Bridge Report:(2722)IK Second Quarter of the Fiscal Year ending May 2023

Chairman & CEO Hiroshi Iida | IK HOLDINGS Co., Ltd(2722) |

|

Company Information

Market | Tokyo stock exchange Prime Market and Nagoya stock exchange Premier Market |

Industry | Retail Business (Commerce) |

Chairman & CEO | Hiroshi Iida |

HQ Address | KDX Nagoya Station Building 5F, 3-26-8 Meieki, Nakamura-ku, Nagoya-shi, Aichi |

Year-end | End of May |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE (Act) | Trading Unit | |

¥388 | 8,308,000 shares | ¥3,224 million | -30.1% | 100 shares | |

DPS (FCST) | Dividend yield (FCST) | EPS (FCST) | PER (FCST) | BPS (Act) | PBR (Act) |

¥0.00 | 0.0% | ¥-11.98 | -x | ¥321.94 | 1.2x |

*The share price is the closing price on Jan 25. Each figure and number of shares outstanding (including treasury stock) were taken from the financial results for the second quarter of the fiscal year ending May 2023.

*Market cap was calculated by multiplying the closing price on Jan 25 by the number of outstanding shares. ROE, BPS, and PBR were taken from the financial results for the term ended May 2022. The figures were rounded.

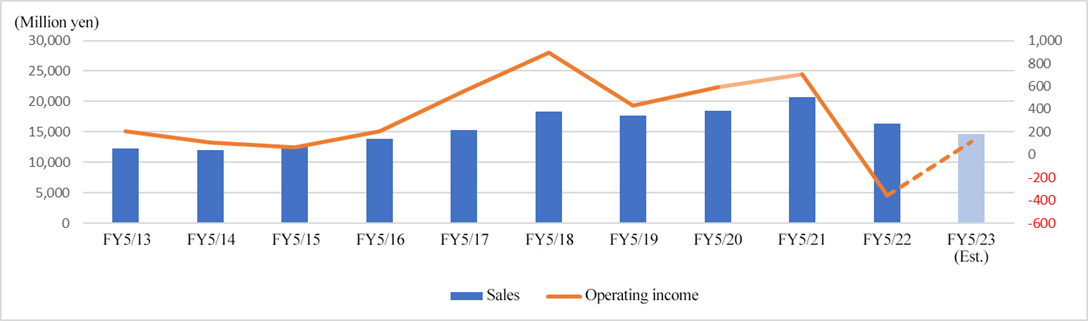

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

May 2019 (Act) | 17,614 | 431 | 437 | 238 | 31.85 | 12.00 |

May 2020 (Act) | 18,483 | 590 | 623 | 384 | 52.19 | 12.00 |

May 2021 (Act) | 20,754 | 705 | 730 | 321 | 42.60 | 12.00 |

May 2022 (Act) | 16,335 | -360 | -323 | -905 | -115.95 | 12.00 |

May 2023 (Est) | 14,706 | 113 | 131 | -92 | -11.98 | 0.00 |

*Unit: million yen. The estimated values are those announced by the Company.

The financial statement for the second quarter of the fiscal year ending May 2023 and many more about IK HOLDINGS Co., Ltd. will be described.

Table of Contents

Key Points

1. Company Overview

2. The Second Quarter of the Fiscal Year ending May 2023 Earnings Results

3. The Fiscal Year ending May 2023 Earnings Forecasts

4. Future Strategy

5. Interview with Mr. Iida, the Chairman & CEO

6. Conclusions

<Reference: Regarding Corporate Governance>

Key points

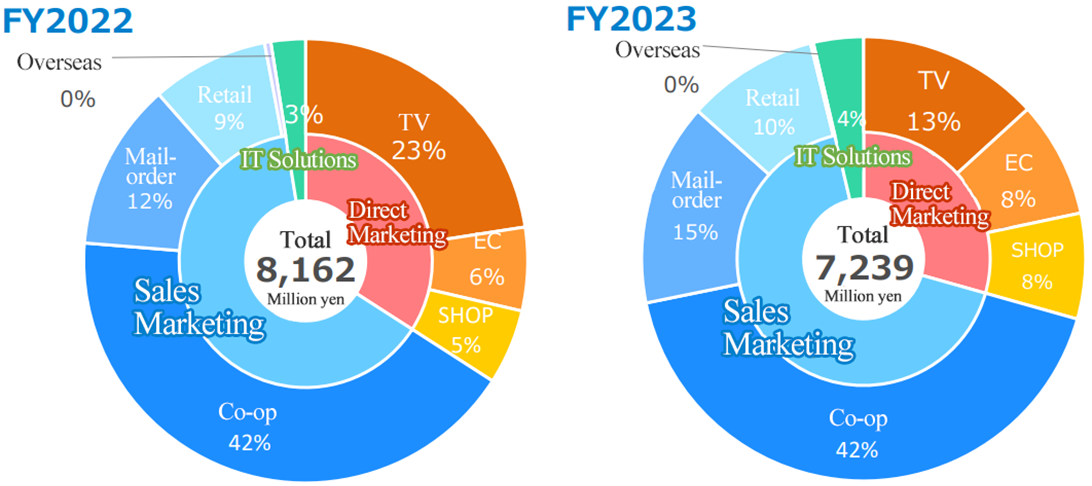

- In the second quarter of the fiscal year ended May 2023, sales decreased and operating loss shrank. Sales declined 11.3% year on year to 7,239 million yen. The sales of TV shopping and co-ops fell as the demand from people staying at home has subsided. Despite improving 213 million yen year on year, operating loss stood at 101 million yen. Gross profit margin declined 4.6 points year on year to 43.0%, due to the drop in sales and the depreciation of the yen in foreign currency exchange. However, as advertising expenses were reduced in step with the deterioration of TV shopping, the ratio of SG&A expenses improved as much as 7.0 points year on year.

- A downward revision was made to the original forecast for the fiscal year ending May 2023, with sales of 14.7 billion yen and an operating loss of 100 million yen. This revision reflects the significant decrease in sales of the Sales Marketing Business and Direct Marketing Business and the outlook that the reduction of SG&A expenses will not be enough to offset the increase in cost caused by the depreciation of the yen in regard to profit. Dividends were revised and will not be paid out as the downward revision was made and the funds will be allocated to creating a new profitable business in step with future business expansion. As new selling prices reflecting the rise in cost will be gradually applied during January and February, the cost of sales ratio is expected to drop.

- We interviewed Mr. Iida, the Chairman & CEO, on initiatives for expanding the sale of Korean cosmetics, the customer-oriented approach and a message toward shareholders and investors. He stated that “I.K Co., Ltd. itself stably generates sales and profit, but our two subsidiaries, Prime Direct and Food Cosmetic, recorded a significant loss in the previous term. However, I believe that if the two companies, which are agile now, start contributing to our revenues in one or two years from now on, they will be able to proceed to a higher stage with I.K, which is stably growing. I would greatly appreciate the continued support from shareholders and investors from a medium- to long-term viewpoint.”

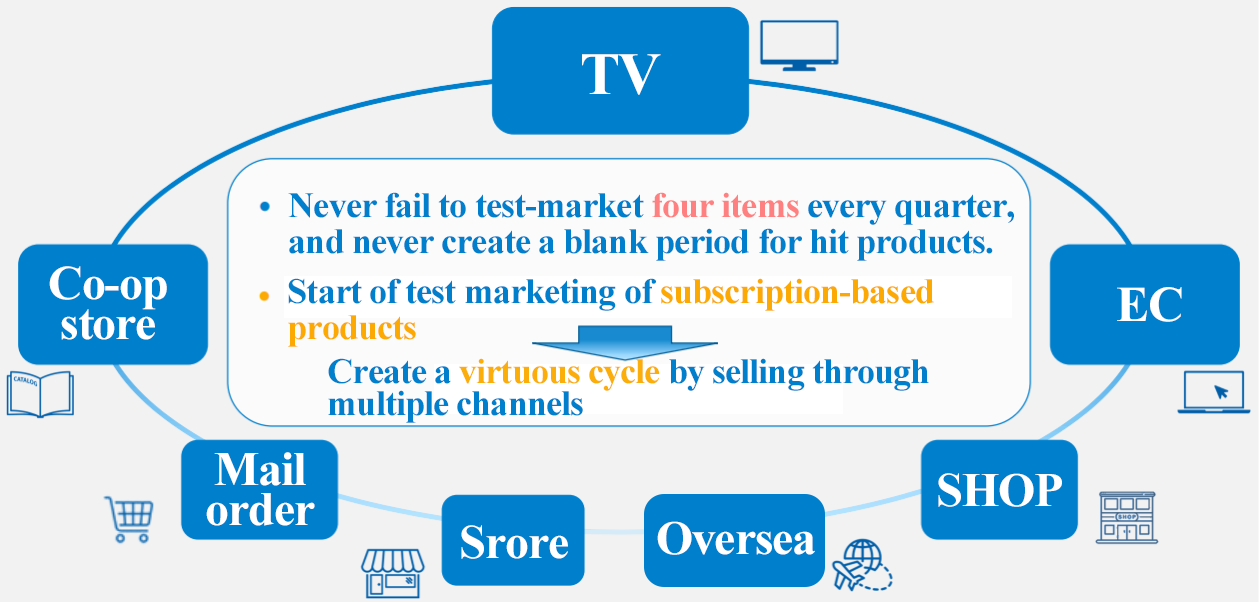

- In addition to practicing the virtuous cycle of “sparking interest on TV and selling through multiple channels,” which has driven the group’s growth so far, they stated that they will reinforce the sale of Korean cosmetic brands. As Korean cosmetics look attractive on social media such as Instagram and Twitter, their popularity easily spreads through online reviews and it can thus be highly anticipated that they will contribute to the revenues from now on. We would like to pay attention to future development to see if the company can recover from the losses recorded in the previous term and again return to the growth trajectory, utilizing its strength as a marketing producer.

1. Company Overview

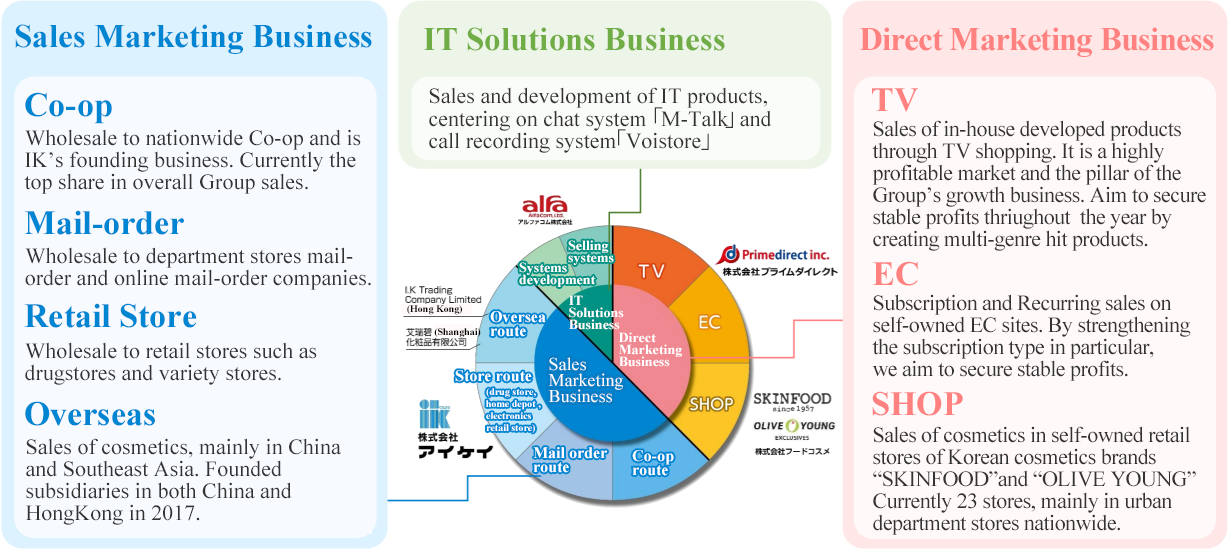

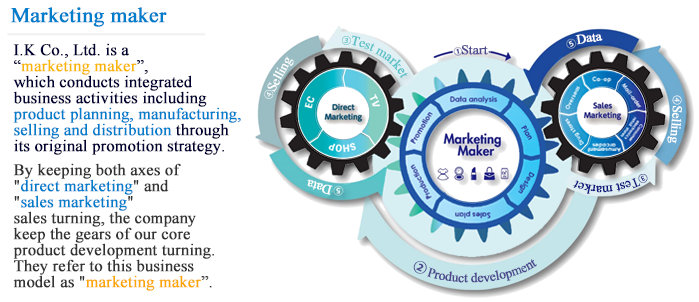

I.K Co., Ltd. is a “marketing manufacturer,” which conducts integrated business activities including product planning, manufacturing, selling and distribution through its original promotion strategy.

The company operates the three businesses: the “Direct Marketing Business,” to sell sundries, food products, and cosmetics via TV shopping, EC, and shops to consumers, the “Sales Marketing Business,” to sell products via various routes, including co-op stores, mail-order companies, shops, overseas channels, etc., and the “IT Solutions Business,” to offer IT solutions for developing and selling systems.

The company strives to establish group management to make all stakeholders its fans by promoting “the increase of fans” as its corporate philosophy.

◎Performance Trends

1-1 Corporate History

After spending his high school and college days in a “freewheeling” school environment, Mr. Hiroshi Iida (present chairman and CEO), who had a strong entrepreneurial spirit from the beginning, worked for a nonlife insurance company and went on to establish I.K Ltd. in May 1982. While working on the sales of various products, he opened an account with Aichi CO-OP Union in April 1983 on getting favors from people in charge of sales and started trading with occupational co-ops.

As the sales of flyers about a rechargeable cleaner, the first product, became a major hit, the horizontal expansion to other co-ops progressed, the number of items handled also increased and the business expanded rapidly. It got listed on the JASDAQ market in December 2001.

Due to the increase in recognition and reliability after the listing, the company began supplying products to the mail-order systems of department stores and retailers in a full-fledged manner, steadily expanding sales outlets, and achieved sales increases for 25 consecutive terms until the fiscal year ended May 2007.

However, as the Lehman’s bankruptcy put the growth at a halt, the company shifted to a “marketing manufacturer” that conducts integrated business activities including product planning, manufacturing, sales and distribution of products on its own using a unique promotion strategy and established “B to C channels” in addition to “B to B to C” to offer its products directly to customers, which allowed it to return to the growth track once again.

The company is actively putting efforts into M&A such as making Prime Direct Inc., a major company for television shopping, into a wholly owned subsidiary in September 2014.

In April 2022, I.K got listed on the Prime Market of the Tokyo Stock Exchange and the Premier Market of the Nagoya Stock Exchange.

In December 2022, they changed the corporate name to IK HOLDINGS Co., Ltd. and became a holding company.

1-2 Management Philosophy

Increase of fans | What they should pursue to become a leading company in the 21st century is not the number of sales, capital or the number of employees. When they look ahead 100 years, they consider that making more and more people their “fans” will lead to prosperity for the company, therefore, they set “increase of fans” as the company’s management philosophy with a goal of “making all people involved in I.K Co., Ltd its fans.” |

1-3 Business Description

(1) Segments

In the fiscal year ending May 2022, the company changes the names of the business segments to Direct Marketing (former B-to-C) Business, Sales Marketing (former B-to-B-to-C) Business, and IT Solutions (former Other) Business in an effort to describe the details of its businesses more appropriately in the course of pursuing a business model of a marketing manufacturer.

(Source: The company’s material)

(Source: The company’s material)

① Sales Marketing Business: Wholesale

The cosmetics, apparel goods, shoes, bags, products related to beauty and health, etc. designed and developed by the company as a manufacturer are offered to consumers through various routes, including co-op stores, mail-order companies, shops, and overseas channels.

(Major Sales Routes)

Co-op route | Co-op Sapporo, Co-op Tohoku Sun Net Business Union, Co-op deli Consumer’s Co-operative Union, Palsystem Consumer’s Co-operative Union, Tohto Co-op, U Co-op, Tokai Co-op Business Union, Co-op Kinki Business Union, Co-op Kobe, Co-op Chugoku Shikoku Business Union, Co-op Hokuriku Business Union, Green Co-op Union, Co-op Kyushu Business Union, All School Co-operative Unions in Japan, Aichi Co-op Union, Japan Consumer’s Co-operative Union, etc. | |

Mail-order route | TOKAI TV Enterprise Co.,Ltd., Takashimaya Co., Ltd., Dinos Corporation Co., Ltd., Cecile Co., Ltd., Belluna Co. Ltd., Senshukai Co., Ltd., Nissen Co., Ltd., au Commerce & Life, Inc., ABC Media Communications, JAF Service, JALUX Inc., Shogakukan-Shueisha Productions Co., Ltd., QVC Japan, Inc., Ropping Life, Nihon Bunka Center Co., Ltd., Zenkokutsuhan Co., Ltd., Japan Green Stamp Co., Ltd., Shaddy Co., Ltd., Yamachu Co., Ltd., LightUp Shopping Club Inc., TV Tokyo Direct Inc., Credit Saison Co., Ltd., Japan Post Trading Service Co., Ltd., U-CAN Inc., MBS innovation DRIVE inc., XPRICE Inc., FELISSIMO CORPORATION, Halmek Corporation., CATALOGHOUSE Ltd., J.O.D CO,.Ltd., etc. | |

Store route | Variety type | Don Quijote Co., Ltd., Nagasakiya Co., Ltd., UD Retail Co., Ltd., Loft Co., Ltd., cosme next Co., Ltd., Tokyo Dome Co., Ltd., Izumi Co., Ltd., TokyuHands Co., Ltd., etc. |

Drug store type | MatsukiyoCocokara & Co., Tsuruha Holdings Co., Ltd., Create SD Co., Ltd., Ain Pharmaciez Co., Ltd., Sundrug Co., Ltd., Sugi Holdings Co., Ltd., AEON Retail Co., Ltd., Daikoku Corporation, etc. | |

Home Center type | Komeri Co., Ltd., Cainz Co., Ltd., etc. | |

Home appliance type | Yamada Denki Co., Ltd., Biccamera Co., Ltd., Yodobashi Camera Co., Ltd, etc. | |

Overseas route | China, Taiwan, Hong Kong, Vietnam, Thailand, and Indonesia etc. | |

② IT Solutions Business

The subsidiary AlfaCom, Ltd. sells systems for the establishment of contact centers, such as the voice call recording system “Voistore,” the business version of LINE “LINE WORKS,” the chat system “M-Talk,” etc.

③ Direct Marketing Business: Retail

While the subsidiary Prime Direct Inc. provides products directly to consumers through websites and TV shopping slots, the subsidiary Food Cosmetic Co., Ltd. now operates only 11 directly managed “SKINFOOD” physical stores as of November 2022, as four unprofitable directly managed stores and three franchise stores were closed down. As one Korean cosmetic brand store “hince” and one “CHANCE UPON” store, which offers multiple Korean cosmetic products, were opened, the total number of stores is now 15, including two “OLIVE YOUNG” stores.

(2) Main Products Developed by the Company

As a marketing manufacturer, the company develops products in various genres in house.

<<Healthcare>>

(Source: The company’s material)

<<Beauty>>

(Source: The company’s material)

<<Entertainment >>

(Source: The company’s material)

1-4 Characteristics and strengths: Business model as a marketing manufacturer

The primary point characterizing the company is a business model as a "marketing manufacturer" which conducts integrated business activities including planning, manufacturing, sales, and distribution of products on its own with a unique promotion strategy.

The company’s business model is composed of the following 3 functions.

(1) Powerful product development, discovery, and procurement

The company is developing, discovering and procuring attractive products by taking advantage of information gained from a wide range of sales channels and experiences cultivated over 40 years. The "Development Approval Conference" is held every other week, and three teams of cosmetics, sundries and food with 7 to 8 members in each team, propose new products to officers and people in charge of sales.

In their company where challenges are valued, each team proposes an average of 10 or more items each month based on freewheeling ideas, but not everything is approved.

The company has set "10 rules for development," which stipulates "emphasis on originality" and "thorough differentiation" regarding product development, and the proposed product is strictly criticized based on them, and homework is given out sometimes. However, these processes train the staff members in charge of development and are leading to further enhancement of product development capabilities.

(2) High marketing ability

“High marketing ability” is playing a major role in developing a hit product.

Test marketing is conducted using various sales channels to check whether candidate products actually sell well. By making innovations in various aspects such as package, timing, target and price and conducting new promotions, the company has been creating many hit products.

(3) Various sales channels

Rather than just proposing products to the various sales outlets mentioned above, they propose the best ways of selling and showcasing in other sales channels together with successful stories of those channels.

They blend ideas unique to I.K co., Ltd. with the needs and feedbacks of customers and brush them up daily.

It is a major feature of the company that it provides all solutions, which fit the sales channels, to customers including product selection, catalog and medium creation, quality control, order reception, logistics and customer service.

Solutions | Outline |

Creation | Create a flyer/catalogue sized paper tailored to the project |

Order reception | They have a flexible core system that can handle all order reception styles such as calls, emails, FAX and post cards with which it performs order receiving work faster and more accurately. |

Quality control | In addition to preparing for compliance, they set voluntary standards for each product category, and they check the products to prevent complaints. |

Logistics | They provide individual delivery service from their own distribution center to the end user, keeping in mind the five keywords: sorting, setting in order, cleaning, hygiene, discipline. |

Customer Service | In-house staff members provide one-stop services such as responding to inquiries about products, delivery and exchange, and after sales services at the call center. |

While many other companies in the same industry specialize in planning and marketing of products, have only stores as their sales channels, and outsource manufacturing and distribution work to other companies, the company can execute a unique promotion strategy that they cannot imitate as the company can respond flexibly with the system and know-how.

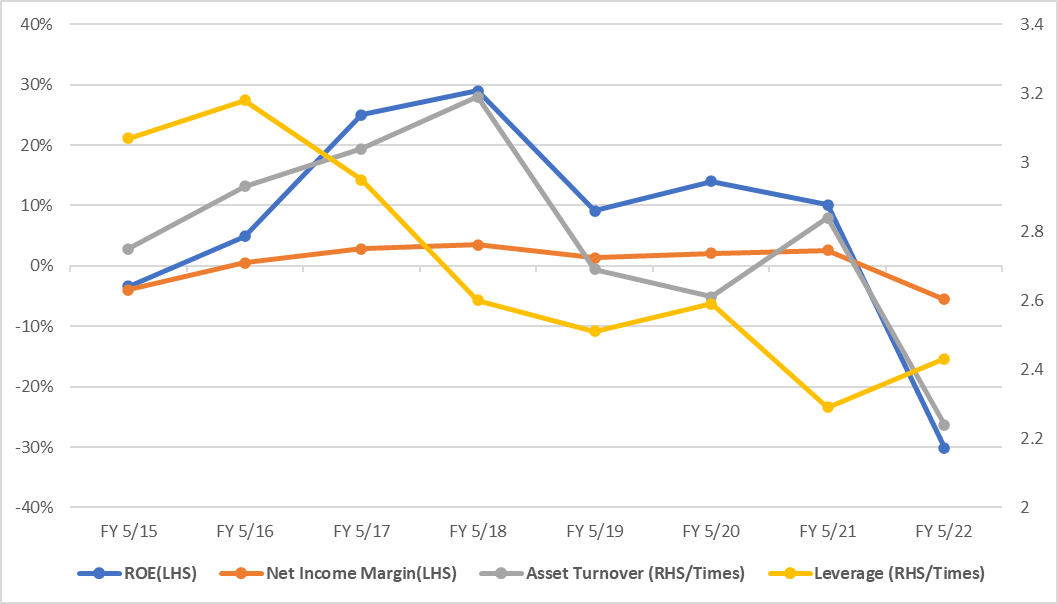

1-5 ROE Analysis

| FY 5/15 | FY 5/16 | FY 5/17 | FY 5/18 | FY 5/19 | FY 5/20 | FY 5/21 | FY 5/22 |

ROE (%) | -3.4 | 4.9 | 25.0 | 29.0 | 9.1 | 14.0 | 10.1 | -30.1 |

Net income margin (%) | -0.40 | 0.53 | 2.79 | 3.50 | 1.35 | 2.08 | 1.55 | -5.54 |

Total asset turnover [times] | 2.75 | 2.93 | 3.04 | 3.19 | 2.69 | 2.61 | 2.84 | 2.24 |

Leverage [times](x) | 3.07 | 3.18 | 2.95 | 2.60 | 2.51 | 2.59 | 2.29 | 2.43 |

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

In the fiscal year ended May 2022, ROE declined due to the drop in the net income margin caused by the company falling into the red. For FY 5/23, it is projected that the net income margin will improve to be 1.1% after the improvement of marketing strategies for the TV shopping business, etc.

2. The Second Quarter of the Fiscal Year ending May 2023 Earnings Results

2-1 Consolidated Business Results

| FY 5/22 2Q | Ratio to Sales | FY 5/23 2Q | Ratio to Sales | YoY |

Sales | 8,162 | 100.0% | 7,239 | 100.0% | -11.3% |

Gross Profit | 3,882 | 47.6% | 3,111 | 43.0% | -19.9% |

SG&A | 4,198 | 51.4% | 3,213 | 44.4% | -23.5% |

Operating Income | -315 | - | -101 | - | - |

Ordinary Income | -297 | - | -82 | - | - |

Net Income | -598 | - | -186 | - | - |

*Unit: million yen. Net income is profit attributable to the owners of parent.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

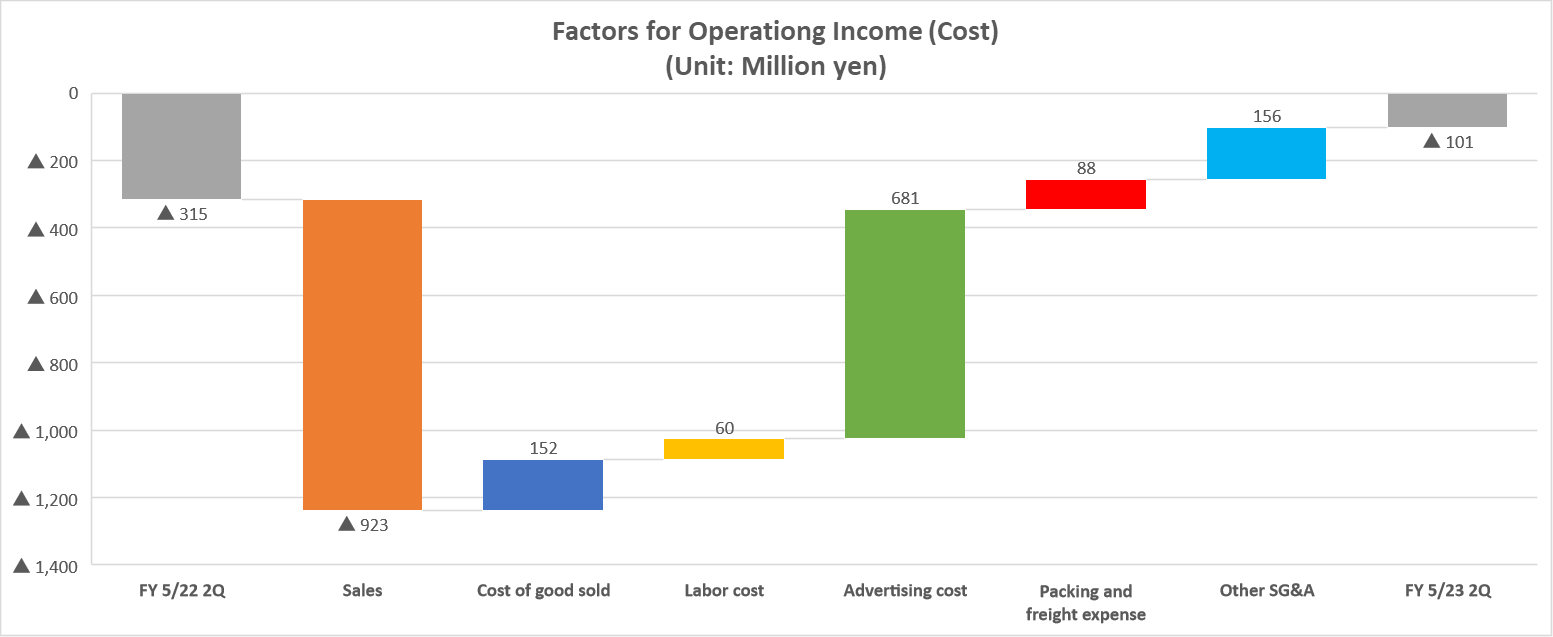

*A ▲ in the expense item indicates an increase in expenses.

Sales dropped, reducing an operating loss.

Sales decreased and operating loss shrank. Sales declined 11.3% year on year to 7,239 million yen. The sales of TV shopping and co-ops fell as the demand from people staying at home has subsided. Despite improving 213 million yen year on year, operating loss stood at 101 million yen. Gross profit margin declined 4.6 points year on year to 43.0%, due to the drop in sales and the depreciation of the yen in foreign currency exchange. However, as advertising expenses were reduced in step with the deterioration of TV shopping, the ratio of SG&A expenses improved as much as 7.0 points year on year.

(Variation in Selling, General and Administrative Expenses)

| FY 5/22 2Q | Ratio to Sales | FY 5/23 2Q | Ratio to Sales | YoY |

Labor cost | 758 | 9.3% | 698 | 9.7% | -7.9% |

Advertising cost | 1833 | 22.5% | 1,152 | 15.9% | -37.2% |

Packing and freight expenses | 744 | 9.1% | 656 | 9.1% | -11.8% |

Others | 861 | 10.6% | 705 | 9.7% | -18.1% |

Total SGA | 4,198 | 51.4% | 3,213 | 44.4% | -23.5% |

*Unit: million yen.

As a result of reducing broadcasting slots, seeing that the response to core TV shopping products was not good, the ratio of advertising costs significantly declined by 6.6 points year on year. While the actual amount of labor costs decreased, its ratio rose 0.4 points, due to the decrease in sales. Although the company is optimizing logistics costs, its ratio remained unchanged due to the impact of the decrease in sales.

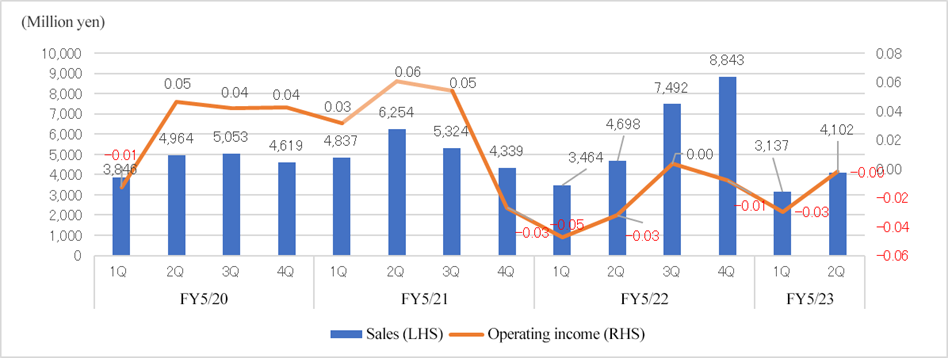

It can be seen that the effects of the reduction of advertising costs are starting to appear in operating income margin on a quarterly basis.

