Bridge Report:(2884)Yoshimura Food Fiscal Year ended February 2021

Representative director and CEO Motohisa Yoshimura | Yoshimura Food Holdings K.K. (2884) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

Representative director and CEO | Motohisa Yoshimura |

Address | 18F, Fukoku Seimei Bldg., 2-2-2, Uchisaiwai-cho, Chiyoda-ku, Tokyo |

Year-end | February |

URL |

Stock Information

Share price | Shares Outstanding | Total Market Cap | ROE(Actual) | Trading Unit | |

¥779 | 23,784,595 shares | ¥18,528 million | 8.1% | 100 shares | |

DPS(Estimate) | Dividend Yield(Estimate) | EPS(Estimate) | PER(Estimate) | BPS(Actual) | PBR(Actual) |

¥0.00 | - | ¥14.59 | 53.4x | ¥192.61 | 4.0x |

*Share price is as of closing on June 11. Each number is based on the financial statement of FY 2/21.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2018 (Actual) | 20,035 | 494 | 554 | 419 | 19.19 | 0.00 |

February 2019 (Actual) | 23,716 | 354 | 420 | 263 | 12.04 | 0.00 |

February 2020 (Actual) | 29,875 | 808 | 740 | 177 | 8.02 | 0.00 |

February 2021 (Actual) | 29,289 | 488 | 752 | 323 | 14.39 | 0.00 |

February 2022 (Estimate) | 30,607 | 805 | 811 | 346 | 14.59 | 0.00 |

*Unit: Million yen. The estimated values were provided by the company.

This Bridge Report presents Yoshimura Food Holdings K.K.’s earnings results for the Fiscal Year ended February 2021and interview with CEO Yoshimura about future strategy, etc.

Table of Contents

Key Points

1.Company Overview

2. Fiscal Year ended February 2021 Earnings Results

3.Fiscal Year ending February 2022 Earnings Estimates

4. Business Strategy

5. Interview with CEO Yoshimura

6.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The company has developed an original business model in the food industry and pursues growth with two engines: “the increase in the number of group companies by M&A” and “the expansion of business of existing group companies.”

- The sales for the term ended February 2021 were 29,289 million yen, down 2.0% year on year. Amid the novel coronavirus pandemic, the domestic business remained healthy, but overseas subsidiaries saw a significant drop in sales due to the lockdown in Singapore. Operating income was 488 million yen, down 39.6% year on year. The profit from the domestic business increased 173 million yen year on year, but the profit from the overseas business, whose profit margin is high, declined significantly by 535 million yen year on year, due to the shrinkage of sales. EBITDA was 1,607 million yen, the same level as the previous term. In Singapore and Malaysia, partial lockdowns were implemented, so sales plummeted from the second quarter. As a result, both sales and profit fell below the estimates.

- For the term ending February 2022, sales are estimated to rise 4.5% year on year to 30.6 billion yen and operating income is projected to increase 64.9% year on year to 800 million yen. It is assumed that the domestic business will grow stably, and the overseas business will remain stagnant and then start recovering gradually from the second half. The growth due to new M&A is not taken into account.

- In February 2021, the company formed capital and business alliances with KOKUBU GROUP CORP. and allocated new shares to a third party, which was, KOKUBU GROUP CORP. They aim to improve their corporate value further through the cooperation utilizing Yoshimura Food Holdings’ accumulated know-how to conduct M&A of small and medium-sized food enterprises and support and energize subsidiaries and, KOKUBU GROUP’s firm business base in the wholesale and distribution fields, broad knowledge of “food,” and network with about 35,000 client firms, which have been developed for many years.

- We interviewed the Representative Director and CEO Motohisa Yoshimura about their business strategy, policy for ESG management, message to shareholders and investors, etc. As for M&A, they have been passive in most cases, but from now on, they will select target enterprises and approach them actively. In addition, the company will accelerate its growth by cooperating with alliance partners, including P&E DIRECTIONS and KOKUBU GROUP. The company is also seeking new alliance partners for improving corporate value. He said, “We hope that you will keep supporting our company that aims to support small and medium-sized enterprises and vitalize local economies by growing sales and profit and improving corporate value.”

- This term, as the previous term, sales and profit are expected to grow, but the impact of the novel coronavirus on the overseas business is significant, so the business environment will remain uncertain. Meanwhile, the company has launched more active M&A strategies, formed alliances with KOKUBU GROUP, and increased capital, developing the grounds for growth in the medium term. As mentioned in the interview with the CEO Yoshimura, they are negotiating for a new alliance in the marketing field for optimizing the value chain, so we would like to keep an eye on their news releases. In addition, we would like to expect from the concrete progress of the alliance with KOKUBU GROUP.

1.Company Overview

Yoshimura Food Holdings acquires small and medium-sized food products makers, facing various issues such as the difficulty in finding successors, through M&A at the same time as they possess excellent products and technologies. It also facilitates the growth of the entire corporate group by solving problems with their core skill, “a platform for supporting small and medium-sized enterprises (SME Support Platform),” and energizing each group company. Its strengths are the overwhelming advantage toward investment funds and large companies and the high barrier to entry. The company aims to accelerate growth through alliances. As of the end of February 2021, there are 20 major consolidated subsidiaries.

【1-1 Corporate History】

One day, a food company that was facing financial difficulties and could not find a buyer was introduced to Mr. Yoshimura, who was managing the listed companies’ fundraising and M&A in the corporate business division at Daiwa Securities Co. Ltd. and Morgan Stanley Securities Co., Ltd.

Mr. Yoshimura took on this food company and established L Partners Co., Ltd. on his own in March 2008, which was the predecessor of Yoshimura Food Holdings K.K. because he strongly felt that Japan could be more appreciated through its “food” since his MBA days in the USA while working for Daiwa Securities. Through his efforts to revitalize the company using his experience and network, he succeeded in turning a profit.

Many food SMEs started seeking help from Mr. Yoshimura upon learning about his reputation. He thought that it was possible to efficiently achieve results if the companies complemented each other in various functions, such as product development, production, and sales under a holding company system, instead of working on each company individually. Hence, he named the corporate Yoshimura Food Holdings K.K. in August 2009.

Since then, the company has continued acquiring companies facing problems with business succession or failing to handle management on their own. Due to the high reputation of the company for its unique position of not competing with major food companies and investment funds and its policy of not selling the companies it acquired, it received financing from Japan Tobacco (JT) and expanded its business. In March 2016, it was listed on the Mothers of Tokyo Stock Exchange, and in March 2017, it was listed in the first section of Tokyo Stock Exchange.

The company is pursuing further growth by acquiring not only Japanese companies, but also overseas companies in Singapore, Malaysia, etc.

【1-2 Target Social Image】

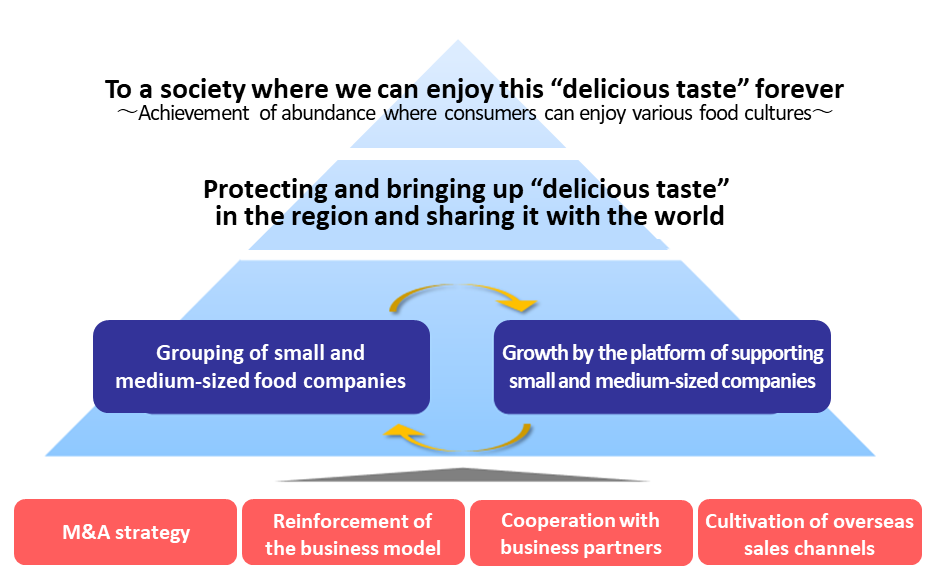

As the social meaning of its existence as an enterprise, the company decided to pursue the mission: “working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures,” and set its vision (roles to be fulfilled) and values (values they cherish).

Mission Working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures | *We believe that a society in which people can choose from various options freely according to their respective preferences and a society in which those choices are respected is affluent and happy. *We aim to achieve an affluent society in which consumers around the world can choose from a wide array of high-quality “delicious foods” freely and enjoy them. |

Vision To protect and nurture the “delicious foods” in each region, and distribute them around the world | *In order to realize “a society where we can enjoy this ‘delicious taste’ forever,” we will discover “delicious foods” that have been cherished in Japan and around the world, protect and nurture them, and deliver them to people around the world. *To do so, we will develop our own ability to find “delicious foods”, a business base for protecting “delicious foods”, functions to support the growth of “deliciousness”, and sales networks to deliver “delicious foods” to people around the world. *As a result, our company will become a global producer that promotes the cultures and diversification of foods around the world and the vitalization of local communities. |

Values To cherish individuality | *We cherish the individuality of everyone related to us. *We value the “individuality”, “new ideas”, and “desire to take on new challenges” of each employee working in our corporate group. *We value the “history”, “culture”, “employees”, “business partners”, and “local communities” of each of our group companies. *We brush up the “strengths” of our group companies, mutually make up for their “weaknesses,” and grow together. *We will contribute to the development of an affluent society with a variety of options available, by cherishing the individuality of everyone related to us. |

【1-3 Market Environment and the Background of the Company’s Establishment】

As a company aiming for supporting and revitalizing SMEs throughout Japan, Yoshimura Food Holdings explained the conditions of the food SMEs as follows:

(Investment Bridge extracted, summarized and edited the information from Yoshimura Food Holdings’ annual securities reports and reference material)

(The Conditions of the Food SMEs)

*Japanese cuisine has been highly appreciated worldwide and is attracting attention. Also, on the national level, the food manufacturing industry has been one of the largest industries based on its number of business establishments, number of employees and GDP since the 1990s and it is one of the key industries that Japan is proud of.

*99% of the companies are SMEs where each one of them has strong products and technical skills.

*However, the domestic market scale is shrinking and some of the food SMEs find it hard to survive on their own as the business environment remains stringent due to the falling birthrate and aging population.

*Therefore, many companies give up on continuing their businesses and end up choosing to close down or suspend their business.

(Conditions of the SMEs’ Business Succession)

*The average age of managers is 60.1, and it is expected that around 50% of the managers will reach the average retirement age in the upcoming 10 years as the average retirement age of managers is around 70.

*Meanwhile, 65.1%, nearly two thirds of domestic enterprises are suffering the lack of successors, and the ratio of enterprises that plan to conduct business succession is only 34% in all industries. Namely, the preparations for business succession have not progressed.

*Moreover, in 2020, the number of SMEs that suspended or discontinued business reached 49,698, and have increased rapidly for 13 years in comparison with in 2007 where that number was around 21,000.

(According to SME Agency “White Paper on Small and Medium Enterprises” (2021 Edition), Teikoku Databank, Ltd. “Analysis of the age of company presidents in Japan (2021),” Teikoku Databank, Ltd. “Survey of Trends on ‘Companies without a Successor’ in Japan” (2020), Teikoku Databank, Ltd., and small and Medium Enterprise Agency “Basic Survey on the Actual Situation of SMEs” (Report in FY 2019 [Financial results in FY 2018])

(Conditions of Business Succession of Food SMEs through Acquisition)

*Although there are increasing needs for business succession from food SMEs, the number of companies and organizations that would acquire them is small.

*The scale of many food SMEs is too small for major companies to acquire so, for investment funds’ whose primary aim is to rapidly grow independent companies and sell them off within a few years, the mature market of food SMEs tends not to be one of their investment targets.

*Under these conditions, there is a tremendous shortage in the bearers of the responsibility of taking on the business of the SMEs.

【1-4 Business Description】

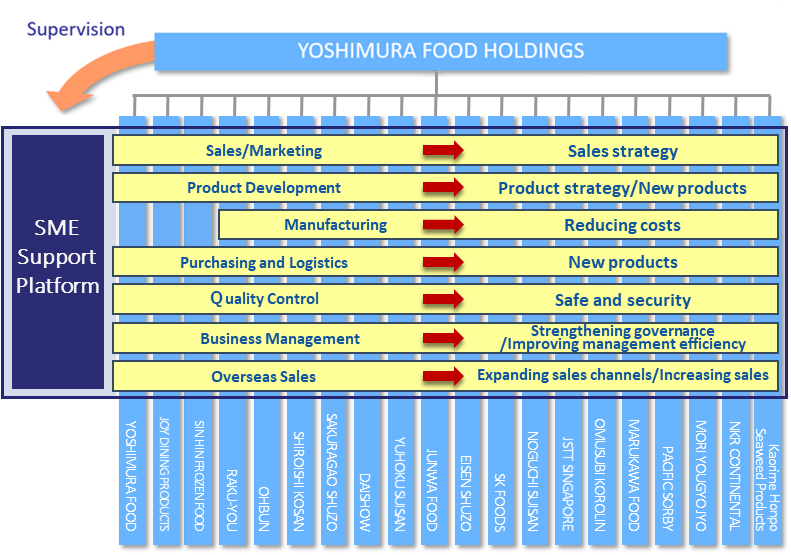

Having Yoshimura Food Holdings as its holding company, the corporate group consists of 20 group companies in February 2021.

Yoshimura Food Holdings aims to support and revitalize SMEs that manufacture and sell food products by creating a corporate group, composed of the food SMEs that are facing problems in securing a successor, through M&A. Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each company in the group. It also supports and supervises their sales, manufacturing, procurement, distribution, product development, quality control, and business management.

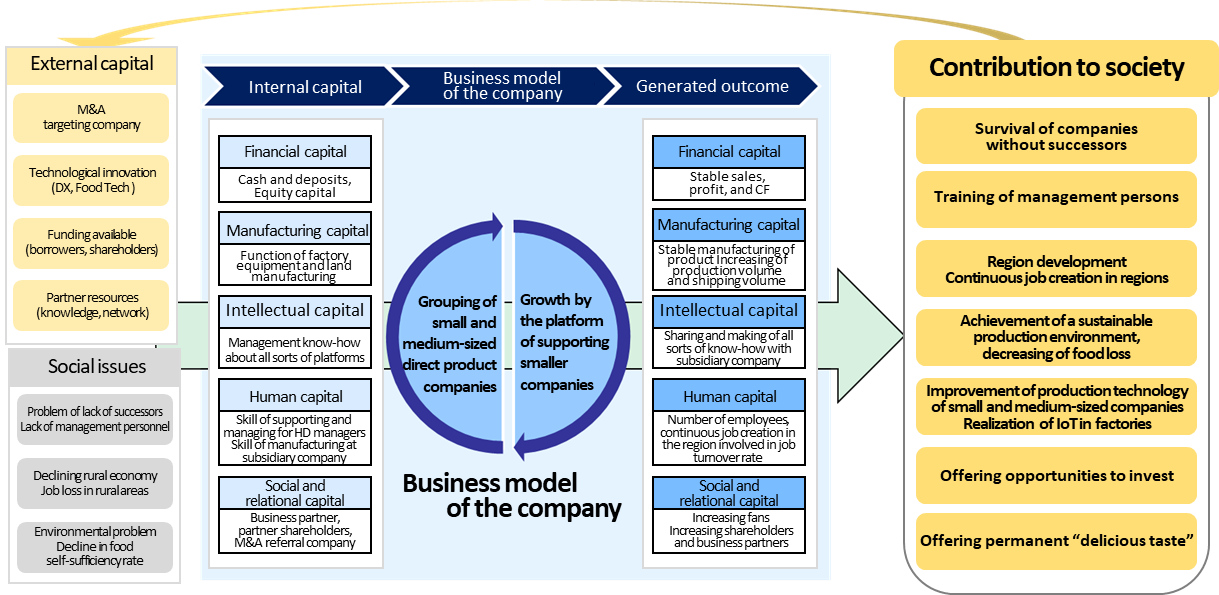

① Business Model

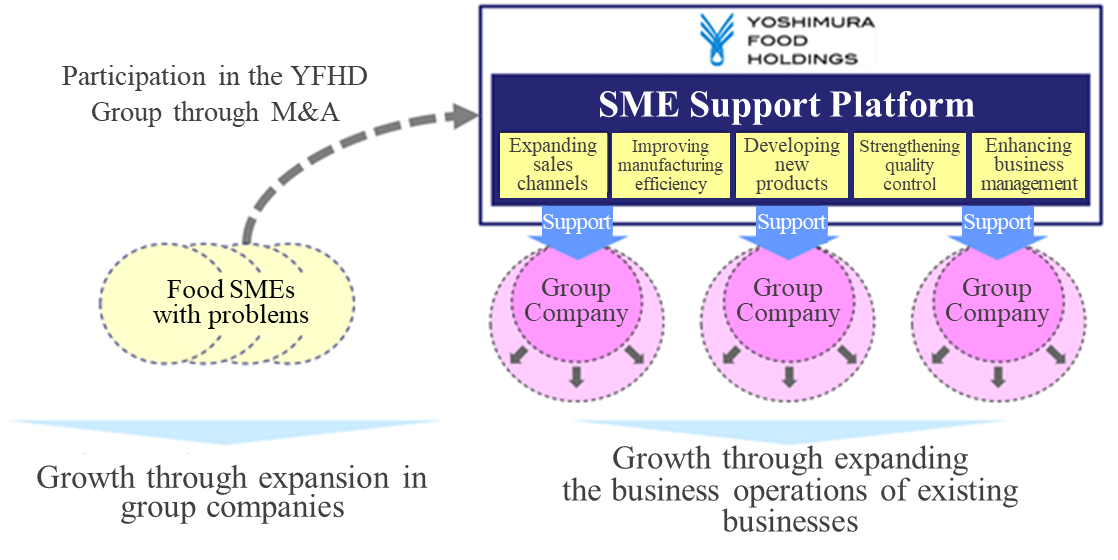

The company developed a unique business model in the food industry and is pursuing growth based on two engines.

One of them is the increase in the number of group companies through M&A.

Since its establishment in 2008, the company prevented food SMEs that had business succession and financial problems from shutting down or facing business suspension by acquiring them. Thus, it has managed to solve their problems.

As of February, 2021, the company had 20 group companies. It is recently focusing on adding not only Japanese companies to the group, but also overseas ones.

Target companies are found by mainly M&A mediating companies, local financial institutions such as regional banks, lawyers and accountants. The company plans to improve its own function for finding target companies from the aspect of costs as well.

The company has used the “indirect approach” to find business opportunities through the introductions from M&A brokerage firms, local financial institutions, such as local banks, lawyers, and accountants, but from now on, the company will enhance the “direct approach,” by producing a list of targets, approaching them to foster relationships, and utilizing the network of KOKUBU GROUP, which is an alliance partner, in order to speed up the business. The company plans to find business opportunities voluntarily and more actively.

The other one is the expansion of business of existing group companies.

Yoshimura Food Holdings supports the expansion of business operations of each company and solves problems by supervising each function of these companies, which have excellent products and technologies but could not achieve growth for reasons such as the lack of sales channels, labor shortage or poor business management, through the “SME Support Platform.”

(Taken from the reference material of the company)

What is the SME Support Platform?

The core of this unique business model is the “SME Support Platform,” a product of the company’s accumulation of know-how and achievements through its specializing in food manufacturing and sales.

As a holding company, Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each subsidiary in the group. It also aims to strengthen the business foundation of each subsidiary through the company supervisor’s horizontal supervision of its functions (sales marketing, manufacturing, procurement, distribution, product development, quality control, business management, and securing personnel) in a manner that goes beyond the company barriers and through his support for the business by building organic relations between subsidiary companies.

For example, Company A which has an excellent product but is worried about sales growth can use the sales channels and sales know-how of Company B that has a nationwide sales network. Also, it can achieve a stable financial position by using the creditworthiness of Yoshimura Food Holdings which is listed in the stock market to raise funds.

This cooperation is made to be more effective through appointing the personnel in the group with the highest levels of expertise as supervisors.

Hence, the “SME Support Platform” is a system in which each company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds, or sales channels are supplemented.

“The platform for supporting SMEs” functions effectively and produces effects with the current structure, but as subsidiaries will increase further, their know-how will be added as a new strength, and the managerial resources of the corporate group will be accumulated, bringing out a new synergy so that existing subsidiaries will be able to seize opportunities to grow business and acquire the know-how to streamline production processes.

Such scalability of the platform will fortify the business foundation of Yoshimura Food Holdings.

(Taken from the reference material of the company)

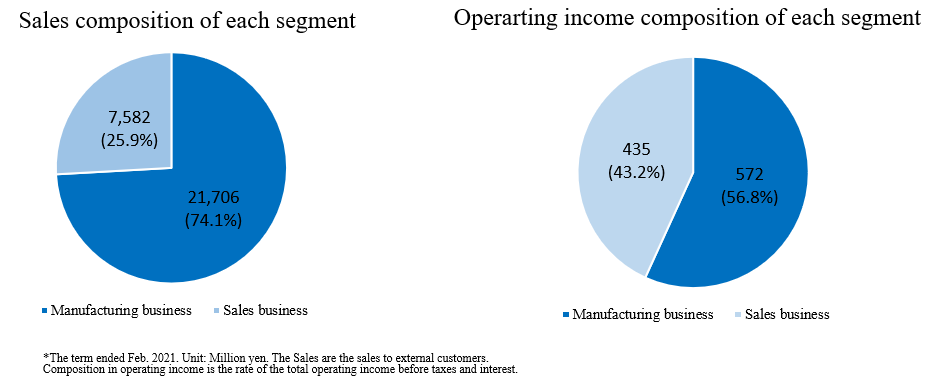

② Segments

The company has two segments: “manufacturing business segment” and “sales business segment.”

◎ Manufacturing Business Segment

Each company develops and manufactures its original products, domestic enterprises sell products to supermarkets, convenience stores, and drugstores around Japan via mainly wholesalers, and overseas enterprises sell products to hotels, restaurants, supermarkets, etc. in Singapore and Malaysia. As of the end of February 2021, there are 17 group companies as tabulated below.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

RAKU-YOU INC. (Adachi Ward, Tokyo) | Five factories in Japan manufacture and sell chilled shumai and chilled dumpling. It has the largest share of chilled shumai production in Japan. |

Daishow Co., Ltd. (Tokigawa-machi, Hiki-gun, Saitama Prefecture) | It is a pioneer in the peanut butter industry. “Peanut Butter Creamy” made by its own unique manufacturing methods has been continuously a long-selling product since started being sold in 1985. |

Shiroishi Kosan Co., Ltd. (Shiroishi City, Miyagi Prefecture) | Started business in 1886. Its core product is Shiroishi-uumen, which is a local specialty in Shiroishi-City, Miyagi Prefecture. It produces and sells the dry noodles, etc. with a traditional method. |

Sakuragao Shuzo K.K. (Morioka City, Iwate Prefecture) | It was established in 1973 as a collective of 10 local breweries in Iwate Prefecture. Its sake which is brewed using the skills of the biggest Toji (head brewers) group in Japan, Nanbu Toji, has a high reputation for its fruity taste. |

Ohbun Co., Ltd. (Shikokuchuo City, Ehime Prefecture) | It has original routes for procuring oysters harvested in Hiroshima, whose supply amount is limited. Its core product is deep-fried oyster, and it also produces and sells deep-fried soft chicken bone, deep-fried chicken breast strips, etc. |

Yuhoku Seafood Processing Co., Ltd. (Oi-machi, Ashigarakamigun, Kanagawa Prefecture) | The company manufactures and sells negitoro and tuna slices using tuna that is immediately frozen on the ship at minus 50-60 degrees as soon as it is caught. |

JUNWA FOOD Corporation (Kumagaya City, Saitama Prefecture)

| It has constructed a perfect quality control system, including having acquired the Saitama Prefecture HACCP. Although it is a jelly manufacturing start-up company, it has an established reputation by major hypermarkets for its products’ quality and technological capabilities. |

Eisen Shuzo Co., Ltd. (Bandai-machi, Yama-gun, Fukushima Prefecture) | It was established in Aizu Wakamatsu in 1869. In a serene natural environment, the company brews delicious sake with a smooth taste that you would never get tired of drinking by employing traditional handmade techniques that have been inherited through generations to utilize the five senses to the maximum and using the crystal clear water from “the natural springs in the western foot of Mt. Bandai that has been designated as one of the Best 100 Natural Water Resources in Japan.”

|

SK Foods Co., Ltd. (Yorii-machi, Osato-gun, Saitama Prefecture) | It mainly manufactures and sells chilled and frozen pork cutlet and makes products that meet customer needs. Also, it conducts direct procurement and direct sales without depending on any trading companies. |

Yamani Noguchi Suisan K. K. (Rumoi City, Hokkaido Prefecture) | For half a century, the company has manufactured and sold Hokkaido Prefecture’s specialties such as salmon jerky and herring that are prepared by its skilled workers who use unique manufacturing techniques. |

JSTT SINGAPORE PTE. LTD. (Singapore) | The company located in Singapore manufactures and sells sushi, makimono, rice balls, etc. by using fresh Japanese seafood transported by air. |

Omusubi Kororin Honpo K.K. (Azumino City, Nagano Prefecture) | Using its own freeze-dry device, it manufactures ingredients for confectionery, emergency food, etc. The company’s “Mizu Modori Mochi” (rice cakes that can be prepared by adding water) is famous for being used in the Space Shuttle Endeavour. |

Marukawa Shokuhin Co, Ltd. (Iwata City, Shizuoka Prefecture) | A famous dumpling shop in Hamamatsu area. It manufactures and sells dumplings using carefully selected ingredients and a secret recipe the company has been following since its establishment. |

PACIFIC SORBY PTE. LTD. (Singapore) | It processes and wholesales chilled and frozen seafood products in Singapore. |

Mori Yougyojou Co., Ltd. (Ogaki City, Gifu Prefecture) | The company’s harvest amount of farmed ayu (sweetfish) is top-class in Japan. It has nurtured the original know-how to collect roe, incubate them, grow and ship fish stably. In addition, it possesses the technology to make fish give birth to male or female fish. |

NKR CONTINENTAL PTE. LTD. (Singapore) | In Singapore and Malaysia, where its subsidiary is located, the company manufactures, imports, sells, designs, installs, and maintains kitchen equipment. |

Kaorime Honpo Co., Ltd. (Izumo City, Shimane Prefecture) | It produces a wide array of high-quality products ranging from original products to OEM ones, including soft dried seaweed for seasoning rice, dried hijiki for seasoning rice, seaweed soup, ochazuke with seaweed, etc. |

◎ Sales Business Segment

Its strengths are sales capability and planning skills. Domestic enterprises sell products to mainly industrial catering companies, consumer cooperatives, etc., while overseas enterprises sell products to mainly supermarkets, hotels, restaurants, etc. As of the end of February 2021, group companies are the following three.

(Group Companies within the Sales Business Segment)

Company Name | Features |

Yoshimura Food Co., Ltd. (Koshigaya City, Saitama Prefecture) | Mainly conducts the planning and sales of industrial food ingredients. It does not have distribution channels, but it has constructed a business model where it sends products directly to customers. |

Joy Dining Products Co., Ltd. (Koshigaya City, Saitama Prefecture) | It conducts the planning and sales of frozen foods. Also, it has direct accounts with consumer co-ops throughout Japan and utilizes them to sell the products of the group companies. |

SIN HIN FROZEN FOOD PRIVATE LIMITED (Singapore) | It procures high quality, safe and trusted frozen seafood products and processed seafood products from the influential seafood companies in various parts in Asia. |

【1-5 Characteristics and Strengths】

①The Advantage in Business Succession through Acquisition

There are influential players in the M&A, such as major food companies and investment funds; however, this company has three main points that form strong competitive advantages, which are explained below.

*Ability to Acquire Companies of Various Scales

The company does not aim to sell the companies it acquired. It aims to not only achieve short term business recovery, but also achieve sustainable growth from a medium to long term perspective. Therefore, the company can acquire a variety of SMEs, including those with a small business scale that would take time to achieve growth and those that lack management resources for growth. This point creates a huge difference between the company and other major food companies and investment funds that need the companies they will acquire to be of a certain scale. Moreover, it is not easy for investment funds aiming to generate capital gains from selling companies to gain the trust of owners and managers of food SMEs. Regarding this point, this company operating company groups with the aim of achieving sustainable growth from a medium-term perspective also has a huge advantage.

*Advanced Capability of M&A

Since its establishment, the company has worked on creating many company groups out of food-related SMEs and later has achieved re-growth of these companies. Thus, it has thorough knowledge of the market environment of the food industry, business practices and risks that are peculiar to food SMEs, and strong assessment abilities, which enable the company to choose companies that have strengths from a large number of SMEs.

Also, the company has an extremely high capability of M&A since it has great expertise and accumulated knowledge in due diligence and negotiations.

*Rich and High-Quality M&A Data through its Wide Network

The company can gather plenty of M&A data on the food SMEs since it has a wide network of financial institutions, such as city banks, regional banks, credit associations, securities companies and companies that provide M&A advisory services.

Furthermore, “the company’s specialization in the food industry” and “the reassurance that the company is not aiming to sell” are the two factors allowing the company to access not only to a huge amount of data, but also high-quality data that meets its needs.

②Core Skill: SME Support Platform

The company revitalizes the group companies through the “SME Support Platform” in which each group company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds or sales channels are supplemented. These achievements are highly evaluated.

③Contribution to regional vitalization

The company has actively implemented the business succession, etc. of local small and medium-sized food enterprises, including Sakuragao Shuzo K. K. (Iwate Prefecture), Shiroishi Kosan Co., Ltd. (Miyagi Prefecture), and Ohbun Co., Ltd. (Ehime Prefecture), which are subsidiaries.

By utilizing the platform for supporting SMEs, it is possible to distribute attractive products that have been available only in some regions to all around Japan (and overseas) and invest in new equipment by using the funds of the corporate group. Through this, the company contributes to the regrowth of local small and medium-sized food enterprises and the vitalization of local economies.

【1-6 Dividend Policy and Shareholders’ Benefit System】

(Dividend Policy)

Although payout to shareholders is one of the important business challenges, it is thought that allocating the cash to investment in the facilities to actively expand the business and to strengthen the business foundation by expanding the platform is what would lead to the highest payout to the shareholders because the company is considered to be within the growth process.

Therefore, the company has not provided dividend payout to its shareholders since its establishment and as of the time being, it plans to continue on using the cash to invest in business expansion and as necessary operating capital for the existing companies. The company is planning to look into providing dividend payouts to its shareholders while considering the operating performance and financial conditions for each business year.

(Shareholders’ Benefit System)

The company offers special benefits to the shareholders mentioned below according to the number of shares they hold.

Number of Shares | Number of Times to Receive Special Benefits | Special Benefit Content |

300 shares to 499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 800 yen from the group companies |

500 shares to 2,499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 1,500 yen from the group companies |

2,500 shares or more | Twice a year (Shareholders recorded in the shareholder register as of the end of February and on the 31st of August of every year) | Products worth 4,000 yen from the group companies each time |

【1-7 ESG Management】

The company is working on its ESG management based on the goal mentioned above, “working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures.”

Items | Main Initiatives |

E(Environment) | Production of environmentally friendly, sustainable products *To hold the technology and know-how to produce sustainable products that do not depend on environmental changes or produce environmental burdens *To utilize a limited amount of food resources and conduct efficient production

Moriyougyojou: It supplies farmed ayu (sweetfish) stably with its original technology, while the natural resources of ayu are decreasing due to climate changes, water pollution in the rivers, etc. Yamani Noguchi Suisan: It helps reduce food loss by developing products using residue and food that do not satisfy size specs. Yuhoku Seafood Processing: It produces and sells negitoro (minced tuna and green onion) and nakaochi (tuna meat scraped from the backbone) efficiently, by effectively utilizing ingredients.

Recycling of industrial waste from the manufacturing process *Group companies: To utilize food waste by offering the waste produced during the manufacturing process to local livestock breeders and others

Reduction of power consumption *Group companies: To install LED lighting, highly efficient boilers, etc. for reducing power consumption at factories |

S(Society) | To contribute to the business continuity, by involving enterprises that have loyal fans in each region

To contribute to the diversity of food in local communities *To develop products with rigorously selected ingredients and recipes, which are strongly demanded by local consumers

Kaorime Honp It has a lion’s share in the rice seasoning market in the Chugoku region. Marukawa Shokuhin: Rigorously selected ingredients, such as fresh pork and locally grown cabbage, and secret recipes Omusubikororin Honp To develop local specialties by taking advantage of the location of Shinshu-azumino and the freeze-drying technology Eisen Shuzou: To produce refined sake from “Ryugasawa Spring Water” boasted by the local community and selected as one of the 100 best waters of Japan Daisho It does not use preservatives or colorants. Smooth texture and taste you will never get tired of. Ohbun: To procure oysters harvested in the clean sea areas of Hiroshima and conditional clean sea areas

Diversity of employees *Group companies: To prepare opportunities for female employees to flourish, and take measures for recruiting disabled and foreign workers |

G(Governance) | Support for managerial resources *To support the management of group companies, by procuring funds and training next-generation employers for them

Support with a platform for supporting SMEs *To design business plans and get involved in progress management according to situations while securing the autonomy of each group company *To establish the control section for each function, support business and manage progress as a corporate group |

The company recognizes that taking over companies that have no successors and revitalizing it as their group companies is ESG management itself.

Also, the company believes that contributing to local communities and providing value to consumers by promoting ESG management, as well as increasing the number of good companies that sympathize with the group and want to participate, and the companies and consumers that sympathize with the group and support them as shareholders, will lead to the realization of sustainable growth.

(Taken from the reference material of the company)

2. Fiscal Year ended February 2021 Earnings Results

(1) Consolidated results

| FY 2/20 | Ratio to sales | FY 2/21 | Ratio to sales | YoY | Ratio to forecast |

Net sales | 29,875 | 100.0% | 29,289 | 100.0% | -2.0% | -5.2% |

Gross profit | 6,025 | 20.2% | 6,209 | 21.2% | +3.1% | - |

SG&A expenses | 5,216 | 17.5% | 5,721 | 19.5% | +9.7% | - |

Operating income | 808 | 2.7% | 488 | 1.7% | -39.6% | -46.3% |

Ordinary income | 740 | 2.5% | 752 | 2.6% | +1.6% | -18.4% |

Net income | 177 | 0.6% | 323 | 1.1% | +82.6% | -23.0% |

EBITDA | 1,623 | 5.4% | 1,607 | 5.5% | -1.0% | -7.6% |

*Unit: Million yen. Net income is profit attributable to owners of the parent. EBITDA is calculated by adding amortization (depreciation, goodwill) and acquisition costs associated with M&A to operating income.

Sales and Operating income decreased. EBITDA is at the same level as the previous year. Both sales and profits were below the forecast.

The sales were 29,289 million yen, down 2.0% year on year. Amid the novel coronavirus pandemic, the domestic business remained healthy, but overseas subsidiaries saw a significant drop in sales due to the lockdown in Singapore. Operating income was 488 million yen, down 39.6% year on year. The profit from the domestic business increased 173 million yen year on year, but the profit from the overseas business, whose profit margin is high, declined significantly by 535 million yen year on year, due to the shrinkage of sales. EBITDA was 1,607 million yen, the same level as the previous term. In Singapore and Malaysia, partial lockdowns were implemented, so sales plummeted from the second quarter. As a result, both sales and profit fell below the estimates.

(Domestic business)

As for the domestic manufacturing business, the performance of some subsidiaries improved through the platform support. In addition, the sales toward supermarkets and mass retailers increased. As a result, sales and profit grew.

As for the domestic sales business, sales declined, but profit rose, as the sales toward co-op stores increased, but the sales for industrial catering decreased.

Consequently, the total sales of the domestic business were the same level as the previous year, and profit grew considerably.

(Overseas business)

The impact of the novel coronavirus lingered, and the sales toward retailers, including supermarkets, were stable, but the sales toward hotels and airlines decreased. As a result, sales and profit dropped considerably from the previous year.

(2) Results of each segment

| FY 2/20 | Composition ratio | FY 2/21 | Composition ratio | YoY |

Net sales |

|

|

|

|

|

Manufacturing business | 20,639 | 69.1% | 21,706 | 74.1% | +5.2% |

Sales business | 9,236 | 30.9% | 7,582 | 25.9% | -17.9% |

Total | 29,875 | 100.0% | 29,289 | 100.0% | -2.0% |

Operating income |

|

|

|

|

|

Manufacturing business | 758 | 3.7% | 572 | 2.6% | -24.5% |

Sales business | 566 | 6.1% | 435 | 5.7% | -23.1% |

Adjusted amount | -516 | - | -519 | - | - |

Total | 808 | 2.7% | 488 | 1.7% | -39.6% |

*Unit: Million yen. The composition ratio of operating income means the ratio of operating income to sales.

*Manufacturing business segment

Sales grew, but profit dropped.

The sales and profit of domestic manufacturing subsidiaries increased, as the demand from retailers, including supermarkets, grew due to the spread of COVID-19, and because Kaorime Honpo joined the corporate group.

The sales and profit of overseas manufacturing subsidiaries declined, due to the partial lockdowns in Singapore and Malaysia and the drop of sales toward hotels and airlines.

*Sales business segment

Sales and profit declined.

Due to COVID-19, domestic sales subsidiaries saw a decline in sales toward mainly industrial catering and a growth of sales toward co-ops, so profit rose.

The sales and profit of overseas sales subsidiaries decreased, due to the partial lockdowns in Singapore and the decline in export from Singapore.

(3) Financial conditions and cash flow

◎Main balance sheet

| End of 2/20 | End of 2/21 | Y to Y |

| End of 2/20 | End of 2/21 | Y to Y |

Current assets | 14,148 | 14,828 | +680 | Current liabilities | 9,749 | 7,009 | -2,740 |

Cash and deposits | 3,015 | 4,942 | +1,927 | Notes and accounts payable - trade | 2,757 | 2,465 | -292 |

Notes and accounts receivable - trade | 5,585 | 4,973 | -611 | Short term interest-bearing liabilities | 4,608 | 2,458 | -2,150 |

Inventories | 5,350 | 4,681 | -669 | Non-current liabilities | 7,449 | 8,821 | +1,371 |

Non-current assets | 9,729 | 8,806 | -922 | Long term interest-bearing liabilities | 7,119 | 8,621 | +1,501 |

Property, plant and equipment | 4,128 | 3,843 | -284 | Liabilities | 17,199 | 15,831 | -1,368 |

Intangible assets | 4,811 | 4,264 | -546 | Net assets | 6,678 | 7,804 | +1,126 |

Investments and other assets | 789 | 698 | -91 | Retained earnings | 2,216 | 2,539 | +323 |

Total assets | 23,877 | 23,635 | -241 | Total liabilities and net assets | 23,877 | 23,635 | -241 |

|

|

|

| Total interest-bearing liabilities | 11,728 | 11,079 | -648 |

*Unit: Million yen

Total assets decreased 241 million yen from the end of the previous term to 23.6 billion yen, as cash and deposits increased through the issuance of new shares, but trade receivables, inventories, and intangible assets declined.

Total liabilities dropped 1.3 billion yen to 15.8 billion yen, due to the decrease in interest-bearing liabilities, etc.

Net assets rose 1.1 billion yen to 7.8 billion yen, due to the increases in capital and capital reserves through the issuance of new shares, the growth of retained earnings, etc.

The equity capital ratio increased 5.1% from the previous term to 19.4%.

◎Cash flows

| FY 2/20 | FY 2/21 | Change |

Operating CF | 603 | 2,092 | +1,489 |

Investing CF | -5,004 | -387 | +4,616 |

Free CF | -4,401 | 1,704 | +6,106 |

Financing CF | 4,816 | 359 | -4,457 |

Balance of cash and cash equivalents | 2,495 | 4,544 | +2,048 |

*Unit: Million yen

The surplus of operating CF expanded due to the decline in inventories, etc. The deficit of investing CF shrank, as the expenditure for acquiring the shares of subsidiaries through the change in the scope of consolidation decreased from the previous term. Free CF turned positive.

The surplus of financing CF shrank, as short-term debts decreased although there were revenues from the issuance of new shares.

The cash position has risen.

【2-4 Topics】

(1) Alliance with KOKUBU GROUP CORP.

In February 2021, the company announced that it would form capital and business alliances with KOKUBU GROUP CORP. and allocate new shares to a third party, that is, KOKUBU GROUP.

(Outline of KOKUBU GROUP CORP.)

KOKUBU GROUP CORP. is a top-class wholesaler of alcoholic beverages and food products that has been involved in the distribution of foods for 300 years since the start-up in 1712.

As a “food marketing company,” it has a broad nationwide network (about 35,000 client companies and 10,000 partner manufacturers). In addition, under the management policy: “community-based, nationwide wholesale,” it cements the relationships with local producers and enterprises, supports a variety of local food cultures and attractive food products, and vitalize local economies with food products.

The company is located in Nihonbashi, Chuo-ku, Tokyo. For the term ended December 2019, sales were 1.7 trillion yen, operating income was 2.2 billion yen, total assets were 708.8 billion yen, and net assets were 95.9 billion yen.

Yoshimura Food Holdings and KOKUBU GROUP decided to form capital and business alliances, because their ideas and values for business are consistent with each other as “both companies aim to protect and nurture local foods and deliver them around Japan” and Yoshimura Food Holdings, which supports the business administration of small and medium-sized food enterprises, can proceed with mid/long-term business strategies, improve corporate value, and fortify its financial base by increasing capital through the allocation of new shares to a third party, by fostering a close relationship with KOKUBU GROUP, which is an independent wholesaler.

(Purposes in the alliance)

Through this alliance, Yoshimura Food Holdings believes that mainly the following merits can be shared.

☆ | To approach small and medium-sized food enterprises that could not be contacted by Yoshimura Food Holdings alone, by utilizing KOKUBU GROUP’s robust network around Japan. |

☆ | To find enterprises that have excellent products and know-how, but lack successors and enterprises that cannot grow any further by themselves and further promote M&A. |

☆ | After developing a corporate group through M&A, they jointly support the group by utilizing the resources of Yoshimura Food Holdings and KOKUBU GROUP, and facilitate further growth. |

☆ | To enhance the sale of products of Yoshimura Food Holdings Group by utilizing the nationwide sales network of KOKUBU GROUP (marketing agency and expansion of sales channels and marketing areas by KOKUBU GROUP). |

☆ | To streamline the logistics and warehousing functions by utilizing the nationwide and overseas product supply networks and the know-how for supply chain management. |

☆ | To reduce procurement costs. |

☆ | To develop products collaboratively. |

☆ | To strengthen the marketing and merchandising functions. |

They aim to improve their corporate value further through the cooperation utilizing Yoshimura Food Holdings’ accumulated know-how to conduct M&A of small and medium-sized food enterprises and support and energize subsidiaries and, KOKUBU GROUP’s firm business base in the wholesale and distribution fields, broad knowledge of “food,” and network with about 35,000 client firms, which have been developed for many years as a “food marketing company”.

(Details of the alliance)

① Details of the business alliance

① Cooperation in supporting and vitalizing small and medium-sized food enterprises in Japan | The two companies will cooperatively support and vitalize small and medium-sized food enterprises that are on the verge of going out of business due to the lack of successors although they possess excellent products and know-how or cannot take full advantage of their strengths. Yoshimura Food Holdings will acquire such enterprises as group companies through M&A, allow SMEs that should survive to continue business, protect products, employment, and business partners, and contribute to the maintenance and development of local economies, by combining its skills for business administration and production management and KOKUBU GROUP’s sales capability, distribution know-how, product development skills, and purchase capacity. |

② Cooperation in developing, producing, improving, and selling local products | They will grasp the needs for product development from clients of both companies, develop products by utilizing the product development know-how of the two companies, select manufacturers by using the networks of both companies, manufacture products by utilizing Yoshimura Food Holdings’ abilities to rationalize manufacturing processes and manage quality, and sell products by utilizing the sales and distribution networks of KOKUBU GROUP. As for the products that are demanded by clients of KOKUBU GROUP and can be produced by the Yoshimura Food Holdings Group, the group will undertake production, and sell products via the sales and distribution networks of KOKUBU GROUP, to improve the business performance of both companies. |

③ Cooperation in the supply of products, including ingredients, materials, and consumables, from KOKUBU GROUP to Yoshimura Food Holdings Group and the provision of services, including marketing agency and support services | By utilizing KOKUBU GROUP’s network for purchasing ingredients, materials, consumables, etc., they aim to reduce procurement costs of Yoshimura Food Holdings. By taking advantage of KOKUBU GROUP’s nationwide sales network and services for supporting sales and marketing agency, they aim to increase sales of Yoshimura Food Holdings. |

④ Cooperation in distribution and warehousing in Japan | By outsourcing the distribution and warehousing tasks, which have been outsourced to external enterprises, to KOKUBU GROUP, Yoshimura Food Holdings Group aims to streamline these tasks. |

⑤Cooperation in distribution, warehousing, development, manufacturing, improvement, and sale of products overseas (ASEAN) | They will discuss the outsourcing of distribution and warehousing tasks in Singapore from Yoshimura Food Holdings to KOKUBU GROUP. In addition, they will share the clients in ASEAN countries, and promote the sale, development, manufacturing, and improvement of products in Japan. |

⑥ Cooperation in improving corporate value, by tightening governance, streamlining production processes, enhancing the capability of selling products, and so on | By sharing KOKUBU GROUP’s know-how to develop and sell products and Yoshimura Food Holdings’ know-how to support business administration of group companies, develop governance systems, and streamline production processes, they will strengthen Yoshimura Food Holdings’ platform for supporting SMEs and improve corporate value. |

⑦ Sharing know-how by personnel exchange and cooperation in developing human resources | By dispatching or temporarily transferring employees to each other, they will promote the cooperation between the two companies and promote human resources development. |

② Details of the Capital Alliance

On February 24, 2021, KOKUBU GROUP CORP. was allocated ordinary shares through a third-party allocation of shares.

Number of shares for subscription: 1,188,500. Amount paid: approximately 950 million yen.

With an ownership ratio of 5%, KOKUBU GROUP CORP. became the third largest shareholder.

As Yoshimura Food Holdings was able to improve its capital adequacy ratio, an extra bank loan (1.8-2.7 billion yen), which is 2-3 times larger than the increase in capital value (approximately 900 million yen) is now available to them. 2.7-3.6 billion yen, including the increased capital value, will be utilized for new M&A projects.

Further, in order to expand business and strengthen their financial base, they are planning on proactively considering capital business collaborations with other companies like KOKUBU GROUP CORP. with whom they can produce synergy in business activities.

(2) Conclusion of an Agreement for Capital and Business Alliances with the Consolidated Subsidiary Eisen Shuzou Co., Ltd.

As an initiative to start a new whiskey business as part of the group, the consolidated subsidiary Eisen Shuzou Co., Ltd. formed an agreement for capital and business alliances with LionDor Inc., a company which runs a supermarket business centered in Fukushima Prefecture, and also decided to carry out a third-party allocation of shares with LionDor Inc.

(Objectives of the Alliance)

Eisen Shuzou Co., Ltd. is a major brewery in the Aizu region of Fukushima Prefecture with a history spanning 150 years. LionDor Inc. is a company that operates a supermarket chain mainly focused on groceries, with its main base located in Aizuwakamatsu City, Fukushima Prefecture.

These two companies, which are indispensable for the Aizu region, will join hands and work together in order to promote local production and local consumption in Aizu and Fukushima, as well as protect the employment in the region, strengthen their relationship with client companies in the region, and strengthen the initiatives taken towards the vitalization of the region in Aizu and Fukushima as well.

Further, by cooperating for a new whiskey business, they will aim for further growth of both companies along with the development of the region.

(Background of the Alliance)

In recent years, the Japanese sake market has been shrinking due to the diversification of the preferences of consumers regarding food and drinks, and the move of young people away from alcoholic beverages, and this trend is even more apparent in Fukushima Prefecture because of the depopulation due to the additional effects of the Tohoku Earthquake, and the effects of restrictions on export overseas.

On the other hand, the whiskey market has been growing for 11 consecutive years due to the heightened demand for “Highball”, and steady growth is expected in the future especially with the domestically-produced Premium Whiskey continuing to be in short supply due to a shortage of refined alcohol.

Eisen Shuzou Co., Ltd. has formed an agreement for capital and business alliances with LionDor Inc. and will begin its new whiskey business by procuring funds through third-party allocation of shares.

LionDor Inc. will be increasing its sales by selling the Japanese sake and whiskey produced by Eisen Shuzou Co., Ltd. at its stores. Both companies will aim for medium-to-long term improvement in performance through cooperation in the whiskey business whose market is expected to expand.

Further, through this capital business collaboration (payment date for the third-party allocation of shares: June 14, 2021) as the ownership ratio of Yoshimura Food Holdings became 19%, Eisen Shuzou Co., Ltd. can no longer be considered as a consolidated subsidiary of Yoshimura Food Holdings, or an affiliated company accounted for by the equity-method, but it will continue to pursue initiatives toward the improvement in performance for Eisen Shuzou Co., Ltd. together with LionDor Inc. by continuing to promote cooperation.

3.Fiscal Year ending February 2022 Earnings Estimates

【3-1 Full-year earnings forecasts】

| FY 2/21 | Ratio to sales | FY 2/22 (Estimate) | Ratio to sales | YOY |

Net sales | 29,289 | 100.0% | 30,607 | 100.0% | +4.5% |

Gross profit | 6,209 | 21.2% | - | - | - |

SG&A expenses | 5,721 | 19.5% | - | - | - |

Operating income | 488 | 1.7% | 805 | 2.6% | +64.9% |

Ordinary income | 752 | 2.6% | 811 | 2.6% | +7.8% |

Net income | 323 | 1.1% | 346 | 1.1% | +7.2% |

EBITDA | 1,607 | 5.5% | 1,670 | 5.5% | +4.0% |

*Unit: Million yen. Net income is net income attributable to shareholders of the parent company. EBITDA is calculated by adding amortization expenses (depreciation and amortization, goodwill) and acquisition costs related to M&A to operating income.

Both Sales and profits are expected to growth.

Sales are estimated to rise 4.5% year on year to 30.6 billion yen and operating income is projected to increase 64.9% year on year to 800 million yen. It is assumed that the domestic business will grow stably, and the overseas business will remain stagnant and then start recovering gradually from the second half. The growth due to new M&A is not taken into account.

【3-2 Impact of the novel coronavirus】

① In Japan

The sales toward mass retailers, including supermarkets, which account for a significant portion, will remain healthy, while the demand from housebound consumers will subside.

The sales toward restaurants and sightseeing facilities will keep declining due to the novel coronavirus.

The sales of Japanese subsidiaries will be unchanged from the previous term, unless the novel coronavirus spreads again rapidly.

② Overseas

In Singapore, about 10% of the population have been vaccinated against the novel coronavirus, and in late March 2021, the vaccination targeted at people aged 45-59 years was started. As the vaccination will progress, the economy in Singapore is expected to recover.

The performance of supermarkets and restaurants, which are clients, is expected to remain stable. In addition, buffet services in hotels were resumed in April, and the restrictions on the number of people attending a wedding ceremony, a party, or the like will be lifted, so a sign of recovery is expected to be seen.

The sales of overseas subsidiaries will recover gently, but for full-scale recovery, we have to wait until the novel coronavirus will subside globally, so the sales are estimated to be unstable.

4. Business Strategy

The company has established an original business model in the food industry based on a “platform for supporting small and medium-sized enterprises” and pursues growth with two engines: “growth based on the increase of the number of group companies through M&A” and “growth based on the expansion of business of existing group companies.”

While the basic strategy and road map remain unchanged, the following four strategies were anew brought up in order to further accelerate the growth speed based on M&A enhancement and business model improvement: “Strategy 1: Creation of new core businesses through M&A,” “Strategy 2: Reinforcement of the business model,” “Strategy 3: Growth based on cooperation with business partners, and “Strategy 4: Establishment of overseas sales channels.”

The company aims for the realization of their vision and the achievement of their mission by organically linking strategies.

(Taken from the reference material of the company)

【4-1 Strategy 1: Creation of new core businesses through M&A】

(1) Basic policy

From this term, the company will further boost the basic policy of “discovering companies which will form the new pillar of the group and companies which manufacture local niche products, and speeding up M&A through proactive approach and negotiation.”

The company has mostly considered business opportunities in a passive way until now, due to the limitations of their resources, but from now on they will also proactively propose business opportunities.

Furthermore, while business revitalization and transfer used to be the main reasons for M&A, from now on the company will expand the target to include carve-out business opportunities which have sufficient profitability, such as the subsidiaries of major corporations. In step with this, it will also broaden the range of target companies to encompass middle- and large-sized corporations.

In regard to the type of industry as well, instead of being limited to food manufacturing and wholesale, they will also target upper-class primary industry.

(2) Strategy

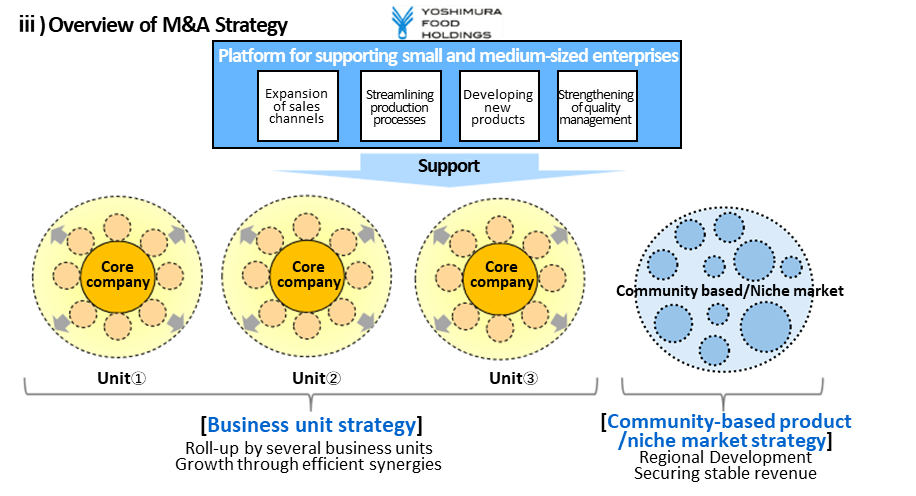

① The base of the M&A strategy

It is based on two strategies: “business unit strategy” and “community-based product/niche market strategy.”

“Business unit strategy”

The company will merge and acquire companies that will become a new pillar (core) of the group and conduct M&A of companies in the same field/same category (roll-up strategy).

They will improve the profit margin by establishing several business units centered around the core company and thus bringing out an even greater synergy.

“Community-based product/niche market strategy”

The company will form a group through M&A of companies which manufacture local specialties, famous regional products and products liked in the local community, and utilize the group’s sales channels to deliver the products to the whole country as well as overseas. Through this, they will contribute to the local economy as well as job retention, and furthermore to countryside revitalization.

(Taken from the reference material of the company)

② Finding business opportunities: Independent discovery of business opportunities

From now on, the company will discover business opportunities by using both indirect and direct approaches.

As for the indirect approach, target companies have been introduced predominantly by M&A mediating companies and financial institutions. However, from now on, the company will reinforce the approach by finding prominent M&A mediating companies and regional banks and cementing relationships with them, and utilizing the network of P&E DIRECTIONS, INC., the company’s business partner.

As for the direct approach, the company has mainly contacted the targets by building relationships with buyers and suppliers, establishing an enquiry form on their website and through M&A mediating companies. However, from now on, the company will form a group of companies which will become the group’s new mainstay through M&A based on the independent discovery of business opportunities by approaching target companies on the target list created by the company itself and establishing medium- to long-term relations, and also through an approach utilizing the network of the KOKUBU GROUP CORP., etc.

As the restructuring of major corporations keeps progressing in addition to the absence of successors, it is estimated that the number of M&A targets will further increase. Therefore, the company assumes that engaging in active and independent discovery of business opportunities instead of only considering business opportunities “passively” as they did until now, will lead to the acceleration of the growth speed.

③ PMI consolidation

With regard to M&A, how to maximize synergy after the acquisition is more important than the acquisition itself, and the quality of the integration after the acquisition called “PMI: Post Merger Integration” holds the key.

In order to secure a smooth progress of PMI and improve the profit of the acquired companies, specialized human resources with abundant experience and knowledge regarding not only business, but also management such as personnel affairs and accounting, are required. The company hired human resources from trading companies, food-related companies and marketing companies.

Through this, the company will improve PMI and realize an early integration in approximately 100 days (100 Day Plan), working toward achieving an even swifter synergy maximization after M&A.

【4-2 Strategy 2: Restrengthening of the business model】

(1) Basic policy

The company aims to improve their performance with a new support system based on the recruitment of specialized human resources and organizational reform.

The company has worked toward the growth of the group companies and enhancement of corporate value based on multifaceted support through its platform for supporting small and medium-sized enterprises.

While this mechanism itself remains unchanged, the company reflects on the fact that there were rather ambiguous points in regard to numerical value management of each group company and locus of responsibility pertaining to it. They therefore newly established four business headquarters which will support the management of the subsidiaries, and clarified that the management ranks of each company and the business headquarters to which the company belongs will be responsible for the numerical values of each group company. On the other hand, the general headquarters will keep providing support in order to create synergy in the group.

Furthermore, while the company provided efficient support with a few people until now, both specialized and efficient support is now possible due to the above-mentioned recruitment of specialized human resources. In addition, while the management personnel of each company were appointed from full-time employees of each subsidiary until now, from the viewpoint of improving development speed, the company will proactively consider the employment of personnel from outside the company in addition to in-house development, and thus enhance the development of management personnel even further.

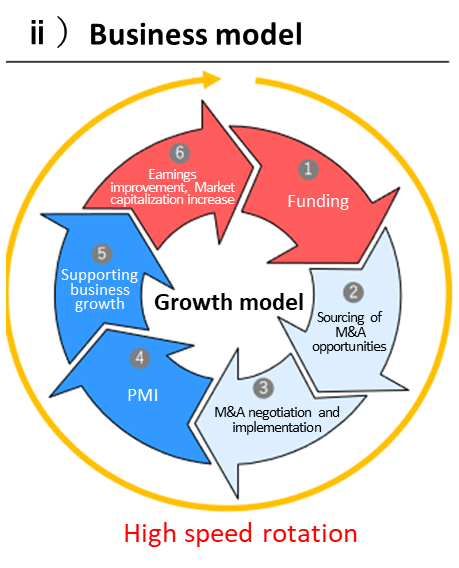

(2) Business model

The company will implement an even greater number of M&A and engage in supporting growth by increasing the speed of the sourcing of M&A opportunities, M&A implementation and the procedure up to PMI based on the recruitment of specialized human resources and organizational reform.

(Taken from the reference material of the company)

【4-3 Strategy 3: Growth based on cooperation with alliance partners】

(1) Basic policy

The company will speed up growth through cooperation with alliance partners that will contribute to enhancing corporate value.

While the company has focused on its growth by itself until now, they will proactively promote the alliance with P&E DIRECTIONS, INC. and KOKUBU GROUP CORP., and work toward growth while also utilizing resources outside the company.

Furthermore, they will strive to find new alliance partners that will play a part in enhancing corporate value.

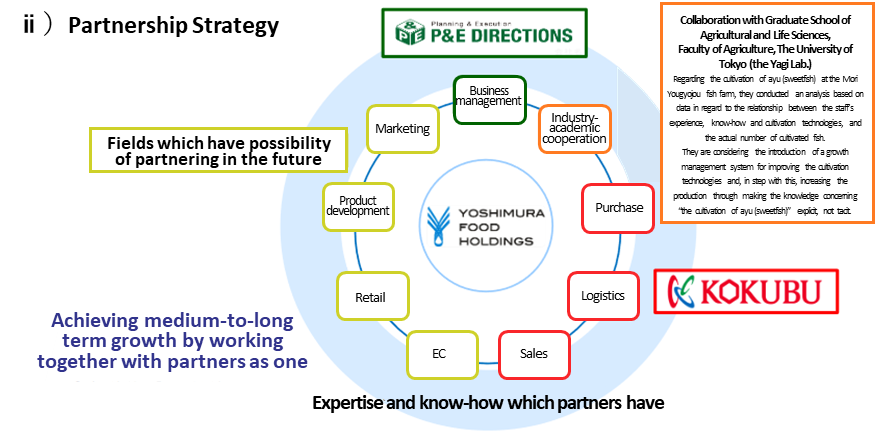

(2) Partnership strategy

The company will aim for further growth based on cooperation with optimal partners in each value chain.

(Taken from the reference material of the company)

The company thinks that they should focus on discovering alliance partners in the field of marketing, product development and e-commerce in the value chain in addition to P&E DIRECTIONS, INC. and KOKUBU GROUP CORP.

Furthermore, they engage in industry-academic cooperation.

In collaboration with Graduate School of Agricultural and Life Sciences, Faculty of Agriculture, The University of Tokyo (the Yagi Lab.) regarding the cultivation of ayu (sweetfish) at the Mori Yougyojou fish farm, they conducted an analysis based on data in regard to the relationship between the staff’s experience, know-how and cultivation technologies, and the actual number of cultivated fish. They are considering the introduction of a growth management system for improving the cultivation technologies and, in step with this, increasing the production through making the knowledge concerning “the cultivation of ayu (sweetfish)” explicit, not tacit.

(3) Cooperation with alliance partners

① KOKUBU GROUP CORP.

The growth of Yoshimura Food Holdings as well as group companies will be accelerated by utilizing tangible and intangible assets belonging to KOKUBU GROUP CORP., such as the know-how fostered through business spanning over more than 300 years in addition to 35,000 client companies, 10,000 partner manufacturers, 54 group companies and the product lineup including approximately 600,000 items.

As for KOKUBU GROUP CORP., they expect the increase of transactions with Yoshimura Food Holdings as well as the acquisition of know-how concerning the management of small and medium-sized food companies which Yoshimura Food Holdings has nurtured until now (business management, production streamlining, governance reinforcement, etc.), the acquisition of M&A opportunities and know-how, and the development of management personnel (the development of executive candidates and management personnel based on temporary employee placement).

In regard to M&A and business, following initiatives are in progress based on the alliance.

◎M&A

Challenge | Promotion of the cooperation | Goal to be achieved |

Discovery of business opportunities | Sourcing which utilizes the network of KOKUBU (10,000 partner manufacturers) | Approaching an even greater number of small and medium-sized food companies facing problems with business succession or surviving on their own, discovering M&A opportunities |

Consideration of business opportunities/ execution of investment | Collaborative consideration of growth strategy utilizing the resources and know-how of KOKUBU | Implementing M&A of an even greater number of companies by taking into account synergy with KOKUBU, it will become possible to handle opportunities which were difficult for Yoshimura Food Holdings to handle on their own |

PMI | PMI implementation in collaboration with KOKUBU (expansion of sales channels, reduction of procurement costs, product development, streamlining of logistics, etc. based on the resources of KOKUBU) | Achieving a more rapid growth and securing stable business performance by utilizing the resources of KOKUBU and providing collaborative growth support |

◎Business

Challenge | Promotion of the cooperation | Goal to be achieved |

Sales | Promotion of sales based on the resources owned by KOKUBU (sales channels, human resources, sales capabilities) | *Expanding sales channels to cover the whole country/increasing sales *Building a robust sales system and sales network |

Purchase | *Increase of channels for procurement with KOKUBU as the point of contact *Review of conditions for bulk purchases of consumable goods | *Increasing gross profit through the reduction of procurement costs *Maintaining procurement costs when the prices of raw materials sharply rise |

Product development | Product development as part of marketing, utilizing the expertise and know-how of KOKUBU | *Developing long-selling products *Joint development of new products and KOKUBU’s private brand products (such as the Kantsuma canned appetizers), manufacturing in Yoshimura Food Holdings |

Logistics | Review of the logistics network utilizing the logistics know-how, company warehouses, etc. of KOKUBU | *Increasing gross profit through the reduction of logistics costs *Expanding the area for product supply (sales) |

Other | *Promotion of sales based on the resources of KOKUBU *Review of the logistics network | Improving the business performance of overseas subsidiaries |

② P&E DIRECTIONS, INC.

An alliance with P&E DIRECTIONS, INC. was formed in August 2020 and a management plan as well as M&A strategy were formulated through the cooperation with them until now.

From now on, the company will achieve growth by receiving support in implementing the formulated plan.

*See the previous report in regard to the alliance with P&E DIRECTIONS, INC.

Bridge report: (2884) Yoshimura Food Holdings; Financial results for the second quarter of the term ending February 2021

https://www.bridge-salon.jp/report_bridge/archives/eng/2884/20210127.html

Challenge | Growth based on the plan implementation (future initiatives) |

Business strategy | *Implementation of management strategy Management of the progress of numerical goals (KGI/KPI), PDCA

*Enhancement of the operation of the Holdings Support for operation in a new organization |

M&A | *Implementation of M&A strategy Target approach

*Enhancement of support after M&A Pursuit of synergy effects Support based on manpower, goods and funds |

【4-4 Strategy 4: To establish overseas sales channels】

(1) Basic policy

One of the functions of the platform for supporting SMEs is to promote the products of Japanese group companies via the subsidiary in Singapore in overseas markets.

Products have been sold mainly in Singapore, but the sales channels will be expanded also in Southeast Asia and China.

In addition, the company will pursue growth while utilizing the resources of alliance partners, such as KOKUBU GROUP.

(2) Actual cases

JSTT Singapore, which produces and sells sushi, etc. in Singapore, has enhanced the sale of products of Japanese group companies at the sushi section of each supermarket.

② Development of private brand products of jelly

Junwa Food developed private brand products for Bread Talk, which operates the bakery chain in Asia based in Singapore, and released them at about 46 Singaporean stores.

5. Interview with CEO Yoshimura

Representative Director and CEO Motohisa Yoshimura was interviewed on his company’s business strategies and his way of thinking regarding ESG management.

Q: “I would like to ask you once again about your company’s business strategies. It seems like there have been changes in your strategies and the initiatives taken towards them.”

Firstly, I want to talk about M&A, which is one of the most important strategies for our company. Until now we have discussed projects with a passive attitude, but we plan to implement more proactive project sourcing from our side in the future.

There are 2 reasons behind this decision.

The first reason is that we strongly feel that M&A projects will increase beyond the levels seen previously, which will lead to an increase in business opportunities.

Under the extremely harsh management environment after the 2008 Financial Crisis, stopping the bleeding by controlling costs for businesses with deteriorating management and making efforts to produce profits, that is, corporate revitalization became the main role of our company, which had just been founded. But in the last 3 or 4 years, I think, there has been an increase in cases where companies with no successors want to sell a company, even though it is steadily producing profits. A huge factor behind this is the significant shift in the perception of owners regarding M&A, with the recognition of companies as “something that can be sold” starting to permeate deeply.

Further, as large companies are forced to change their business structure, from a governance viewpoint, companies that are carving out subsidiaries are also increasing.

The second reason was the arrangement of a system which could steadily reconstruct small and medium enterprises that underwent M&A, through the know-how we gathered over the years.

In the case of a company that has been producing steady profits, we definitely perform cost control as well, but the supporting service expected from us is centered around marketing support, such as the expansion of sales channels, product development, and promotion.

In a little over 10 years, we have developed a clear understanding as to which companies we should target.

Until now we primarily focused on a passive stance with regards to project discovery, but with the new potential for an increase in business opportunities, we have gained confidence in our ability as a company to respond to each new project, which is why we have decided to switch from a passive stance to a more proactive stance when searching for new projects.

In addition, we will not only be increasing the number of projects, but also expand on the scale of the target companies. As for industry types, we are planning on working with more upper-class primary industries instead of limiting ourselves to industries dealing with the manufacturing and wholesale of food products.

P&E DIRECTIONS INC., with whom we formed an alliance last year, will have a significant role in making sure we can take an aggressively proactive approach.

P&E DIRECTIONS INC. has many client companies in food-related industries, which is why we are outsourcing project discoveries to them based on a targeting list that we created together. I think it will lead to great synergy.

We are also promoting the expansion of our company’s website and DM usage. Regarding DM, previously there was a time when we had zero replies, but after our recognition and reliability improved after being listed on the stock market as well as the widening recognition of companies as “something that can be sold,” our response ratio has been improving.

Q: “Can you explain “Business Unit Strategy” which has been brought up as a focal point of your M&A strategy?

“Business Unit Strategy” is a part of our M&A strategy where we merger and acquire companies which form a new pillar or core of our corporate group, further merger and acquire equipment and companies within the same field or category, construct multiple business units centered around these core companies, and improve the profit rate of these business units by generating even greater synergy. RAKU-YOU INC., which holds the top share of the domestic production of Chilled Shumai, is the quintessential example of this strategy.

The sales of RAKU-YOU INC. were around 2 billion yen at the start of their M&A, but now their sales have reached 5 billion yen.

Their decision to start selling Gyoza also contributed to it, but they were able to grow by taking initiatives such as acquiring other Chilled Shumai companies, buying the factories of companies which went bankrupt, hiring more employees, etc.

Similarly, depending on the sector within the food-related industry, as there is a very high possibility for significant growth through a “roll-up,” where we merger and acquire core companies, then further merger and acquire similar and related businesses, we would like to increase the number of cases like RAKU-YOU INC.

Q: “Are you also strengthening PMI and your integration process after acquisition?”

Through many M&A that we have handled, we have been able to gather an abundance of know-how and rules of thumb about what went right and what did not go right.

We compiled this knowledge in a manual in order to clarify the goal of completing the extremely important task of combining two companies together within 3 months, 100 days, and named it the “PMI 100 Day Plan.”

Further, we have started recruiting specialists for that purpose.

Previously, we had been picking up outstanding personnel working at a company that underwent M&A and having them review or go to other companies at a holding company, and this had been effective for our previous revitalization-related supporting services, but as I stated previously, once the supporting services expected from us started to center around marketing support such as the expansion of markets, product development and promotion, we needed to invite personnel for those tasks from outside.

We recruited managers from food companies and employees from trading companies with deep knowledge on marketing. We will continue our internal training, and also continue to recruit personnel with a high level of expertise.

Q: “You raised the “Restrengthening of the Business Model” as your second strategy. Could you tell us some points regarding that?”

In addition to the recruitment of specialists, we will change our organizational structure and further strengthen the support system for group companies.

We are working toward the growth of our group companies and the improvement of their enterprise value through multifaceted support provided through a small and medium-enterprise support platform, which is one of our strengths.

We will not be changing this system itself, but as the value control for each group company and the locus of responsibility for it had been vague, excuses could be made for the management ranks of a business firm and the person in charge of the holding company supporting the business firm, in case the target value could not be achieved.

After reflecting on this point, our first step was to make a clear announcement to the business firms that the responsibility for the values of a company lied with the company itself, regardless of whether they supported the holding company as instructed.

On the other hand, as for the holding company, the group companies will be divided into 4 groups and each group leader will bear the responsibility for the values of that group. As the group leader is responsible for the total value of each company within their group, they will have to compensate for the non-completion of plans for one company, for example, through the values of the remaining companies.

This should have been obvious, but we have finally shifted into an organization which clarifies the locus of responsibility for company values, with no room for excuses for either the holding company or the business firms.

At the same time, we have adopted a performance-based compensation system, where the compensation changes according to the contribution to the performance.

Through a recruitment of specialists and an organizational change, we accelerate the M&A project sourcing, M&A execution, and process till PMI, in order to achieve greater M&A execution and growth support.

Q: “The third strategy brought up was growth through cooperation with your business partners. As an example of that strategy, I wanted to ask about your alliance with KOKUBU GROUP CORP., which has been drawing a lot of attention. Kindly tell us about the background behind the formation of the alliance, and what you wanted from it.”

As I mentioned previously, among the supporting services expected from us, the importance of expansion of sales channels has grown further.

Till now, we have uniformly managed our services for expansion of sales channels through the small and medium-enterprise support platform, but we are approaching our limit.

Thus, we considered finding a partner for expansion of sales channels and outsourcing. We first thought about supermarkets, but decided that from a volume perspective, wholesale of food products would be more appropriate.

KOKUBU GROUP CORP. ranks third in the food-product wholesale industry, but with their motto of “Community-based Nationwide Wholesale,” their specialty lies in the fact that they sell products from relatively small-scale companies to local communities with diligence, instead of selling nationally branded products all over the country, which is why we decided that they were compatible with our sense of scale and approached them from our side.

After many discussions starting from the summer of last year, we were finally able to form capital and business alliances in February of this year.

Q: “This must be a very significant alliance for your company. Could you tell us what your major expectations from this alliance are?”