Bridge Report:(2884)Yoshimura Food Holdings Fiscal Year February 2019

Representative director and CEO Motohisa Yoshimura | Yoshimura Food Holdings K.K. (2884) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

Representative director and CEO | Motohisa Yoshimura |

Address | 18F, Fukoku Seimei Bldg., 2-2-2, Uchisaiwai-cho, Chiyoda-ku, Tokyo |

Year-end | February |

URL |

Stock Information

Share price | Shares Outstanding | Total Market Cap | ROE(Actual) | Trading Unit | |

¥895 | 21,915,695 shares | ¥19,614 million | 6.3% | 100 shares | |

DPS(Est.) | Dividend yield (Est.) | EPS(Est.) | PER(Est.) | BPS(Actual) | PBR(Actual) |

¥0.00 | - | ¥15.58 | 57.4 times | ¥195.83 | 4.6 times |

*Share price is as of closing on June 18. The number of shares outstanding, ROE, DPS, EPS, and BPS were taken from the brief financial report for the term ended February 2019.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2016 (Actual) | 12,833 | 328 | 328 | 461 | 23.33 | 0.00 |

February 2017 (Actual) | 16,241 | 493 | 530 | 353 | 16.28 | 0.00 |

February 2018 (Actual) | 20,035 | 494 | 554 | 419 | 19.19 | 0.00 |

February 2019 (Actual) | 23,716 | 354 | 420 | 263 | 12.04 | 0.00 |

February 2020 (Estimate) | 28,181 | 645 | 660 | 341 | 15.58 | 0.00 |

*Unit: Million yen, yen. The estimated values were provided by the company.

This report outlines Yoshimura Food Holdings K.K. and includes its financial results, the interview with CEO Yoshimura, etc.

Table of Contents

Key Points

1. Company Overview

2. Financial Results

3. Future Growth Strategy

4. Interview with the CEO Yoshimura

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

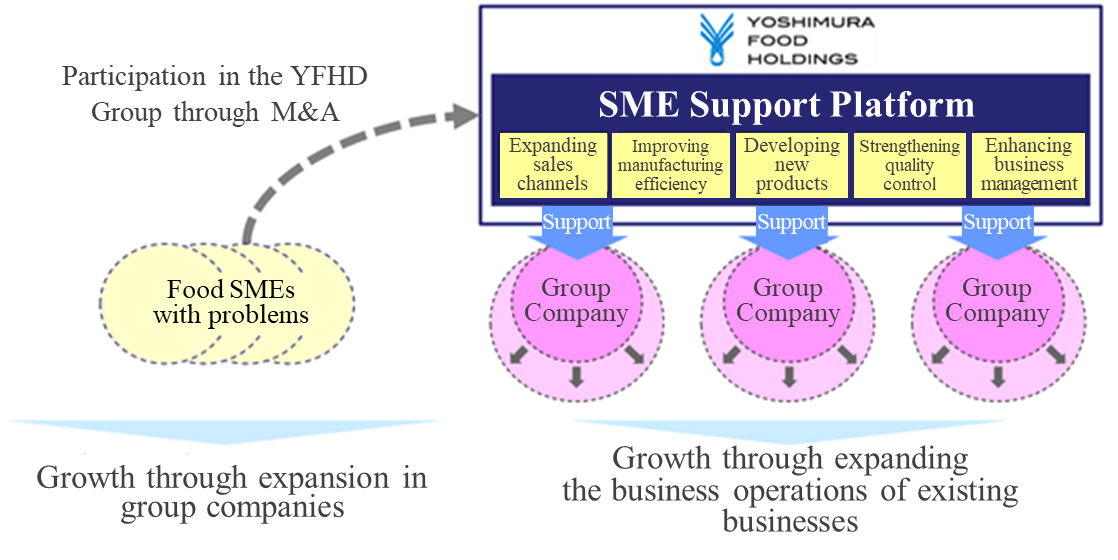

- Yoshimura Food Holdings acquires small and medium-sized food products makers, facing various issues such as the difficulty in finding successors, through M&A at the same time as they possess excellent products and technologies. It also facilitates the growth of the entire corporate group by solving problems with their core skill, “a platform for supporting small and medium-sized enterprises (SME Support Platform),” and energizing each group company. Its strengths are an overwhelming advantage compared to investment funds and large companies as well as a high entry barrier. In recent years, the company has been concentrating on overseas M&A.

- The company has developed an original business model in the food industry and pursues growth with two engines: “the increase in the number of group companies” and “the expansion of business of existing group companies.”

- We interviewed CEO Yoshimura about the roles of his company, the state of the Yoshimura Food Holdings Group, his company’s advantages, his message toward shareholders and investors, and so on. He said “We would like investors who understand our business and would hold our company’s shares in the mid/long term to be our shareholders. We would like you to understand that the environment surrounding our business is quite favorable thanks to external factors and our advantages, and to hold our company’s shares from the mid/long-term viewpoint rather than trading them on a short-term basis.”

- According to CEO Yoshimura, some owners of small and medium-sized enterprises (SMEs) did not know that their companies could be sold. Although it is an extreme case, it is very difficult for business owners to sell their companies so that they tend to be skeptical about a proposal for “business transfer” when facing the difficulty in finding successors. Thus, it does not progress smoothly in most cases. However, in the case of Yoshimura Food Holdings, the purpose of establishment is to support and energize SMEs, and it has never sold acquired companies and has energized them via SME Support Platform. It also established reliability since it is listed in the first section of Tokyo Stock Exchange. Accordingly, it is expected that the company will foster trusting relationships with business owners in a shorter period of time. In this light, the company will further enhance its competitive advantage compared with investment funds and large companies. We also would like to pay attention to how they will conduct fund procurement they think is necessary for their activities at the next stage.

1. Company Overview

Yoshimura Food Holdings acquires small and medium-sized food products makers, facing various issues such as the difficulty in finding successors, through M&A at the same time as they possess excellent products and technologies. It also facilitates the growth of the entire corporate group by solving problems with their core skill, “a platform for supporting small and medium-sized enterprises (SME Support Platform),” and energizing each group company. Its strengths are an overwhelming advantage compared to investment funds and large companies as well as a high entry barrier. In recent years, the company has been concentrating on overseas M&A.

【1-1 Corporate History】

One day, a food company that was facing financial difficulties and could not find a buyer was introduced to Mr. Yoshimura, who was managing the listed companies’ fundraising and M&A in the corporate business division at Daiwa Securities Co. Ltd. and Morgan Stanley Securities Co., Ltd..