◎Quarterly Earnings

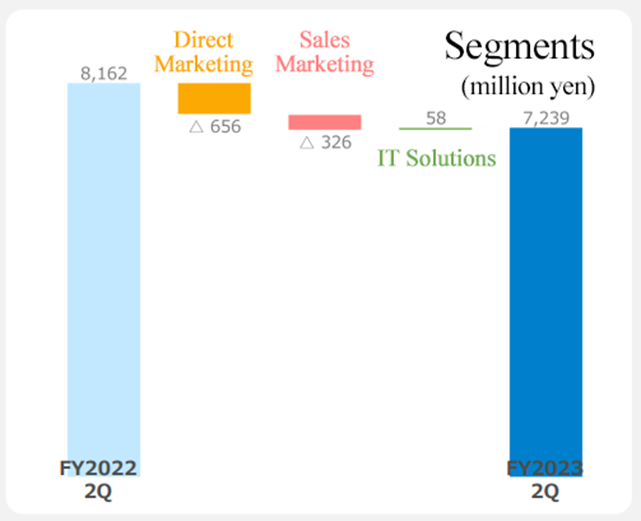

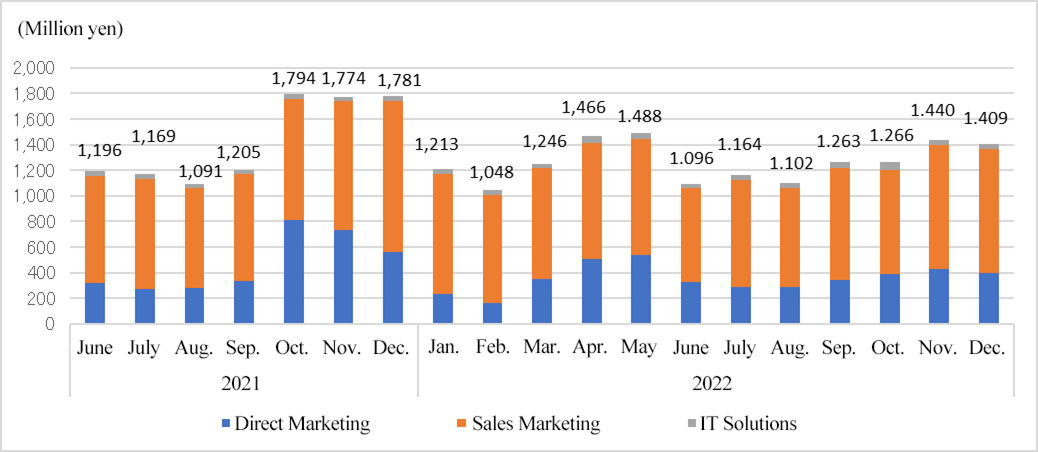

2-2 Trend of each segment

| FY 5/22 2Q | Ratio to Sales | FY 5/23 2Q | Ratio to Sales | YoY |

Sales |

|

|

|

|

|

Direct Marketing Business | 2,782 | 34.1% | 2,126 | 29.4% | -23.6% |

Sales Marketing Business | 5,173 | 63.4% | 4,847 | 67.0% | -6.3% |

IT Solution Business | 206 | 2.5% | 264 | 3.6% | 28.6% |

Total | 8,162 | 100.0% | 7,239 | 100.0% | -11.3% |

Operating income |

|

|

|

|

|

Direct Marketing Business | -449 | - | -124 | - | - |

Sales Marketing Business | 122 | 2.4% | 21 | 0.4% | -82.3% |

IT Solution Business | 8 | 4.1% | -1 | - | - |

Total | -315 | - | -101 | - | - |

*Unit: million yen. Composition ratio of operating income is operating income margin.

(Source: The company’s material)

① Direct Marketing Business

Sales declined, but operating loss shrank.

The broadcasting of the Speed Heat Thermal Vest through the TV and e-commerce was significantly curtailed, reducing advertising costs. While “Atelier Okada” shoes and “ACCORDIO” long leather wallet became hit products, it was not enough to complement the sales of the Speed Heat Thermal Vest in the previous term, leading to a drop in sales. Sales of the overall Direct Marketing Business stood at 2,126 million yen, down 656 million yen year on year.

Although gross profit margin dropped 4.6 points year on year, it was offset by the reduction of SG&A expenses by curtailing advertising costs, etc. and operating income of the overall Direct Marketing Business improved 325 million yen year on year despite the deficit of 124 million yen.

② Sales Marketing Business

Sales decreased and profit significantly declined.

Demand from people staying at home in the previous term has already subsided and although sales of food products through the co-op route remained steady, sales of sundries were sluggish and sales of the overall Sales Marketing Business dropped 326 million yen year on year to 4,847 million yen. Operating income dropped considerably by 101 million yen to 21 million yen due to the yen depreciation and high costs.

③ IT Solutions Business

Sales grew, but a loss was posted.

While sales of M-talk steadily increased, the depreciation of the yen caused operating loss.

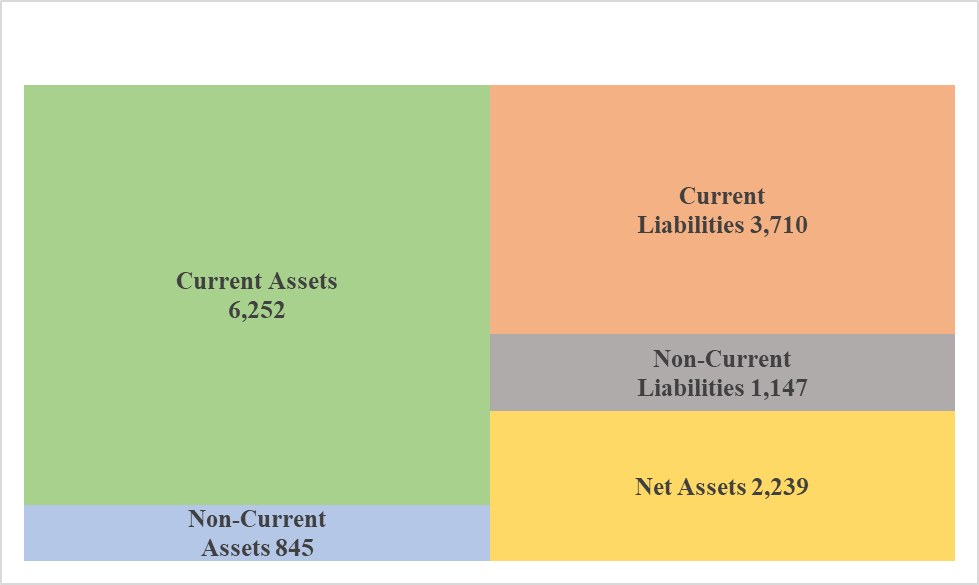

2-3 Financial condition and cash flow

◎Main BS

| End of May 2022 | End of Nov 2022 |

| End of May 2022 | End of Nov 2022 |

Current Assets | 6,553 | 6,252 | Current Liabilities | 3,519 | 3,710 |

Cash | 1,075 | 926 | Payables | 893 | 898 |

Receivables | 2,612 | 2,533 | ST Interest Bearing Liabilities | 1,492 | 1,841 |

Inventories | 2,420 | 2,432 | Noncurrent liabilities | 1,353 | 1,147 |

Noncurrent Assets | 825 | 845 | LT Interest Bearing Liabilities | 1,044 | 833 |

Tangible Assets | 197 | 200 | Total Liabilities | 4,873 | 4,858 |

Intangible Assets | 208 | 271 | Net Assets | 2,504 | 2,239 |

Investment, Others | 419 | 372 | Retained Earnings | 1,401 | 1,123 |

Total Assets | 7,378 | 7,097 | Total Liabilities and Net Assets | 7,378 | 7,097 |

*Unit: million yen. |

|

| Balance of Debts | 2,536 | 2,674 |

|

|

| Capital adequacy ratio | 33.5% | 30.9% |

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

A decline in current assets caused total assets to decrease 281 million yen from the end of the previous year to 7,097 million yen. Although current liabilities increased, there was a significant decrease in noncurrent liabilities, decreasing total liabilities to 4,858 million yen, down 15 million yen from the end of the previous year. Net assets stood at 2,239 million yen, down 265 million yen from the end of the previous year, due to a drop in retained earnings, etc. Equity ratio declined 2.6 points from the end of the previous year to 30.9%.

