Bridge Report:(2593)ITO EN the second quarter of fiscal year ending April 2022

ITO EN, LTD. (Common stock: 2593, Preferred stock: 25935) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

President | Daisuke Honjo |

Address | 47-10, Honmachi 3-chome, Shibuya-ku, Tokyo |

Year-end | April |

URL |

Stock Information

<Common Stock>

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Act) | Trading Unit | |

¥6,050 | 89,212,380 shares | ¥539,734 million | 4.7% | 100 shares | |

DPS(Est) | Dividend yield(Est) | EPS(Est) | PER(Est) | BPS(Act) | PBR(Act) |

¥40.00 | 0.7% | ¥102.84 | 58.8 times | ¥1,250.37 | 4.8 times |

* The share price is the closing price on December 15. Number of shares issued, DPS and EPS are taken from the financial results for the second quarter of fiscal year ending April 2022. ROE and BPS are taken from the financial results of the last term.

<Preferred Stock>

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Act) | Trading Unit | |

¥1,989 | 34,246,962 shares | ¥68,117 million | 4.7% | 100 shares | |

DPS (Est) | Dividend yield (Est) | EPS (Est) | PER (Est) | BPS (Act) | PBR (Act) |

¥50.00 | 2.5% | ¥112.84 | 17.6 times | ¥1,255.37 | 1.6 times |

* The share price is the closing price on December 15. Number of shares issued, DPS and EPS are taken from the financial results for the second quarter of fiscal year ending April 2022. ROE and BPS are taken from the financial results of the last term.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

April 2018 (Act) | 494,793 | 22,043 | 21,441 | 12,553 | 99.79 | 40.00 |

April 2019 (Act) | 504,153 | 22,819 | 23,211 | 14,462 | 116.02 | 40.00 |

April 2020 (Act) | 483,360 | 19,940 | 19,432 | 7,793 | 61.53 | 40.00 |

April 2021 (Act) | 446,281 | 16,675 | 17,029 | 7,011 | 55.10 | 40.00 |

April 2022 (Est) | 403,100 | 20,000 | 19,800 | 12,800 | 102.84 | 40.00 |

*The forecast is company’s one. Unit: million yen, yen. The company began to apply the revenue recognition criteria in the term ending April 2022.

This Bridge Report outlines the results of ITO EN for the second quarter of fiscal year ending April 2022 and the forecast for the term ending April 2022.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of Fiscal Year Ending April 2022 Earnings Results

3. Fiscal Year Ending April 2022 Financial Forecasts

4. Marketing Strategies

5. Conclusions

<Reference: Regarding Corporate Governance>

Key points

- In the second quarter of the term ending April 2022, sales grew 1.9% year on year to 241 billion yen. The non-consolidated performance of ITO EN was on a plateau, but the performance of Tully’s Coffee Japan recovered from the same period of the previous term, in which it was strongly affected by the COVID-19 pandemic because its shops are located in metropolitan areas, and the US business performed well, too. Operating income rose 24.7% year on year to 10.7 billion yen. The company strived to improve profitability. The non-consolidated profit of ITO EN increased 8.9% year on year. The loss from Tully’s Coffee Japan shrank considerably.*The old standard for revenue recognition is applied in this report.

- The annual sales in the full-year estimates for the term ending April 2022 have been revised downwardly. When the full-year consolidated earnings estimates were announced in June 2021, the vaccination against COVID-19 had been already started, and it was expected that consumer confidence would recover to some degree, although it was unclear when COVID-19 would subside. However, the recovery of consumer confidence, which dropped due to the prolonged voluntary restraint, turned out to be weaker than expected, and the bad weather in August and September significantly affected mainly the sale of drinks. These are major factors in the downward revision. The sales in the second half are expected to exceed the initial estimate, so the initial estimate of operating income has not been revised.

- Although the estimates have been revised downwardly, sales are projected to grow from the previous term, offsetting the augmentation of SG&A expenses, and operating income is forecasted to increase by double digits. The expected dividend has not been revised. The company plans to pay a dividend of 40 yen/share for common shares and a dividend of 50 yen/share for preferred shares like in the previous term. The expected payout ratio is 38.9% for common shares and 44.3% for preferred shares.

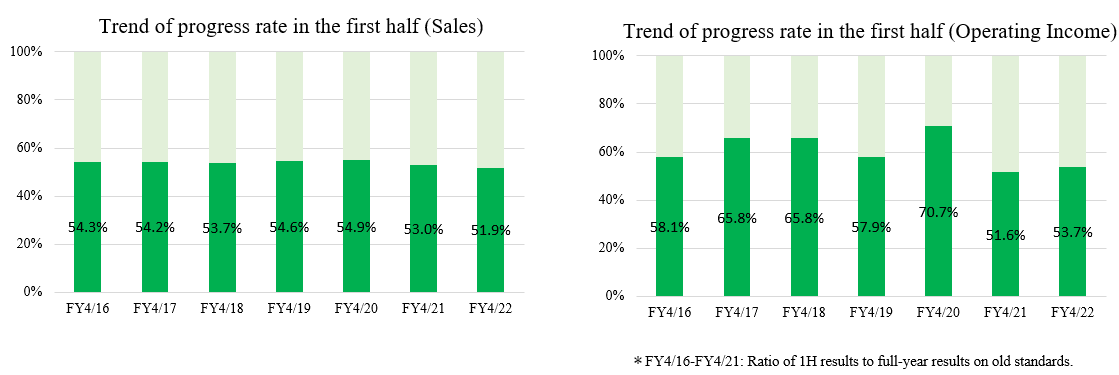

- The progress rate in the first half is 51.9% for sales and 53.7% for operating income. As a characteristic of ITO EN, the sales and profit in the first half, including the period from July to September, which is the best season for selling beverages, are better than those in the second half, but the above progress rates are low compared with those in the past several years. The company assumes that sales in the second half will exceed the estimate. We would like to pay attention to their pace of earning sales from the third quarter.

- ITO EN has developed original products as well as industry’s first products, occupying a high share in the market. The company’s policies and initiatives for research, planning, and development are introduced on page 40 of “ITO EN Integrated Report 2021”, which was issued in November 2021.

- According to the report, the company engages in research, planning, and development under the five concepts for product development: “Natural,” “Healthy,” “Safe,” “Well-designed,” and “Delicious.” In particular, as a health-enhancing enterprise that contributes to the health of customers, it makes efforts to solve health problems by providing delicious healthy products, such as sugar-free beverages, food products for specified health use, and food products with functional claims, by utilizing the efficacy of tea and natural ingredients.

- It is difficult for the company to recover its performance to the pre-pandemic level in the short term, but we would like to pay attention to the progress of the mid-term measures of the company, which possesses overwhelming competitive advantage in product development.

1. Company Overview

ITO EN mainly manufactures and sells beverages (including tea beverages such as green tea, coffee, and vegetable beverage), and tea leaves, and also operates restaurants and conducts franchise (FC) business of Tully’s Coffee, etc., manufactures and sells supplements via its subsidiaries. In Japan, the company has the largest share of 33% (as of 2020) in the market of green tea beverages, including “Oi Ocha.” In addition, it owns a variety of popular product brands, such as “Kenko Mineral Mugicha” (barley tea) which is the bestselling caffeine-free tea beverage, “Ichinichibun no Yasai” (Vegetable Beverage), the most selling 100% vegetable beverage, and “TULLY’S COFFEE” which is the top-selling bottle-shaped canned black coffee product developed in cooperation with Tully’s Coffee Japan Co., Ltd.. Each of them has achieved an annual sales quantity of over 10 million cases (“Oi Ocha” has sold about 80 million cases).

The ITO EN Group is composed of 31 consolidated subsidiaries, including Tully’s Coffee Japan Co., Ltd. and Chichiyasu Company, and 3 companies accounted for using the equity method. With the aim of becoming a “Global Tea Company,” it is developing the “Oi Ocha” brand and cultivating new green tea markets in the U.S. (mainly New York), China, Australia and Southeast Asia.

Management Principle “Always Putting the Customer First”

1-1.Five Concepts for Product Development since the Establishment of the Company

(Source: The company)

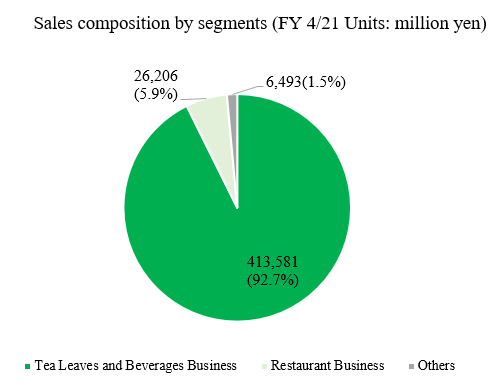

1-2.Outline of the business

The business of ITO EN is classified into the Beverages Business and Tea Leaves, which manufactures and sells tea leaves and beverages, the Restaurant Business, in which Tully’s Coffee Japan Co., Ltd. operates specialty coffee shops and FC business, and The Others, in which Mason Distributors, Inc. (Florida, the U.S.) manufactures and sells supplements.

Product brands representative of ITO EN, LTD. that have sold over 10 million cases annually

(Source: The company)

1-3 Global tea company

As a global tea company, the company aims to be the corporate group ITO EN that can contribute to the health of customers around the world, and support the affluent life of each customer. To attain this goal, the company is conducting activities as a health-enhancing enterprise that supports corporate sustainability and affluent lives, and strengthening its ROE management.

Corporate sustainability

The company set the medium/long-term environmental goals of the ITO EN Group, and takes measures for containers and packages, and for coping with climate changes, while advertising the value of tea, such as catechin and theanine, through their products. In addition, the company concentrates on the tea plantation development project, which is an original sustainable agricultural model, and on recycling used tea leaves which are excreted after the production of tea beverages, etc.

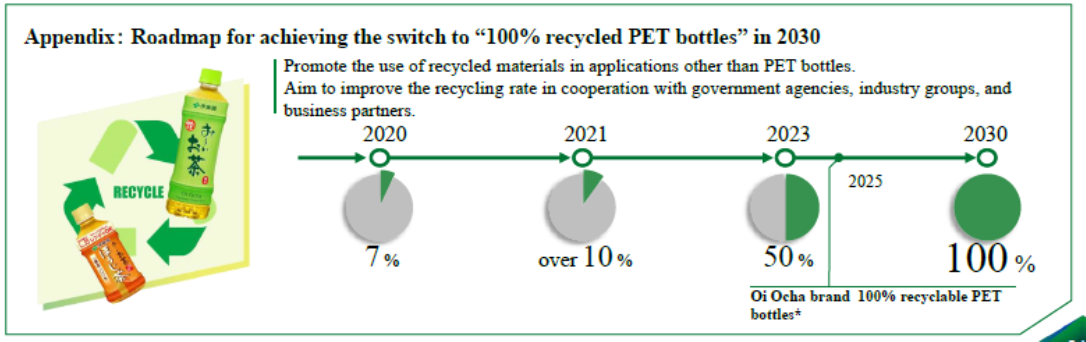

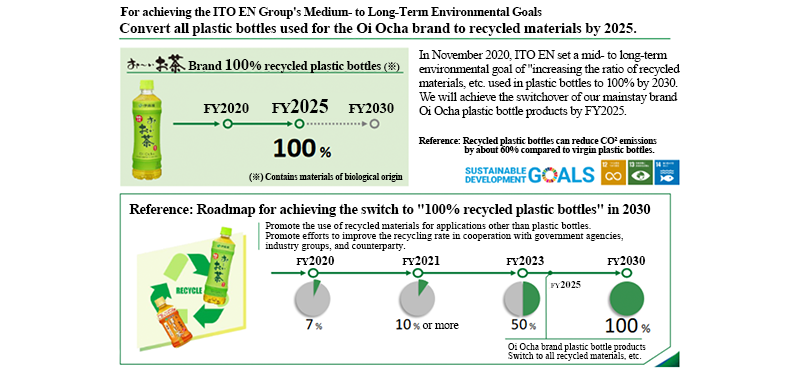

Packaging Initiatives

Following the basic policy of “3Rs (recycling, reduction, and replacement & reuse) + Clean,” the company aims to replace the material used in all the plastic bottles of the “Oi Ocha” brand and all of the plastic-bottled products with recyclable materials (including biological origin ones) by the end of the fiscal year 2025 and by 2030, respectively.

(Source: The company)

Policy regarding the plastics of the ITO EN Group

Recycling resources | -To fully make the material used in plastic bottles to recyclable materials* by 2030. -To promote the use of recyclable materials other than plastic bottles. -To conduct activities for improving the ratio of recycling in cooperation with administrative bodies, industrial groups, business partners, etc. *including biological materials |

Reduction (resource saving) | -To modify the designs and production methods of containers for further decreasing the weights and consumption of containers and packages |

Replacement & Reuse | -To promote the use of biological and biodegradable materials -To promote installing reusable containers in the restaurant business |

Clean (environmental conservation) | -To promote the sorting-out of waste for utilizing plastic resources, participate in social contribution activities, such as cleaning activities, and continuously support environmental conservation activities in each region |

(Produced based on the reference material of the company)

Response to climate changes

The company is striving to reduce CO2 emissions by setting goals and analyzing climate changes related to tea leaves.

The company defined the response to climate changes as one of the most important missions in September 2020, and set the goal of reducing the CO2 emissions of Scope 1 (direct discharge amount) and Scope 2 (amount of indirect discharge from energy) by 26% from fiscal 2018 by fiscal 2030, and the goal of decreasing the emissions per product of Scope 3 (other indirect discharge amount) by 26%. The company also set the goal of reducing total emissions of Scopes 1 and 2 by 50% and the goal of reducing the emissions per product of Scope 3 by 50% by fiscal 2050. The company has engaged in the installation of environmentally friendly filling systems in beverage factories, modal shift, promotion of eco-driving of commercial vehicles, active installation of heat pump-type vending machines, etc. As the company does not own factories for producing beverages, but adopted the fabless business model in which production is outsourced, the company will enhance cooperation with about 50 factories in 5 blocks around Japan to attain the goals for fiscal 2030. Under ITO EN Group’s policy regarding plastics, the company aims to fully make the materials used for plastic bottles to recyclable materials and such by 2030. Compared with virgin resin, recyclable materials and such are expected to reduce CO2 emissions considerably, and help achieve the goals for Scope 3.

Goals of reducing CO2 emissions

Target fiscal year | Scopes 1 and 2 | Scope 3 |

FY 2030 | To reduce total emissions by 26% | To reduce emissions per product by 26% |

FY 2050 | To reduce total emissions by 50% | To reduce emissions per product by 50% |

*The reference year is the fiscal year 2018 for both. (Produced based on the reference material of the company)

In the analysis of climate changes related to tea leaves, the company continuously conducts original analysis and scenario analysis, and based on the analysis results, the company develops new plantations, cultivation management methods, technology developments, etc. in cooperation with tea farmers.

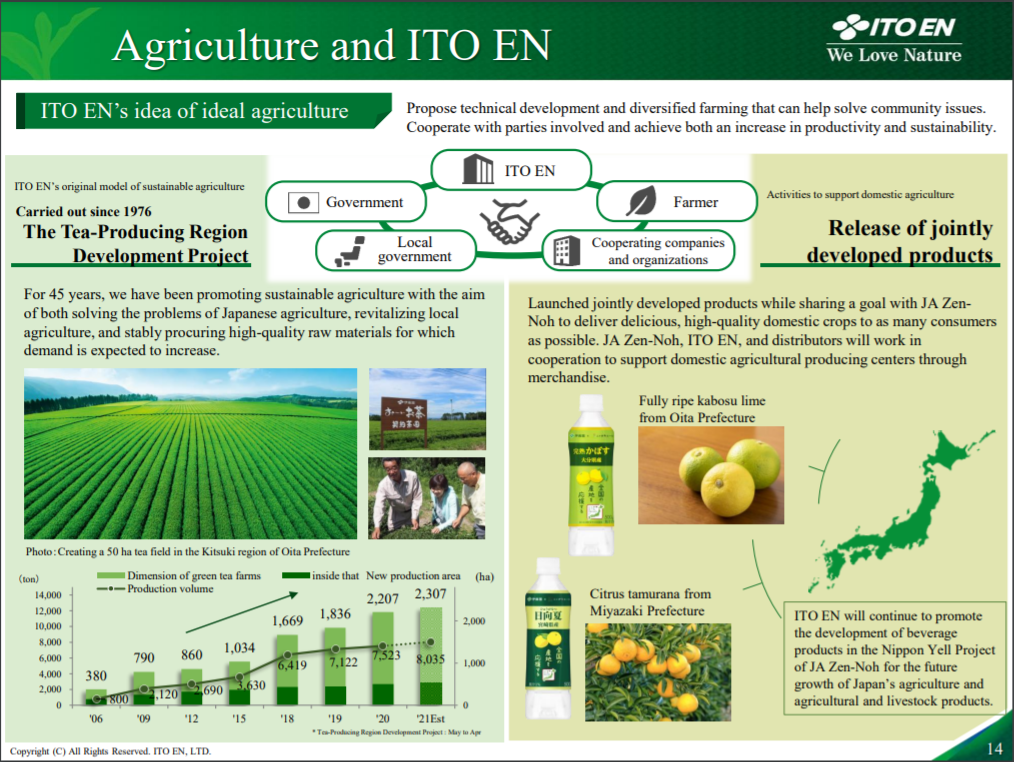

The Tea-Producing Region Development Project, a sustainable agricultural model unique to ITO EN (from 1976)

The area of tea plantations in Japan has been on the decline, and the production amount of green tea (unrefined tea) fell below 70,000 tons, down 22% from 10 years ago. The number of farmers is also on a downward trend with the average age standing at 67.8, indicating that the agricultural industry is aging.

Under these circumstances, the company started a project for developing tea plantations, in which the company signs contracts with individual tea farmers or engages in development of tea plantations (a new plantation project), in 1976 with the aim of stably procuring high-quality tea leaves, and strives for sustainable procurement of tea ingredients in collaboration with tea farmers, including the farmers of large-scale tea plantations. The efforts to save labor and improve operational efficiency have delivered unprecedented results, that is, the average age of those engaging in the tea plantation development project (new plantation project) being 45 and the adoption rate of ridable tea-picking machines being 100%.

The “new plantation project,” which brings high value to the society and enterprises through regional vitalization, sustainable agricultural management, etc., was started in Miyazaki Prefecture in 2001, and is to be spread to Shizuoka Prefecture in 2020. The company also achieved the mid/long-term goal of increasing the plantation area to 2,000 ha by the end of April 2021. The company will enhance this initiative further, to promote sustainable agriculture.

The company is also making concentrated efforts in the agricultural industry with an eye toward the future in cooperation with the government, local municipalities, producers, Japan Agricultural Cooperatives, and subcontracting companies.

In Nippon Yell Project organized by JA, the company is developing products collaboratively to support agricultural areas in Japan with those products. The company produces beverages from fruits around Japan in each season and sells them via all channels.

The company believes that ITO EN is the only food manufacturer that is capable of producing and selling tea leaves and beverages using ingredients cultivated in the fields. Having formulated a roadmap toward technological development and promotion of tea agriculture, the company intends to contribute to promoting sustainable agriculture through development of a variety of technologies by utilizing information technology (IT), etc. and implementation of mixed husbandry.

(Source: The company)

Recycling used tea leaves discharged in the production process of tea beverages for daily necessities, etc. (from 2001)

In the used tea leaves recycling system, the company creates products with high added value utilizing the tea leaves’ (green tea) characteristics, such as the antibacterial and odor eliminating effects, based on the technology to transport tea leaves while keeping them at room temperature and keeping moisture, the technology for developing products made from used tea leaves with moisture, and the fixation technology for using used tea leaves that have absorbed CO2 in products.

Activities as a health-enhancing enterprise and SDGs

In the COVID-19 crisis, interest in our own health and our family members’ health is heightened. The company’s main business is to handle products that would contribute to health, and will enhance such business activities. In detail, the company supports healthy, affluent lives by utilizing the functions of tea, which is consumed by Japanese people on a daily basis, creates a new chapter of 1200 year-long history of tea, and strives to solve social issues. As part of such business activities, the company started the education for deepening the knowledge of cognitive function and health enhancement programs. In detail, the company cooperated in the development of caregivers for dementia patients, attending the lectures for developing caregivers for dementia patients at 196 sites nationwide, and conducted screening tests for mild cognitive impairment, targeting about 280 employees aged 50 years or older whose cognitive function (attentiveness and judgment) are considered to decline due to aging. According to the test results, the company takes measures for improving the habits of eating and drinking, etc.

In addition, under the group’s ethos, Customers First, the company aims to achieve sustainable growth as an enterprise that enhances health, and will engage in corporate activities to attain SDGs, while addressing important problems related to consumers, communities, society, and the earth environment.

Material issues | ITO EN’s policies and initiatives | Major related SDGs |

Consumer issues ・Diversification of lifestyles ・Healthy life expectancy, lifestyle , MCI | ・Proposal of tea products and other products contributing to health ・Scientific research on health factors of tea nutrition ・Efforts to prevent “loss of eating” |

|

Communities and society ・Issues in domestic agriculture and tea industry ・Changes in workstyles and communication | ・Promotion of the Tea-Producing Region Development Project ・Educational activities for tea culture by ITO EN Tea Tasters ・Continuation of new Haiku awards |

|

Global environment- Plastic pollution, ・Resource exhaustion, global warming | ・Used Tea Leaves Recycling System ・Establishment of plastic policy and activity promotion ・Response to climate change |

|

(Produced based on the reference material of the company)

Strengthening of ROE Management

With the goal of achieving a ROE of 10% or higher, the company carries out business administration focused on profitability (ratio of net income to sales), efficiency (asset turnover ratio), and financial stand (financial leverage).

(Source: The company)

| FY 4/17 | FY 4/18 | FY 4/19 | FY 4/20 | FY 4/21 |

ROE(%) | 10.5 | 9.0 | 9.9 | 5.2 | 4.7 |

Net Income to Sales Ratio (%) | 2.88 | 2.54 | 2.87 | 1.61 | 1.57 |

Asset Turnover Ratio (Times) | 1.61 | 1.64 | 1.67 | 1.63 | 1.43 |

Leverage (Times) | 2.25 | 2.17 | 2.07 | 2.00 | 2.08 |

*Calculated by Investment Bridge Co, Ltd.

2. Second Quarter of Fiscal Year Ending April 2022 Earnings Results

2-1. Trend of the domestic beverage market

| 2019 | 2020 | YoY | Outlook of 2021 | YoY | Compared to 2019 |

Tea total | 9,665 | 8,770 | -9.3% | 8,860 | +1.0% | -8.3% |

Green Tea | 4,450 | 4,180 | -6.1% | 4,230 | +1.2% | -4.9% |

Other Tea | 5,215 | 4,590 | -12.0% | 4,630 | +0.9% | -11.2% |

Coffee | 9,150 | 8,050 | -12.0% | 8,160 | +1.4% | -10.8% |

Carbonated | 7,330 | 7,350 | +0.3% | 7,400 | +0.7% | +1.0% |

Mineral Water | 2,840 | 2,560 | -9.9% | 2,610 | +2.0% | -8.1% |

Fruits | 2,800 | 2,240 | -20.0% | 2,210 | -1.3% | -21.1% |

Sports Drink | 2,265 | 1,930 | -14.8% | 1,850 | -4.1% | -18.3% |

Vegetable | 1,540 | 1,570 | +1.9% | 1,550 | -1.3% | +0.6% |

Others | 2,000 | 1,780 | -11.0% | 1,690 | -5.1% | -15.5% |

Domestic beverage market | 37,590 | 34,250 | -8.9% | 34,330 | +0.2% | -8.7% |

*Unit: 100 million yen. Created based on the company’s materials.

In 2021, the size of the domestic beverage market is expected to be almost the same as the previous year, although it will recover from the large drop in 2020 caused by the COVID-19. Compared to 2019, the year before the outbreak of Corona disaster, almost all products are expected to be negative.

On the other hand, the percentage of sugar-free beverages in the Japanese beverage, which was 1% in 1980 when the company released canned oolong tea has gone up to 53% in 2020. The company expected that as people’s awareness of health increases, the percentage of sugar-free beverages continues to rise.

(Created based on the company’s materials.)

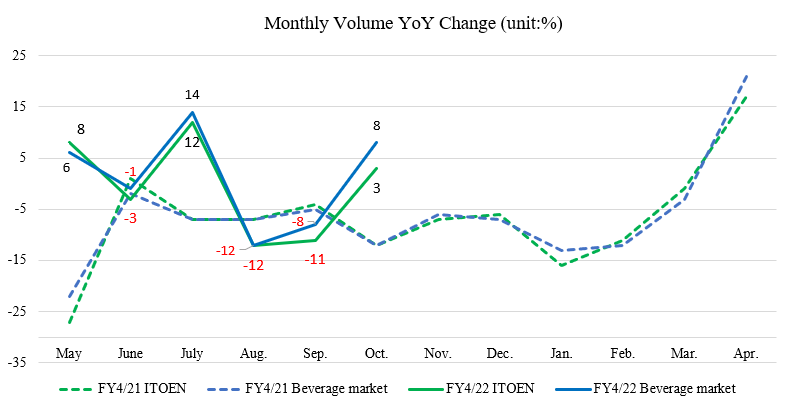

In July, sales volume increased considerably as the rainy season ended early nationwide, but from August, sales volume declined considerably, due to the record rainfall caused by the unusual prolonged rain, the extension of the period of the state of emergency, etc.

In October, the state of emergency was lifted, and the demand for beverages outside home grew, so sales volume increased in both the beverage market and the company.

The ratio of sugar-free beverages of the company accounted for over 75% in the first half. The sales volume of tea leaves increased 2% from the previous year, and the sales volume of drinks was unchanged from the previous year.

2-2.Consolidated earnings

2Q of FY 4/22 New standard

| 2Q of FY 4/21 | Ratio to sales | 2Q of FY 4/22 | Ratio to sales | YoY |

Sales | 236,585 | 100.0% | 208,716 | 100.0% | - |

Gross Profit | 112,475 | 47.5% | 82,469 | 39.5% | - |

SG&A expenses | 103,864 | 43.9% | 71,612 | 34.3% | -31.1% |

Operating Income | 8,610 | 3.6% | 10,856 | 5.2% | +26.1% |

Ordinary Income | 8,317 | 3.5% | 11,303 | 5.4% | +35.9% |

Profit attributable to owners of parent | 4,596 | 1.9% | 7,752 | 3.7% | +68.7% |

*unit: million yen. The company started applying the recognition revenue standard in the term ending April 2022. For items that are strongly affected by the new standard, increase/decrease rate is not written.

2Q of FY 4/22 Old standard

| 2Q of FY 4/21 | Ratio to sales | 2Q of FY 4/22 | Ratio to sales | YoY |

Sales | 236,585 | 100.0% | 241,041 | 100.0% | +1.9% |

Gross Profit | 112,475 | 47.5% | 114,828 | 47.6% | +2.1% |

SG&A expenses | 103,864 | 43.9% | 104,090 | 43.2% | +0.2% |

Operating Income | 8,610 | 3.6% | 10,737 | 4.5% | +24.7% |

Ordinary Income | 8,317 | 3.5% | 11,184 | 4.6% | +34.5% |

Profit attributable to owners of parent | 4,596 | 1.9% | 7,674 | 3.2% | +67.0% |

*unit: million yen.

Sales and profit grew.

(The following contents are based on the old standard.)

Sales grew 1.9% year on year to 241 billion yen. The non-consolidated performance of ITO EN was on a plateau, but the performance of Tully’s Coffee Japan recovered from the same period of the previous term, in which it was strongly affected by the COVID-19 pandemic because its shops are located in metropolitan areas, and the US business performed well, too.

Operating income rose 24.7% year on year to 10.7 billion yen. The company strived to improve profitability. The non-consolidated profit of ITO EN increased 8.9% year on year. The loss from Tully’s Coffee Japan shrank considerably.

Sales and Operating Income in each company

(2Q of FY 4/22 New standard)

| 2Q of FY 4/21 | Ratio to sales | 2Q of FY 4/22 | Ratio to sales | YoY |

ITO EN (Non-consolidated) | 189,522 | 80.1% | 159,505 | 76.4% | - |

Tully`s Coffee Japan Co., Ltd. | 11,860 | 5.0% | 14,017 | 6.7% | - |

Chichiyasu Company | 7,376 | 3.1% | 6,155 | 2.9% | - |

Other Domestic Subsidiaries | 27,059 | 11.4% | 25,494 | 12.2% | - |

US Business | 14,904 | 6.3% | 17,224 | 8.3% | +15.6% |

Other Overseas Subsidiaries | 2,857 | 1.2% | 2,844 | 1.4% | -0.4% |

Elimination of Internal Transactions | -16,993 | - | -16,524 | - | - |

Consolidated Sales | 236,585 | 100.0% | 208,716 | 100.0% | - |

ITO EN (Non-consolidated) | 8,399 | 4.4% | 9,149 | 5.7% | +8.9% |

Tully`s Coffee Japan Co., Ltd. | -1,243 | - | 115 | 0.8% | - |

Chichiyasu Company | 434 | 5.9% | 440 | 7.1% | +1.4% |

Other Domestic Subsidiaries | 414 | 1.5% | 595 | 2.3% | +43.7% |

US Business (unit: thousand dollars) | 438 | 2.9% | 330 | 1.9% | -24.6% |

Other Overseas Subsidiaries | 612 | 21.4% | 555 | 19.5% | -9.3% |

Elimination of Internal Transactions | -444 | - | -329 | - | - |

Consolidated Operating Income (Profit Ratio) | 8,610 | 3.6% | 10,856 | 5.2% | +26.1% |

*unit: million yen. Foreign exchange rate (Average to US dollar during the period): 2Q of FY4/21 ¥106.46, 2Q of FY4/22 ¥110.49.

Sales and Operating Income in each company

(2Q of FY 4/22 Old standard)

| 2Q of FY 4/21 | Ratio to sales | 2Q of FY 4/22 | Ratio to sales | YoY |

ITO EN (Non-consolidated) | 189,522 | 80.1% | 190,614 | 79.1% | +0.6% |

Tully`s Coffee Japan Co., Ltd. | 11,860 | 5.0% | 13,898 | 5.8% | +17.2% |

Chichiyasu Company | 7,376 | 3.1% | 6,999 | 2.9% | -5.1% |

Other Domestic Subsidiaries | 27,059 | 11.4% | 26,481 | 11.0% | -2.1% |

US Business | 14,904 | 6.3% | 17,224 | 7.1% | +15.6% |

Other Overseas Subsidiaries | 2,857 | 1.2% | 2,844 | 1.2% | -0.4% |

Elimination of Internal Transactions | -16,993 | - | -17,021 | - | - |

Consolidated Sales | 236,585 | 100.0% | 241,041 | 100.0% | +1.9% |

ITO EN (Non-consolidated) | 8,399 | 4.4% | 9,149 | 4.8% | +8.9% |

Tully`s Coffee Japan Co., Ltd. | -1,243 | - | -3 | - | - |

Chichiyasu Company | 434 | 5.9% | 440 | 6.3% | +1.4% |

Other Domestic Subsidiaries | 414 | 1.5% | 594 | 2.2% | +43.5% |

US Business (unit: thousand dollars) | 438 | 2.9% | 330 | 1.9% | -24.6% |

Other Overseas Subsidiaries | 612 | 21.4% | 555 | 19.5% | -9.3% |

Elimination of Internal Transactions | -444 | - | -329 | - | - |

Consolidated Operating Income (Profit Ratio) | 8,610 | 3.6% | 10,737 | 4.5% | +24.7% |

*unit: million yen. Foreign exchange rate (Average to US dollar during the period): 2Q of FY4/21 ¥106.46, 2Q of FY4/22 ¥110.49.

2-3. Impact of COVID-19, 2Q of FY 4/22 (August to October of 2021)

(The following description is based on the old standard.)

◎ ITO EN (non-consolidated)

Sales dropped 5.9% year on year. The opportunities to go out decreased due to the bad weather in August, which is originally the best season for selling beverages, and the declaration of a state of emergency. The impact of popularization of working from home on the convenience store business became evident.

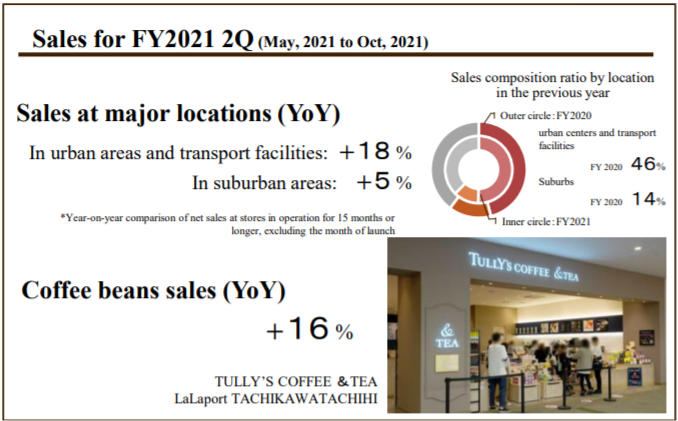

◎ Tully’s Coffee Japan

Sales grew 4% year on year, showing a rapid recovery from the same period of the previous term, in which sales dropped 22%. Due to the state of emergency from August to September, the recovery of the number of customers slowed down, but from October, sales performance and the number of customers visiting shops have been on a recovery trend, mainly in urban areas.

◎ Business in North America

Sales rose 13% year on year. As vaccination progressed, consumer spending is recovering steadily, but there is a concern over the continuously skyrocketing marine transportation cost.

2-4.Financial Status and Cash Flows (CF)

◎Balance sheet

| April 2020 | Oct. 2021 | Increase/ Decrease |

| April 2020 | Oct. 2021 | Increase/ Decrease |

Current assets | 223,880 | 227,466 | +3,586 | Current liabilities | 93,548 | 90,529 | -3,019 |

Cash and deposits | 109,430 | 111,952 | +2,522 | Accounts payable | 29,999 | 25,249 | -4,750 |

Accounts receivables | 53,137 | 55,381 | +2,244 | Short-term loans payable | 25,004 | 24,604 | -400 |

Inventories | 45,432 | 47,737 | +2,305 | Non-current liabilities | 86,459 | 86,324 | -135 |

Fixed assets | 109,184 | 107,996 | -1,188 | Long-term loans payable | 65,858 | 65,603 | -255 |

Property, plant and equipment | 78,099 | 76,753 | -1,346 | Total liabilities | 180,007 | 176,853 | -3,154 |

Intangible fixed assets | 8,355 | 8,114 | -241 | Net assets | 153,057 | 158,609 | +5,552 |

Investments and other assets | 22,749 | 23,127 | +378 | retained earnings | 123,679 | 128,520 | +4,841 |

Total assets | 333,065 | 335,462 | +2,397 | Total liabilities and net assets | 333,065 | 335,462 | +2,397 |

*unit: million yen

Total assets increased by 2.3 billion yen from the end of the previous fiscal year to 335.4 billion yen due to an increase in cash and deposits. Total liabilities decreased by 3.1 billion yen to 176.8 billion yen due to a decrease in notes and accounts payable trade. The equity ratio rose 1.3 points from the end of the previous fiscal year to 46.9%.

◎Cash Flows (CF)

| 2Q of FY 4/21 | 2Q of FY 4/22 | Increase/Decrease |

Operating CF (A) | 13,490 | 11,762 | -1,728 |

Investing CF (B) | -4,300 | -4,385 | -85 |

Free CF (A+B) | 9,190 | 7,377 | -1,813 |

Financing CF | 4,782 | -5,383 | -10,165 |

Balance of cash and cash equivalents at end of period | 77,645 | 110,067 | +32,422 |

*unit: million yen.

The surpluses of operating CF and free CF shrank, due to the increase in inventories, the decrease in trade payables, etc.

Financing CF turned negative, as there was no revenue from long-term borrowing.

The cash position increased.

3. Fiscal Year Ending April 2022 Financial Forecasts

3-1 Consolidated Earnings

◎Old standard

| FY 4/21 | Ratio to sales | FY 4/22 (Est.) | Ratio to sales | YoY | Revised rate | Progress rate |

Sales | 446,281 | 100.0% | 464,400 | 100.0% | +4.1% | -1.7% | 51.9% |

Gross profit | 215,003 | 48.2% | 223,600 | 48.1% | +4.0% | -2.1% | 51.4% |

SG&A expenses | 198,327 | 44.4% | 203,600 | 43.8% | +2.7% | -2.3% | 51.1% |

Operating income | 16,675 | 3.7% | 20,000 | 4.3% | +19.9% | 0% | 53.7% |

Ordinary income | 17,029 | 3.8% | 19,800 | 4.3% | +16.3% | 0% | 56.5% |

Net income | 7,011 | 1.6% | 12,800 | 2.8% | +82.5% | 0% | 60.0% |

*unit: million yen

Forecasted sales were revised downwardly, but both sales and profit are forecasted to increase.

The annual sales in the full-year estimates for the term ending April 2022 have been revised downwardly. When the full-year consolidated earnings estimates were announced in June 2021, the vaccination against COVID-19 had been already started, and it was expected that consumer confidence would recover to some degree, although it was unclear when COVID-19 would subside. However, the recovery of consumer confidence, which dropped due to the prolonged voluntary restraint, turned out to be weaker than expected, and the bad weather in August and September significantly affected mainly the sale of drinks. These are major factors in the downward revision. The sales in the second half are expected to exceed the initial estimate, so the initial estimate of operating income has not been revised.

Although the estimates have been revised downwardly, sales are projected to grow from the previous term, offsetting the augmentation of SG&A expenses, and operating income is forecasted to increase by double digits. The expected dividend has not been revised. The company plans to pay a dividend of 40 yen/share for common shares and a dividend of 50 yen/share for preferred shares like in the previous term. The expected payout ratio is 38.9% for common shares and 44.3% for preferred shares.

Major Components of SG&A (Old standard)

| FY 4/21 | Ratio to sales | FY 4/22 (Est.) | Ratio to sales | YoY | Revised rate |

Selling commission | 74,313 | 16.7% | 76,626 | 16.5% | +3.1% | -1.6% |

Advertising cost | 9,808 | 2.2% | 10,579 | 2.3% | +7.9% | -4.5% |

Freight cost | 13,833 | 3.1% | 13,601 | 2.9% | -1.7% | -3.5% |

Depreciation and amortization | 10,207 | 2.3% | 9,214 | 2.0% | -9.7% | -4.1% |

Others | 198,327 | 44.4% | 203,600 | 43.8% | +2.7% | -2.3% |

*unit: million yen.

Sales and Operating Income in each company

◎Old standard

| FY 4/21 | Ratio to sales | FY 4/22 (Est.) | Ratio to sales | YoY | Progress rate |

ITO EN (Non-consolidated) | 352,732 | 79.0% | 362,300 | 78.0% | +2.7% | 52.6% |

Tully`s Coffee Japan Co., Ltd. | 26,215 | 5.9% | 31,500 | 6.8% | +20.2% | 44.1% |

Chichiyasu Company | 13,897 | 3.1% | 13,610 | 2.9% | -2.1% | 51.4% |

Other Domestic Subsidiaries | 51,620 | 11.6% | 53,808 | 11.6% | +4.2% | 49.2% |

US Business | 30,068 | 6.7% | 32,045 | 6.9% | +6.6% | 53.7% |

Other Overseas Subsidiaries | 5,286 | 1.2% | 5,439 | 1.2% | +2.9% | 52.3% |

Elimination of Internal Transactions | -33,538 | - | -34,302 | - | - | - |

Consolidated Sales | 446,281 | 100.0% | 464,400 | 100.0% | +4.1% | 51.9% |

ITO EN (Non-consolidated) | 15,759 | 4.5% | 17,000 | 4.7% | +7.9% | 53.8% |

Tully`s Coffee Japan Co., Ltd. | -1,374 | - | 1,000 | 3.2% | - | - |

Chichiyasu Company | 702 | 5.1% | 680 | 5.0% | -3.2% | 64.7% |

Other Domestic Subsidiaries | 685 | 1.3% | 821 | 1.5% | +19.9% | 72.4% |

US Business (unit: thousand dollars) | 717 | 2.4% | 734 | 2.3% | +2.4% | 45.0% |

Other Overseas Subsidiaries | 1,146 | 21.7% | 1,161 | 21.3% | +1.2% | 47.8% |

Elimination of Internal Transactions | -962 | - | -1,396 | - | - | - |

Consolidated Operating Income (Profit Ratio) | 16,675 | 3.7% | 20,000 | 4.3% | +19.9% | 53.7% |

*unit: million yen. Foreign exchange rate (Average to US dollar during the period): FY4/21 ¥106.20, FY4/22 ¥108.00.

4. Marketing Strategies

4-1 Oi Ocha

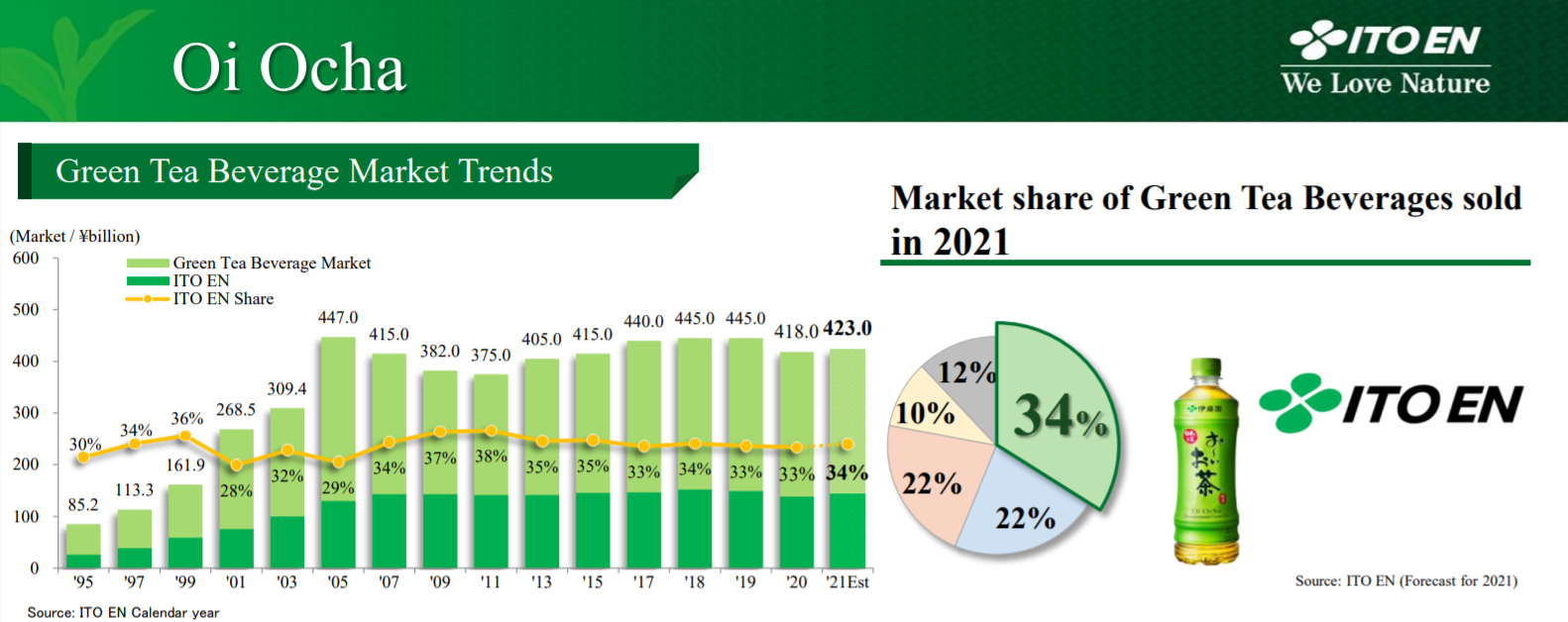

The scale of the green tea beverage market in 2021 is estimated to be 423 billion yen, up 1% from the previous year. ITO EN’s market share in terms of sales increased 1 point to 34%. In particular, “Oi Ocha Bold Green Tea” contributed significantly.

In addition, ITO EN’s share in the hot green tea beverage market in terms of sales is 52%. The company considers that customers highly evaluated its unique microwavable products and the aroma and deliciousness as if it were brewed with a teapot.

The company aims to keep the position of "No.1 as it is selected because of its good taste" by focusing more on quality and taste.

(Source: the company)

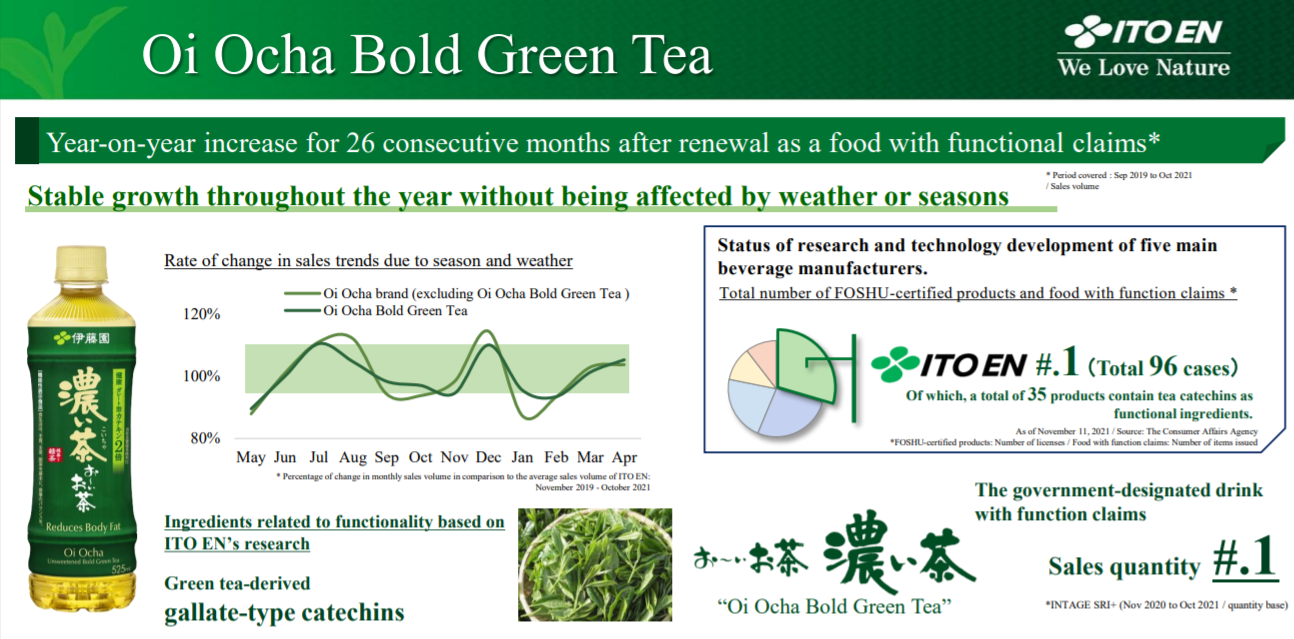

“Oi Ocha Bold Green Tea” is recognized as a beverage for meeting customers’ preference that can be sold stably regardless of weather and season.

Since it started indicating the functions of catechin gallate, sales grew for 26 consecutive months as of October 2021. A broad range of customers like this product, because it is a product with functional claim and delicious taste.

ITO EN will keep pursuing its own unique path and concentrate on the development of unprecedented products.

(Source: the company)

4-2 Tea leaves

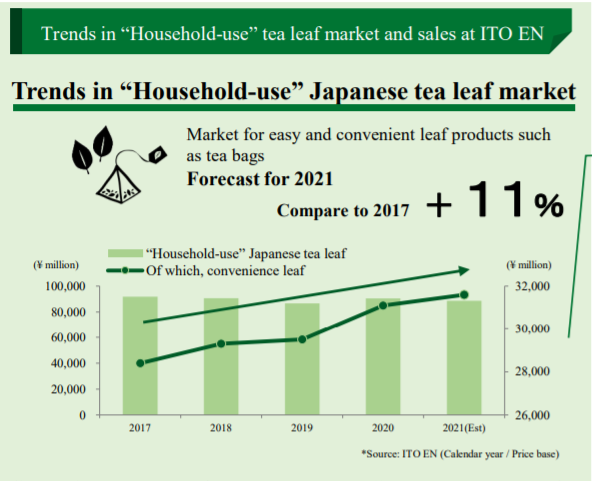

The tea leaves for household use kept performing well, thanks to the demand from housebound consumers. As consumers now have more spare time, the style of brewing and drinking tea spread among young generations, in addition to senior generations.

In particular, the sales of easy-to-use tea leaf products, such as tea bags, in the market grew 11% from five years ago, and the sales of such products of ITO EN increased 15% from five years ago, exceeding the growth rate of the market.

It is considered that consumers highly evaluated ITO EN’s efforts for easy-to-use leaf products to innovate technologies pursuing tea as if it was brewed with a tea pot.

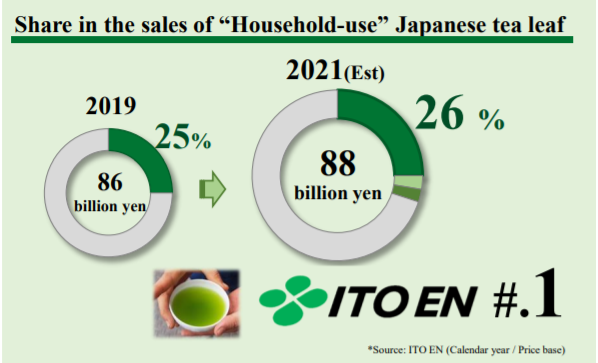

The company has the overwhelming No.1 position with a 26% share in the market of tea leaves for household use. The company aims to grow further by implementing SNS measures targeted at young generations, etc.

|

|

(Source: the company)

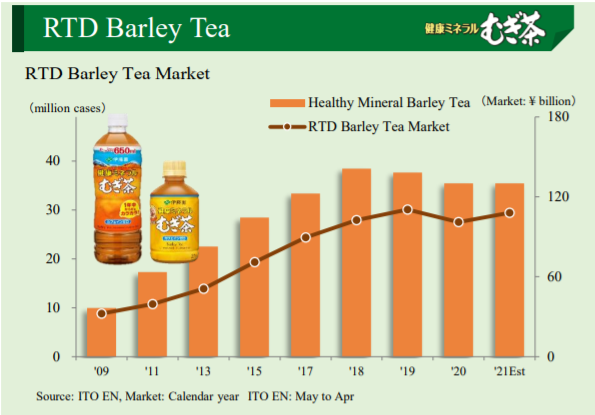

4-3 Barley tea

The period from July to September is the best season for beverage makers, but the weather in August and September this year was unfavorable. “Kenko Mineral Mugicha” was strongly affected by the bad weather in the best season, but its beverages and tea bags keep the largest market share in terms of sales.

The company will keep advertising its minerals, pursue the taste of tea brewed with a kettle by rigorously selecting ingredients, roasting, and extraction methods, and brush up its products while taking environmentally friendly measures.

|

|

(Source: the company)

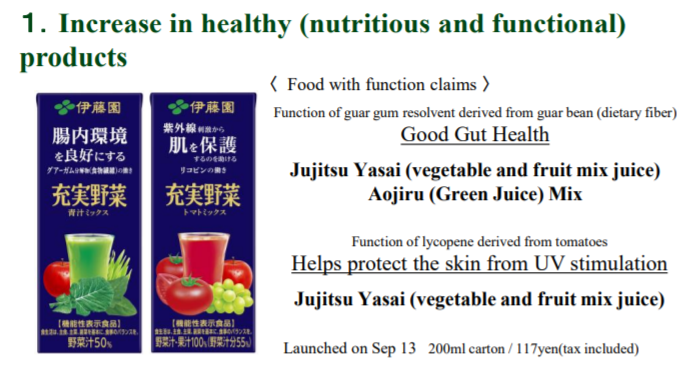

4-4 Vegetable beverages

This year, the company concentrates on health and the environment as the value of vegetable beverages. In September, the company released some products with functional claim, including Jujitsu Yasai (vegetable and fruit mix juice)—Aojiru (Green Juice) Mix and Jujitsu Yasai (vegetable and fruit mix juice)—Tomato Mixed, for which aluminum-less eco-friendly containers were adopted, to offer new value.

For large plastic bottles used for vegetable beverages, the company adopted environmentally friendly ECO bottles at the time of change in the capacity of the container in the second quarter.

The company will keep enriching the product lineup while caring for health and the environment.

|

|

(Source: the company)

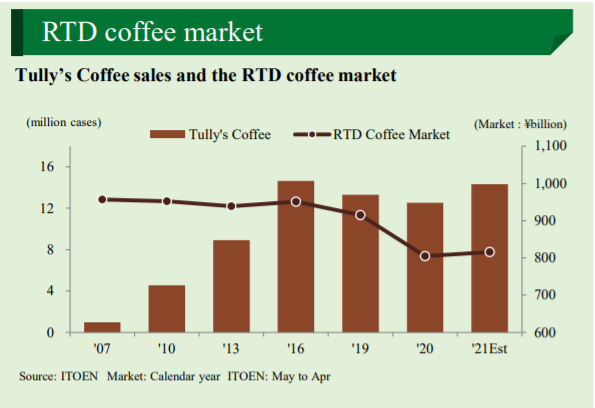

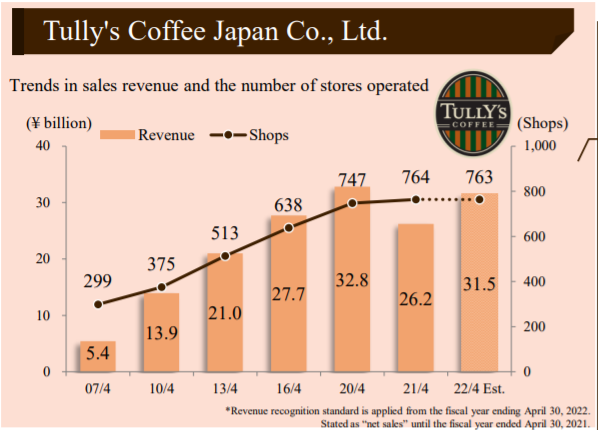

4-5. Tully’s Coffee Japan

The marketing strategy focused on bottle-shaped canned coffee of ITO EN turned out to be effective, and the “TULLY’S COFFEE” brand has been performing well.

As sugar-less coffee became popular, not only bottle-shaped canned black coffee, which is the core product, but also Tully’s Coffee Barista’s Sugarless Latte sold well, and sales grew 32% from the previous year.

This year, the company started selling coffee for household consumption, releasing the easy-to-brew dripcoffee, TULLY’S COFFEE THE BARISTA’S ROAST in June, and disposable packs in October. For tea, the company has been selling tea leaves and beverages in a linked manner. For coffee, it will sell both canned coffee and coffee for household consumption, as the lineup of coffee for household consumption has been enriched.

The company will grow “TULLY’S COFFEE” brand from the three aspects: coffee sold at retail stores, beverages sold at retail stores, and coffee shops. In areas where there are no coffee shops, the company will promote coffee and beverages sold at retail stores and make a lead to open coffee shops.

Since the shops of Tully’s Coffee Japan are located in urban areas, they are struggling in the COVID-19 pandemic, and the number of shops in the current term is projected to be unchanged from the previous year.

Meanwhile, from the second half, it is expected that the crowds of people come back in urban areas and sales performance will improve, and the number of shops is projected to grow from the next term.

The company also focuses on the sale of products, and the collaborative Harry Potter project is performing well. As environmental measures, the company will adopt paper packs that can be used for hot and cold beverages, to reduce the consumption of plastics by over 100 tons.

|

|

|

|

(Source: the company)

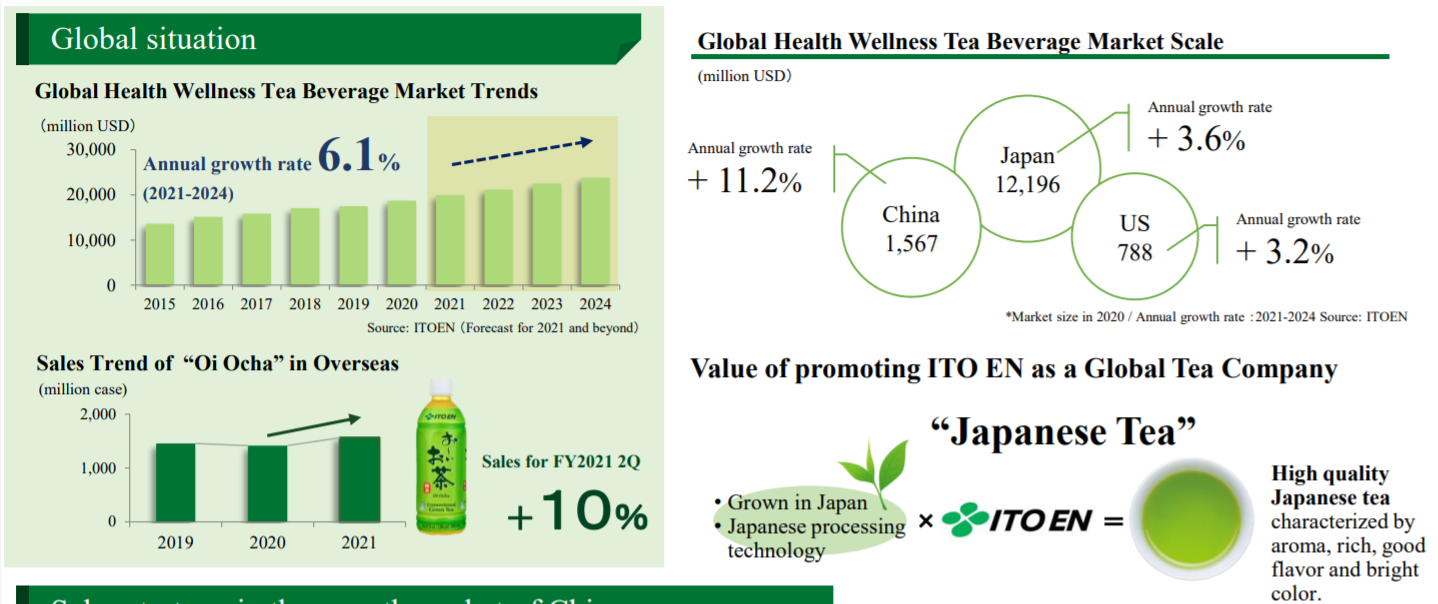

4-6 Overseas strategy

As people became more health-conscious amid the COVID-19 pandemic, the global market of tea beverages for health and wellness is expected to grow with an annual rate of 6% or higher.

In particular, the Chinese market is expected to grow by double digits, and the markets in Japan and the U.S. are forecasted to grow, too. ITO EN will disseminate the healthy features, taste, quality, etc. of Japanese tea in various ways around the world, and aim to become a global tea company.

|

(Source: the company)

4-7. Corporate Sustainability

As a measure for reducing environmental burdens, the company adopted 100% recyclable plastic bottles in 2019. In August 2021, the company signed an agreement with Himeji City, to recycle used plastic bottles sorted and discarded by citizens into new plastic bottles.

Through such resources-recycling efforts, the company plans to adopt 100% recycled plastic bottles for all products of the Oi Ocha brand by 2025 and for all its beverage products by 2030. While promoting the reduction of waste and the effective use of resources, the company aims to improve the sustainability of the environment, society, and economy.

(Source: the company)

5. Conclusions

The progress rate in the first half is 51.9% for sales and 53.7% for operating income. As a characteristic of ITO EN, the sales and profit in the first half, including the period from July to September, which is the best season for selling beverages, are better than those in the second half, but the above progress rates are low compared with those in the past several years. The company assumes that sales in the second half will exceed the estimate. We would like to pay attention to their pace of earning sales from the third quarter.

ITO EN has developed original products as well as industry’s first products, occupying a high share in the market. The company’s policies and initiatives for research, planning, and development are introduced on page 40 of ITO EN INTEGRATED REPORT 2021, which was issued in November 2021.

According to the report, the company engages in research, planning, and development under the five concepts for product development: “Natutal,” “Healthy,” “Safe,” “Well-designed,” and “Delicious.” In particular, as a health-enhancing enterprise that contributes to the health of customers, it makes efforts to solve health problems by providing delicious healthy products, such as sugar-free beverages, food products for specified health use, and food products with functional claims, by utilizing the efficacy of tea and natural ingredients.

It is difficult for the company to recover its performance to the pre-pandemic level in the short term, but we would like to pay attention to the progress of the mid-term measures of the company, which possesses overwhelming competitive advantage in product development.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors and auditors

Organization type | Company with corporate auditor |

Directors | 14 directors, including 4 outside ones |

Auditors | 4 auditors, including 3 outside ones |

◎Corporate Governance Report:Updated December 1, 2021

Basic Policy

The management philosophy of the ITO EN Group (hereinafter "the Group") is "Always Putting the Customer First." In the Group's Corporate Mission Statement, the foundation of management is that the Group exists for the benefit of all people who work there and their families, as well as the entire society, and that we fulfill our corporate social responsibility in cooperation with our stakeholders, including the national government, local communities, consumers, shareholders, sales partners, suppliers, and financial institutions.

This management philosophy is the basic concept of the Group's corporate ethics and is an unchanging truth that supports corporate governance. The Group will actively promote management that lives up to the trust of all stakeholders and realizes a sustainable society through the concerted efforts of all executives and employees.

Based on this philosophy, the Group, as a health-enhancing company, aims to become a global tea company in its medium/long-term vision. In addition, by contributing to the health of our customers around the world, we will work to achieve sustainable growth, enhance our corporate value over the medium/long term, and further strengthen our corporate governance.

To realize an appropriate form of corporate governance, our company, which has a board of auditors, carries out audits in which the auditors inquire the business conditions, the decision-making processes, etc. of the representative directors, the directors in charge, the executive officers or the employees of our group companies.

The auditors attend every meeting of the board of directors in order to give their objective and impartial opinions on the audit situations concerning the company in general or individual issues, and audit the business execution by the directors in accordance with the audit policies set out by the board of auditors.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

This information is based on the code revised in June 2021.

【Principle 4-11: Prerequisites for Ensuring the Effectiveness of the Board of Directors and Board of Corporate Auditors】

The composition of the Board of Directors of the Company shall be determined by taking into consideration the knowledge, experience, and ability of the members in light of the management strategy, etc., ensuring that the Board of Directors is well-balanced as a whole, having the necessary and appropriate number of members to ensure effective decision-making and substantive discussions at the Board of Directors meetings, and giving due consideration to the perspective of ensuring diversity of gender, internationality, professional experience, and age.

Currently, there are no female directors, but we will continue to examine ways to ensure diversity in terms of gender.

(Article 6 “Composition of the Board of Directors” of the Company's Corporate Governance Guidelines)

Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)

[Disclosure in accordance with the principles of the corporate governance code]

Our company formulated “Corporate Governance Guidelines of ITO EN, Ltd. (hereinafter called “ITO EN Guidelines”)” based on resolutions of the board of directors, for describing the basic concept and policy for corporate governance, and disclosed them in our corporate site. Please refer to them.

https://www.itoen.co.jp/csr/governance/

【Principle 1-4 Strategically held shares】

In principle, our company will not hold any shares of other companies, unless it is considered that the shareholding would smooth transactions, procurement, or fund raising. If the shareholding is not expected to contribute to the improvement in mid/long-term corporate value, we will reduce the number of shares we hold step by step. As for the shares of listed companies we hold in accordance with the above proviso (hereinafter called “strategically held shares”), we check whether the return of invested capital exceeds capital cost for each stock at the annual meeting of the board of directors. From the viewpoint of maintaining and cementing the mid/long-term relations with counterparty, we check the meanings of shareholding, and confirm at the meetings of the board of directors that we will sell or reduce the shares whose economic rationality and meanings have diluted after consulting with the parties concerned.

As for the exercise of voting rights for strategically held shares, we check the contents of each bill and comprehensively judge whether it will contribute to the improvement in corporate value of our company and the invested company, before exercising them. (Article 14 of the Guidelines of our company-Policy for strategic shareholding)

【Supplementary Principle 2-4 (1) Ensuring Diversity in Appointing Core Personnel, etc.】

<Approach for ensuring diversity in the appointment of core personnel, etc.>

Since its foundation, the Group has established the ITO EN Group Mission Statement with the objective of becoming an incomparably great company. As a general rule, the promotion of human resources is based on competence, without regard to mere seniority, academic background, or clique. Based on this principle, we will create an environment in which a diverse range of human resources can play an active role in accordance with their individual abilities and aptitudes, without any loss of opportunities afforded by their gender, nationality, age, mid-career hires, or disabilities. By fostering an organizational culture based on this meritocracy approach, we aim to become a global tea company.

(Article 18 “Diversity Policy” of our guidelines)

<Voluntary and measurable targets for ensuring diversity in the recruitment of core human resources>

(1) Promotion of women to management positions

Based on the idea of competency-based recruitment, we promote our executives and managers without distinction of gender. In addition, we recognize that the promotion of women's activities is an important management issue from the perspective of ensuring diversity, and we are working to improve the retention rate of female employees, strengthen support for balancing work and family life, and foster managers. As the ratio of female managers was 2.3% and the ratio of female candidates for management positions (equivalent to assistant managers) was 5.0% in FY 2020, we set a goal of increasing female managers by 150% and female candidates for management positions (equivalent to assistant managers) by 130% from FY 2020 by FY 2023. We aim to further develop and promote female managers as a long-term goal (2030).

(2) Promotion of mid-career hires to management positions

The ratio of mid-career hires to our managers is equal to the ratio of mid-career hires to all employees (approximately 20%), and people with a variety of experience and knowledge are promoted to management positions according to their abilities. At present, we have not set voluntary and measurable goals, but we will continue to hire and train diverse human resources based on competency-based thinking to create an environment where they can be more active.

(3) Appointment of non-Japanese nationals to management positions

We currently have 16 non-Japanese hires, four of whom are active in management positions. Approximately 10% of the Group's employees (about 800 people) are non-Japanese, and they are appointed according to their abilities in each country and each group company. In our company, the percentage of non-Japanese managers is equal to or higher than the percentage of managers to all employees, and employees having diverse backgrounds are active in the company. At present, we have not set any voluntary and measurable goals, but as a company aiming to become a global tea company, we will promote the promotion of employees throughout the Group under our competency-based approach.

<Human resources development policy and internal environment improvement policy for ensuring diversity, and their status>

(1) Human resources development policy

Under our competency-based approach, we focus on human resources development based on the principle of equal opportunities for each employee and fair evaluation. We will promote health management that enables every employee to work vigorously in good health by fostering diverse human resources and reforming work styles based on the practice of the Group's management philosophy "Always Putting the Customer First."

① Education on compliance

Based on the Guide for ITO EN Group Compliance Code of Conduct, we educate all employees to respect human rights and to treat individuals fairly, according to their aptitudes and abilities, without discrimination based on gender, age, ethnicity, race, nationality, religion, belief, social status, family origin, or disability.

② Management education

We provide education to managers to deepen their understanding of the importance of ensuring diversity, and educate them on the purpose and content of the various systems in place to enable diverse human resources to play an active role.

③ Training to facilitate the flourishing of women

We provide opportunities for female employees to reconsider and formulate their career and life plans so that they can fully demonstrate their abilities and play an active role in the company. By providing education for women at different levels, we are strengthening the motivation and retention rate of female employees, supporting them in balancing work and family life, and training them for management positions.

④ Overseas human resources development education

With the aim of developing human resources who can support our future overseas business, we provide education that focuses on promoting cross-cultural understanding and communication. Specifically, we have a pre-entry system where we invite employees who wish to work overseas in the near future and provide them with training in advance, and an overseas trainee system where they actually travel overseas to receive training, to support their careers and promote their understanding of different cultures.

(2) Internal environment improvement policy

We promote work-life balance by allowing our diverse human resources to flexibly choose their work styles according to their individual circumstances, and we are working to improve the environment so that everyone can have a comfortable workplace.

① ITO EN Family Support System

We have established the ITO EN Family Support System to provide comprehensive support for employees and their families during life events (marriage, childbirth, childcare, nursing care, etc.).

② Workplace Environment Improvement Promotion Committee

We have established the Workplace Environment Improvement Promotion Committee (whose meeting is held twice a year in principle) to examine overall workplace environment issues and improvement measures, and to create a better workplace environment. Under the committee, regional committees (28 meetings were held in FY 2020) were set up with representatives from each business site to exchange opinions on issues such as working hours, workplace safety and health management, and reviewing future work styles.

③ Support for people with disabilities

For employees with disabilities working in each workplace, the human resources department makes regular visits, meets with employees and their families, and collaborates with public support groups to support people with disabilities so that they can work vigorously for a long time.

④ Voice system (Internal proposal system)

We have a Voice System that allows all employees, regardless of job title, to propose new products and sales promotions. Through this system, all employees are always aware of the "spirit of STILL NOW = what customers are still dissatisfied with," and also contribute to the improvement of employee motivation by giving internal awards for outstanding proposals.

For more information on human resources development and internal environment improvement, please refer to our corporate website.

https://www.itoen.co.jp/csr/labour/

【Supplementary Principle 3-1 (3) Initiatives for Sustainability, etc.】

<Initiatives for Sustainability>

Based on the management philosophy of "Always Putting the Customer First," the Group is working to realize its medium/long-term vision of becoming a global tea company by implementing CSV management and promoting ESG, with the aim of both solving environmental and social issues and enhancing corporate value. To this end, based on the ITO EN Group CSR Charter, we have established seven core themes in accordance with the ISO 26000 international standard: organizational governance, human rights, labor practices, the environment, fair business practices, consumer issues, and community involvement and development, and have positioned consumer issues, community involvement and development, and the environment as particularly important issues.

Regarding environmental issues, we have formulated the ITO EN Group Medium/Long-Term Environmental Targets based on the ITO EN Group Environmental Policy, and are working to reduce our environmental impact. Among these, against the backdrop of the plastic issues related to the containers and packaging of our products, we formulated the ITO EN Group Policy on Plastics in September 2020, and are working on resources recycling with the aim of adopting recycled materials, etc. fully for our plastic bottles by 2030.

Please refer to the CSR/ESG (Environmental, Social and Governance) section of our corporate website.

https://www.itoen.co.jp/csr/

<Initiatives for human capital>

We believe that our most important asset is our people, and we aim to develop human resources who can always take on challenges in a proactive manner. We view human resources as human assets and realize initiatives linked to management strategies by transforming human resources from cost (= management) to investment (= value creation) in human capital.

(1) Internal training system: ITO EN University and ITO EN Graduate School

As means of promoting the growth of our employees and supporting them in realizing their own dreams, we opened in-house training system, ITO EN University and ITO EN Graduate School, every year to actively support self-development for employees by providing educational opportunities to acquire the specialized knowledge necessary for business and management.

(2) ITO EN Tea Taster System

The Tea Taster (tea qualification) System, which was launched in 1994, is a system unique to the ITO EN Group that provides qualifications to employees with advanced tea-related knowledge and skills, with the aim of improving tea-related knowledge and skills and promoting tea culture both inside and outside the company (since March 2017, the system has been an in-house certification approved by the Ministry of Health, Labour and Welfare). The program is being implemented at Group companies in Japan and overseas as part of efforts to strengthen employee training with the aim of becoming a global tea company.

(3) Health management

In May 2021, we formulated the ITO EN Group Vigorous Health Declaration. Through the implementation of health management, we aim to be a company that contributes to society through the healthy and vigorous work of every employee and their cheerful and positive approach to challenges. Specifically, we aim to increase our corporate value over the medium/long term through the revitalization of the organization by improving the vitality and productivity of our employees by encouraging regular lifestyle habits among all employees, focusing on the four pillars of a balanced diet, maintenance of an appropriate weight, moderate exercise, and good sleep.

(4) Extension of retirement age

Our company previously had a reemployment system that allowed employees to work for up to five years after the retirement age of 60, but we have decided to extend the retirement age to 65 from May 2022 to create an environment where employees can work with peace of mind and vigor. We will create an environment in which employees can use the experience and knowledge they have accumulated to date in a variety of workplaces, and promote the creation of a system in which employees can work healthily and vigorously until the age of 70.

<Initiatives for intellectual property>

(1) Utilization and protection of intellectual property rights

We consider intellectual property activities to be essential for business continuity and development, and we will build an IP landscape using intellectual property information to support management strategies, the growth of our business, and the promotion of innovation, and promote the use of intellectual property rights for brands, existing and new businesses, and overseas development, which are the pillars of our medium/long-term business plans.

We provide intellectual property information to R&D, marketing, and new business divisions to support future R&D and brand strategies. At the same time, we have secured intellectual property rights for the products, technologies, designs, naming, etc. that support our business and thereby maintain our competitive advantage in the market. In particular, in our core tea-related business, we have secured intellectual property rights for everything from tea plantations to tea products and recycling of tea leaves with an awareness of the supply chain, and we are contributing to the settlement of environmental and social issues through our business.

(2) Investment in human resources development

We have a specialized Intellectual Property Department with in-house patent attorneys and lawyers, as well as utilizing outside experts. Regarding human resources in departments related to the creation of intellectual property, mainly in research and development, we are working to develop human resources who can design research, utilize rights, and formulate strategies with an awareness of the acquisition of rights through continuous training to build their knowledge and skills.

(3) Research on intellectual property rights of other companies

We respect the intellectual property rights of other companies and conduct patent searches and information gathering to avoid the risk of infringement. In particular, to support overseas expansion toward becoming a global tea company, we will promote the appropriate and effective acquisition of intellectual property rights in each country while collecting information on the actual status of disputes and inspections in each country to avoid risks.

<Response to TCFD recommendations>

For the response to climate change, four IPCC representative concentration pathway scenarios, RCP2.6, RCP4.5, RCP6.0, and RCP8.5, were selected based on TCFD recommendations. We conducted an analysis of the impact on the yield and quality of domestic tea leaves, our main ingredients, and disclosed the results in the Integrated Report in FY 2020.

In addition, we have set medium/long-term CO2 emission reduction targets and KPIs, and are promoting environmental management by utilizing the ISO 14001 system, which has been certified for all departments.

We will continue to conduct scenario analysis based on TCFD and other frameworks to enhance the quality and quantity of our disclosure.

【Principle 5-1 Policy for constructive dialogue with shareholders】

After grasping its own capital cost accurately, our company listens to the voices of shareholders and pays proper attention to their interests and concerns through the constructive dialogue between the management and shareholders, revises its business portfolio, explicitly explains its management policies including the investment in equipment, R&D, and human capital, and win the understanding of shareholders. Furthermore, at the Board of Directors' meeting following the announcement of financial results, we will share the opinions received from shareholders and analysts and actively utilize them in the review of management strategies.

(Article 16 of the Guidelines of our company-Policy for constructive dialogue with shareholders)

For details, please see the report titled “Situation of IR-related activities.”

| This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on ITO EN, LTD. (2593) and Bridge Salon (IR seminar), please go to our website at the following URL.www.bridge-salon.jp/