Mr. Yoshimura took on this food company and established L Partners Co., Ltd. on his own in March 2008, which was the predecessor of Yoshimura Food Holdings K.K. because he strongly felt that Japan could be more appreciated through its “food” since his MBA days in the USA while working for Daiwa Securities. Through his efforts to revitalize the company using his experience and network, he succeeded in turning a profit.

Many food SMEs started seeking help from Mr. Yoshimura upon learning about his reputation. He thought that it was possible to efficiently achieve results if the companies complemented each other in various functions, such as product development, production, and sales under a holding company system, instead of working on each company individually. Hence, he named the corporate Yoshimura Food Holdings K.K. in August 2009.

Since then, the company has continued acquiring companies facing problems with business succession or failing to handle management on their own. Due to the high reputation of the company for its unique position of not competing with major food companies and investment funds and its policy of not selling the companies it acquired, it received financing from Japan Tobacco (JT) and expanded its business. In March 2016, it was listed on the Mothers of Tokyo Stock Exchange, and in March 2017, it was listed in the first section of Tokyo Stock Exchange.

The company is pursuing further growth by acquiring not only Japanese companies, but also overseas companies in Singapore, Taiwan, etc.

【1-2 Market Environment and the Background of the Company’s Establishment】

As a company aiming for supporting and revitalizing SMEs throughout Japan, Yoshimura Food Holdings explained the conditions of the food SMEs as follows:

(Investment Bridge extracted, summarized and edited the information from Yoshimura Food Holdings’ annual securities reports and reference material)

(The Conditions of the Food SMEs)

*Japanese cuisine has been highly appreciated worldwide and is attracting attention. Also, on the national level, the food manufacturing industry has been one of the largest industries based on its number of business establishments, number of employees and GDP since the 1990s and it is one of the key industries that Japan is proud of.

*99% of the companies are SMEs where each one of them has strong products and technical skills.

*However, the domestic market scale is shrinking and some of the food SMEs find it hard to survive on their own as the business environment remains stringent due to the falling birthrate and aging population.

*Therefore, many companies give up on continuing their businesses and end up choosing to close down or suspend their business.

(Conditions of the SMEs’ Business Succession)

*The average age of managers is 59.7, and it is expected that around 50% of the managers will reach the average retirement age in the upcoming 10 years as the average retirement age of managers is around 70.

*Under such conditions, two-thirds (66.4%) of domestic companies do not have a successor. The percentage of companies, with presidents in their 60s, which have finished the business succession or prepared for business succession is only around 36%. Thus, the preparation for business succession has not progressed.

*Moreover, in 2018, the number of SMEs that suspended or discontinued business doubled to reach 46,724 in comparison with the previous year where that number was around 21,000.

(According to SME Agency “White Paper on Small and Medium Enterprises” (2019 Edition), Teikoku Databank, Ltd. “Analysis of the age of company presidents in Japan (2019),” Teikoku Databank, Ltd. “Survey of Trends on ‘Companies without a Successor’ in Japan” (2018), Teikoku Databank, Ltd. “Survey of Companies’ Attitude towards Business Succession” (2017) and data from Tokyo Shoko Research, Ltd.)

(Conditions of Business Succession of Food SMEs through Acquisition)

*Although there are increasing needs for business succession from food SMEs, the number of companies and organizations that would acquire them is small.

*The scale of many food SMEs is too small for major companies to acquire.

*Furthermore, investment funds’ primary aim is to rapidly grow independent companies and sell them off within a few years. Therefore, the mature market of food SMEs tends not to be one of their investment targets.

*Under these conditions, there is a tremendous shortage in the bearers of the responsibility of taking on the business of the SMEs.

【1-3 Business Description】

Having Yoshimura Food Holdings as its holding company, the corporate group consists of 18 group companies.

Yoshimura Food Holdings aims to support and revitalize SMEs that manufacture and sell food products by creating a corporate group, composed of the food SMEs that are facing problems in securing a successor, through M&A. Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each company in the group. It also supports and supervises their sales, manufacturing, procurement, distribution, product development, quality control, and business management.

① Business Model

The company developed a unique business model in the food industry and is pursuing growth based on two engines.

One of them is the increase in the number of group companies.

Since its establishment in 2008, the company prevented food SMEs that had business succession and financial problems from shutting down or facing business suspension by acquiring them. Thus, it has managed to solve their problems.

As of June 2019, the company had 18 group companies. It is recently focusing on adding not only Japanese companies to the group, but also overseas ones.

Target companies are found by mainly M&A mediating companies, local financial institutions such as regional banks, lawyers and accountants. The company plans to improve its own function for finding target companies from the aspect of costs as well.

The other one is the expansion of business of existing group companies.

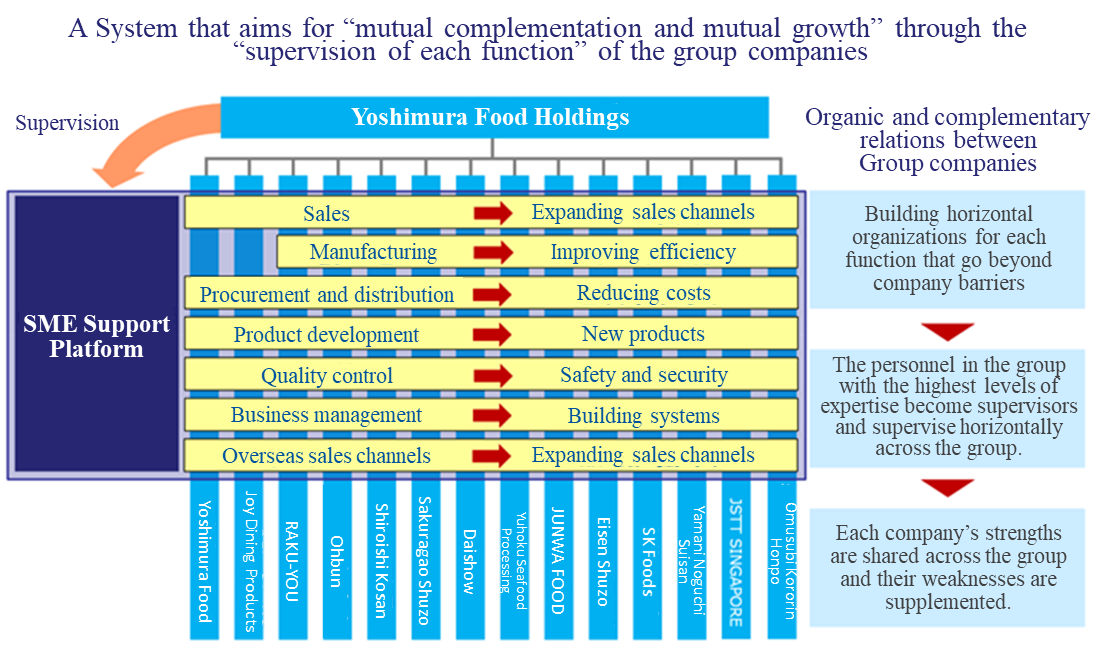

Yoshimura Food Holdings supports the expansion of business operations of each company and solves problems by supervising each function of these companies, which have excellent products and technologies but could not achieve growth for reasons such as the lack of sales channels or labor shortage and poor business management, through the “SME Support Platform.”

(Taken from the reference material of the company)

What is the SME Support Platform?

The core of this unique business model is the “SME Support Platform,” a product of the company’s accumulation of know-how and achievements through its specializing in food manufacturing and sales.

As a holding company, Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each subsidiary in the group. It also aims to strengthen the business foundation of each subsidiary through the company supervisor’s horizontal supervision of its functions (sales, manufacturing, procurement, distribution, product development, quality control and business management) in a manner that goes beyond the company barriers and through his support for the business by building organic relations between subsidiary companies.

For example, Company A which has an excellent product but is worried about sales growth can use the sales channels and sales know-how of Company B that has a nationwide sales network. Also, it can achieve a stable financial position by using the creditworthiness of Yoshimura Food Holdings which is listed in the stock market to raise funds.

This cooperation is made to be more effective through appointing the personnel in the group with the highest levels of expertise as supervisors.

Hence, the “SME Support Platform” is a system in which each company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds, or sales channels are supplemented.

(Taken from the reference material of the company)

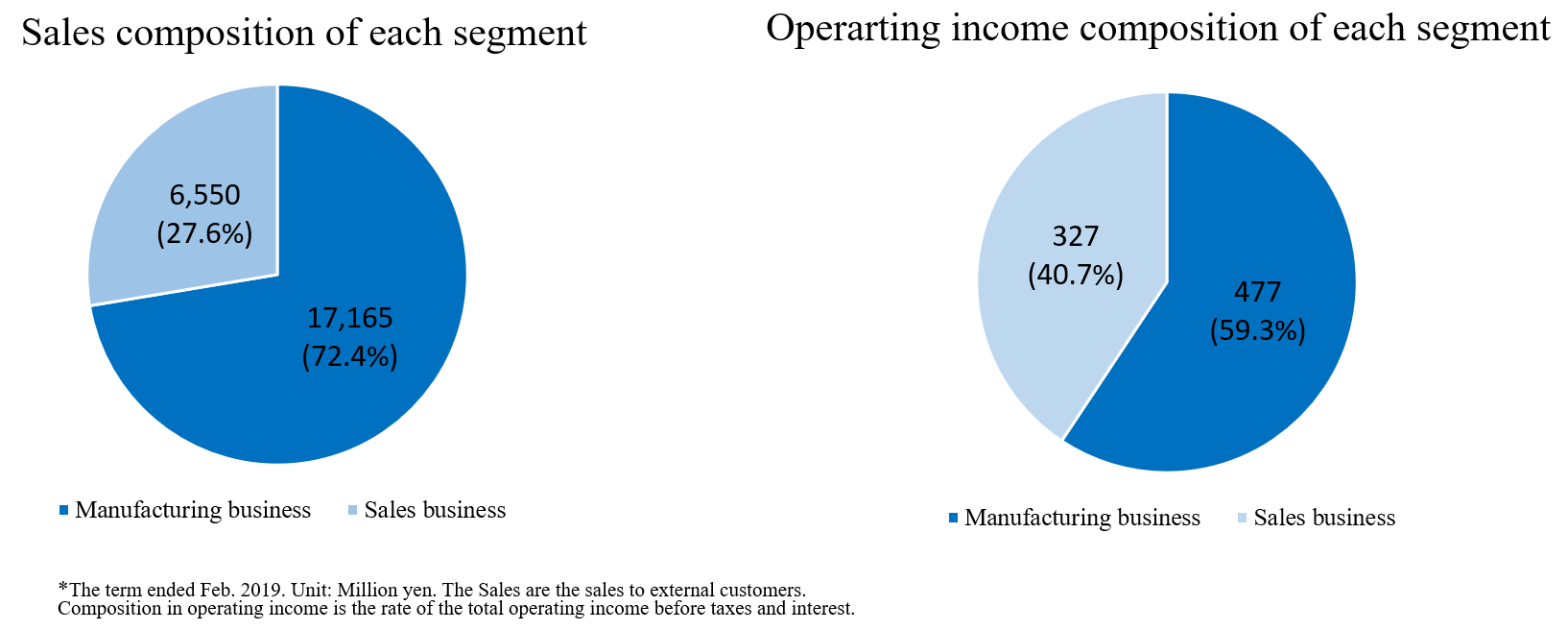

② Segments

The company has two segments: “manufacturing business segment” and “sales business segment.”

◎ Manufacturing Business Segment

Each company develops, manufactures and sells its unique products through wholesalers to supermarkets, convenience stores, drug stores, etc. in Japan.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

RAKU-YOU INC. (Adachi Ward, Tokyo) | Six factories in Japan manufacture and sell chilled shumai and chilled dumpling. It has the largest share of chilled shumai production in Japan. In the term ended February 2019, the company sold approximately 28.12 million packages of its main product, chilled shumai. |

Ohbun Co., Ltd. (Shikokuchuo City, Ehime Prefecture) | It has an independent route to procure oysters with a limited supply from Hiroshima Prefecture. Fried oysters are its leading product, but it also manufactures and sells other products such as deep-fried chicken cutlets and fried chicken breast. |

Shiroishi Kosan, Inc. (Shiroishi City, Miyagi Prefecture) | Founded in 1886. Its leading product is Shiroishi hot noodles, which are a specialty of Shiroishi City. The company also sells dry noodles and other products using traditional manufacturing methods. |

Daishow Co., Ltd. (Tokigawa-machi, Hiki-gun, Saitama Prefecture) | It is a pioneer in the peanut butter industry. “Peanut Butter Creamy” made by its own unique manufacturing methods has been continuously a long-selling product since started being sold in 1985. |

Sakuragao Shuzo K.K. (Morioka City, Iwate Prefecture) | It was established in 1973 as a collective of 10 local breweries in Iwate Prefecture. Its sake which is brewed using the skills of the biggest Toji (head brewers) group in Japan, Nanbu Toji, has a high reputation for its fruity taste. |

Yuhoku Seafood Processing Co., Ltd. (Oi-machi, Ashigarakamigun, Kanagawa Prefecture) | The company manufactures and sells negitoro and tuna slices using tuna that is immediately frozen on the ship at minus 50-60 degrees as soon as it is caught. |

JUNWA FOOD Corporation (Kumagaya City, Saitama Prefecture)

| It has constructed a perfect quality control system, including having acquired the Saitama Prefecture HACCP. Although it is a jelly manufacturing start-up company, it has an established reputation by major hypermarkets for its products’ quality and technological capabilities. |

Eisen Shuzo Co., Ltd. (Bandai-machi, Yama-gun, Fukushima Prefecture) | It was established in Aizu Wakamatsu in 1869. In a serene natural environment, the company brews delicious sake with a smooth taste that you would never get tired of drinking by employing traditional handmade techniques that have been inherited through generations to utilize the five senses to the maximum and using the crystal clear water from “the natural springs in the western foot of Mt. Bandai that has been designated as one of the Best 100 Natural Water Resources in Japan.” |

SK Foods Co., Ltd. (Yorii-machi, Osato-gun, Saitama Prefecture) | It mainly manufactures and sells chilled and frozen pork cutlet and makes products that meet customer needs. Also, it conducts direct procurement and direct sales without depending on any trading companies. |

Yamani Noguchi Suisan K. K. (Rumoi City, Hokkaido Prefecture) | For half a century, the company has manufactured and sold Hokkaido Prefecture’s specialties such as salmon jerky and herring that are prepared by its skilled workers who use unique manufacturing techniques. |

JSTT SINGAPORE PTE. LTD. (Singapore) | The company located in Singapore manufactures and sells sushi, makimono, rice balls, etc. by using fresh Japanese seafood transported by air. |

Omusubi Kororin Honpo K.K. (Azumino City, Nagano Prefecture) | Using its own freeze-dry device, it manufactures ingredients for confectionery, emergency food, etc. The company’s “Mizu Modori Mochi” (rice cakes that can be prepared by adding water) is famous for being used in the Space Shuttle Endeavour. |

Marukawa Shokuhin Co, Ltd. (Iwata City, Shizuoka Prefecture) | A famous dumpling shop in Hamamatsu area. It manufactures and sells dumplings using carefully selected ingredients and a secret recipe the company has been following since its establishment. |

PACIFIC SORBY PTE. LTD. (Singapore) | The company procures frozen seafood and fresh fish, and it processes and sells them by wholesale to hotels and hospitals in Singapore. The products the company mainly handles are frozen seafood, such as crab, lobster, shrimp and salmon, and fresh fish caught in the sea around Singapore. |

Mori Yougyojou Co., Ltd. (Ogaki City, Gifu Prefecture) | An ayu (sweetfish) farming company that runs three fisheries in Gifu Prefecture and possesses the best scale and high-level facilities among fish farming companies in Japan. As an old-established company that has been running a business for more than 50 years, it raises high-quality ayu (sweetfish) using advanced fish farming technologies, the plentiful groundwater of “the Land of Pure Water Gifu,” and the large scale farming facilities that are managed by technicians. |

◎ Sales Business Segment

Having sales and planning functions as its strengths, this segment plans and develops products that meet the consumer needs and mainly sells its products to industrial channels. Also, this segment plays a role in the expansion of sales channels through supplying the required raw materials to companies in the group and selling their products, using its unique procurement and sales routes.

(Group Companies within the Sales Business Segment)

Company Name | Features |

Yoshimura Food Co., Ltd. (Koshigaya City, Saitama Prefecture) | Mainly conducts the planning and sales of industrial food ingredients. It does not have distribution channels, but it has constructed a business model where it sends products directly to customers. |

Joy Dining Products Co., Ltd. (Koshigaya City, Saitama Prefecture) | It conducts the planning and sales of frozen foods. Also, it has direct accounts with consumer co-ops throughout Japan and utilizes them to sell the products of the group companies. |

SIN HIN FROZEN FOOD PRIVATE LIMITED (Singapore) | It procures high quality, safe and trusted frozen seafood products and processed seafood products from the influential seafood companies in various parts in Asia. |

【1-4 Characteristics and Strengths】

① The Advantage in Business Succession through Acquisition

There are influential players in the M&A, such as major food companies and investment funds; however, this company has three main points that form strong competitive advantages, which are explained below.

*Ability to Acquire Companies of Various Scales

The company does not aim to sell the companies it acquired. It aims to not only achieve short term business recovery, but also achieve sustainable growth from a medium to long term perspective. Therefore, the company can acquire a variety of SMEs, including those with a small business scale that would take time to achieve growth and those that lack management resources for growth. This point creates a huge difference between the company and other major food companies and investment funds that need the companies they will acquire to be of a certain scale. Moreover, it is not easy for investment funds aiming to generate capital gains from selling companies to gain the trust of owners and managers of food SMEs. Regarding this point, this company operating company groups with the aim of achieving sustainable growth from a medium-term perspective also has a huge advantage.

*Advanced Capability of M&A

Since its establishment, the company has worked on creating many company groups out of food-related SMEs and later has achieved re-growth of these companies. Thus, it has thorough knowledge of the market environment of the food industry, business practices and risks that are peculiar to food SMEs, and strong assessment abilities, which enable the company to choose companies that have strengths from a large number of SMEs.

Also, the company has an extremely high capability of M&A since it has great expertise and accumulated knowledge in due diligence and negotiations.

*Rich and High-Quality M&A Data through its Wide Network

The company can gather plenty of M&A data on the food SMEs since it has a wide network of financial institutions, such as city banks, regional banks, credit associations, securities companies and companies that provide M&A advisory services.

Furthermore, “the company’s specialization in the food industry” and “the reassurance that the company is not aiming to sell” are the two factors allowing the company to access not only to a huge amount of data, but also high-quality data that meets its needs.

② Core Skill: SME Support Platform

The company revitalizes the group companies through the “SME Support Platform” in which each group company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds or sales channels are supplemented. These achievements are highly evaluated.

【1-5 Dividend Policy and Shareholders’ Benefit System】

(Dividend Policy)

Although payout to shareholders is one of the important business challenges, it is thought that allocating the cash to investment in the facilities to actively expand the business and to strengthen the business foundation by expanding the platform is what would lead to the highest payout to the shareholders because the company is considered to be within the growth process.

Therefore, the company has not provided dividend payout to its shareholders since its establishment and as of the time being, it plans to continue on using the cash to invest in business expansion and as necessary operating capital for the existing companies. The company is planning to look into providing dividend payouts to its shareholders while considering the operating performance and financial conditions for each business year.

(Shareholders’ Benefit System)

The company offers special benefits to the shareholders mentioned below according to the number of shares they hold.

Number of Shares | Number of Times to Receive Special Benefits | Special Benefit Content |

300 shares to 499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 800 yen from the group companies |

500 shares to 2,499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 1,500 yen from the group companies |

2,500 shares or more | Twice a year (Shareholders recorded in the shareholder register as of the end of February and on the 31st of August of every year) | Products worth 4,000 yen from the group companies each time |

Special Benefit Content(the photo is for illustrative purposes only)

|

(According to the company’s website)

2. Financial Results

(1) Overview of the financial results for the fiscal year ended February 2019

① Overview of consolidated financial results

| FY 2/18 | Ratio to sales | FY 2/19 | Ratio to sales | YOY | Difference from the initial estimate | Difference from the revised estimate |

Net sales | 20,035 | 100.0% | 23,716 | 100.0% | +18.4% | +1.9% | -1.0% |

Gross profit | 4,295 | 21.7% | 5,087 | 21.5% | +18.4% | - | - |

SG&A expenses | 3,801 | 18.7% | 4,732 | 20.0% | +24.5% | - | - |

Operating income | 494 | 3.0% | 354 | 1.5% | -28.2% | -36.0% | +7.6% |

Ordinary income | 554 | 3.3% | 420 | 1.8% | -24.2% | -27.5% | +9.4% |

Net income | 419 | 2.2% | 263 | 1.1% | -37.1% | -27.4% | +14.8% |

EBITDA | 902 | 5.0% | 963 | 4.1% | +6.8% | -3.7% | +5.9% |

*Unit: Million yen. Net income is profit attributable to owners of the parent. The revised estimates were announced in October 2018.

Sales grew, but profit dropped from the previous term. The values followed the revised estimate.

Sales increased by 18.4% year on year to 23,717 million yen. The 4 companies acquired through M&A contributed to this result.

Operating income dropped by 28.2% year on year to 354 million yen due to the decline in productivity of RAKU-YOU INC. and the skyrocketing prices of ingredients and materials.

In October 2018, the earnings estimate was revised, considering the decline in productivity of RAKU-YOU INC., cost rise from the skyrocketing prices of ingredients and materials, etc. However, sales and profit were both almost as planned.

Sales were slightly less than the revised estimate due to the decrease in sales of shumai of RAKU-YOU INC.

Operating income exceeded the revised estimate, despite the decline in productivity of RAKU-YOU, since other group companies performed well.

② Results of each segment

| FY 2/18 | Composition ratio | FY 2/19 | Composition ratio | YOY |

Net sales |

|

|

|

|

|

Manufacturing business | 15,306 | 76.4% | 17,165 | 72.4% | +12.1% |

Sales business | 4,728 | 23.6% | 6,550 | 27.6% | +38.5% |

Total | 20,035 | 100.0% | 23,716 | 100.0% | +18.4% |

Operating income |

|

|

|

|

|

Manufacturing business | 682 | 4.5% | 477 | 2.8% | -30.0% |

Sales business | 225 | 4.8% | 327 | 5.0% | +45.5% |

Adjusted amount | -412 | - | -449 | - | - |

Total | 494 | 2.5% | 354 | 1.5% | -28.2% |

*Unit: Million yen. The composition ratio of operating income means the ratio of operating income to sales.

*Manufacturing business segment

RAKU-YOU saw a decline in sales of its core product, chilled shumai, due to the rise in prices.

Procured products and deep-fried oyster from Ohbun performed well.

JUNWA FOOD sold national brand products well.

The four companies acquired through M&A contributed to this result.

*Sales business segment

SIN HIN that joined the corporate group contributed, and Yoshimura Food saw a significant sales growth of frozen food (ingredients).

③ Financial conditions and cash flow

◎ Main balance sheet

| End of FY 2/18 | End of FY 2/19 |

| End of FY 2/18 | End of FY 2/19 |

Current assets | 6,903 | 9,691 | Current liabilities | 4,850 | 7,248 |

Cash and deposits | 1,598 | 2,085 | Notes and accounts payable - trade | 1,559 | 2,298 |

Notes and accounts receivable - trade | 2,752 | 3,525 | Short term interest-bearing liabilities | 2,181 | 3,565 |

Inventories | 2,427 | 3,766 | Non-current liabilities | 1,765 | 3,336 |

Non-current assets | 3,825 | 5,488 | Long term interest-bearing liabilities | 1,571 | 3,183 |

Property, plant and equipment | 2,115 | 2,312 | Liabilities | 6,615 | 10,585 |

Intangible assets | 1,379 | 2,794 | Net assets | 4,112 | 4,595 |

Investments and other assets | 330 | 382 | Retained earnings | 1,775 | 2,038 |

Total assets | 10,728 | 15,180 | Total liabilities and net assets | 10,728 | 15,180 |

|

|

| Total interest-bearing liabilities | 3,753 | 6,748 |

*Unit: Million yen

Thanks to M&A, etc., total assets grew 4.4 billion yen from the end of the previous term to 15.1 billion yen.

Interest-bearing liabilities augmented 2.9 billion yen from the end of the previous term, and total liabilities rose 3.9 billion yen from the end of the previous term to 10.5 billion yen.

Net assets grew 400 million yen from the end of the previous term to 4.5 billion yen as retained earnings increased although foreign currency translation adjustment decreased.

Capital-to-asset ratio dropped by 10% from the previous term to 28.3%.

◎ Cash flows

| FY 2/18 | FY 2/19 | Change |

Operating CF | 257 | 250 | -7 |

Investing CF | -1,581 | -2,075 | -494 |

Free CF | -1,323 | -1,824 | -501 |

Financing CF | 1,150 | 2,370 | +1,220 |

Balance of cash and cash equivalents | 1,545 | 2,072 | +527 |

*Unit: Million yen

(2) Forecasts of the financial results for the fiscal year ending February 2020

*Full-year earnings forecast

| FY 2/19 | Ratio to sales | FY 2/20 (Estimate) | Ratio to sales | YOY |

Net sales | 23,716 | 100.0% | 28,181 | 100.0% | +18.8% |

Operating income | 354 | 1.5% | 645 | 2.3% | +82.0% |

Ordinary income | 420 | 1.8% | 660 | 2.3% | +57.1% |

Net income | 263 | 1.1% | 341 | 1.2% | +29.5% |

EBITDA | 963 | 4.1% | 1,165 | 4.1% | +20.9% |

*Unit: Million yen. The estimates are provided by the company.

Sales and profit will grow. Sales and operating income are estimated to hit a record high.

Sales are projected to rise by 18.8% year on year to 28,181 million yen. In addition to the growth of existing group companies, SIN HIN will fully contribute to the results.

Operating income is forecasted to rise by 82.0% year on year to 645 million yen. The productivity of RAKU-YOU will be improved, and SIN HIN will contribute.

Both sales and operating income are expected to mark a record high.

The growth and expenses due to M&A are not taken into account.

<Regarding the opening of the second Niigata factory of RAKU-YOU>

The full-scale operation of the second Niigata factory of RAKU-YOU started in March 2019.

Since it can produce only gyoza (jiaozi, a kind of Chinese dumpling) continuously, the production cost for gyoza can be reduced, and the increase in output per hour and productivity will allow the company to distribute products in Kanto, Kansai, Tohoku, etc. Thus, the new factory will enhance production capacity and productivity dramatically.

Since the opening of the second Niigata factory will reduce the burden on the Chichibu factory line, it will be able to develop and produce profitable products, such as large-sized shumai and 10 pieces of shumai, and correct the imbalance between manufacturing lines, resulting in a significant synergy with the main production site, Chichibu Factory.

The investment amount will be about 230 million yen. According to the company, the investment amount was not so large since there had been already a factory building.

3. Future Growth Strategy

Yoshimura Food Holdings has established an original business model in the food industry, and pursues growth with two engines: “the increase of group companies” and “the expansion of business of existing group companies.”

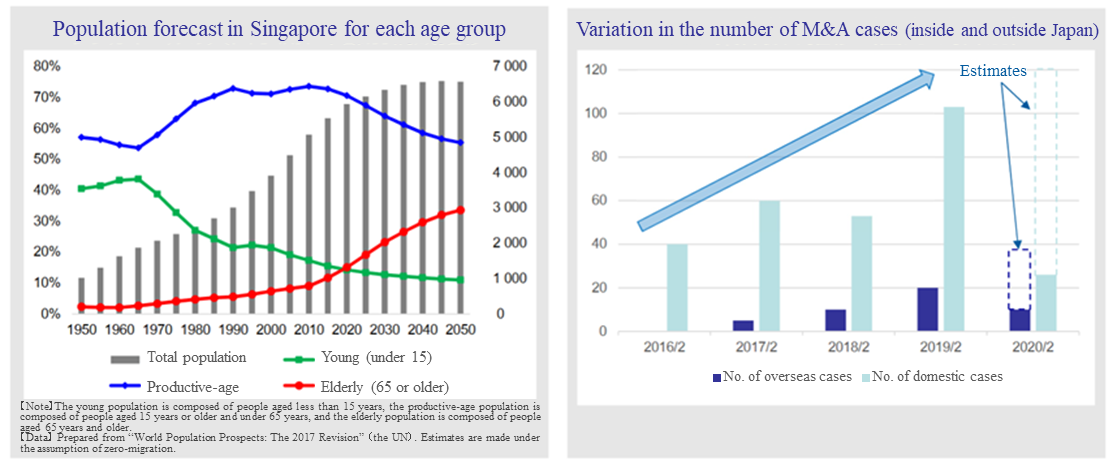

① Growth through the increase in the number of group companies

As mentioned in Section 1-2 “Market Environment and the Background of the Company’s Establishment,” the problem of business succession is getting more serious. The company gave over 100 M&A proposals in the term ended February 2019. As you can see, the number of M&A cases is increasing.

The ratio of cases attributable to the lack of successors is growing as well.

Due to the external environment and the increase in popularity of the company through listing, the number of M&A cases is expected to keep increasing. By taking advantage of the function to deal with business succession, the company will surely increase M&A.

Yoshimura Food Holdings acquired two Singaporean enterprises, JSTT in 2017 and SIN HIN in 2018, and then PACIFIC SORBY PTE. LTD. in 2019.

It will pursue growth through M&A outside Japan as well.

In Singapore, the aging of the population has been accelerated since 2015, and the productive-age population is estimated to decline. Therefore, the needs for M&A are expected to grow due to the lack of successors, similarly to the situation in Japan.

Over the past several years, the number of cross-border transactions between Yoshimura Food Holdings and overseas enterprises has been growing. Despite the aging population, which is an external factor, the company considers that its active stance is recognized outside Japan as it has acquired JSTT and SIN HIN.

Since Taiwanese enterprises are suffering from the lack of successors as well, the same kinds of needs exist there. Accordingly, the Taiwanese market is considered promising.

(Taken from the reference material of the company)

② Growth through the expansion of business of existing group companies

The company will keep brushing up the mutual complement and growth functions of SME Support Platform and will strongly support new group companies while expanding operation of the existing businesses.

The company will work on the expansion of its overseas business as well based on this growth strategy.

JSTT sells sushi and rice balls produced at its own factory as well as importing and selling Japanese products at the sushi section of major supermarkets in Singapore. It also handles or sells the jelly of JUNWA FOOD, the sake of Sakuragao Shuzo, the furikake (dry Japanese seasoning) of Omusubi kororin, the salmon roes of Yamani Noguchi Suisan, the deep-fried oyster of Ohbun, the peanut butter of Daishow, and so on.

SIN HIN procures high-quality frozen seafood from major suppliers in Asia and sells it to wholesalers, retailers, restaurants, etc. in Singapore and other Asian countries. SIN HIN also supplies ingredients for sushi to JSTT, contributing to the procurement cost reduction of JSTT, and sells the jelly of JUNWA FOOD to large supermarkets in Singapore and major bakery shops in Singapore.

Meanwhile, PACIFIC SORBY, which became a group company in April 2019, sells ingredients processed in-house to the clients of SIN HIN and proceeds with joint purchase with SIN HIN. In addition, the company aims to sell the sushi and rice balls produced by JSTT and the products of Japanese group companies via PACIFIC SORBY’s sales channels to hotels and hospitals. Further, the company started selling their products to SIN HIN’s customer.

In such a way, Yoshimura Food Holdings aims to expand its business further in Asia in which market is expected to keep growing, and it established YOSHIMURA FOOD HOLDINGS ASIA PTE. LTD. in Singapore in April 2019 to manage local business by establishing an efficient, robust management system.

The company will apply its business model conducted in Japan, which is to grow business through M&A and synergy using SME Support Platform, to Asian markets based in Singapore.

The company is considering to list in overseas markets, such as Singapore Exchange (SGX) and Hong Kong Exchanges and Clearing, and aims to grow by enhancing its capability of fund procurement, credibility, and popularity.

4. Interview with CEO Yoshimura

We asked the representative director and CEO Yoshimura about his company’s role, the current state of Yoshimura Food Holdings Group, the company’s superiorities and challenges, and a message to shareholders and investors.

The company’s role in the stock market

Our company’s role is to raise funds and take over capital from SMEs which are facing the difficulty in finding successors.

If we separate the capital and management of SMEs – in other words, if we take responsibility for companies which have an owner-president but no successors, and improve the management to increase the company’s value, the owners who left the responsibility to us, the employees, the respective regions, and we can become happy.

I had such thoughts from the beginnings in this line of business and initially worked with my own personal funds. After that, I received funds from companies along with public and private funds which sympathized with my thoughts.

In the future, we would like to take advantage of the merits of listing in order to raise funds, and we also would like to accept funds from a wider range of investors.

For SMEs, our company is a unique receptacle of funds and a provider of equity, while for investors, it is a unique provider of investment opportunities for SMEs.

Recognizing the needs of both SMEs and investors accurately, our company takes up both of them and creates great value by circulating funds.

We would like to strengthen our ability to raise funds through the use of capital markets in order to further increase the aforementioned value.

Currently, a loan about four times larger will be attached if you provide one equity, in the case of a listed company.

For instance, if we could raise 3 billion yen, we could secure a total investment limit of 15 billion yen along with a loan of 12 billion yen, meaning that we could level-up by one or two stages and expand the company diversely as a receptacle of SMEs’ capital.

In that sense, we would like to firmly develop our IR activities and foster the growth of our supporters in order for you to further understand the significance of our listing and our potential for future growth.

The Current State of Yoshimura Food Holdings Group

To express the current state of our company, one could say with an oft-used expression, “There are 18 subsidiaries under the holding company Yoshimura Food Holdings Group, and we will continue to expand by growing our subsidiaries through M&A” – but in reality, this is not the case.

A parent company acquiring a subsidiary is not a significant issue, but what matters is how to invigorate SMEs with all their strengths and weaknesses through grouping and integration. In order to achieve this, our holding company functions and involves SMEs which have good management resources but are faced with the difficulty in finding successors, and that developed the current state of Yoshimura Food Holdings Group by consolidating enterprises through the “SME support network.”

Normally, I think that it is common for the parent company to send personnel to its subsidiaries to observe how management is being carried out when a holding company carries out M&A.

Similarly, the owner-manager decides to retire and the manager newly chosen by our company takes up the post, in many of our company’s cases as well, after our company takes over responsibility of a company from its owner. In addition to that, we also invite talented people from each of the group’s companies – the type of people that can bring out the value of the group as a whole well into the future – to Yoshimura Food Holdings. We would like to provide an opportunity for such people to see the group as a whole and to grow into management leaders in holdings or in group companies in the future.

These unique efforts are what I would like people from the outside world to know about the current state of Yoshimura Food Holdings Group.

I would like you to observe that growth is taking place steadily across the entire group rather than looking at individual group companies.

It is very difficult for all of the group’s food SMEs to grow steadily year after year. For some companies, we would like to concentrate our efforts on their business because their environment is good this year. With some other companies enduring hardships, we will wait for a better timing, seeing the chance for growth in the medium/long term.

We are often asked to provide the quarterly sales and profit growth rates for each individual company, but the conclusion would be that some companies are good and others are bad.

Moreover, many businesses are changing rapidly as we expand our group’s companies and continue operation of the SME support network, meaning that there are many cases in which a comparison with last year is unnecessary.

As I mentioned earlier, our group is completely different from typical holding companies in its origin and the way our management thinks. Therefore, one should look at how our group’s SMEs, with all their strengths and weaknesses, are invigorated through grouping and integration and are contributing to the steady growth of the group as a whole, rather than looking at our group’s individual companies.

Reasons for choosing companies, differences from investment funds, our company’s superiorities/strong barriers to entry

Aspects such as whether they have good products or whether they have brand power are important among the criteria for selecting a company to join our group, but it is also important to consider, “How much it costs to acquire and invigorate that company.”

Starting at the stage when a possible acquisition case has been introduced to us, we envision an ideal state of that company and investigate how much effort and work it would take to transform that company into that state, and then consider the price we would have to pay to acquire that company. Since there are many who simply want to sell, we do not acquire companies if the price is not right or if they are expected to continue getting worse despite our various efforts, no matter how low the price is.

However, in extreme cases in which the associated costs are not too high, for instance, we can acquire companies at a considerably low price even if they are not projected to bring any growth in sales or profits. This is because there are some companies we think should not go out of business although it may be difficult for them to increase sales since the environment is highly competitive.

Such companies are usually not acquired by investment funds or large companies. Therefore, I think that this is a task we have to undertake.

On the other hand, there are companies which change significantly after considerable time and effort following their acquisition by us, as well as those which are in fact fantastic companies and can steadily increase sales and profits without the need for too much time or effort although the acquisition price is high.

Therefore, the range of SMEs which we can take responsibility for is far wider than that for investment funds and large companies.

When I established this company, I wanted to do the type of work which investment funds could not do.

In terms of gaining owners’ trust, we think that our company's overwhelming superiority and an extremely strong barrier to entry are that our company has a strong management foundation, is listed on the first section of the stock exchange, and will not sell even after carrying out M&A, as well as the achievement of invigoration through our SME support network after introducing SMEs which face the difficulty in finding successors into our group.

Growth strategy: Acceleration of overseas expansion

Since 2017, we have brought three Singaporean companies into our group. The number of SMEs is smaller in Singapore than in Japan, but there is a rooted culture of buying and selling companies in Singapore. The difficulty in finding successors is also prominent in Singapore, making it a highly attractive market.

Going forward, we will pursue further growth overseas through M&A. In addition, introducing the products of our group’s companies to Singaporean markets would also accelerate the growth.

Moreover, we will list “YOSHIMURA FOOD HOLDINGS ASIA,” which we have established as a regional headquarters, and aim for speedy business operation not only in Singapore, but also in growing markets in Thailand, Taiwan, Vietnam, the Philippines, Malaysia and Indonesia.

Target industries: Regarding non-food industries

We will first focus on the food industry.

If we were to declare that we will target SMEs from all industries, I think we would receive a large number of inquiries. However, if we take the best offers from those, we would end up solely with food companies because our current base is the food industry and we think that it would create a sort of synergy.

If there emerges a large number of reasonable offers that can be managed and supported through SME Support Platform in other industries due to changes in the environment, we may consider taking the opportunity.

Challenges: Human resources development

In order to accelerate the growth speed, our most important task is to develop project managers who can properly execute PMI*.

Although creating and running an organization comprised of owners’ SMEs is something we have been doing until now, experience means so much in this line of work that we will have to carry out in-house training and create growth within our company.

In a management sense, when building up a company, we have to be able to do business at the same time as being very active and strongly numbers-oriented. In addition, we have to have soft-hearted communication, so to speak, with on-site employees. Thus, as I mentioned earlier, our shortcut is to pick up and develop talented people from within, who can eventually create value for the entire group, rather than recruiting from outside.

It may take some time, but we would like to continue working steadily on this.

*PMI (Post Merger Integration): Integration process after M&A. This refers to the process of establishing and promoting a management structure that supports improvement in corporate value and long-term growth in order to realize the synergy which was originally planned to be created by the integration of management under the new organizational system. The success of M&A largely depends on the quality of PMI.

Message to shareholders and investors

We would like investors who understand our business and will retain stocks in the medium/long term to be our shareholders.

In other words, as a message to shareholders and investors who are our partners and our supporters, I would like to say that there is a very high possibility that big opportunities will come to our business.

There is no doubt that more and more SMEs will face the difficulty in finding successors, but then, who will be the buyers, and who will take over responsibility?

Investment funds can only buy companies which have a certain scale and foreseeable exits. Meanwhile, in the case of large companies, they can buy a company if it wants to buy a company which is already in the Tohoku market as its headquartered in Osaka plans to expand into the Tohoku region. However, without such a strategy, large companies would not be able to make such a purchase. There is a limit in this case as well.

In that respect, the range of SMEs that we can acquire is overwhelmingly wide, and we are not in competition with funds or large companies.

This means that our company has an exceedingly high chance of taking over SMEs which are facing the difficulty in finding successors since it is the only company that is listed in the first section of the stock exchange, has achieved invigoration of food SMEs, and has not done any selling off.

We would like you to understand that the environment surrounding our business is quite favorable, thanks to external factors and our advantages, and to hold our company’s shares from the mid/long-term viewpoint rather than trading them on a short-term basis.

5. Conclusions

According to CEO Yoshimura, some owners of small and medium-sized enterprises (SMEs) did not know that their companies could be sold. Although it is an extreme case, it is very difficult for business owners to sell their companies so that they tend to be skeptical about a proposal for “business transfer” when facing the difficulty in finding successors. Thus, it does not progress smoothly in most cases.

However, in the case of Yoshimura Food Holdings, the purpose of establishment is to support and energize SMEs, and it has never sold acquired companies and has energized them via SME Support Platform. It also established reliability since it is listed in the first section of Tokyo Stock Exchange. Accordingly, it is expected that the company will foster trusting relationships with business owners in a shorter period of time.

In this light, the company will further enhance its competitive advantage compared with investment funds and large companies.

We also would like to pay attention to how they will conduct fund procurement they think is necessary for their activities at the next stage.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎ Corporate Governance Report

The latest update: May 31, 2019

<Basic Policy>

Our company believes that our sustainable growth and creation of mid/long-term corporate value can be achieved especially through the trusting relationships and cooperation with our stakeholders, including shareholders, clients, business partners, employees, and local communities.

Accordingly, we consider that the most important mission in management is to keep tightening corporate governance as a base for securing the soundness, transparency, and efficiency of business administration. We will strive to secure the transparency and fairness of our company and timely disclose information to all stakeholders by streamlining the decision-making process, improving the supervisory function for business execution, strengthening the function to oversee directors, and developing an internal control system.

<Principles that have not been followed and the reasons>

Principle | Reason for not following the principle |

<Supplementary Principle 1-2-4> | We have not adopted the electronic exercise of voting rights. We do not translate convocation notices into English, either. We will think of them while considering the ratio of overseas shareholders, etc. |

<Supplementary Principle 4-1-2> | Although our company has formulated a mid-term management plan, we do not disclose it as of now because it is difficult to estimate the effects of M&A, which is the pillar of our business. From now on, we will consider announcing our mid/long-term vision for growth, so as to gain a further understanding of shareholders. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Disclosed information |

<Principle 1-4 Strategically held shares> | For the purpose of maintaining and strengthening transaction relations, we hold shares strategically to a limited extent. In this case, we judge whether or not to invest, while comprehensively considering the benefits, risks, capital costs, etc. arising out of the maintenance and strengthening of transaction relations, and whether they would contribute to the increase in our corporate value. The board of directors examines economic rationality of individual strategically held shares every year, such as whether the benefits and risks arising out of strategic holding of each stock will recoup capital cost and whether it will increase our corporate value from the mid/long-term viewpoint. We will try to reduce the number of shares we hold if we determined that the significance of holding of that stock is not sufficient. We exercise voting rights appropriately with the criteria considering whether it will lead to the increase in corporate value from the mid/long-term viewpoint or whether it will degrade the significance of shareholding. We will not agree with any proposals by the company or a shareholder that would degrade the share value. |

<Principle 5-1 Policy for promoting constructive dialogue with shareholders> | Our IR activities are led by the representative director and CEO, and operated by the management department. For shareholders and investors, we regularly hold a briefing session, targeting analysts and institutional investors, to enrich the dialogue with shareholders, and the results of each session are reported to directors and the management. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on ITO EN, LTD. (2593) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/