Bridge Report:(2884)Yoshimura Food the First Half of the Fiscal Year ending February 2026

Representative director and CEO Motohisa Yoshimura | Yoshimura Food Holdings K.K. (2884) |

|

Corporate Information

Exchange | TSE Prime Market |

Industry | Food products (manufacturing) |

Representative director and CEO | Motohisa Yoshimura |

Address | 18F, Fukoku Seimei Bldg., 2-2-2, Uchisaiwai-cho, Chiyoda-ku, Tokyo |

Year-end | February |

URL |

Stock Information

Share price | Shares Outstanding (Term-end) | Total Market Cap | ROE(Actual) | Trading Unit | |

¥642 | 24,083,371 shares | ¥15,461 million | 18.8% | 100 shares | |

DPS(Estimate) | Dividend Yield(Estimate) | EPS(Estimate) | PER(Estimate) | BPS(Actual) | PBR(Actual) |

¥0.00 | - | ¥35.62 | 18.0x | ¥463.27 | 1.4x |

*The share price is the closing price on October 29. Each value is taken from the brief report on results of the second quarter of the fiscal year ending February 2026. ROE and BPS are actual results for the previous fiscal year.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2022 (Actual) | 29,283 | 655 | 993 | 500 | 21.03 | 0.00 |

February 2023 (Actual) | 34,937 | 678 | 1,323 | 613 | 25.77 | 0.00 |

February 2024 (Actual) | 49,781 | 2,366 | 2,989 | 1,036 | 43.77 | 0.00 |

February 2025 (Actual) | 58,110 | 4,161 | 4,251 | 1,861 | 78.13 | 0.00 |

February 2026 (Estimate) | 56,400 | 2,000 | 1,950 | 850 | 35.62 | 0.00 |

*Unit: Million yen. The estimated values were provided by the company.

This Bridge Report presents Yoshimura Food Holdings K.K.’s earnings results for the first half of the Fiscal Year ending February 2026.

Table of Contents

Key Points

1. Company Overview

2. First Half of the Fiscal Year ending February 2026 Earnings Results

3. Fiscal Year ending February 2026 Earnings Estimates

4. Conclusions

<Reference 1: Medium-term Management Plan>

<Reference 2: Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year ending February 2026, sales and profit declined. Sales decreased 3.4% year on year to 27.7 billion yen. The domestic business was healthy, but the sales of the overseas business dropped due to the economic slowdown of Singapore, etc. Operating income decreased 52.3% year on year to 900 million yen. As the sales quantity of scallop meat, which has a high profit margin, in the domestic business declined, gross profit decreased 14.4% year on year, and gross profit margin dropped 2.6 points year on year, while SG&A expenses increased 1.6% year on year.

- In Japan, the non-scallop-related business (business not related to scallop outside MARUKICHI and the YS Foods Group) was healthy, so sales and profit grew. On the other hand, the scallop-related business saw the decreases in sales and profit, due to the decline in sales of products (frozen scallop meat ), etc. In particular, they sold inventory assets while decreasing their book values in response to China’s banning of import of Japanese seafood in the first half of the previous fiscal year, and there was no such sale in the first half of the current fiscal year, decreasing sales significantly. Outside Japan, the sale to retailers, such as supermarkets, and restaurants was sluggish due to the economic slowdown of Singapore caused by the soaring commodity prices and the decrease of sightseers from China, and the export of scallops with shells (ingredients) from Singapore dropped significantly. Sales and profit dropped, as costs increased due to the rise in commodity prices.

- They have downwardly revised the full-year earnings forecast for the fiscal year ending February 2026, after reviewing the results in the first half of the fiscal year, including the economic slowdown of Singapore, the downturn of demand for eating out, the decline in sales of scallop meat (products) in the domestic business, etc. Sales are projected to decrease 2.9% from the previous fiscal year to 56.4 billion yen, and operating income is forecast to drop 51.9% from the previous fiscal year to 2 billion yen. Regarding the overseas business, sales and profit are expected to recover gently, as they will expand sales channels by strengthening the marketing structure and secure profitable products by cementing the cooperation with suppliers, although the business environment will remain harsh. Regarding the domestic scallop-related business, the selling price of scallops is expected to rise because global demand is strong, but the decline in sales quantity of scallop meat (products) due to the decrease in the catch of scallops caused by the rise in water temperature will be a short-term risk factor.

- Due to the U.S. tariff policy, the sales of scallops to the U.S., where the consumption of scallops is the largest, are low, but the price of scallops is rising, indicating that the global demand for scallops is extremely high. On the other hand, we would like to pay attention to “China,” a huge consumption area. In June 2025, the General Administration of Customs of the People's Republic of China announced “the resumption of conditional import of seafood from some regions of Japan,” so it became possible to export the scallops harvested in Japan to China, but in order to actually export them, Japanese enterprises need to apply for the registration of Japanese factories and obtain approval from Chinese authorities. The company is waiting for such approval. Due to the 2-year banning of import, there remains no inventory of scallops in China, so if import is actually resumed, there will be significant upward pricing pressure. We don’t know when China will approve the import, but the company is preparing for the expansion of revenue in the current and next fiscal years, by stockpiling scallops as the catch of scallops is forecast to decline. We would like to pay attention to the news release of the resumption of export to China.

1. Company Overview

Yoshimura Food Holdings conducts M&A of food-related small and medium-sized enterprises that, regardless of their quality products or unique manufacturing techniques, are facing various issues such as the difficulty in finding successors. It also facilitates the growth of the entire corporate group by solving problems with their core service, which is to build “a platform for supporting small and medium-sized enterprises (SME Support Platform).” and energizing each group company. Its strengths lie in the overwhelming advantage it has towards investment funds or large companies and the high barrier to entry. The company aims to accelerate its growth through further alliances. As of the end of August 2025, there are 38 consolidated subsidiaries.

[1-1 Corporate History]

One day, a food company that was facing financial difficulties and could not find a buyer was introduced to Mr. Yoshimura, who was managing the listed companies’ fundraising and M&A in the corporate business division at Daiwa Securities Co. Ltd. and Morgan Stanley Securities Co., Ltd.

Mr. Yoshimura took on this food company and established L Partners Co., Ltd.-- the predecessor of Yoshimura Food Holdings K.K.--on his own in March 2008 because he strongly felt that Japan could be more appreciated through its food since his MBA days in the United States while working for Daiwa Securities. Through his efforts to revitalize the company using his experience and network, he successfully turned a profit.

Many food SMEs started seeking help from Mr. Yoshimura upon learning of his work. He thought that it was possible to efficiently achieve results if the companies complemented each other in various functions, such as product development, production, and sales under a holding company system, instead of working on each company individually. Hence, he named the corporate Yoshimura Food Holdings K.K. in August 2009.

Since then, the company has continued acquiring companies facing problems with business succession or failing to handle management on their own. They are praised for their unique position of not competing with major food companies or investment funds as well as their policy of not selling off the companies. They received financing from INCJ, Ltd. (Innovation Network Corporation of Japan) and Japan Tobacco Inc. (JT) and expanded their business. In March 2016, it was listed on the Mothers of Tokyo Stock Exchange, and in March 2017, it was listed in the first section of Tokyo Stock Exchange. In April 2022, it was transited to the Prime Market of Tokyo Stock Exchange.

The company is pursuing further growth by acquiring not only Japanese companies, but also overseas companies in Singapore, Malaysia, and more.

[1-2 Target Social Image]

For the social responsibility of the enterprise, the company decided to pursue the mission: "A society where we can enjoy this 'delicious taste' forever 〜Achieving affluence that allows consumers to enjoy diverse food cultures〜," and set its vision (roles to be fulfilled) and values (values they cherish) as such.

Mission A society where we can enjoy this “delicious taste” forever 〜Achieving affluence that allows consumers to enjoy diverse food cultures〜 | *We believe that a society in which people can choose from various options freely according to their respective preferences and a society in which those choices are respected is affluent and happy. *We aim to achieve an affluent society in which consumers around the world can choose from a wide array of high-quality “delicious foods” freely and enjoy them. |

Vision Protect and nurture regional “delicious foods” and distribute them around the world | *In order to realize a society where we can enjoy this “delicious taste” forever, we will discover “delicious foods” that have been cherished in Japan and around the world, protect and nurture them, and deliver them to people around the world. *To do so, we will develop our own ability to find “delicious foods”, a business base for protecting “delicious foods”, functions to support the growth of “deliciousness”, and sales networks to deliver “delicious foods” to people around the world. *As a result, our company will become a global producer that promotes the cultures and diversification of foods around the world and the invigoration of local communities. |

Values “Cherish individuality” | *We cherish the individuality of everyone related to us. *We value the “individuality”, “new ideas”, and “desire to take on new challenges” of each employee working in our corporate group. *We value the “history”, “culture”, “employees”, “business partners”, and “local communities” of each of our group companies. *We brush up the “strengths” of our group companies, mutually make up for their “weaknesses,” and grow together. *We will contribute to the development of an affluent society with a variety of options available, by cherishing the individuality of everyone related to us. |

[1-3 Market Environment and the Background of the Company’s Establishment]

As a company aiming for supporting and revitalizing SMEs throughout Japan, Yoshimura Food Holdings views the conditions of the food SMEs as follows:

(Investment Bridge extracted, summarized, and edited the information from Yoshimura Food Holdings’ annual securities reports and reference material)

(The Conditions of the Food SMEs)

*Japanese cuisine has been highly appreciated worldwide and is attracting increasing attention. On a national scale, the food manufacturing industry has also been one of Japan’s largest and proudest largest industries based on its number of business establishments, number of employees and GDP since the 1990s.

*99% of the companies are SMEs where each one of them has strong products and technical skills.

*However, the domestic market is shrinking and some of the food SMEs find it hard to survive on their own as the business environment remains stringent due to falling birthrates and an aging population.

*Therefore, many companies give up on continuing their businesses and end up shutting down or suspending their business.

(Conditions of the SMEs’ Business Succession)

*As of 2024, the majority of business owners in small and medium-sized enterprises are aged 60 or older, with the average age reaching a record high of 63.59 years. Notably, the proportion of owners aged 70 and above has also reached a record high of 34.47%, indicating that many owners are expected to reach retirement age in the coming years.

*However, 62.15% of domestic small and medium-sized enterprises currently lack a successor, and preparations for business succession remain insufficient. In particular, among companies whose representatives are in their 50s, 71.82% have no successor, while in those with representatives in their 60s, the figure is 47.88%. Although the absence rate decreases with increasing age, it remains at a high level. Amid this situation, only 31.8% of companies across all industries are currently considering business succession, showing that preparations are still lagging.

(Information from SME Agency “White Paper on Small and Medium Enterprises” (2025 Edition), TOKYO SHOKO RESEARCH, LTD. “Analysis of the age of company presidents in Japan (2024),” TOKYO SHOKO RESEARCH, LTD. “Survey of Trends on ‘Successor Absence Rate’ in Japan” (2024), SME Agency “Basic Survey on the Actual Situation of SMEs” (Report in fiscal year 2023 [Financial results in fiscal year 2022])

(Conditions of Business Succession of Food SMEs through Acquisition)

*Although there are increasing needs for business succession from food SMEs, the number of companies and organizations that would acquire them is small.

*The scale of many food SMEs is too small for major companies to acquire, and for investment funds’ whose primary aim is to rapidly grow independent companies and sell them off within a few years, the mature market of food SMEs tends not to be one of their investment targets.

*Under these conditions, there is a tremendous shortage in the bearers of the responsibility of taking on the business of the SMEs.

[1-4 Business Description]

Having Yoshimura Food Holdings as its holding company, the corporate group consists of 38 consolidated subsidiaries, two companies accounted for using the equity method, and one non-consolidated subsidiary as of the end of August 2025.

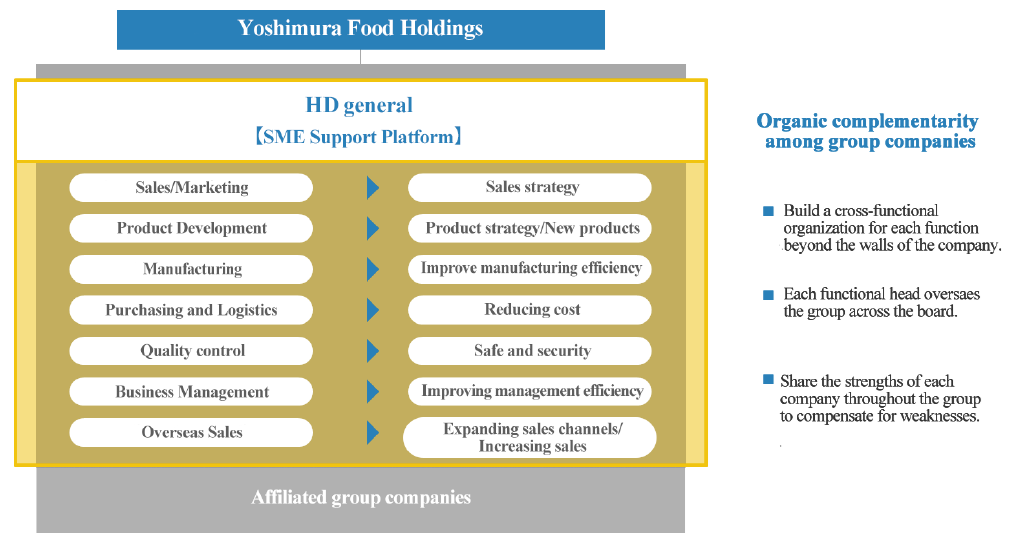

Yoshimura Food Holdings aims to support and revitalize SMEs that manufacture and sell food products by creating a corporate group, composed of the food SMEs that are facing problems in securing a successor, through M&A. Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each company in the group. It also supports and supervises their sales and marketing, production management, procurement and manufacturing, distribution, product development, quality control, and business management.

① Business Model

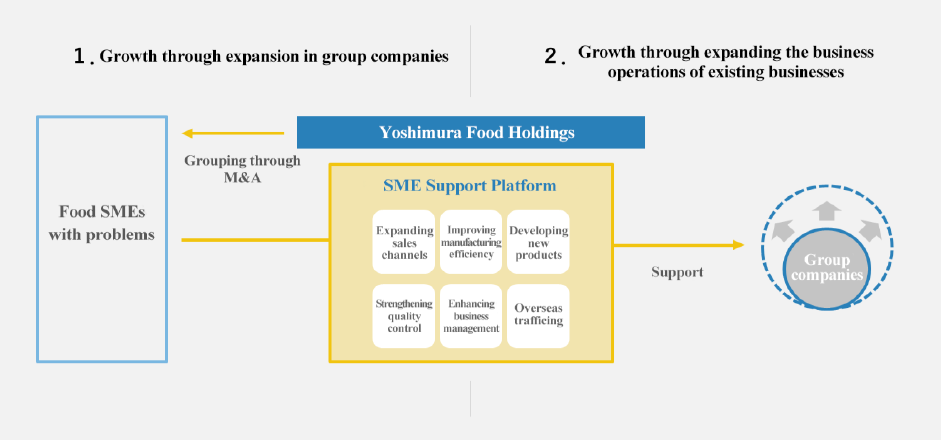

The company develops a unique business model in the food industry and is pursuing growth based on two engines.

One of them is the increase in the number of group companies through M&A.

Since its establishment in 2008, the company prevented food SMEs that had business succession and financial problems from shutting down or facing business suspension by acquiring them. Thus, it has managed to solve their problems.

It is recently focusing on adding not only Japanese companies to the group, but also overseas ones.

Projects sourcing have been so far found (discovered) mainly with an "indirect approach" through introductions from M&A brokerage firms, regional financial institutions (mainly local banks), lawyers, and accountants. In order to speed up the process, the company intends to strengthen its “direct approach” to build relationship for future M&A and to more proactively and aggressively seek out new projects. This will be done by creating a target list and approaching the companies independently as well as by utilizing the network of KOKUBU GROUP CORP.

The other goal is the expansion of business for existing group companies.

Yoshimura Food Holdings supports the expansion of business operations of each company and solves problems by supervising each of the company’s functions. The “SME Support Platform” is applied to these companies which have excellent products and technologies but could not achieve growth for reasons such as the lack of sales channels, labor shortage or poor business management.

(Taken from the reference material of the company)

What is the SME Support Platform?

The core of this unique business model is the “SME Support Platform,” a product of the company’s accumulation of skill, knowledge, and achievements through its specializing in food manufacturing and sales.

As a holding company, Yoshimura Food Holdings is responsible for business strategies’ design and implementation, as well as the business management of each subsidiary in the group. It also aims to strengthen the business foundation of each subsidiary through the company supervisor’s horizontal supervision of its functions (sales and marketing, production management, procurement and distribution, product development, quality control, business management, and securing personnel) in a manner that goes beyond the company barriers and by building organic relations between subsidiary companies.

For example, Company A which has an excellent product but is worried about sales growth can use the sales channels and skills of Company B that has a nationwide sales network. Also, it can achieve a stable financial position by using the creditworthiness of Yoshimura Food Holdings which is listed in the stock market to raise funds.

This cooperation is made to be more effective through appointing the personnel in the group with the highest levels of expertise as supervisors.

Hence, the “SME Support Platform” is a system in which each company’s “strengths” such as strong products and technologies, sales channels, and manufacturing skills are shared across the group and their “weaknesses” such as a shortage in personnel, funds, or sales channels are supplemented.

The “SME Support Platform” is functioning effectively under the current structure, but as subsidiaries will increase further, their s skills will be added as a new strength, and the managerial resources of the corporate group will be accumulated, bringing out a new synergy so that existing subsidiaries will be able to seize opportunities to grow their business and acquire the skills necessary to streamlining their production processes.

Such scalability of the platform will fortify the business foundation of Yoshimura Food Holdings.

(Taken from the reference material of the company)

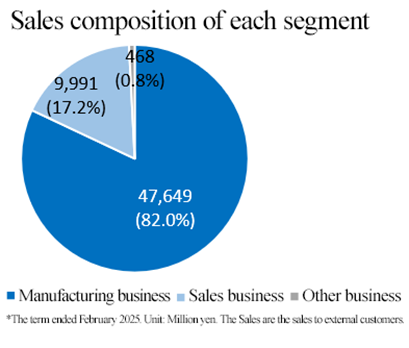

② Segments

The company has two main segments: the “manufacturing business segment” and “sales business segment.” “Other businesses” are composed of the rental and management of real estate, event media marketing, etc.

◎ Manufacturing Business Segment

Each company develops and manufactures their own unique products. Domestic enterprises sell these products mainly to supermarkets, convenience stores, drugstores, restaurants, etc. throughout Japan through wholesalers, while marine products, predominantly scallops, are sold mainly to exporting companies. Overseas enterprises sell products to hotels, restaurants, supermarkets, etc. in Singapore and Malaysia and also manufacture kitchen instruments and other products. As of the end of August 2025, there are 28 main group companies as tabulated below.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

Raku-you Food Co., Ltd. (Adachi-ku, Tokyo) | With five factories in Japan, the company manufactures and sells chilled shumai and chilled dumpling. It has the largest share of chilled shumai production in Japan. |

Ohbun Co., Ltd (Shikokuchuo City, Ehime Prefecture) | The company has a unique route to procure oysters from the rare supplies of Hiroshima Prefecture and produces and sells fried oysters as its main product. They also sell fried chicken cartilage, fried chicken meat, and other items. |

Shiroishi Kosan, Inc. (Shiroishi City, Miyagi Prefecture) | It was established in 1886, the company’s main product is Shiroishi Umen, a specialty of Shiroishi City, Miyagi Prefecture. It manufactures and sells dried noodles and other products made using traditional methods. |

Sakuragao Shuzo K.K. (Morioka City, Iwate Prefecture) | The company was established in 1973 as a collective of 10 local breweries in Iwate Prefecture. The sake is brewed using the skills of the biggest Toji (head brewers) group in Japan, Nanbu Toji, and has a high reputation for its fruity taste. |

Daishow Co., Ltd. (Tokigawa-machi, Hiki-gun, Saitama Prefecture) | The company is a pioneer in the peanut butter industry. “Peanut Butter Creamy” made by its own unique manufacturing methods has been continuously a long-selling product since when it was first sold in 1985. |

Yuhoku Suisan Co., Ltd. (Oi-machi, Ashigarakami-gun, Kanagawa Prefecture) | The company manufactures and sells negitoro and tuna slices using tuna that is immediately frozen on the ship at minus 50-60 degrees Celsius as soon as it is caught. |

Junwa Food Corporation (Kumagaya City, Saitama Prefecture) | The company manufactures and sells jellies. It has constructed a perfect quality control system, including having acquired the Saitama Prefecture HACCP certification. Although it is still a start-up company in jelly production, it has an established reputation within major hypermarkets for its products’ quality and technological capabilities. |

SK Foods Co., Ltd. (Yorii-machi, Osato-gun, Saitama Prefecture) | The company mainly manufactures and sells chilled and frozen pork cutlet and makes products that meet customer needs. It also conducts direct procurement and direct sales without depending on any trading companies. |

Yamani Noguchi Suisan Co.,Ltd. (Rumoi City, Hokkaido Prefecture) | For half a century, the company has manufactured and sold Hokkaido prefecture’s specialties such as salmon jerky and herring that are prepared by its skilled workers with unique manufacturing techniques. |

JSTT SINGAPORE PTE. LTD. (Singapore) | Located in Singapore, the company manufactures and sells sushi, makimono, rice balls, etc. |

Omusubikororin Honpo Co., Ltd. (Azumino City, Nagano Prefecture) | Using its own freeze-dry device, the company manufactures ingredients for confectionery, emergency food, etc. Its “Mizu Modori Mochi” (rice cakes that can be prepared by adding water) is famous for being used in the Space Shuttle Endeavour. |

Marukawa Shokuhin Co, Ltd. (Iwata City, Shizuoka Prefecture) | A famous dumpling shop in Hamamatsu area. The company manufactures and sells dumplings at the store, using carefully selected ingredients and a secret recipe the company has been following since its establishment. |

PACIFIC SORBY PTE. LTD. (Singapore) | The company processes and wholesales chilled and frozen seafood products in Singapore. |

Mori Yougyojou Co., Ltd. (Ogaki City, Gifu Prefecture) | The company harvests the highest quantity of farmed ayu (sweetfish). It has nurtured an original technique for collecting and incubating roe to grow and ship a stable supply of fish. In addition, it possesses the technology to make fish give birth to male or female fish. |

NKR CONTINENTAL PTE. LTD. (Singapore) | Located in both Singapore and Malaysia, the company manufactures, imports, sells, designs, installs, and maintains kitchen equipment. |

Kaorime Honpo Co., Ltd. (Izumo City, Shimane Prefecture) | The company produces a wide array of high-quality products that is both original and by OEM orders, including soft dried seaweed for seasoning rice, dried hijiki for seasoning rice, seaweed soup, ochazuke with seaweed, etc. |

Junido Co., Ltd. (Dazaifu City, Fukuoka Prefecture) | The company manufactures and sells soft furikake (rice seasoning) such as Umenomi-hijiki. It has many fans all over the country and is very popular. |

K.K. Odakishouten (Kasama-shi, Ibaraki Prefecture) | The company manufactures and sells products made mainly from Iwama Chestnuts in Ibaraki Prefecture. |

Hosokawa Foods, Co., Ltd. (Kanonji-shi, Kagawa Prefecture) | The company manufactures and sells frozen delicatessen products such as kakiage and chijimi using domestic vegetables, as well as frozen rice products such as sekihan (red bean rice). |

Kobayashi Noodle Co., Ltd. (Sapporo-shi, Hokkaido) | The company is mainly engaged in producing and selling fresh noodles (ramen), producing gyoza (dumpling) skins, and selling seasonings including sauce. |

Hayashi-Kyuemon-Shoten Co.,Ltd. (Fukuoka City, Fukuoka Prefecture) | The company produces, processes, and sells flaked bonito and broth, with its main product being Monaka Osuimono (lightly seasoned broth placed inside rice wafers), which was originally developed by the company. |

Marukichi Co.,Ltd. (Abashiri City, Hokkaido) | The company manufactures, processes and sells mainly large and meaty scallops caught in the Sea of Okhotsk, as well as salmon, salted salmon roe, crab, etc. |

YS Foods Co., Ltd. (Mori-machi, Kayabe-gun, Hokkaido) | The company manufactures, processes and sells mainly scallops caught in the Funka Bay, which is regarded as a prominent fishing zone in Hokkaido, as well as salmon, salted salmon roe, squid, etc. |

Matatsu Suisan Co., Ltd. (Oshamambe-cho, Yamakoshi-gun, Hokkaido) | The company sells mainly scallops and salmon caught in Oshamambe, Hokkaido and processed with advanced technologies at cutting-edge facilities. |

Seidou Suisan Co.,Ltd. (Mori-machi, Kayabe-gun, Hokkaido) | The company processes fresh shelled scallops caught in the Funka Bay by removing a half of the shell, and sells them, boasting an overwhelming market share in the domestic production amount of half-shelled scallops. |

Fukyo Food Co., Ltd. (Noda City, Chiba Prefecture) | The company manufactures and sells Chinese food ingredients, with spring roll wrappers as its main product. |

EXAMAS JAYA SDN. BHD. (Malaysia) | The company imports, sells, and maintains kitchen equipment for professional use. |

EQUIPMAX PTE. LTD. (Singapore) | The company imports, sells, and maintains kitchen equipment for professional use. |

◎ Sales Business Segment

Companies whose strengths are sales capability and planning skills. Domestic enterprises sell products to mainly industrial catering companies, consumer cooperatives, etc., while overseas enterprises sell products to mainly supermarkets, hotels, restaurants, etc. As of the end of August 2025, group companies are the following four.

(Group Companies within the Manufacturing Business Segment)

Company Name | Features |

KK Yoshimura・Food (Koshigaya City, Saitama Prefecture) | The company mainly conducts the planning and sales of industrial food ingredients. It does not have distribution channels, but it has constructed a business model where it sends products directly to customers. |

Joy Dining Products K.K. (Koshigaya City, Saitama Prefecture) | The company conducts the planning and sales of frozen foods. It also has direct accounts with consumer co-ops throughout Japan and utilizes them to sell the products of the group companies. |

SIN HIN FROZEN FOOD PRIVATE LIMITED (Singapore) | The company procures high quality, safe and trusted frozen seafood products and processed seafood products from the influential seafood companies in various parts in Asia. |

YS Kaisyo Co., Ltd. (Mori-machi, Kayabe-gun, Hokkaido) | In addition to careful selection of ingredients from Hokkaido, which is called “the treasure trove of food,” and the sale at shops and online, the company operates a hot spring facility and a restaurant. |

◎ Other segments

As of the end of August 2025, the group companies are the following two companies.

(Other Segment Group Companies)

Company | Characteristics |

SHARIKAT NATIONAL FOOD PTE. LTD. (Singapore) | The Company owns a food factory and a cold storage warehouse for food products in Singapore and is engaged in the real estate leasing business. |

ONESTORY Inc. (Shibuya-ku, Tokyo) | The company conducts event businesses. It rediscovers and restructures the food and culture hidden in the local region and produces them as premium content. |

[1-5 Characteristics and Strengths]

① The Advantage in Business Succession through Acquisition

There are leading strong buyers in M&A in the food industry, such as major food companies and investment funds; however, this company has three main points that form strong competitive advantages, which are explained below.

*Ability to Acquire Companies of Various Scales

The company does not aim to sell the companies it acquired. It aims to not only achieve short term business recovery, but also sustainable growth from a medium to long term perspective. Therefore, the company can acquire a variety of SMEs, including those with a small business scale that would take time to achieve growth and those that lack management resources for growth.

This point creates a huge difference between the company and other major food companies and investment funds that need the companies they will acquire to be of a certain scale. Moreover, it is not easy for investment funds aiming to generate capital gains from selling companies to gain the trust of owners and managers of food SMEs. Regarding this point, this company operating company groups with the aim of achieving sustainable growth from a medium-term perspective also has a huge advantage.

*Advanced Capability of M&A

Since its establishment, the company has worked on creating many company groups out of food-related SMEs and later has achieved re-growth of these companies. Thus, it has thorough knowledge of the market environment of the food industry, business practices and risks that are peculiar to food SMEs, and strong assessment abilities, which enable the company to choose companies that have strengths from a large number of SMEs.

Also, the company has an extremely high capability of M&A since it has great expertise and accumulated knowledge in due diligence and negotiations.

*Rich and High-Quality M&A Data through its Wide Network

The company can gather plenty of M&A data on the food SMEs since it has a wide network of financial institutions, such as city banks, regional banks, credit associations, securities companies and companies that provide M&A advisory services.

Furthermore, the company’s specialization in the food industry and the reassurance that the company is not aiming to sell are the two factors allowing the company to access not only to a huge amount of data, but also high-quality data that meets its needs.

② Core Skill: SME Support Platform

The company revitalizes the group companies through the “SME Support Platform” in which each group company’s “strengths” such as strong products and technologies, sales channels, and manufacturing know-how are shared across the group and their “weaknesses” such as a shortage in personnel, funds or sales channels are supplemented. These achievements are highly evaluated.

③ Contribution to regional vitalization

The company has actively implemented the business succession, etc. of local food SMEs, including Sakuragao Shuzo K. K. (Iwate Prefecture), Shiroishi Kosan Co., Ltd. (Miyagi Prefecture), and Ohbun Co., Ltd. (Ehime Prefecture), which are subsidiaries.

By utilizing the SME Support Platform, it is possible to distribute attractive products that have been available only in some regions to all around Japan (and overseas) and invest in new equipment by using the funds of the corporate group. Through this, the company contributes to the regrowth of local small and medium-sized food enterprises and the vitalization of local economies.

[1-6 Dividend Policy and Shareholders’ Benefit System]

(Dividend Policy)

Although payout to shareholders is one of the important business challenges, it is thought that allocating the cash to M&A and investment in the facilities to actively expand the business and to strengthen the business foundation by expanding the platform is what would lead to the highest payout to the shareholders because the company is within the growth process.

Therefore, the company has not provided dividend payout to its shareholders since its establishment and as of the time being, it plans to continue using the cash to invest in business expansion and as necessary operating capital for the existing companies. The company is planning to look into providing dividend payouts to its shareholders while considering the operating performance and financial conditions for each business year.

(Shareholders’ Benefit System)

To enhance shareholder satisfaction, the company offers benefits to shareholders based on the number of shares held and the duration of the holding period.

(Outline of the benefit system for shareholders)

Number of Shares | Number of Times to Receive Special Benefits | Special Benefit Content |

300 - 499 shares | Once a year (shareholders as of the end of February who have been holding shares for a year or longer) | Products worth 1,500 yen from the group companies |

500 - 2,499 shares | Once a year (shareholders as of the end of February who have been holding shares for a year or longer) | Products worth 2,500 yen from the group companies |

2,500 - 9,999 shares | Twice a year (shareholders as of the end of February and August who have been holding shares for a year or longer) | Seafood set including scallops and salted salmon roe worth 10,000 yen |

10,000 - 49,999 shares | Twice a year (shareholders as of the end of February and August who have been holding shares for a year or longer) | Premium Hokkaido set worth 40,000 yen |

50,000 shares or more | Four times a year (shareholders as of the end of February, May, August, and November who have been holding shares for a year or longer) | Premium Hokkaido set worth 40,000 yen |

The Premium Hokkaido set includes rare products unavailable in the market, which are specially manufactured or handled mainly by the group companies MARUKICHI and YS Foods.

[1-7 ESG Management]

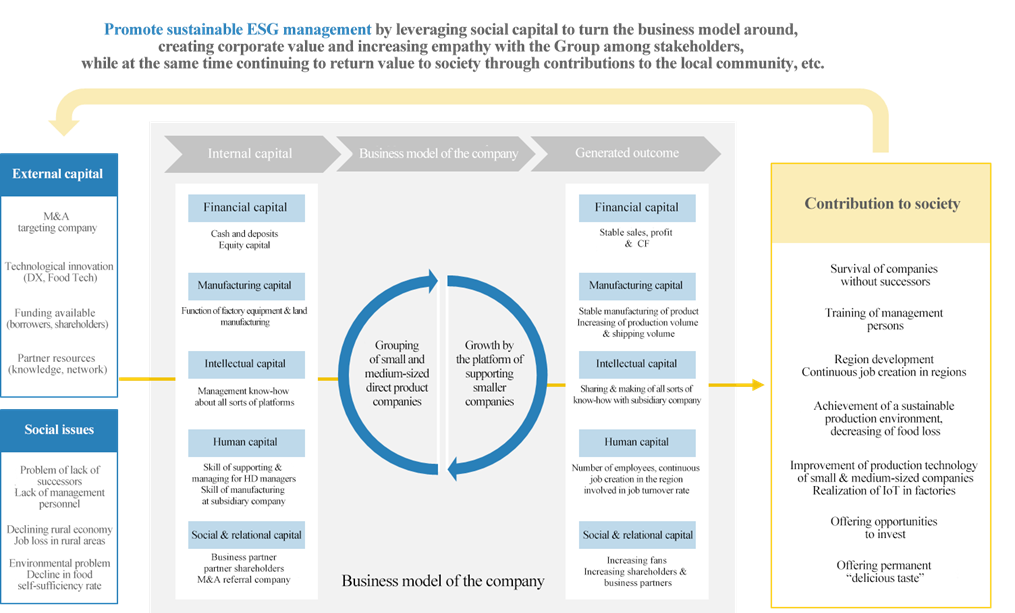

The company is working on its ESG management based on the goal mentioned above, "A society where we can enjoy this 'delicious taste' forever 〜Achieving affluence that allows consumers to enjoy diverse food cultures〜."

Items | Main Initiatives |

E (Environment) | Production of environmentally friendly, sustainable products *To hold the technology and skill to produce sustainable products that do not depend on environmental changes or produce environmental burdens *To utilize a limited amount of food resources and conduct efficient production

Mori Yougyojou: It supplies farmed ayu (sweetfish) stably with its original technology, while the natural resources of ayu are decreasing due to climate changes, water pollution in the rivers, etc. Yamani Noguchi Suisan: It helps reduce food loss by developing products using residue and food that do not satisfy size specs. Yuhoku Seafood Processing: It produces and sells negitoro (minced tuna and green onion) and nakaochi (tuna meat scraped from the backbone) efficiently, by effectively utilizing ingredients.

Recycling of industrial waste from the manufacturing process *Group companies: To utilize food waste by offering the waste produced during the manufacturing process to local livestock breeders and others

Reduction of power consumption *Group companies: To install LED lighting, highly efficient boilers, etc. for reducing power consumption at factories |

S (Society) | Contribution to the business continuity by involving enterprises that have loyal fans in each region

Contribution to the diversity of food in local communities *To develop products with rigorously selected ingredients and recipes, which are strongly demanded by local consumers

Kaorime Honp It has a dominating share in the rice seasoning market in the Chugoku region. Marukawa Shokuhin: It uses rigorously selected ingredients, such as fresh pork and locally grown cabbage, and secret recipes Omusubikororin Honp It develops local specialties by taking advantage of its location of Shinshu-azumino and their freeze-drying technology Daisho It does not use preservatives or colorants. This creates a smooth texture and taste you will never get tired of. Ohbun: It procures oysters harvested in the clean sea areas of Hiroshima and conditional clean sea areas

* Participating in a free lunch support project for students (Omusubikororin Honpo) and providing field trips for elementary school students and gifts (Mori Yougyojou and Junwa Food)

Diversity of employees *Group companies: To prepare opportunities for female employees to flourish, and take measures for recruiting disabled and foreign workers |

G (Governance) | Support with the SME Support Platform *To design business plans and get involved in progress management according to situations while securing the autonomy of each group company *To establish the control section for each function, support business and manage progress as a corporate group

Support for managerial resources *To support the management of group companies, by procuring funds and training next-generation employers for them |

The company recognizes that taking over companies that have no successors and revitalizing it as their group companies is ESG management itself.

Also, the company believes that contributing to local communities and providing value to consumers by promoting ESG management, as well as increasing the number of good companies that sympathize with the group and want to participate, and the companies and consumers that sympathize with the group and support them as shareholders, will lead to the realization of sustainable growth.

(Taken from the reference material of the company)

2. First Half of the Fiscal Year ending February 2026 Earnings Results

[2-1 Consolidated results]

| FY 2/25 1H | Ratio to sales | FY 2/26 1H | Ratio to sales | YoY |

Net sales | 28,738 | 100.0% | 27,765 | 100.0% | -3.4% |

Gross profit | 6,517 | 22.7% | 5,581 | 20.1% | -14.4% |

SG&A expenses | 4,587 | 16.0% | 4,660 | 16.8% | +1.6% |

Operating income | 1,930 | 6.7% | 921 | 3.3% | -52.3% |

Ordinary income | 1,937 | 6.7% | 872 | 3.1% | -54.9% |

Interim net income | 806 | 2.8% | 528 | 1.9% | -34.5% |

EBITDA | 3,165 | 11.0% | 2,103 | 7.6% | -33.6% |

*Unit: Million yen. Interim net income is interim net income attributable to owners of the parent. EBITDA is calculated by adding amortization (depreciation, goodwill), COVID-19-related subsidy income and acquisition costs associated with M&A to operating income.

Both sales and profit decreased.

Sales decreased 3.4% year on year to 27.7 billion yen. The domestic business was healthy, but the sales of the overseas business dropped due to the economic slowdown of Singapore, etc.

Operating income decreased 52.3% year on year to 900 million yen. As the sales quantity of scallop meat, which has a high profit margin, in the domestic business declined and the sales of the overseas business, too, dropped, gross profit decreased 14.4% year on year, and gross profit margin dropped 2.6 points year on year, while SG&A expenses increased 1.6% year on year.

[2-2 Results of each segment]

| FY 2/25 1H | Composition ratio | FY 2/26 1H | Composition ratio | YoY |

Net sales |

|

|

|

|

|

Manufacturing business | 23,356 | 81.3% | 23,032 | 83.0% | -1.4% |

Sales business | 5,171 | 18.0% | 4,646 | 16.7% | -10.1% |

Other businesses | 209 | 0.7% | 86 | 0.3% | -58.8% |

Total | 28,738 | 100.0% | 27,765 | 100.0% | -3.4% |

Operating income |

|

|

|

|

|

Manufacturing business | 1,922 | 8.2% | 1,321 | 5.7% | -31.3% |

Sales business | 430 | 8.3% | 69 | 1.5% | -83.8% |

Other businesses | -12 | - | -80 | - | - |

Adjusted amount | -410 | - | -389 | - | - |

Total | 1,930 | 6.7% | 921 | 3.3% | -52.3% |

*Unit: Million yen. Sales are sales to external clients. The composition ratio of operating income means the ratio of operating income to sales.

*Manufacturing business segment

Sales and profit dropped.

In Japan, the non-scallop-related business (business not related to scallops outside MARUKICHI and the YS Foods Group) was healthy, so sales and profit grew. On the other hand, the scallop-related business saw the decreases in sales and profit, due to the decline in sales of products (frozen meat), etc. In particular, they sold inventory assets while decreasing their book values in response to China’s banning of import of Japanese seafood in the first half of the previous fiscal year, and there was no such sale in the first half of the current fiscal year, decreasing sales significantly.

Outside Japan, the sale to retailers, such as supermarkets, and restaurants was sluggish due to the economic slowdown of Singapore caused by the soaring commodity prices and the decrease of sightseers from China, and the export of scallops with shells (ingredients) from Singapore dropped significantly. Sales and profit dropped, as costs increased due to the rise in commodity prices.

*Sales business segment

Sales and profit declined.

In Japan, sales decreased slightly as the business environment remained harsh, but profit was unchanged year on year.

Outside Japan, sales and profit decreased as the sale to retailers, such as supermarkets, and restaurants was sluggish and there was no longer the sale of scallops as ingredients, which was conducted in the previous fiscal year.

[2-3 Financial conditions and cash flow]

◎ Main balance sheet

| End of Feb. 2025 | End of Aug. 2025 | Increase/ Decrease |

| End of Feb. 2025 | End of Aug. 2025 | Increase/ Decrease |

Current assets | 32,448 | 37,337 | +4,888 | Current liabilities | 20,479 | 24,189 | +3,710 |

Cash and deposits | 13,170 | 11,193 | -1,977 | Notes and accounts payable - trade | 3,309 | 3,936 | +626 |

Notes and accounts receivable - trade | 8,186 | 8,270 | +84 | Short term interest-bearing liabilities | 12,434 | 15,979 | +3,544 |

Inventories | 10,177 | 16,863 | +6,686 | Non-current liabilities | 19,055 | 18,595 | -459 |

Non-current assets | 23,620 | 23,138 | -481 | Long term interest-bearing liabilities | 16,476 | 16,037 | -438 |

Property, plant and equipment | 11,217 | 10,919 | -298 | Total liabilities | 39,534 | 42,785 | +3,250 |

Intangible assets | 10,197 | 10,116 | -80 | Total net assets | 16,534 | 17,691 | +1,156 |

Investments and other assets | 2,205 | 2,102 | -103 | Retained earnings | 6,627 | 7,155 | +528 |

Total assets | 56,069 | 60,476 | +4,407 | Total liabilities and net assets | 56,069 | 60,476 | +4,407 |

|

|

|

| Total interest-bearing liabilities | 28,910 | 32,017 | +3,106 |

*Unit: Million yen

Total assets grew 4.4 billion yen from the previous fiscal year to 60.4 billion yen, as inventory assets increased because they enhanced the procurement of scallops as ingredients while expecting that the catch of scallops will decline.

Total liabilities increased 3.2 billion yen from the previous fiscal year to 42.7 billion yen, due to the rise in short-term interest-bearing liabilities for enhancing procurement.

Total net assets grew 1.1 billion yen from the previous fiscal year to 17.6 billion yen, due to an increase in retained earnings.

Equity ratio decreased 0.7 points from the previous fiscal year to 19.0%.

◎ Cash flows

| FY 2/25 1H | FY 2/26 1H | Increase/Decrease |

Operating CF | 2,811 | -4,260 | -7,071 |

Investing CF | -473 | -990 | -517 |

Free CF | 2,337 | -5,251 | -7,588 |

Financing CF | -2,059 | 2,913 | +4,973 |

Balance of cash and cash equivalents | 8,537 | 8,692 | +154 |

*Unit: Million yen

Operating CF and free CF turned negative, due to the decrease in net income before taxes and other adjustments, the increase in inventory assets, etc. Financing CF turned positive thanks to the increase in short-term debt.

The cash position was almost unchanged.

[2-4 Topics]

(1) About the market price of scallops

The global demand for scallops remains strong, and the selling price of scallops is still on the rise. While the amount of scallop meat (products) sold is falling in reaction to a decline in the catch of scallops, the company will consider sales strategies with its eye kept on China’s resumption of import of Japanese marine products.

(Taken from the reference material of the company)

(2) Acquisition of the shares in two companies that engage in the import, sale, and maintenance of kitchen equipment for professional use in Malaysia and Singapore

In July 2025, YOSHIMURA FOOD HOLDINGS ASIA PTE. LTD., a subsidiary that is in charge of the overseas business, acquired 70% of the shares in EXAMAS JAYA SDN. BHD. (EXAMAS) and EQUIPMAX PTE. LTD. (EQUIPMAX), which engage in the import, sale, and maintenance of kitchen equipment for professional use in Malaysia and Singapore, and they became subsidiaries indirectly owned by YOSHIMURA FOOD HOLDINGS K.K.

(Overview of EXAMAS and EQUIPMAX)

EXAMAS and EQUIPMAX are engaged in the import, sale, and maintenance of kitchen equipment for professional use in Malaysia and Singapore. They sell high-quality kitchen equipment for professional use, which they import mainly from Europe and the United States, to fast-food chains, restaurants, café chains, or other food service operators in Malaysia and Singapore, and offer after-sales maintenance services.

The companies have established secure positions and formed stable business foundations in the respective countries on the basis of the following strengths:

① Maintenance service network throughout Malaysia

EXAMAS has seven bases in Malaysia and EQUIPMAX has a base in Singapore, and they not only sell kitchen equipment for professional use, but also offer regular after-sales maintenance services and other services for swiftly dealing with sudden malfunctions. The customer support know-how that they have cultivated over the years and their maintenance service systems that cover a wide range of areas and swiftly provide solutions to trouble enable them to earn great customer trust and secure their own positions that discourage competitors from entering the market.

② Exclusive distribution rights granted by major European and American manufacturers

One of the most important factors in the business of selling kitchen equipment for professional use is to hold the distribution rights granted by the kitchen equipment manufacturers designated by leading fast-food chains. With their business achievements delivered for many years and wide-ranging service systems, EXAMAS and EQUIPMAX have obtained the exclusive distribution rights of major manufacturers of kitchen equipment for professional use based in Europe and the United States and built systems for exclusively selling the equipment of such manufacturers in Malaysia and Singapore.

③ Trading with major fast-food chains

Using the aforementioned maintenance service systems and exclusive distribution rights of leading manufacturers, EXAMAS and EQUIPMAX have continuously conducted transactions with fast-food chains that operate globally and local leading café chains. In Malaysia, where the economy is booming significantly, in particular, improvement in business performance can be expected on a continuous basis because fast-food chains are opening stores proactively there.

(Reasons behind the share acquisition)

YOSHIMURA FOOD HOLDINGS ASIA PTE. LTD. has acquired 70% of the outstanding shares in the subject companies and the current managers of the subject companies continue to hold the remaining 30% of the shares. The two newly acquired subsidiaries will strive for further growth in the Asian region through initiatives to bring about synergetic effects while continuing to maintain their independent business administration structures under the management that remains unchanged.

(Overview of the shares acquired)

The total amount of the acquired shares in the new subsidiaries is about 1.6 billion yen. The shares were transferred to the company in July 2025.

(3) Each company’s progress with initiatives

Each of the group companies implements initiatives to expand the scope of the business and boost the profitability on a continuous basis. In addition, YOSHIMURA FOOD HOLGINDS K.K. takes the lead in accelerating the growth of the corporate group as a whole by utilizing the SME Support Platform, offering the group companies support for business administration and synergy generation, and promoting cooperation across the corporate group.

Group company | Initiatives |

Raku-you Food Co., Ltd. | Raku-you Food aims to enhance the production efficiency and improve the profitability by standardizing the shumai package containing 12 pieces and optimizing the production line. Raku-you Food stabilizes the quality and produces a higher yield by making strategic capital investment, such as the replacement of shumai forming machines. |

JUNWA FOOD Corporation | JUNWA FOOD endeavors to increase the number of orders received during the off-season. JUNWA FOOD strives to increase sales, improve operating rate, and boost profitability by raising the number of OEM transactions with new business partners. |

Hayashi-Kyuemon-Shoten Co., Ltd. | Hayashi-Kyuemon-Shoten increases sales and enhances the revenue structure by promoting the development of new products through collaboration among the corporate group’s personnel and finding new revenue sources. |

Kobayashi Noodle CO., LTD. & KOKUBU GROUP CORP | Kobayashi Noodle and KOKUBU GROUP promote joint development and expansion of sales channels for new brand products with the aim of reducing costs and improving profitability by increasing sales volume. Kobayashi Noodle and KOKUBU GROUP endeavor to increase operating rate and improve profitability by utilizing the corporate group’s production capacity to the fullest. While Kobayashi Noodle’s products had conventionally been designed only for professional use, it began to develop and sell new brands for supermarkets and mass retailers, in which it made a good start. |

Merger between OHBUN CO., LTD. and HOSOKAWA FOODS CO., LTD. | OHBUN and HOSOKAWA FOODS are propelling forward the integration of their organizational structures and systems toward the merger scheduled for 2026. OHBUN and HOSOKAWA FOODS enhance business administration efficiency, generate business synergy, and strengthen the governance framework, including the enhancement of HOSOKAWA FOODS’ sales capability. |

NKR & Examas | NKR and Examas are discussing cross-organizational synergy policies, such as sharing of sales channels and maintenance departments, by holding regular meetings. NKR and Examas aim to increase sales and streamlining business operations. |

(4) Progress with consideration regarding M&A

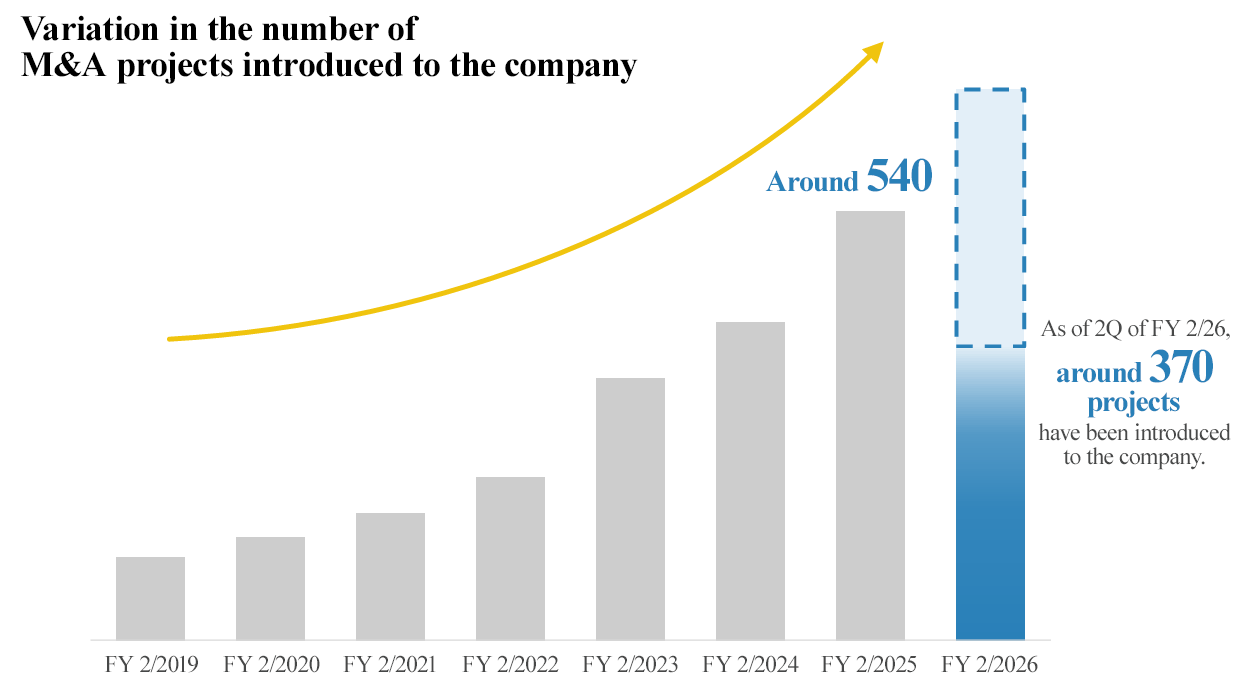

With the growing needs for business succession being a tailwind, a significantly increasing number of companies are introduced for M&A deals to the company, which completed the development of a system for accepting other companies after many years’ efforts and is now capable of taking over the businesses of companies that are large in scale and have tremendous growth potential and high profit margins. The number of companies introduced to YOSHIMURA FOOD HOLDINGS K.K. for M&A deals, which was about 540 in the fiscal year ended February 2025, stood at about 370 as of the first half of the fiscal year ending February 2026. The company is considering merging and acquiring promising companies that are in line with its roll-up strategy and niche market strategy.

(Taken from the reference material of the company)

3. Fiscal Year ending February 2026 Earnings Estimates

[Earnings estimates]

| FY 2/25 | Ratio to sales | FY 2/26 (Estimate) | Ratio to sales | YoY | Revision rate | Progress rate |

Net sales | 58,110 | 100.0% | 56,400 | 100.0% | -2.9% | -11.5% | 49.2% |

Operating income | 4,161 | 7.2% | 2,000 | 3.5% | -51.9% | -50.0% | 46.1% |

Ordinary income | 4,251 | 7.3% | 1,950 | 3.5% | -54.1% | -50.0% | 44.8% |

Net income | 1,861 | 3.2% | 850 | 1.5% | -54.3% | -46.2% | 62.2% |

EBITDA | 6,626 | 11.4% | 4,200 | 7.4% | -36.6% | -36.1% | 50.1% |

*Unit: Million yen. Net income is net income attributable to owners of the parent. EBITDA is calculated by adding amortization (depreciation, goodwill) and acquisition costs associated with M&A to operating income. Revision rate means the one with respect to the upper limit of the previously announced forecast range.

Earnings forecast revised downwardly. Expected to decrease in sales and profit.

They have downwardly revised the full-year earnings forecast, after reviewing the results in the first half of the fiscal year, including the economic slowdown of Singapore, the downturn of demand for eating out, the decline in sales of scallop meat (products) in the domestic business, etc. Sales are projected to decrease 2.9% from the previous fiscal year to 56.4 billion yen, and operating income is forecast to drop 51.9% from the previous fiscal year to 2 billion yen.

Regarding the overseas business, sales and profit are expected to recover gently, as they will expand sales channels by strengthening the marketing structure and secure profitable products by cementing the cooperation with suppliers, although the business environment will remain harsh. Regarding the domestic scallop-related business, the selling price of scallops is expected to rise because global demand is strong, but the decline in sales quantity of scallop meat (products) due to the decrease in the catch of scallops caused by the rise in water temperature will be a short-term risk factor.

4. Conclusions

Due to the U.S. tariff policy, the sales of scallops to the U.S., where the consumption of scallops is the largest, are low, but the price of scallops is rising, indicating that the global demand for scallops is extremely high.

On the other hand, we would like to pay attention to “China,” a huge consumption area. In June 2025, the General Administration of Customs of the People's Republic of China announced “the resumption of conditional import of seafood from some regions of Japan,” so it became possible to export the scallops harvested in Japan to China, but in order to actually export them, Japanese enterprises need to apply for the registration of Japanese factories and obtain approval from Chinese authorities. The company is waiting for such approval. Due to the 2-year banning of import, there remains no inventory of scallops in China, so if import is actually resumed, there will be significant upward pricing pressure. We don’t know when China will approve the import, but the company is preparing for the expansion of revenue in the current and next fiscal years, by stockpiling scallops as the catch of scallops is forecast to decline. We would like to pay attention to the news release of the resumption of export to China.

<Reference 1: Medium-term Management Plan>

A medium-term management plan toward the fiscal year ending February 2030 was announced.

[1 Future Vision]

They aim to become a “global producer of small and medium-sized food enterprises.”

They will provide aid to small and medium-sized enterprises that support the “delicious taste” of Japan and thus contribute to continuous regional development and the richness of global food culture. Moreover, by taking advantage of the popularity of Japanese food overseas, they will aim for global business growth.

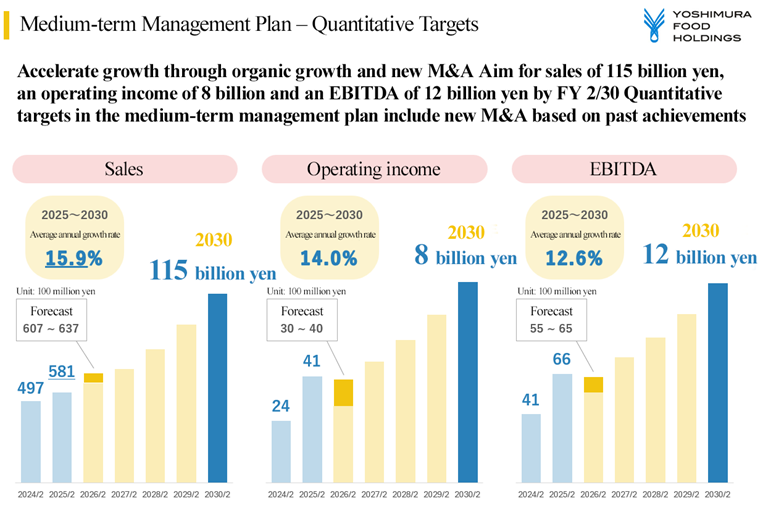

[2 Quantitative Targets]

They will accelerate growth through organic growth and new M&A, aiming for “sales of 115 billion yen, an operating income of 8 billion yen and an EBITDA of 12 billion yen” by the fiscal year ending February 2030.

Quantitative targets in the medium-term management plan include new M&A based on past achievements.

(Taken from the reference material of the company)

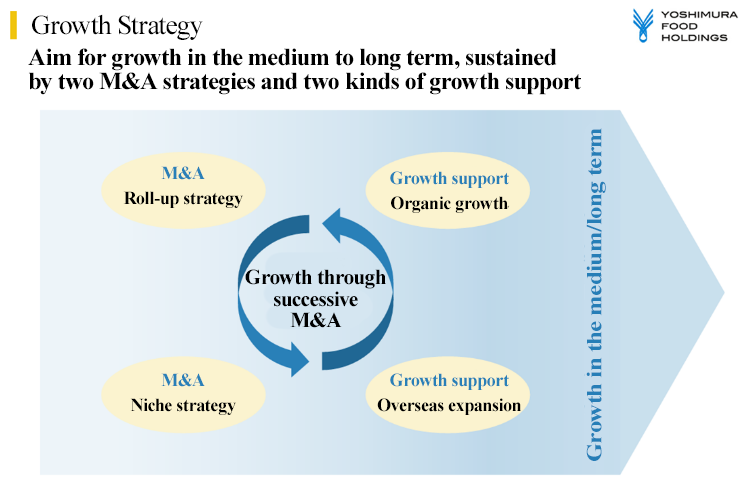

[3 Growth Strategy]

They have stated three growth strategies – “M&A (roll-up strategy and niche strategy),” “organic growth” and “overseas expansion.” At the same time, they will enhance and promote the system for complying with laws and regulations at each group company through the Compliance Department set up at Yoshimura Food Holdings, with the aim of reinforcing their management foundation.

|

|

(Taken from the reference material of the company)

(1) M&A Strategy

① Roll-up strategy

By involving industry peers, mainly core companies, they will generate synergetic effects such as “stabilization of performance,” “cost reduction” and “production streamlining,” while expanding their market share.

The integration of fishery processing business in Hokkaido can be given as a concrete example.

In the scallop processing industry in Hokkaido, where many small and medium-sized companies compete, they forged ahead with a roll-up strategy centered on the representative companies of MARUKICHI and YS Foods, acquiring a high market share in the scallop processing field. They will strive for a further expansion of revenues by inducing synergy.

<Major synergetic effects>

・Standardization of the production volume through cooperation within the group to improve production efficiency

・Group-wide utilization of raw materials, facilities and human resources

・Elevation of profitability through economics of scale

・Sharing of growth opportunities through the integration of procurement and sales channels

② Niche strategy

Acquire companies with a high share on niche markets or companies that have established a competitive advantage based on high value-added products as subsidiaries, and pursue growth through synergy within the group.

(Taken from the reference material of the company)

“Mori Yougyojou” and “Fukyo Food” can be given as concrete examples.

* Mori Yougyojou

A pioneer in land-based aquaculture of ayu (sweetfish), handling the whole process from the hatching of fry to shipment within the company. Mori Yougyojou has established a competitive advantage by acquiring a high share on a niche market and boasts a high profit margin.

After joining the corporate group, their sales grew about 1.6 times and operating income about 1.8 times in approximately 6 years.

*Fukyo Food

This company has maintained the largest share on the niche market of spring roll wrappers for business use over many years. They achieve high quality, which cannot be reproduced by other companies, through original recipes and production methods that have been passed on since the establishment, and their products are used at many high-end Chinese cuisine restaurants.

③ M&A Targets

The company will promote M&A, defining the following targets based on respective strategies.

| Roll-up strategy | Niche strategy | Other |

Strategy | 1. M&A centered on core companies that have established a distinctive position in a particular field 2. Integration of peripheral companies | 1. Companies with a high share on niche markets 2. Companies with a high profit margin, manufacturing high value-added products | 1. Companies with potential for synergetic effects with their corporate group companies 2. Companies with distinctive products, technologies, etc. |

Industry type | Food Manufacturing Industry, Food Wholesale Industry, Food E-commerce Industry, Food Machinery Industry | Food Manufacturing Industry, Food Machinery Industry | Food Manufacturing Industry, Food Wholesale Industry, Food E-commerce Industry, Food Machinery Industry |

Area | Whole Japan | Whole Japan | Whole Japan Southeast Asia (mainly Singapore and Malaysia) |

Sales (rough estimate) | Core companies: 2 billion yen or more Integrated businesses: 300 million yen or more | 300 million yen or more | 300 million yen or more |

Profitability | Core companies: Operating profit of 500 million yen or more Integrated businesses: Focus on synergy | High profitability (Sales/EBITDA of 10% or higher)

| Substantial profitability |

Form | Transfer of a majority of shares (including business transfers) No minority stakes | ||

(Taken from the reference material of the company)

(2) Organic growth

Utilize the SME Support Platform to elevate performance by providing support for management and creation of synergy to group companies.

Representative examples of concrete cases are as follows.

Company name | Details and effects of support |

Kobayashi Noodle Co., Ltd. (M&A conducted in December 2022) | Joint product development in cooperation with KOKUBU GROUP, their capital alliance partner. Release of the first Kobayashi Noodle product available at regular stores (noodles produced by Kobayashi Noodle were packed by Raku-you Food and released in supermarkets as a KOKUBU Hokkaido’s exclusive product).

After joining the corporate group, their sales grew about 1.3 times and operating income about 1.6 times in approximately 2 years. |

Junido Co., Ltd (M&A conducted in January 2022) | Elevation of production efficiency through investment in production facilities. The brand is now widely recognized and the number of high-end supermarkets that sell their products has grown.

After joining the corporate group, their sales grew about 1.5 times and operating income about 2.0 times in approximately 3 years. |

K.K. Odakishouten (M&A conducted in June 2022) | Dispatch of human resources from the head office to provide support for business expansion in the medium/long term. The company started to harvest their own chestnuts through an alliance with business partners. Amid the increase of fallow land and difficulty in procurement of chestnuts caused by the lack of successors to chestnut farms, a stable production system is built through the expansion of fields managed by the company. |

(3) Overseas expansion

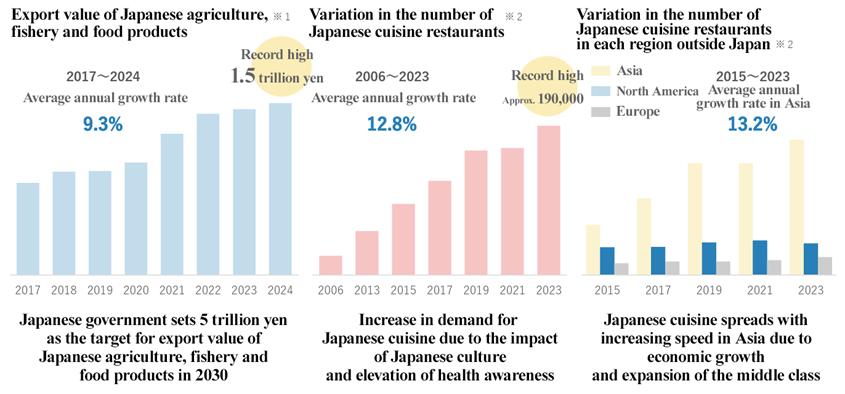

The number of Japanese cuisine restaurants has been rising in recent years, especially in Asia. As Japanese cuisine becomes widely recognized all over the world, the export value of food products also shows an increasing trend year by year.

Amid such environment, they will supply products offered by their group companies to the entire Asia, mainly Singapore.

(Taken from the reference material of the company)

[4 Financial Strategy]

The target ROE in 2030 is 20% or higher. They will promote M&A utilizing financial leverage while maintaining financial soundness.

ROE currently shows a rising trend owing to M&A of companies with high profit margins.

In the medium-term management plan, they will strive for further elevation of profit by streamlining management and inducing synergy effects within the group in addition to utilizing the favorable procurement environment and continuing M&A based mainly on loans.

They will work toward maintaining and elevating profit margin, withdrawing from unprofitable projects and revising the business portfolio as necessary.

[5 Shareholder Return]

Their basic policy for the five years until the fiscal year ending February 2030 lies in “increasing profit through M&A and organic growth and providing return on profit to shareholders by raising stock value.”

Concretely, while they continue to allocate the cash generated by their business to investment in growth, primarily M&A, they will create fans among their shareholders by utilizing shareholder benefits. They will consider share buybacks and dividends depending on their growth stage.

*Gift system for shareholders

With the intention to express gratitude toward shareholders who hold shares in the medium/long term, they decided to enrich the gift system for shareholders, raising the benefit yield in addition to defining requirements for continuous shareholding in the fiscal year ending February 2026.

They will express their everyday gratitude by presenting gifts to shareholders who have kept holding 300 or more shares for a year or longer.

(Taken from the reference material of the company)

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with internal auditors |

Directors | 5 directors, of which 2 are external (Both are designated as independent executives) |

Auditors | 3 auditors, of which 3 are external (All three are designated as independent executives) |

◎ Corporate Governance Report

The latest update: May 30, 2025

<Basic Policy>

Our company believes that our sustainable growth and creation of mid/long-term corporate value can be achieved especially through the trusting relationships and cooperation with our stakeholders, including shareholders, clients, business partners, employees, and local communities.

Accordingly, we consider that the most important mission in management is to keep tightening corporate governance as a base for securing the soundness, transparency, and efficiency of business administration. We will strive to secure the transparency and fairness of our company and timely disclose information to all stakeholders by streamlining the decision-making process, improving the supervisory function for business execution, strengthening the function to oversee directors, and developing an internal control system.

<Reason for not implementing the principles of the Corporate Governance Code (excerpt)>

Principle | Reason for not following the principle |

(Supplementary Principle 5-2-1 Basic Policy on Business Portfolio) | We will strive to present our basic policy on business portfolios and the status of business portfolio reviews to our shareholders in an easy-to-understand manner after discussions at the meetings of the Board of Directors. |

<Disclosure based on the principles of the Corporate Governance Code (excerpt)>

Principle | Disclosed information |

(Principle 1-4 Strategically held shares) | For the purpose of maintaining and strengthening transaction relations, we hold shares strategically to a limited extent. In this case, we judge whether or not to invest, while comprehensively considering the benefits, risks, capital costs, etc. arising out of the maintenance and strengthening of transaction relations, and whether they would contribute to the increase in our corporate value. The board of directors examines economic rationality of individual strategically held shares every year, such as whether the benefits and risks arising out of strategic holding of each stock will recoup capital cost and whether it will increase our corporate value from the mid/long-term viewpoint. We try to reduce the number of shares we hold if we determine that the significance of holding of that stock is not sufficient. We exercise voting rights appropriately with the criteria considering whether it will lead to the increase in corporate value from the mid/long-term viewpoint or whether it will degrade the significance of shareholding. We will not agree with any proposals by the company or a shareholder that would degrade the share value. |

(Supplementary Principle 2-4-1 Ensuring diversity in the appointment of core human resources, etc.) | Our company believes that ensuring and fostering diversity in human resources will lead to medium- to long-term improvements in corporate value, and we are committed to the fair recruitment and promotion of human resources, regardless of gender, age, or nationality, with an emphasis on ability and performance. The percentage of female workers in managerial positions was 17.9% as of the end of February 2025, and we are working to further support female workers in flourishing with the goal of increasing this percentage to over 30% by the fiscal year ending February 2036. With regard to non-Japanese core human resources, we have promoted non-Japanese nationals to managerial positions in our overseas subsidiaries. We will continue to promote diversity in Japan by considering appointment without distinction based on nationality. Furthermore, to enhance our medium- to long-term corporate value and achieve sustainable growth, we will establish a human resource system and an education and training system in order to realize appropriate staffing for the purpose of improving organizational strength and to build a system that will lead to the development of the next generation of human resources for the management of subsidiaries. |

(Supplementary Principle 3-1-3 Sustainability Initiatives) | Under our mission of “Toward a society where we can enjoy this 'delicious taste' forever,” and guided by our corporate philosophy of “Protect and nurture regional 'delicious foods' and distribute them around the world,” we aim to help address the social challenges facing Japan through our business activities, enhance our medium/long-term corporate value, and contribute to the realization of a sustainable society. Our business model—acquiring companies facing challenges such as a lack of successors through M&A, incorporating them into our group, and revitalizing and growing them using our SME support platform—is a direct embodiment of ESG-focused management. We are committed to strengthening our sustainability initiatives moving forward, striving for even more sustainable management. For detailed information on our specific sustainability efforts, please refer to the “Sustainability Policy and Initiatives” section of our Annual Securities Report. With regard to investment in human capital, we operate under the value “Cherish individuality,” striving to secure diverse talent regardless of gender, age, or nationality. We believe that creating an environment where each employee can fully realize their potential will drive our medium/long-term corporate value and sustainable growth. To that end, we are actively working to strengthen our recruitment efforts, personnel systems, and talent development initiatives. Details on our human capital investments are also disclosed in the “Sustainability Policy and Initiatives” section of our Annual Securities Report.

|

(Principle 5-1 Policy for promoting constructive dialogue with shareholders)

| In order to conduct constructive dialogue and communication with shareholders and investors, our company will develop a system with the business management headquarters in charge of IR. Regarding interviews with shareholders and investors, the business management headquarters discusses the best way to carry them out with the CEO, CFO, and chief of business management headquarters, etc., and conducts them up to a reasonable extent. In addition, our company holds quarterly briefing sessions on financial results, which are distributed in a video format. The opinions, etc. received in the dialogue with shareholders and investors are reported to directors and other executives as appropriate. |

[Initiatives to Achieve Management with a Focus on Capital Cost and Share Price] | As of the end of the fiscal year ended February 2025, our PBR stood at 2.13, exceeding the weighted average of 1.5 for the food industry in the Prime Market at the time, and our ROE was 18.8%. We continue to strive for management that prioritizes capital cost and share price while working to enhance profitability to achieve our ROE target of 20%, as outlined in the medium-term management plan announced on April 14, 2025. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports and contents of Bridge Salon (IR seminars) can be seen at www.bridge-salon.jp/