Bridge Report:(2915)KENKO Mayonnaise Co. , Ltd.

President Takashi Sumii | KENKO Mayonnaise Co., Ltd. (2915) |

|

Company Information

Market | TSE 1st Section |

Industry | Foodstuff (manufacturing) |

President | Takashi Sumii |

HQ Address | 3-8-13, Takaido Higashi, Suginami-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading unit | |

¥2,331 | 16,475,422 shares | ¥38,404 million | 7.2% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥31.00 | 1.3% | ¥142.64 | 16.3 times | ¥1,996.95 | 1.2times |

*The share price is the closing price on June 7.

Earning Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March. 2016 (Actual) | 66,933 | 3,436 | 3,426 | 2,085 | 146.76 | 28.00 |

March. 2017 (Actual) | 70,812 | 3,987 | 4,017 | 2,867 | 194.88 | 37.00 |

March 2018 (Actual) | 72,759 | 4,173 | 4,149 | 2,877 | 174.65 | 37.00 |

March 2019 (Actual) | 73,989 | 3,116 | 3,145 | 2,296 | 139.40 | 30.00 |

March 2020 (Forecast) | 76,000 | 3,300 | 3,300 | 2,350 | 142.64 | 31.00 |

* Unit: million yen

*The forecasted values were provided by the company.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year March 2019 Earnings Results

3. Fiscal Year March 2020 Earnings Estimates

4. Progress of Medium-term management plan “KENKO Value Action – Create Value”

5. Conclusion

<Reference: Social and environmental activities>

<Reference: Regarding Corporate Governance>

Key Points

- In FY3/19, sales grew 1.7% and ordinary income dropped 24.2% year on year. The sales of the delicatessen-related business increased due to stronger production capabilities associated with operation of new factories and new lines, but sales of salads and delicatessen in the seasoning and processed foods business decreased due to sluggish sales of potato salads. While the sales were sluggish, operating costs exceeded initial forecasts due to delays in getting the production on track in some factories. However, in the fourth quarter (January-March), ordinary income increased 5.5% year on year, as the production got on track towards the end of the fiscal year. The company plans to pay a year-end dividend of 15 yen per share so that the total annual dividend will be 30 yen per share (payout rati 21.5%).

- Sales and ordinary income in FY3/20 are forecasted to increase 2.7% and 4.9%, respectively, year on year. Sales of potato salads are on a recovery trend from the 3rd quarter last year, and sales are expected to increase in all segments. The operation of a new line of the Nishi-Nihon factory began in April. Although material costs, distribution costs, and labor costs will increase, they will be absorbed by sales increase and productivity improvement. The dividend is scheduled to be 31 yen/share (15 yen/share at the end of the first half, 16 yen/share at the end of the term) (payout ratio:21.7%). The company plans to pay dividends based on business results, aiming for a payout ratio of 20%.

- Although there are some concerns including fewer openings of convenience stores and tax hikes, the company will expand business opportunities by responding to the expansion of the home-meal replacement market and labor shortages. In addition, there is still a great chance of new product development due to diversification of food values and so on. We would like to pay attention to how much they can add to the initial forecast in FY3/20.

1. Company Overview

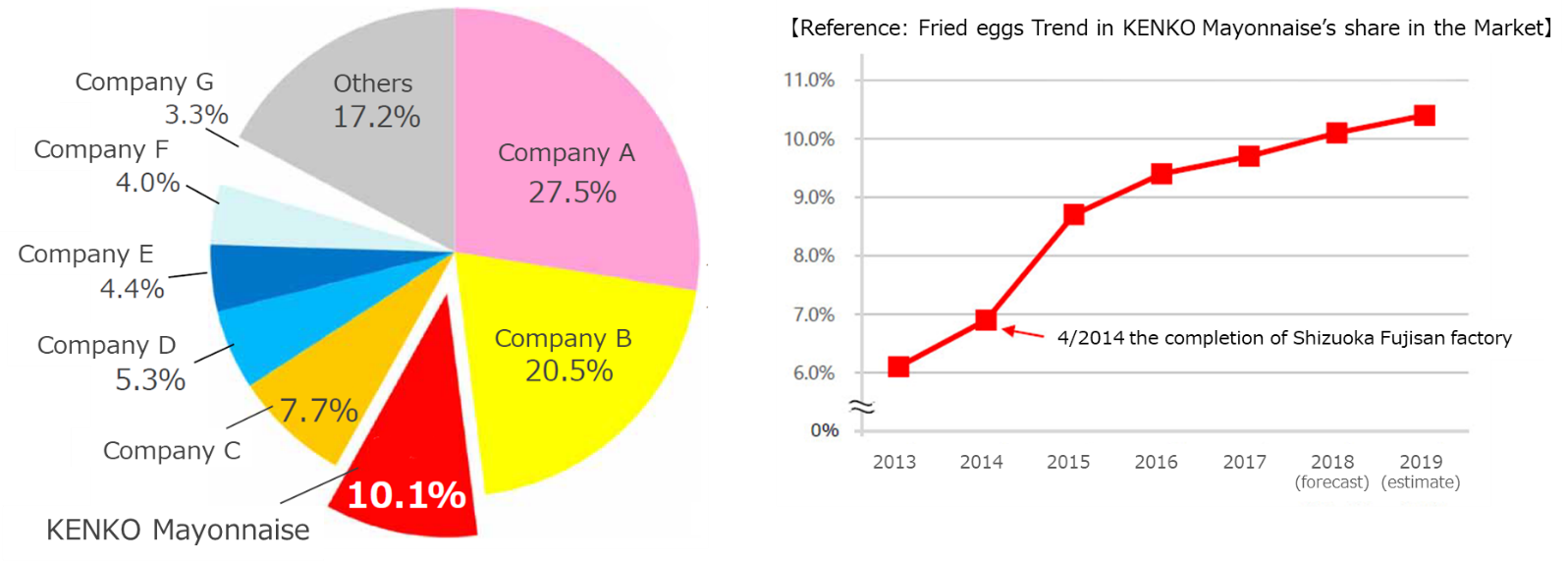

KENKO Mayonnaise Co., Ltd. is a commercial food manufacturer focusing on salads. The company started out specializing in the commercial manufacture of mayonnaise, and using mayonnaise and dressings as its foundation, expanded business to include salads, delicatessen, and processed egg products. Utilizing its consolidated subsidiaries, the company also handles fresh delicatessen for mass retailers. It developed the “Long-life Salad,” which boasts an extended shelf life, for the first time in Japan as well as special salads using unconventional ingredients such as burdock and pumpkin. As a pioneer in its industry, KENKO has held the top market share for long-life salad since the product’s release. It is ranked 2nd in mayonnaise and dressings, and 3rd in the omelet market. (company estimate based on Fuji Economics’ “Food Marketing Handbook”).

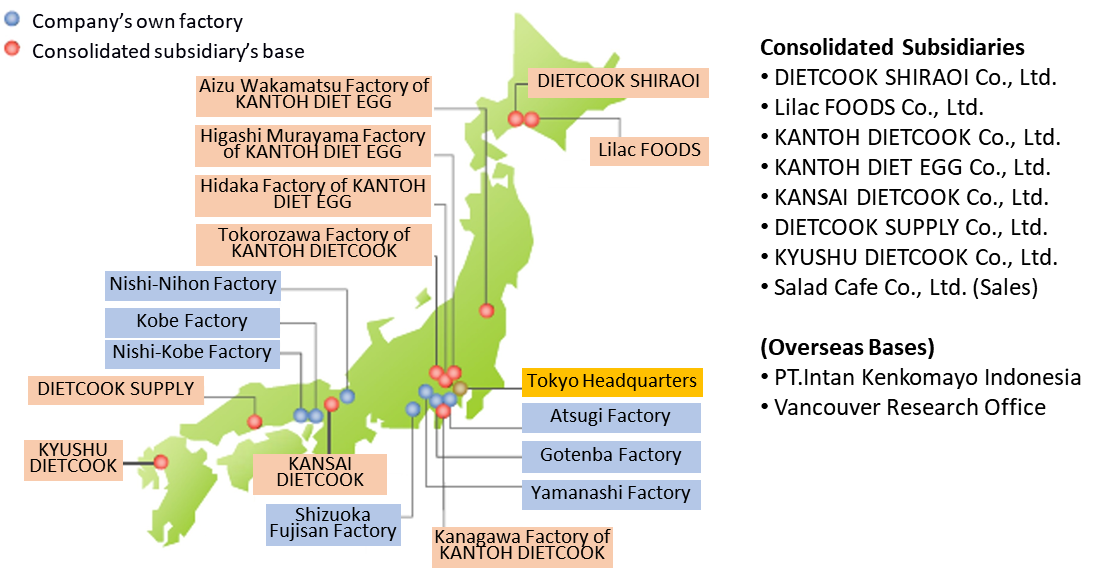

In addition to KENKO Mayonnaise Co., Ltd., the company group contains 7 consolidated subsidiaries, 10 factories, and PT.Intan Kenkomayo Indonesia, an equity-method affiliate based in Indonesia. The company manufactures and sells products such as mayonnaise, dressings, and processed eggs (seasoning and processed foods business), and its consolidated subsidiaries sell fresh delicatessen, etc. to mass retailers. (delicatessen-related business). The company's production bases are located in Atsugi, Yamanashi, Gotenba, Shizuoka Fujisan, Nishi-Nihon (Kyoto), Kobe, and Nishi-Kobe.

【Company Philosophy “Contributing to the world by providing quality foods”】

The company philosophy indicates the raison d'etre of the Group in society. Although the philosophy originally stated “contributing to the world by providing food products”, it was amended from “food products” to “food” as the company’s activities have been widely expanded including information dissemination using the Internet and food education activities with communities. The company contributes to society through the provision of various food-related products, services and information such as food education activities, support for food bank activities, and activities to contribute to the international community, while working on environmental initiatives including reducing waste, saving energy, and high value-added recycling.

【The Group’s Business Philosophy “Body and Mind (mind/body/soul) and Environment”】

The group’s Business Philosophy shows the passion of our company group based on the company philosophy. We care about the mental and physical aspects as well as the souls of our consumers and other people concerned with our business, who are loyal to our products. Also, we devote ourselves to work on environmental issues affecting earth, where the source of our soul (food) grows.

【The Group’s Management Policy “To become No.1 Salad Company,” “To provide the number one quality products/services in Japan”】

The Group ’s management policy is based on the group’s business philosophy and indicates the direction the Group should aim for. The aim is to be “a company which offers salads that can be the main dish, or the king in other words, at the dining table.” The company is also working on “creating a market with a focus on salads” and “establishing salad dishes as one of the genres.” The company is still pursuing to improve the quality and service, based on the idea that “it is the manufacturer’s responsibility to provide safe, secure, and high-quality products in order to improve customer satisfaction.

【Business contents】

The company’s business segments consist of the seasoning and processed foods business, which manufactures and sells salads, delicatessen, processed eggs, mayonnaise and dressings; the delicatessen-related business, which is handled by consolidated subsidiaries and deals with the manufacture and sale of fresh delicatessen (salad and foodstuffs with a shelf life of 1-2 days) as well as contract manufacturing within the company group; and others which are the shop business (cafe) and overseas business.

Sales composition ratios for FY3/19 were 80.7% (82.7% in FY3/18), 17.7% (15.6%), and 1.6% (1.8%), respectively. By product type, salads account for 44.3% (44.6% in FY3/18), eggs 29.0% (28.8%), mayonnaise and dressings 24.5% (24.4%), and others 2.2% (2.2%). By field of sale, dining out such as fast food and family restaurants accounts for 27.9% (26.1%), convenience stores 27.4% (28.3 % in FY3/18), mass retailers such as supermarkets 22.9% (21.9%), manufactured bread 13.3% (13.5%), school lunch services 4.5% (4.6%), and others, such as co-op and commercial cash & carry 4.1% (5.6%).

Seasoning and processed foods business

1 Salads and delicatessen (long-life salad, fresh salad, Japanese dishes, etc.)

KENKO was the first in Japan to develop “long-life salad”, the salad with an extended shelf life. It is also the first to introduce “burdock salad” to the world. This long-life salad is a brand called “FDF® (Fashion Delica Foods®),” and is used in restaurants, bakeries, convenience stores, etc. As the industry’s first manufacturer and seller of long-life salad, the company takes pride in being the market leader and holding the top market share, and it is continuously striving to develop new products.

(Images above and below taken from the company’s website)

2 Processed Eggs (fresh eggs, omelets, Kinshi-Tamago etc.)

The company produces all kinds of processed egg products, such as egg salad to be used in sandwiches and snack breads, Atsuyaki-Tamago (Japanese style ) for lunch boxes, Kinshi-Tamago (narrowly stripped cooked eggs) used for cold Chinese noodles, and boiled eggs for Oden soup. In April 2014, the Shizuoka Fujisan egg baking factory began operation. The factory is equipped with an integrated manufacturing line that takes raw eggs with eggshell all the way to finished products.

3 Mayonnaise & Dressings (mayonnaise, dressings, cooking sauces, etc.)

This is KENKO’s main business. Since the company’s foundation, the company has developed many types of mayonnaise and dressings to meet the demands of professional clients as a commercial manufacturer. Some examples include solidified dice-shape sauces developed for use in frozen foods, and mayonnaise-flavored powder which can be sprinkled on snacks such as potato chips.

Delicatessen-related business, etc.

This business handles the manufacture and sale of fresh delicatessen (daily salads, ready-to-eat foods) for supermarkets and mass retailers. For the main product, potato salad, the company constantly strives to make the most of its ingredients by rotating production areas and offering seasonal varieties, in order to consistently deliver high quality products.

Others

Salad Cafe business

This is the only business in the KENKO mayonnaise company group to have direct contact with customers. Utilizing both the Web and its actual shops, the company relays information to customers, and in turn, customers are able to voice their opinions. There are currently 16 shops, located in places such as supermarkets and department stores found at major railway terminals, as well as within station buildings themselves.

Overseas business

The company exports goods to more than 30 different countries and regions. Demand is expected to rise even further in Indonesia, which has the largest population in Southeast Asia and whose food culture is becoming more diverse due to rapid economic growth. As such, in 2012, the company established PT.Intan Kenkomayo Indonesia. A production facility was completed in 2013, establishing a system for local manufacturing and sales. In 2015, the Vancouver Research Office was established in Canada as a base for collecting food-related information, particularly in North America and Europe. As a market-oriented company, KENKO intends to promptly identify new food cultures and take actions based on this information.

Overseas businesses are not included in net sales as they are accounted for by the equity method.

Manufacturing and sales network (Japan: 7 company-managed factories, and 10 factories managed by 7 consolidated subsidiaries)

In Japan, there are 7 company-managed factories and 10 factories managed by 7 consolidated subsidiaries. The company builds production systems that are closely tied to the region, and one of its strengths is its ability to meet the needs of clients by providing freshness, variable quantities, and customer-specific service.

(Source: The company)

【Industry positioning (Source: the company)】

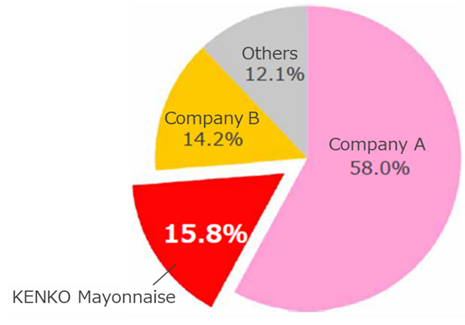

Mayonnaise and dressings

The market size (expected) in 2018 is 216,800 million yen. The company ranks second in production quantity in this industry.

Market sale trends

| 2014 | 2015 | 2016 | 2017 | 2018 (forecast) | 2019 (estimate) | 2023 (estimate) |

Sales volume(ton) | 426,800 | 431,900 | 436,200 | 442,700 | 441,050 | 445,400 | 458,300 |

Sales amount(million yen) | 201,850 | 204,450 | 207,100 | 217,400 | 216,800 | 219,450 | 226,100 |

*Sales volume is based on manufacturers shipping data. The table is taken from the same company, referring to FUJI KEIZAI CO., LTD.” Food marketing report”. (Applies to all data in this report)

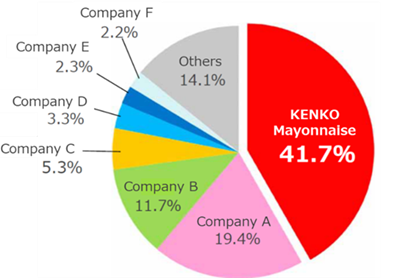

Long-life salad

The market size (expected) in 2018 is 64,350 million yen. The company holds the absolute No. 1 share as it is the pioneer of “long-life salad”

Market scale trends

| 2014 | 2015 | 2016 | 2017 | 2018 (forecast) | 2019 (estimate) | 2023 (estimate) |

Sales volume(ton) | 119,000 | 119,000 | 119,800 | 123,700 | 125,300 | 126,800 | 128,900 |

Sales amount(million yen) | 60,300 | 60,450 | 61,000 | 63,350 | 64,350 | 65,300 | 67,000 |

Cooked egg products

The market size (expected) in 2018 is 61,450 million yen. The company ranks third in sales amount although they entered the market late. Its market share is still expanding, and it pursues a further expansion.

| 2014 | 2015 | 2016 | 2017 | 2018 (forecast) | 2019 (estimate) | 2023 (estimate) |

Sales volume(ton) | 81,400 | 82,200 | 84,750 | 85,500 | 86,100 | 86,700 | 88,300 |

Sales amount(million yen) | 58,000 | 58,700 | 60,500 | 61,050 | 61,450 | 61,850 | 63,000 |

2. Fiscal Year March 2019 Earnings Results

| FY 3/18 | Ration to sales | FY 3/19 | Ration to sales | YOY | Initial Forecast | Difference from the forecast |

Sales | 72,759 | 100.0% | 73,989 | 100.0% | +1.7% | 74,500 | -0.7% |

Gross profit | 18,922 | 26.0% | 18,210 | 24.6% | -3.8% | - | - |

SG&A expenses | 14,748 | 20.3% | 15,094 | 20.4% | +2.3% | - | - |

Operating income | 4,173 | 5.7% | 3,116 | 4.2% | -25.3% | 2,920 | +6.7% |

Ordinary income | 4,149 | 5.7% | 3,145 | 4.3% | -24.2% | 3,000 | +4.8% |

Net income | 2,877 | 4.0% | 2,296 | 3.1% | -20.2% | 2,270 | +1.2% |

※ Some data is calculated by Investment Bridge, and some data contained within this report may vary from actual results. (Applies to all data in this report)

(unit: million yen)

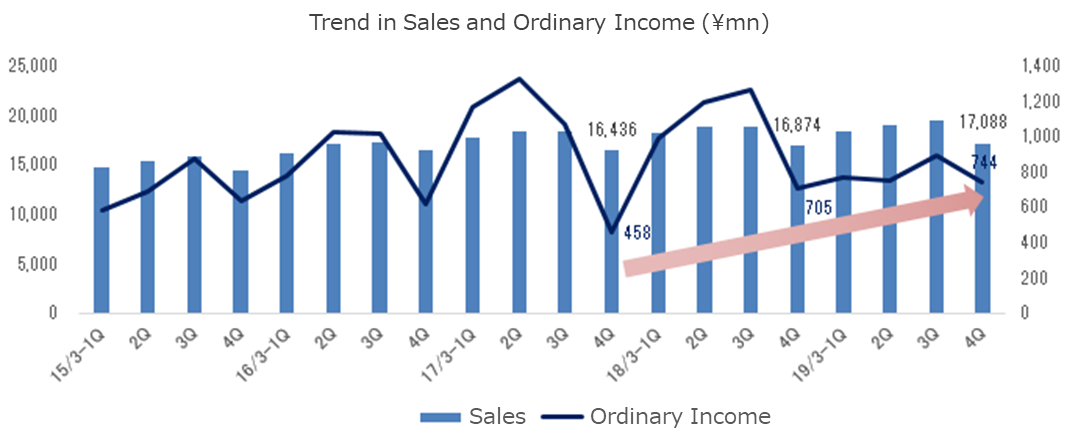

Sales increased by 1.7% and ordinary income dropped 24.2%, year on year.

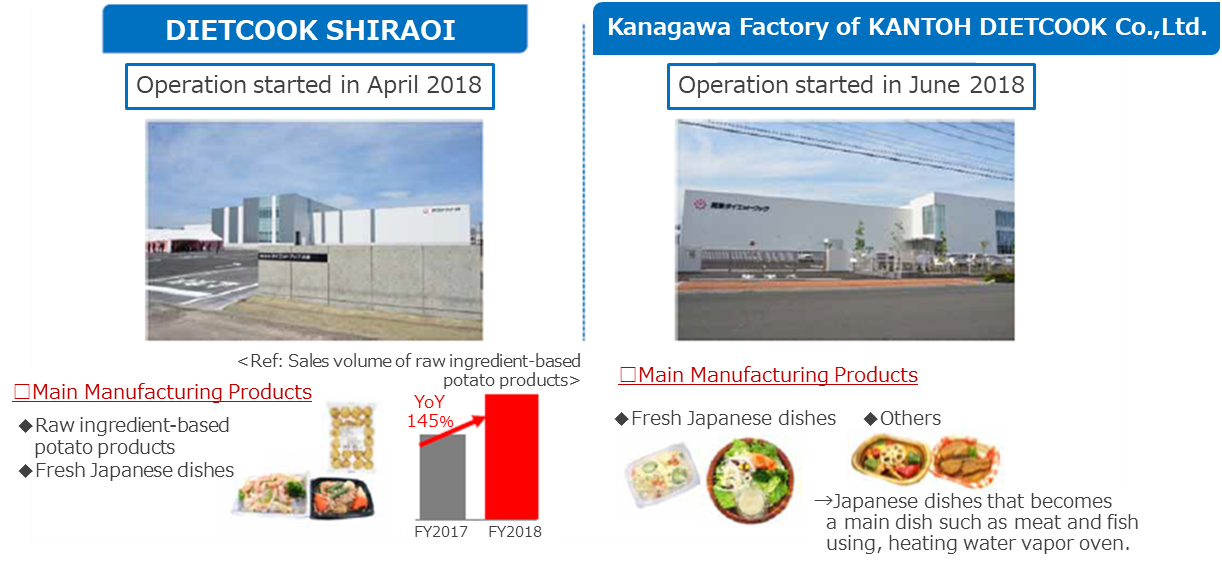

Sales grew 1.7% year on year, resulting in 73,989 million yen. Although sales of the seasoning and processed foods business decreased by 0.7% year on year due to sluggish sales of its main product, potato salads, sales of the delicatessen-related business increased by 15.7% year on year, thanks to greater production capabilities associated with operation of DIETCOOK SHIRAOI factory (April 2018) and the Kanagawa Factory of KANTOH DIETCOOK (June 2018) (in addition, operation of a new line began at the Shizuoka Fujisan Factory in February 2019).

Ordinary income decreased by 24.2% year on year to 3,145 million yen. Operating costs grew 3.3% year on year to 70,872 million yen due to increase in expenses for new factories (line test, consumables, etc.) and personnel expenses, mainly at the factories. Although foreign exchange losses occurred, non-operating profit and loss improved, mainly due to the improvement of equity method investment loss and gain (negative 94 million yen to 3 million yen).

Sales by product type

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YOY |

Salads | 32,458 | 44.6% | 32,806 | 44.3% | +1.1% |

Eggs | 20,964 | 28.8% | 21,438 | 29.0% | +2.3% |

Mayonnaise & dressings | 17,777 | 24.4% | 18,149 | 24.5% | +2.1% |

Others | 1,560 | 2.2% | 1,596 | 2.2% | +2.3% |

Consolidated sales | 72,759 | 100.0% | 73,989 | 100.0% | +1.7% |

※Sales of salads include fresh salads which expire in 1 to 2 days, sold by consolidated subsidiaries, and salads at Salad Cafes, as well as long-life salads, whichare manufactured and sold by the company.

(unit: million yen)

Sales by field

| FY 3/18 | FY 3/19 |

|

Eating out | 26.1% | 27.9% | Fast food chains, family-style restaurants, BBQ restaurants, taverns, coffee shops, etc. |

CVS | 28.3% | 27.4% | Convenience stores |

Mass retailer | 21.9% | 22.9% | Supermarkets (national chain, regional chain) |

Bread | 13.5% | 13.3% | Bread manufacturers, retail bakeries |

School lunch | 4.6% | 4.5% | Contract food service for business establishments, hospitals, and school lunch |

Others | 5.6% | 4.1% | Co-op, C & C (Cash and Cary) for business, etc. |

Ordinary income increase/decrease factors

Ordinary income, FY3/18 | 4,149 | First Half | Second Half |

|

Increased sales | +80 | +29 | +51 |

|

Impact of raw material price fluctuations | +4 | -73 | +77 | Fluctuation of egg price |

Impact of fixed expenses | +23 | -30 | +53 | Fixed cost reduction, equity method profit and loss improvement in overseas business |

Impact of production efficiency | -508 | -100 | -408 | Delays in getting on track of the Kanagawa Factory of KANTOH DIETCOOK |

New factory related expenses | -603 | -498 | -105 | Costs incurred before and within 3 months after operation |

Ordinary income, FY3/19 | 3,145 | -672 | -332 |

|

Trends by business

| FY 3/18 | Composition ratio | FY 3/19 | Composition ratio | YOY | Initial Forecast | Divergence | |

Salads/delicatessen | 20,347 | 28.0% | 18,960 | 25.6% | -6.8% | 18,833 | +0.7% | |

Processed eggs | 20,520 | 28.2% | 21,042 | 28.4% | +2.5% | 21,454 | -1.9% | |

Mayonnaise/dressings | 17,777 | 24.4% | 18,149 | 24.5% | +2.1% | 17,954 | +1.1% | |

Others | 1,495 | 2.1% | 1,538 | 2.1% | +2.9% | 1,586 | -3.0% | |

Seasoning and processed foods business | 60,139 | 82.7% | 59,689 | 80.7% | -0.7% | 59,827 | -0.2% | |

Delicatessen related business | 11,327 | 15.6% | 13,105 | 17.7% | +15.7% | 13,446 | -2.5% | |

Others | 1,292 | 1.8% | 1,194 | 1.6% | -7.6% | 1,227 | -2.7% | |

Consolidated sales | 72,759 | 100.0% | 73,989 | 100.0% | +1.7% | 74,500 | -0.7% | |

| FY 3/18 | Profit margin | FY 3/19 | Profit margin | YOY | Initial forecast | Divergence | |

Seasoning and processed foods business | 3,400 | 5.7% | 3,219 | 5.4% | -5.3% | - | - | |

Delicatessen related business | 811 | 7.2% | -83 | - | - | - | - | |

Others | -98 | - | 6 | 0.5% | -1.061224 | - | - | |

Adjustment | 36 | - | 2 | - | - | - | - | |

Consolidated ordinary income | 4,149 | 5.7% | 3,145 | 4.3% | -24.2% | 3,000 | +4.8% | |

(unit: million yen)

Seasoning and processed foods business

Sales decreased by 0.7% year on year (sales weight: 0.4% down, unit price: 1.9 yen/kg down). Sales of processed eggs and mayonnaise/ dressings rose, but it did not cover the decline in salads and delicatessen. Sales of salads and delicatessen decreased by 6.8% year on year (sales weight: 9% down). In addition to the decline in the flagship, 1-kg form and small-sized form of potato salads (affected by reputational damage across the industry), changes in menu of dining-out chain restaurants led to decreases in sales of pumpkin salads, cod roe, items using corns, and so on. Meanwhile, sales of processed eggs grew by 2.5% year on year (same period last yea 2.3% up). Sales of Kinshi-Tamago for noodles, Dashimaki-Tamago for lunch boxes, and scrambled eggs for omelet rice increased mainly at convenience stores. Furthermore, sales of boiled eggs also increased as they were adopted in the restaurant industry. Sales of mayonnaise and dressings grew by 2.1% year on year (same period last yea 1.0% up). In addition to the positive trend in the fast food industry, the demands for sauces and tartar sauce increased mainly at convenience stores and restaurants, respectively.

Delicatessen related business

Sales increased by 15.7% year on year due to increased supply capacity associated with the operation of the new factory at DIETCOOK SHIRAOI and the Kanagawa Factory of KANTOH DIETCOOK. Sales of the main product, potato salads, and seasonal products increased.

Others

Sales declined by 7.6% year on year due to the closing of two stores in the Kanto region (Imotamaya Isetan Shinjuku stores and WaSaRa Sogo Yokohama store) in March 2018. In Kanto, seasonal leaf salads such as coleslaw and green salads are popular while fruit salads and potato salads are persistently popular in Kansai. Overseas businesses are not included in the sales because they are operated by the equity method affiliates.

Expansion of web services as a part of Salad Café business

-Introduction of more than 1200 recipe of salad dishes, information of shops and questionnaire survey-

Financial position and cash flow

Financial position

| March 2018 | March 2019 |

| March 2018 | March 2019 |

Cash and deposits | 13,072 | 10,927 | Trade payables | 10,765 | 10,551 |

Trade receivables | 13,566 | 13,398 | Income taxes payable | 6,606 | 4,933 |

Inventories | 2,976 | 2,948 | Other provision (Current liabilities) | 866 | 604 |

Current assets | 30,121 | 27,945 | Net defined benefit liability and Other provision | 3,986 | 5,792 |

Property, plant and equipment | 30,466 | 35,501 | Interest-bearing debts | 8,296 | 11,781 |

Intangible assets | 219 | 201 | Liabilities | 33,853 | 37,204 |

Investments and other assets | 4,030 | 6,450 | Net assets | 30,984 | 32,900 |

Noncurrent assets | 34,716 | 42,159 | Total liabilities, Net assets | 64,837 | 70,105 |

(unit: million yen)

As a result of investments based on the production site concept, operation of the factory of DIETCOOK SHIRAOI (April 2018), the Kanagawa Factory of KANTOH DIETCOOK (June 2008), and the Shizuoka Fujisan second factory (February 2019) began, and tangible fixed assets grew to 7,443 million yen (21.4%). Investment and Other (Investment Securities) increased due to acquisition of shares of Hans Kissle Company, LLC (hereinafter referred to as “Hans Kissle”), a food manufacturing and sales company in Massachusetts, aiming to enter the home-meal replacement market in the US. It acquired shares for approximately 12 billion yen through a special purpose company “MKU Holdings, Inc.,” a joint venture with Mitsui & Co., Ltd., with a 20% stake by the company and 80% by Mitsui & Co., Ltd.

Equity ratio is 46.9%. (The ratio taking account of the effect of holidays at the end of the year is 48.0%. It was 47.8% at the end of the previous year.)

Cash Flow(CF)

| FY 3/18 | FY 3/19 | YOY | |

Operating CF (A) | 4,950 | 2,405 | -2,545 | -51.4% |

Investing CF (B) | -11,811 | -8,895 | +2,916 | - |

Financing CF | 6,154 | 4,345 | -1,809 | -29.4% |

Balance of cash and cash equivalents at end of period | 13,072 | 10,927 | -2,145 | -16.4% |

Operating CF decreased due to a decline in income before income taxes. Investing CF increased mainly due to acquisition of tangible fixed assets and the US business (acquisition of shares of an affiliated company: Acquisition of “Hans Kissle” shares through a joint venture with Mitsui & Co.). Financing CF decreased due to accumulation of long-term borrowings.

The balance of cash and cash equivalents at the end of the fiscal year was 10,927 million yen.

3. Fiscal Year March 2020 Earnings Estimates

| FY 3/19 Actual | Ratio to sales | FY 3/20 Forecast | Ratio to sales | YOY |

Sales | 73,989 | 100.0% | 76,000 | 100.0% | +2.7% |

Operating income | 3,116 | 4.2% | 3,300 | 4.3% | +5.9% |

Ordinary income | 3,145 | 4.3% | 3,300 | 4.3% | +4.9% |

Net income | 2,296 | 3.1% | 2,350 | 3.1% | +2.4% |

(unit: million yen)

Sales and ordinary income will increase by 2.7% and 4.9% year on year, respectively

Sales are estimated to be 76,000 million yen, 2.7% up year on year. Sales of the seasoning and processed foods business and that of the delicatessen-related business will increase by 2.1% and 5.5% year on year, respectively, reflecting the recovery of potato salads as well as launch and full operation of new factories which began last year. In terms of profit, although material costs, distribution costs, and personnel costs will increase, ordinary income is expected to increase by 4.9% to 3,300 million yen due to increased sales and improved production efficiency at the new factories.

Factors in growth/decline of ordinary income

FY3/19 Ordinary income result | 3,145 |

|

Increased sales | +450 |

|

Impact of raw material price fluctuations | +4 | Stabilization of food oil and egg market conditions. It will absorb increased material cost, logistics and labor cost by improving productivity. |

Impact of production efficiency | +115 | Stabilization of the Kanagawa Factory of KANTOH DIETCOOK and the new factory of DIETCOOK SHIRAOI. |

Impact of fixed expenses | -219 | Corresponding to the truth-in-advertising law (update of the original plate for film printing) |

New factory related expenses | -195 | Operation of new lines at Nishi-Nihon factory (building extension) in April |

FY 3/20 Ordinary income forecast | 3,300 |

|

Forecast and activities by business

| FY3/19 Actual | Composition ratio & profit margin | FY3/20 Forecast | Composition ratio & profit margin | YOY |

Salads & Delicatessen | 18,960 | 25.6% | 19,468 | 25.6% | +2.7% |

Processed eggs | 21,042 | 28.4% | 21,401 | 28.2% | +1.7% |

Mayonnaise & Dressings | 18,149 | 24.5% | 18,324 | 24.1% | +1.0% |

Others | 1,538 | 2.1% | 1,758 | 2.3% | +14.3% |

Seasoning and processed foods business | 59,689 | 80.7% | 60,951 | 80.2% | +2.1% |

Delicatessen-related business, etc. | 13,105 | 17.7% | 13,829 | 18.2% | +5.5% |

Others | 1,194 | 1.6% | 1,220 | 1.6% | +2.2% |

Consolidated Sales | 73,989 | 100.0% | 76,000 | 100.0% | +2.7% |

(unit: million yen)

Seasoning and processed foods business

The company is estimating increased sales of 2.1% year on year. It will increase sales volume by utilizing the enhanced production capacity. Specifically, it will emphasize the proposal for potato-based frozen products and frozen potatoes (DIETCOOK SHIRAOI) mainly to dining-out companies and also respond to individual customer needs by alternating the business form of long-life salads (Nishi-Nihon Factory) including small sized salads. As for processed egg products (Shizuoka Fujisan Factory), it will expand sales channels to the home-meal replacement market for newly introduced small-sized products. It is also encouraged to expand series of products and to improve brand value. The company launched various brands and has been developing their product lineup including high value-added Japanese ready-to-eat food “Wasai Bansai®” series, egg-processed food such as Atsuyaki-Tamago “Sozaitei®” series manufactured by Shizuoka Fujisan Factory, low calories, low sugar, reduced salt and oil free dressings “Triple Balance®.” It will continue to develop the product lineup to meet customer needs and work on popularizing the brands and improving values through the Internet and SNS.

Delicatessen-related business, etc.

Sales are expected to increase by 5.5% year on year. In addition to increasing sales volume of fresh products utilizing the new factory of DIETCOOK SHIRAOI and the Kanagawa Factory of KANTOH DIETCOOK, the company will enhance the development of main staple products made from meat and fish.

Others

The company pursues to attract and expand female customers by designing beauty-themed products for Salad Café.

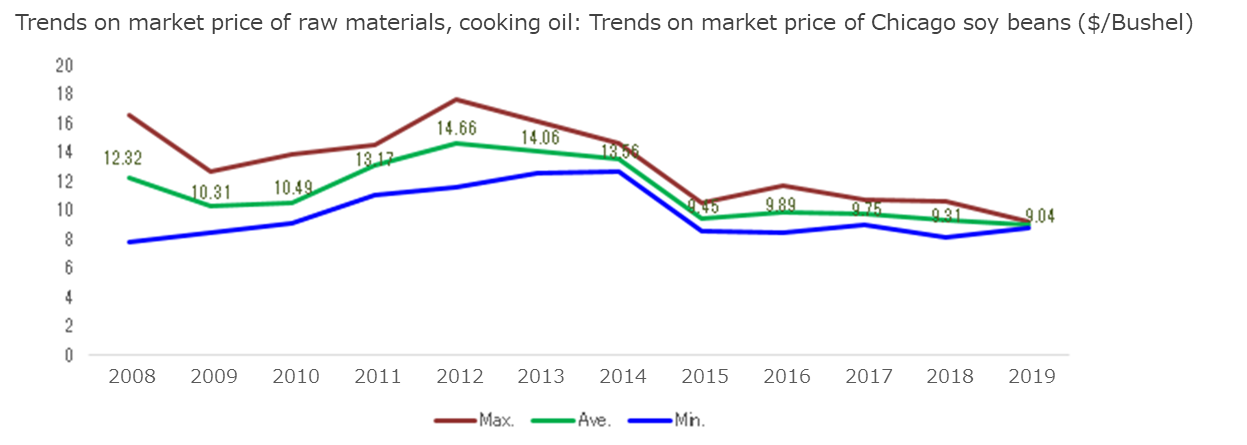

Trends on market price of raw materials

(Taken from the company)

Outlook for 2019

South American soybeans are expected to have roughly good yields in 2019. As the future situation of crop growth in North America and the trade war between the US and China that began last year are concerned, the price of Canadian rapeseed oil, the main oilseed in Japan, is greatly affected by political issues between China and Canada that occurred last year. It is difficult to predict currency exchange rates as they fluctuate depending on interest rate policies, economic conditions, and international political conditions.

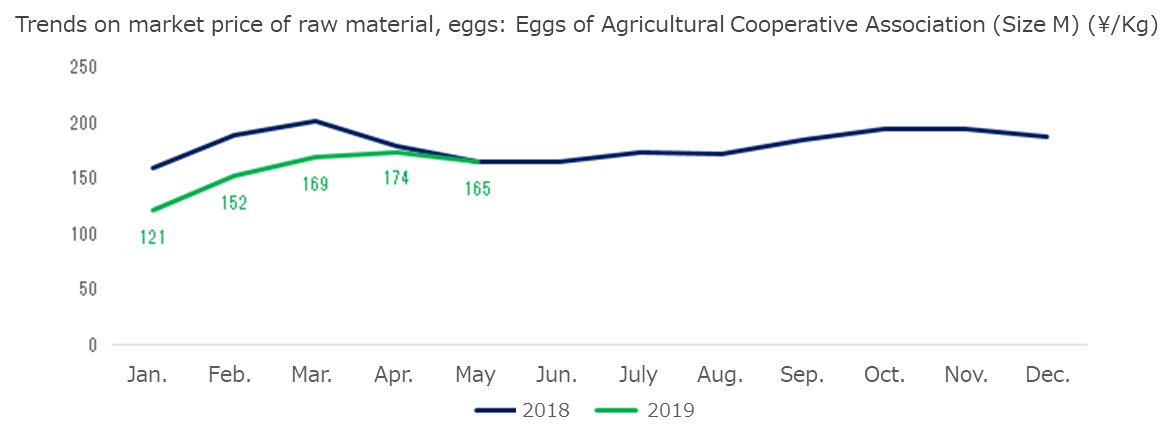

Outlook for 2019

Egg production volume grew by 101% year on year, resulting in 2627 thousand ton. It is forecasted that the volume in 2019 will be steadily increasing and the demand of processed egg products are solid while the market price of eggs will remain nearly unchanged from the previous year.

4. Progress of medium-term management plan “KENKO Value Action – Create Value” (FY3/19 – 3/21)

Basic policy and five themes

With its basic policy, Creating Shared Value (CSV) Management “Creation of Common Values,” the company will promote corporate activities that create value for both society and company. In order to practice the CSV management, it has five themes: (1) local community contribution, (2) environment and resources, (3) supply chains, (4) solutions, and (5) work style.

(1) Local community contribution

The company will work on promoting local production and consumption, and utilizing local special products in order to become the leading company contributing to local. In addition, it will promote recruitment activities of local human resources, and contribution activities such as joint management and training to maintain agricultural production activities.

(2) Environment and Resources

The company will work on logistics reform aiming for reducing CO2 emissions, reducing raw material and product losses, and reviewing packaging materials to streamline the usage of resources and energy.

(3) Supply chains

The company will shorten the time required to provide service to the final consumers from the production sites by shortening supply chains and reforming business activities.

(4) Solutions

The company will work on commercialization of technology and services. Specifically, it will promote development of products and menus, hold cooking classes and workshops, provide recipe assets (website), and carry out consulting of menu development, etc. In addition, it will improve knowledge and technology related to quality assurance to make further progress in the customer support system, support for introducing HACCP, support for inspection and sanitation guidance, etc.

(5) Work style

The company will improve the satisfaction of employees by making the workplace comfortable, enhancing the human resources development and training system, reviewing the personnel evaluation system, etc.

Targets and three business strategies

Along with the CSV Management, in order to achieve the targets, it will promote three business strategies: (1) creating business with customers, (2) a production system to “create, respond and expand,” and (3) promoting salad dishes to the world.

Business strategy 1: Creating business with customers

The company works closely with customers to solve problems by taking advantage of their skilled product appeals, menu proposals, outreach, etc. The company added the low calorie, low sugar, and low sodium dressing "oil-free Wakankitsu" to the Triple Balance series in 2016 in response to the increasing awareness of health and the upward trend of a healthy lifestyle. The number of the company’s product lineup is increasing year after year as the Triple Balance series are combined with the renewal products, resulting in 10 different types as of the end of FY 3/2019. Additionally, the company launched "Vegetables & Soy Meat," which contains a plant-derived ingredient, soybean meat, to adapt to the increasing awareness of health, foreign demand, and the diversifying consumer preferences. Soy meat is produced by extracting protein from defatted soybeans and processing it in the shape of chunks, grains, or flakes. It has been popularized as a healthy meat substitute. Meanwhile, the "oil-free dressing Ocean Blue®" released in last July is a very trendy product. This product was designed to appear fancy to women on social media. In fact, its sales has been successful especially in food service industry as photogenic menu has become popular due to the development of social network service.

The company is also working on developing user-friendly small-sized products. The demand for these products has been increasing as they are single-use and can minimize loss. From the salad series "Salad Made by a Salad Pro®" released in March this year, "Red Skin Pumpkin Salad" was released in February. Also, 100 g size of Atsuyaki-Tamago and Dashimaki-Tamago were released from the egg brand, the “Sozaitei” series.

Furthermore, the sales of raw ingredient-based products manufactured at the factories of DIETCOOK SHIRAOI Co., Ltd., which started operation in April last year, is increasing as expected to provide improved efficiency of cooking operations in the foodservice industry to cover labor shortages. Raw ingredient-based products here means the 4 types of chilled potatoes released in last September and the Wasouzai series, "Wasai-Bansai®." Wasai-Bansai® has been adopted to various sales channels such as Japanese-style bars, food courts bakeries, and convenience stores since it can serve Japanese traditional dishes just by opening the package and placing it on a plate. The number of products has increased to 17 (as of the end of March 2019) as their sales is successful.

Business strategy 2: Production system to “create, respond and expand”

In the factories of DIETCOOK SHIRAOI Co., Ltd., sales of the main product, raw ingredient-based potato products, is favorable especially among the foodservice industries, which suffers from a labor shortage. The sales volume of fresh delicatessen for food supermarkets in Hokkaido has increased due to improved production capacity. Furthermore, there were no damages to the employees or the buildings although the factories experienced a temporary power outage last September due to the Hokkaido Eastern Iburi earthquake.

Meanwhile, Kanagawa Factory of KANTOH DIETCOOK, Co., Ltd., aiming to establish a dual base production system with the existing Tokorozawa factory, was a few months behind the schedule in establishing a stable production system (this is why the production plan of FY 3/19 wasn’t achieved); however, the sales volume has increased and the business is certainly growing after the second half. In particular, a further growth of the sales of fresh delicatessen, a mainstay manufactured product for food supermarkets in the Tokyo Metropolitan Area, is expected. The company plans to expand its sales by utilizing a dual base production system of the Kanagawa factory and the Tokorozawa factory.

The second factory of Shizuoka Fujisan Factory and a new production line (the factory enlarged) of Nishi-Nihon Factory started operation in February 2019 and April 2019, respectively.

Product capacity is expected to rise from 6,000 tons/year to 9,000 tons/year with the help of the operation of the second factory of Shizuoka Fujisan Factory. About three months have passed since the operation started (as of May 22), and the production has been carried out without any significant problems. The second factory will focus on producing small-packaged products for which demand is rising, in addition to producing Tamagoyaki (rolled egg omelet) products that are produced in the existing factory. The small-package products are very user-friendly since they're microwaveable and pre-divided into pieces of 100g for single use to minimize food waste. The company is working on increasing the market share of Tamagoyaki (rolled egg omelet) products as it predicts that there are still some opportunities to extend their sales channels for lunch boxes and delicatessen to respond to the increased demand for home meal replacements.

Meanwhile, the construction for the extension of Nishi-Nihon Factory was finished in March 2019, and full-blown operations started in April. Production capacity is expected to increase from 33,000 tons/year to 37,300 tons/year, and the company will increase the production of long-life salads including the small-packaged form. Due to the labor shortages and the expansion of the home meal replacement market, the demand for long-life salads has been continuously increasing. Among them, the demand for the products in the small-package form is especially high since they are handy. The Nishi-Nihon Factory attempts to respond to customers demand by covering a wide range of long-life salad product sizes, ranging from 100-g packages to large-packages.

The company will increase production capacity by operating the 4 factories (expanding supply volume) mentioned above and equalize production capacity levels. It will then apply these changes to the innovation of work style such as reduction of work hours, as well as to its further growth.

Business strategy 3: Promoting salad dishes to the world

The company is working on researching and transmitting information related to food trends. Numerous kinds of menu and cooking styles for different eating styles such as vegetarians, gluten-free, and vegan are available oversea. It picks up such information early on, and the research center in Vancouver, Canada gives feedback to Japan. In this way, the company attempts to develop new products and menu. The number of products developed with the help of the research activities including overseas exhibitions are gradually increasing. As a result, 8 dressing and cooking sauce products, 2 processed egg products, and 6 salads or delicatessen products have been developed and released since 2016. The company will enhance these activities further.

As for export sales, the company exported products to 44 countries and regions as of the end of FY 3/19. The scale is not so big, but sales are steadily growing. The company plans to develop its business by increasing the number of exportable products. For example, it extended expiry dates and improved the packages of the domestically popular “garlic butter sauce” to allow its export. It also conducts public relations activities and actively participates in overseas exhibitions to increase its outreach to the world.

As for overseas bases, the Indonesian equity-method affiliate, PT. Intan Kenkomayo Indonesia, established in July 2012 continued to record a profit on a single month basis since April 2018, and profitability was recorded throughout the previous term. Concerning business in North America, the company acquired stocks of the American home meal replacement manufacturer Hans Kissle Company, LLC with Mitsui & Co., Ltd. in December 2018. The company considers it a foothold to enter the promising American home meal replacement market.

5. Conclusion

Many food factories rely on the workers. The Kanagawa Factory of KANTOH DIETCOOK, which started operations in June 2018 to establish a two-site system with the existing Tokorozawa Factory, was a start from scratch including hiring personnel, and its full operationalization was delayed due to issues related to proficiency of the workers. In the absence of labor, the company was forced to invest more than planned to fulfill its supply responsibility, which resulted in increased labor cost. Although the yield remained low until the fourth quarter, the manufacturing process and yield began improving rapidly. It is attempting to continuously improve productivity along with sales expansion as further improvements are conceivable.

The business environment remains favorable. Development of the home-meal replacement market will continue as a result of the social advancement of women, the increase in single-person households, and the change in household composition due to the declining birthrate and the aging of the population. The company needs to respond to the diversification of customers’ attitudes and values towards food such as health, wellness and their commitment to raw materials. It also needs to pay attention to inbound demand of over 30 million people (the number of foreign tourists visiting Japan in 2018). In addition, the need for more efficient cooking is increasing in various industries, particularly in the food service industry, due to serious labor shortages.

Overseas, increasing number of Japanese companies are entering into the market mainly in emerging countries and North America due to rising purchasing power and population. There is also a growing interest in Japanese food.

In order to catch such business opportunities, the company will enhance its response to the home-meal replacement market by proposing fresh delicatessen for supermarkets and lunch boxes and delicatessen for convenience stores. It will also meet the needs for more efficient cooking by increasing sales of processed egg products and long-life salads targeting the dining-out industry which is suffering from labor shortages. In addition, the company will work on adding higher values to products though development as it considers and maintains functionality, health, forms, and globalization. As for overseas, profitability has been established in an equity-method affiliate operating in Indonesia, and it will also expand the business in the home-meal replacement market in the US with Mitsui & Co..

As it is the second year of the medium-term management plan, we would like to pay attention to the company’s outcomes in Japan and overseas.

<Reference: Social and environmental activities>

[Attempts for the Environment]

Environmental management

In order to promote environmental management within the Group, it formed an environmental management committee, set environmental goals and plans, implements measures to grasp the environmental conditions to preserve it, conducts renewal examination of zero emission activities, etc. Furthermore, each environmental management promoting committee carries out initiatives such as reducing waste, zero CO2 emissions and energy-saving activities, managing compliance with environmental laws, internal audits for zero CO2 emissions, etc.

Measures for reducing waste

After the review and partial amendment of the Food Recycling Law in 2007 (the law was enforced in 2001), the company group succeeded in achieving the goal to recycle 85% or more of food waste (except some of its factories). The company is reducing food waste by drying and dehydration as well as turning the waste into feedstuff, fertilizers, etc. From FY 3/10, the Nishi-Nihon Factory in Maizuru City, Kyoto started supplying liquid feeds to pig farms. The liquid feeds are produced from by-products in the process of making potato salad within the factory, such as potato peels and residues, to maintain the environment by preventing bad smells surrounding the plant, etc. The activity was adopted by the Ministry of Agriculture, Forestry and Fisheries as an activity for Utilization of Recyclable Food Waste in FY 2009. Furthermore, the company received the 22nd Food Safety, Security and Environment Contribution Award (November 2013) and the 1st Food Industry Waste Reduction Grand Prize (March 2014).

|

|

|

Feed production plant | Potato peel after liquefaction treatment | Eggshell power

|

Measures for zero CO2 emissions

Since FY 3/07, the company adopted 3R activities, which consist of initiatives to Reduce, Reuse and Recycle the resources the company consumes. It particularly addressed waste reduction by improving manufacturing processes. As a result, the company succeeded in accomplishing recycling 90% or more of waste in FY 3/08, and the entire factory achieved the goal of zero CO2 emissions in FY 3/09. An in-house meeting is held once a year to report the current conditions for the CO2 emissions reduction activities at each factory, and awards are given to factories with the highest or higher grades. In FY 3/16, measures for zero CO2 emissions are carried out in related companies (subsidiaries) as well in order to accomplish zero CO2 emissions in the entire Group.

[Measures for food education]

The measures for food education activities started in October 2007 with grade 5 students of a local elementary school in Setagaya-ku, Tokyo, where the old headquarters was located. Even after relocated in Suginami-ku in 2009, the company continued the activities on food education including lectures about nutrition, eating habits and cooking practice sessions.

・Two nearby elementary schools (for students in Grades 3 and 4)

・Orphanages (for children and staff)

・Apartments in local areas (for elderly club members)

・Social welfare organizations in local areas (for elderlies requiring long term care or those close to needing care)

After listening to the participants' requests, including their common problems and area of their interest, the company visits them directly to have a discussion with them in order to decide the theme.

For inquiries: 0120-851-793 (weekdays; 09:00 to 17:00), https://www.kenkomayo.co.jp/inquiry

[Relationships with local communities and society]

For the 2 days, November 3 (Sat.) and 4 (Sun.), 2018, the company set a booth at Suginami Industrial Fair (it has been consecutively participating for 6 years since 2013) in Suginami Festa 2018 which took place in Momoi Harappa Park (Suginami-ku, Tokyo). Suginami Festa is an event organized by Suginami Ward, and its basic philosophy is to bring people and regions together and rejuvenate Suginami. It brings vigor to Suginami through communication and connections among ward residents, etc. The venue is filled with elements representing the city and its attractions such as Suginami-grown fresh vegetables and local delicious foods. There are many tents that offer stage events for families or children, games, and food to enjoy. The company sells its products such as mayonnaise, dressing, and donates the sales (except for operation and setup expenses) to the Suginami Ward Next Generation Development Fund. The company has been contributing to the fund since 2014, and this year it received a letter of appreciation from Suginami Ward. The company plans to promote CSR activities by proactively engaging in food education activities and social contribution activities for the region.

| |

Suginami Festa | The company’s booth |

| |

The donation made to the fund | Appreciation letter |

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 7 directors, including 2 outside ones |

Auditors | 5 auditors, including 3 outside ones |

◎ Corporate Governance Report (Updated on December 28,2018)

Basic Policies

In order to fulfill our social responsibilities and remain a trusted company, we are committed to not only complying with laws and regulations but also strengthening and developing our management foundation. We believe that continuity forms the foundation of corporate governance. We also strive to be an open corporation by building an even more thorough system of governance, and by improving the transparency of our corporate activities with the timely and appropriate disclosure of information.

(1) Ensure rights and equality for shareholders

In order to ensure practical equality for all shareholders including minority and foreign shareholders and to ensure shareholders’ rights and their ability to exercise these rights, we have established an environment that facilitates prompt information disclosure on our website and the Timely Disclosure Network provided by Tokyo Stock Exchange.

(2) Collaborate appropriately with non-shareholding stakeholders

We consider that the cooperation with all stakeholders including shareholders is indispensable for us to achieve sustainable growth and to improve corporate value in the mid/long term. Additionally, in order to activate cooperation with stakeholders, the management including the president takes the initiative in fostering the corporate culture while respecting the corporate ethics and stakeholders’ rights and positions.

(3) Properly disclose information and ensure transparency

Disclosing information is an important management issue, and we believe that ensuring appropriate disclosure is indispensable to gain understanding from our shareholders and other stakeholders. Backed by this belief, we proactively disclose information (including non-financial information) that we deem valuable for our shareholders and other stakeholders through various channels such as our website, the Corporate Report, the business report (our tool for communication with our shareholders), etc. regardless of whether disclosing such information is not enforced by law.

(4) Oversee responsibilities of the Board of Directors

Our company separates the management decision-making and supervisory system from business execution and attempts to establish an efficient management and executive system while realizing high-transparency management by appointing outside directors. We established a highly effective audit system for directors through the appointment of 2 outside directors and established a highly independent audit system for execution of operations by directors through the appointment of 3 outside auditors.

(5) Create a dialogue with shareholders

In our company, the head of the Corporate Planning Division is responsible for IR, and the Corporate Planning Division serves as a department related to IR activities. In addition to holding financial results briefings for shareholders and investors once every half-term, in which the top management participate, we hold information meetings for individual investors several times a year. And the results are regularly reported to top executives. Furthermore, as for dialogue with shareholders, we carefully manage insider information to prevent any leakage.

<Disclosure Based on the Principles of the Corporate Governance Code>

Principle 5-1 Policy regarding constructive dialogue with shareholders

We emphasize constructive dialogue with shareholders. We strive to create dialogues through a variety of opportunities, particularly by senior executives. The head of the Corporate Planning Division, who is also responsible for IR, oversees departments related to IR activities, such as the Corporate Planning Office, the Finance and Accounting Headquarters, and the General and Judicial Affairs Headquarters, and works to form an integrated link between them.

At the Corporate Planning Office, we actively accept IR interviews from investors in the form of telephone interviews and small meetings, etc., and financial results briefings are conducted twice per year by the president and IR directors. The IR directors report these results to executives twice each month at progress meetings. As for dialogue with investors, we carefully manage insider information by centering the topic on our business contents and the growth strategies outlined in our medium-term management plan. The silent period takes place from the time accounts are closed to the time financial statements are announced.

This report is intended solely for informational purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on KENKO Mayonnaise Co., Ltd. (2915) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/