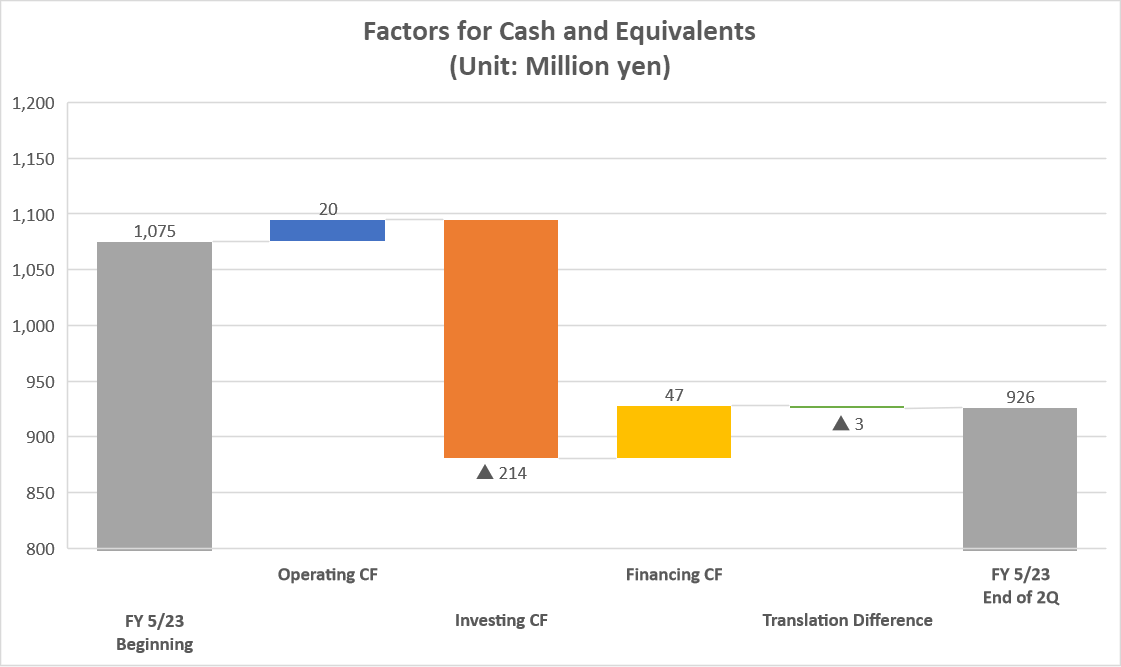

◎Cash Flow

| FY 5/22 2Q | FY 5/23 2Q | Increase/ Decrease |

Operating cash flow | -708 | 20 | +729 |

Investing cash flow | -205 | -214 | -9 |

Free cash flow | -913 | -193 | +719 |

Financing cash flow | 925 | 47 | -877 |

Cash and equivalent | 986 | 926 | -59 |

*Unit: million yen.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

In addition to the shrinkage of net loss, accounts receivable, inventories, consumption tax receivable/payable, etc. decreased, so there was a cash inflow from operating activities. The deficit in free cash flow considerably shrank.

Financing cash flow significantly declined due to an increase in short-term loans payable. The cash position fell.

3. The Fiscal Year ending May 2023 Earnings Forecasts

3-1 Full-year earnings forecast

| FY 5/22 | Ratio to sales | FY 5/23 (Current) | Ratio to sales | YoY | FY 5/23 (Previous) | Ratio to sales | Previous Comparison |

Sales | 16,335 | 100.0% | 14,706 | 100.0% | -10.0% | 16,426 | 100.0% | -10.5% |

Operating Income | -360 | - | 113 | 0.8% | - | 511 | 3.1% | -77.9% |

Ordinary Income | -323 | - | 131 | 0.9% | - | 520 | 3.2% | -74.8% |

Net Income | -905 | - | -92 | - | - | 186 | 1.1% | - |

*Unit: million yen. The estimated values are those announced by the company.

Decrease in sales, operating profit expected

A downward revision was made to the original forecast for the fiscal year ending May 2023, with sales of 14.7 billion yen and an operating loss of 100 million yen. This revision reflects the significant decrease in sales of the Sales Marketing Business and Direct Marketing Business and the outlook that the reduction of SG&A expenses will not be enough to offset the increase in cost caused by the depreciation of the yen in regard to profit. Dividends were revised and will not be paid out as the downward revision was made and the funds will be allocated to creating a new profitable business in step with future business expansion.

As new selling prices reflecting the rise in cost will be gradually applied during January and February, the cost of sales ratio is expected to drop.

3-2 Trend of each segment

*Sales forecast for each segment

| FY 5/22 | Ratio to Sales | FY 5/23 (Est) | Ratio to Sales | YoY |

Direct Marketing Business | 5,184 | 31.7% | 4,282 | 29.1% | -17.4% |

Sales Marketing Business | 10,699 | 65.5% | 9,911 | 67.4% | -7.4% |

IT Solutions Business | 452 | 2.8% | 513 | 3.5% | 13.5% |

Total | 16,335 | 100.0% | 14,706 | 100.0% | -10.0% |

*Unit: million yen.

(Monthly sales for each segment)

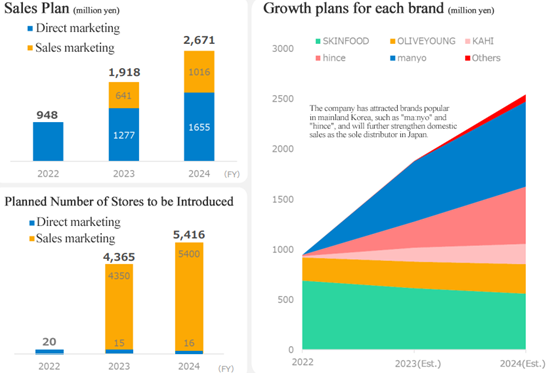

4. Future Strategy

4-1. Growth engines of the IK group

① Reinforcing the sale of Korean cosmetic brands

The company will reinforce the sale of Korean brands in categories such as skincare and cosmetics, utilizing a wide array of sales channels.

They will focus on the sale of “OLIVE YOUNG EXCLUSIVES,” “KAHI,” “hince” and “mnyo.” In order to enhance the appeal of the products to the maximum, they will utilize the multi-channels of the corporate group, such as e-commerce, shops and wholesale, to reinforce the sales (aiming for the fusion of offline and online channels to enhance sales). They will further accelerate the business based on the know-how which they have cultivated until now and group synergy.

(Source: The company’s material)

In Japan, the import number of cosmetic products from South Korea is on an upward trend every year, and such upward trend is expected to continue.

According to the cosmetics statistics announced by the Japan Cosmetic Industry Association on November 7, 2022, South Korea surpassed France to stand on the top in regard to the import number of cosmetics between January and September 2022.

The company will expand the number of stores offering Korean cosmetics to about 5000 through the route of directly managed stores and wholesale by fiscal 2024 and increase fans of each brand.

(Source: The company’s material)

② Practicing the virtuous cycle of “sparking interest on TV and selling through multiple channels”

(Source: The company’s material)

・Existing products, and new products expected to become hit products… Expand the number of profitable hit products they deal in to 20

(Source: The company’s material)

4-2. The strategy of the Direct Marketing Business

TV Shopping Route

Expand the number of profitable products to 20 in the TV shopping route.

E-Commerce Route

①Link to TV for receiving orders through TV shopping to maximize profit

②Further expand the scale of the Nanarobe brand.

Shop Route

They will reinforce the sale of Korean brands in the shop route. They will broaden the fanbase of each brand such as “SKINFOOD,” “OLIVE YOUNG EX,” “KAHI,” “hince” and “mnyo.”

4-3. Strategy of the Sales Marketing Business

Co-Op/Mail-Order Route

While pursuing the synergy with TV shopping, they will expand the sale of mainly hit products in TV shopping to the co-op and mail-order routes. They will reinforce the product lineup and marketing activities in all genres and pursue how to present the products while providing accurate information based on plenty of product information, such as having the staff in charge of product development accompany sales staff during marketing activities.

Rebuilding the Store Business

As with the SHOP, the company will strengthen its handling of Korean cosmetics and increase sales efficiency and expand sales channels by using wholesaling through wholesalers, in addition to direct wholesaling to retailers.

They aim for offering the products at a total of about 5000 stores by the next fiscal year.

Furthermore, they will reinforce promotion to work toward the launch of products developed within the company.

4-4. IT Solutions Business

New growth strategies for IT Solutions

● To receive project orders without fail and commence the operation

● To start developing new services as up-front investment

M-Talk

M-Talk is the only chat system that covers the specification for contact center operations.

The company utilizes not only websites, but also LINE, etc. as its interfaces in an integrated manner. They aim to achieve the hybrid operation of contact centers through the fusion of people and AI based on the linkage of the Chatbot, and through the operation utilizing not only texts but also documents and stamps, as well as the linkage of various systems.

5. Interview with Mr. Iida, the Chairman & CEO

We interviewed Mr. Iida, the Chairman & CEO, on initiatives for expanding the sale of Korean cosmetics, the customer-oriented approach and a message toward shareholders and investors.

◎ Regarding Korean cosmetics

* | A powerful tailwind is blowing in the business of Korean cosmetics and I view it as a big chance. |

* | We used to deliver products to drugstores directly through our accounts until now, but this time we are going to deliver via wholesalers to spread the products to a larger number of stores than ever before. We need the products to be properly displayed on the sales floor when we gather micro-influencers and launch promotions on social media. |

* | In regard to marketing as well, previously most products would become a hit when you aired a TV commercial, which was a method extremely easy to understand, but currently social media are the most important. In order to speed up our business with all that we have, we will engage in marketing activities while utilizing not only in-house staff, but also outside resources. |

* | As for the balm stick of the new brand KAHI, we will launch it not only in stores, but also via TV shopping. It’s a product frequently used in Korean TV series as well, so I expect that if we get a commercial slot after a Korean series and broadcast it there, it will most probably become a hit. |

◎ Regarding the customer-oriented approach

* | I often come across the words “customer-first approach,” but I feel discomfort in giving priorities by myself. Instead of that, I believe that the company needs to think about all kinds of things from the customer’s standpoint and act accordingly. |

* | If making a customer feel good and happy comes as first in the “customer-oriented approach,” you will be likely to explain your product in a way that is easy to understand, and naturally, you will answer the phone cheerfully and politely. You will avoid being out of stock, the products will be shipped to reach the customer as quickly as possible and you will most probably care about how they look when they are delivered. |

* | And as the “customer-first approach” is also “the other party-oriented approach,” I think that interpersonal relationships in the company should follow it as well. Work cannot be done just by one person, so it is extremely important to think about the standpoint of the other party when proceeding with work. |

* | I believe that the essence of the success of an enterprise comes down to “whether it can keep being a good company from the customer’s viewpoint,” and the strength of I.K, which keeps growing, lies precisely in this management philosophy. This key point is one thing that will never waver. |

◎ Message toward shareholders and investors

* | I.K Co., Ltd. itself stably generates sales and profit, but our two subsidiaries, Prime Direct and Food Cosmetic, recorded a significant loss in the previous term. |

* | However, I believe that if the two companies, which are agile now, start contributing to our revenues in one or two years from now on, they will be able to progress to a higher stage with I.K, which is stably growing. |

* | I would greatly appreciate the continued support of shareholders and investors from a medium- to long-term viewpoint. |

6. Conclusions

In addition to practicing the virtuous cycle of “sparking interest on TV and selling through multiple channels,” which has driven the group’s growth so far, they stated that they will reinforce the sale of Korean cosmetic brands. As Korean cosmetics look attractive on social media such as Instagram and Twitter, their popularity easily spreads through online reviews and it can thus be highly anticipated that they will contribute to the revenues from now on.We would like to pay attention to future development to see if the company can recover from the losses recorded in the previous term and again return to the growth trajectory, utilizing its strength as a marketing producer.<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 6 directors, including 3 outside ones |

◎ Corporate Governance Report

Last updated: December 15, 2022

<Basic Policy>

While corporate governance is expected to function effectively, the company strives to become a reliable firm by improving its management foundation, maintaining high ethics and increasing the transparency of the management further in order to fulfil the social mission and responsibility as a listed company.

Also, the company considers the establishment of a management structure that can respond to the changes in the business environment fast and accurately as one of the important business challenges, and it is making efforts in information sharing from many sides by holding a regular meeting of Board of Directors (once/month), an extraordinary meeting of Board of Directors (as per the need), an in-house officers meeting (once/week) with regular directors (including directors serving as audit and supervisory committee members) and executive officers, and a top meeting (once/week) composed of people from team mangers post or above.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

Supplementary Principle1-2.(4) Electronic exercise of voting rights, English translation of convocation notices | The company does not use an online voting platform or provide English translation of convocation notices for ordinary general meetings of shareholders, but it will take the shareholders’ convenience into account based on the composition of shareholders such as institutional investors and foreign investors, and discuss them as necessary. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 So-called Strategically-held Shares | The company owns strategically held shares in order to maintain and strengthen a continuous, stable and good business relation with its clients. However, it will conduct tests regularly from a medium-to-long term perspective based on returns, risks, etc., and it will recommend the sale of shares in case there is no longer necessity. Regarding the concerned shares, the board of directors verifies the holding purpose, reasonability and the status of dividend income, compares the acquisition price and current price, and checks the need for holding the shares every year. Furthermore, since the company makes its decision regarding the exercise of voting rights by comprehensively considering strengthening and maintenance of business relation, circumstances of the company concerned, etc., it does not have external standards. |

Principle 5-1 Policy to have Constructive Dialogue with Shareholders | In the company, the management team/general affairs group are designated as the IR department, and they respond to the requests for dialogue by the shareholders within reasonable range in order to contribute to sustainable growth of the company and improvement of corporate value over medium-to-long term. The company’s chairman holds the financial results briefing twice a year for shareholders and institutional investors. Further, the company upload videos and handouts of the briefing on its website for shareholders and investors who are not able to attend the briefing. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment.」 Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |