Bridge Report:(2722)IK Fiscal year ended May 2022

Chairman & CEO Hiroshi Iida | I.K CO., LtD(2722) |

|

Company Information

Market | Tokyo stock exchange Prime Market and Nagoya stock exchange Premier Market |

Industry | Retail Business (Commerce) |

Chairman & CEO | Hiroshi Iida |

HQ Address | KDX Nagoya Station Building 5F, 3-26-8 Meieki, Nakamura-ku, Nagoya-shi, Aichi |

Year-end | End of May |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE (Act) | Trading Unit | |

¥446 | 8,308,000 shares | ¥3,705 million | -30.1% | 100 shares | |

DPS (FCST) | Dividend yield (FCST) | EPS (FCST) | PER (FCST) | BPS (Act) | PBR (Act) |

¥12.00 | 2.7% | ¥24.34 | 18.3x | ¥321.94 | 1.4x |

*The share price is the closing price on July 22. Each figure and number of shares outstanding (including treasury stock) were taken from the financial results for fiscal year ended May 2022. *Market cap was calculated by multiplying the closing price on Jul. 22 by the number of outstanding shares. ROE, BPS, and PBR were taken from the financial results for the term ended May 2022. The figures were rounded.

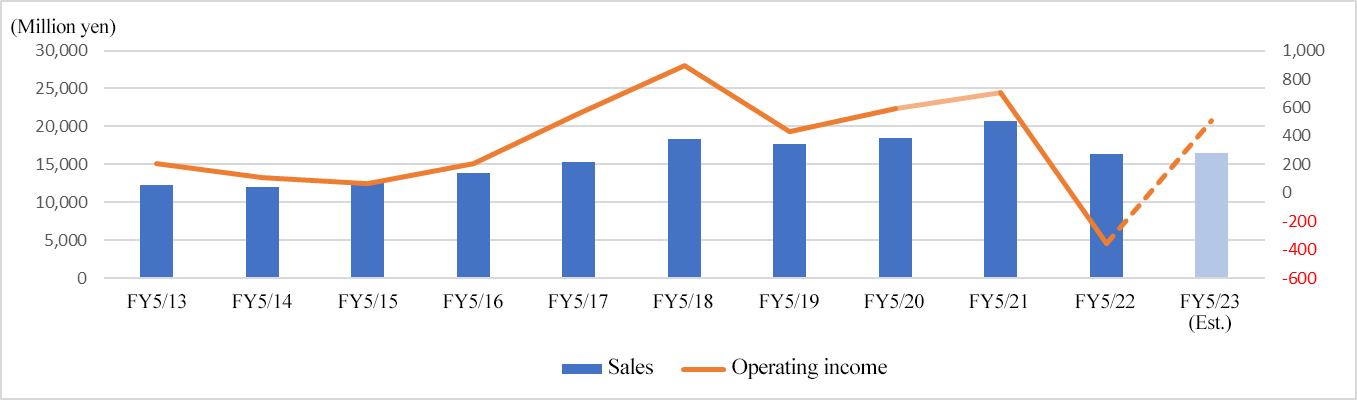

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May 2019 (Act) | 17,614 | 431 | 437 | 238 | 31.85 | 12.00 |

May 2020 (Act) | 18,483 | 590 | 623 | 384 | 52.19 | 12.00 |

May 2021 (Act) | 20,754 | 705 | 730 | 321 | 42.60 | 12.00 |

May 2022 (Act) | 16,335 | -360 | -323 | -905 | -115.95 | 12.00 |

May 2023 (FCST) | 16,426 | 511 | 520 | 186 | 24.34 | 12.00 |

*Unit: million yen. The estimated values are those announced by the Company.

The financial statement for fiscal year ended May 2022 and many more about I.K Co., Ltd. will be described.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended May 2022 Earnings Results

3. Fiscal Year ending May 2023 Earnings Forecasts

4. Future Strategy

5. Medium-Term Business Plan “IK Way to 2024”

6. Conclusions

<Reference: Regarding Corporate Governance>

Key points

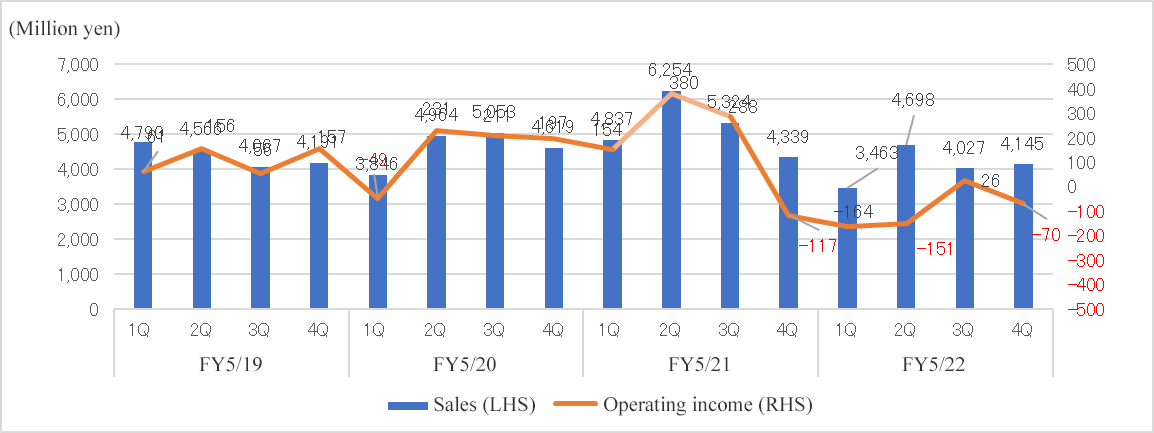

- Sales fell and an operating loss was posted in the fiscal year ended May 2022. Sales decreased 21.3% year on year to 16,335 million yen, due to a significant decline in the performance of TV shopping in the Direct Marketing Business, which was caused by their marketing mistakes. Operating income dropped 1,065 million yen year on year, recording a deficit of 360 million yen. A significant drop in their highly profitable TV shopping business caused gross profit margin to decrease 5.8 points year on year to 45.3%. However, the ratio of selling, general and administrative (SG&A) expenses improved 0.2 points year on year, as a result of reduction in advertising expenses in response to the worsening of the TV shopping business.

- The sales in the fiscal year ending May 2023 are expected to reach 16.4 billion yen, almost unchanged from the previous year, however, operating income is forecasted to move into the black, standing at 500 million yen. The sales of the Sales Marketing Business are expected to grow because of the continuing stable revenue from the co-op and mail-order shopping business. For the Direct Marketing Business, the company reviews their marketing strategy and aims to increase sales in Nanarobe, the business transferred from Combi Corporation, as well as in Korean cosmetics. A dividend to be paid will be unchanged at 12.00 yen per share, while the company aims at a payout ratio of 20%.

- Stabilizing the TV shopping business is considered to be the key. We would like to pay attention to whether the company can resume the virtuous cycle: “Spark a boom on TV and sell products via multiple channels.” This business model would increase revenues if the cycle repeats smoothly. Furthermore, the company expects to see the effect of introducing new brands from South Korea. For the co-op cosmetics, we would like to pay attention to their sales doubling plan in which they will launch new brands in addition to cosmetics made from eggs and cosmetics for treating age spots.

1. Company Overview

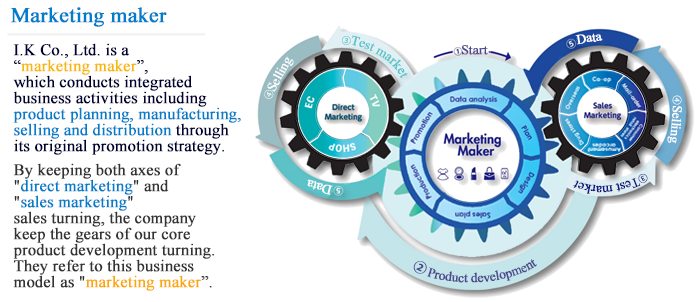

I.K Co., Ltd. is a “marketing manufacturer,” which conducts integrated business activities including product planning, manufacturing, selling and distribution through its original promotion strategy.

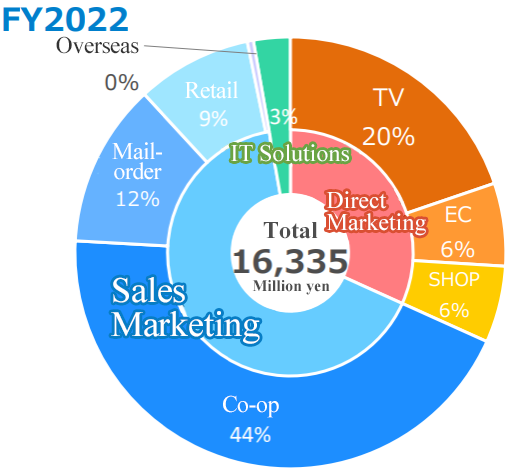

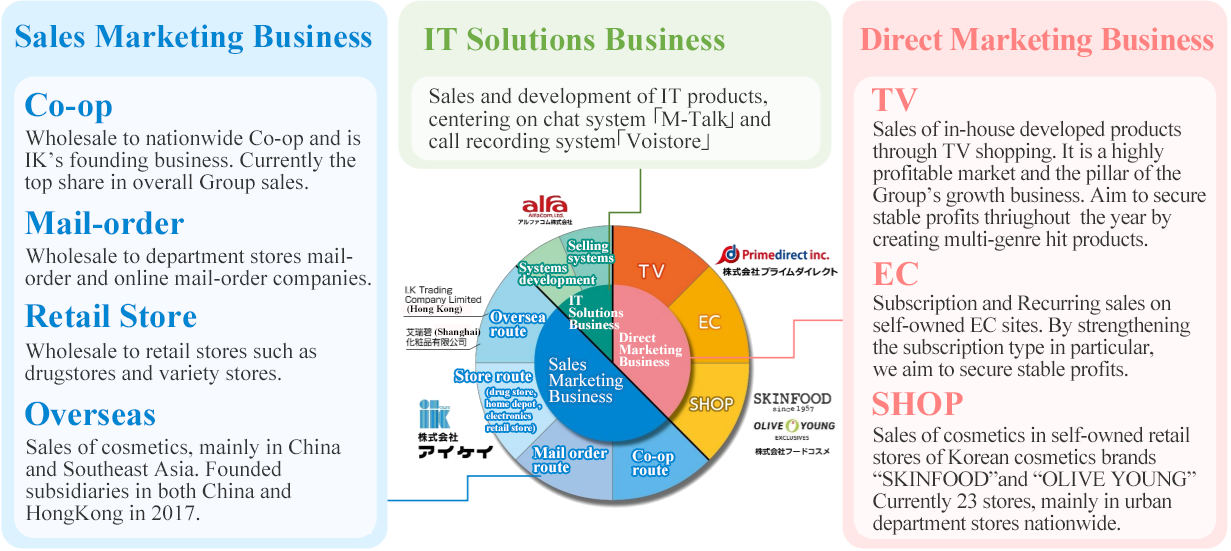

The company operates the three businesses: the “Direct Marketing Business,” to sell sundries, food products, and cosmetics via TV shopping, EC, and shops to consumers, the “Sales Marketing Business,” to sell products via various routes, including co-op stores, mail-order companies, shops, overseas channels, etc., and the “IT Solutions Business,” to offer IT solutions for developing and selling systems.

The company strives to establish a group management to make all stakeholders its fans by promoting “the increase of fans” as its corporate philosophy.

◎Performance Trends

1-1 Corporate History

After spending his high school and college days in a “freewheeling” school environment, Mr. Hiroshi Iida (present chairman and CEO), who had a strong entrepreneurial spirit from the beginning, worked for a nonlife insurance company and went on to establish I.K Ltd. in May 1982. While working on the sales of various products, he opened an account of Aichi CO-OP Union in April 1983 on getting favors from people in charge of sales and started trading with occupational co-ops.

As the sales of flyers about a rechargeable cleaner, the first product, became a major hit, the horizontal expansion to other co-ops progressed, the number of items handled also increased and the business expanded rapidly. It got listed on the JASDAQ market in December 2001.

Due to the increase in recognition and reliability after the listing, the company began supplying products to the mail-order systems of department stores and retailers in a full-fledged manner, steadily expanding sales outlets, and achieved sales increases for 25 consecutive terms until the fiscal year ended May 2007.

However, as the Lehman’s bankruptcy put the growth at halt, the company shifted to a “marketing manufacturer” that conducts integrated business activities including product planning, manufacturing, sales and distribution of products on its own using a unique promotion strategy and established “B to C channels” in addition to “B to B to C” to offer its products directly to customers, which allowed it to return to the growth track once again.

The company is actively putting efforts in M&A such as making Prime Direct Inc., a major company for television shopping, into a wholly owned subsidiary in September 2014.

1-2 Management Philosophy

Increase of fans | What they should pursue to become a leading company in the 21st century is not the amount of sales, capital or the number of employees. When they look ahead 100 years, they consider that making more and more people their “fans” will lead to prosperity for the company, therefore, they set “increase of fans” as the company’s management philosophy with a goal of “making all people involved in I.K Co., Ltd its fans.” |

1-3 Business Description

(1) Segments

In the fiscal year ending May 2022, the company changes the names of the business segments to Direct Marketing (former B-to-C) Business, Sales Marketing (former B-to-B-to-C) Business, and IT Solutions (former Other) Business in an effort to describe the details of its businesses more appropriately in the course of pursuing a business model of a marketing manufacturer.

(Source: The company’s material)

(Source: The company’s material)

① Sales Marketing Business: Wholesale

The cosmetics, apparel goods, shoes, bags, products related to beauty and health, etc. designed and developed by the company as a manufacturer are offered to consumers through various routes, including co-op stores, mail-order companies, shops, and overseas channels.

(Major Sales Routes)

Co-op route | Co-op Sapporo, Co-op Tohoku Sun Net Business Union, Co-op deli Consumer’s Co-operative Union, Palsystem Consumer’s Co-operative Union, Tohto Co-op, U Co-op, Tokai Co-op Business Union, Co-op Kinki Business Union, Co-op Kobe, Co-op Chugoku Shikoku Business Union, Co-op Hokuriku Business Union, Green Co-op Union, Co-op Kyushu Business Union, All School Co-operative Unions in Japan, Aichi Co-op Union, Japan Consumer’s Co-operative Union, etc. | |

Mail-order route | TOKAI TV Enterprise Co.,Ltd., Takashimaya Co., Ltd., Dinos Corporation Co., Ltd., Cecile Co., Ltd., Belluna Co. Ltd., Senshukai Co., Ltd., Nissen Co., Ltd., au Commerce & Life, Inc., ABC Media Communications, JAF Service, JALUX Inc., Shogakukan-Shueisha Productions Co., Ltd., QVC Japan, Inc., Ropping Life, Nihon Bunka Center Co., Ltd., Zenkokutsuhan Co., Ltd., Japan Green Stamp Co., Ltd., Shaddy Co., Ltd., Yamachu Co., Ltd., LightUp Shopping Club Inc., TV Tokyo Direct Inc., Credit Saison Co., Ltd., Japan Post Trading Service Co., Ltd., U-CAN Inc., MBS innovation DRIVE inc., XPRICE Inc., FELISSIMO CORPORATION, Halmek Corporation., CATALOGHOUSE Ltd., J.O.D CO,.Ltd., etc. | |

Store route | Variety type | Don Quijote Co., Ltd., Nagasakiya Co., Ltd., UD Retail Co., Ltd., Loft Co., Ltd., cosme next Co., Ltd., Tokyo Dome Co., Ltd., Izumi Co., Ltd., TokyuHands Co., Ltd., etc. |

Drug store type | MatsukiyoCocokara & Co., Tsuruha Holdings Co., Ltd., Create SD Co., Ltd., Ain Pharmaciez Co., Ltd., Sundrug Co., Ltd., Sugi Holdings Co., Ltd., AEON Retail Co., Ltd., Daikoku Corporation, etc. | |

Home Center type | Komeri Co., Ltd., Cainz Co., Ltd., etc. | |

Home appliance type | Yamada Denki Co., Ltd., Biccamera Co., Ltd., Yodobashi Camera Co., Ltd, etc. | |

Overseas route | China, Taiwan, Hong Kong, Vietnam, Thailand, and Indonesia etc. | |

② IT Solutions Business

The subsidiary AlfaCom, Ltd. sells systems for the establishment of contact centers, such as the voice call recording system “Voistore,” the business version of LINE “LINE WORKS,” the chat system “M-Talk,” etc.

③ Direct Marketing Business: Retail

A subsidiary named Prime-Direct, Inc. offers products directly to consumers through its website and the TV shopping program, and another subsidiary named Food Cosmetic Co., Ltd. runs directly-managed stores to sell products of Korean cosmetic brands called SKINFOOD and OLIVE YOUNG. As of July 2022, they manage 17 directly-managed stores and 4 franchise stores, that is, a total of 21 stores mainly in train station buildings in major cities in Japan. They opened 2 stores for a new cosmetic brand from South Korea, OLIVE YOUNG PB COSMETICS.

(2) Main Products Developed by the Company

As a marketing manufacturer, the company develops products in various genres in house.

<<Healthcare>>

(Source: The company’s material)

<<Beauty>>

(Source: The company’s material)

<<Entertainment >>

(Source: The company’s material)

1-4 Characteristics and strengths: Business model as a marketing manufacturer

The primary point characterizing the company is a business model as a "marketing manufacturer" which conducts integrated business activities including planning, manufacturing, sales, and distribution of products on its own with a unique promotion strategy.

The company’s business model is composed of the following 3 functions.

(1) Powerful product development, discovery, and procurement

The company is developing, discovering and procuring attractive products by taking advantage of information gained from a wide range of sales channels and experiences cultivated over 30 years. The "Development Approval Conference" is held every other week, and three teams of cosmetics, sundries and food with 7 to 8 members in each team, propose new products to officers and people in charge of sales.

In their company where challenges are valued, each team proposes an average of 10 or more items each month based on freewheeling ideas, but not everything is approved.

The company has set "10 rules for development," which stipulates "emphasis on originality" and "thorough differentiation" regarding product development, and the proposed product is strictly criticized based on them, and homework is given out sometimes. However, these processes train the staff members in charge of development and are leading to further enhancement of product development capabilities.

(2) High marketing ability

“High marketing ability” is playing a major role in developing a hit product.

Test marketing is conducted using various sales channels to check whether candidate products actually sell well. By making innovations in various aspects such as package, timing, target and price and conducting new promotions, the company has been creating many hit products.

(3) Various sales channels

Rather than just proposing products to the various sales outlets mentioned above, they propose the best ways of selling and showcasing in other sales channels together with successful stories of those channels.

They blend ideas unique to I.K co., Ltd. with the needs and feedbacks of customers and brush them up daily.

It is a major feature of the company that it provides all solutions, which fit the sales channels, to customers including product selection, catalog and medium creation, quality control, order reception, logistics and customer service.

Solutions | Outline |

Creation | Create a flyer/catalogue sized paper tailored to the project |

Order reception | They have a flexible core system that can handle all order reception styles such as calls, emails, FAX and post cards with which it performs order receiving work faster and more accurately. |

Quality control | In addition to preparing for compliance, they set voluntary standards for each product category, and they check the products to prevent complaints. |

Logistics | They provide individual delivery service from their own distribution center to the end user, keeping in mind the five keywords: sorting, setting in order, cleaning, hygiene, discipline. |

Customer Service | In-house staff members provide one-stop services such as responding to inquiries about products, delivery and exchange, and after sales services at the call center. |

While many other companies in the same industry specialize in planning and marketing of products, have only stores as their sales channels, and outsource manufacturing and distribution work to other companies, the company can execute a unique promotion strategy that they cannot imitate as the company can respond flexibly with the system and know-how.

1-5 ROE Analysis

| FY 5/15 | FY 5/16 | FY 5/17 | FY 5/18 | FY 5/19 | FY 5/20 | FY 5/21 | FY 5/22 |

ROE (%) | -3.4 | 4.9 | 25.0 | 29.0 | 9.1 | 14.0 | 10.1 | -30.1 |

Net income margin (%) | -0.40 | 0.53 | 2.79 | 3.50 | 1.35 | 2.08 | 1.55 | -5.54 |

Total asset turnover [times] | 2.75 | 2.93 | 3.04 | 3.19 | 2.69 | 2.61 | 2.84 | 2.24 |

Leverage [times](x) | 3.07 | 3.18 | 2.95 | 2.60 | 2.51 | 2.59 | 2.29 | 2.43 |

In the fiscal year ended May 2022, ROE declined due to the drop in the net income margin caused by the company falling into the red. For FY 5/23, it is projected that the net income margin will improve to be 1.1% after the improvement of marketing strategies for the TV shopping business, etc.

2. Fiscal Year ended May 2022 Earnings Results

(1) Consolidated Business Results

| FY 5/21 | Ratio to Sales | FY 5/22 | Ratio to Sales | YoY |

Sales | 20,754 | 100.0% | 16,335 | 100.0% | -21.3% |

Gross Profit | 10,643 | 51.1% | 7,400 | 45.3% | -30.3% |

SG&A | 9,908 | 47.7% | 7,760 | 47.5% | -21.7% |

Operating Income | 705 | 3.4% | -360 | - | - |

Ordinary Income | 730 | 3.5% | -323 | - | - |

Net Income | 321 | 1.5% | -905 | - | - |

*Unit: million yen. Net income is profit attributable to owners of parent.

Sales dropped, and an operating loss was posted.

Sales fell and an operating loss was posted. Sales decreased 21.3% year on year to 16,335 million yen, due to a significant decline in the performance of TV shopping in the Direct Marketing Business, which was caused by their marketing mistakes. Operating income dropped 1,065 million yen year on year, recording a deficit of 360 million yen. A significant drop in their highly profitable TV shopping business caused gross profit margin to decrease 5.8 points year on year to 45.3%. However, the ratio of selling, general and administrative (SG&A) expenses improved 0.2 points year on year, as a result of reduction in advertising expenses in response to the worsening of the TV shopping busines

(Variation in Selling, General and Administrative Expenses)

| FY 5/21 | Ratio to sales | FY 5/22 | Ratio to sales | YoY |

Labor cost | 1,500 | 7.2% | 1,489 | 9.1% | -0.7% |

Advertising cost | 4,306 | 20.8% | 3,203 | 19.6% | -25.6% |

Packing and freight expenses | 1,744 | 8.4% | 1,422 | 8.7% | -18.5% |

Others | 2,356 | 11.4% | 1,645 | 10.1% | -30.2% |

Total SGA | 9,908 | 47.7% | 7,760 | 47.5% | -21.7% |

*Unit: million yen.

Since the response of major products to TV shopping was not good, the company decreased broadcast slots, so advertising cost decreased considerably by 25.6% year on year. Labor cost was unchanged, but the ratio of labor cost to sales rose 1.9 points due to the drop in sales. The company is striving to reduce packing and freight expenses, but due to the drop in sales, the ratio of packing and freight expenses to sales increased 0.3 point.

◎Quarterly Earnings

(2) Trend of each segment

| FY 5/21 | Ratio to Sales | FY 5/22 | Ratio to Sales | YoY |

Sales |

|

|

|

|

|

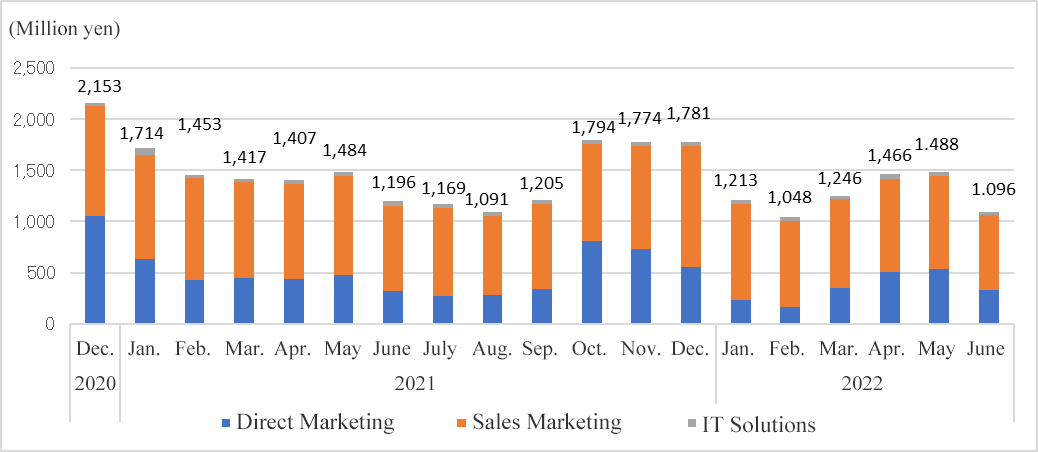

Direct Marketing Business | 8,467 | 40.8% | 5,184 | 31.7% | -38.8% |

Sales Marketing Business | 11,885 | 57.3% | 10,699 | 65.5% | -10.0% |

IT Solution Business | 402 | 1.9% | 450 | 2.8% | +12.1% |

Total | 20,754 | 100.0% | 16,335 | 100.0% | -21.3% |

Operating income |

|

|

|

|

|

Direct Marketing Business | 298 | 3.5% | -805 | - | - |

Sales Marketing Business | 324 | 2.7% | 395 | 3.7% | 21.9% |

IT Solution Business | 52 | 13.0% | 29 | 6.6% | -43.0% |

Adjustments | 30 | - | 20 | - | - |

Total | 705 | 3.4% | -360 | - | - |

*Unit: million yen. Composition ratio of operating income is operating income margin.

① Direct Marketing Business

Sales dropped, and an operating loss was posted.

The company failed to predict when their flagship product “Speed Heat Thermal Vest” would pass its peak, due to the marketing mistakes in the TV shopping business, which created a blank period of their top-selling product, and caused a decrease in sales efficiency, causing both sales and profit to decline significantly. The sales of the entire Direct Marketing Business dropped 3,282 million yen to 5,184 million yen.

As gross profit margin decreased 6.8 points year on year, the total operating income of the Direct Marketing Business dropped 114 million yen year on year to negative 805 million yen.

② Sales Marketing Business

Sales declined but profit increased.

The demand from housebound consumers in the same period of the previous year subsided, and the number of the food media decreased, so sales declined slightly year on year. The total sales of the Sales Marketing Business decreased 1,185 million yen year on year to 10,699 million yen. As the ratio of PB declined, but the ratio of SG&A expenses fell, operating income rose 71 million yen to 395 million yen, hitting a record high.

③ IT Solutions Business

Sales grew, but profit dropped.

The company increased the number of staff members by 7 to strengthen sales activities, augmenting labor costs and decreasing operating income.

(3) Financial condition and cash flow

◎Main BS

| End of May 2021 | End of May 2022 |

| End of May 2021 | End of May 2022 |

Current Assets | 6,230 | 6,553 | Current Liabilities | 2,614 | 3,519 |

Cash | 800 | 1,075 | Payables | 1,007 | 893 |

Receivables | 2,800 | 2,612 | ST Interest Bearing Liabilities | 570 | 1,492 |

Inventories | 1,947 | 2,420 | Noncurrent liabilities | 1,055 | 1,353 |

Noncurrent Assets | 996 | 825 | LT Interest Bearing Liabilities | 737 | 1,044 |

Tangible Assets | 361 | 197 | Total Liabilities | 3,669 | 4,873 |

Intangible Assets | 157 | 208 | Net Assets | 3,557 | 2,504 |

Investment, Others | 476 | 419 | Retained Earnings | 2,400 | 1,401 |

Total Assets | 7,226 | 7,378 | Total Liabilities and Net Assets | 7,226 | 7,378 |

*Unit: million yen. |

|

| Balance of Debts | 1,308 | 2,536 |

|

|

| Capital adequacy ratio | 49.0% | 33.5% |

Due to the increase in inventory assets, total assets rose 151 million yen from the end of the previous term to 7,378 million yen. Due to the augmentation of short and long-term interest-bearing liabilities, etc., total liabilities grew 1,204 million yen from the end of the previous term to 4,873 million yen. Due to the decline in retained earnings, etc., net assets decreased 1,052 million yen from the end of the previous term to 2,504 million yen. Equity ratio decreased 15.5 points from the end of the previous term to 33.5%.

◎Cash Flow

| FY 5/21 | FY 5/22 | Increase/ Decrease |

Operating cash flow | 636 | -769 | -1,406 |

Investing cash flow | -220 | -319 | -98 |

Free cash flow | 415 | -1,089 | -1,505 |

Financing cash flow | -258 | 1,135 | +1,394 |

Cash and equivalent | 967 | 1,075 | +108 |

*Unit: million yen.

Free cash flow dropped, because net profit fell into the red.

Financing cash flow grew considerably, due to the increase in short-term interest-bearing liabilities. The cash position increased.

3. Fiscal Year ending May 2023 Earnings Forecasts

(1) Full-year earnings forecast

| FY 5/22 | Ratio to sales | FY 5/23 (Forecast) | Ratio to sales | YoY |

Sales | 16,335 | 100.0% | 16,426 | 100.0% | +0.6% |

Operating Income | -360 | - | 511 | 3.1% | - |

Ordinary Income | -323 | - | 520 | 3.2% | - |

Net Income | -905 | - | 186 | 1.1% | - |

*Unit: million yen. The estimated values are those announced by the company.

It is forecast that sales will decrease, and an operating loss will be posted.

The sales in the fiscal year ending May 2023 are expected to reach 16.4 billion yen, almost unchanged from the previous year, however, operating income is forecasted to move into the black, standing at 500 million yen. The sales of the Sales Marketing Business are expected to grow because of the continuing stable revenue from the co-op and mail-order shopping business. For the Direct Marketing Business, the company reviews their marketing strategy and aims to increase sales in Nanarobe, the business transferred from Combi Corporation, as well as in Korean cosmetics. A dividend to be paid will be unchanged at 12.00 yen per share, while the company aims at a payout ratio of 20%.

(2) Trend of each segment

*Sales forecast for each segment

| FY 5/22 | Ratio to Sales | FY 5/23 (FCST) | Ratio to Sales | YoY |

Direct Marketing Business | 5,184 | 31.7% | 4,717 | 28.7% | -9.0% |

Sales Marketing Business | 10,699 | 65.5% | 11,188 | 68.1% | 4.6% |

IT Solutions Business | 450 | 2.8% | 520 | 3.2% | 15.3% |

Total | 16,335 | 100.0% | 16,426 | 100.0% | 0.6% |

*Unit: million yen.

(Monthly sales for each segment)

4. Future Strategy

(1) Direct Marketing Business

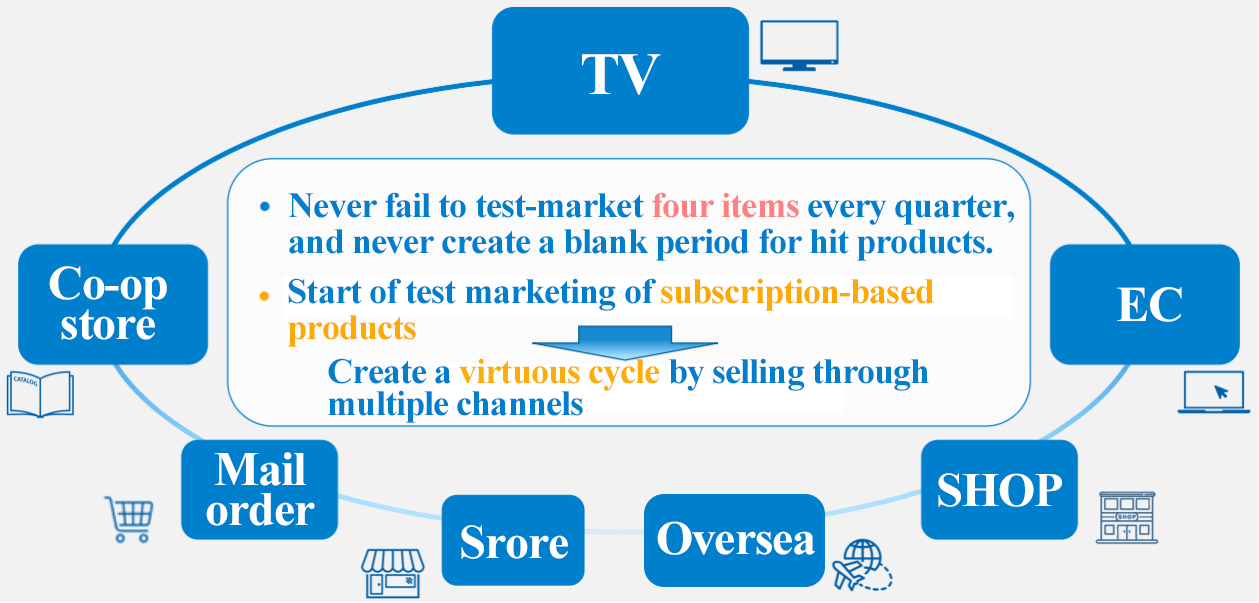

The company will increase the sales of their subscription products, and strengthen sales promotion of Korean cosmetic products. For the TV shopping business, the company will continue test marketing with the aim of stabilizing their business.

①To increase sales of subscription products, and stabilize the TV shopping business

For the E-commerce, the company aims to maximize profit while creating synergy with the television business, as a tool for receiving orders through the TV shopping business. They strive to carry out unique E-commerce promotions to expand sales of Nanarobe, whose business was transferred from Combi Corporation.

For the TV shopping business, the company continues test marketing for 16 items per year, with the aim of stabilizing the business.

②To strengthen the sales promotion of Korean cosmetic products

In the SHOP business, the company continues to strengthen the sales promotion of Korean brands.

In addition to serving as the general distributor for SKINFOOD and OLIVE YOUNG PB in Japan, the company started selling KAHI, hince, and mnyo brands. They also strive to expand sales at stores while the flow of people is on a gradual upward trend.

In Japan, the import amount of cosmetic products from South Korea is on an upward trend every year, and such upward trend is expected to continue.

Furthermore, according to the Cosmetic Importers Association of Japan, the import amount of cosmetic products (excluding toothpastes and soaps) from January through March in 2022 rose 23.7% year on year to 17.5 billion yen for South Korea, and increased 11.3% year on year to 17.08 billion yen for France. The amount for South Korea exceeded that for France for the first time to become the largest.

This is not a temporary boom, but it indicates that Korean brand cosmetics have been firmly rooting in Japan.

The company continues to invite popular brands in South Korea, such as hince and mnyo, for which the company signed contracts, and strengthen domestic sales as their general distributor in Japan.

(Source: The company’s material)

(2) Sales Marketing Business

In the Sales Marketing Business, the company aims to secure stable revenues as a group-wide revenue base.

In the previous fiscal year, the company headed for the stable growth in the co-op and mail-order businesses going forward.

①Stable growth of the co-op and mail order shopping business

The company strives to create synergy with the TV shopping business, and they will increase sales of mainly the top-selling products in TV shopping to co-op and retail stores, to boost sales and profit of PB products.

In the co-op market, the company will increase sales of their PB (private brand) products of cosmetics made from eggs and cosmetics for treating age spots, to boost profit growth.

In addition, the company will start working on expanding distribution routes for Nanarobe.

②Rebuilding the Store Business

Even though the company was significantly impacted by the Covid-19 pandemic, a flow of people is on a gradual upward trend, and the company continues to deal in more Korean cosmetics, like in the SHOP business.

The company will switch from direct wholesale to retail stores to wholesale through wholesale stores, to boost sales efficiency as well as to expand distribution routes.

As the restriction on going out has been eased, this business is considered to have more room to grow.

(3) IT Solutions Business

The company will absorb Communication Bridge, Inc. in April 2022, and expand its business as a profitable Japanese general distributor of the growing chat system “M-talk.”

① New growth strategies for IT Solutions

● To commence business operation in the new structure after the merger with Communication Bridge, Inc.

● To receive project orders without fail and commence the operation

● To start developing new services as up-front investment

② M-Talk

M-Talk is the only chat system that covers the specification for contact center operations.

The company utilizes not only websites, but also LINE, etc. as its interfaces in an integrated manner. They aim to achieve the hybrid operation of contact centers through the fusion of people and AI based on the linkage of the Chatbot, and through the operation utilizing not only texts but also documents and stamps, as well as the linkage of various systems.

(4) Organizational Reform

Planning to transition to be a holding company structure in December 2022. → Transformation into the IK Group with higher competitiveness.

The company aims to execute M&A strategies, strengthen the business portfolio management, enhance their governance structure, and strengthen the human resources development.

(5) Engines that drive growth in the Direct Marketing Business and the Sales Marketing Business

① To repeat the virtuous cycle: ‘‘To spark a boom on TV, and sell products via multiple channels”

・Never fail to carry out test marketing for 4 items for each quarter, or allow a blank period for top-selling products

・Start test marketing of subscription products

(Source: The company’s material)

②To strengthen sales activities for Korean cosmetic brands

・Strengthen sales activities with the aim of achieving the integration of the online and the offline

・Add PB brands of SKINFOOD and OLIVE YOUNG, and concentrate on selling products of hince and mnyo, for which the company signed contracts, as well as KAHI.

(Source: The company’s material)

③To strengthen marketing to expand the co-op cosmetic products

In the cosmetic product area, sales of skincare products have been growing in the co-op market, therefore, the company continues to strengthen its sales promotion activities. They will also work on expanding sales of cosmetics made from eggs and medicated products for treating age spots, and developing a new co-op cosmetic brand that follows these products.

(Source: The company’s material)

5. Medium-Term Business Plan “IK Way to 2024”

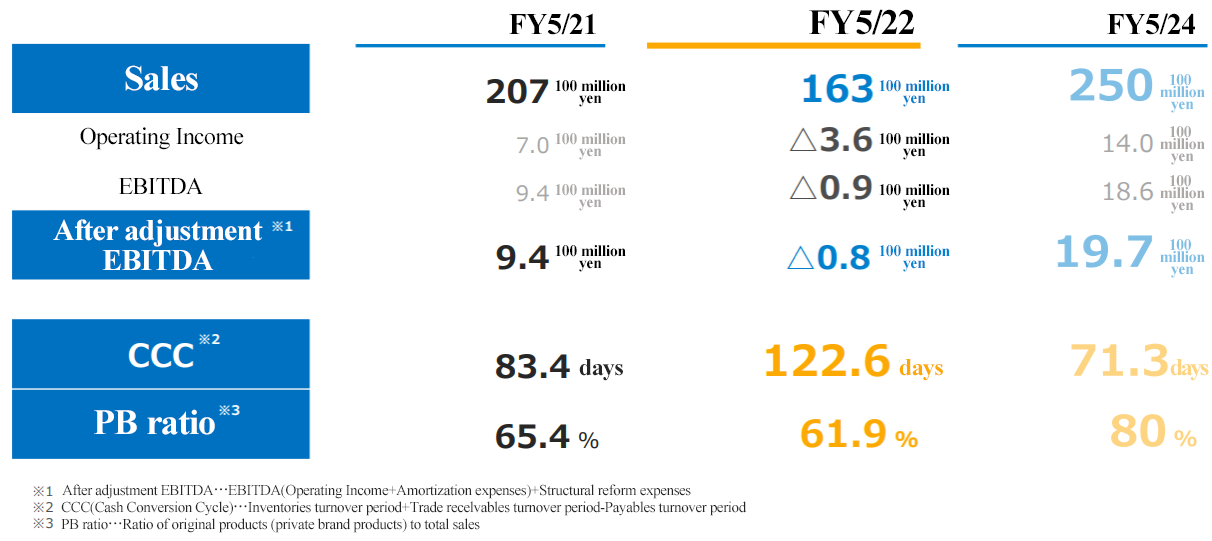

(1) Overall numerical goals

(Source: The company’s material)

CCC: If the Direct Marketing Business takes a greater share, the company will be able to collect cash more quickly. So, the company will increase the scale of the Direct Marketing Business.

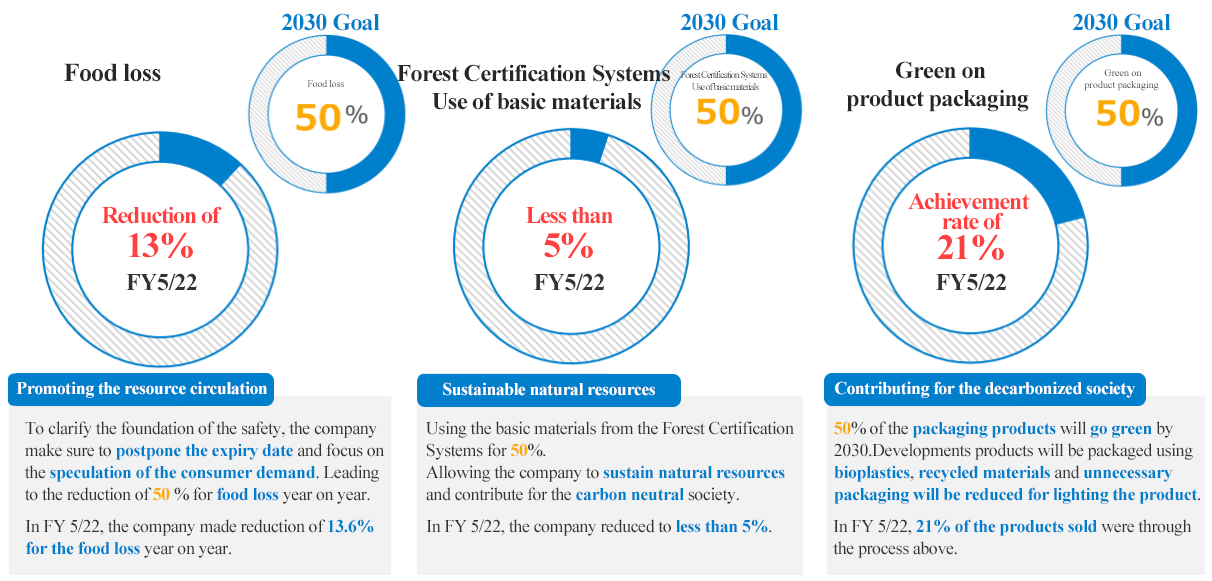

(2) Initiatives for the environment

(Source: The company’s material)

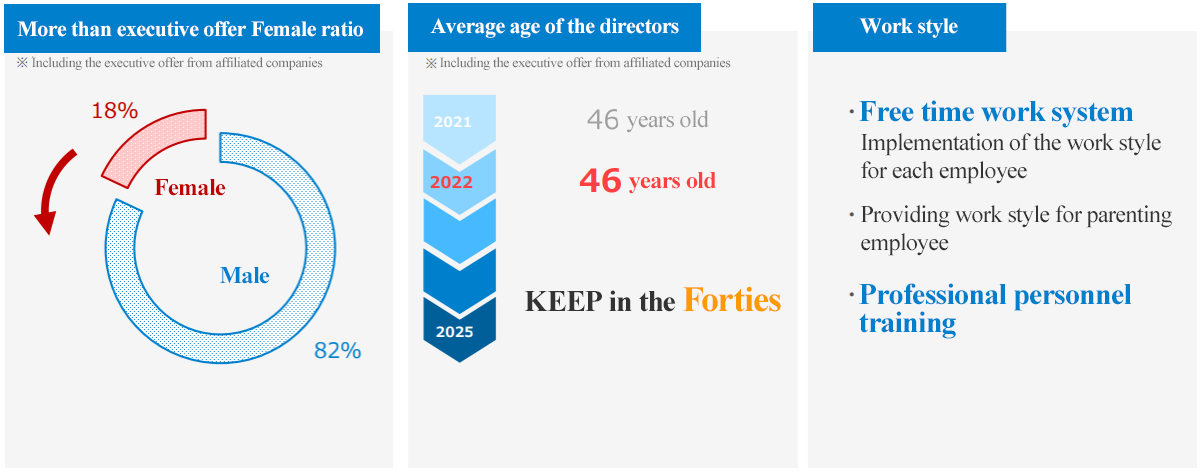

(3) Initiatives for human resources and work styles

The company follows its basic policies to increase the ratio of female employees in the executive officer position and above to 25% or higher, and achieve the average age of directors in the 40s, both by 2025, in order to build a composition of executives that is well-balanced and filled with vitality. In addition, the company will actively promote transitions of full-time employees to professional human resources.

(Source: The company’s material)

6. Conclusions

Stabilizing the TV shopping business is considered to be the key. We would like to pay attention to whether the company can resume the virtuous cycle: “Spark a boom on TV and sell products via multiple channels.” This business model would increase revenues if the cycle repeats smoothly. Furthermore, the company expects to see the effect of introducing new brands from South Korea. For the co-op cosmetics, we would like to pay attention to their sales doubling plan in which they will launch new brands in addition to cosmetics made from eggs and cosmetics for treating age spots.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 7 directors, including 3 outside ones |

◎ Corporate Governance Report

Last updated: June 21, 202

<Basic Policy>

While corporate governance is expected to function effectively, the company strives to become a reliable firm by improving its management foundation, maintaining high ethics and increasing the transparency of the management further in order to fulfil the social mission and responsibility as a listed company.

Also, the company considers the establishment of a management structure that can respond to the changes in the business environment fast and accurately as one of the important business challenges, and it is making efforts in information sharing from many sides by holding a regular meeting of Board of Directors (once/month), an extraordinary meeting of Board of Directors (as per the need), an in-house officers meeting (once/week) with regular directors (including directors serving as audit and supervisory committee members) and executive officers, and a top meeting (once/week) composed of people from team mangers post or above.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

Supplementary Principle1-2.(4) Electronic exercise of voting rights, English translation of convocation notices | The company does not use an online voting platform or provide English translation of convocation notices for ordinary general meetings of shareholders, but it will take the shareholders’ convenience into account based on the composition of shareholders such as institutional investors and foreign investors, and discuss them as necessary. |

Supplementary Principle 4-1.(2)Explanation of a medium-term management plan | The company has its medium-term plan, and it makes efforts to allow shared recognition with shareholders and investors through medium-term vision. The medium-term profit plan is not disclosed, but the company will consider disclosing it in future. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 So-called Strategically-held Shares | The company owns strategically held shares in order to maintain and strengthen a continuous, stable and good business relation with its clients. However, it will conduct tests regularly from a medium-to-long term perspective based on returns, risks, etc., and it will recommend the sale of shares in case there is no longer necessity. Regarding the concerned shares, the board of directors verifies the holding purpose, reasonability and the status of dividend income, compares the acquisition price and current price, and checks the need for holding the shares every year. Furthermore, since the company makes its decision regarding the exercise of voting rights by comprehensively considering strengthening and maintenance of business relation, circumstances of the company concerned, etc., it does not have external standards. |

Principle 5-1 Policy to have Constructive Dialogue with Shareholders | In the company, the management team/general affairs group are designated as the IR department, and they respond to the requests for dialogue by the shareholders within reasonable range in order to contribute to sustainable growth of the company and improvement of corporate value over medium-to-long term. The company’s chairman holds the financial results briefing twice a year for shareholders and institutional investors. Further, the company upload videos and handouts of the briefing on its website for shareholders and investors who are not able to attend the briefing. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment.」 Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |