Bridge Report:(2722)IK the first half of fiscal year May 2020

Chairman & CEO Hiroshi Iida | I.K Co., Ltd. (2722) |

|

Company Information

Market | Tokyo stock exchange 2nd section and Nagoya stock exchange 2nd |

Industry | Retail Business (Commerce) |

Chairman & CEO | Hiroshi Iida |

HQ Address | KDX Nagoya Station Building, 3-26-8 Meieki, Nakamura-ku, Nagoya-shi |

Year-end | End of May |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,131 | 7,808,000 shares | ¥8,830 million | 9.1% | 100shares | |

DPS Est | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥12.00 | 1.1% | ¥53.76 | 21.0x | ¥359.61 | 3.1x |

*The share price is the closing price on January 31. Shares Outstanding, DPS, and, EPS are taken from the financial settlement report for the second quarter of FY 5/20. ROE and BPS are the values as of the end of the previous term.

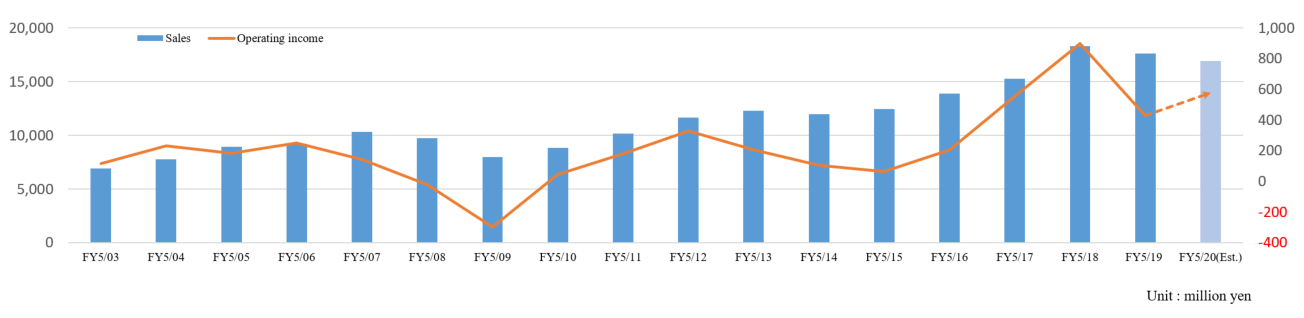

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May 2016 Act. | 13,908 | 205 | 182 | 73 | 9.85 | 5.00 |

May 2017 Act. | 15,273 | 557 | 554 | 425 | 57.13 | 7.50 |

May 2018 Act. | 18,337 | 898 | 899 | 641 | 86.07 | 10.00 |

May 2019 Act. | 17,614 | 431 | 437 | 238 | 31.85 | 12.00 |

May 2020 Est. | 16,946 | 577 | 585 | 402 | 53.76 | 12.00 |

*Unit: million yen. Stock split in a ratio 1:2 was conducted on 1st December, 2017 and 1st April, 2018. EPS and DPS were retroactively adjusted.

The financial statement for the first half of fiscal year ending May 2020 and many more about I.K Co., Ltd. will be described.

Table of Contents

Key Points

1. Company Overview

2. The First Half of Fiscal Year ending May 2020 Earnings Results

3. Fiscal Year ending May 2020 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for the first half of the fiscal year ending May 2020 were 8,810 million yen, down 5.8% year on year. The sales from TV shopping and SKINFOOD shops increased, but the demand from foreign visitors was sluggish. Gross profit rate rose through the growth of the B-to-C business, but gross profit declined due to the drop in sales. SGA was unchanged, but operating income and other incomes decreased. Sales shrank year on year, but exceeded the initial estimate, because a hit product emerged in TV shopping.

- There is no revision to the earnings forecast. For the fiscal year ending May 2020, it is estimated that sales will be 16,946 million yen, down 3.8% year on year, and operating income will be 577 million yen, up 33.6% year on year. The dividend is to be 12.00 yen/share, unchanged from the previous term. The estimated payout ratio is 22.3%. In order to become a full-fledged “marketing manufacturer,” which is one of a kind in the world, the company will analyze market data while operating the B-to-C and B-to-B-to-C businesses, utilize them for product development, and sell products via diverse sales channels of the B-to-C and B-to-B-to-C businesses while promoting sales. In addition, the company will concentrate on “the improvement in productivity” through the enrichment of the employee education system, the streamlining of in-company business operations by utilizing RPA and AI, and so on.

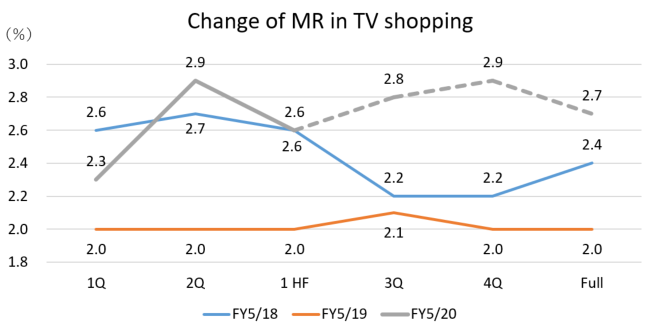

- Due to the downturn of demand from foreign visitors to Japan, etc., the sales and profit for the cumulative second quarter declined, with the profit falling below the estimate, but the sales and profit for the second quarter (Sep. to Nov.) recovered rapidly, thanks to some hit products, including “Speed Heat.” The company thinks that its product portfolio has been enriched further for expanding “the multi-channel sale starting with TV shopping.” The media ration (MR; sales/media cost) in the second half is estimated to be higher than those in the past 2 years, making a favorable impression in the market, although the progress rate of profit is low, and the share price of the company is recovering steadily.

- From the short-term viewpoint, we would like to see the variations in sales and profit in the third and fourth quarters and the progress toward the earnings estimates for this term. From the mid-term viewpoint, we would like to pay attention to how speedily “LB” and “B! FREE+,” for which SKU is increasing after the company obtained the approval from NMPA (former CFDA), will contribute to revenue.

1. Company Overview

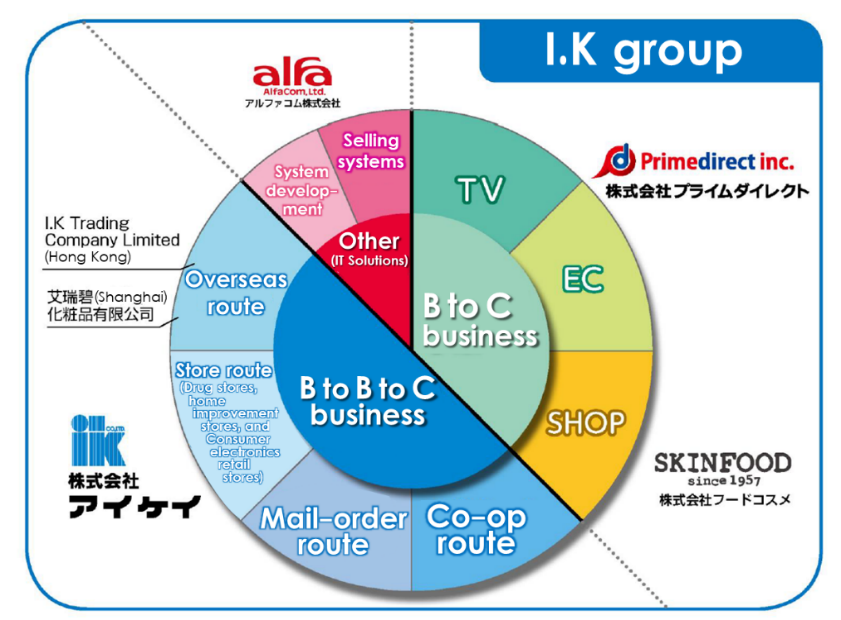

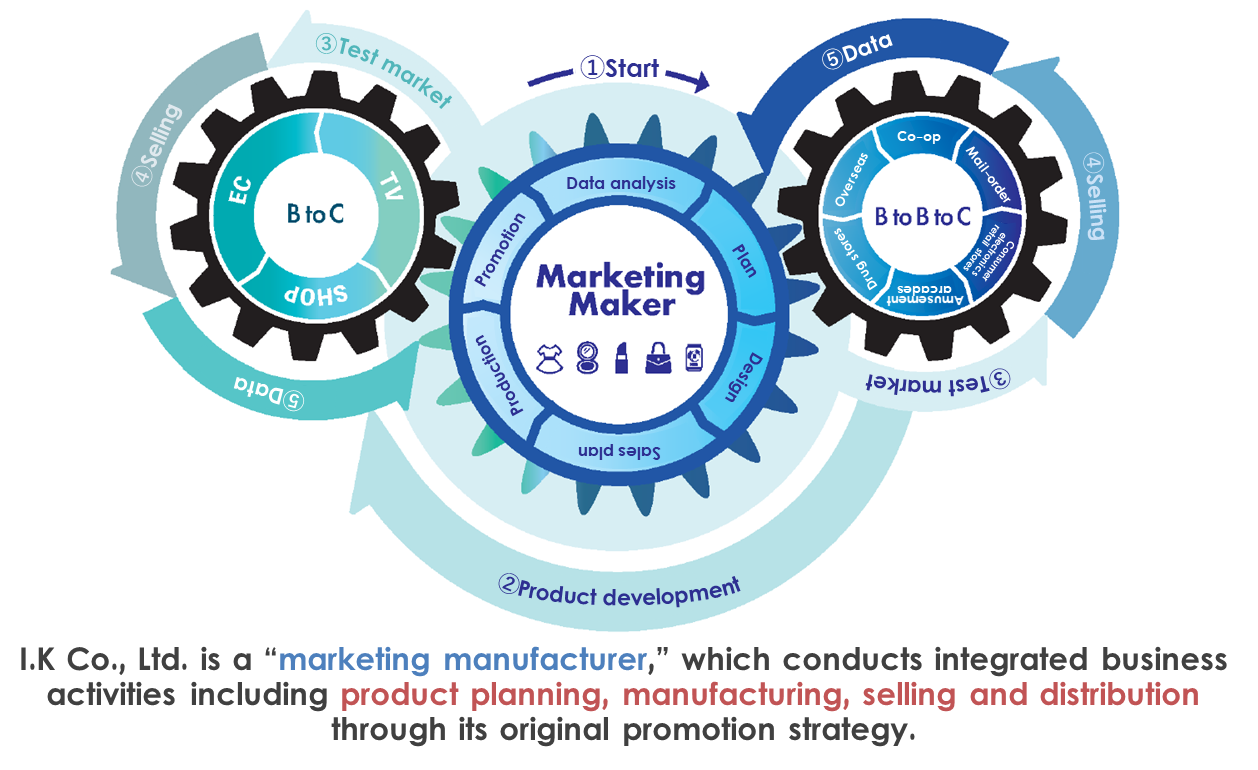

I.K Co., Ltd. is a “marketing manufacturer,” which conducts integrated business activities including product planning, manufacturing, selling and distribution through its original promotion strategy.

The company operates the three businesses: the “B-to-C business,” to sell sundries, food products, and cosmetics via TV shopping, EC, and shops to consumers, the “B-to-B-to-C business,” to sell products via various routes, including co-op stores, mail-order companies, shops, overseas channels, etc., and the “other business,” to offer IT solutions for developing and selling systems.

The company strives to establish a group management to make all stakeholders its fans by promoting “the increase of fans” as its corporate philosophy.

1-1 Corporate History

After spending his high school and college days in a “freewheeling” school environment, Mr. Hiroshi Iida (present chairman and CEO), who had a strong entrepreneurial spirit from the beginning, worked for a nonlife insurance company and went on to establish I.K Ltd. in May 1982. While working on the sales of various products, he opened an account of Aichi CO-OP Union in April 1983 on getting favors from people in charge of sales, and started trading with occupational co-ops.

As the sales of flyers about a rechargeable cleaner, the first product, became a major hit, the horizontal expansion to other co-ops progressed, the number of items handled also increased and the business expanded rapidly. It got listed on the JASDAQ market in December 2001.

Due to the increase in recognition and reliability after the listing, the company began supplying products to the mail-order systems of department stores and retailers in a full-fledged manner, steadily expanding sales outlets, and achieved sales increases for 25 consecutive terms until the fiscal year ended May 2007.

However, as the Lehman’s bankruptcy put the growth at halt, the company shifted to a “marketing manufacturer” that conducts integrated business activities including product planning, manufacturing, sales and distribution of products on its own using a unique promotion strategy and established “B to C channels” in addition to “B to B to C” to offer its products directly to customers, which allowed it to return to the growth track once again.

The company is actively putting efforts in M&A such as making Prime Direct Inc., a major company for television shopping, into a wholly owned subsidiary in September 2014.

1-2 Management Philosophy

Increase of fans | What they should pursue to become a leading company in the 21st century is not the amount of sales, capital or the number of employees. When they look ahead 100 years, they consider that making more and more people their “fans” will lead to prosperity for the company, therefore, they set “increase of fans” as the company’s management philosophy with a goal of “making all people involved in I.K Co., Ltd its fans.” |

1-3 Business Description

(1) segments

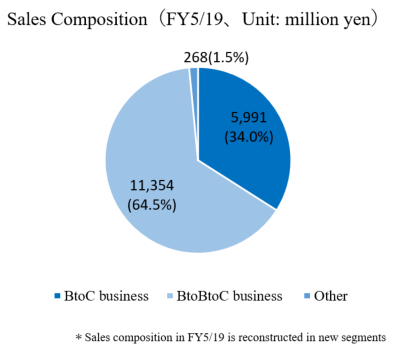

From the fiscal year ending May 2020, the company will enhance the operation speed and focus investments on promising businesses, all of which are necessary steps for growth. In addition, it will try to let investors gain a better understanding about its business. That is why the company will change the business segment to “BtoC Business,” “BtoBtoC Business,” and “Other.”

|

|

* About the new segments

The old segment was reconstructed to a new segment as below.

Old Segments | Business description | New segments |

Manufacturer-vendor Business | Co-op wholesale route | BtoBtoC Business |

Mail-order wholesale route | ||

Store wholesale route | ||

Overseas wholesale route | ||

Foreign retail sales route | BtoC Business | |

TV&EC retail sales route | ||

SKINFOOD Business | Retail sales in SKINFOOD stores | |

IT Solutions Business | Building call recording systems, etc. | Other |

* The IT Solutions Business is categorized as Other because it is less significant.

①B to C business

The subsidiary, Primedirect Inc. offers products directly to consumers via websites and TV shopping slots, while the subsidiary Food Cosmetic Co., Ltd. sells SKINFOOD, which is the food cosmetic of a South Korean cosmetic brand, at shops. The total number of shops as of the end of Nov. 2019 was 23, including 21 directly managed shops and 2 franchised ones, which are located mainly in station buildings of major cities in Japan.

②B to B to C business

The cosmetics, apparel goods, shoes, bags, products related to beauty and health, etc. designed and developed by the company as a manufacturer are offered to consumers through various routes, including co-op stores, mail-order companies, shops, and overseas channels.

(Major Sales Routes)

Co-op route | Co-op Sapporo, Co-op Tohoku, Co-opdeli Consumer’s Co-operative Union, Palsystem Consumer’s Co-operative Union, Tohto Co-op, U Co-op, Tokai Co-op Business Union, Co-op Kinki Business Union, Co-op Kobe, Co-op CS Net, Co-op Hokuriku Business Union, Green Co-op Business Union, Co-op Kyushu Business Union, All School Co-operative Unions in Japan, Aichi Co-op Union, Japan Consumer’s Co-operative Union, etc. | |

Mail-order route | Takashimaya Co., Ltd., Tokyu Department Store Co., Ltd., Dinos Cecile Co., Ltd., Belluna Co. Ltd., Senshukai Co., Ltd., Nissen Co., Ltd., Aeon Retail Co., Ltd., au Commerce & Life, Inc., ABC Media Communications, JAF Service, JALUX Inc., East Japan Railway Trading Co., Ltd., Yomiuri Agency, Shogakukan-Shueisha Productions Co., Ltd., QVC Japan, Inc., Ropping Life, Nihon Bunka Center Co., Ltd., Zenkokutsuhan Co., Ltd., Japan Green Stamp Co., Ltd., Shaddy Co., Ltd., Television Shopping Kenkyujo Co., Ltd., Yamachu Co., Ltd., LightUp Shopping Club Inc., TV Tokyo Direct Inc., Credit Saison Co., Ltd., Japan Post Trading Service Co., Ltd., etc. | |

Store route | Variety type | Don Quijote Co., Ltd., Nagasakiya Co., Ltd., UD Retail Co., Ltd., Loft Co., Ltd., cosme next Co., Ltd., Tokyo Dome Co., Ltd., Izumi Co., Ltd., TokyuHands Co., Ltd., etc. |

Drug store type | Matsumoto Kiyoshi Co., Ltd., Tsuruha Holdings Co., Ltd., Kokumin Co., Ltd., Create SD Co., Ltd., Ain Pharmaciez Co., Ltd., Sundrug Co., Ltd., Sugi Holdings Co., Ltd., cocokara fine Holdings Inc., AEON Retail Co., Ltd., AMANO Corporation, Daikoku Corporation, etc. | |

Home Center type | Komeri Co., Ltd., Cainz Co., Ltd., Nafco Co., Ltd., etc. | |

Home appliance type | Yamada Denki Co., Ltd., Biccamera Co., Ltd., Yodobashi Camera Co., Ltd, etc. | |

Overseas route | New Zealand, the U.S., China, Taiwan, Hong Kong, South Korea, Singapore, Malaysia, Thailand, the Philippines, Australia, Vietnam, and Cambodia | |

③Other

The subsidiary AlfaCom, Ltd. sells systems for the establishment of contact centers, such as the voice call recording system “Voistore,” the business version of LINE “LINE WORKS,” the chat system “M-Talk,” etc.

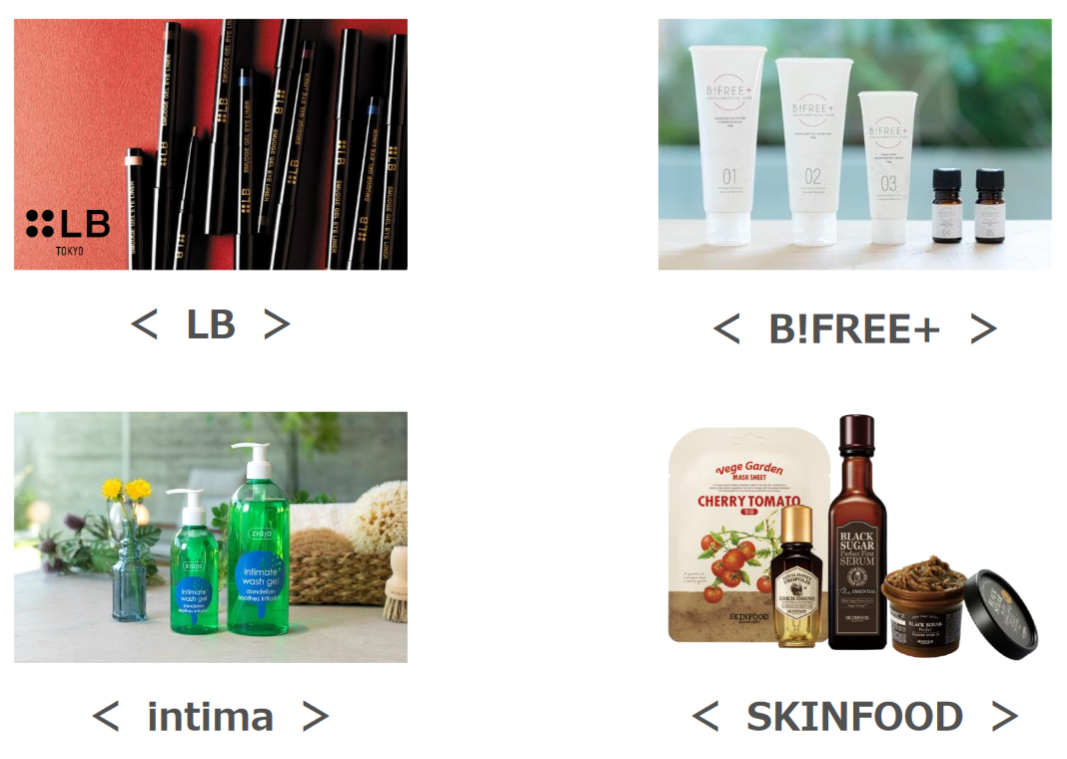

(2) Main Products Developed by the Company

As a marketing manufacturer, the company develops products in various genres in house.

<<cosmetics>>

(Source: the company)

<< Sundries>>

(Source: the company)

<<Food Products>>

|

|

<Aged black garlic> | <tear grass extract> |

|

|

<Lowcalo Life> | <Prussia 8> |

(Source: the company)

1-4 Characteristics and strengths: Business model as a marketing manufacturer

The primary point characterizing the company is a business model as a "marketing manufacturer" which conducts integrated business activities including planning, manufacturing, sales, and distribution of products on its own with a unique promotion strategy.

The company’s business model is composed of the following 3 functions.

(1) Powerful product development, discovery, and procurement

The company is developing, discovering and procuring attractive products by taking advantage of information gained from a wide range of sales channels and experiences cultivated over 30 years. The "Development Approval Conference" is held once a week, and three teams of cosmetics, sundries and food with 7 to 8 members in each team, propose new products to officers and people in charge of sales.

In their company where challenges are valued, each team proposes an average of 10 or more items each month based on freewheeling ideas, but not everything is approved.

The company has set "10 rules for development," which stipulates "emphasis on originality" and "thorough differentiation" regarding product development, and the proposed product is strictly criticized based on them, and homework is given out sometimes. However, these processes train the staff members in charge of development and are leading to further enhancement of product development capabilities.

(2) High marketing ability

“High marketing ability” is playing a major role in developing a hit product.

Test marketing is conducted using various sales channels to check whether candidate products actually sell well. By making innovations in various aspects such as package, timing, target and price and conducting new promotions, the company has been creating many hit products.

(3) Various sales channels

Rather than just proposing products to the various sales outlets mentioned above, they propose the best ways of selling and showcasing in other sales channels together with successful stories of those channels.

They blend ideas unique to I.K co., Ltd. with the needs and feedbacks of customers and brush them up daily.

It is a major feature of the company that it provides all solutions, which fit the sales channels, to customers including product selection, catalog and medium creation, quality control, order reception, logistics and customer service.

Solutions | Outline |

Creation | Create a flyer/catalogue sized paper tailored to the project |

Order reception | They have a flexible core system that can handle all order reception styles such as calls, emails, FAX and post cards with which it performs order receiving work faster and more accurately. |

Quality control | In addition to preparing for compliance, they set voluntary standards for each product category, and they check the products to prevent complaints. |

Logistics | They provide individual delivery service from their own distribution center to the end user, keeping in mind the five keywords: sorting, setting in order, cleaning, hygiene, discipline.

|

Customer Service | In-house staff members provide one-stop services such as responding to inquiries about products, delivery and exchange, and after sales services at the call center. |

While many other companies in the same industry specialize in planning and marketing of products, have only stores as their sales channels, and outsource manufacturing and distribution work to other companies, the company can execute a unique promotion strategy that they cannot imitate as the company can respond flexibly with the system and know-how.

1-5 ROE Analysis

| FY 5/13 | FY 5/14 | FY 5/15 | FY 5/16 | FY 5/17 | FY 5/18 | FY 5/19 |

ROE (%) | 4.2 | -2.3 | -3.4 | 4.9 | 25.0 | 29.0 | 9.1 |

Net income margin (%) | 0.51 | -0.29 | -0.40 | 0.53 | 2.79 | 3.50 | 1.35 |

Total asset turnover [times] | 2.81 | 2.74 | 2.75 | 2.93 | 3.04 | 3.19 | 2.69 |

Leverage [times]( x) | 2.89 | 2.91 | 3.07 | 3.18 | 2.95 | 2.60 | 2.51 |

All 3 factors declined. Particularly, due to the decline in the net income margin, ROE was set back all the way to single digits.

The net income margin during this term is expected to increase from the previous term of 2.37%. ROE is expected to rise thanks to the expected steady achievement of forecasted results.

2. The First Half of Fiscal Year ending May 2020 Earnings Results

(1) Consolidated Business Results

| 1H of FY 5/19 | Ratio to sales | 1H of FY 5/20 | Ratio to sales | YY change | Compared with the initial forecasts |

Sales | 9,356 | 100.0% | 8,810 | 100.0% | -5.8% | +4.8% |

Gross profit | 4,268 | 45.6% | 4,199 | 47.7% | -1.6% | - |

SG&A | 4,050 | 43.3% | 4,017 | 45.6% | -0.8% | - |

Operating Income | 218 | 2.3% | 182 | 2.1% | -16.6% | 0% |

Ordinary Income | 228 | 2.4% | 180 | 2.1% | -20.7% | -2.7% |

Net Income | 147 | 1.6% | 109 | 1.2% | -25.6% | -8.5% |

*Unit: million yen

*Net income is profit attributable to owners of parent. Revised forecasts were announced in April 2019.

Sales and profits decreased due to the downturn of demand from foreign visitors

The sales for the first half of the fiscal year ending May 2020 were 8,810 million yen, down 5.8% year on year. The sales from TV shopping and SKINFOOD shops increased, but the demand from foreign visitors was sluggish. Gross profit rate rose through the growth of the B-to-C business, but gross profit declined due to the drop in sales. SGA was unchanged, but operating income and other incomes decreased. Sales shrank year on year, but exceeded the initial estimate, because a hit product emerged in TV shopping.

(Variation in Selling, General and Administrative Expenses)

| 1H of FY 5/19 | Ratio to sales | 1H of FY 5/20 | Ratio to sales | YY change |

Labor cost | 725 | 7.8% | 740 | 8.4% | +2.1% |

Advertising cost | 1,852 | 19.8% | 1,692 | 19.2% | -8.6% |

Packing and freight expenses | 588 | 6.3% | 609 | 6.9% | +3.6% |

Total SGA | 4,050 | 43.3% | 4,017 | 45.6% | -0.8% |

*Unit: million yen

Advertising cost decreased, as the company advertised products efficiently through TV shopping. Labor cost and packing & freight expenses augmented due to the temporary posting of merit bonuses, etc. after the abolishment of the system for retirement benefits for executives and increase in shipping costs, but overall SGA was unchanged. The ratio to sales increased.

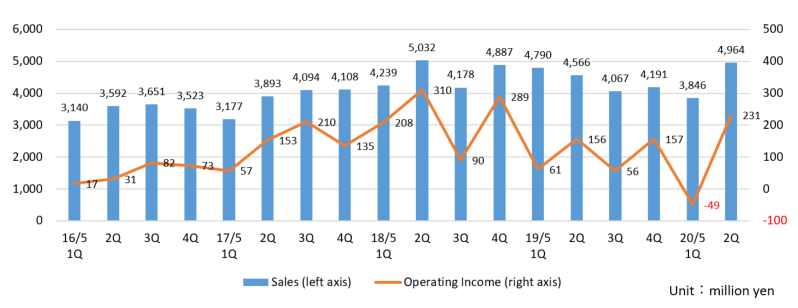

◎Quarterly Earnings

As for quarterly results, the sales and profit in the second quarter recovered steeply.

(2) Trend of each segment

| 1H of FY 5/19 | Ratio to sales | 1H of FY 5/120 | Ratio to sales | YY change |

Sales |

|

|

|

|

|

B to C Business | 3,577 | 38.2% | 3,222 | 36.6% | -9.9% |

B to B to C Business | 5,666 | 60.6% | 5,470 | 62..1% | -3.5% |

Other | 112 | 1.2% | 117 | 1.3% | +4.1% |

Total | 9,356 | 100.0% | 8,810 | 100.0% | -5.8% |

Operating Income |

|

|

|

|

|

B to C Business | 58 | 1.6% | 203 | 6.3% | +246.2% |

B to B to C Business | 169 | 3.0% | -24 | - | - |

Other | -11 | - | -12 | - | - |

Adjustments | 1 | - | -16 | - | - |

Total | 218 | 2.3% | 182 | 2.1% | -16.6% |

*Unit: million yen. Composition ratio of operating income is operating income margin. The classification of segments to be reported was changed in the first quarter, and the figures in the same period of the previous year are those of the revised segments.

① B to C business

Sales and profit decreased.

The sales from TV shopping and SKINFOOD shops increased, but the sales of products targeted at foreign customers declined. As a result, the total sales of this business dropped.

The sales of Speed Heat and Step 8 via TV shopping were larger than the estimate.

Profit increased considerably, as sales were healthy because the company rigorously selected slots for TV shopping and sales efficiency (media ration: MR) increased 0.6 points to 2.6.

The total number of SKINFOOD shops as of the end of Nov. 2019 was 23, including 21 directly managed shops (unchanged year on year) and 2 franchised ones (unchanged year on year).

② B to B to C business

Sales and profit decreased.

The sales from the co-op channel were unchanged from the previous term, but the total sales of this business dropped, mainly due to the decrease of selling sites of existing business partners in the mail-order channel.

Mainly in the co-op market, the plan for sundries progressed almost as planned, but the plan for food products did not reach the initial estimate, because the unprofitable plan for home-delivery services was discontinued.

As for profit, the company incurred an operating loss, as SGA ratio increased 2 points, as gross profit rate declined due to the drop in sales and the merit bonuses, etc. after the abolishment of the system for retirement benefits for executives were posted.

③ Other

Sales increased, but profit dropped.

The sales of M-Talk, which is a chat system and a core product of the company, were healthy.

The posting of sales from the establishment of Voistore was postponed until the second half, so it fell below the estimate.

As for profit, SGA ratio improved, but gross profit rate decreased because the sales of M-Talk, whose profit rate is low, increased, so operating loss increased slightly.

(3) Financial condition and cash flow

◎Main BS

| End of May 2019 | End of November 2019 |

| End of May 2019 | End of November 2019 |

Current Assets | 5,741 | 6,056 | Current liabilities | 3,123 | 3,419 |

Cash | 410 | 427 | Payables | 1,094 | 1,083 |

Receivables | 2,766 | 2,978 | LT Interest Bearing Liabilities | 1,143 | 1,264 |

Inventories | 2,054 | 1,989 | Noncurrent liabilities | 1,006 | 1,104 |

Noncurrent Assets | 1,077 | 991 | ST Interest Bearing Liabilities | 742 | 808 |

Tangible Assets | 364 | 377 | Total Liabilities | 4,129 | 4,523 |

Intangible Assets | 121 | 117 | Net Assets | 2,688 | 2523 |

Investment, Others | 590 | 495 | retained earnings | 1,917 | 1,891 |

Total assets | 6,818 | 7,047 | Total Liabilities and Net Assets | 6,818 | 7,047 |

|

|

| Balance of debts | 1,885 | 2,072 |

|

|

| Equity ratio | 39.4% | 35.8% |

*Unit: million yen

Current assets increased 315 million yen from the end of the previous term, due to the rise in trade receivable. Noncurrent assets decreased 85 million yen due to the decline in investments and other assets, and total assets rose 229 million yen from the end of the previous term to 7,047 million yen. Total liabilities augmented 394 million yen to 4,523 million yen, due to the increase in borrowing, etc. Net assets declined 165 million yen to 2,523 million yen, due to the drop in retained earnings, etc.

Equity ratio decreased 3.6% from the end of the previous term to 35.8%.

◎Cash Flow

| 1H of FY 5/19 | 1H of FY 5/20 | Increase/decrease |

Operating Cash Flow | -707 | 143 | +851 |

Investing Cash Flow | -57 | -124 | -67 |

Free Cash Flow | -765 | 19 | +784 |

Financing Cash Flow | 621 | -52 | -674 |

Term End Cash and Equivalents | 550 | 561 | +10 |

*Unit: million yen

Operating and free CFs turned positive, due to the decrease in inventory assets, etc.

Financing CF turned negative, because of the acquisition of treasury shares. The cash position was unchanged.

3. Fiscal Year ending May 2020 Earnings Forecasts

(1) Full-year earnings forecast

| FY 5/19 | Ratio to sales | FY 5/20 Est. | Ratio to sales | YY change | Progress rate |

Sales | 17,614 | 100.0% | 16,946 | 100.0% | -3.8% | 52.0% |

Operating Income | 431 | 2.5% | 577 | 3.4% | +33.6% | 31.6% |

Ordinary Income | 437 | 2.5% | 585 | 3.5% | +33.6% | 30.9% |

Net Income | 238 | 1.4% | 402 | 2.4% | +68.8% | 27.3% |

*Unit: million yen. The estimated values are those announced by the Company.

There is no revision of the earning forecast. Sales dropped and profit increased

There is no revision of the earning forecast. The sales for the fiscal year ending May 2020 are estimated to decline by 3.8% year on year to 16,946 million yen and operating income is projected to rise by 33.6% year on year to 577 million yen. The amount of dividend that the company will pay is expected to remain unchanged at 12.00 yen/share. The estimated payout ratio is 22.3%.

(2) Trend of each segment

(Sales forecast for each segment.)

| FY 5/19 | Ratio to sales | FY 5/20 Est. | Ratio to sales | YY change | Progress rate |

BtoC business | 5,991 | 34.0% | 4,607 | 27.2% | -23.1% | 69.9% |

BtoBtoC business | 11,354 | 64.5% | 12,019 | 70.9% | +5.9% | 45.5% |

Other | 268 | 1.5% | 320 | 1.9% | +19.0% | 36.6% |

Total | 17,614 | 100.0% | 16,946 | 100.0% | -3.8% | 52.0% |

*Unit: million yen

(3) Strategies for each segment in the second half of the term

① Company-wide Strategy

As a company-wide initiative, in order to be the world’s one and only “marketing manufacturer,” the company plans to analyze the market data while proceeding with BtoC and BtoBtoC businesses. Then, it will utilize this data for product development and sell the products again through the diverse sales channels of BtoC and BtoBtoC with promotions. Moreover, it will put the effort into enriching the training system of its employees and using RPA and AI to improve productivity by streamlining internal operations.

② Strategies for each segment

① BtoC Business

◎ TV & EC routes

* Increase of slots in media for advertising hit products in the first half and brand development

・To increase slots in media for advertising “Step 8,” “Black Garlic,” and “Ryuhyou Mat (Drift Ice Mat)”

・To prepare for promotional campaigns for Speed Heat in the next season

* To remake video ads for burgeoning products

・To remake the video ads for “Air Yawn,” “Risara girdle for coping with incontinence,” “Black soybean hair foundation,” and “Peeling gel for freckles”

・To produce TV shopping programs featuring TV personalities

◎ Store route

To carry out the following measures for increasing in-store sales of SKINFOOD cosmetics

・To distribute sample coupons, obtain LINE membership, produce cards for introducing products to friends, and so on, to increase the ratio of repeat customers

・To fully transfer apps for customers, analyze trends, and utilize Instagram, in order to develop shops that will be remembered by customers

・To make efforts to increase sales from online shops, including the company’s website, Rakuten, ZOZOTOWN, and Qoo10

・To release products available only in Japan

② BtoBtoC Business

◎ Fostering growing businesses

* Sale of cosmetics, including LB

・To release the eye shadow developed in collaboration with “ColleenMaliaWilcox”

・To release the limited package of the popular product “Power of Eyeliner”

・To release the new products “Galaxy Shadow” and “Glossy Fit Rouge”

・To conduct promotional activities based on TV and Instagram

* Expand cosmetics sales overseas

・To expand sales channels by registering B! FREE+ in NMPA (health registration)

・To increase sales by enriching the lineup of LB products

◎ Synergy with the BtoC Business

- Aim to expand sales of products developed by the company and to improve the gross profit margin through strengthening multichannel retailing with home shopping as the starting point.

4. Conclusions

Due to the downturn of demand from foreign visitors to Japan, etc., the sales and profit for the cumulative second quarter declined, with the profit falling below the estimate, but the sales and profit for the second quarter (Sep. to Nov.) recovered rapidly, thanks to some hit products, including “Speed Heat.” The company thinks that its product portfolio has been enriched further for expanding “the multi-channel sale starting with TV shopping.” The media ration (MR; sales/media cost) in the second half is estimated to be higher than those in the past 2 years, making a favorable impression in the market, although the progress rate of profit is low, and the share price of the company is recovering steadily.

From the short-term viewpoint, we would like to see the variations in sales and profit in the third and fourth quarters and the progress toward the earnings estimates for this term. From the mid-term viewpoint, we would like to pay attention to how speedily “LB” and “B! FREE+,” for which SKU is increasing after the company obtained the approval from NMPA (former CFDA), will contribute to revenue.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 7 directors, including 3 outside ones |

◎Corporate Governance Report

Last updated: December 17, 2019

<Basic Policy>

While corporate governance is expected to function effectively, the company strives to become a reliable firm by improving its management foundation, maintaining high ethics and increasing the transparency of the management further in order to fulfil the social mission and responsibility as a listed company.

Also, the company considers the establishment of a management structure that can respond to the changes in the business environment fast and accurately as one of the important business challenges, and it is making efforts in information sharing from many sides by holding a regular meeting of Board of Directors (once/month), an extraordinary meeting of Board of Directors (as per the need), an in-house officers meeting (once/week) with regular directors (including directors serving as audit and supervisory committee members) and executive officers, and a top meeting (once/week) composed of people from team mangers post or above.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

Supplementary Principle1-2.(4) Electronic exercise of voting rights, English translation of convocation notices | The company does not use an online voting platform or provide English translation of convocation notices for ordinary general meetings of shareholders, but it will take the shareholders’ convenience into account based on the composition of shareholders such as institutional investors and foreign investors, and discuss them as necessary. |

Supplementary Principle 4-1.(2)Explanation of a medium-term management plan | The company has its medium-term plan, and it makes efforts to allow shared recognition with shareholders and investors through medium-term vision. The medium-term profit plan is not disclosed, but the company will consider disclosing it in future. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 So-called Strategically-held Shares | The company owns strategically held shares in order to maintain and strengthen a continuous, stable and good business relation with its clients. However, it will conduct tests regularly from a medium-to-long term perspective based on returns, risks, etc., and it will recommend the sale of shares in case there is no longer necessity. Regarding the concerned shares, the board of directors verifies the holding purpose, reasonability and the status of dividend income, compares the acquisition price and current price, and checks the need for holding the shares every year. Furthermore, since the company makes its decision regarding the exercise of voting rights by comprehensively considering strengthening and maintenance of business relation, circumstances of the company concerned, etc., it does not have external standards. |

Principle 5-1 Policy to have Constructive Dialogue with Shareholders | In the company, the management team/general affairs group are designated as the IR department, and they respond to the requests for dialogue by the shareholders within reasonable range in order to contribute to sustainable growth of the company and improvement of corporate value over medium-to-long term. The company’s chairman holds the financial results briefing twice a year for shareholders and institutional investors. Further, the company upload videos and handouts of the briefing on its website for shareholders and investors who are not able to attend the briefing. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |