Bridge Report:(2884)Yoshimura Food Fiscal Year ended February 2022

Representative director and CEO Motohisa Yoshimura | Yoshimura Food Holdings K.K. (2884) |

|

Corporate Information

Exchange | TSE Prime Market |

Industry | Food products (manufacturing) |

Representative director and CEO | Motohisa Yoshimura |

Address | 18F, Fukoku Seimei Bldg., 2-2-2, Uchisaiwai-cho, Chiyoda-ku, Tokyo |

Year-end | February |

URL |

Stock Information

Share price | Shares Outstanding | Total Market Cap | ROE(Actual) | Trading Unit | |

¥529 | 23,782,272 shares | ¥12,580 million | 8.5% | 100 shares | |

DPS(Estimate) | Dividend Yield(Estimate) | EPS(Estimate) | PER(Estimate) | BPS(Actual) | PBR(Actual) |

¥0.00 | - | ¥15.76 | 33.6x | ¥265.39 | 2.0x |

*The share price is the closing price on April 21. Each value is taken from the brief report on results of the fiscal year ended Feb. 2022.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2019 (Actual) | 23,716 | 354 | 420 | 263 | 12.04 | 0.00 |

February 2020 (Actual) | 29,875 | 808 | 740 | 177 | 8.02 | 0.00 |

February 2021 (Actual) | 29,289 | 523 | 787 | 417 | 18.59 | 0.00 |

February 2022 (Actual) | 29,283 | 655 | 993 | 500 | 21.03 | 0.00 |

February 2023 (Estimate) | 30,526 | 835 | 783 | 468 | 19.60 | 0.00 |

*Unit: Million yen. The estimated values were provided by the company.

This Bridge Report presents Yoshimura Food Holdings K.K.’s earnings results for Fiscal Year ended February 2022 and earnings forecasts.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended February 2022 Earnings Results

3.Fiscal Year ending February 2023 Earnings Estimates

4.Growth Strategies

5.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales in the term ended February 2022 were 29,283 million yen, nearly unchanged from the previous term. Domestic business sales declined due to the impact of the novel coronavirus crisis. The sales of the overseas business increased due to the loosening of regulations to prevent the novel coronavirus. Operating income rose 25.1% year on year to 655 million yen. In the domestic business, personnel expenses increased due to the hiring of human resources, and profit decreased slightly. On the other hand, the overseas business recovered, and profit increased, mainly in fields with high-profit margins. Ordinary income grew 26.2% year on year to 993 million yen. Foreign exchange gains increased by 184 million yen year on year. EBITDA decreased 1.9% year on year to 1,577 million yen. With respect to the plan, neither sales nor operating income reached the target because the impact of the novel coronavirus crisis lingered longer than expected both in Japan and overseas. Ordinary income and net income exceeded the estimates due to foreign exchange gains and novel coronavirus-related subsidy income.

- For the term ending February 2023, sales are expected to increase 4.2% year on year to 30,526 million yen. Assuming that the current conditions will continue in the domestic business, sales are expected to increase with the addition of Junido Co.,Ltd., and the overseas business is expected to recover moderately. Operating income is forecast to increase 22.2% year on year to 800 million yen. The domestic business is projected to increase profit due to price revisions and production efficiency improvement, and the overseas business is expected to grow profit due to sales recovery. However, the estimates do not include the growth through new M&A.

- The company has built a unique business model centered on the SME Support Platform in the food industry and is pursuing growth by increasing the number of group companies through M&A and expanding the business of existing group companies. There is no change in the basic strategies or routes. However, the company set up Strategy (1): strengthening M&A, Strategy (2): re-enhancing the business model, Strategy (3): collaborating with business partners and in-house production of missing functions, and Strategy (4): strengthening overseas sales channels to speed up the processes from M&A to PMI and business growth support, execute more M&A, implement growth support, and improve corporate value.

- While the impact of the novel coronavirus is weakening, there are still many uncertainties in the company's business environment, such as soaring raw material prices and fluctuations in exchange rates. In addition to price revisions (hikes) and standard revisions (volume changes), we would like to pay attention to how further rationalization of manufacturing and cost reductions will contribute to business performance.

- We would like to focus on the progress of the four strategies, Strategy (1): strengthening M&A, Strategy (2): re-enhancing the business model, Strategy (3): collaborating with business partners and in-house production of missing functions, and Strategy (4): strengthening overseas sales channels. In particular, regarding Strategy (3): collaborating with business partners and in-house production of missing functions, making ONESTORY Inc. a subsidiary would contribute to strengthening marketing functions. We can also expect the acquisition of ONESTORY shares to enhance the relationship with Hakuhodo DY Media Partners Inc., which is the transferor of ONESTORY shares and continues to be their shareholder. Moreover, we look forward to the outcomes of the alliance with the Kokubu Group Corp..

1. Company Overview

Yoshimura Food Holdings acquires small and medium-sized food products makers, facing various issues such as the difficulty in finding successors, through M&A at the same time as they possess excellent products and technologies. It also facilitates the growth of the entire corporate group by solving problems with their core skill, “a platform for supporting small and medium-sized enterprises (SME Support Platform),” and energizing each group company. Its strengths are the overwhelming advantage toward investment funds and large companies and the high barrier to entry. The company aims to accelerate growth through alliances. As of the end of February 2022, there are 22 major consolidated subsidiaries.

【1-1 Corporate History】

One day, a food company that was facing financial difficulties and could not find a buyer was introduced to Mr. Yoshimura, who was managing the listed companies’ fundraising and M&A in the corporate business division at Daiwa Securities Co. Ltd. and Morgan Stanley Securities Co., Ltd.

Mr. Yoshimura took on this food company and established L Partners Co., Ltd. on his own in March 2008, which was the predecessor of Yoshimura Food Holdings K.K. because he strongly felt that Japan could be more appreciated through its “food” since his MBA days in the USA while working for Daiwa Securities. Through his efforts to revitalize the company using his experience and network, he succeeded in turning a profit.

Many food SMEs started seeking help from Mr. Yoshimura upon learning about his reputation. He thought that it was possible to efficiently achieve results if the companies complemented each other in various functions, such as product development, production, and sales under a holding company system, instead of working on each company individually. Hence, he named the corporate Yoshimura Food Holdings K.K. in August 2009.

Since then, the company has continued acquiring companies facing problems with business succession or failing to handle management on their own. Due to the high reputation of the company for its unique position of not competing with major food companies and investment funds and its policy of not selling the companies it acquired, it received financing from Japan Tobacco Inc. (JT) and expanded its business. In March 2016, it was listed on the Mothers of Tokyo Stock Exchange, and in March 2017, it was listed in the first section of Tokyo Stock Exchange. In April 2022, it was transited to the Prime Market of Tokyo Stock Exchange.

The company is pursuing further growth by acquiring not only Japanese companies, but also overseas companies in Singapore, Malaysia, etc.

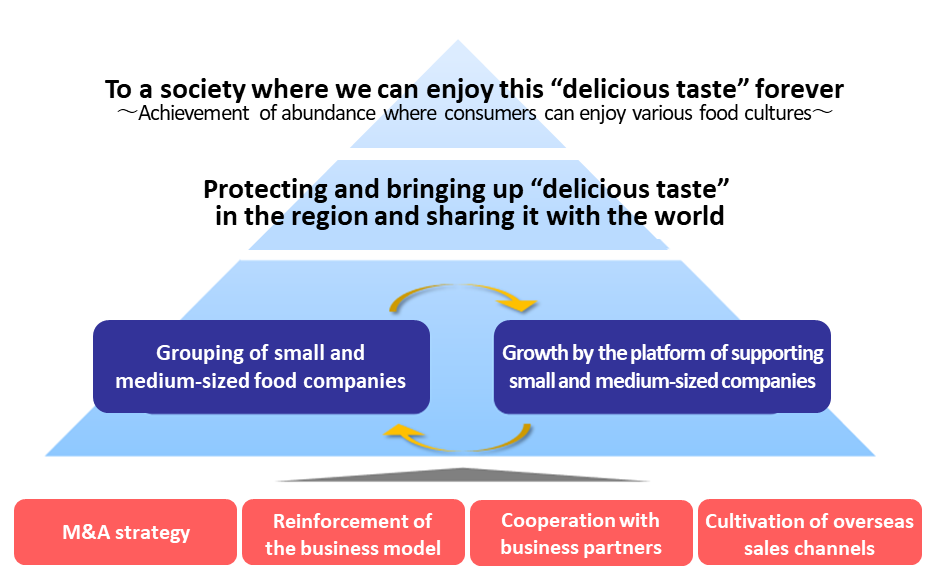

【1-2 Target Social Image】

As the social meaning of its existence as an enterprise, the company decided to pursue the mission: “working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures,” and set its vision (roles to be fulfilled) and values (values they cherish).

Mission Working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures | *We believe that a society in which people can choose from various options freely according to their respective preferences and a society in which those choices are respected is affluent and happy. *We aim to achieve an affluent society in which consumers around the world can choose from a wide array of high-quality “delicious foods” freely and enjoy them. |

Vision To protect and nurture the “delicious foods” in each region, and distribute them around the world | *In order to realize “a society where we can enjoy this ‘delicious taste’ forever,” we will discover “delicious foods” that have been cherished in Japan and around the world, protect and nurture them, and deliver them to people around the world. *To do so, we will develop our own ability to find “delicious foods”, a business base for protecting “delicious foods”, functions to support the growth of “deliciousness”, and sales networks to deliver “delicious foods” to people around the world. *As a result, our company will become a global producer that promotes the cultures and diversification of foods around the world and the vitalization of local communities. |

Values To cherish individuality | *We cherish the individuality of everyone related to us. *We value the “individuality”, “new ideas”, and “desire to take on new challenges” of each employee working in our corporate group. *We value the “history”, “culture”, “employees”, “business partners”, and “local communities” of each of our group companies. *We brush up the “strengths” of our group companies, mutually make up for their “weaknesses,” and grow together. *We will contribute to the development of an affluent society with a variety of options available, by cherishing the individuality of everyone related to us. |

【1-3 Market Environment and the Background of the Company’s Establishment】

As a company aiming for supporting and revitalizing SMEs throughout Japan, Yoshimura Food Holdings explained the conditions of the food SMEs as follows:

(Investment Bridge extracted, summarized, and edited the information from Yoshimura Food Holdings’ annual securities reports and reference material)

(The Conditions of the Food SMEs)

*Japanese cuisine has been highly appreciated worldwide and is attracting attention. Also, on the national level, the food manufacturing industry has been one of the largest industries based on its number of business establishments, number of employees and GDP since the 1990s and it is one of the key industries that Japan is proud of.

*99% of the companies are SMEs where each one of them has strong products and technical skills.

*However, the domestic market scale is shrinking and some of the food SMEs find it hard to survive on their own as the business environment remains stringent due to the falling birthrate and aging population.

*Therefore, many companies give up on continuing their businesses and end up choosing to close down or suspend their business.

(Conditions of the SMEs’ Business Succession)

*The average age of managers is 60.1, and it is expected that around 50% of the managers will reach the average retirement age in the upcoming 10 years as the average retirement age of managers is around 70.

*Meanwhile, 65.1%, nearly two thirds of domestic enterprises are suffering the lack of successors, and the ratio of enterprises that plan to conduct business succession is only 34% in all industries. Namely, the preparations for business succession have not progressed.

*Moreover, in 2020, the number of SMEs that suspended or discontinued business reached 49,698 and have increased rapidly for 13 years in comparison with in 2007 where that number was around 21,000.

(According to SME Agency “White Paper on Small and Medium Enterprises” (2021 Edition), Teikoku , “Analysis of the age of company presidents in Japan (2021),” Teikoku , “Survey of Trends on ‘Companies without a Successor’ in Japan” (2020), SME Agency “Basic Survey on the Actual Situation of SMEs” (Report in FY 2019 [Financial results in FY 2018])DatabankLtd.DatabankLtd.

(Conditions of Business Succession of Food SMEs through Acquisition)

*Although there are increasing needs for business succession from food SMEs, the number of companies and organizations that would acquire them is small.

*The scale of many food SMEs is too small for major companies to acquire, and for investment funds’ whose primary aim is to rapidly grow independent companies and sell them off within a few years, the mature market of food SMEs tends not to be one of their investment targets.

*Under these conditions, there is a tremendous shortage in the bearers of the responsibility of taking on the business of the SMEs.

【1-4 Business Description】

Having Yoshimura Food Holdings as its holding company, the corporate group consists of 22 group companies in February 2022.

Yoshimura Food Holdings aims to support and revitalize SMEs that manufacture and sell food products by creating a corporate group, composed of the food SMEs that are facing problems in securing a successor, through M&A. Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each company in the group. It also supports and supervises their sales and marketing, production management, procurement and manufacturing, procurement, distribution, product development, quality control, and business management.

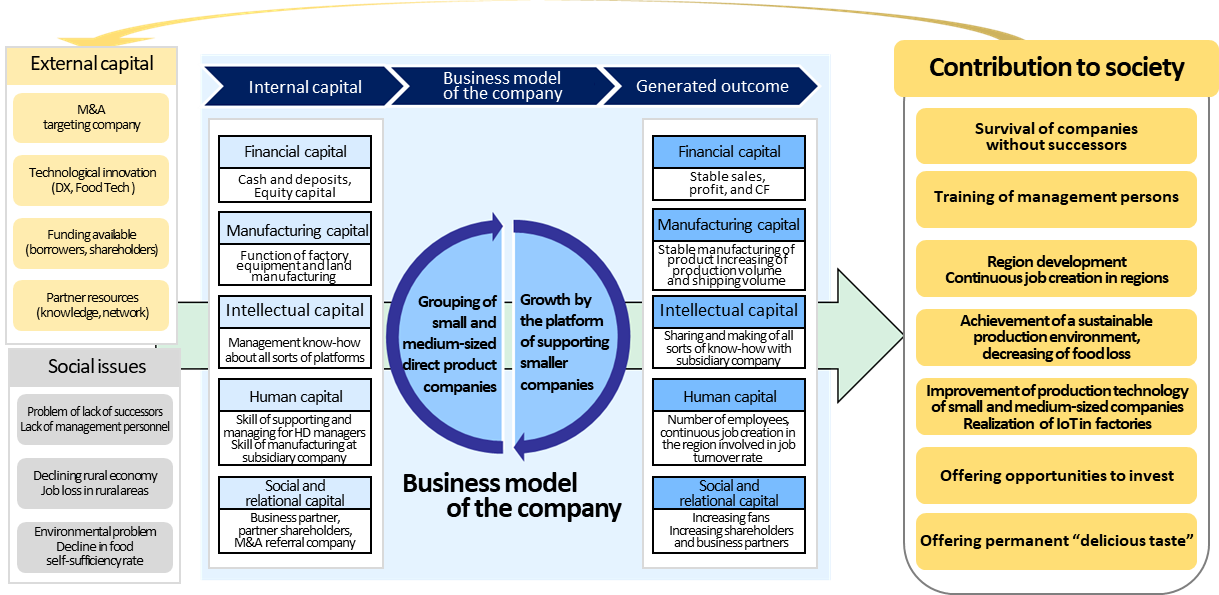

①Business Model

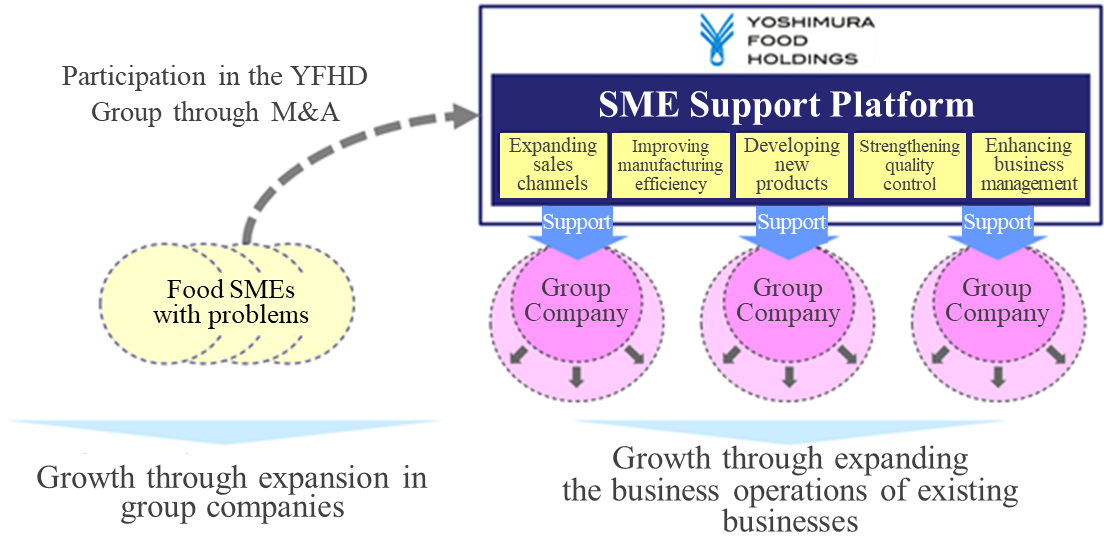

The company develops a unique business model in the food industry and is pursuing growth based on two engines.

One of them is the increase in the number of group companies through M&A.

Since its establishment in 2008, the company prevented food SMEs that had business succession and financial problems from shutting down or facing business suspension by acquiring them. Thus, it has managed to solve their problems.

As of February, 2022, the company has 22 group companies. It is recently focusing on adding not only Japanese companies to the group, but also overseas ones.

Target companies are found by mainly M&A mediating companies, local financial institutions such as regional banks, lawyers, and accountants. The company plans to improve its own function for finding target companies from the aspect of costs as well.

The company has used the “indirect approach” to find business opportunities through the introductions from M&A brokerage firms, local financial institutions, such as local banks, lawyers, and accountants, but from now on, the company will enhance the “direct approach,” by producing a list of targets, approaching them to foster relationships, and utilizing the network of KOKUBU GROUP, which is an alliance partner, in order to speed up the business. The company plans to find business opportunities more voluntarily and actively.

The other one is the expansion of business of existing group companies.

Yoshimura Food Holdings supports the expansion of business operations of each company and solves problems by supervising each function of these companies, which have excellent products and technologies but could not achieve growth for reasons such as the lack of sales channels, labor shortage or poor business management, through the “SME Support Platform.”

(Taken from the reference material of the company)

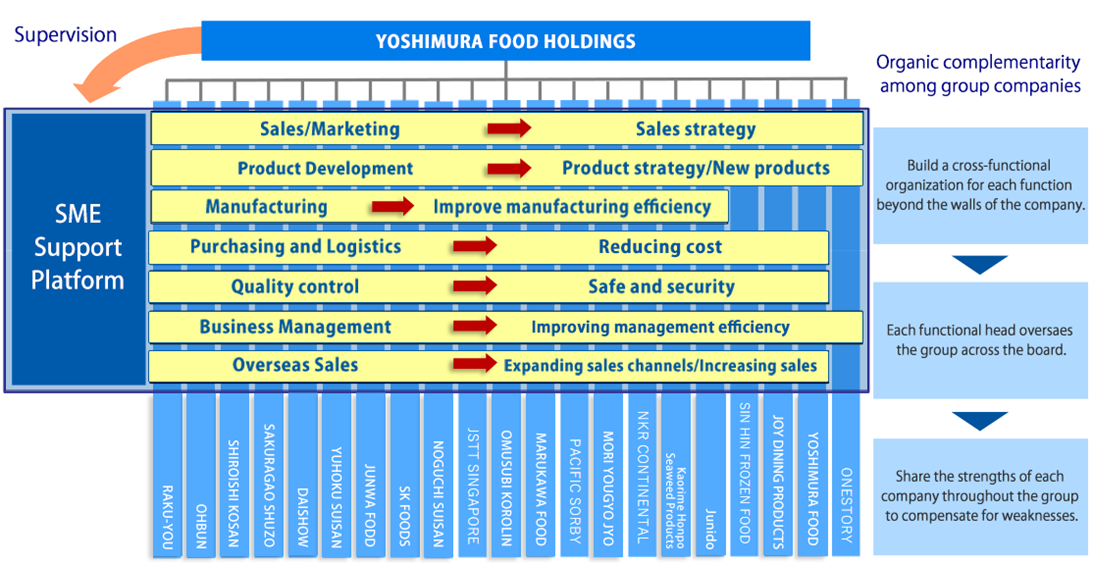

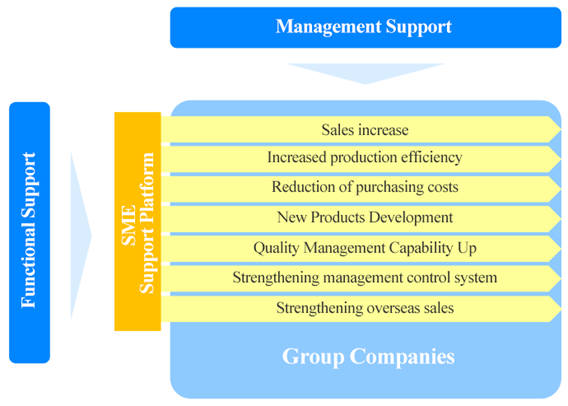

What is the SME Support Platform?

The core of this unique business model is the “SME Support Platform,” a product of the company’s accumulation of know-how and achievements through its specializing in food manufacturing and sales.

As a holding company, Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each subsidiary in the group. It also aims to strengthen the business foundation of each subsidiary through the company supervisor’s horizontal supervision of its functions (sales and marketing, production management, procurement and distribution, product development, quality control, business management, and securing personnel) in a manner that goes beyond the company barriers and by building organic relations between subsidiary companies.

For example, Company A which has an excellent product but is worried about sales growth can use the sales channels and sales know-how of Company B that has a nationwide sales network. Also, it can achieve a stable financial position by using the creditworthiness of Yoshimura Food Holdings which is listed in the stock market to raise funds.

This cooperation is made to be more effective through appointing the personnel in the group with the highest levels of expertise as supervisors.

Hence, the “SME Support Platform” is a system in which each company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds, or sales channels are supplemented.

“SME Support Platform” functions effectively and produces effects with the current structure, but as subsidiaries will increase further, their know-how will be added as a new strength, and the managerial resources of the corporate group will be accumulated, bringing out a new synergy so that existing subsidiaries will be able to seize opportunities to grow business and acquire the know-how to streamline production processes.

Such scalability of the platform will fortify the business foundation of Yoshimura Food Holdings.

(Taken from the reference material of the company)

② Segments

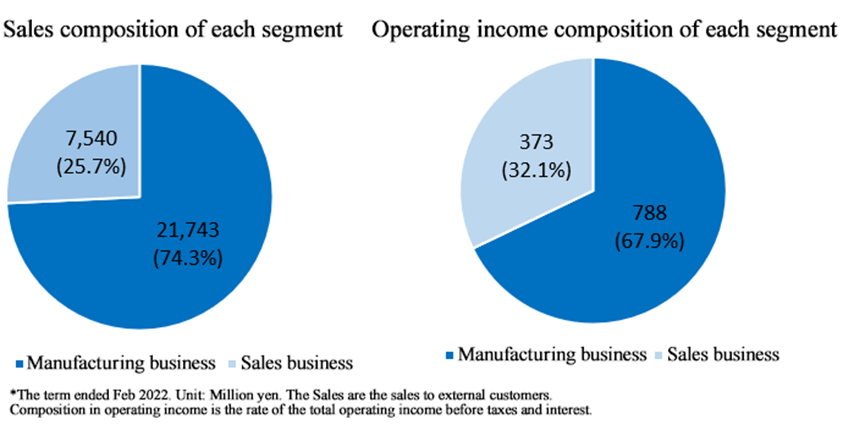

The company has two segments: “manufacturing business segment” and “sales business segment.”

◎ Manufacturing Business Segment

Each company develops and manufactures its original products, domestic enterprises sell products to supermarkets, convenience stores, and drugstores around Japan via mainly wholesalers, and overseas enterprises sell products to hotels, restaurants, supermarkets, etc. in Singapore and Malaysia. As of the end of February 2022, there are 17 group companies as tabulated below.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

RAKU-YOU INC. (Adachi-ku, Tokyo) | Five factories in Japan manufacture and sell chilled shumai and chilled dumpling. It has the largest share of chilled shumai production in Japan. |

Daishow Co., Ltd. (Tokigawa-machi, Hiki-gun, Saitama Prefecture) | It is a pioneer in the peanut butter industry. “Peanut Butter Creamy” made by its own unique manufacturing methods has been continuously a long-selling product since started being sold in 1985. |

Shiroishi Kosan Co., Ltd. (Shiroishi City, Miyagi Prefecture) | Started business in 1886. Its core product is Shiroishi-uumen, which is a local specialty in Shiroishi-City, Miyagi Prefecture. It produces and sells the dry noodles, etc. with a traditional method. |

Sakuragao Shuzo K.K. (Morioka City, Iwate Prefecture) | It was established in 1973 as a collective of 10 local breweries in Iwate Prefecture. Its sake which is brewed using the skills of the biggest Toji (head brewers) group in Japan, Nanbu Toji, has a high reputation for its fruity taste. |

Ohbun Co., Ltd. (Shikokuchuo City, Ehime Prefecture) | It has original routes for procuring oysters harvested in Hiroshima, whose supply amount is limited. Its core product is deep-fried oyster, and it also produces and sells deep-fried soft chicken bone, deep-fried chicken breast strips, etc. |

Yuhoku Seafood Processing Co., Ltd. (Oi-machi, Ashigarakami-gun, Kanagawa Prefecture) | The company manufactures and sells negitoro and tuna slices using tuna that is immediately frozen on the ship at minus 50-60 degrees as soon as it is caught. |

JUNWA FOOD Corporation (Kumagaya City, Saitama Prefecture)

| It has constructed a perfect quality control system, including having acquired the Saitama Prefecture HACCP. Although it is a jelly manufacturing start-up company, it has an established reputation by major hypermarkets for its products’ quality and technological capabilities. |

SK Foods Co., Ltd. (Yorii-machi, Osato-gun, Saitama Prefecture) | It mainly manufactures and sells chilled and frozen pork cutlet and makes products that meet customer needs. Also, it conducts direct procurement and direct sales without depending on any trading companies. |

Yamani Noguchi Suisan Co.,Ltd. (Rumoi City, Hokkaido Prefecture) | For half a century, the company has manufactured and sold Hokkaido Prefecture’s specialties such as salmon jerky and herring that are prepared by its skilled workers who use unique manufacturing techniques. |

JSTT SINGAPORE PTE. LTD. (Singapore) | The company located in Singapore manufactures and sells sushi, makimono, rice balls, etc. by using fresh Japanese seafood transported by air. |

Omusubikororin Honpo K.K. (Azumino City, Nagano Prefecture) | Using its own freeze-dry device, it manufactures ingredients for confectionery, emergency food, etc. The company’s “Mizu Modori Mochi” (rice cakes that can be prepared by adding water) is famous for being used in the Space Shuttle Endeavour. |

Marukawa Shokuhin Co, Ltd. (Iwata City, Shizuoka Prefecture) | A famous dumpling shop in Hamamatsu area. It manufactures and sells dumplings using carefully selected ingredients and a secret recipe the company has been following since its establishment. |

PACIFIC SORBY PTE. LTD. (Singapore) | It processes and wholesales chilled and frozen seafood products in Singapore.

|

Mori Yougyojou Co., Ltd. (Ogaki City, Gifu Prefecture) | The company’s harvest amount of farmed ayu (sweetfish) is top-class in Japan. It has nurtured the original know-how to collect roe, incubate them, grow and ship fish stably. In addition, it possesses the technology to make fish give birth to male or female fish. |

NKR CONTINENTAL PTE. LTD. (Singapore) | In Singapore and Malaysia, where its subsidiary is located, the company manufactures, imports, sells, designs, installs, and maintains kitchen equipment. |

Kaorime Honpo Co., Ltd. (Izumo City, Shimane Prefecture) | It produces a wide array of high-quality products ranging from original products to OEM ones, including soft dried seaweed for seasoning rice, dried hijiki for seasoning rice, seaweed soup, ochazuke with seaweed, etc. |

Junido Co., Ltd. (Dazaifu City, Fukuoka Prefecture) | It manufactures and sells soft furikake (rice seasoning) such as Umenomi-hijiki. It has many fans all over the country and is very popular. |

◎ Sales Business Segment

Its strengths are sales capability and planning skills. Domestic enterprises sell products to mainly industrial catering companies, consumer cooperatives, etc., while overseas enterprises sell products to mainly supermarkets, hotels, restaurants, etc. As of the end of February 2022, group companies are the following three.

(Group Companies within the Sales Business Segment)

Company Name | Features |

Yoshimura Food Co., Ltd. (Koshigaya City, Saitama Prefecture) | It mainly conducts the planning and sales of industrial food ingredients. It does not have distribution channels, but it has constructed a business model where it sends products directly to customers. |

Joy Dining Products Co., Ltd. (Koshigaya City, Saitama Prefecture) | It conducts the planning and sales of frozen foods. Also, it has direct accounts with consumer co-ops throughout Japan and utilizes them to sell the products of the group companies. |

SIN HIN FROZEN FOOD PRIVATE LIMITED (Singapore) | It procures high quality, safe and trusted frozen seafood products and processed seafood products from the influential seafood companies in various parts in Asia. |

◎ Other segments

Company | Characteristics |

ONE STORY Inc. (Shibuya-ku, Tokyo) | It conducts events. It rediscovers and restructures the food and culture hidden in the local region and produces them as premium content. |

SHARIKAT NATIONAL FOOD PTE .LTD. (Singapore) | It owns a food factory and a constant-temperature warehouse for food in Singapore and is engaged in the real estate leasing business. |

* ONESTORY Inc. became a subsidiary on April 1, 2022.

【1-5 Characteristics and Strengths】

①The Advantage in Business Succession through Acquisition

There are influential players in the M&A, such as major food companies and investment funds; however, this company has three main points that form strong competitive advantages, which are explained below.

*Ability to Acquire Companies of Various Scales

The company does not aim to sell the companies it acquired. It aims to not only achieve short term business recovery, but also achieve sustainable growth from a medium to long term perspective. Therefore, the company can acquire a variety of SMEs, including those with a small business scale that would take time to achieve growth and those that lack management resources for growth. This point creates a huge difference between the company and other major food companies and investment funds that need the companies they will acquire to be of a certain scale. Moreover, it is not easy for investment funds aiming to generate capital gains from selling companies to gain the trust of owners and managers of food SMEs. Regarding this point, this company operating company groups with the aim of achieving sustainable growth from a medium-term perspective also has a huge advantage.

*Advanced Capability of M&A

Since its establishment, the company has worked on creating many company groups out of food-related SMEs and later has achieved re-growth of these companies. Thus, it has thorough knowledge of the market environment of the food industry, business practices and risks that are peculiar to food SMEs, and strong assessment abilities, which enable the company to choose companies that have strengths from a large number of SMEs.

Also, the company has an extremely high capability of M&A since it has great expertise and accumulated knowledge in due diligence and negotiations.

*Rich and High-Quality M&A Data through its Wide Network

The company can gather plenty of M&A data on the food SMEs since it has a wide network of financial institutions, such as city banks, regional banks, credit associations, securities companies and companies that provide M&A advisory services.

Furthermore, “the company’s specialization in the food industry” and “the reassurance that the company is not aiming to sell” are the two factors allowing the company to access not only to a huge amount of data, but also high-quality data that meets its needs.

②Core Skill: SME Support Platform

The company revitalizes the group companies through the “SME Support Platform” in which each group company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds or sales channels are supplemented. These achievements are highly evaluated.

③Contribution to regional vitalization

The company has actively implemented the business succession, etc. of local food SMEs, including Sakuragao Shuzo K. K. (Iwate Prefecture), Shiroishi Kosan Co., Ltd. (Miyagi Prefecture), and Ohbun Co., Ltd. (Ehime Prefecture), which are subsidiaries.

By utilizing the SME Support Platform, it is possible to distribute attractive products that have been available only in some regions to all around Japan (and overseas) and invest in new equipment by using the funds of the corporate group. Through this, the company contributes to the regrowth of local small and medium-sized food enterprises and the vitalization of local economies.

【1-6 Dividend Policy and Shareholders’ Benefit System】

(Dividend Policy)

Although payout to shareholders is one of the important business challenges, it is thought that allocating the cash to investment in the facilities to actively expand the business and to strengthen the business foundation by expanding the platform is what would lead to the highest payout to the shareholders because the company is considered to be within the growth process.

Therefore, the company has not provided dividend payout to its shareholders since its establishment and as of the time being, it plans to continue on using the cash to invest in business expansion and as necessary operating capital for the existing companies. The company is planning to look into providing dividend payouts to its shareholders while considering the operating performance and financial conditions for each business year.

(Shareholders’ Benefit System)

The company offers special benefits to the shareholders mentioned below according to the number of shares they hold.

Number of Shares | Number of Times to Receive Special Benefits | Special Benefit Content |

300 shares to 499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 800 yen from the group companies |

500 shares to 2,499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 1,500 yen from the group companies |

2,500 shares or more | Twice a year (Shareholders recorded in the shareholder register as of the end of February and on the 31st of August of every year) | Products worth 4,000 yen from the group companies each time |

【1-7 ESG Management】

The company is working on its ESG management based on the goal mentioned above, “working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures.”

Items | Main Initiatives |

E(Environment) | Production of environmentally friendly, sustainable products *To hold the technology and know-how to produce sustainable products that do not depend on environmental changes or produce environmental burdens *To utilize a limited amount of food resources and conduct efficient production

Mori Yougyojou: It supplies farmed ayu (sweetfish) stably with its original technology, while the natural resources of ayu are decreasing due to climate changes, water pollution in the rivers, etc. Yamani Noguchi Suisan: It helps reduce food loss by developing products using residue and food that do not satisfy size specs. Yuhoku Seafood Processing: It produces and sells negitoro (minced tuna and green onion) and nakaochi (tuna meat scraped from the backbone) efficiently, by effectively utilizing ingredients.

Recycling of industrial waste from the manufacturing process *Group companies: To utilize food waste by offering the waste produced during the manufacturing process to local livestock breeders and others

Reduction of power consumption *Group companies: To install LED lighting, highly efficient boilers, etc. for reducing power consumption at factories |

S(Society) | Contribution to the business continuity by involving enterprises that have loyal fans in each region

Contribution to the diversity of food in local communities *To develop products with rigorously selected ingredients and recipes, which are strongly demanded by local consumers

Kaorime Honpo: It has a lion’s share in the rice seasoning market in the Chugoku region. Marukawa Shokuhin: It usesigorously selected ingredients, such as fresh pork and locally grown cabbage, and secret recipes Omusubikororin Honpo: It develops local specialties by taking advantage of the location of Shinshu-azumino and the freeze-drying technology Eisen Shuzou: I produces refined sake from “Ryugasawa Spring Water” boasted by the local community and selected as one of the 100 best waters of Japan Daishow: It does not use preservatives or colorants. Smooth texture and taste you will never get tired of. Ohbun: It procures oysters harvested in the clean sea areas of Hiroshima and conditional clean sea areas

* Participating in a free lunch support project for students (Omusubikororin Honpo) and providing field trips for elementary school students and gifts (Mori Yougyojou and Junwa Food)

Diversity of employees *Group companies: To prepare opportunities for female employees to flourish, and take measures for recruiting disabled and foreign workers |

G(Governance) | Support with the SME Support Platform *To design business plans and get involved in progress management according to situations while securing the autonomy of each group company *To establish the control section for each function, support business and manage progress as a corporate group

Support for managerial resources *To support the management of group companies, by procuring funds and training next-generation employers for them |

The company recognizes that taking over companies that have no successors and revitalizing it as their group companies is ESG management itself.

Also, the company believes that contributing to local communities and providing value to consumers by promoting ESG management, as well as increasing the number of good companies that sympathize with the group and want to participate, and the companies and consumers that sympathize with the group and support them as shareholders, will lead to the realization of sustainable growth.

(Taken from the reference material of the company)

2. Fiscal Year ended February 2022 Earnings Results

【2-1 Consolidated results】

| FY 2/21 | Ratio to sales | FY 2/22 | Ratio to sales | YoY | Expected ratio |

Net sales | 29,289 | 100.0% | 29,283 | 100.0% | -0.0% | -4.3% |

Gross profit | 6,209 | 21.2% | 6,343 | 21.7% | +2.2% | - |

SG&A expenses | 5,685 | 19.4% | 5,687 | 19.4% | +0.0% | - |

Operating income | 523 | 1.8% | 655 | 2.2% | +25.1% | -18.6% |

Ordinary income | 787 | 2.7% | 993 | 3.4% | +26.2% | +22.6% |

Net income | 417 | 1.4% | 500 | 1.7% | +19.7% | +44.5% |

EBITDA | 1,607 | 5.5% | 1,577 | 5.4% | -1.9% | -5.6% |

*Unit: Million yen. Net income is the net profit attributable to shareholders of the parent company. EBITDA is calculated by adding amortization (depreciation, goodwill), Covid-19-related subsidy income and acquisition costs associated with M&A to operating income.

Sales were unchanged year on year but profit increased due to the recovery in overseas business.

In the term ended February 2022, sales were unchanged year on year, but profit increased thanks to the recovery of overseas business. Sales were 29,283 million yen. Sales decreased in the domestic business due to the impact of the novel coronavirus. Overseas business sales grew thanks to deregulation of Covid-19. Operating income increased 25.1% year on year to 655 million yen. Domestic business slightly declined due to an increase in labor costs resulting from personnel hiring, but overseas business recovered, mainly in high-margin fields, and profit increased. Ordinary income increased 26.2% year on year to 993 million yen. The foreign exchange gains increased 184 million yen from the previous fiscal year. EBITDA decreased 1.9% year on year to 1,577 million yen.

Sales and operating income did not reach the plan due to the longer-than-expected impact of Covid-19, both in Japan and overseas. Ordinary profit and net income exceeded the plan due to foreign exchange gains and Covid 19-related subsidy income.

【2-2 Results of each segment】

| FY 2/21 | Composition ratio | FY 2/22 | Composition ratio | YoY |

Net sales |

|

|

|

|

|

Manufacturing business | 21,706 | 74.1% | 21,743 | 74.3% | +0.2% |

Sales business | 7,582 | 25.9% | 7,540 | 25.7% | -0.6% |

Total | 29,289 | 100.0% | 29,283 | 100.0% | -0.0% |

Operating income |

|

|

|

|

|

Manufacturing business | 607 | 2.7% | 788 | 2.7% | +29.7% |

Sales business | 435 | 1.5% | 373 | 1.3% | -14.3% |

Adjusted amount | -519 | - | -506 | - | - |

Total | 523 | 1.8% | 655 | 2.2% | +25.1% |

*Unit: Million yen. The composition ratio of operating income means the ratio of operating income to sales.

*Manufacturing business segment

Sales and profit increased.

Domestic manufacturing subsidiaries' sales decreased, and their profit increased as there was a recoil from the special demand in the first quarter due to people spending more time at home and sales for retail stores such as food supermarkets and drug stores slowing down in the prolonging novel coronavirus situation, as well as the improvement of production efficiency and the reduction of costs mainly for distribution.

Regarding overseas manufacturing subsidiaries, sales to retail stores such as supermarkets were favorable due to the easing of novel coronavirus restrictions on socio-economic activities, and sales to hotels and restaurants also have recovered gradually. Thus, sales and profit increased.

*Sales business segment

Sales and profit decreased.

Sales of domestic sales subsidiaries, mainly for industrial catering, decreased, while sales to co-ops increased. Hence, earnings were about the same as those in the previous year.

Sales and profit of overseas sales subsidiaries declined due to a decrease in export sales to countries other than Singapore and a rise in some raw material prices.

【2-3 Financial conditions and cash flow】

◎Main balance sheet

| End of 2/21 | End of 2/22 | Y to Y |

| End of 2/21 | End of 2/22 | Y to Y |

Current assets | 14,828 | 12,545 | -2,283 | Current liabilities | 7,009 | 6,367 | -641 |

Cash and deposits | 4,942 | 3,293 | -1,649 | Notes and accounts payable - trade | 2,465 | 2,338 | -126 |

Notes and accounts receivable - trade | 4,973 | 4,347 | -626 | Short term interest-bearing liabilities | 2,458 | 2,208 | -250 |

Inventories | 4,681 | 4,503 | -177 | Non-current liabilities | 8,821 | 9,060 | +239 |

Non-current assets | 8,321 | 11,197 | +2,876 | Long term interest-bearing liabilities | 8,621 | 8,354 | -266 |

Property, plant and equipment | 3,843 | 5,672 | +1,828 | Liabilities | 15,831 | 15,428 | -402 |

Intangible assets | 3,762 | 4,160 | +398 | Net assets | 7,319 | 8,314 | +995 |

Investments and other assets | 715 | 1,365 | +649 | Retained earnings | 2,633 | 3,115 | +481 |

Total assets | 23,150 | 23,743 | +593 | Total liabilities and net assets | 23,150 | 23,743 | +593 |

|

|

|

| Total interest-bearing liabilities | 11,079 | 10,562 | -516 |

*Unit: Million yen

While cash and deposits, notes and accounts receivable, and inventories decreased, property, plant and equipment increased due to the acquisition of shares of Sharikat, a real estate holding company in Singapore, and total assets increased 590 million yen from the end of the previous term to 23.7 billion yen.

Total liabilities decreased 0.4 billion yen to 15.4billion yen due to a decrease in interest-bearing debt.

Net assets increased 0.99 billion yen to 8.3 billion yen due to an increase in retained earnings and foreign currency exchange adjustments.

The equity ratio increased by 3.0 points from the previous fiscal year to 26.6%.

◎Cash flows

| FY 2/21 | FY 2/22 | Y to Y |

Operating CF | 2,092 | 1,320 | -772 |

Investing CF | -387 | -1,168 | -780 |

Free CF | 1,704 | 151 | -1,553 |

Financing CF | 359 | -1,938 | -2,297 |

Balance of cash and cash equivalents | 4,544 | 2,879 | -1,664 |

*Unit: Million yen

Positive range of operating CF and free CF narrowed.

Cash position decreased.

【2-4 Topics】

(1) Acquiring SHARIKAT NATIONAL FOOD PTE. LTD. (Singapore) as a subsidiary

In December 2021, YOSHIMURA FOOD HOLDINGS ASIA PTE. LTD. (YOSHIMURA FOOD ASIA), which oversees overseas business, acquired the shares of SHARIKAT NATIONAL FOOD PTE. LTD. (Sharikat), a company that owns a food factory and a low-temperature food warehouse in Singapore, and made it a subsidiary to integrate the bases of three Singapore subsidiaries and expand the business.

(Outline of Sharikat)

Established in April 2009.

Sharikat owns a food factory and a low-temperature food warehouse in Singapore and operates a real estate leasing business. The real estate is rented to Sharikat's group companies and third parties. YOSHIMURA FOOD ASIA and its Singapore subsidiary SIN HIN also rent part of it.

SHARIKAT NATIONAL PTE. LTD., the parent company of Sharikat, which owns multiple real estate properties in Singapore and operates a real estate management business, has decided to reorganize the group. Thus, YOSHIMURA FOOD ASIA took over Sharikat's shares.

(Purpose of Making it a Subsidiary)

After making it a subsidiary, JSTT and PACIFIC SORBY will relocate their head offices and factories to Sharikat's properties, and the four companies, including YOSHIMURA FOOD ASIA and SIN HIN will be integrated into one base. As a result, the following synergistic effects can be realized within the group, and Sharikat will continue to rent properties to third parties other than the Yoshimura Food Holdings Group and earn rent income, so sales and profit can be expected to increase.

①Improving distribution efficiency | Currently, SIN HIN delivers products daily to PACIFIC SORBY and JSTT. Since delivery will not be necessary due to the integration of bases, distribution costs will be reduced. |

②Handling renting in-house | Currently, SIN HIN and PACIFIC SORBY rent factories and low-temperature warehouses from third parties and pay rents. However, by moving to the Sharikat properties, costs can be reduced as the rent payments will be paid in-house. |

③Increasing JSTT production capacity | JSTT, which manufactures and sells sushi and other products in Singapore, has been praised for its high-quality products and has been contacted by existing client supermarkets to increase transaction volume and by new client supermarkets to begin transactions. However, the existing factory space is insufficient. Therefore, it is challenging to receive further orders. By moving to the Sharikat properties, the factory space can be expanded. Thus, it could increase sales by fulfilling new orders. |

④Increasing the production capacity of PACIFIC SORBY and strengthening the quality control system | Prior to the outbreak of the novel coronavirus, PACIFIC SORBY had a shortage of production capacity due to an increase in factory utilization rate because of the increased demand for processed frozen marine products in Singapore and favorable order volume. If the novel coronavirus crisis ends and the order volume returns to the previous level, the factory space can be expanded by relocating to Sharikat properties. Therefore, it will be able to take on new orders, and sales could increase. In addition, it will be possible to develop new clients such as hotels by strengthening the quality control system, which may lead to business expansion. |

⑤Promoting collaboration within the group | By consolidating bases, communication between group companies will be smooth, and they will be able to share information promptly. Hence, it will be possible to achieve greater synergistic effects, such as sharing sales channels and reducing costs within the group. |

Singapore Food Agency has licenses and various regulations for real estate regarding food processing and food warehouses in Singapore. Moreover, the supply of low-temperature food warehouses is tight due to increased demand for frozen foods. Thus, rents are on the rise.

By acquiring the real estate through the acquisition of Sharikat's shares, it will be possible to curb future increases in rents and maintain a medium- to long-term advantage in terms of costs.

By making Sharikat a subsidiary, the company aims to improve business performance and create synergies between groups to achieve the early listing of YOSHIMURA FOOD ASIA on the Stock Exchange of Singapore.

(2) Acquiring ONESTORY Co., Ltd. as a subsidiary

On April 1, 2022, the company acquired 70% of the shares of ONESTORY Inc., a wholly owned subsidiary of Hakuhodo DY Media Partners Inc., making it a consolidated subsidiary.

(Outline of ONESTORY Inc.)

Established in April 2016.

With "further exploring the hidden joys in Japan" as its concept, the company's strength is rediscovering and restructuring the food and culture hidden in the local area and planning and producing them as premium content.

DINING OUT (https://www.onestory-media.jp/diningout/), a premium outdoor restaurant that opens only for a few days somewhere in Japan and is planned and operated by ONESTORY, has been held 19 times (18 times in Japan and one time overseas) since 2012. It has introduced the ingredients grown in the area and the richness of the area.

ONESTORY is creating places that give participants new ways of enjoying various parts of Japan and help the locals rediscover the area's attractions as the famous chefs invited to each event infuse new sensations into the ingredients grown in the area through special dishes and unique productions.

In addition, ONESTORY takes time to cover various parts of Japan besides the DINING OUT venue and disseminate the area's charm through ONESTORY MEDIA (https://www.onestory-media.jp/).

ONESTORY provides marketing solutions to local governments and advertiser companies based on its unique planning know-how cultivated through these businesses and its network of top chefs and celebrities who are globally active. In addition to advertising production, product development, brand development support, and space production, ONESTORY develops businesses that include regional revitalization support that discovers the region's charm and revalues it.

(Purpose of Making it a Subsidiary)

Yoshimura Food Holdings was fascinated by ONESTORY's unique marketing and brand development know-how related to food, its driving force and execution capabilities to develop business while involving related regions with companies and local governments, and the planning and development capabilities that constantly create new businesses and sales channels related to food while utilizing its unique know-how. Thus, the company decided to acquire its shares.

The company will further develop the business conducted by ONESTORY by utilizing the network of Yoshimura Food Holdings and its partner Kokubu Group. Moreover, by utilizing the strengths of ONESTORY, such as its unique know-how and its network of top chefs, Yoshimura Food Holdings will enhance its SME Support Platform’s sales and marketing areas, improve the products and corporate brand power of all group companies through collaboration, and raise the level of marketing power.

In addition, by combining the management support know-how and regional network capabilities cultivated by the Yoshimura Food Holdings Group, the company will work to rediscover new attractions hidden in various parts of Japan and create new business opportunities there.

Yoshimura Food Holdings will acquire 70% of the issued shares of ONESTORY, but Hakuhodo DY Media Partners will continue to hold 30%. By promoting collaboration with Hakuhodo DY Media Partners, which has a strong relationship with media content holders, the company will work to improve the business performance of Yoshimura Food Holdings and ONESTORY.

3. Fiscal Year ending February 2023 Earnings Estimates

【3-1 Full-year earnings forecasts】

| FY 2/22 | Ratio to sales | FY 2/23 (Estimate) | Ratio to sales | YOY |

Net sales | 29,283 | 100.0% | 30,526 | 100.0% | +4.2% |

Operating income | 655 | 2.2% | 835 | 2.7% | +27.5% |

Ordinary income | 993 | 3.4% | 783 | 2.6% | -21.2% |

Net income | 500 | 1.7% | 468 | 1.5% | -6.2% |

EBITDA | 1,577 | 5.4% | 1,660 | 5.4% | +5.3% |

*Unit: Million yen. Net profit is net income attributable to shareholders of the parent company. EBITDA is calculated by adding amortization (depreciation, goodwill) and acquisition costs associated with M&A to operating income.

Sales and operating income increase.

Sales are projected to increase 4.2% year on year to 30,526 million yen.

The domestic business is expected to maintain the status quo, and with the new addition of Junido, sales are expected to increase, while the overseas business is expected to recover moderately. Operating income is expected to increase 27.5% year on year to 835 million yen.

The domestic business is expected to see an increase due to price revisions and production efficiency improvements, while the overseas business is expected to see an increase due to a recovery in sales. The forecast does not include growth through new M&A.

【3-2 Impact of Soaring Raw Material Prices and Foreign Exchange】

Food ingredient prices are soaring worldwide due to global supply chain disruptions, unseasonable weather, and rising energy costs. Prices of raw materials and packaging materials purchased by the company group and distribution costs are also rising. Price revisions (hikes), standard revisions (volume changes), and further manufacturing rationalization and cost reduction are being implemented to respond to these increases to maintain and improve the profit margin.

In addition, the exchange rate has fluctuated significantly, and the company's valuation of loans to its Singapore subsidiary may fluctuate, resulting in foreign exchange gains or losses. To continue the business in Singapore, the company plans to avoid hedging through foreign exchange contracts.

4. Growth Strategies

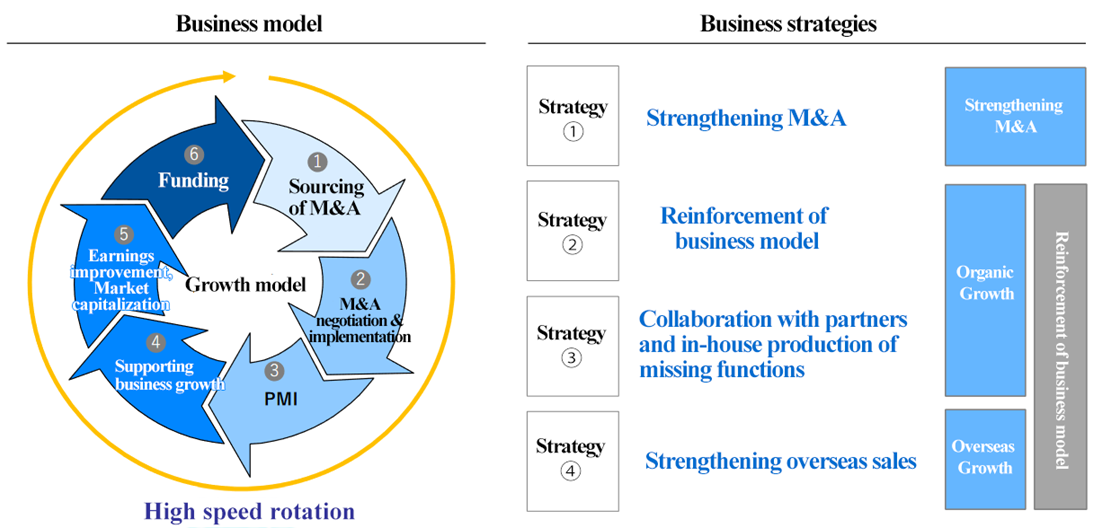

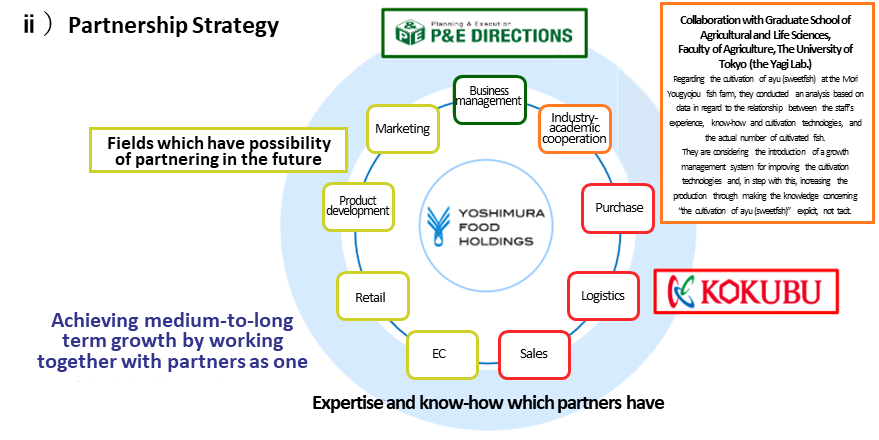

The company has built a unique business model centered on the SME Support Platform in the food industry and is pursuing growth by increasing the number of group companies through M&A and expanding the business of existing group companies.

There is no change in the basic strategies and routes. However, the company set up Strategy (1): strengthening M&A, Strategy (2): re-enhancing the business model, Strategy (3): collaborating with business partners and in-house production of missing functions, and Strategy (4): strengthening overseas sales channels, to speed up the processes from M&A to the PMI and business growth support, execute more M&A, implement growth support, and improve corporate value.

(Taken from the reference material of the company)

By organically linking each strategy, the company aims to realize its vision and achieve its mission.

(Taken from the reference material of the company)

【4-1 Strategy 1: Strengthening M&A】

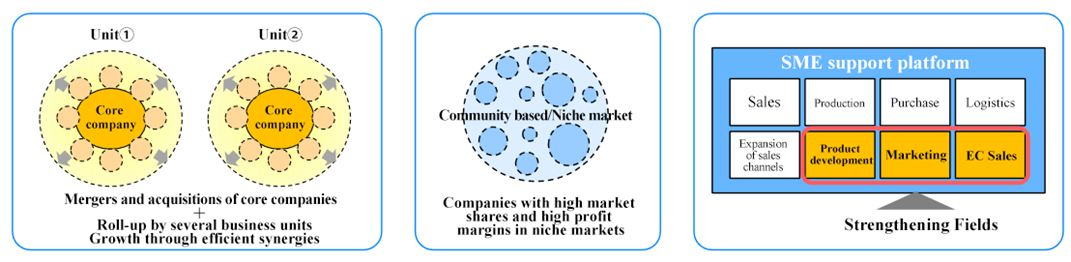

The company will aggressively promote M&A through the three strategies: the business unit strategy, the community-based product and niche market strategy, and the platform strengthening strategy to effectively demonstrate synergistic effects and improve profitability.

Business unit strategy

The company will conduct M&A with companies with a certain degree of business scale and market share and will be a new pillar (core) of the business.

After that, the company will implement roll-up mergers (M&A) of companies in the same field to improve efficiency.

The company will also achieve synergies within the units and improve profitability.

Community-based product and niche market strategy

The company will conduct M&A of companies with a high market share, product strength, and high-profit margins in niche markets.

It will utilize the platform to grow profits by increasing sales.

Platform strengthening strategy

The company will conduct M&A of companies that will improve the SME Support Platform.

In particular, it will strengthen product development, marketing, and EC sales fields.

(Taken from the reference material of the company)

Although the number of M&A deals introduced and executed temporarily dropped due to the impact of the novel coronavirus, it has been on a recovery trend recently. In the future, the company will further expand earnings by accelerating M&A.

【4-2 Strategy 2: Re-enhancing the Business Model】

By hiring specialized human resources, the company aims to improve business performance by improving management support and support for each function.

In management support, the company will hire human resources with abundant management experience and appoint them as presidents of group companies.

In addition, the company will hire excellent young human resources and help them gain management experience in group companies to enhance management innovation.

In support for each function, it will provide support utilizing the SME Support Platform. It will also recruit specialized personnel in each function to strengthen the platform.

(Taken from the reference material of the company)

【4-3 Strategy 3: Collaborating with Business Partners and In-house Production of Missing Functions】

The company aims for further growth by forming alliances and conducting M&A with the most suitable partners for each value chain.

(Taken from the reference material of the company)

Cooperation with KOKUBU GROUP CORP.

The status of collaboration with the Kokubu Group Corp., which has about 35,000 customers, approximately 10,000 trading manufacturers, 54 group companies, almost 600,000 items in the product lineup, and know-how cultivated through over 300 years of business, is as follows.

Challenge | Promotion of the cooperation | Progress |

Sales | *Promotion of sales based on the resources owned by KOKUBU (sales channels, human resources, sales capabilities) | *Proposed Yoshimura Food Holdings' products to Kokubu's business partners (major supermarkets, etc.), and some of them decided to adopt the products |

Purchase | *Increase of channels for procurement with KOKUBU as the point of contact *Increase in gross profit due to lower procurement costs *Review of conditions for bulk purchases of consumable goods | *Successfully reduced costs by switching to procurement of some raw materials through Kokubu *Reduced costs for the entire group by switching to a centralized purchasing system operated by Kokubu for the purchase of consumables |

Product development | *Product development as part of marketing, utilizing the expertise and know-how of KOKUBU | *Commercialization of new products developed in cooperation with Kokubu, such as Kantsuma canned appetizers *Sharing of Kokubu's marketing information with Yoshimura Food Holdings Group and its use in sales and marketing |

Logistics | *Review of the logistics network utilizing the logistics know-how, company warehouses, etc. of KOKUBU *Expansion of product supply (sales) area | *Holding discussions to reduce logistics costs, taking into account the regional characteristics of each Group subsidiary |

M&A | *Identifying and reviewing M&A projects in cooperation with Kokubu *PMI implementation in collaboration with KOKUBU | *Establishment of a system to collect M&A needs in a timely manner by leveraging Kokubu's information network*Investigating projects that can be specifically considered by both companies, including joint PMI and value-up measures, as required |

Other | *Promotion of company-to-company collaboration *Realization of mid- to long-term collaboration | *Introduction of Yoshimura Food Holdings Group to Kokubu Area Company and holding discussions for joint business *Receiving a permanent transfer from Kokubu and maintaining close ties with the company |

【4-4 Strategy 4: Strengthening Overseas Sales Channels】

As one of the functions of the SME Support Platform, the company will strengthen sales of domestic group company products through the Singapore subsidiary.

To that end, it will expand its sales channels to Southeast Asia and China, centering on Singapore. It is also necessary to hire human resources who can communicate in English.

In addition, the company will continue to study conducting M&A of companies that will lead to the group's growth as needed, mainly in Southeast Asia.

It will also aspire for growth by utilizing the resources of the company and partner companies such as Kokubu.

The company has set up its own sales booth at Jurong Point, the largest shopping mall in western Singapore, to improve Japanese group companies' product sales.

5. Conclusions

While the impact of the new coronavirus is weakening, there are still many uncertain factors in the company's business environment, such as soaring raw material prices and exchange rate fluctuations. It will be interesting to see how further manufacturing rationalization and cost reductions, in addition to price revisions (price increases) and standardization revisions (content volume changes), will contribute to earnings.

In the medium term, we will focus on the progress of four strategies: "Strategy 1: Strengthening M&A," "Strategy 2: Re-enhancing the business model," "Strategy 3: Collaborating with business partners and in-house production of missing functions," and "Strategy 4: Strengthening overseas sales channels.

In particular, regarding "Strategy 3: Collaborating with business partners and in-house production of missing functions," we expect the conversion of ONESTORY Inc. into a subsidiary to strengthen the marketing function and strengthen the relationship with Hakuhodo DY Media Partners Inc. The acquisition of ONESTORY is also expected to strengthen the relationship with Hakuhodo DY Media Partners, Inc. We look forward to the results of the alliance with Kokubu as well.

<Reference : Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with internal auditors |

Directors | 5 directors, including 2 outside ones (Both are designated as independent executives) |

Auditors | 3 auditors, including 3 outside ones (All three are designated as independent executives) |

◎Corporate Governance Report

The latest update: December 29, 2021

<Basic Policy>

Our company believes that our sustainable growth and creation of mid/long-term corporate value can be achieved especially through the trusting relationships and cooperation with our stakeholders, including shareholders, clients, business partners, employees, and local communities.

Accordingly, we consider that the most important mission in management is to keep tightening corporate governance as a base for securing the soundness, transparency, and efficiency of business administration. We will strive to secure the transparency and fairness of our company and timely disclose information to all stakeholders by streamlining the decision-making process, improving the supervisory function for business execution, strengthening the function to oversee directors, and developing an internal control system.

<Reason for not implementing the principles of the Corporate Governance Code (excerpt)>

Principle | Reason for not following the principle |

(Supplementary Principle 2-4-1 Ensuring Diversity in Appointing Core Human Resources) | We believe securing and training diverse human resources will improve corporate value over the medium to long term. Thus, we will hire and promote human resources fairly and impartially, emphasizing ability and achievements regardless of gender, age, or nationality. At this time, we have not set measurable numerical targets for the promotion of women, foreigners, and mid-career hires to managerial positions, but we will continue to promote measures to ensure diversity and will also consider setting targets. |

(Supplementary Principle 3-1-3 Sustainability Initiatives) | We disclose information on sustainability policies and specific initiatives using financial results briefing materials. We do not disclose the investment in human capital or intellectual property, but we will review disclosing it in consideration of its consistency with our management strategy and challenges. Regarding the impact of the risks and profit opportunities related to climate change on our business activities and profits, we will consider the disclosure method and framework after organizing the issues to be dealt with by analyzing the risks and opportunities related to our company. |

<Principle 5-2> | Our company has disclosed our mid/long-term growth strategies via the reference material for briefing financial results, etc. We will discuss methods for giving understandable explanations on concrete goals, execution measures, etc. to shareholders. |

<Disclosure based on the principles of the Corporate Governance Code (excerpt)>

Principle | Disclosed information |

<Principle 1-4 Strategically held shares> | For the purpose of maintaining and strengthening transaction relations, we hold shares strategically to a limited extent. In this case, we judge whether or not to invest, while comprehensively considering the benefits, risks, capital costs, etc. arising out of the maintenance and strengthening of transaction relations, and whether they would contribute to the increase in our corporate value. The board of directors examines economic rationality of individual strategically held shares every year, such as whether the benefits and risks arising out of strategic holding of each stock will recoup capital cost and whether it will increase our corporate value from the mid/long-term viewpoint. We will try to reduce the number of shares we hold if we determined that the significance of holding of that stock is not sufficient. We exercise voting rights appropriately with the criteria considering whether it will lead to the increase in corporate value from the mid/long-term viewpoint or whether it will degrade the significance of shareholding. We will not agree with any proposals by the company or a shareholder that would degrade the share value. |

<Principle 5-1 policy For promoting constructive dialogue with shareholders> | In order to conduct constructive dialogue and communication with shareholders and investors, our company will develop a system with the management department being in charge of IR. If shareholders and investors request an interview, mainly our representative director and CEO will attend to them within a reasonable range, hold a session for briefing financial results every quarter, and distribute contents via videos. The opinions, etc. received in the dialogue with shareholders and investors are reported to directors and other executives every time. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |