Bridge Report:(2935)PICKLES CO Second quarter of the Fiscal Year Ending February 2024

President Naoji Kageyama | PICKLES HOLDINGS CO,. LTD. (2935) |

|

Corporate Information

Stock Exchange | TSE Prime Market |

Industry | Food products (manufacturing) |

Representative | Naoji Kageyama |

Address | 7-8, Higashisumiyoshi, Tokorozawa-shi, Saitama |

Accounting term | February |

URL |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,170 | 12,858,430 shares | ¥15,044 million | 6.8% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥22.00 | 1.9% | ¥91.40 | 12.8x | ¥1,362.11 | 0.9x |

*Stock price is the closing price on October 12. Shares Outstanding, DPS and EPS are from the second quarter of the financial results for the FY24/2. ROE and BPS are actual results for the previous term.

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2020 Act. | 41,417 | 1,871 | 1,973 | 1,290 | 100.83 | 15.00 |

February 2021 Act. | 46,020 | 2,711 | 2,829 | 1,832 | 142.96 | 17.50 |

February 2022 Act. | 45,006 | 2,942 | 3,068 | 2,128 | 165.59 | 20.00 |

February 2023 Act. | 41,052 | 1,538 | 1,650 | 1,138 | 88.80 | 22.00 |

February 2024 Est. | 42,200 | 1,620 | 1,755 | 1,150 | 91.40 | 22.00 |

*Results for PICKLES CORPORATION until FY2/22, and results and forecasts for PICKLES HOLDINGS CO., LTD. after that. Unit: Million-yen, yen. Net income is the net income attributable to owners of the parent company. The same applies below. EPS and DPS are retroactively adjusted for the 1:2 stock split implemented on September 1, 2021. Since the first quarter of the term ending February 2023, the accounting standards for revenue recognition, etc. have been applied.

This Bridge Report presents PICKLES HOLDINGS’ summary of Financial Results for the second quarter of the Fiscal Year Ending February 2024.

Table of Contents

Key Points

1. Company Overview

2. Financial Results for the second quarter of the Fiscal Year Ending February 2024

3. Fiscal Year Ending February 2024 Earnings Forecasts

4. Major Future Policies

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

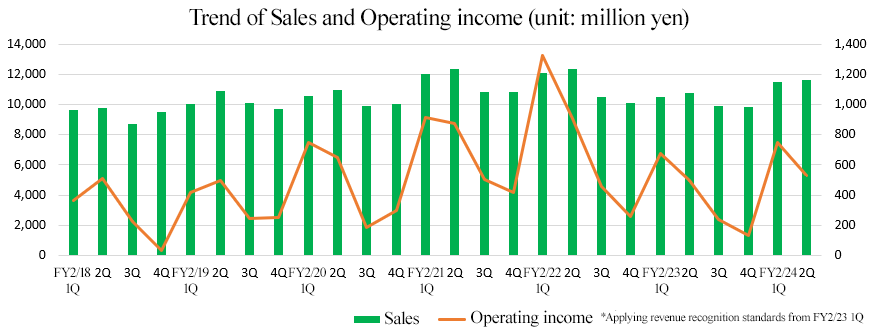

- In the second quarter of the term ending February 2024, sales increased 8.5% year on year to 23,111 million yen. The decline in demand due to the recoil from the demand from housebound consumers has subsided, and sales to convenience stores have been performing well. Operating income grew 9.3% year on year to 1,280 million yen. Although the increase rate of gross profit was limited to 1.5% due to rising prices of raw materials such as seasonings and packaging materials, selling, general, and administrative expenses decreased 1.0%, despite the surge in logistics costs. Both sales and profit exceeded forecasts.

- There are no changes to the earnings forecast. Sales are expected to increase 2.8% year on year to 42.2 billion yen, and operating income is projected to rise 5.3% to 1.62 billion yen in the term ending February 2024. Sales are forecast to grow thanks to demand recovery, expanding sales of delicatessen, etc. Despite the continued impact of soaring raw material costs, the company plans to increase profit by reviewing product contents and prices. The company plans to pay an ordinary dividend of 22.00 yen per share (in the previous fiscal year, the company paid an ordinary dividend of 20.00 yen per share and a commemorative dividend of 2.00 yen per share, for a total of 22.00 yen per share). The expected dividend payout ratio is 24.1%.

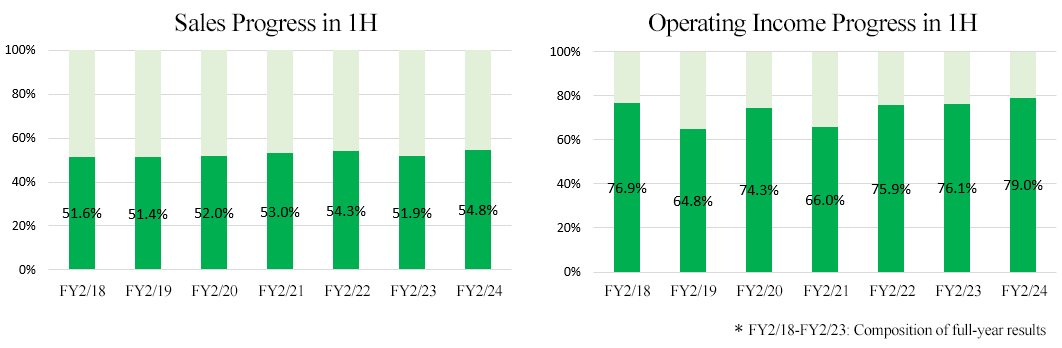

- The progress rate in the first half of the term ending February 2024 is 54.8% for sales and 79.0% for operating income. Both are at a high level compared to those in the previous years. The decrease in demand due to the recoil from the demand from housebound consumers until the previous fiscal year subsided, and the performance appears to be healthy.

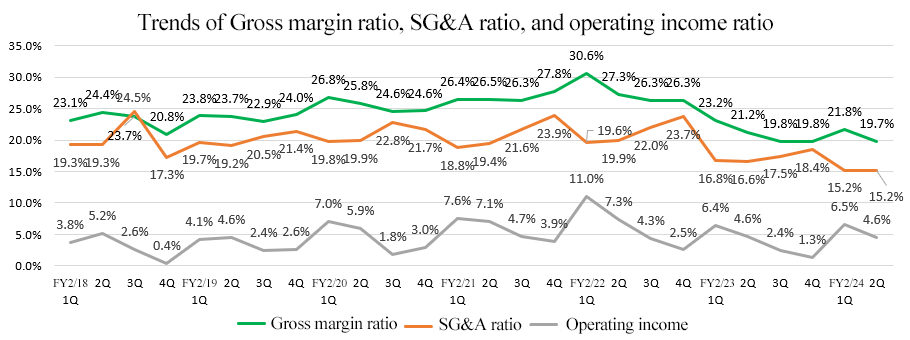

- On the other hand, the decline in gross profit margin continues. The gross profit margin in the second quarter of the term ending February 2024 (June-August) was 19.7%, the lowest level in recent years. Although the selling, general, and administrative expense ratio is on a downward trend due to changes in the method of accounting for logistics costs following the application of revenue recognition standards, there has been no significant change in operating income margin. However, with the strengthening of human resources and anticipated increase in depreciation expenses due to the construction of new factories, it is imperative to improve gross profit margin. In addition to the expansion of business operations through four strategic pillars: “strengthening product development,” “widening sales areas,” “expanding the customer base,” and “venturing into new businesses,” we would like to pay attention to their initiatives such as revising the vegetable procurement process, reviewing non-profitable items, and integrating items.

1. Company Overview

As a holding company, PICKLES HOLDINGS CO., LTD. has established a nationwide production and sales network, with PICKLES CORPORATION, which is engaged in the production and sales of lightly pickled vegetables, kimchi, and delicatessen, as well as the purchase and sale of pickles, etc., PICKLES CORPORATION SAPPORO, PICKLES CORPORATION KANSAI, FOOD LABEL CO., LTD.and other group companies.

The theme color of the company, green, represents freshness under a slogan of “We deliver the vitality of vegetables.” The company’s own products are produced using vegetables grown and harvested mainly in Japan by contracted farmers so that their traceability is ensured (about 80% of the vegetables used are supplied by contracted farmers), and no preservatives or synthesized food colorings are used. Furthermore, the company has displayed “a commitment to food safety” at its production sites as demonstrated by such endeavors as thorough temperature control at the factories, checkups of the clothes and health of all the employees before they enter the factories, devotion to the 5S activities (5S represents sorting, setting-in-order, shining, standardizing, and sustaining the discipline) and acquisition of the certification of FSSC22000 and JFS-B.

【1-1 Corporate Philosophy】

PICKLES HOLDINGS’ philosophy is “We deliver tasty and safe foods to consumers and aim at eco-conscious corporate management.” Under the corporate philosophy, it is pursuing the following management policies: (1) quality control for producing safe and delicious food products, (2) environmentally friendly corporate management, and (3) arrangement of a working environment that puts instillation of morals and the principle of safety and health first. Following these policies, the company is working on standards for food safety, including FSSC22000 and JFS-B, and international standards for environmental control such as ISO14001. In addition, it focuses on training and education of its employees through various approaches, such as enrichment of the personnel system and education programs.

On the basis of the corporate philosophy, the company focuses also on Environmental, Social, and Governance (ESG)-based business operations and SDGs, and prepares ESG reports with the aim of introducing its efforts and challenges related to ESG and its stories of enhancing the corporate value.

「ESG Bridge Report」

https://www.bridge-salon.jp/report_bridge/archives/2023/03/230328_2935.html

【1-2 Business Description】

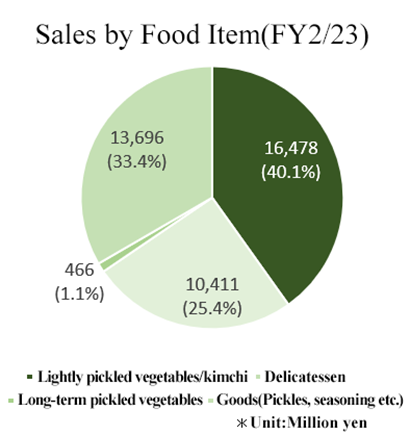

In the term ended February 2023, sales from products (manufactured by PICKLES CORPORATION at its own factories) accounted for 66.6% (40.1% from lightly pickled vegetables and kimchi, 25.4% from delicatessen, and 1.1% from long-term pickled vegetables), and those from products of a consolidated subsidiary, FOOD LABEL CO., LTD., and products purchased from outside companies made up 33.4%.

(Produced by Investment Bridge Co., Ltd. based on the company's reference material)

(Product and Goods overview)

◎Lightly pickled vegetables and kimchi

The company offers a lineup of lightly picked vegetable, which can be eaten like a salad, according to the season of the vegetables. In recent years, as consumers have become more health-conscious, the company has been selling "low-sodium lightly pickled vegetable," which is lower in salt than conventional products.

As the holdings emphasizes the provision of safe and secure food, the main ingredients, such as Chinese cabbage and cucumber, are produced in Japan. No preservatives or synthetic coloring agents are used.

The mainstay product, "Gohan ga Susumu kimchi" which was launched in October 2009, has been developed with an original taste that accentuates sweetness and umami to suit Japanese tastes, abandoning the traditional basic concept of kimchi being spicy and coming up with a concept of kimchi that housewives would want to feed to their families. While most kimchi products have a capacity of 300 to 400 grams, the new product is 200 grams so that a family can eat it all, making it easier to buy and more affordable. In addition, the package was designed to be slim enough to fit in the refrigerator, and the main color of the package was black instead of red or orange. As a result, the new product was well received by women and children.

The company has also developed products in collaboration with characters and food manufacturers to enrich its lineup.

Currently, lightly pickled vegetables and kimchi account for about 50% of the pickled vegetables market. Although the overall pickle market is shrinking, the market for lightly pickled vegetables and kimchi is stable.

Lightly pickled vegetables and kimchi are made mainly from vegetables and are being reevaluated as low-calorie foods rich in dietary fiber, and future growth in demand is expected.

|

|

|

Gohan ga Susumu Kimchi | JOJOEN Pogi Kimchi | 4 Kinds of Bran-flavored vegetables |

(Source: the company)

◎Delicatessen

The company began handling delicatessen in August 2002 and has been steadily increasing its sales. In recent years, consumers have become more budget-conscious and have been cutting back on eating out, resulting in a growing trend toward eating in at home by buying delicatessen, as well as a change in eating styles due to the increase in the number of elderly people, single-person households, and dual-earner households.

Demand for delicatessen is expected to continue to grow in the future. The corporate group is developing products based on the keyword "vegetables," which is one of its strengths, and currently Salad and other products are doing well. In addition, the corporate group is developing products with originality and added value to its delicatessen, for example, by focusing on different varieties of vegetables and developing salad dressings in-house, etc. In addition, the company utilizes technologies such as pH control to prevent discoloration of green vegetables.

|

|

|

4 kinds of Namul Set | Bangbangji Salad | Cabbage Salad with Umami Salt |

(Source: the company)

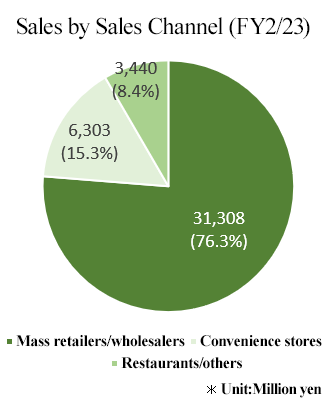

(Sales Destination)

Mass merchandisers, retailers, and wholesalers throughout Japan are the sales destinations, with 76.3% of the total sales channels being mass merchandisers and wholesalers, 15.3% being convenience stores, and 8.4% being restaurants and others as of FY2/23.

(Prepared by Investment Bridge Co., Ltd. based on the company's materials)

【1-3 Features, Strengths, and Competitive Advantages】

The company has the following features, strengths, and competitive advantages.

(1) Top share in the pickles industry

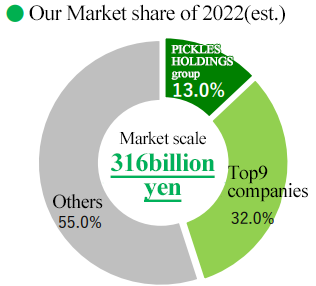

According to the ranking of companies that generate good sales in the pickles industry as presented by PICKLES HOLDINGS CO., LTD. based on THE JAPAN FOOD NEWS articles, PICKLES HOLDINGS group ranked first with consolidated sales of 41.1 billion yen, pulling far ahead of the other companies with a market share of 13.0% while endeavoring to attain its target of a market share of 15% through M&A etc.

(Source: the company)

(2) Highly unique product development capabilities

In order to realize product development quickly and flexibly, we have established a team system of having a development staff and a sales staff for each customer, such as convenience stores, mass merchandisers, and the food service industry. By reflecting the opinions of our customers, we are able to develop highly original products that are different from those of other companies.

The company promotes development from multiple aspects, from the selection of ingredients such as vegetables and seasonings to processing methods, taste, and packaging.

The Research and Development Laboratory, which is responsible for basic research, is engaged in future-oriented initiatives, including research on lactic acid bacteria, such as the plant-derived lactic acid bacteria Pne-12 (Pene lactic acid bacteria), which the company has developed on its own.

(3) Production and distribution system covering the entire country

The group companies, including PICKLES CORPORATION, cover the entire Japan. It is the only company in the pickles industry that has established a nationwide network of manufacturing, distribution, development, and sales functions. As a result, the company is able to provide the same lightly pickled vegetables, kimchi, and delicatessen to all of its customers' stores nationwide, which is a major selling point for the company.

In terms of manufacturing, the company has introduced the FSSC22000 and JFS-B standards for food safety and has established a system to supply safer and more secure products.

(Source: the company)

(4) Proposal-Based Sales with Close Relationships to Customers

At the sales bases located throughout Japan, proposal-based sales are conducted in close contact with each region and customer.

In addition to the mainstay lightly pickled vegetables and Kimchi products, the company is enhancing its product lineup for the delicatessen section, and its sales representatives are proposing sales methods, creating sales areas, holding pickle fairs, and considering various approaches to consumers together with the customers. In addition, information obtained from communication with customers is fed back to the company and used for product development based on consumer trends.

(5) Vendor functions to meet the needs of customers

The company has two functions: one as a manufacturer of its own products such as lightly pickled vegetables, kimchi, and delicatessen, and the other as a wholesaler of products such as pickled plums that cannot be manufactured at its own factory, which it purchases from pickle manufacturers throughout Japan. By taking advantage of its vendor function, which allows it to offer both its own products and those of other companies at the same time, the company is able to propose total sales floor development that meets the needs of its customers.

【1-4. ROE Analysis】

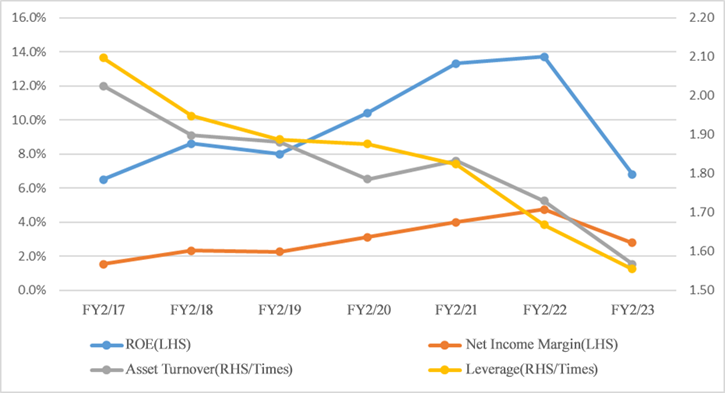

| FY2/17 | FY2/18 | FY2/19 | FY2/20 | FY2/21 | FY2/22 | FY2/23 |

ROE (%) | 6.5 | 8.6 | 8.0 | 10.4 | 13.3 | 13.7 | 6.8 |

Net Profit Margin (%) | 1.53 | 2.32 | 2.26 | 3.11 | 3.98 | 4.73 | 2.77 |

Total Asset Turnover (times) | 2.02 | 1.90 | 1.88 | 1.79 | 1.83 | 1.73 | 1.57 |

Leverage (times) | 2.10 | 1.95 | 1.89 | 1.88 | 1.83 | 1.67 | 1.55 |

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

ROE exceeded 10% for three consecutive terms until the term ended February 2022, but it fell short of 8%, which is generally considered a target for Japanese companies, in the term ended February 2023.

2. Financial Results for the second quarter of the Fiscal Year Ending February 2024

2-1 Consolidated Business Results

| FY2/23 2Q | Ratio to sales | FY2/24 2Q | Ratio to sales | YoY | Compared to the forecast |

Sales | 21,308 | 100.0% | 23,111 | 100.0% | +8.5% | +4.2% |

Gross profit | 4,722 | 22.2% | 4,795 | 20.7% | +1.5% | - |

SG&A expenses | 3,550 | 16.7% | 3,515 | 15.2% | -1.0% | -0.4% |

Operating income | 1,171 | 5.5% | 1,280 | 5.5% | +9.3% | +8.9% |

Ordinary income | 1,232 | 5.8% | 1,355 | 5.9% | +9.9% | +9.7% |

Net Income | 831 | 3.9% | 915 | 4.0% | +10.1% | +14.4% |

*Unit: million yen. Figures as of the end of February 2Q 2023 are based on the brief financial report of PICKLES CORPORATION and February 2Q 2024 are based on that of PICKLES HOLDINGS CO., LTD.

Sales and profits increased and exceeded forecasts

In the second quarter of the term ending February 2024, sales increased 8.5% year on year to 23,111 million yen. The decline in demand due to the recoil from the demand from housebound consumers has subsided, and sales to convenience stores have been performing well. Operating income grew 9.3% year on year to 1,280 million yen. Although the increase rate of gross profit was limited to 1.5% due to rising prices of raw materials such as seasonings and packaging materials, selling, general, and administrative expenses decreased 1.0%, despite the surge in logistics costs. Both sales and profit exceeded forecasts.

①Trends by Food Item and Sales Channel

◎Sales by Food Item

| FY2/22 2Q | Ratio to sales | FY2/23 2Q | Ratio to sales | FY2/24 2Q | Ratio to sales | YoY |

Product | 16,211 | 66.4% | 14,535 | 68.2% | 15,721 | 68.0% | +8.2% |

Lightly pickled vegetables /kimchi | 10,368 | 42.5% | 9,088 | 42.7% | 8,852 | 38.3% | -2.6% |

Delicatessen | 5,580 | 22.8% | 5,209 | 24.4% | 6,608 | 28.6% | +26.8% |

Long-term pickled vegetables | 263 | 1.1% | 237 | 1.1% | 260 | 1.1% | +9.6% |

Goods | 8,211 | 33.6% | 6,773 | 31.8% | 7,390 | 32.0% | +9.1% |

Total Sales | 24,423 | 100.0% | 21,308 | 100.0% | 23,111 | 100.0% | +8.5% |

*Unit: million yen. Year-on-year is not stated due to the applying Accounting Standard for Revenue Recognition from FY2/23 1Q.

◎Sales by Sales Channel

| FY2/22 2Q | Ratio to sales | FY2/23 2Q | Ratio to sales | FY2/24 2Q | Ratio to sales | YoY |

Mass retailers/wholesalers | 18,110 | 74.2% | 16,293 | 76.5% | 17,265 | 74.7% | +6.0% |

Convenience stores | 4,168 | 17.1% | 3,175 | 14.9% | 3,691 | 16.0% | +16.2% |

Restaurants/others | 2,143 | 8.8% | 1,839 | 8.6% | 2,154 | 9.3% | +17.1% |

Total Sales | 24,423 | 100.0% | 21,308 | 100.0% | 23,111 | 100.0% | +8.5% |

*Unit: million yen. The rate of decrease is not stated due to the applying Accounting Standard for Revenue Recognition from FY2/23 1Q.

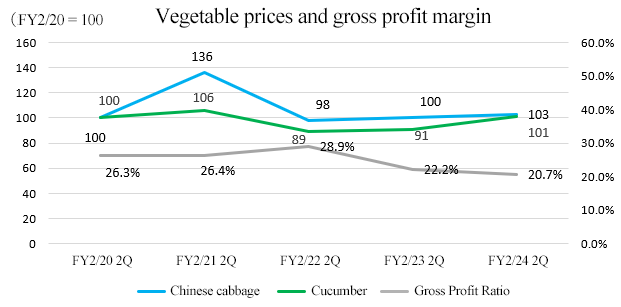

②Gross profit margin and situation surrounding vegetable prices

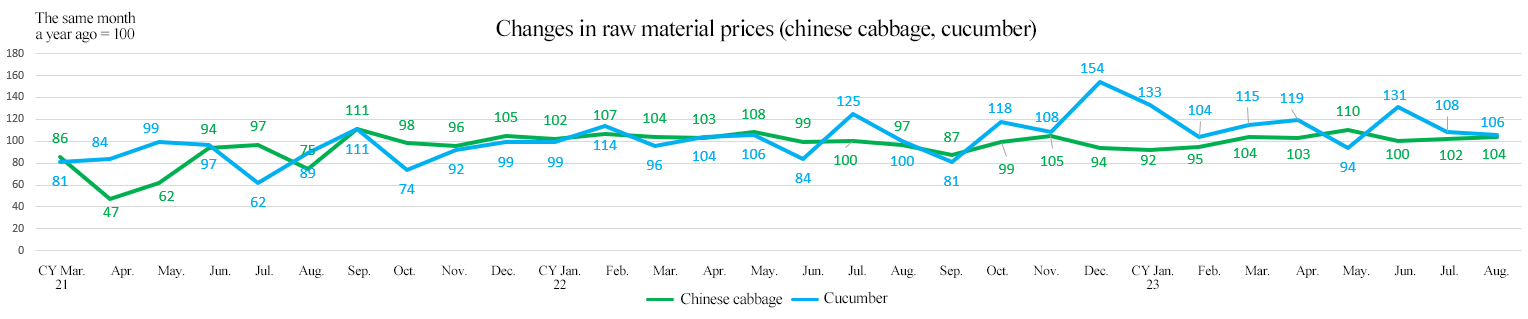

(Price of Chinese cabbages)

From March to April 2023, in the main production region of Ibaraki Prefecture, crop growth was accelerated due to high temperatures and moderate rainfall. As a result, although the reduced shipments and a price increase in May, there was no significant impact, and the situation remained mostly the same as that in the previous year.

(Price of cucumbers)

Around June 2023, in the main production region of Fukushima Prefecture, production delays occurred due to rainfall and low temperatures, causing prices to soar higher than those in the previous year.

The company continuously strives to improve the gross margin rate on a continuous basis by entering into contracts with more farmers and cementing its relationship with them.

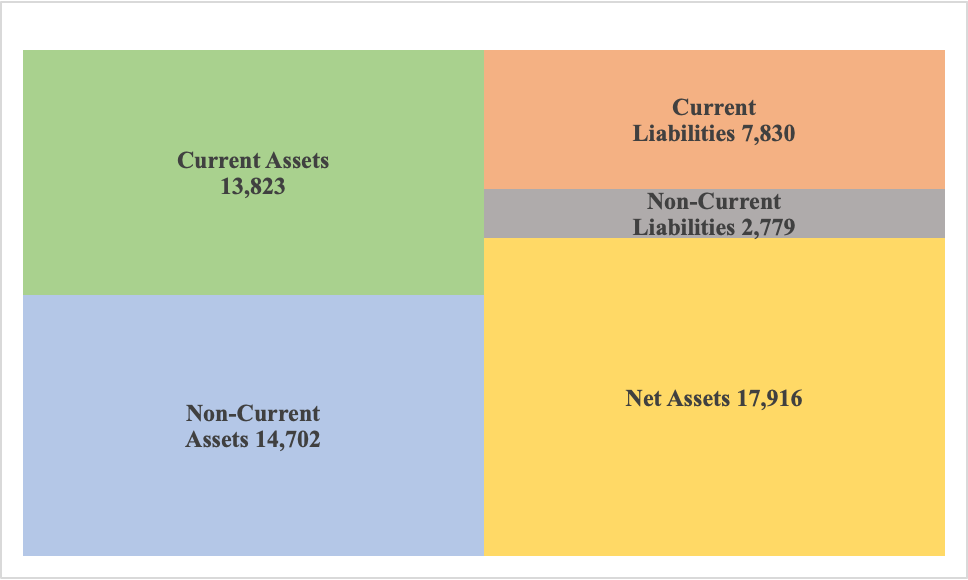

2-2 Financial Conditions and Cash Flow

Financial conditions

| Feb.22 | Aug.23 | Increase/ Decrease |

| Feb.22 | Aug.23 | Increase/ Decrease |

Current Assets | 11,249 | 13,823 | +2,574 | Current liabilities | 7,257 | 7,830 | +573 |

Cash | 5,940 | 7,927 | +1,987 | Payables | 2,922 | 3,999 | +1,077 |

Receivables | 4,251 | 5,000 | +749 | ST Interest-Bearing Liabilities | 2,114 | 1,436 | -678 |

Inventories | 672 | 829 | +157 | Noncurrent liabilities | 1,646 | 2,779 | +1,133 |

Noncurrent Assets | 15,058 | 14,702 | -356 | LT Interest-Bearing Liabilities | 539 | 1,658 | +1,119 |

Tangible Assets | 13,387 | 13,067 | -320 | Total Liabilities | 8,904 | 10,609 | +1,705 |

Intangible Assets | 463 | 399 | -64 | Net Assets | 17,404 | 17,916 | +512 |

Investments and Others | 1,207 | 1,236 | +29 | Total Liabilities and Net Assets | 26,308 | 28,526 | +2,218 |

Total Assets | 26,308 | 28,526 | +2,218 | Equity Ratio | 65.1% | 61.7% | -3.4p |

*Unit: million yen. Interest-bearing liabilities include lease liabilities.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Total assets increased by 2.2 billion yen from the end of the previous fiscal year to 28.5 billion yen due to increases in cash, and other assets. Total liabilities increased by 1.7 billion yen to 10.6 billion yen due to a decrease in payables. Net assets grew from 0.5 billion yen to 17.9 billion yen due to an increase in retained earnings, etc.

The capital-to-asset ratio decreased 3.4pt from the end of the previous year to 61.7%.

【2-3 Topics】

◎ Construction of a New Factory

In September 2023, the construction of a new factory, “Ibaraki Factory” (tentative name), was announced.

(Background of the new factory construction)

The company's main products, including “Gohan ga Susumu Kimchi” and other kimchi products, are currently manufactured on dedicated lines at Tokorozawa Factory and in various regional factories. To ensure continued profitability, further automation and labor reduction in the manufacturing process are necessary. The proposed location for the new factory in Yachiyo-machi, Yuki-gun, Ibaraki Prefecture, is a major production area for Chinese cabbage, the main ingredient for kimchi. This advantageous location for ingredient procurement led to the decision to build Ibaraki Factory (tentative name), a specialized factory for kimchi production.

(Overview of the new factory)

Location: | Sugenoya, Yachiyo-machi, Yuki-gun, Ibaraki Prefecture |

Site Are | Approximately 15,000 m2 |

Building: | Steel structure, total floor are approximately 5,300 m2 |

Investment Amount: | Buildings and equipment: approximately 5 billion yen |

Production Items and Quantity: | Kimchi, daily production of 66,000 packs (production quantity at operation commencement) |

Completion Period: | Scheduled for delivery in December 2024 |

3. Fiscal Year ending February 2024 Earnings Forecasts

Consolidated Earnings Forecast

Major income statements

| FY2/23 | Ratio to sales | FY 2/24 Est. | Ratio to sales | YoY | Progress rate |

Sales | 41,052 | 100.0% | 42,200 | 100.0% | +2.8% | 54.8% |

Gross profit | 8,633 | 21.0% | 8,704 | 20.6% | +0.8% | 55.1% |

SG&A | 7,094 | 17.3% | 7,084 | 16.8% | -0.1% | 49.6% |

Operating Income | 1,538 | 3.7% | 1,620 | 3.8% | +5.3% | 79.0% |

Ordinary Income | 1,650 | 4.0% | 1,755 | 4.2% | +6.3% | 77.2% |

Net Income | 1,138 | 2.8% | 1,150 | 2.7% | +1.0% | 79.6% |

*Unit: million yen.

There are no changes to the earnings forecast. Forecasted increase in sales and profit

There are no changes to the earnings forecast. Sales are expected to increase 2.8% year on year to 42.2 billion yen, and operating income is projected to rise 5.3% to 1.62 billion yen in the term ending February 2024. Sales are forecast to grow thanks to demand recovery, expanding sales of delicatessen, etc. Despite the continued impact of soaring raw material costs, the company plans to increase profit by reviewing product contents and prices. The company plans to pay an ordinary dividend of 22.00 yen per share (in the previous fiscal year, the company paid an ordinary dividend of 20.00 yen per share and a commemorative dividend of 2.00 yen per share, for a total of 22.00 yen per share). The expected dividend payout ratio is 24.1%.

◎Sales by Food Item

| FY2/23 | Ratio to sales | FY 2/ 24 Est. | Ratio to sales | YoY | Progress rate |

Product | 27,355 | 66.6% | 27,905 | 66.1% | +2.0% | 56.3% |

Lightly pickled vegetables /kimchi | 16,478 | 40.1% | 16,746 | 39.7% | +1.6% | 52.9% |

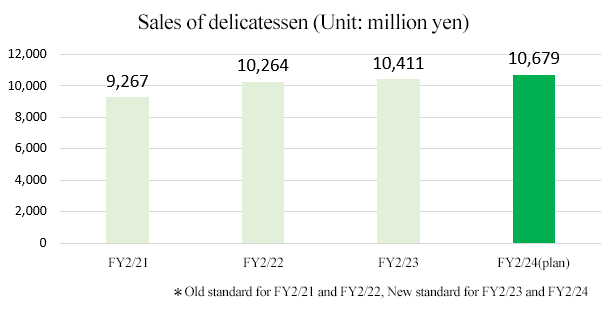

Delicatessen | 10,411 | 25.4% | 10,679 | 25.3% | +2.6% | 61.9% |

Long-term pickled vegetables | 466 | 1.1% | 479 | 1.1% | +2.8% | 54.3% |

Goods | 13,696 | 33.4% | 14,294 | 33.9% | +4.4% | 51.7% |

Total Sales | 41,052 | 100.0% | 42,200 | 100.0% | +2.8% | 54.8% |

*Unit: million yen.

The company is expected to see performance recovery from the previous term and sales growth in all categories.

◎Sales by Sales Channel

| FY2/23 | Ratio to sales | FY 2/ 24 Est. | Ratio to sales | YoY | Progress rate |

Mass retailers/wholesalers | 31,308 | 76.3% | 32,188 | 76.3% | +2.8% | 53.6% |

Convenience stores | 6,303 | 15.4% | 6,495 | 15.4% | +3.0% | 56.8% |

Restaurants/others | 3,440 | 8.4% | 3,515 | 8.3% | +2.2% | 61.3% |

Total | 41,052 | 100.0% | 42,200 | 100.0% | +2.8% | 54.8% |

*Unit: million yen.

◎Plan of SG&A Expenses

| FY2/23 | Ratio to sales | FY 2/ 24 Est. | Ratio to sales | YoY |

Total SG&A expenses | 7,094 | 17.3% | 7,084 | 16.8% | -0.1% |

Logistics cost | 2,170 | 5.3% | 2,224 | 5.3% | +2.5% |

Personnel cost | 3,260 | 7.9% | 3,100 | 7.4% | -4.9% |

Advertising cost | 33 | 0.1% | 267 | 0.6% | +709.1% |

Others | 1,630 | 4.0% | 1,491 | 3.5% | -8.5% |

Sales | 41,052 | 100.0% | 42,200 | 100.0% | +2.8% |

*Unit: million yen.

4. Major Future Policies

【4-1 Future strategies】

The company intends to expand business by taking advantage of its strengths and forging ahead with the following four strategies: reinforcing product development, expansion of sales area, expansion of sales channels, and new businesses.

(1) Reinforcing product development

①Lightly pickled vegetables and kimchi

(Market environment)

According to the ranking of companies that generate good sales in the pickles industry as presented by PICKLES HOLDINGS based on THE JAPAN FOOD NEWS articles, only five companies have achieved sales of over 10 billion yen, with PICKLES HOLDINGS ranked first with consolidated sales of 41.1 billion yen followed by Tokai Pickling Co., Ltd. whose sales are 22.9 billion yen, AKIMOTO FOODS Co., Ltd., with sales of 12.8 billion yen, Bingo Tsukemono Co., Ltd., which has generated sales of 11.5 billion yen, and YAMAMOTO SYOKUHIN Co., Ltd., with sales of 10.1 billion yen in descending order.

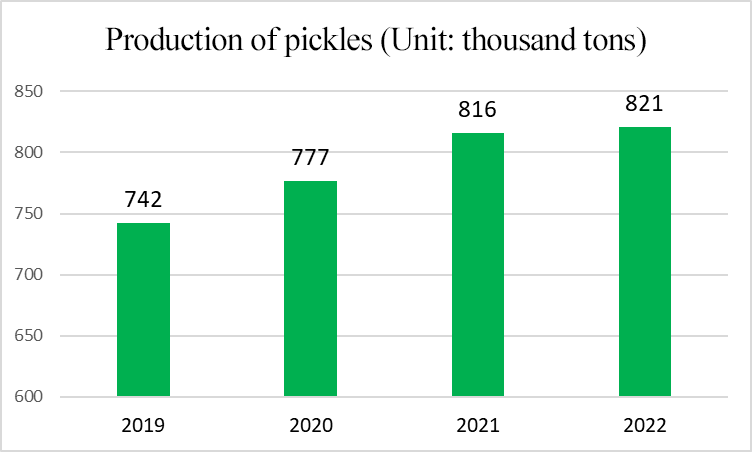

While the size of the market of pickles shrank from 480 billion yen in 2000 to 316 billion yen in 2022, the number of enterprises continue to decrease and aggregation is underway.

PICKLES HOLDINGS pulls far ahead of the other companies with a market share of 13.0% (as of 2022) while endeavoring to attain its target of a market share of 15%.

Although sales of pickled vegetables have been stopped falling due to multifarious factors, including changing eating habits and falling demand for rice, the sales decline has bottomed out in the market as a whole thanks to some products that have been selling well, such as kimchi. The production volume of pickles is on the rise. The company will keep enhancing product development and strive to expand its market share.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

(Examples of product development)

<Kimchi>

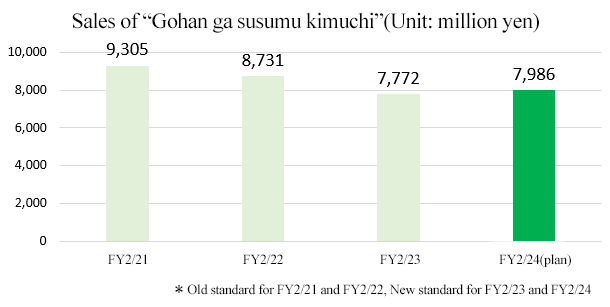

The company's main product, “Gohan ga Susumu Kimchi,” which experienced a decline in demand due to the recoil from demand from housebound consumers last year, is forecast to achieve a sales revenue of 7,986 million yen in the term ending February 2024, up 2.8% from the previous fiscal year.

Amid growing cost-saving consciousness, a campaign to increase the quantity by 20 grams, conducted in November 2022 and February 2023, is to be implemented again in November 2023. Furthermore, there are plans to implement a free LINE stamp distribution campaign in November 2023.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

<Lightly Pickled Vegetables>

The product lineup includes a variety of lightly pickled vegetables under the brand concept of “Lightly pickled vegetables you want to eat every day."

Standard food items | Pickle products popular as individual servings as well as in large volumes |

Seasonal delicacy | Limited-time products to savor the four seasons |

Snacks | Responding to the demand for side dishes (snacks), which fall under a growing category |

Easy-to-take healthy/fermented food items | Products based on health trends such as fermented and low-sodium foods, as well as foods high in dietary fibers and proteins |

Original vegetable-based items | Sauces that can be used as an alternative to seasonings, vegetable-based sweets, etc. |

Specialty food items | Domestically produced food items with no preservatives or artificial coloring |

②Delicatessen

(Market environment)

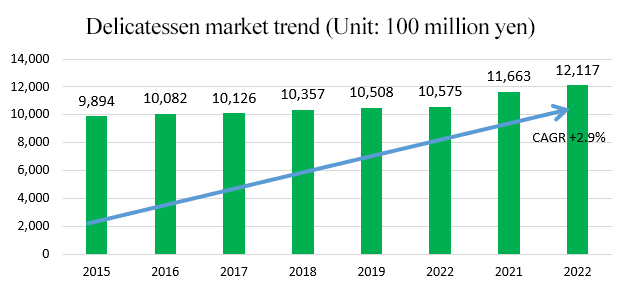

According to the company's data (researched by the Japan Chain Stores Association), the market size of the delicatessen market (Japanese, Western, and Chinese deli foods, boxed meals, sandwiches, etc.) in 2022 was 1.2117 trillion yen, growing at a CAGR (Compound Annual Growth Rate) of 2.9% since 2015.

The growth is believed to be driven by factors such as an increase in single-person households, an aging population, the advancement of women in society, heightened interest in health and nutritional balance, and the need for convenience and time-saving in household chores.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

In this sector, PICKLES CORPORATION is vying with listed companies such as FUJICCO Co., Ltd. (sales of 53.9 billion yen and a net income of 1.4 billion yen, Results for the previous period, same as below), KENKO Mayonnaise CO., Ltd. (Sales of 82.3 billion yen and a net income of 0.4 billion yen), and Ebara Foods Industry, Inc. (sales of 43.4 billion yen and a net income of 2.1 billion yen), and subsidiaries of listed companies, including Deria Foods Co., Ltd. (Kewpie Group) and initio foods inc. (Nisshin Seifun Group Inc.)

Although the corporate group is a latecomer that entered the market in 2003, it has expanded its sales by focusing on delicatessen using vegetables that match health trends, differentiating the taste through pickling techniques developed in the pickle production industry, and through meticulous sales efforts. In term ended February 2022, sales exceeded 10 billion yen for the first time. For the term ending February 2024, the company plans to achieve sales of 10.6 billion yen, up 2.6% from the previous fiscal year.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

(Product development case)

the company endeavors to renew the existing products (such as namul, salads, and pirikara (spicy) cucumbers), develop products that meet demand for drinking at home, and develop salads seasoned with dressings targeting health-conscious consumers.

③ New fields

The company is focusing on product development in new fields other than lightly pickled vegetables, kimchi, and delicatessen.

◎Frozen food related products

Developed a frozen kimchi hot pot that goes well with rice, "Reito gohan ga susumu kimchi nabe."

Delicatessen with sealing film lids is sold at mass retailers.

◎ LL gas-filled delicatessen

The company developed LL(Long-Life) gas-filled delicatessen that enables long-term storage by creating a vacuum inside the container and replacing it with inert gas.

The company sales at mass retailers for four products: kiriboshi daikon (dried radish strips), hijiki-ni (simmered dark edible seaweed), unohana (soybean pulp), and kinpira (chopped burdock root and carrot cooked in sugar and soy sauce).

Frozen food related products

| LL gas-filled delicatessen  |

(Source: the company)

(2)Expansion of selling areas

The sales composition by region shows that the Kanto region accounts for 51.0%, while the Western Japan area (Kinki, Chugoku-Shikoku, Kyushu-Okinawa) makes up about 25%.

In contrast, the population ratio is 34.4% in Kanto and about 38% in the West Japan area. Considering the population, there is significant room for sales expansion in the Western Japan area. Therefore, the company will increase its focus on sales expansion in this area, to raise the sales composition ratio of the Western Japan area to over 30%.

Taking advantage of the supply capacity of Western Japan Factories and Saga Factory of PICKLES CORPORATION NISHINIHON and TEGARA FOOD CO., LTD., the corporate group will reinforce production and sales in the Kinki region, the Chugoku and Shikoku region, and the Kyushu region. The corporate group will leverage the strength as the only company in the industry with a nationwide network to cultivate the market.

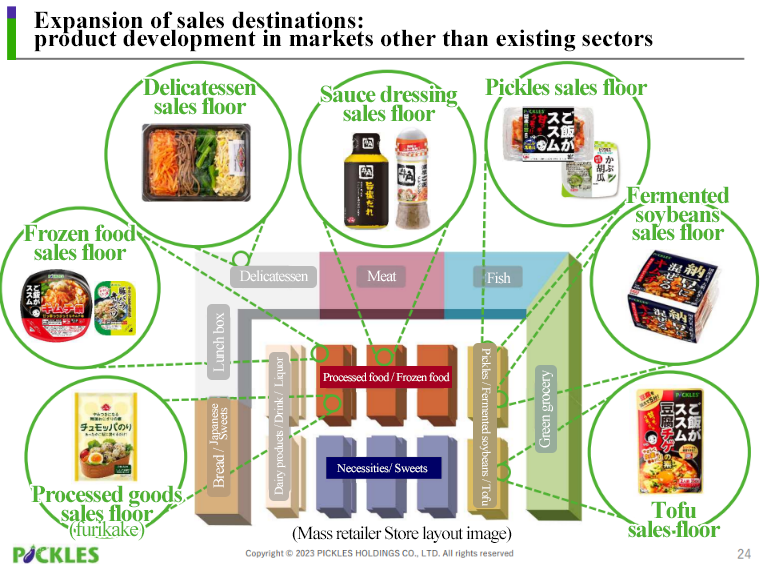

(3)Expansion of sales channels

While increasing its market share in the selling spaces for pickles and delicatessen at convenience stores and mass retailers, restaurants, etc., the company will concentrate on selling products in new selling spaces for tofu, natto, sauces, dressings, processed food products, and frozen food products in addition to the selling spaces for pickles and delicatessen, at drugstores that actively sell food products and mass retailers.

The company is actively engaging in the expansion of its products beyond existing sales areas. This strategy is advantageous as it leverages existing sales channels and enhances the loading efficiency of delivery vehicles. Consequently, this initiative is expected to lead to improvements in both marketing and logistics efficiency.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

(4)New businesses

① Retail and Restaurant Business

OH CO., LTD., conduct the restaurant and retail businesses in a complex featuring fermentation and health, OH!!! , (Hanno City, Saitama Prefecture).

In addition to developing products such as to-go dishes, meal menus, and sweets, increasing the number of trial classes, and planning and organizing various events such as Zen meditation and hand-copying sutras with Noninji Temple, and the company sells PICKLES FARM vegetables.

The company is also strengthening its EC business.

As “OH!!! Online Store,” the company sells products available at OH!!! facilities and some products of PICKLES CORPORATION.

Performance in the term ended February 2023 is 255 million yen in sales and 55 million yen in operating loss. For the current fiscal year, the company expects sales of 305 million yen and an operating loss of 29 million yen, aiming for early realization of profitability.

②Agricultural Business

PICKLES FARM CO.,LTD., which is a subsidiary, was established in March 2022, and started agricultural business in Saitama Prefecture.

It grows komatsuna (Japanese mustard spinach) and sweet potato. It aims to vitalize each region through stable procurement and agriculture.

Specifically, the company will work on operations in accordance with JGAP*, undertake harvesting work for farmers, etc., provide planting and harvesting experience (in-house training and restaurants serving dishes to children in need free of charge or at low prices based on donations from adult customers), realize recycling-oriented agriculture using vegetable waste, and export the vegetables it produces.

Additionally, the company is increasing the production of sweet potatoes and is advancing the installation of facilities for the storage and processing of sweet potatoes produced in line with this increase.

*JGAP: Certification specifying the standards for appropriate agricultural farm management from the viewpoints of farm management, food safety, environmental conservation, occupational safety, human rights and welfare, while considering Japanese laws, production and social environments. The factory of the corporate group, too, procures vegetables that are managed in accordance with JGAP as ingredients.

The company posted sales of 9 million yen and an operating loss of 1 million yen in the first year of the term ended February 2023. The company is expected to return to profitability with sales of 20 million yen and an operating income of 2 million yen in the current term ending February 2024.

③ Establishment of the Subsidiary “VEGEPAL CO., LTD.”

In September 2023, the company established VEGEPAL CO., LTD. as a joint venture with Asue Co., Ltd., a multifunctional trading company involved in sensing devices, semiconductors, FPD-related products, agricultural materials, and food additives.

Under the cooperative relationship between the company and Asue Co., Ltd., VEGEPAL CO., LTD. was established as a subsidiary responsible for the procurement and sales of sweet potatoes and processed food products made of sweet potato.

The corporate group intends to develop its business by leveraging its experience in food manufacturing and sales, along with the trading and intermediary functions of Asue Co., Ltd..

Utilizing sweet potatoes produced by PICKLES FARM CO., LTD. the subsidiary will not only sell sweet potatoes as fresh produce, but also develop products such as sweet potato paste, frozen baked sweet potato, dried sweet potato, and pet food. Furthermore, amid a declining domestic population, the company will also focus on export.

【4-2 Various efforts】

The following is a list of other efforts that PICKLES HOLDINGS made at production, ESG, and SDGs:

①Production and management

The company will review vegetable procurement (risk diversification, procurement in each region, etc.), review unprofitable items, consolidate items, change containers (from cups to bags), automate production and reduce manpower in production by adopting AI, etc., improve the efficiency of logistics (inventory management and sorting) and administrative processing (order processing, expense processing, etc.) within the group, and research manufacturing technologies (expiry date or shelf life extension).

②SDGs

◎Environment

Solar power generation equipment was installed at the Hiroshima Factory of PICKLES CORPORATION KANSAI. The company will examine its effectiveness and consider adopting solar power generation at other Factories.

The entire company is working to adopt LED lighting at all facilities.

To prevent feeding damage by sea urchins and the increase of sea urchins with no edible content, joint research is in progress with Yaizu Fisheries High School and the University of Yamanashi on sea urchin cultivation using vegetable waste as bait.

◎Safety and Security

The company is working to adopt and maintain a food management system.

◎Employees

Promoting health management to improve the working environment for employees.

In February 2023, the company announced a health management declaration.

Health-oriented Management Declaration

We, the Pickles Group, believe that contributing to the realization of a healthy lifestyle for consumers by providing safe and delicious products is our social responsibility. Recently, we have launched the OH!!! complex facility, which is focused on fermentation, to pursue the joys and health benefits obtained through food.

Recognizing that the health and happiness of our employees are indispensable for the company's development, we have adopted “improving employee morale and prioritizing safety and health in the workplace” as our management policy and have been working toward maintaining and enhancing health.

Moving forward, we declare our commitment to promoting the health and happiness of our employees and their families, as we continue to propose new values in “vegetables,” “fermentation,” and “health” and deliver the rich food culture that arises from them.

February 1, 2023 Naoji Kageyama President and Representative Director PICKLES HOLDINGS CO., LTD.

|

In the first year, the program will work to achieve a 100% health checkup rate, increase the implementation rate of specific health guidance, improve dietary habits, promote opportunities for exercise and establish the habit, and promote communication.

【4-3 Medium-Term Management Plan】

| FY2/23 | Ratio to sales | FY2/24 (Plan) | Ratio to sales | FY2/25 (Plan) | Ratio to sales | FY2/26 (Plan) | Ratio to sales | CAGR |

Sales | 41,052 | 100.0% | 42,200 | 100.0% | 42,500 | 100.0% | 43,000 | 100.0% | +1.6% |

Gross Margin | 8,633 | 21.0% | 8,704 | 20.6% | 8,800 | 20.7% | 8,950 | 20.8% | +1.2% |

SG&A expenses | 7,094 | 17.3% | 7,084 | 16.8% | 7,100 | 16.7% | 7,150 | 16.6% | +0.3% |

Operating Income | 1,538 | 3.7% | 1,620 | 3.8% | 1,700 | 4.0% | 1,800 | 4.2% | +5.4% |

Ordinary Income | 1,650 | 4.0% | 1,755 | 4.2% | 1,830 | 4.3% | 1,930 | 4.5% | +5.4% |

Net income | 1,138 | 2.8% | 1,150 | 2.7% | 1,160 | 2.7% | 1,230 | 2.9% | +2.6% |

* Unit: million yen. From next term, CAGR is the average annual growth rate from the term ended February 2023 to the term ending February 2026. Calculated by Investment Bridge Co., Ltd.

| FY2/23 | FY2/26 (Plan) | CAGR |

Lightly pickled vegetables /kimchi | 16,478 | 17,058 | +1.2% |

Delicatessen | 10,411 | 10,941 | +1.7% |

Old pickled vegetables | 466 | 488 | +1.6% |

Product | 13,696 | 14,512 | +2.0% |

Total | 41,052 | 43,000 | +1.6% |

*Unit: million yen. CAGR is the average annual growth rate from FY2/23 to FY2/26, calculated by Investment Bridge Co., Ltd

| FY2/21 | FY2/22 | FY2/23 | FY2/24(Plan) | FY2/25(Plan) | FY2/26(Plan) |

Capital Expenditure | 1,409 | 718 | 883 | 1,700 | 3,500 | 3,700 |

Depreciation | 931 | 963 | 980 | 968 | 1,226 | 1,252 |

* Unit: million yen.

The company is planning a capital investment of 8.9 billion yen over the next three years.

The main items are: "Term ending February 2024: facility upgrade, etc.," "Term ending February 2025: Ibaraki factory (Kimchi Factory, temporary name), facility upgrade, etc.," "Term ending February 2026: New Factory (Kansai), facility upgrade, etc."

The investment for the Ibaraki Factory, initially estimated to be around 3.5 billion yen, is now expected to be approximately 5 billion yen as mentioned above.

In order to strengthen production capabilities in the Kansai region, including the Hokuriku area, the company is revising the investment plan for the new Kansai factory, which is planned as a new manufacturing base, including the use of buildings with all its furnishings and equipment and consideration of M&A.

As for M&A, the company will explore a wide range of potential targets, including seasonings and frozen foods.

5. Conclusions

The progress rate in the first half of the term ending February 2024 is 54.8% for sales and 79.0% for operating income. Both are at a high level compared to those in the previous years. The decrease in demand due to the recoil from the demand from housebound consumers until the previous fiscal year subsided, and the performance appears to be healthy.

On the other hand, the decline in gross profit margin continues. The gross profit margin in the second quarter of the term ending February 2024 (June-August) was 19.7%, the lowest level in recent years. Although the selling, general, and administrative expense ratio is on a downward trend due to changes in the method of accounting for logistics costs following the application of revenue recognition standards, there has been no significant change in operating income margin. However, with the strengthening of human resources and anticipated increase in depreciation expenses due to the construction of new factories, it is imperative to improve gross profit margin. In addition to the expansion of business operations through four strategic pillars: “strengthening product development,” “widening sales areas,” “expanding the customer base,” and “venturing into new businesses,” we would like to pay attention to their initiatives such as revising the vegetable procurement process, reviewing non-profitable items, and integrating items.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 3 from outside |

Auditors | 4 directors, including 3 from outside |

◎Corporate Governance Report (Updated on June 2, 2023)

Basic Policy

Our company considers corporate governance to be the important issue of business management for acting in conformity with the law and social norms, realizing the management policies, and achieving continuous growth.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4: Policy Retention Co.]

In principle, our company will not hold the shares of listed companies. However, if we hold shares for a reasonable purpose, such as the maintenance or strengthening of transaction relationships, we regularly check whether the purpose is satisfied.

We will discuss methods for examining the appropriateness of strategic shareholding and disclosing the detailed information on strategic shareholding.

Regarding the exercise of voting rights for strategically held shares, we judge each case individually. We appropriately exercise voting rights, while comprehensively considering whether they would contribute to the improvement in mid/long-term corporate value of our company and invested companies.

Going forward, we will examine procedures to ensure objectivity and transparency in the determination of the compensation system’s design and of specific remuneration amounts.

【Supplementary Principle 2-4-①】

Our group promotes highly motivated and skilled employees to management posts (division chiefs or higher) regardless of age, nationality, gender, etc. Regarding the promotion to management posts, the ratio of female managers is 8.3%, and we will increase this ratio. The company was established through a sole share transfer of PICKLES CORPORATION, meaning that the company is part of PICKLES CORPORATION, so the percentage of women in management positions above is based on the values of PICKLES CORPORATION as of February 28, 2022. For non-Japanese employees, the ratio of them is low, so we have not set a goal for them. For mid-career workers, we promote them to management posts while comprehensively considering their experiences, abilities, etc., so we have not set a goal for them.

With the aim of honing the ability of each employee, we make efforts to foster the stance of learning voluntarily, adopting systems for supporting self-development, incentives for acquiring qualifications, etc. In addition, we recognize that the development of a comfortable working environment as an important management issue, and adopted refreshing holidays, overtime-free days, staggered working hours, etc.

Additionally, creating a comfortable working environment is recognized as an important management issue. Within our group, we have implemented measures such as refreshing leave, overtime-free days, and staggered working hours.

【Supplementary Principle 3-1-③】

Regarding sustainability, we recognize the environment, safety, reliability, etc. as important issues, and take initiatives. As the investment in human capital, we develop educational systems and pursue a comfortable working environment for employees, and as the investment in intellectual property, we research lactic acid bacteria, etc. These are disclosed via our ESG reports and IR documents, which are available in our website. For more information about our corporate group's sustainability efforts, please visit our website.

We will consider disclosure based on the TCFD, a globally established disclosure framework, or an equivalent framework, going forward.

<Disclosure based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 5-1. Policy on Constructive Dialogue with Shareholders】

With a basis in transparency, fairness, and continuity, we strive to disclose information promptly so that our shareholders and investors can understand our company correctly.

We will strive to disclose information based on related laws and regulations such as the Financial Instruments and Exchange Act as well as the timely disclosure rules established by financial instruments exchange, and to actively disclose information that can be considered effective for understanding our company with appropriate measures.

Specifically, we will hold financial results briefings twice a year and hold briefings for individual investors as appropriate. The President and Chief Executive Officer and the Public Relations and IR Office will also handle individual interviews within a reasonable range.

Additionally, along with establishing a Public Relations/IR Office as the department in charge of IR, we have posted the disclosure policy on our home page.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |