Bridge Report:(2935)PICKLES CO second quarter of Fiscal Year Ending February 2023

President Naoji Kageyama | PICKLES HOLDINGS CO,. LTD. (2935) |

|

Corporate Information

Stock Exchange | TSE Prime Market |

Industry | Food products (manufacturing) |

Representative | Naoji Kageyama |

Address | 7-8, Higashisumiyoshi, Tokorozawa-shi, Saitama |

Accounting term | February |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,031 | 12,858,430 shares | ¥13,257 million | 13.7% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥20.00 | 1.9% | ¥98.77 | 10.4x | ¥1,288.57 | 0.8x |

*Stock price is the closing price on October 31. The number of outstanding shares is based on PICKLES CORPORATION’s financial results for the second quarter of the term ending February 2023. ROE and BPS are the results in the previous fiscal year; DPS and EPS are based on PICKLES HOLDINGS's disclosure.

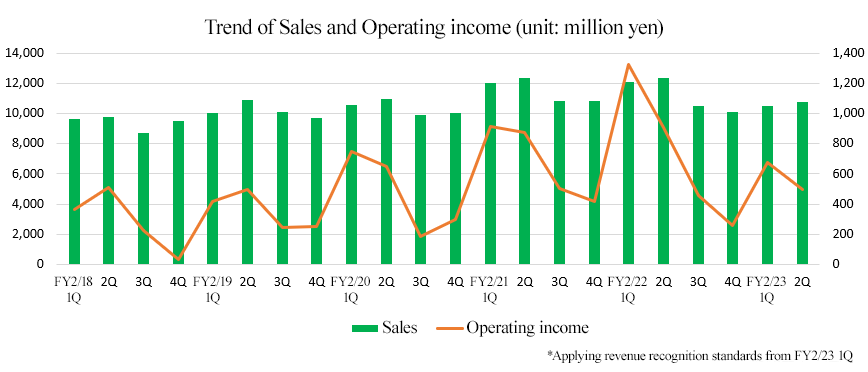

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2019 Act. | 40,670 | 1,409 | 1,561 | 920 | 71.94 | 14.00 |

February 2020 Act. | 41,417 | 1,871 | 1,973 | 1,290 | 100.83 | 15.00 |

February 2021 Act. | 46,020 | 2,711 | 2,829 | 1,832 | 142.96 | 17.50 |

February 2022 Act. | 45,006 | 2,942 | 3,068 | 2,128 | 165.59 | 20.00 |

February 2023 Est. | 40,000 | 1,800 | 1,910 | 1,270 | 98.77 | 20.00 |

*The actual results were provided by PICKLES CORPORATION and the estimated values were provided by PICKLES HOLDINGS. Unit: Million-yen, yen. Net income is the net income attributable to owners of the parent company. The same applies below. EPS and DPS are retroactively adjusted for the 1:2 stock split implemented on September 1, 2021. Since the first quarter of the term ending February 2023, the accounting standards for revenue recognition, etc. have been applied.

This Bridge Report presents PICKLES CORPORATION’s summary of Financial Results for the second quarter of Fiscal Year Ending February 2023 along with PICKLES HOLDINGS’ estimates for the term ending February 2023.

Table of Contents

Key Points

1. Company Overview

2. Financial Results for the Second Quarter of the Fiscal Year Ending February 2023

3. Fiscal Year Ending February 2023 Earnings Forecasts

4. Major Future Policies

5. Interview with President Kageyama

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The Accounting Standards for Revenue Recognition, etc. have been applied from the first quarter of the term ending February 2023. Net sales decreased due to the adoption of said standards, a reactionary decline in demand from housebound consumers resulting from a decrease of COVID-19 cases, and the impact of budget-conscious consumers due to food price hikes caused by soaring raw material costs (the rate of decrease is not shown due to the impact of the application of Accounting Standards for Revenue Recognition, etc.). Operating income declined 47.5% year on year to 1,171 million yen. Although the weather was relatively favorable and prices of vegetables as ingredients were stable, profit declined due to the drop in sales and the skyrocketing of raw material, utility, and logistics costs. Both sales and profit fell short of projections.

- The full-year earnings forecast was revised. Sales in the term ending February 2023 are expected to be 40 billion yen. In addition to the impact of Accounting Standards for Revenue Recognition, etc. that will be applied from this fiscal year, factors such as the reactionary decline in demand from housebound consumers and budget-conscious consumers will lead to a decline in sales. Operating income is projected to decrease 38.8% year on year to 1.8 billion yen. Gross profit is forecast to drop 29.7% year on year due to lower sales and higher raw material costs. Although the company will continue to reduce SG&A expenses, profit is projected to decline for the first time in six terms. There is no revision to the dividend projection. The projected dividend is 20.00 yen/share, unchanged from the previous year. Payout ratio is expected to be 14.6%.

- We interviewed President Naoji Kageyama about the purpose of shifting to a holding company structure, future initiatives, and his message to shareholders and investors. He said, “We will take the transition to a holding company structure as an opportunity to continue to take on various challenges and meet your expectations, and we would appreciate your continued support in these endeavors.”

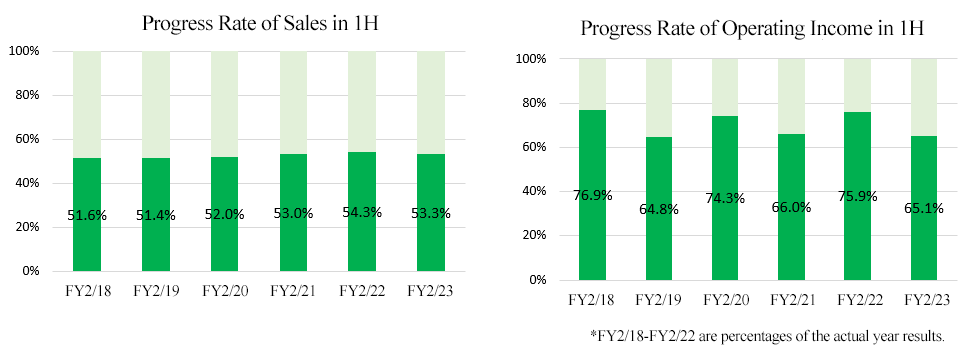

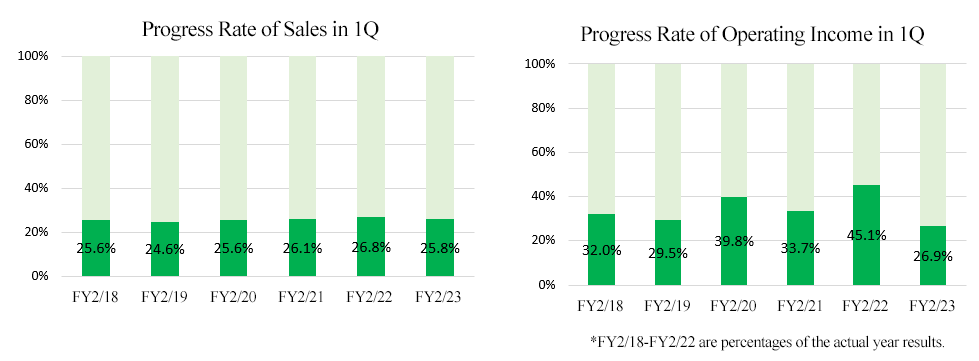

- Although both sales and operating income in the first quarter were lower than usual, the progress rate of sales in the first half of the year was almost on par with that of a typical year, due in part to the revision of the earnings forecast, and the recovery of operating income, too, progressed. Although conditions in the external environment remain challenging due to a reactionary decline in demand from housebound consumers, the impact of budget-conscious consumers, and rising raw material costs, it will be interesting to see how sales and profit will increase through key strategies such as "enhancing product development," "expanding sales areas," and "increasing clients" from the third quarter onward.

1. Company Overview

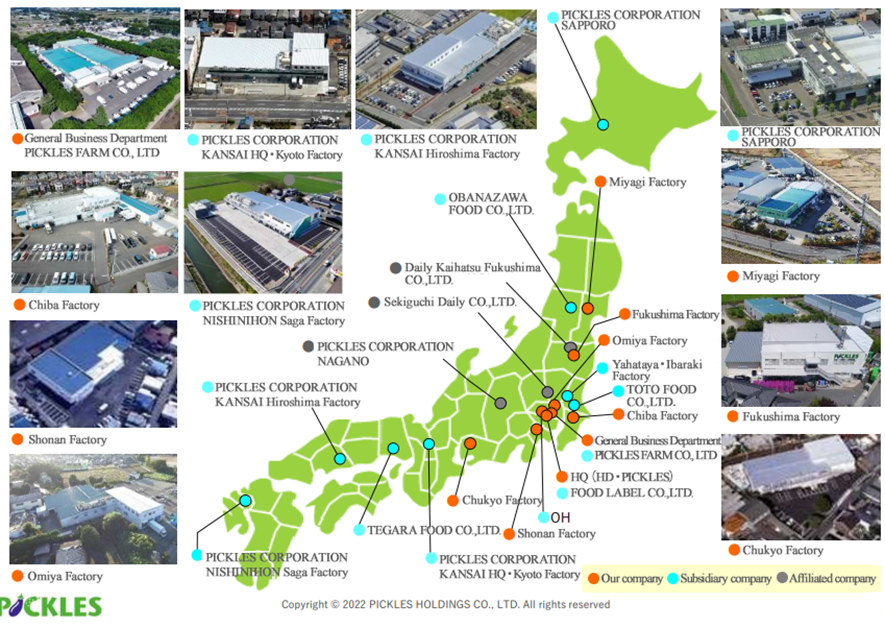

As a holding company, the company has established a nationwide production and sales network, with PICKLES CORPORATION, which is engaged in the production and sales of lightly pickled vegetables, kimchi pickles, and prepared food items, as well as the purchase and sale of pickles, etc., PICKLES CORPORATION Sapporo, PICKLES CORPORATION Kansai, Food Label, and other group companies.

The theme color of the company, green, represents freshness under a slogan of “We deliver the vitality of vegetables.” The company’s own products are produced using vegetables grown and harvested mainly in Japan by contracted farmers so that their traceability is ensured (about 80% of the vegetables used are supplied by contracted farmers), and no preservatives or synthesized food colorings are used. Furthermore, the company has displayed “an absolute commitment to food safety” at its production sites as demonstrated by such endeavors as thorough temperature control at the factories, checkups of the clothes and health of all the employees before they enter the factories, devotion to the 5S activities (5S represents sorting, setting-in-order, shining, standardizing, and sustaining the discipline) and acquisition of the certification of FSSC22000 and JFS-B.

【1-1 Corporate Philosophy】

PICKLES CORPORATION’s philosophy is “We deliver tasty and safe foods to consumers and aim at eco-conscious corporate management.” Under the corporate philosophy, it is pursuing the following management policies: (1) quality control for producing safe and delicious food products, (2) environmentally friendly corporate management, and (3) arrangement of a working environment that puts instillation of morals and the principle of safety and health first. Following these policies, the company is working on standards for food safety, including FSSC22000 and JFS-B, and international standards for environmental control such as ISO14001. In addition, it focuses on training and education of its employees through various approaches, such as enrichment of the personnel system and education programs.

On the basis of the corporate philosophy, the company focuses also on Environmental, Social, and Governance (ESG)-based business operations and SDGs, and prepares ESG reports with the aim of introducing its efforts and challenges related to ESG and its stories of enhancing the corporate value.

「ESG Bridge Report」

https://www.bridge-salon.jp/report_bridge/archives/2022/04/220405_2925.html

【1-2 Business Description】

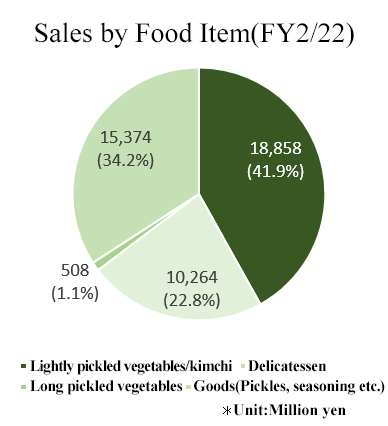

In the term ended February 2022, sales from products (manufactured by PICKLES CORPORATION at its own factories) accounted for 65.8% (41.9% from lightly pickled vegetables and kimchi, 22.8% from delicatessen, and 1.1% from long pickled vegetables), and those from products of a consolidated subsidiary, FOOD LABEL Co., Ltd., and products purchased from other companies (products manufactured at factories other than the factories operated by PICKLES CORPORATION) made up 34.2%.

(Product and Goods overview)

◎Lightly pickled vegetables and kimchi

The company offers a lineup of lightly picked vegetable, which can be eaten like a salad, according to the season of the vegetables. In recent years, as consumers have become more health-conscious, the company has been selling "low-sodium lightly picked vegetable," which is lower in salt than conventional products.

As the holdings emphasizes the provision of safe and secure food, the main ingredients, such as Chinese cabbage and cucumber, are produced in Japan. No preservatives or synthetic coloring agents are used.

The mainstay product, "Gohan ga Susumu kimchi" which was launched in October 2009, has been developed with an original taste that accentuates sweetness and umami to suit Japanese tastes, abandoning the traditional basic concept of kimchi being spicy and coming up with a concept of kimchi that housewives would want to feed to their families. While most kimchi products have a capacity of 300 to 400 grams, the new product is 200 grams so that a family can eat it all, making it easier to buy and more affordable. In addition, the package was designed to be slim enough to fit in the refrigerator, and the main color of the package was black instead of red or orange. As a result, the new product was well received by women and children.

The company has also developed products in collaboration with characters and food manufacturers to enrich its lineup.

Currently, asazuke lightly pickled vegetables and kimchi account for about 50% of the pickled vegetables market. Although the overall pickle market is shrinking, the market for asazuke and kimchi is stable.

Asazuke and kimchi are made mainly from vegetables and are being reevaluated as low-calorie foods rich in dietary fiber, and future growth in demand is expected.

|

|

|

Gohan ga Susumu Kimchi | JOJOEN Pogi Kimchi | 4 Kinds of Bran vegetables |

(Source: the company)

◎Delicatessen

The company began handling delicatessen in August 2002 and has been steadily increasing its sales. In recent years, consumers have become more budget-conscious and have been cutting back on eating out, resulting in a growing trend toward eating in at home by buying delicatessen, as well as a change in eating styles due to the increase in the number of elderly people, single-person households, and dual-earner households.

Demand for delicatessen is expected to continue to grow in the future. The holdings is developing products based on the keyword "vegetables," which is one of its strengths, and currently Namul and other products are doing well. In addition, the company is developing products with originality and added value to its prepared foods, for example, by focusing on different varieties of vegetables and developing salad dressings in-house, etc. In addition, the company utilizes technologies such as pH control to prevent discoloration of green vegetables.

|

|

|

4 kinds of Namul Set | Bangbangji Salad | Boiled Okra |

(Source: the company)

(Sales Destination)

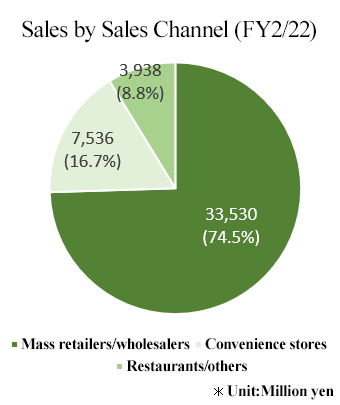

Mass merchandisers, retailers, and wholesalers throughout Japan are the sales destinations, with 74.5% of the total sales channels being mass merchandisers and wholesalers, 16.7% being convenience stores, and 8.8% being restaurants and others as of FY2/22.

(Prepared by Investment Bridge Co., Ltd. based on the company's materials)

【1-3 Features, Strengths, and Competitive Advantages】

The company has the following features, strengths, and competitive advantages.

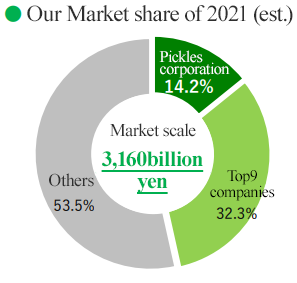

(1) Top share in the pickles industry

According to the ranking of companies that generate good sales in the pickles industry as presented by PICKLES CORPORATION based on THE JAPAN FOOD NEWS articles, PICKLES CORPORATION ranked first with consolidated sales of 45 billion yen, pulling far ahead of the other companies with a market share of 14.2% while endeavoring to attain its target of a market share of 15% through M&A etc.

(Source: the company)

(2) Highly unique product development capabilities

In order to realize product development quickly and flexibly, we have established a team system of having a development staff and a sales staff for each customer, such as convenience stores, mass merchandisers, and the food service industry. By reflecting the opinions of our customers, we are able to develop highly original products that are different from those of other companies.

The company promotes development from multiple aspects, from the selection of ingredients such as vegetables and seasonings to processing methods, taste, and packaging.

The Research and Development Laboratory, which is responsible for basic research, is engaged in future-oriented initiatives, including research on lactic acid bacteria, such as the plant-derived lactic acid bacteria Pne-12 (hereinafter referred to as "Pene lactic acid bacteria"), which the company has developed on its own.

(3) Production and distribution system covering the entire country

The group companies, including PICKLES CORPORATION, cover the entire Japan. It is the only company in the pickles industry that has established a nationwide network of manufacturing, distribution, development, and sales functions. As a result, the company is able to provide the same lightly pickled vegetables, kimchi, and delicatessen to all of its customers' stores nationwide, which is a major selling point for the company.

In terms of manufacturing, the company has introduced the FSSC22000 and JFS-B standards for food safety and has established a system to supply safer and more secure products.

(Source: the company)

(4) Proposal-Based Sales with Close Relationships to Customers

At the sales bases located throughout Japan, proposal-based sales are conducted in close contact with each region and customer.

In addition to the mainstay lightly pickled vegetables and Kimchi products, the company is enhancing its product lineup for the delicatessen section, and its sales representatives are proposing sales methods, creating sales areas, holding pickle fairs, and considering various approaches to consumers together with the customers. In addition, information obtained from communication with customers is fed back to the company and used for product development based on consumer trends.

(5) Vendor functions to meet the needs of customers

The company has two functions: one as a manufacturer of its own products such as lightly pickled vegetables, kimchi, and delicatessen, and the other as a wholesaler of products such as pickled plums that cannot be manufactured at its own factory, which it purchases from pickle manufacturers throughout Japan. By taking advantage of its vendor function, which allows it to offer both its own products and those of other companies at the same time, the company is able to propose total sales floor development that meets the needs of its customers.

【1-4. ROE Analysis】

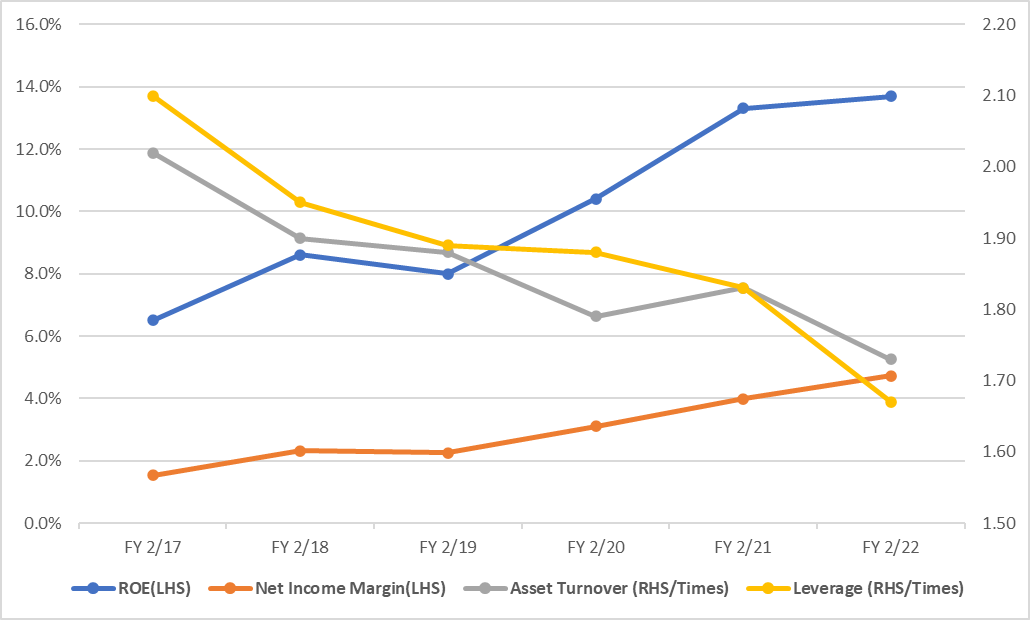

| FY2/17 | FY2/18 | FY2/19 | FY2/20 | FY2/21 | FY2/22 |

ROE (%) | 6.5 | 8.6 | 8.0 | 10.4 | 13.3 | 13.7 |

Net Profit Margin (%) | 1.53 | 2.32 | 2.26 | 3.11 | 3.98 | 4.73 |

Total Asset Turnover (times) | 2.02 | 1.90 | 1.88 | 1.79 | 1.83 | 1.73 |

Leverage (times) | 2.10 | 1.95 | 1.89 | 1.88 | 1.83 | 1.67 |

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Sustained improvement in profitability has led to higher ROE, which has exceeded 10% for three consecutive fiscal years.

2. Financial Results for the Second Quarter of the Fiscal Year Ending February 2023

2-1 Consolidated Business Results

① Outline

| FY2/22 2Q | Ratio to sales | FY2/23 2Q | Ratio to sales | YoY(Applied) | Compared to the forecast | References (Not Applied) | References (YoY, not applied) |

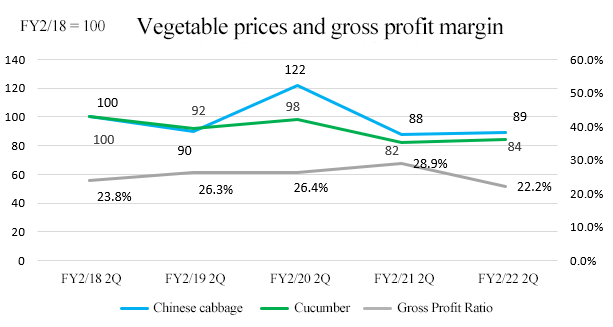

Sales | 24,423 | 100.0% | 21,308 | 100.0% | - | -3.0% | 22,658 | -7.2% |

Gross profit | 7,056 | 28.9% | 4,722 | 22.2% | - | - | 4,758 | -32.6% |

SG&A expenses | 4,823 | 19.8% | 3,550 | 16.7% | - | -0.5% | 4,881 | +1.2% |

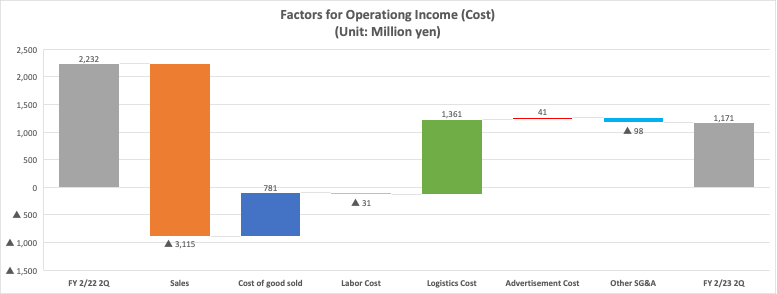

Operating income | 2,232 | 9.1% | 1,171 | 5.5% | -47.5% | -32.9% | 1,155 | -48.3% |

Ordinary income | 2,307 | 9.4% | 1,232 | 5.8% | -46.6% | -32.0% | 1,215 | -47.3% |

Net Income | 1,630 | 6.7% | 831 | 3.9% | -49.0% | -34.2% | - | - |

*Unit: million yen. The Accounting Standards for Revenue Recognition, etc. have been applied from the first quarter of the term ending February 2023. Accordingly, the decrease rate of net sales, gross profit or SG&A expenses is not shown. YoY changes in net sales, gross profit, and SG&A expenses without the application of the Accounting Standards for Revenue Recognition are reference values calculated by Investment Bridge based on disclosed data.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

▲ of expense account indicates that the expense has increased.

Both sales and operating income declined

Sales declined due to the application of the Accounting Standard for Revenue Recognition, etc., a reactionary drop in demand for nest eggs due to a decrease in the number of cases of new coronavirus infection, and price hikes in various food items due to soaring raw material prices, resulting in a decline in sales due to thrifty consumers.

Operating income declined 47.5% year on year to 1,171 million yen. Although the weather was relatively favorable, resulting in stable prices for raw vegetable materials, lower sales and higher raw material, utility, and logistics costs resulted in lower profits.

Both sales and profits fell short of projections.

②Trends by Food Item and Sales Channel

◎Sales by Food Item

| FY2/21 2Q | Ratio to sales | FY2/22 2Q | Ratio to sales | FY2/23 2Q | Ratio to sales |

Product | 15,902 | 65.2% | 16,211 | 66.4% | 14,535 | 68.2% |

Lightly pickled vegetables /kimchi | 10,488 | 43.0% | 10,368 | 42.5% | 9,088 | 42.7% |

Delicatessen | 5,002 | 20.5% | 5,580 | 22.8% | 5,209 | 24.4% |

Long pickled vegetables | 412 | 1.7% | 263 | 1.1% | 237 | 1.1% |

Goods | 8,496 | 34.8% | 8,211 | 33.6% | 6,773 | 31.8% |

Total Sales | 24,398 | 100.0% | 24,423 | 100.0% | 21,308 | 100.0% |

*Unit: million yen. The rate of decrease is not stated due to the applying Accounting Standard for Revenue Recognition from FY2/23 1Q.

◎Sales by Sales Channel

| FY2/21 2Q | Ratio to sales | FY2/22 2Q | Ratio to sales | FY2/23 2Q | Ratio to sales |

Mass retailers/wholesalers | 18,333 | 75.1% | 18,110 | 74.1% | 16,293 | 76.5% |

Convenience stores | 4,171 | 17.1% | 4,168 | 17.1% | 3,175 | 14.9% |

Restaurants/others | 1,893 | 7.8% | 2,143 | 8.8% | 1,839 | 8.6% |

Total Sales | 24,398 | 100.0% | 24,423 | 100.0% | 21,308 | 100.0% |

*Unit: million yen. The rate of decrease is not stated due to the applying Accounting Standard for Revenue Recognition from FY2/23 1Q.

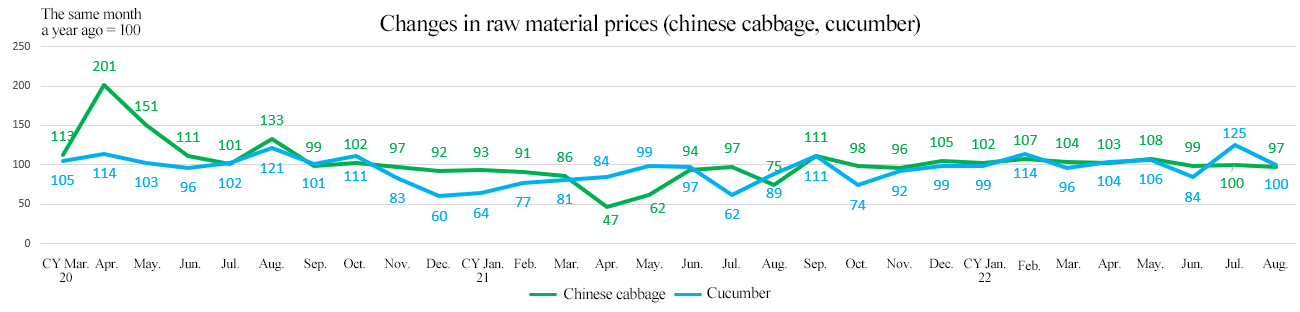

③Gross profit margin and situation surrounding vegetable prices

(Price of Chinese cabbages)

Around February, Ibaraki Prefecture, which is a major production area, experienced low temperatures and drought, but there was no major impact. From March to August, the weather was stable in Ibaraki and Nagano Prefectures, which are major production areas, and growth progressed smoothly, resulting in almost the same level as that last year.

(Price of cucumbers)

From April to June, production was delayed due to low temperatures in Gunma and Saitama Prefectures, which are major production areas, but this did not cause a significant decrease in shipment volume. From July onward, growth progressed steadily in Fukushima Prefecture, which is another major production area, and the price was almost unchanged from last year.

The company continuously strives to improve the gross margin rate on a continuous basis by entering into contracts with more farmers and cementing its relationship with them.

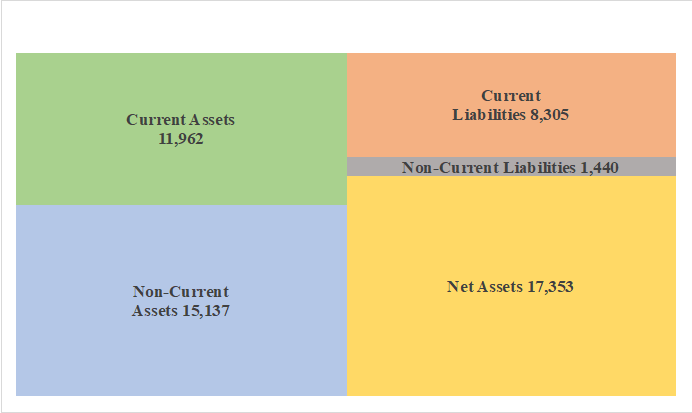

2-2 Financial Conditions and Cash Flow

Financial conditions

| Feb.22 | Aug.22 | Increase/ Decrease |

| Feb.22 | Aug.22 | Increase/ Decrease |

Current Assets | 10,864 | 11,962 | +1,098 | Current liabilities | 7,345 | 8,305 | +959 |

Cash | 6,034 | 6,362 | +328 | Payables | 2,828 | 3,753 | +925 |

Receivables | 4,205 | 4,772 | +567 | ST Interest-Bearing Liabilities | 1,893 | 2,192 | +299 |

Inventories | 578 | 778 | +200 | Noncurrent liabilities | 1,989 | 1,440 | -548 |

Noncurrent Assets | 15,227 | 15,137 | -90 | LT Interest-Bearing Liabilities | 1,055 | 496 | -559 |

Tangible Assets | 13,588 | 13,535 | -53 | Total Liabilities | 9,334 | 9,746 | +412 |

Intangible Assets | 571 | 524 | -47 | Net Assets | 16,757 | 17,353 | +596 |

Investments and Others | 1,066 | 1,076 | +10 | Total Liabilities and Net Assets | 26,091 | 27,099 | +1,007 |

Total Assets | 26,091 | 27,099 | +1,007 | Total Interest-Bearing Liabilities | 2,948 | 2,688 | -260 |

*Unit: million yen. Interest-bearing liabilities include lease liabilities.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Total assets stood at 27,099 million yen, up 107 million yen from the end of the previous term, due to the increase in cash and account receivables. Total liabilities increased 412 million yen from the end of the previous term to 9,746 million yen, due to the increase in account payables and decline in interest-bearing liabilities. Net assets rose 596 million yen from the end of the previous term to 17,353 million yen, due to the growth of retained earnings.

Capital-to-asset ratio decreased 0.3pt from the end of the previous year to 63.2%.

【2-3 Topics】

◎ Established PICKLES HOLDINGS CO.,LTD.

On September 1, 2022, the company established PICKLES HOLDINGS CO.,LTD., to shift to the holding company system.

The purposes are to improve the function to design strategies for corporate group management, including M&A and new businesses, optimize the allocation of managerial resources inside the corporate group, clarify the roles and responsibilities of the holding company and business companies by separating the overseeing function and the business execution function, develop a system for enabling each business company to make a decision swiftly, and strengthen the competitiveness of the corporate group by speedily responding to the changes in the times.

3. Fiscal Year ending February 2023 Earnings Forecasts

3-1 Full-year Business Forecast

① Major income statements

| FY2/22 | Ratio to sales | FY 2/ 23 Est. | Ratio to sales | YoY | Revision Rate | Progress Rate |

Sales | 45,006 | 100.0% | 40,000 | 100.0% | - | -1.7% | 53.3% |

Gross profit | 12,466 | 27.7% | 8,763 | 21.9% | - | -8.7% | 53.9% |

SG&A | 9,523 | 21.2% | 6,963 | 17.4% | - | -1.9% | 51.0% |

Operating Income | 2,942 | 6.5% | 1,800 | 4.5% | -38.8% | -28.0% | 65.1% |

Ordinary Income | 3,068 | 6.8% | 1,910 | 4.8% | -37.8% | -27.4% | 64.5% |

Net Income | 2,128 | 4.7% | 1,270 | 3.2% | -40.3% | -27.8% | 65.4% |

*Unit: million yen.

The Accounting Standards for Revenue Recognition, etc. have been applied from the current term. Accordingly, the decrease rate in net sales, gross profit or SG&A expenses is not shown.

Revenue Forecast are revised

Revenue forecast are revised. The sales for the term ending February 2023 are projected to be 40.0 billion yen. Due to the drop in demand from housebound consumers and the effect of the “accounting standards for revenue recognition”, sales are expected to drop. Operating income is forecasted to decline 38.8% year on year to 1,800 million yen. Gross profit is expected to decline 29.7% year on year due to the planned sales decline and raw material prices. Despite efforts to reduce SG&A expenses, the company expects operating income to decline for the first time in six years. The company forecast to pay a dividend of 20.00 yen/share, unchanged from the previous term. The expected payout ratio is 14.6%.

◎Sales by Food Item

| FY2/22 | Ratio to sales | FY 2/ 23 Est. | Ratio to sales | Revision Rate | Progress Rate |

Product | 29,631 | 65.8% | 26,840 | 67.1% | -1.8% | 54.2% |

Lightly pickled vegetables /kimchi | 18,858 | 41.9% | 16,360 | 40.9% | -5.3% | 55.6% |

Delicatessen | 10,264 | 22.8% | 10,000 | 25.0% | +4.4% | 52.1% |

Long pickled vegetables | 508 | 1.1% | 480 | 1.2% | -1.0% | 49.4% |

Goods | 15,374 | 34.2% | 13,160 | 32.9% | -1.5% | 51.5% |

Total Sales | 45,006 | 100.0% | 40,000 | 100.0% | -1.7% | 53.3% |

*Unit: million yen. The Accounting Standards for Revenue Recognition, etc. have been applied from the current term. Accordingly, the decrease rate in net sales, gross profit or SG&A expenses is not shown.

◎Sales by Sales Channel

| FY2/22 | Ratio to sales | FY 2/ 23 Est. | Ratio to sales | Revision Rate | Progress Rate |

Mass retailers/wholesalers | 33,530 | 74.5% | 30,600 | 76.5% | 0.0% | 53.2% |

Convenience stores | 7,536 | 16.7% | 5,940 | 14.9% | -10.5% | 53.5% |

Restaurants/others | 3,938 | 8.8% | 3,460 | 8.7% | 0.0% | 53.2% |

Total | 45,006 | 100.0% | 40,000 | 100.0% | -1.7% | 53.3% |

*Unit: million yen. The Accounting Standards for Revenue Recognition, etc. have been applied from the current term. Accordingly, the decrease rate in net sales, gross profit or SG&A expenses is not shown.

Plan of SG&A Expenses

| FY2/22 | Ratio to sales | FY 2/ 23 Est. | Ratio to sales | Revision Rate |

Total SG&A expenses | 9,523 | 21.2% | 6,963 | 17.4% | -1.9% |

Logistics cost | 4,677 | 10.4% | 2,140 | 5.4% | +1.0% |

Personnel cost | 3,104 | 6.9% | 3,135 | 7.8% | -2.4% |

Advertising cost | 196 | 0.4% | 131 | 0.3% | -51.5% |

Others | 1,544 | 3.4% | 1,556 | 3.9% | +3.9% |

Sales | 45,006 | 100.0% | 40,000 | 100.0% | -1.7% |

*Unit: million yen. The Accounting Standards for Revenue Recognition, etc. have been applied from the current term. Accordingly, the decrease rate in net sales, gross profit or SG&A expenses is not shown.

4. Major Future Policies

【4-1 Future strategies】

The company intends to expand business by taking advantage of its strengths and forging ahead with the following four strategies: reinforcing product development, expansion of sales area, expansion of sales channels, and new businesses.

① Reinforcing product development

*Pickled vegetables and kimchi

(Market environment)

According to the ranking of companies that generate good sales in the pickles industry as presented by PICKLES CORPORATION based on THE JAPAN FOOD NEWS articles, only five companies have achieved sales of over 10 billion yen, with PICKLES CORPORATION ranked first with consolidated sales of 45 billion yen followed by Tokai Pickling Co., Ltd. whose sales are 23.4 billion yen, AKIMOTO FOODS Co., Ltd., with sales of 13.0 billion yen, Bingo Tsukemono Co., Ltd., which has generated sales of 10.1 billion yen, and YAMAMOTO SYOKUHIN Co., Ltd., with sales of 10.1 billion yen in descending order.

While the size of the market of pickles shrank from 480 billion yen in 2000 to 316 billion yen in 2021, the number of enterprises continue to decrease and aggregation is underway.

PICKLES CORPORATION pulls far ahead of the other companies with a market share of 14.2% (as of 2021) while endeavoring to attain its target of a market share of 15%.

Although sales of pickled vegetables have been stopped falling due to multifarious factors, including changing eating habits and falling demand for rice, the sales decline has bottomed out in the market as a whole thanks to some products that have been selling well, such as kimchi. After an increase in demand due to the impact of the new coronavirus on nest egg demand and other factors, the number of pickled vegetables produced grew from 777,000 tons in 2020 to 816,000 tons in 2021 although there has been a reactionary decline this year.

The company will keep enhancing product development and strive to expand its market share.

(Examples of product development)

<Kimchi>

The company estimates sales from its core product, “Gohan ga Susumu Kimchi,” at 7.1billion yen in the term ending February 2023.

In addition to the family-friendly taste, the company added the Piene lactic acid bacterium and met the demand for health-oriented products.

"Gyukaku Kimchi," a collaborative product with Gyukaku, has been redesigned from the conventional three 50-g packs to four 40-g packs, making them more convenient to consume. Its shelf life was extended for reducing food loss.

In November 2022, the company plans to launch a campaign to increase the amount of kimchi in each product while keeping prices unchanged.

<Lightly Pickled Vegetables>

The product lineup includes a variety of lightly pickled vegetables under the brand concept of “Lightly pickled vegetables you want to eat every day."

Standard food items | Pickle products popular as individual servings as well as in large volumes |

Seasonal delicacy | Limited-time products to savor the four seasons |

Snacks | Responding to the demand for side dishes (snacks), which fall under a growing category |

Easy-to-take healthy/fermented food items | Products based on health trends such as fermented and low-sodium foods, as well as foods high in dietary fibers and proteins |

Original vegetable-based items | Sauces that can be used as an alternative to seasonings, vegetable-based sweets, etc. |

Specialty food items | Domestically produced food items with no preservatives or artificial coloring |

The company offers recipes etc. for hot-pots featuring, for example, Chinese cabbage in roasted sesame or ginger broth.

*Delicatessen

(Market environment)

According to the reference material presented by the company (based on research by the Japan Chain Stores Association), the scale of the delicatessen market (including Japanese-style, Western-style, and Chinese-style delicatessen products, packed meals, and sandwiches) was 1,166.3 billion yen in 2021 (which was 1,050.8 billion yen in 2019 and 1,057.5 billion yen in 2020).

The market continues booming on the back of a growing number of one-person households, aging population, a higher number of working women, growing interest in food from the viewpoint of health and nutritional balance and needs for simplifying and reducing time of household chores.

In this sector, PICKLES CORPORATION is vying with listed companies such as FUJICCO Co., Ltd. (sales of 55.0 billion yen and a net income of 2.1 billion yen), KENKO Mayonnaise CO., Ltd. (Sales of 75.6 billion yen and a net income of 1.2 billion yen), and Ebara Foods Industry, Inc. (sales of 43.3 billion yen and a net income of 2.7 billion yen), and subsidiaries of listed companies, including Deria Foods Co., Ltd. (Kewpie Group) and initio foods inc. (Nisshin Seifun Group Inc.)

Although PICKLES HOLDINGS is a late comer (which entered the industry in 2003), it has been increasing sales from delicatessen products by making careful sales activities and focusing on vegetable-based delicatessen products that attract health-conscious consumers.

The sales in the term ended February 2022 exceeded 10.0 billion yen for the first time at 10.2 billion yen and sales in the term ending February 2023 is projected to be 10.0 billion yen.

(Product development case)

the company endeavors to renew the existing products (such as namul, salads, and pirikara (spicy) cucumbers), develop products that meet demand for drinking at home, and develop salads seasoned with dressings targeting health-conscious consumers.

"Gyukaku Garlic Salt Dressing" and "Gyukaku Rich Sesame Dressing" were launched as dry products.

The former is an all-purpose dressing full of “umami” with an addictive garlic and black pepper flavor. The packaging was changed to feature a photo that better evokes the dining scene in addition to a new name that conveys the flavor more accurately.

The latter, with its rich sesame flavor and secret ingredient (garlic) as key flavor elements, has also been repackaged and renamed.

② Expansion of selling areas

Sales in the Kanto region account for 50.9% of the total sales of the company while sales in Western Japan (the Kinki region, the Chugoku and Shikoku region, and the Kyushu region and Okinawa Prefecture) make up about 25%.

Considering that the combined population ratio by region of Western Japan is about 38%, there is ample room for expanding sales and the company aims to increase sales in the area to over 30% by enhancing sales activities there.

Taking advantage of the supply capacity of Hiroshima Factories of PICKLES CORPORATION KANSAI, which now have capability enough to spare for production thanks to the start of the operation of Saga Factory, and Tegara Foods Co., Ltd., for which building extension and repair have been completed, PICKLES CORPORATION will reinforce production and sales in the Kinki region, the Chugoku and Shikoku region, and the Kyushu region. The company will leverage the strength as the only company in the industry with a nationwide network to cultivate the market.

③ Expansion of sales channels

While increasing its market share in the selling spaces for pickles and delicatessen at convenience stores and mass retailers, restaurants, etc., the company will concentrate on selling products in new selling spaces for tofu, natto, sauces, dressings, processed food products, and frozen food products in addition to the selling spaces for pickles and delicatessen, at drugstores that actively sell food products and mass retailers. The company will also approach enterprises that deliver meals to elderly people and others.

This fall or winter, the company will launch frozen roasted sweet potato as a new product.

The company will strive to expand selling areas of its products, because it will improve efficiency of marketing and distribution.

④ New businesses

OH Co., Ltd., a subsidiary established in March of 2019, began the restaurant and retail businesses in a complex featuring fermentation and health, OH!!! – Magic of Fermentation, Health, and Food!!! –, (Hanno City, Saitama Prefecture) in October 2020.

The company endeavors to develop products including takeaway foods, increase the number of trial classes, plan and organize various events such as zen meditation and hand-copying sutra in cooperation with Noninji Temple which is the landowner, raise public awareness of the park via social media, utilize tours organized by travel agents, and coordinate with the e-commerce business. In addition,

OH!!! (OH Co., Ltd.) updated its e-commerce site in September 2022 to enable customers to purchase products handled by the company on the e-commerce site, thereby integrating the "Piene Online Shop" and the "YAWATAYA Online Shop" into one site. In the term ended February 2022, sales stood at 223 million yen and operating loss was 82 million yen. For the current fiscal year, the company expects sales of 238 million yen and an operating loss of 46 million yen.

PICKLES FARM CO.,LTD., which is a subsidiary, was established in March 2022, and started agricultural business in Saitama Prefecture.

It grows komatsuna (Japanese mustard spinach) for Tokorozawa Factory, and sweet potato for OH!!!. It aims to vitalize each region through stable procurement and agriculture.

Specifically, the company will work to operate in accordance with JGAP(*), undertake harvesting work for farmers, etc., provide planting and harvesting experiences (in-house training and cafeterias for children in need), and realize recycling-oriented agriculture by using vegetable waste.

Currently, there are 38 instructors certified by the JGPA, and the company aims to increase this number going forward.

*JGAP: Certification specifying the standards for appropriate agricultural farm management from the viewpoints of farm management, food safety, environmental conservation, occupational safety, human rights and welfare, while considering Japanese laws, production and social environments. The factory of the holdings, too, procures vegetables that are managed in accordance with JGAP as ingredients.

【4-2 Various efforts】

The following is a list of other efforts that PICKLES HOLDINGS made at production, ESG, and SDGs:

①Production and management

The company will strive to reduce costs and streamline operations, upgrade the system for procuring vegetables (procurement in each region, etc.), review unprofitable items, integrate items, install labor-saving equipment (equipment for removing the cores of Chinese cabbages and an automated kimchi production line), and improve and streamline product inspection by adopting label inspection equipment, etc. The company will also replace cups with bags as new containers. In addition to reducing costs, this will contribute to the reduction of waste plastic.

The company requires its employees to measure their body temperatures at home and when they come to the office, wear face masks and use hand sanitizers during work, and work in staggered working hours and from home as a preventive measure against Covid-19. It made consolation payments to the employees who are vaccinated.

②ESG, SDGs

The company's initiatives include "support for cafeterias for children in need," "adoption of an original Eco Mark," "supply chain management and procurement of raw materials," and "expansion of the educational system."

In March 2022, they opened a website regarding sustainability, to introduce their future policies and activities.

https://www.pickles-hd.co.jp/sustainability/

【4-3 Medium-Term Management Plan】

| FY2/22 | Ratio to sales | FY2/23 (Plan) | Ratio to sales | FY2/23 (Revised) | Ratio to sales | FY2/24 (Plan) | Ratio to sales | FY2/25 (Plan) | Ratio to sales |

Sales | 45,006 | 100.0% | 40,700 | 100.0% | 40,000 | 100.0% | 41,500 | 100.0% | 42,000 | 100.0% |

Gross Margin | 12,466 | 27.7% | 9,600 | 23.6% | 8,763 | 21.9% | 9,750 | 23.5% | 9,900 | 23.6% |

SG&A expenses | 9,523 | 21.2% | 7,100 | 17.4% | 6,963 | 17.4% | 7,200 | 17.3% | 7,300 | 17.4% |

Operating Income | 2,942 | 6.5% | 2,500 | 6.1% | 1,800 | 4.5% | 2,550 | 6.1% | 2,600 | 6.2% |

Ordinary Income | 3,068 | 6.8% | 2,630 | 6.5% | 1,910 | 4.8% | 2,680 | 6.5% | 2,730 | 6.5% |

Net income | 2,128 | 4.7% | 1,760 | 4.3% | 1,270 | 3.2% | 1,800 | 4.3% | 1,830 | 4.4% |

* Unit: million yen. From next term, the “accounting standards for revenue recognition,” etc. are applied.

| FY2/22 | FY2/25 (Plan) | CAGR |

Asazuke lightly pickled vegetables /kimchi | 18,858 | 17,663 | +1.1% |

Delicatessen | 10,264 | 10,121 | +2.8% |

Furuzuke old pickled vegetables | 508 | 487 | +0.2% |

Product | 15,374 | 13,728 | +1.4% |

Total | 45,006 | 42,000 | +1.6% |

*Unit: million yen. CAGR is the average annual growth rate from FY2/23 to FY2/25, calculated by Investment Bridge Co., Ltd

From next term, the “accounting standards for revenue recognition,” etc. are applied.

With the revision to the projection for this fiscal year, the company intends to consider whether a revision of the figures is necessary, while monitoring the situation going forward.

| FY2/20 | FY2/21 | FY2/22 | FY2/23(Plan) | FY2/24(Plan) | FY2/25(Plan) |

Capital Expenditure | 1,769 | 1,409 | 718 | 1,400 | 1,900 | 2,700 |

Depreciation | 838 | 931 | 963 | 1,007 | 1,026 | 1,022 |

* Unit: million yen.

The company plans to make capital investment of 6 billion yen for the next three years mainly in upgrading equipment in FY 2/23, building a factory dedicated to kimchi production (Kanto area) and upgrading equipment in FY 2/24, and newly establishing a factory (Kansai area) and upgrading equipment in FY 2/25.

The company will invest more funds in mechanization for saving labor and upgrade production footholds for expanding sales channels in the Hokuriku region and western Japan.

Regarding kimchi production, the company considers that it is possible to reduce personnel cost considerably.

The company is aware of the possibility of delays in the completion of construction due to the effects of soaring raw material costs and other factors.

As for M&A, the company will explore a wide range of potential targets, including seasonings and frozen foods.

5. Interview with President Kageyama

We asked the President Naoji Kageyama about the purpose of the shift to a holding company structure, future initiatives, and a message to shareholders and investors.

Q: Your company adopted a holding company structure on September 1st, 2022. Please tell us about the purpose.

We have chosen a system that allows business activities to progress under the responsibility and judgment of each company's president according to the actual situation in each region.

Up until now, we were supposed to check with PICKLES CORPORATION, our parent company, and obtain confirmation before taking action. However, each company can now take action under its responsibility once policies and directions are decided. This will result in faster decision-making and action.

In addition, we will consider M&A as we need to expand our business areas in order to achieve sustainable growth in the future. Regarding M&A in the future, we have collaboration and tie-ups in our mind. We believe that the holding company system is more suitable for strengthening in-group cooperation with the concept of "operating business together" and responding swiftly and flexibly.

As the top management and responsible leader of each company understand that the missions and roles assigned to them are changing, we would like to realize the advantages of the holding company structure as soon as possible.

Q: As a graduate from the Faculty of Agriculture, Shizuoka University, will your career be related to the role and mission of the president in your company in the future?

I learned processing techniques for agricultural products at the Faculty of Agriculture, Shizuoka University. After working at Tokai Pickling Co., Ltd, I joined PICKLES CORPORATION in 1984. As PICKLES CORPORATION manufactures lightly pickled vegetables, kimchi, and other products using fresh vegetables such as Chinese cabbage and cucumbers, I felt that this job is my vocation. I have personally grown vegetables in my home garden for about 40 years, and the vegetables I have grown myself taste uniquely wonderful. I have worked at vegetable-processing companies while experiencing this.

For that reason, one of my favorite tasks is to talk with farmers about various things. Everyone is growing vegetables with great care even though there are various difficulties. I feel great significance in processing such vegetables and delivering delicious products to customers, and this has been the basis of my work.

Q: What specific initiatives are you planning to take?

In terms of growing vegetables, we entered the agricultural business in March this year through our subsidiary, PICKLES Farm.

However, this does not mean replacing all the vegetables grown by professional farmers, who are our important stakeholders.

One of the reasons is that we want our employees to experience growing vegetables first-hand.

Additionally, as you know, the population is aging throughout Japan, and the average age of farmers is over 65 years old. The white radishes, Chinese cabbages, and cabbages we handle are heavy, and harvesting them is strenuous work. Therefore, we believe that having PICKLES Farm undertake the transportation from the harvesting site to our factory, and having the contracted farmers concentrate on raising them, are significantly beneficial to both parties.

We would like to once again make a strong appeal to the world about our company's mission of "delivering the vitality of vegetables."

Along with the decline in rice consumption, unfortunately the consumption of processed vegetables such as pickles is also decreasing. However, because your body is made from what you eat, instead of taking supplements, we would like everyone to eat delicious vegetables that are really good for his/her body so that he/she can live a healthy life.

In recent years, we have been focusing on fermentation. Centering on the fermentation-themed company “OH!!!”, which commemorated the 2nd anniversary, we would like to contribute to a healthy and delicious diet by combining the merits of fermentation with the deliciousness of vegetables. In order to accomplish this, we are focusing on disseminating information and providing products.

Q: What are the challenges for achieving your future growth path and growth strategy with a sense of urgency?

The first is the expansion of our business domain.

Although our company has the largest share in the pickles market and we will continue to seek to increase our share, the market itself is unlikely to grow significantly. Therefore, business operation in growing markets is essential.

Frozen foods are our current focus.

In the past, they were chosen because they could save time, but now their tastes have improved dramatically. They are also attracting attention for their usefulness as they can reduce food waste.

Frozen foods require distribution warehouses for frozen storage, distribution networks, and facilities for freezing. For this reason, we plan to capture demand through collaboration and M&A instead of starting from scratch.

Currently, we have started tentative sales through collaboration, and we will consider more specific initiatives in the future.

The second is that various endeavors are necessary.

Our company has a long track record in the pickles industry and has occupied the largest market share. The production of light pickles began 40 years ago, and we have changed seasonings and ingredients according to the needs and circumstances of the times. Although we are still supported by many customers, no major advances have been made in the manufacturing method. We cannot talk about the process in detail, however, if we want to be more successful, we need to do more than just stick to the old method. In order to improve the efficiency of production, we ask young employees, who have no preconceived notions, to make improvement proposals and pursue production in a completely different way than before.

We are sending a message throughout our company that it is important to continue to take on challenges without resting on our long track record, and this is not just limited to lightly pickled vegetables.

Q: “Finally, please give a message to investors and shareholders.”

We believe that our shareholders and investors have high expectations for our company's sustainable growth.

To that end, we will of course endeavor to increase our share in the pickles market, but we will also strive to expand our business domain, including frozen foods.

In addition, as there is a limit to what we can do in Japan alone, we believe that it is necessary to work on cultivating overseas markets, and we have begun discussions with external companies and organizations.

We would appreciate your continuous support as we will keep taking on various challenges as a company, after the transition to a holding company structure, and strive to meet everyone’s expectations.

6. Conclusions

Although the first quarter progress rate for both sales and operating income was lower than usual, the progress rate for the first half of the fiscal year was almost the same as usual, due in part to the revision of the earnings forecast, and the level of sales and operating income were also revised upward.

Although the external environment remains challenging due to the rebound in demand for nest eggs, consumers' thrifty spending habits, and rising raw material prices, it will be interesting to see how sales and profits will improve by implementing key strategies such as "strengthening product development," "expanding sales areas," and "expanding customers" from Q3 onward.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 3 from outside |

Auditors | 4 directors, including 3 from outside |

◎Corporate Governance Report (Updated on September 1, 2021)

Basic Policy

Our company considers corporate governance to be the important issue of business management for acting in conformity with the law and social norms, realizing the management policies, and achieving continuous growth.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4: Policy Retention Co.]

In principle, our company will not hold the shares of listed companies. However, if we hold shares for a reasonable purpose, such as the maintenance or strengthening of transaction relationships, we regularly check whether the purpose is satisfied.

We will discuss methods for examining the appropriateness of strategic shareholding and disclosing the detailed information on strategic shareholding.

Regarding the exercise of voting rights for strategically held shares, we judge each case individually. We appropriately exercise voting rights, while comprehensively considering whether they would contribute to the improvement in mid/long-term corporate value of our company and invested companies.

Going forward, we will examine procedures to ensure objectivity and transparency in the determination of the compensation system’s design and of specific remuneration amounts.

【Supplementary Principle 2-4-①】

Our company promotes highly motivated and skilled employees to management posts (division chiefs or higher) regardless of age, nationality, gender, etc. Regarding the promotion to management posts, the ratio of female managers is 8.3%, and we will increase this ratio. For non-Japanese employees, the ratio of them is low, so we have not set a goal for them. For mid-career workers, we promote them to management posts while comprehensively considering their experiences, abilities, etc., so we have not set a goal for them.

With the aim of honing the ability of each employee, we make efforts to foster the stance of learning voluntarily, adopting systems for supporting self-development, incentives for acquiring qualifications, etc. In addition, we recognize that the development of a comfortable working environment as an important management issue, and adopted refreshing holidays, overtime-free days, staggered working hours, etc.

【Supplementary Principle 3-1-③】

Regarding sustainability, we recognize the environment, safety, reliability, etc. as important issues, and take initiatives. As the investment in human capital, we develop educational systems and pursue a comfortable working environment for employees, and as the investment in intellectual property, we research lactic acid bacteria, etc. These are disclosed via our ESG reports and IR documents, which are available in our website. We will consider disclosure based on the TCFD, a globally established disclosure framework, or an equivalent framework, going forward.

<Disclosure based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 5-1. Policy on Constructive Dialogue with Shareholders】

With a basis in transparency, fairness, and continuity, we strive to disclose information promptly so that our shareholders and investors can understand our company correctly.

We will strive to disclose information based on related laws and regulations such as the Financial Instruments and Exchange Act as well as the timely disclosure rules established by financial instruments exchange, and to actively disclose information that can be considered effective for understanding our company with appropriate measures.

Specifically, we will hold financial results briefings twice a year and hold briefings for individual investors as appropriate. The President and Chief Executive Officer and the Public Relations and IR Office will also handle individual interviews within a reasonable range.

Additionally, along with establishing a Public Relations/IR Office as the department in charge of IR, we have posted the disclosure policy on our home page.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |