Bridge Report:(2925)PICKLES the second quarter of the Fiscal year ending February 2021

President Masahiro Miyamoto | PICKLES CORPORATION (2925) |

|

Corporate Information

Stock Exchange | TSE 1st Section |

Industry | Food products (manufacturing) |

Representative | Masahiro Miyamoto |

Address | 7-8, Higashisumiyoshi, Tokorozawa-shi, Saitama |

Accounting term | February |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥3,125 | 6,397,707 shares | ¥19,992 million | 10.4% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥30.00 | 1.0% | ¥250.09 | 12.5x | ¥2,017.79 | 1.5x |

*Share price is as of closing on October 9. Number of shares outstanding is as of the end of the most recent quarter, and does not include treasury shares. ROE and BPS are based on the previous term.

Consolidated Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Profit Attributable to Owners of Parent | EPS | DPS |

February 2017 Act. | 35,801 | 780 | 867 | 548 | 105.63 | 22.00 |

February 2018 Act. | 37,616 | 1,131 | 1,233 | 872 | 144.81 | 25.00 |

February 2019 Act. | 40,670 | 1,409 | 1,561 | 920 | 143.88 | 28.00 |

February 2020 Act. | 41,417 | 1,871 | 1,973 | 1,290 | 201.67 | 30.00 |

February 2021 Est. | 45,000 | 2,300 | 2,400 | 1,600 | 250.09 | 30.00 |

*The estimated values were provided by the company. Unit: Million-yen, yen

This Bridge Report presents PICKLES CORPORATION’s overview of the financial results for the second quarter of the Fiscal year ending February 2021 and describes the earnings forecast for the term ending February 2021.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of the Fiscal Year ending February 2021 Earnings Results

3. Fiscal Year ending February 2021 Earnings Forecasts

4. External environment and main measures for the future

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of the term ending February 2021, sales and operating income increased 13.3% and 28.6%, respectively, year on year. As people started having meals at home more frequently due to the voluntary restraint of going out, and the demand for kimchi as a product including lactic acid bacteria grew because people became more health-conscious, the sales of original products rose 16.7% year on year, and the sales of purchased products such as pickles, seasonings increased 7.5% year on year. As for profit, the effect of the skyrocketing of prices of vegetables as ingredients caused by the unfavorable weather was offset by the growth of sales and the streamlining of production processes for coping with the novel coronavirus through the integration of production items for reducing working hours, etc.

- According to the full-year forecast revised upwardly considering the results in the first half, sales and operating income are estimated to grow 8.7% and 22.9%, respectively, year on year. While the sales of original products are projected to increase 13.2% year on year, the sales of purchased products are forecasted to grow 0.6% year on year in a healthy manner. As for profit, the prices of vegetables as ingredients have been conservatively estimated, and expenses for launching the theme park for fermentation, OH!!!— Fermentation, health, magic of food!!!— (hereinafter referred to as “OH!!!”), which will operate restaurant and retail businesses (to be opened on October 16, 2020) have been taken into account, but they are expected to be offset by sales growth, etc. The term-end dividend is to be 30 yen/share.

- The coronavirus crisis generated the demand from people staying home in the food product industry, and for the company, it also induced the streamlining of the production processes. In detail, the company integrated production items for the purpose of reducing working hours, etc. as measures for coping with the novel coronavirus, and succeeded in improving profitability while the prices of vegetables as ingredients rose steeply. They plan to continue such efforts, along with cost reduction and measures for dealing with the shortage of workforce, including the installation of labor-saving machinery and the revision of product specs. These are expected to strengthen their competitiveness. In the next term, we would like to pay attention to the progress of the OH!!! business, whose real value will be tested, and the outcomes of their efforts.

1. Company Overview

PICKLES CORPORATION engages in production and sale of asazuke lightly pickled vegetables, kimchi, and delicatessen, and procurement and sale of Japanese-style pickles through a nationwide production and sales network that it has built up in cooperation with its 17 consolidated subsidiaries, including PICKLES CORPORATION Sapporo, PICKLES CORPORATION Kansai, and Food Label Co., Ltd., and 3 affiliated companies accounted for by the equity method. The theme color of the company, green, represents freshness under a slogan of “We deliver the vitality of vegetables.” The company’s own products are produced using vegetables grown and harvested mainly in Japan by contracted farmers so that their traceability is ensured (about 80% of the vegetables used are supplied by contracted farmers), and no preservatives or synthesized food colorings are used. Furthermore, the company has displayed “an absolute commitment to food safety” at its production sites as demonstrated by such endeavors as thorough temperature control at the factories, checkups of the clothes and health of all the employees before they enter the factories, devotion to the 5S activities (5S represents sorting, setting-in-order, shining, standardizing, and sustaining the discipline) and acquisition of the certification of FSSC22000 and JFS-B.

By product, sales from the products (produced at the company’s own factories) accounted for 63.9% (41.8% from asazuke lightly pickled vegetables and kimchi products, 20.1% from delicatessen, and 2.0% from Furuzuke old pickled vegetables), and those from products such as Japanese-style pickles, including the products of a consolidated subsidiary, Food Label, made up 36.1% (produced at factories other than the company’s own ones) in the term ended February 2020. By sales channel, sales at mass retailers and wholesalers made up 74.9%, those at convenience stores accounted for 15.9%, and those through other distributors accounted for 9.2%.

【Corporate Philosophy】

PICKLES CORPORATION’s philosophy is “We deliver tasty and safe foods to consumers and aim at eco-conscious corporate management.” Under the corporate philosophy, it is pursuing the following management policies: (1) quality control for producing safe and delicious food products, (2) environmentally friendly corporate management, and (3) arrangement of a working environment that puts instillation of morals and the principle of safety and health first. Following these policies, the company is working on standards for food safety, including FSSC22000 and JFS-B, and international standards for environmental control such as ISO14001. In addition, it focuses on training and education of its employees through various approaches, such as enrichment of the personnel system and education programs. PICKLES CORPORATION would like to maintain its fundamental attitude as a food company, which is provision of “safe and quality” foods, in order to earn trust of consumers and contribute to society by being devoted to corporate activities on the basis of these policies.

2. Second quarter of the Fiscal year ending February 2021 Earning Results

2-1 Consolidated Business Results

| First half of FY2/20 | Ratio to sales | First half of FY2/21 | Ratio to sales | YoY | Initial estimate | Estimate comparison |

Net Sales | 21,537 | 100.0% | 24,398 | 100.0% | +13.3% | 22,324 | +9.3% |

Gross profit | 5,665 | 26.3% | 6,455 | 26.4% | +13.9% |

|

|

SG&A expenses | 4,274 | 19.8% | 4,666 | 19.1% | +9.2% |

|

|

Operating income | 1,391 | 6.5% | 1,788 | 7.3% | +28.6% | 1,440 | +24.1% |

Ordinary income | 1,475 | 6.9% | 1,854 | 7.6% | +25.6% | 1,508 | +22.9% |

Profit attributable to owners of parent | 1,007 | 4.7% | 1,293 | 5.3% | +28.3% | 1,008 | +28.2% |

* Unit: million yen

Sales and operating income grew 13.3% and 28.6%, respectively, year on year.

Sales grew 13.3% year on year to 24,398 million yen. As people started having meals at home more frequently due to the voluntary restraint of going out caused by the coronavirus crisis, and the demand for kimchi as a product including lactic acid bacteria grew because people became more health-conscious, the sales of original products rose 16.7% year on year to 15,902 million yen, and the sales of purchased products such as pickles, seasonings increased 7.5% year on year to 8,496 million yen.

Operating income rose 28.6% year on year to 1,788 million yen. The effect of the skyrocketing of prices of vegetables as ingredients caused by the unfavorable weather was offset by the growth of sales, and the streamlining of production processes as measures for coping with the novel coronavirus through the integration of production items for reducing working hours, etc.

Sales by Food Item and sales channel (YoY)

| First half of FY2/20 | Ratio to sales | First half of FY2/21 | Ratio to sales | YoY |

Asazuke lightly pickled vegetables /kimchi | 8,656 | 40.2% | 10,488 | 43.0% | +21.8% |

Delicatessen | 4,544 | 21.1% | 5,002 | 20.5% | +10.1% |

Furuzuke old pickled vegetables | 431 | 2.0% | 412 | 1.7% | -4.3% |

Product (above totals) | 13,631 | 63.3% | 15,902 | 65.2% | +16.7% |

Product (pickles, fruits and vegetables, etc.) | 7,906 | 36.7% | 8,496 | 34.8% | +7.5% |

Total | 21,537 | 100.0% | 24,398 | 100.0% | +13.3% |

* Unit: million yen

| First half of FY2/20 | Ratio to sales | First half of FY2/21 | Ratio to sales | YoY |

Mass retailers/wholesalers | 16,262 | 75.5% | 18,333 | 75.1% | +12.7% |

Convenience stores | 3,346 | 15.5% | 4,171 | 17.1% | +24.7% |

Restaurants/others | 1,929 | 9.0% | 1,893 | 7.8% | -1.8% |

Total | 21,537 | 100.0% | 24,398 | 100.0% | +13.3% |

* Unit: million yen

As for the performance of each item, the sales of both original and purchased products increased, thanks to the growth of demand from people staying home and the demand for kimchi as people became more health-conscious. As for the performance of each sales channel, the sales of products for restaurants declined 1.8% year on year, due to the drop in sales in the restaurant industry, but the sales of products for mass retailers, wholesalers, etc. ,which is their mainstay, rose 12.7% year on year and the sales of products for convenience stores increased 24.7% year on year, thanks to the growth of demand from people staying home. The company analyzed that there are two factors in the increase of sales for convenience stores, which is (1) the products of Pickles Corporation are mostly consumed at home and, (2) the favorable sales of cup-type delicatessen for convenience stores due to the effects of in-store campaigns.

Variations in gross profit margin and prices of vegetables

The price of Chinese cabbage skyrocketed, due to the growth of demand for Chinese cabbage in the wake of consumption by people staying home in April and May and the delay in growing of Chinese cabbage in its main production area, Ibaraki Prefecture, caused by the low temperatures in the spring. Its high price was seen in August too, due to insufficient growth of Chinese cabbage in its main production area, Nagano Prefecture, due to the lack of sunshine in July, and the intense heat in August.

The price of cucumbers rose around August compared to last year, in its main production area, Fukushima Prefecture, Iwate Prefecture, etc., due to the lack of sunshine in July.

Changes in Chinese cabbage and cucumber prices (FY 2/17 = 100)

| First half of FY2/17 | First half of FY2/18 | First half of FY2/19 | First half of FY2/20 | First half of FY2/21 |

Chinese cabbages | 100 | 115 | 108 | 97 | 132 |

Cucumbers | 100 | 92 | 101 | 94 | 99 |

Gross profit margin | 23.2% | 23.8% | 23.8% | 26.3% | 26.5% |

*Based on the company’s documents

Monthly changes in Chinese cabbage and cucumber prices (the same month of the previous year = 100)

| March | April | May | June | July | August |

Chinese cabbages | 113 | 201 | 151 | 111 | 101 | 133 |

Cucumbers | 105 | 114 | 103 | 96 | 102 | 121 |

*Based on the company’s documents

Breakdown of SG&A Expenses

| First half of FY2/20 | Ratio to sales | First half of FY2/21 | Ratio to sales | YoY |

Logistics cost | 2,167 | 10.1% | 2,449 | 10.0% | +13.1% |

Personnel cost | 1,261 | 5.8% | 1,378 | 5.7% | +9.3% |

Advertising cost | 62 | 0.3% | 77 | 0.3% | +25.1% |

Others | 783 | 3.6% | 760 | 3.1% | -3.0% |

Total SG&A expenses | 4,274 | 19.8% | 4,666 | 19.1% | +9.2% |

* Unit: million yen

2-2 Financial Conditions and Cash Flow

Financial conditions

| Feb.20 | Aug.20 |

| Feb.20 | Aug.20 |

Cash | 3,309 | 5,670 | Payables | 3,484 | 4,213 |

Receivables | 4,998 | 5,420 | ST Interest-Bearing Liabilities | 2,439 | 3,789 |

Inventories | 621 | 713 | Current liabilities | 8,444 | 11,238 |

Current Assets | 8,990 | 11,882 | LT Interest-Bearing Liabilities | 1,857 | 1,470 |

Tangible Assets | 13,661 | 14,282 | Noncurrent liabilities | 2,810 | 2,381 |

Intangible Assets | 733 | 682 | Net Assets | 13,016 | 14,160 |

Investments and Others | 885 | 933 | Total Liabilities and Net Assets | 24,271 | 27,781 |

Noncurrent Assets | 15,280 | 15,898 | Total Interest-Bearing Liabilities | 4,297 | 5,259 |

* Unit: million yen

The total assets as of the end of the second quarter stood at 27,781 million yen, up 3,509 million yen from the end of the previous term. While cash grew through the increase of short-term debts for securing liquidity amid the coronavirus crisis, receivables increased due to the growth of sales. Tangible assets (buildings and structures) increased, through the installation of in-store equipment, etc. for OH!!! which operates restaurant and retail businesses (location: Hanno City, Saitama Prefecture). In the section of liabilities and net assets, interest-bearing liabilities, including short-term debts, augmented, and net assets rose. Capital-to-asset ratio was 50.5% (53.2% at the end of the previous term).

Cash flows (CF)

| First half of FY2/20 | First half of FY2/21 | YoY | |

Operating cash flow(A) | 1,454 | 1,915 | +461 | +31.7% |

Investing cash flow (B) | -1,132 | -286 | +846 | - |

Free Cash Flow(A+B) | 322 | 1,629 | +1,307 | +405.9% |

Financing cash flow | 170 | 731 | 561 | +330.0% |

Cash and Equivalents at the end of term | 3,328 | 5,670 | +2,342 | +70.4% |

* Unit: million yen

The company secured an operating CF of 1,915 million yen (2,303 million yen in the previous term), as pretax profit was 1,856 million yen and depreciation was 437 million yen. Investing CF was negative 286 million yen (negative 1,777 million yen in the previous term) as the company paid 237 million yen for acquiring tangible assets for OH!!!, etc., while financing CF was 731 million yen (negative 52 million yen in the previous term), as short-term borrowings amounted to 1 billion yen. As a result, the balance of cash, etc. as of the end of the second quarter stood at 5,670 million yen, up 2,361 million yen from the end of the previous term.

3. Fiscal Year ending February 2021 Earnings Forecasts

3-1 Full-year Business Results

| FY 2/ 20 Act. | Ratio to sales | FY 2/ 21 Est. | Ratio to sales | YoY | 2Q Act. | Rate of progress |

Sales | 41,417 | 100.0% | 45,000 | 100.0% | +8.7% | 24,398 | 54.2 |

Gross profit | 10,560 | 25.5% | 11,425 | 25.4% | +8.2% | 6,455 | - |

SG&A | 8,688 | 21.0% | 9,124 | 20.3% | +5.0% | 4,666 | - |

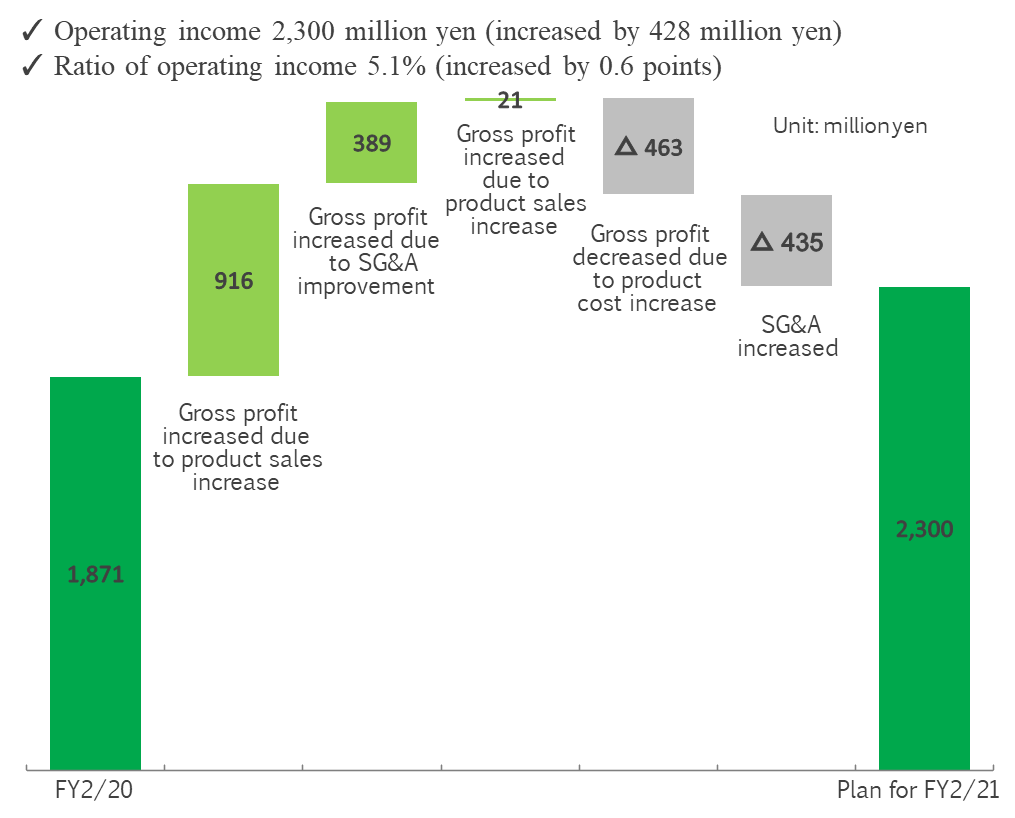

Operating Income | 1,871 | 4.5% | 2,300 | 5.1% | +22.9% | 1,788 | 77.7 |

Ordinary Income | 1,973 | 4.8% | 2,400 | 5.3% | +21.7% | 1,854 | 77.2 |

Net Income | 1,290 | 3.1% | 1,600 | 3.6% | +24.0% | 1,293 | 80.8 |

* Unit: million yen

Sales and operating income are estimated to grow 8.7% and 22.9%, respectively, year on year

Considering the results in the first half, the company revised the full-year forecast upwardly, but for the forecast of the second half, the estimate of sales was slightly decreased, because the demand for people staying home subsided and there remain uncertainties, while the estimates of profits were slightly increased. Sales are projected to grow 8.7% year on year to 45 billion yen. In detail, the sales of original products are estimated to increase 13.2% year on year to 29,954 million yen, and the sales of purchased products are forecasted to rise 0.6% year on year to 15,045 million yen. Operating income is projected to grow 22.9% year on year to 2.3 billion yen. The prices of vegetables as ingredients in the second half were conservatively estimated, and the costs for launching the new business OH!!! were taken into account, but the augmentation of expenses will be offset by sales growth, etc.

The company plans to pay a term-end dividend of 30 yen/share.

Sales by Food Item (YoY)

| FY 2/ 20 Act. | Composition ratio | FY 2/ 21 Est. | Composition ratio | YoY |

Asazuke lightly pickled vegetables /kimchi | 17,308 | 41.8% | 20,129 | 44.7% | +16.3% |

Delicatessen | 8,321 | 20.1% | 9,039 | 20.1% | +8.6% |

Furuzuke old pickled vegetables | 831 | 2.0% | 786 | 1.7% | -5.4% |

Product (above total) | 26,462 | 63.9% | 29,954 | 66.6% | +13.2% |

Product (pickles, fruits and vegetables, etc.) | 14,955 | 36.1% | 15,045 | 33.4% | +0.6% |

Total | 41,417 | 100.0% | 45,000 | 100.0% | +8.7% |

* Unit: million yen

Sales by Sales Channel (YoY)

| FY 2/ 20 Act. | Composition ratio | FY 2/ 21 Est. | Composition ratio | YoY |

Mass retailers/wholesalers | 31,030 | 74.9% | 33,645 | 74.8% | +8.4% |

Convenience stores | 6,587 | 15.9% | 7,595 | 16.9% | +15.3% |

Restaurants/others | 3,799 | 9.2% | 3,760 | 8.3% | -1.0% |

Total | 41,417 | 100.0% | 45,000 | 100.0% | +8.7% |

* Unit: million yen

The factors for fluctuation of consolidated operation income (YoY)

(Source: the company)

Breakdown of SG&A Expenses

| FY 2/ 20 Act. | Composition ratio | FY 2/ 21 Est. | Composition ratio | YoY |

Logistics cost | 4,248 | 10.3% | 4,556 | 10.1% | +7.2% |

Personnel cost | 2,630 | 6.3% | 2,833 | 6.3% | +7.7% |

Advertising cost | 326 | 0.8% | 286 | 0.7% | -12.2% |

Others | 1,483 | 3.6% | 1,447 | 3.2% | -2.4% |

Total SG&A expenses | 8,688 | 21.0% | 9,124 | 20.3% | +5.0% |

* Unit: million yen

4. External environment and main measures for the future

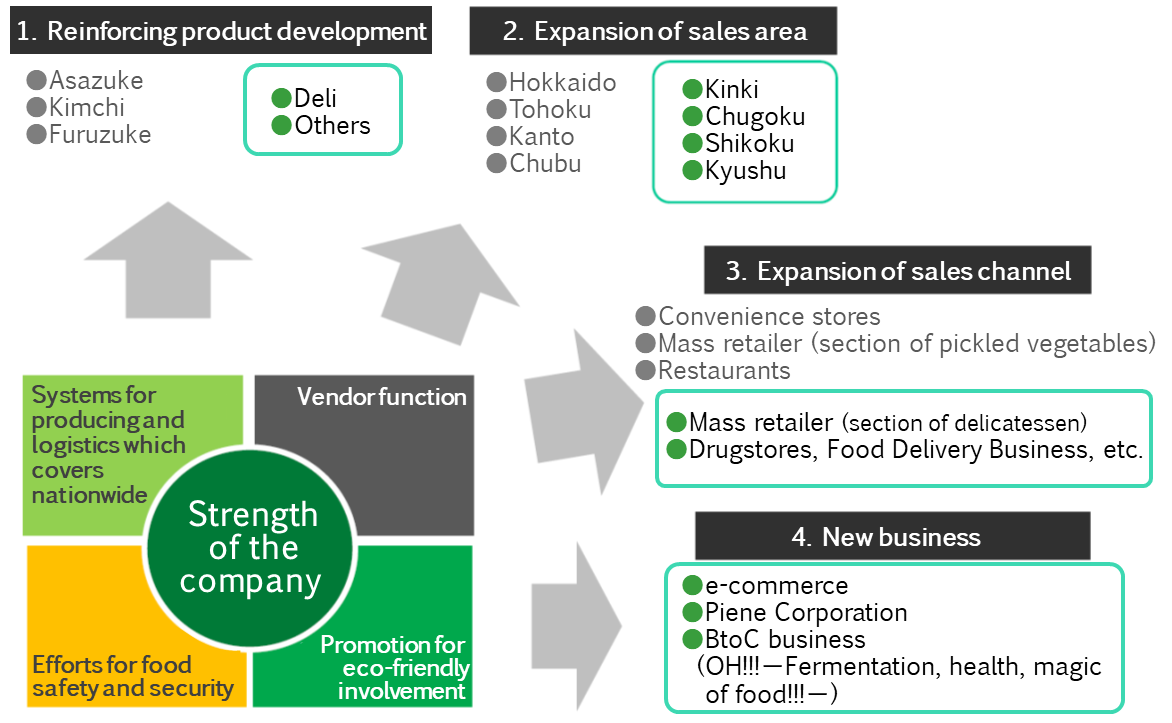

4-1 future strategies

(Source: the company)

As for product development, the company will reinforce the development of delicatessen products while forging ahead with the development of new products which will become its new pillar. As for the sales area, it will enhance sales promotion in Kinki, Chugoku/Shikoku, and Kyushu regions by making the most of the production increase at Saga Factory and Tegara Foods. As for clients, in addition to the pickles sections in convenience stores and supermarkets where the products are now sold, the company will concentrate on enhancing sales at supermarket delicatessen sections and seek new clients such as drugstores. Concerning new businesses, while engaging in expansion of the sales at their e-commerce sites, they will open OH!!!, which is focused on restaurant and retail businesses for mainly fermented food products, on October 16, 2020.

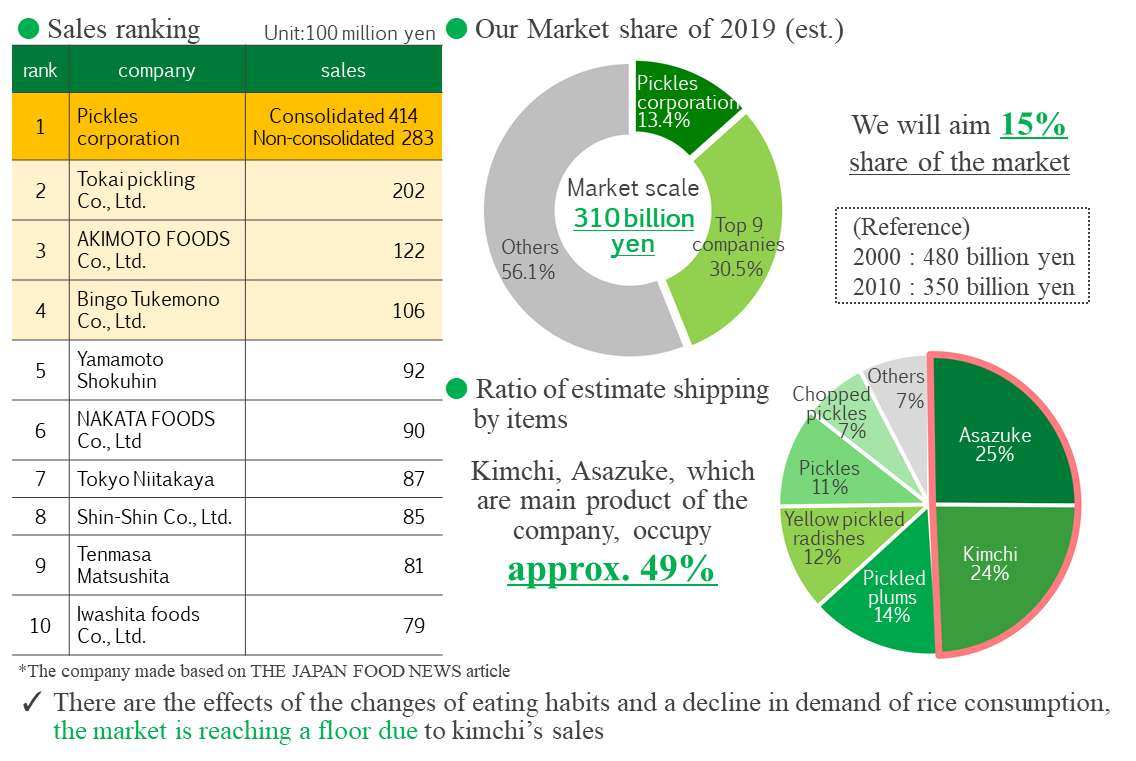

4-2 Asazuke lightly pickled vegetables and kimchi

(Source: the company)

The scale of the pickles market was 310 billion yen in 2019 (according to the estimate by the company). The scale of the pickles market keeps diminishing after its peak of 500 billion yen in 1998, caused by the shrinkage of rice consumption due to diversifying eating habits, declining birth rate, aging population, etc. In addition, many enterprises in the pickles industry are micro-, small- or medium-sized. These businesses are failing to survive and being reorganized not only due to the difficulty in finding a successor, but also due to the lack of the capability to meet strict quality control standards and develop products meeting the needs for such as health consciousness, capacity to provide delicatessen and appealing functionality. The company currently holds the top market share of 13.4% and has set a goal of reaching 15% for the time being. It plans to forge ahead with the development of products with an additional value addressing health consciousness and functionality, while flexibly engaging in M&A as well.

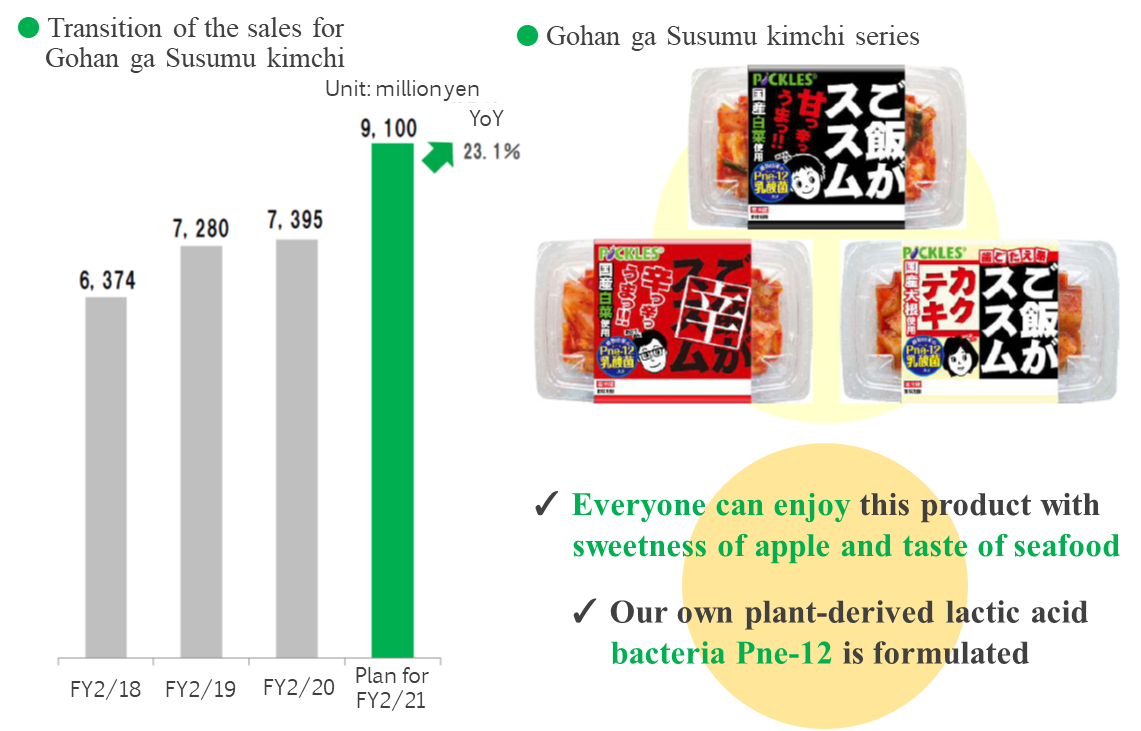

Product development: kimchi products

(Source: the company)

The market of fermented food products, such as yogurt, natto (fermented soybeans), and kimchi, has been expanding on the background of the increase in demand from people staying home and health consciousness. The company also expects a great growth in the sales of products related to Gohan ga Susumu Kimchi (kimchi that goes well with rice) in the term ending February 2021, up 23.1% year on year to 9.1 billion yen.

The company continues to expand its product lineup through myriad approaches, and in March of this year, it released Gohan ga Susumu Kimchi: two packs of single serving, to meet the needs for eating alone. In addition, it is also putting efforts into Local Kimchi products, utilizing its strong point of operating 20 branch offices across the whole country from Hokkaido to Kyushu. These products include kimchi with salmon sold in Hokkaido area and Gohan ga Susumu: Senmai kimchi sold in Kansai area, based on senmaizuke pickled sliced radishes.

(Source: the company)

4-3 Delicatessen

(Source: the company)

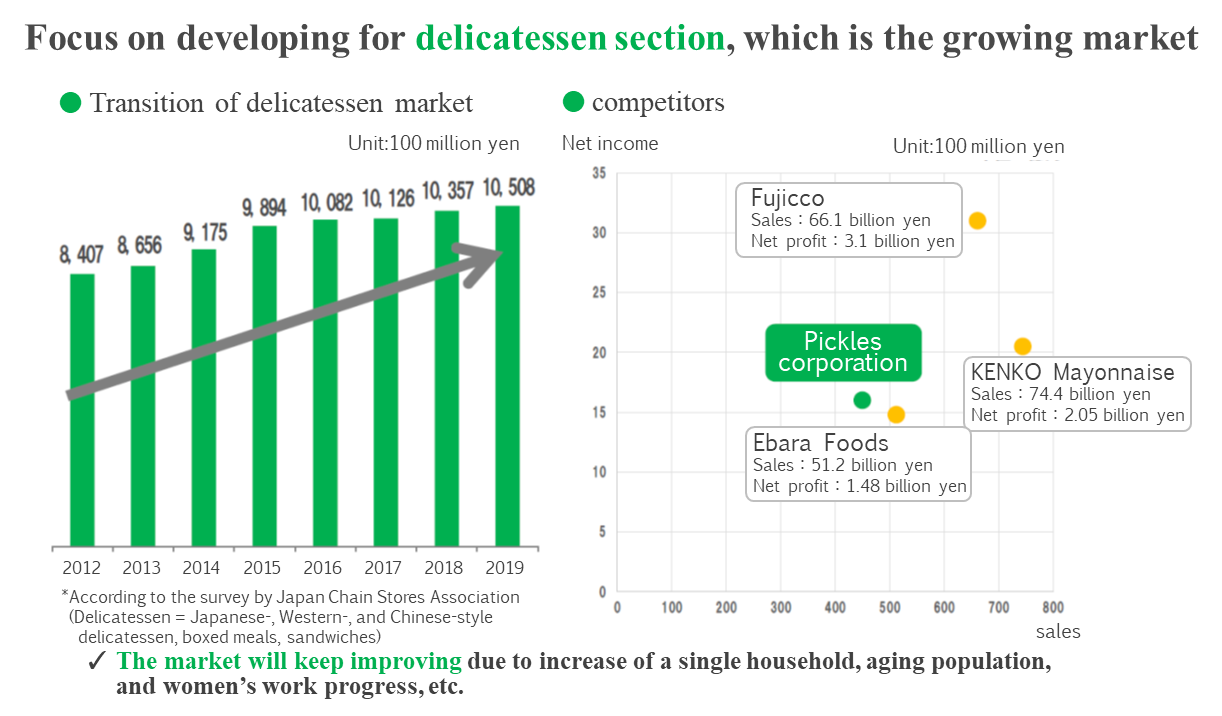

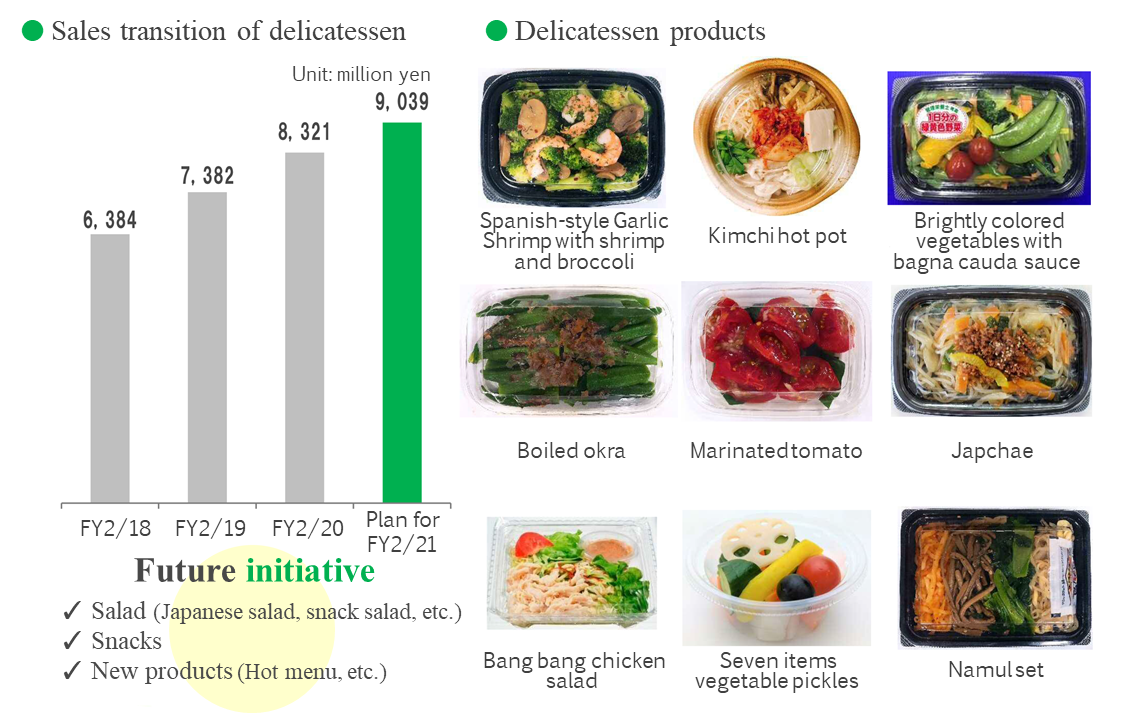

According to the material prepared by the company (surveyed by Japan Chain Stores Association), the scale of the delicatessen market (dealing delicatessen such as Japanese-, Western-, and Chinese-style delicatessen, boxed meals, sandwiches) stood at 1,050.8 billion yen in 2019 (1,035.7 billion yen in 2018). It continues to expand, reflecting the growing number of one-person households, aging population, rising number of working women, increasing interest in food from the viewpoint of health and nutritional balance, and needs for simplifying and saving time of household chores. However, in the delicatessen industry, large corporations such as Fujicco, KENKO Mayonnaise, and Ebara Foods Industry exist contrary to the pickles industry. The company has been successful in achieving differentiation through concentrating mainly on vegetable delicatessen products, which allow it to utilize its forte, the ability to procure and process vegetables. The sales in the term ending February 2021 are expected to rise 8.6% year on year to 9,039 million yen.

(Source: the company

4-4 dry products

(Source: the company)

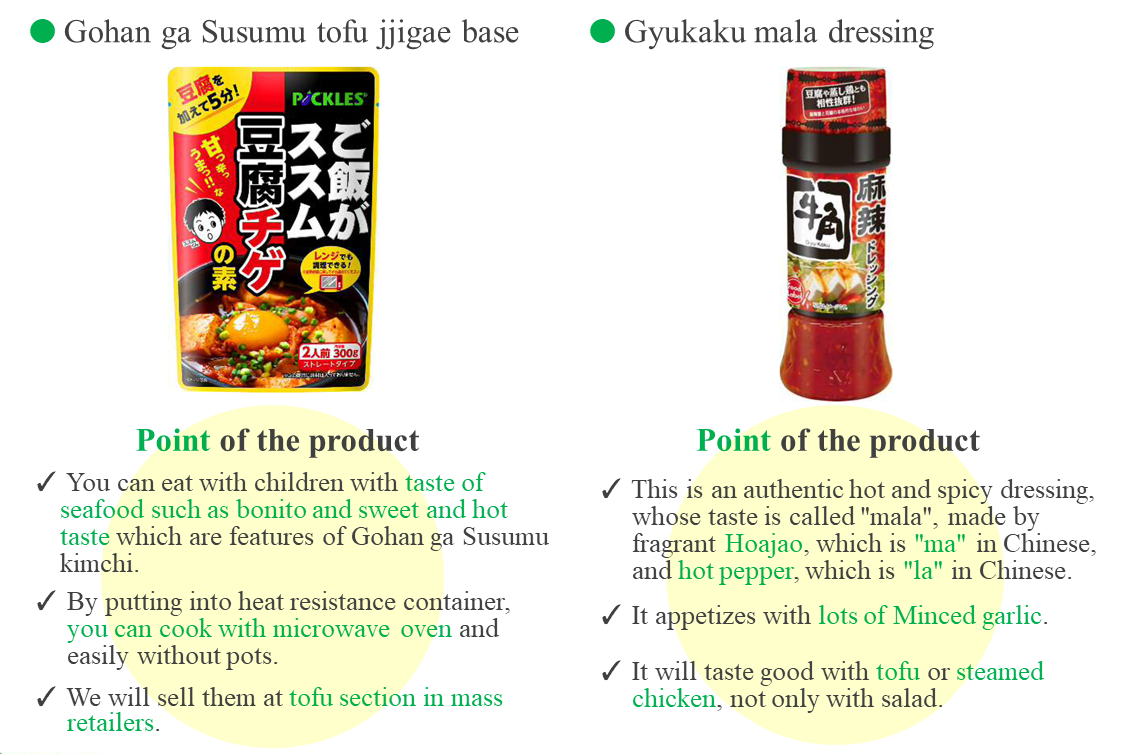

The company has also engaged in opening and expanding sections other than those for kimchi products and delicatessen, and is putting efforts into the development of dry products as part of this. In August of this year, it started to sell Gohan ga Susumu: tofu jjigae base as a product of Gohan ga Susumu series in the tofu section, and in September, it released Gyu-Kaku Mala Dressing from its subsidiary, Food Label Holdings, as a product for the dressing section, using the Gyu-Kaku brand.

4-5 operating strategies with a nationwide network

(Taken from the reference material of the company)

The Pickles Corporation Group is the only company in the pickles industry that has built a nationwide network. This allows the company to supply same asazuke lightly pickled vegetable products and delicatessen items to each branch store of their clients, which are operated all over Japan. This also functions as an appealing point when to negotiating business deals. The company aims to promote the sales of asazuke lightly pickled vegetables and delicatessen among clients acquired through Gohan ga Susumu Kimchi, while expanding its sales to other sections in stores such as the tofu section.

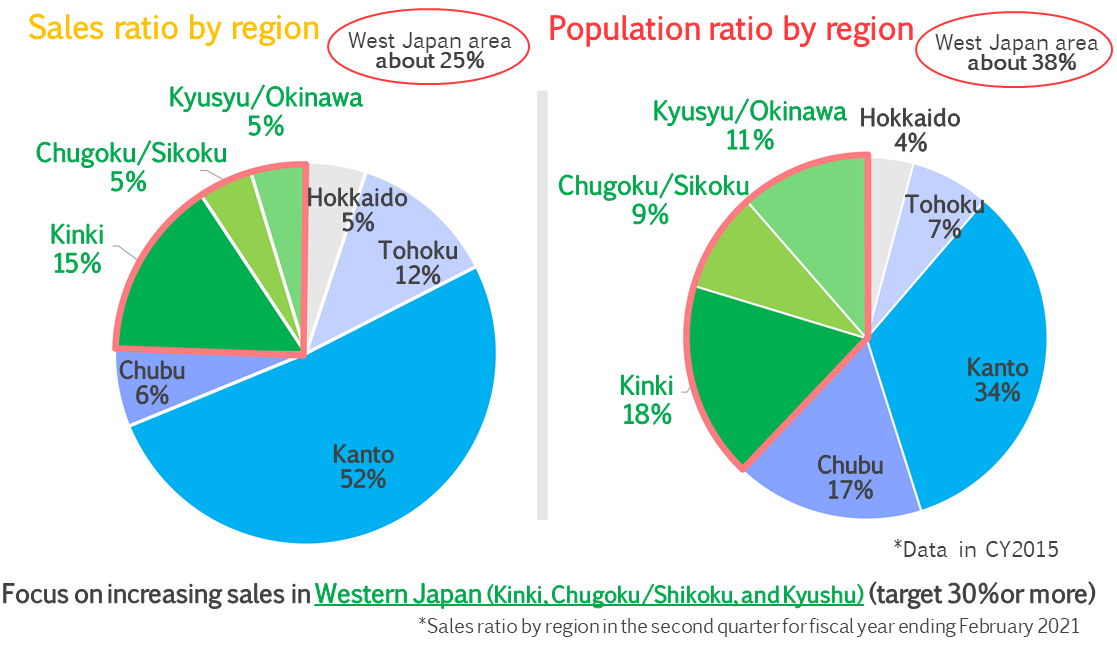

4-6 Expansion of sales areas:sales by region

(Source: the company)

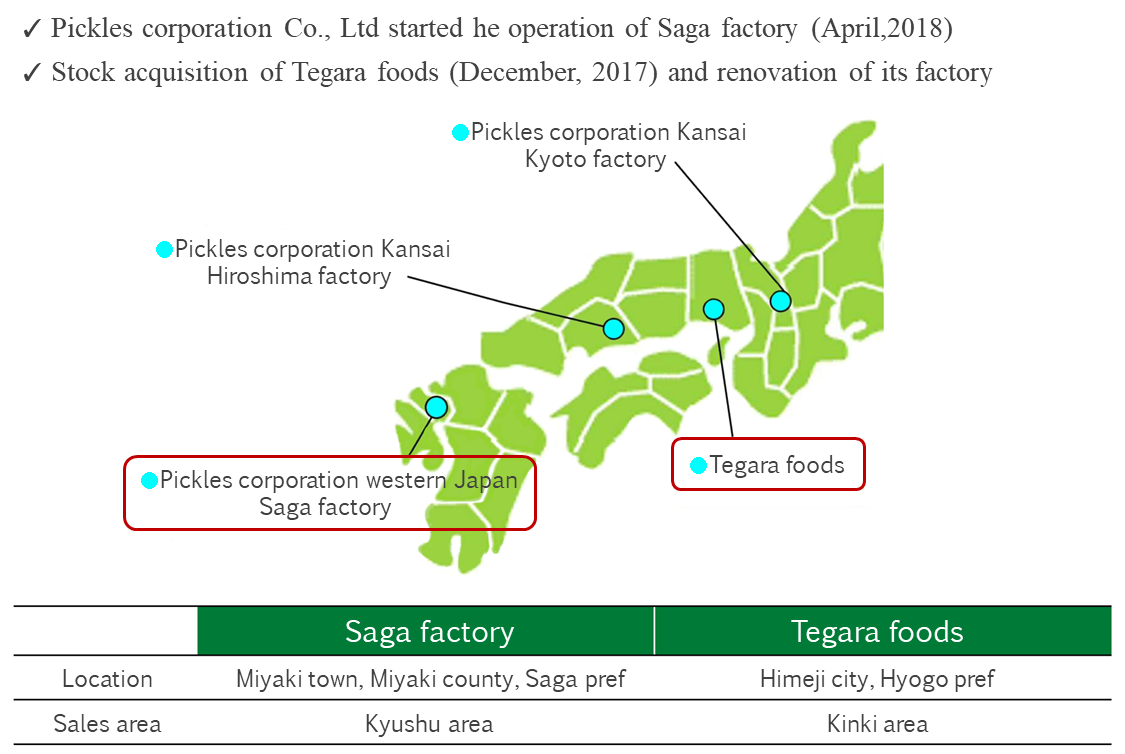

While the ratio of sales of the company in the Kanto region is high compared with that for the population, the ratio of sales in the regions to the west from the Chubu region is low compared with that for the population. Therefore, the company needs to focus on increasing sales in western Japan. For this, it is enhancing sales in the Kyushu region by achieving a full-capacity operation of Saga Factory (on the scale of 4 billion yen), which has been operating for two years. Meanwhile, in the Kansai region as well as the Chugoku/Shikoku region, the company is boosting sales through cooperation between three factories: Kyoto Factory, the factory of its subsidiary Tegara Foods Co., Ltd. located in Himeji City, Hyogo Prefecture, and Hiroshima Factory.

(Source: the company)

4-7 expansion of sales channels

(Source: the company)

The company will strive to increase sales channels to the food sections of drugstores, delicatessen sections of supermarkets etc., and food delivery enterprises (such as selling pickles for boxed meals).

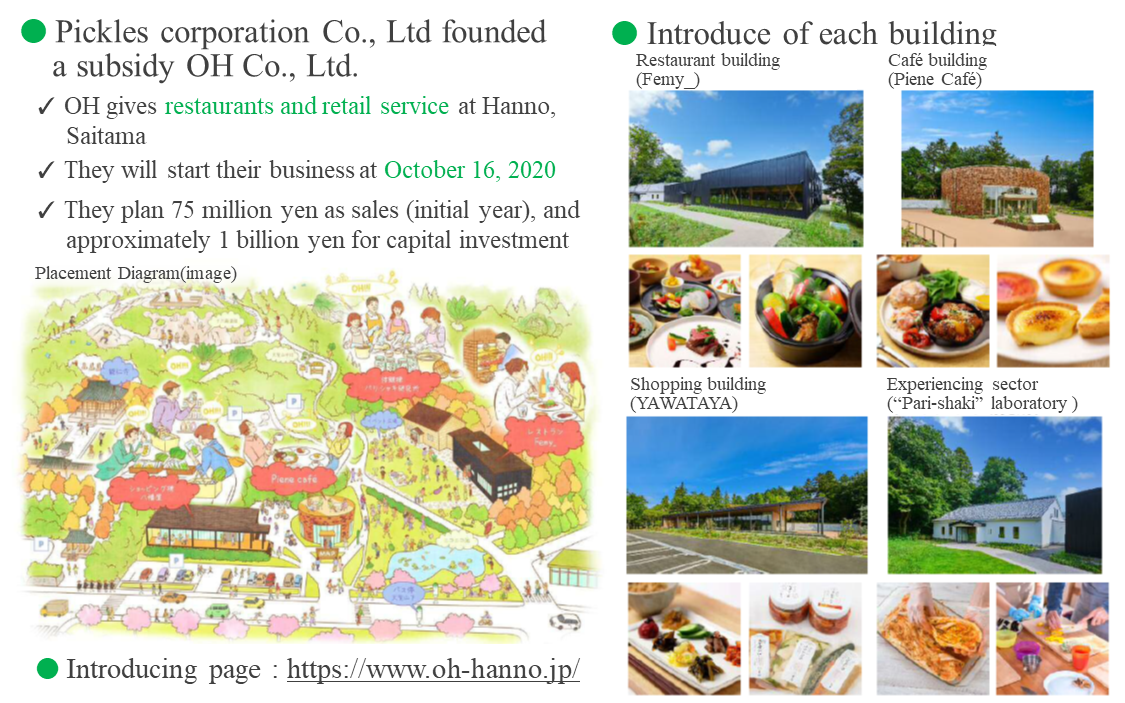

4-8 New businesses

(Source: the company)

The company opened two e-commerce sites in April 2018, Piene Online Shop and YAWATAYA Online Shop. Piene Online Shop sells products developed using the company’s original Pne-12 lactic acid bacteria, while YAWATAYA Online Shop offers authentic pickles made from ingredients produced in Japan without any synthetic seasonings.

A factory for products related to Pne-12 lactic acid bacteria was established in April 2019 and started to ship goods in June. The company is also planning to promote products related to Pne-12 lactic acid bacteria in OH!!!’s cafés, sale of goods etc., which will open in October 2020. By establishing stable sales at OH!!!, the company aims to expand e-commerce and street-level stores.

(Source: the company)

OH!!! consist of four sectors, restaurant, café, shopping, and experiencing sector. These sectors will convey the wonder and deliciousness of fermented food products. As it will be necessary to restrict the number of visitors due to the coronavirus crisis, the sales in the term ending February 2021 are estimated to stand at 75 million yen.

4-9 Advertising and promotion activities

(Source: the company)

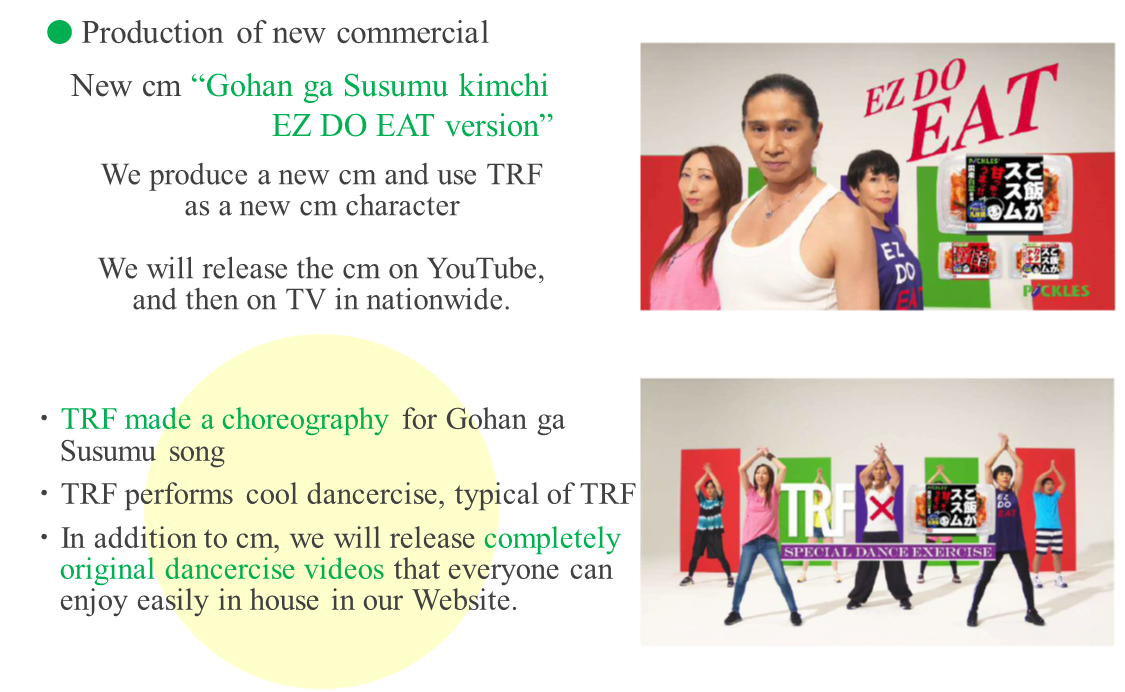

A new commercial featuring the dance team TRF was produced. Nationwide broadcasting is planned after the release on YouTube on October 20. The commercial appeals to health consciousness, while encouraging people to exercise at home, as there is demand from people staying home.

(Source: the company)

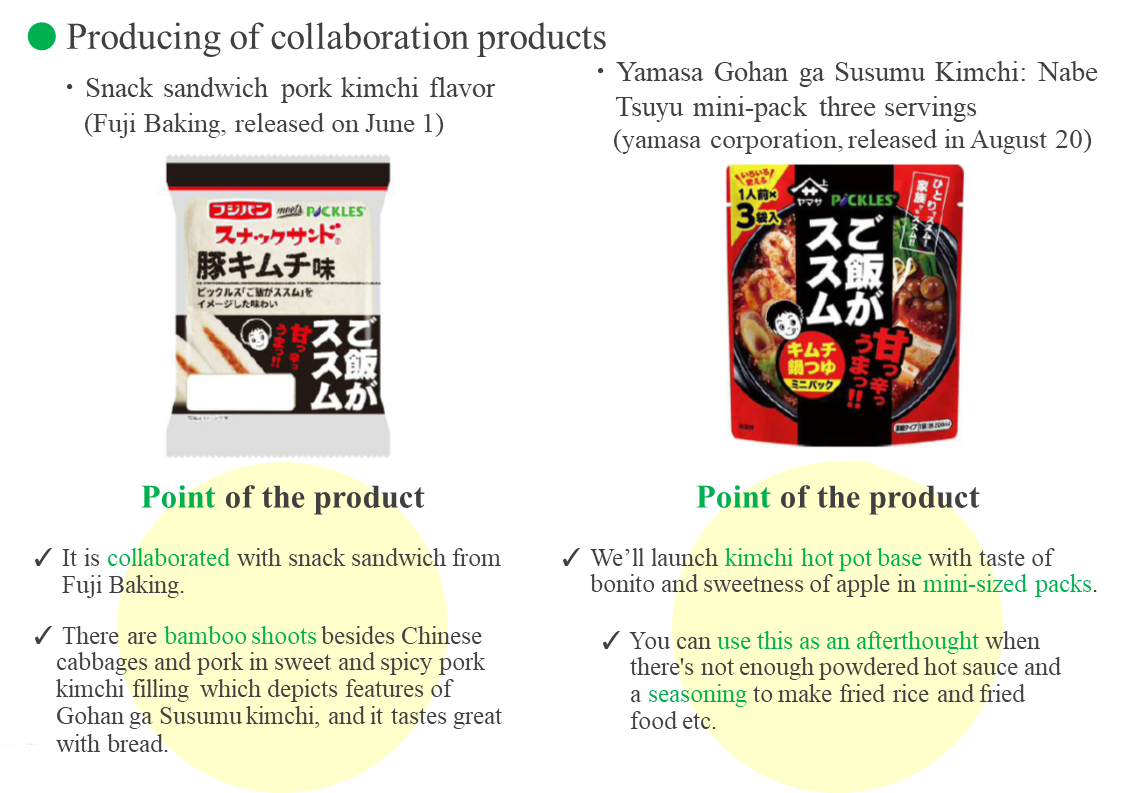

In addition, as part of advertising activities, Snack Sandwich: Pork kimchi flavor was released in collaboration with Fuji Baking in June, and Yamasa Gohan ga Susumu Kimchi: Nabe Tsuyu mini-pack three servings, was released in collaboration with YAMASA CORPORATION in August.

The company also intends to keep focusing on advertising activities such as outdoor signboard at MetLife Dome, campaigns on social media, ad-wrapped buses, and is planning to post advertising costs of 286 million yen for the term ending February 2021.

4-10 Initiatives Regarding Production, etc.

As its initiatives regarding production, etc., the company pursues cost reduction, organizational changes, disclosure of information on Environment, Society and Governance (ESG) activities, securing human resources, initiatives for dealing with workforce shortages and reduction of employment cost, as well as measures to prevent the spread of the novel coronavirus.

As for cost reduction, the company will reconsider the process of procuring vegetables (such as procurement in each region) and the reduction of food waste (donation to food banks), while also forging ahead with reducing the weight of the plastic cup for asazuke lightly pickled vegetables (by about 8%) and partly using plant-based materials for the plastic cup (changes have been made one after another since mid-September 2020). Reducing the weight of the plastic cup for asazuke lightly pickled vegetables is expected to decrease the annual amount of plastic usage by about 12 tons, and by reducing the weight of the plastic cup for asazuke lightly pickled vegetables while using plant-based materials for the plastic cup, it is estimated to decrease the annual emission amount of CO2 by about 42 tons.

As for organizational changes, the company aims to enhance corporate governance as well as the strategy for the whole group on product development and sale, by establishing a compliance office, a product planning department, and a wide-area distribution department.

As for disclosure of information on ESG activities, the company will create a report summarizing ESG information and publish it on its website (planned for November 2020).

As for securing human resources, the company will enrich the welfare and the personnel systems (affiliate in group medical insurance), and as for initiatives for dealing with workforce shortages and reduction of employment cost, it will consider and adopt energy-saving machinery, product revision, and production concentration.

As for measures to prevent the spread of the novel coronavirus, the company implements temperature measurement before and upon arriving to work, mask-wearing and hand disinfection during work hours, regular ventilation, staggered working hours, and remote work.

4-11 Medium-Term Management Plan

| FY 2/ 20 Act. | FY 2/ 21 Est. fixed | YoY | FY 2/ 22 Plan | YoY | FY 2/ 23 Plan | YoY |

Sales | 41,417 | 45,000 | +8.7% | 44,350 | -1.4% | 45,700 | +3.0% |

Gross profit | 10,560 | 11,425 | +8.2% | 11,211 | -1.9% | 11,463 | +2.2% |

SG&A | 8,688 | 9,124 | +5.0% | 9,206 | +0.9% | 9,380 | +1.9% |

Operating Income | 1,871 | 2,300 | +22.9% | 2,005 | -12.8% | 2,083 | +3.9% |

* Unit: million yen

| FY 2/ 20 Act. | Ratio to sales |

| FY 2/ 23 Plan | Ratio to sales | Compared to FY 2/20 | |

Product | Asazuke lightly pickled vegetables /kimchi | 17,308 | 41.8% |

| 20,936 | 45.8% | +21.0% |

Delicatessen | 8,321 | 20.1% |

| 9,391 | 20.5% | +12.9% | |

Furuzuke old pickled vegetables | 831 | 2.0% |

| 873 | 1.9% | +5.1% | |

Product (pickles) | 14,955 | 36.1% |

| 14,498 | 31.7% | -3.1% | |

Total | 41,417 | 100.0% |

| 45,700 | 100.0% | +10.3% | |

* Unit: million yen

The profit in the term ending February 2021 is estimated to exceed the estimate for the term ending February 2023, so the company plans to revise the mid-term management goals when designing a plan for the next term.

As for the investment in equipment in the above-mentioned period, the company plans to invest 1.9 billion yen (depreciation: 893 million yen) in OH!!! facilities, equipment renewal, etc. in the term ending February 2021, 1,352 million yen (depreciation: 680 million yen) in the expansion of the area of Chukyo Factory, equipment renewal, etc. in the term ending February 2022, and 1,008 million yen (depreciation: 609 million yen) in equipment renewal, etc. in the term ending February 2023.

5. Conclusions

It is said that the favorable performance in the first half is attributable to the growth of sales at grocery stores and the positive effects of the coronavirus pandemic. However, the special demand caused by the coronavirus crisis seems to have subsided, and demand is estimated to return to normal in the second half.

The coronavirus crisis generated the demand from people staying home in the food product industry, while encouraging Pickles Corporation to streamline their production processes. In detail, the company integrated production items for the purpose of reducing working hours, etc. to cope with the novel coronavirus, and succeeded in improving profitability while the prices of vegetables as ingredients skyrocketed in the first half.

The company plans to continue such efforts along with cost reduction through the improvement of vegetables procurement, reduction of losses, and the decrease of weights of plastic cups for asazuke lightly pickled vegetables. They will also continue to take measures for coping with the shortage of workforce, including the installation of labor-saving machinery and the revision to product specs. These are expected to strengthen the company’s competitiveness. In the next term, we would like to pay attention to the progress of the OH!!! business, whose true value will be tested, and the outcomes of their efforts.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9directors, including 3 from outside |

Auditors | 4directors, including 3 from outside |

◎Corporate Governance Report (Updated on June. 1, 2020)

Basic Policy

Our company considers corporate governance to be the important issue of business management for acting in conformity with the law and social norms, realizing the management policies, and achieving continuous growth.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Supplementary Principle 2-2-1]

Going forward, the Code of Conduct will be disseminated through explanations at annual policy briefings and in-house newsletters. We will also consider to add the status of compliance with the Code of Conduct in personnel evaluations, and report the results to the Board of Directors.

[Supplementary Principle 4-2-1]

As for the remuneration of internal directors, as described in Principle 3-1 (3), in order for the directors to share the merits and risks of stock price fluctuations with shareholders, and increase their desire to contribute to elevating stock price and enhancing corporate value more than ever before, we have introduced stock acquisition rights in the form of stock options.

Going forward, we will examine procedures to ensure objectivity and transparency in the determination of the compensation system’s design and of specific remuneration amounts.

[Supplementary Principle 4-3-1]

As described in Principle 3-1 (4), we appoint internal directors who have a high degree of expertise in their fields of responsibility and who can respond quickly and accurately to changes in the business environment. Regarding outside directors, we appoint capable personnel who can supervise management independently from an objective standpoint without being biased toward the interests of management or specific stakeholders.

In the future, we will examine procedures to ensure objectivity and transparency.

[Principle 4-7. Roles and Responsibilities of Independent Outside Directors]

(1) The three outside directors of the company have abundant experience and wide-ranging insight as corporate managers. Utilizing those experiences and insights, they give advice on the management strategy etc. for the company.

(2) At present, there is no system in which the opinions of outside directors are reflected in the appointment, dismissal, and compensation of executives. However, as described in Supplementary Principle 4-3-1, going forward we will examine such procedures.

(3) The three independent outside directors of the company supervise conflicts of interest of the Board of Directors from an independent standpoint.

(4) The three independent outside directors of the company are independent from management and controlling shareholders, and appropriately reflect the opinions of stakeholders, including minority shareholders, in the Board of Directors.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 5-1. Policy on Constructive Dialogue with Shareholders]

With a basis in transparency, fairness, and continuity, we strive to disclose information promptly so that our shareholders and investors can understand our company correctly.

We will strive to disclose information based on related laws and regulations such as the Financial Instruments and Exchange Act as well as the timely disclosure rules established by financial instruments exchange, and to actively disclose information that can be considered effective for understanding our company with appropriate measures.

Specifically, we will hold financial results briefings twice a year and hold briefings for individual investors as appropriate. The President and Chief Executive Officer and the Public Relations and IR Office will also handle individual interviews within a reasonable range.

Additionally, along with establishing a Public Relations/IR Office as the department in charge of IR, we have posted the disclosure policy on our home page.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |