| KENKO Mayonnaise Co., Ltd. (2915) |

|

||||||||

Company |

KENKO Mayonnaise Co., Ltd. |

||

Code No. |

2915 |

||

Exchange |

TSE 1st Section |

||

Industry |

Foodstuff (manufacturing) |

||

President |

Takashi Sumii |

||

Address |

3-8-13, Takaido Higashi, Suginami-ku, Tokyo |

||

Year-end |

March |

||

URL |

|||

*The share price is the closing price on November 22. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter.

|

||||||||||||||||||||||||

|

|

*The forecasted values were provided by the company. From the term ended Mar. 2016, net income is profit attributable to owners of the parent. Hereinafter the same applies.

|

| Key Points |

|

| Company Overview |

|

KENKO Mayonnaise Co., Ltd. is a commercial food manufacturer focusing on salads. The company started out specializing in the commercial manufacture of mayonnaise, and using mayonnaise and dressings as its foundation, expanded business to include salads, delicatessen, and processed egg products. Utilizing its consolidated subsidiaries, the company also handles fresh delicatessen for mass retailers. It developed the "Long-life Salad," which boasts an extended shelf life, for the first time in Japan as well as special salads using unconventional ingredients such as burdock and pumpkin. As a pioneer in its industry, KENKO has held the top market share for long-life salad since the product's release. It is ranked 2nd in mayonnaise and dressings, and 3rd in the omelet market. (company estimate based on Fuji Economics' "Food Marketing Handbook").

In addition to KENKO Mayonnaise Co., Ltd., the company group contains 7 consolidated subsidiaries, 10 factories, and PT.Intan Kenkomayo Indonesia, an equity-method affiliate based in Indonesia. The company manufactures and sells products such as mayonnaise, dressings, and processed eggs (seasoning and processed foods business), and its consolidated subsidiaries sell fresh delicatessen, etc. to mass retailers. (delicatessen-related business). The company's production bases are located in Atsugi, Yamanashi, Gotenba, Shizuoka Fujisan, Nishi-Nihon (Kyoto), Kobe, and Nishi-Kobe.

【Company Philosophy (Taken from the company's website)】

"Contributing to the world by providing quality foods"

Our company philosophy indicates the degree of the position of our company group in society. The philosophy has been amended to "contributing to the world by providing good food" (previously `good food products'). This is because, our activities have been widely expanded thanks to internet as they involve more community activities such as information distribution and food education to local residents rather than only implementing food manufacturing. We continue to contribute to our society through providing various food, service and information on food.

【The Group's Business Philosophy (Taken from the company's website)】

"Body and Mind (mind/body/soul) and Environment"

The group's Business Philosophy shows the passion of our company group based on the company philosophy. We care about the mental and physical aspects as well as the souls of our consumers and other people concerned with our business, who are loyal to our products. Also we devote ourselves to work on environmental issues affecting earth, where the source of our soul (food) grows.

【The Group's Management Policy (Taken from the company's website)】

"To become No.1 Salad Company," "To provide the number one quality products/services in Japan"

The group's Management Policy directs a goal of our company group according to the group's business philosophy. Our goal is to have usual salad become a main cast of our consumers' meal. Moreover, with `salad' as a key driver to promote the market, we conduct business activities that always relate to salad in attempt to establish a new cuisine genre with Salad. In addition, we are aware of our responsibility to provide food products that are safe, reliable and high quality. To achieve that, we at KENKO Mayonnaise Co., Ltd continue to put our best efforts to create higher quality services.

【Business contents】

The company's business segments consist of the seasoning and processed foods business, which manufactures and sells salads, delicatessen, processed eggs, mayonnaise and dressings; the delicatessen-related business, which is handled by consolidated subsidiaries and deals with the manufacture and sale of fresh delicatessen (salad and foodstuffs with a shelf life of 1-2 days) as well as contract manufacturing within the company group; and others which are the shop business (Salad Cafe) and overseas business.

Sales composition ratios for FY3/18 were 82.6% (82.6% in FY3/17), 15.6% (15.6%), and 1.8% (1.7%), respectively. By product type, salads account for 44.6% (43.7% in FY3/17), eggs 28.8% (28.7%), mayonnaise and dressings 24.4% (24.8%), and others 2.2% (2.8%). By field of sale, convenience stores account for 28.3% (27.9% in FY3/17), dining out such as fast food and family restaurants 26.1% (27.4%), mass retailers such as supermarkets 21.9% (20.0%), manufactured bread 13.5% (14.4%), school lunch services 4.6% (4.8%), and others, such as co-op and commercial cash & carry 5.6% (5.5%).

Seasoning and processed foods business

1 Salads and delicatessen (long-life salad, fresh salad, Japanese dishes, etc.)

KENKO was the first in Japan to develop a salad with an extended shelf life. It is also the first to introduce "burdock salad" and "pumpkin salad" to the world. This long-life salad is a brand called "FDFR (Fashion Delica FoodsR)," and is used in restaurants, bakeries, convenience stores, etc. As the industry's first manufacturer and seller of long-life salad, the company takes pride in being the market leader and holding the top market share, and it is continuously striving to develop new products.

2 Processed Eggs (fresh eggs, omelets, Kinshi-Tamago)

The company produces all kinds of processed egg products, such as egg salad to be used in sandwiches and snack breads, Atsuyaki-Tamago (Japanese style rolled omelet) for lunch boxes, Kinshi-Tamago (narrowly stripped cooked eggs) used for cold Chinese noodles, and boiled eggs for Oden soup. In April 2014, the Shizuoka Fujisan egg baking factory began operation. The factory is equipped with an integrated manufacturing line that takes raw eggs with eggshell all the way to finished products. 2 Processed Eggs (fresh eggs, omelets, Kinshi-Tamago)

The company produces all kinds of processed egg products, such as egg salad to be used in sandwiches and snack breads, Atsuyaki-Tamago (Japanese style rolled omelet) for lunch boxes, Kinshi-Tamago (narrowly stripped cooked eggs) used for cold Chinese noodles, and boiled eggs for Oden soup. In April 2014, the Shizuoka Fujisan egg baking factory began operation. The factory is equipped with an integrated manufacturing line that takes raw eggs with eggshell all the way to finished products.

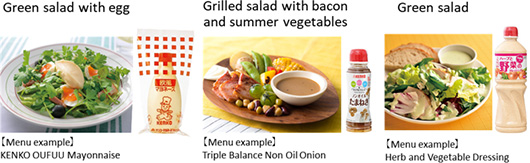

3 Mayonnaise & Dressings (mayonnaise, dressings, cooking sauces, etc.)

This is KENKO's main business. Since the company's foundation, the company has developed many types of mayonnaise and dressings to meet the demands of professional clients as a commercial manufacturer. Some examples include solidified dice-shape sauces developed for use in frozen foods, and mayonnaise-flavored powder which can be sprinkled on snacks such as potato chips. 3 Mayonnaise & Dressings (mayonnaise, dressings, cooking sauces, etc.)

This is KENKO's main business. Since the company's foundation, the company has developed many types of mayonnaise and dressings to meet the demands of professional clients as a commercial manufacturer. Some examples include solidified dice-shape sauces developed for use in frozen foods, and mayonnaise-flavored powder which can be sprinkled on snacks such as potato chips.

Delicatessen-related business, etc.

This business handles the manufacture and sale of fresh delicatessen (daily salads, ready-to-eat foods) for supermarkets and mass retailers. For the main product, potato salad, the company constantly strives to make the most of its ingredients by rotating production areas and offering seasonal varieties, in order to consistently deliver high quality products.

Others

Salad Cafe business

This is the only business in the KENKO mayonnaise company group to have direct contact with customers. Utilizing both the Web and its actual shops, the company relays information to customers, and in turn, customers are able to voice their opinions. There are currently 16 shops, located in places such as supermarkets and department stores found at major railway terminals, as well as within station buildings themselves.

Overseas business

The company exports goods to more than 30 different countries and regions. Demand is expected to rise even further in Indonesia, which has the largest population in Southeast Asia and whose food culture is becoming more diverse due to rapid economic growth. As such, in 2012, the company established PT.Intan Kenkomayo Indonesia. A production facility was completed in 2013, establishing a system for local manufacturing and sales. In 2015, the Vancouver Research Office was established in Canada as a base for collecting food-related information, particularly in North America and Europe. As a market-oriented company, KENKO intends to promptly identify new food cultures and take actions based on this information.

*Overseas businesses are not included in sales because they are affiliates which are accounted for by the equity method.

Manufacturing and sales network (Japan: 7 company-managed factories, and 10 factories managed by 7 consolidated subsidiaries)

In Japan, there are 7 company-managed factories and 10 factories managed by 7 consolidated subsidiaries. The company builds production systems that are closely tied to the region, and one of its strengths is its ability to meet the needs of clients by providing freshness, variable quantities, and customer-specific service. Delicatessen-related business, etc.

This business handles the manufacture and sale of fresh delicatessen (daily salads, ready-to-eat foods) for supermarkets and mass retailers. For the main product, potato salad, the company constantly strives to make the most of its ingredients by rotating production areas and offering seasonal varieties, in order to consistently deliver high quality products.

Others

Salad Cafe business

This is the only business in the KENKO mayonnaise company group to have direct contact with customers. Utilizing both the Web and its actual shops, the company relays information to customers, and in turn, customers are able to voice their opinions. There are currently 16 shops, located in places such as supermarkets and department stores found at major railway terminals, as well as within station buildings themselves.

Overseas business

The company exports goods to more than 30 different countries and regions. Demand is expected to rise even further in Indonesia, which has the largest population in Southeast Asia and whose food culture is becoming more diverse due to rapid economic growth. As such, in 2012, the company established PT.Intan Kenkomayo Indonesia. A production facility was completed in 2013, establishing a system for local manufacturing and sales. In 2015, the Vancouver Research Office was established in Canada as a base for collecting food-related information, particularly in North America and Europe. As a market-oriented company, KENKO intends to promptly identify new food cultures and take actions based on this information.

*Overseas businesses are not included in sales because they are affiliates which are accounted for by the equity method.

Manufacturing and sales network (Japan: 7 company-managed factories, and 10 factories managed by 7 consolidated subsidiaries)

In Japan, there are 7 company-managed factories and 10 factories managed by 7 consolidated subsidiaries. The company builds production systems that are closely tied to the region, and one of its strengths is its ability to meet the needs of clients by providing freshness, variable quantities, and customer-specific service.

|

| Group's production base concept and medium-term management plan "KENKO Value Action - Create Value" (FY3/19 - 3/21) |

|

【Group Production Base Concept】

The home-meal replacement market continues to expand, thanks to fresh delicatessen supplied to supermarkets on a daily basis and lunch boxes and delicatessen supplied to convenience stores (CVS) on a daily basis. Also in the home-meal replacement market, demand for long-life salads, frozen products, etc. is increasing to address the need for simplification due to shortage of manpower. To respond to increased demand by a stable supply, the company is working on strengthening the production structure and leveling the production capacity by establishing two new factories and adding lines at two factories under the group's production base concept.

Progress status

DIETCOOK SHIRAOI Co., Ltd. 68-11 Ishiyama, Shiraoi town, Shiraoi district, Hokkaido

In April, the new factory began the operation to produce potato-based frozen products, frozen potato, and fresh delicatessen and Japanese dishes supplied on a daily basis. A new factory was built to replace the aged existing factory. In the new factory, production capacity will increase by about 3,000 tons per year, and production efficiency will also improve. The company will strengthen the proposal for potato-based frozen products and frozen potato to dining-out companies that have an increasing need for streamlining of operation due to shortage of manpower. Furthermore, it will capture the needs associated with expansion of the home-meal replacement market by suppling fresh delicatessen on a daily basis and Japanese dishes to supermarkets in Hokkaido.

Kanagawa Factory of KANTOH DIETCOOK Co., Ltd. 2880-6 Kita-momoe, Kozu, Odawara-city, Kanagawa

The new factory which distributes fresh delicatessen and Japanese dishes to supermarkets in the Tokyo metropolitan area on a daily basis began the operation in June. The factory uses heated steam ovens that can make juicy and delicious products while retaining moisture and nutrients contained in foods and also produces delicatessen made of meat and fish which can be used as staple food. The Kanagawa Factory of KANTOH DIETCOOK Co., Ltd. was launched from scratch to respond to rapidly increasing demand for r home-meal replacement by supermarkets, etc. in the Tokyo metropolitan area. The factory has production capacity of about 6 billion yen on an annual basis.

In addition to the above two factories, the company is also expanding the existing Shizuoka Fujisan Factory and Nishi-Nihon Factory. The Shizuoka Fujisan Factory, which is scheduled to begin operation in February 2019, produces egg products such as Atsuyaki-Tamago (thick-baked eggs) and Kinshi-Tamago (crumbled eggs), and the annual production capacity will increase by about 3,020 tons as a result of the expansion. The Nishi-Nihon Factory, which is scheduled to begin operation in March 2019, produces long-life salads including small-sized potato salads, and annual production capacity will increase by about 4,300 tons as a result of the expansion. After FY3/19, the company is planning to strengthen its production system and level the production capacity by steadily operating the 4 bases and lead further growth and development.

【medium-term management plan "KENKO Value Action - Create Value" (FY3/19 - 3/21)】

Basic policy and five themes

With its basic policy, Creating Shared Value (CSV) Management "Creation of Common Values," the company will promote corporate activities that create value for both society and company. In order to practice the CSV management, it has five themes: (1) local community contribution, (2) environment and resources, (3) supply chains, (4) solutions, and (5) work style.

1. Local community contribution

The company will work on promoting local production and consumption, and utilizing local special products in order to become the leading company contributing to society. In addition, it will promote recruitment activities of local human resources, and contribution activities such as joint management and training to maintain agricultural production activities.

2. Environment and Resources

The company will work on logistics reform aiming for reducing CO2 emissions, reducing raw material and product losses, and reviewing packaging materials to streamline the usage of resources and energy.

3. Supply chains

The company will shorten the time required to provide service to the final consumers from the production sites by shortening supply chains and reforming business activities.

4. Solutions

The company will work on commercialization of technology and services. Specifically, it will promote development of products and menus, hold cooking classes and workshops, provide recipe assets (website), and carry out consulting of menu development, etc. In addition, it will improve knowledge and technology related to quality assurance to make further progress in the customer support system, support for introducing HACCP, support for inspection and sanitation guidance, etc.

5. Work style

The company will improve the satisfaction of employees by making the workplace comfortable, enhancing the human resources development and training system, reviewing the personnel evaluation system, etc.

Targets and three business strategies

As numerical targets, the company has set the achievement of net sales of 85 billion yen and an ordinary income of 4.6 billion yen in FY3/21, which is the last year of the medium-term management plan. Along with the CSV Management, in order to achieve the targets, it will promote three business strategies: (1) creating business with customers, (2) a production system to “create, respond and expand," and (3) promoting salad dishes to the world.

1) Creating business with customers

In the first half, the company expanded the lineup of high value-added products such as “Wasai Bansai (Japanese ready-to-eat dishes)" that contributes to simplification and loss reduction and health-conscious “Triple Balance." The company also carried out activities aimed at embodying salad dishes by developing small-size kitchen classes “Kitchen Space 831" and workshops for business customers.

2) Production system to "create, respond and expand"

As already explained, the company is implementing the group production base concept. New factories of DIETCOOK SHIRAOI Co., Ltd. and KANTOH DIETCOOK Co., Ltd. began the operation in the first quarter, and in the fourth quarter, new lines of the Shizuoka Fujisan Factory and the Nishi-Nihon Factory will begin the operation.

3) Promoting salad dishes to the world

The company is working on developing globally compatible products that reflect global taste, meet inbound demand, and are exportable. As of the end of September 2018, sales routes have spread to 42 countries and regions. In addition, as part of information dissemination, it actively participates in overseas exhibitions. In the first half (results of April - September, 2018), it participated in seven exhibitions in the countries such as United States and UK. Progress status

DIETCOOK SHIRAOI Co., Ltd. 68-11 Ishiyama, Shiraoi town, Shiraoi district, Hokkaido

In April, the new factory began the operation to produce potato-based frozen products, frozen potato, and fresh delicatessen and Japanese dishes supplied on a daily basis. A new factory was built to replace the aged existing factory. In the new factory, production capacity will increase by about 3,000 tons per year, and production efficiency will also improve. The company will strengthen the proposal for potato-based frozen products and frozen potato to dining-out companies that have an increasing need for streamlining of operation due to shortage of manpower. Furthermore, it will capture the needs associated with expansion of the home-meal replacement market by suppling fresh delicatessen on a daily basis and Japanese dishes to supermarkets in Hokkaido.

Kanagawa Factory of KANTOH DIETCOOK Co., Ltd. 2880-6 Kita-momoe, Kozu, Odawara-city, Kanagawa

The new factory which distributes fresh delicatessen and Japanese dishes to supermarkets in the Tokyo metropolitan area on a daily basis began the operation in June. The factory uses heated steam ovens that can make juicy and delicious products while retaining moisture and nutrients contained in foods and also produces delicatessen made of meat and fish which can be used as staple food. The Kanagawa Factory of KANTOH DIETCOOK Co., Ltd. was launched from scratch to respond to rapidly increasing demand for r home-meal replacement by supermarkets, etc. in the Tokyo metropolitan area. The factory has production capacity of about 6 billion yen on an annual basis.

In addition to the above two factories, the company is also expanding the existing Shizuoka Fujisan Factory and Nishi-Nihon Factory. The Shizuoka Fujisan Factory, which is scheduled to begin operation in February 2019, produces egg products such as Atsuyaki-Tamago (thick-baked eggs) and Kinshi-Tamago (crumbled eggs), and the annual production capacity will increase by about 3,020 tons as a result of the expansion. The Nishi-Nihon Factory, which is scheduled to begin operation in March 2019, produces long-life salads including small-sized potato salads, and annual production capacity will increase by about 4,300 tons as a result of the expansion. After FY3/19, the company is planning to strengthen its production system and level the production capacity by steadily operating the 4 bases and lead further growth and development.

【medium-term management plan "KENKO Value Action - Create Value" (FY3/19 - 3/21)】

Basic policy and five themes

With its basic policy, Creating Shared Value (CSV) Management "Creation of Common Values," the company will promote corporate activities that create value for both society and company. In order to practice the CSV management, it has five themes: (1) local community contribution, (2) environment and resources, (3) supply chains, (4) solutions, and (5) work style.

1. Local community contribution

The company will work on promoting local production and consumption, and utilizing local special products in order to become the leading company contributing to society. In addition, it will promote recruitment activities of local human resources, and contribution activities such as joint management and training to maintain agricultural production activities.

2. Environment and Resources

The company will work on logistics reform aiming for reducing CO2 emissions, reducing raw material and product losses, and reviewing packaging materials to streamline the usage of resources and energy.

3. Supply chains

The company will shorten the time required to provide service to the final consumers from the production sites by shortening supply chains and reforming business activities.

4. Solutions

The company will work on commercialization of technology and services. Specifically, it will promote development of products and menus, hold cooking classes and workshops, provide recipe assets (website), and carry out consulting of menu development, etc. In addition, it will improve knowledge and technology related to quality assurance to make further progress in the customer support system, support for introducing HACCP, support for inspection and sanitation guidance, etc.

5. Work style

The company will improve the satisfaction of employees by making the workplace comfortable, enhancing the human resources development and training system, reviewing the personnel evaluation system, etc.

Targets and three business strategies

As numerical targets, the company has set the achievement of net sales of 85 billion yen and an ordinary income of 4.6 billion yen in FY3/21, which is the last year of the medium-term management plan. Along with the CSV Management, in order to achieve the targets, it will promote three business strategies: (1) creating business with customers, (2) a production system to “create, respond and expand," and (3) promoting salad dishes to the world.

1) Creating business with customers

In the first half, the company expanded the lineup of high value-added products such as “Wasai Bansai (Japanese ready-to-eat dishes)" that contributes to simplification and loss reduction and health-conscious “Triple Balance." The company also carried out activities aimed at embodying salad dishes by developing small-size kitchen classes “Kitchen Space 831" and workshops for business customers.

2) Production system to "create, respond and expand"

As already explained, the company is implementing the group production base concept. New factories of DIETCOOK SHIRAOI Co., Ltd. and KANTOH DIETCOOK Co., Ltd. began the operation in the first quarter, and in the fourth quarter, new lines of the Shizuoka Fujisan Factory and the Nishi-Nihon Factory will begin the operation.

3) Promoting salad dishes to the world

The company is working on developing globally compatible products that reflect global taste, meet inbound demand, and are exportable. As of the end of September 2018, sales routes have spread to 42 countries and regions. In addition, as part of information dissemination, it actively participates in overseas exhibitions. In the first half (results of April - September, 2018), it participated in seven exhibitions in the countries such as United States and UK.

|

| First Half of Fiscal Year March 2019 Earnings Results |

Sales were up 1.0% year on year, while ordinary income was down 30.8% year on year.

Sales were 37,409 million yen, up 1.0% year on year.

Sales increased in the delicatessen-related business where salads, etc. supplied to supermarkets on a daily basis due to stronger production capabilities associated with operation of factories at DIETCOOK SHIRAOI Co., Ltd. and KANTHO DIETCOOK. However, in addition to the decline of sales of salads and delicatessen including potato salads, which are the company's flagship products, and sales of the seasoning and processed foods business which were affected to overall their products by bad weather and natural disasters slightly decreased.

Ordinary income was 1,512 million yen, down 30.8% year on year. Cost rate was 76.5%, up 1.5 points and gross profit was 9,117 million yen, down 4.8% year on year, due to escalation of raw material prices and personnel expenses and posting of expenses related to new factories from the launch of production to full operationalization. On the other hand, SG&A expenses increased 3.2% year on year to 7,660 million yen, and operating income margin was 3.9%, down 1.9 points.

Factors for the differences with the initial forecasts

While sales declined due to the struggle of salads and delicatessen and the impact of natural disasters, the expenses incurred from setting up and full operationalization of new factories exceeded the initial estimates. Sales were up 1.0% year on year, while ordinary income was down 30.8% year on year.

Sales were 37,409 million yen, up 1.0% year on year.

Sales increased in the delicatessen-related business where salads, etc. supplied to supermarkets on a daily basis due to stronger production capabilities associated with operation of factories at DIETCOOK SHIRAOI Co., Ltd. and KANTHO DIETCOOK. However, in addition to the decline of sales of salads and delicatessen including potato salads, which are the company's flagship products, and sales of the seasoning and processed foods business which were affected to overall their products by bad weather and natural disasters slightly decreased.

Ordinary income was 1,512 million yen, down 30.8% year on year. Cost rate was 76.5%, up 1.5 points and gross profit was 9,117 million yen, down 4.8% year on year, due to escalation of raw material prices and personnel expenses and posting of expenses related to new factories from the launch of production to full operationalization. On the other hand, SG&A expenses increased 3.2% year on year to 7,660 million yen, and operating income margin was 3.9%, down 1.9 points.

Factors for the differences with the initial forecasts

While sales declined due to the struggle of salads and delicatessen and the impact of natural disasters, the expenses incurred from setting up and full operationalization of new factories exceeded the initial estimates.

Seasoning and processed foods business <Salads and delicatessen, processed eggs, mayonnaise and dressing, etc.>

Sales were 30,498 million yen (down 1.3% year on year), sales volume in weight decreased 1.5% year on year, and unit sales price decreased 0.1 yen/kg year on year. Of these, sales and sales volume in weight of salads and delicatessen decreased 8.9% and 7.8%, respectively, year on year. In addition to the decrease in the 1 kg form and small-sized form of potato salads, which are the company's main products, the pumpkin salads and the products that include cod roe, corn, etc. also decreased due to menu changes by dining out chain restaurants. Meanwhile, sales and sales volume in weight of processed eggs were up 3.8% and 3.6%, respectively, year on year. Kinshi-Tamago for noodles and scrambled eggs for omelet rice increased mainly around for convenience stores, and boiled eggs also increased as they were widely used mainly for the dining out industry. Sales of mayonnaise and dressings increased 0.8% year on year, while sales volume in weight of mayonnaise and dressings decreased 0.3% year on year. Although the sales of mayonnaise in 10 kg form and 1 kg form decreased, the sales of nugget sauce, etc. for the fast food industry grew. The sales of dressings in the overseas market also increased.

Delicatessen-related business, etc. <Fresh delicatessen (daily salads, delicatessen), contract manufacturing within the company group>

Sales were 6,310 million yen, up 14.7% year on year. Products for sale in supermarkets that contained seafood (squid, crab, cod roe, and others), as well as potato salads, which are the regular products, performed well. Summer products such as bang-bang chicken salads also contributed.

Others <Shop business `Salad Cafe,' overseas businesses (Overseas business is not included in sales because it is handled by equity method affiliates)>

Sales were 599 million yen, down 5.8% year on year. Sales declined due to the effect of closing two stores in the Kanto region (Imotamaya Isetan Shinjuku stores and WaSaRa Sogo Yokohama store). However, in the Kanto region, leafy salads such as green salad and coleslaw maintained popularity, as did the regular long-sellers such as fruit salads, potato salads, and burdock salads in the Kansai region. The flagship store “Shinjuku Odakyu Department Store Salad Cafe" was re-branded as “SAROUND" in the Kanto region. Seasoning and processed foods business <Salads and delicatessen, processed eggs, mayonnaise and dressing, etc.>

Sales were 30,498 million yen (down 1.3% year on year), sales volume in weight decreased 1.5% year on year, and unit sales price decreased 0.1 yen/kg year on year. Of these, sales and sales volume in weight of salads and delicatessen decreased 8.9% and 7.8%, respectively, year on year. In addition to the decrease in the 1 kg form and small-sized form of potato salads, which are the company's main products, the pumpkin salads and the products that include cod roe, corn, etc. also decreased due to menu changes by dining out chain restaurants. Meanwhile, sales and sales volume in weight of processed eggs were up 3.8% and 3.6%, respectively, year on year. Kinshi-Tamago for noodles and scrambled eggs for omelet rice increased mainly around for convenience stores, and boiled eggs also increased as they were widely used mainly for the dining out industry. Sales of mayonnaise and dressings increased 0.8% year on year, while sales volume in weight of mayonnaise and dressings decreased 0.3% year on year. Although the sales of mayonnaise in 10 kg form and 1 kg form decreased, the sales of nugget sauce, etc. for the fast food industry grew. The sales of dressings in the overseas market also increased.

Delicatessen-related business, etc. <Fresh delicatessen (daily salads, delicatessen), contract manufacturing within the company group>

Sales were 6,310 million yen, up 14.7% year on year. Products for sale in supermarkets that contained seafood (squid, crab, cod roe, and others), as well as potato salads, which are the regular products, performed well. Summer products such as bang-bang chicken salads also contributed.

Others <Shop business `Salad Cafe,' overseas businesses (Overseas business is not included in sales because it is handled by equity method affiliates)>

Sales were 599 million yen, down 5.8% year on year. Sales declined due to the effect of closing two stores in the Kanto region (Imotamaya Isetan Shinjuku stores and WaSaRa Sogo Yokohama store). However, in the Kanto region, leafy salads such as green salad and coleslaw maintained popularity, as did the regular long-sellers such as fruit salads, potato salads, and burdock salads in the Kansai region. The flagship store “Shinjuku Odakyu Department Store Salad Cafe" was re-branded as “SAROUND" in the Kanto region.

Total assets at the end of the first half were 65,727 million yen, up 889 million yen from the end of the previous term. While noncurrent assets increased due to making progress towards the production base concept (launch of 4 factories including Shizuoka Fujisan Factory, Nishi-Nihon Factory, DIETCOOK SHIRAOI Co., Ltd., and Kanagawa Factory of KANTOH DIETCOOK Co., Ltd.), cash and deposits decreased. Furthermore, trade receivables and payable temporarily stagnated because the last day of the first half ended on a holiday. Equity ratio was 48.3% (47.8% at the end of the previous fiscal term).

Total assets at the end of the first half were 65,727 million yen, up 889 million yen from the end of the previous term. While noncurrent assets increased due to making progress towards the production base concept (launch of 4 factories including Shizuoka Fujisan Factory, Nishi-Nihon Factory, DIETCOOK SHIRAOI Co., Ltd., and Kanagawa Factory of KANTOH DIETCOOK Co., Ltd.), cash and deposits decreased. Furthermore, trade receivables and payable temporarily stagnated because the last day of the first half ended on a holiday. Equity ratio was 48.3% (47.8% at the end of the previous fiscal term).

Although operating CF decreased from the same period of the previous year due to a decrease in income before income taxes and settlement of accounts payable, 2,191 million yen was secured.

Operating CF decreased due to investment in plants and equipment, and investing CF increased due to a decrease of new long-term borrowings.

Although operating CF decreased from the same period of the previous year due to a decrease in income before income taxes and settlement of accounts payable, 2,191 million yen was secured.

Operating CF decreased due to investment in plants and equipment, and investing CF increased due to a decrease of new long-term borrowings.

|

| Fiscal Year March 2019 Earnings Estimates |

|

【Business environment】

The domestic market environment surrounding foods is good against the backdrop of women's social advancement, increase of single-person households, expansion of the home-meal replacement market due to declining birthrate and aging population, diversification of values for foods, increase in demand for high value-added and globally compatible products associated with inbound demand, and increasing needs for simplification of cooking due to shortage of manpower and an increase in foreign workers. The company intends to capture business opportunities through marketing strategies and product development that match the market needs.

Sales will increase 2.4% year on year but ordinary income will decrease 27.7% year on year.

Reflecting the first half results, which were below the initial estimates, the company lowered the forecasts for the second half. Sales are estimated to rise 2.4% year on year to 74.5 billion yen. Although sales of the seasonings and processed foods business will decline 0.5% year on year due to decreased sales of salads and delicatessen centered on potato salads, sales of the delicatessen related business, etc. which are increasingly capturing demand associated with increased production from operation of the new factories (revised the initial forecast upwardly) will increase 18.7% year on year.

Ordinary income is expected to decrease 27.7% year on year to 3,000 million yen. Getting the production on track at the Kanagawa Factory of KANTOH DIETCOOK Co., Ltd. is slightly behind schedule. Furthermore, in the fourth quarter, expenses related to the launch and getting production on track will be incurred as the operation of new lines begin at the company's Shizuoka Fujisan Factory and the Nishi-Nihon Factory. (The expenses related to the launch of new factories and new lines and getting production on track will cause a profit decline of 1,286 million yen in the full year.)

The year-end dividend is scheduled to be 15 yen/share, and together with the first-half dividend, the annual dividend will be 30 yen/share (the initial forecasts of 18 yen at the end of the first half, 19 yen at the end of the fiscal year, and 37 yen for the full year were revised in conjunction with the earnings forecasts). Sales will increase 2.4% year on year but ordinary income will decrease 27.7% year on year.

Reflecting the first half results, which were below the initial estimates, the company lowered the forecasts for the second half. Sales are estimated to rise 2.4% year on year to 74.5 billion yen. Although sales of the seasonings and processed foods business will decline 0.5% year on year due to decreased sales of salads and delicatessen centered on potato salads, sales of the delicatessen related business, etc. which are increasingly capturing demand associated with increased production from operation of the new factories (revised the initial forecast upwardly) will increase 18.7% year on year.

Ordinary income is expected to decrease 27.7% year on year to 3,000 million yen. Getting the production on track at the Kanagawa Factory of KANTOH DIETCOOK Co., Ltd. is slightly behind schedule. Furthermore, in the fourth quarter, expenses related to the launch and getting production on track will be incurred as the operation of new lines begin at the company's Shizuoka Fujisan Factory and the Nishi-Nihon Factory. (The expenses related to the launch of new factories and new lines and getting production on track will cause a profit decline of 1,286 million yen in the full year.)

The year-end dividend is scheduled to be 15 yen/share, and together with the first-half dividend, the annual dividend will be 30 yen/share (the initial forecasts of 18 yen at the end of the first half, 19 yen at the end of the fiscal year, and 37 yen for the full year were revised in conjunction with the earnings forecasts).

In the seasoning and processed foods business, the company will strengthen activities for each field and business style. It will also focus on the sales of potato-based products and frozen potatoes that are produced by DIETCOOK SHIRAOI Co., Ltd., where the production is already getting on track. It will also work on expanding the lineup of various series such as the new brand of Japanese ready-to-eat food "Wasai Bansai" series (salad and delicatessen), the "Sozaitei" series (egg processed food) of Atsuyaki-Tamago and Dashimaki-Tamago produced at the Shizuoka Fujisan Factory, which is known for its flavor and quality, and the oil-free dressing "Triple Balance" (mayonnaise and dressings) which realized low-calorie, low sugar and low sodium.

With regard to the delicatessen-related business, etc., it will focus on sales expansion of the products made at the Kanagawa Factory of KANTOH DIETCOOK as well as fresh delicatessen of each group company. With regard to the shop business, it will improve Japanese salads at shops and on-line stores and strengthen information dissemination.

In the seasoning and processed foods business, the company will strengthen activities for each field and business style. It will also focus on the sales of potato-based products and frozen potatoes that are produced by DIETCOOK SHIRAOI Co., Ltd., where the production is already getting on track. It will also work on expanding the lineup of various series such as the new brand of Japanese ready-to-eat food "Wasai Bansai" series (salad and delicatessen), the "Sozaitei" series (egg processed food) of Atsuyaki-Tamago and Dashimaki-Tamago produced at the Shizuoka Fujisan Factory, which is known for its flavor and quality, and the oil-free dressing "Triple Balance" (mayonnaise and dressings) which realized low-calorie, low sugar and low sodium.

With regard to the delicatessen-related business, etc., it will focus on sales expansion of the products made at the Kanagawa Factory of KANTOH DIETCOOK as well as fresh delicatessen of each group company. With regard to the shop business, it will improve Japanese salads at shops and on-line stores and strengthen information dissemination.

|

| Conclusion |

|

The launch of a new factory and getting production in track of DIETCOOK SHIRAOI Co., Ltd seems to have progressed almost as planned because it was a shift from the aged old factory. On the other hand, the Kanagawa Factory of KANTOH DIETCOOK Co., Ltd., which started from scratch including employment of staff, took time during the launch and has been slightly delayed to get the production on track. However, improvement is expected for the next term. The two factories that will be launched in the second half will be operating in the fourth quarter, so the costs exceed revenues during this term. However, because of the expansion of the lines within existing factories, launch and production will move forward in accordance with the expectations.

Struggle of the sales of potato salads which are the main products of the seasoning and processed foods business was also the point of the performance of the first half. It seems that it was influenced by a food poisoning incident occurred at a delicatessen chain store operated by Fresh Corporation, Co., Ltd. last summer and the reorganization of the convenience store industry. Food poisoning is thought to be caused by salads (i.e. coleslaw, marinated salad, potato salad) offered at the chain store, and the company was not involved. However, the incident deteriorated the image of potato salad, and the company received the aftermath. From the experience, the company believes that the influence will continue for about a year, and so we would like to pay attention to the trend in the second half of the year.

While sales declined as the mainstay products struggled, the company lowered the business forecasts for FY3/19 due to burden of expenses related to new factories. However, it did not change the sales and profit targets of the medium-term management plan. There is no change in the favorable business environment, such as expansion of the home-meal replacement market and the need for simplification in the dining out market due to shortage of manpower. Therefore, if the company can develop ways to return to the growth path in the second half, the concerns about achieving the medium-term management plan will be eased. The key points will be to put production of the new factories on track at early stage and recover the salad and delicatessen business.

|

| <Reference: Regarding Corporate Governance> |

|

◎ Organization type, and the composition of directors and auditors

Basic Policies

In order to fulfill our social responsibilities and remain a trusted company, we are committed to not only complying with laws and regulations but also strengthening and developing our management foundation. We believe that continuity forms the foundation of corporate governance. We also strive to be an open corporation by building an even more thorough system of governance, and by improving the transparency of our corporate activities with the timely and appropriate disclosure of information.

(1) Ensure rights and equality for shareholders

(2) Collaborate appropriately with non-shareholding stakeholders

(3) Properly disclose information and ensure transparency

(4) Oversee responsibilities of the Board of Directors

(5) Create a dialogue with shareholders

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 Strategically held shares

1. Principles behind strategically held shares

With regard to the holding of shares of an operating company, it is anticipated that it will lead to business expansion and profit strengthening by further enhancing relationships with shareholding interests, and as a policy we hold shares that can collect investment funds due to its cash flow increase effect. With respect to shares of financial partners, we hold shares that we believe will facilitate the procurement of funds for the Group's growth and stabilization of the financial base.

2. Exercising policy of voting rights pertaining to strategically held shares

Our principles are to lead to business expansion and profitability enhancement by maintaining a smooth relationship with business partners and strengthening further relationships, which are the holding objective, by becoming a stable medium-term and long-term shareholder. We will review and decide on each proposal on the basis of avoiding damage to the corporate value of our company and the investee company. Also, if it is judged that the draft is significantly deviated from the current operating results and financial condition, and if it is judged to be inappropriate, we will decide to exercise the voting right as a shareholder after proceeding with the dialogue through the department in charge.

Principle 3-1 Improving the disclosure of information

(1) We disclose our management philosophy, management strategy, and management plan on the company website.

Http: //www..kenkomayo.co.jp/company/philosophy

Http://www.kenkomayo.co.jp/ir/policy/managementplan

(2) The basic policies and concepts behind our corporate governance are stated in this report, section 1: “Basic policies."

(3) Determination policy and procedures for remuneration of directors.

Remuneration of full-time directors consists of fixed compensation and performance-linked compensation is determined based on medium-to-long term performance and evaluations. Outside directors will be given fixed remuneration only. The deciding procedure is determined by the Board of Directors based on advice from unaffiliated independent outside directors.

(4) Nomination policy and procedures for candidates for director and corporate auditor positions.

Based on our policy of comprehensively evaluating and judging the experience, knowledge, expertise, etc. for candidates who can judge as appropriate, the decision procedure is decided by the Board of Directors based on the advice of independent outside directors. As for corporate auditors, based on the advice from the outside directors, we will make decisions at Board of Directors meetings with the consent of the Board of Corporate Auditors.

(5) Reasons for appointing individual candidates for directors and corporate auditors are as described in the appendix of this report.

Principle 5-1 Policy regarding constructive dialogue with shareholders

We emphasize constructive dialogue with shareholders. We strive to create dialogues through a variety of opportunities, particularly by senior executives. The head of the Corporate Planning Division, who is also responsible for IR, oversees departments related to IR activities, such as the Corporate Planning Office, the Finance and Accounting Headquarters, and the General and Judicial Affairs Headquarters, and works to form an integrated link between them.

At the Corporate Planning Office, we actively accept IR interviews from investors in the form of telephone interviews and small meetings, etc., and financial results briefings are conducted twice per year by the president and IR directors. The IR directors report these results to executives twice each month at progress meetings. As for dialogue with investors, we carefully manage insider information by centering the topic on our business contents and the growth strategies outlined in our medium-term management plan. The silent period takes place from the time accounts are closed to the time financial statements are announced.

Basic Policies

In order to fulfill our social responsibilities and remain a trusted company, we are committed to not only complying with laws and regulations but also strengthening and developing our management foundation. We believe that continuity forms the foundation of corporate governance. We also strive to be an open corporation by building an even more thorough system of governance, and by improving the transparency of our corporate activities with the timely and appropriate disclosure of information.

(1) Ensure rights and equality for shareholders

(2) Collaborate appropriately with non-shareholding stakeholders

(3) Properly disclose information and ensure transparency

(4) Oversee responsibilities of the Board of Directors

(5) Create a dialogue with shareholders

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 Strategically held shares

1. Principles behind strategically held shares

With regard to the holding of shares of an operating company, it is anticipated that it will lead to business expansion and profit strengthening by further enhancing relationships with shareholding interests, and as a policy we hold shares that can collect investment funds due to its cash flow increase effect. With respect to shares of financial partners, we hold shares that we believe will facilitate the procurement of funds for the Group's growth and stabilization of the financial base.

2. Exercising policy of voting rights pertaining to strategically held shares

Our principles are to lead to business expansion and profitability enhancement by maintaining a smooth relationship with business partners and strengthening further relationships, which are the holding objective, by becoming a stable medium-term and long-term shareholder. We will review and decide on each proposal on the basis of avoiding damage to the corporate value of our company and the investee company. Also, if it is judged that the draft is significantly deviated from the current operating results and financial condition, and if it is judged to be inappropriate, we will decide to exercise the voting right as a shareholder after proceeding with the dialogue through the department in charge.

Principle 3-1 Improving the disclosure of information

(1) We disclose our management philosophy, management strategy, and management plan on the company website.

Http: //www..kenkomayo.co.jp/company/philosophy

Http://www.kenkomayo.co.jp/ir/policy/managementplan

(2) The basic policies and concepts behind our corporate governance are stated in this report, section 1: “Basic policies."

(3) Determination policy and procedures for remuneration of directors.

Remuneration of full-time directors consists of fixed compensation and performance-linked compensation is determined based on medium-to-long term performance and evaluations. Outside directors will be given fixed remuneration only. The deciding procedure is determined by the Board of Directors based on advice from unaffiliated independent outside directors.

(4) Nomination policy and procedures for candidates for director and corporate auditor positions.

Based on our policy of comprehensively evaluating and judging the experience, knowledge, expertise, etc. for candidates who can judge as appropriate, the decision procedure is decided by the Board of Directors based on the advice of independent outside directors. As for corporate auditors, based on the advice from the outside directors, we will make decisions at Board of Directors meetings with the consent of the Board of Corporate Auditors.

(5) Reasons for appointing individual candidates for directors and corporate auditors are as described in the appendix of this report.

Principle 5-1 Policy regarding constructive dialogue with shareholders

We emphasize constructive dialogue with shareholders. We strive to create dialogues through a variety of opportunities, particularly by senior executives. The head of the Corporate Planning Division, who is also responsible for IR, oversees departments related to IR activities, such as the Corporate Planning Office, the Finance and Accounting Headquarters, and the General and Judicial Affairs Headquarters, and works to form an integrated link between them.

At the Corporate Planning Office, we actively accept IR interviews from investors in the form of telephone interviews and small meetings, etc., and financial results briefings are conducted twice per year by the president and IR directors. The IR directors report these results to executives twice each month at progress meetings. As for dialogue with investors, we carefully manage insider information by centering the topic on our business contents and the growth strategies outlined in our medium-term management plan. The silent period takes place from the time accounts are closed to the time financial statements are announced.

Disclaimer

This report is intended solely for informational purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2018 Investment Bridge Co., Ltd. All Rights Reserved. |