussions. Although there are no female directors as of the date of submission of this report, we will make efforts to appoint female directors from the viewpoint of securing diversity in gender and internationality, and expertness.

(Article 6 of ITO EN’s Guidelines (Composition of the Board of Directors))

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

In principle, our company will not hold any shares of other companies, unless it is considered that the shareholding would smooth transactions, procurement, or fund raising. If the shareholding is not expected to contribute to the improvement in mid/long-term corporate value, we will reduce the number of shares we hold step by step. As for the shares of listed companies we hold in accordance with the above proviso (hereinafter called “strategically held shares”), we check whether the return of invested capital exceeds capital cost for each stock at the annual meeting of the board of directors. From the viewpoint of maintaining and cementing the mid/long-term relations with business partners, we check the meanings of shareholding, and confirm at the meetings of the board of directors that we will sell or reduce the shares whose economic rationality and meanings have diluted after consulting with the parties concerned. As for the exercise of voting rights for strategically held shares, we check the contents of each bill and comprehensively judge whether it will contribute to the improvement in corporate value of our company and the invested company, before exercising them. (Article 14 of the Guidelines of our company-Policy for strategic shareholding)

【Principle 1-7 Transactions among related parties】

If our company makes a transaction with an executive, a major shareholder, or the like, we will discuss said transaction at a meeting of the board of directors to obtain their approval, unless the conditions for said transaction are the same as those for general transactions so that said transaction will not harm the common interests of our company and shareholders, etc. (Article 13 of the Guidelines of our company-System for managing transactions among related parties)

【Principle 5-1 Policy for constructive dialogue with shareholders】

After grasping its own capital cost accurately, our company listens to the voices of shareholders and pays proper attention to their interests and concerns through the constructive dialogue between the management and shareholders, revises its business portfolio, explicitly explains its management policies including the investment in equipment, R&D, and human resources, and win the understanding of shareholders. (Article 16 of the Guidelines of our company-Policy for constructive dialogue with shareholders)

For details, please see the report titled “Situation of IR-related activities.”

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on ITO EN, LTD. (2593) and Bridge Salon (IR seminar), please go to our website at the following URL.www.bridge-salon.jp/