Bridge Report:(2935)PICKLES Fiscal Year Ended February 2025

President Naoji Kageyama | PICKLES HOLDINGS CO., LTD. (2935) |

|

Corporate Information

Stock Exchange | TSE Prime Market |

Industry | Food products (manufacturing) |

Representative | Naoji Kageyama |

Address | 7-8, Higashisumiyoshi, Tokorozawa-shi, Saitama |

Accounting term | February |

URL |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥919 | 12,858,430 shares | ¥11,816 million | 5.3% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥27.00 | 2.9% | ¥79.60 | 11.5x | ¥1,482.42 | 0.6x |

*Stock price is the closing price on April 25. Each number is based on PICKLES HOLDINGS’ financial results for the fiscal year ended February 2025.

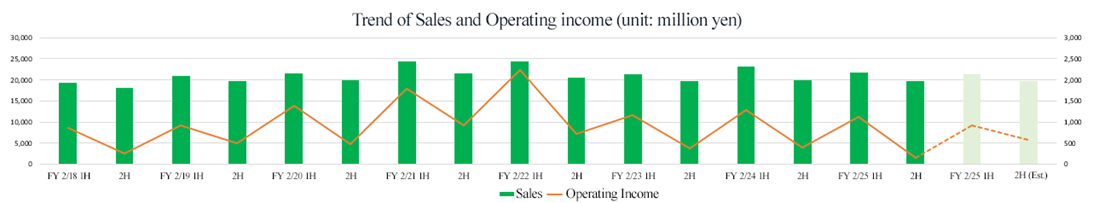

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

February 2022 Act. | 45,006 | 2,942 | 3,068 | 2,128 | 165.59 | 20.00 |

February 2023 Act. | 41,052 | 1,538 | 1,650 | 1,138 | 88.80 | 22.00 |

February 2024 Act. | 43,028 | 1,668 | 1,771 | 1,175 | 94.29 | 24.00 |

February 2025 Act. | 41,518 | 1,279 | 1,345 | 958 | 77.09 | 26.00 |

February 2026 Est. | 41,000 | 1,500 | 1,532 | 990 | 79.60 | 27.00 |

*Results for PICKLES CORPORATION until fiscal year ended February 2022, and results and forecasts for PICKLES HOLDINGS CO., LTD. after that. Unit: Million-yen. Net income is the net income attributable to owners of the parent company. The same applies below. EPS and DPS are retroactively adjusted for the 1:2 stock split implemented on September 1, 2021. Since the first quarter of the fiscal year ended February 2023, the accounting standards for revenue recognition, etc. have been applied.

This Bridge Report presents PICKLES HOLDINGS’ summary of Financial Results of the Fiscal Year Ended February 2025 and Earnings Forecasts of the Fiscal Year Ending February 2026.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended February 2025 Financial Results

3. Fiscal Year Ending February 2026 Earnings Forecasts

4. Progress of Medium/Long-Term Management Strategy

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

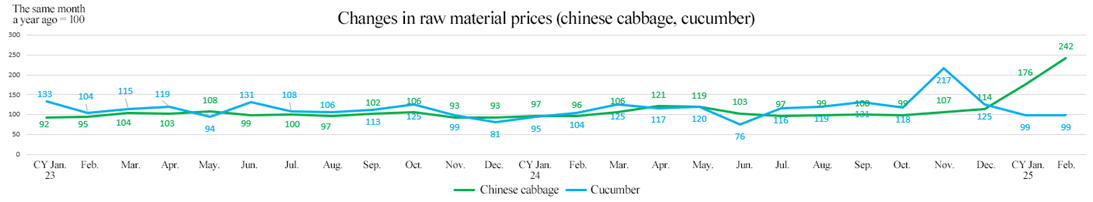

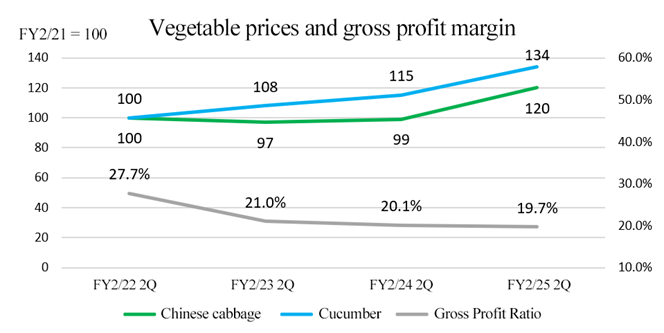

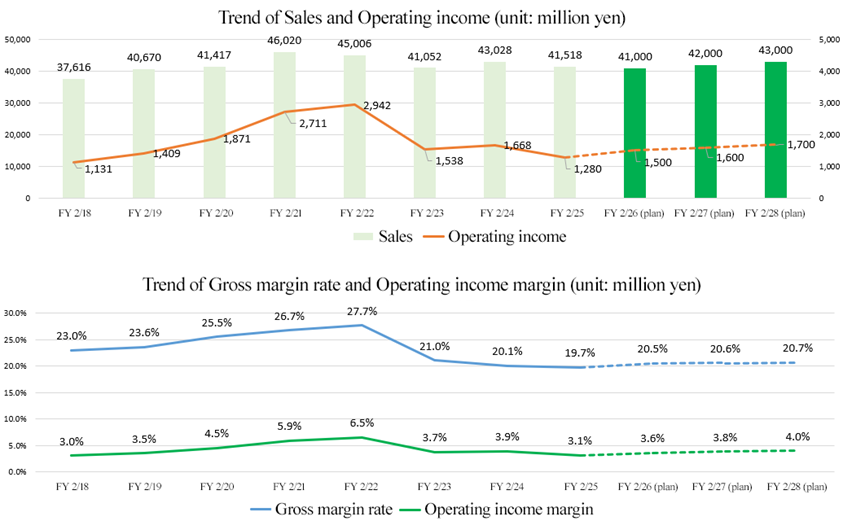

- In the fiscal year ended February 2025, sales and profit declined. Sales decreased 3.5% year on year to 41,518 million yen, because the rise in commodity prices urged consumers to save money and the skyrocketing of vegetable prices due to the weather made them curtail sale. Operating income dropped 23.3% year on year to 1,279 million yen. Gross profit decreased 5.1% year on year as SGA expenses was unchanged from the previous fiscal year, but sales dropped and the prices of vegetables, including Chinese cabbages and cucumbers, which are main ingredients soared, due to the abnormal weather at the beginning of spring, the high air temperature in the summer, the poor growth of vegetables in the winter, etc.

- For the fiscal year ending February 2026, it is projected that sales will drop and profit will rise. It is forecast that sales will decrease 1.2% year on year to 41 billion yen, operating income will rise 17.3% year on year to 1.5 billion yen, and EBITDA will grow 18.9% year on year to 2,716 million yen. They will engage in active marketing based on their nationwide network and the development of a wide array of products, but their business will be affected by the frugality of consumers in the wake of the revisions to selling prices for improving profit and the rise in commodity prices, and the business trends of major clients, too, will be affected, so sales are projected to drop. It is expected that gross profit will rise 2.8% year on year and gross profit margin will increase 0.8 points, but SGA expenses will be unchanged from the previous year, so operating income will grow by double digits. They plan to pay a dividend of 27.00 yen/share, up 1 yen/share from the previous fiscal year. The expected payout ratio is 33.9%.

- In their rolling plan, they aim to achieve “sales of 43 billion yen and an operating income of 1.7 billion yen” in the fiscal year ending February 2028. Sales are expected to keep growing slightly from the next fiscal year, while operating income is projected to increase with annual growth rate being nearly double-digit, and operating income margin is forecast to recover to 4.0%. However, the annual growth rate of gross profit is around 3%, so it seems that it takes some time to improve profitability on a full-scale basis. In addition to the diffusion of revised prices, we would like to expect from the progress of development and sales promotion of delicatessen with high added value, health-conscious products, frozen food-related products, etc.

1. Company Overview

As a holding company, PICKLES HOLDINGS CO., LTD. has established a nationwide production and sales network, with PICKLES CORPORATION, which is engaged in the production and sales of lightly pickled vegetables, kimchi, and delicatessen, as well as the purchase and sale of pickles, etc., PICKLES CORPORATION KANSAI, FOOD LABEL CO., LTD. and other group companies.

The theme color of the company, green, represents freshness under a slogan of “We deliver the vitality of vegetables.” The company’s own products are produced using vegetables grown and harvested mainly in Japan by contracted farmers so that their traceability is ensured (about 80% of the vegetables used are supplied by contracted farmers), and no preservatives or synthesized food colorings are used. Furthermore, the company has displayed “a commitment to food safety” at its production sites as demonstrated by such endeavors as thorough temperature control at the factories, checkups of the clothes and health of all the employees before they enter the factories, devotion to the 5S activities (5S represents sorting, setting-in-order, shining, standardizing, and sustaining the discipline) and acquisition of the certification of JFS-B.

1-1 Corporate Philosophy and Vision

PICKLES HOLDINGS’ philosophy is “We deliver tasty and safe foods to consumers and aim at eco-conscious corporate management.” Under the corporate philosophy, it is pursuing the following management policies: (1) quality control for producing safe and delicious food products, (2) environmentally friendly corporate management, and (3) arrangement of a working environment that puts instillation of morals and the principle of safety and health first. In accordance with this policy, they follow JFS-B, which is the standard for food safety, and ISO14001, which is an international standard for environmental management. In addition, they put energy into the education of employees while enriching systems for human resources, education, etc. and make efforts to foster the stance and corporate culture for encouraging employees to take on challenges.

The company focuses also on SDGs and sustainability management, and prepares ESG reports with the aim of introducing its efforts and challenges related to ESG and its stories of enhancing the corporate value.

「ESG Bridge Report」

https://www.bridge-salon.jp/report_bridge/archives/2025/03/250311_2935.html

Under the corporate philosophy, they pursue a “general maker of vegetables, fermented food, and health” that keeps creating new value as an ideal state in the medium/long term.

1-2 Market environment

(1) Lightly pickled vegetables and kimchi

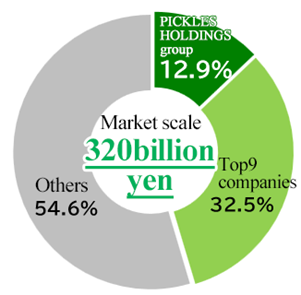

According to the sales ranking in the field of pickled foods produced by the company with reference to the articles of the Shokuhin Shinbun, the company occupies the largest share with consolidated sales of 41.5 billion yen, followed by Tokai Pickling with sales of 23.8 billion yen, Akimoto Foods with sales of 13 billion yen, Bingo Tsukemono with sales of 12.4 billion yen, and Yamamoto Shokuhin with sales of 10.7 billion yen. Only five companies earn sales of over 10 billion yen.

Due to the changes in eating habits and a decline in demand for meals with rice, the scale of the market of pickles shrank from 480 billion yen in 2000 to 320 billion yen in 2023. The number of enterprises has been declining, and integration has been progressing, but the shrinkage of the entire market is subsiding. Under such an environment, lightly pickled vegetables and kimchi account for about 50% of the market of pickled foods, so the market scale is stable.

The market share of the company is 12.9%, much higher than that of the second company, and they have been aiming to increase it to 15%.

The POS data show that the unit purchase price of lightly pickled vegetables has increased over the previous year. Still, the quantity of pickles purchased has decreased, affected by a decrease in the number of items purchased by consumers due to rising prices. Market trends for the company's mainstay products, lightly pickled vegetables and kimchi are on the same trend.

The company will keep enhancing product development and strive to expand its market share.

(2) Delicatessen

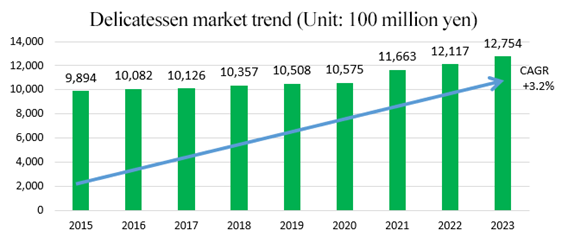

According to the company's data (researched by the Japan Chain Stores Association), the market size of the delicatessen market (Japanese, Western, and Chinese deli foods, boxed meals, sandwiches, etc.) in 2023 was 1.2754 trillion yen, growing at a CAGR (Compound Annual Growth Rate) of 3.2% since 2015.

The growth is believed to be driven by factors such as an increase in single-person households, an aging population, the advancement of women in society, heightened interest in health and nutritional balance, and the need for convenience and time-saving in household chores.

In this field, they are competing with some listed companies, including Fujicco (sales: 55.7 billion yen, net income: 1.1 billion yen in the previous fiscal year), KENKO Mayonnaise (sales: 88.7 billion yen, net income: 2.7 billion yen), and Ebara Foods Industry (sales: 45.2 billion yen, net income: 1.8 billion yen), and subsidiaries, etc. of listed companies, such as Deria Foods (the Kewpie Group) and initio foods (the Nisshin Seifun Group).

(Produced by Investment Bridge Co., Ltd. based on the company's reference material)

1-3 Business Description

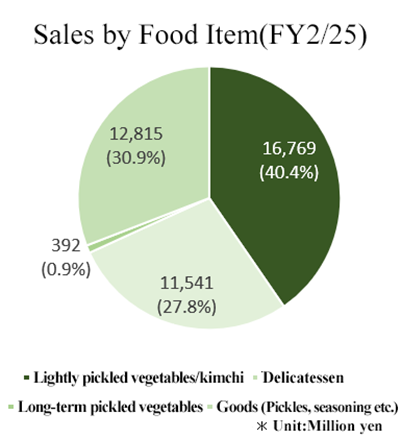

In the fiscal year ended February 2025, sales from products (manufactured by PICKLES CORPORATION at its own factories) accounted for 69.1% (40.4% from lightly pickled vegetables and kimchi, 27.8% from delicatessen, and 0.9% from long-term pickled vegetables), and those from products of a group company, FOOD LABEL CO., LTD., and products purchased from outside companies made up 30.9%.

(Produced by Investment Bridge Co., Ltd. based on the company's reference material)

(1) Product and Goods overview

◎ Lightly pickled vegetables and kimchi

The company offers a lineup of lightly picked vegetable, which can be eaten like a salad, according to the season of the vegetables. In recent years, as consumers have become more health-conscious, the company has been selling "low-sodium lightly pickled vegetable," which is lower in salt than conventional products.

As the holdings emphasizes the provision of safe and secure food, the main ingredients, such as Chinese cabbage and cucumber, are produced in Japan. No preservatives or synthetic coloring agents are used.

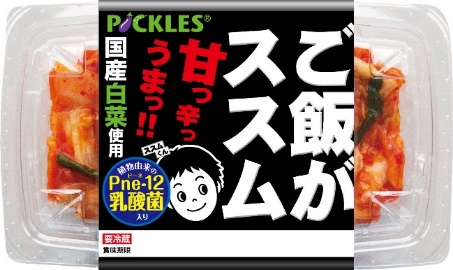

“Gohan ga Susumu Kimchi (kimchi that goes well with rice),” which was released in October 2009 and became a long-selling core product for all generations as the cumulative sales quantity of 3 major products has exceeded about 500 million packs, was embodied based on an idea of a young employee: “kimchi that can be enjoyed by all family members because it is not so spicy” under their stance of taking on challenges, while breaking away from the conventional mindset that kimchi is spicy.

They have developed with an original taste that accentuates sweetness and umami to suit Japanese tastes. In Addition, the package was designed to be slim enough to fit in the refrigerator, and the main color of the package was black instead of red or orange. As a result, the new product was well received by women and children.

They have developed some products in collaboration with some characters and food makers, and expanded the domain of products by utilizing the brand power of the “Gohan ga Susumu Kimchi” series, including delicatessen, seasonings, and frozen food products.

Lightly pickled vegetables and kimchi are made mainly from vegetables and are being reevaluated as low-calorie foods rich in dietary fiber, and future growth in demand is expected.

|

|

|

Gohan ga Susumu Kimchi | JOJOEN Pogi Kimchi | 4 Kinds of Bran-flavored vegetables |

(Source: the company)

◎ Delicatessen

The company began handling delicatessen in August 2002 and has been steadily increasing its sales. In recent years, consumers have become more budget-conscious and have been cutting back on eating out, resulting in a growing trend toward eating in at home by buying delicatessen, as well as a change in eating styles due to the increase in the number of elderly people, single-person households, and dual-earner households. Demand for delicatessen is expected to continue to grow in the future.

The corporate group is developing products based on the keyword "vegetables," which is one of its strengths, and currently Namul, Salad, rice bran pickles, and other products are doing well. In addition, the corporate group is developing products with originality and added value to its delicatessen, for example, by focusing on different varieties of vegetables and developing salad dressings in-house, etc. In addition, the company utilizes technologies such as pH control to prevent discoloration of green vegetables.

|

|

|

4 kinds of Namul Set | Protein-rich Bangbangji Salad | Assortment of rice bran pickles |

(Source: the company)

(Sales Destination)

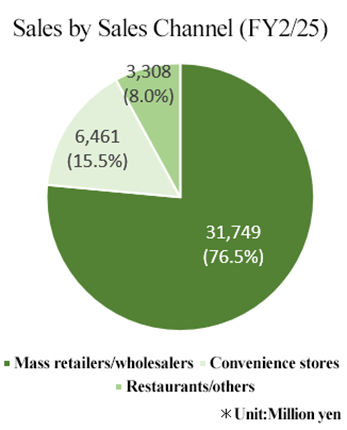

Mass merchandisers, retailers, and wholesalers throughout Japan are the sales destinations, with 76.5% of the total sales channels being mass merchandisers and wholesalers, 15.5% being convenience stores, and 8.0% being restaurants and others as of fiscal year ended February 2025.

(Prepared by Investment Bridge Co., Ltd. based on the company's materials)

1-4 Features, Strengths, and Competitive Advantages

The company has the following features, strengths, and competitive advantages.

(1) Top share in the pickles industry

According to the ranking of companies that generate good sales in the pickles industry as presented by PICKLES HOLDINGS CO., LTD. based on THE JAPAN FOOD NEWS articles, PICKLES HOLDINGS group ranked first with consolidated sales of 41.5 billion yen, pulling far ahead of the other companies with a market share of 12.9% while endeavoring to attain its target of a market share of 15% through M&A etc.

(Source: the company)

(2) Highly unique product development capabilities

In order to swiftly and flexibly develop about 400 items per year, they have organized development and marketing teams for respective business partners, including convenience stores, mass retailers, and restaurants, to reflect the opinions of clients in product development and differentiate our products from competitors’. The company promotes development from multiple aspects, from the selection of ingredients such as vegetables and seasonings to processing methods, taste, and packaging.

Development personnel are assigned to business establishments around Japan, so that local needs can be grasped and met.

The Research and Development Laboratory, which is responsible for basic research, is engaged in future-oriented initiatives, including research on lactic acid bacteria, such as the plant-derived lactic acid bacteria Pne-12 (Pene lactic acid bacteria), which the company has developed on its own.

(3) Production and distribution system covering the entire country

There are about 20 production sites, and they can produce about 600,000 packs per day. Group companies, mainly PICKLES CORPORATION, cover the entire Japan, and can produce and ship products 365 days a year. It is the only company in the pickles industry that has established a nationwide network of manufacturing, distribution, development, and sales functions. As a result, the company is able to provide the same lightly pickled vegetables, kimchi, and delicatessen to all of its customers' stores nationwide, which is a major selling point for the company.

For production, they have adopted JFS-B as the standards for food safety, and produced an HACCP plan for each factory for pickles and delicatessen, to supply safer and more worry-free products.

(Source: the company, the operation of Ibaraki Factory began in December 2024.)

(4) Proposal-Based Sales with Close Relationships to Customers

There are a broad range of clients, including leading nationwide chains and local small-sized retailers. Their sales offices scattered around Japan had about 60 marketing staff members as of March 2025, who conduct proposal-based marketing for each region and each client and make direct transactions based on the trusting relationships and sales networks they have developed for many years.

In addition to the mainstay lightly pickled vegetables and Kimchi products, the company is enhancing its product lineup for the delicatessen section, and its sales representatives are proposing sales methods, creating sales areas, holding pickle fairs, and considering various approaches to consumers together with the customers. In addition, information obtained from communication with customers is fed back to the company and used for product development based on consumer trends.

(5) Vendor functions to meet the needs of customers

The company has two functions: one as a manufacturer of its own products such as lightly pickled vegetables, kimchi, and delicatessen, and the other as a wholesaler of products such as pickled plums that cannot be manufactured at its own factory, which it purchases from pickle manufacturers throughout Japan. By taking advantage of its vendor function, which allows it to offer both its own products and those of other companies at the same time, the company is able to propose total sales floor development that meets the needs of its customers.

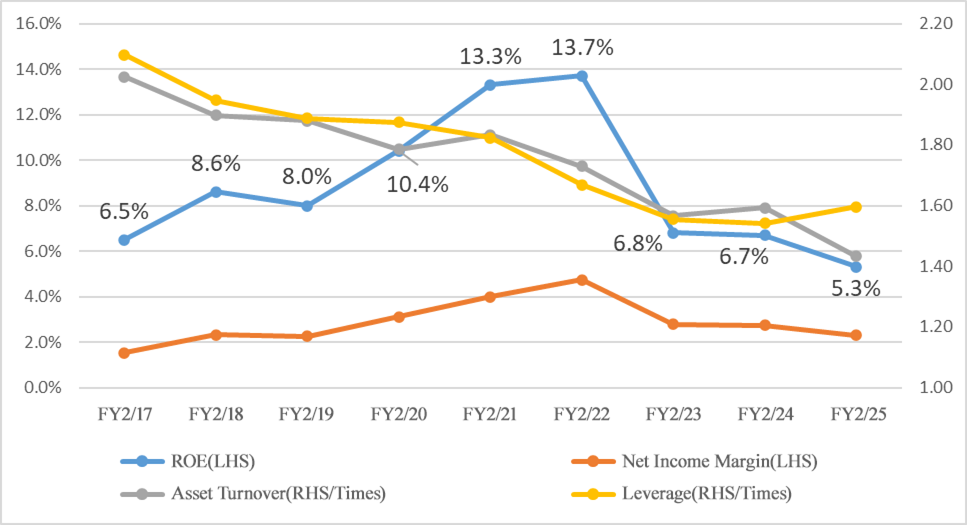

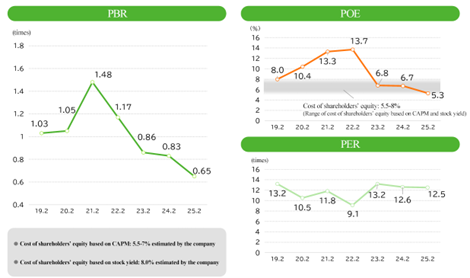

1-5 ROE Analysis

| FY 2/18 | FY 2/19 | FY 2/20 | FY 2/21 | FY 2/22 | FY 2/23 | FY 2/24 | FY 2/25 |

ROE (%) | 8.6 | 8.0 | 10.4 | 13.3 | 13.7 | 6.8 | 6.7 | 5.3 |

Net Profit Margin (%) | 2.32 | 2.26 | 3.11 | 3.98 | 4.73 | 2.77 | 2.73 | 2.31 |

Total Asset Turnover (times) | 1.90 | 1.88 | 1.79 | 1.83 | 1.73 | 1.57 | 1.59 | 1.43 |

Leverage (times) | 1.95 | 1.89 | 1.88 | 1.83 | 1.67 | 1.55 | 1.54 | 1.60 |

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

ROE was over 10% for 3 consecutive fiscal years until the fiscal year ended February 2022, but it has been declining to less than 8%, which is the value general Japanese companies should aim for, in fiscal year ended February 2025. Profitability and asset efficiency need to be improved.

2. Fiscal Year Ended February 2025 Financial Results

2-1 Consolidated Business Results

| FY 2/24 | Ratio to sales | FY 2/25 | Ratio to sales | YoY | Compared to the forecast |

Sales | 43,028 | 100.0% | 41,518 | 100.0% | -3.5% | -4.6% |

Gross profit | 8,637 | 20.1% | 8,193 | 19.7% | -5.1% | -8.2% |

SG&A expenses | 6,969 | 16.2% | 6,913 | 16.7% | -0.8% | -4.4% |

Operating income | 1,668 | 3.9% | 1,279 | 3.1% | -23.3% | -24.8% |

Ordinary income | 1,771 | 4.1% | 1,345 | 3.2% | -24.1% | -24.4% |

Quarterly net income | 1,175 | 2.7% | 958 | 2.3% | -18.5% | -20.1% |

EBITDA | 2,608 | 6.1% | 2,284 | 5.5% | -12.4% | -17.4% |

*Unit: million yen. EBITDA was calculated with the equation: Operating income + Depreciation, by Investment Bridge with reference to the brief financial report.

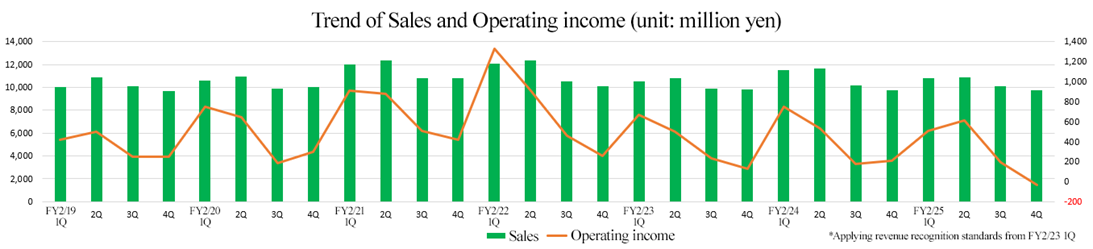

Sales and profits decreased

Sales decreased 3.5% year on year to 41,518 million yen. The frugality of consumers caused by the rise in commodity prices affected their performance, they curtailed sale in response to the skyrocketing of prices of vegetables due to the weather, and the sales of pickles for professional use, such as pickled plums used for boxed meals and rice balls, decreased.

Operating income dropped 23.3% year on year to 1,279 million yen. Gross profit decreased 5.1% year on year as SGA expenses was unchanged from the previous fiscal year, but sales dropped and the prices of vegetables, including Chinese cabbages and cucumbers, which are the ingredients have soared, due to the abnormal weather at the beginning of spring, the high air temperature in the summer, the poor growth of vegetables in the winter, etc.

Regarding quarterly performance, sales and profit decreased year on year and quarter on quarter, and they posted an operating loss and an ordinary loss in the fourth quarter (December to February).

① Trends by Food Item and Sales Channel

◎ Sales by Food Item

| FY 2/23 | Composition ratio | FY 2/24 | Composition ratio | FY 2/25 | Composition ratio | YoY | Compared to the forecast |

Product | 27,355 | 66.6% | 29,259 | 68.0% | 28,702 | 69.1% | -1.9% | -2.4% |

Lightly pickled vegetables /kimchi | 16,478 | 40.1% | 17,545 | 40.8% | 16,769 | 40.4% | -4.4% | -4.6% |

Delicatessen | 10,411 | 25.4% | 11,241 | 26.1% | 11,541 | 27.8% | +2.7% | +1.6% |

Long-term pickled vegetables | 466 | 1.1% | 473 | 1.1% | 392 | 0.9% | -17.1% | -16.1% |

Goods | 13,696 | 33.4% | 13,768 | 32.0% | 12,815 | 30.9% | -6.9% | -9.1% |

Total Sales | 41,052 | 100.0% | 43,028 | 100.0% | 41,518 | 100.0% | -3.5% | -4.6% |

*Unit: million yen. Year-on-year is not stated due to the applying Accounting Standard for Revenue Recognition from the first quarter of the fiscal year ended February 2023.

◎ Sales by Sales Channel

| FY 2/23 | Composition ratio | FY 2/24 | Composition ratio | FY 2/25 | Composition ratio | YoY | Compared to the forecast |

Mass retailers/ wholesalers | 31,308 | 76.3% | 32,537 | 75.6% | 31,749 | 76.5% | -2.4% | -3.3% |

Convenience stores | 6,303 | 15.4% | 6,663 | 15.5% | 6,461 | 15.5% | -3.0% | -6.0% |

Restaurants/others | 3,440 | 8.4% | 3,827 | 8.9% | 3,308 | 8.0% | -13.6% | -12.8% |

Total Sales | 41,052 | 100.0% | 43,028 | 100.0% | 41,518 | 100.0% | -3.5% | -4.6% |

*Unit: million yen. Year-on-year is not stated due to the applying Accounting Standard for Revenue Recognition from the first quarter of the fiscal year ended February 2023.

The sales of products other than delicatessen decreased year on year, falling below the forecast.

In all sales channels, sales dropped year on year, falling below the forecast.

② Gross profit margin and situation surrounding vegetable prices

Gross profit margin declined 0.4 points year on year, due to the skyrocketing of prices of Chinese cabbages and cucumbers due to the abnormal weather at the beginning of spring, the high air temperature in the summer, the poor growth of vegetables in the winter, etc.

Regarding the procurement of vegetables as ingredients, they will improve the methods for procuring vegetables by utilizing more Chinese cabbages stored when their price was stable and procuring ingredients from the regions around each factory to disperse the risk of poor crops in a production area, and improve gross profit margin in a sustainable manner.

2-2 Financial Conditions

Financial conditions

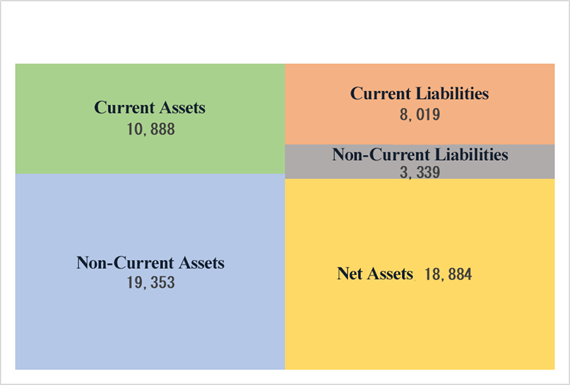

| End of Feb. 2024 | End of Feb. 2025 | Increase/ Decrease |

| End of Feb. 2024 | End of Feb. 2025 | Increase/ Decrease |

Current Assets | 12,622 | 10,888 | -1,734 | Current liabilities | 6,668 | 8,019 | +1,351 |

Cash | 7,754 | 4,974 | -2,780 | Payables | 2,892 | 2,974 | +82 |

Receivables | 4,119 | 4,083 | -36 | ST Interest-Bearing Liabilities | 1,505 | 2,672 | +1,167 |

Inventories | 662 | 725 | +63 | Noncurrent liabilities | 2,791 | 3,339 | +548 |

Noncurrent Assets | 15,091 | 19,353 | +4,262 | LT Interest-Bearing Liabilities | 1,634 | 2,176 | +542 |

Tangible Assets | 13,436 | 17,788 | +4,352 | Total Liabilities | 9,459 | 11,358 | +1,899 |

Intangible Assets | 326 | 186 | -140 | Net Assets | 18,254 | 18,884 | +630 |

Investments and Others | 1,327 | 1,378 | +51 | Total Liabilities and Net Assets | 27,713 | 30,242 | +2,529 |

Total Assets | 27,713 | 30,242 | +2,529 | Equity Ratio | 64.6% | 61.0% | -3.6pt |

*Unit: million yen. Interest-bearing liabilities include lease liabilities.

Total assets stood at 30.2 billion yen, up 2.5 billion yen from the end of the previous fiscal year, as cash & deposits decreased while tangible fixed assets increased through the construction of Ibaraki Factory of PICKLES CORPORATION, etc. Total liabilities augmented 1.8 billion yen year on year to 11.3 billion yen, due to the increase in interest-bearing liabilities, etc.

Net assets increased 600 million yen from the end of the previous fiscal year to 18.8 billion yen.

Capital-to-asset ratio dropped 3.6 points from the end of the previous fiscal year to 61.0%.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

2-3 Topics

◎ Certified as a Health and Productivity Management Organization for the first time

In March 2025, PICKLES HOLDINGS CO., LTD. and PICKLES CORPORATION were certified as a “2025 Health and Productivity Management Organization (Large Corporation Category)” according to the system for certifying Health and Productivity Management Organization. They received this certification for the first time.

The PICKLES Group actively promotes health-conscious business administration while putting importance on the health and safety of employees. While pursuing the “arrangement of a working environment that puts instillation of morals and the principle of safety and health first” as one of their management policies, they engage in activities for “promoting all employees to undertake a health checkup,” “improving the rate of specific health guidance,” “improving dietary habits,” “increasing opportunities to exercise and promoting employees to make exercise a habit,” “facilitating communication,” etc.

3. Fiscal Year Ending February 2026 Earnings Forecasts

Consolidated Earnings Forecast

Major income statements

| FY 2/25 | Ratio to sales | FY 2/26 Est. | Ratio to sales | YoY |

Sales | 41,518 | 100.0% | 41,000 | 100.0% | -1.2% |

Gross profit | 8,193 | 19.7% | 8,419 | 20.5% | +2.8% |

SG&A | 6,913 | 16.7% | 6,919 | 16.9% | +0.1% |

Operating Income | 1,279 | 3.1% | 1,500 | 3.7% | +17.3% |

Ordinary Income | 1,345 | 3.2% | 1,532 | 3.7% | +13.9% |

Net Income | 958 | 2.3% | 990 | 2.4% | +3.3% |

EBITDA | 2,284 | 5.5% | 2,716 | 6.6% | +18.9% |

*Unit: million yen. EBITDA is calculated by operating income + depreciation.

Forecasted decrease in sales but increase in profit

It is forecast that sales will decrease 1.2% year on year to 41 billion yen, operating income will rise 17.3% year on year to 1.5 billion yen, and EBITDA will grow 18.9% year on year to 2,716 million yen.

They will engage in active marketing based on their nationwide network and the development of a wide array of products, but they consider that their business will be affected by the frugality of consumers in the wake of the rise in commodity prices. They also consider the business trends of major clients.

It is expected that gross profit will rise 2.8% year on year and gross profit margin will increase 0.8 points, but SGA expenses will be unchanged from the previous year, so operating income will grow by double digits.

They plan to pay a dividend of 27.00 yen/share, up 1 yen/share from the previous fiscal year. The expected payout ratio is 33.9%.

◎ Sales by Food Item

| FY 2/25 | Composition ratio | FY 2/26 Est. | Composition ratio | YoY |

Product | 28,702 | 69.1% | 28,124 | 68.6% | -2.0% |

Lightly pickled vegetables /kimchi | 16,769 | 40.4% | 16,782 | 40.9% | +0.1% |

Delicatessen | 11,541 | 27.8% | 11,342 | 27.7% | -1.7% |

Long-term pickled vegetables | 392 | 0.9% | 414 | 1.0% | +5.6% |

Goods | 12,815 | 30.9% | 12,460 | 30.4% | -2.8% |

Total Sales | 41,518 | 100.0% | 41,000 | 100.0% | -1.2% |

*Unit: million yen.

The sales of lightly pickled vegetables and kimchi are projected to be unchanged from the previous year, and the sales of delicatessen, which grew in the previous fiscal year, are forecast to decline.

◎ Sales by Sales Channel

| FY 2/25 | Composition ratio | FY 2/26 Est. | Composition ratio | YoY |

Mass retailers/wholesalers | 31,749 | 76.5% | 31,011 | 75.6% | -2.3% |

Convenience stores | 6,461 | 15.5% | 6,555 | 16.0% | +1.5% |

Restaurants/others | 3,308 | 8.0% | 3,432 | 8.4% | +3.8% |

Total | 41,518 | 100.0% | 41,000 | 100.0% | -1.2% |

*Unit: million yen.

The sales via convenience stores are expected to grow, but the sales via mass retailers, wholesalers, etc. are projected to drop for the second consecutive year.

◎ Plan of SG&A Expenses

| FY 2/25 | Ratio to sales | FY 2/26 Est. | Ratio to sales | YoY |

Total SG&A expenses | 6,913 | 16.6% | 6,919 | 16.9% | +0.1% |

Logistics cost | 2,279 | 5.5% | 2,360 | 5.8% | +3.6% |

Personnel cost | 3,029 | 7.3% | 3,041 | 7.4% | +0.4% |

Advertising cost | 40 | 0.1% | 44 | 0.1% | +10.0% |

Others | 1,564 | 3.7% | 1,472 | 3.6% | -5.9% |

Sales | 41,518 | 100.0% | 41,000 | 100.0% | -1.2% |

*Unit: million yen.

Logistics expenses are projected to increase 3.6% year on year. In response to the 2024 logistics problem, the company will implement various measures, including switching from store-by-store deliveries to consolidated deliveries, which will improve loading efficiency and reduce the number of delivery trips, switching to new delivery providers, and restructuring the group's logistics network following the operation of the new factory in Ibaraki. In addition to the measures for improving efficiency, they will request distributors, where the ratio of delivery costs has increased, to revise selling prices.

4. Progress of Medium/Long-Term Management Strategy

4-1 Overall picture

Taking into account management challenges such as the “improvement of profitability considering the soaring prices of raw materials and personnel costs,” the “improvement of PBR” and “expansion of the business scale throughout the group by creating new growth drivers,” the company is promoting the priority strategies of “elevation of profitability,” “management conscious of capital efficiency” and “endeavoring to develop new products and enter new fields.” The current progress is as follows.

4-2 Progress of priority strategies

(1)Elevation of profitability

The company is working to “improve its operating income margin” and “reduce costs.”

Measures to improve its operating income margin include “narrowing down the number of items” and “revising selling prices in response to soaring costs.”

Their measures for the reduction of costs are “streamlining and automation of the production system” and “revision and streamlining of raw material procurement.”

① Improvement of operating income margin

<To narrow down items>

At Tokorozawa Plant, which is the core plant of the company, the number of items was reduced by approximately 10% in the fiscal year ended February 2025 compared to the previous fiscal year.

The company implemented a consolidation of items, focusing on delicatessen products, whose product codes varied among business partners and whose production efficiency had deteriorated due to the small-batch production of a wide variety of products. The company has communicated carefully with each store and endeavored to maintain relationships of trust, proposing alternative products for those who request the reduction of items.

Labor costs improved as a result of the reduction of the number of items, and sales at the factory alone increased from the previous year.

The company aims to further reduce costs by 10% in the fiscal year ending February 2026.

The company also plans to introduce standards for the number of items in order to reduce it at factories other than Tokorozawa Plant while taking into account production capacity, promoting efficiency improvement across the entire group.

<To revise selling prices in response to soaring costs>

For the company’s products, the selling prices tend to fluctuate less compared with the changes in raw material prices. On the other hand, as consumers are becoming increasingly frugal, the company has been cautious about raising prices, as this could lead to a drop in sales. However, as the recent increases in raw material, labor, and logistics costs have had a significant impact, the company has revised the selling prices and adjusted the quantities of its flagship "Gohan ga Susumu Kimchi" series, whose prices had not been previously raised.

In September 2024, the company started to raise prices for the three mainstay products in the “Gohan ga Susumu Kimchi” series at wholesalers and some retailers. From May 2025, the company will raise the prices and adjust the quantities of the three main products in the "Gohan ga Susumu Kimchi" series at all retailers, including mass retailers and convenience stores.

In the future, the company will also revise the selling prices of other products, such as lightly pickled vegetables, while monitoring the balance between the impact on sales and profit improvement, as well as the reaction of retailers.

② Reduction of costs

<Streamlining and automation of the production system>

The investment amount is approximately 5 billion yen, and Ibaraki Factory, which began full-scale operation in December 2024, produces the "Gohan ga Susumu Kimchi" series for the entire Kanto region. The maximum production capacity is over 10,000 packs per hour, but it is currently operating at just over 80% of the capacity. The processes, including the receipt of raw Chinese cabbages, inspection, processing, packaging, packing, and shipping, have been mechanized using automated machines, and hourly production efficiency is expected to increase approximately 2 times.

The company plans to establish a stable production system that can be operated throughout the year and maximize production capacity, and have Ibaraki Factory take over production from Miyagi Factory, which produces products for the Tohoku area, and Chukyo Factory, which produces products for the Chukyo and Hokuriku areas.

The company will also work to improve production efficiency and automation at its factories other than Ibaraki Factory.

At Tokorozawa Plant, the company will transfer a dedicated production line to the group company Tegara Shokuhin (Hyogo and Himeji), improving the production capacity and manufacturing efficiency of “Gohan Ga Susumu Kimchi” in western Japan. In addition to improving quality by utilizing AI-based sorting machines and inspection devices, the company also aims to establish quick pickling technologies and realize a production and logistics system that does not use containers.

|

Ibaraki Factory |

<Revision and streamlining of raw material procurement>

Each division in charge of raw material procurement will recognize respective challenges and forge ahead with revisions and streamlining.

◎ Vegetables: Ingredient Section

The section’s policies are the procurement of vegetables that takes into account weather risks and the establishment of a system for procuring locally grown vegetables.

With regard to Chinese cabbage, the main ingredient, they will develop a market that is not overly focused on pricing in preparation for expanding sales in autumn and winter. Regarding weather risks, they will store Chinese cabbage in spring and make pricing transactions to lower the price while striving to broaden production areas in summer. In addition, they will work on establishing a system allowing for market purchase by cultivating the fruit and vegetable market.

◎ Seasonings: Food Product Material Section

The section’s policy is to make stable purchases that take into account the information on production areas, exchange rates and prices of raw materials.

In order to achieve this, they will consider exchange rates, reconsider suppliers and sales channels by making direct transactions with producers, etc. and engage in procurement that makes use of the group scale and regional characteristics.

◎ Packaging: Packaging Material Section

The section’s policies are to decrease purchase costs through timely negotiations and to thoroughly reduce waste by revising the manufacturing process.

Concretely, they will engage in stable procurement by collecting information from existing and new partners and controlling the stock in packaging manufacturers and plants; price negotiations considering the prices of crude oil and naphtha, exchange rates, etc.; reduction of waste from disposal through cooperation with marketing and development sections and reduction of waste in the company’s manufacturing process based on the cooperation between plants and the equipment department.

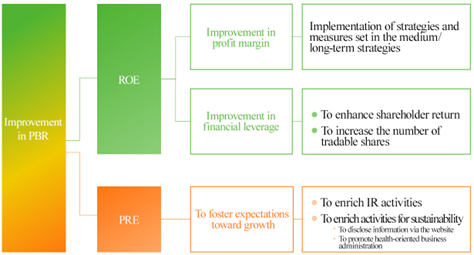

(2)Management conscious of capital efficiency

Regarding the “Measures to realize management that is conscious of capital costs and share prices” requested by the Tokyo Stock Exchange, the company’s analysis and future initiatives are as follows.

(Analysis of the current situation)

*PBR

PBR had been above 1 until the fiscal year ended February 2022, driven by strong performance due to the demand from housebound consumers during the COVID-19 pandemic. However, it has been less than 1 due to the reactionary decline against the demand from housebound consumers.

*Cost of Capital

The company estimates that cost of shareholders’ equity is 5.5 to 7.0% in the CAPM and about 8.0% based on stock yield.

*ROE

ROE had been above 8% until the fiscal year ended February 2022, but it has been less than 8% for three consecutive fiscal years, from the fiscal year ended February 2023 to the fiscal year ended February 2025.

Although the company has not set a target, it hopes to return ROE to above 8% in the future.

(Source: the company)

(General measures)

The company is aiming for the recovery of PBR to 1.0 or higher, through the improvement of ROE based on the medium/long-term strategy.

They believe that the improvement of ROE and elevation of PER are necessary for the improvement of PBR and they will strive to “elevate profit margin” and “elevate financial leverage” in order to improve ROE and focus on “fostering expectations for growth” in order to improve PER.

(Source: the company)

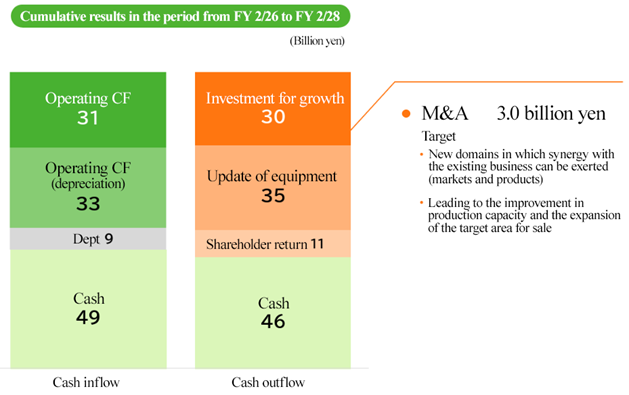

Regarding “Measures to realize management that is conscious of capital costs and share prices,” the company recognizes that the demonstration of cash allocation to investors and enhancement of return to shareholders are important challenges.

◎ Capital allocation

The company will invest 3 billion in growth during the three years from the fiscal year ending February 2026 to the fiscal year ending February 2028.

The company will continue to make growth investments, including M&A, following the operation of the new factory in Ibaraki. They will target new fields (markets and products) which allow for synergy with existing businesses and business opportunities leading to the elevation of production capacity and expansion of sales areas.

(Source: the company)

◎ Enhancement of return to shareholders

The company will enrich return on profit by combining dividends and shareholder benefits.

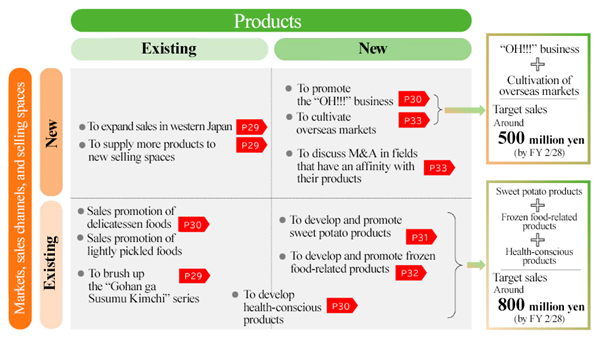

(3)Endeavoring to develop new products and enter new fields

The following measures will be taken to boost existing fields while generating new sales of over 1 billion yen in new fields.

(Source: the company)

① Main measures

◎ Brushing up the "Gohan ga Susumu Kimchi" series

Currently, the "Gohan ga Susumu Kimchi" series is the top brand of kimchi.

Sales of “Gohan ga Susumu Kimchi” were on a downward trend through the fiscal year ended February 2023, but have begun to show signs of recovery due to the company's strategic focus on “expansion of sales in western Japan” and “enhancement of sale of products in new selling spaces.” This includes efforts to increase sales through non-supermarket channels such as drugstores in western Japan and promotional campaigns. Based on sales figures using the previous revenue recognition standard, sales have returned to the record-high levels seen during the fiscal year ended February 2021, when demand from housebound consumers arose due to the COVID-19 pandemic.

In the future, the company aims to become the top brand in "rice accompaniments" that are indispensable to rice and appear on the dinner table every day by expanding into easy-to-prepare products, seasonings, frozen foods, and delicatessen foods.

As a concrete measure, the company opened a fan community site, "Pickles Shokudo," in February 2025. Through direct communication with customers, the company plans to create fans and promote awareness of the group's product lineup other than kimchi, as well as to explore potential needs and use them in product development for national brands that will lead to increased sales and profits.

◎ Expanding sales of delicatessen products and developing health-conscious products

As consumers become more health-conscious, health-conscious foods and foods with functional claims continue to grow. Meanwhile, manufacturers are developing new products one after another, intensifying competition. The delicatessen food market has also been growing since the COVID-19 pandemic.

In this context, the company is selling "Protein-rich Bangbangji Salad" in the delicatessen food category as a health-conscious product, and is also developing packages and products that highlight its patented Plant Origin Lactic Acid Bacteria "Pne-12."

Going forward, the company plans to use the research and development technology of "Pne-12" and its own fermented rice bran extract to strengthen its rice bran pickle products, which can demonstrate its strengths by combining it with its original pickling technology.

In addition, by using rice malt containing Pne lactic acid bacteria in the dough of the bread offered at "Hanno Bakery POCO-POCO" located in “OH!!! Fermentation, Health, Food Magic!!!,” a commercial facility for the restaurant and retail business, the company will be able to increase the added value of a variety of products by giving the bread a natural sweetness, a unique moistness, etc.

◎ Promotion of the “OH!!!” business

In “OH!!! Fermentation, Health, Food Magic!!!,” which opened in Hanno City, Saitama Prefecture, in October 2020 as a complex commercial facility with the theme of health and fermentation, the company operates both restaurant and retail businesses. A restaurant, bakery, shopping and experience classes are available at the complex, offering the opportunity to introduce the group’s products and approach to production from many aspects through each facility, and it is popular among a wide range of people, including local customers and tourists, and sales have been increasing year by year.

In March 2024, the café building was renovated and reopened as “Hanno Bakery POCO-POCO.”

Going forward, they will develop products and hold promotions and events unique to “OH!!!,” by utilizing the synergy among group companies, and make preparations for running restaurants, bakeries, etc. in the “OH!!!” business in other regions.

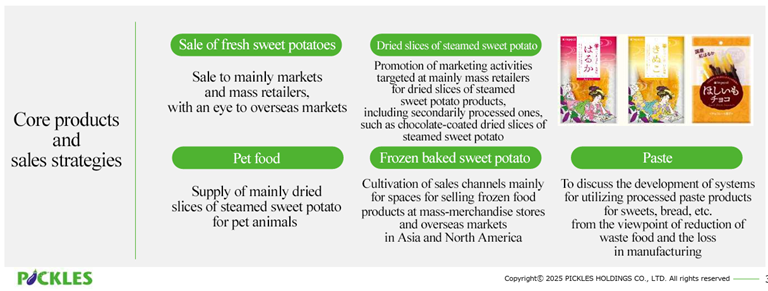

◎ Development and sales promotion of products related to sweet potatoes

The purposes of use and selling methods of sweet potatoes grown in Japan have diversified, due to the growth of demand for baked sweet potato and the popularization of processed products, such as dried slices of steamed sweet potato, and sweet potato as an ingredient for sweets. As inquiries from outside Japan have increased, export has grown.

Vegepal Co., Ltd., which is a joint-venture firm established in September 2023, stably receives orders from leading clients. They concentrate on the development of differentiated products while brushing up core products. In order to improve their popularity, they set up a booth at “Coedo Imo Park (Sweet Potato Festival 2025),” an event held in Kawagoe City, Saitama in February 2025.

From now on, they will promote product development centered around Vegepal Co., Ltd., and aim to expand sales based on the cooperation among group companies.

Core products and sales strategies related to sweet potato are as follows. They aim to meet demand from a broad range of customers with products developed from various viewpoints.

(Source: the company)

◎ Development and sales promotion of frozen food-related products

The demand for frozen food is growing, because it is possible to shorten cooking time and reduce the amount of waste food significantly.

Leading makers have significant advantages in selling products to consumers, and competition is fierce. Regarding the products for professional use, the scale of the market of frozen food products for professional use in 2023 stood at 380.3 billion yen, up 6.3% year on year. Due to the shortage of manpower at restaurants and other commercial facilities, demand is high and will probably keep growing.

Regarding products for consumers, the company has released “Gohan ga Susumu Kimchi-nabe (kimchi pot dish as an accompaniment to rice),” which was developed with the technology for retaining the texture of fresh vegetables nurtured in the production of lightly pickled vegetables, as part of efforts to differentiate their products, and started tentatively selling frozen products of “Gohan ga Susumu Kimchi (kimchi as an accompaniment to rice),” Chinese cabbage with yuzu, okra, and delicatessen.

They have started transactions for products for professional use.

Regarding products for consumers, they will develop side dishes, snacks for alcoholic beverages, sweets, etc. by utilizing strengths. Regarding products for professional use, they will expand sales channels, including frozen food wholesalers and local restaurants around Japan, while increasing transactions with existing clients.

They will promote “Gohan ga Susumu Kimchi” in overseas markets, including North America and Hong Kong.

◎ Cultivation of overseas markets

In countries where it is difficult to grow or harvest vegetables, the demand for frozen food products is expected to grow, so it is considered that there is a business chance there. In particular, the markets in Hong Kong and Singapore where food self-efficiency ratio is low and there are many high-income individuals are promising, but the hurdle to local production is high.

Accordingly, they will export products made in Japan. For the foreseeable future, they will concentrate on frozen food products. The export of rice bran for pickling and frozen kimchi pot dishes began. Firstly, they will cultivate the Asian market, including Vietnam and Hong Kong, and then promote initiatives with Japanese exporting companies.

They will keep targeting Asia, and cultivate the market with frozen food products. In North America, they are surveying the market.

◎ Discussion on M&A in fields with which the company has an affinity

They will keep promoting M&A to accelerate growth speed.

Assumed target enterprises and fields are those with which the company can evolve or improve their capabilities of development, manufacturing, and sale, which are the strengths of the company and which possess functions, customer bases, products, or human resources the PICKLES Group does not have, so it can be expected that synergetic effects will be produced soon.

4-3 Numerical goals

| FY 2/25 | Ratio to sales | FY 2/26 (Plan) | Ratio to sales | FY 2/27 (Plan) | Ratio to sales | FY 2/28 (Plan) | Ratio to sales | CAGR |

Sales | 41,518 | 100.0% | 41,000 | 100.0% | 42,000 | 100.0% | 43,000 | 100.0% | +1.2% |

Gross Margin | 8,193 | 19.7% | 8,419 | 20.5% | 8,657 | 20.6% | 8,899 | 20.7% | +2.8% |

SG&A expenses | 6,912 | 16.6% | 6,919 | 16.9% | 7,057 | 16.8% | 7,199 | 16.7% | +1.4% |

Operating Income | 1,280 | 3.1% | 1,500 | 3.6% | 1,600 | 3.8% | 1,700 | 4.0% | +9.9% |

Ordinary Income | 1,346 | 3.2% | 1,532 | 3.7% | 1,670 | 4.0% | 1,770 | 4.1% | +9.6% |

Net income | 974 | 2.3% | 990 | 2.4% | 1,070 | 2.5% | 1,130 | 2.6% | +5.1% |

*Unit: million yen. CAGR is the average annual growth rate from the fiscal year ended February 2025 to the fiscal year ending February 2028. Calculated by Investment Bridge Co., Ltd.

Sales are projected to keep increasing slightly, while operating income is forecast to grow with annual growth rate being nearly double-digit.

| FY 2/25 | FY2/28 (Plan) | CAGR |

Lightly pickled vegetables /kimchi | 16,769 | 17,803 | +2.0% |

Delicatessen | 11,541 | 11,810 | +0.8% |

Old pickled vegetables | 392 | 469 | +6.2% |

Product | 12,815 | 12,917 | +0.3% |

Total | 41,518 | 43,000 | +1.2% |

*Unit: million yen. CAGR is the average annual growth rate from the fiscal year ended February 2025 to the fiscal year ending February 2028. Calculated by Investment Bridge Co., Ltd.

| FY 2/23 | FY 2/24 | FY 2/25 | FY 2/26 (Plan) | FY 2/27 (Plan) | FY 2/28 (Plan) |

Capital Expenditure | 883 | 951 | 4,700 | 1,400 | 900 | 700 |

Depreciation | 980 | 940 | 1,005 | 1,210 | 1,106 | 1,053 |

* Unit: million yen.

The company is planning a capital investment of 3 billion yen over the next three years. Mainly, the company will “conduct repair, upgrade equipment, and so on at the factory of Tegara-shokuhin in fiscal year ending February 2026.” From fiscal year ending February 2027, they will keep upgrading equipment.

Deprecation will reach a peak in fiscal year ending February 2026.

5. Conclusions

In their rolling plan, they aim to achieve “sales of 43 billion yen and an operating income of 1.7 billion yen” in the fiscal year ending February 2028. Sales are expected to keep growing slightly from the next fiscal year, while operating income is projected to increase with annual growth rate being nearly double-digit, and operating income margin is forecast to recover to 4.0%. However, the annual growth rate of gross profit is around 3%, so it seems that it takes some time to improve profitability on a full-scale basis. In addition to the diffusion of revised prices, we would like to expect from the progress of development and sales promotion of delicatessen with high added value, health- conscious products, frozen food-related products, etc.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 3 from outside (including 3 independent directors) |

Auditors | 4 directors, including 3 from outside (including 3 independent directors) |

◎ Corporate Governance Report (Updated on May 31, 2024)

Basic Policy

Our company considers corporate governance to be the important issue of business management for acting in conformity with the law and social norms, realizing the management policies, and achieving continuous growth.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4: Policy Retention Co.]

In principle, our company will not hold the shares of listed companies. However, if we hold shares for a reasonable purpose, such as the maintenance or strengthening of transaction relationships, we regularly check whether the purpose is satisfied.

We will discuss methods for examining the appropriateness of strategic shareholding and disclosing the detailed information on strategic shareholding.

Regarding the exercise of voting rights for strategically held shares, we judge each case individually. We appropriately exercise voting rights, while comprehensively considering whether they would contribute to the improvement in mid/long-term corporate value of our company and invested companies.

[Supplementary Principle 2-4-①]

Our group promotes highly motivated and skilled employees to management posts (division chiefs or higher) regardless of age, nationality, gender, etc. Regarding the promotion to management posts, the ratio of female managers is 10.1%, and we will increase this ratio. The percentage of women in management positions above is based on the values of PICKLES CORPORATION (our main subsidiary). For non-Japanese employees, the ratio of them is low, so we have not set a goal for them. For mid-career workers, we promote them to management posts while comprehensively considering their experiences, abilities, etc., so we have not set a goal for them.

With the aim of honing the ability of each employee, we make efforts to foster the stance of learning voluntarily, adopting systems for supporting self-development, incentives for acquiring qualifications, etc. In addition, we recognize the development of a comfortable working environment as an important management issue, so our corporate group has adopted refreshing holidays, overtime-free working days, etc.

[Supplementary Principle 3-1-③]

Regarding sustainability, we recognize the environment, safety, reliability, etc. as important issues, and take initiatives. As the investment in human capital, we develop educational systems and pursue a comfortable working environment for employees, and as the investment in intellectual property, we research lactic acid bacteria, etc. These are disclosed via our ESG reports and IR documents, which are available in our website. For more information about our corporate group's sustainability efforts, please visit our website.

We will consider disclosure based on the TCFD, a globally established disclosure framework, or an equivalent framework, going forward.

<Disclosure based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 3-1 Enrichment of information disclosure]

(1) Our corporate philosophy and policy are disclosed in our website, etc.

(2) Our basic policy for corporate governance is disclosed in this report.

(3) The basic policy for our directors’ remuneration is to contribute to the sustainable improvement in corporate performance and value and set the remuneration of each director at an appropriate level according to each post. In detail, the remuneration of each executive director is composed of the basic remuneration, which is fixed, a bonus, and a stock option. The remuneration of each outside director is composed of only the basic remuneration, because of their duties. The details of the policy and procedure for determining the remuneration of each director are disclosed in this report.

(4) The board of directors choose candidates for internal directors from those who possess expertise in their respective fields and can respond to changes in the business environment swiftly and accurately, and candidates for outside directors from those who can oversee our business administration from an objective, independent standpoint without seeking the benefits of the management or specific stakeholder. Candidates for auditors are chosen by the board of auditors from those who possess plenty of experience and advanced insight, and then determined by the board of directors after having discussions and reaching an agreement. If the above policy for appointing directors cannot be fulfilled or a director violates or is suspected of violating a law, a regulation or the articles of incorporation, the board of directors will discuss the dismissal of said director.

(5) The reasons for choosing candidates for directors and auditors are disclosed in convocation notices for a general meeting of shareholders.

[Supplementary Principle 4-11①]

The board of directors of our company is composed of directors who possess technical knowledge and plenty of experience in respective fields, such as business administration and finance, while securing an appropriate scale and diversity of gender, work history, and age so that the board can fulfill its roles and duties effectively. The policy and procedure for appointing directors are as described in Section (4) of “Principle 3-1.”

This report discloses the skill matrix, which lists the knowledge, experience, abilities, etc. of each director. Independent outside directors include those who have the experience of business administration in another company.

[Principle 5-1. Policy on Constructive Dialogue with Shareholders]

With a basis in transparency, fairness, and continuity, we strive to disclose information promptly so that our shareholders and investors can understand our company correctly.

We will strive to disclose information based on related laws and regulations such as the Financial Instruments and Exchange Act as well as the timely disclosure rules established by financial instruments exchange, and to actively disclose information that can be considered effective for understanding our company with appropriate measures.

In detail, a financial results briefing sessions is held twice a year, and a briefing session for individual investors is held when necessary, and the representative director and president gives explanations. Individual interviews are handled by the publicity/IR division.

[Measures to realize management that is conscious of capital costs and stock prices]

Regarding measures to realize management that is conscious of capital costs and stock prices, these measures are described in the reference material for the session for briefing the financial results for the fiscal year ended February 2024 held on April 19, 2024 (pp. 33-34). This material is disclosed on the company's website (https://pickles-hd.co.jp/ir/).

In this material, the company aims to demonstrate the growth trajectory of the group by implementing initiatives such as “Initiatives to Achieve Medium-term Management Targets,” “Enhancement of IR Activities,” “Enhancement of Sustainability Activities,” and “Strengthening Shareholder Returns.” Through the implementation of these initiatives, the company strives to enhance corporate value and increase stock price by improving profitability and asset efficiency. It also aims to improve its PBR through these initiatives.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |