Bridge Report:(2884)Yoshimura Food The second quarter of the Fiscal Year ending February 2024

Representative director and CEO Motohisa Yoshimura | Yoshimura Food Holdings K.K. (2884) |

|

Corporate Information

Exchange | TSE Prime Market |

Industry | Food products (manufacturing) |

Representative director and CEO | Motohisa Yoshimura |

Address | 18F, Fukoku Seimei Bldg., 2-2-2, Uchisaiwai-cho, Chiyoda-ku, Tokyo |

Year-end | February |

URL |

Stock Information

Share price | Shares Outstanding | Total Market Cap | ROE(Actual) | Trading Unit | |

¥1,015 | 23,876,621 shares | ¥24,234 million | 8.9% | 100 shares | |

DPS(Estimate) | Dividend Yield(Estimate) | EPS(Estimate) | PER(Estimate) | BPS(Actual) | PBR(Actual) |

¥0.00 | - | ¥31.48 | 32.2x | ¥314.11 | 3.2x |

*The share price is the closing price on October 30. Share Outstanding, DPS and EPS are from the second quarter of the financial results for the FY24/2. ROE and BPS are actual results for the previous term.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2020 (Actual) | 29,875 | 808 | 740 | 177 | 8.02 | 0.00 |

February 2021 (Actual) | 29,289 | 523 | 787 | 417 | 18.59 | 0.00 |

February 2022 (Actual) | 29,283 | 655 | 993 | 500 | 21.03 | 0.00 |

February 2023 (Actual) | 34,937 | 678 | 1,323 | 613 | 25.77 | 0.00 |

February 2024 (Estimate) | 46,679 | 1,574 | 1,575 | 749 | 31.48 | 0.00 |

*Unit: Million yen. The estimated values were provided by the company.

This Bridge Report presents Yoshimura Food Holdings K.K.’s earnings results for the second quarter of the Fiscal Year ending February 2024.

Table of Contents

Key Points

1. Company Overview

2. The second quarter of the Fiscal Year ending February 2024 Earnings Results

3. Fiscal Year ending February 2024 Earnings Estimates

4. Growth Strategies

5. Interview with CEO Yoshimura

6. Conclusions

<Reference1: Collaborating with Business Partners >

<Reference2: Regarding Corporate Governance>

Key Points

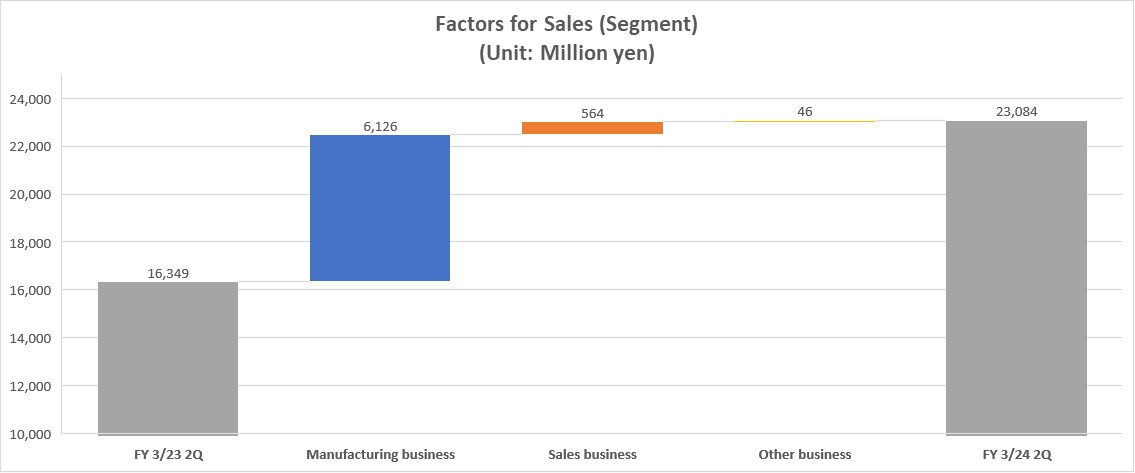

- The sales in the second quarter of the term ending February 2024 were 23,084 million yen, up 41.2% year on year. Sales increased both domestically and overseas. Six companies that newly joined the corporate group through M&A also contributed to sales. Operating income rose 376.4% year on year to 921 million yen. In addition to price revisions in response to soaring raw material prices, suspending unprofitable transactions and narrowing down production items have been effective. Profits increased significantly as these factors absorbed the increase in SG&A expenses.

- There are no changes to the earnings forecast. For term ending February 2024, the company forecasts sales of 46,679 million yen, up 33.6% year on year; an operating income of 1,574 million yen, up 131.9% year on year; and an EBITDA of 2,718 million yen, up 36.3% year on year. In addition to organic growth of existing companies, they will start posting profits from newly acquired group companies (Kobayashi Noodle Co., Ltd., Hayashi-Kyuemon-Shouten Co.,Ltd., and MARUKICHI Co., Ltd.), and a decrease in M&A-related expenses will also contribute. In response to cost increases due to soaring raw material and distribution costs, the company will work to further improve production efficiency and cut costs, while implementing price and standard revisions for customers in order to secure appropriate profits.

- In October 2023, the company acquired 70% of the outstanding shares of YS Foods Co., Ltd., which processes scallops, and made it a subsidiary. The reasons for the stock acquisition included “securing a procurement route for Japanese scallops, whose demand is increasing overseas,” “the company’s position as a major scallop processing company with high-quality control capabilities and production and processing facilities,” and “creating synergy with Yoshimura Food Holdings group companies.”

- Although China’s suspension of imports of Japanese marine products may have a temporary impact on earnings, such as a decrease in YS Foods Group’s sales to China, it is unlikely that demand for Japanese scallops, which are increasingly highly regarded around the world, will decline, and the impact on mid- to long-term earnings is expected to be limited. The Japanese government and Tokyo Electric Power Company have announced that they will compensate fishery-related companies that have suffered damage as a result of the suspension of imports, and the company will proceed with procedures to receive compensation if any damage occurs.

- We interviewed CEO Yoshimura about the impact of China’s suspension of scallop imports and asked him to send a message to shareholders and investors. In his interview, he stated, “If the number of scallops exported from Japan to China is 100, half of the processed scallops will be exported to the United States, and China will consume 20 to 30, so this problem is merely due to a temporary disruption in the supply route.” He also said, “We are not losing sales because of some problem with scallops, which are the top export product by category, surpassing whiskey and beef due to the stable supply and high quality of farmed scallops. We hope you understand that with strong global demand, there is a huge business opportunity for our company, which has factories that can export products to both EU and the U.S.” “We are now able to add companies like MARUKICHI and YS Foods that are both large and profitable to our group, and we look forward to your continued support as we aggressively pursue our growth strategy to increase our corporate value and solve social issues.”

- Preparations for a project to establish an intermediate holding company in Hokkaido with MARUKICHI and YS Foods as core companies and to add Hokkaido fisheries and other companies to the group appear to be steadily underway. Yoshimura’s recognition has increased significantly as a result of making two prominent companies subsidiaries in the Hokkaido fisheries industry, and the scheme to conduct an IPO of the intermediate holding company in which the former owner owns 30% of the shares will be highly beneficial to both Yoshimura and group companies and will be an engine that will greatly promote adding leading companies to the group. Scallops and other Japanese marine products are highly valued by wealthy overseas consumers, and with the market expected to continue to expand, we look forward to the release of the third and fourth rounds.

1. Company Overview

Yoshimura Food Holdings conducts M&A of food-related small and medium-sized enterprises that, regardless of their quality products or unique manufacturing techniques, are facing various issues such as the difficulty in finding successors. It also facilitates the growth of the entire corporate group by solving problems with their core skill, “a platform for supporting small and medium-sized enterprises (SME Support Platform),” and energizing each group company. Its strengths are the overwhelming advantage toward investment funds or large companies and the high barrier to entry. The company aims to accelerate its growth through alliances. As of the end of August 2023, there are 27 major group companies.

【1-1 Corporate History】

One day, a food company that was facing financial difficulties and could not find a buyer was introduced to Mr. Yoshimura, who was managing the listed companies’ fundraising and M&A in the corporate business division at Daiwa Securities Co. Ltd. and Morgan Stanley Securities Co., Ltd.

Mr. Yoshimura took on this food company and established L Partners Co., Ltd. on his own in March 2008, which was the predecessor of Yoshimura Food Holdings K.K. because he strongly felt that Japan could be more appreciated through its “food” since his MBA days in the USA while working for Daiwa Securities. Through his efforts to revitalize the company using his experience and network, he succeeded in turning a profit.

Many food SMEs started seeking help from Mr. Yoshimura upon learning about his reputation. He thought that it was possible to efficiently achieve results if the companies complemented each other in various functions, such as product development, production, and sales under a holding company system, instead of working on each company individually. Hence, he named the corporate Yoshimura Food Holdings K.K. in August 2009.

Since then, the company has continued acquiring companies facing problems with business succession or failing to handle management on their own. Due to the high reputation of the company for its unique position of not competing with major food companies and investment funds and its policy of not selling the companies it acquired, it received financing from INCJ, Ltd. (Innovation Network Corporation of Japan) and Japan Tobacco Inc. (JT) and expanded its business. In March 2016, it was listed on the Mothers of Tokyo Stock Exchange, and in March 2017, it was listed in the first section of Tokyo Stock Exchange. In April 2022, it was transited to the Prime Market of Tokyo Stock Exchange.

The company is pursuing further growth by acquiring not only Japanese companies, but also overseas companies in Singapore, Malaysia, etc.

【1-2 Target Social Image】

As the social meaning of its existence as an enterprise, the company decided to pursue the mission: “working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures,” and set its vision (roles to be fulfilled) and values (values they cherish).

Mission Working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures | *We believe that a society in which people can choose from various options freely according to their respective preferences and a society in which those choices are respected is affluent and happy. *We aim to achieve an affluent society in which consumers around the world can choose from a wide array of high-quality “delicious foods” freely and enjoy them. |

Vision To protect and nurture the “delicious foods” in each region, and distribute them around the world | *In order to realize a society where we can enjoy this “delicious taste” forever, we will discover “delicious foods” that have been cherished in Japan and around the world, protect and nurture them, and deliver them to people around the world. *To do so, we will develop our own ability to find “delicious foods”, a business base for protecting “delicious foods”, functions to support the growth of “deliciousness”, and sales networks to deliver “delicious foods” to people around the world. *As a result, our company will become a global producer that promotes the cultures and diversification of foods around the world and the invigoration of local communities. |

Values To cherish individuality | *We cherish the individuality of everyone related to us. *We value the “individuality”, “new ideas”, and “desire to take on new challenges” of each employee working in our corporate group. *We value the “history”, “culture”, “employees”, “business partners”, and “local communities” of each of our group companies. *We brush up the “strengths” of our group companies, mutually make up for their “weaknesses,” and grow together. *We will contribute to the development of an affluent society with a variety of options available, by cherishing the individuality of everyone related to us. |

【1-3 Market Environment and the Background of the Company’s Establishment】

As a company aiming for supporting and revitalizing SMEs throughout Japan, Yoshimura Food Holdings explained the conditions of the food SMEs as follows:

(Investment Bridge extracted, summarized, and edited the information from Yoshimura Food Holdings’ annual securities reports and reference material)

(The Conditions of the Food SMEs)

*Japanese cuisine has been highly appreciated worldwide and is attracting attention. Also, on the national level, the food manufacturing industry has been one of the largest industries based on its number of business establishments, number of employees and GDP since the 1990s and it is one of the key industries that Japan is proud of.

*99% of the companies are SMEs where each one of them has strong products and technical skills.

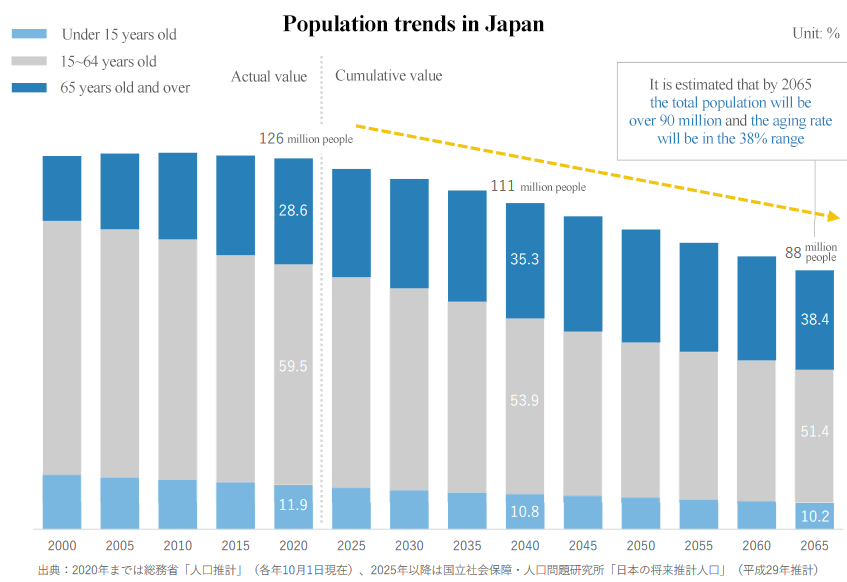

*However, the domestic market scale is shrinking and some of the food SMEs find it hard to survive on their own as the business environment remains stringent due to the falling birthrate and aging population.

*Therefore, many companies give up on continuing their businesses and end up choosing to close down or suspend their business.

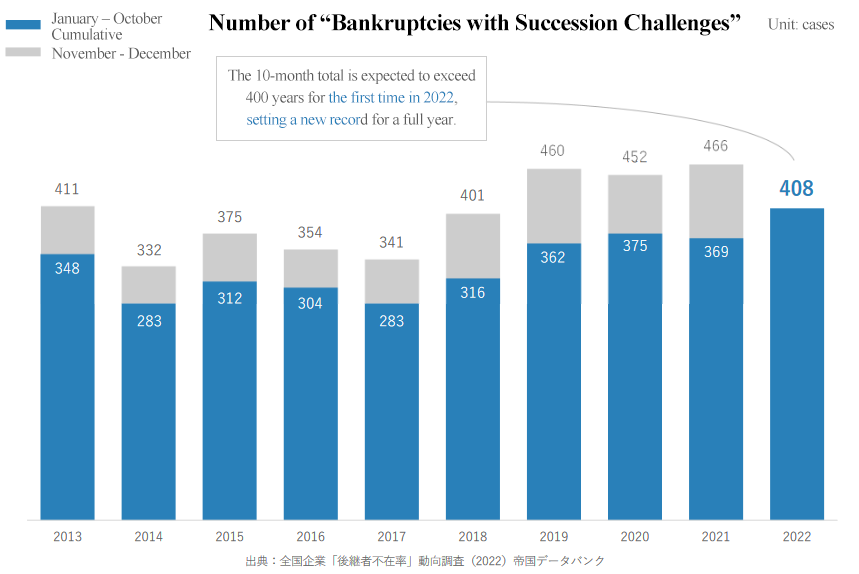

(Conditions of the SMEs’ Business Succession)

*The average age of managers is 63.02, and it is expected that around 50% of the managers will reach the average retirement age in the upcoming 7 years as the average retirement age of managers is around 70.

*Meanwhile, 57.2%, nearly two thirds of domestic enterprises are suffering the lack of successors, and the ratio of enterprises that plan to conduct business succession is only 33% in all industries. Namely, the preparations for business succession have not progressed.

*Moreover, in 2020, the number of SMEs that suspended or discontinued business reached 49,698 and have increased rapidly for 13 years in comparison with in 2007 where that number was around 21,000.

(According to SME Agency “White Paper on Small and Medium Enterprises” (2023 Edition), Teikoku “Analysis of the age of company presidents in Japan (2022),” Teikoku “Survey of Trends on ‘Companies without a Successor’ in Japan” (2022), SME Agency “Basic Survey on the Actual Situation of SMEs” (Report in FY 2022 [Financial results in FY 2021])

(Conditions of Business Succession of Food SMEs through Acquisition)

*Although there are increasing needs for business succession from food SMEs, the number of companies and organizations that would acquire them is small.

*The scale of many food SMEs is too small for major companies to acquire, and for investment funds’ whose primary aim is to rapidly grow independent companies and sell them off within a few years, the mature market of food SMEs tends not to be one of their investment targets.

*Under these conditions, there is a tremendous shortage in the bearers of the responsibility of taking on the business of the SMEs.

【1-4 Business Description】

Having Yoshimura Food Holdings as its holding company, the corporate group consists of 27 group companies in August 2023.

Yoshimura Food Holdings aims to support and revitalize SMEs that manufacture and sell food products by creating a corporate group, composed of the food SMEs that are facing problems in securing a successor, through M&A. Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each company in the group. It also supports and supervises their sales and marketing, production management, procurement and manufacturing, procurement, distribution, product development, quality control, and business management.

①Business Model

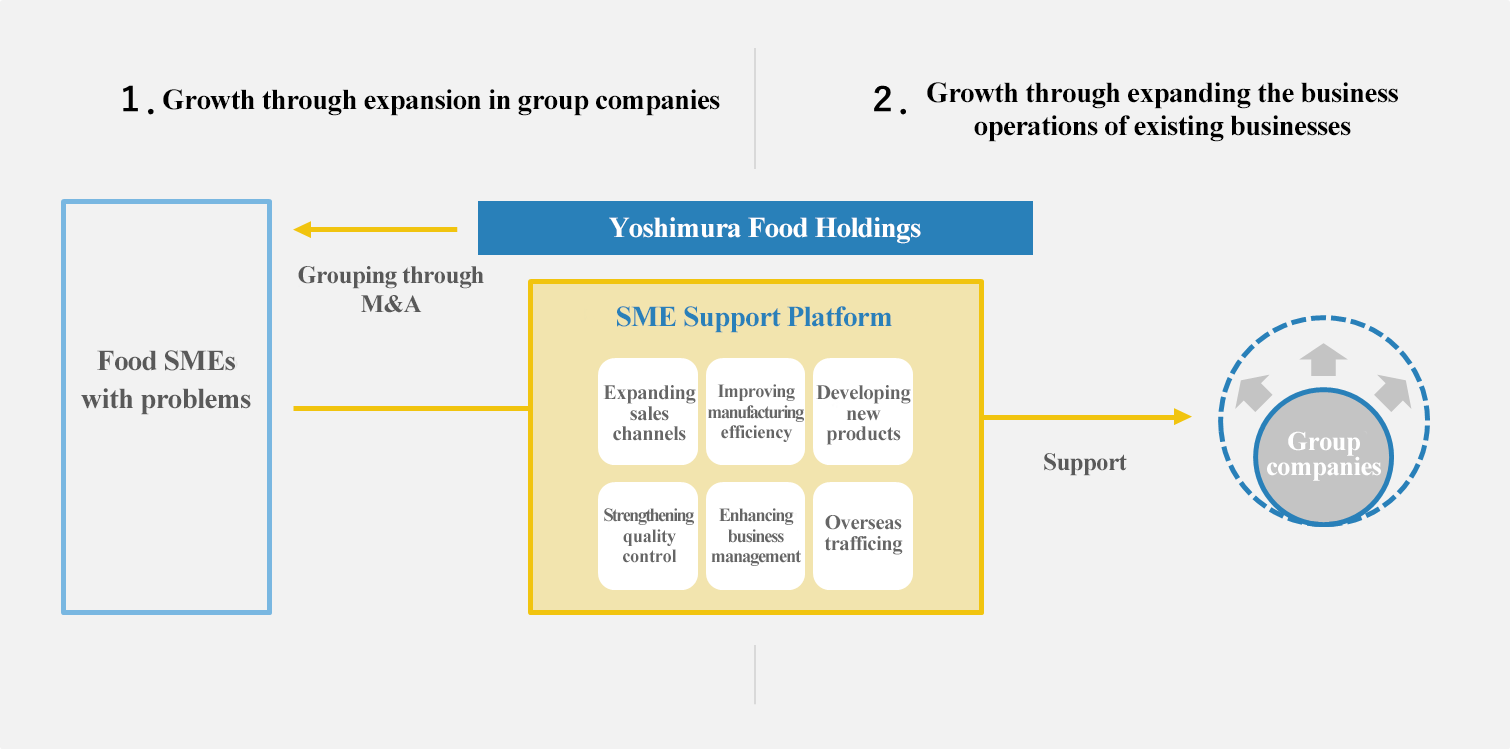

The company develops a unique business model in the food industry and is pursuing growth based on two engines.

One of them is the increase in the number of group companies through M&A.

Since its establishment in 2008, the company prevented food SMEs that had business succession and financial problems from shutting down or facing business suspension by acquiring them. Thus, it has managed to solve their problems.

It is recently focusing on adding not only Japanese companies to the group, but also overseas ones.

Projects sourcing have been so far found (discovered) mainly with an "indirect approach" through introductions from M&A brokerage firms, regional financial institutions (mainly local banks), lawyers, and accountants. In order to speed up the process, the company intends to strengthen its “direct approach” to build relationship for future M&A and to more proactively and aggressively seek out new projects, which is planned to be done by creating a target list and approaching the companies on its own as well as by utilizing the network of KOKUBU GROUP CORP.

The other one is the expansion of business of existing group companies.

Yoshimura Food Holdings supports the expansion of business operations of each company and solves problems by supervising each function of these companies, which have excellent products and technologies but could not achieve growth for reasons such as the lack of sales channels, labor shortage or poor business management, through the “SME Support Platform.”

(Taken from the reference material of the company)

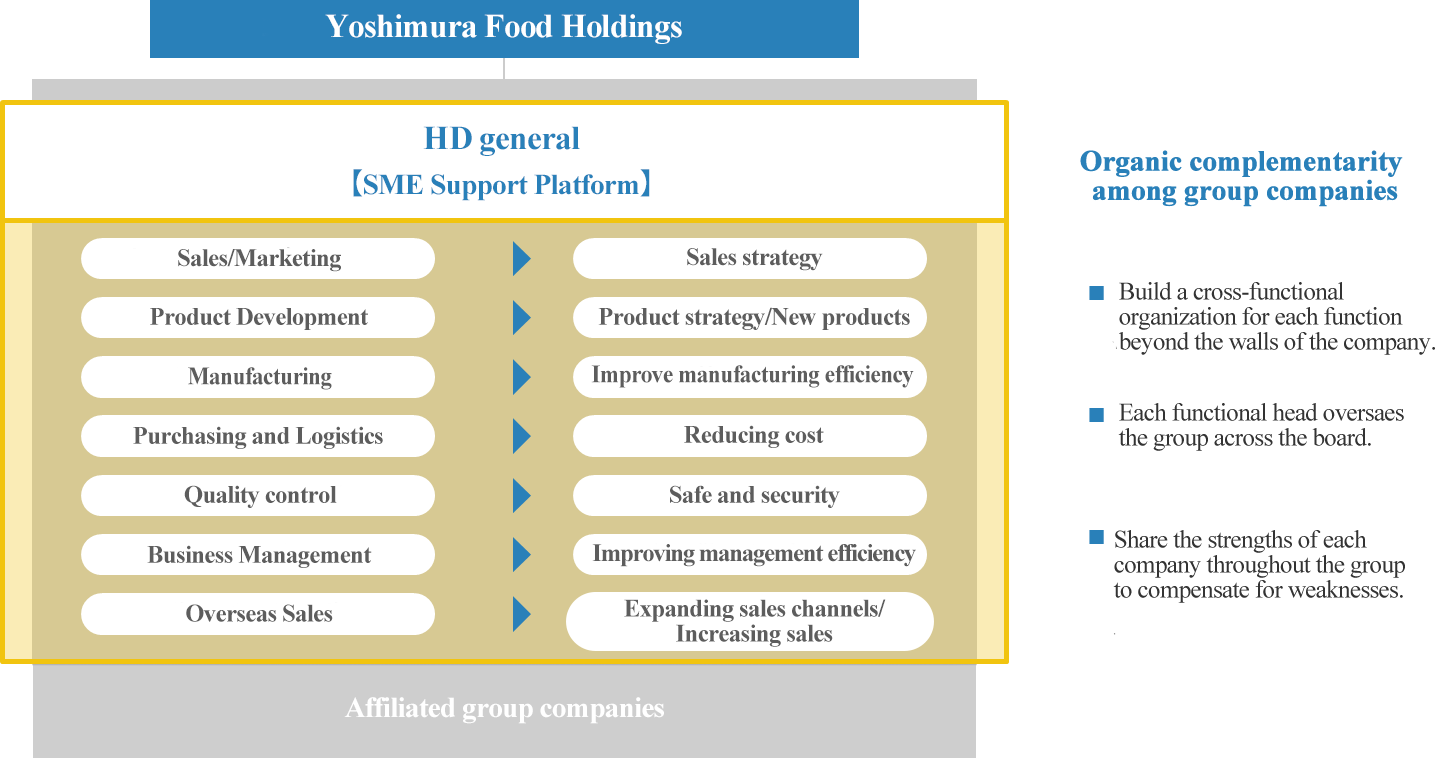

What is the SME Support Platform?

The core of this unique business model is the “SME Support Platform,” a product of the company’s accumulation of know-how and achievements through its specializing in food manufacturing and sales.

As a holding company, Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each subsidiary in the group. It also aims to strengthen the business foundation of each subsidiary through the company supervisor’s horizontal supervision of its functions (sales and marketing, production management, procurement and distribution, product development, quality control, business management, and securing personnel) in a manner that goes beyond the company barriers and by building organic relations between subsidiary companies.

For example, Company A which has an excellent product but is worried about sales growth can use the sales channels and sales know-how of Company B that has a nationwide sales network. Also, it can achieve a stable financial position by using the creditworthiness of Yoshimura Food Holdings which is listed in the stock market to raise funds.

This cooperation is made to be more effective through appointing the personnel in the group with the highest levels of expertise as supervisors.

Hence, the “SME Support Platform” is a system in which each company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds, or sales channels are supplemented.

“SME Support Platform” functions effectively and produces effects with the current structure, but as subsidiaries will increase further, their know-how will be added as a new strength, and the managerial resources of the corporate group will be accumulated, bringing out a new synergy so that existing subsidiaries will be able to seize opportunities to grow business and acquire the know-how to streamline production processes.

Such scalability of the platform will fortify the business foundation of Yoshimura Food Holdings.

(Taken from the reference material of the company)

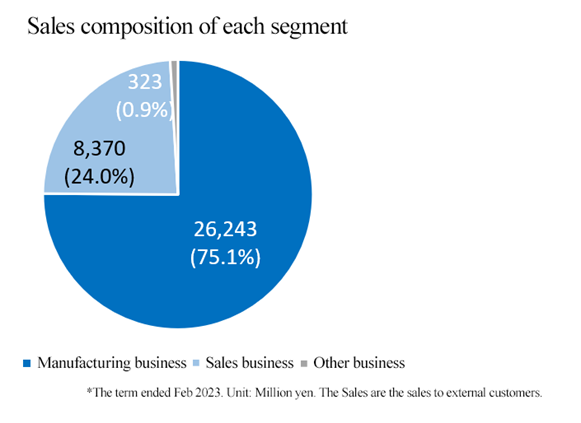

②Segments

The company has two main segments: “manufacturing business segment” and “sales business segment.” From FY 2/2023, "Other Businesses," consisting of real estate leasing and management businesses, as well as event, media, and marketing businesses, have been reported.

◎ Manufacturing Business Segment

Each company develops and manufactures its original products, domestic enterprises sell products to supermarkets, convenience stores, and drug stores around Japan via mainly wholesalers, and overseas enterprises sell products to hotels, restaurants, supermarkets, etc. in Singapore and Malaysia. As of the end of August 2023, there are 22 group companies as tabulated below.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

Raku-you Food Co., Ltd. (Adachi-ku, Tokyo) | Having five factories in Japan, the company manufactures and sells chilled shumai and chilled dumpling. It has the largest share of chilled shumai production in Japan. |

Ohbun Co., Ltd (Shikokuchuo City, Ehime Prefecture)

| The company has a unique route to procure oysters from Hiroshima Prefecture, whose supply is limited, and produces and sells fried oysters as its main product, as well as fried chicken cartilage, fried chicken meat, and other items. |

Shiraishi Kosan Co., Ltd. (Shiraishi City, Miyagi Prefecture) | It was established in 1886, the company’s main product is Shiroishi Umen, a specialty of Shiroishi City, Miyagi Prefecture. It manufactures and sells dried noodles and other products made using traditional methods. |

Daishow Co., Ltd. (Tokigawa-machi, Hiki-gun, Saitama Prefecture) | The company is a pioneer in the peanut butter industry. “Peanut Butter Creamy” made by its own unique manufacturing methods has been continuously a long-selling product since started being sold in 1985. |

Shiroishi Kosan Co., Ltd. (Shiroishi City, Miyagi Prefecture) | The company started business in 1886. Its core product is Shiroishi-uumen, which is a local specialty in Shiroishi-City, Miyagi Prefecture. It produces and sells the dry noodles, etc. with a traditional method. |

Sakuragao Shuzo K.K. (Morioka City, Iwate Prefecture) | The company was established in 1973 as a collective of 10 local breweries in Iwate Prefecture. The sake is brewed using the skills of the biggest Toji (head brewers) group in Japan, Nanbu Toji, and has a high reputation for its fruity taste. |

Ohbun Co., Ltd. (Shikokuchuo City, Ehime Prefecture) | The company has original routes for procuring oysters harvested in Hiroshima, whose supply amount is limited. Its core product is deep-fried oyster, and it also produces and sells deep-fried soft chicken bone, deep-fried chicken breast strips, etc. |

Yuhoku Seafood Processing Co., Ltd. (Oi-machi, Ashigarakami-gun, Kanagawa Prefecture) | The company manufactures and sells negitoro and tuna slices using tuna that is immediately frozen on the ship at minus 50-60 degrees as soon as it is caught. |

JUNWA FOOD Corporation (Kumagaya City, Saitama Prefecture) | The company manufactures and sells jellies. It has constructed a perfect quality control system, including having acquired the Saitama Prefecture HACCP. Although it is still a start-up company in jelly production, it has an established reputation by major hypermarkets for its products’ quality and technological capabilities. |

SK Foods Co., Ltd. (Yorii-machi, Osato-gun, Saitama Prefecture) | The company mainly manufactures and sells chilled and frozen pork cutlet and makes products that meet customer needs. It also conducts direct procurement and direct sales without depending on any trading companies. |

Yamani Noguchi Suisan Co.,Ltd. (Rumoi City, Hokkaido Prefecture) | For half a century, the company has manufactured and sold Hokkaido prefecture’s specialties such as salmon jerky and herring that are prepared by its skilled workers with unique manufacturing techniques. |

JSTT SINGAPORE PTE. LTD. (Singapore) | Located in Singapore, the company manufactures and sells sushi, makimono, rice balls, etc. |

Omusubikororin Honpo K.K. (Azumino City, Nagano Prefecture) | Using its own freeze-dry device, the company manufactures ingredients for confectionery, emergency food, etc. Its “Mizu Modori Mochi” (rice cakes that can be prepared by adding water) is famous for being used in the Space Shuttle Endeavour. |

Marukawa Shokuhin Co, Ltd. (Iwata City, Shizuoka Prefecture) | A famous dumpling shop in Hamamatsu area. The company manufactures and sells dumplings at the store, using carefully selected ingredients and a secret recipe the company has been following since its establishment. |

PACIFIC SORBY PTE. LTD. (Singapore) | The company processes and wholesales chilled and frozen seafood products in Singapore.

|

Mori Yougyojou Co., Ltd. (Ogaki City, Gifu Prefecture) | The company’s harvest amount of farmed ayu (sweetfish) is top-class in Japan. It has nurtured the original know-how to collect roe, incubate them, grow and ship fish stably. In addition, it possesses the technology to make fish give birth to male or female fish. |

NKR CONTINENTAL PTE. LTD. (Singapore) | In Singapore and Malaysia, the company manufactures, imports, sells, designs, installs, and maintains kitchen equipment. |

Kaorime Honpo Co., Ltd. (Izumo City, Shimane Prefecture) | The company produces a wide array of high-quality products ranging from original products to OEM ones, including soft dried seaweed for seasoning rice, dried hijiki for seasoning rice, seaweed soup, ochazuke with seaweed, etc. |

Junido Co., Ltd. (Dazaifu City, Fukuoka Prefecture) | The company manufactures and sells soft furikake (rice seasoning) such as Umenomi-hijiki. It has many fans all over the country and is very popular. |

K.K. ODAKISHOUTEN (Kasama-shi, Ibaraki Prefecture) | The company manufactures and sells products, mainly Iwama Chestnuts from Ibaraki Prefecture. |

HOSOKAWA FOODS, CO., LTD. (Kanonji-shi, Kagawa Prefecture) | The companyanufactures and sells frozen delicatessen products such as kakiage and chijimi using domestic vegetables, as well as frozen rice products such as sekihan (red bean rice). |

Kobayashi Noodle CO.,LTD. (Sapporo-shi, Hokkaido) | The company is mainly engaged in producing and selling fresh noodles (ramen), producing gyoza (dumpling) skins, and selling seasonings including sauce. |

Hayashi-Kyuemon-Shoten Co.,Ltd. (Fukuoka City, Fukuoka Prefecture) | The company produces, processes, and sells flaked bonito and broth, with its main product being Monaka Osuimono (lightly seasoned broth placed inside rice wafers), which was originally developed by the company. |

Marukichi Co., Ltd. (Abashiri City, Hokkaido) | The company produces, processes, and sells scallops, salmon, salmon roe, crab, and other products. |

*In October 2023, YS Foods Co., Ltd., which processes and manufactures seafood, became a subsidiary.

◎ Sales Business Segment

Its strengths are sales capability and planning skills. Domestic enterprises sell products to mainly industrial catering companies, consumer cooperatives, etc., while overseas enterprises sell products to mainly supermarkets, hotels, restaurants, etc. As of the end of August 2023, group companies are the following three.

(Group Companies within the Sales Business Segment)

Company Name | Features |

Yoshimura Food Co., Ltd. (Koshigaya City, Saitama Prefecture) | The company mainly conducts the planning and sales of industrial food ingredients. It does not have distribution channels, but it has constructed a business model where it sends products directly to customers. |

Joy Dining Products Co., Ltd. (Koshigaya City, Saitama Prefecture) | The company conducts the planning and sales of frozen foods. It also has direct accounts with consumer co-ops throughout Japan and utilizes them to sell the products of the group companies. |

SIN HIN FROZEN FOOD PRIVATE LIMITED (Singapore) | The company procures high quality, safe and trusted frozen seafood products and processed seafood products from the influential seafood companies in various parts in Asia. |

◎ Other segments

As of the end of August 2023, the group companies are the following two companies.

(Other Segment Group Companies)

Company | Characteristics |

SHARIKAT National FOOD (Singapore) | The Company owns a food factory and a cold storage warehouse for food products in Singapore, and is engaged in the real estate leasing business. |

ONE STORY Inc. (Minato-ku, Tokyo) | The company conducts event businesses. It rediscovers and restructures the food and culture hidden in the local region and produces them as premium content. |

【1-5 Characteristics and Strengths】

①The Advantage in Business Succession through Acquisition

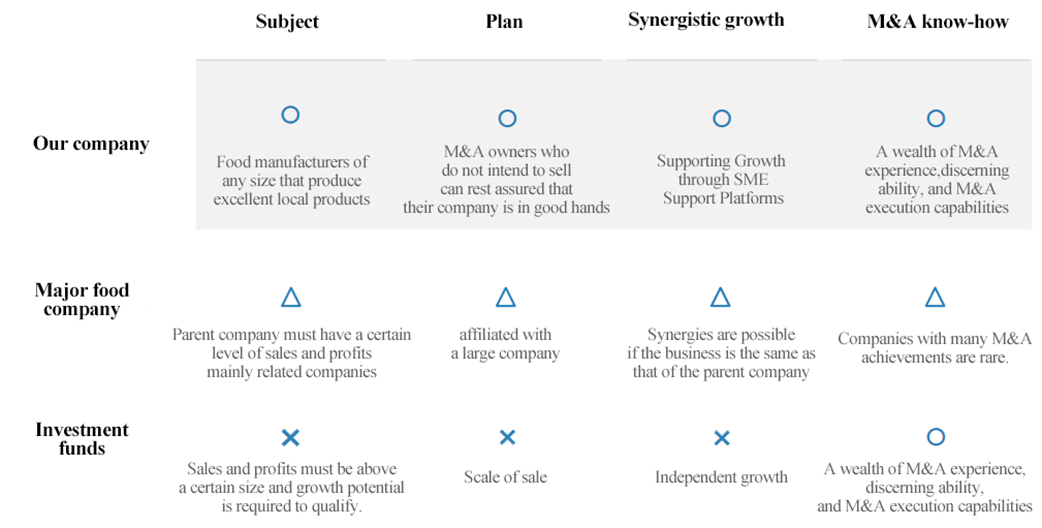

There are the leading strong buyers in M&A in the food industry, such as major food companies and investment funds; however, this company has three main points that form strong competitive advantages, which are explained below.

*Ability to Acquire Companies of Various Scales

The company does not aim to sell the companies it acquired. It aims to not only achieve short term business recovery, but also achieve sustainable growth from a medium to long term perspective. Therefore, the company can acquire a variety of SMEs, including those with a small business scale that would take time to achieve growth and those that lack management resources for growth. This point creates a huge difference between the company and other major food companies and investment funds that need the companies they will acquire to be of a certain scale. Moreover, it is not easy for investment funds aiming to generate capital gains from selling companies to gain the trust of owners and managers of food SMEs. Regarding this point, this company operating company groups with the aim of achieving sustainable growth from a medium-term perspective also has a huge advantage.

*Advanced Capability of M&A

Since its establishment, the company has worked on creating many company groups out of food-related SMEs and later has achieved re-growth of these companies. Thus, it has thorough knowledge of the market environment of the food industry, business practices and risks that are peculiar to food SMEs, and strong assessment abilities, which enable the company to choose companies that have strengths from a large number of SMEs.

Also, the company has an extremely high capability of M&A since it has great expertise and accumulated knowledge in due diligence and negotiations.

*Rich and High-Quality M&A Data through its Wide Network

The company can gather plenty of M&A data on the food SMEs since it has a wide network of financial institutions, such as city banks, regional banks, credit associations, securities companies and companies that provide M&A advisory services.

Furthermore, “the company’s specialization in the food industry” and “the reassurance that the company is not aiming to sell” are the two factors allowing the company to access not only to a huge amount of data, but also high-quality data that meets its needs.

②Core Skill: SME Support Platform

The company revitalizes the group companies through the “SME Support Platform” in which each group company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds or sales channels are supplemented. These achievements are highly evaluated.

③Contribution to regional vitalization

The company has actively implemented the business succession, etc. of local food SMEs, including Sakuragao Shuzo K. K. (Iwate Prefecture), Shiroishi Kosan Co., Ltd. (Miyagi Prefecture), and Ohbun Co., Ltd. (Ehime Prefecture), which are subsidiaries.

By utilizing the SME Support Platform, it is possible to distribute attractive products that have been available only in some regions to all around Japan (and overseas) and invest in new equipment by using the funds of the corporate group. Through this, the company contributes to the regrowth of local small and medium-sized food enterprises and the vitalization of local economies.

【1-6 Dividend Policy and Shareholders’ Benefit System】

(Dividend Policy)

Although payout to shareholders is one of the important business challenges, it is thought that allocating the cash to investment in the facilities to actively expand the business and to strengthen the business foundation by expanding the platform is what would lead to the highest payout to the shareholders because the company is considered to be within the growth process.

Therefore, the company has not provided dividend payout to its shareholders since its establishment and as of the time being, it plans to continue on using the cash to invest in business expansion and as necessary operating capital for the existing companies. The company is planning to look into providing dividend payouts to its shareholders while considering the operating performance and financial conditions for each business year.

(Shareholders’ Benefit System)

The company offers special benefits to the shareholders mentioned below according to the number of shares they hold.

Number of Shares | Number of Times to Receive Special Benefits | Special Benefit Content |

300 shares to 499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 800 yen from the group companies |

500 shares to 2,499 shares | Once a year (Shareholders recorded in the shareholder register as of the end of February of every year) | Products worth 1,500 yen from the group companies |

2,500 shares or more | Twice a year (Shareholders recorded in the shareholder register as of the end of February and on the 31st of August of every year) | Products worth 4,000 yen from the group companies each time |

【1-7 ESG Management】

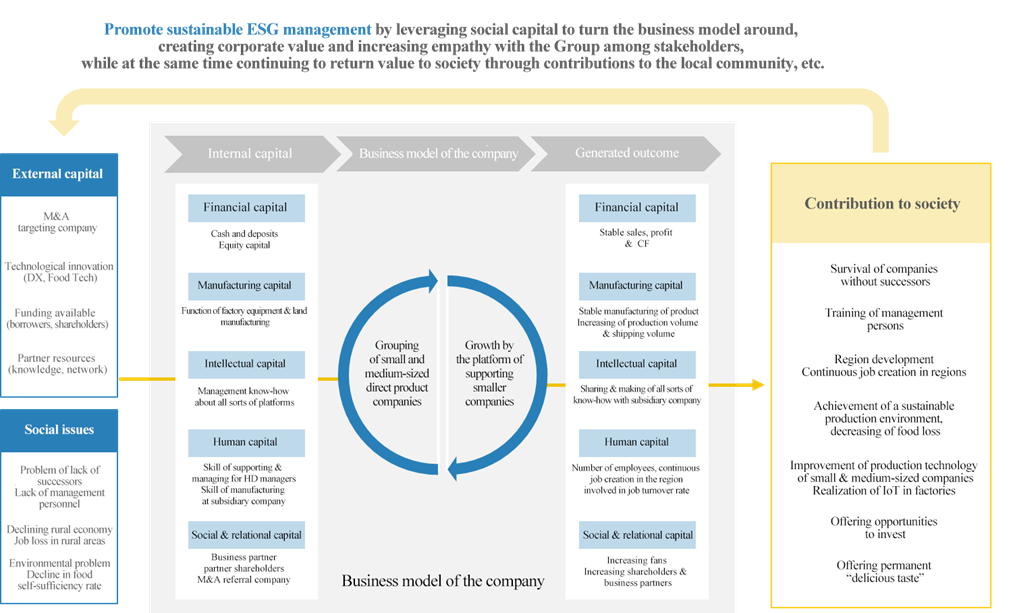

The company is working on its ESG management based on the goal mentioned above, “working towards a society where we can enjoy this ‘delicious taste’ forever—achieving affluence that allows consumers to enjoy diverse food cultures.”

Items | Main Initiatives |

E (Environment) | Production of environmentally friendly, sustainable products *To hold the technology and know-how to produce sustainable products that do not depend on environmental changes or produce environmental burdens *To utilize a limited amount of food resources and conduct efficient production

Mori Yougyojou: It supplies farmed ayu (sweetfish) stably with its original technology, while the natural resources of ayu are decreasing due to climate changes, water pollution in the rivers, etc. Yamani Noguchi Suisan: It helps reduce food loss by developing products using residue and food that do not satisfy size specs. Yuhoku Seafood Processing: It produces and sells negitoro (minced tuna and green onion) and nakaochi (tuna meat scraped from the backbone) efficiently, by effectively utilizing ingredients.

Recycling of industrial waste from the manufacturing process *Group companies: To utilize food waste by offering the waste produced during the manufacturing process to local livestock breeders and others

Reduction of power consumption *Group companies: To install LED lighting, highly efficient boilers, etc. for reducing power consumption at factories |

S (Society) | Contribution to the business continuity by involving enterprises that have loyal fans in each region

Contribution to the diversity of food in local communities *To develop products with rigorously selected ingredients and recipes, which are strongly demanded by local consumers

Kaorime Honpo: It has a lion’s share in the rice seasoning market in the Chugoku region. Marukawa Shokuhin: It usesigorously selected ingredients, such as fresh pork and locally grown cabbage, and secret recipes Omusubikororin Honpo: It develops local specialties by taking advantage of the location of Shinshu-azumino and the freeze-drying technology Daishow: It does not use preservatives or colorants. Smooth texture and taste you will never get tired of. Ohbun: It procures oysters harvested in the clean sea areas of Hiroshima and conditional clean sea areas

* Participating in a free lunch support project for students (Omusubikororin Honpo) and providing field trips for elementary school students and gifts (Mori Yougyojou and Junwa Food)

Diversity of employees *Group companies: To prepare opportunities for female employees to flourish, and take measures for recruiting disabled and foreign workers |

G (Governance) | Support with the SME Support Platform *To design business plans and get involved in progress management according to situations while securing the autonomy of each group company *To establish the control section for each function, support business and manage progress as a corporate group

Support for managerial resources *To support the management of group companies, by procuring funds and training next-generation employers for them |

The company recognizes that taking over companies that have no successors and revitalizing it as their group companies is ESG management itself.

Also, the company believes that contributing to local communities and providing value to consumers by promoting ESG management, as well as increasing the number of good companies that sympathize with the group and want to participate, and the companies and consumers that sympathize with the group and support them as shareholders, will lead to the realization of sustainable growth.

(Taken from the reference material of the company)

2. The second quarter of the Fiscal Year ending February 2023 Earnings Results

【2-1 Consolidated results】

| FY 2/23 2Q | Ratio to sales | FY 2/24 2Q | Ratio to sales | YoY |

Net sales | 16,349 | 100.0% | 23,084 | 100.0% | +41.2% |

Gross profit | 3,216 | 19.7% | 4,611 | 20.0% | +43.4% |

SG&A expenses | 3,023 | 18.5% | 3,689 | 16.0% | +22.0% |

Operating income | 193 | 1.2% | 921 | 4.0% | +376.4% |

Ordinary income | 747 | 4.6% | 1,390 | 6.0% | +85.9% |

Quarterly Net income | 406 | 2.5% | 830 | 3.6% | +104.1% |

EBITDA | 742 | 4.5% | 1,734 | 7.5% | +133.7% |

*Unit: Million yen. Quarterly net income is the quarterly net profit attributable to shareholders of the parent company. EBITDA is calculated by adding amortization (depreciation, goodwill), Covid-19-related subsidy income and acquisition costs associated with M&A to operating income.

Sales incrased, profit increased significantly

Sales increased 41.2% year on year to 23,084 million yen. Sales increased both domestically and overseas. Six companies were newly added to the corporate group through M&A (ONESTORY, Odaki Shoten, Hosokawa Foods, Kobayashi Noodle, Hayashi Kyuemon Shoten, and MARUKICHI) and contributed to sales.

Operating income increased 376.4% year on year to 921 million yen. In addition to price revisions in response to soaring raw material prices, suspending unprofitable transactions and narrowing down production items have been effective. The improved competitive environment for some companies also contributed. These factors absorbed the increase in SG&A expenses, leading to a significant increase in profits.

Adjusted operating income and EBITDA, which include acquisition costs of 68 million yen related to M&A, increased significantly by 315.3% and 133.7%, respectively.

【2-2 Results of each region】

| FY 2/23 2Q | FY 2/24 2Q | YoY |

Domestic | 12,409 | 17,775 | +43.2% |

Overseas | 3,870 | 5,223 | +34.9% |

Singapore | 2,983 | 4,213 | +41.2% |

Other Overseas | 886 | 1,009 | +13.8% |

Total | 16,279 | 22,998 | +41.3% |

*Unit: Million yen. Total is revenue generated from contracts with customers.

◎ Domestic Business

In the sales business, revenue increased due to the enhancement of marketing targeted at existing customers. In the manufacturing business, sales increased due to the effect of price revision.

◎ Overseas Business

Sales continued to increase in both the sales and manufacturing business due to a decrease in the impact of the COVID-19. In particular, sales of Pacific Sorby and NKR Singapore Group increased significantly due to a recovery in the number of tourists in Singapore and increased demand from hotels and restaurants.

【2-3 Results of each segment】

| FY 2/23 2Q | Composition ratio | FY 2/24 2Q | Composition ratio | YoY |

Net sales |

|

|

|

|

|

Manufacturing business | 12,098 | 74.0% | 18,224 | 78.9% | +50.6% |

Sales business | 4,143 | 25.3% | 4,707 | 20.4% | +13.6% |

Other businesses | 107 | 0.7% | 153 | 0.7% | +43.1% |

Total | 16,349 | 100.0% | 23,084 | 100.0% | 41.2% |

Operating income |

|

|

|

|

|

Manufacturing business | 371 | 3.1% | 1,109 | 6.1% | +198.8% |

Sales business | 173 | 4.2% | 282 | 6.0% | +62.8% |

Other businesses | -77 | - | -33 | - | - |

Adjusted amount | -273 | - | -436 | - | - |

Total | 193 | 1.2% | 921 | 4.0% | +376.4% |

*Unit: Million yen. The composition ratio of operating income means the ratio of operating income to sales.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

*Manufacturing business segment

Sales and profit increased.

Domestic manufacturing subsidiaries improved production efficiency by implementing price revisions in response to soaring raw material prices, reviewing unprofitable transactions, and reducing the number of production items through a profit-oriented strategy. Additionally, the profits and losses of the newly added subsidiary companies through M&A (Odaki Shoten, Hosokawa Foods, Kobayashi Noodle, Hayashi Kyuemon Shoten, and MARUKICHI) were included in the scope of consolidation, which led to a growth in sales and profits.

Overseas manufacturing subsidiaries recorded an increase in sales and profits as sales to hotels and restaurants recovered despite the decreased sales to some supermarkets as restrictions on social and economic activities due to the novel coronavirus were eased.

*Sales business segment

Sales and profit increased.

Domestic sales subsidiaries saw a slight decrease in sales to co-ops and home delivery companies, but sales to industrial catering companies increased significantly.

At overseas sales subsidiaries, sales to hotels and restaurants have recovered as the impact of the novel coronavirus has diminished.

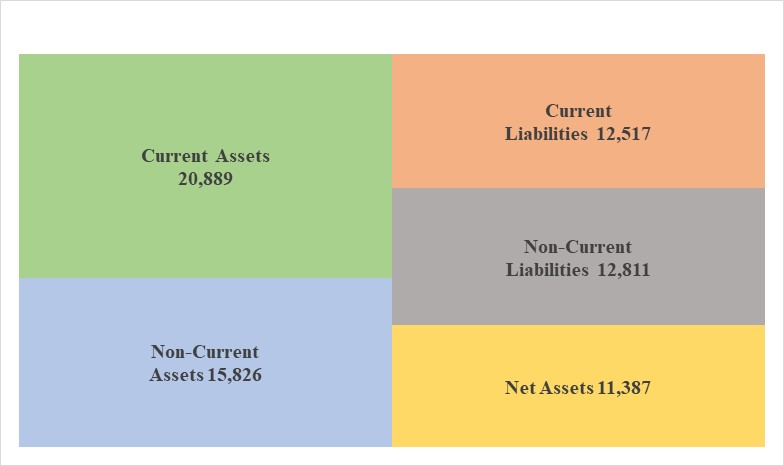

【2-4 Financial conditions and cash flow】

◎Main balance sheet

| End of 2/23 | End of 8/23 | Increase/ Decrease |

| End of 2/23 | End of 8/23 | Increase/ Decrease |

Current assets | 18,381 | 20,889 | +2,508 | Current liabilities | 11,176 | 12,517 | +1,340 |

Cash and deposits | 5,000 | 4,592 | -408 | Notes and accounts payable - trade | 3,890 | 3,192 | -697 |

Notes and accounts receivable - trade | 5,493 | 6,596 | +1,103 | Short term interest-bearing liabilities | 4,966 | 6,516 | +1,549 |

Inventories | 7,314 | 8,955 | +1,681 | Non-current liabilities | 10,828 | 12,811 | +1,982 |

Non-current assets | 13,473 | 15,826 | +2,352 | Long term interest-bearing liabilities | 9,918 | 11,840 | +1,921 |

Property, plant and equipment | 6,917 | 8,000 | +1,083 | Liabilities | 22,005 | 25,328 | +3,323 |

Intangible assets | 5,103 | 6,187 | +1,083 | Net assets | 9,850 | 11,387 | +1,537 |

Investments and other assets | 1,453 | 1,638 | +185 | Retained earnings | 3,728 | 4,559 | +830 |

Total assets | 31,855 | 36,716 | +4,861 | Total liabilities and net assets | 31,855 | 36,716 | +4,961 |

|

|

|

| Total interest-bearing liabilities | 14,885 | 18,356 | +3,471 |

*Unit: Million yen

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Total assets increased 4.8 billion yen from the end of the previous fiscal year to 36.7 billion yen due to an increase in trade receivables, a rise in inventories due to MARUKICHI becoming a subsidiary, and an increase in tangible fixed assets (buildings and structures).

Total liabilities increased 3.3 billion yen to 25.3 billion yen due to an increase in interest-bearing debt due to MARUKICHI becoming a subsidiary and new M&A.

Net assets grew 1.5 billion yen to 11.3 billion yen due to a rise in retained earnings and foreign currency translation adjustments.

Equity ratio was 22.9%, down 0.6 points from the previous fiscal year.

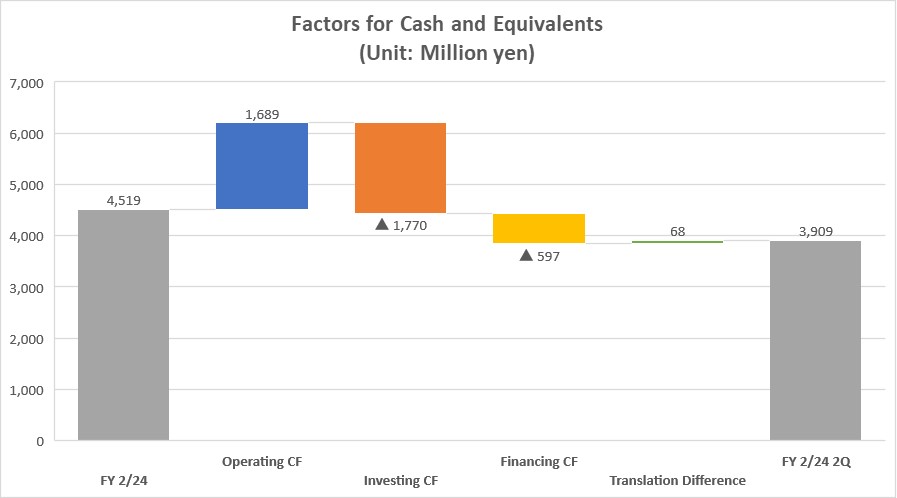

◎Cash flows

| FY 2/22 | FY 2/23 | Increase/Decrease |

Operating CF | -8 | 1,689 | +1,697 |

Investing CF | -459 | -1,770 | -1,311 |

Free CF | -467 | -81 | +386 |

Financing CF | 913 | -597 | -1,511 |

Balance of cash and cash equivalents | 3,419 | 3,909 | +489 |

*Unit: Million yen

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Operating CF recorded a surplus due to an increase in net income before taxes and other adjustments. However, the cash outflow from investing activities grew due to an increase in purchase of shares of subsidiaries resulting in change in scope of consolidation. The deficit in free CF shrank.

Financing CF recorded a deficit due to a larger net decrease in short-term loans and purchase of treasury shares.

The cash position risen.

【2-5 Topics】

(1) Made YS Foods Co., Ltd. a subsidiary

On October 16, 2023, the company acquired 70% of the outstanding shares of YS Foods Co., Ltd., which processes and manufactures seafood and made it a subsidiary.

(Overview of YS Foods Co., Ltd.)

Established in September 1998. This company has its head office and factory in Morimachi, Kayabe-gun, Hokkaido, and mainly processes scallops caught along the coast of Funka Bay.

YS Foods has the largest scallop processing and storage facilities in the Funka Bay area, and it purchases scallops from fisheries cooperatives with purchasing rights (the right to purchase seafood directly from fisheries cooperatives, which is difficult to obtain for new customers). The company processes and sells mainly to domestic seafood wholesale companies and Chinese seafood processing companies.

The company has business relationships with MARUKICHI Co., Ltd., a member of Yoshimura Food Holdings, in which it purchases scallops caught along the Okhotsk coast and is entrusted with processing scallops.

There are three companies under the YS Foods umbrell Matatsu Suisan Co., Ltd., Seido Suisan Co., Ltd., and YS Kaisyo Co., Ltd.

Matatsu Suisan is based in Oshamambe, Hokkaido, and processes scallops, salmon, etc., at its factory, which has been certified as a seafood processing facility for export to EU and the U.S. and thus requires strict management and sells them mainly through major domestic seafood wholesalers to supermarkets and other mass retailers.

Seido Suisan is a company that processes half shell scallops (a process in which half of the scallop shells are removed) and boasts an overwhelming 80% share of the domestic production of half shell scallops, which are sold to restaurants and other customers, mainly through domestic seafood wholesalers.

YS Kaisyo is engaged in the mail order business, such as hometown tax payment, the operation of Chappurinkan (a bathing facility owned by Morimachi, Kayabe District), and the operation of Sakura Hana (a restaurant) within the same facility. As a mail-order business, it mainly purchases crabs, salmon roe, scallops, etc., from group companies and sells them as tax return gifts for Morimachi, Hokkaido.

*Performance and financial status

| FY 7/21 | FY 7/22 |

Net sales | 12,981 | 16,865 |

Operating income | 729 | 1,634 |

Total assets | 10,806 | 11,291 |

Net assets | 2,054 | 2,857 |

*Unit: Million yen

(Background of acquiring the company as a subsidiary)

Yoshimura Food Holdings decided to make it a subsidiary mainly because of the following three reasons.

(1) Securing a procurement route for Japanese scallops, whose demand is increasing overseas

Scallops distributed around the world are of two different varieties: “the scallop grown mainly in Japan”, and “the other scallops primarily grown in China and other countries”. Japanese scallops are recognized worldwide as a rare and valuable food due to their large size, sweetness, and significant advantages in terms of size, taste, and quality. Thus, their demand has been increasing in Europe, the United States, and Asia in recent years. As evidence of this, the Ministry of Agriculture, Forestry and Fisheries has released the “Agricultural, Forestry and Fisheries Products Import/Export Information and Overview,” which shows that the value of scallop exports in 2022 was 91 billion yen, an increase of 42.4% from the previous year. By category, scallops are the No.1 export of agricultural, forestry, and fishery products in Japan, surpassing whiskey and beef.

YS Foods, Matatsu Suisan, and Seido Suisan each have the right to purchase seafood from the fishing cooperatives along the coast of Funka Bay, and in addition to being able to procure fresh scallops caught along the coast of Funka Bay, MARUKICHI owns the right to buy from the fishermen’s cooperatives along the Sea of Okhotsk coast and can procure Okhotsk scallops.

With YS Foods’ participation in the group, the Yoshimura Food Holdings Group will have the right to stably procure scallops from the Funka Bay coast and the Sea of Okhotsk coast, which are the two major producing areas for Hokkaido scallops.

(2) Established as a major scallop processing company with production and processing facilities and high-quality control capabilities

When purchasing scallops, a relationship of trust with fishing cooperatives and fisheries-related companies is essential. In addition, in order to process and store food while maintaining its freshness, large-scale processing facilities that can continuously process the amount purchased and sufficient personnel are crucial, making it an industry with high barriers to entry.

In this context, YS Foods Group is one of the few companies in Hokkaido that owns large-scale scallop processing and storage facilities.

In recent years, while many other companies in the industry have gone out of business or downsized due to a lack of capital investment, the company has established itself as a major scallop processing company in Hokkaido by making aggressive capital investments.

Moreover, the YS Foods factory is certified as a HACCP-certified factory for China, and the Matatsu Suisan factory is certified as a facility that handles seafood products for export to the EU and a seafood processing facility for export to the United States. Thus, they have built a high-quality control system.

(3) Synergy with Yoshimura Food Holdings group companies

By sharing the resources and know-how of YS Foods Group and MARUKICHI, Yoshimura Food Holdings can expect to expand its market share further and improve its business performance in the scallop industry.

For example, scallops from Funka Bay are mostly caught from winter to spring, while the best fishing season from the Sea of Okhotsk is from summer to autumn. Therefore, by mutually supplementing production according to the busy and quiet seasons of the two companies, the utilization rate and productivity of both plants can be improved.

In addition, Sin Hin Frozen Food Private Limited, a Yoshimura Food Holdings group company and a seafood wholesaler in Singapore, purchases over 170 tons of scallops annually as one of its main products and sells them to major local supermarkets under the Emerald brand. Currently, Sin Hin purchases some of its scallops from YS Foods through processing companies in China. Therefore, arranging the purchasing routes and sales channels among the three companies, including MARUKICHI, will enable the group to ensure a stable supply and further strengthen overseas sales channels.

Moreover, with YS Foods and MARUKICHI as core companies, the company will work to expand its food business in Hokkaido by adding Hokkaido’s marine products and other food companies to the group to increase its market share further and establish a competitive advantage through capital investment.

* Details are stated later in Section 4: Growth Strategy.

(The suspension of imports of Japanese marine products by China)

The suspension of imports of Japanese marine products by China may have a temporary impact on earnings, such as a decrease in sales to China by the YS Foods Group, but the company believes that the impact on medium- to long-term earnings will be limited as it is unlikely that demand for Japanese scallops, which are gaining recognition worldwide, will decline.

In addition, although the market price of scallops may fall due to the suspension of Chinese imports, YS Foods and MARUKICHI have large-scale, high-performance freezing and storage facilities. Since frozen scallops have a shelf life of 2-3 years, they can maintain inventories until market conditions improve.

Moreover, the company is considering taking steps to ensure that when YS Foods is included in the scope of consolidation, the unit price of inventory will be revalued appropriately based on market prices so that the company’s profit and loss will not deteriorate after the inclusion in the scope of consolidation. The Japanese government and Tokyo Electric Power Company have announced that they will compensate fishery-related companies that have suffered damage as a result of the suspension of imports to China, and the company will proceed with procedures to receive compensation if any damage occurs.

(Background of acquiring the company as a subsidiary)

Yoshimura Food Holdings acquired 70% of the outstanding shares of YS Foods. The acquisition price is approximately 6 billion yen, including acquisition audit costs. The company created a business plan for YS Foods, taking into account China’s import regulations, and based on this plan, the company evaluated the value of the shares.

Takuya Sakamoto, representative director and president of YS Foods, and Yusuke Sakamoto, a senior managing director of YS Foods, will continue to hold 30% of the shares of YS Foods, and Takuya Sakamoto will continue to serve as president, and Yusuke Sakamoto as a managing director of YS Foods. Together, they will work to improve the group’s performance and revitalize the Japanese food industry, especially in Hokkaido, by building a cooperative relationship and creating synergies.

The company plans to finance the acquisition with bank loans.

3. Fiscal Year ending February 2024 Earnings Estimates

【Earnings estimates】

| FY 2/23 | Ratio to sales | FY 2/24 (Estimate) | Ratio to sales | YoY | Rate of progress |

Net sales | 34,937 | 100.0% | 46,679 | 100.0% | +33.6% | 49.5% |

Operating income | 678 | 1.9% | 1,574 | 3.4% | +131.9% | 58.6% |

Ordinary income | 1,323 | 3.8% | 1,575 | 3.4% | +19.0% | 88.3% |

Net income | 613 | 1.8% | 749 | 1.6% | +22.2% | 110.9% |

EBITDA | 1,994 | 5.7% | 2,718 | 5.8% | +36.3% | 63.8% |

*Unit: Million yen. Net profit is net income attributable to shareholders of the parent company. EBITDA is calculated by adding amortization (depreciation, goodwill) and acquisition costs associated with M&A to operating income.

There are no changes to the earnings forecast. Substantial growth in sales and income expected.

Sales are expected to increase 33.6% YoY to 46,679 million yen, operating income to increase 131.9% YoY to 1,574 million yen, and EBITDA to increase 36.3% YoY to 2,718 million yen.

In addition to organic growth of existing companies, new M&As will start to bring in profits from group companies (Kobayashi Noodle, Hayashi Kyuemon Shoten, and Marukichi), and a decrease in M&A acquisition-related expenses will also contribute.

In response to cost increases due to soaring raw material and distribution costs, the company will work to further improve production efficiency and cut costs, and at the same time, implement price and standard revisions for customers in order to secure appropriate profits.

The earnings of YS Foods, which became a subsidiary, in the term ending July 2022 were sales of 16.8 billion yen, an operating income of 1.6 billion yen, and a net income of 800 million yen. Yoshimura Food Holdings will start incorporating its profit and loss in the fourth quarter of the term ending February 2024. The impact of incorporating YS Foods’ earnings into consolidated earnings is currently being examined and will be disclosed promptly if anything arises. YS Foods will contribute to the earnings of the entire term ending February 2025.

4. Growth Strategies

【4-1 Background and Results in the Previous Fiscal Year】

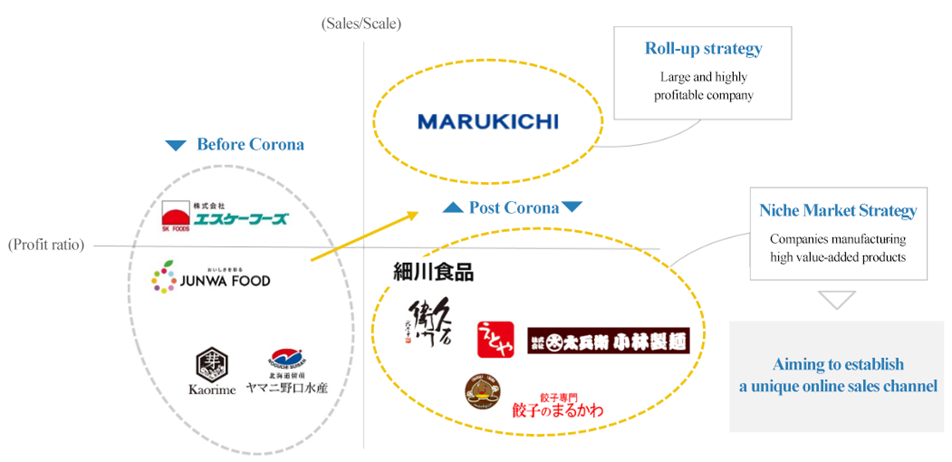

The company's mission is "Working toward a society where we can enjoy this “delicious taste” forever - achieving affluence that allows consumers to enjoy diverse food culture," its vision is "To protect and nurture the “delicious foods” in each region, and distribute them around the world," and its value is "To cherish individuality." In the food industry, the company is creating its own unique business model centered on an SME support platform. Since its establishment, the company has pursued growth through two engines: "growth through the expansion of the number of group companies through M&A" and "growth through expansion of the business of existing group companies."

The company uses a wide variety of referral channels to find M&A deals, including business partners of existing group companies, M&A brokerage firms, and financial institutions.

The number of referrals has increased with each passing year, and in the term ending February 2023, when the impact of the novel coronavirus crisis subsided, the number of referrals increased significantly to over 300.

This increase is due to the company’s extensive M&A track record, which has increased since going public, and the trust it has built since its founding.

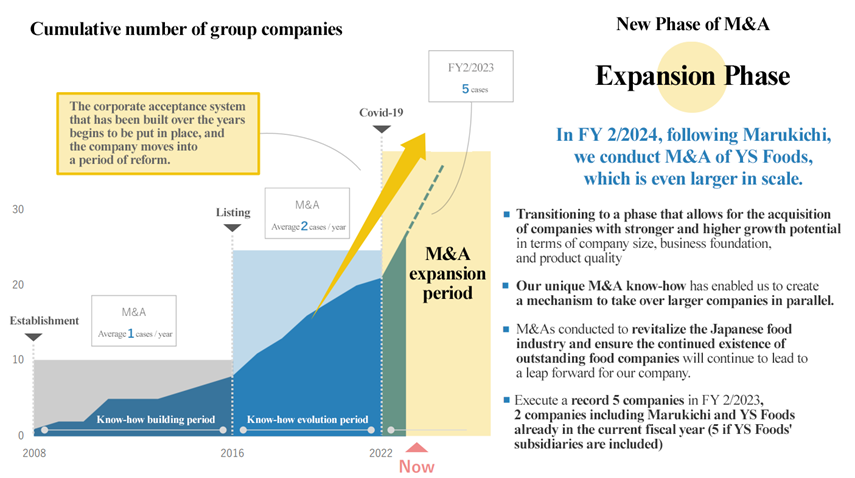

With this expansion in the number of referrals, the average number of M&A deals concluded in the first eight years since the company’s establishment was one per year and two in the following six years. However, in the term ending February 2023, the number of executed M&A deals reached a record high of five per year. In the term ending February 2024, the company acquired the largest-ever shares in MARUKICHI, followed by the even larger M&A of YS Foods.

The company believes that it has moved into a new phase in which it can acquire companies with higher growth potential and higher profit margins that are stronger in terms of corporate size, business foundation, and product quality as the system for accepting companies that the company has built over the years has begun to stabilize its management base, expand its team, accumulate expertise in project decision making, improve its fund-raising capabilities, and expand overseas sales channels.

(Taken from the reference material of the company)

【4-2 Challenges in the Domestic Food Industry】

In the domestic food industry, as the domestic market inevitably shrinks due to the declining population, an aging society and falling birth rate, companies are also facing the challenges of an aging population and an increasing number of companies are going out of business due to the lack of successors.

|

|

(Taken from the reference material of the company)

The company's five projects in the previous fiscal year and the MARUKICHI and YS Foods project in the fiscal year ending February 2024 all faced challenges regarding succession.

【4-3 The Company's Business Model】

The company is pursuing growth through two engines: "1. expansion of group companies" by executing new M&A projects, and "2. expansion of existing businesses" by utilizing its SME support platform.

【4-4 The Company's Competitive Advantages】

Unlike investment funds, the company does not assume sale, making it easier to gain the trust of target company owners. In addition, the company has a wealth of M&A expertise compared to other large food companies and also has a significant advantage in terms of growth support through its SME support platform.

The company is uniquely positioned to conduct M&A of companies with superior products, technologies, and brands, regardless of size or industry, and is capable of conducting M&A of small- and medium-sized food companies, which other prominent buyers are unlikely to target. Thus, the company believes it can realize high ROI through appropriate acquisition pricing and synergy effects.

(Taken from the reference material of the company)

【4-5 Strategy】

The company aims to achieve medium to long-term growth by pursuing a "Roll-Up Strategy" and "Niche Market Strategy" with respect to new M&A projects and an "Organic Growth Strategy" with respect to existing companies.

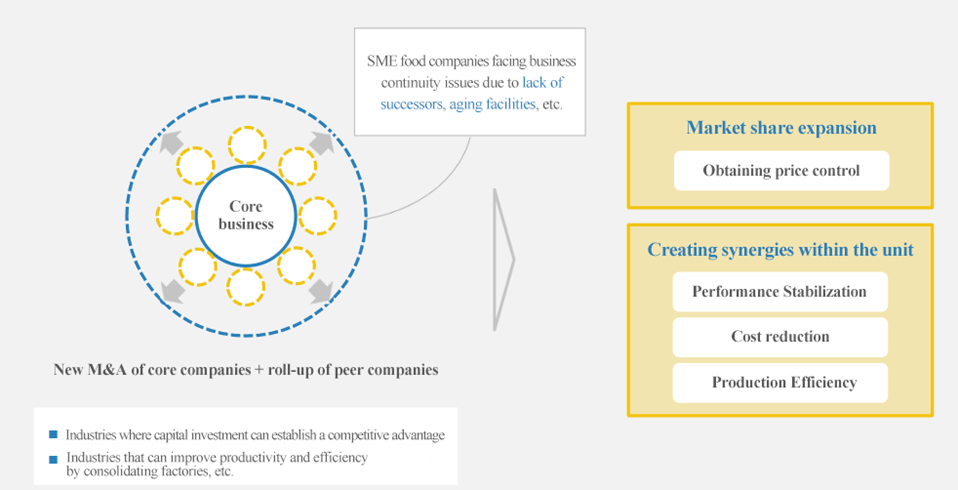

(1) Strategy 1: Roll-up strategy

After incorporating the core companies in a particular industry into a group, incorporate other companies in the same industry as the core companies into the group.

To roll up the companies in the same industry around the core companies to increase market share and improve performance through synergies.

(Taken from the reference material of the company)

(2) Strategy 2: Niche Market Strategy

To group together companies that have a certain share of niche markets or companies that have high profit margins with unique products, and improve their profit margins by improving their overseas sales and B2C businesses.

(Taken from the reference material of the company)

(3) Strategy 3: Organic Growth Strategy

*Management Support

To hire personnel with extensive management experience and assign them as presidents of group companies.

To hire talented young personnel and have them gain management experience in group companies, and achieve management reform.

*Function-based support

To provide support by utilizing the SME support platform.

To hire personnel specializing in each function and improve the platform.

【4-6 Future initiatives: Promoting acquiring seafood companies in Hokkaido】

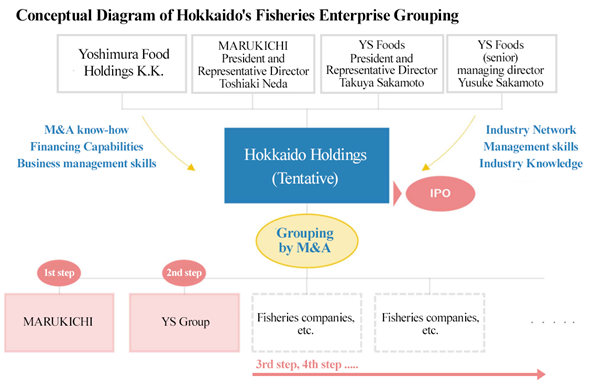

Taking the opportunity of making YS Foods a subsidiary in October 2023, the company plans to establish Hokkaido Holdings (tentative name), with MARUKICHI and YS Foods as its core companies, promote the adding of Hokkaido seafood companies to the group, and aims to conduct an IPO.

(Purpose in Establishing Hokkaido Holdings)

Hokkaido Holdings (tentative name) will promote adding Hokkaido’s marine products companies to the group and will combine the strengths and advantages of each company, including Yoshimura Food Holdings’ M&A know-how, fund-raising capabilities, and business management capabilities, as well as the industry networks, management capabilities, and industry knowledge of MARUKICHI and YS Foods’ management teams. In addition, using loans and staffing from regional banks, the company aims to “reduce costs, improve production efficiency, expand overseas sales channels, and stabilize business performance by creating synergies among group companies,” “streamlining operations and establishing competitive advantage through factory consolidation and capital investment,” and “expand profitability by increasing market share through a roll-up strategy.”

The former owners will continue to hold 30% of the shares of both MARUKICHI and YS Foods and will continue to be responsible for the management of both companies. The IPO of Hokkaido Holdings (tentative name), due to its increased scale and performance, will be highly beneficial to both Yoshimura Food Holdings and the former owners. Thus, they intend to build a win-win relationship for further development.

(Taken from the reference material of the company)

5. Interview with CEO Yoshimura

We interviewed the CEO Motohisa Yoshimura about their current situation, future action, the status of M&A strategies, and his message to shareholders and investors.

◎ Financial Results for the Second Quarter of the Term Ending February 2024

Our company’s sales increased year on year, resulting in a significant profit growth.

Price revisions promoted from the previous term have contributed significantly in Japan. Although sales declined in the second half of the previous fiscal year due to lower shipment volume, the first half of the current fiscal year saw a higher-than-expected sales growth. While many other companies did not raise prices in the previous fiscal year, they had to raise prices in this fiscal year, leading to an increase in our sales. Companies with strong brand power and competitive products, such as Marukawa Shokuhin, which produces and sells Hamamatsu Gyoza dumplings, saw significant effects of price revisions. In addition, the profit-oriented strategy to improve production efficiency by reviewing unprofitable deals and reducing production items also contributed to this result.

With regard to overseas markets, the easing of restrictions on economic activities caused by the COVID-19 pandemic led to a recovery in sales for hotels and restaurants.

◎ About the M&A Strategy

Following the conclusion of five M&A deals in the previous fiscal year (ended in February 2023), this fiscal year (ending in February 2024) saw the largest-ever acquisition of MARUKICHI shares, followed by a much larger acquisition of YS Foods.

Since the company’s establishment, we have faced various challenges. However, through our unique approach to M&A, we have achieved stability in our business foundation, expanded our team, accumulated know-how in project assessment, improved our fundraising capabilities, and expanded our overseas sales channels. As a result, we believe that our company has established a solid acceptance system, enabling us to transition to a new phase where we can acquire companies with a strong, more growth-oriented presence and higher profitability in terms of company size, business foundation, and merchantability.

We have established a reputation through several decades of experience and diligent promotional efforts. Many small and medium-sized food companies, many of whom lack successors, have come to know about us. In addition, unlike investment funds, our approach is not based on the sale of the company, so we get a significant advantage as the owner considers our proposal with a sense of reassurance.

◎ Acquisition of YS Foods as a Subsidiary and the Roll-up Strategy in Hokkaido

In recent years, the seafood industry has been facing business continuity challenges due to declining birthrate, labor shortage, and limited financial resources, resulting in the aging of facilities. As a result, more companies are considering closure or downsizing of operations.

In such circumstances, safeguarding and further advancing Japan’s world-class “food culture” is a crucial mission for our company.

Therefore, we intend to use the acquisition of YS Foods as an opportunity to establish an intermediate holding company (IHC). We aim to make MARUKICHI and YS Foods the core companies, encouraging the inclusion of seafood companies in Hokkaido in our corporate group.

At present, the intermediate holding company is tentatively named “Hokkaido Holdings.”

The company encourages the inclusion of seafood and other food companies in Hokkaido in our corporate group. In addition, it leverages the strengths and advantages of MARUKICHI and YS Foods, including know-how, fundraising capabilities, and business management skills in M&A activities, their industry network, management capabilities, and industry knowledge.

Additionally, by leveraging financing and utilizing dispatched staff services of regional banks in Hokkaido, we aim to create synergies within the group companies. This strategic approach involves cost reduction, production efficiency improvement, expansion of overseas sales channels, performance stabilization, as well as the improvement of efficiency and competitive advantage through factory consolidation and capital investment. We also aim to increase profitability through market share expansion via roll-ups.

Hokkaido Holdings will aim to conduct an IPO while expanding its profitability.

Since the former owners of MARUKICHI and YS Foods will continue to hold 30% of the shares of both companies and will remain involved in management, the IPO of Hokkaido Holdings will be highly beneficial to our company and to the former owners due to its increased size and business.

We intend to build a win-win relationship with the companies that will join our corporate group in the future to achieve further development.

◎ About China’s Halt on Imports of Japanese Seafood

In August 2023, China suspended all imports of Japanese fishery products due to the release of ALPS-treated water from TEPCO’s Fukushima Daiichi Nuclear Power Station into the ocean.

China is Japan’s most important export market, accounting for more than 20% of Japan’s seafood exports, and 50% of scallop exports are bound for China.

Thus, we received some concern about the impact on MARUKICHI and YS Foods. However, we believe this measure will have a limited impact, and we want the investors to know the background and reasons for this.

Most of MARUKICHI and YS Foods’ exports to China are frozen scallops in shells.

Chinese companies that import scallops peel the shells, process them with water to increase volume and texture, and then sell them to distributors and others. The United States accounts for about 50% of these regional sales, and domestic consumption in China is only 20-30%.

On the other hand, domestic plants of MARUKICHI and YS Foods have obtained HACCP certification in seven countries and currently export to ten or more countries besides China, including the United States, Canada, the EU, Taiwan, Vietnam, Thailand, and Australia.

Approximately half of MARUKICHI and YS Foods’ combined sales are for the domestic market, with approximately 18% of sales to China.

There is indeed an impact on sales due to the import halt by China. However, it is common for the phrase “China’s import halt of Japanese scallops” to be taken out of context, leading to the misconception that it will significantly affect our performance. As mentioned above, our dependence on China is by no means high.

In addition, Japanese scallops are highly valued around the world for their large size and high quality. It is unlikely that such demand will decrease sharply, and while there may be short-term impacts, we believe that the medium to long-term effects will be extremely limited.

Since imports from Japan have halted, Chinese processors are processing the existing scallop inventory for export to the United States and for consumption in China. However, there is a possibility that the scallop inventory in China may be depleted by the end of this year, leading to financially challenging situations for some processing companies of China.

As the future depends on the decision of the Chinese authorities, there are many uncertainties. However, if the import halt continues, we are considering options such as “increasing production capacity in Japan by utilizing government subsidies,” “starting production in cooperation with partners in third countries such as Thailand and Vietnam,” and “starting production in Singapore” to steadily fulfill the global demand for scallops.

In addition, MARUKICHI and YS Foods possess four certified facilities for exporting scallops to the EU and two certified facilities for exporting seafood to the United States (final processing facilities). We believe that this will be a significant advantage for our group in the future.

◎ Message for Shareholders and Investors

When watching TV or browsing the Internet, you may come across news like “Scallop dealers are facing challenges,” which might be causing concern among investors.

However, as mentioned earlier, if we consider the export of scallops from Japan to China as 100, approximately 50 processed scallops are exported to the United States, while China consumes only 20 to 30. In other words, the current issue is just a temporary disruption in the supply chain.

When considering the future of the scallop business from a medium- to long-term perspective, we believe that the most important factor is the “global competitive advantage of scallops from Hokkaido.”

Scallops are consistently supplied through aquaculture, ensuring both stability and high quality. There is no issue affecting their sales, and they remain the top export item by product category, surpassing even whiskey and beef.

Amid a strong demand globally, it’s crucial to understand that if the inventory depletes, exports from China will not be possible. At that juncture, our company, equipped with factories capable of exporting to both the EU and the United States, stands to gain a significant opportunity to secure an extensive distribution.

With the ability to bring together companies of significant scale and high profitability, such as MARUKICHI and YS Foods, our company has entered into a phase of active growth. We will continue to drive forward our growth strategies, aiming to enhance corporate value and contribute to solving social challenges. We would appreciate your continued support.

6. Conclusions

Preparations for a project to establish an intermediate holding company in Hokkaido with MARUKICHI and YS Foods as core companies and to add Hokkaido fisheries and other companies to the group appear to be steadily underway. Yoshimura’s recognition has increased significantly as a result of making two prominent companies subsidiaries in the Hokkaido fisheries industry, and the scheme to conduct an IPO of the intermediate holding company in which the former owner owns 30% of the shares will be highly beneficial to both Yoshimura and group companies and will be an engine that will greatly promote adding leading companies to the group. Scallops and other Japanese marine products are highly valued by wealthy overseas consumers, and with the market expected to continue to expand, we look forward to the release of the third and fourth rounds.

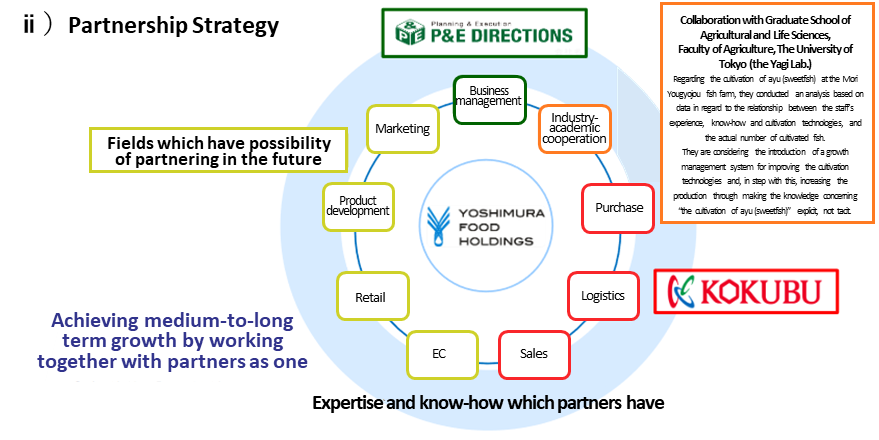

<Reference1: Collaborating with Business Partners >

(Taken from the reference material of the company)

Cooperation with KOKUBU GROUP CORP.

The status of collaboration with the Kokubu Group Corp., which has about 35,000 customers, approximately 10,000 trading manufacturers, 54 group companies, almost 600,000 items in the product lineup, and know-how cultivated through over 300 years of business, is as follows.

| Promotion of the cooperation | Progress |

Sales | *Promotion of sales based on the resources owned by Kokubu (sales channels, human resources, sales capabilities) | *Proposed Yoshimura Food Holdings' products to Kokubu's business partners (major supermarkets, etc.), and some of them decided to adopt the products |

Purchase | *Increase of channels for procurement with Kokubu as the point of contact *Increase in gross profit due to lower procurement costs *Review of conditions for bulk purchases of consumable goods | *Successfully reduced costs by switching to procurement of some raw materials through Kokubu *Reduced costs for the entire group by switching to a centralized purchasing system operated by Kokubu for the purchase of consumables |

Product development | *Product development as part of marketing, utilizing the expertise and know-how of Kokubu | *Commercialization of new products developed in cooperation with Kokubu, such as Kantsuma canned appetizers *Sharing of Kokubu's marketing information with Yoshimura Food Holdings Group and its use in sales and marketing |

Logistics | *Review of the logistics network utilizing the logistics know-how, company warehouses, etc. of Kokubu *Expansion of product supply (sales) area | *Holding discussions to reduce logistics costs, taking into account the regional characteristics of each Group subsidiary |

M&A | *Identifying and reviewing M&A projects in cooperation with Kokubu *PMI implementation in collaboration with Kokubu | *Establishment of a system to collect M&A needs in a timely manner by leveraging Kokubu's information network*Investigating projects that can be specifically considered by both companies, including joint PMI and value-up measures, as required |

Other | *Promotion of company-to-company collaboration *Realization of mid- to long-term collaboration | *Introduction of Yoshimura Food Holdings Group to Kokubu Area Company and holding discussions for joint business *Receiving a permanent transfer from Kokubu and maintaining close ties with the company |

<Reference2: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with internal auditors |

Directors | 5 directors, including 2 outside ones (Both are designated as independent executives) |

Auditors | 3 auditors, including 3 outside ones (All three are designated as independent executives) |

◎Corporate Governance Report

The latest update: May 30, 2023

<Basic Policy>

Our company believes that our sustainable growth and creation of mid/long-term corporate value can be achieved especially through the trusting relationships and cooperation with our stakeholders, including shareholders, clients, business partners, employees, and local communities.

Accordingly, we consider that the most important mission in management is to keep tightening corporate governance as a base for securing the soundness, transparency, and efficiency of business administration. We will strive to secure the transparency and fairness of our company and timely disclose information to all stakeholders by streamlining the decision-making process, improving the supervisory function for business execution, strengthening the function to oversee directors, and developing an internal control system.

<Reason for not implementing the principles of the Corporate Governance Code (excerpt)>

Principle | Reason for not following the principle |

(Supplementary Principle 2-4-1 Ensuring Diversity in Appointing Core Human Resources) | We believe securing and training diverse human resources will improve corporate value over the medium to long term. Thus, we will hire and promote human resources fairly and impartially, emphasizing ability and achievements regardless of gender, age, or nationality. At this time, we have not set measurable numerical targets for the promotion of women, foreigners, and mid-career hires to managerial positions, but we will continue to promote measures to ensure diversity and will also consider setting targets. |