Bridge Report:(2593)ITO EN the second quarter of the fiscal year ending April 2021

ITO EN, LTD. (Common stock: 2593, Preferred stock: 25935) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

President | Daisuke Honjo |

Address | 47-10, Honmachi 3-chome, Shibuya-ku, Tokyo |

Year-end | April |

URL |

Stock Information

<Common Stock>

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥6,440 | 88,198,913 shares | ¥568,000 million | 5.2% | 100 shares | |

DPS (Forecast) | Dividend yield (Forecast) | EPS (Forecast) | PER (Forecast) | BPS (Actual) | PBR (Actual) |

¥40.00 | 0.6% | ¥45.09 | 142.8 times | ¥1,221.92 | 5.3 times |

* The share price is the closing price on December 21. ROE and BPS are the last term’s results.

<Preferred Stock>

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥2,105 | 33,053,362 shares | ¥69,577 million | 5.2% | 100 shares | |

DPS (Forecast) | Dividend yield (Forecast) | EPS (Forecast) | PER (Forecast) | BPS (Actual) | PBR (Actual) |

¥50.00 | 2.4% | ¥55.09 | 38.2 times | ¥1,226.92 | 1.7 times |

* The share price is the closing price on December 21. ROE and BPS are the last term’s results.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

April 2017 (Actual) | 475,866 | 21,774 | 21,524 | 13,693 | 108.77 | 40.00 |

April 2018 (Actual) | 494,793 | 22,043 | 21,441 | 12,553 | 99.79 | 40.00 |

April 2019 (Actual) | 504,153 | 22,819 | 23,211 | 14,462 | 116.02 | 40.00 |

April 2020 (Actual) | 483,360 | 19,940 | 19,432 | 7,793 | 61.53 | 40.00 |

April 2021 (Forecast) | 450,000 | 12,300 | 12,100 | 5,800 | 45.09 | 40.00 |

* Unit: Million yen, yen

This Bridge Report outlines the results of ITO EN for the second quarter of the fiscal year ending April 2021 and the outlook for the term ending April 2021.

Table of Contents

Key Points

1. Company Overview

2.Second Quarter of Fiscal Year Ending April 2021 Earnings Results

3. Fiscal Year Ending April 2021 Financial Estimates

4. Marketing Strategies

5. Conclusions

<Reference: Regarding Corporate Governance>

Key points

- For the first half of the term ending April 2021, sales and operating income dropped 10.9% and 39.0%, respectively, year on year. The domestic and overseas businesses were affected by COVID-19, but the domestic businesses were also affected by the prolonged rainy season in July, the low temperatures and abundant rainfall in early October, and the voluntary restraint of holding seasonal events. As for profit, the non-consolidated operating income of ITO EN decreased 23.5% year on year, and Tully’s Coffee Japan posted an operating loss, as it was forced to temporarily close its shops or shorten business hours. Like this, domestic subsidiaries, excluding Chichiyasu, saw a decline in profit.

- As for the full-year estimates, sales and operating income are estimated to decrease 6.9% and 38.3%, respectively, year on year. The company revised the estimated sales downwardly, under the assumption that the impact of COVID-19, which was first expected to peak out in the first quarter, will linger throughout the year. As for profit, the company took into account the effects of the decline in sales, and the allocation of managerial resources to the core business and brand for the society with COVID-19 and the post-pandemic society. As for term-end dividends, the company plans to pay a dividend of 20 yen/share for common shares (40 yen/share per year, combined with the interim dividend), and a dividend of 25 yen/share for type-1 preferred shares (50 yen/share per year).

- In the first half, sales and profit dropped, but the company maintained its share in the green tea beverage market, while competitors went on an offensive, renewing their products considerably and conducting sales promotion. In the second half, the company will meet the demand in the winter season by providing microwavable products and release products with high added value such as products with appealing functions like Oi Ocha Strong Green Tea, one after another. In addition, the tea leaves market is gathering steam, as tea leaves are demanded by customers who are eager to have experiential consumption at home. This brightens the outlook for the next term. In the next term, the company is expected to achieve a V-shaped recovery of business performance.

1. Company Overview

ITO EN mainly manufactures and sells beverages (including tea beverages such as green tea, coffee, and vegetable beverage), and tea leaves, and also operates restaurants and conducts franchise (FC) business of Tully’s Coffee, etc., manufactures and sells supplements via its subsidiaries. In Japan, the company has the largest share of 33% (as of 2019) in the market of green tea beverages, including “Oi Ocha.” In addition, it owns a variety of popular product brands, such as “Kenko Mineral Mugicha” (barley tea) which is the bestselling caffeine-free tea beverage, “Ichinichibun no Yasai” (Vegetable Beverage), the most selling 100% vegetable beverage, and “TULLY’S COFFEE” which is the top-selling bottle-shaped canned black coffee product developed in cooperation with Tully’s Coffee Japan Co., Ltd.. Each of them has achieved an annual sales quantity of over 10 million cases (“Oi Ocha” has sold about 90 million cases).

The ITO EN Group is composed of 31 consolidated subsidiaries, including Tully’s Coffee Japan Co., Ltd. and Chichiyasu Company, and 3 companies accounted for using the equity method. With the aim of becoming a “Global Tea Company,” it is developing the ITO EN brand and cultivating new green tea markets in the U.S. (mainly New York), China, Australia and Southeast Asia.

Management Principle “Always Putting the Customer First”

1-1.Five Concepts for Product Development since the Establishment of the Company

(Source: The company)

1-2.Outline of the business

The business of ITO EN is classified into the Beverages Business and Tea Leaves, which manufactures and sells tea leaves and beverages, the Restaurant Business, in which Tully’s Coffee Japan Co., Ltd. operates specialty coffee shops and FC business, and The Others, in which Mason Distributors, Inc. (Florida, the U.S.) manufactures and sells supplements.

For the term ended April 2020, the sales of ITO EN (non-consolidated) accounted for 85.0% of the Tea Leaves and Beverages Business (78.2% of consolidated sales). As for the composition of the sales(non-consolidated), tea leaves make up 9.3%, beverages 89.9%, and others 0.8%.

| Sales | Composition ratio | YoY | Operating income | Composition ratio | YoY |

Tea Leaves and Beverages Business (A) | 444,411 | 91.3% | -4.1% | 18,783 | 4.2% | -5.2% |

Restaurant Business | 32,811 | 6.7% | -5.1% | 1,725 | 5.3% | -50.8% |

Others | 9,424 | 1.9% | -1.3% | 656 | 7.0% | -14.9% |

Adjustment | -3,287 | - | - | -1,224 | - | - |

Total (Consolidated sales/operating income) | 483,360 | 100.0% | -4.1% | 19,940 | 4.1% | -12.6% |

ITO EN (non-consolidated):B (composition rati B/A) | 377,787 | 78.2% | -4.2% | 16,626 | 4.4% | +4.9% |

* Unit: Million yen

Product brands representative of ITO EN, LTD. that have sold over 10 million cases annually

(Source: The company)

1-3 Global tea company

As a global tea company, the company aims to be the corporate group ITO EN that can contribute to the health of customers around the world, and support the affluent life of each customer. To attain this goal, the company is conducting activities as a health-enhancing enterprise that supports corporate sustainability and affluent lives, and strengthening its ROE management.

Corporate sustainability

The company set the medium/long-term environmental goals of the ITO EN Group, and takes measures for containers and packages, and for coping with climate changes, while advertising the value of tea, such as catechin and theanine, through their products. In addition, the company concentrates on the tea plantation development project, which is an original sustainable agricultural model, and on recycling used tea leaves which are excreted after the production of tea beverages, etc.

Packaging Initiatives

Under the basic policy of 3Rs (recycling, reduction, and replacement & reuse) + Clean, the company aims to make every material used in plastic bottles to recyclable materials, including biological materials, by 2030.

Policy regarding the plastics of the ITO EN Group

Recycling resources | -To fully make the material used in plastic bottles to recyclable materials* by 2030. -To promote the use of recyclable materials other than plastic bottles. -To conduct activities for improving the ratio of recycling in cooperation with administrative bodies, industrial groups, business partners, etc. *including biological materials |

Reduction (resource saving) | -To modify the designs and production methods of containers for further decreasing the weights and consumption of containers and packages |

Replacement & Reuse | -To promote the use of biological and biodegradable materials -To promote installing reusable containers in the restaurant business |

Clean (environmental conservation) | -To promote the sorting-out of waste for utilizing plastic resources, participate in social contribution activities, such as cleaning activities, and continuously support environmental conservation activities in each region |

(Produced based on the reference material of the company)

Response to climate changes

The company is striving to reduce CO2 emissions by setting goals and analyzing climate changes related to tea leaves.

As for the reduction of CO2 emissions, the company defined the response to climate changes as one of the most important missions in September 2020, and set the goal of reducing the CO2 emissions of Scope 1 (direct discharge amount) and Scope 2 (amount of indirect discharge from energy) by 26% from fiscal 2018 by fiscal 2030, and the goal of decreasing the emissions per product of Scope 3 (other indirect discharge amount) by 26%. The company also set the goal of reducing total emissions of Scopes 1 and 2 by 50% and the goal of reducing the emissions per product of Scope 3 by 50% by fiscal 2050. The company has engaged in the installation of environmentally friendly filling systems in beverage factories, modal shift, promotion of eco-driving of commercial vehicles, active installation of heat pump-type vending machines, etc. As the company does not own factories for producing beverages, but adopted the fabless business model in which production is outsourced, the company will enhance cooperation with about 50 factories in 5 blocks around Japan to attain the goals for fiscal 2030. Under ITO EN Group’s policy regarding plastics, the company aims to fully make the materials used for plastic bottles to recyclable materials and such by 2030. Compared with virgin resin, recyclable materials and such are expected to reduce CO2 emissions considerably, and help achieve the goals for Scope 3.

Goals of reducing CO2 emissions

Target fiscal year | Scopes 1 and 2 | Scope 3 |

FY 2030 | To reduce total emissions by 26% | To reduce emissions per product by 26% |

FY 2050 | To reduce total emissions by 50% | To reduce emissions per product by 50% |

*The reference year is the fiscal year 2018 for both. (Produced based on the reference material of the company)

In the analysis of climate changes related to tea leaves, the company continuously conducts original analysis and scenario analysis, and based on the analysis results, the company develops new plantations, cultivation management methods, technology developments, etc. in cooperation with tea farmers.

Tea plantation development project, a sustainable agricultural model unique to ITO EN (from the 1970s)

The company implements “a project for developing tea plantations,” in which the company signs contracts with farmers for growing teas and develops tea plantations (new plantation project), for the purpose of procuring high-quality tea leaves stably. This activity leads to the actualization of a sustainable agriculture model contributing to the stable business operation of enterprises, procurement of ingredients, regional vitalization, etc. Especially, the “new plantation project,” which brings high value to the society and enterprises through regional vitalization, sustainable agricultural management, etc., was started in Miyazaki Prefecture in 2001, and is to be spread to Shizuoka Prefecture in 2020. It is certain that the company will achieve the mid/long-term goal of increasing the plantation area to 2,000 ha by the end of April 2021.

Recycling used tea leaves discharged in the production process of tea beverages for daily necessities, etc. (from July 2003)

In the system of recycling used tea leaves, the company creates products with high added value utilizing the tea leaves’ (green tea) characteristics, such as the antibacterial and odor eliminating effects, based on the technology to transport tea leaves while keeping them at room temperature and keeping moisture, the technology for developing products made from used tea leaves with moisture, and the fixation technology for using used tea leaves that have absorbed CO2 in products.

Activities as a health-enhancing enterprise and SDGs

In the COVID-19 crisis, interest in our own health and our family members’ health is heightened. The company’s main business is to handle products that would contribute to health, and will enhance such business activities. In detail, the company supports healthy, affluent lives by utilizing the functions of tea, which is consumed by Japanese people on a daily basis, creates a new chapter of 1200 year-long history of tea, and strives to solve social issues. As part of such business activities, the company started the education for deepening the knowledge of cognitive function and health enhancement programs. In detail, the company cooperated in the development of caregivers for dementia patients, attending the lectures for developing caregivers for dementia patients at 196 sites nationwide, and conducted screening tests for mild cognitive impairment, targeting about 280 employees aged 50 years or older whose cognitive function (attentiveness and judgment) are considered to decline due to aging. According to the test results, the company takes measures for improving the habits of eating and drinking, etc.

In addition, under the group’s ethos, Customers First, the company aims to achieve sustainable growth as an enterprise that enhances health, and will engage in corporate activities to attain SDGs, while addressing important problems related to consumers, communities, society, and the earth environment.

Material issues | ITO EN’s policies and initiatives | Major related SDGs |

Consumer issues -Diversification of lifestyles -Healthy life expectancy, lifestyle , MCI | Proposal of tea products and other products contributing to health • Scientific research on health factors of tea nutrition

• Efforts to prevent “loss of eating”

|

|

Communities and society

-Issues in domestic agriculture and tea industry - Changes in workstyles and communication | • Promotion of the Tea-Producing Region Development Project

• Educational activities for tea culture by ITO EN Tea Tasters

• Continuation of new Haiku awards

|

|

Global environment- Plastic pollution,

- Resource exhaustion, global warming | • Used Tea Leaves Recycling System

• • Establishment of plastic policy and activity promotion

• Response to climate change |

|

(Produced based on the reference material of the company)

Strengthening of ROE Management

With the goal of achieving a ROE of 10% or higher, the company carries out business administration focused on profitability (ratio of net income to sales), efficiency (asset turnover ratio), and financial stand (financial leverage).

(Source: The company)

2. Second Quarter of Fiscal Year Ending April 2021 Earnings Results

2-1. Trend of the domestic beverage market

| 2019 | Outlook of 2020 | YoY | ITO EN Beverages Business (May to Oct.) |

Tea Beverages | 9,665 | 8,780 | -9% | -10% |

Coffee | 9,150 | 8,050 | -12% | -13% |

Carbonated Beverages | 7,330 | 7,350 | +0% | -15% |

Mineral Water | 2,840 | 2,560 | -10% | -23% |

Fruits | 2,800 | 2,240 | -20% | - |

Sports Drinks | 2,265 | 1,930 | -15% | - |

Vegetable Beverages | 1,540 | 1,570 | +2% | +1% |

Functional Others | 2,000 | 1,780 | -11% | -18% |

Domestic Beverage market | 37,590 | 34,260 | -9% | -10% |

* Unit: 100 million yen. Created based on the company’s materials.

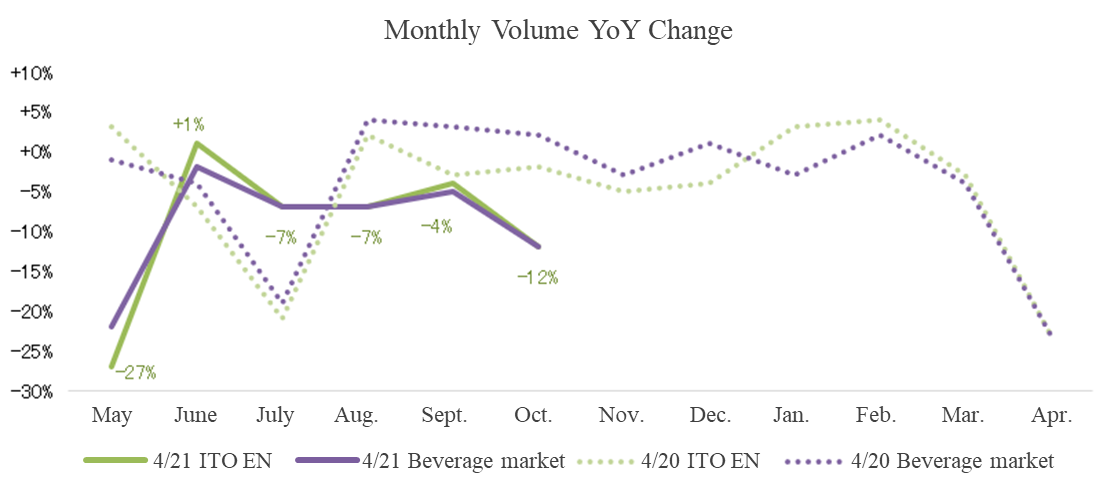

The company estimates that the scale of the domestic beverage market in 2020 (January to December) is 3,426 billion yen, down 9% from the previous year. As factors in the shrinkage of the market, we can enumerate the impact of COVID-19, the prolonged rainy season in July, low temperatures and abundant rainfall in early October, and the voluntary restraint of seasonal events. As for the performance of each category, the sales of sports drinks, mineral water, coffee, etc. are estimated to drop over 10%. Meanwhile the sales of mainly sugar-free carbonated beverages and vegetable beverages are expected to increase from the previous year, with the heightened health awareness.

(Created based on the Company’s source)

In the first half, the performance of the beverage business of ITO EN was similar to that of the domestic beverage market. In May, it dropped considerably due to the recoil from the special demand following the price increase of large plastic bottles in the previous year, and in October, it was affected by the decrease of selling opportunities, due to the bad weather and the voluntary restraint of seasonal events, just like the beverage market.

As for the performance of each category, the sales of tea beverages declined 10.2% from the previous year, indicating a harsh business environment, but the sales of vegetable beverages increased slightly.

The share of ITO EN in the beverage market from January to September 2020 did not change considerably, being 12.2% (ranking 4th in this industry).

2-2.Consolidated earnings

| First half of FY 4/20 | Ratio to sales | First half of FY 4/21 | Ratio to sales | YOY |

Sales | 265,471 | 100.0% | 236,585 | 100.0% | -10.9% |

Gross Profit | 126,923 | 47.8% | 112,475 | 47.5% | -11.4% |

SG&A expenses | 112,815 | 42.5% | 103,864 | 43.9% | -7.9% |

Operating Income | 14,107 | 5.3% | 8,610 | 3.6% | -39.0% |

Ordinary Income | 13,872 | 5.2% | 8,317 | 3.5% | -40.0% |

Profit attributable to owners of parent | 8,925 | 3.4% | 4,596 | 1.9% | -48.5% |

*unit: million yen

Sales and operating income dropped 10.9% and 39.0%, respectively, year on year.

Sales decreased 10.9% year on year to 236.58 billion yen. The non-consolidated sales of ITO EN declined 9.3% year on year, as the sales of tea beverages, which are the mainstay, decreased 10% year on year, and the sales of domestic and overseas group companies, excluding Chichiyasu which produces and sells dairy products such as yogurt, dropped.

As for profit, Chichiyasu and the businesses in the U.S. and China, where sales in the latest quarter recovered to the level in the same period of the previous year (down 1%), saw the growth of profit, but the non-consolidated operating income of ITO EN decreased 23.5% year on year, and Tully’s Coffee Japan posted an operating loss, because it was affected by the COVID-19 crisis through temporary closure, shortening business hours, etc.

Major Components of SG&A

| First half of FY 4/20 | Ratio to sales | First half of FY 4/21 | Ratio to sales | YOY |

Selling commission | 44,488 | 16.8% | 40,348 | 17.1% | -9.3% |

Advertising cost | 6,408 | 2.4% | 5,622 | 2.4% | -12.3% |

Freight cost | 8,082 | 3.0% | 7,397 | 3.1% | -8.5% |

Depreciation and amortization | 5,665 | 2.1% | 5,153 | 2.2% | -9.0% |

Others | 48,172 | 18.1% | 45,344 | 19.2% | -5.9% |

Total | 112,815 | 42.5% | 103,864 | 43.9% | -7.9% |

*unit: million yen

Sales in each company

| First half of FY 4/20 | Ratio to sales | First half of FY 4/21 | Ratio to sales | YOY |

ITO EN (Non-consolidated) | 208,881 | 73.8% | 189,522 | 74.7% | -9.3% |

Tully`s Coffee Japan Co., Ltd. | 17,609 | 6.2% | 11,860 | 4.7% | -32.6% |

Chichiyasu Company | 7,366 | 2.6% | 7,376 | 2.9% | +0.1% |

Other Domestic Subsidiaries | 30,316 | 10.7% | 27,059 | 10.7% | -10.7% |

US Business | 15,806 | 5.6% | 14,904 | 5.9% | -5.7% |

Other Overseas Subsidiaries | 3,030 | 1.1% | 2,857 | 1.1% | -5.7% |

Elimination of Internal Transactions | -17,538 | - | -16,993 | - | - |

Consolidated Sales | 265,471 | - | 236,585 | - | -10.9% |

ITO EN (Non-consolidated) | 10,983 | 5.3% | 8,399 | 4.4% | -23.5% |

Tully`s Coffee Japan Co., Ltd. | 1,759 | 10.0% | -1,243 | - | - |

Chichiyasu Company | 260 | 3.5% | 434 | 5.9% | +66.7% |

Other Domestic Subsidiaries | 889 | 2.9% | 414 | 1.5% | -53.4% |

US Business (unit: thousand dollars) | 388 | 2.5% | 438 | 2.9% | +12.9% |

Other Overseas Subsidiaries | 573 | 18.9% | 612 | 21.4% | +6.8% |

Elimination of Internal Transactions | -745 | - | -444 | - | - |

Consolidated Operating Income (Profit Ratio) | 14,107 | 5.3% | 8,610 | 3.6% | -39.0% |

*unit: million yen. Average to the US dollar in the first half of FY4/20 ¥108.01, first half of FY4/21 ¥106.46.

2-3 Impact of COVID-19

ITO EN (Non-consolidated)

| April | May | June | July | 1Q | August | September | October | 2Q | |

ITO EN (Non-consolidated) | -22% | -25% | +0% | -8% | -11% | -8% | -4% | -10.0% | -7% | |

Business type | Supermarkets | -13% | -12% | +9% | +1% | -1% | +0% | -1% | -11% | -3% |

Convenience Store | -23% | -33% | -6% | -18% | -19% | -19% | -6% | -9% | -12% | |

Vending Machines | -36% | -38% | -8% | -13% | -20% | -12% | -6% | -13% | -10% | |

E-commerce | - | - | - | +14% | - | +24% | +14% | +25% | +21% | |

Byproduct | Tea Total (RTD) | -27% | -27% | +4% | -8% | -11% | -9% | -5% | -15% | -10% |

Vegetable (RTD) | +1% | -8% | +6% | +6% | +2% | +2% | -2% | +0% | +0% | |

Tea Leaf | - | - | - | +2% | - | +5% | +10% | +6% | +7% | |

The non-consolidated sales of ITO EN decreased 11.2% year on year in the first quarter (May to July), and declined 7.4% year on year in the second quarter (August to October). This indicates a gentle recovery trend.

The sales of the company were affected by the shift to telework (working from home), change in lifestyles due to the voluntary restraint of going out, and the decrease of foreign visitors to Japan due to the spread of COVID-19. In detail, through the shift to telework (working from home), customers who visit convenience stores mainly in urban areas and customers who purchase products from vending machines in offices, etc. decreased, and as their lifestyles changed due to the voluntary restraint of going out, an increasing number of consumers enjoy beverages brewed from tea leaves and coffee beans at home. Although this is partly due to the recoil from the sports-related demand in the previous year, the use of vending machines in sightseeing spots dropped through the decrease of foreign visitors to Japan.

Tully’s Coffee Japan

| April | May | June | July | August | September | October |

Sales | -75% | -68% | -34% | -28% | -29% | -21% | -15% |

Ratio of shops that suspended operations or shortened business hours (at the end of the month)

| 97% | 85% | 49% | 35% | 26% | 32% | 24% |

The sales in the second quarter (August to October) decreased 22% year on year, while that in the first quarter (May to July) dropped 43% year on year, meaning diminution has shrunk. Thanks to the decrease of shops that suspended operations or shortened business hours, monthly sales are recovering, but the recovery at shops in urban areas and around transportation means, which were the strengths of the company, is sluggish. As of the end of October, about 180 shops were that suspended operations or shortened business hours.

Business in North America

Sales dropped 14% year on year in May to July, and decreased 1% year on year in August to October, showing recovery. Online sales (mail-order business) remain healthy. As the consumption at home is growing, the sales of tea leaves (tea bags) are increasing.

Business in China

As the COVID-19 pandemic is subsiding, business is recovering, and sales are improving, as the y/y drop rate in sales was 5% in April to June and 1% in July to September.

2-4.Financial Status and Cash Flows (CF)

Main balance sheet

| April 2020 | October 2020 |

| April 2020 | October 2020 |

Cash and deposits | 64,813 | 79,074 | Trade payables | 26,447 | 26,234 |

Trade receivables | 49,168 | 53,694 | Accrued expenses | 23,631 | 25,421 |

Inventories | 45,723 | 44,806 | Interest-bearing debts | 55,742 | 64,938 |

Total current assets | 173,966 | 189,478 | Lease obligations | 9,935 | 8,878 |

Property, plant and equipment | 82,986 | 81,166 | Net defined benefit liability | 10,612 | 10,764 |

Intangible fixed assets | 11,570 | 10,961 | Total liabilities | 140,956 | 152,181 |

Investments and other assets | 22,128 | 22,294 | Total net assets | 149,695 | 151,719 |

Total fixed assets | 116,685 | 114,422 | Total liabilities and net assets | 290,651 | 303,900 |

*unit: million yen

As working capital was accumulated mainly through long-term borrowings, total assets as of the end of the second quarter stood at 303.9 billion yen, up 13.24 billion yen year on year. As for liabilities and net assets, interest-bearing debts and retained earnings grew. Capital-to-asset ratio was 49.5% (51.0% at the end of the previous term).

Cash Flows (CF)

| First half of FY 4/20 | First half of FY 4/21 | YoY | |

Operating CF (A) | 13,595 | 13,490 | -105 | -0.8% |

Investing CF (B) | -4,652 | -4,300 | +352 | - |

Free CF (A+B) | 8,943 | 9,190 | +247 | +2.8% |

Financing CF | -8,059 | 4,782 | +12,841 | - |

Balance of cash and cash equivalents at end of period | 62,435 | 77,645 | +15,210 | +24.4% |

*unit: million yen

Operating CF was unchanged year on year, as pretax profit was 8.08 billion yen (13.68 billion yen in the same period of the previous term), depreciation and amortization was 6.22 billion yen (6.66 billion yen in the same period of the previous term), impairment loss was 480 million yen (100 million yen in the same period of the previous term), goodwill amortization was 630 million yen (880 million yen in the same period of the previous term), and working capital decreased. Investing CF is mainly due to the acquisition of fixed assets, while financing CF is due to long-term borrowings, repayment of finance lease obligations, payment of dividends, etc.

3. Fiscal Year Ending April 2021 Financial Estimates

3-1. Consolidated Earnings

| FY 4/20 Results | Ratio to sales | FY 4/21 Forecast | Ratio to sales | YOY | Estimate at the beginning of the period | Difference from the estimate |

Sales | 483,360 | 100.0% | 450,000 | 100.0% | -6.9% | 481,000 | -6.4% |

Gross profit | 232,755 | 48.2% | 218,000 | 48.4% | -6.3% | 233,300 | -6.6% |

SG&A expenses | 212,814 | 44.0% | 205,700 | 45.7% | -3.3% | 213,300 | -3.6% |

Operating income | 19,940 | 4.1% | 12,300 | 2.7% | -38.3% | 20,000 | -38.5% |

Ordinary income | 19,432 | 4.0% | 12,100 | 2.7% | -37.7% | 19,800 | -38.9% |

Net income | 7,793 | 1.6% | 5,800 | 1.3% | -25.6% | 13,000 | -55.4% |

*unit: million yen

Sales and operating income are estimated to decrease 6.9% and 38.3%, respectively, year on year.

The company revised the estimated sales downwardly, under the assumption that the impact of COVID-19, which was first expected to peak out in the first quarter, will linger throughout the year. As for profit, the company took into account the effects of the decline in sales and the allocation of managerial resources to the core business and brand for the society with COVID-19 and the post-pandemic society.

Major Components of SG&A

| FY 4/20 Results | Ratio to sales | FY 4/21 Forecast | Ratio to sales | YOY | Estimate at the beginning of the period | Difference from the estimate |

Selling commission | 80,537 | 16.7% | 76,056 | 16.9% | -5.6% | 80,764 | -5.8% |

Advertising cost | 11,206 | 2.3% | 10,845 | 2.4% | -3.2% | 11,359 | -4.5% |

Freight cost | 14,651 | 3.0% | 13,994 | 3.1% | -4.5% | 14,592 | -4.1% |

Depreciation and amortization | 10,957 | 2.3% | 10,231 | 2.3% | -6.6% | 10,402 | -1.6% |

Others | 95,463 | 19.7% | 94,574 | 21.0% | -0.9% | 96,183 | -1.7% |

Total | 212,814 | 44.0% | 205,700 | 45.7% | -3.3% | 213,300 | -3.6% |

*unit: million yen

Performance in each company

| FY 4/20 Results | Ratio to sales | FY 4/21 Forecast | Ratio to sales | YOY | Estimate at the beginning of the period | Difference from the estimate |

ITO EN (Non-consolidated) | 377,787 | 73.1% | 356,000 | 73.5% | -5.8% | 376,200 | -5.4% |

Tully`s Coffee Japan Co., Ltd. | 32,811 | 6.3% | 27,500 | 5.7% | -16.2% | 33,700 | -18.4% |

Chichiyasu Company | 14,251 | 2.8% | 14,042 | 2.9% | -1.5% | 13,548 | +3.6% |

Other Domestic Subsidiaries | 55,824 | 10.8% | 51,203 | 10.6% | -8.3% | 55,087 | -7.1% |

US Business | 30,971 | 6.0% | 29,920 | 6.2% | -3.4% | 31,621 | -5.4% |

Other Overseas Subsidiaries | 5,311 | 1.0% | 5,394 | 1.1% | +1.6% | 5,163 | +4.5% |

Elimination of Internal Transactions | -33,595 | - | -34,059 | - | - | -34,319 | - |

Consolidated Sales | 483,360 | - | 450,000 | - | -6.9% | 481,000 | -6.4% |

ITO EN (Non-consolidated) | 16,626 | 4.4% | 14,300 | 4.0% | -14.0% | 16,700 | -14.4% |

Tully`s Coffee Japan Co., Ltd. | 1,725 | 5.3% | -1,500 | - | - | 1,750 | - |

Chichiyasu Company | 410 | 2.9% | 648 | 4.6% | +58.0% | 411 | +57.7% |

Other Domestic Subsidiaries | 1,062 | 1.9% | -920 | - | - | 956 | - |

US Business | 654 | 2.1% | 941 | 3.1% | +43.9% | 1,075 | -12.5% |

Other Overseas Subsidiaries | 963 | 18.1% | 1,136 | 21.1% | +18.0% | 1,018 | +11.6% |

Elimination of Internal Transactions | -1,500 | - | -2,305 | - | - | -1,910 | - |

Consolidated Operating Income (Profit Ratio) | 19,940 | 4.1% | 12,300 | 2.7% | -38.3% | 20,000 | -38.5% |

*unit: million yen. Average to the US dollar in the term FY4/20: ¥108.39, FY4/21(est.): ¥108.00, estimate at the beginning of the period: ¥108.00.

4. Marketing strategies

ITO EN (non-consolidated)

| FY 4/20 Results | Ratio to sales | FY 4/21 Forecast | Ratio to sales | YOY | Estimate at the beginning of the period | Difference from the estimate |

Tea leaves | 35,269 | 9.3% | 36,142 | 10.2% | +2.5% | 35,621 | +1.5% |

Beverages | 339,395 | 89.9% | 316,838 | 89.0% | -6.6% | 337,653 | -6.2% |

Others | 3,122 | 0.8% | 3,019 | 0.8% | -3.3% | 2,925 | +3.2% |

Sales | 377,787 | 100.0% | 356,000 | 100.0% | -5.8% | 376,200 | -5.4% |

Japanese Tea/Healthy Tea | 193,246 | 51.2% | 183,814 | 51.6% | -4.9% | 194,645 | -5.6% |

Chinese Tea | 17,219 | 4.6% | 14,838 | 4.2% | -13.8% | 17,234 | -13.9% |

Black tea | 7,677 | 2.0% | 4,138 | 1.2% | -46.1% | 7,070 | -41.5% |

Total sales of teas | 218,142 | 57.7% | 202,790 | 57.0% | -7.0% | 218,949 | -7.4% |

Vegetable | 43,960 | 11.6% | 44,741 | 12.6% | +1.8% | 44,022 | +1.6% |

Coffee | 36,538 | 9.7% | 33,895 | 9.5% | -7.2% | 36,399 | -6.9% |

Mineral Water | 9,396 | 2.5% | 7,547 | 2.1% | -19.7% | 8,979 | -15.9% |

Carbonated | 11,175 | 3.0% | 10,101 | 2.8% | -9.6% | 10,586 | -4.6% |

Fruit | 8,855 | 2.3% | 7,797 | 2.2% | -11.9% | 7,927 | -1.6% |

Functional, Others | 11,325 | 3.0% | 9,965 | 2.8% | -12.0% | 10,791 | -7.7% |

Total sales of beverages | 339,395 | 89.9% | 316,838 | 89.0% | -6.6% | 337,653 | -6.2% |

*unit: million yen

4-1. Oi Ocha

The market of green tea beverages was significantly affected by COVID-19, but the market share of the company is expected to remain 33%, unchanged from the previous year. Competitors renewed their green tea beverages considerably and intensified sales promotion, but it seems that the rank of the company in the market of green tea beverages will be unchanged in 2020.

To stir the demand in the winter season by releasing microwavable and environmentally friendly products

Oi Ocha is the top share beverage that boasts the 54% share in the market of hot sugar-free tea beverages (Intage SRI Data; Sep. 2019 to Aug. 2020/in value terms). In the second half, the company will meet demand in new lifestyles, including telework, by releasing microwavable products, which can be heated easily without fire in a short period of time, environmentally friendly label-less products, etc.

Situation of the market of green tea beverages and microwavable products

(Source: the company)

“Oi Ocha Bold Green Tea” selling well

The company is developing the “Oi Ocha” brand, while focusing on “Green Tea,” “Bold Green Tea,” and “Roasted Tea,” which performs well in winter. In the first half, the sales volume of “Oi Ocha Bold Green Tea” grew 1.5 times year on year. It was renewed as the beverage with functional claims in the previous term, and even after its effect subsided, the sales volume in September to October increased about 30% year on year. While the market scale of general green tea beverages and green tea beverages for specified health use for shrinking, it seems that “Oi Ocha Bold Green Tea” reigns supreme.

In addition, “Catechin Green Tea 500 with Two Functions,” which was renewed and released last autumn, has been selling well. The company will keep allocating managerial resources to healthy products derived from green tea, including them and “Catechin,” a supplement released in the official online shop “Kenkoutai (Healthy Body)” of ITO EN, to support healthy lives with the functions of “tea catechin.”

(Source: the company)

Matcha project

The company launched the large-scale project “ITO EN MATCHA PROJECT.” Through this project, the company plans to operate business in a multifaceted manner, developing products based on research results, conducting collaborative research, and engaging in CSR activities in cooperation with local communities and other enterprises. As the first product, the company released “Oi Ocha Omatcha,” including bottled beverages and stick-type packages, on December 7. These are food products with functional claims, which would “enhance the precision of cognitive function (attentiveness and judgment)” with the effects of theanine and tea catechin. According to the survey of the company, ITO EN released a food product with functional claims regarding cognitive function by combining theanine and tea catechin for the first time in Japan.

In this project, the company proactively addresses local issues and conducts activities for making daily lives affluent from the viewpoints of prevention and coexistence in the 100-year life age, by not only commercializing products, but also promoting healthy dietary habits, exercise, daily conversation, etc.

(Source: the company)

4-2 Tea leaves

The entire tea leaf market is growing, mainly thanks to the demand from people staying home due to the COVID-19 crisis. The growth rate of the company is higher than that of the market, thanks to its enriched product lineup and the outcomes of efforts for invigorating the tea leaf market.

It is said that customers aged 49 years or younger are increasing. The company considers this is because of introduction of “how to brew tea so as to produce rich tea” by utilizing SNS of tea tasters of ITO EN, and proposal of “methods for producing delicious tea” by utilizing the avatar technology, while telework is becoming common.

Trend of the tea leaf market

(Source: the company)

4-3 Barley tea and black tea

In the first half, the barley tea market was strongly affected by the weather and the decline in demand for recreation. The sales of barley tea of the company dropped in the first half, but in the second half, the company will release new products and promote “the replenishment of minerals,” to increase the scenes of drinking them throughout the year. Especially, the company focuses on seeking athletes, no matter whether they are professional or amateur, and gives various proposals to athletes. As new products, the company released microwavable products in September 2020, and the beverage with functional claims “Sarasara Kenkou Mineral Mugicha (healthy barley tea with minerals for making blood flow smooth)” in November 2020.

As for black tea, its sales are estimated to decline due to the recoil from the performance in the previous year, but the company plans to release new products at the beginning of the spring for the next term.

Trend of the barley and black tea beverages market.

(Source: the company)

4-4 Vegetable beverages

As consumers became more health-conscious, there is growing demand for vegetable beverages, from which consumers can take nutrients easily and make up for a deficiency in the intake of vegetables. The company concentrates on the development of the 3 brands: “Vegetables for one day,” “Vitamin-rich vegetables,” and “Fulfilling vegetables.” All of them performed well in the first half; for example, the sales of “Vitamin-rich vegetables” increased over 20% year on year. The market is expected to be more vibrant, so the company will enhance sales activities.

The sales of Aojiru, which was renewed considerably in the summer of 2020, grew, mainly for the sugar-free product “Oishii Aojiru (Delicious Aojiru).” The company considers that Aojiru products still have great potential, so it will upgrade products to achieve low carbs and low calories, which are demanded by customers, and improve functionality.

Sales trend of vegetable beverages series and Aojiru beverage series

(Source: the company)

4-5 Tully’s Coffee

The locations of shops in urban areas and around transportation means had been the forte of Tully’s Coffee Japan, but sales opportunities decreased, due to the popularization of telework induced by the spread of COVID-19, etc. On the other hand, the sales of coffee beans rose 9.1% year on year, thanks to the demand from people staying home. From now on, Tully’s Coffee Japan will enhance the sales of products, such as coffee beans, and cement the cooperation with ITO EN, Ltd. in product development. The number of shops of Tully’s Coffee Japan at the end of the term is to be 775, up 30 from the end of the previous term.

Transition of Sales and Number of Stores, sales trend of the first half of FY 4/21

(Source: the company)

4-6 Overseas strategy

In the first half, the sales of tea leaves under the global brand increased 14% year on year, and the number of shops handling “Oi Ocha” increased 23% in 6 months. In addition, for expanding sales globally, the company obtained the halal certification for MATCHA GREEN TEA, which is tailored to the religious characteristics of target countries, and started production in October. In China, the company opened a flagship shop in the cross-border EC platform “Taobao Mall,” and tentatively conducted live sales promotion featuring Mr. Austin Li, who is a top-class Chinese KOL (key opinion leader). By selling vegetable beverages and Aojiru powder made in Japan, the company will conduct marketing while developing the brand as an enterprise that contributes to health.

5. Conclusions

In the first half, sales and profit dropped due to the COVID-19 crisis and bad weather, but the company maintained its share in the green tea beverage market thanks to the stably good performance of “Oi Ocha,” while competitors went on an offensive, renewing their products considerably and conducting sales promotion. In the second half, the company will meet the demand in the winter season by providing microwavable products and environmentally friendly products, although the business environment is harsh due to the third wave of the pandemic.

In the second half, the company start initiatives for the next term. The company plans to release products with their functions highlighted, such as “Oi Ocha Strong Green Tea,” which was renewed last year as the beverage with functional claims and is selling well, one after another from the fourth quarter of this term to the next term, and the preparation for it is underway. Another positive factor is a new trend in the field of tea leaves. Tea leaves are now popular by customers who are eager to have experiential consumption at home, and the company recognizes this trend as a chance, and plans to approach those who did not brew tea, especially young people, by utilizing SNS, etc. In the next term, the company is expected to achieve a V-shaped recovery of business performance.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 14 directors, including 4 outside ones |

Auditors | 4 auditors, including 3 outside ones |

◎Corporate Governance Report:Updated December 1, 2020

Basic Policy

“Always Putting the Customer First” is the ITO EN Group’s management philosophy. In the ITO EN Group’s Basic Policies, the basis of our business administration to take corporate social responsibility in cooperation with interested parties such as the government, local communities, consumers, shareholders, clients, suppliers, and financial institutions, in order to achieve sustainable growth and development as well as increasing our corporate value. This management philosophy is the fundamental policy behind our group’s corporate ethics and the unchanging truth that supports our corporate governance. Based on this philosophy, all the executives and employees of our group will actively pursue an operation that works towards a sustainable society while responding to the trust of all the interested parties. To realize an appropriate form of corporate governance, our company, which has a board of auditors, carries out audits in which the auditors inquire the business conditions, the decision-making processes, etc. of the representative directors, the directors in charge, the executive officers or the employees of our group companies. The auditors attend every meeting of the board of directors in order to give their objective and impartial opinions on the audit situations concerning the company in general or individual issues, and audit the business execution by the directors in accordance with the audit policies set out by the board of auditors.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

【Supplementary Principle 4-11 (1) Policies for the balance, diversity, and scale of the Board of Directors】

The number of members of the Board of Directors of our company is up to the limit specified by our articles of incorporation. As for its composition, the Board of Directors is basically composed of the necessary and appropriate number of members for making effective decisions and securing substantial discussions. Although there are no female directors as of the date of submission of this report, we will make efforts to appoint female directors from the viewpoint of securing diversity in gender and internationality, and expertness.

(Article 6 of ITO EN’s Guidelines (Composition of the Board of Directors))

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Disclosure in accordance with the principles of the corporate governance code]

Our company formulated “Corporate Governance Guidelines of ITO EN, Ltd. (hereinafter called “ITO EN Guidelines”)” based on resolutions of the board of directors, for describing the basic concept and policy for corporate governance, and disclosed them in our website. Please refer to them.

https://www.itoen.co.jp/csr/governance/

【Principle 1-4 Strategically held shares】

In principle, our company will not hold any shares of other companies, unless it is considered that the shareholding would smooth transactions, procurement, or fund raising. If the shareholding is not expected to contribute to the improvement in mid/long-term corporate value, we will reduce the number of shares we hold step by step. As for the shares of listed companies we hold in accordance with the above proviso (hereinafter called “strategically held shares”), we check whether the return of invested capital exceeds capital cost for each stock at the annual meeting of the board of directors. From the viewpoint of maintaining and cementing the mid/long-term relations with business partners, we check the meanings of shareholding, and confirm at the meetings of the board of directors that we will sell or reduce the shares whose economic rationality and meanings have diluted after consulting with the parties concerned. As for the exercise of voting rights for strategically held shares, we check the contents of each bill and comprehensively judge whether it will contribute to the improvement in corporate value of our company and the invested company, before exercising them. (Article 14 of the Guidelines of our company-Policy for strategic shareholding)

【Principle 5-1 Policy for constructive dialogue with shareholders】

After grasping its own capital cost accurately, our company listens to the voices of shareholders and pays proper attention to their interests and concerns through the constructive dialogue between the management and shareholders, revises its business portfolio, explicitly explains its management policies including the investment in equipment, R&D, and human resources, and win the understanding of shareholders. (Article 16 of the Guidelines of our company-Policy for constructive dialogue with shareholders)

For details, please see the report titled “Situation of IR-related activities.”

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on ITO EN, LTD. (2593) and Bridge Salon (IR seminar), please go to our website at the following URL.www.bridge-salon.jp/