Bridge Report:(2925)PICKLES the First Half of Fiscal Year February 2020

President Masahiro Miyamoto | PICKLES CORPORATION (2925) |

|

Corporate Information

Stock Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

Representative | Masahiro Miyamoto |

Address | 7-8, Higashisumiyoshi, Tokorozawa-shi, Saitama |

Accounting term | February |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥2,698 | 6,397,743 shares | 17,261 million | 8.0% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥28.00 | 1.0% | ¥205.07 | 13.2 x | ¥1,849.88 | 1.5 x |

*Share price is as of closing on October 4. Number of shares outstanding is as of the end of the most recent quarter, and does not include treasury shares. ROE and BPS are the values as of the end of the previous term.

Consolidated Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit Attributable to Owners of Parent | EPS | DPS |

February 2016 Act. | 30,152 | 931 | 975 | 692 | 139.35 | 17.00 |

February 2017 Act. | 35,801 | 780 | 867 | 548 | 105.63 | 22.00 |

February 2018 Act. | 37,616 | 1,131 | 1,233 | 872 | 144.81 | 25.00 |

February 2019 Act. | 40,670 | 1,409 | 1,561 | 920 | 143.88 | 28.00 |

February 2020 Est. | 42,716 | 1,853 | 1,996 | 1,312 | 205.07 | 28.00 |

*The estimated values were provided by the company. Unit: Million-yen, yen

This Bridge Report presents PICKLES CORPORATION’s overview of the financial results for the First Half of term ending February 2020 and describes the earnings forecast for the term ending February 2020

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year ending February 2020 Earnings Results

3. Fiscal Year ending February 2020 Earnings Forecasts

4. Policies from the second half and medium-term goals

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the term ending February 2020, sales and operating income grew 3.1% and 52.3%, respectively, year on year. Operating income rate improved year on year from 4.4% to 6.5%, as the purchase prices of vegetables as ingredients were stable and the production efficiency at Saga Factory, which has been operated for one year since the start of operation, increased. Sales followed the initial estimate, while operating income was about 52% larger than the initial estimate, as the purchase prices of vegetables as ingredients were stable, cost was smaller than the initial estimate, and the production efficiency at Saga Factory improved more than expected.

- As for the full-year forecast, sales and operating income are projected to grow 5.0% and 31.4%, respectively, year on year. Seeing the results for the first half, they revised the full-year forecast upwardly, but the estimated sales and profits for the second half are conservative. Sales were larger than estimated in the first half, and the initial estimate of sales in the second half were left unchanged. The profit for the second half is estimated to decline year on year, as the company will increase advertisement expenses for actively implementing a campaign for commemorating the 10th anniversary of release of “Gohan ga Susumu Kimchi (kimchi that goes well with rice)” ,while assuming that the purchase prices of vegetables as ingredients will rise. It is forecasted that sales will grow for the 10th consecutive term and operating income will increase for the 3rd consecutive term, both hitting a record high.

- The company held a groundbreaking ceremony on August 23 at the site for constructing OH!!! Magic of Fermentation, Health, and Food, a theme park promoting fermentation and health, which is expected to accelerate corporate growth in the mid/long term. It is scheduled to be opened in the spring of 2020, and will run restaurant and retail businesses. The company hopes to increase its popularity by operating the theme park, to strengthen its EC and promote its shops at department stores, etc. There is Moominvalley Park, the world’s first one except those in the mother country Finland, located about 10 minutes by car from the company’s theme park, so we can expect synergetic effects for reeling in customers. As this endeavor is accompanied by risks, its future progress is noteworthy.

1. Company Overview

PICKLES CORPORATION engages in production and sale of asazuke lightly pickled vegetables, kimchi, and delicatessen, and procurement and sale of Japanese-style pickles through a nationwide production and sales network that it has built up in cooperation with its 17 consolidated subsidiaries, including PICKLES CORPORATION Sapporo, PICKLES CORPORATION Kansai, and Food Label Co., Ltd., and 3 affiliated companies accounted for by the equity method. The theme color of the company, green, represents freshness under a slogan of “We deliver the vitality of vegetables.” The company’s own products are produced using vegetables grown and harvested mainly in Japan by contracted farmers so that their traceability is ensured (about 80% of the vegetables used are supplied by contracted farmers), and no preservatives or synthesized food colorings are used. Furthermore, the company has displayed “an absolute commitment to food safety” at its production sites as demonstrated by such endeavors as thorough temperature control at the factories, checkups of the clothes and health of all the employees before they enter the factories, devotion to the 5S activities (5S represents sorting, setting-in-order, shining, standardizing, and sustaining the discipline), adoption of Hazard Analysis and Critical Control Point (HACCP), and acquisition of the certification of ISO9001 and FSSC22000.

By product, sales from the products (produced at the company’s own factories) accounted for 60.6% (40.4% from asazuke lightly pickled vegetables and kimchi products, 18.1% from delicatessen, and 2.1% from old pickled vegetables), and those from products such as Japanese-style pickles, including the products of a consolidated subsidiary, Food Label, made up 39.4% (produced at factories other than the company’s own ones) in the term ended February 2019. By sales channel, sales at mass retailers and wholesalers made up 76.5%, those at convenience stores accounted for 13.0%, and those through other distributors accounted for 10.5%.

【Corporate Philosophy】

PICKLES CORPORATION’s philosophy is “We deliver tasty and safe foods to consumers and aim at eco-conscious corporate management.” Under the corporate philosophy, it is pursuing the following management policies: (1) quality control for producing safe and delicious food products, (2) environmentally friendly corporate management, and (3) arrangement of a working environment that puts instillation of morals and the principle of safety and health first. Following these policies, the company is working on international standards for quality control, including ISO9001, HACCP, and FSSC22000, and international standards for environmental control such as ISO14001. In addition, it focuses on training and education of its employees through various approaches, such as enrichment of the personnel system and education programs. PICKLES CORPORATION would like to maintain its fundamental attitude as a food company, which is provision of “safe and quality” foods, in order to earn trust of consumers and contribute to society by being devoted to corporate activities on the basis of these policies.

1-1 Strength

PICKLES CORPORATION’s strengths are the capability of developing products that enables it to release new products seamlessly, such as the product line of “Gohan ga Susumu Kimchi (kimchi that goes well with rice)” that has been a big hit and various other delicatessen, and the sales, production, and logistics network covering all the regions of Japan.

There is a multitude of methods and flavorings for making kimchi products. The company has been continuing to increase sales by enriching the lineup of its kimchi products with its product development capability, which is one of its strong points, and it achieved the sales of products related to Gohan ga Susumu Kimchi over 7 billion yen in the term ended February 2019. This capability of product development has been utilized also in the delicatessen business that is thriving as a business pillar next to the business of asazuke lightly pickled vegetables and kimchi. Utilizing combination with the enrichment of the lineup of deli items and the continuous improvement of the existing products, it allows the company to prospect for sales floors at a number of distributors such as supermarkets. Furthermore, the corporate group is the only company in the pickles industry that has built a nationwide network. This has enabled it to supply the same kind of pickles product and delicatessen item to each store of the company’s clients that have branch stores all across Japan, which is one of the company’s selling points on business.

1-2 Environment, Society, and Governance (ESG) Activity

Social contribution activities

The company has made donations on the basis of an idea to “return some of the revenue of PICKLES CORPORATION to society as part of the social contribution activity.” It continuously plans to donate roughly 1% of the net income in total each year to a host of organizations, including ones that support orphans who lost their parents in disaster and ones that conserve the environment.

Major organizations to which PICKLES CORPORATION made donations in the First Half of term ending February 2020

WWF Japan, The MICHINOKU Future Fund, KOTSUIJI IKUEIKAI, Ashinaga Foundation, Kids’ Door, Saitama Inochi no Denwa, Saitama Adapted Sports Association

Environmental preservation activities

PICKLES CORPORATION is the first company in the food industry that obtained the certification of ISO14001 collectively for all of its offices in August 1999. Based on the environmental policies formulated by the management, it is aiming to become a more environmentally friendly corporate group through multifarious approaches, including efforts to reduce resource and energy waste, cut down on industrial wastes, comply with environment-related laws and regulations, educate the employees, and support environmental preservation organizations.

|

|

(Taken from the reference material of the company)

2. First Half of Fiscal Year ending February 2020 Earnings Results

2-1 Consolidated Business Results

| 1H FY 2/ 19 | Ratio to sales | 1H FY 2/ 20 | Ratio to sales | YoY | Initial estimate | Initial estimate comparison |

Net Sales | 20,888 | 100.0% | 21,537 | 100.0% | +3.1% | 21,332 | +1.0% |

Gross profit | 4,970 | 23.8% | 5,665 | 26.3% | +14.0% | 5,118 | +10.7% |

SG&A expenses | 4,056 | 19.4% | 4,274 | 19.8% | +5.4% | 4,202 | +1.7% |

Operating income | 913 | 4.4% | 1,391 | 6.5% | +52.3% | 915 | +52.0% |

Ordinary income | 989 | 4.7% | 1,475 | 6.8% | +49.1% | 1,010 | +46.1% |

Profit attributable to owners of parent | 599 | 2.9% | 1,007 | 4.7% | +68.1% | 606 | +66.1% |

* Unit: million yen

Sales and operating income grew 3.1% and 52.3%, respectively, year on year.

Sales were 21,537 million yen, up 3.1% year on year. As the sales of pickled Japanese plums for preventing heatstroke increased considerably in the same period of the previous year, the sales of purchased products declined 5.7%, but the sales of original products increased 9.0% thanks to the good performance of the delicatessen.

Operating income was 1,391 million yen, up 52.3% year on year. While sales grew, the purchase prices of vegetables as ingredients were stable and the production efficiency of Saga Factory, which has been operated for one year since the start of operation, improved. Accordingly, gross profit rate rose 2.5 points to 26.3%. It offset the augmentation of SGA, mainly the costs for distribution and human resources.

As for the comparison with the initial forecast, the sluggish performance of lightly pickled vegetables and kimchi was offset by the growth of sales of the delicatessen, and sales followed the initial estimate. Cost rate was lower than the assumed rate due to the stable purchase prices of vegetables as ingredients and the production efficiency of Saga Factory improved more than expected, so operating income was about 52% larger than the initial estimate.

The company has been increasing production and sales in western Japan, and established a factory in Saga Prefecture, but was not affected by the torrential rain in northern Kyushu in August this year.

Sales by Food Item

| 1H FY 2/ 19 | Composition ratio | 1H FY 2/ 20 | Composition ratio | YoY |

Asazuke pickles /kimchi | 8,644 | 41.4% | 8,656 | 40.2% | +0.1% |

Delicatessen | 3,397 | 16.3% | 4,544 | 21.1% | +33.8% |

Old pickled vegetables | 460 | 2.2% | 431 | 2.0% | -6.4% |

Product (above totals) | 12,502 | 59.9% | 13,631 | 63.3% | +9.0% |

Product (pickles, fruits and vegetables, etc.) | 8,386 | 40.1% | 7,906 | 36.7% | -5.7% |

Total | 20,888 | 100.0% | 21,537 | 100.0% | +3.1% |

* Unit: million yen

Due to the sluggish sales at supermarkets caused by the bad weathers in July and August, the growth rate of sales of lightly pickled vegetables and kimchi was only 0.1%, but the sales of the delicatessen increased 33.8% year on year thanks to the favorable performance of products sold at convenience stores (7 kinds of pickles). On the other hand, the sales of purchased products declined 5.7% year on year, due to the decrease of Japanese pickled plums, whose demand was extraordinarily high in the same period of the previous year. (In the same period of the previous year, Japanese pickled plums were featured in TV as products for salt intake to prevent heatstroke.)

Sales by Sales Channel

| 1H FY 2/ 19 | Composition ratio | 1H FY 2/ 20 | Composition ratio | YoY |

Mass retailers/wholesalers | 16,200 | 77.6% | 16,262 | 75.5% | +0.4% |

Convenience stores | 2,423 | 11.6% | 3,346 | 15.5% | +38.1% |

Restaurants/others | 2,264 | 10.8% | 1,929 | 9.0% | -14.8% |

Total | 20,888 | 100.0% | 21,537 | 100.0% | +3.1% |

* Unit: million yen

Vegetable Price

Monthly Changes in Vegetable Price (The same term of last year = 100)

| March | April | May | June | July | August |

Chinese cabbage | 62 | 97 | 100 | 96 | 100 | 97 |

Cucumber | 111 | 113 | 92 | 100 | 89 | 72 |

The price of Chinese cabbage has been nearly unchanged year on year since April. In March, the air temperature in Ibaraki Prefecture, which is a major production area, was higher than usual, so Chinese cabbage tended to be larger and the shipment amount increased, and the price was significantly lower than that in the same month of the previous year. Chinese cabbage accounted for 30% of all ingredients in the first half.

The price of cucumber was higher than that in the same month of the previous year in March and April, but unchanged in May and June, and lower than that of the same month of the previous year in July and August, as the weathers in Fukushima and Iwate Prefectures, which are major production areas, were favorable. Cucumber accounted for 35% of all ingredients in the first half.

Changes in Vegetable Price (1H of FY2/16 = 100) and Gross Profit Margin

| 1H FY 2/ 16 | 1H FY 2/ 17 | 1H FY 2/ 18 | 1H FY 2/ 19 | 1H FY 2/ 20 |

Chinese cabbages | 100 | 89 | 102 | 95 | 86 |

Cucumbers | 100 | 106 | 97 | 107 | 99 |

Gross profit margin | 22.5% | 23.2% | 23.8% | 23.8% | 26.3% |

Ratio by raw material item

Cucumbers | Chinese cabbages | Daikon radish | Turnip | Cabbage | Others | Total |

35% | 30% | 6% | 2% | 2% | 25% | 100% |

Breakdown of SG&A Expenses

| 1H FY 2/ 19 | Ratio to sales | 1H FY 2/ 20 | Ratio to sales | YoY |

Logistics cost | 2,060 | 9.9% | 2,167 | 10.1% | +5.2% |

Personnel cost | 1,173 | 5.6% | 1,261 | 5.8% | +7.5% |

Advertising cost | 101 | 0.5% | 62 | 0.3% | -38.4% |

Others | 721 | 3.4% | 783 | 3.6% | +8.6% |

Total SG&A expenses | 4,056 | 19.4% | 4,274 | 19.8% | +5.4% |

* Unit: million yen

Distribution cost augmented 5.2% year on year due to the rise in fees, etc. and personnel cost augmented 7.5% year on year due to the increase of personnel for business expansion. In the second half, the company will strive to improve the efficiency of distribution further by reconsidering delivery routes, etc. On the other hand, advertisement cost declined year on year, but is estimated to increase in the second half, as the company plans to launch a campaign for commemorating the 10th anniversary of release of “Gohan ga Susumu Kimchi,” which is a core product. In addition, considering the situation that overall consumption is on a downward trend, the company plans to increase advertisement cost in the second half. It has been taken into account in the full-year earnings forecast that has been revised upwardly.

2-2 Financial Conditions and Cash Flow

Financial conditions

| Feb.18 | Aug.19 |

| Feb.18 | Aug.19 |

Cash | 2,835 | 3,328 | Payables | 2,905 | 4,239 |

Receivables | 3,925 | 5,741 | ST Interest-Bearing Liabilities | 2,618 | 2,880 |

Inventories | 601 | 727 | Current liabilities | 7,916 | 9,719 |

Current Assets | 7,509 | 9,863 | LT Interest-Bearing Liabilities | 1,380 | 1,525 |

Tangible Assets | 12,931 | 13,405 | Noncurrent liabilities | 2,311 | 2,458 |

Intangible Assets | 796 | 751 | Net Assets | 11,904 | 12,718 |

Investments and Others | 893 | 876 | Total Liabilities and Net Assets | 22,132 | 24,896 |

Noncurrent Assets | 14,622 | 15,032 | Total Interest-Bearing Liabilities | 3,998 | 4,405 |

* Unit: million yen

The total assets as of the end of the second quarter were 24,896 million yen, up 2,764 million yen from the end of the previous term. In the debit side, notes and accounts receivable and payable - trade increased because the end of the second quarter fell on a holiday of financial institutions, and property, plant and equipment augmented through the establishment of a factory of Piene Corporation. Capital-to-asset ratio was 50.7% (53.5% at the end of the previous term).

Cash flows (CF)

| 1H FY 2/ 19 | 1H FY 2/ 20 | YoY | |

Operating cash flow(A) | 1,083 | 1,454 | +371 | +34.2% |

Investing cash flow (B) | -1,634 | -1,132 | +503 | - |

Free Cash Flow(A+B) | -551 | 323 | +874 | -158.6% |

Financing cash flow | 196 | 170 | -25 | -13.1% |

Cash and Equivalents at the end of term | 3,451 | 3,328 | -123 | -3.6% |

* Unit: million yen

3. Fiscal Year ending February 2020 Earnings Forecasts

3-1 Business Results

| FY 2/ 19 Act. | Ratio to sales | FY 2/ 20 Est. | Ratio to sales | YoY | Forecast | Difference from the forecast |

Sales | 40,670 | 100.0% | 42,716 | 100.0% | +5.0% | 42,513 | +0.5% |

Gross profit | 9,612 | 23.6% | 10,481 | 24.5% | +9.0% | 10,038 | +4.4% |

SG&A | 8,202 | 20.1% | 8,628 | 20.2% | +5.2% | 8,458 | +2.0% |

Operating Income | 1,409 | 3.5% | 1,853 | 4.3% | +31.4% | 1,580 | +17.3% |

Ordinary Income | 1,561 | 3.8% | 1,996 | 4.7% | +27.8% | 1,739 | +14.8% |

Net Income | 920 | 2.3% | 1,312 | 3.1% | +42.5% | 1,040 | +26.1% |

* Unit: million yen

The full-year forecast has been revised upwardly, considering the results in the first half. It is projected that sales and operating income will grow 5.0% and 31.4%, respectively, year on year.

Sales are estimated to grow 5.0% year on year to 42,716 million yen. Sales were larger than estimated in the first half, and the initial estimate of sales in the second half was left unchanged. The sales of original products are projected to increase 8.2% year on year to 26,674 million yen, and the sales of purchased products, which declined in the first half, are forecasted to be 16,041 million yen, unchanged from the previous term.

Operating income is estimated to grow 31.4% year on year to 1,853 million yen. The estimated purchase prices of vegetables as ingredients in the second half are conservative compared with those in the first half. Accordingly, it is assumed that gross profit rate will increase year on year and from the first half. As for SGA, the company plans to increase advertisement expenses, as overall consumption is on a downward trend. The company plans to actively conduct a campaign for commemorating the 10th anniversary of release of “Gohan ga Susumu Kimchi,” which is a core product.

Equipment investment and depreciation

Equipment investment is estimated to be 1,444 million yen (2,681 million yen in the previous term), due to the renewal of factories of Piene lactic acid bacteria and other factories, and depreciation is projected to be 652 million yen (690 million yen in the previous term).

Impact of Typhoon No. 15

Due to Typhoon No. 15, which hit the Kanto region in September, the supply of electric power to Chiba Factory (Yachimata-shi, Chiba Prefecture) was stopped from Sep. 9 to 17. After the resumption of power supply, sanitation was carried out (sterilization and cleansing for cleaning the inside of the factory), and it has been in normal operation since September 24. There were no personal damage or significant physical damage for the products that are usually produced at Chiba Factory were produced at Tokorozawa Factory (Iruma-gun, Saitama Prefecture), Omiya Factory (Kita-adachi-gun, Saitama Prefecture), Shonan Factory (Hiratsuka-shi, Kanagawa Prefecture), etc., so there was no inconvenience in supply.

Sales by Food Item

| FY 2/ 19 Act. | Composition ratio | FY 2/ 20 Est. | Composition ratio | YoY | Forecast | Difference from the forecast |

Asazuke pickles/kimchi | 16,420 | 40.4% | 17,181 | 40.2% | +4.6% | 17,194 | -0.1% |

Delicatessen | 7,382 | 18.2% | 8,649 | 20.2% | +17.2% | 8,409 | +2.9% |

Old pickled vegetables | 854 | 2.1% | 843 | 2.0% | -1.3% | 821 | +2.7% |

Product(above total) | 24,656 | 60.6% | 26,674 | 62.4% | +8.2% | 26,425 | +0.9% |

Product (pickles, fruits and vegetables, etc.) | 16,012 | 39.4% | 16,041 | 37.6% | +0.2% | 16,087 | -0.3% |

Total | 40,670 | 100.0% | 42,716 | 100.0% | +5.0% | 42,513 | +0.5% |

* Unit: million yen

Sales by Sales Channel

| FY 2/ 19 Act. | Composition ratio | FY 2/ 20 Est. | Composition ratio | YoY | Forecast | Difference from the forecast |

Mass retailers/wholesalers | 31,132 | 76.5% | 32,262 | 75.5% | +3.6% | 32,300 | -0.1% |

Convenience stores | 5,288 | 13.0% | 6,346 | 14.9% | +20.0% | 5,800 | +9.4% |

Restaurants/others | 4,250 | 10.4% | 4,107 | 9.6% | -3.4% | 4,413 | -6.9% |

Total | 40,670 | 100.0% | 42,716 | 100.0% | +5.0% | 42,513 | +0.5% |

* Unit: million yen

Breakdown of SG&A Expenses

| FY 2/ 19 | Ratio to sales | FY 2/ 20 | Ratio to sales | YoY | Forecast | Difference from the forecast |

Logistics cost | 4,078 | 10.0% | 4,263 | 10.0% | +4.5% | 4,243 | +0.5% |

Personnel cost | 2,422 | 5.9% | 2,516 | 5.9% | +3.9% | 2,520 | -0.2% |

Advertising cost | 280 | 0.7% | 409 | 0.9% | +46.1% | 352 | +16.0% |

Others | 1,421 | 3.5% | 1,438 | 3.4% | +1.2% | 1,341 | +7.3% |

Total SG&A expenses | 8,202 | 20.1% | 8,628 | 20.2% | +5.2% | 8,458 | +2.0% |

* Unit: million yen

4. Policies from the second half and medium-term goals

Policies from the second half

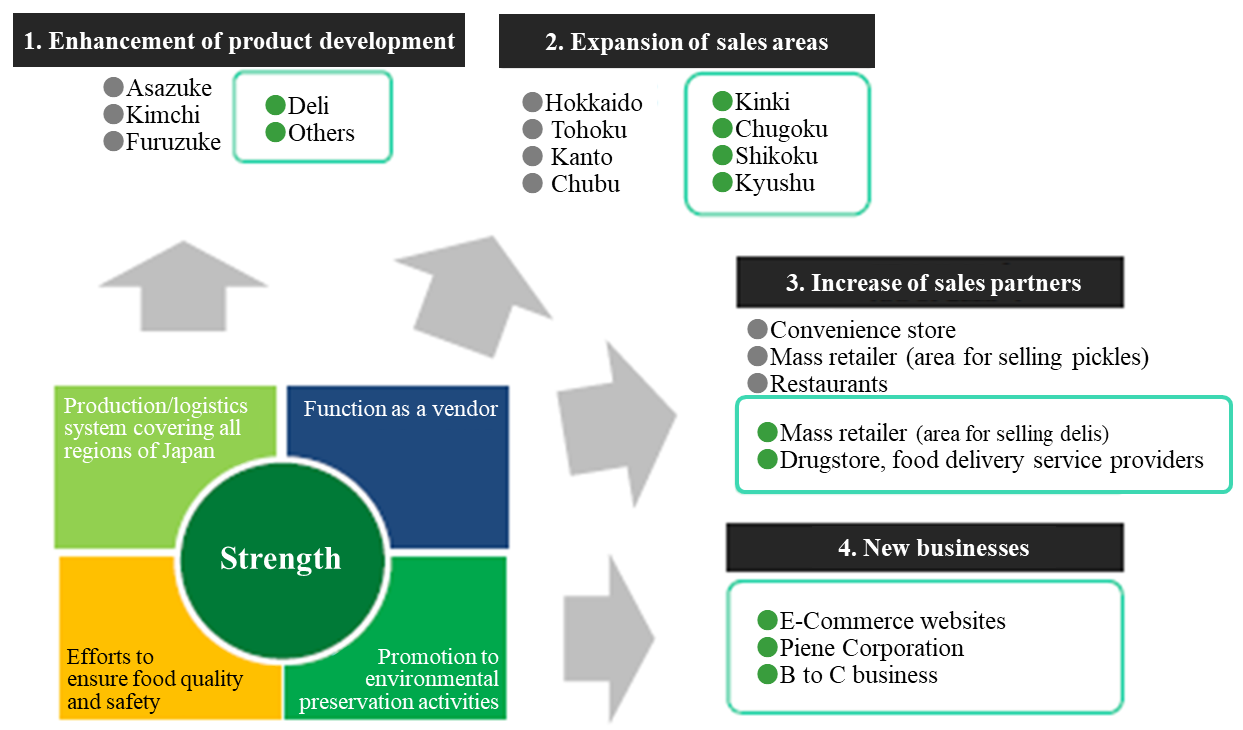

The company will expand business fields through enhancement of product development, expansion of sales areas, increase of sales partners, and the launch of new businesses. For product development, it will reinforce the development of new delicatessen products while considering diversifying needs, such as “eating alone” and “ready-made meals,” and forge ahead with the development of new types of food items, including products related to the Pne-12 lactic acid bacteria. It will also continue developing new Asazuke (lightly pickled vegetables) and kimchi products and renewing their existing product lines. In order to expand sales areas, the company will enhance sales in the Kinki, Chugoku and Shikoku regions by making the most of the supply capability of Hiroshima Factory of PICKLES CORPORATION Kansai, which now has capacity enough to spare for production thanks to Saga Factory that has been in operation and Tegara Foods, which factory has been renovated. For increasing clients, the company will focus on taking a bigger share at the section of the delicatessen in supermarkets, and seek food delivery service providers such as drugstores that have been expanding the selling floor for food items and food delivery services aimed at aged people. Concerning new businesses, the company operates 2 e-commerce websites, which are “Piene Online Shop” (selling products developed using lactic acid bacteria) and “YAWATAYA Online Shop” (selling authentic Japanese-style pickles), and a restaurant and retail business (a theme park promoting fermentation and health, “OH!!! Magic of Fermentation, Health, and Food” to be opened in the spring of 2020) primarily by OH Co., Ltd, which was established as a subsidiary in March 2019.

In addition, it will implement business strategies by utilizing its nationwide network, which is the only network built up in Japan by a pickle manufacturer, and focus on advertising activities, including not only the conventional ones such as TV commercials, ad-wrapped buses, and outdoor signs, but also advertisements via social media.

(Taken from the reference material of the company)

4-1 Product development

Asazuke lightly pickled vegetable/kimchi product

The scale of the pickles market was 320 billion yen in 2018 (according to the estimate by PICKLES CORPORATION). The shrinking amount of rice consumption due to diversifying eating habits, and the aging society decrease the scale of the pickles market from 500 billion yen in 1998 to 380 billion yen in 2008, and even to 320 billion yen in 2018. With that being said, amid the declining market scale for takuwan pickled radishes, suzuke vinegar pickles, and kizamizuke chopped pickles, the market of asazuke lightly pickled vegetables and kimchi, which are the mainstays of the company, is seemingly stable. The markets of asazuke lightly pickled vegetables and kimchi are bullish in the pickles industry, and THE JAPAN FOOD NEWS reported that the share of each pickles product in the market (the estimated ratio of shipment by item in 2018) was as follows: asazuke lightly pickled vegetables and kimchi accounted for 26%(27% in 2017) and23%(21% in 2017), respectively, followed by umeboshi salted plums making up 15%(14% in 2017), takuwan pickled radishes accounting for 12%(12% in 2017), suzuke vinegar pickles that made up 10%(11% in 2017), kizamizuke chopped pickles which accounted for 7%(6% in 2017), and others accounting for 7%(8% in 2017.) Asazuke lightly pickled vegetables and kimchi together made up around 49% (48% in 2017.)

According to the rankings of sales prepared by PICKLES CORPORATION based on an article published by THE JAPAN FOOD NEWS, the company is the top with consolidated sales of 40.6 billion yen, followed by Tokai Pickling Co., Ltd. of 19.5 billion yen, AKIMOTO FOODS Co., Ltd. of 12.2 billion yen, and Bingo Tsukemono Co., Ltd. of 11 billion yen. These 4 companies are the only ones that have achieved sales of over 10 billion yen; however, even PICKLES CORPORATION that has pulled far ahead of the other 3 companies in terms of sales has taken only 12.7% of the market share, and the market share held by the top 10 companies, including PICKLES CORPORATION, has made up merely 42.3%(41.5% in 2017). Many of pickling enterprises are small- and medium-sized. These small pickling businesses are being sifted and reorganized in the wake of not only the difficulty in finding a successor, but also a required capability to develop products based on such keywords as health consciousness, capacity to provide delicatessen, and appealing functionality, not to mention the severe quality control enforced by HACCP, etc. The company has set a goal of having a market share of 15% for the time being and will endeavor to increase the share through myriad approaches, including M&A.

In the term ending February 2020, it will expand sales of “Gohan ga Susumu Kimchi,” which will mark the 10th anniversary in October 2019 by releasing “Gohan ga Susumu Kimchi” campaign packages and premium Kimchi as well as expanding collaborative products. By doing so, it plans to raise sales from the product line by 7.1% year on year to 7.8 billion yen.

As for asazuke lightly pickled vegetables, it will focus on developing regular items available through the year and new seasonal products, and redeveloping the existing items and low-salt products.

Gohan ga Susumu PREMIUM

| The premium Kimchi for commemorating the 10th anniversary of the “Gohan ga Susumu” brand.

A premium Kimchi that uses luxurious scallop strings, Japanese common squid, kelp, etc., which give it a rich seafood umami flavor and an addictive pungent taste. You can enjoy it as is, as a snack with drinks, or even put it on rice. Contains the company’s own plant-based Pne-12 lactic acid bacteria.

Japanese common squid |

(Source: the company)

Delicatessen

According to the material prepared by the company (surveyed by Japan Chain Stores Association), the scale of the delicatessen market (Japanese-, Western-, and Chinese-style delicatessen, bento box meals, delicatessen such as sandwiches) stood at 1,035,700 million yen in 2018 (1,012,600 million yen in 2017). It continues expanding on the background of the rising number of one-person households, the graying population, the growing number of working women, the increasing interest in food such as health and nutritional balance, and the rising needs for simpler household chores and time saving. In this field, PICKLES CORPORATION will have to vie with such listed companies as Fujicco Co., Ltd. (sales of 64.1 billion yen, net income of 4,180 million yen), KENKO Mayonnaise Co., Ltd. (sales of 73.9 billion yen, net income of 2,290 million yen), and Ebara Foods Industry, Inc. (sales of 51.3 billion yen, net income of 1,640 million yen), and subsidiaries of listed companies, including Deria Foods Co., Ltd. (subsidiary of Kewpie Corporation) and Initio Foods Inc. (subsidiary of Nissin Food Products Co., Ltd.).

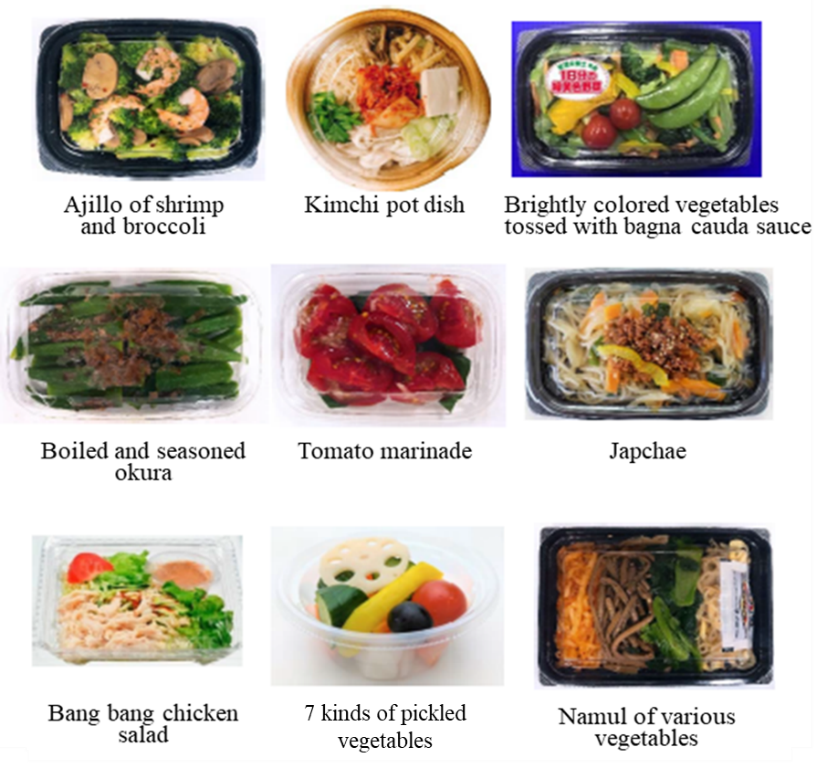

Although PICKLES CORPORATION is a new comer in the industry(in 2003), it increased sales of delicatessen from 5,756 million yen in fiscal year 2017 to 6,384 million yen in fiscal year 2018 and further to 7,382 million yen in fiscal year 2019 by focusing on mindful sales activities unique to a company that sells products directly and on delicatessen cooked mainly using vegetables that satisfy health-conscious people. The company has estimated sales for fiscal year 2020 at 8,600 million yen, with weight attached to the development of salads (such as Japanese-style salads and salad appetizers), appetizer products, and new products (warm food items).

(Taken from the reference material of the company)

Dry Products

The company will seek selling spaces at the grocery sections of supermarkets with the dried products of Food Label Co., Ltd. The company collaborated with the popular steak house IKINARI STEAK and launched “IKINARI Sauce (garlic butter) of IKINARI STEAK” and “Gyu-Kaku Nori Furikake rich in sesame aroma and a tasty salt flavor.”

“IKINARI Sauce (garlic butter) of IKINARI STEAK” is a steak sauce with rich butter flavor and the umami of garlic, a product inspired by the IKINARI STEAK taste. It is offered in user-friendly single-serving packages. It was designed to be suitable for various usages, including such leisure times as barbeques and people living alone. On the other hand, “Gyu-Kaku Nori Furikake rich in sesame aroma and a tasty salt flavor” was designed by making the already popular “Gyu-Kaku Nori flakes with Korean seasoning” into a Furikake to make it go well with rice. To make more suitable as a Furikake the company increased its saltiness and made it smaller in size for better texture. It’s expected to be used in a variety of dishes such as Bento (lunch boxes), Kaisen-Don, and Ramen.

IKINARI! STEAK IKINARI! Source(Sliced garlic and butter) | GYUKAKU Furikake Nori Salt Flavor with Sesami |

|

|

(Taken from the reference material of the company)

4-2 Expansion of sales areas

Sales in the Kanto region make up 52% of total sales. Meanwhile, sales in the Chugoku, Shikoku, Kyushu, and Okinawa regions remain 5% of total sales. Including the Kinki region, whose sales comprise 15% of total sales, the company aims to earn sales of 30% or more of the total sales in western Japan (Kinki, Chugoku and Shikoku, and Kyushu regions).

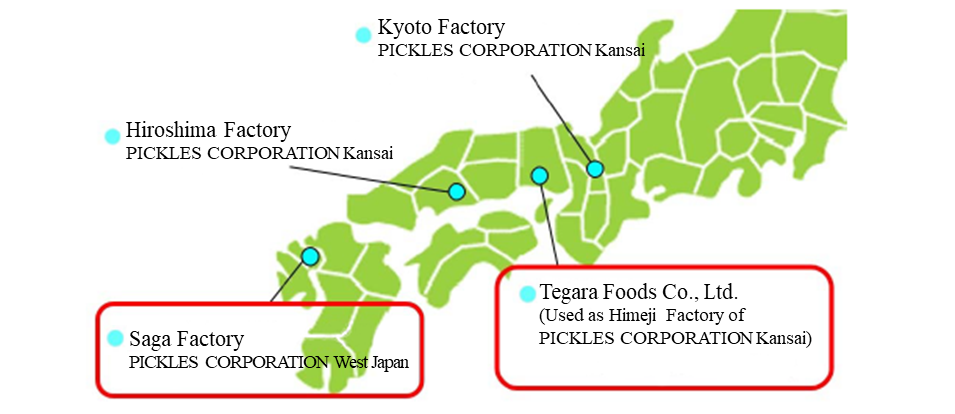

The Saga factory of PICKLES CORPORATION West Japan started operation in April 2018, and the renovation of the factory of Tegara Foods, which was acquired by the company as a subsidiary in December 2017, was completed. Both of the factories will contribute not only to the supply of products, but also to the improvement of the delivery efficiency through the elimination of the need for long-distance delivery. The profitability improvement made by the Saga factory of PICKLES CORPORATION West Japan has exceeded expectations, and the company expects to restore profitability in the term ending February 2020. Tegara Foods Co., Ltd. withdrew the unprofitable products and the spared production capacity was shifted to the Kansai and Kyoto factories of PICKLES CORPORATION West Japan, which resulted in improved profitability and it is expected to move into the black in the term ending February 2020.

| Saga Factory Address: Miyaki-cho, Miyaki-gun, Saga Sales Are Kyushu region

Tegara Foods Co., Ltd. Address: Himeji-shi, Hyogo Sales Are Kinki region |

(Taken from the reference material of the company)

4-3 New businesses

The company opened 2 e-commerce websites in April 2018, which are “Piene Online Shop” and “YAWATAYA Online Shop” as new businesses. It sells products developed using the company’s own Pne-12 lactic acid bacteria via “Piene Online Shop” and offers authentic Japanese-style pickles, which are produced based on an absolute commitment to using ingredients cultivated in Japan and not adding synthetic seasonings, on “YAWATAYA Online Shop.” The company completed the construction of a factory for products related to the Pne-12 lactic acid bacteria in April 2019 and began shipment of products in June 2019. Thanks to this factory, Kouji Amazake products, etc., which used to be refrigerated products, can now be handled at room temperature.

Moreover, OH Co., Ltd., the company established in March 2019 as a subsidiary, will begin a restaurant and retail business by opening a theme park promoting fermentation and health, “OH!!! Magic of Fermentation, Health, and Food” in the spring of 2020 (Hanno City, Saitama Prefecture). It will start full-fledged operation in the term ending February 2021.

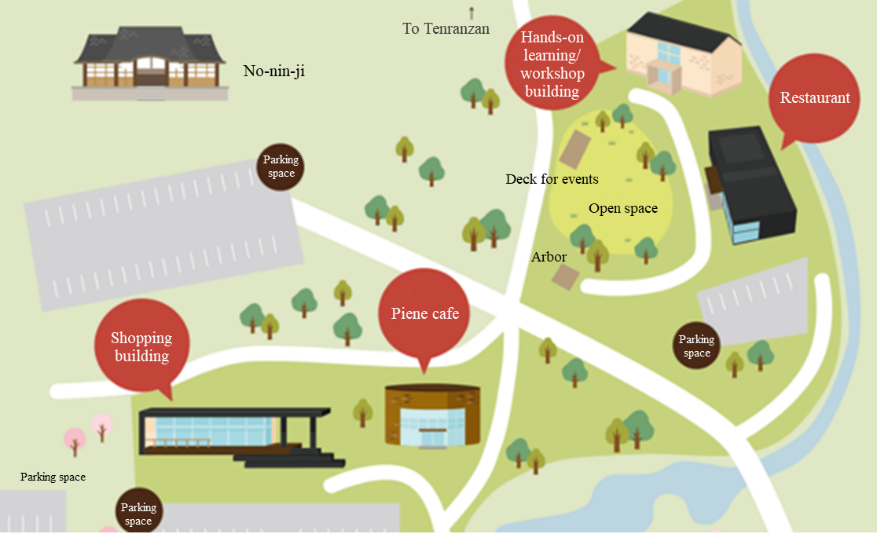

This is a B to C business that can also serve as an enlightenment activity on fermented food items, and the company expects support from Hanno City. The company plans to construct 4 buildings, including one for shopping, one for a restaurant, one for a café where visitors can enjoy Piene-related food menus, and one for hands-on learning and workshops, in part of the premise of the “No-nin-ji,” a temple of Soto School of Zen Buddhism with a sango title of Buyosan, which was a leading figure that received a stamp for its 50 koku of rice production as the main temple of 20 branch temples in Hanno region in the Edo period.(A groundbreaking ceremony was held on August 23, 2019)。The company also plans to make capital investment of 700 million yen in fiscal 2021, expecting that the number of visitors will be nearly 300,000 per year and sales will reach 700 million yen.

Hanno City successfully invited the theme park of Moomin, “Metsa,” making it the world’s first Moomin theme park in a country other than its home country, Finland. The city opened “Metsa Village” where visitors can experience the life in Northern Europe in November 2018 and “Moomin Valley Park” at which people can feel the world of Moomin in March 2019.(About 10 minutes by car from “OH!!! Magic of Fermentation, Health, and Food”)

(Taken from the reference material of the company)

4-4 Advertisement activities

As a TV commercial character, the company chose Mr. Hanawa, a solo entertainer (belonging to K DASH Stage), who not only appears in TV programs, but also writes songs, composes music, and serves as a music producer, and produced a commercial for commemorating the 10th anniversary of release of Gohan ga Susumu, titled “10th Anniversary of Gohan ga Susumu,” and a corporate brand commercial titled “Vegetable Field and the Rising Sun” (on-air from September 21). On September 17, the TV commercials and behind-the-scenes videos were uploaded to YouTube.

Product CM “10th Anniversary of Gohan ga Susumu” https://www.youtube.com/watch?v=9-Ft7n3wIV4

Corporate brand CM “Vegetable Field and the Rising Sun” https://www.youtube.com/watch?v=hjitnvTABKk

In addition, the company planned collaborative products, including “Gohan ga Susumu Soup for Kimchi Pot” (Yamasa Corporation: released on August 15), “Fried Domestic Chicken Flavored with Tasty Kimchi” (TableMark: released on September 1), and “Kaki-no-tane Gohan ga Susumu Flavored with Kimchi” (Abeko-Seika Co., Ltd.: released on October 7). While striving to popularize the “Gohan ga Susumu” brand, the company released the package for commemorating the 10th anniversary of “Gohan ga Susumu Kimchi.”

The company will continue advertisement activities, including TV and radio commercials, outdoor signboards (MetLife Dome), SNS campaigns, and wrap advertising.

4-5 Efforts at production

The company is propelling forward adoption of energy-saving machines, such as automatic packaging machines and automatic weighing machines, in order to deal with labor shortages and cut reduction of employment costs. In addition, it will reconsider the process of procuring vegetables (such as procurement activities in each region) and materials (reducing the weight of packages and changing film thickness). Also, it will reconsider the facilities to which it outsources the treatment of industrial waste. As for changing film thickness, using thinner films for “Gohan ga Susumu Kimchi” is expected to reduce the annual amount of plastic usage by about 4 tons (streamlining costs and reducing the impact on the environment.)Taking into account how to secure human resources, the company will endeavor to enrich the welfare and personnel systems.

【Medium-Term Management Plan】

| FY 2/ 20 Est. | Ratio to sales | YoY | FY 2/ 21 Plan | Ratio to sales | YoY | FY 2/ 22 Plan | Ratio to sales | YoY |

Sales | 42.716 | 100.0% | +5.0% | 45,110 | 100.0% | +5.6% | 46,541 | 100.0% | +3.2% |

COGS | 32.235 | 75.5% | +3.8% | 33,643 | 74.6% | +4.4% | 34,665 | 74.5% | +3.0% |

Gross profit | 10.481 | 24.5% | +9.0% | 11,467 | 25.4% | +9.4 | 11,876 | 25.5% | +3.6% |

SG&A | 8,628 | 20.2% | +5.2% | 9,797 | 21.7% | +13.5% | 10,099 | 21.7% | +3.1% |

Operating Income | 1,853 | 4.3% | +31.4% | 1,670 | 3.7% | -9.9% | 1,777 | 3.8% | +6.4% |

Ordinary Income | 1,996 | 4.7% | +27.8% | 1,842 | 4.1% | -7.7% | 1,955 | 4.2% | +6.1% |

Net Income | 1,312 | 3.1% | +42.5% | 1,164 | 2.6% | -11.3% | 1,248 | 2.7% | +7.2% |

* Unit: million yen

The company plans to increase the number of sales partners, expand sales areas, and enrich the range of products that it sells through the capability of product development, utilization of the manufacturing and logistics systems and vendor function that cover all the regions of Japan, efforts to ensure food quality and safety and environmental preservation activities, development of new businesses, and agile response to M&A, all of which are its strengths and characteristics.

The company has set its goal for sales and profit as mentioned above. However, the estimated profits in FY 2/20 is expected to exceed those of FY 2/21 due to the upward modification of the earning forecast in FY 2/20. The company will reconsider the plan regarding FY 2/21 and later terms. In terms of medium-term management plan, it expects that sales from delicatessen will grow 26.0% by the term ending February 2022, and those from asazuke lightly pickled vegetables and kimchi will also increase 14.1%, respectively. As a fermentation and health theme park, “OH!!! Magic of Fermentation, Health, and Food,” will be opened in early 2020, SG&A expenses will rise in and after the term ending February 2021 due mainly to an increase in personnel cost; however, the company will be able to achieve a steady profit rise by offsetting this growth of cost.

Sales by Food Item

| FY 2/ 19 Act. | Ratio to sales | FY 2/ 22 Plan | Ratio to sales | Compared to FY 2/ 19 | |

Product | Asazuke pickles/kimchi | 16,420 | 40.4% | 18,736 | 40.3% | +14.1% |

Delicatessen | 7,382 | 18.1% | 9,300 | 20.0% | +26.0% | |

Old pickled vegetables | 854 | 2.1% | 855 | 1.8% | +0.1% | |

Product (pickles) | 16,012 | 39.4% | 16,900 | 36.3% | +5.5% | |

Restaurant/retail | - | - | 750 | 1.6% | - | |

Total | 40,670 | 100.0% | 46,541 | 100.0% | +14.4% | |

* Unit: million yen

Capital investment

The company plans to make capital investment of 1,444 million yen in a construction of a factory for products related to the Pne-12 lactic acid bacteria and equipment upgrade at the existing factories in the term ending February 2020, therefore it has taken into consideration a depreciation expense of 652 million yen in the earnings estimate. For fiscal year 2021, it will also make capital investment amounting to 1,731 million yen in the facility of a subsidiary, OH Co., Ltd., expansion of Chukyo Factory, and equipment upgrade at the existing factories, estimating a depreciation expense at 656 million yen. For fiscal year 2022, it is scheduled to make capital investment of 1 billion yen in equipment upgrade at the existing factories and has estimated that a depreciation expense will stand at 636 million yen; however, the company will flexibly make capital investment and perform M&A depending on the situation.

5. Conclusions

The performance of the company is affected by the growth status of vegetables, so the full-year earnings forecast is conservative. In addition, they seem to think that the consumption tax hike has weakened overall consumption, which made the outlook for the second half conservative. Therefore, the company will increase advertisement expenses, and implement the campaign for commemorating the 10th anniversary of release of “Gohan ga Susumu Kimchi.” In the case of the company, there is significant room for expanding its market share in western Japan, so the development of networks for production and sale is progressing steadily. As the company succeeded in meeting the demand for ready-made meals with its delicatessen utilizing the strengths of its vegetables, the mid-term outlook is bright. Accordingly, it is unnecessary to fret over the results for every fiscal year.

The expected factors for growth acceleration are the restaurant and retail businesses at OH!!! Magic of Fermentation, Health, and Food, a theme park promoting fermentation and health, which will be opened in the spring of 2020. Through the operation of the theme park, the company hopes to increase its popularity and then strengthen its EC and open shops in department stores, etc. Their future progress is noteworthy.

Reference: Regarding Corporate Governance

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 7directors, including 2 from outside |

Auditors | 4directors, including 3 from outside |

◎Corporate Governance Report (Updated on May. 31, 2019)

Basic Policy

Our company considers corporate governance to be the important issue of business management for acting in conformity with the law and social norms, realizing the management policies, and achieving continuous growth.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4. Strategically held shares】

In principle, our company does not possess shares of any listed companies; however, if we have decided to hold shares of a listed company for a reasonable managerial purpose for maintaining and strengthening a transaction partnership, we will regularly check that we hold the shares in a manner to fulfill the purpose. We will consider how to verify the appropriateness of holding strategically held shares of individual companies and how to disclose the details of the verification. We will make judgment on whether or not we should exercise the voting rights of the strategically held shares of individual listed companies, and exercise the voting rights when necessary after comprehensively judging if doing so contributes to medium- and long-term improvement of the value of our company and the corporations in which we have invested.

【Supplementary Principle 4-10-1】

Our company appoints 2 independent outside directors, and they give opinions from the independent, objective standpoint at meetings of the board of directors, etc. so that our management supervision system is highly effective, but we do not have an independent advisory committee. From now on, we will discuss the establishment of independent advisory committees, such as nomination and remuneration committees, who are composed of mainly independent outside directors, under the board of directors.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 5-1. Policy for promoting constructive dialogue with shareholders】

Our company endeavors to expeditiously disclose information on the basis of transparency, fairness, and continuity so that shareholders and investors can correctly understand our company. We strive to disclose information in accordance with the associated laws and regulations, such as Financial Instruments and Exchange Act, and the rules on timely disclosure stipulated by the financial instruments exchange, and disclose information that we have judged to be useful for shareholders and investors to have a better idea of our company in a more proactive manner through an appropriate method.

Specifically, we hold financial results briefings twice a year and explanatory meetings for individual investors as necessary, and the president and the public and investor relations division deal with individual interviews as much as possible. In addition, we have established the public and investor relations division as a department responsible for investor relations activities, and posted our disclosure policy on our website.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved |